Story stocks, momentum stocks, hyperventilation stocks, consensual hallucination stocks, financial engineering stocks: anything but reality.

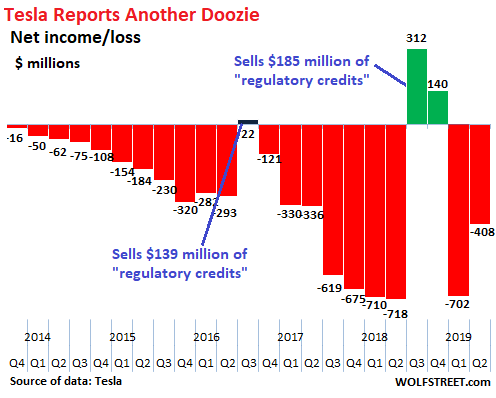

You see, Tesla is different. It just reported another doozie, a loss of $408 million in the second quarter, after its $702 million loss in the first quarter, for a total loss in the first half of $1.1 billion. In its 14-year history, it has never generated an annual profit.

It has real and popular products and surging sales, but it subsidizes each of those sales with investor money. And here’s where it’s different this time: investors don’t care. They dig how the company has been consistently overpromising and underdelivering. They dig the chaos at the top. They dig everything that should scare them off.

Yeah, its shares plunged [TSLA] 11% afterhours today, but that takes those shares only down to where they’d been on May 1. Big deal. Shares are down 32% from the peak. But their peak should have been a small fraction of that. Even today, the company is still valued at over $40 billion.

Tesla lacks a viable business model in the classic sense. Its business model is a new business model of just burning investor cash that it raises via debt and equity offerings on a near-annual basis because investors encourage it to do that, and love it for it, and eagerly hand it more money to burn, and they’re rewarding each other by keeping the share price high. It’s just a game, you see. And nothing else matters.

Then there is Boeing [BA]. It just reported the largest quarterly loss in its history of $2.9 billion due to a nearly $5-billion charge related to its newest bestselling all-important 737 Max, two of which crashed, killing 346 people, due to the way the plane is designed. The flight-control software that is supposed to mitigate this design issue is not working properly. And a software fix that is acceptable to regulators remains elusive.

The plane has been grounded globally since March. No one, especially not the regulators, can afford a third crash. So today, Boeing announced that it may further cut production of the plane or suspend it altogether if the delays continue to drag out. This is big enough to start impacting US GDP.

The entire 737 Max episode has been tragic from the first minute, and the cost in human lives has been huge, and it has cost and continues to cost billions of dollars to deal with, among calls that the plane should never fly again.

And what does Boeing’s share price do? It dipped 3% today and is up 2% from a year ago, before all this happened. In essence, two crashes and the grounding of its bestselling plane, and the potential suspension of production of this plane, and its uncertain future … and the stock has ticked up over a 12-month period.

Instead of spending the resources necessary to design a modern plane from ground up, Boeing kept basing its new models on versions of its many-decades-old 737 airframe that wasn’t designed at all for what it is being used for today. This was a decision Boeing made to save some money and pump up its share price.

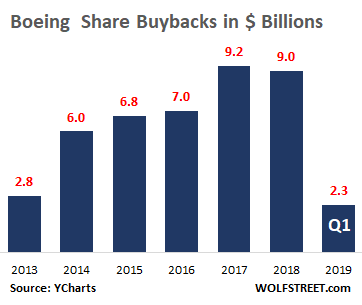

But here we go: From 2013 through Q1 2019, Boeing has blown a mind-boggling $43 billion on share buybacks (buyback data via YCharts):

Blowing these $43 billion on share buybacks has caused Boeing to have a “total equity” of a negative $5 billion. In other words, it has $5 billion more in liabilities than in assets. This company is out of wriggle room. If it can’t borrow enough money to make payroll, it’s over.

But nothing matters.

If Boeing had invested some of this money that it blew on share buybacks to design a new modern plane from ground up to replace the ancient 737 airframe, these tragedies could have been prevented, and Boeing wouldn’t have this nightmare on its hands. But the corporate cost-cutters and financial engineers, rather than real engineers, had the final word.

Markets don’t care about any of this. They don’t care about real engineers either. They love corporate cost-cutters and financial engineers. They want share buybacks, and if something bad happens, they’ll overlook the $5 billion to pay for the fallout because it’s just a “one-time item.”

And now Boeing still has this plane, instead of a modern plane, and the history of this plane is now tainted, as is its brand, and by extension, that of Boeing. But markets blow that off too. Nothing matters.

Companies are getting away each with their own thing. There are companies that are losing a ton of money and are burning tons of cash, with no indications that they will ever make money. And market valuations are just ludicrous.

A tiny maker of fake-meat hamburgers and hot dogs with just $40 million in sales in the last quarter, its best quarter ever, generating $6.6 million in losses, after 10 years in business, Beyond Meat [BYND] has a stock price that values the company at $12 billion because it will change the way the universe operates, or whatever.

Anything goes: story stocks, momentum stocks, hyperventilation stocks, consensual hallucination stocks, and financial engineering stocks that generate mind-boggling share prices that give these companies incomprehensible market capitalizations, and the mere mention of “fundamentals” gets naysayers ridiculed and thrown out. It’s like the whole market has gone nuts.

In the most important US market of the Tesla Model S and Model X, the plunge in registrations far outpaced their already stunning global decline. Which opens a whole new question. Read… Californians Sour on Tesla Model S and Model X

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I guess that tells you what people think of the Fed and the Dollar. Why? Boeing will never go bankrupt. TBTF and would be bailed out. Fact.

I’ve been wondering about the form of backstop. The business is important, but are the investors? Take GM for example – the US gov seems to appreciate the importance of keeping the institutional knowledge, seeing as they wiped out the stockholders and kept the business.

Yes – I am sure the bailout of GM and in keeping the UAW (one of the biggest campaign contributors for a certain party) from getting a scratch from the bankruptcy and upending 100 years of contract law had nothing to do with it.

In other fake news. Jon Corzine is still a free man and is back at it in hedge funds. I am sure that was all about keeping “institutional knowledge” around too.

GM Bond holders got the hair cut ( Unions got to be rescued!) but NOT the BANK Bond holders, courtesy of’ Change we believe in ‘ Prez O

Another smooth talking hypocrite sided with Bankers and Wall St during GFC!

Sure, and Deutsche Bank can be bailed out, but how many times can they do that before the system breaks down?

The system has already broken down. The bail-outs in 2009 destroyed the system. From now on, bankers can make any bad bet they want and in the end, they know they will be made whole. That’s why the stock market is doing what it is doing. It’s the moral hazard that happens when massive losses are off the table.

It’s the destruction of capitalism. But completely unavoidable when the population clammers for “deregulation”.

Fed (and other central bankers) have assured everyone that the downside is covered. Only logical conclusion is currency will continue to be devalued. Equity seems like the easiest safe place to hide.

Regarding regulations:

-it’s almost impossible to write regulations that match the intent. There will be loopholes and unintended consequences.

– regulations have costs associated with them which get passed on to the consumers.

– regulations need to exist to only to protect third party interests not first party.

– way cheaper to stop banks from speculating with others’ money (Glass-Steagall) than to let them and have infinite regulations.

Completely agree with Kent, sadly.

“change the way the universe operates”, LMAO on that one, WR! Might as well laugh as cry. May cry later, anyway. Still gotta have hope, always….that’s hard wired into us humans. Ref; line in “Matrix”.

RE: 737

Only airframes that can be unstable are Military. Saw one at airshow fly length of runway at 30 degree angle of attack, and pretty slow, too. Same, maybe others, went straight up…just for kicks. 1:1 thrust to weight. Software “fix” for that 737 airframe/engines on currently req’d steep climb out will take same Mil-spec hardware/software, and redundancy, or at least closer to it. Maybe make all passengers sit in first #n rows? No point in that, except might work, and keep them flying, anyway. Better than bulldozing of brand new homes in Victorville. Plus Military pilot could eject sitting still at ground level and probably live, just in case. Airliner occupants can’t punch out.

