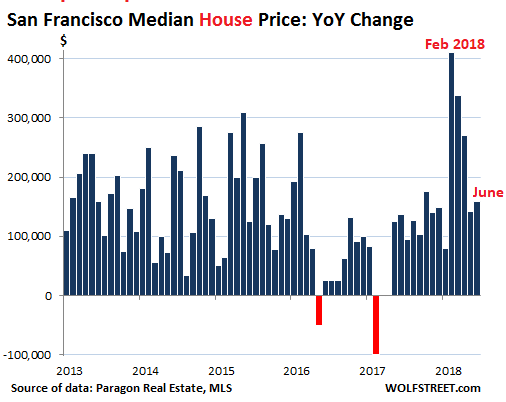

After the blistering spike earlier this year.

In San Francisco, the median price of a single-family house (we’ll get to condos in a moment) soared by 11% in June compared to a year ago, or by $159,000, to $1.62 million.

That surge, as crazy as it seems, is mild compared to the kind of heck that had broken loose in February, when the median price of a single-family house spiked 32% year-over year, or by $410,000, to a still standing record high of $1.7 million. For a median house, which is nothing special in San Francisco!

Median price means half of the homes were sold at prices above it, and half at prices below it. June data reflects closings in June.

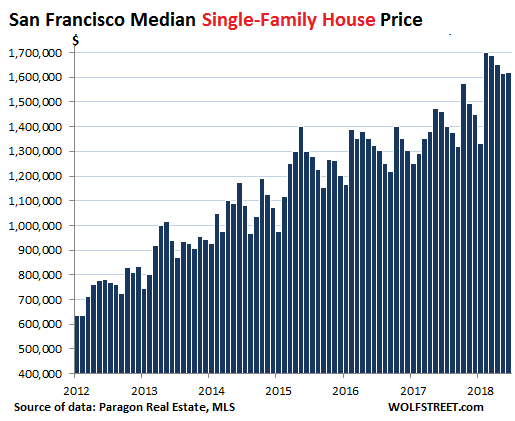

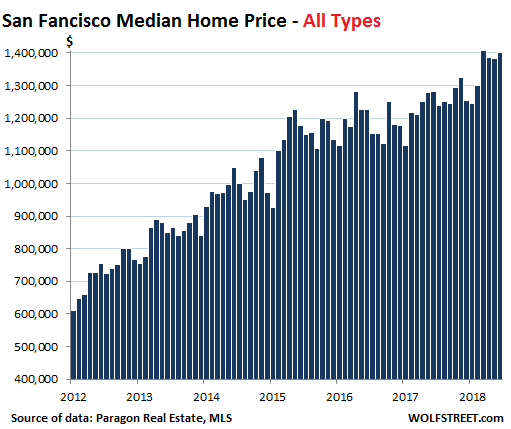

But in those four months since that February spike, the median price of a single-family house has fallen by $80,000. A price decline in the spring is not uncommon. Over the six-and-half years since January 2012, the median house price has ballooned by 155%:

San Francisco, which has the second-highest population density in the US behind New York, is a city of multi-family buildings. In recent decades, nearly all new construction has been condos and rental apartments, and practically no single-family houses have been built. By now, condo sales – in which I include the small number of sales of TICs (tenancy in common) and co-ops – represent 58% of the market. On average per month this year, 249 condos were sold, compared to 177 single-family houses. It doesn’t take a lot of sales at the high end to shift the mix upward and move the price needle.

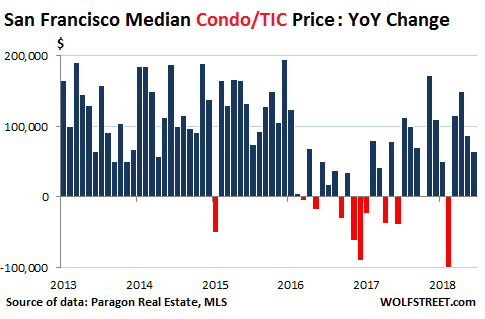

Condos had been flat-lining since early 2015, with major ups and downs in between. The construction boom is putting a lot of new units on the market, nearly all of them high-end. And there have been some sharp year-over-year price declines. The last one occurred in February, when the median condo price plunged 8% year-over-year, or by $100,000, to $1,085,000.

