We knew “free money would inevitably end. Affordability would become an issue – particularly around new vehicles.”

It has been a tad rough in the stock market for AutoNation, the largest auto retailer in the US, with 242 new-vehicle dealerships, selling 33 brands, including Toyota, Lexus, Honda, Acura, Ford, GM’s brands, Fiat-Chrysler, Mercedes-Benz, Nissan, Infiniti, BMW, Volkswagen, Audi, Porsche, etc. After the company reported earnings on Tuesday, shares [AN] dropped 4%, and this morning, they’re down another 3% (despite the overall market which has been up sharply on both days). Shares have now plunged 37% from their 52-week high in January.

The problem is in new-vehicles sales.

Many customers are strung out by high vehicle prices and rising interest rates, and they’re switching to used vehicles, which AutoNation also sells – and that part of the business is good. But the new-vehicle business was lousy in the third quarter, compared to the same period last year:

- New-vehicle sales fell 5.6%, to $2.93 billion.

- The number of new vehicles retailed fell 6% to 78,300 vehicles (overall industry sales fell 4%).

- Due to rising prices from manufacturers and a consumer shift from cars to more expensive SUVs and trucks, average revenue per new vehicle retailed rose by nearly $1,000 to $37,017.

- New-vehicle gross profit (revenue minus what manufacturers charge after incentives) plunged 13.4% to $125 million.

- Per new vehicle retailed, gross profit dropped 7% to $1,571.

During the conference call, the company cited “pressure on new vehicle margins” – meaning the dealer is getting caught between rising prices charged by manufacturers and consumers unwilling to accept them.

“We anticipated headwinds coming in the new vehicle business,” said CEO Mike Jackson in the conference call. And preparing for it entailed a “shift from new towards pre-owned” vehicles. This shift to used vehicles took several forms, including a $50-million investment for a 7% stake in online used-vehicle-sales startup Vroom Inc., which was announced before the conference call. In a subsequent interview, Jackson added some color:

“We concluded several years ago that free money would inevitably end. Affordability would become an issue – particularly around new vehicles – and we better have created new capabilities for the company to deal with the double whammy of rising rates, both for us and for our consumers.”

“They’re looking at more affordable alternatives,” he said.

The double whammy are rising costs for highly leveraged companies, such as auto dealers, and consumers facing rising prices of vehicles to be financed at higher rates. Something has to give.

Hence the shift to used vehicles.

For AutoNation, every metric on used vehicles was up.

- Sales rose 4.3% to $1.28 billion.

- Revenue per used-vehicle retailed rose 3.3% to $20,044.

- The number of used vehicles retailed rose 3% to 58,700.

- Used-vehicle gross profit rose 6% to $88 million.

- Used-vehicle gross profit per vehicle retailed rose 2% to $1,456.

For consumers this makes sense: the average amount they paid for a used vehicle at AutoNation of $20,044 is just over half of the average they paid for a new vehicle ($37,017).

These new and used vehicle numbers do not include Finance and Insurance (F&I), which in the industry is treated as a separate profit center for new and used vehicles combined. This is where the dealer makes money off arranging auto loans with lenders and sells additional warranties, dubious insurance products, and miscellaneous fluff & buff. At AutoNation, F&I gross profit rose 4% to $244 million; on a per-vehicle-retail basis, it rose 6% to $1,781.

In other words, as is industry norm, the dealer makes more money in F&I off each vehicle than by actually selling the vehicle.

Parts and service sales rose 2.7% to $864 million, generating a gross profit of $473 million. In every department except new vehicles, sales and gross profit rose. But due to the dominance of new vehicles (55% of total sales), whose sales slumped, total revenues fell 1.5%. And total gross profit, also weighed down by new vehicles, inched up only 1.1%.

Operating income swoons

Selling, general, and administrative expenses rose, and depreciation and amortization also rose, while “other income” made up for some of it, and total operating income fell 3.6% to $204 million.

Borrowing costs surge, due to higher interest rates

The interest expense of floorplan financing (to finance new and used vehicle inventories) jumped by 30% year-over-year to $32.7 million.

