Tesla’s Stock Makes it the Second Most Valuable Automaker in the World. But How About its Size?

By Wolf Richter for WOLF STREET.

Tesla shares took a little dip today, but no biggie. They still produce an astounding market capitalization of $102 billion, “astounding” not because the market cap per se is huge – there are now some trillion-dollar companies out there – but because the business Tesla is in: auto manufacturing and solar panels.

Solar panels have been a nasty business from get-go; and auto manufacturing is one of the most mature industries facing saturated markets globally, and particularly the largest markets – China, the US, Europe, and Japan – where the number of passenger vehicles sold has been declining. In the US, new car and truck sales in 2019 were below where they had been in the year 2000.

And so profitable automakers, operating in a no-growth or negative-growth environment, have relatively down-to-earth market capitalizations, compared to their sales and profits.

The past five years have been very profitable for the industry overall, as automakers increased their revenues by raising prices and shifting consumers into more expensive models (from sedans into SUVs). All major auto makers have generated big profits during those years.

But Tesla is not in that group for two reasons:

- It’s a niche automaker, not a major automaker, given the minuscule number of vehicles it sells.

- In its entire existence, it has never ever made an annual profit.

No major automaker still alive today has been able to lose money and burn cash year-after-year, living off the eagerness of befuddled investors to throw more money at it. Only Tesla has accomplished this unique feat of investor-befuddlement.

And there was huge hoopla this week after these befuddled investors, scared-to-death short-sellers, and spaghetti-code algos had driven up Tesla’s stock to such a degree that Tesla became the second most valuable automaker in the world, as measured by market capitalization, behind only Toyota, and ahead of Volkswagen and all the giants.

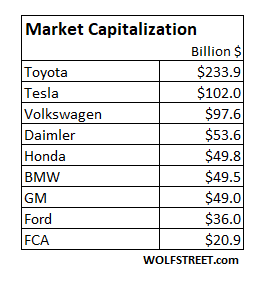

The table below shows some of the most valuable automakers by market capitalization. I converted the market caps of Japanese and European automakers into dollars at today’s exchange rate:

Why are Hyundai-Kia and the Renault-Nissan Alliance missing in this table? There are complications with market cap. Hyundai-Kia, in terms of shares, separates into Hyundai Motor Company, which owns about one-third of Kia’s shares, but a portion of Kia’s shares remains publicly traded. Adding the two market caps together would amount to $43 billion, but would entail some double-counting due to the ownership structure. The Renault-Nissan Alliance has a similar issue.

So how crazy is Tesla’s market cap of $102 billion compared to the major automakers?

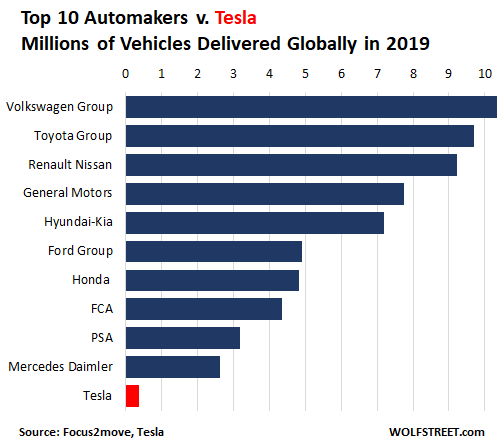

In 2019, Volkswagen delivered 10.34 million vehicles globally, according to Focus2move, and was thus the largest automaker in the world. Number two was Toyota with 9.70 million deliveries. All of the top ten automakers counted their deliveries in multiple millions. The smallest of the top 10, Mercedes Daimler, delivered 2.62 million vehicles.

By comparison, Tesla delivered 0.37 million vehicles globally, meaning 367,500 vehicles. Volkswagen delivered 28 times as many vehicles as Tesla. Toyota delivered 26 times as many. General Motors delivered 21 times as many. Ford delivered 13 times as many. I marked Tesla’s bar in red so you can find it without pulling out your magnifying glass:

GM and Ford combined delivered 12.65 million vehicles globally, or 34 times as many vehicles as Tesla’s 367,500. And both GM and Ford have been profitable in recent years, and Tesla has lost money every year. The market cap of GM and Ford combined amounts to $85 billion.

Yet, the market cap of Tesla amounts to $102 billion, as bamboozled investors and spaghetti-code algos think that the minuscule perennially money-losing auto-and-solar-panel-maker must be worth more than the giants.

Don’t get me wrong: I don’t think Ford and GM are undervalued; for me, they’re not a buy at these prices, given the difficulties they face in their main markets.

What I’m saying is that Tesla, the minuscule auto-and-solar-panel maker, is ludicrously overvalued, and I don’t mean overvalued by a little, such as by 30%, but by a lot.

If it doubles its deliveries in the future to 0.73 million vehicles, it would still be overvalued by 90%, given its still minuscule size, even after having doubled it.

And that assumes that it can produce an annual profit, because a company that keeps losing money is eventually going to be worth zero.

Tesla’s all-out move to China makes sense for a niche automaker struggling mightily in the US. But headwinds in China are even stronger than in the US. Read… Tesla, Hit by Sagging US Sales, Goes Full-China with Design Center, Loans & Factory

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is NOT going to end well…..and when it does it will take the savings of many.

The most important thing to keep in mind with Tesla is the market cap number itself.

Tesla has graduated into the realm of TBTF companies and banks.Recollect on the bailout that GM received to protect thousands of high paying union jobs that were about to evaporate.

Now rather than thinking about job preservation,think about WEALTH PRESERVATION.There are just too many well connected people in very powerful places that have invested a tremendous amount of wealth into Tesla.They will never allow this wealth just evaporate,never!

The wild card is the climate change religion that is bringing more and more politicians on board.This company then becomes a great temple against the fossil fuel industry.

Bottom line,don’t short it,you will lose.

I disagree. Tesla is not TBTF to the US government, only to its investors and itself.

If Trump is re-elected, it mighty be time to short Tesla. Tesla’s glamour derives from the electric car / solar panel / battery market that Tesla popularized. However, Trump is a petrochemical guy – he’ll work to get rid of renewable energy subsidies and increase the subsidies / tax breaks for the “drill baby, drill” folks.

Tesla is sort of the Apple Computer of electric cars: if the glamour wears off, or if other electric cars look more practical (like Windows 95 versus Mac OS 8) – or if Elon leaves the company for some reason – Tesla stock will plummet. (Remember Apple in the years after Steve Jobs left, and before he returned?)

Tesla is a big American exporter. And not only to the North American market. I don’t think Trump has a real problem with Tesla

Renewable energy subsidies, as they are used today, almost exclusively benefit rich people.

The EV subsidy users were all rich people.

Take it down.

Marginal additions and replacements of existing electricity generation with renewables are already more heavily favored than hydrocarbon sources. The mix depends on the area and how naturally windy/sunny it is, but it is nearly 60/40 in most places favoring renewables without subsidies, which have been slowly eliminated as the technology matures. The only reason they aren’t 100% is because of the intermittency issue and the cost of energy storage. However, tech advancement in that area too is rapidly bring down costs.

Coal is already priced out of the market and no one is investing in it. Natural gas is cheap because we have an oversupply due to the fracking boom, but if that money losing charade is ever forced to break even or pare back its debt levels then natural gas will go back up in price. Renewables face far less of a headwind because so far there is no strong evidence that they won’t keep getting cheaper and more efficient with increasing returns of scale and new technological breakthroughs. Even at current prices, all they need is marginally cheaper utility scale storage options to jump from ~60% marginal installion to 90% which is likely to happen in this decade to 100% either end of this decade or next, just based on the trends of cost decline in energy storage.

Old coal and natural gas plants will slowly be retired as they age and the maintenance costs rise above the alternative, which means we’re far away from converting the whole grid to renewables, but we’re on the cusp of where for the next several decades pure economics and technological advancement is going to drive a massive turnover in how we get our energy. This is not a political issue, just analyzing the numbers and trends.

https://mashable.com/article/trump-protect-elon-musk/

Trump says society needs to ‘cherish’ and ‘protect’ Elon Musk

It was not the Union jobs the US government was protecting with the bailout but the industry. When has the US government ever protected union jobs?

