But how low might the Fed’s balance sheet go?

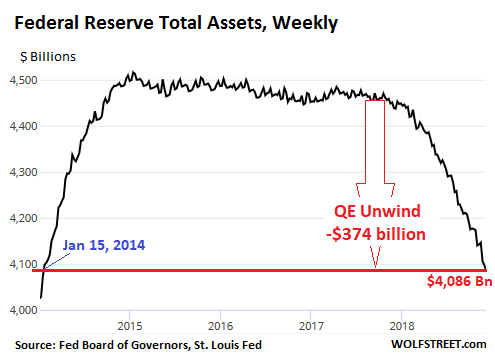

The Federal Reserve shed $54 billion in assets over the five weekly balance sheet periods that encompass the calendar month of November. This reduced the assets on its balance sheet to $4,086 billion, the lowest since January 15, 2014, according to the Fed’s balance sheet for the week ended December 5, released this afternoon. Since the beginning of the QE unwind — or “balance sheet normalization,” as the Fed calls it — in October 2017, the Fed has now shed $374 billion:

The Fed holds a variety of assets, including the Treasury securities and mortgage-backed securities (MBS) that it had acquired as part of QE. Between the end of QE in late 2014 and the beginning of the QE unwind in October 2017, the Fed replaced maturing securities with new securities to keep their levels roughly the same. Starting in October 2017, the Fed has been shedding Treasury securities and MBS.

How much lower will the balance sheet go?

The Fed held about $910 billion in assets in the summer of 2008, before the whole mess started. Over the prior decades, the amount of assets on its balance sheet had roughly grown in line with nominal GDP (not inflation adjusted); and this trend would have continued. In other words, there is zero chance the assets on the balance sheet will ever revert to $910 billion.

Since Q4 2008, nominal GDP has grown by 42%. Assuming that QE continues for five more years: At the average growth rate of the past few years, nominal GDP in 2023 will have grown by 72% since Q4 2008. If the Financial Crisis had never happened and if therefore the Fed had continued expanding its balance sheet in line with nominal GDP, the balance sheet would have reached about $1,570 billion by 2023.

This marks the absolute lowest point for the assets on the Fed’s balance sheet by the time the QE unwind is finished – but more likely, the balance sheet won’t drop quite that far.

Treasury Securities

Until October, the QE unwind had been in ramp-up mode. In October, it reached cruising speed, according to the Fed’s plan. In the cruising-speed phase, the Fed is scheduled to shed “up to” $30 billion in Treasuries and “up to” $20 billion in MBS a month, for a total of “up to” $50 billion a month. So how did it go in November?

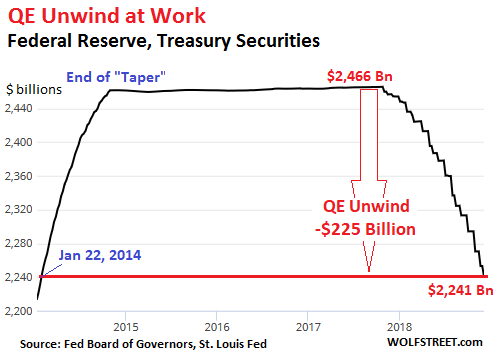

From November 1 through December 5, the Fed’s holdings of Treasury Securities fell by $30 billion to $2,241 billion, the lowest since January 22, 2014. Since the beginning of the QE-Unwind, the Fed has shed $225 billion in Treasuries:

The Fed sheds Treasury securities by allowing them to “roll off” when they mature. When Treasury securities mature, the Treasury Department sends money to all holders of those maturing bonds to redeem them at face value. Treasuries mature mid-month or at the end of the month. Hence the step-pattern of the QE unwind in the chart above.

On November 15, three issues matured totaling $34 billion. On November 30, three more issues matured totaling $25 billion. So for the month in total, $59 billion in Treasury securities matured. This was an unusually large amount, the most since the QE unwind began.

Sticking to the plan, the Fed did two things:

- It collected $30 billion from the Treasury Department for part of the securities that matured. The Fed creates money, and it destroys money; but it doesn’t sit on trillions of dollars in cash. So when it received the $30 billion from the Treasury Department, it then destroyed this money just as it had created this money to purchase these securities. That was the QE unwind part.