RE: “the population”

Most suitably dumbed down, scared to death by number of the homeless, just blind greedy and plan to get mine and “get out” (to where?), anxiously awaiting the “rapture”, and who knows what else….alien intervention?

“It’s them what dies will be the lucky ones” -Long John Silver

Sorry for negativity, very very sorry.

While it is a fun read, Wolf’s rant is based upon a fundamentally flawed notion.

Stocks are not measures of value or assessments of future performance. Discussions of P/E ratios or debt/asset ratios are mere parlor games for people who need to maintain their delusions that they are “investing” in something of value.

Stocks are casino chips whose function is to provide a registry and score keeping system for the few thousand oligarchs who control almost all of them and find amusement in hiring mathematically inclined underlings to invent ways to multiply them and hide the winnings in offshore accounts.

GP

Regulations also saves a lot of money by not needing to negotiate

Unfortunately we are probably going to find out by actually doing the experiment.

Deutsche Bank is a criminal enterprise. Why would society benefit from bailing it out? It’s not so special it would need “saving” should the occasion arise – unless it is your money laundering institution of choice.

Deutsche Bank should be shut down all together since it can’t or won’t follow the law. This goes for Wells Fargo too for a seemingly lesser evil of charging fake fees and opening accounts illegally for customers.

Please see citibank for example of the fate of criminally inclined, bankrupt banks. DB too can do a 1,000 to one reverse split and it too can soon again be an 80 dollar stock.

Dood. People buying TSLA and BYND don’t even know how to spell F-E-D.

And they sure as hec don’t know what TBTF stands for.

What’s sad to me is the number of smart guys like you that can’t figure out, in the words of a world-renowned cellist I studied with, “how to use these people” and generate some profits.

I recommend options.

If you’re young, and still building wealth, options may be a good strategy. If you are older, like me, and just trying to make a tiny sliver of income while protecting yourself from the massive inflation event on the horizon, owning stocks outright is the obvious path (or productive real estate if you are higher net worth and can afford it).

Central banks are now openly funding government spending with money they conjure from nothing. With the purchase of any and all government bonds, to fund government spending, central banks have eliminated bonds as an investment option leaving only stocks to earn income.

The jig is up, governments (or their central bank proxies) are printing money to fund government spending. They cannot stop printing money to fund governments and the money printing is accelerating and out of control – this is the very definition of the circumstance that leads to hyperinflation.

Obviously a huge number of stocks are zombies that have no value but, because of corrupt accounting rules, they are impossible to identify. This leaves older investors, who can’t afford to fund governments via inflation, only one option – buy an eft of stocks and pray you are left with something (anything) when the dust settles.

The term TINA was invented for a reason, it is real, there simply is no alternative to stocks for income and inflation protection at this stage of the central bank chess game – checkmate.

Buy now because the price is only going up (my humble opinion of course)

Options ‘risk managing’ tools!

I am retired with 50% cash and the rest in long/short positions -ETFs, numerous, worldwide, sector/region/country dividend paying , very few stocks and Vang Mfunds with periodic additions.

On top these I use options both long and short to protect my positions in the long portfolio, elsewhere! Never feared the down cycles or the bear mkts!

Been in the mkt since ’82. self educated!

Sunny sees it.

Van, I’m not young, and stumbling around in the equities is like taking a nice drunken stroll through a minefield with snow shoes on. So dispense with that kind of thinking unless you want to take one in the engine room during the next market disruption.

For income, look at holding solid closed-end funds in tax advantaged accounts, and only hold individual equities in the rarest of circumstances.

Boeing may not go bankrupt, but it might become irrelevant if their planes are deemed unfit to fly and airlines switch to Airbus.

The two paragraphs about Boeing are among the saddest I’ve ever read about an industrial company; Having negative net worth, lives lost, and the financial engineers >>> than the aerospace engineers.

Just bad and sad.

….nothing is real

Strawberry Fields Forever

Buy pot stocks !!!

The lemming effect is what some call it. We are well into it. The frauds of the banksters to transfer wealth to their banks through unnecessarily low interest rates from their “Federal” Reserve are the cause.

Price earnings ratios stopped supporting these valuations long ago, even those that are not inflated. Next financial collapse, we should strike nationwide until the Constitution is amended to allow bills of attainder against banks’ control groups, i.e., the banksters. No prosecutor can get them into a jail as we saw in 2008 to the present.

Make them forfeit all assets. The next collapse will cause the loss of most pensions for the rest of us due to their frauds.

I Got it, Nothing Matters.

Not anymore. It’s too late. The situation is too far gone.

When reality does at long last assert itself it won’t be possible to manage the disaster. It won’t just be a collapse, but a series of collapses, in stages. Nothing goes to hell in a straight line, but they do go to hell, and do a bit of exploring on the way. The distortions are catenated and concatenated, non-linear, matrixed, inevitable, and predictably horrific in result.

And that’s just finance. Civilization’s most onerous debts have only an indirect relation to mere matters of finance, and those can no longer be repaid, or even serviced. They are moral, and ecological. Reality can be misrepresented, and distorted, and delayed, at a price and at a cost. But in the end, it cannot be denied.

All that was needed to bring it about was to let the liars, and the cheaters, and the crooks to have their way, for too long, and with too much impunity, and too much power, and to let their perversions escalate until the whole thing shatters. And now it is far too late to change. They wanted to rule, and they will rule over the ashes.

For some problems, there are no solutions. And nothing matters. Not any more.

Very insightful article and great comment from Unamused. The part on Boeing is the most powerful for me.

If this type of post does not get people who believe there is really not much going wrong today and that things can keep going the way they are, to think twice, I don’t know what else would.

They often try to say after crisis hit that no one really saw them coming. This kind of article and this site in general will be a testament that there were plenty of folks that did.

Actually having a lot of cash matters.

Cash is fiat money and its fate IN THE EYES OF THE POPULACE is uncertain – it may fail as a useful medium of exchange.

Historically, the populace has rediscovered precious metals, primarily gold, in such times and an informal valuation for exchange is established. Today, it might a a 77% silver dime for a loaf of bread, etc.

Eventually, gold becomes the basis for a new fiat currency, agreed upon within governments, e.g., the Bretton Woods agreements post WWII, made necessary by the destruction of axis fiat money.

Ah, the hospital accepted my cash, the car dealer accepted my cash, so did CVS, Whole Foods, Costco, Amazon, etc. etc. Vanguard also welcomed my cash and so did Treasury Direct and the IRS. Any doubts?

I used to think that precious metals would work in a crisis and who knows, maybe they still will work. If you look at Venezuela as the latest example of a hyperinflation, they are all getting by with debit and CC. You can’t carry cash because of volume & weight issues.

I saw a Vlogger called Indigo Travels on YT and he just did a trip to Venezuela.

Gold hasn’t been “coin of the realm” for a long long time. When it is, I’ll go along with the King.

I don’t know.

The traditional “keep your tinder dry” was invented in an era with a gold-backed dollar.

Today, the annual $trillion plus deficit should be seen as a direct swipe on the dollar’s purchasing power. Let me put it this way: the US GDP was $19.39 trillion in 2018. $1 trillion deficit spending is a pretty damn significant percentage of that, if not a very big percentage of all dollars in existence.

Secondly, keeping tinder dry only makes sense if valuations become reasonable – i.e. in line with historical averages. How likely is that to happen when everything is bubbled up so far? And how would anyone know when is the right time to buy? The adage about falling knives comes to mind.

Nail on the head. You are a wise man.

The government will continue to waste money, in a huge excess of what they collect in taxes, and the Fed will fund this wasteful spending with more magic money.

Hyperinflations are not fantasy, they are real events that occur in the real world when governments print money to piss it away. When the event occurs it will have seemed so obvious, it is a wonder so few can see it now.

I’m close to retirement, it’s nice that I can buy stuff with cash today, but if I can’t buy stuff with it in the future it has little use for me.

Cash is trash.

Thanks, I don’t feel quite so guilty about my post above, now.

You nailed it!

The money wasted on stock buybacks could have designed a new aircraft.

With the inevitable bear market and contraction, Boeing will be under immense pressure.