Tesla is still to small to kill an industry. It is also not 2008 so bankruptcy leads to unpaid loans and lost equity but not a closing of the factory.Especial not when Tesla sells cars for more than their variable cost.

GM/Chrysler bail out-mergers were only to save the bond holders,a jobs save was just a little give away to Dems. The real reason tesla stocks are rocketing is the Federal Reserve and market manipulation,they are not just in the bailout,repo,PM manipulation business anymore they are directly buying in stocks(FAANG+T)

To Jerry

“Bottom line,don’t short it,you will lose.”

Deeper than bottom line:

First rate men can never be dummies. Third rate men can never be prevented from being dummies.

Material interests can never ever be put forward than wise thinking….

With the rumors of war and decline of the American Age Tesla is the poster child for global free flow over capital over exhuberance. Any feel the wiff of 1928 here and now. Where the proselytizers of that era sung the praise of the up, up, and more up stock market. While the Coronavirus litteraly is the last player in the repeat of that era. I.e.: the Spanish flu. Everything seems much more compressed

In the end I suppose nothing changes as people rain the same and there’s a sucker born every day.???

I wonder if Tesla worries the Fed. It’s hard to think of where else a hundred billion could lose 80% ? of its value in a simple application of normal metrics, (P/E etc.)

Does T present a systemic risk to the overall economy, not because its physical operations are big but because its stock crash sets off a psychological reaction?

In an crash previous to the 29 crash, JP Morgan lead a successful bankers pool onto the floor and behind the scenes. In 29 the same thing was tried again with prominent banker- backed bids for US Steel etc., briefly stabilizing the market.

There has been lots of talk about the Fed actually buying stocks in a crisis. But they would have to hold their noses to buy Tesla (at more than a few dollars)

“It’s hard to think of where else a hundred billion could lose 80% ?”

What? It is literally all over the place. Start with any cloud, fintech, pharmatech, or any other tech company selling for 15-30 times sales and make your way up.

Oh there is lots of froth everywhere, but name a pharma worth a hundred billion that has only once squeaked out a profit. There is a reason WS keeps coming back to Tesla: it is the poster child.

The only hype machine comparable to Tesla was Wework but that was 90% one big investor/ loser, Softbank. Tesla is largely an American cult largely supported by individual US investors.

Wolf,

An interesting analysis might be to see how semi-normalizing FAANG stocks to a healthier long term PE (20-25) would impact SP500, QQQ, and other indices.

Since these indices are mkt cap wtd, the PE disease that most FAANGs display, gets communicated in a semi diluted fashion to the indices as a whole.

We are living through a period like that of the Nifty Fifty in the early 70’s – except now it is more like the Final Four.

In the end, the bad mkts of the later 70s occurred bcs the Nifty Fifty were taken out and shot one by one.

I live in Qingdao and follow the EV market closely. Tesla was the car all the cool kids and trendoids drove two years ago. In a day traveling around this prosperous city of 3 million, I would see one or two a day. Now I see less than one a day. In contrast, I can see SEVERAL Chinese EVs a MINUTE on any busy street. The rich trendoids are a fickle bunch, and are now more likely to be driving the new BYD Tang EV SUV, or SUV’s made by Maserati, Jaguar, Bentley, or Alfa Romeo. I have seen SUV EVs made by the revered Hong QI.

I don’t think the Model 3 has a chance. There are so many affordable EVs made here, and there is a backlash against anything American because of the trade wars. Among the younger population, iPhones are no longer cool. Everybody has switched to Honor, a Huawei brand.

Tesla is the first auto company allowed to operate without a Chinese partner company. There is no worthwhile technology to transfer. It is a Mazda look-alike with 20 year old Li-Ion battery tech provided by Panasonic. and 100 year old electric motor tech. The battery management tech regularly sets the cars on fire. Here, 25% of the city buses use locally manufactured LiFePO (lithium iron phosphate) batteries. They can be fast charged to 80% in 15 minutes, or to 100% in 40 minutes. Tesla is behind the curve.

‘ There is no worthwhile technology to transfer’

That makes sense now why Tesla was allowed in without a partner.

Suzie: A few years ago I took the trouble to investigate Tesla’s electrical technology.

I reviewed their wheel drive motors and was shocked that Tesla was using less than the best motors. If I remember about 10% less efficient motors than the Chinese EVs currently use!

O.K. 10% doesn’t sound like a lot but it still matters. 10% means more than 10% saving on car weight!

The batteries, well what more can I say? Tesla BBQs anyone?

These Tesla cars should never be parked inside of any building period! I am surprised car insurance companies don’t have this stipulation in their insurance contracts!

Recently a parked Tesla caught fire and destroyed several hundred cars inside a public car garage!

The bottom line from my electrical point of view, Tesla’s technology was not state of the art!

It is all marketing and hype!

10% sounds to me like a bullshit, made-up number.

What about Tesla’s claim that their range is significantly greater than the competition?

This reads like Chinese propaganda. No way on earth a Tesla battery caught fire and destroyed 100 cars.

China has about 59% coal electric power generation compared to US 28% coal power generation. China recently expanded coal power generation.

China is building enough generating capacity to supply electricity to 7 billion American like electricity consumers.

ps. Only slightly exaggerated but it is true that Chinese demand wont grow nearly as much as the number of new coal plants, wind farms, hydro dams, solar parks and gas generators that are being build

The car that caught fire was a diesel-powered vehicle. Tesla motors are the most efficient in use, last I heard. EV’s catch fire less often than ICE vehicles and that includes Teslas. Gee, I wonder why you would make such statements?

Not to pick sides but to provide some information, for the pro Tesla crowd – yes the number of fires is low but remember that the amount of EV users is also low. Thermal runaway is a real concern, you can google it and fined a lot of stories and they aren’t all Chinese.

The funniest one is the guy that took a damaged Tesla cell, salvaged the good parts and put them in a buggy. That buggy lit up like the 4th of July.

It makes sense to allow Tesla into China without a local partner simply because no potential Chinese partner would want to invest in a money loosing business. In other words, the Chinese are not like the tpypical befuddled Tesla investors.

Tesla’s entire market cap is based on POTENTIAL sales in China. Not the US. Not Europe.

It’s totally screwed.

Their sales will actually decline markedly here in the US. Every one of their cars looks VERY dated, and at least 8 years old looking. Basically they look like Chinese smurfs.

Not only can EV’s NOT be built and sold profitably to the masses, they can’t even be built and sold profitably to rich people.

Worse than all of that, is today’s battery technology is so utterly unviable, and super toxic, and tomorrow’s technology is literally at least 10 years away, most EV companies will be long gone before the 10 years gets here. They are using lithium battery designs, that were developed over 25 years ago. They are attempting to improve upon 25 year old technology incrementally, because absolutely nothing else is even remotely close to commercialization. All that talk you hear about this battery chemistry and that anode or cathode, or lithium air, or stuff not using lithium at all, is in the freaking LAB, and is where today’s lithium technology was 25 years ago. Folks this is no different than all the hoopla you heard about fuel cells, back around the dot.com era. Somehow Tesla managed to suck in millions of stupid investors to bring a lab product, basically raw science, into something people want to call commercial.

The sin here too, is every one of our federal agencies that should be keeping their cars so far off the road its not even funny, is failing us big time. These accidents, these fires, these batteries re-igniting into flames days after they are towed have been long known about in many labs for decades. Tesla has absolutely not improved upon ANY OF IT. They are using software to MITIGATE a highly flawed product that is incredibly unsafe, and Federal regulators have totally failed every citizen.

Folks its no different than the fraud perpetrated by Boeing on the 737Max, where Boeing attempted to use software to correct a flawed aerodynamic design that cannot possibly fly without it. It should not have EVER left the tarmac. Should not have even been sold. Every sane pilot with a shred of credibility knew it, before it ever left the simulator. Thing is, here you have in Musk, someone that is beyond ethically challenged seen everyday in the littlest of things, as no one with a proper mind, or sane level of ethos would EVER call out someone publicly as a pedo, and not expect to be sued to high heaven. Musk believes he is above not only all laws, but all human morals. Most would call that sociopathy.

Tesla shareholders have been duped just as every federal agency has been duped into allowing these vehicles on the road, and even allowing something to be called ‘auto pilot’.