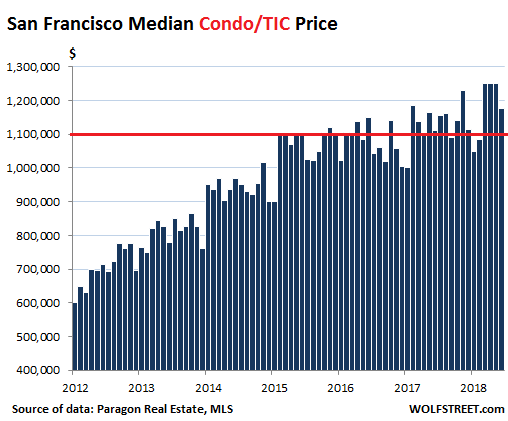

But in March, the median price surged 10% year-over-year, or by $114,750, to a record $1.251 million. That record still stands, and the median price has since then dropped by $76,000 to $1.176 million.

The chart below shows the year-over-year price changes. Note the accumulation of red in 2016 through June 2017:

And this chart shows the median condo/TIC prices over time. June’s median price of $1.176 million is now down $54,000 from November:

The median price of all types of dwellings combined jumped 9% year-over-year, or by $120,000, to $1.4 million, though this was down a smidgen from the peak in March. Since January 2012, the combined median price has skyrocketed 130%:

Patrick Carlisle, Chief Market Analyst at Paragon Real Estate Group, who provided the data, explained:

The second quarter of 2018 saw the highest quarterly number of SF homes selling for $2 million and above: When late-reported sales are entered into MLS, we expect the total to be over 320 for the 3-month period, far exceeding the previous high of 267 sales in Q2 2017. Monthly luxury condo sales in particular hit a new monthly peak for sales volume in May 2018.

By any measure, the heat of the San Francisco market in the first half of 2018 has been among the most blistering ever. Probably only 3 or 4 other periods over the past 50 years have seen a comparable intensity of buyer demand vis a vis the supply of listing inventory available to purchase. This despite both significant increases in interest rates and changes in federal tax law severely limiting the deductibility of mortgage interest and property tax costs. As mentioned before, the market is particularly ferocious in the lower and middle-price segments of house sales.

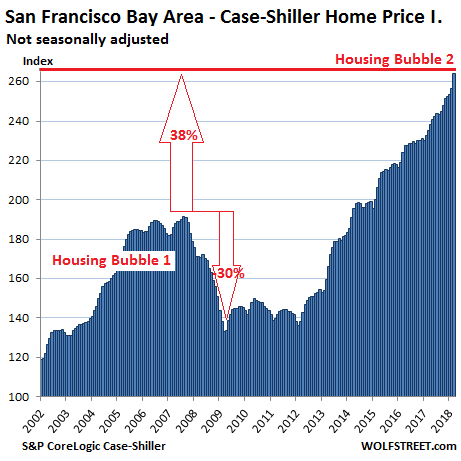

This boom in median prices far outpaces the already steep increases reflected in the Case-Shiller Index for “San Francisco.” The Case Shiller index for “San Francisco” jumped 11% from a year earlier, as I reported on June 26 [It Gets Spiky: The Most Splendid Housing Bubbles in America].

And since January 2012, the Case-Shiller index has soared 89%.

But wait… over the same period, the median price in San Francisco for all types of dwellings combined, as reported above, has skyrocketed 130%.

So there are a few things to note in this comparison:

- The Case-Shiller index for “San Francisco” covers the counties of San Francisco, Alameda, Contra Costa, Marin, and San Mateo (San Francisco plus the northern part of Silicon Valley, part of the East Bay, and part of the North Bay). By contrast, the median prices cited above are for the city (=county) of San Francisco only.

- The Case-Shiller index is based on a rolling three-month average. The release on June 26 was for sales that occurred in February, March, and April. So it lags median-price data by several months.

- The Case-Shiller index is based on “home price sales pairs,” comparing the current sales price of a home to the price of the last transaction of the same home years earlier. The index incorporates other factors and uses algorithms to calculate data points. Thus, the index is not susceptible to shifts in the mix, which is one of the weaknesses of median prices.