Boeing builds swords for the king. Boeing isn’t going anywhere.

Boeing isn’t going anywhere until blockchain and the age of trust create relationships globally where swords are pointless and rendered useless. Boeing’s Remote controlled planes do exist, how controlled is the question. Friction between parties will look very different to today’s frictions. Boeing’s electric propulsion tech will contribute to the new transportation system which is coming alongside the space ports already being built . Mother Earth and her fragile protective layer from the sun will decide if we get there or an intervention will arrive sooner. The future is undecided. Just as oil companies have diversified to renewables, digging oil out of the ground will appear as antiquated as the 122m Idaho shortest runway. Runways are a thing of the past and so too are planes using oil. Electromagnetic and interdimensional transport futures are ahead if we can but get there and at last leave alone the diverse Earth inhabitants and species to flourish and be wild again without noise or pollution or interference. The EW Chain is just one example of how markets will become decentralised on this current time line. Kings – is that concept antiquated too?

The ultralight Beaver (Canuk designed) I flew at Elsinore in the 80’s could land, stop and take off again on that 122M of runway, easily. Maybe even 3 times. But it’s not everyone’s cup of tea.

Digging oil out of the ground is going to continue unabated until green energy and batteries weigh less than kerosene and avgas. It ain’t gonna happen before 2050 or later. Thorium powered aircraft are more likely than green and battery powered planes.

Until such time as the world is conflict free and inhabited by peace-loving unicorns and care bears, companies like Boeing will continue to exist if for no other purpose than to build swords.

As all of mankind’s physical production relies on products derived from the refining of crude oil, “digging” oil out of the ground will be an essential aspect of our existence for many decades to come.

And blockchain is a sucker’s bet, suitable only for dinosaurs like IBM to run vaporware commercials about non-existent solutions during golf on Sundays.

As for your definition of antiquated, whatever. The rest of your screed was just utter nonsense.

Well put; thank you for a refreshing “other” look at our future.

Boeing management and shareholders may feel the king’s axe, however…

Just so we’re clear…

Boeing’s management, having gorged themselves on stock-based compensation plans turbo-charged by tens of billions in buy backs, and having outsourced critical engineering to offshore entities employing borderline morons at $15 or less an hour, should be forcibly boarded onto a 737 MAX, and auto-piloted into a small debris field after a short AI-guided aerobatics demonstration.

Any left over seats can be filled by management teams of other US corporations that have engaged in the types of activities.

Citizen just suggested first constructive solution to this problem.

“Anything goes….It’s like the whole market has gone nuts.”

Add to the list the margin debt which last year reached $627 billion, an all-time high. $100 billion more than in 2016. The margin debt in June was $575B. Below last year’s top but still beyond nuts!

(Got the figures from Edward Yardeni’s company, Yardeni research, https://www.yardeni.com/pub/stmkteqmardebt.pdf )

Thanks for the great article.

Thanks Old Dog…what was the margin debt levels in 2007?

I know that margin interest rates for retail accounts have gone up a lot since 2006, when the rates were close to the Fed funds rate. See margin rates at one large discount brokerage firm here: http://www.tdameritrade.com/pricing/margin-and-interest-rates.page

Buying on margin really makes no sense these days.

Great piece Wolf,have been getting flashbacks from 2000 (Web Van) for a while now. it is truly stunning to watch. the complicity of the financial Media in promoting this Craziness is especially galling. so here we have a Co that makes Vegetarian Hamburger patties and it is propagated as some revolutionary product. I can remember these being available since the 1970s in health food stores. My gut feeling is there is so much “Money” sloshing around the world right now that EVERYTHING is being bought no matter how bad. this will be “corrected” as always. Keep some substantial funds ready to deploy to go short and you will do VERY well. the hard part is the timing of course as i can happen very sudden at ANY time. thanks for keeping your Readers at the Pinnacle of Developments as they evolve. we are in un charted Waters with a Monster the CBs created they may not be able to control.

“…Keep some substantial funds ready to deploy to go short…”

‘Ready’ in the banks? Where ever & when ever bank failures begin they’ll ripple around the globe like a tsunami.

In my little corner of the universe bail-in legislation was quietly introduced about 18 months ago and hardly anyone is aware of it. When I go into banks I bring the subject up, just for fun and get mostly blank looks even from ‘managers’.

I’ve thought about buying puts, but then there’s the timing, so for me it’s about silver – because of the GSR – and gold and silver miners. Then wait for the blood on the streets moment.

Yep, that’s biggest problem buying PUTS!

Time and TREND has to match with one’s strategy. It worked so dandy during GFC!

BUT not when the ‘BAD news is GOOD”!? The whole investment matrix I learned is upside down since ’09!

But I think those times are coming in the months ahead!

I’m interested in puts myself, I’ve been researching charting and market indicators and such – timing is certainly everything.

As of now, I have a few small option plays, 2 are straddle (just move the price either way) and 1 is bullish. I also have a good bit of money in 2.25% short term CDs waiting for a better time to jump in.

My sense on this is that stocks, while fragile, have more room to run. When we see less companies at 52 week highs and consumer staples outperforming consumer discretionary, we can start thinking puts. Until then I don’t want to risk my portfolio being long stocks (I’m actually positioned like 70% gold related and 30% bonds), but I don’t want to bet on short term price declines yet either. Patience is key.

The Bail-In thing was introduced in the Federal budget a few years qgo by the Canadian Conservative government. Most people are totally unaware of it.

Not so many are unaware. Just waiting to see how it works though!

Gold, what little corner of the Universe are you in? US, Europe, Down Under?

Steins law

Things that can’t go on forever eventually stop

%99 of stocks with ridiculous market caps and no to little free cash flow will be just footnotes in history’s dustbins within 5 years

And along with their collapse , investors who are gambling on these stocks will be taken to the cleaners.

R Cohn – you say:

And along with their collapse , investors who are gambling on these stocks will be taken to the cleaners.

“Let our ears hear, what our lips are saying…”

By Definition… Investors, who are gambling..

Are not NOT – Investors…

They will learn the very expensive lessons of history…

I GUARANTEE – that after the Poo hits the fan.. they will all be screaming for Government bail outs (for them)

Happens. Every. Time.

It’s a wealth stripping scheme, pump and dump on a massive scale. The insiders will be cashed out and long gone before the ship of chumps sinks. Unfortunately, the whirlpool will suck all the ‘sane’ investments of the W2 caste’s 401ks down along with it.

All that “free money” for the wealthy has to somewhere – that’s where it goes. The dollar will crash before the stock market does, but the market will follow right afterwards. It will be very scary!

Stocks will recover with the advent of the new currency – the dollar will not.

Currency was worthless in Brazil in 1994. After the sixth new currency (the Real) was introduced and commerce started up again stocks had retained their value. If you owned stocks you survived in the lifeboat to reach shore, anyone who held cash was wiped out.

People become anchored to the idea that currency has value, when the currency losses it’s value they hang on, believing everything is in a bubble, but it’s the currency that is the true bubble and everything else that has value.

The US dollar is the #1 risk-off asset. If investors get spooked on stocks, real estate, etc it leads to short-term dollar strength.

Curious about “new currency”. SDR? BIS has no Military.

Do admire your housing solution though. I lived in old bread van for several years in 70’s, but I could do it on most city streets and run power from friend’s houses. No more of that allowed if caught.

‘The dollar will crash before the stock market does’

unlikely in the near future!

US $ is the dominant global trade currency (60%+), the least dirty shirt hated but wanted all over the World. Study the previous BEAR mkts and where did all the CASH go after the selling? Look at those 13 Trillions in NIRP! compare that with 2.07% yield by 10 yr bond! ( been in the mkt since ’82!)

The dollar’s status as global reserve currency is waning. There are already payment mechanisms in place to circumvent the dollar and limit the reach of US foreign policy (sanctions).

Greater currency diversification is being advised right now due to rising fiscal and trade problems in the US that could leave those holding an imbalance of the dollar overly exposed to losses relative to Asian currencies, the euro and gold.

Keep your eye on this as this is a structural shift away from the dollar as opposed to a central bank policy, one that will extend over time and space regardless of any given political dictats .

