GM shifts even more production to Mexico (even as its US sales fall). But Ford’s imports from Mexico plunge. FCA’s, Audi’s, Nissan’s down too.

By Nick Corbishley, for WOLF STREET:

Hit by the global swoon in auto sales, Mexico’s exports of cars and trucks to the rest of the world fell by 3.4%, to 3.3 million units in 2019, the first annual decline since 2009. Exports to Europe plunged.

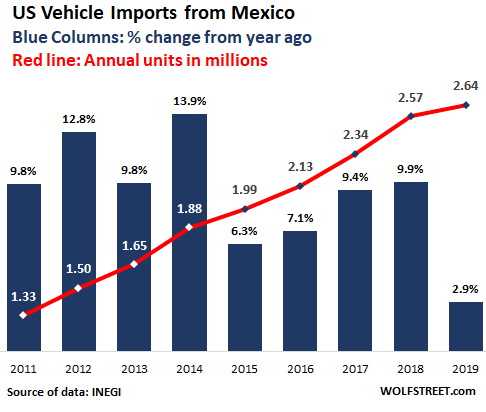

The U.S. imports eight out of 10 cars and trucks that are assembled in Mexico. Over the first nine months of 2019, auto imports from Mexico grew at 8% year-over-year. But in Q4, imports suddenly plunged 11%, according to data from the Mexican automotive industry association AMIA (released by the National Institute of Statistics and Geography INEGI). In December alone, auto imports tumbled 16.7%. The year-end swoon slashed year-total growth of imports from Mexico to just 2.9%, the smallest increase in over a decade. In 2019, the US imported 2.64 million vehicles from Mexico:

The multi-year surge of vehicles imported from Mexico into the US occurred even as new-vehicle sales in the US have fallen for three years, including 1.2% to 11.1 million vehicles in 2019, the lowest since 2014, and below where they’d been in 2000. This increased the share of Mexico-built vehicles in 2019 to a record 15.5% of total US sales, up from a share of 10.5% in 2013.

Mexico’s auto industry is worried. Over the past decade-and-a-half, it has enjoyed the benefits of non-stop growth, largely based on exports to the US. Between 2011 and 2018 the total number of vehicles sent to the U.S. from Mexican assembly plants surged by 93%, rising every single year, sometimes by double-digit percentages, including 13.9% in 2014. Even in 2015, the worst year until this year, the total imports still grew by 6.3%.

These increases happened even as the U.S. car market has been declining for the past three yeas. But now the impact is being felt south of the border.

Of the 12 global automakers with plants in Mexico, seven reduced their shipments to the U.S. in 2019. For Q4, the data is even grimmer with 10 out of the 12 automakers reducing their shipments from Mexico to the US. The companies that cut back the most were:

- Mazda’s imports from Mexico plunged 55% over the course of the year, to 26,177 units.

- Audi’s imports from Mexico dropped 19%.

- Nissan’s imports fell 11%. In the last quarter of 2019, Nissan’s imports from Mexico tumbled over 30% year-on-year.

- Chrysler, whose imports from Mexico dropped 11% year-on-year, to 450,000 units. Like GM, Fiat Chrysler has hugely expanded its Mexico operation over the last nine years, increasing its total annual imports from Mexico by over 200%, to 504,793 units in 2018. But last year the trend began to reverse.

- Ford slashed its imports from Mexico by 66% year-on-year in the last quarter of 2019. In the first three quarters of 2019 its total imports from Mexico had risen 18% before collapsing, due largely to the Ford’s decision to phase out several car lines — most of them assembled in Mexico.

There were three big exceptions:

- Honda, whose U.S. imports from Mexico increased 20% year-on-year between October and December and 46% over the whole of 2019.

- Volkswagen, which increased its imports from Mexico to the U.S. by 32% year-over-year, with its car models up 36% to 146,792 units and its Tiguan SUV model up 27% to 118,046 units.