China is about the only country left that could possibly let a vehicle as unsafe as every Tesla is, on the roads going forward. Eventually US regulators will be forced to play catch and admit all of their errors, and it will be extremely embarrassing as we will continue to see on the nightly news, more and more of these batteries unpredictably and spontaneously ignite, and eventually first responders refuse to go anywhere near them when a tesla gets in an accident. Lets hope it doesn’t take much longer.

So Mike, Which fossil fuel company/ice auto maker do you work for?

Rudolf:. Mike is trying to look at Tesla cars from a practical or engineering point of view.

The faults he points out are there but only if you want to see them!

EV cars are not new! They were invented well over a hundred years ago in the late 1800s! It was the batteries that killed them off back then!

So now we are having a second go round with EVs but this time supported by taxpayer’s!

Maybe we are still pushing on a string? Only time will tell!

Maybe the same one that powers those tesla batteries?

Contrary to popular belief, EVs dont run on unicorn farts.

Nice ad-hominem attack Rudolf.

Lots of Teslas in Vancouver, Canada.

Your comment is very good.

My response is to Mike’s post.

software to correct a flawed aerodynamic design that cannot possibly fly without it.

uh.

no.

you obviously are a classic example of keeping your mouth shut to be thought a fool, or opening your mouth to remove all doubt.

and you know nothing of the 737MAX kerfuffle.

the MCAS system was installed on the MAX series aircraft not for stability, but to give the MAX series aircraft the handling characteristics of the 700/800/900 series of 737 aircraft. in doing so, boeing did not have to get a new type certificate from the FAA. this saved the company billions. one website you could not stand to go to would be the blancolirio website and listen to juan browne. it would be poison to your ears, as you would be hearing the truth about the MAX series aircraft. and aircraft in general.

https://spectrum.ieee.org/aerospace/aviation/how-the-boeing-737-max-disaster-looks-to-a-software-developer

This article was posted here recently about the MAX nacelle and angle of attack problems. I’m not an expert, but intuitively, if a plane pulls up into a stall whenever you hit the gas, that’s a deal breaker. The angle of attack problems, if you believe the author, compound as you pull up into the stall due to the wing and nacelle design.

To me that seems like a classic, fix an unfixable hardware problem with a non robust software patch. I’ll never fly on a MAX every again, even if Boeing cries to the feds that it needs a regulatory bailout.

Paul Gilpin,

The article Phaedrus cites is pretty convincing. I’d be interested in how you would go about dismissing its findings.

Thank you.

Tesla makes one of the safest vehicles in the world and currently the ones with the most range at 370 miles Tesla market cap has something to do with China, but not all to do with China. Gigafactory 4 just broke ground in Germany and will be in production by 2021. The Model Y is starting delivery next month. The Cybertruck has 250K reservations. They are a great US company.

People day the bond market is smarter than stock market.

Bond market says US economy not that good, stock market says wonderful.

Bond market says Tesla is one hiccup away from default and stock market says it’s best car company in the US.

President Xi, is that you? Chinese EVs…..please.

Am Swiss, I live in China. Lots of good EV in China

TSLA is not an auto company, it’s a tech company. And really it’s a data company if you think about it.

Just Some Random Guy,

I keep hearing that. But here is something you as smart tech guy already know:

Tesla’s data is nearly worthless because Tesla has data only on a few hundred-thousand people in the US (Tesla drivers), while every smartphone maker and app maker has a heck of a lot more data on each person, and there are about 300 million smartphones in the US alone, and hundreds of thousands of apps, and everyone who has a smartphone is being tracked to the nth degree, everywhere, by the device and the apps installed on it.

People take their smartphone to BED with them. They don’t do that with Teslas. Smartphones have motion sensors, microphones, and cameras. They follow you around the house, while you drive, while you sneak into your girlfriend’s place, at the doctor’s office, while you shop in a shopping center (should you accidentally end up there)….

Every Tesla owner must have a smartphone, but these phones and apps track much more than the car can. But even the 300 million people, from kids to seniors, that have smartphones and don’t drive a Tesla, constantly give their data away to smartphone makers and app makers.

This includes data on their phone calls, text messages, internet browsing activities, your address book, increasingly your biometrics, where they go, how fast they go there, how long they stay three, what they do there, who they meet there, if these people they meet are in their address book, what they do, who leaves first, etc.

You see, everyone out there has this data. It’s all over the place. No one has more data than Google. Google has data on billions of people globally. Compared to Google, Tesla has nothing. Compared to the big app makers, including Uber, Tesla has nothing.

So why would such a commodity product as data, of which Tesla has almost nothing compared to other companies, add value to Tesla? It doesn’t. It’s worthless for anyone other than Tesla. Everyone else has a lot more data.

Tesla is just an automaker and a solar panel maker. There is no way around it.

Wolf’s answer just emphasised why I do not have a smart phone, and never will. I simply do not understand the addiction.

I’m reading WS on my phone right now. On the shores of the Red Sea.

Me either As a matter of fact I haven’t had any phone for years and I love it Not being bothered constantly is priceless If I need a phone I borrow my wife’s Samsung

Me, too.

I recently got a questionnaire from USCellular asking me if I was interested in a smartphone if they gave me one free. I told them no, and why not.

Now I’m getting text messages on my dumb flip phone, trying to give me a smart phone! So, maybe USCellular collects a lot of data but they use it only to pursue their ends, not to serve their customers the customer’s way, IMO.

Nicko2

I was just going to post a similar observation, except I’m Wolfstreeting from nowhere near as glamorous as the Red Sea….Paulo, I get to Wolfstreet while in line at Target! God bless technology (and yes I just turned Wolfstreet into a verb)

LOL about the verb.

@RD

Flip phones use old cellular technology. It could be that they want to discontinue that service

Wolf, I read somewhere that most of the revenue that Tesla makes is From the sale of carbon tax credits. Is there any truth to this?

Jako,

Not “most of the revenues.” Tesla periodically sells its pollution tax credits to other companies, and this goes straight to its profits, or reduces its losses. The amounts can be in the several hundred-million-dollar range, so in terms of revenues, they’re small. But there are no costs associated with them, as Tesla just gets them for free, and selling them goes straight to profits/reduction of losses.

So in quarters where Tesla made a profit, much of that profit (not revenues) came from those pollution tax credits.

I sorted this out here:

https://wolfstreet.com/2019/04/29/tesla-discloses-record-pollution-credits-for-q1-without-them-it-would-have-lost-918-million-and-bled-1-14-billion-in-cash/

Last summer, I used a free trial from Strava to track my bicycle rides. It’s easy to install the app, and you click on a start and stop on your phone to use it.

The accuracy of the tracking is amazing. Distance to within a 100th of a mile, elevation gain to the foot, speed to a 10th of a MPH and it even calculates max speed on the fastest decent. There’s a neat map of the rout that’s been traveled, and everything can be shared – if one wants to.

All the data is taken from my phone that is in my jersey pocket as I ride.

Electric bikes that combine battery power and pedal power are the new city thing these days …

I get a kick out of folks with their “digital precision” syndrome confusing precision with accuracy. I have several digital outdoor remote thermometers with 0.1 degree F precision. Checked with a certified lab mercury (Oh My G*d) thermometer they are variously off by up to +- 5.0 degrees. I would prefer 1 degree accuracy to 0.1 degree meaningless precision.

Lisa, I see your point – to a degree. Without doing an actual check on distances to compare to what Strava tells you, there may be a difference. I made the assumption that the readouts from Strava on speed, distance and elevation gain are accurate. Are they? Maybe not, but I would bet that the timing is precise.

For years, I have ridden the same rides, but never knew how far or fast I was going. Having the ability to click on my phone at the start and stop of various rides was a cool thing to try, and it does make you want to go faster each time to compete against yourself.

I do have a Precision-Syndrome I must admit.

Today, I set up my new turntable, arm and cartridge. Tracking force of 1.78 grams was double-checked with a digital scale that was calibrated with a 5 gram weight and tared.

I would bet it is no where near as accurate as you think.

Go on an identical ride with someone and see if you get the same result.

I do a lot if walking, using Viewranger. Other walkers on the same walk use Viewranger, Garmin, Magellan etc. All return different results with differences being in the order of 10% and oftentimes more….