- The Fed also reinvested (“rolled over”) directly with the Treasury Department the proceeds of the remaining $29 billion in Treasuries that had matured.

There won’t be many months with this many Treasury securities maturing, and it will become rarer that the Fed, if it sticks to its plan, can shed the full “up to” amount capped at $30 billion a month. For example, in December, only $18 billion in Treasuries will mature, which will be the maximum that the Fed can shed under its plan.

Mortgage-Backed Securities (MBS)

Under QE, the Fed also acquired residential MBS that were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Holders of residential MBS receive principal payments as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. To keep the balance of MBS from declining after QE ended, the New York Fed’s Open Market Operations kept buying MBS in the market.

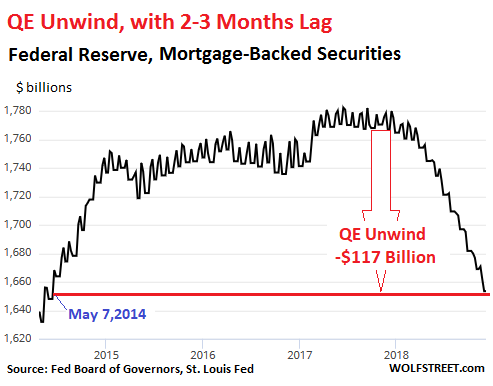

The Fed books the trades at settlement, which lags the trade by two to three months. Due to this lag, the amount of MBS on today’s balance sheet reflects trades in August and September when the cap for shedding MBS was $16 billion a month.

And this is how it panned out. From November 1 through today’s balance sheet, the balance of MBS fell by $16 billion, to $1,653 billion, the lowest since May 7, 2014. Since the beginning of the QE unwind, the Fed has whittled down its holdings of MBS by $117 billion:

So in November, the Fed shed $30 billion in Treasury securities and $16 billion in MBS, for a total QE unwind of $46 billion, the largest monthly amount since the QE unwind began.

Instead of “bubble” or “collapse,” the Fed uses “valuation pressures” and “broad adjustment in prices.” Business debt, not consumer debt, is the bogeyman this time. Read... The Fed Explains the Rate Hikes: To Prevent Financial Crisis 2

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Dear Readers,

There have been rumors that I summarily cancelled the WOLF STREET REPORT for all times to come because there was none last Sunday.

This is not the case. The reason I didn’t do the WOLF STREET REPORT last Sunday was much more mundane: I got a really bad cold shortly after I arrived in Japan, and I lost my voice. That’s not a handicap for me in Japan, given my inability to speak Japanese beyond a few basics. But no voice, no WOLF STREET REPORT.

My voice is gradually recovering. At the moment, it’s a gravelly smokey voice about an octave lower than normal. It’s really just a deep whisper. My wife likes it. But…

As soon as my voice is operational, the WOLF STREET REPORT will return. This might be this coming Sunday, or the Sunday after.

Hope you fully recover soon and looking forward to you insights. And no worries about the one day absence – it’s not like the insanity you cover weekly is going anywhere by your next report. :)

I hope you feel better soon. I would hate it if your illness diminished the joy of your trip to Japan.

I was worried it was part of a joint Department of Justice / Federal Trade Commission / F.C.C. move to strip the podcast away from your empire to reduce the power of your media conglomerate – now that you are part of the Big 7.

Get well soon.

Wolf, get well soon and enjoy your vacation. You might want to record a sentence or two in your present voice for posterity and maybe entertainment for your adoring readers.

BK

Wolf,

Hope you are feeling better soon. In the meantime, download the GoodRx app on your phone. Will save you some bucks on any prescriptions and may be less expensive than using your health insurance. Have a good trip.

Best wishes for a speedy recovery.

You could call it the TOM WAITS REPORT.

i dig the tom waits report idea, too, but how could you hold back on telling us san franciscans that the housing market’s tanking in a sexy raspy whispery voice???

Best wishes for a speedy recovery Wolf.

