“The high household debt load is the most important risk facing the financial system”: Bank of Canada Governor Poloz, another central banker that bemoans the effects of this handiwork.

By Wolf Richter for WOLF STREET.

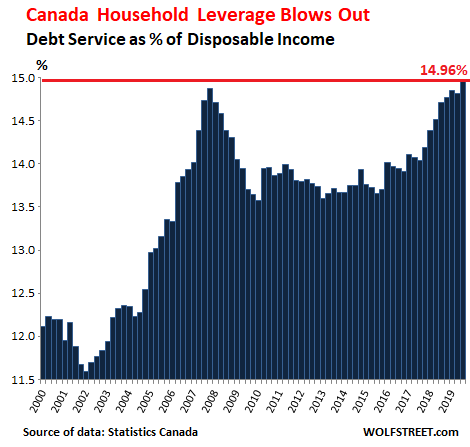

Canadian households, rated near the top of the most indebted in the world, accomplished something awe-inspiring: They got even more indebted and their leverage rose to a new record, according to data released today by Statistics Canada. The portion of their disposable income (total incomes from all sources minus taxes) that Canadian households spent on making principal and interest payments, including on mortgage debts and non-mortgage debts such as credit card balances, reached a new record of 14.96% in the third quarter, This record beat the prior record of 2007, and this happened despite still ultra-low interest rates:

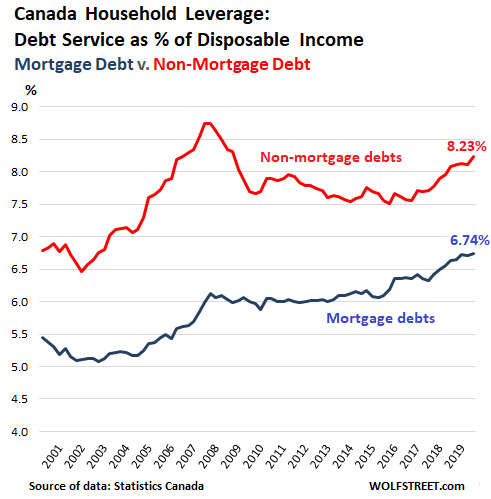

Mortgage debt was the driver behind this new record, as the portion of disposable income that Canadians spent to make interest and principal payments on their mortgages rose to 6.74%, the highest ever.

But these are aggregate numbers, and for some individual households, the burden is a lot higher. Based on data from the 2016 census, 67.8% of Canadian households own their home, and the ratio has been dropping. The remaining households rent, and they do not have a mortgage. And a portion of those who own a home do not have a mortgage either because they’d already paid it off. And another portion of homeowners only carries a relatively small amount of mortgage debt.

But among the remaining homeowners, particularly those who bought in recent years, the burden of their mortgage is heavy. And it’s this portion that everyone is worrying about, not the large number of other Canadian households. In the US, it was this portion that triggered the mortgage crisis — not the renters, and not the one-third of homeowners who’d already paid off their mortgages, and not those homeowners who’d paid down their mortgages significantly.

Non-mortgage debt, such as credit-card balances and personal loans, also increased, but did not take out the previous high. In the third quarter, debt service on non-mortgage debts reached 8.23% of disposable income, the highest since Q3 2008. This chart shows the two ratios separately:

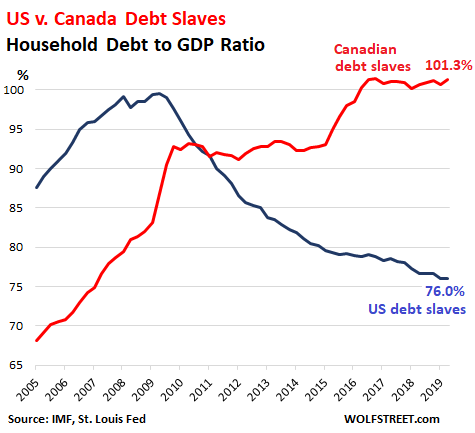

To compare the household-debt burden on the economy between Canada and the US, we can look at household debt to nominal GDP measures, each in their own currencies, which eliminates exchange rate fluctuations and inflation issues.

Americans were forced to deleverage during the mortgage bust and housing bust, and have never re-leveraged to the full extent, particularly with mortgage debt and credit card debts, which are barely higher than they were at the peak in 2007, but over those 12 years the economy had grown, and the population has grown, and the ratio of mortgage debt and credit card debt to GDP has declined sharply. The exception are student loans, which have totally blown out, and auto loans which have also increased faster than GDP.

Canadian households in aggregate never really experienced the full effects of the Financial Crisis in the housing market, and they weren’t forced to deleverage, and there was no lesson to be learned, and they have gone hog-wild on debt to fund their housing bubbles:

“The high household-debt load is the most important risk facing the financial system,” Bank of Canada governor Stephen PolozPoloz said in a speech on Thursday, whereupon he was challenged by BNN Bloomberg’s Andrew Bell during the press conference.

“But aren’t you the man who is to blame for that?” Bell asked. “You kept those interest rates so low all those years. You’re the main author of that bubble, aren’t you?”

Rather than just agreeing with the obvious, Poloz said this:

“A lot of things may have contributed to it, and certainly I would say keeping interest rates low, as many countries have had to do for over 10 years now.”

“If we go back to 2008/9/10, we had a lot of fiscal action, at the same time as monetary stimulus. And then globally, we saw enough of a recovery at that time in 2010 that governments decided, OK, we got things back on track, so we can consolidate on the fiscal side. Monetary policy makers figured we’d be coming out of it too.

“But then the economy faltered again, and we had the period that we call ‘serial disappointment.’ And it’s in that phase that monetary policy kind of got stuck in this very stimulative place, offsetting headwinds that are hard to really quantify by conventional analysis. But they’re obviously there.

“Even though the economy is at full employment, more or less, and inflation is on target, we’re there, but at really low interest rates from a historical standpoint. So those low interest rates are still stimulating against some contrary force. The fact inflation is on target suggests that the Bank of Canada has done its job.

“Now if there are side effects – one of them you mentioned – well, those are secondary effects. They’re not our prime mission. Our prime mission is to stabilize the economy and keep inflation on target. And we succeeded with that.”

And BNN Bloomberg’s Bell asked: “Are you worried that your legacy could be seen as leaving Canadians with a bunch of unsustainable debt.”

This time, Poloz was more direct – deny, deny, deny, because those were only “side effects.”

“No, I don’t see this household debt as unsustainable. That’s an important distinction. I see it as a vulnerability if a nasty shock came along and unemployment in Canada rose significantly.”

