Consumer credit rose to 19.3% of GDP, the highest ever.

By Wolf Richter for WOLF STREET.

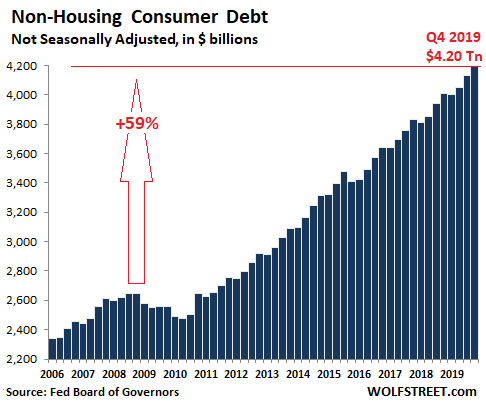

Consumer debt – student loans, auto loans, and revolving credit such as credit cards and personal loans but excluding housing-related debts such as mortgages and HELOCs – jumped by $187 billion in the fourth quarter 2019, compared to a year earlier, or by 4.7%, to a record $4.2 trillion, according to Federal Reserve data released Friday afternoon:

How much did all this borrow-and-spend contribute to GDP?

Almost all non-housing consumer debts translate into consumer spending on goods and services, which is added to GDP. That $187 billion increase in consumer debt in 2019 amounted to nearly a quarter of the $849 billion increase in nominal GDP over the same period.

Without this $187 billion in additional spending funded by $187 billion in additional debt, the US economy would not have grown 2.3% in 2019, but only about 1.8%. This is why economists from the Fed on down want policies that encourage consumers to spend money they don’t have. It’s the American thing to do. And if there’s a hiccup down the road, so be it. And now there are some hiccups.

How heavy is the burden of this consumer debt on consumers? For a substantial part of Americans, there is no burden. They pay off their credit card balances every month, they have no student loans, and if they financed their vehicles it may be through leases that they took out not because that’s the only way they could buy the vehicle but because they saw various advantages in leasing.

Then there is another group of Americans where every month is a mad scramble to make ends meet. Some earn good money but live above their means. Others are scraping by every month on low incomes. Both are up to their ears in debt. They’re one or two paychecks away from defaulting on that debt. That’s where the debt burden is, and that’s where the risks are. But in terms of overall consumer debt, this bifurcation gets averaged out.

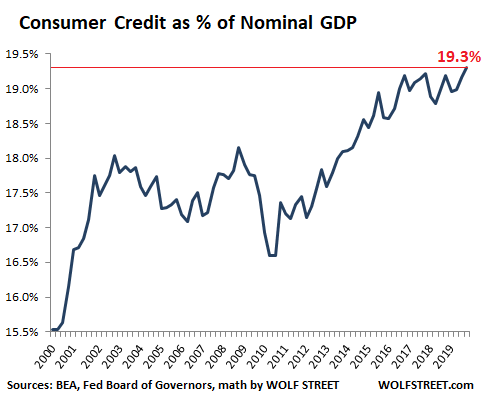

When measured against the size of the US economy, that $4.2 trillion in consumer debt amounts to 19.3% of nominal GDP, the highest ever in the data. Here are the last two decades:

But keep in mind: household mortgage debt, which is not included in consumer credit, amounted to $10.5 trillion in Q4. It had plunged after the Financial Crisis and is now still a tad below where it had been at the peak in 2008, though the population, the economy, the housing stock, and home prices have grown since then. So, unless home prices crater again, Americans are in pretty good shape in terms of housing debt.

The problem is in consumer credit. And the big force behind the surge of consumer credit to 19.3% of GDP aren’t credit cards, as we will see in a moment, but auto loans and particularly student loans.

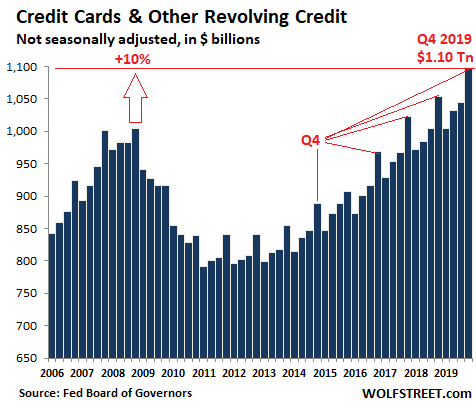

Credit cards and other Revolving credit

Outstanding balances on credit cards and other revolving credit, rose 4.2% year-over-year in Q4, to a record $1.1 trillion. But in overall terms, it amounted to only 5.4% of GDP, a big drop from peak-credit-card-craziness in Q4 2008, when it amounted to 6.9% of GDP.

So when it comes to credit cards, Americans have become more prudent, to the great anguish of our economists and the banks that charge between 8% to 30% interest on those loans. Note the seasonality, induced by holiday-shopping season in Q4 and hangover season in Q1:

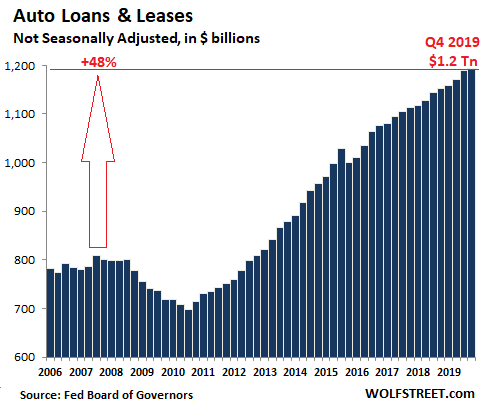

Auto loans and leases – a hiccup for automakers.

Total auto loans and leases outstanding for new and used vehicles in Q4 rose 3.5% year-over-year, to a record of $1.193 trillion. Since the pre-crisis peak in 2008, auto loan balances have soared 48%. In terms of the size of the overall economy, auto-loan balances have ticked up from 5.3% of GDP in Q4 2008 to 5.5% of GDP currently. That was high back then, and it’s even higher now:

Not so ironically, the 3.5% year-over-year increase in auto loan balances occurred despite a 1.2% decline in new-vehicle unit sales. This is the result of higher average transaction prices for new vehicles, rising loan-to-value ratios, and longer average duration of auto loans (therefore slower pay-downs). This debt is getting more difficult to deal with for many consumers, and it’s making it impossible for many to trade and buy a new vehicle, and US automakers and some imports have seen unit sales decline since their peak in 2015, and the industry overall has seen unit sales decline since the industry-peak in 2016.

Student loans – the big hiccup.

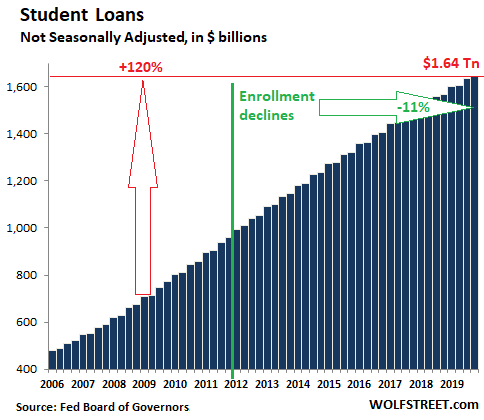

Student-loan balances rose by 4.7% in Q4 compared to a year earlier, or by $74 billion, to $1.64 trillion. Over the past decade, student-loan balances have soared 120%. In terms of the size of the overall economy, student loans have soared from 4.6% of GDP in Q4 2008, to 7.6% of GDP now. This has occurred despite an 11% drop in student enrollment since 2011:

Student loans is where consumers are really strung out. But according to a study by Moody’s, student loan debt is concentrated in a relatively small group of students, including graduate students. According to Moody’s, at the end of 2017, half of the 45 million federal student-loan borrowers owed less than $17,500. All combined, they owed less than $200 billion. This is very manageable debt.

But at the top, 7% of federal student loan borrowers owed over $100,000 each, and these were primarily borrowers with one or more graduate degrees. And that small group of 7% of all borrowers owed $500 billion.

The amount students spent on their education, in terms of the percent of median household income, had soared in the years through 2012 but then hit a ceiling and has since remained roughly flat with median household income, according to Moody’s study. So why did loan balances soar like they did since 2012? Repayments have come to a trickle, with many students not even paying enough to cover interest expenses and their balance have actually risen. Here is my plunge into the screwed-up student loan fiasco. Read… Student Enrollment Dropped 11% Since 2011, Student-Loan Balances Surged 74%. Why?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Depressing. Are we the only people who think there is a debt problem?