Finally, if the FED keeps printing the dollar to fund the govt., it won’t be able to stem the tide of a sudden hyperdeflation event and the world knows this. And it’s preparing now for it.

“Story stocks, momentum stocks, hyperventilation stocks, consensual hallucination stocks, financial engineering stocks: anything but reality.”

What a sheer waste of capital. Not to mention the bubble world that has been created that might lead to devastation that could scar generations. Does it sound like it is going to have a good ending. How come if it is not rocket science to understand this, do the powers that be keep proving Einstein right with such a ridiculous display of insanity (instead of being sensible, accepting you have been wrong and try and do the right thing – may be painful today but will help in the long run like a much needed surgery). Imagine the after effects on society. I wonder how anyone with a conscience can inflict such punishment on average citizen and be smug about it as if he is doing god’s own work. Seems like Devil’s work to me!

Many do understand but dare not speak, because their whole reality would be shattered. We humans need to go through the wringer. Then we start learning and changing.

If you have any sense you learn. If not you will get another beating!

“Beatings” for this sort of thing tend to be administered to entire societies, perhaps even to all life-forms. I, for one, am very tired of getting beaten for *other peoples’* failure to learn.

The sad thing is that the political systems of the western world seem to be totally oblivious to anything unusual in the ‘markets’! I think America could live through a strictly economic/financial collapse. We have been there before. What is different this time is that we face possible political and social collapse where people lose complete faith in the system. This causes lethargy, apathy, and huge amounts of criminal behavior as witnessed in many countries over many centuries. We just did not think it would ever come ‘here.’ Well, we are ‘here’.

@stephen

Well your half right except it won’t just be America it will be world wide as they have all created so much money and debt that their is no solution or way to pay off the debt and nothing any longer has true value because of it.

Unfortunately I think a total collapse is inevitable their will be no smart place to move wealth be it property, cash, gold, bonds or stocks the whole lot will implode.

The social collapse will leave many unable to feed themselves or their families have access to basic medical care or have any where safe to live. It could IMO trigger the biggest revolution the planet has ever seen as the most dangerous people are those that are fighting just to live and have nothing left to lose.

I am beginning to understand why there are so many huge underground bunkers for those in power to retreat to now as those responsible won’t be able to hide anywhere but there.

Here’s a fix to the problems facing Boeing, Tesla and Beyond Meat

Merge Tesla with Boing. Redesign the 737 Max to be run 4 Tesla X using solar power Boeing could take all the grounded 737 Maxs, attach 2 Teslas per wing, cover the top surface of the wings and cabin roof with solar panels.

It won’t get off the ground but it might just roll down the highway nicely.

Each passenger is served hamburgers made with Beyond Meat. With the addition of all the solar panels, Musk’s Solar City gets a much needed boost. Tesla is saved. Boeing goes back into production and since nowadays airlines only serve nuts and dreck in the dining car, Beyond Meat would be a welcome treat I’d prefer a rack of BBQ unicorn but that might be asking too much

See—I fixed it

Aw, to hell with this. Just take me out back and shoot me. Everything is so screwed up I don’t know if I can’t take it any more :-)

Naha— Just merge Boeing with Beyond Meat and banish all the executives to Yellowstone Park where there is an oversupply of hungry wolves.

If you think your solution as a frequent flyer is to never fly on a Boeing Tin Can again I can show you photos of failed Airbus 300 rudders that exhibit the same kind of engineering proficiency as the bean counters who specified a single O ring for the Space Shuttle boosters.

The “powers that be” (or “god” etc) that decide the ratio of intelligent to dumbarse people in this reality are the ones that have botched it (from the perspective of the intelligent). If the dumbarses massively outnumber the intelligent, then you will get chaos because dumbarses can’t see in big picture terms. On top of this, the modern “academic system” has done an excellent job of turning out brainless consumertrons. There is a thing called “the arrogance of ignorance” that makes the ignorant think they are right, even in the face of blatant contrary evidence. There are whole generations that think that the stockmarket can only ever go up (they’ve never seen a proper bust cycle). If these generations are in the majority making these “investment decisions”, then this little shindig will only stop when the money runs out. Any bets as to how much [real] “sucker cash” is still left out there? Of course the federal banksters can just keep printing more. Time to dust off the history books regarding what happened in the Weimar Republic in the 1920s.

Wolf keeps bashing Tesla, but how smart is being able to stay in business 14 years without making a profit. I think Musk is a genius. Most businesses couldn’t stay open two months without making a profit.

Anyway, keep funding your/their 401Ks and re-electing the same bunch year after year.

Petunia,

I agree, Musk is a genius, I’ve said this before, for the very reason you mention, and for a few others, such as putting EVs on the map. For the latter, he deserves huge kudos. No one before him has been able to do this. He created an entire industry.

Nortel Networks didn’t produce a profit for over 10 ten years. The company went into bankruptcy protection in Jan/2009. All the divisions and IP was sold off. Nortel is known now as the “biggest pump and dump” in Canadian history. During the high tech run, Nortel was buying companies, acquiring land for expansion and building factories.

When the high tech bubble burst, Nortel was sitting on $1B in cash and bleeding $1B per quarter. Cisco was sitting on $18B in cash

Tesla seems to following the same Nortel trajectory: “We remain on track to launch local production of the Model 3 in China by the end of the year and Model Y in Fremont by fall of 2020. We are also accelerating our European Gigafactory efforts and are hoping to finalize a location choice in the coming quarters.” What happen to building the factory in China having acquired the land? All of this expansion activity occurring as the we enter a global recession.

I find Tesla’s 1Q and 2Q 2019 cash flow numbers very suspicious. They are burning through the cash from their most recent financing. I smell an accounting scandal coming in the next 6 to 12 months.

Hmmm, Nortel died because it stupidly went into China along with all of the other fiber telco guys. And the killer is usually IDed as Huawei, and to a lesser extent ZTE and the other Chinese manufacturers.

I am not sure how much Musk is risking by opening up in China, mainly because there are already so many Chinese EV companies, but we will see, if Tesla collapses, it won’t be because of China.

I used to respect him until it became obvious he was in the business of raising money and not making money. I think you two give him too much credit. Tesla was there before Musk took it over. Musk squandered a golden opportunity to make Tesla a success because he let himself be lead by ambition and ego instead of sound business decisions. Numerous twitter faux pas and PR gaffes has made him the subject of derision, not to mention entire YT channels dedicated to Tesla cars quality control problems. Musk needs to go back to basics and focus his energy on sound business decisions or he’s going to lose Tesla. People are rooting for him to fail and nobody is to blame but him. He can turn it around- it’s not too late.

I think Tesla is doomed.

An EV only comprises of a battery and electric motor and controller. It is therefore very simple to manufacture compared to a ICE (Internal Ciombustion Engine that has an engine, gearbox and all the paraphernalia to comply with emissions.

The battery appears to be 60% of the cost of the vehicle.

The batteries come from China and are made from rare earth, China being the largest producer of rare earth.

China manufactures many more EVs than Tesla.

It will not take Mercedes and large car manufacturers to produce cars more efficiently and more reliable and cheaper than Tesla.

Yeah but Amazon closed at $2000.

Unamused,

I Got it, Nothing Matters.

You are incorrect . What matters is a 0.25 bps or a 0.50 bps rate cut ;-) .

Boeing is dead man walking . They cannot design a new plane . It cost them 60 billion dollars and 10 years to bring the 787 . If they start now a new plane by 2030 ?? . By that time the world is over peak oil and short of aviation fuel to fly . Sayonara .

Yup, the Dreamliner was one bridge too far in a world where productivity matters no more, only debt. No wander it’s going rapidly downhill for the most capital intensive ndustry on Earth.

Speaking of kitten’s lots of “alpha dogs and alpha thinkers” here, South Park is on now, and for a while yet tonite. Wonderful! So I’m signing out.

Corporations don’t care about spending boat loads of profits on R&D & improvement for the wellbeing of society. Improvement that ultimately leads to radical transformation & new innovation which then spurs real inflation. Only the kind of mindboggling artificial asset inflation we’ve witnessed since the Great Recession. It’s all about lining the pockets of shareholders. Greed to the nth degree. Anything and everyone else be damned.

