Nearly a quarter of all subprime auto loans are 90+ days delinquent. Why?

By Wolf Richter for WOLF STREET.

Auto loan and lease balances have surged to a new record of $1.33 trillion. Delinquencies of auto loans to borrowers with prime credit rates hover near historic lows. But subprime loans (borrowers with a credit score below 620) are exploding at a breath-taking rate, and they’re driving up the overall delinquency rates to Financial Crisis levels. Yet, these are the good times, and there is no employment crisis where millions of people have lost their jobs.

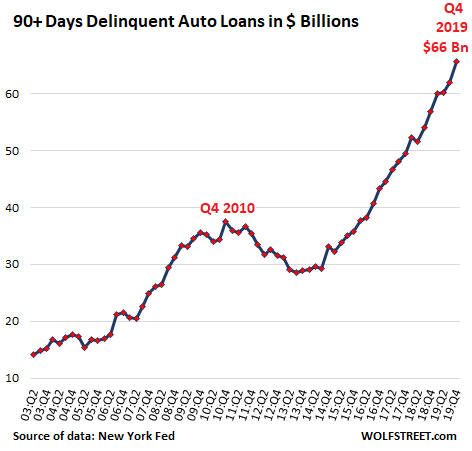

All combined, prime and subprime auto-loan delinquencies that are 90 days or more past due – “serious” delinquencies – in the fourth quarter 2019, surged by 15.5% from a year ago to a breath-taking historic high of $66 billion, according to data from the New York Fed released today:

Loan delinquencies are a flow. Fresh delinquencies that hit lenders go into the 30-day basket, then a month later into the 60-day basket, and then into the 90-day basket, and as they move from one stage to the next, more delinquencies come in behind them. When the delinquency cannot be cured, lenders hire a company to repossess the vehicle. Finding the vehicle is generally a breeze with modern technology. The vehicle is then sold at auction, a fluid and routine process.

These delinquent loans hit the lenders’ balance sheet and income statement in stages. In the end, the combined loss for the lender is the amount of the loan balance plus expenses minus the amount obtained at auction. On new vehicles that were financed with a loan-to-value ratio of 120% or perhaps higher, losses can easily reach 40% or more of the loan balance. On a 10-year old vehicle, losses are much smaller.

As these delinquent loans make their way through the system and are written off and disappear from the balance sheet, lenders are making new loans to risky customers, and a portion of those loans will become delinquent in the future. This creates that flow of delinquent loans. But that flow has turned into a torrent.

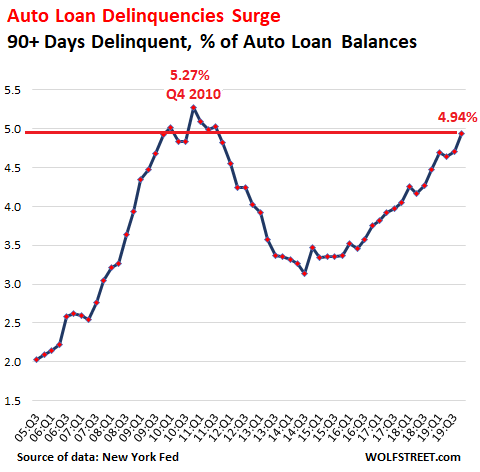

Seriously delinquent auto loans jumped to 4.94% of the $1.33 trillion in total loans and leases outstanding, above where the delinquency rate had been in Q3 2010 as the auto industry was collapsing, with GM and Chrysler already in bankruptcy, and with the worst unemployment crisis since the Great Depression approaching its peak. But this time, there is no unemployment crisis; these are the good times:

About 22% of the $1.33 trillion in auto loans outstanding are subprime, so about $293 billion are subprime. Of them, $66 billion are 90+ days delinquent. This means that about 23% of all subprime auto loans are seriously delinquent. Nearly a quarter!

Subprime auto loans are often packaged into asset-backed securities (ABS) and shuffled off to institutional investors, such as pension funds. These securities have tranches ranging from low-rated or not-rated tranches that take the first loss to double-A or triple-A rated tranches that are protected by the lower rated tranches and generally don’t take losses unless a major fiasco is happening. Yields vary: the riskiest tranches that take the first lost offer the highest yields and the highest risk; the highest-rated tranches offer the lowest yields.

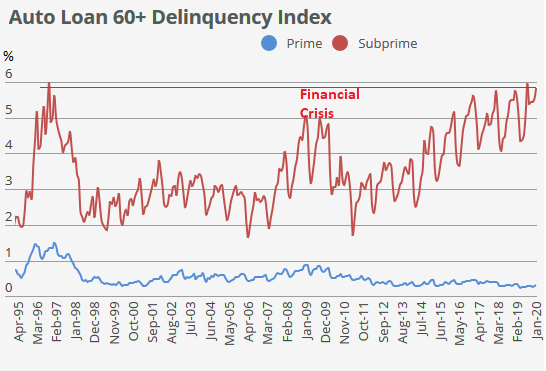

These subprime auto-loan ABS are now experiencing record delinquency rates. Delinquency rates are highly seasonal, as the chart below shows. In January, the subprime 60+ day delinquency rate for the auto-loan ABS rated by Fitch rose to 5.83%, according to Fitch Ratings, the highest rate for any January ever, the third highest rate for any month, and far higher than any delinquency rate during the Financial Crisis:

But prime auto loans (blue line in the chart) are experiencing historically low delinquency rates.

Why are subprime delinquencies surging like this?

It’s not the economy. That will come later when the employment cycle turns and people lose their jobs. And those delinquencies due to job losses will be on top of what we’re seeing now.

It’s how aggressive the subprime lending industry has gotten, and how they’ve been able to securitize these loans and selling the ABS into heavy demand from investors who have gotten beaten up by negative-interest-rate and low-interest-rate policies of central banks. These investors have been madly chasing yield. And their demand for subprime-auto-loan ABS has fueled the subprime lending business.

Subprime is a very profitable business because interest rates range from high to usurious, and customers with this credit rating know that they have few options and don’t negotiate. Often, they might not do the math of what they can realistically afford to pay every month; and why should they if the dealer puts them in a vehicle, and all they have to do is sign the dotted line?

So profit margins for dealers, lenders, and Wall Street are lusciously and enticingly fat.

Subprime lending is a legitimate business. In the corporate world, the equivalent is high-yield bonds (junk bonds) and leveraged loans. Netflix and Tesla belong in that category. The captive lenders, such as Ford Motor Credit, GM Financial, Toyota Financial Services, etc., or credit unions, take some risks with subprime rated customers but generally don’t go overboard.

The most aggressive in this sector are lenders that specialize in subprime lending. These lenders include Santander Consumer USA, Credit Acceptance Corporation, and many smaller private-equity backed subprime lenders specializing in auto loans. Some sell vehicles, originate the loans, and either sell the loans to banks or securitize the loans into ABS.

And they eat some of the losses as they retain some of the lower-rated tranches of the ABS. Some banks are exposed to these smaller lenders via their credit lines. The remaining losses are spread around the world via securitizations. This isn’t going to take down the banking system though a few smaller specialized lenders have already collapsed.

But demand for subprime auto loan ABS remains high. And as long as there is demand from investors for the ABS, there will be supply, and losses will continue to get scattered around until a decline in investor demand imposes some discipline.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Anyone who reports on any other economic indicator other than stock indices will be quarantined on suspicion of coronavirus.

Everything is Awesome!

Imagine what auto sales would have looked like without these subprime sales to begin with.

It was awesome while it lasted.

WW,

Exactly…the general public very badly underestimates the necessity of “junk credit” sales to keeping overall sales volumes up – without the doomed credit sales, volumes would fall.