And the corona virus better not get here, or were doomed.

It’s a pretty old debate:

The rich rule over the poor, and the borrower is slave to the lender.

— Proverbs 22:7

For the rich men thereof are full of violence, and the inhabitants thereof have spoken lies, and their tongue is deceitful in their mouth.

Micah 6:12

“Religion is regarded by the common people as true, by the wise as false, and by the rulers as useful” -Seneca c 50 AD

Rich rule over the poor? It depends on where you live in the world. The poorest Americans are techincally ruling over the working class in all those cheap labor countries. China is basically America’s Walmart while Malaysia is America’s dumping ground. I wouldn’t say American’s standard of living sucks by any means….that is fact.

The reality is…..dont borrow money you dont have. All this debt….credit cards, auto loans, student loans….this is not a rich vs poor thing. This is clearly a bad decision on a consumer level thing.

Yeah, it is a fact. I wouldn’t say “ruling” but definitely much much better off. So we can afford a Green New Deal with, by world standards, very very minimal individual pain.

So let’s quit all the damned shameless whining and do it!

That’s right. I contend there are no poor people in the USA. Even the most wretched homeless person in the USA has access to services and government materiel that the average east or south-east Asian could only DREAM of. Ditto for Africans. It’s up to them to decide if they want to access it or not.

Sustainable as long as the USD is the world currency.

How long will that continue?

True…However, the crucial topic isn’t poverty, but debt slavery.

Many dignified, honorable humans have lived lives of poverty in material possessions. Both Christianity (classical) and Islam teach that the true riches are those of the inner life…that externals can’t show how wonderful or saintly a person may be…or how happy or peaceful.

But being chattel to the banks. That’s closer to the slavery of the African trade, condoned by both Christianity and Islam. That scarred everybody, including the owners, whose true inner life was so warped and rationalized there’s no telling how decent they might have become without that stigma.

In short, we’re all Sambo now…equal at last, equal at last…thank God Almighty.

USA – United Slavery Amalgamated

Always been that way.

However the above said, nobody forces anybody to get into debt, I always avoided debt, and always paid off any and all loans as quickly as possible.

Anybody that has debt, brings it on to himself, and DEBT is Slavery, make no mistake about this, but its Volunteer Slavery in our system, the beauty is the Slaves think that the Debt “Makes them Free”.

True freedom is having no debt, for instance today if you owe the IRS more than $50k, then they can deny your passport, which means your a prisoner of the USA.

@Deanna Johnston Clark

[skip to the last paragraph if you want…]

Kurt Vonnegut, Slaughterhouse-Five (1969)

“America is the wealthiest nation on Earth, but its people are mainly poor, and poor Americans are urged to hate themselves. To quote the American humorist Kin Hubbard, ‘It ain’t no disgrace to be poor, but it might as well be.’ It is in fact a crime for an American to be poor, even though America is a nation of poor. Every other nation has folk traditions of men who were poor but extremely wise and virtuous, and therefore more estimable than anyone with power and gold. No such tales are told by the American poor. They mock themselves and glorify their betters. The meanest eating or drinking establishment, owned by a man who is himself poor, is very likely to have a sign on its wall asking this cruel question: ‘if you’re so smart, why ain’t you rich?’ There will also be an American flag no larger than a child’s hand – glued to a lollipop stick and flying from the cash register.

Americans, like human beings everywhere, believe many things that are obviously untrue. Their most destructive untruth is that it is very easy for any American to make money. They will not acknowledge how in fact hard money is to come by, and, therefore, those who have no money blame and blame and blame themselves. This inward blame has been a treasure for the rich and powerful, who have had to do less for their poor, publicly and privately, than any other ruling class since, say Napoleonic times. Many novelties have come from America. The most startling of these, a thing without precedent, is a mass of undignified poor. They do not love one another because they do not love themselves.”

― Kurt Vonnegut, Slaughterhouse-Five (1969)

Coronavirus is already here in the US, economically. The press isn’t reporting it.

My wife’s eyelash girl said her glue supply is running out and the stuff is on back order from China. When she runs out, how will she pay her salon rent? Then her personal expenses. Multiply that X10 if the girl was working in China.

I run a landscape company and I buy my workers all new equipment each spring. Toro is changing up the transmission on this year’s 30” model and none of the dealers have been able to get them. I am guessing the new transmissions were supposed to manufactured in China, but that is just a guess.

China just locked down their fifth largest city today… 15 million. This could get ugly, fast. And that’s without the virus showing up in the states.

911 there is some truth in your concern, but people are incredibly adaptable. Ladies in need of pampering will find alternative eyelash glues to use, or invent entirely new forms of pampering!

And I imagine you and your landscape crews will find a way to cut grass even if you can’t get the latest and greatest new mowers.

There may be a lot of impacts like that, but the important stuff will hold together long enough to outlast this thing.

Many will adapt of course, they will be poorer for it however. China is the engine of the world.

Airbus had to close a plant that making six A320-NEO’s per month. This trickles down to GE, which is already suffering from the MAX production halt. I read that Hyundai had to close a plant for lack of parts.

It isn’t just vain women’s eye lashes. It’s the entire economy. The everything bubble could pop because of this. The Off Balance Sheet financing that exists just about everywhere on Wall Street and even with local governments will finally have the light of truth shown on it. I’m buying more gold.

It only takes a plugged $10 fuel filter to put a million-dollar machine out of service. Better hope those filters don’t come from China.

The entire system is extremely brittle. People will come to learn that “Just Ran Out” inventory management may be good for management bonuses, but not so good for the actual economy where the rest of us live.

Wishful thinking.

A number of korean auto manufacturers have already idled their lines because they have run out of components.

If this persists for another 2 or 3 weeks then the auto industry will begin to collapse.

SARS took 6 months to burn out. And SARS was not out of control in China.

Cathay Pacific just suspended half of its flights for a two month period. I suspect most of the remaining flights will be losing money.

Hotels, airlines, and the overall travel industry employs hundreds of millions of people directly/indirectly. They are already cutting staff, or putting them on unpaid leave.

What about all the debt that these companies need to service?

We don’t have to run out of parts and ‘stuff’ to realize a horrific outcome.

If this virus has not peaked out within a month, we may hit the point of no return. There is no way in hell we can hold this together for 6 months or more.

Feb. 10 is when the factory closures from the corona virus in China are supposed to end. We’ll know more then. Based on the growing numbers of infected people and deaths, it does not appear that they caught the infection quickly enough, and I doubt the spread of the virus will be contained by Feb. 10. If they extend the closures, watch out! Especially my favorite Apple stock [sarc].

But if they don’t extend the closures, the virus is likely to keep spreading.

Alernatively, Let’s hope crazy glue does Not stick to eyelids !

‘;0

How is life in LOLLIPOP LAND?

People have no clue what’s coming.

The fragile global economy is not resilient enough to withstand the quarantine measures necessary to slow down a disease that kills so many, everyone in the world will lose at least one person in their life to it.

Americans are blissfully unaware, but the economic waves are coming and they will be felt.

My theory: I think China is declaring economic war on the world. The Coronavirus may be real, it may be fake or it may be worse than what we’re being told. Regardless, China is, for lack of a better word, on strike..They aren’t making our stuff anymore.

It’s not better pay they want. No. They want it all… worlds reserve currency status. I’ve heard on numerous podcasts that their central bank has been buying, literally, tons of gold, and they have been planning a gold backed crypto currency. Instead of being hated vehemently by the world, with Coronavirus, they’ll be the victim, just trying to do what’s best for everyone after economic Armageddon has bankrupted the world.

The Special Purpose Vehicles through out all of corporate America are hiding hundreds of billions, possibly trillions, in Off Balance Sheet financing. Ticking time bombs. And the Chinese are well aware.

Just my theory. Can’t prove any of it. But I am suspicious that all but two deaths are outside China and one is in Hong Kong.

I’m buying gold.

re: “My wife’s eyelash girl said her glue supply is running out …”

Harbor Freight has her covered*

https://www.harborfreight.com/10-piece-high-strength-super-glue-68345.html

Wonder how the nCoV lockdown will affect HF? It’s my go-to for oddball tools I’ll only use once in a while.