- General Motors, the biggest outlier of all. No company has bet as heavily on Mexican production as GM. In 2019, the company imported a grand total of 766,165 cars and trucks from Mexico, up 15% on 2018 and 140% on its 2011 total. That was despite UAW’s 40-day strike, which prompted GM to idle its plant in Silao, Mexico, that accounts for roughly half of its entire Mexican output. A staggering 99% of the vehicles GM imported from Mexico in 2019 were SUVs, compact SUVs, and pickup trucks.

For most automakers in Mexico, 2019 was a tough year. New vehicle sales in the domestic market slumped 7.5%, the worst contraction since the Global Financial Crisis.

Mexico’s auto industry is also tangled up in the current global slowdown in auto demand, with total auto exports falling by 3.4% to 3.3 million units in 2019, the first annual decline since 2009.

“It’s not a matter of the plants’ capacity, it’s about how much of this production the market is absorbing,” departing AMIA president Eduardo Solis told a news conference. “We’re seeing major falls at a global level.”

There were sharp drop-offs in exports to other countries: Canada (-12.5%), Brazil (-34.4%), Chile (-34.5%), Peru (-19%), Germany (-8.5%), Spain (-52%), Italy (-29%), and France (-50%). Exports to Europe as a whole were down by 18.9% from 248,000 vehicles to 201,000 vehicles, a reflection of the decline in auto sales in much of Europe. By Nick Corbishley, for WOLF STREET.

But not all automakers in the US had falling sales. Here are the top automakers in charts. Read… US New Car & Truck Sales in 2019 Fell Below Year 2000 Level, 3rd Year in a Row Below 2016 Peak

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Guadalajara Motors”, as banned??? user “DeadWeight” on another site calls them.

“NAFTA means jobs. American jobs, and good paying American jobs. If I didn’t believe that, I wouldn’t support this agreement.”

— William Clinton

“NAFTA will create a million jobs in the first 5 years.”

— William Clinton

“The real end winner of NAFTA is going to be Mexico because we have the human capital. We have that resource that is vital to the success of the U.S. economy.”

— Vincente Fox

‘Our goal must be a day when the free flow of trade, from the tip of Tierra del Fuego to the Arctic Circle, unites the people of the Western Hemisphere in a bond of mutually beneficial exchange.”

Ronald Reagan, State of the Union, 1988

“NAFTA is an investment in America’s future.”

Ronald Reagan, 1993

yep it’s great – allowed corporations to EVADE taxes and globalize wages – of course that meant that 40,000,000++ former living wage jobs would now be gone forever

except for 1%

I only came here to hear about Tesla, the worlds most valuable brand.

Tesla’s market share in the US is 1.3%. In terms of sales, it barely matters. In terms of hype, it’s HUGE.

Tesla sold 367k+ cars in 2019 (3 models—Model 3 taking vast majority of sales). This is the same number as America’s best-selling car Ford Taurus back in its heyday. Was that just hype, too?

Rolex produces 0.1% of watches sold each year (my estimate); are they hype, or do they fill a certain niche?

noname,

The problem with Tesla fans is that they don’t even try to understand the stuff they themselves are spouting off. So here we go down debunk lane:

1. Tesla’s 367K sales of Model 3s were GLOBAL sales, not US sales.

2. In the US, Model 3 sales are now fizzling.

3. Folks that compare GLOBAL sales of Model 3s today with Taurus sales in the US sometime in the past are seriously trying to delude themselves (though they’re not going to be able to delude others with it).

But yes, you totally nailed it with your Rolex comment: Tesla is a niche automaker, with a market share of essentially 0% in China, the largest market in the world; with a market share of 1.3% in the US, the second largest market; and with a market share of essentially 0% in Japan, the third largest market. But, as you said, it fills a niche and has built a well-known brand.

Tesla and Musk also put EVs on the map, which was a big accomplishment that no other company before had been able to do. EVs have been around since the late 1800s, competing with steam-powered vehicles, and until Tesla came along, that was their heyday. So that’s a big accomplishment, funded by over $20 billion in investor money that has now been burned.

I have no problem with the cars — but with the stock. This valuation of the company is just plain stupid and is based on nothing but hype. That’s what my above comment referred to – not the cars.