Hope you get well soon.

Wolf, I’m continue to be confused about the impact of “QT”. As I understand it, the Fed is letting Treasuries and MBS that it holds mature, and cancels the money it receives from them.

That said, the Treasury has to get the money to repay the Treasuries that mature from somewhere, which I assume is the bond market, China or somewhere. So my question is, unless the Treasury debt is retired and not rolled over, isn’t the real impact just a bookkeeping entry, and a tighter borrowing conditions for those who compete with the US Gubmint?

Yes, it’s a bookkeeping entry since they don’t hold cash. They buy $20 billion in treasuries with money they create out of thin air but don’t literally print and then when they mature, they buy more with the money that matured or they just book a new entry and it disappears just as it appeared. Borrowing gets tighter because their support is removed from the market driving up yields. Rates stay low if the 500lb gorilla is buying up a huge chunk of bonds and almost all MBS.

HB Guy,

No, it’s not just a book-keeping entry. It’s a chain of cash events. In basic terms, the QE unwind drains money from the market like this, in steps, going backwards in time:

Step 1: When the Treasury securities that the Fed holds mature, the Treasury Department transfers the money to the Fed. If the Fed doesn’t buy other assets with the money, that money just disappears at the Fed.

Step 2: Since the Treasury Department doesn’t have the money to pay off maturing bonds – as the US government runs a big deficit – it raises this money in advance by selling new bonds at regular auctions.

Step 3: By buying the new debt that the Treasury Department issues, the bond market gives its money in advance to the Treasury Department that the Treasury Department then gives to the Fed to redeem the Fed’s maturing bonds.

Step 4: Because private bond buyers replace the Fed by the amount of the QE unwind, these bond buyers have to sell something else to raise the money to buy those bonds.

It’s by this mechanism via the bond market and the Treasury Department that the QE unwind drains “liquidity” – or whatever else you might want to call it – out of the broader markets.

“…there is zero chance the assets on the balance sheet will ever revert to $910 billion.”

Never say never.

QE was rolled out entirely to prevent the deflationary collapse that was, and is, inevitable. This has delayed deflation but has not defeated it.

Don’t fight the Fed? OK. But don’t fight demographics either. The Fed hasn’t learned that one (nor has the ECB, PBOC or BOJ).

There is no step 3, Wolf, step 2 by definition makes it a ponzi scheme

Rollover of debt is not the same thing as a Ponzi scheme. Social Security is a Ponzi scheme.

Simple version: When the Fed rolls over less treasuries, the US government sells more on the open market.

This direct affect on the markets is identical to that of the US government selling more treasuries to increase spending, just without the increased spending taking place. Wall Street used to worry about the effects of “crowding out” of private debt from increased US deficits, until the central bank balance sheet expansion started to make up for it under Reagan/Greenspan.

The thing is that huge commissions were paid for little QE work transacting to the banks after the banksters were defrauding investors by selling tranches of securitized mortgages to gullible investors, which banksters knew would fail and bet would fail. Those commissions form a significant part of QE debt.

Now, the government cannot ever repay a significant fraction of it’s debt. Not enough people will buy refinanced treasuries. Interest rates would have to grow huge to attract that many buyers.

The offensive thing is not an entity that watches over the financial system. The academics that run the Fed must take steps to protect corrupt or criminal entities that enjoy effectively a government guarantee against failing, ultra low interest rate loans from their Fed even when insolvent, and fractional reserve banking that lets them make effortless profits from others and effectively government money.

We should expand the privilege of being a bank to include entities of national importance like Boeing or steel companies and not just the most corrupt, banksters-controlled, parasitic, largely foreign owned entities. They pay little in taxes and corrupt our government, much worse than the aristocrats that the French overthrew.

I notice that currency requiring collateralization (i.e. in circulation), a balance sheet liability, stands at over $1.6 trillion which is larger than your estimate of what the balance sheet would be in 2023 (total liabilities plus equity) based on nominal gdp growth. Does this represent some sort of stealth monetization of debt?