All the Harbor-Freight stuff comes from China, from Wuhan ( Chicago of China )

It will not be long before HF run’s out of stock of high turnover items,

Remember everything is now “Just in Time”, my guess is 1-2 months from now and most common items at Harbor Frieght will be gone.

So who gets all the “old” equipment? Landscape workers who don’t like the title of “my”?

I wish it were possible for me to email the author, like on a real news site, instead of just leaving this comment… I think this is an alarmist article, that fails to take into account something major about why student loans are being paid back for more slowly since 2009. 2009 is when very progressive legislation was passed permitting borrowers to make income-based repayments, sometimes as little as $0 per month, with a guarantee of full loan forgiveness after 10 or 25 years. As the article quite rightly points out, most of the student debt is held by people with fancy graduate degrees who, I am very willing to bet since I know so many of them, are making good incomes. The reason folks like that would opt for income-based repayments is, particularly when they have public interest positions where the loans are forgivable after 10 years, it makes more sense to pay as little as possible then to pay them off quickly. That didn’t used to be the case before the 2009 legislation. So, when it says that student loans have added 4.7% of GDP 2 the consumer debt to GDP ratio over the last 10 years, and the overall ratio has gone up by 2.7%, it might actually mean that debt to GDP has fallen by 2%, and as much as the entire rise and student loans is eventually going to be forgiven by the government. Big prediction, I know, but prove to me that I’m wrong.

Richard Stenberg,

Good lordy. I’m the author.

1. “I wish it were possible for me to email the author” – YES you can. On PC/laptop, just go to the “Contact US” tab. On smartphone, go to the hamburger menu at the top left above the logo, and then choose “Contact us.” Email address is right there.

If you had contacted me by email, I would have told you to post your complaint in the comments for all to read, and for me to respond to publicly. That’s the only way you get a substantive answer out of me.

2. You see, we agree on the slow repayment part. I encourage you to read the article in its entirety and click on the link at the bottom of the article. In both, I explain that much of the student loan fiasco is due to SLOW REPAYMENTS. This is what I said in the article. Make sure you click on the link at the bottom for my full report on it and all the details and numbers:

“The amount students spent on their education, in terms of the percent of median household income, had soared in the years through 2012 but then hit a ceiling and has since remained roughly flat with median household income, according to Moody’s study. So why did loan balances soar like they did since 2012? Repayments have come to a trickle, with many students not even paying enough to cover interest expenses and their balance have actually risen. Here is my plunge into the screwed-up student loan fiasco. Read… Student Enrollment Dropped 11% Since 2011, Student-Loan Balances Surged 74%. Why?

In case you didn’t click on the link, here is my report on the slow repayment issue:

https://wolfstreet.com/2020/01/30/whats-behind-the-screwed-up-student-loan-fiasco/

Student loans now amount to 7.4% of GDP (chart below). We’ll have to see what part of this will be forgiven. My vote goes to zero forgiveness, because one person’s debt is another person’s asset. People have to get a grip on that. Debt forgiveness means the other person’s asset gets destroyed.

In this case, the asset belongs to the taxpayer, namely me, and the government funded this $1.6 trillion in student loans by issuing $1.6 trillion in Treasury debt, on which taxpayers are now paying the interest. Debt forgiveness means that the asset got destroyed, but the liability (Treasury debt) that funded that assets, is still burdening the taxpayer.

Student loan forgiveness is one of the unfairest deals in the world, punishing the prudent and enriching the splurgers, while destroying the taxpayers’ assets.

I would be more flexible in allowing student loans to be treated in bankruptcy court like other consumer debts, where a judge decides what a consumer can pay every month, and that’s what the consumer HAS to pay every month under court order. Since bankruptcy reform of 2005, consumer debts don’t just get wiped clean in court. The judge decides what you can pay, and if you earn a lot of money, you can make big monthly payments on your debts.

I mentioned this some two weeks ago on this forum, and most of the time the posts got deleted, cuz it was a message that nobody wanted to hear.

The fact is Alibaba who does all the fulfillment is done from Wuhan, and this thing started in Mid January, that’s almost a month ago, since then all order’s here in ASIA, have ground to a halt, makes sense some 6 weeks on average in USA, all Chinese stuff will grind to a halt.

I quit ordering from China a month ago, but now the stocks in my country are running low, so here too soon common items like carb-rebuild kits for Stihl chainsaws will not be available, stock up, with any known local supplier if you can, because the Chinese stuff is coming to a halt, and when it opens again, how in the hell are they going to fumigate all the incoming? Knowing full well that everything&anything could have been packed by a Wuhan host.

Common timers for irrigation are now “out of stock” a critical thing for farming, prices have gone through the roof I’m seeing 10x for what remains of stock.

Trump’s China Shutdown,

“I mentioned this some two weeks ago on this forum, and most of the time the posts got deleted,…”

You’re posting under different aliases each time. For example, under this article you posted under seven different aliases and with seven different emails, thinking that I can’t figure this out. So I unblock the least toxic of your comments. And some comments are good, and they’re welcome. You’re posting from Thailand, so your anti-American stuff is going to get looked at carefully before it passes, if it passes.

TRUMPS CHINA SHUTDOWN : My first company I started was designing and building timers and definite purpose control devices . That business was killed off by ISO 9000 . ISO 9000 purpose was to kill “consolidate” fragmented vendors ,like me, either by acquisition or “QUALITY CONTROL” . If you were large enough to go to China and hand them your art and knowledge at %51 , you were in the club . I still have the same business but more diverse ,with NO DEBT, I can , along with hundreds of companies in the US make all the timers and more , that we need. China will fail in transitioning to being the middleman between cheaper labor , such as Vietnam , and our domestic market . Americas sensibilities have not been aroused.Fortunately China’s standard of living has increased to the point it’s becoming a factor , not the sole factor,but a factor. If China and their Corporate Washington DC agents falter for any reason armies of little piss ants like me will pick their bones ,ergo timers .We have absorbed body blows and round houses to the head and we are still standing. The corona virus may be one of the multiplicity of things the old dead white guy from Edinburg called the Silent Hand of the marketplace.

The largest student loans are just over $1 million for an individual.

This is like Black Comedy.

The Consumers are in the hole with debt which can never be repaid.

The banks have to find ways to keep the American Consumer consuming even if most consumers are broke.

This is because if the under water consumer can’t get credit he can’t pay for retail consumer goods.

Retail consumer goods he must consume to keep an economy based on.Consumerism alive

(71%+of total economy).

And if the consumer can’t consume enough,while being broke,

the whole economy will crash & if the American economy crashes,the whole Global Economy will also crash.

And this all depends upon impoverished & almost out of credit consumers who don’t know that they are all that is holding the world up,…..And probably wouldn’t care if they did know!

“We”???? The “doomed” folks include (as always) mostly older folks like you and me, with aged immune systems, and those on the ragged edge of malnutrition or other serious body stresses. Better skip that Mediterranean cruise, those things seem as bad as care homes, and avoid stressful financial bets, too. Every little bit helps.

Yes, I would say we are the last holdouts who still believe economic fundamentals should rule the day. Why should there be consequences when, deus ex machina, every bad actor can be bailed out for the good of economic system (socialism).

People went crazy speculating in the housing market and the Fed bailed them out by lowering their interest rate (by fiat) from 7% to 3.5%. People have gone crazy consuming beyond their means. I expect the Fed will once again bail out these same individuals by lowering their credit card interest rates from 20% to 3%. At 3% suddenly all that debt is not so onerous.

But hold on, you say, it’s illegal for the Fed to buy credit card debt, to which I say it’s illegal for the Fed to own mortgage debt. Laws only matter when they are enforced.

Know anyone who has been given a ticket for violating the speed limit by 10+ mph in the last ten years? The only laws that matter are the ones we CHOOSE to enforce and we have chosen to grant the Fed extra-legal authority, they have the authority to bail out any group they deem to be a systemic threat no matter how irresponsible they have behaved. Turns out moral hazard is good for the economy, just ask Jerome.

There will be a bailout (a Fed bailout) of credit card debt and student debt. It is on the way – invest accordingly.

Money is tools.

And, it is not made for fools.