If that nasty shock came along, it “would be magnified” by the pile of household debt. “So we would have a bigger and probably more prolonged recession than we would if the debt was not there.” But of course, “even in the most extreme stress tests we can bring to the picture that combine the worst of 1981 with the worst of 2008, etc.,” with falling house prices, rising unemployment, and a big recession, “our financial system remains very resilient through those experiments.”

“Now that doesn’t say that there wouldn’t be people suffering from those recessions, of course, with high unemployment, possibly having to default on mortgages. I’m not dismissing that. That matters a great deal to me.”

To its credit, the Bank of Canada under Poloz has raised rates, starting in 2017, from 0.5% to currently 1.75%, to put a lid on the rampant housing bubbles in Greater Toronto and the Vancouver metro, and it has never dipped into the negative-interest-rate absurdity that has broken out in Europe and Japan, and it has worked with other regulators to put macroprudential measures in place that would tamp down on the ballooning household-debt bubble that was feeding the housing bubbles, but these measures came years too late, and what’s left now are the questions and worries over just how “sustainable” this household-debt bubble really is.

What does it mean when the Fed and other central banks jointly bemoan the effects of their own policies? Worried about not being able to keep all the plates spinning? Read… Is the Corporate-Debt Bubble Ripe Yet?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Related:

‘One of Calgary’s largest property development and management companies has just put 50 properties — a combined 3.7 million square feet — with mortgages totaling nearly $651 million, under creditor protection.’

The outfit is the ‘Strategic Group’

One in four Calgary office buildings are vacant.

Since the downturn in oil and gas, Calgary office buildings have lost 14 billion in value leaving a 250 million hole in the city’s taxes.

Via CBC

Apparently someone tried to assassinate the CEO of Strategic Group a few years ago.

Ya five shots with several hits. Cops say he was saved by the glass of his Rolls, which is bullet resistant. Apparently they penetrated but were deflected away from his head, the target. Maybe Musk should check out the supplier, but true bullet- proof as in armored limo is very thick.

The borrowing and spending binge by Canadian households, businesses, and governments (all levels) continues unabated. Growing the debt in the economy significantly faster than the economy itself grows seems to have developed into a way of life in Canada.

At the end of September, 2019 the total debt outstanding in Canada (bottom line of the Statistics Canada credit market summary data table) was $8.565 trillion. At the end of September, 2018 the total debt outstanding was $8.174 trillion. In the 1 year period from the end of September, 2018 to the end of September, 2019 it increased by $391.3 billion. This is an increase of 4.8%.

Don’t Canadians have a five years reset on their mortgages? If so, they will be crushed between mortgages and non-mortgages?

Cyclops,

Many variables to choose from; from floating up to 2-3-5 years locked in.

When I used to have a mortgage I always locked at 5 years for the sake of budgeting.

My kids (age 35 and 40) have had homes for about 10 years. Their outstanding mortgage balance is equal to one years gross income for my daughter, and about 1.5 years gross income for the 35 year old son. They each have a vehicle loan. They are sitting okay due to our single payer medical system and their pension plans. My daughter has a defined benefit plan and son contributes 40K per year to a defined contribution plan (this includes employer matching funds).

I have always said to them, “It’s not what you can afford when you’re working, it’s what you can afford when you are not working”. They could suck it up and get by if they lost employment.

I think these stats are the nightmare skews from Toronto and Vancouver….la la lands, both as far as RE bubbles go..

Paulo

Canada is mostly an illusion of “someone else will work and pay for my expenses.”

On your Vancouver Island, the union has been out on strike since last July. The old IWA pension was so underfunded that the United Steelworkers still haven’t been able to fill the gap. Unionized Coast forest companies say that C$12/hour into the Pension Fund is what the USW wants from this new contract.

I watched a good customer of mine got run out of business in Chicago (2010) as more and more businesses went broke and the pension liabilities fell onto fewer and fewer employers/employees. His last contract (which he didn’t sign) before he closed his business and sold the land, would have had $12 USD go into the Pension Fund on top of regular wages. Legitimate businesses, with Union labor, cannot ever compete with illegal labor and Chinese slave labor.

Pensions are promises founded on governments spinning the top.

As to Wolf’s article, look at the Royal Bank Balance sheets from 2009 – 2019. Household debt more than doubled, and please do not tell me that Canadian incomes doubled over the same period.

Poloz ? I visited my daughter in Vancouver. Big Mac meal (I was desperate) C$9.23. In 1970, I got change back from C$1.

Yep. Central Banks are keeping the cheat sheet on inflation under 2% annually. Yep, uh huh.

Merry Christmas to everyone. Thanks Wolf, it will be good New Year.

Kam:

” Legitimate businesses, with Union labor, cannot ever compete with illegal labor and Chinese slave labor.”

Whether “slave labor” is appropriate your comment is the bottom line re globalization.

There is no other path for “labor” in US/Canada etc., but to go down to a “level playing field” in order to “compete” globally. It is a no brainer! Something that no politician wants to admit…

Its not just Toronto, it’s the GTA and Montreal too. There’s alot of debt out there. Now more than ever alot of people want their material goodies NOW. Instant gratification. People don’t want to save and get whatever it is when they have all or most of the money.

My smaller house outside of Toronto is worth maybe 2-1/2 to 3 times what my brother’s bigger house in Rochester, a suburb of Detroit, is worth.

So obviously there is no housing bubble in Canada /s.

Oh yeah! Canada’s banks are more resilient than US banks are. /s.

In 2008 the Fed spent $700 billion to bail out US banks.

In 2008 the BofC spent well over half that amount to just bailed out only the top 5 Cdn banks!

And Canada is only 1/10 or less the size of the US!

Yeah, so Cdn banks are great! /s.

Of the 140 billion in support given the perfectly sound Canadian banks after the US fraudulent subprime- mortgage lending threatened to halt the world’s legitimate lending, the largest component was 69 billion from the sale of bank mortgages to Canadian federal mortgage guarantor CMHC.

CMHC made a healthy profit from these sound mortgages unlike the junk that Freddie and Fannie ended up with.

None of the big six Canadian banks were threatened with insolvency but they were obviously going to slow lending to small business etc. and the gov wished to soften this.

I guess this being Xmas they’ll be playing ‘It’s a Wonderful Life’ where James Stewart explains to the crowd why the bank doesn’t have all their deposits on hand. No bank does. How would it make a profit it did?

Canada is not 1/10th. US population is 8.8 times more. Not 10 times. Please note that.

Just for the record, there were TRILLIONS in welfare given to the US crimino-genic banks. Citi bank alone got 2.5 trillion secretly (only uncovered in c.2011)in addition to the publicly revealed 1 trillion dollars plus. Failed Money Center Bankers are the biggest Socialists to ever exist.