HRH,

Note that “currency in circulation” (Federal Reserve Notes and coins) is a liability on the Fed’s balance sheet, not an asset. On any balance sheet, Assets = Liabilities + Capital. So don’t add up Treasury securities (assets) and currency (liabilities). They’re on opposite sides of the balance sheet.

Currency in circulation has grown more steeply since the Financial Crisis than it did before, if you look at the long-term chart.

This is actual dollar cash. The Fed’s job is to provide enough cash for the economy to function. The Treasury Department produces the bills and coins. But the Fed manages the amounts in circulation via the banking system. Currency in circulation grows when there is a lot of demand for dollar cash. And there must always be enough cash in the banking system to satisfy the demand by customers for the physical dollars.

There are several factors why demand for cash has risen sharply since the Financial Crisis, including ZIRP, or NIRP, that encouraged people to stuff their mattresses with cash, and the collapse of currencies in some countries, such as Venezuela and Argentina, where locals keep dollars on hand to do business and as a store of value. Demand for euros has also increased sharply over the same period.

But the growing amount of currency (liability) has to be balanced on the balance sheet with some assets to keep the balance sheet balanced. And that’s what we’re seeing.

This is one of the reasons why I said that “the balance sheet won’t drop quite that far.” There are other reasons too. Some people have said that in practical terms, it’s unlikely that the balance sheet will drop below $2 trillion. There are also a lot of variables over the next five years.

My main reason for pointing out the absolute low point of the assets was to explain why the balance sheet will never drop to $910 billion again. This is a figure people keep throwing out as to whether or not the QE unwind is rally taking place, but it’s really nonsense to use $910 billion as target. That target number should be much higher. That was my main point.

I agree but was shocked whenI looked closely at how much cash in circulation had grown. Much faster than the economy overall. The fed was going to control overall bank lending by reverse repos and IOES buy seems to have let currency run wild.

Falling prey to a common fallacy, far more cash circulates outside of the USA. And money is constantly being printed to make up for a huge drain here in the domestic economy. Do some simple research. There is no massive cash based inflation here.

wolf, thank you for spelling this out in plain english. it’s amazing to me that i never got any of this insight from my econ professors in that fancy pants college i went to…

Thank you for the great reporting Wolf.

I think very soon you will have second thoughts about the whole Fed QE unwind. You were very confident that the 10 year was going to hit 4% and mortgage rates 6% but it looks like that things are going downhill.

The market is already discounting any rate hikes for 2019 and I bet if the dow went below 20k next week, we might not even get a rate hike in December. Despite what anyone says, Fed is stock market’s bitch, read the “courage to act”of Bernanke, they even had a Bloomberg terminal in their office for god’s sake and were glued daily to cnbc reporting.

Investors who buy the 10-year at the current yield are nuts. Investors have been nuts for a decade. The Fed, the ECB, the BOJ, and other CBs have successfully fried their brains with ZRIP, QE, and NIRP. So these brain-fried investors are going to do stupid things galore, going forward. Just count on it. It will take a long time to get their brains back to function normally.

If they don’t destroy the U.S. dollar the buyers of the 10 year note today will look like geniuses in a couple of years’ time.

I’ve read that the collateral value of treasuries (eg rehypothecation) was what made zirp work. And that fails-to-deliver started undermining zirp.

can you explain why this is ?

“Investors who buy the 10-year at the current yield are nuts”

with stocks losing 2% a day you’ll buy anything.

i suspect powell may slow the rate hikes due to political pressure but as long as the fed keeps rolling off the balance sheet, they will be reducing the money supply which is half the battle.

The Nikkei 225 is down about 1,000 points for the week, yet the Bank of Japan (BOJ) has been keeping up their generous direct support of financial markets like before. The BOJ has been doing exactly what supposedly smart market partecipants have been demanding of monetary authorities, yet it failed to make any difference.

The Bank of Japan has been doing more than any other central bank in the world to directly prop up financial markets, even more so than the People’s Bank of China (PBOC) and the European Central Bank (ECB), basically bowing down to every request originating from corporate HQ’s in Tokyo and Osaka and flooding markets with liquidity. Yet the Nikkei 225 has wiped 18 months worth of breakneck growth worth of the 80’s in just 90 days, 90 days during which the BOJ did exactly what it was supposed to do, including directly intervening in stock markets time and time again.