On the other hand…perhaps the product sellers are using “crap credit” sales less as a desperate way to support volume and more as a tool to maximize price discrimination/capture of consumer surplus.

Hard to tell which is more true…either is probably bad for general public.

In the old days, efficiency improvements lowered costs, allowing greater volume sales – that virtuous dynamic seems to have been replaced by doomed financial plate spinning (either desperate or predatory).

While surfing my fashionista sites, I am noticing more companies offering to split up the payments on goods not costing all that much. The last site I saw doing this sells handbags at about $100-$200, they were offering to split the payments into 4 monthly charges. A sign of the times.

Petunia, one anecdotal bit is not “a sign of the times”. It’s a smart idea. HSN (and I assume QVC) has been doing this for years. No interest. Brings in the buyers.

noname,

The point was that it wasn’t an isolated case. Now, other sellers are finding customers don’t have enough credit or cash to make minor purchases. And BTW those channels you mention now have apps to reach the cord cutters. Now that they have a few more dollars available each month.

Her sign of the times isn’t one small outlier. It is quite common place for sub-prime lenders to start offering services for small items under the “build your credit back up” market place for those in need of credit but no access to prime rates. Not new at all, just new to the fashion world maybe.

Look at the chart above for delinquencies, I would bet the graph looks similar for the amounts in general to have that much of a gap as legitimate lenders tighten and freeze credit. The reports just ignore it cause subprime lenders picked up the pace so borrowing still maintains pace with the norms.

Prairies,

This is no “build your credit” scheme. It’s simply purchasing a product, i.e. blouse for $50, and putting it on 5 payments of $10 each with no interest (on any credit/debit card you already possess). Their big market is women’s clothing and purse-type things, things that Petunia was referring to. So, again, this is an already established payment plan with no risk.

Petunia,

I wouldn’t consider $100-200 purse purchases “minor”, even though yes, many do. The HSN/QVC route of that purse for $100 on 5 0% payments for $20 each makes it much more palatable for buyers (I’m not getting into the ethics of said purchases however); the website/s you described earlier are just learning of this smart selling point.

I’ve seen HSN/QVC on the “FREE CHANNELS!” list when looking at TV antennas. I think you have to be in a big market to receive them though. They have free live streaming on their websites and perhaps Y.T. as well.

@Cas127

In the old days. Wages kept going up. Above inflation. That meant a greater need for efficiency to keep prices level.

It is an old game.

GM “split” its financing arm (GMAC) to a “separate” company to sell as many vehicles as possible to anyone who could sign a piece of paper. It kept the GM factories humming and offloaded the liabilities off the balance sheet.

When the bankruptcy/bailout happened, GM didn’t look as bad as it really should as GMAC (treated as a bank) was bailed out ($2 billion of taxpayer money that was never paid back) and is now called “Ally.”

Now – TODAY – with Ford there is “Ford Credit.”

Same.exact.game.

Ford’s rating was recently downgraded to “junk” status. Ford Credit lends to anyone. Keep those factories humming!

When (not if) Ford goes bankrupt in the next recession – they will do the exact same thing as GM did with GMAC.

“offloaded the liabilities off the balance sheet.”

That is the key step – without buyers of the shittiest, most exposed tranches, the whole “crap credit” machine breaks down.

What I don’t get is how creditors (no matter how ZIRP’d) keeping getting suckered into paying for the trash tranches.

Bubble 1.0 illustrated with virulent horror just how little manufacturers care about loan underwriting quality when somebody else is on the hook for the default risk of loans – yet apparently ABS trash tranche buyers keep lining up to be defrauded.

Promised yield is meaningless in default…when you might only get 20 pct of your principal back.

Ally financial is a Ripoff. At the dealership I purchased a car from told me if I pay my payment on time for 1 year that ally would refinance my car and bring the payment down. I called them when that time came and they told me no and I wasn’t told that. My payment is higher than I need but I felt like I could at least handle it being tight with money for 1 year. But to find out I was lied to makes me feel like just giving them the car back and take a hit on my credit. Besides the loan is in my husband’s name, I never signed any thing, but now because we are married, ally says I am also responsible to pay the loan back. They are crazy and I will never use them again. I purchased 4 cars from this dealership that uses them and I will never buy another car from them. The dealership is in high point nc

Why are you buying cars you can’t afford? Buy a beater and don’t be a DebtDonkey.

This explanation of the car credit cycle squares with what I’ve seen in my area: over the last years every small-time weed dealer and his unemployed ghetto mates started driving around in new and increasingly fancy cars. Lately this dynamic seems to have gone static.

Very informative and balanced article, and I enjoy the comments as much.

Wolfstreet is picking up in some ways where ZH left it an increasingly long time ago!

22% sub prime of an entire industry, auto finance, is crazy.

What, lend the money and just hope for the best?

I suppose the only worry is if the car is wrecked or maintenance not done before repossession and auction/resale. Then again, just pass it on as the price of doing business. They probably just have to beat the depreciation spread to make a buck.

“What, lend the money and just hope for the best?”

Why not if some poor, ZIRP crazed ABS buyer has purchased the loan contract and bears 99pct of the default risk.

People do not understand the extent to which product sellers have become little more than middle man bookies in terms of credit default risk – especially the worst default risks.

> People do not understand the extent to which product sellers have become little more than middle man bookies in terms of credit default risk – especially the worst default risks.

Isn’t it great!

That’s what I often forget, that everything is bundled and sold for investment. Everything, I guess.

And they want lower rates. It’s almost like someone who is running the Country used to be in the casino industry. Or in reality TV productions.

*Rates were 0% – 0.25%, well below current rates, during the previous Administration.

Every Administration wants low rates. This didn’t start in 2017,

This is really just showing you that we are at a catabolic stage in many sectors, auto sales included.

The public bottomless wallet covers it all!

Channel stuffing doesn’t work indefinitely, so they start consumer stuffing instead. If you stuff them with credit they can buy product. That’s until they don’t pay back the loans, then it’s back to the lots with cardboard dummies strapped to the seats. Sorry, looking pretty in a car got automated too.

Wolf,

As you said…to move the iron, the sellers have to dip deeper and deeper into the can-barely-fog-a-mirror poor credit population…and then convince some ZIRP starved ABS buyers that loan due diligence consisted of something more than taking a pulse and being able to make an X on the loan signature line.

The scary thing is that there has been no shortage of buyers for the bottom tranches…ZIRP is a helluva drug…

As long as there are new buyers for the repossessed vehicles, it is all figured into the cost of doing business. No one is losing even at these high and rising numbers because the spread is great enough. Still way better than parking your money in a MM account and getting .025% interest. The big problem will come when the supply chain of new buyers is damaged. Most likely by job reductions.. As in the previous piece. When the income stream slows down and the defaults rise even higher. When FEAR trumps Greed, the exit door won’t be big enough.

Or…manufacturers could get back to improving efficiency so prices can be lowered…gaming both buyers and ABS creditors has a finite lifespan – sooner or later creditors will wise up to the manufacturers’ adverse selection of credit risk that they dump into ABS.

Or, sooner or later some Chinese or Indian importer will bring a 10 to 12k non-design-crippled car to the US and even the borrowers of credit-inflated 25 to 30k existing cars will start having second thoughts – regardless of whatever payment f*ckery pokery Ally et al can come up with.

Desperate measures are required to keep debt growing. Hopefully this crap will collapse sooner than later before more people are hurt.

That’s what Peter Schiff said in 2006 And everyone poo pooed him to death

In all fairness over the years Mr Schiff has provided more than a little ammunition for his critics.