Detroit’s population has been in decline for 20 years. People in the US are moving south. The city declared bankruptcy due to the over generous retirement packages and decreased tax base. Toronto’s population keeps growing and home supply just hasn’t keep up with supply.

Moving south and moving OUT in my case

Nobody cares if there is a debt meltdown. Taxpayers will pay for it all. Zero accountability. Central bank just keeps employment and inflation on track, even though it creates a debt bubble. Seeing the big picture is not it’s job, it says. This is typical government at work.

“Taxpayers will pay for it all.”

They can’t. It’s much to large.

It might be inflated away, or defaulted.

It’s the same thinking I see in Netherlands; never mind that half the country has a 100%-plus mortgage based on extreme valuations. I guess the basic idea is that all the people who are renting outside the social housing sector (about 5% of the population) and who are often spending over 50% of their income on rent will pay the bill for bailing out the epic Dutch RE bubble when it pops. Good luck with that …

It’s even more tricky as by far the biggest chunk of home equity is owned by boomers who have pensions that won’t do so well when government tries to inflate away a housing bust. We need more financial fairy dust.

Your right, both inflate and default. Last resort for Cdn govt.

will be to theft your remaining liquid fait through a new currency

swap on a 5/1 conversion in their favor. That should eliminate it’s

trillions of debt and leave us broke.

As Trump noted last week, Canada is a wealthy country, I’m not worried. ;)

Besides, we have a Liberal minority gov, who is working with the NDP and BLOC… there will be no bank failures, there will be bailouts.

American is also wealthy. American median incomes are higher. I am talking about median income. Not average.

What could possibly go wrong?

nicko2, “Trump noted last week, Canada is a wealthy country…” What he left out was, “oh yeah, it’s also now a vassal state of the USA with the signing of the new Free Trade Agreement.” Canada now lives in interesting times to come.

The fact that almost all the G20 countries are squatting in the same sailboat of high debts for households, businesses, government indicates complete systemic failure. Soon these sailboats arrive at the waterfall. The resulting plunge and what happens next who can tell?

Common arguments. Borrowing is cheap. Borrow as much before the price goes up.

Borrow more to buy houses. Houses goes up in value over time. You make big bugs before you die.

Of course these are reinforced by housing developers, those involved in home sales, lenders etc.

Business borrowings is an everyday affair. An entire financing industry caters to all these. CEOs, CFOs and all the Cs are window dressing everyday. They need loans to help make their corporations Cinderellas.

When they leave it is someone else’s problems.

Ruling elites prefer long term borrowings. 10 years, 20 years, 30 years. So everyday is a new airport project,

rail project, road building, township or any dream project.

A new project immediately 20 billion, 30 billion is available.

Repayment? O. everyyear just 6%. Why not. aElites dont live that long. They know. It is someone else’s problem.

There are many Argentinas around. If a country has hundreds of billions in debt, that country has problems?

big bug for sure :)

Rule of thumb

The median price of an average property in a country should not exceed 3.5 times the average income of that country (w/o CB’s & ZIRP)

Also, financial institutions will not provide you with a 100% mortgage exceeding the factor 3.5 x your income (or even less)

Median income Canada app Can$ 60 000

Median house price Canada CAN$ 480 000

This is Factor 8 and “should be” factor 3.5 or CAN$ 210 000.

Only 56% to go down (ouch)

Alternatively, Canadians should just start earning more /s

https://www.investmentexecutive.com/news/research-and-markets/median-household-income-rising-again-statscan-reports/

https://www.statista.com/statistics/604228/median-house-prices-canada/

Or they could move to New Brunswick or Nova Scotia where a house can be had for 100k or less just good luck finding a good paying job

The whole premise of investing in Canada is based on attracting foreign investors and emigrants to keep labor costs lower…

Meanwhile more laws, regulations and taxes being implemented to try to keep this financial system going is doing the opposite as nobody wants to be bankrupt by the governments all constantly taking.

The media is making it far worse by going after any politicians who want to be fiscally responsible.

Cutting even one penny of any proposed increase of any social program means you are a nazi.

And someone who wants to starve little kids and throw grandma into the street (although I may those backwards).

The fake legacy media told me so.

Why not slash defense spending?

Joe:

But, but ,but according to the “Sunny Ways Theory of Fiscal Management” budgets balance themselves so lets spend like drunken sailors on shore leave.

Now all the B of Canada needs to do is lower the mortgage stress test threshold so that Canadian borrowers can dig the hole deeper.

What could possibly go wrong with that ??? (sarc/on)

You shouldn’t slander drunken sailors by comparing their spending habits to our politicians. Drunken sailors stop spending when their pockets are empty.

This makes zero sense. The lowest labour costs i see are in central east europe. Canada has huge labour costs in relation. Those societies have zero immigration and low labour costs. Canada has high immigration and still high labour costs. It’s a communist dump. That’s the problem.

Communist dump? You are deluded And Poland is in central/ Eastern Europe and does have substantial immigration especially from Ukraine I was in Warsaw in August and the city is booming with gorgeous Ukrainian girls working nearly everywhere Every year on my annual jaunt to Warsaw I am amazed at how the city improves

That’s alittle on the ground reality for you right there

My 55+ community in Florida once had over 50% Canadian winter residents owning homes here. More recently Canadians have been moving back to Canada and Americans have been buying their homes. Two stated reasons for Canadians moving back north are the fall of the Canadian dollar and their out of country healthcare costs were not reimbursed.

Some Canadians invested in real estate and may have multiple properties with multiple mortgages. Toronto is on a list of the world’s worse housing bubbles.

When the Canadian dollar was at par or close, it was great visit and enjoy many of the tourist traps off-season as the prices were lower and much cooler with the humidity.

My father-in-law owned one of those and sold it about 15 years ago due to health. He found it difficult to find people to look after it in the off season. Some maintenance problems would occur such as lawnmowers cutting the heads off his pop-up sprinkler system.

Or a hurricane ripping down the car port.

Sounds like the English and Dutch speculators at the Spanish Costa in the runup to the Financial Crisis. Part of this is also elderly owners moving to the warmer south and profiting from generous pensions, social security and healthcare benefits from the home country where they still live on paper.

English speculators have been trying to offload some of their Spanish properties at top prices for some time because those foreign homes are getting less attractive (maybe even more when there really is a Brexit?). Most Dutch speculators haven’t budged yet because Dutch mortgages that are the foundation for their foreign properties have been generously papered over after the Financial Crisis, few homeowners got into real trouble. My impression is that asking prices at the Spanish Costa are close to those just before the Financial Crisis and sometimes even higher.

Talking about offloading properties, a quick search on just one uk property portal shows just under 4000 villas for sale in Tuscany. Cheapest 1.5m, dearest 25m. I somehow don’t think this is Italians selling their country pads.