Stimulus has run its course, and we all know it. It’s now time to send speculators of all stripes, land rats and zombie company shareholders back to where they came from: now it’s time for somebody else to have it good for a decade.

Once everything is state owned well that’s the end of your country lock, stock and barrel. Everyone will become penniless and the state has no one to sell anything to. The last page in the book to total ruination. Japan will be the first.

Many foreigners make the assumption that just because Americans helped reorganize Japan after WWII and because Japan helped give them cars that didn’t break down every other week, Japan has a political system and an economy similar to that of the US. In reality everything is a little different.

The Bank of Japan does not buy equity or REIT’s to “own” the country through some sinister plot: it’s merely doing so to desperately try and re-inflate selected several asset bubbles without causing an inflationary flare-up. People often say the Dutch and the Germans are “naturally aversed” to inflation but the Japanese are even more so, especially given their wage/pension structure system struggles to cope even with a consumer price inflation we would consider rather mild.

Make no bone about it: if every single nation on Earth wasn’t bent on destroying its own currency for dubious gains, Japan would be on the road to one massive currency crisis. But as things stand right now the yen is just another dirty shirt in the laundry basket.

Rather more tangible is the threat of a serious political crisis, but let’s leave that to others to discuss. ;-)

“now it’s time for somebody else to have it good for a decade.”

???????????

Try 4 + decades.

Thats how long the BOJ has been Overtly pumping.

“There won’t be many months with this many Treasury securities maturing, and it will become rarer that the Fed, if it sticks to its plan, can shed the full “up to” amount capped at $30 billion a month.”

All the more reason for Dow 50,000 in 2019!

The Fed’s plan to tap down asset prices has work magnificently! Give dat Fed a cookie!

Add to the Fed’s dismissing ability to roll off QE (well, the Fed could SELL it’s assets but that would be UN-possible in the Land of Fed “Gradualist Hawks”) the increasing rumors of a halt/cut in interest rates…and…well…let’s make it Dow 100,000 in 2019.

Boy, dat Fed sure has been hawkish on “gradualism-ness-ish.”

Other than IOER, what are these excess reserves used for by the banks? Since we keep on hearing that they aren’t being used for loans, then how and what is the game?

With Federal deficits of $1T plus as far as the eye can see, with no politician having the guts to touch the 70% part of the national budget of entitlements, the Fed will be the “buyer of the last resort”.

$21.5 trillion national debt and flying higher. The long term outlook for the dollar and its status as the reserve currency?

The Fed is the enabler as Bretton Woods was buried in 1971. RIP.

Silly question, no doubt, but why does the column use the British method of determining trillions rather than the American method ?

“How low might the Fed’s balance sheet go?”

Probably not as low as they were hoping for, because for all of that PhD economic talent the Fed employs, they still can’t forecast their way out of a paper bag.

The Fed’s first mistake was initiating QE to begin with, but they are bankers. If your only tool is a hammer, every problem looks like a nail. If you are Wall Street bankers (which they are), what better way to enrich your real constituents than throwing free, or virtually free money at them.

As we are finding out, the inflection point where damage to the housing market gets real is closer to 5%, not 6% as some have suggested. The Freddie Mac weekly survey results, not the puffed up retail survey rates, still haven’t hit 5 percent. If they do, home sales continue their slump/rollover because the housing market is now similar to the other speculative bubbles the Fed created. The Fed’s most recent mistake was in underestimating the degree of tightening they were/are actually doing. That $50 billion per month has a similar effect to a quarter point rate hike, so in effect they have been tightening more than they realized.

The Fed is suddenly waking up to their gross miscalculations and thus the backpeddling and doublespeak will only ramp up from this point. I watched that interview here in Dallas, and it became crystal clear that they haven’t learned a damn thing. Why should they, when the continued policy errors pay so well.

The Fed is suddenly waking up to their gross miscalculations and thus the backpeddling and doublespeak will only ramp up from this point.