Tesla & Boeing are prime examples in different ways but within the same context. Debt creation the likes of which we’ve never seen was designed to impoverish the many & enrich the few. It’s the grandest of all Ponzi schemes. The whole market has gone nuts & nothing really does matter except except the continuance of the almighty profits…at any cost.

I’m glad you wrote this article. I can feel your exasperation as I read it. All the worst behaviors, everywhere; rewarded. Clearly there’s a corporate debt fiasco unfolding under our very eyes, yet if we point it out we’re all Debbie downers … or something.

At least you’ll have it all on record for when the “who could have foreseen this?” excuses get rolled out.

Prior to reading this article, if you had asked me to estimate the value of Boeing’s stock compared to the December lows, I’d have said it probably is quite a bit lower now because of the crash (maybe 20%). If you had asked me to estimate where it’s trading relative to its 50 day moving average, I’d have said lower given today’s negative headline. I just looked at the chart and it’s about 16% higher than the lows in December and still a few dollars above its 50 day moving average.

Many years ago I read about the massive debt load of Supervalu (which ran the better-known supermarket chain Albertson’s). I think the debt was something ridiculous like 5 or 10 times its market cap, so I wondered why I never heard about this company finally going bankrupt. Reading this article reminded me of Supervalu, so I look it up only to find it has been bought by United Natural Foods. Supposedly, the synergies of the two were supposed to produce great value to shareholders, but its stock price has collapsed around 75% since the acquisition a year ago. But Supervalue shares surged over 50% after the acquisition was announced, so it’s almost like rewarding financial irresponsibility. Taking on a manageable amount of debt can be punished as we saw in the case of Cloud Peak Energy, an American coal producer that had substantially lower debt levels relative to its size compared to competitors such as Arch Coal or Massey Energy. But the more indebted coal companies filed for bankruptcy and after being relieved of their debt burden were able to run profitably at a price point that forced Cloud Peak Energy into bankruptcy. So in our financial system it’s almost stupid not to go for broke and take on maximum debt and maximum leverage.

This Boeing affair is making my hair stand on end.

I am an engineer. Years ago, I voluntarily quit a very well remunerated job, sold everything, packed up and moved to a dilapidated ruin in France that I’m slowly doing up. Don’t ask about my current income. At least my engineering background is still of some use.

The reason I quit my profession can be summarized as: disgust with managers, specifically the beancounting variety. Over the course of my career the notion of “shareholder value” entrenched itself in the companies I worked for. With the foreseeable consequences. More and more short-term decisionmaking based on this year’s profit figures, stock option valuations and bonuses. Less and less weight to arguments having to do with engineering, customer loyalty, social responsibility, whatever. The suits do what they can and the engineers suffer what they must.

When the 737max was grounded, I thought this would be a wake-up call to a system in which financial engineering had become the only engineering deemed important. Finally, a clear and unequivocal message to the beancounters that there really IS an end to only squeezing dollars from a product with little regard for anything else. Adages like “penny wise, pound foolish” resurrected. After all, it won’t be long before Boeing will have lost more money on the 737max affair than it would have cost them to develop a completely new airframe from scratch. Serves them right, I say.

In such a situation, I would expect to see consequences. Like collapsing stock prices. Fired managers. CEO departing in disgrace, if not outright deposed. Announcements of drastic strategy changes. Serious blowback, you know.

But no. Some bad figures are published, some compensation is promised, some corporatespeak issued. The stock price holds up, people are working on the problem, nothing to see here, move along people.

I am completely flabbergasted. And disgusted. I feel like I have been beamed to another universe where different natural laws apply. I am obviously losing contact with reality. Which might be a good thing, actually.

I’m off, got to do some roof repairs before the next rain.

I can strongly relate to this and totally understand your disgust.

I am an engineer myself and my fellow colleagues and engineer friends have complained and discussed about the beancounters and robber-barons taking over “engineering shops” ad nauseam.

Personally, I think this happens in fields/markets that have matured where innovation comes to a crawl. So growth in profit can no longer rely on technical innovation — that’s when they turn to “financial innovation” and bring in the beancounters and cheerleaders.

Well, it isn’t just engineers making moves, or plans.

Engineers see problems and have the skills and training to develop solutions. At least real practicing ones do, and not those who use the ‘ticket’ to rise into management. I would expect engineers would be building their own wood-fired trucks by this time. :-)

I just talked with my sister down in WA, where Boeing is king and a few friends of hers were ex Boeing engineers. She thinks the economy is robust and strong. The media is propagating this story like the self-replicating ticks currently killing cows in the US, and she believes it. Why? Because she has to. Everything is riding on her acceptance of myth and hopium. What else can she do but hope? She and her husband have no options to draw upon, and that is the situation of most people.

And even those, those who have made preps and do not accept the current narrative, will be bloodied, bludgeoned, and shaken as this plays out. We are all in this together and if people show up at your door hungry, we will feed them. My question, are investment bankers and ilk deserving of support when this blows up? Nope.

I use to own an engineering design company, and must say I cleaned up a lot of “shady” design work for multiple companies that thought $15/hour foreign engineering was worth the risk. What I found is the training was not consistent, and there was a lot of bad habits in modeling parts and understanding the American design process. The attention to detail, and fear of liability, was simply not part of their engineering culture. My company would have been wiped out if I released a dangerous design that harmed even one person, yet their companies basically had diplomatic immunity. If their plane sensor design sent 300 people into the ground at 500mph, they did not suffer any consequences. This has been the reality since at least the last 20 years…buyer beware.

But thanks to the fed free money, my income producing “hard” assets inflated over 700% over a very short time frame, to the point where I retired at half the age of most Americans. I switched from job creating design engineer to fed debating financial engineer. I think in 20 years, the unintended consequences of virtually free money will have dire effects to our once highly productive society…unless you define productive as producing something from nothing, and by something I mean free money.

FedMadeMeFakeWealthy

Really nothing new.

See the Ford Pinto issue to see how engineers were overruled by beancounters in the 1970s. And disaster followed then too.

There are still plenty of companies where engineers “rule.”

And as an engineering decision – moving to France to fix a dilapidated house with no source of income?

Ummm –

@2banana

You’re not the first questioning my decision. In fact, most “normal” people do. After all, they have their careers to worry about. Their mortgage. Their status. Debt service. Keeping up with the Joneses. Whatever.

However, I only have one life, and I do not want to waste it in traffic jams en kowtowing to dumb empty suits.

I have some capital but thanks to the central bank’s war on savers that doesn’t go as far as I hoped. But living frugally I hope it’ll last until I kick the bucket. You really don’t need much, living in a ruin in the French countryside.

I am poorer than ever. Happier than ever, too.

+1000. You are a rich man, owned by no one. Suits aren’t the only ones that can pile up debt to leave mouldering. You can always fake your death. :)

Congratulations on your escape. Or should we say manumission? Try not to always toil. Also admire the mines at Baux, and the lavender near Les Mees, and the parfums of Grasse, and les calanques de Cassis, and ride the wild white horses of the Camargue. Not everyone can, and very few will, but now that you’re there, these can be your solace, such as it is.

For us bound to our land, there is beauty, solitude and solace in the Appalachian Mountains.

And Vancouver Island, RD. The salmon will be jumping in front of my house in 1-2 more weeks.

@Unamused

Thank you.

And yes, I try to enjoy this simple life to the fullest. Now is the season for the “fetes de village”, where folks spend the evening eating, drinking and having fun at the long trestle tables under the centenary trees.

For me, it doesn’t get much better than this.

Empires rot (financial as well as political) when there is no accountability at the top. We’re there already.

My first para would be the same as yours, except not France.

I used to lecture both on flight control systems and systems design. There at least 7 major errors Boeing has made with the MCAS, the software being only two of them. I do not see it flying in the US before next year at the very earliest (and maybe never). It will be another year before it flies elsewhere.

Must go also, as I have an entire roof to replace ;)

In medicine x 30+ years.