There were lots of German speculators too My good friends from Hamburg Eva and Hubert tried it for awhile in Benidorm Finally gave up and moved back up north Not sure if they profited much from the experience though

Due to global warming, Canada will become Florida in foreseeable future.

Sure, just like the Netherlands will be the new French Rivièra when things get too hot over there in a decade, or so they tell me … but a bit strange they don’t mention this boon when talking about the need for a Green Deal with the required huge taxes etc. ;(

The frozen north would become prime real estate. Why are the Canadians fighting global warming? Makes little sense.

Exactly, to hell with the rest, works every time!

ps. don’t forget you’ll probably still have Russia as the other/only world superpower.

Agree with your reasons why Canadians are now sellimg their US properties. Also many bought at the bottom of the US housing crash around 2010 when the $Cdn was around par. Now they are selling to reap a very nice cap gain.

Yes there are two sides to that coin…. It could just be thre USD is historically overvalued… the CAD is hovering around 75 cents, if canucks bought their US properties after the last US financial crisis…(hey are sitting pretty. And some forgot to note, unlike in most of Canada, some US states have onerous property taxes.

So what can these countries do? If they are inconsequential to the World, they can just default and wither in the sunset. Or, they can inflate their way on and try to live another several decades or so. How long can perpetual QE last? Depends if the debt is foreign or domestic. Look at the Japanese person’s opportunities today. You survive but …

The West going nut bird crazy on future technology and not including what current technology is made from is also a problem.

One massive problem that we now have is it is impossible to recycle our complicated products.

The cost is astronomical for the huge makes and models of vehicles also the unknown composition of the metals and plastics. Every year new styles, makes, models and components.

Ha, OT but true. Our 20 y/o Kitchenaid ran like a clock and needed repair. Amazingly there were parts but the cost to fix would have been $400+ so we bought a new one. Surprise, no food grinder so dishes need to be scarped/rinsed before washing and I was told by the repair man that they stop making parts after 5-10 years most so you have to $#!tcan the whole thing sooner. Planned obsolescence, eh?

What happens when you are a Canadian in your late 40s or 50s and buy several investment condos you can’t sell for the price you paid, rent out to cover the cost of ownership or transfer to your home equity line of credit (HELOC) because there’s not enough equity in your house to put more stuff on your credit line?

Don’t have an answer for that now, we’ll find out in late 2020.

There is an answer for that it’s called speculation and if you speculate, you get burned and you have no one to blame but yourself.

The Amish don’t speculate and they own most of Pennsylvania and Ohio.

Very true I was a spec builder most of my working life and never over extended myself as many of my colleagues did during boom times only to get crushed when things went south Greed is dangerous

The Amish own most of PA and OH? Citation please. That sounds like prime BS to me.

Zantetsu,

I once lived in Ohio, on an 80 acre farm (small). In the 1970’s, I was encouraged by the State University Extension that it was either “get big, or get out”. Many decided to ‘get big’ by borrowing, and then came the ‘crisis’. The Federal Land Bank collapsed. Interest rates skyrocketed, and prices for crops dived. The result was that almost all of my neighbors (some owning thousands of acres) suddenly found themselves employees, not owners.

The land was first seized by the banks, who then sold them off to (often) insurance companies. Individual tracts were suddenly combined into huge properties owned by corporations. Fences were torn down. Houses were bulldozed. Methinks you don’t know that history.

True, the Amish probably don’t own most of Ohio, however they were impervious to the disaster that drove so many from their land and left it in corporate control. I can well imagine that they became a very large block in the ‘private ownership’ category.

I left my farm, however, not because of that crisis. I sold to another private owner. But, the largest landowners in Ohio became corporations. Do the Amish own more than corporations? I doubt it. However, among private farmers, it seems reasonable to me that they are one of the larger remaining groups.

Daedalus, so you agree with me. Good to know.

Do they really rent out speculator condo’s in Canada? How old fashioned … almost no one in Netherlands bothers with that and just enjoys the automatic 10-20% yearly appreciation courtesy of the ECB, and possibly buy a few more condo’s every year …

And “not enough equity in your house”, don’t make me laugh – everyone uses 102% mortgages over here and both industry and consumer groups are demanding the return of 120% or even higher mortgages like in the late nineties. You are stupid to put equity in the home…

Canada needs to learn from Netherlands and introduce some great ideas to fireproof their road to richness, like the NHG (free government-backed insurance against any loss when you have to sell your home).

/s

nhz, I am so glad that you added the little “/s” at the bottom of your posts.

but in Netherlands the majority would be shocked or offended if I included the /s …

SimplyPut7

“What happens when you are a Canadian in your late 40s or 50s and buy several investment condos …” Are you in this situation? Just do what wet condo owners did in the lower-BC mainland in the 1990s–demand the government bail you out for your poor investment choices.

What does it mean when the Fed and other central banks jointly bemoan the effects of their own policies?

It means they expect their racket to blow up soon and that the usual program of gaslighting will get them off the hook just like last time, only more so.

It’s all there. The Fed has given another $4 trillion to the banks to bail them out in advance of the meltdown, in the same way JPMorgan Chase demanded large sums of cash collateral to protect itself from the Lehman Brothers collapse just days before Lehman’s bankruptcy filing in 2008, and just as 15 financial institutions agreed to chip in $3.5 billion to keep alive the Long-Term Capital Management L.P. hedge fund in 1998, which blew up anyway.

Also as usual, no one really knows where the money is going. Meanwhile, in the midst of a liquidity crisis, the Fed has rolled back liquidity requirements, shareholder resolutions have effectively been banned, Morgan Stanley is hiding its trading losses, NY Fed repo data has conveniently disappeared, top regulators at the SEC and Treasury are openly lying to congressional investigators from both parties, and the NY Fed is rejecting FOIA requests.

You can only assume the worst.

And the solution is? We are in a debt bubble. If anyone stops buying or stops getting credit to spend, then “hiss”…the air starts to come out of the bubble…no money for homes, no money for consumption, people lose their jobs, they can’t get credit, they stop buying things…hissing gets worse and it’s look out below. The Debt Trap, the Everything Bubble, they call it….in Canada it’s a Balloon and it’s a long way down….so everyone better buy, borrow and buy, or else…..

The average Canuck can just get by paying room, board, and transportation but after that there is little disposable income to live let alone enjoy life. This used to be known as being a slave. Governments have figured out how to structure Canada such that it is inefficient, with high prices and taxes, and just enough transfers to keep people dependent. Anyone with any means gets out as there are many better places to live.

My wife has a friend here in Turkey who is a Canadian citizen of Turkish descent She goes back to Canada occasionally but prefers to live most of the year here Warmer and better food

Nothing wrong with enjoying expat life. We canucks pay enough taxes, revenue Canada gets its kilogram of flesh one way or another.