What are these “gross miscalculations” you speak of? The Fed is doing a brilliant job when it comes to its central purpose: serving as the oligarchy’s chief instrument of plunder against the proles. The Fed’s engineered boom-bust cycles every 8-10 years, orchestrated with its Wall Street grifter accomplices, are systematically looting the wealth and property of the middle and working classes, with the latest Great Muppet Reaping likely to yield the biggest haul yet. Sure, millions of proles will lose their houses and see their retirement accounts vaporized, but as Goldman Sachs CEO Lloyd Blankfein reminded us, using these rigged, broken, manipulated markets to further enrich the already super-wealthy is nothing less than God’s work.

@ Gershon: Bingo! We have a winner. :)

Gary Cohen, former CEO Goldman Sachs addressing new members of Congress yesterday: “You guys are way over your head, you don’t know how the game is played.”

Why is this guy invited to Congress and allowed to hold the elected representatives of the people hostage in a room forced to listen to him?

Also as one new Congresswoman pointed out:

“No. of CEOs in the room: 4

No. of labor representatives: 0”

Not gonna defend GC and definitely the 29 y/o congress person you reference, who by the way doesn’t understand there are 3 branches of govt.

Gershon, I agree with you. Do you anticipate a deflationary collapse up ahead? I can’t see why the powers-that-be would want to hyperinflate the dollar when it seems they have the means to avoid that. Or do they? Do you think the federal reserve can ultimately preserve the federal reserve note?

They certainly can’t forecast but where have the tightened too much?

https://fred.stlouisfed.org/series/NFCI

Unless their model is wrong and not picking up the impact of QT.

Nothing has expanded as fast as the Fed’s lies which have expanded exponentially since 2009. Today at exactly 8:30am we will be treated to a dozy of a total lie to make up for the falling stock markets. “Thee old Goldilocks number” is right around the corner. It’s simply sickening to see all these lies unfold and bigger and bigger lies to cover up for all the previous lies.

I’ve seen it stated that there are more genuine US $100 bills in Moscow than in all the rest of the world combined. If there’s truth in that, then perhaps someday a whole lot of fiat paper might someday “return home”.

Slowly at first, then all of a sudden. Ala Hemingway

The Russians and Chinese have been stockpiling gold against the day that the Fed’s deranged money printing spells the end of the dollar as the world’s reserve currency. Exchanging the Fed’s debauched Yellen Bux, created out of thin air and backed by nothing, for physical precious metals and life’s essentials might be a good idea before the Fed goes full Weimar 2.0 on us with QE4 and producers stop accepting worthless pieces of green paper in exchange for items of value.

According to our Soviet-style official data, the economy is still going gangbusters. Why is it, then, that 93 million people are “out of the work force” (but not unemployed) while the middle and working classes are sinking further into debt as the elites’ financialization of everything and Fed’s debasement of the currency erodes the purchasing power of wages that in real terms have remained stagnant since the 1970s?

https://www.marketwatch.com/story/us-gains-155000-jobs-in-november-and-unemployment-rate-stays-at-37-2018-12-07

“Since Q4 2008, nominal GDP has grown by 42%. Assuming that QE continues for five more years: *At the average growth rate of the past few years, nominal GDP in 2023 will have grown by 72% since Q4 2008.*”

IMO it’s a very good bet that average growth rate will not be anywhere near as high in the next 5 years and may well be net negative over that time period (and longer).

I believe that most of the foregoing comments are based on thoughtful interpretations of what the Fed chooses to tell us as part of its effort to manage the economy for the benefit of all (some?). But what about the presumably much larger volume of information that the Fed has but chooses NOT to share with us? I don’t think the Fed deliberately lies to us unless they consider it absolutely necessary; unlike many in government today, they are fully aware of the risks of discovery. So their strategy is simply not to reveal information that might make their job more difficult. That’s not lying, exactly, but it can achieve the same end.

Today we live in a world of memory loss, outright lies and – my favorite – redaction. Its probably a good idea to keep that in mind as we pore over lengthy reports or parse official statements by an institution whose primary mission is to manage the economy and only secondarily to inform the public ….. sort of.