- The Case-Shiller, as an index (set at 100 for January 2000), only shows changes in the index value; it does not show actual price levels or price changes in dollars, something that median prices do well.

As they say, results may vary.

San Francisco’s housing market is dependent on an ebullient stock market – rich payouts via stock-based compensation packages – and on the community of venture capital and other funds that plow money into startups, and on Corporate America that buys those startups for ludicrous amounts of money, thus creating lots of instantly rich employees – only to shut them down quietly a little later in many cases. This is global money that is washing tsunami-like over San Francisco during boom times, and it recedes tsunami-like during the busts that have become legendary in San Francisco.

There are plenty of homes for sale in San Francisco, at dizzying prices for what you get. But asking prices are now getting “reduced.” Read… Graphic Details of the Crazy Housing Bubble in San Francisco, According to Zillow

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Given that this is insane, and prices cannot possibly keep going up on any sensible basis. My prediction is that prices will double from here!

Methinks we are living through the final bipolar mania phase before asset prices crash on the rocks of economic reality. The fallout from quantitative tightening (QT) could be really devastating.

I hear the words bubble and and crash so often that by now is deaf ears as far as I know. I don’t know anybody who is in default or having problems paying for sh!te… Here in silicon valley everybody “seems to have” enough money for everything, and everyone makes big money.

There’s more jobs than people to do them.

Money, money everywhere… but not a drop to spend for us lowly serfs toiling in the fields for our lords and madams.

Money galore if you’re in the top 10% which almost everyone in here is. People who knows people, or at least know people who know people…

For the rest of us, the Silicon Valley economy “booming” means there are a great many dishwashing jobs here.

You are in the land of opportunity. Learn to code some Python.

Come on get real. Who is going to hire me to “code in Python” if I don’t know someone who worked for whatever company it is?

It’s all connections here.

The only “in” for me in coding is to be a lone wolf maverick type who posts such genius code to places like Github that I *grab* attention. I mean, PhD thesis at MIT level code.

In other words, it’s a one in a million shot. I’m far better off doing pretty much anything else.

This is what the serfs voted for by electing stooges of the oligarchy’s captured Republicrat duopoly. Ipso facto, they willingly grabbed their ankles and continue to do so every time they vote for a Wall Street puppet.

An excellent description of the symptoms, as usual. Really first-rate. But if you please, Doctor, where’s the diagnosis, the treatment, the prognosis?

The field has been so nicely plowed, fertilized, irrigated. Ever think about maybe planting it?

Mr Wolf is a Doctor of Economics. What is needed here is a Doctor of Psychology, for it is fear and greed, rather than supply and demand, that is the root cause of this malady.

With a straight face yet. What’s a psychologist going to know about the intricacies of market rigging and high-end political corruption? Not much. How useless. How convenient.

No, I’m persuaded that Our Illustrious Host doesn’t stick his neck out by going beyond superficialities because he knows the gangsters running the show are already plenty pissed at him and that he senses limitations requiring self-censorship if he wants to continue having a blog. Discretion being the better part of valour, as it were.

You should know that my interest in this site is as a play-by-play of a rather narrow aspect of the decline and ultimate extinction of civilization, which is financial and economic corruption. My problem is that I keep foolishly hoping for an insightful analysis of the nefarious root causes, beyond the simple reporting of the facts.

It’s really too late to do anything about it anyway. TPTB can bleed you fast or they can bleed you slow, but you’re bound to bleed no matter how you try to fight it, so maybe it’s just as well.

The wise pig enjoys what’s in his swill bucket today; and ignores the distant sound of a knife sharpening and a fire being lit…..

“I’m persuaded that Our Illustrious Host doesn’t stick his neck out by going beyond superficialities because he knows the gangsters running the show are already plenty pissed at him and that he senses limitations requiring self-censorship if he wants to continue having a blog …. My problem is that I keep foolishly hoping for an insightful analysis of the nefarious root causes, beyond the simple reporting of the facts.”

i smiled at your posts because this is the reason many of us leave out of despair and return: THERE IS NO ANSWER TO ALL THIS.

and yes, i see what happens to Black Agenda Report and other sites who’re considered against perpetuating this sick system; google et al make it so you cannot FIND them. and i personally know Wolf has been threatened by google to have his ads pulled for one of my comments using the “N” word. I HATE THAT I HAVE TO FXCKING SAY “THE ‘N’ WORD.” the internet has turned us all into touchy frustrated children.