Become a naturalized American citizen. Then you can pay American taxes on what you make anywhere in the world no matter where you live.

Turkish food is a good second to Italian – high praise by the way! Sensible choice.

I agree Italian is hard to beat We eat a lot of Italian and my wife’s cousin married an Italian so we go to Arezzo, Tuscany often Good Mexican and Chinese is unheard of here though and I miss that being from NYC

Poloz: “No, I don’t see this household debt as unsustainable. That’s an important distinction. I see it as a vulnerability if a nasty shock came along and unemployment in Canada rose significantly.” Also mentioned that Canada is at full employment, like the 6% of unemployed people don’t count.

Saying all this at the same time all news sources are pointing out a spike in unemployment in Canada. I can’t stand these puppets, they can’t even come up with simple white lies.

Indeed, Canada’s unemployment rate just shot up by almost a half a percent in the last month. Something like more than 70,000 people lost jobs. Since Canada is almost exactly 1/10 the population of the US can you imagine if last month BLS had to report that instead of a gain of 266,000 jobs we had lost 700,000!

Time for everyone to make a generational adjustment: the US now has about nine times the Canadian population. It was twelve times in the days of my misspent youth.

In any case, the employment numbers in both countries are largely fiction with a good chunk of the data deriving from birth-death models, not actual counts.

Agreed that the employment numbers are fiction I’m living proof of that

Trend is important. If we are using the same trend it doesn’t matter. BTW, US numbers are surveyed every month. And they go back and correct for 3 months. Finally in April they go back and correct again. I do not find such methodology in Canada. Canada numbers jump up and down drastically.

Again wrong stat. US is 8.8 times of Canadian population. People keep quoting 10 times.

Ramesh – they keep quoting 10 times because until a very few short years ago, it “was” 10 times. You probably don’t know that because you didn’t live in Canada then.

It wasn’t that long ago that Canada would take in only 80,000 immigrants/year, but then it lost its mind and now it’s up to 500,000/year, the highest immigration ratio of any country in the world.

Corporate greed.

What is the out of pocket healthcare expenditure for the average Canadian vs. the average American? And how many Canadians have to buy their own primary healthcare insurance?

That question really needs a lot of graphs to answer because in the US a average person is hard to find.

There are a lot of people in the US paying zero and a lot more paying next to zero. There is a lot of cost shifting from non paying to private insurance.

In the US companies started providing insurance under Nixon’s stupid wage freeze policies. Most employed people pay maybe $200 per month with company paying $800 per month. It’s one of the reasons people’s wages have been stagnant while company total cost for employee goes up.

The US is getting to be such a opaque pricing country as policy makers try to obtain funding in the least transparent way possible. It’s morphed into the company being responsible for determining and withholding many taxes and in a way health insurance is part of it.

Everything could be funded with one transparent tax but then people would see the total is really too high. The latest sleight of hand is interest rate repression which allows govt to borrow for free.

Well, let’s start by looking at the out-of-pocket costs for the self-employed in both countries.

Medicare in US covers prescription. In Canada it does not.

There are a few escape valves in the US. I have done high deductible for 15 years. I had two separate occasions where I had a blocked oil gland cyst the needed lancing. Each time I paid out of pocket about $300 at a ‘minute clinic’. Thats my total in 15 years. There are a few docs around that are cash only and don’t deal with insurance.

re: “I had a blocked oil gland cyst the[sic] needed lancing”

TMI

yeah “two separate occasions where I needed a minor outpatient procedure” would have been just as informative and alot easier on the eyes.

Actually employer sponsored health insurance dates to wage freezing laws in the 1940s, like so many other crappy policies, this one is on FDR.

https://www.peoplekeep.com/blog/part-1-the-history-of-u.s.-employer-provided-health-insurance-post-world-war-ii

Very few Canadians have to buy their own primary health insurance due to the government single-payer system. Many have supplemental insurance to cover things like drugs and dental and there is a patchwork of pharmacare systems to cover all or part of drugs for seniors and children.

Out of pocket is hard to compare because the overall healthcare cost in Canada is about 12% of GDP compared to about 20% in the US. Single payer will not really be practical in the US until the underlying costs are negotiated down to levels more typical of G20 countries. Any plan I’ve seen just reveals the huge tax burden that would be required to support the US system.

Any plan I’ve seen just reveals the huge tax burden that would be required to support the US system.

Rackets and rigged markets do tend to be grossly overpriced, yes, whether for medical, housing, insurance, and so forth. In the US only a very few markets aren’t grossly overpriced, like food and gasoline, because the true costs are heavily disguised by taxpayer subsidies so as not to overly enrage the general population and still generate unearned windfalls for the rentier class.

Are you guys feeling screwed yet? Or have you just decided to pay up and shut up because resistance is futile?

I have been assimilated, but I’m trying to break free. ;-)

Crush, the answer to that is nada. The total cost for CDN single payer is about 12% GDP, or a little more than 1/2 of the US version. It is taken care of by budgets, taxes, etc

I have absolutely no complaints about our healthcare system. My wife has been a type 1 diabetic for almost 50 years and is considered to be in excellent health under the guidance of a specialist visit once per year, and regular A1C monitoring under our GP. I have had many broken bones, knee surgeries, and a few other surgeries (active life) and have yet to receive a bill for any of it. I go to the GP once per year for the annual prostate check and every 5 years for a colonoscopy as cancer runs in my Dad’s side of the family. Like everything I suppose it could be better, but our family has done well by it. Certainly no complaints from us. (We always buy travel insurance from BCAA when visiting the States due to the hospital horror stories from those who didn’t).

I know of no one who actually buys health insurance beyond Green Shield or Blue Shield extended health care top ups. We do this for my wife’s diabetic supplies, dental, eyeglasses, etc. It is marginally worth it after crunching the numbers.

Preach. Canada has its problems like every other developed country (ie. See uk or France healthcare), but overall Canada’s system works, and does not discriminate On the basis of the size of one’s bank account. The new minority gov will no doubt roll out a $15 billion pharmacare program in the next year or two, I wish them luck.

When we export our corporate IP protection via USMCA you’ll pay the pharma tax just like us. You’re welcome.

Canadian Central bank hasn’t cut yet, so they have a long way to go to zero. As it will likely take 3-4 yrs to get to zero, I think debt service will get much easier for the Canadian debtor.

Soon Canadians will be flooded with ‘0%’ offers to roll their debt into a new card. This is the old game they’re still playing up there. But more importantly there is a near infinte amount of global capital seeking returns in the realtively small Canadian real estate marker.

Helocs are safe for many years to come. The worse the global economy gets, the more money will enter Canada.