Bean counters in suits also have ruined medicine.

Medicine became all about how much can you extract from the providers , how little can you provide for the patients.

While the bean counters got rich the rest of us got miserable.

The moment Medicine became business, docs lost! It is Corporatocracy running America. Corporate Medicine has no soul!

Been there, Seen that and also done that. Quit nearly 20 yrs ago and have NEVER regretted it!

Worse the docs are highly divided among themselves, against each other in terms of Foreign vs Domestic trained, Proceduralists ( specialists) vs GP/FP/internist, old vs young, racial/minority bias. you name it! They are willing to throw their brethren to curry or save themselves! 90% are members of BOHICA society ( Bend over here it comes)

AMA, State Medical associations, County Medical Societies are useless nothing more than ‘supper’ club. BTW the growth of Hosp Administrators is 1000% vs 200% for docs in the last 2-3 decades!

https://khn.org/news/analysis-a-health-care-overhaul-could-kill-2-million-jobs-and-thats-ok/

This a GREAT medical bean spilling site for non-med lingo speakers.

Don’t let the name fool ya, the Kaiser Family itself sponsors this….some regrets for what happened to their health care notion, I suppose. They were really just about steel & stuff, anyway.

Boeing:

“Self-seppuku”

What might “save” Boeing is the MIC……

“Self-seppuku”

If you are going to play around with other languages please get them correct.

“What might “save” Boeing is the MIC”

Expect part of boeing to be hived off and go the way of Lockheed and the liability’s to be resolved in a bankruptcy of the civilian aircraft side.

“All the real talent gets siphoned off into the Arts and Sciences. That leaves the dregs to put it all together”. -Bucky Fuller…..a long time ago…..

I feel your pain, and I was just a Tech, like Alex in SV.

Tulips are back in fashion, what am I bid?

A bubble, fresh from the South Seas ;)

“Instead of spending the resources necessary to design a modern plane from ground up, Boeing kept basing its new models on versions of its many-decades-old 737 airframe that wasn’t designed at all for what it is being used for today. This was a decision Boeing made to save some money and pump up its share price.“

This is a classic mistake that most highly successful companies make: they cling to the product/technology/method that made them what they are.

Intel failed with their mobile processors because they were based on their PC processors. Their offerings were bloated and inefficient compared to ARM-based products.

Microsoft failed with the touch-based application ecosystem because they have been clinging to Windows, an OS designed with keyboard and mouse in mind. They added a thin layer of paint on top of Windows and introduced a line of tablets/laptops and expect the whole industry to jump on board the clumsy solution. That didn’t happen. Virtually no developer seriously released or redesigned their desktop applications for touch (most were just unconvincing conversion efforts). Few users use Windows as a touch-based OS. Consequently, Microsoft’s app store is in a pathetic state. They even scaled down their own effort for touch-enable their applications. (Apple didn’t make that mistake (yet) — they didn’t shoehorn a touch-UI into MacOS — despite vocal complaints from emotional and impulsive gadget geeks who are quick to ask for something new without thinking it through.)

Let me be perfectly clear: You haven’t one scintilla of a clue as to which you speak.

I use, and code to, WinOS, MAC OS, iOS, and Android. And I work as a technologist for one of the largest financial services companies in the world.

Windows 10 across all hardware platforms, including phone, is *vastly* superior to anything Apple or Google have built to date and the touch interface in the tablet\laptop environment absolutely destroys the crap that Apple and Google have conned you into using. This also helps explain why the best selling apps across all app stores are Microsoft.

As for your ludicrous statement “Few users use Windows as a touch-based OS” I am assuming you live under a rock and have never seen a Surface, or, for that matter, Windows 10 running on any sort of touch-enabled display – and fully deployable into enterprise computing environments.

The failure of Windows 10 phone is tragic. The OS runs great and offers an excellent UX. However, to get the most out of the OS the hardware requirements are skewed to the high end and this may be the source of its demise. As far as I am concerned, in terms of phone, either Microsoft is stupid on the same level of stupidity as XEROX in the days shortly before the PC revolution – or they have something else in the pipeline.

From a phone perspective, I’ll go back to a clamshell before I buy any iPhone or any Android based device.

Maybe you should get out more and try some new stuff before you just jump out here and spew things that are just malinformed?

Clayton Christensen in his book ‘The Innovator’s Dilemma’ explains exactly how and why companies lose their market leadership to new competitors.

Don’t rest on your laurels or someone will steal them. Told to me by employee number one at Msft.

Ah, yes, a millennial recoiling like a vampire to light at a direct response…

Your response clearly demonstrates your utter cluelessness on the topic. In fact, I bet you haven’t even held a touch-capable windows device, let alone actually used one. Meanwhile, in arms reach I have three Android tablets, two Windows stations (one touch-enabled, the other running 3 4k monitors) and an iMac.

I know of which I speak, broheen.

Lol. I worked for M$FT for a decade. Windows is decades old overbloated spaghetti, completely out of control. I have no love for Apple or Google, but their software is simply newer and therefore slimmer and nimbler.

Agree. Kinda like DEC VMS which was the only one I ever got halfway good at (just command language). Did program my use of an App on IBM 360 (Punch cards), and programmed an 8086 in hex to ad and subtract instructor assigned #s, though. My beef came when I was forced to just memorize menus, plus when tubes and TTL were gone and I had to become a board jockey.

Total Luddite and love my dumb flip phone, very small, easy to slip in pocket. Had to pay extra for it.

Quotes from Adam Smith and Maynard Keynes: ‘There is a lot of ruin in a nation’ and ‘the market stay irrational longer than you can stay solvent’. This can run on for many many years and will.

I must intervene here. I hope people won’t take it the wrong way: this is just a friendly correction.

Boeing did not opt for the MAX series to have more money to use on share buybacks. It’s far more near-sighted than that.

In 2005 Boeing decided to develop a completely new family of airliners to replace all of their existing models, informally called ‘Yellowstone’.

Yellowstone was to consist of three models: Y1 to replace the 737 and 757, Y2 to replace the 767 and the 777-200 and Y3 to replace the 777-300 and the 747.

This family was to make as much use of common technologies as possible, thus reducing development costs and times.

At the time no new narrowbody (or ‘Little Boy’ in Boeing parlance) engine was available to offer serious improvements over the existing CFM-56 used on the 737, to it was decided to give priority to Y2, which became the 787 Dreamliner.

In February 2011 with new narrowbody engines such as the Pratt & Whitney PW1000G in the final stages of development, it was decided to greenlight the Y1, with the goal of having it in revenue-generating service by 2020. This was a very conservative schedule which could have been well met even assuming troubles during engine development.

However in December 2010 Airbus had launched the A320neo, nothing more than the plain old A320 with new engine options. While it promised conspicuous fuel savings over the old variant, it was no match for the proposed Y1 using advanced technologies aimed at cutting not merely fuel consumption but also airframe maintenance costs.

We’ll never know exactly what happened, but in August 2011 the Boeing leadership decided to “freeze” Y1 development and to launch a modest re-engineering of the existing 737 model (the New Generation or NG) provisionally named 737-RS which became the 737 MAX.

The MAX was introduced in revenue generating service in 2017, saving Boeing a measly 3 years over the Y1, but at a terrible cost.

Even before the two deadly accidents the MAX was seen as an “also run” or a “second choice” and several faithful Boeing customers felt like the US company committed what Henri Ziggler of Breguet and later Airbus fame called “the capital sin of commercial aviation”: designing an aircraft after minimal consulations with the airlines that will have to use it daily for years. Airlines wanted the Y1, and big Boeing customers like Ryanair and Southwest wanted a saying during the design phase. Instead they got a lot of compromises and an aircraft they didn’t really want.

But the alternative was either that or get in line for the not-exactly groundbreaking A320neo. Or wait at least a decade for China or Japan to design a remotely palatable narrowbody, if any.

Leaving financial conditions aside, Boeing displayed some nigh-on unbelievable leadership flaws which should have made potential shareholders extremely wary and existing shareholders extremely angry. Those flaws were repeated with the 777X, another masterpiece of flip-flopping and near-sightness which is being rightly punished by markets. Should Qatar Airways or Emirates experience the same problems Etihad has experienced and cancel orders it will be really funny to see how the Boeing leadership will flip-flop its way out of another fiasco.