The big problem is not so much debt in itself: as long as it’s fine with my creditors I can keep on piling debt to the sky. See Korean Airlines, Uber or the myriad of meal delivery outfits.

The big problem is the moral hazard born out of making everybody a winner. Just look at Europe’s perpetually fragile banks: bailing out the creditors (bondholders) was the worst [expletive needed but redacted] thing we could have done, for no other reason those same bondholders have not learned anything from their mistakes, such as not demanding more honest risk disclosure and higher interests to compensate for the risks they are taking.

These days rating agencies have mostly learned their lessons (see how stock market darlings such as Tesla are deservedly junk-rated) but creditors haven’t. They still take huge risks for inadequate compensation, sure somebody will swoop in and bail them out, perhaps at a profit. That’s how you create that sea of malinvestment that needs to be disposed of right now.

And not allowing it is just another nice layer of moral hazard on top of what we already have.

Peter Schiff just wants to sell you gold. Nothing wrong with that, but that is what I believe anyway.

I disagree completely Look at what happened to his father and maybe yourll get an indication about his motivation And I’m sure glad I listened to his advice Good luck finding physical when this nonsense comes unglued which it will

Peter Schiff: right on Gold- wrong on the dollar IMHO.

Hey, I enjoy The Peter Schiff Show Podcast, however, the man sells Gold for a living.

These things can take a long time to play out. As an example, 10 years ago when my son was playing competitive sports we did a lot of road trips. My wife and I used wo der who is buying at all these stores and restaurants (way too many of them). It has taken a good 8 years for a lot of them to start going bankrupt.

Along the way, some people are making good money. So its interesting to watch you just font want to be the bag holder. In my life time Ive never seen the markets just keep going up and up. I suspect there is such a dependency on stocks staying hing a d intrest rates staying low that the whole system will do whatever is possible to keep it that way.

What would be the impact on life as we know it if interest rates went up to 5% and the stock market fell 25% in 2 years? The answer to that question is probably why interest rates are being supressed and the market is being supported more than in the past.

Dave,

Actually we have a very, very recent answer to the interest rate VS. stock mkt equation.

From fall 2017, the Fed allowed long rates to go from about 2% to 3% (in the 90’s, the US was able to survive/thrive with rates at 6% to 8%…).

By the end of 2018, stock mkts had fallen by 20 percent. DC furiously scurried to reverse the “massive” one pt hike off of historic lows…

That is about as clear a correlation as you are going to get in real world economics.

Since about 2000-2003, the truth has been that the US has been on a disguised form of life support, using interest rate vampirism to convert the earning power of private savings into borrower subsidies (not the least of which is the US gvt – provider of monopoly fiat which determines interest rates…)

There are no historical correlations between interest rates, the stock market and the economy. The last ten years confirms this, economic growth has been well below other post recovery comparisons. The stock market since 2009 has gone higher on relaxation of accounting rules, post 2008, and added liquidity, which has nothing to do with interest rates. Fed can run REPO in any case. If rates did rise to 5% that would imply higher GDP growth, unfortunately with employment already at capacity such a move would spike inflation. Fed chief wants higher inflation and believes lower rates are the solution?? Higher interest rates often signal credit tightening, as in growth acceleration and competition for available funds heats up, and sometimes rising rates signals a crack in the bond markets ratings, a hit to it’s collateral. Facing a deficit crisis, an extended period of trade deficits, oversupply of oil pressuring the petrodollar, and EMs writing shaky debt in dollars, you can make the case that higher interest rates are a problem.

AB,

I’ll stand by what the mkts actually *did* from Fall 2017 thru the end 2018.

Alternative theoretical paths can be offered up…but they aren’t what actually *happened*.

Shades of insisting for 50 years that one sided intl free trade by US would ultimately result in trade balance…still waiting on that, many trillions later.

Economic theories are full of assumptions…once those assumptions are violated, the theories tend to lose value fast.

Of all the dubious credits out there, to me this is the strangest ( ex. unicorns Wework etc. )

The repo is described as a smooth fluid business, i.e., the underlying value of the collateral flows from the defaulter back to the lender, less the repo fee.

But what is the condition of the collateral? I have no idea, but I hear that some of these defaulters never make the first payment. They are fraudsters.

So what is the chance they will change the oil etc.?

Normally this is done to maintain the warranty. But what if the buyer never intended to hold the vehicle for the warranty period? What if he just rents the vehicle out to make deliveries?

No doubt there are great deals to be had buying good used like ex. lease. But a repo possibly from a disgruntled or resentful owner seems like a different deal. How are these guys able to borrow 40+ K when they could render the collateral almost worthless?

These early payment defaults (EPD) are a true problem in the subprime sector, and often there is fraud involved by either side. The thing is, if there is no payment within 90 days or 120 days, the car is going to get repo’ed, and there is no need for the borrower to change the oil in such a short time. So maintenance issues are not near the top of the priority list for lenders. But body damage, cigarette burns on the seats, bad odors, etc. might be.

Let’s assume quite a few of these subprime people are shall we say ‘riff raff’

Essentially many are dead-enders who are likely headed for the Fentanyl solution.

If they have recently watched The Joker, might they be a little angry with the way things have turned out for them and be blaming ‘the system’ (they’d be partially right)

Is the repo man and the finance company likely to be considered part of ‘the system’ and might some of these car owners who are about to lose their vehicles not take out their anger on their cars?

I am wondering how many let their dogs use the seats as toilets. Or maybe the owners do? Or maybe the owners let their cats live in the car in the days before the repo man stops by.

Willy Winky,

You misunderstand subprime. It doesn’t have anything to do with income or drug use, but with credit and payment history. There are plenty of high-income, highly educated people — that dentist on the corner — who went into debt over their head and now have too much debt, and then they were late on a few payments, and suddenly their credit score drops below 620 and they’re subprime. This goes pretty fast. It has nothing to do with drug use or “riff raff.” Just credit and payments, that’s all. The way people improve their credit score and get rid of that subprime rating is by making all payments on time and reducing their debt load. And pretty soon they’re prime.

I have met people over the years that quit paying for the vehicle on the subprime market. 2 examples were unaware how front heavy the interest was until a year into the payments, once they saw 90% interest and 10% real purchase price they cut off payments. Let the vehicle sit in the driveway until the tow truck came.

Subprime is loading up uninformed buyers with debt using the same old sales pitch “everyone is approved, good or bad credit doesn’t matter”. When you say that to a parent in need they will always grasp at the sliver of hope.

Yeah. I’m riff-raff. By at least lower 30-40% lifestyle measures and still debt free. I stink as a consumer.

No idea what my credit rating is and don’t care

Wolf – I am not saying all of the subprimers are riff raff. That said, a banker is probably more likely to smear dog shit onto the seat of his Porsche before the meth addict, because bankers can be like that

I used to take the bus, sometimes with small children, and use a clothes line and cloth diapers…now young people are used to what we called luxuries…too snotty to take the bus and a houseful of smart phones.

My son’s business partner has his credit cards payed off by his retired parents every month. They live in Hilton Head. My son lives with us and can’t afford a car…same income from their work!!!

My question is, what will happen if the market corrects and those boomers in Hilton Head can’t pay off their middle aged children’s debts!! or private school fees, or school loans.

I help mine with lots of services and a little money, but it’s hard to see those Iphones whipped out especially with children charging toys themselves from Amazon.

What a screwy culture!!

You mean those Boomers where:

“Subprime auto loans are often packaged into asset-backed securities (ABS) and shuffled off to institutional investors, such as pension funds. ”

In another generation, these retirees will be all but vanished along with their nice nest-eggs.