Canadians are not even close to peaking in the use of credit cards. It’s their national religion.

James – are your glasses rose-colored?

Apple is giving out 0% loans for $1000 mobile phones… surely we’re entering the end-times.

I’m surprised you aren’t paid a hefty sum each month for carrying these personal trackers …

Where did this mythical 3X income number come from? I’m guessing sometime in the 70s or 80s when a mortgage was 12%. You need to update the number for 3-4% mortgages. 5X or 6X income is more appropriate. A $100K income can easily afford a $500K home.

As for Canada, Vancouver has been in a “bubble” for 40 years. Which means the “bubble” isn’t a bubble but a new reality. Same with Toronto to a lesser extent. That city transformed itself from a sleepy mid sixed city to a leading world city in the past 30-40 years. And with it came an appreciation in real estate prices.

5-6x more appropriate because we now buy on double income and there is no need to pay off the mortgage, because RE always goes up?

No. 5-6 is more appropriate because when mortgages are at 3% vs 10%, people can afford a lot more house for the same income. And single vs double income doesn’t matter since the ratio is for HH income, regardless of how many people contribute.

and what when mortgages go back from 3% to 10% (or from 1% to 10%, for Europe)? Your proposal would greatly amplify the boom and the bust, not a good idea if you ask me.

Double income DOES matter for maximum mortgages, as with a two income household there is a bigger risk than households will not be able to pay (even though the ability to keep paying something is better, but with a maximum mortgage something means default).

nhz: Exactly. Base your budget and loans on 2 incomes . See what happens when one of you gets laid off or loses a job or decides to start a family. And that’s during the “good times” . Try that when a recession hits. Been there done that before. Just remember : most of Canadian provinces are recourse IIRC so if you are lucky they write down the balance and stick you with an R9 rating for 7 years OR they’ll come after you for the outstanding balance thru wage garnishment, voiding your various licenses (Drivers. Pilot, etc), etc.

Oh and don’t forget Student loans and Child support cannot be escaped thru bankruptcy. In other words——–you’re screwed.

In Netherlands the financial risk of a mortgage default for the “homeowners” is actually quite small. In many cases all loss will be covered by a government-backed insurance fund, and in the unlikely case that people end up with large debts they can get rid of them in three years and take out the maximum mortgage again to play the game. There are some exceptions e.g. for self employed people the situation is much riskier.

For most small housing speculators the only real risk is more practical, having to find a new home quickly. But most cities give special priority to such cases and provide them another home. Which makes sure that people never learn :(

A Harvard finance professor once covered this problem in her book “The Two-Income Trap.”

Must disagree about that 5-6 #. I have always always preached to my kids the 3X number and so far they have stuck by it. They will be mortgage free in their 40s because of it. Plus, their mortgage payments have always been less than rent so they pay off more of the principal on their mortgage anniversary.

This is what Canadians did before the RE reno craze tv shows flooded the airwaves about 10 years ago.

Why would you want to be mortgage free in an era of 3.5% mortgages when the long term average stock market return is 8%?

Because debt peonage is, after all, economic slavery, investment markets are rigged to enrich insiders at the expense of everybody else, and because gaslighting by con artists isn’t particularly effective on people with critical thinking skills.

Hey, you asked.

The Spanish side of my family bought their first property way back, in the Middle Ages.

Cash down, mortgage-free: guess what, that was somewhat useful over the next 900 years or so of good marriages, graft and corruption….

Mortgage free property is always desirable.

You are the slave of whomever you owe money too.

It may not seem like it, but you are…..

Xabier, but the people who who money to you (those that you lend your investment out for 8% return) are even greater slaves to you than you are to the bank who lent you the money at 4%.

The risk, of course, is that the numbers can flip and you can become the bigger slave. But we already know about that problem and call it ‘bad return on investment’.

My point is that your slave comment is not as meaningful as you think.

When I bought a house in England, in 2000, I was offered 6 x my salary (with a big deposit).

I settled, although briefly tempted, for 3x: most sensible thing that I – a fool in most things – ever did.

Ancestral caution saved me.

When I temporarily lost ALL of my customers in 2008 it was not so big a problem as it might have been. at 6x……

A lot of people in all aspects of life make a basic mistake which is to focus on the trophy aspect of the real estate either residential, commercial or government. The purchase price is only a partial cost. Taxes, maintenance, insurance and opportunity cost become reality after owning the real estate for a few years. Buy the minimum that will get the job done.

5x or 6x income, because ultra low rates and 3x inflated RE? Sounds realistic to me!/(sarc switch totally ON). What could go wrong?

Just Some Random Guy: I’ve finally got it – you are an ironical humourist!

Your financial speculations make little sense otherwise……

I applaud and savour your sense of humour. Bravo!

Xabier,

I’m simply an island of reality in an ocean of doom and gloom.

Famous last words?

“Vancouver has been in a “bubble” for 40 years. Which means the “bubble” isn’t a bubble but a new reality.”

There was a time when the eternal longevity of the Holy Roman Empire was “the new reality”. It’s just a matter of time before the particular asset you mention disappears, one way or another. Hubris tends to speed that up.

A 500K home??? Try 500 down on a very ordinary detached house but 500 total would barely buy a one bed condo.

Not coincidentally, thanks to the current downturn and the massacre of anyone trying to flip, Van just acquired its first house under a million. About a hundred bucks under. It is a foreclosure (they are sprouting like weeds) bought about a year ago for 1.25 million. So unless the flipper had a big down, the lender is going to lose at least the commission.

For an up to date look at Van realty check out Mortimer’s site. We are back to 2015 prices and heading south. There are lots of sales with a 30% loss if bought at the top: 2016. But this correction that has taken us to 2015 prices is only a year old.

PS: of course the million dollar house is a tear down. What is for sale is a lot 30 by 80 or so.

Back in the day when markets were rational the rule of thumb was home mortgage = 2 1/2 times income. It worked. But that was long ago (and far away?).

It came from Dr. Morton Shulman who in many of his books stated never pay more than 3 times the husbands annual salary for a house. This was etched in stone at the time as the rule for buying a house in Canada.

Perhaps the siren songs of BMWs, 4,000 square foot mini mansions, exotic travel, $250k Masters Degrees in Gender Studies, matching Peloton bikes, 18 hours per day of child care, and investing in UBER, Lyft, Tesla, and BitCoin are just too much to resist for the modern generations making $90k per year.

I have taken note of the increased number of flat bed trucks with a Beemer strapped onto it. They aren’t going in for repair…

Sell your financial soul to the lenders, and pay the ultimate price I guess. Good luck.

I always laugh when people use BMW as some status symbol of being rich. A well equipped F150 costs more than a 3-series.