I honestly don’t know what modern day stock market jockeys are drinking/smoking/sniffing. Paint stripper doesn’t destroy brains so throughly.

Boeing is one of those companies, just like Deutsche Bank, which may be too big to fail but are also too big to bail out. It’s not merely just a matter of government snapping its fingers to make everything right because Wall Street is throwing a temper tantrum.

Boeing needs strong, competent leadership with a vague idea of what they are doing, not these two-bit financial alchemists, and only shareholders can get the right leadership on board.

The 737 MAX should have been named the 737 NG.

Or 737 NFG

MC01,

You’ve pretty much nailed it with respect to Boeing’s decisions. The 737MAX will remain James McNerney’s legacy. This was his call as President, CEO and Chairman of the Board back in 2011. He owns it. Should we be surprised? Not in the least. He was the first without an aviation background or engineering degree to run the company (B.A. from Yale and an MBA from Harvard).

My only disagreement pertains to your final bit:

“…and only shareholders can get the right leadership on board”.

No, shareholders won’t set anything right since institutional investors are complicit in the short-term decision-making which will serve to maximize profits in the here and now, not five or ten years down the road.

Boeing is just one more vivid example of the void in leadership, ethics, integrity, honesty, humility and common sense that our world faces. Doesn’t matter if one looks for these characteristics in the business world, political arena or religious institutions. They’re not to be found (with rare exceptions).

The world will have to encounter its next big crisis and upheaval before a new Age of Consequences arrives and then great character will rise to the top again.

“… the void in leadership, ethics, integrity, honesty, humility and common sense that our world faces. Doesn’t matter if one looks for these characteristics in the business world, political arena or religious institutions. They’re not to be found (with rare exceptions).”

True, IMO. What’s the individual to do, sans decent leadership?

Abandon it, as best one can, and march to one’s own drummer, away from densely populated places.

“Don’t follow leaders, and watch the parking meters”

-Total Artistic Genius

McNerney also butchered 3M between GE and Boeing. Ask 3Mers about that.

Another of the wreckage executives from GE.

The list is longer than most people think, if you look into the subject.

Another one of Jack Welch’s poison apples, along with Nardelli, Immelt and others. It sickens me how much the vacuous business press used to slather over GE and Welch, his sleazy numbers manipulations and scorched-earth destruction of employees.

The signs were right there in your first paragraph. Every time I see “President, CEO and Chairman”, three things come to mind:

1. Combining the roles of CEO and Chairman is a governance failure and leading indicator of bad corporate decision making to come

2. Unless they occupy the White House, using the title “President” is a leading indicator of a narcissist

3. Combining all three positions in a title (President, CEO and Chairman) is a leading indicator of an insecure megalomaniac … and a small wiener

It’s been pointed out that it’s too late to fix things. Boeing will be an impportant ingredent in the soon- coming global meltdown. The central banksters will be overwhelmed.

MC01 thanks as always for informative and insightful info. And thanks especially for not comparing the Max to previous ‘similar’ situations where ‘the media’ got all worked up about the crash of an early model (Embraer?) to use a lot of composites, or this is just like when ‘the media’ got all worked up about crashing DC-10s when in reality it was faulty maintenance. This situation is unprecedented and is about greed and fraud and regulatory capture and lack of accountability that is evolving from defying logic and financial fundamentals to trying to defy the laws of gravity.

Saw CBS news this morning summed up the whole problem in 15 seconds…Boeing is working on the software that caused the 2 crashes…So apparently ‘the media’ isn’t getting all worked up any more on behalf of the past or future victims.

MC01,

You left out the part where Boeing lobbied the current US Govt to implement 300% tariffs on the Bombardier C series to protect the 737, whereas Bombardier just sold the controlling interest to Airbus in response.

When companies have to resort to tariffs and interference to protect their products, like US softwood lumber producers and Boeing, the curtain is lifted for people to see what really is going on?

Like aging people, you either keep moving forward as much as possible, or you sit back in the recliner and watch yourself slowly die.

What’s next? Tariffs on German autos? Ohhhhh

Insightful post. Thank You. The difference between Deutsche Bank and Boeing is that Boeing has stealth infused technologies not available on the market which were developed in black projects. The fast turnover of contractor staff ensures silo working and no one person gets to see the whole picture thus technologies remain hidden. Of note the discussion around updates to the 737 aeroplane manual ie known technologic capability intentionally omitted. This I believe is the reason that people appear to be drinking/smoking/sniffing. Some people know, some don’t. Those that know lead a few, chinese whispers. And this might explain what we see today, chaos.

“black projects”.

Deutsche Bank “Wealth Management” div (or whatever) will remain as

black as Epstein’s “client list”. I’d put money on it.

Chaos will continue as scheduled, at peasant level, anyway

The 737 Max saved Alaska, Southwest and the other 737 fleet flyers untold costs and time to retrain and certify their existing pilots on a new aircraft. It is my understanding that it was the airlines that actually pushed Boeing toward upgrade and away from development of a new plane. Plus Boeing had to worry about pilots being trained on the NEO and thus losing future orders to the A320 NEO.

Correction re: Alaska – they have two 737 MAX 9s on order but no MAX 8s parked @ VCV as SWA has. They also fly the 320 including a few 321NEOs. If Airbus could meet the demand it would be interesting to see if airlines would switch. Massive task for SWA with only 37s in the fleet. Of course the 320 design is not really new, only “less old” than the 1967 737.

Good to see someone is sticking McNerney (and by extension, Welch) with this fiasco, now can a way be found to claw back his ill gotten gains? The road not taken by passing on naming Mulally CEO, a real engineer, not the financial kind.

For all that, Boeing will persevere. There is no way in hell that the Federal government will let Boeing fail. It would be worse than not bailing out General Motors.

As for Jimmy McNerdy… said it a hundred times before, he was the loser of the three way fight for Jack Welch’s spot. He went to screw over 3M before he was promoted upward to fuck over Boeing.

It’s funny, all of Welch’s potential successors ended up being losers. Don’t remember what happened to the other guy, Nardelli I think, but Immelt killed GE.

Nardelli wrecked Home Depot and then Chrysler. It would be staggering to tote up all the capital destroyed by GE management ideology while the purveyors enjoyed plaudits and plutocratic wealth.

The big question is always was Welch successful because he was Welch, and nobody could out-Welch him. Or was it that it was just a fluke due to his rather draconian management style. Or perhaps, he always had a bunch of B players working for him, who had no ability to really stand on their own.

Because his potential successors were all big losers.

Nailed it.

“If Boeing had invested some of this money that it blew on share buybacks to design a new modern plane from ground up to replace the ancient 737 airframe, these tragedies could have been prevented, and Boeing wouldn’t have this nightmare on its hands. But the corporate cost-cutters and financial engineers, rather than real engineers, had the final word.”

This paragraph above pretty much sums up why the United States is going a break- neck speed to the trash bin of history, the bin that accommodates far larger and more exuberant Empires of Yore.

Then again Who cares!

All the rats will be deserting the sinking ship anyway.

Agree. But just where will rats go? To Mars with Elon?

Yes, the idea that you can borrow your way out of debt seems to be proving itself false.

The game is called global ZIRP, and it will get even more bizarre.

The game is ‘global deregulated insane speculation’.

Ask the Japanese how that worked out for them 30 years ago!

You can regulate a dog, but not a wolf that’s been living in the wild.

Couldn’t agree more, except IMHO the entire world has gone nuts.

The result of political correct “thinking”, i.e mass hysteria?

Even engineers appear to adhere to “positive thinking”, probably the result of constant brain washing at college and university.

Murphy’s Laws and market corrections are outdated.

My gut feeling is Western Civilization has peaked and there is not much else, except for Japan. But they had chosen collective suicide a while ago.

I believe when the crash hits the Algos will also go nuts.

“My gut feeling is Western Civilization has peaked …”

I agree. I’m an old man, remember well Mom crying when job after job disappeared for Dad during the great depression of the 1930s.