[[Wolf here: Let me explain to our readers who may not know the story — because this is important. I’ve had the honor of meeting Kitten Lopez. Her books have been published by a major US publishing house. You can find her in Wikipedia under her real name. In prior comments, she described herself as “colored” and “black” (of mixed ancestry). I can confirm her description from having met her. This is important with regards to the N-word comment she made. She wrote in one of her fiery laments: “We’re all N-word-plural now.” Normally, no one can use the N-word on this site. But because of her race and because of the context, I allowed it once. Google, which constantly combs through the entire internet, called it “dangerous and derogatory content” and threatened to pull its adds off this site. I tried to argue with their bot, but no go. So I deleted this line.]]

that’s why i still have a flip phone and it’s only so James can make sure i’m not in jail after i go out for the day.

the internet is over and rigged and censored. all Wolf CAN do is post the numbers graphs charts and leave us to make our own judgements.

that’s uncomfortable, i know. (smile)

this despair rage and sadness we all feel… yes.. this is NOT just a “money site.” but until we’re in person and talking offline, everything we say that gets to stay up here is at the pleasure of the corporate state.

Wolf is dangerously radical even if he thinks he’s just talking common sense. you all here know now that common sense IS hella RADICAL now in an age of constant b.s. and no attention spans.

when Wolf questions whether privatizing prisons is such a great idea, i know he’s in dangerous territory because he’s questioning the entire amerikkkan SYSTEM that is built on cheap/slave labor from jump.

but right now the conversations are overly simplified BECAUSE of this internet and the way things have gone binary and dangerous. forget what’s happening on the ground with po’ and colored as you bougie folks can and will lose your entire career for touching a woman’s back (or NOT).

everything is CRAZY.

i’m not defending Wolf because he doesn’t even need defending. i’m saying i agree with you: ALL THIS BUT WHAT NOW? AND yeah… Wolf’s already been dogged and they WILL take your livelihood away and render you (and me) powerless and invisible.

the perfection of this system is that all the people who lose everything figure it’s their own fault and shamefully keep it to themselves instead of fighting back.

and i don’t want ONE man ONE person to come up with another overly simplistic “solution” as there is NONE.

and yes. the moment Wolf takes a definite stance against all this, then he loses credibility. it’s best to let us all chew our own and each others’ legs.

no one’s even talking about this stuff. everything out there is ranting OPINIONS. this is gonna take much much work on the way DOWN before any rebuilding of anything happens.

this exploitation was baked in the original settling of this continent. the race to the bottom and fxck everyone else and teaching us to hate ourselves each other and treat eachother as objects to consume or distract us from the reality of Death etcetera. all the shxt humanities classes were about before everyone wanted an MBA.

i used to dream and wait and PINE for the day there’d be revolt against all this evil, but the new boss would be same as old boss. watching the liberal elite lose their cotton picking MINDS over this trump stuff scares me more than i ever knew it COULD.

yes. it IS class. and we’re all ravaging each other.

what’s the answer? it’s for each of us to determine and my way is evolving as i learn all i CAN do is want need less. that’s not much but everytime i make our own bread now or fix something instead of buying a replacement, i feel a tad more “free.”

but the government is not cute and we are not as “free” as they tell us we are. if they don’t like what you say or do, you could be exiled homeless or broke. this country is full of creepy stories you should take another look at now that you’re older and know what “propaganda” is and how complicated it can be.

i lost my MIND when i realized as a so-called “bad ass” artist i realized i was just the Loyal Opposition. i wasn’t criticizing this system or doing anything different radical or outside of it; i was an escape valve. a dancing monkey.

i wanted the stuff.

i think we’re all at different stages of coming to terms with the decline of this global civilization, and Walter Map, no one can tell you any “solutions.” this took hundreds of years to perfect and as Albert Einstein said: we cannot solve problems with the same consciousness that caused them.