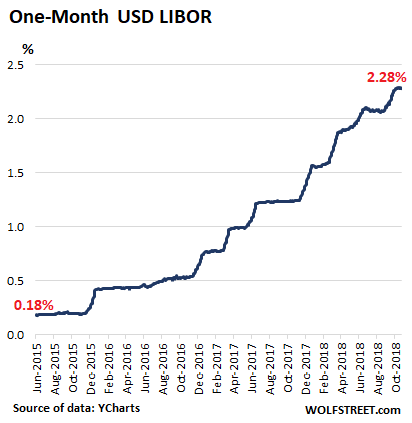

The company’s floorplan facility is based on one-month dollar LIBOR, which tracks slightly higher than the US Treasury one-month yield, which has been pushed up by the Fed’s rate hikes. The one-month Treasury yield is at 2.21%, and one-month dollar LIBOR is 2.28% — both of them up from near-0% three years ago (data by YCharts):

This is how the normalization of borrowing costs – and that’s all this really is as the era of “free money” has ended – is beginning to bite.

Non-vehicle interest expense fell slightly to $28.4 million, “primarily due to lower average debt balances and lower average interest rates as we refinanced higher cost debt with lower rate senior notes and commercial paper towards the end of last year.” And total interest expense jumped by 11% to $61 million.

But the corporate tax cuts saved the day

With operating profit down 3.6% (at $204 million), and total interest expense up 11% (at $61 million), pretax income fell 8.1%, or by $12.8 million, to $145 million.

But thank you, thank you, thank you for the corporate tax cuts. Income tax provisions plunged by 46% from $60.3 million in Q3 a year ago to $32.8 million: “We have not completed our accounting for the tax effects of enactment of the Act; however, we made a reasonable estimate of the effects,” the company said.

And due to this $27.5 million reduction in income taxes, after-tax net income actually rose 15% to $112 million.

So that tax cut came in the nick of time, to temporarily overcome the growing “double whammy” as Jackson put it, generated by what is still just the normalization of interest rates, layered on top of rising prices, and consumers having to juggle it all.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“…average revenue per new vehicle retailed rose by nearly $1,000 to $37,017…”

absolute insanity.

I suppose a lot of the new vehicles are written off by small businesses in the year of purchase, which can reduce tax by $10k or so. They’ve loosened up those rules last time I checked. This especially applies to the expensive diesel trucks.

Once you’ve offered all the tax gimmicks imagineable, then what does the country do to stimulate?

And what a skimpy profit: about 1600 on a 37 G sale or just over 4 %.

When Starbucks sells a 4 buck latte, after everything, I’ll bet their profit is at least a buck or 6 times 4 %.

No doubt the master of the car lot WR, knows how that is hammered into a living: beginning with finance, extended warranty, buyer protection fees, undercoating. Then there is the down stream income from all the oil changes etc.

4% is good. This is high because of the luxury brands AutoNation sells where profit margins are much higher. Back in the day, we used average around 2% on Fords. I think this is similar today.

2% profit and maybe 4% profit is less than legacy costs on new cars? Hell of a way to run a business!

Wolf, did you used to sell Lincoln vehicles at your dealership as well? I presume the profits were higher on those.

The issue these days is that after sales service, F&I, and selling “extras” has become the profit margin these days. I guess there is also some market in selling used vehicles at a mark-up.

Just Fords on the new side. We sold Lincoln Town Cars that we bought at the rental auctions on the used side. We sold a ton of those, as fast as we could get them. Very profitable business.

BTW-The last time I saw undercoating sold at a dealership I worked for was in the ’90s. Undercoating actually voids part of the new car non-rustwarranty as it traps water and allows rust to form.

from the rust belt… when i asked the specialist who has been helping me restore my van why i should use his undercoating instead of the mass brands, he told me the same thing. he said his undercoating doesn’t seal the metal like the big brands. he also told me they tend to just spray the stuff on and clog up the car’s drains which is a disaster. he uses a formula that’s marketed for marine use and breathes. the downside is that it needs to be reapplied about every three years.

I used to joke that the dealers gave you the car to sell you the car loan, but now I think they give you the car and make money on the service.

All the dealerships near me have used ZIRP to build out HUGE service centers.

AutoNation is not an OEM. it’s added value in selling a new vehicle isn’t that high, therefore it couldn’t demand a higher margin.