Because when I started as a banker 42 years ago bankers made loans as if it was their money. Today they are under pressure to make loans like its government money with no accountability or responsibility. Our society has changed……just watch that movie with Jack Nicholson when he defines how he thinks of a women. Its the answer to everything.

Yes…”As Good As it Gets”….really fun movie.

And like many of us females today, they expect endless pity when their chickens come home to roost. Banks have discovered the victim power play.

However, thanks to Wolf and a few others, we know who is being really played for a chump.

Fred, when I started as a banker 47 years ago money was not a “product.” A loan was a security, it said it right there on the contract. Then credit cards and green stamps became interchangeable. I was in subprime the last 12 years of my career. It was the only “labor intensive” banking left. It no longer took 20 credit people and committee members to loan $2 billion to Walt Disney.

The fact is that subprime borrowers cannot afford 24.99% interest rates on cars no more than they can afford them on credit cards. The banks go to the discount window and get money at less than 2%, it takes 7% for Admin & Collection which allows a 6% loss factor. At credit scores under 600, at 24.99%, the bank is making 10% before taxes. They excuse themselves by saying they loan at LIBOR +, but how many billions in fines were paid by banks manipulating LIBOR?

To qualify a borrower on monthly payment, loan terms extended from 60 to 72 to 84 months, well beyond the physical obsolescence of the vehicle.

The borrower usually buys a 3 year old car so the max usage he will get out of it minimized, while his loss potential is sky high.

As far as first payment defaults, they are situational. I did a “deep study” on them at my employer. Circumstances as varied as crippling injury or illness of either buyer or spouse or family member, the vehicle was purchased so the customer could drive it to bankruptcy court, fraudulent identity or credit information and finally, the most obvious, the buyer never intended to make a payment for any number of screwball reasons.

After I got out of the business I wasn’t surprised to see the changes made. Vehicle manufacturers continued to put pressure on dealers to “move the iron.” Subprime lenders loosened credit underwriting to “you got a phone, you got a loan,” and , if the customer could “fog a window, he got a car.”

Subprime is definitely the underbelly of finance. I had started out in 1973 on the marble floors and in the walnut paneled offices and worked my way downwards. Even though I worked as a modern Dilbert in my cramped cube, it still came down to whether the math worked or not. Too often, in subprime, the numbers don’t add up but no one cares. Just keep pushing that iron and keep your dealer happy. Let Loss Mitigation worry about the rest…

Thanks for the numbers and practical insight.

The numbers tell us where/when things might start to get ugly.

But the two major ones are vendors being able to borrow at 2 (to 5, when Corp borrowing is so cheap, the cost of funds does not have that much of an impact) and 25 – the cost at which vendors re-lend on to bad credit risks.

25 minus 2 (or 5) is a huge spread, leaving plenty of room for profit, admin cost (including repo), and expected default losses.

But this raises a question – why doesn’t competition drive that 25 pct down?

25 pct cost of money is enormous – and since underwriting is so non-existent, there are not a lot of true admin costs (if more repo costs). That leaves a lot of room for default losses and tgt profit.

You would think there is a ton of room in the mkt for entities offering 15 to 25 pct financing to the customer.

Well — it IS government money, isn’t it? It’s not your banker’s picture on $USD, eh?

I love this, the reach for yield is gonna push buyers of auto ABS yields lower and lower, as well as push yields on collateral those leveraged positions lower and lower again until overnight rate trades higher than the 30 year trash again… all while we will have ongoing overnight and term repos by the FRBNY for broke-dealers so they sponsor repo all the rehypoticated trash!

Isn’t FED doing repo everyday at these XX billion levels? To sink FED, you need an asset class at 10 trillion level where 1 trillion goes wrong. XX billion is just noise.

JZ,

I hate to disappoint you. Repos are in-and-out transactions that unwind when they mature (the next day or in 14 days) and go to zero on the balance sheet, as the Fed gets its money back, and the counter party gets its securities back. The Fed’s repos were down to a total balance of $170 billion as of the last balance sheet last Thursday. You can forget about the trillions:

https://wolfstreet.com/2020/02/07/end-of-qe-4-feds-repos-drop-to-oct-2-level-t-bills-balloon-mbs-fall-total-assets-down-to-dec-25-level/

Wolf,

“Repos are in-and-out transactions that unwind when they mature (the next day or in 14 days) and go to zero on the balance sheet, as the Fed gets its money back, and the counter party gets its securities back.”

In theory, yes.

What evidence do you have (or does the Fed publish) that all repos are being unwound on time and in full?

That’s why the Fed only deals with primary dealers – mostly the largest bank holding companies.

George_Cloonotney,

Yes, the Fed publishes this transaction data on a daily basis, and it publishes the balance as of Wednesday every week. You can track the repos to the penny. These securities involved in the repos have CUSIP numbers that are tracked and their ownership is known.

Wolf, I thought the FED said they weren’t going to release the rate of these repo defaults until Fall 2021. Could you help provide me with a link to their default rates or at least tell me what key words to Google so I can track it down myself, because I haven’t been able to find them on my own (but I am not very good at this type of thing so that isn’t a surprise).

Nat,

I’m not sure what you’re referring to and how that is related to what I said. I was talking about what happens when repos mature, and the Fed gets its money back, and how the Fed publishes this data. There have been no repo defaults. But if there were a default, the Fed would come out ahead because it would keep the securities that it bought under the repo, which have a slightly higher value than the cash it handed out under the repo.

If there is a repo default, with one of the big financial firms not being able to buy back the securities, you’ll instantly see it because it would shake up the entire market. Fireworks would begin that second.

“JZ,

I hate to disappoint you.”

No you don’t *chuckle*

I understand the Repo’s term and its balance may or may NOT fade depending on how many people gets liquidity issues. But I think my point is still valid. In the world, there is this pile of stinking shit called debt, be it US treasury or car loans. When this shit go bad, FED will jump out and spray some perfumes and calm everybody. When can this pile of shit takes the FED down? You need 1 or 2 trillion goes bad like the mortgages in 2008. When the number is large enough, people either don’t believe the FED can handle it, or if the FED dares to handle it, people will torch the US$. To have 1 or 2 trillion goes bad, car loans don’t cut it. I am NOT suggesting REPO is the mechanism to fight bad car loans, what I am suggesting is that car loans are sooo small that it is like noise for the FED to deal with.

Imagine FED is Avengers and you need Thanos to end Iron man. That’s when end game begins. Car loans is like Thor’s brother maximum.

You have just guaranteed that the next round of Fed emergency lending programs will now be codenamed after Marvel characters (and run by Disney characters…Goofy, Daffy, Dumpy…)

That big pile of debt is Thanos, and it is waiting for all the infinity stones. CoronaVirus is one stone. Once he got 5, he will take down all asset by half. The FED needs to invent time machines to put down Thanos and in the process kill the US $. This, ladies and gentlemen, is the END GAME.

In my opinion, the repo issue was a manufactured problem.

If you follow the money, the Fed bought more than $225 billion of Treasury Bills already form primary dealers to help the deficit problem. Powell told Congress that the Fed intends to buy more $60 bil/mo in T bills till the end of the 2nd qtr (or end of June). So that’s more buying of the deficit.

Who made money? The Treasury and the primary dealers.

Who lost money? The retired people living on the interest of their savings.

“The retired people living on the interest of their savings.”

As has been the case since 2000.

This entire trend is just another example of our increasingly fragile and duct-taped together economy and society. The only way to eek out any profit is to use recklessly underwritten debt to pull demand forward and securitize it (spread the risk around) so that any losses are diluted enough that the big players are willing to keep staying at the table. However, as was the case with the much larger and more contagious mortgage bubble, chickens inevitably come home to roost. When the big auto shakeout happens, will we have as many OEMs as we have now? Is there the public appetite for any bailouts of manufacturers? Time will tell.