Google has wonderful data for its business … selling stuff. Tesla has wonderful data for its business – developing self driving cars. In each Tesla car on the road it is running simulations as you drive. That is just phenomenal data and experience. That is how it will have the data to be far far ahead in self driving. It has boatloads more data that Waymo has, which is a far better comparison.

Is Tesla overvalued – sure. Is it a dead company walking? I seriously doubt it. It is in the ramp up phase. At the moment US sales are slower (although I would still have a 2 month wait to buy a Model 3), but it is shipping lots of cars to Europe – Norway and the Netherlands being big markets. If the model Y turns out as it looks to, this will be big, as will the plant in China. With scale will come cost reductions and higher profits – (check out the one stamp Model Y body – vs 72 pieces standard) Add that to self driving features and Tesla will be hard to beat in the EV market. If EVs grow, Tesla will do quite nicely, thank you.

If it’s a data company fine.

Show me how they are monetizing the data.

Tesla is not special. Their tech is no different than any other car companies. Most cars have tech that monitors data.

My wife left the lights on in our car a few weeks ago. A few hours later I got an email alert from BMW ‘Turn off your lights’

If I am flying along at 150km and I suddenly stop (as in hit a tree). BMW will be aware of that and they will organize emergency crews.

I don’t think BMW is monetizing the data they have on me. I am not sure how they could even if they wanted to.

It’s easy to claim a company is a ‘data company’ If they don’t make money off the data they are a failed data company.

Tesla is nothing special.

Well hang on a sec – they lose billions year after year yet they have a massive market cap. That is very impressive!

They are special like WeWork and Fyre Festival were special.

Jeez Willy, my twenty year old GMC has a warning buzzer/bell that goes off if I leave my lights on. No surveillance required.

And if you hit a tree at 150Km, I hope BMW organises a hearse for you. Better yet, don’t drive so fast or hit one. :-)

I contend that if none of those cars had the identifying little metal tag on the front hood that signifies the owners supposed social strata, no one would buy them. No one, especially Tesla which incorporates virtue signalling with the price tag.

I hear you.

Two reasons for buying this car:

1. It’s part of the bucket list. When the central banks run out of ammo, we are doomed. So what’s the point of not spending extra cash since it’s going to zero — and I am told you don’t buy much when you’re dead. Seriously.

2. I do a lot of driving on remote, winding roads. The speed limit is 100km/hr but nobody in their right mind would do 100 on those roads. I am not in my right mind. It sure is fun though. There are very few cars there so I am only endangering the rock cuts.

I did consider a Tesla (actually I didn’t) but the drive I often do is about 8 hours and if you push a Tesla hard I suspect you’d need to recharge the battery every couple of hours. There are no charging stations along the way and I prefer not to take 4 days to go 8 hours and paying for accommodation – while waiting for the car to be recharged.

I went for the BMW I suppose because their advertising slogan is embedded somewhere deep in my mind ‘The Ultimate Driving Machine’….

I didn’t consider Mercedes because for whatever reason I perceive those cars as being in favour with pompous, fat, old, men who believe driving them makes them look 30 years younger and sauve. I picture Roger Ailes or Harvey Weinstein driving a Merc.

But it is not going to zero. Can it half? That is possible but zero in 10 years is extremely unlikely outside nuclear etc but that your worries are not about money

I’m not seeing individuals step up to buy $50k+ “data” or “technology”; they’re paying $50k+ for electric cars (which include some technology) that are pure FUN to drive.

Yea, there is definitely some “irrational enthusiasm” with the financials, but considering the length of time the mob of commenters have been predicting Musk’s abject failure, there is absolutely no doubt Musk has spectacularly demonstrated electric vehicles can be effective, attractive and fun.

I fully agree charity isn’t the way to fund a car company, so we’ll see what happens to the EV market in the future…

The only thing Musk has demonstrated is that a fool and his money are easily parted. Both the tesla vehicle buyers and shareholders share that same characteristic.

As far as I know, most people who buy a Tesla really like it. Calling them all fools because they enjoy something different than you do is childish.

The investors are as foolish as any other gamblers are. I’ve made money on two separate occasions buying and selling Tesla stock. I don’t feel particularly foolish. Actually I could be said to be foolish for having sold mine last September. It has doubled since then.

Lots of Tesla friends, and they love their cars.

Yes, range suffers in winter.

The lithium in the batteries is likely to be recyclable. But the crazy thing is, if you look at early model S cars which have been on the road a really long time now — the batteries are still usable. And there is a community of people that can replace individual cells in the battery packs DIY style.

Tesla single handedly kicked off the EV revolution, and they kicked off the self-driving thing. Still pretty impressive.

Given that the newer cars don’t come with free supercharging, there is a potential revenue stream there. Ford doesn’t get to own a large network of gas stations, Tesla does.

Two of my high school classmate’s kids died in the collapse of the Towers on 9/11. I drive electric (Tesla Model 3 and Chevy Bolt) as one way to fight back against people who like to saw off other peoples’ heads. Second, Exxon Mobil has a chart showing the peaking of liquid oil supply in their Energy Outlook: A view to 2040. They have been consistent over the pass 4 to 5 years. The 2016 issue shows the Peaking in 2005 that everyone was getting their knickers in a knot over but it was for “conventional” sources.

I love driving electric!!! When I try to get on the Interstate going uphill, no worries about coming up to speed. It’s quiet, smooth and a joy to drive. On long trips, I recharge while going to use the rest room and grabbing a bite to eat (generally takes about 45 minutes). The Supercharger network makes it possible for me to go cross country.

The main point is crude oil production will peak followed by natural gas and we had better be ready.

What Musk has spectacularly demonstrated is that in an era of cheap money, there are many charging stations to keep the cash-burning companies‘ furnace glowing.

Zanetsu – have you seen the video of the fella who bought the S or whatever the 100k Tesla is called?

He spends literally half an hour detailing the defects – and how he kept bringing the car back to Tesla and kept finding more defects even after they tried to fix the original problems.

It goes on and on with his Tesla stuck in the service centre for months.

I can’t find that specific video because there are now a deluge of similar videos when you search Google.

Anyway, at the end of the video the guy says something like ‘in spite of all of this I still love Tesla and I want to give them a chance to sort out their problems’

Seriously??????????? If this clown had spent 100k on a car made by a real car company and had these sorts of problems (squeaks, leaks, out of line body parts etc…) I guarantee you that after the first time in with a complaint if he still had problems he’d drive the sucker through the dealers window, throw the keys on the floor and hand the manager his back account number and scream ‘ MONEY BACK- NOW’

But Noooooooooo…. Tesla owners live in a delusional world.

Most of them believe Tesla is saving the world so they overlook the fact that Teslas are GARBAGE. They don’t mind if the body parts have 1cm gaps, they don’t mind if the doors leak, they don’t mind if their are rattles and squeaks….

BECAUSE that’s the kind of sacrifices you have to make when you are on board with Elon to save the world.

And one other thing, the vast majority of these delusional clowns almost never complain about the biggest mistake they ever made in their lives. To buy a 100k car and then moan about how crappy it is, makes you look like you are dumb or a sucker.

Nobody wants to admit being a sucker.

So the suckers suck it up, while watching their 500kg battery lose charging capacity after a couple of years (just like a mobile phone battery does) and proudly continuing to virtue signal as they pull into the parking lot and bask in the admiring glances of the Greta fanboys and girls.

Yes they do love their lemons.

It sound like if you bought a Ferrari in the 90’s and you got the notMonday version. Monday version would be worse. But most people who bought a Ferrari loved them too.

TSLA is not a tech company.

Tesla is public relations company with a temporary small manufacturing sideline.

Elon has several of these.

Lisa,

And every time one of his over hyped pdts is about to fail, he bullsh*ts about the next wonderful one to come.

Agreed – PR is pretty central to the Musk experience (which is about as much fun as it sounds…)

Tesla is not an auto company, it’s not a software or data company either; it a stock. Buy the stock, it may well never go done. Ditch the car.

WeWork was also a data company…

If you look entreprise value. And say the bulk of the accumulated debt in the established companies purchased legacy assets. The overvaluationisnt so bad.