A more comparable margin example would be how much Costco earns by selling Starbucks bottled beverages.

He needs to suck it up and tell his suppliers to stop producing bling infested pimp mobiles. Was a time a person could choose from a base level 6 passenger car or a loaded out high performance version of the same 6 passenger car model at almost double the price. Now a W2 wage slave has to spend $37000 for a family car, no low end base model available. Want a crew cab small pickup? Sorry, not available without high level trim package. The dumb money going 6 years long with money they don’t have for options they don’t need is gone.

In recent months I’ve been getting regular offers from Ford to buy a new Ford with “low, low” financing. I just toss their offers and think “Well good luck and all that, Mr. Ford.” Because my diesel F-250 Super Duty is almost paid for and has only 18,000 miles original miles on the odometer. It’ll still be running long after I’m dead and gone.

More good news! The recently announced, aptly timed tax cut (coming) of 10 percent for the middle class!

Here’s an idea: why not just abolish income taxes for everyone, including corporate ‘persons’ ? I believe that was the case before WWI.

Nor is there any need to slash social security etc.

As the President advised his (soon to resign) Economic Adviser Gary Cohen: ‘just print the money’

There’s no need for printing presses. Ones and noughts are essentially free.

Why not just adopt tree leaves as legal tender? That will end poverty and everybody will be rich. This could create horrible inflation, of course, but that is easily solved by eradicating all the forests.

Treehuggers have no appreciation for innovative economic solutions.

My accountant and the groundskeepers refuse to approve this message.

When do we get to talk about the effect of upcoming tariffs on the North American auto industry?

I already covered the “effects of tariffs” on the US auto industry. Despite all the scaremongering by the corporate lobby and NPR — which is totally in the pocket of the corporate lobby and Wall Street — about the tariffs, automakers may at the most see their margins getting squeezed a little. And that’s fine. They just got a HUGE tax cut. So a little tax increase on their margins isn’t the end of the world.

They’ve been raising prices to the maximum possible level for years, and are now paying out incentives like maniacs to move the iron, and so they can’t pass on the costs of tariffs to consumer. The automakers have to eat the costs of the tariffs.

I must have missed your coverage of the effects of tariffs on the auto industry. I’ll look.

Differing opinions run the gamut from ‘no effect at all’ to ‘disaster’.

It seems most reasonable that margins may be squeezed somewhat but that tariffs may prove a very minor factor relative to the dynamics you discuss here.

It does not seem at all reasonable to suppose the effects of tariffs on the NA auto industry would be comparable to the effects of other tariffs on other industries.

I’m still in the early stages of an analysis process, so we’ll see.

These are probably not all, but it’s a start:

https://wolfstreet.com/2018/06/27/beyond-the-hysteria-about-auto-tariffmageddon/

https://wolfstreet.com/2018/09/23/what-i-told-the-white-house-about-trade/

https://wolfstreet.com/2018/07/16/us-lost-trade-war-with-japan-over-autos-long-ago-but-has-better-leverage-with-china-automotive-news-china/

>> NPR — which is totally in the pocket of the corporate lobby and Wall Street

“Support for NPR comes from..” – is that what you are referring to? Or is this something else?

Have always thought NPR is as closest to neutral as we have among the major media outlets. Happy to stand corrected.

Pelican,

NPR is great on a variety of topics. But if you think NPR is “neutral” when it comes to business and finance, you need to listen to its segments on those topics. Once you do, and you pay attention to what really is going on, you will see how manipulative NPR is on those topics. It’s painfully obvious.

I wish they’d dig into corporate and Wall Street propaganda with the same zeal with which they’re digging into Trump. But no, they’re basically just reading out loud on air the propaganda Wall Street and Corporate America hand them.

Thanks. You are spot on about NPR. Subtle bias in virtually every piece.

We could do this and if the system allowed it to be done well it would probably work. But creating money to pay for services instead of using tax dollars is a totally different paradigm for how the government is funded. And if done in our current system would eventually lead to inflation.

I forget the term for it, but proponents of simply creating the money we need require taxes to work differently. Taxes need to rise and fall, in such a system, as a means to remove money from the system to control inflation. This is of course because the natural consequence of creating more money depending on who it is given to. If you never remove it inflation will ramp up. So taxes must quickly shift to compensate.