Today’s most common example is Car or Truck Rentals.

Money is not to be buried.

Is that what is said, You Can Not Take It With You.

American debt slaves keeping the economy from sinking into depression. Absolutely pathetic. There is no money in the economy, only credit and debt. How can you have real prosperity in this system? Everything is a veneer of well being. Scratch the surface and all you find is rot. When 90% of your population can’t rub two pennies together, how robust is the health of your nation? George Carlin said it best, “It’s called the American Dream because you have to be asleep to believe it.”

George said ALOT of things best

GOAT

He told the truth people spend their whole lives trying to avert their eyes from.

Isn’t all U.S. money debt anyways. On the dollar bill it reads, “Federal Reserve Note.”

I think that the secret plan in Washington is to siphon financial sustenance out of the rest of the world!

The rest of the world has no choice because they need to export products to live.

And the American Mass Volume Consumer Market is the last market of it’s kind still operating.

The secret, that was no secret, was to move the wealth of the west to the far East. It’s been happening under our noses for 50 years, planned for longer.

Washington had no power to change the plan, it came from much higher up. These are the finishing touches. It isn’t the fault of the Chinese people. It’s just that they had no cranky middle class to hang on to guns and a constitution and other inconveniences.

We look like idiots in our slave made Nukes and tee shirts, waving guns and claiming we love freedom….

George Carlin said it best, “It’s called the American Dream because you have to be asleep to believe it.”

That’s pretty good!

This is an excellent article; thank you. The charts tell a story of impending ruin during the next recession for many Americans.

Wolf,

Yes, excellent charts and ratios – having a bit of a handle on the macro measures gives us a sense of where the wheels are likely to come off first and which counter productive steps the Fed’s are likely to take next…

So, a year or so ago, outside the coffee shop (last private owned one in large area) that friends and I meet at, I met a kid who almost finished his BA or BS (mostly on loans). He didn’t know if he got the job (start at $8, go to $10 quick if owner thinks you are good plus good tips) and was debating whether or not to go to grad school. I told him if it were me today I would go as far as I could, they can never take knowledge from you.

I told him he didn’t have the good deal I had, and likely never would,

and paying for an educated workforce is some rich bean counting bastards problem.

I meant it all.

About time for a huge reset & that reset will scalp the financial sector.

The Billionaires will lose,but they will survive very well with the $billions they will still have after the hammer falls.

The working middle class won’t lose much more than they have already lost,& will squeak by with government assistance.

The poor won’t lose because they have nothing to lose & will also be wards of the state.

The People who will take the Deep Haircut are the

Nuveau Riche who are underwater with debt & loaded with leveraged & vanishing paper assets.

I guess the remaining 80% of GDP is military industrial complex spending.

Look over the various charts:

https://www.google.com/search?q=federal+budget+pie+charts

Meanwhile, Fidelity has client assets of over $7 trillion, Blackrock is not far behind with $6.5 trillion, Vanguard with $5 trillion. Those 3 together hold $18.5 trillion in customer assets.

And i have not even included Schwab, Merrill, UBS, TD Ameritrade, Pimco, Allianz, Goldman, etc..

Some of those assets are mine. But I’m not sure what that has to do with student loans and auto loans.

OMG, you have assets in places like Fidelity???? You are part of the 1%, you are the problem, WOLF. you should contribute more to taxes and not be such a mooch on the backs of the hard working immigrants who can’t afford health care because you are getting rich off of wall street.

You should vote for me to take away your money and redistribute it to the masses.

Don’t hate the playa, hate the game.

You should vote for me to take away your money and redistribute it to the masses.

Contrasted with the present system, where it is taken from the masses and redistributed to you.

@unamused

Exactly, this is the reason why people with money in Fidelity, Schwab, etc, must be punished. How dare they make money by leveraging the capital they already have.

Can we get a 99% tax on their sales… not their gain, but proceeds from sales. We have to raise the funds to forgive student debt somehow.

You’re just angry because you have over $50 million in assets. I’d be angry too if I had that much, especially if I’d worked for it. Might as well stop working MCH, afterall by the time you’ve saved that much, it’s hard to spend it all before you keel over.

@Rhodium,

Wish I had 1/50th of that as a part of my net worth. That isn’t the point though. I can understand how the middle class is getting ripped off by the corporations, but I just don’t think that free stuff Is the right way to go.

Seriously, someone has to pay for all of that stuff, and if anyone thinks the 1% is going to foot the bill, I have a bridge or two I would like to sell them.

In fact the policies enacted in CA for example is written as if they are for the masses, but in fact only favored the 1%, think the EV tax credit when that was rolled out, was your average middle income family likely to buy a Model S? How about our wonderfully environmentally friendly gas tax increase, does anyone in their right mind thinks that it squeezes anyone other than the working schmucks who has to commute from Tracy into the Bay Area?

It is only called progressive policy because in reality, it progressively screws over the working and the middle class.

I turned off the tv. I want to hear real solutions. Give this, give that. No I want to hear work for this and that.

“Ask not what your country can do for you. Ask what you can do for your country”

Newly discovered 1960s nazee propaganda. Most likely a closet T rump supporter.

That damned person was also a sexual predator, a big no no, if he were alive today, he would be disowned by the party. And branded

But while I am at it, give me this and give me that. I am going to teach my kid the way to get ahead is to whine and complain about everything and wait for handouts, cause why not. And oddly, it seems to work well for the politicians want our votes, and votes need bribes to work.

Hmmm, that’s actually not a bad idea, cut the kid off, let the kid borrow a ton of money, student loan debt, the go through bankruptcy to discharge the debt.

And here’s 2banana right on queue, making it political. Good job 2banana.

It takes a special kind of fool to believe that one party is more or less guilty of government handouts than the other. The only difference is to whom the handout is given.

You are absolutely right. And then you can chose between tax and spend govt policy and borrow and spend govt policy. Though it appears tax and spend is dead for the foreseeable future.

The (partial) solution is pretty obvious to those of us who are informed.

Student loans need to be once again classified as ordinary debt, as in credit cared debt or other dischargeable debt. That horrible law passed in 2005(?) must be abolished.

While we technically statistically have a “bankruptcy” process for student debe, it is not a process that “works” in the sense it allow people to discharge debt in a reasonable way.

Ergo, we do not really have a “process” regarding student debt forgiveness.

While Wolf has been extraordinary providing factual data in a statistical sense, he seems to be looking at the tree in the forest by avoiding the essential difference in student debt vs other debt.

Student debt is not an acceptable process, because is overly burdensome to discharge and the lenders are provided government subsidies to over lend and engage in fraudulent lending.

I have read Wolf’s articles on student debt, and noticed he almost always misses this very important fact.

Note: this is a partial solution, because it is not the total solution. Another part of the solution, is for the Fed to raise interest rates.

All most all student loans now are issued by DoE, the federal government. Private sector merely administers them with a few companies who are connected to DoE.

Student loans are non discharge unless you meet a high legal standard. Amount of people who were able to do it number in thousands if not hundreds.

There is a favorable program called PLSF which allows qualified gov and non profit employees to discharge debt after 10 years with out a tax on forgiven debt. Aimed at teacher etc, abused by lawyers and possibility doctors.

The rest can discharge after 20 or 25 years with a tax event for the balance discharged. Colloquially called the tax bomb.

Student loan rates are in 4.5-7% rage and were higher prior to 2015. This arrangement was profitable until recently with DoE taking 50b profit in a year. However, we reached a tipping point it seems since about half the people don’t pay enough to lower their balances.

This is a bit off-topic, but I remember when ‘student debt’ was very rare. I could earn enough working in summers on a general labor crew to cover tuition at one of the most expensive ‘institutes of technology’ in the country. In graduate school, I had ‘free tuition’ and got paid on top of that (student assistantship) so I covered both tuition and (rather primitive) room and board in the late 1960’s.

How could this be? Well, back then the country viewed investing in educated people as being similar to investing in infrastructure, like roads and bridges. Today, as Northern Europe adopts this model, the US fails to even fill the potholes.

All most all student loans now are issued by DoE, the federal government. Private sector merely administers them with a few companies who are connected to DoE.

Because nothing can happen unless tycoons get a thick percentage and send the proceeds to the Caymans. Because they earned it.