And apply staggering relentless growth to tesla. Assume unimpeded growth. In other words you take the most optimistic view. You still have a situation where you have to ask where is the legitimate upside? Anything short of the most optimistic view is very bearish.

You can arrove at upside if you attribute science fiction future scenarios.

So, I drive my Tesla to my Uber office coding job located in a WeWork building…

Should I start to worry?

Yea; change jobs & get the hell out of the building.

Chip:. Especially if you parked your Tesla BBQ in the building’s underground parking lot!

I see dozens of Teslas every day. I have never seen one catch fire. What FUD are you trying to spread exactly?

Tesla BBQs are great for cooking up fake meat products…

A simple search, Wes, proves you don’t know what you are talking about.

I mean, Tesla car catches fire in China. It might of been a fake Tesla purchased from the Wish App or something.

Only if when you get there you dial it in with your smart phone. Otherwise you’re good.

What investors like about Tesla group is that it gets billions of free government *subsidies* from dozens of countries around the world. Subsidies to make cars (and rockets), subsidies to sell cars, and subsidies to tax cars… It is one big gravy train of free government cash. For example, the UK will give you (at least) $5,000 free to buy a Tesla! Those subsidies for the upcoming truck and SUV are going to get bigger, hence the bigger stock valuation. If Tesla can sell 2 million cars, SUVs and trucks worldwide by 2025, Tesla’s shares will top $1 trillion.

Or $500 000 in stock market value per sold car

Good God! Really??

Char

$101B market cap today; 367,500 cars sold in 2019;

$101,000,000,000 / 367,500 cars = $274,000 per 2019 car sold

1 trillion/2million

And with 2 million you don’t have space to grow. That 367k value is but we will be as big as BMW

Javert Chip,

That’s a good way of looking at it!

Tesla and subsidiaries received $10-20 billion in free subsidies worldwide during the 2010s. More to come in the 2020s. No other car company gets so much free cash.

If Tesla sales can reach 1m vehicles by 2021, and 2m by 2025, it has the momentum for 10m units a year by 2030. That means a conservative $100k value per car, to become the world’s first trillion-dollar carmaker.

And don’t forget the autonomous wave of private cars / SUVs, public taxis, mobile offices, commuter “trains”, and commercial trucks arriving in 2025-2050. Tesla will be filling up with data, not just electricity.

It would if the competiton was absent.

Other manufacurers are on the train now and the subsidies wil have to be split among them. And believe me, Germany will support their industry more then others, especially if those are from outside the EU. And China will do the same for it’s industry.

Subsidies will not be forever. Tax-advantages are being cut as we speak. Governments are not that stupid, to aid a foreign company forever. It was only to get the train going and now it is, aid can be switched off.

The recent massive deliveries in Q4/2019 in The Netherlands were only because of the tax benefits, which were cut at 01-01-2020. No forsee no massive deliveries for 2020 or beyond. Meanwhile every EU manufacturer makes one or more EV-models in every size you like. Tesla was first on the train and most probably will be the first to get thrown off, when the smallest sign of a worstening economy will stick its ugly head up.

The current marked cap is based on future hope, and Wolf’s article and other developments everybody can see, tell you that that hope has no basis in reality.

“If Tesla sales can reach 1m vehicles by 2021, and 2m by 2025, it has the momentum for 10m units a year by 2030. ”

Where do you have those numbers from?

That would mean 3x production increase by next year and double again the next year?

Is Tesla building the capacity for such?

The models were selling as fun to drive and cool and with subsidies.

Subsidies go down everywhere.

Are they still so cool? Are there new models in the pipeline? Would those sell in the numbers?

Battery technology – is anything to change by next year?

The BBQs keep on happening, with more cars and more BBQs …

“That means a conservative $100k value per car, to become the world’s first trillion-dollar carmaker.”

China is the biggest car market by far, but with the trade war I can’t imagine american cars to look cool there, so what other incentive will have people to buy Tesla?

I wonder if Tesla survives 2021 and if the production hits half a million by then.

There are still massive subsidies. But if you drive a company car you have to add a percentage of the new value to your income. For electric cars it went from 4% to 8%, but that is still much less than the IIRC 16% for non-EV

Umm… Toyota sells 10m cars TODAY and isn’t even worth a quarter of a $ Trillion. Why should Tesla be worth 4x more based on this twisted logic?

I guess that means Tesla unit sales should hit around 250 million by 2100. Everyone that still has a job can have a half dozen.

Ya a gravy train that is coming to an end. Their subsidies have run out in the US, and China is also ending/slashing EV subsidies.

Your assertion would make sense IF Tesla were to have demonstrated that those subsidies helped it be wildly profitable.

But that has not been the case – years of subsidies and years of massive losses.

And now no subsidies.

And the share price is increasing?

This is either insanity or someone with a lot of juice needs Tesla to stay afloat because it gives the sheeple hope that we can wean off of oil.

I am inclined towards door number 2.

Partially because Elon Musk is a complete imbecile who is not qualified or capable of running a hot dog stand nevermind an automobile company.

Ben Graham tried to get people to think of stocks as a bond alternative. Only stocks with predictable income streams are investments, all others are speculations. You can get rich on speculating or go bust, but it’s not the same as investing where you are trying to make a business like calculation.

“Noah Cross : The future, Mr. Gittes! The future”

Wolfe,

These hyped, ultra high profile customer facing companies are pitched to the hipster doofi who buy overpriced Apple products on physical reflex – any stock price can be rationalized if such shareholders assume “multi-bazillions” in future sales.

Of course, they have no idea of actual current worldwide sales. Or market shares. Or current earnings. Or debt maturity dates.

Like gvts and politicians, these type of stocks are valued based on promised outcomes rather than sordid realities.

Our revels now are ended. These our actors,

As I foretold you, were all spirits, and

Are melted into air, into thin air:

And like the baseless fabric of this vision,

The cloud-capp’d tow’rs, the gorgeous palaces,

The solemn temples, the great globe itself,

Yea, all which it inherit, shall dissolve,

And, like this insubstantial pageant faded,

Leave not a rack behind. We are such stuff

As dreams are made on; and our little life

Is rounded with a sleep.

The Tempest Act 4, scene 1, 148–158

❤️

It’s nostalgic to recall those lines, Lisa!

I was maybe twelve years old, lying on a mattress in an attic in Detroit when I first read them from a Worldbook Encyclopedia Children’s Classic anthology.

Yet who dares to short it in this era of utter & extreme madness?

Not I.

The irony is, if short selling were outlawed on Monday, tesla’s stock would drop 90% by next Friday. Musk keeps baiting the short sellers into more shorting which keeps his stock at the prices they are. Look at his cyber fruck. He intentionally made it look so outrageously ugly, that shorts would pile on. The glass breaking was intentionally done as well. They easily could have used Lexan in the demo, and not a soul would have known the difference, and those steel balls would have ricocheted back and hit the thrower in the gonads. The vehicle as shown will never make it to market. Musk is truly at the end of the gamesmanship and his own rope, and will be likely hung by it before the end of 2020.

Yes!

Read up on shorting this weekend. It’s a good concept as certain stocks get into a bubble but you give up too much control in that if there is a problem in the system functioning the stock can be bought for you no matter the price. A few more bad things can happen that you have no control over because you have borrowed and don’t own.

Not if you have sufficient cash (T-bills) in reserve in your account to cover the worse-case margin calls. Shorting in this “market” requires capital.

Nice graph (magnifying glass needed). Obviously there is only “technical trading” going on now. Fundamentals are so “last century”. If it walks like a casino and quacks like a casino…..

18 months or so ago the Fed was all about targeting inflated asset prices. Then someone at the Fed passed around The Blue Pill and they all swallowed it, and now they realized their job is to make the stock market go up. There’s got to be an insider tell-all story in there. Someone should write a book about it….”As The Fed Turns”….

I think I liked the old days much better when profits made stocks go up in price. Where are the modern versions of “The Intelligent Investor” and “Securities Analysis”?

There seems to be an apostasy of reason that no one will admit. Or am I just going out of my mind?

Yeah, the old days when the book value of cash, land & buildings, and machinery considerably outweighed the debt and put a floor under losses. I think it was called capitalism, but it’s hard to remember that far back.

It’s still here, but in little bits owned by genuine entrepreneurs.