However given the state of our government quickly raising taxes is pretty much impossible. So that doesn’t really work.

Otherwise I love this idea. I am sure it probably has other caviates. But it would be cool to see a nation try it.

It’s no less crazy than our current system which relies on growing debt and creating variable amounts of fiat currency.

question: (opinions anyone?)

If there is a current switch/surge to pre-owned, is there also a forecast for developing and producing simpler vehicles without all the driver assits and other electronic gimmicks?

It sounds like this switch is just a temporary adaption to tightening for both consumers and car companies.

Long term I would hope for a return to product sanity.

Every automaker went upscale, even Kia and Hyundai — because that’s where the money is.

not a sustainable strategy

Yeah, that’s the problem with it :-]

Exactly! Home builders are finding it difficult to adapt to the shift in demand. The pool of buyers/families willing/able to shell out $500,000 for a new home is finite, and shrinking with the Fed’s still-bloated balance sheet. Auto industry will be forced to adapt as well. Average payments, terms on many new cars are insane.

the shift in supply in RE is toward rentals (the demand is another matter) and in the car business we can see the same rental supply-side shift happening; see ‘millenials love to share everything’ meme (which is not true, no one likes to share anything unless it’s not theirs, it’s not primary AND only if they get paid or gain in some way for sharing it or theyre forced to ‘share’ under economic desperation) which the car industry is now increasingly trying to mainline in order to maintain the top line.

And when everybody goes upscale, nobody will be.

My chauffeuse refuses to approve this message.

I think there should be a correction to this answer. That’s where the “Debt” is.

They can get high end loans approved right now, but the industry needs to offer real entry level cars. They are using used cars to fill that gap but I can’t see some of the new models being very friendly to the used market in the future. Way to expensive to fix and the used numbers will drop when that wave hits.

My last auto was purchased precisely because I was able to find a “plain Jane” version, i.e. sans all the wiz bang electronics. It took some searching, but the car was about $7,000 less as a result. I can get by without gps and all the other stuff in the bundled option package. My hope is to drive it well past the point of when all the electronics on comparable sedans are obsolete or inoperable.

i watch a lot of car repair videos on youtube – scotty kilmer in particular hilariously berates car companies for building overly complicated crap. a decent car should have no problem going 200k miles with the original drivetrain if you 1) change the oil 2) don’t drive let it overheat 3) go easy on the transmission

i love that guy so much, hes great.

you just detailed whats wrong with American autos .

toyota hiace/hilux 4 cyl diesels, in this town, on original drive trains, in the hands of tradesmen who donrt look after them ,300k + miles, normal. look after them and you can get 500K miles from them, the bodies tend to fatigue by then.

The more complex the design, the harder to DYI. The ignition key slots lasted forever and at worst, the teeth got so reduced, that you could start you car with a screwdriver. Now, when the ignition button goes bad, its back to the dealer for servicing for most people. They gauge on pasts and labor. i bet the dealers make more on R&M than the profit on the initial sale. Plus, once they have the hood up in the repair bay, they can suggest any number of high margin services.

I start my 32 year old Toyota with any key in my pocket, screwdriver, knife…whatever. I have rebuilt the vehicle so it looks brand new, but things are wearing out. I’m 63, and may replace it for a birthday treat when I turn 65. And maybe not. My one worry is a frame repair I fabbed up. If caught out the truck will be grounded and that is the end of that despite the fact the frame is stronger than new. This summer I painted everything downunder a flat black so it’s hard to tell. :-) It took about 1/2 hour. Apparently, these old restored 4X4s are lusted after by teenage rednecks. I have even had girls come up to me and tell me, “I like your truck”. I kid you not.

regards

Oh, heck yeah! Repair and maintenance is a huge profit center.

Case in point… a true story from last week…

Over the past decade I’ve owned Lexus vehicles, purchased new. I always get the oil change done at the dealer.