Unfortunately, the present regime, especially in D of non-Edu.- which probably doesn’t exist at all anymore has pretty much used every trick in the book to deny, and circumvent all contract standards for the people who thought they had a forgiven debt. Most are NOT being honored for numerous trumped up denial factors, (fabricated ???). Deny, Deny, Deny is being maximized beyond any extents of any laws.

timbers,

“Student loans need to be once again classified as ordinary debt, as in credit cared debt or other dischargeable debt. That horrible law passed in 2005(?) must be abolished.”

But wait… student loans are NOT ordinary debt. Students have no assets and no income; they don’t qualify for “ordinary debt.” So there is a guarantor and lender, namely the US government, namely me (Joe-six-pack taxpayer who paid off his own student loans), and that changes the entire equation.

But even if you allowed student loans to be dealt with in bankruptcy court, borrowers would still face those loans: in the reformed bankruptcy code, consumer loans don’t just get discharged. The judge decides what you are able to pay per month for X many years, and that’s what you pay under court order. This idea that you can slough off all your debts died in 2005 with the reform of the bankruptcy code.

Wolf,

And don’t forget the standard lecture that student debts are somebody else’s asset – write them off and you are stealing somebody else’s money (not the corrupt colleges, they are the crooked bookies in the middle who get their money upfront).

And those defrauded loan holders – they include government worker pension funds…who tax the taxpayers (again) for shortfalls.

DC has really spent decades convincing too many Americans that it is some kind of magic money fairy that can forgive all sins costlessly – while imposing the true cost via some private sector patsy that can be vilified.

As has been said of Hollywood – DC talks like hippies and acts like gangsters.

student debts are somebody else’s asset – write them off and you are stealing somebody else’s money

US higher education worked pretty well, and without crushing debt, until the financiers discovered they could turn it into an enormous profit center.

That’s what’s changed.

The purpose of the US higher education system is no longer to provide education, any more than the purpose of the US medical industry is to provide medical services, or the purpose of the MIC is to protect the country. All have been reorganised into wealth extraction mechanisms, and nothing happens any more unless it feeds the avarice of the billionaire class.

We don’t charge kids $100k for kindergarten.

We don’t charge kids $100k to learn how to write and do arithmetic in grade school.

We also shouldn’t be charging $100k for people to learn to be doctors, nurses, computer programmers, or statisticians.

Taxpayer fund state unis like we used to in the 50s and abolish student debt.

This isn’t hard. Return America to the economic deal we had in the 50s before the billionaires corrupted everything for tax cuts.

Why do people leave out the entities that are actually *charging* the tuitions that have inflated relentlessly for decades – the schools.

As with doctors, they are not some innocent bystanders to ruin – they are a primary cause of it.

And yet they get a pass.

Financiers may facilitate and amplify debt – Ivory Tower hypocrites and Medical Industrial Complex phonies originate it.

Whoa, A.

You just gave the game away. Give it a few months and the leverage buyout crowd will be securing the relevant legislation from their friendly politicians, to give them the universal monopoly on primary schooling. Or, as it will be called, providing the choice services to the youngest consumers echelon.

In due course, the young consumers will also be given access to body-organs exchange, a choice of supplies of heroin (afghani at a premium price to turkish) and so on.

The juicy target kid consumers are already well hooked on phone-app gambling, brain-ruining reality TV and all other humanity destroying methods of racking up the God GDP.

Just eliminate student loans and watch tuition fall like a rock.

Why complicate things?

rediculous, you signed an agreement to get a loan to fund your college, which when completed puts you in front of the crowd on all job listings, even though you could still be a college dunce graduate. No one is going to pay for someone’s choice to go to college. If any student debt is wiped out expect a civil war, everyone could have decided to do the same but the prudent saved for their kids college while sacrificing.

If you wipe out student loan debt, then college degree is no better than a hs diploma and you will have to change all job descriptions to no college degree required….and pay me back 50K

we have become a nation of whiners and free loaders.

If you take your parent’s money to go to college are you a freeloader?

My parents put me (back) in college in my mid-twenties. I told my father I felt kinda funny being supported by my parents when I was nearing 30; my dad–a JC teacher and career counselor–said “I’d rather support you now than when you’re 40.” That worked.

The problem that nobody is talking about is ROI

Sure ‘if’ a kid can become a doc say six years $100k, but make $300k/year, then he should be able to pay off the first 5 years of employ.

But the problem is most of these BS degrees, don’t qualify for any kind of job, so the kid graduates and drive for UBER, and make enough to eat,sleep; But certainly nothing left over to garnish.

Then there are vested interests private prisons, that wish to fill their prisons with young educated kids to work as ‘call center’ rep’s for Amazon.

The real choice here is the ROI, the kid should be smart enough, not to go to college, if he can’t pay off the loan. But our society say’s “You Must Go to College”, and these day’s as we all know, College has become a joke.

They’re now saying that the majority of all STEM kids in the USA are ASIAN, that’s a big part of why there is no ROI, as non-ASIA have no interest in STEM pre-college, which of course makes them major in non-employable majors.

The only real choice for kids is Military, or if they got rich parents, then get the free ride. There was a day, say pre 1950’s that nobody went to college, unless they won the birth lotto; it was only post ww2 that created the mil-scholarship, which flooded the colleges, then 1960’s the Great-Society offered cheap UNIV study, but I fondly remember my first day in UNIV the President of the School told us “They only reason your here, is to keep you out of the job market”, so there you go the entire narrative for the past 50 years of “Must Go to College” was low-unemployment, but now there no good paying jobs, and of course the colleges go greedy, because they could.

What if a partial solution was to restrict school access to loans for students based on outcomes? Put the school on the hook if the degree doesn’t meet an average return necessary to payback the loan. The school have leveraged the taxpayer to line their pockets via the students, THAT is the issue.

^ Yep, been thinking that for a while now. Seems pretty obvious but of course then Somebody would have to take responsibility for providing an actually useful education.

College advisors, in my indirect experience, also provide bad advice which appears to just be efforts to pad the length of time in college thus raising the ‘take’ on the student.

This very idea was starting to get put into law and enforced under the Obama administration. The current administration rolled all of that back.

Ah yesss, and just who had a big, honkin, lead gauntlet weighting down the scales on That preciously sweet piece of Legistlation ??

‘Anyone .. Bueller, Bueller, Bueller ? ..

Ok, You there ! .. rubbing the TA’s shoulders …..’

Student loans are measuring sticks,,, you make sure your first job out of college pays 2x’s + annually than you paid for the entire education… Ie,, spend $50k on college over 4 years,. You better land $100k job or you just finished adult daycare. Same math ratio when buying a house,, dont spend more than 2x’s annual income (of 1 person not both).

+++++ That $187 billion increase in consumer debt in 2019 amounted to nearly a quarter of the $849 billion increase in nominal GDP over the same period.++++

I would argue that the $187B may have created all of the GDP growth. When someone borrows to spend, for example, dining out, that money gets spent again by the restaurant. They pay the employees, the food distributers, the list goes on. The employees spend their money, the food distributors pay their employees, etc. The dollars keep getting recycled. And I don’t think anyone really knows how GDP is calculated.

Don’t forget the billions printed and spent by FedGov. Although some of that may have gone overseas via the Department of Overseas Wars, to boost another nation’s GDP…

Bombing another country back to the Stone Age does not actually boost their GDP because wrecked schools and hospitals are not really economic assets any more than hordes of maimed refugees constitute a productive work force. But it does keep the executive bonuses coming.

We haven’t “bombed someone back to the Stone age” since WW2, Korea, Vietnam, Afghanistan, etc were not advanced economies, and our more recent wars have generated economic opportunities for base builders and such in Iraq and Afghanistan. It’s pretty hard to argue that US involvement in Iraq and Afghanistan haven’t been a net boon to those countries.

But for the US taxpayer a bottomless pit with no benefit.

It’s pretty hard to argue that US involvement in Iraq and Afghanistan haven’t been a net boon to those countries.

You’re kidding, right? Tell it to the victims. Tens of millions of them. While you’re at it, let the Iraqis know the WMD excuse was phony and that even Greenspan admitted the conquest of Iraq was for its oil, and that the conquest of Afghanistan has also been exposed as based on imperial lies and motivated by profit.

Every war criminal knows you have to destroy a country in order to save it.