Since when do they need approval from the public to bail out auto companies or banks? They will do whatever serves their interests and you know it as well as I do

F,

I agree – but there comes a point where the currency has been/will be so thoroughly abused via gvt printing/ZIRP-NIRP that the currency is distrusted (and therefore disused from the get go).

American gvts used to fear this, now it seems they pathologically court it.

It isn’t as though it is beyond the mind of Man to conceive of and develop alternatives to the US dollar (even if every other world currency were equally abused…though they are not).

Sure, the gvt can make it “illegal” to use anything other than their debauched paper – just like at various times it has made drugs, booze, and porn illegal…and look how effective those laws are on the supply of infinitely more dubious items than a reliable currency, trusted to have/hold value.

All in the name of hitting some heavily theorized Keynesian optimal growth path/median home values/etc.

If you’re an American you will keep right on using $USD regardless of how “debauched” you or anybody else thinks it is because your taxes, fees and fines will continue to be denominated in it.

Well, right up until the US Federal government can’t compel its populace to pay its taxes, fees and fines — but that’s revolution, civil war or anarchy.

For now, I’m betting on Uncle Sam’s guns to keep that utter breakdown of the sovereign’s monopoly on the use of force at bay …

Yes, the oil frackers are lining up.

Yes…this society increasingly looks like those barnstorming planes held together with chicken wire, chewing gum, and duct tape…

In reference to the Barnstorming planes… and with Jerome Powell & Neil Kashkari playing tennis up on top of the Wing.

Friend of mine “bought” a new car from a local dealership in 2018 for $27,000. No down payment.

He got to keep the car for 8 months, without making any payments at all in fact.

He had no job and drew welfare because he was certified as crazy/incompetent by the state of Oregon.

Subprime?

I am now trying to talk him into buying a house.

Why stop at one? Have him set up a REIT, if he can pull it off. If he ever faces charges, he can claim the whole thing was performance art to critique the terminal decline of the Western financial system.

you should run for office, michael. you have fresh ideas, at the very least…

Dada financial art?

The government, federal and local, are great teachers of creation of debt and failure to address the obligation of that debt.

People see this, even subliminally, and it seeps into their behavior.

Faked and forced interest rates to all time lows to prompt the economy works for a while, but there is a “hang over”.

Debt Debt Debt ….personal and governmental ..explodes as rates are so low as to promote debt. Now what Mr. central banker?

Shadow Stats is right. The government changed its stat methods in 1994. We have had negative GDP since 2005. All of the numbers are cooked.

John Williams is an honest, olde school kind of guy and if he says it’s so that’s good enough for me

“We have had negative GDP since 2005” — if you live in a small town in Ohio whose only manufacturer shut down in 2005, and that manufacturer had provided 20% of all jobs in town, well, that’s probably correct in terms of the local economy in that small town. In terms of the US economy overall, it’s pure unadulterated BS. Shadow Stats is a joke, and the guy knows it. Just don’t take it seriously.

Wolf,

I know I am a broken record on GDP mismeasurement, but I guess my larger point is that a serious look at some independently determined aggregate measure of US production (shorn of financial overlays that the Gvt can goose or invent), might reveal some very surprising things about US growth since 2000.

Consider the fact that DC has better info than all of us…and they have pretty much kept the pedal to the metal for almost all of the last 20 years.

I don’t think they were doing it for laughs.

It is just a question of agreeing on those aggregate measures of output/wealth that should be used.

US auto production volumes? New home completions?

Bottom line, I think physical output measures (versus $ priced output measures) might tell a truer, more surprising story of the US from 2000 to 2020.

Let’s get personal …

States with the highest auto-retail loan delinquency rate among borrowers with a subprime credit score are Alabama (21 percent), South Carolina (20 percent), and Tennessee (18 percent)

And those with the lowest share are North Dakota and Oregon (8 percent), and Maine, Massachusetts, and Nebraska (9 percent)

The social implications are immense. Look at the stats on the left of the screen linked.

https://apps.urban.org/features/debt-interactive-map/?type=auto&variable=autoopen_pct

1) Sub prime borrowers help moving used cars out of the lot.

Without them thing don’t move.

2) A dealerships selling a new car is likely to buy customer old car. They will buy at below wholesale prices and sell at high margin.

3) Used cars profit margin is higher than new cars.

4) Sub prime rate are lower than credit car rates and about equal

to your stock broker rates on medium size account, but higher than prime 5) If sub prime stall, new cars sale will stall.

Really so dang tired of seeing ‘trade optimism’, ‘virus under control optimism’, etc. What a joke. It’s because central banks have, are, and will flood the world with fiat dollars. Claiming all this tangential optimism crap is just another way of fooling people into thinking the fed is just doing business as normal.

Central bankers are the very face of evil on this planet. They will destroy more lives than any dictator ever did.

An automobile is not as much of a requirement or status symbol as it once was. Lose your car – take Uber or a scooter.

True to some extent but in some areas and some older people’s minds if you don’t own a car you are considered a nobody , regardless of your net worth

In most of America having a car is not a choice, it is an economic necessity. We have used a subprime car loan at 24% and were grateful to have been able to get it. The alternative was homelessness, not so funny or caviler. The status for us in having a car was employment, shelter, and survival.

These loans are not used by the idiotic poor, they are used by the down on their luck working and middle class. I truly hope you never have to find this out first hand.

Petunia,

True – but there are still an array of car prices available – especially if used cars are included.

My guess at least is that subprime buyers are using debt to reach for the median new car at 30k (or more) rather than the 6k used car.

I might be wrong, but my sense is that credit is actually much more freely available the more expensive items are (to keep production/sales/fees up).

Used cars can have reliability risks…but I don’t know if they have 24K+ worth.

Cas127,

Our subprime loan was on a used car selling for just under $6k. When you buy used with subprime you are at the mercy of the dealer. You buy what they are willing to sell you. We traded it in a few payments short of paying it off, because it needed expensive work.

Our next car was new and at a better rate, under 10%, but still not the best rate. We bought new because it was cheaper, same payment, no maintenance. Again we were grateful to be able to trade up before it got more expensive. We had income but no savings for repairs.

These are the choices people make when economic hard times impact them. We are not stupid, we make the best choice from among the bad choices available. This is the way the working poor survive. They are kept poor by low wages and predatory lending rates.

Very true.

The best aka minimum rates to borrow money be it for car or for house or for anyone is available only for who needs them the least aka rich people.

“Lose your car – take Uber or a scooter.”

Or mobilate on Shanks Mare, as in my micro-economy.

When I had a cow-calf herd, a mule skinner on the Bright Angel trail off the South rim of the Grand canyon, who owned a cowherd out West, was surprised to learn that I wore a ball cap not a ten-gallon hat and walked up and down my mountainsides to find newborn calves. He rode horseback (flat country …).

I just came from my doctor’s office. There was a long line of Uber and Lyft drivers (customer are old rich to not so rich). Some of the welathy who drove themselves were snoring in their MB and Lexus at the handicapped parking. The funniest scene was this rich old lady who obviously could not drive anymore, so she made her Asian-looking care taker drive her around. We are getting old. Not sure what are car and drivers options will be. But looking around, Uber-type services will be around for a long time.

A lot of older drivers shouldn’t even be on the road Just plain dangerous to themselves and others and that’s coming from another so young driver Wonder how I will feel in a few more years

To take an Uber you need a credit card and a phone.

30% rate on the card.