“ Then someone at the Fed passed around The Blue Pill and they all swallowed it”

That someone works for a guy with small hands who twits all day. And that guy’s gonna soon renew his contract for another 4 years, because he’s working for Wall Street.

That Testla is a Ponzi in the making and very clear with this huge investment by small and medium investors, that Tesla is the creation of high finance and even more evident, when high finance will decide to sell and collect the profit many will cry but now they are all happy and deaf to any warning.

There is no deaf perior from here does not want to hear Wolf

You might like this 109 page report on Tesla:

https://www.plainsite.org/realitycheck/tesla.html

That is, if you haven’t already seen it

Elon Musk wears the aroma of illusion and castes his mind control with help from space industries which laud their story line in media to benefit their own personal ends. Tesla financial statements thanks to Wolf have been shown to carry the illusion and it worked to flurry the markets until it didnt. Given the employee issues which leaked into press regarding Musk’s management style, we see continuation of the illusion at work. Musk is a puppet – a patsy – allowing huge money to invest in space tech while keeping it hidden and isolated in a private firm backed by deep state investors who like to act out of the public eye. We know Musk has no concern for business reputation when he threatened a hero with his pedo guy comment. The damage this comment did to Tesla but more – risking exposure of the Tesla investors up to no good – was critical. Even Musks own father has an interesting take on his sons illusions. His solar roof tops launch suffered possibly catastrophic impact to Tesla solar roof brand. I hope solar roof tops are picked up by competitors who hopefully will do a better job at launch having data based on longitudinal studies. The planet needs solar oil industry – get over yourselves.

The Chinese car market is not anywhere near saturation. If you assume they buy just as many cars per person as the US than 60 million is easily do-able but their max until now is only 25 million vehicles per year.

“No major automaker still alive today has been able to lose money and burn cash year-after-year, living off the eagerness of befuddled investors to throw more money at it. Only Tesla has accomplished this unique feat of investor-befuddlement.”

Tesla has been selling cars for 7 years*). Opel made losses for decades (according to GM) and i doubt the Koreans made a profit in the last century without extreme support of the Korean state. And i suspect that Saab, the minor Japanese, the Australian builders, Leyland, Rolls Royce, any sport car maker, that Malaysian car company, Seat, Lada, etc. all had years if not decades that they made losses.

*) I don’t consider the Roadster a car. It is like a Ferrari a 4 wheeled specialty vehicle using none car technics.

There are 1.3 BILLION people in China – on similar landmass as the lower 48 in the US. Most of them live in high-rises, not single-family houses in the suburbs. Congestion is unreal. Parking is very expensive and hard to find. Think of Manhattan, but all over the urban areas, not just one city. Not that many people own a car in Manhattan, and fewer households still own two cars. But in the US, Manhattan is the exception. In China it’s the rule.

To add a finer point to Wolf’s comment. All of my wife’s family and our friends in China are 1 car households. Unlike my 2 car household in the US, there is very little reason for a family in China to own more than 1 vehicle.

Antidotal: We have friends in Guangzhou, in their early 30s, dual income-no kids, who traded in their 1 car for a fully loaded Volvo S90. They looked seriously at Chinese luxury EVs but opted for the S90… Tesla wasn’t even in the running.

The number is 1.4 billion. But you could compare it with car ownership of japan and the sales per year/ownership ratio of the US. That still leaves big future growth

ps Japan makes it very advantages to buy a new car instead of keeping an old car so i use the American replacement rate

Indeed Mr Richter and that conundrum is rarely evident in the US discourse on China.

It is the reason China lays more railway track each year than the entire world. It is the reason China has plans to have a unique fleet of electric buses throughout the nation within five years. It is a reason why a lot of their strategic development along the New Silk Road emphasizes the development of railways and rail corridors. China’s focus on mass transport has been in tandem with their explosion in personal MV manufacturing capacity

The thought of seeing China’s 1.3 billion people using the world’s resources to shuttle around in electric or combustion MV, as we have done over the past seventy or more years, is the stuff of nightmares.

I remember Enron went up vertical and then dropped to zero. Just saying.

Stock price move makes people think and come up with theories.

Investing is about generating cash flows AKA wealth creation.

Speculation is about transfer other people’s money into my hands.

To justify Telsla as investment, entire auto industry need to turn 100%EV and Telsla has to be at least No.2 to justify its valuation.

To speculate Tesla, you do the same shit as what you do to BitCoin. You buy the dips, you sell the rips, you sit the trend.

For those who is confused about whether Tesla is a car company or a data company or a “tech” company, if you are NOT even sure what Tesla is, how can you forecast its cash flow? With safety margin?

Musk has pulled off a lot of shady stunts to keep Tesla and Solar City above water. He has pocketed billions at the helm of a company that loses money at an astronomical rate. In America, nothing happens to these people. Look at Elizabeth Holmes and Theranos. Why isn’t she in prison?

Musk should realize that financial fraud in China results in a show trial to make an example of you and deter others. This is followed by very long jail sentences or execution. It is my opinion from reading about Xi Jinping’s ongoing crackdown on corruption, that Musk has crossed over the line that mandates capital punishment.

Wouldn’t that make all the Musk fans soil their drawers.

I read today that Musk is being considered to head up the new Space Force as a technical advisor and head of civilian oversight.

The only concern is with the astronauts who can no longer say, “Let’s just kick the tires and light the fire”. Or, “Light this candle”. Apparently, it’s all going to be self-driving space craft, with lunar stops on the way to Mars. They’re going to finance everything by carrying Amazon products and booking tourists.

Did you see the badges? “Jim. Jim. Where’s Captain Kirk”?

‘Elizabeth Holmes, the founder of the now-defunct biotech unicorn Theranos, will face trial in federal court next summer with penalties of up to 20 years in prison and millions of dollars in fines.

Jury selection will begin July 28, 2020, according to U.S. District Judge Edward J. Davila, who announced the trial will commence in August 2020 in a San Jose federal court Friday morning.’

She IS going to jail.

The sentencing guidelines will I think preclude a year or two cuz she is a she and young, dumb and cute.

I’ll guess 6 to 10 in a Club Fed.

But for some reason people think she got away with it.

Legal stuff takes a while.

Hey Nick Kelly …. you must be joking. The rich in America don’t go to jail, unless they need to be executed by Mossad in a Federal Gulag like Epstein ….. How about the sweet list of her Board Of Directors ?

You expect them to join her ? Hahahahha good one ….

which included William Perry (former U.S. Secretary of Defense), Henry Kissinger (former U.S. Secretary of State), Sam Nunn (former U.S. Senator), Bill Frist (former U.S. Senator and heart-transplant surgeon) … etc etc etc

Here is a partial list of those defrauded by Theranos.

‘George Shultz, former US secretary of state.

Gary Roughead, a retired US Navy admiral.

William Perry, former US secretary of defense.

Sam Nunn, a former US senator.

James Mattis, a retired US Marine Corps general who went on to serve as President Donald Trump’s secretary of defense.

More items…•Mar 19, 2019’

See any names you know? The board itself was heavily invested and were victims.

Even if they weren’t how would it affect Holmes sentence? It is not a defense to say others were guilty. No logical connection.

Financial journo Ken Auletta interviewed the board before the scandal broke and found them ‘mesmerized’ by Holmes. Were they stupid? That’s not a crime. Be thankful.

As for the rich not going to jail…if you are serious, try reading a newspaper or watch a show called American Greed. Enron ring a bell? That was quite a while ago but Skilling hasn’t been out long. If he had lived CEO Ken Lay would have got a longer sentence despite being a personal friend of George Bush. Remember Madoff, at 150 years he is by means doing the big bit. Shalom Weiss’s release date is in 2754.

Hear is a name you might recall: Lou Pearlman, one time boy- band manager. He is only in for 28 years. Remember World.com? Bernie Ebbers at 78 just got out after doing 13 of 25 on health grounds.

Obviously, big time securities fraud, mortgage fraud, banking fraud can ONLY be done by the rich.

Is it mathematically certain that Holmes isn’t going to jail? No, because she MIGHT be found not guilty. Look at the Casey Anthony verdict, or the OJ verdict. With an American jury you never know.

But if, as I expect she is found guilty, the judge will apply the sentence guidelines.