Yes, and I just happened to spec out the most expensive F-150 I could put together for my next article, a 2020 F-150 Limited SuperCrew Cab 4X4 with the EcoBoost High Output Engine, electronic 10-Speed automatic transmission, and all the bells and whistles I could locate: $76,935 MSRP — vs. base MSRP of $58,000 for an i3. An M3 will get you close to $70K. But a 5-series and up can get into serious money.

Those prices don’t yet sound like serious money over here in Netherlands with its crazy car taxes ;(

A friend of mine always drives 5-series and higher but he buys them lightly used with solid history from the dealer, at a huge discount (usually around 1/3 of new price). Even the exclusive i8 looks a lot more affordable lightly used ;)

True, Ms will get pricy. But if you look around, most BMWs on the street are 2 or 3 series.

I owned a 2001 M5 for a while. One of the best cars I drove. But I have ADD when it comes to car ownership so I sold it. E39 M5, if you can ever get your hands on one, get it. Best $25K you’ll spend on a car.

I always laugh when people use BMW as some status symbol of being rich.

That’s what the Bentley is for, other than transport. It does get rather a lot of attention, mostly from people who like having a pretext to flirt with my chauffeuse.

I have always preferred Maybachs, but I get your point.

re: “I have taken note of the increased number of flat bed trucks with a Beemer strapped onto it. ”

Why would you use a flatbed to haul a motorcycle? Your average F-150 could do the job.

GDP in the US has nothing to do with the welfare of the average citizen, I wonder if it is different in Canada?

GDP in the US has nothing to do with the welfare of the average citizen

Obviously not. One doesn’t invest more in herd animals than the expected ROI.

“Citizen” is some sort of euphemism, isn’t it?

According to FRED, Canadian Household debt has been over 100% of GDP since the end on 2016.

https://fred.stlouisfed.org/series/HDTGPDCAQ163N

It has been very high (over 90%) since 2009.

I wonder if this is good or bad.

Yeah, look at my beautiful chart #3, which overlays this very data set (red line) with the US ratio of household debt to GDP (blue line).

Great, I see it now. Nice graph showing it together. I did not realize it at first; but …

I wonder HOW the US Households managed to lower their Debt to GDP to around 76% when it was already close to 100% during the GFC. How much “inflation” of house pricing and assets did we have to do?

No wonder my next point:

Central Bank Assets to GDP for United States = 21.74650

So all we did was the Fed borrowed a lot and transferred the wealth to household and business ASSETS.

We need a class in creative accounting; or cheating with numbers.

Look at household NET WORTH to GDP

https://fred.stlouisfed.org/graph/?g=pJC5

It went way up before the GFC, then dropped like a rock, then went up again like a rocket.

Looks like the Fed did a lot to manipulate net worth by inflating assets a lot.

We need a class in creative accounting; or cheating with numbers.

Those are taught at TBTF banks and PE firms, but you have to sign six or eight non-disclosure agreements with two lawyers present while recorded on video. You also have to agree to having a recording/tracking chip implanted in either femur (your choice), which can be very expensive to remove later as it would not be covered by insurance.

Corporate grifting is a high-end profession and only a select few qualify. Initial screenings to ensure an utter lack of scruples eliminates most candidates.

I think the all power central planners believe a society should run with at least 300% debt to gdp, maybe more if you have decent growth rate. Dirty little secret is if consumers pull back the government is going to borrow for you as USA government did the last 10 years.

That’s OK. I am not going to borrow unless loan rate is less than treasury rate and I am not thinking that can happen even in this crazy world.

I am not going to borrow unless loan rate is less than treasury rate

I am not going to borrow unless I’m paid more than I could achieve with self-financing, somewhere north of 6%, depending on the project and the associated loan costs. Central bank NIRP rates still aren’t competitive by a wide margin but they’re sure to get there eventually.

Central Bank Assets to GDP for Canada = 4.62464

Central Bank Assets to GDP for United States = 21.74650

Central Bank Assets to GDP for Japan = 73.41690

Central Bank Assets to GDP for China = 1.88626

Observation 2017, updated Oct 21, 2019

Ok so you know where this is going…

FYI:

Central Bank Assets to GDP for Russian Federation = 0.29361

So it is possible to run a country responsibly.

Source: https://fred.stlouisfed.org/series/DDDI06RUA156NWDB

Lisa_Hooker,

“So it is possible to run a country responsibly.” In Russia, the state-owned companies are heavily indebted (dollar and euro debt mostly) and so government borrowing is happening via state-owned enterprises. Ruble-debt has very high interest rates due to the risks of currency devaluations. Over the past 10 years, the ruble has lost 63% of its value against the USD. So that’s not a sign of running a “country responsibly.”

Wolf, I dunno. Tiny economy with crippled by non-economic political sanctions. Ruble devaluation hurt, I know I got a job offer there and crunched the numbers. However, ruble has devalued about as much as it can and they continue to adjust to the sanctions. The future looks much better. And debt via state-owned enterprises? One man’s state-owned is another man’s private enterprise. Methinks of Raytheon, General Dynamics, Lockheed-Martin, BAE, etc. etc. Government or private? How many of their “products” do you have and use at home? They wouldn’t exist without government. It’s typical of BS accounting tricks and shell games in any country. I think that low government debt, which is what we are talking about, and a large pile of gold compared to their GDP indicates responsible management. YMMD.

You wonder why we pay these CBers.

“And it’s in that phase that monetary policy kind of got stuck in this very stimulative place, offsetting headwinds that are hard to really quantify by conventional analysis”

Umm, try HHs up to the gunnels in debt and no more capacity to borrow so spending reduces across the board, lowering GDP.

Umm, also try, retirees and savers see income on $1m drop from $50k pa to $15k pa and reduce spending/save more, lowering GDP.

Yup. If interest rates were the same as they were for 40 years of work I’d be spending at least $1000-1500/month more into the economy. After 2019 September who knows what the FED will do next.

there is no comparison CA nd the USA. CA has a greater welfare state than the USA. for example, healthcare is only 12 % of GDP vs 18 % of GPD in the USA. Also, if you get sick in CA, you will not go bankrupt. In the USA, 60 % of bankruptcies are due to medical debt per Prof Elizabeth Warren.

Thefore, Canadians can take risks (get in to debt) and do not get ruined.

Canada ranks #1 in quality of life overall in 2019 yet again, USA is down around #17. Canada also ranked #1 in the world in reading comprehension tests in public schools. Indeed, many of the top ten best cities ranked by quality of life are in Canada, and Toronto is perennially ranked the best city in North America. Our public universities now outrank many high priced private American counterparts. Canadians cough up a lot of taxes, but we get a lot in return.

Enjoy it while it lasts because it’s all built on a massive heap of debt.