Unamused,

1. Afghanistan has not been conquered – it’s just the latest US tar baby.

2. There was a reason to go into Afghanistan initially, to drive out Al Qaeda and get bin Laden (remember 9-11?), but he escaped to Pakistan, where he was finally offed.

3. Getting out of Afghanistan does seem to be a good idea except it may devolve into another ISIS crisis if it isn’t somehow stabilized before we leave.

4. Nobody knows the right answer to Afghanistan now.

our more recent wars have generated economic opportunities for base builders and such in Iraq and Afghanistan.

Which benefits base-building corporations, not Iraqis or Afghans. Since they can’t be trusted your base-builders have to import cheap foreign labor from India.

But for the US taxpayer a bottomless pit with no benefit.

And yet, even you promote imperial base-building in the conquered territories. Spare me your crococile tears.

That’s a good point, Wisdom. If the Federal Government added ~$1 Trillion in deficit spending, how did GDP increase by a lower amount? Did the Social Security checks not get spent into the economy?

The GDP calculation is flawed. Like the story where two friends, exchange 1 dollar between each other, both of them has the same amount of money. However, they exchanged 100 times. Then GDP is $100.

HappyOne:

“It’s pretty hard to argue that US involvement in Iraq and Afghanistan haven’t been a net boon to those countries.”

Awfull!

Tell that to the maimed, ruined, crushed, and the dead.

GDP is more a measure of “activity” than it is a measure of increased wealth.

Any counterproductive policy or gvt spending will be counted as an increase in GDP – regardless if it is likely to result in a multiplied decline in GDP in the future.

DC could pay the unemployed to burn down every structure in the US…and GDP would increase by that amount – and be doubled when the structures are rebuilt.

Keynes knew this (and preferred it to “stasis”/”suboptimal” “growth”) – he used the example of digging and filling in holes.

But in doing so he really just put an intellectual

veneerr on the fiscal (and other) totalitarian instincts of the kind of people attracted to “government”

Cas127,

You impress me as being very intelligent. So, I’m puzzled why you’re railing against “government”. If you consider that any complex human system has it’s overlords: professional sports, religion, education, military, etc., you might recognize that at some level of development, a “ruling class” will appear.

Religion isn’t to serve the laity, it’s designed for the clergy. The educational system most benefits the administrators and, for a few, the executive class, not the masses The government is now serving corporations, not the citizenry. The military serves the high command and corporations that turn the gears, not the guys in the trenches. Pro-sports teams have nothing to do with the local athletes or the local fans, they exist for the owners.

These levels within systems are inevitable. All we can hope to do is control corruption. That requires vigilance and energy. But, as systems get more complex, they metastasize. It’s inevitable.

But your ranting and railing is misplaced (unless you’re trolling). Why not stop choosing a straw man to flail? It’ll be better if we blew the whistle on corruption – truly a growth industry If government were to be destroyed, what do you think would fill the vacuum? Invisible hands?

The polarization of America isn’t about who’s right or wrong. It’s about distraction.

You make good points about “government” and other organisational entities that society needs. BUT once the people’s representatives are able to grow personally rich via their relationships with these entities then it all breaks down. Notice how everyone of these pigs in Washington retire INCREDIBLY rich. I don’t have an issue with corporations as they function properly, it is the political hacks who screw us.

“All we can hope to do is control corruption.”

There is a point at which the political system becomes an *engine* for corruption well beyond any real world role (vs. empty talk) the gvt has in *preventing* corruption.

A strong case can be made that that point was passed decades ago.

I’m not advocating for the abolition of gvt – I am urging that everyone examine very closely the actual operational results of gvt (vs. the ultimately meaningless promises that politicians habitually excrete).

I would argue that by attempting to do much, much less (most of which it is failing at/making worse anyway) the gvt could actually accomplish more.

But there is a very real political class of 5 to 10 million that feeds off of taxes and power and stands in the way (to the death) of effective reform – bc it would reduce their money/power.

To illustrate – Maryland has the highest per capita number of millionaires in the ctry (higher than NY, CA, CT, HA, etc) – do you think it is bc of the f*cking crab cake industry?

Or because there is an entire political class economy that survives and thrives in the suburban beltway around DC?

The same exists – on a smaller scale – in every state capital.

And the public sector unions (numbering in the millions, among the last large unions) are the foot soldier army of this pro-status quo political class.

The graphs seem to indicate that the policies of the central banksters really started gaining traction around 2011. The effect seems quite pronounced in the graphs. Seems that maybe people were expecting the 2008/9 “policies” to be wound back up until 2011 when it became obvious that the criminals had no intention of turning off the tap. Seems like all the major philosophies (fascism, religion, communism, democracy, capitalism) have now died, some having achieved zombie status. A good war or pandemic should finnish it all up very nicely.

Debt is a tool of the Devil, and debt slavery is a result.

Debt is my terror. My wife says that I need treatment. Won’t work , I am terminal.

Meanwhile in Australia, the only debt young people want is a mortgage: https://www.theage.com.au/business/banking-and-finance/credit-cards-are-for-seniors-cba-steps-up-battle-for-millennials-20200206-p53ya0.html

I can’t understand ‘Muricans when it comes to this. Your capacity to take on more and more credit card debt is dumbfounding.

I’m American and the only debt I’ve ever had is mortgage debt and building loans for speculative housing Never had credit card, student or auto loans but evidently I’m the exception

I’m American. I’ve had mortgage debt, and business equipment debt.

Only reason for the business debt…it has been over 14 yrs since

I’ve been asked to pay over 0% for the loan on heavy machinery.

My children are in there 20’s. They both earn more than their parents.

Have mortgage payments, and that’s it. They are not unusual. They were taught by their parents.

Very similar experience in our family, only we are a generation farther along in life. We can say it continues to work, if you stick to the program.

From Tom to Dr Doom, and comments in between.

I applaud your common sense. Sometimes debt in modest amounts for a directed purpose is wise, but as a lifestyle?

I think the following quote and link is a logical off topic addition to your comments and poses one question. If you have large amounts of debt, what happens to you resiliency and ability to survive unforseen circumstances?

“SARS sickened 8,098 people and killed 774 before it was contained. The new coronavirus, which originated in the central Chinese city of Wuhan, has already killed more than 700 people and infected over 34,400 across 25 countries and territories. Chinese officials have locked down Wuhan and several other cities, but the virus continues to spread.”

I don’t usually look at a CNN business article with very many expectations, but this one made me sit up and notice. This week Wolf asked if this virus was the Black Swan? When you look at the numbers and see CNN is asking the same thing…..the cheerleader in chief for the oligarchs, maybe it is time to for folks to sit up and lose some complacency? Especially, those in debt and living pay cheque to pay cheque, or below.

https://www.cnn.com/2020/02/08/business/coronavirus-global-economy/index.html

I think, as well as most of Wolf’s readers, that taking on more and credit card debt is not the best idea. However, most U.S. citizens disagree and that is what is keeping this economy going. If history is any guide this will not change anytime soon.

Is there any separate data for ‘medical debt’? I don’t doubt there is a lot of unnecessary ‘consumption’ but medical insurance isn’t what it was before Obamacare. In my pre Medicare days I spent 23 days in hospital. Cost to me- $450. Actually it was $500 but the kid from the hospital finance department offered me a $50 discount if I paid in full on the first day. My employer provided insurance paid the rest.

I gather patient out of pocket costs would be 10 times that today. In my most recent experience I spent 1 day in hospital and with Medicare and Medicare supplemental insurance and the hospital still managed to bill me $798!

You are underestimating the actual bill by an order of magnitude, a typical 20 day hospital stay now, with a few ICU days and maybe a procedure or two, would easily be a 200K total bill in most health systems. The bill for an ER visit can be 10K by itself, and even one surgery will be 20K minimum.

my friend who recently passed had a million dollar surgery that gave him about 3 more years…..

The billed price and the actual cost to the provider are entirely separate numbers.

And the value to the patient may be a third as well.

No surgery is a million dollars, you would be surprised at how reasonable the surgeons and support staff fees are. The average heart surgery and recovery is between 150 and 200 grand. Now extended cancer care gets expensive but that is outside of any surgery.

My son’s visit to the ER was $1500, that was the reduced amount due to insurance, and not covered because of the high deductible. Then there was the surprise bill from the doctor for $800, that was also the reduced amount due to insurance. Medical care in America is a scam.