Hey Arbuthnot, my impression is that this has been the case with a great many institutions, whether private or public (or semi public..?), or whether here or there on this limited planet. All information that is made available just seems to be becoming gradually less detailed, more obfuscated and more wrapped in complexity as time passes.

The reality, as I see it, is that we passed peak energy productivity around about the early 80s (i.e. our energy mix ceased to provide us with ever more (versatile) energy at a static or declining relative energy cost level). Since then we haven’t been able to replicate former productivity growth in real terms, so we’ve employed exponential debt growth to mask the faltering productivity of our energy, and largely tried not to look at the real balance sheet.

This, I believe, is also why our monetary systems have developed the way they have; They simply need to continue to snowball debts on aggregate in order to keep the illusion of economic growth alive and not collapse on themselves, whilst we simultaneously deplete our balance sheet on all levels (debt, natural resources, climate, ecosystems) at an accelerating rate in order to maintain the exponential impetus.

Thanks Wolf, I get it thanks to your succinct reporting. I read your blog all year long and I’m better informed for it. So just like last year, here’s my “contribution”.

Happy Holidays.

Interesting thing just a few moments ago. Effective yields on some 1 year T-notes spike up about 50 basis points. Was able to buy at well above 3% before it dried up in about 5 minutes. Also saw similar spike at 9 mos.

What could cause such a large and very temporary spike?

Any insight into the performance of the MBS on the FED’s balance sheet?

They’re doing fine. They’re guaranteed by the GSEs, which carry the credit risk. So if a mortgage defaults, the GSEs take that hit and make the MBS holder whole. The Fed now holds only MBS that were issued after the Financial Crisis.

Which kinda reinforces that the notion that the Fed really only cares about the banking sector.

Yes and the problem there is really fundamental change, because shadow banking is still banking, (Buffet owns one of each, WF, and Quicken). The Fed is there to oversee and regulate a dying industry which is being replaced by new technology (like the FCC trying to regulate FB with its TV standards for profanity.) Ellen Brown suggests we have state run banks, (outside the Fed charter?) and when the industry does unravel a lot of interesting things may happen.

I remember back when Fed started purchasing the MBS, there was no market for them. Fed purchased these bonds at face value rather than fair market value (which was pennies to the dollar).

I find it hard to believe the MBS portfolio did just fine. I will take your word for it since I couldn’t find anything about this on the Fed websites.

I don’t think the Fed bought those at face value, though it might paid more than market at the time, which was close to zero. The MBS it bought from Bear Stearns and others were not part of QE. They were put in special accounts — “Maiden Lane,” etc. — that were disclosed on the balance sheet. The Fed has since shed all those and recently disclosed how much money it made on them — quite a bit, actually. The Fed was the buyer of last resort and bought during a total panic, when no one wanted to touch those MBS. Turns out, most of them were just fine. That’s typical in a financial panic. There is lots of money to be made in a financial panic.

@Wolf: assuming Fed bought MBS at fair prices is wishful thinking. Here is the transaction data that shows the price paid was even more than the face value: https://www.federalreserve.gov/regreform/reform-mbs.htm

https://www.federalreserve.gov/regreform/files/mbs.xls

On the Fed and “conspiracy”…

I tend to lean toward stupidity when it alone can explain an action. I think it can explain a lot of what the Fed does/has done. They don’t know how weak their social “science” of economics really is (it would destroy their livelihood so don’t look for them to admit it any time soon).

One way to tell this is how the individuals handle their personal business. If you go way back in time you’ll see that Bernanke and Geithner got caught up in the housing bubble with their personal residences. They lost some money and didn’t know how or when to sell their personal residences when things were so volatile in their home markets.

I think that tells you all you need to know about these people. They really aren’t all that street/market-smart. They got really good grades in school though.

One of Bernanke’s profs wrote a scathing report on him back in the day- that he was exactly that- good at the books but not long on common sense — in economics. Ouch.

Maybe another way to look at it is, what was the balance sheet used for. AFAIK, it was primarily used to maintain the target rate in a market based system by buying and selling securities. After QEs, does anybody think that market based system still exist?