I also remember the renaissance of the 1950, when America was culturally united in the aftermath of WWII.

Our pinnacle as a civilization is past, IMO – it was during the third quarter of the 20th century.

It’s my understanding the algos will no longer go nuts, the bids will simply disappear.

Wolf, what’s keeping it up I say to myself. Nuts is right!

Rampant speculation and the greater fool concept (now called ‘momentum’) is what’s keeping it up…same as ever, with the once difference that the greater fool now may well be a machine running computer code!

It will turn, and when it does it will be nasty.

I agree. It’s all about momentum in the s. market. Parallels what we see in politics: it’s all about celebrity. No concept of quality.

The 737 Max 8 belonging to Ethiopian Air was going 700mph when it crashed in an almost vertical nose-down pitch. It’s hard to imagine anything in the debris field remotely resembled a commercial airliner. The reason it crashed at such a high speed was because the thrust levers were left at full take-off power. Even if the pilots monitored air speed it wouldn’t have changed the outcome. There’s been a lot of criticism of the pilots for not disabling STAB TRIM, or not knowing they should, but the CDR revealed they did disable it.

As for Tesla- it’s been tapping the debt markets for years and Musk has been making unkept promises just as long. Investors know by now that Tesla cannot deliver on Musk’s promises. The market does not support it and Teslas have ongoing quality control issues. So why do investors keep throwing good money after bad? One possible answer is that they expect the Fed will keep buying Tesla stock through its primary dealers. Deutsche Bank has been buying up Tesla stock for months now.

Just a matter of time before central banks enter equity market with both feet.

You mean openly admit to it.

Been reading a few articles lately how the Fed is acknowledging that their plan to blow asset bubble has not worked, but they had to do it because Congress wouldn’t do it’s job of restructuring economy. Not sure about that, but the Fed did get the market trained to keep buying because we are not going to let assets fall in price. My guess is in the next crash, Congress will change the law so the Fed can have even more extreme policy like buying corporate bonds and stocks to keep assets inflated.

Bad monetary policy corrupts a society by basically penalizing rational thought and replacing it with speculation and by rewarding financial engineering over longer term production improvement.

That’ll destroy the USD, the world reserve currency. That’ll be fun…

The 1950’s and 1960’s were the glory years of Keynesian economics where the federal government quietly stepped into the economy during downturns with massive infrastructure projects like the Eisenhower Interstate Highway System and the Apollo program among many others.

This economic system had the effect of empowering labor unions which drove up working class wages, matching any productivity improvements. Coupled with extreme enforcement against monopolies, the economy had high growth, low unemployment, low inflation and high wages. But it also minimized corporate profits.

In steps Milton Friedman. His entire goal was to shift economic power away from the federal government and towards the banks, the federal reserve, and corporate CEOs. And with the presidency of Reagan (and later Clinton), he achieved his dream through a change in the popular myth. Whereby the government stifled the economy and the private sector should be unleashed to create wealth, all under the watchful eye of the federal reserve.

What we are witnessing today is the final results of that very successful campaign.

WHAT?

Govt spending as a % of GDP is higher today – MUCH HIGHER – than in the 1950s and 60s.

Yeah. Massive military spending (tax payer funded giveaways to corporate contractors) and interest on the debt (accumulated to pay these corporate contractors).

Tax rates was much higher in the 1950s.

Government spending is largely defense and healthcare, which is a byproduct of high prices in these sectors, which is driven by rampant corporate profiteering enabled by toothless regulations and monopolies in these sectors, which is a byproduct of the overall shift of political power toward banks and corporations.

Kent’s comment was spot on. Too bad the general public has no idea what’s happening, and the few folks that do (e.g., readers of this site) can’t do anything about it except vote and hope.

yes but the majority of it is spent on rubbish that does not return any asset to the nation or feed the economy.

What is the point of the state providing loan funding for students to study golf course design which returns nothing positive to the Economy as the best golf course designers are old golf pros.

just 1 example of the many bad state investments in tertiary education loans that will never be paid off, or in many case even down.

Kent,

You should write a book: the history of the American Economy since 1950. Maybe “The Onion” will publish it. It appears to be a little too late for “Mad Magazine”. Whew… have to hold my nose on that one.

Awww, come on. For a mere 4 paragraphs, it wasn’t that far off from including all the major factors of the times. And most certainly was not Mad Magazine material, or a nasal irritant. And you quite obviously got the gist of it.

BTW, would you prefer the “horse and sparrow” Econ analogy from the Gilded Age to Uncle Milty’s “credentialed” agenda?

It’s for sure less sneaky than “supply-side”, neither of which have been very kind to peasants.

And yet again, there is NO such thing as the Nobel prize for economics.

Corporate bean counters and their robber Barron counter parts will soon ask this very question, who is John Galt

I spent a month in the hospital staring at cielings. I asked the nurses how they keep on going despite what they see around them. Their answer is they don’t watch the news and just keep on going. I followed their advice.

If you were ever near death and survived, you know what really matters.

Trouble with that is that kind of ‘head in sand’ thinking leads to all kinds of wrong people floating to the top…and then third-world country status, as those people carve the place up for themselves, their family and their pals.

Vigilance is required.

And you don’t need a near-death experience to realize what’s valuable – just a pause for thought.

About 12 years ago, a young guy I worked with on wall street went through a near death experience. He only had one 7 figure bonus check under his belt, so he was not wealthy. Then, he had a near death experience. He was in the hospital for months. He survives and returns to work. What did he do? Packed his desk and quit work. He told all of us we were wasting our time. He moved to a lake cabin away from the rat race and married a small town girl.

Good. You understand.

I get it. Important life lesson.

Iamafan, I wish you all the best.

He’s fine! According to his comment 2 days ago, he’s out shopping for a new ‘Vette ;-]

Thank you, Wolf.

We had more than 2 feet of snow and I was out snow blowing at night. After it was all done, I had a massive stroke (a head bleed), but the bleeding stopped just before they cut my brain. I was out, totally. When I woke up in ICU, I could not do a thing. Nothing except breathe. I was nursed and after a week I moved up to CCU. One more week. Still zero movement. They moved me down to PT. In the end of the 3rd week, I moved. But balance and dizziness was out of this world.

After 3 weeks of not moving, you’ll cry out of self pity because you hear others waking the corridors of the hospital. I could not even walk to the bathroom. They wheel chaired mt to PT. I did everything and more I was told. You are like a baby trying to learn to walk again.

They knew I was fine when they gave me 10 numbers to add and I beat the doctor that needed a calculator. Obamacare only paid for one month so I went home. Nurses visited my home and made sure I would not fall and hurt myself. But I was determined to walk again without a walker or a cane. I bought a balance beam built of foam and balanced on it again and again and again. It worked. Today I do my whole yard (more than 1 acre) with a walk behind mower. I detail all our cars. I read almost all the gospel from the Fed. Very lucky.

I hope this never happens to anyone. By the way, never skip your blood pressure meds. That was my downfall.

On the investment side, my Dad who is in his 90’s decided to gift me because of my situation. I put everything in Treasuries and did not regret it. I will follow SocalJim’s advise and buy that house near a lake.

Super-glad to hear that you’re recovering from this ordeal.

“House by the lake” sounds good! Make sure it has internet access so you can come to WOLF STREET ;-]

Ozark maybe! Sorry could not resist myself, been binging and re-binging on season 1 & 2, waiting for 3. That is a helluva story… made me stop feeling sorry for my little backache from doing yard work over the weekend.

Well done by you!

4 Trillion bucks of QE had to go somewhere, into ‘real’ assets so why not borrow the money from the banks at zero interest, pump it into the stock market and pocket your slice of the bonuses? When you have criminals running things that’s how it goes.

It doesn’t matter until it does.

The stock letters for Boeing are BA

They should read MBA. There fixed it

BA is the DOW as it is a price weighted index. The elephants have to keep it up

In the air with their algo software MCAS

The markets are under going long term distribution. The internals are weakening and there are fewer soldiers leading

Do I fore see a 2000 or 2008 crash? No