I’m a republican and support universal health insurance. Don’t tell me to become a democrat, I was one, they had multiple chances to do something about the healthcare mess and never did. They never will.

I want to thank all the doctors and nurses and technicians who kept me alive and nurtured me back to a functioning human being after a massive head bleed (stroke) in 2018. Lucky for me, Obamacare paid for that and I didn’t have to go bankrupt.

A few months ago I collapsed and EMS took me to the emergency room. The crew remembered me as the man with the head bleed who survived. Since I was knocked out cold and luckily did not hit my head, they observed me for a night. Came out ok. Bill to Medicare, almost 20k.

So please don’t tell me Obamacare and Medicare doesn’t work as I am living proof it does. By the way, I did vote for the current guy so now I am very confused. I hope we fix the medical care issue without hate and greed. Thank you and please take care of yourself and others. Oops this was supposed to about credit card debt.

Iamafan,

Thanks for sharing your real-life story to make a point about Obamacare and Medicare.

Wouldn’t M4A reduce corporate and small business overhead in that they wouldn’t need to pay for their employee’s insurance? I would think republicans would be all for it.

The medical care system “works” in the sense that good care is almost received.

Note that it is not legal to deny medical care in emergency situations, so people get care. Also “standard of care” is required to be rendered (depends on certain variables).

Everybody in the US is “insured in a de facto sense”.

Medicare was instituted as part of the Social Security law to reduce the problem of high poverty rates in the elder population. It has “worked” to do that.

The issue is that none of this is free. A system that is actuarially unsound “does not work” (in the long run).

The solution to every problem can’t be a government takeover of the delivery of that economic good, unless we want a socialist economy.

The health care insurance system needs sensible regulation.

It will take smart, dare I say, statesman (-like) action to accomplish.

The medical system in the US is predatory and parasitic, how does pushing this enormous blood sucking leach onto the taxpayer solve the problem?

I know this foray into healthcare seems off topic but it would be interesting to know how much of that consumer debt went toward buying new Porsches for hospital administrators.

The reason NOTHING gets done in terms of “healthcare” is people can’t process the difference between healthcare and insurance. People NEED access to reasonable catastrophic insurance managed by the federal government. That insurance backed by the patients HSA would provide everyone the access to care they need WITHOUT having government involved in healthcare delivery.

Yerfej,

Watch out for all the fees charged on the wonderful HSA account, not to mention the increased charges for medicare because with an HSA you can afford to pay more.

Here in UK, you pay £350 just to have a 15-20 mins chinwag with the consultant. You get offered a glass of water or a cup of tea while you wait. Then you meet HRH the consultant, you spend 10 minutes going through your problems, and then you listen through the other 10mins being told how it will be necessary to have someone go through the scans.

Then you’re out on your a**, freshly tangoed, and go negotiate with the secretarial automatons, how to come back with further fresh 7 fifties, to hear if someone has looked at the scans.

The dance goes through about 6-7 meetings, lasting three months, all of which could be condensed into a two-day, three-letters exchange.

And then to get some work done; a day case, with an hour of two of consultants’ involvement, is about £10k.

So… is the next 10 years a deflation or inflation period? With so much debt and ageing population… nothing against old, I an becoming one myself!

My guess for what it’s worth is severe deflationary event followed by hyperinflation but I’ve been wrong before at least according to government statistics anyway

Something like that was my best guess too. But, there are so many x-factors like the corona virus combined with my understanding that China is alot weaker than people think. If China begins a death spiral before usa hits recession, all bets are off.

what would happen in that case?

If we knew that we probably wouldn’t be spending our time on an internet forum, we would be a billionaire from having predicted the last 10 years of economic events :)

But Wolf’s articles are so entertaining, we are all willing to forgo becoming a billionaire.

I might be willing to forgo becoming a millionaire to keep wolfstreet. But, ill sacrifice wolfstreet to become a billionaire. Wolf probably feels the same way.

It’s deflation that’s coming. The only thing going up is the stock market and that pie is shrinking along with everything else. Downsizing and minimalism is what’s being sold to the old and the young. Does that sound inflationary?

The system cannot deleverage. http://creditbubblebulletin.blogspot.com/2018/10/weekly-commentary-contemporary-finances.html Today’s monetary stimulus will not disappear. The rollout of leveraged ETFs guarantees anyone access to a short position, without an uptick, or borrowing those closely held shares through swaps and derivatives, which FED will always protect with zero interest rates. This is an all futures market now, completely commoditized. The first inflationary surge will destroy the dollar, and feed into lower stock and bond prices, and higher nominal inflation in services and wages. Fed will try chasing inflation Volcker-like, only to restart deflation of the currency. Rinse and repeat all the way to the bottom.

Don’t know how we could go down the same monetary path as Japan and expect a different outcome.

Oh, cone on Petunia .. you say that like it’s a bad thing! I mean, who doesn’t enjoy th confines of ‘Pod Living’, right ?

I’m going to have to pay for yoga classes to get into that pod.

With all due respect, there’s more than a fair amount of chartsmanship going on here. Most of these charts need to be expanded on both axis to get a better perspective. Also, using inflation adjusted data would be more appropriate, or at least show the inflation adjusted data in addition to non-adjusted. If you do this you will see a different picture. A pie chart of the overall debt distribution would also help.

True. Also population has grown during this time as well.

To Wolf’s credit though, he did include figures representing debt in terms of its relation to GDP, albeit except for one chart, in the verbiage only.

People tend to fixate on the charts though.

“in relation to GDP” is problematic because GDP’s detailed methodology is unknown to most and its actual construction generates results that simply favor DC narratives over the actual experiences of the other 315 million of us (ie, DC can gin up bogus, counterproductive “growth” that benefits few outside of DC).

Why not compare debt growth rates to median household income growth rates for instance?

Along with the headline unemployment figures, DC has an array of misleadingly named, consciously miscalculated stats that it uses to tell Americans not to believe their own experiences.

There are better gvt stats…but they are not the publicized ones.

You could compare to median household income but if you do that you’d also need to adjust for population growth since the absolute number of households is also growing.

Based on what I know the figures of these alternative parameters to be, after doing the calculations you’d probably end up with a figure close to what using GDP gives you.

The gist of things is that if you track to GDP or to income you’d see that most consumer debt numbers have been either flat or declining, with one glaring exception: student loans – which have absolutely exploded.

Keepcalmeverythingisfine,

BS. So, you’re now going to get shot down because you didn’t even LOOK AT the charts. Get ready.

1. “Also, using inflation adjusted data would be more appropriate,….”

This is why there is chart #2, nominal debt v. nominal GDP as a percentage. Dividing nominal debt (not adjusted for inflation) by nominal GDP (not adjusted for inflation) cancels out the impact of inflation. This is basic math. That’s the single most important chart, and it is in the subtitle of the article. And you IGNORED that chart.

In the same vein, debt-to-nominal-gdp are mentioned in the text for all subcategories of debt, which you didn’t see because you didn’t read the article.

2. “Most of these charts need to be expanded on both axis to get a better perspective….”

If you had actually looked at the charts, you would have seen that these are 15-YEAR charts. Do you want charts that go back to Adam and Eve, with zero visible detail as to what is going on in the current quarter? That is nuts.

3. Taking the vertical axis to zero is equally nuts. Have you ever looked at a GDP chart in US trillion dollars where the vertical axis goes to zero? It’s essentially a straight line at the top of the chart, and you cannot see any details. You have no idea if GDP went up or down over the past quarter.

I understand what you are saying, but try using/adding the data that is adjusted for inflation and you will see what I mean with regard to the visual of the charts. The time period (x axis) is the one that I most often see and feel I am missing the previous few decades of data, and not just here but on other charts. I sincerely apologize the the “chartsmith” comment, it was not appropriate.

I also encourage you to READ the actual article. The charts serve as illustrations of a few key points. If you don’t read the article, you miss almost everything, including what I said about housing debt (it’s relatively sane), the bifurcation in consumer credit (which consumers are at risk, because many are not, but many are in deep trouble), how the heavy auto-loan burden is already impacting auto sales, and how that student loan debt ballooned to this extent (insufficient repayments).