Paid premium price on the phone to spread it over 2 years.

Might as well buy a car…

There will be one after another of these credit problems as we go forward. Car credit isn’t alone. But total credit is what the stock mkt runs on. And the central banks are not going to allow total credit to contract.

They’re already making plans.

1. They’re going to fight global warming.

2 they’re going to let inflation run hotter ‘for just a little while.’

When cars and homes and credit card debt contracts, the central banks are going to be funding two trillion dollar infrastructure and green energy scam investment.

We have seen the last of total money supply ever contracting again.

Clyde,

Just when everyone thinks it will be impossible for the money supply to contract, it will, and fortunes will be made.

Actually, people tend to forget the Fed is capable of wringing some excess out of the system…witness the 2013 taper tantrum – which whipsawed some who were sure they knew what the Fed was going to do (forever) and when they would do it…

Tthe profit margins an these transactions must be so they huge that

after auction they make a profit.

The cost of the used cars are usually recouped in the first year or two. If the borrowers default, the resale value recouped is usually most to all profit. This is the case with most consumer goods sold at high interest rates.

I know a family who owns a couple of used car dealerships. They have told me they make more money off of the car loans than the actual act of selling a used car.

Wolf, are you considering doing another section of your hawk-o-meter ? To see how dovish or hawkish the fed is based on its comments?

I may not. The Fed now includes in the minutes some discussions of other topics, such as historic stuff, or discussions of the repo policies and T-bill policies, and it uses the words “strong,” “stronger,” and “strongly” (the counters for the Hawk-o-Meter) in different contexts now, rather than just to describe the economy. This is new. This happened in the last minutes. So there was a large number of counters in the text that I had go through and sort out and make judgement calls about. That’s not fun. It’s like they tried to throw a monkey wrench into my Hawk-o-Meter :-]

I just spit my coffee!

“It’s like they tried to throw a monkey wrench into my Hawk-o-Meter :-]”

Smiley noted, but I’ll bet you DID touch a nerve at the fed!

Then do a Fed debt monetization meter – :)

And here I still sit, watching the trees grow on our timber land, increasing in girth and thus in value every year, without regard to “price”, while many of us are agonizing over debt – our own, subprimers, the gov’mits …

RD,

True…but then newspapers cease to exit and fat trees are less in demand…until screwed up Green accounting makes it profitable to sell wood pellets to Germany…

LOL

Yup. But Shanks Mare gets firewood to my Housewarmer.

Seriously, paper, including newsprint, is made from pulpwood, which is made from small diameter trees of little value otherwise. Timber quality trees are more valuable hardwood species, of girth generally 13 inches or more, measured three feet above the ground.

Wood pellets are made from the discarded wood and bark from pulpwood mills and sawmills.

All of this wood varies in price from time to time, but my point is that standing timber doesn’t care.

Reuters) – American households added $193 billion of debt in the fourth quarter, driven by a surge in mortgage loans, and overall debt levels rose to a new record at $14.15 trillion, the Federal Reserve Bank of New York said on Tuesday.

So where are we going? Raoul Pal’s portrayal of the Retirement Crisis is super scary. The demographics argument looks logical.

Iamafan,

Read these two articles and look at all the charts. They also give you debt-to-GDP levels for mortgage debt and non-mortgage consumer debt — and you will get the answer to your question:

On housing debt:

https://wolfstreet.com/2020/02/09/heloc-balances-plunge-to-15-year-low-whats-going-on-here/

On consumer debt other than housing:

https://wolfstreet.com/2020/02/07/the-state-of-the-american-debt-slaves-q4-2019/

Its a bailout culture. The money churns around behind the black curtain. The FED dumps more fuel into the fire. Ultimately the taxpayer foots the bill. Credit Acceptance Corporation Chairman some years ago was betting against his own company in the options market. This company could be in Atlas Shrugged.

We all are aware of “the market pressure” on revenues and in some cases, profits. In an industry awash in production, the main stay of borrowing future sales is rebates, and other incentives. Not so talked about is opening the credit gates, perhaps more effective than rebates as you don’t have to discount price to sell to a non qualified borrower.

When you have reached too far into future sales, a plateau is reached, just when those non qualified credit buyers predictably start to default.

Worked 40 years in the big numbers credit game. Need revenue? Relax credit. Just remember, bad debt always follows a year or two later. Its about the same everywhere.

Subprime is another Buzz for the economy, produces jobs from beginning to end of the process. The FED would be worried if suddenly the subprime population decided it didn’t need the credit.

Powell just said rate suppression is not a choice but a must have policy. Interest rates can’t be raised. He also said he will use QE and other tools aggressively if equity prices don’t keep going up.

I guess that mean bigger debt ratios for those buying cars, maybe.

timbers,

“…he will use QE and other tools aggressively if equity prices don’t keep going up.”

Hahahaha, that’s not what he said. That’s your joke. And it’s funny. He said he will use QE to fight a recession.

Yah I know I improvise but is really such a stretch to say the Fed thinks stock markets ARE the whole economy and nothing but the economy?

“…Powell said Wednesday the central bank would fight the next economic downturn by buying large amounts of government debt”

“Asked what level (U.S. national debt) would be concerning, Powell replied: “I would be concerned now.””

All in the same breath. Uhhmazing!!!

shorter Powell testimony:

you have to be a reality denier to think liquidity will ever contract.

and since more liquidity equal higher asset prices by default,

then………

This isn’t the 1920’s, we are living in the 2020’s and an automobile is no longer a luxury but a basic human right. If someone can’t afford a car they can’t drive to the Taco Bell drive-through and they could starve. This is a serious problem that needs to be addressed by governments and central banks. Cars need to be provided to those in desperate need to avoid the risk of people starving in front of their flat screens watching The Office on Netflix – oh the humanity.

I can’t imagine the suffering of someone in desperate need of Flaming Hot Cheetos with no way to get to the corner shop, the Fed needs to intervene to prevent a humanitarian crisis.

I thought I read we are living in our automobiles.

I wanted to buy a VW California camper van. It was fake news.

Wolf, I have a question. Who is buying these Auto ABS securities, especially the subprime variety? Are the buyers’ crazy?

I understand that some end up in ABS repo.

TINA

Been living under a rock?

Iamafan,

These are structured securities, and investors can choose what tranches (slices) to buy. The higher rated tranches are perceived to be low-risk since the low-rated tranches take the first loss. So if the loan portfolio in the ABS has a loss ratio of 30%, the top tranches might still be unscathed, while the lower ones take some loss and the bottom ones get wiped out. Each tranche has a different yield, so it’s a risk-reward math that investors are doing in deciding which tranche to take.

If there is less demand for these ABS, all it would mean is that yields would have to rise to be attractive.

What is amazing to me is that I have been reporting on this for several years, and the loan defaults just keep getting worse and worse, and yet investors still have the hots for these ABS. This is an example of how central-bank interest-rate-repression policies, if they persist long enough, work their way into the economy and into decision making where a lot of stuff just skewed to where it wouldn’t make sense in normal times.

Both during the subprime mortgage disaster and now, the entities whose behavior is difficult to explain are the investors who snap up the securities based on these subprime loans. Both times it did not take a rocket scientist to see that failure was only a matter of time.

It sure would be nice to find out more about just who is buying these things. My strong opinion: it must be managers of Other People’s Money. Pension funds and such, whose managers have finagled things so their own personal compensation goes up with future paper profits but is magically set free of performance to the downside.

“it must be managers of Other People’s Money”

If you think about it too long and hard, the best candidate for habitually buying the trash tranches is the ultimate manager of Other People’s Money…the Fed.