I was coming up on 20K miles so time for an oil change (Lexus now does all synthetic, with oil change intervals every 10K miles with the first one being gratis). So, I call up the dealership and I tell them I want to come in in a couple of days and get the oil changed. The service writer asks me how many miles on the car. I say 20,000. He says: well, do you want to get just the oil change ($100) or the “20,000 mile service” – which turns out is a cool $350. Intrigued, I asked “what does the 20,000 mile service include besides an oil change”, to which he answers “vehicle inspection, topping off of the fluids and replacing the cabin air filter”. Having gotten quite a few oil changes there in the past decade I knew his answer was a bit disingenuous given that they always inspect the vehicle and top off the fluids with a just an oil change anyway. So, I tell the guy, “that’s okay, I’ll just get the oil change”.

Afterwards I looked in the maintenance schedule booklet and sure enough the only thing on there which isn’t included as part of a routeine oil change is replacing the cabin air filter – which you can buy at any Auto Zone ($18) or even most Wal-Marts ($14; FRAM brand). No need for SAE certification to install, either. Takes about a total of 3 minutes (working very slowly) to replace the filter which is located behind a panel in the back of the glovebox.

The funny thing is that on my oil change invoice there was a line saying “customer declined 20,000 mile service”. Ha! It should have said “Customer declined $250 cabin air filter” :)

I do wonder how many people fall for this scheme though.

Paulo, when my ’95 Lexus SC400 needs replacing, here’s what I have my eyes on.

https://www.tvr.co.uk/new-car

Like you, I take care of my ride so that should be a long way off. And like you, I just want a vehicle to drive. Don’t need to have the internet or a smartphone plugged in when driving …

Wait until all that radar and camera crap starts shitting the bed, even a little fender bender is thousands of dollars of sensors. Windshields with all that ‘stuff’ above the rear veiw mirror, even a tech laden side mirror is a grand. Those CVT go-kart transmissions are going to be crap long term and the simple and durable manual transmission is all but dead.

Bought a new vehicle in July. AutoNation didn’t have the right model of the vehicle, and their pricing was high. I think this is more of an “AutoNation has problems” thing than an industry-wide thing.

“New-vehicle gross profit (revenue minus what manufacturers charge after incentives) plunged 13.4% to $125 million.”

–> Sounds like the real problem is that AutoNation is trying getting squeezed by the manufacturers and bankers (floorpan financing).

“Per new vehicle retailed, gross profit dropped 7% to $1,571.”

–> So, maybe it was a bad idea to continue to use short term financing for working capital in a rising-rate environment with softening demand?

‘So, maybe it was a bad idea to continue to use short term financing for working capital in a rising-rate environment with softening demand’

where is the aggregated demand in the last 10 years? all brought forward by zirp and cash for clunkers etc aka fake demand. meanwhile frothy prices in every retail catagory as wages snore.

Wisdom Seeker,

A few things:

Total new-vehicle sales for all dealers in the US were down 4% in Q3. This is not an “AutoNation problem.” I covered that at the beginning of October.

Your sample with a sample size of n=1 is too small to extrapolate to the entire industry. It’s meaningful only for you. And it leaves open the question why you didn’t negotiate more or better at AutoNation.

“Floorplan” financing is totally standard in the industry and due to its low risk especially for new vehicles (in case of default, other dealers buy them at cost), the rates are extremely low, lower than other rates. Most of the time, floorplan financing is handled directly by the manufacturer through their financing entities. New vehicle floorplan is usually the cheapest debt a dealer has. Since floorplan financing is secured by individual vehicles, it also adjusts automatically to the size of inventory which can vary by a large margin. And the whole process is totally automated, from when the vehicle is invoiced to the dealer to when it is sold to customer.

Wolf, I’m just reading the data in the article differently than you are. The personal-purchase anecdote was just to show how I came to question the idea that AutoNation is a well-run company, and that some of the problem might be company-specific.

The data in the article say AutoNation revenues were down 50% more than the national average. (6% vs 4% in sales $). So there is a company-specific dimension.

The article says that even while bringing in $1000 more per vehicle (+2.8%), and with new-vehicle revenues off only 6%, gross profit in that segment dropped 13.4%. So we know costs weren’t scaled back along with revenue. (BTW, shouldn’t unit sales have been off more than 6% if revenue/unit was up 2.8% and revenues were off 6%?)

The article explicitly stated that they were getting hurt by floorplan financing costs. That’s a no-brainer problem any CFO faces when rates rise (and even I spotted it!), so why didn’t they do something about it? Other companies in other industries take various measures to prevent interest-rate shocks to the bottom line, so why didn’t AutoNation protect themselves financially?