Tesla isn’t unionized, is it? ;)

Wolf,

Thanks for the reply. My numbers were my own research (I didn’t dig deeper to see if the sales number was USA or world, however), including the Taurus comparison (coincidentally you were selling them at that time I bet?!).

I’m not for or against TSLA, was just trying to see why you were so up in arms over them/their stock :D Perhaps they sense a buy-out by a big auto manuf?

On that note, did you read GM plans on bringing back Hummer as their electric vehicle line (or something along that line anyway)? Seems paradoxical… and foretelling ;)

Slight difference. Rolex makes money on ever watch it sells

Ha, I knew there was a difference. I just couldn’t put my finger on it :-]

Tesla is set to have a “good” 2020 – it had no large overhanging debt payments due in 2020.

It’s next large payment of over $1 billion is due in March 2021.

Effectively what I take that to mean is it needs to have upward momentum in Q3 & Q4 2020 to keep selling the dream so it would be smart for them to front load disappointment into Q1 and possibly Q2 and then have a “turnaround” story to sell later in 2020….

Where does that leave Q4 2019? I don’t know.

My thinking on Tesla is that it loses a fortune quarter after quarter after year after decade.

The more is sells the more it loses so it’s a good thing they don’t sell many cars.

Did I mention Tesla is powered by fossil fuels because roughly 80% of all power comes from coal and gas.

So I am thinking someone does not want Tesla to fail. Could it be that Tesla is the poster child that gives billions of people hope that the future will not resemble The Road.

Notice how we are sucking oil out of the carpet (shale), drilling miles beneath the sea and steaming oil out of tar in Alberta.

Now why in the heck would we do that if there was so much of the stuff left?

You still reading papers from the 70’s, 80’s, 90’s, 00’s or 10’s with this “We are running out of oil and gas!” line? Ever heard the story of the boy who cried wolf? That rhetoric always comes out when the prices are too low to make profits, usually from players wanting the prices to go up so they can make a profit. It’s pretty simple and the game has been going on for decades.

Cheap labor is not the end all for growth in dales might be the lesson here.

Well, my problem with this data is that it’s not adjusted for added value. E.g. if an assembly line is moved back to the US it will cause a drop in number of cars manufactured, but it does not implies that all the parts manufacturies (wheels, headlights, seats, engine, etc.) move with it. Thanks to modern logistics methods those can remain in the low-wage areas. So in theory it is possible that the production of end-products in Mexico plunged, but the total automotive goods value (in $) increased. Though since the main export market for MEX is the US, so it’s highly unlikely, but it shows the basic issue why this kind of statistics is not bulletproof.

That also occurred to me. Around 1982 I did the QC/QA (whatever) on a CMM for Empire Castings, Windsor CA. (I never really had a “career”, just a whole lot of different and interesting jobs).

Anyway, we made the molds for alloy wheels to many mfgs specs that were sent to Kelsey-Hayes in Mexico where the wheels were actually cast. (I even did the famous Corvette left and right side rims). Lots of cool stuff in that machine shop, lathe with 3 ft throat, punch tape controlled CCM mills, EDM, etc.

And this was a long time ago. So I suspect many more parts are still coming out of there. So there is more data I’d like to know also, but digging it all up would probably be impossible.

Hell, following the supply chain on anything is nowadays, even foodstuffs, which is kinda scary.

“The three biggest auto makers in the world are: Matchbox, Hot Wheels and Tonka”

— jay leno

Back in the 60’s, my favorite electric car was Scalextric, look what happened to their sales!

The other day on “Dennis the Menace” (1950s/60s), they won an old electric car. 1916 Baker Electric. Most young people would be “mindblown” over its existence I’m sure!

Revell used to be real big, too…..I owned several…..good cars.

NC/Wolf (whoever wrote this),

How about some stats for US based auto production, broken down by foreign or US based company.

That info (relative to annual US demand) would illustrate US vulnerability to FX related price shocks (tied to interest rates), economic embargo, etc.