The rise of tranched, securitized loan packages neatly pre-sorts the worst credit risk to the bottom tranches, ready for purchase by the ultimate risk agnostic buyer – the Fed.

Since the trash tranches make all the safer, higher tranches possible – and, indeed, the original volume/production goosing crap loans from the vendors…whoever buys the trash controls the thermostat of the system (the sort of thing the Fed is into).

And the inevitable huge losses as crap loans default – nobody has as much power to make losses disappear as the Fed, which can simply print to offset.

Costless? No, because immunizing vendor liability on crap loans creates a vendor culture of price inflation in order to make more reimbursed crap loans.

I hope this is not going on sub rosa – but DC has a history of overlooking laws in the name of self-determined “stability”

Wolf, you say

“…customers with this credit rating know that they have few options and don’t negotiate. Often, they might not do the math of what they can realistically afford to pay every month; and why should they if the dealer puts them in a vehicle, and all they have to do is sign the dotted line?”

I thought the much touted “Consumer Protection Bureau” at the Fed was supposed to inform consumers so they know what they’re getting into? Has this entity already become irrelevant?

Not every customer is the same. But there are customers who don’t WANT to know what they’re getting into; they WANT a car. This is fairly common consumer behavior. Many consumers don’t read the disclosures and quite a few don’t do the most basic the math. That’s the same with borrowing on a credit card with 29% interest rate. I have no idea why people do that, but they do!

The trend in that last chart is a problem, steady rise since 2009. We know the recovery is weak, but?? Add higher unemployment numbers you have the recipe for a crash. Easing at the onset of recession tends to be poor economic policy, since it encourages consumers and businesses to accept new debt just before the rug gets pulled out from underneath. If investment leaves the US it gets a lot worse. I would be a lot more worried about the economy if carriers started shutting off customers cell phone service due to non payment.

Micro: my sister’s car blew up a few years ago; she wound up with a 20+% loan from Santander (those “fatherless sons”) . At my advice, she went to local Credit Union & rolled it over into a reasonable rate.

Macro: recently saw some surprising research comparing interest rates across the last 700 years:

https://www.visualcapitalist.com/the-history-of-interest-rates-over-670-years/

https://qz.com/1787281/what-700-years-of-interest-rates-reveal-about-the-global-economy/

The “Current Theories” on the Visual Capitalist site are silly, pertaining only to the last decade or two, not the more interesting very long term.

My theory (or wild guess): accumulation of real capital (productive capacity, including knowledge/technology + physical plant, infrastructure, etc) has increased the total volume of “capital” (money?) immensely across this time-frame, relative to other primary economic factors (static Real Estate, and even Labor Supply?), so the relative price of Capital (interest rates) goes down (supply up, price down).

Anybody here have a better explanation, or refutation of the alleged trend?

Elkern,

While there is some truth to the capital accumulation argument over the long term, if you look at how and when long rates went from 8 pct in the 90’s (with a mostly healthy economy) to 2 pct since 2010 (with a sick economy), the timeline pretty much has the Fed’s fingerprints all over it.

High capital accumulation existed prior to QE, but rates did not drop until post QE.

The Fed simply lowered the cost of borrowing by injecting a sh”t ton of lendable funds.

1) The bank big branch mgr love grandma. She was never so loved

all her whole life.

2) She paid the down payment and 50% of the renovations for her young

son new large house.

3) She also helped to upgrade her two older kids to move to larger place.

4) She co sign her young son new advance computerized machines, so his small can beat the competition.

5) she participate in her granddaughter medical school cost and

support her older grand son who entered a 75K/Y college for the elite.

6) The whole family love grandma, especially her banks officer, because

grandma is a lever to pump his account, squeeze her assets, until she become sub prime.

7) They even allow her to do babysitting.

For years I’ve been hearing about this “crisis” and how any day now bazillions of cars will be repoed and there will be cheap 2 year old luxury cars for sale.

Still waiting…..

Also waiting for that recession everyone promised me in 2018 and 2019.

Don’t worry, everything is going to be fine.

The human condition has been cured by our current financial paradigm.

Based on history and the notion of valuations this is a perfect time to throw caution to the wind and buy all the things.

We are certainly at a permanently high plateau.

Good luck to you sir.

Just Some Random Guy,

You have not read here that this is a “crisis.” I have not once called the subprime auto loan situation a “crisis.” In fact each time that I report on it, I spell out that it will NOT take down the big banks for the reasons I then explain.

But…

“… how any day now bazillions of cars will be repoed.”

Yes, that part has been happening. Some specialized lenders have collapsed. ABS investors are taking losses. Big lenders are taking losses and have been discussing the surge of losses in their quarterly statements. Many people walked out the house in the morning to drive to work or grocery store, only to find that their car had been repoed.

Repo companies and auctions have been very busy. Yes, it’s a good time to buy a used car, to be in the repo business, or in the auction business. There is always another side to everything.

Automakers are seeing their sales decline because they’re losing subprime customers because now they cannot get financed for a new car.

I have been reporting on this for several years, as I pointed out above, and what is amazing to me is that the loan defaults just keep getting worse and worse, and yet investors still have the hots for these ABS.

This is an example of how central-bank interest-rate-repression, if it persists long enough, works its way into the economy and into decision making where a lot of stuff gets skewed to where it wouldn’t make sense in normal times. And I’m starting to think that some of your own thought processes and what you choose to ignore — as revealed in some of your comments — are falling into that category.

Where we have the potential for an earth shaking crisis is China, where 400 million people are in lock down and buying no cars (or much of anything else)

These are good times alright.

Tomorrow the Fed Balance sheet is about the print only 164.4B in repo.

For the week, this is the lowest since September 26, 2019 about the time the “problem” started. I guess the problem is solved.

Meanwhile, the Fed had bought more than $225 billion in T bills?

Mar-Apr-May -June buying left to go.

Wasn’t that the real objective.

Next time don’t bother hide to the truth. Just buy Treasuries directly.

There won’t be a recession. Ever. Not the old fashioned kind.

What will happen eventually is a debt bomb explosion, as the Fed’s “ QE/ZIRP FOREVER” policy keep forcing investors to seek out ever riskier yields until the whole thing blows up.

When that happens, a massive amount of capital will vanish, like magic. No, not really completely disappeared, the Thermodynamic Laws of Conservation of Mass and Energy also apply to finance. This capital was PRE-SPENT, on the current boom times. And what’s left will be a capital void.

The Fed can try to bail this out with MORE QE, ZIRP, NIRP, whatever, but the fundamental problem will be that loss of capital from the debt bomb explosion. The Fed’s tools for money creation don’t go directly to the American consumer or to the service industries that drive the US economy. US GDP will fall

Funding the Federal debt post debt explosion with that loss of capital will be a problem. Nobody with any capital left will want 0.1% yield for long term Treasuries. The Fed will have to do QE FOREVER OUT THE WAZOO to fund the massive Federal debt. This may finally cause the dollar to lose status as a reserve currency, which will likely drive inflation up. Interest rates on long term Treasuries may go up despite ultra low short term rates.

It will be interesting times. Those are just some thoughts on how this will play out

Did you see the 3 & 10 year Treasury auctions yesterday?

The Fed bought more than 30% of notes issued. Of course the yields went down.

What a country?

The yield curve inverted again. Powell is desperate to keep the yield curve un-inverted and stave off a recession by pouring more gasoline on the debt bomb.

That’s the only way to describe it

Gosh darn that pesky yield curve inversion

Gandalf,

Pretty much agree…but the part I find weird is that the long end stays low…

Somehow the Fed keeps losing control of the short end…despite a buying binge of Tbills…while it *has* maintained control of the long end…while letting longer term MBS holdings run off instead of rolling them over.