“Standard in the industry” sounds like the way that lemmings go off a cliff. Adjustable-rate financing killed tons of homeowners in 2005-2007 when rising rates became ARM’d and dangerous. Isn’t the point that AutoNation, as a larger company, can do things differently than small local dealerships? Maybe put on a hedge trade somewhere? Or (gasp) reduce leverage to avoid getting whacked? They seem to have belatedly run off to buy 7% of Vroom… announced just before earnings… isn’t that “too little, too late”? Their inadequate response to an obvious financial issue they claim to have anticipated “years in advance” is definitely an AutoNation issue, given their unique size.

There is a company-specific issue that was addressed in the earnings report. I just didn’t include it because it had nothing to do with anything I covered: AutoNation is huge in Texas. After Hurricane Harvey last year, it benefited from replacement demand that boosted its sales in Q3 and Q4 by a large margin in Texas, and therefore its overall sales nationally. So this made for very tough comparisons this year. They pointed this out in their earnings report, it has been expected for a year, and it makes sense.

Floorplan financing beats all over forms of financing for dealers no matter what the size. Rates are super-low because there is excellent liquid collateral (by VIN!), and risks for lenders are minimal.

There are no fees and no investment bankers involved. It’s all automated. It would be nuts not to use it.

The floorplan interest rate is not dependent on the dealer’s credit rating. AutoNation’s credit rating is at the low end of investment grade (BBB). If they borrowed money in the bond market, they’d pay a fortune in interest compared to floorplan. So rates are going up, but it’s still a LOT cheaper under floorplan now than it would have been had they issued BBB-rated 10-year notes in 2016 — aside from all the other problems of issuing bonds secured by inventories that fluctuate… and if they had issued unsecured bonds, they would have paid an even higher rate. This is just basic finance. These people aren’t morons.

“…as the era of “free money” has ended”

As usual, an excellent and informative article, but I’m a bit surprised by your certainty regarding the end of free money. Of course the Fed is pretending they can allow interest rates to rise but that contention seems to defy reality.

Don’t forget Uncle Ben said he just needed to print $600 billion to save the world, he was lying of course. Now the Fed say they are going to let interest rates normalize to a “neutral rate” – why would I believe they are not of course lying once again. Interest rates have been raised but this will probably show up as a temporary blip on a long term chart.

Jim Cramer has once again demanded the Fed lower rates to continue to inflate assets so the wealthy amongst us (the people that matter) will not see a drought of magical money, the money needs to continue to rain free from above. Powell may try to block out Trump’s demands but when Cramer makes demands on the Fed they acquiesce. The rise in the stock market would seem to indicate that our fearless investment bank leaders have already received a whiff of good news on the Fed front.

AutoNation will be fine. Interest rates will drop back to zero (or less) and Americans will continue to borrow every dime they can lay their hands on (and believe Cramer – it will be enough)

Same as housing…Keeping up with the “Jones” …..people don’t look at the total cost anymore, it’s all about the monthly payment… I asked my brother in-law how much he payed for his $74,000 dollar fully loaded diesel 4×4 that his wife drives the kids to school in every day…. His answer? $750 a month….Oh, and by the way, doesn’t even fit in there driveway….

I blame the consumer…… If they’ll pay it, why the heck wouldn’t the dealer sell it to them?

This is the world we live in…. Nobody takes responsibility for there own decisions anymore…

Same with housing imho…..

In our current hyper-reality only image matters;

surely the pure spectacle of your sister driving her kids to school in a hopped up 4 door 4X4 diesel truck is worth just $750 dollars a month + full coverage insurance + $4 gas no?

Trucks are the male equivalent of a woman’s purse. Can never be too big and price never matters.

Had an acquaintance who was a F&I guy. We’re driving along and I ask him what percentage of the car owners we were meeting were upside down in their car. He half-joking said all of them. Never got a real answer, but I guess the point was a very large %.

Based on F&I stat, sounds like it no longer makes sense to pay cash for an auto. Finance without negotiating the APR, ensure no other fluff or prepayment penalty and then pay it off …seems like a better strategy. Maybe I am missing something?