Thanks

Looking at a five year chart of total US vehicle sales did not scare me. Sales fluctuations are normal.

Congress signed a new NAFTA deal in Dec. 2019. This may raise the minimum wages some auto workers will receive. There is a continued effort to build better robotic assembly lines.

The US GDP was growing according to recent govt. reports.

The price of a pair of Levi’s blue jeans was $25 in 1980.

The price of a pair of Wrangler blue jeans is $18 at Walmart (2020).

You can’t always get what you want… sometimes you get what you need – Rolling Stones

We, Trump & Company included !

Need to rename “TARIFFS” to …”MARKET ACCESS FEES”…

& charge a 100% “ACCESS FEE” of the “MSRP”

( the “Market Suggested Retail Price )

of the “TANGIBLE PRODUCT” or “INTANIGBLE SERVICE”, produced or provided by the for profit, multinational, greedy, global entities, who are domiciled, ( protected ) in/by THE UNITED STATES OF AMERICA.

[ But are committing economic treason by out sourcing to other nation states. ]

IF THEY DON’T “LIKE IT” THEY MUST “RELOCATE” TO…. IRAN, COLUMBIA, MEXICO, CANADA, etc.!

They either support the “United States of America” or they don’t” &…

“GET THE FUCK OUT” *

P.S. Their new, Corporate homes,…. foreign, domiciled, nation states, will take really good care of them! ( I think, …. but really don’t care! )

[ * And bump up the ‘MARKET ACCESS FEE’ to them ( Formally USA domiciled corporations ) by… 200% of their MSRP”! ]

They are not entitled to a free, unfair, unbridled right to us, our assets, or our markets, or our incomes, at our collective expense, without any tangible contribution or commitment to us.,

“The United States of America”

PARDON MY FRENCH!!!!

“parlez-vous francais?”

If you have no job, you can’t pay income tax.

Outsourcing and immigration are still the biggest issues to most of us.

Outsourcing and immigration are the biggest Short Time issues, far shore…

How some ever, the biggest long term, bigger by far, is the continuing degradation of the US dollar; for instance, I made a consistent $10 per hour mowing lawns in 1957 and 58, towing the mower behind my bike, with the rest of the tools in the baskets used for the newspaper delivery work in the early morning.

Although I have made more, briefly, as a hot shot carpenter contractor doing rapid response restoration work to get businesses back in operation, etc., never made any where near, adjusted for inflation, regularly.

According to what I can glean from the BLS inflation data, and anecdotal reports from before World War 1, the US Dollar today is worth less than one cent in 1900.

Why? Because we have allowed a private corporation working as agents of the really rich folks who own us all to continue to degrade the dollars we are paid in and hold our meager wealth in, while the rich hold their wealth in assets that keep up with the inflation such as good dirt, better constructed buildings, best jewels, and the finest art.

Don’t for a minute think that the private corporation that is screwing the working folks of USA doesn’t know what it is doing, as some have suggested: It is now and always has been the hand maiden of the owners of the world.

You should hear the automotive people around here. They are already demanding “extraordinary measures”. Maybe they’ll have a law passed to force me to buy a crate full of cylinder blocks.

Joking (but not much) aside, the automotive sector only has itself to blame for the situation it’s in right now. The general mentality of the sector has been to build as much capacity as possible and then to rely on the financial and political sector to help them shift the extra production. All those factories around the State of Guanajuato were built on the assumption car sales would only go higher forever.

But then the unthinkable happened: the plan didn’t survive the contact with reality.

There are no recessions and we are in full financial stimulus worldwide. Most tax codes actively encourage buying new business cars with frankly wasteful frequency (then the same folks who wrote said codes lecture you at length about waste) and leasing has been extended to categories it was never meant for merely to pump sales up a tiny bit.

So who do you blame? A completely imaginary “trade war” of course. Am I the only one thinking of that scene from The Blues Brother where Elwood (John Belushi) lists the most ludicrous justifications for dumping his promised bride on the altar? Next up a terrible flood and locusts?