The US appears to be an extremely corrupt society, ruled by an insulated elite who do not give a fig for general prosperity, depending heavily on dirt-cheap illegal labour, and subject to extortion by monopolistic industries – ‘healthcare’ being the prime and most shameful example.

Viewed from Europe, an almost nightmarish society. Not that Europe is without severe problems, too.

Setting aside the great differences between the states, it is not a place anyone sensible would actually choose to live, unless coming out of one of the earth’s Hells – or ultra-high net worth. But, in the latter case, I would much prefer Europe as it is much more civilised.

(PS I’m not a Socialist by any means! )

“Setting aside the great differences between the states, (the U.S.) is not a place anyone sensible would actually choose to live …”

But a sensible person would not set aside those differences, nor the different environs within each of the states.

It’s a big country and there are plenty of places where one can hunker down under the radar and not be bothered by much of what’s discussed on Wolf Street.

Probably I am conditioned by a European perspective, in which there is nowhere to hide from the follies of government, being comparatively compact geographically, and highly centralised.

But is it so very different in the US, when push comes to shove?

When Washington went to war in WW1 and WW2, you did get conscripted wherever you lived: I walk (gratefully!) past thousands of US graves here every to remind me of that…..

Imho, the US put the value of the individual, and almighty dollar ahead of the wellbeing of wider society. In some respects, it created more dynamism (ie. Rise of Silicon Valley)…. But in terms of sustainability, the US is probably reaching its zenith. —- signified in increasingly obscene wealth inequality and demise of the middle classes. 2020 will be a big year for America.

The US seems to be on the verge of tipping into a Latin American social model, with the decline of the mass-base middle class – not at all appealing…..

A similar pattern is of course unfolding in Europe, masked somewhat by extensive welfare ,and different patterns of life.

Canada, UK, and USA are in a race for madness. Who can borrow more?

https://www.imf.org/external/datamapper/HH_LS@GDD/CAN/GBR/USA/DEU/ITA/FRA/JPN

Switzerland 127.72

Australia 121.71

Denmark 117.14

Cyprus 109.58

Netherlands 105.53

Norway 101.58

Damn.

‘Viewed from Europe, an almost nightmarish society.’

The view from within is quite similar for many, if not most.

Modern society assumes all of us are capable of rational thoughts, planning and accepting responsibilities for our mistakes. Very few <20% are capable of these expectations. The main difference between rich man debt and others is the rich man buys stocks, properties and companies with debt. Others buys gas guzzling V8 SUVs, granite counter tops and expensive vacations in tourist traps. Do we ever learn from rich dad and poor dad. Nope. Modern economy is counting on that.

A general observation from a guy who discovered Wolf Street back when it was attracting less than twenty posts in its commentary:

There is no other source I know of that produces so much discussion and evidence regarding its subject matter from all over the world.

The best investigative media reports cannot produce so many responses from so many sources.

Wolf inspires people to do research and post to share.

Wolfstreet avoids sterile political tit for tat, thanks to a good , strong, moderation policy.

Sites that have such policies generally attract people who will feel it’s worth making informed comments, or asking questions to which they will get intelligent answers.

Counter example: Zero hedge…….

I took a peak at OECD data. Here they are with my comments:

Household disposable income: Net, Annual growth rate (%), 2018 or latest available

CAN 3.58 USA 2.34 JPN 0.77

UK 2.09 DE 1.95 FR 1.10

Canada household disposable income is growing faster than US. Europe is anemic. Japan is froezen in time.

Household spending: Total, Million US dollars, 2018 or latest available

US 13,555,702.0 Japan 2,929,746.1 Can 1,010,412.4

UK 1,934,818.6 DE 2,228,199.3 FR 1,574,455.5

You can definitely see how big the US is. US is bigger than EU combined.

Household savings: Total, % of household disposable income, 2017

US 6.90 Japan 2.75 Can 1.77

UK -0.33 DE 10.42 FR 8.13

The US household saves more, perecentage wise, because it has to pay for health insurance and it pays less tax.

Germans and French actually save a lot. But the French also borrow a lot.

Household debt: Total, % of net disposable income, 2018 or latest available

Can 180.90 US 108.62 Japan 107.27

UK 145.83 DE 95.31 FR 120.68

Canadian households are borrowing a lot more compared to disposable incomes.

UK is not far behind plus it has negative savings rate.

Household financial assets: Currency and deposits, % of total financial assets, 2016

Japan 52.4 Can 21.1 US 13.1

UK 23.8 DE 39.5 FR 27.6

Japanese households are known for their Mrs. Watanabe, no suprise here. Interesting that US households have lower cash deposits than Canadians. Europeans hold more cash than us.

Household financial transactions: Net balance, % of household net disposable income, 2018 or latest available

Can -7.71 Japan 4.39 (2017) US 5.77 (2017)

UK -0.44 DE 9.96 FR 3.77

No surpise here. With Free and No Commission Trading and thousands of ETFs, and tax deferred accounts, we (Americans) live to trade.

But the German savers have to figure out how to escape NIRP. Not sure what the UK is doing, had 2 negative years from 2017.

Household net worth: Total, % of net disposable income, 2014

Japan 605 US 601 Can 541

UK 477.7 DE 457.9 FR 519.6

US is doing good here. High net worth % of disposable income X high growth of disposable income.

Canada is also doing OK.

Japan’s growth of disposable income is very weak, but their household net worth is already very high.

Europe is entering the twilight zone.

Europe is entering the twilight zone.

The upcoming no-deal Brexit is expected to send Old Blighty into recession and take Europe down with it. Germany is already in recession but nobody will admit it because it would make everybody feel bad.

All the statistics you’ve been citing look a lot worse when you exclude the contributions of the 1% and the Financial Industrial Complex.

I’ve decided not to marry my babysitter. She wouldn’t be getting paid any more and that would cause GDP to go down, and I wouldn’t do that to you. OTOH, I’ve decided to pollute more so somebody will have to pay to clean it up, someday, and that will cause GDP to go up.

The good news is that everybody can still get rich selling overpriced houses to everybody else with borrowed money. I already have more houses than I can reasonably use and will not be taking out a loan unless the lender can pay 6%. That’s negotiable, of course, depending on incentives.

Debt service at less than 15% of disposable income sounds like a non issue, particularly if a good part of that debt service is used to buy housing.

You gotta love Canadians, on a per capita basis, they are among the highest leveraged OECD country, yet they are so creative in finding every excuse in the book to explain why that is a good thing.

I wonder the charts would look like if Health deductibles and co-pays were considered a form of debt? I’m not including health insurance premiums which represents a huge tax to Americans.

something important to keep in mind that most don’t know:

after the GFC, the FED bailed out banks all over the place, including Canadian banks.