In other news, Liz just bought a small island off the coast of Argentina – no extradition.

I am not sure Musk will get away with it. Everything is rosey now. If the company goes belly up, the lawyers will start digging.

– Has Musk been selling his stock options recently ? cashing in before the crash of Tesla shares ?

I like to think of a solid company as one with a “low center of gravity”. One which can withstand rough seas changes which inevitably occur.

The higher that center of gravity the more closely investors must watch out for trouble. Tesla has of course a very high center of gravity making it more sensitive to worry.

Something as sneaky as a substantial outbreak of the coronavirus might be enough to cause investors to hit the panic button. Chinese/Hong Kong/Taiwan/relations could roil markets. Bernie Sanders winning the Presidency would be an interesting test. If wise investors are reminded to be the first to panic, should we measure their blood pressure? Tesla scares me. Investors may feel victorious for routing Short Sellers.

Wanna bet?

American stock prices are massively overprice. See Union Pacific PE of 22. Historic normal for Union Pacific has been something between 10 and 16. Half Tesla because all American stock are massively over price and you get somewhere around the value of BMW. Still overvalued IMHO but could happen. Seeing Tesla as an American BMW with comparable sales is not something impossible.

Referring to Union Pacific. If you like this sort of thing read the Berkshire Hathaway report available on line for the year he bought BNSF (around 2010). He was buying stock in both BNSF and Union P but ended up paying a premium for all of BNSF. He explains why either of those are good investments and now that BNSF is bought up that only leaves Union. It’s probably going to be on my shopping list during the next recession. It’s very high priced right now, but it pays dividend and you could be pretty sure if you held it long enough you would make a mid to high single digit return even at today’s price, but having patience to buy in recession would be better.

char

You are entitled to your opinion…so go out and put your money where your mouth is: short American stock prices.

In your simplistic dystopian view, you could make a fortune in a matter of days.

Or maybe not.

A 25k Camry is not the same as a 50k model 3. So vehicle counting doesn’t apply here.

My experience:

I don’t necessarily like Musk or the company, but I was on the market for a car and – heck why not – test drove a model 3 this weekend… and immediately placed an order. Walked away from a pre-negotiated lease on a bmw 330. It felt like the time I got my first iPhone in 2009 and never considered any other brand since then.

Call it whatever you want, but these cars will sell.

For reference, I’m in Austin. Just moved from SF.

i’ve had a model s for about 2 years with 40k miles on it.

it is by far the best car i’ve ever driven. it brought joy back to driving especially in traffic.

my wife and rush to get out of the house first, because the early bird gets the worm….eer…the tesla.

itesla the car and tesla the company are much different. tesla company’s profits and near term profits dont justify the price.

…reading this makes me sad for you. I hope you will find true happiness and fulfillment someday in your life.

But Wolf, so out of touch dude. Don’t focus on what IS but what CAN BE. /s

The last few months are really giving me deja Vu from dot com days

Thinking to may be short 10 shares of Tesla just to see. I wonder what would happen. May be set a stop loss at $650. I mean unless it has that kind of monster jump. It would cap the losses. And at 10 shares, it would be a small loss unless Tesla doubles in a day.

Be careful shorting this beast. Very little float. Lots of shares owned by institutional investors that have owned it for a long time and don’t want it to go down and that are big enough to move the market if they buy. Huge amount of short interest outstanding. It’s the most obvious short in the world — and therefore the most dangerous. I have been on record for years warning against it.

Options have less risk but come with huge premiums.

If you do, let us know how it went. I’ll keep my fingers crossed that you get the timing right.

Code in case it happens.

Monday

Squeeze

1.5

Short interest is down to 1.5 days currently as of 1/28/20, very low for TSLA.

Whew, all I have to say is that I’m glad I have been too busy to take the time to short 10 shares. Cause that after hours would’ve killed me.

I already figured people were right, the guys who are shorting Tesla are getting their heads handed to them And the premium for options isn’t worth it. But I’m sure someone has made out with today’s pop. I’m just glad I didn’t try to short it.

Think I’m going to stay with the normal people and away from TSLA from now on.

To be fair to Tesla though,

Most companies on the stock market are hugely overvalued. Tesla like almost every stock is a gamble, but if one or 2 good enough battery breakthroughs happen. Tesla is poised to have a major breakout. It could easily be actually worth far more than it’s current value. If that happens.

As it stands now. Most of the rest of the automakers can go only go downhill. I don’t see GM or Ford growing much from where they are now.

As a second possibility Tesla might be capable of licensing it’s self-driving car capability, if it becomes fully automated. Alot of people would pay an extra up to $10,000 for a fully self driving GM or Ford or other car. Tesla might even be able to sell a kit for preapproved used car models. While Toyota for instance might develop it’s own self driving car. It’s not something that can be developed immediately. And if you’re GM and you don’t have a self-driving car yet and Toyota does and they won’t license it to you. Tesla is gonna make alot of money. While Tesla self-driving has caused some accidents, it’s still a below average crash rate and will continue to improve.

There are other possibilities, but Tesla is a viable gamble. Cars make alot of money. It’s not like Wework, where there is no possibility of making money.

Thomas:. Tesla’s self driving software can not even detect a parked fire truck in it’s own lane! Nobody will pay for this kind of software!

There will be bugs along the way, but Tesla’s self driving will continue to improve. They are the only company actually putting a significant number of self-driving cars on the road. And the only one putting them in everyday persons hands. Tesla cars have all the necessary hardware to be fully automated. You do have to have the self-driving package installed or ordered with vehicle, it can be installed retroactively. Over time they release software updates that improve safety and increase automation. Right now in its current software state alot needs to be done yet, but they are the only one actually selling them to the masses.

It’s a risky bet at the current price. I wouldn’t put all my money in Tesla stock, but if I did have stock betting money, I would buy at least a little. Probably, I would definitely buy Tesla before Amazon or many other stocks.

It’s a gamble, but might actually pay off, unlike many other stocks “in the sense the company might actually make enough money to justify its stock price”.

HOPE is a poor investment strategy

WES – That is patently false FUD.

Talking about tech/software/data, it is much more likely that Google will come up with a better self driving software in a vehicle then Tesla. A Tesla looks outside for danger. Google, should be able to know what is happening outside AND inside the car. Google would ‘know’ (= be able to predict very near to 100%) why you drive your car, where to. And Google will know that off everybody and everything around you. That would things make save.

There are a few snags though. Old cars for one, some unforseen competiton, government holding up development, and what not.

When Google meats Tesla in a consortium, that would be something incredible. But why should Google share its knowledge with Tesla? For a fee perhaps? But then every carbuilder could do the same. I’m sure government(s) would demand a standard in such case. Where would the advantage for Tesla be?

Google/Waymo is likely the main competitor for self-driving tech, that would license it. I wouldn’t say Google is ahead though. As for knowing what’s going on inside the car, that’s far less important. Tesla could add that at any time. I’ll pass on that. My car doesn’t need to sell to advertisers, why I’m driving my car.

Even if some company could develop a better self-driving car; they would have to prove it. That’s where Tesla has the advantage, they already sold a bunch of them and updated them in stages until they were feature complete “taking in the future sense”.

It’s possible to have multiple companies licensing the tech and making big money. GM might license Tesla and Ford might license Google/Waymo. Even though any company could try to develop their own self driving car, they wouldn’t complete it at the same time. If your competitors are selling self driving cars to the masses and you don’t have it figured out, you better license it fast.

Tesla is ahead in self-driving semis, where alot of big money is. Google is dependant on other companies to actually make cars/semis.

All of the big car makers are rolling out EV models that will be more reliable and better built than Teslas. And Tesla does not have the best self driving technology available. Kudos to them for exploiting the subsidies, for being first to bring this sort of niche car to market, for portraying themselves as a green company (they are not), and other things, but the competition is heating up and they will not keep up.

isn’t it ..

that business fails to recognize the changing tides ??

that business is fearful of embracing the new ideas & needs of the now / current generation ??

that they are solidified rigid in yesterday ??

trapped is a good word here.

EV’s are easier & cheaper to make .. less labor intensive ??

is it that the auto makers are holding on by their fingernails to a vanishing market of higher profit’s ??