You don’t have to wait for loans to blow up before there are economic consequences of heavy debt burdens: auto sales have been declining for three years (in part because auto-loan subprime started to get in trouble back then and those borrowers are now excluded from the new vehicle market), and student enrollment has been declining since 2011, which is not a good thing.

Nice 14% annual rate pop in Dec after the 3.2% drop in Nov for revolving. Merry Christmas. Note after all the fed rate reduction the rate for all revolving accounts assessed interest has only dropped 26 basis points.

Student loans need to go back to private banks. Where they can determine the sustainability of getting payed back by the degree chosen. I would hope that would reduce the number of students choosing a degree that has questionable collateral for repayment.

I would hope that would reduce the number of students choosing a degree that has questionable collateral for repayment.

Thus ensuring that every scholar assumes a proper role as an optimised profit center and is directed into a career of maximum corporate profitability besides.

That way corporatists can determine issues of history and philosophy as it serves their interests and without interference from scholars, and can dispense with the humanities as subversive and unremunerative.

You are talking out of both sides of your mouth about this, on the one hand, saying “corporatists” are benefitting from student loans now, on the other, that a change to private sector learning would benefit “corporatists”.

The current lending is government backed and largely benefits large non profit and state universities, a democratic party constituency, the laws were passed under Obama during a time of single party rule. Corporate interests derive very little from current policy, and it is a taxpayer disaster because there are no assessments of ability to repay. And the debt cannot be discharged, s it doesn’t help many of the borrowers either.

If private lenders where the rule, then yes, there would be private business or “corporatist” interest, but they would assuredly use some lending standards in a free market (ie no loan for gender studies PhD), and also in a free market, there would be bankruptcy. This hasn’t happened not because of the private sector, which in almost every economy instance does a better job than government, this disaster is at the hand of those who think government does everything best.

Corporate interests derive very little from current policy

‘Very little’, you say? The charts say you’re wrong. Who do you think the creditors are for all that debt? Your assertion is absurd.

I still would like to know where the humanities are remunerative.

The humanities are not intended to be profitable to transnational corporations. They’re intended to elevate exploited people, which gives you two reasons to get rid of the humanities entirely.

Can’t be more concise than that, although the transactional dolts here won’t get it at all. Pathetic people.

Una,

Anybody who has been to college in the last 70 years knows from first hand experience that not 1 out of 100 “scholars” – let alone liberal arts scholars – is worth the 75k+ in annual salary alone they pull from the system, earned via their 6 classroom hour work weeks and “research”

The overwhelming majority of academic “research” is of essentially no value – even to other back-scratching academics looking to game their way into tenure.

That is one reason why the average academic article is cited about *once* subsequently.

Academic journals tend to be vast wastelands of irrelevance, economic or otherwise.

They exist to stage the Kabuki of “expertise” that hugely expensive institutions use to justify their enormously inflated costs.

The overwhelming majority of academic “research” is of essentially no value

Right. It’s not making you any money, so what good is it?

“The overwhelming majority of academic “research” is of essentially no value – even to other back-scratching academics looking to game their way into tenure.”

Hey, maybe it’s time to start burning books! And maybe, too, you, Cas 127, will help us identify books to burn.

In your world, it’s all about “efficiency”. Maybe you’d rather we rid ourselves of those with IQs below 115. Over time, the normal distribution curve will yield a race of super-humans, and it’ll keep improving for eternity. How efficient we’ll be then!

Know what else? We can be even more efficient if we get rid of adjectives. You don’t need to say “really” efficient. If you can’t quantify the degree of precision, “really” is useless.

AGREE,, banks and family money would do a lot to help sort out the folks who are actually interested in an education; as opposed to the tons, some of my and my siblings children included, who go to college to party, with no intent beyond.

But, and it’s a huge butt,,, I gotta keep going back to my studio apt across the street from university for $50 per month in 68-70, while i was able to earn $5 per hour just from the jobs, plentiful jobs, available to anyone who wanted to work,,, That same apt now $2500, or maybe more since that was last year… students very luck to get $10 per hour::: just does not make sense…

Yes, I had to drop out twice to work full time,, and that made me even more determined to get my degree… and, yes, i did party about once a month IF i had time that month…

No matter the source of funding, this problem for our country will not go away until we resume some fair basis for those who want education.

With the absolute power and unlimited opportunities on online learning and participation, there is NO reason to be educated with debt for fuel.

I did a huge chunk of my under grad doing what was called Distance Education, under the BC Open Learning Agency in the early ’90s, well before computers were common. I would finish one course, submit assignments by snail mail as I worked on others, and wrote final exams using invigilators at local Govt offices, or the local college. I completed many geography courses, as well as math. At the time I was planning to leave aviation and go into urban planning. Instead, I ended up teaching Trades (carpentry, etc) and living in the rural boonies.

All this while working full time.

Years later I completed a Masters Program as one of the absolute first offerings of online education through Royal Roads University. We used FTP to submit work and receive feedback. I remember my instructor was in Scotland. This was around the late 90s. The big cost was still less than leaving work, and was solely to pay for the university infrastructure and the degree granting racket. I had to attend in person 2-3 weeks? for two summers.

In today’s world of powerful computing, it is easy to understand that student loans exist to pay off university building loans and inflated admin salaries. Nuts, and shortsighted. Specific labs etc would require attendance, obviously, but lectures and assignments?

Paulo,

I agree wholeheartedly with your first paragraph. However in this competitive environment education and its costs have become a “barrier to entry” in the marketplace, and unfortunately I don’t see it changing. John Taylor Gatto had some interesting ideas on education and I believe you might find yourself agreeing with some of his thoughts.

Have you ever tried hiring someone with an online education? I have, and while I’m sure there are exceptions like you that do well, by and large they are some of the worst job candidates I get every time, so that model is still missing something in the quality of graduate it produces in aggregate.

“they are some of the worst job candidates I get”

It may be bc the system is relatively new and does not attract the most/best candidates (yet) and ranking filters are not well established.

The in-class aspect of education would seem to really only be worth maybe 20 pct of the educational value (vs 80 pct for the book reading part) so it is hard to see where online education is hugely inferior on some intrinsic basis – especially a cost-benefit one.

Paulo:

I’ve done a great deal of self-directed learning in my life, but it take a lot of self-discipline that many just don’t have.

Xypher2000:

So the banks/financiers get to arbitrage what our young will get degrees in according to their (banks) predictions? There must be an algo for that! That is a very narrow viewpoint of our educational system and the potential of the young.

Not sure why all the gloom and doom in the comments here. With the exception of student loans, consumer credit growth relative to the economy has been either essentially flat or declining. Same in housing.

Be cognizant of the scale used in the graph depicting consumer credit as a % of GDP. Its range is not 0 to 100%, it’s 15 to 19%.

With respect to debt, outside of a relatively small percentage of people with sky-high student load debt, consumers haven’t been that profligate.

The real problem has been corporates and government who have gorged on credit, in thanks in large part to being “closer to the plate” of the central bank.

The reason for gloom is that consumer debt is at at an all time high relative to GDP at a time when we are at full employment and the best job market in history. What happens if things revert to the mean, or God forbid, we have a repeat of the recessions of 1979,1991, 2001 or 2009? Large numbers of people will be destitute.

The movement is tiny. From around 17.5% in the 2000s decade to about 19% in the 2010s decade, and virtually all of the increase is due to student loans. It’s not something to be overly concerned over. I would be much more concerned about govt and corporate debt.

Max Power,

A movement in a ratio of 2% of GDP is NOT tiny. It’s $414 billion.

Even more important…”at a time” of near historical lows in interest rates, artificially induced by the gvt – purchased at the cost of inflation (if you would like to live in a house or apartment, ever receive medical care, or get through a gatekeeper college…)

Max Power,

“Its range is not 0 to 100%, it’s 15 to 19%.”

Yes, and it makes a huge difference. When you measure anything against GDP, which is a HUGE Number ($21.7 trillion), even small variations in GDP-based ratios are also HUGE numbers. You see that in the other charts.

That increase of 2 percentage points of GDP (from 17.3% to 19.3%) over the past decade shows that consumer debt grew at the rate of the economy PLUS by $414 billion! In other words, if consumer debt had grown at the rate of the economy, there would be less than $3.8 trillion in debt. But consumers now have $4.2 trillion in debt.