Short end spikes suggest lenders know risk profiles are crap…but are willing to lend *longer* for *less?”

Weird…unless the Fed is using some super secret Jedi mind control trick on the long end.

(Actually, depressingly, the trick may be that the long end is certain that US NIRP is coming and therefore will accept any gruel, while the short end demands a premia in order to pay for last chopper out…)

I do think that underlying Powell’s desperate tactics is that he wants to push the coming recession/debt bomb explosion past the November elections. That way Trump gets re-elected and can blame the Democrats for not passing his budget for whatever happens afterwards

If the blowup happens before the election, anything can happen. Bernie Sanders could be the next President and the Republicans swept out of Congress, as happened in 2008

Remember, in 2008, things tanked with Lehman crashing two months before the election. That was probably the ONLY reason an African American with a Muslim name got elected President. And that’s also how Obamacare got passed after 60 years of futility at trying to pass a National Healthcare plan in the US

But, doing what he’s doing, Powell is going to make the inevitable debt bomb explosion much much worse. And that will be the final judgement of history

After 20 yrs of this, I would say that 1 more yr will only incrementally worsen the murderous ruin.

And that is assuming that institutionalists at the Fed don’t want to see unpredictable, anti-institutionalist Trump gone.

One unannounced 25 bp hike from now to election day would stand a good chance of taking the mkt and therefore Trump down.

He’ll, Trump knows this – He probably has Rudy working on how to get the WH xeroxes to take green toner…

Fed is probably getting ready to move their balance sheet further out on the curve. The Sept blowup was probably a collateral issue which is why it took so long to fix. Now we wait and see. Has Fed convinced everyone of zero rates forever? Economy robust (agitprop?) and asymmetric rate policy, down but never up, gives risk takers a platform. GDP really does drop and Fed drops rates again. If you are buying the V you see through them as they wish.

Gandalf,

I think you may have hit on it.

1 ZIRP chases capital up the risk ladder

2 ZIRP also destabilizes asset pricing by replacing fundamentals.

3 Periodic asset implosions gnaw away at capital

4 ZIRP forever gnaws away at capital that won’t enter the equity casino.

5 End result – All private capital/savings eroded by ZIRP

6 Rinse Repeat

7 Eventual Keynesian paradise of no private savings to subvert “optimal” recycling of earnings back into immediate consumption/production

8 Masterful technocratic gvt keeps machine running smoothly…

Don’t worry “EVERYTHING IS DULY SECURED”… this message is sponsored by the F.R.S.

Nearly a quarter of all subprime auto loans are 90+ days delinquent. Why?

Predatory lenders entice borrowers who can’t afford the loans but need the money to get by.

Most ‘middle class’ people in the US have depended on credit to maintain a ‘middle class’ status for a hundred years. Now that the greed of the predator class has well-exceeded the ability of the US economy to feed that greed the ‘middle class’ has to be squeezed to prevent it from meltdown, which makes the meltdown inevitable.

More and cheaper credit can’t prevent it, but that’s the only approach to the problem that will be allowed by the predator class, even though it’s self-defeating.

If I were making sub prime loans, and dumping them into the investor market that was insatiable as it still seems to be, I’d still be writing every sub prime loan I could sell.

I’d mix in real “stinkers” with the rest, who’d even know? Does anyone really know what “assets” are in an ABS or is it just the rate of return and hope not to be burned by major defaults?

Unless there is “recourse” those defaults are now someone else’s problem so the loan initiators are insulated from the bad credit losses they create. Is that correct?

Auto dealers make serious money selling attractive cars- and vans- to people that they know can not make the payments for very many months.

They make a copy of the key while they have the vehicle, facilitating an easy repossession. They keep the loan on their books so they can claim the loan default as a tax loss. They then resell the repo car or van to another poor-pay credit history customer, repeating the cycle. They will do this over and over with an attractive car. The math: buy a car for $2K, sell for $5K with easy payments, repo for $2K tax loss on loan, repeat three times and make $8K in tax losses on a $2K purchase. The $8K in “losses” covers the profit from good credit sales.

@Wolf There is something strange with your numbers. In the text you write that 90+ subprime deliquency rate is at 23% but the chart just below has the 60+ rate at a mere 6%. Given that, as you say, it’s a pipeline how do you account for such a vast difference between the 60+ and 90+ figures?

Olivier,

I think you might be getting some numbers mixed up here. And maybe the text isn’t clear enough about it.

22% of the $1.33 trillion in total auto loan balances are subprime = $293 billion. The rest are prime.

That 4.94% in the chart means that 4.94% of total auto loans of $1.33 trillion are delinquent = $66 billion, prime and subprime combined. But since only a minuscule part of prime loans are delinquent, you can round them out of the equation, meaning that nearly all of the $66 billion in delinquent loans are subprime-rated.

That $66 billion in delinquent loans (nearly all subprime) = 23% of the $293 billion in subprime loans outstanding. So about 23% of subprime loans are 90+ days delinquent; and 4.94% of total loans (subprime and prime combined) are delinquent.

The same applies to the Fitch figures for 60+ day delinquencies in its ABS data. That Fitch percentage of 5.83% means that subprime auto loan delinquencies amount to 5.83% of total auto loans in the ABS data.

So Fitch’s 60+ day subprime delinquency rate (5.83% of total loans in the ABS data) is higher than the industry total 90+ day delinquency rate (4.94% of industry total loans). Note that these are two different data sets. But it makes sense that 60+ day delinquencies are higher than 90+ day delinquencies because some of the 60+ day delinquencies are cured before they reach the 90-day stage.

@Wolf, thanks for the explanation. That’s indeed quite confusing. So even in the red and blue chart (NOT the chart above) the % are of total loans rather than of their respective categories? Hard to know since there’s no lo legend for the Y axis…

Yes, all percentages in the charts are of total loans in that data set.

Do you think this could be a big crisis?

Jachu,

Not for the banking system overall. The numbers are not big enough.

But there will be ripples. ABS investors are going to feel it in their pockets, losing money on what they thought were A-rated securities. Lenders are going to face bigger write-offs (already happening). Some additional smaller lenders will collapse. When the subprime ABS circus shuts down, automakers are going to lose those sales, and recent-model used cars are going to lose those sales, so the industry will feel it, and investors will feel it, but it won’t be a global crisis, like the mortgage crisis turned into in 2008.

@Wolf, I was trying to figure out what the 90+ day delinquency rate for prime loans (or non-subprime) is, and the numbers seemed to be funny. the total 90+ delinquent loans (for prime and subprime) are 4.94% of $1.33T is $65.7B. But the subprime alone is already $68B.

What did I miss?

Kai-Ching Lin,

That reference of “$68 billion” under the second chart was typo. It should have been “$66 billion,” as in the first chart and in the first paragraph. Thanks for pointing out the typo.

Maybe we should go back to the old ways. I worked for Chrysler Credit in the 70’s. Worked as a Finance and Ins. Mgr for a Ford Dealer in the 80’s. Managed two finance offices and one Credit union and also owned a used car lot. The way we did it seemed to work pretty good.

I was a field rep with Chrysler. My job was collections and dealer audits. If someone got behind I was knocking on their door. And I don’t mean 90 days. 30 days and that car was gone. It went back to the dealer who paid off Chrysler (called recourse). This made both entities interested in solid deals. We did not hire a Repo man, we was the repo man. You will not sell as many cars, but you won’t have these tremendous losses piling up. Bad credit bought their cars from the local “Note Lot”. Go back to the 4 C’s of credit. Sell only solid deals. We need to slow down and take a deep breath.