I get it .. why build 4 vehicles when you can get the same money for 1 vehicle !!

let’s not realize that it is easier cheaper & with less components .. hey !!

dare I wonder if the true nature of Tesla is as a tax evasion / money laundering gizmo ??

i am one for conspiracy theory ..

Autonomous driving is a failure for many manufacturers according to the latest news, may be in the next 50 or 100 years

1) SF = QQQ, Nasdaq 100 ETF.

2) QQQ on, Friday Jan 24, gap higher, to a new all time high and fell

sharply lower, to form a large big red body, on high volume.

3) QQQ at the open was almost the high of the day. Its an upthrust.

The full body swallowed the previous x4 trading days. It close on support with little tail. Its very very bearish. 4) Lower time frame provide more details. There are two 4 hours bars per day, each day. On Fri, the first was a big red full body bar, on high

volume, with little tail at the bottom. it closed on support.

The second bar is anomaly : the volume was almost the same, but

the size was only half. The big red feasted on x8 previous guppy bars. It tell us about the speed, the acceleration of the move on Fri at the open. 5) If next Mon QQQ move lower in direction to the 211 – 216 congestion area it will form a trading range, a Cause #1. It will look like a boy scout tent.

6) Cause #1 can send QQQ to the next congestion area, between

194 – 205, to build a wider trading range, cause #2. It will look like a military tent for 10 soldiers.

7) Cause #2 can send QQQ to the large trading range below.

This trading range is big as a base for whole division. It will build a very large trading range, a huge powerful cause #3.

8) This division can get an order to conquer the Rocky Mountains, or

to join SF tents city.

9) QQQ Fri high might been==> the peak.

US drivers turned away from Toyota Prius and Chevy Volt towards SUV’s and crossovers. Not excited about China illegally acquiring US technology. Gas is cheap, US public charging stations few.

Wuhan has cars, can not leave town. New Year travel plans cancelled. Disney China closed. A speed bump or a slow down.

Tesla may be overpriced. The stock market may be irrational for significant periods of time.

Michael Engel,

“9) QQQ Fri high might been==> the peak.”

Noted. If it was, I will give your comment a shout-out.

Wolf,

Joined you on the short side. Chose to short EM’s this past Wednesday. Based on chart action of the two biggest holdings of the MSCI Emerging Markets index, Alibaba and Ten Cent Holdings. Those two make up 10% of the index.

Jan 29th might be a profitable trading day for your short. Boeing reports results before the open. Likely taking a $6 to $8 B charge on the 737 MAX. Won’t be the last “one-time charge” for the troubled program.

Slainte!

As usual I can’t understand most of what you say but I do have to wonder … does this type of analysis really work? Does anyone really think they can predict stock movements based on shapes of graphs? I see alot of this these days, it sounds like a lot of hot air to me.

The Russel/IWM was more telling on Fri I think. Peak or no peak, I bought few puts and few SQQQ calls for a test.

TTBF

Whoops! TTBTF

Three things I’ve learned over the past 20 years.

1. Don’t bet against Bezos

2. Don’t bet against Musk

3. Don’t bet against The Fed

No bet works forever.

And especially don’t bet against the folks that are behind all three. ;-)

This one thing I’ve learned; Don’t bet.

Invest (genuine meaning) in yourself and your enterprise.

The latest newspeak on Tesla’s valuational vs the rest is that Tesla is going in the right directional while all the other automakers are stuck with these carbon eating machines which in a few years will disappear. That is like the buggy makers-all their “assets” are going to zero. This is the same crank narrative that is being pushed about Oil and Gas investment right now-why are people investing since it will all have to be written off in a few years when we go 100% to alternative energy. Unfortunately, this is about faith and belief, so there is no real argument that will dissuade this crowd-maybe real apocalyptic failure, maybe….

Tesla seems like a poster child for this entire stock market. A Fed-fueled fantasy trip to somewhere special. Better get on-board!

You have proponents of Tesla stock pounding the table about past performance and pipe dreams. On the other side, you have fundamentalists opposing the stock with analysis that hasn’t produced results in decades. Both sides are heavily impacted by Fed action that is random and counterproductive.

Why be in either camp? Just stay away and invest in something less risky.

The major automakers are migrating to high end cars, Tesla already makes high end cars. They are ahead of the industry. Their product is substandard, has room for improvement, ,

good material for boosting the brand during earning call conferences. They could name a CEO, more reason to buy the stock. Meanwhile they will always squeeze the shorts until the system is changed or we go to all futures market. If the pressure gets too intense Musk will take the company private at a premium to share price (hey already on the way to China) If somehow that doesn’t work out, they will be selling EV tanks to the DOD in a few years. First 1T defense budget soon! There was a rumor that Apple, or someone really big, would buy Tesla and this recent high valuation actually makes that more possible, not less.

My continental-European view is that there is definitely value in Tesla. There’s a heavy carbon-tax being introduced on cars here (same forecasted in China), YoY prices jumped about +10%*, and we’re only in the 1st phase of that. Also, safety electronics requirements are increasing in this decade (Wolf used to cover that with his hedonic price adjustment topic). Tesla is safe from both, as it already developed all the tech required. That’s a great start to sell engineering services for everyone else.

So no, it’s not a conventional car company, we must investiagate other potential sources of income as well – last year they struck a carbon-pooling deal with Fiat, meaning Teslas sold in the EU ‘count towards’ FCA’s carbon limit. And Fiat is not even the most in need of those carbon chips (they do not manufacture cars like the G63 AMG), so what if the EU ups the fines for excess CO2 output? Conservative automakers will be begging for Tesla to share their zero-emission sales fleet with them.

The hype is definitely a huge risk – their self-driving option seems useless just to name one dead asset, but overall no other manufacturer has an electric-sedan that can compete with Tesla 3 or S. Sad, but true – there is no VW, Mercedes, Renault, Ford or Toyota alternative of those models. Old industrial players have compliance cars like the I-Pace, e-tron, etc., but no real competition. With the newly built factories Tesla can keep pushing down prices and pushing up sales without restrictions.

So are they overvalued? Possibly, but they are not to be thought of as a miniscule player anymore – I’d say they belong in the 15-30 B Mcap range somewhere.

Oh, and sorry, but I can’t resist to address those comments about what’s under the hood and fire hazard. Some electronic parts in Teslas may indeed originate from the previous millenia. They do not always repackage original designs, instead use them as they are. The IGBT in the Model S for example counts as a rather ancient one. But it works. Yet it is important to note, that efficiency is not really affected by using ‘old’ parts. Bullet trains in the ’80s and ’90s were developed for zillions of dollars, and their power electronics are marvelous piece of engineering even by today’s standards. Many ICE car technology originates from the truck domain, EV things come from electric trains (and electric forklifts in the case of less powerful vehicles).

Fire? Hah, guys – for a 100 years we propelled ourselves using gasoline! While it does not explodes like it does in the movies, it is a lot more dangerous than a pack of batteries. But diesel BMWs are not on the top of fire-safety ratings either. Tesla should take fire-safety seriously, but I don’t think it’s a great issue.

*The new Ford Fiesta-based SUV, the Puma starts from 25.000 USD for example, which is kind of crazy. The spread between EVs and ICEs is still great, but disappearing at the speed of light.

Other potential sources of income?

Why not start with just one source of income, Professor?

Some suppliers for road electric energy have currently gone from 8 euros for a charge to 71 euros while for a full tank of petrol it costs 45 euros, it doesn’t seem very promising to buy an electric car currently in Europe including Tesla.

That is true – however to head-on name those “suppliers” they are called Mercedes-Benz, BMW, Volkswagen and Ford (aka the Ionity brand). Not the companies that would be typically interested in the success of EVs, so it’s a logical market strategy that if they can’t profit from cars they instead try to profit as service stations. But the overwhelming majority of EV users still never use public chargers, so I have doubts about this approach.

speaking of Musk, if he (or Bezos, or Nadella for that matter) owned The UP or The Burlington, u think their trains would be moving 60 mph thru the vast expanses of the west or 60 across the mid-west plains states. Further, u think the 100-year designs for their engines & box-cars w/b unchanged?

tough to compare Ford Motor to Tesla…like comparing George Westinghouse to Nickola Tesla…PJS

Peter Stubben,