I just read on Bloomberg earlier today that Trump and Kudlow saw the S&P drop almost 2% so they quickly decided that Powell will pause on further hikes for quite a while once he squeezes in this last one.

The whole business of central banks buying securities to support markets works until the markets lose faith in currency. This is a factor why I am so over-invested in high quality coastal homes. I am betting on inflation by holding hard assets. The story will end in either inflation or bust. Debt levels are so high that goldlocks is not possible. Hard assets are the answer and I am not selling any real estate. Even in a bust, I still want hard assets.

For 2019, about 262 Billion is scheduled to roll-off for Treasuries, while 112.24 Billion will roll-over. The roll-over breakdown is …

Month “Roll-over Amounts (thousands)” compared to Nov 18:

Nov ’18 29,220,335.9

Feb ’19 26,052,267.7

May ’19 28,532,057.2

Sep ’19 39,488,104.8

Nov ’19 18,168,593.1

September 2019 will be more than 10B than November 2018.

Expect the market to “puke” again. Feb and May are not that far away.

Since these roll-overs are made on 2-year notes and longer, then expect a huge distortion on the longer end of the curve.

For 2020, the roll-over is 82.14 Billion, The roll-off amount for 2020 is 189.37 Billion plus the 2 year SOMA reinvestment last November 26 of $3,424,779,900 or 3.4 bil. This will mature 2 years later in 2020 and November only has 20.99 Bil maturing so the total for the month will not exceed 30B. So there is more fun to come in 2020.

“…the lowest since January 15, 2014…”

And the S&P 500 closed at 1,848.38 on 1/15/2014, which is 30% lower from here. Feel free to draw your own conclusions from these numbers.

Thanks Wolf for your expert analysis. You are the only one who believes in exposing the truth. Keep going and may the Lord bless you with good health.

Update for Aust

“Unbounded Recklessness! The RBA Has Lost The Plot!”

http://digitalfinanceanalytics.com/blog/unbounded-recklessness-the-rba-has-lost-the-plot/

I keep trying to figure out how all of this is going to shake out but like most people I feel mostly in the dark. But there are some basic things I keep pondering…

Since the Fed was created back in 1913 they’ve mostly kept price inflation at a steady & somewhat moderate rate. There’s never been hyperinflation, though there was that time Volcker had to step in and fend it off, which he did. So, I’m wondering why so many people think hyperinflation is an inevitable outcome of this present situation. Seems to me the Fed and the banking cartel they serve would be completely out of business if the dollar crashes. And that said, doesn’t the Fed have the power to extinguish inflation anytime they choose? Under almost an circumstace? And why would they choose not to? Yes it would be a disaster for millions of people but, wouldn’t the preservation of the banking cartel’s own existence take priority? Also these people’s personal wealth is most likely primarily in dollars. And I doubt these people would like to see a day when we have to barter in gold again.

So, why would the next “crisis” not be another deflationary event? Like the great depression.

Deflation might be a possibility. If the Fed doesn’t raise rates with conviction and backs off instead, it will be stuck like Japan’s central bank, link to BoJ rate chart, select maximum time length:

https://tradingeconomics.com/japan/interest-rate

Considering the huge amount Treasuries and MBs they’ve run off, interest rates have held surprisingly steady.

It looks to me like there’s rotation out of stocks into Treasury paper. Stocks are going down, but Treasury bonds are actually gaining value.

Since the whole purpose of QT is to deflate asset bubbles, it appears to be working…..for now. The fall in stock prices won’t really hurt much, compared to what a serious rise in interest rates would do.

my mother – who was the bookkeeper for a mom & pop loan company – told me in the 70s that this new practice of originating loans and then selling them off was a recipe for disaster. she also thought mortgages with less than 20% down was a really bad idea. just to drive her boss nuts, she would occasionally walk into his office with a loan application that was about to be approved and tell him that she thought it would end in default. he would ignore her and write the loan. she was almost always right. he had the last laugh though because he eventually sold the place off for millions (i think it was eventually bought by countrywide) and retired.