This has been true for quite some time. Even if you negotiate all the spread out of the APR, the dealer still gets a flat fee for placing you with the finance company (usually around $200 if memory serves). Plus, if you can pay cash, you probably have sterling credit, which provides the dealer the opportunity to place a marginal buyer with that same finance company, as long as it’s in the same month’s business. This means they get a good shot at making a high-profit deal in the near future.

A buyer sporting a flush checkbook and a set jaw is likely to be politely ushered to the door after a couple perfunctory counter-offers.

Better fire up the used car factories!

Seriously, though, I’m fascinated at how the tax cuts allow the cost of the Fed’s rate increases to be transferred to public debt. Basically, it’s just an accounting trick that allows GDP to keep the appearance of growth; at least for now.

Cash For Clunkers 2.0

What we need is a “new” Henry Ford.

Someone who can manufacture a simple vehicle, similar to Henry’s model T with gravity fed fuel (no fuel pump required), magneto ignition, hand crank start, etc. And you may have any color as long as its black!

Solid, reliable transportation from point A to point B. No frills.

Won’t happen of course. eg: –

Two farmers in the mid nineties, from Underwood Kansas invented and built a new type of axial flow harvest combine. Which improved crop harvest from the then 72% average, up to 92% recovery! With far fewer parts and a new rubber tracked design far superior to anything then offered. They tried in vain to have it manufactured with no luck.

To gain back their capital investment, they sold the design patents and rights to John Deere. Who have “sat” on it since.

This new machine with half the parts of present harvesters, would have caused the resale of parts and service to drastically decline. And the big manufacturers can’t have that. It would bite into their bottom line.

note: The final original axial flow machine was auctioned off Oct.29 2018

No one wants to buy a no frills car. Not when you can get one with all the frills by bumping up the loan from 4 years to 7 years.

Just try to make a car like that and the EPA, insurance companies, and various safety groups will shut you down in a heartbeat. Ford’s cars weren’t actually all that good. He bought an electric for his wife so she didn’t risk breaking her arm cranking it.

the model t’s were far from perfect but the model a is unstoppable. people are still driving them.

The world has evolved. Just need a 3D printer to knock out those the parts and anyone who wishes, and is able, can build their own. Same for anyone with a John Deere machine, scan the original part into a computer and print out a new part. It is the future.

a mid 1990s 4 cylinder honda civic or toyota corolla stripper with a manual transmission will run forever.

That is not true. I only got 333,300 trouble-free miles on my 1993 Honda Accord. :)

I did however get 356,000 miles on a toyota cressida.

If we could just get rid of that stupid requirement that humans need to breath the air around them everything would be fine.

Re. “Two farmers in the mid nineties” — Interesting, but assuming they patented their invention no later than 1998, wouldn’t said patents have expired by now?

Yes. Thats why New Holland Agri Machinery has built a combine that utilizes not one single flow through but a double.

A really interesting story. Look it up.

GM up 10.25% today.

Most likely a one time far outlier.

GM has been “dead money” last 5 years. But a 4.5% dividend.

Ford has been cut in half last 5 years. 6.5% dividend.

GM also announced today that it will send 18,000 of its white-collar US workers packing. That may have had something to do with the jump in share price. Getting rid of US workers has always been good for the stock price.

GM will likely do more hiring in China, where its center of gravity has shifted to after the bankruptcy. From GM’s own mouth:

“GM China Advanced Technical Center (ATC) is the most comprehensive and advanced automotive development center in China. It includes research and development, advanced design, vehicle engineering, powertrain engineering and OnStar laboratories. As a member of GM’s global engineering and design network, the ATC is developing solutions for GM on a domestic and global basis while supporting the company’s vision. The first phase of the facility opened in September 2011 and the second phase opened in November 2012.”

99% of elitists approved this message.

If Tesla gets back over $350 I may finally pull the trigger on some gambling-money puts, thus guaranteeing the price will climb steadily to $500+ over the next 12 months. :)

The people with the highest credit ratings could lease cheaply because easy credit for used vehicles meant high residual values. Curious to see what happens to leasing as money becomes dearer.

You mean this might be the end of 72 month financing for pickup trucks and bass boats? Oh, the humanity!!!

84 months financing is the new normal :-]

They’re all junk, except of course for Tesla.