i paraphrase because when i tried to do a proper search for the quote it jacked up my browser so the internet is becoming more and more useless to me.

but being a true and real bad ass now seems to be about keeping your powder DRY now in a world where everyone’s leaking and spewing. so i get what Wolf’s doing.

i come here even though i’m on the bottom here- one rung before the street– because i made my prior artist career moves based on understanding the system so i could find my place in it. i saw it was rigged and quit trying so damn hard.

no i wanna understand so i can understand why everyone’s going insane and evil greedy mean around here. it’s like it’s a-okay now to be all for greed. there is absolutely no shame.

and that fascinates me how inhumane we’ve all become.

there is no “solution.” that’s how this mess started in the first place. some asxhole figured he knew better than everyone else and made himself king and ruler of the universe.

same consciousness and all that… it’s a whole different way of THINKING that will get us out of this. and it’s gonna start with small stuff like no one is better than you or me.

THAT is radical. they killed jesus and martin luther king over preaching about LOVE! for real. love is sweaty hard and not about getting more stuff.

anyhow, Walter Map… i wasn’t “checkin’ you.” i GET you. you make me smile for having had it.

there is more than of kernel of truth here. woody allen famously observed that commentary and dissent have merged, to form dysentery. dysentery gets flushed and/or ‘treated’ somehow.

The solutions are obvious. Nobody in power wants to hear them because they are too busy rolling in dough.

Could it be that the “worm” has turned?

As a case in point, the Canadian mortgage market growth has fallen to its lowest rate in 17 years. Equifax reports that Canadian households are having trouble dealing with credit. As a declining number are paying off credit card balances and credit growth has stalled.

The Canadian credit cycle appears to be contracting as the great deleveraging gets started and picks up speed.

Everything hit a brick wall when the Chinese stop buying homes. The average Canadian isn’t too bright so it will take several years for the average simpleton to figure this out. When the Chinese stop buying prices in a perfect world go into free-fall mode immediately.

At these prices, I don’t think interest rates, the tax law changes or mortgage availability have much to do with it anymore. These home prices outpace the salaries of most tech workers. But as you say above, there are the ‘rich payouts via stock-based compensation packages’ which have to be factored into the mix. But it would be interesting to know what percentage of sales are all-cash buyouts and of those, how many are initiated by overseas buyers.

Speculation in a non-recourse state (California) + bookoo foreign buyers (money laundering)…

Should be an exhilarating ride down the roller coaster!

Todd H.

Correcting your perception of the foreign buyers (money laundering). Foreign buyers pay immigration lawyers to navigate thru existing EB-5 and other legal immigration entries to the USA. Foreigners entering the ﹰUﹰSﹰA are educated professionals who made personal sacrifices to attain their dream of legally be in USA and invest in its economy.

KQED tried to do an analysis of the foreign money impact around here not too long ago.

https://www.kqed.org/news/11655241/data-dig-are-foreign-investors-driving-up-real-estate-in-your-california-neighborhood

In short, everyone knows it is having a significant impact on the market, but because things get buried in shell companies, LLCs, and buyers don’t have to disclose nationality (amazingly), getting hard data is challenging…..which is exactly the way the RE industry and homebuilders would prefer it.

This. If I were to buy in Germany or France, they’d sure want to know my nationality.

Wouldn’t that be considered nationalistic even though it is one big happy eu?

Or another good way to do it is to walk up my street, Western Addition/Laurel Heights, at night an marvel at all the 2-4 million dollar houses that are either dark or with one living room light on inside. No TV, no sound, no shadows, no people moving inside.

Here in good ole Tucson, a city council member went there. Oh, yes he did. In this article, about proposed student housing, he used the O-word.

And what word might that be? Here it is:

Overbuilt. As in, “already overbuilt in Tucson.”

Link: https://www.tucsonweekly.com/tucson/tall-order/Content?oid=17563402

Methinks that our local housing bubble is about to go ker-blooey.

I wish I lived in Tucson, what a great city, but my employer won’t be moving the business anytime soon (or ever) so I’m stuck in this hell-hole – Seattle. Did you know Mt Lemmon is the Southernmost ski area in the US? Sad the water is going to run out and the place will be a ghost town – all good things must end I suppose.

It’s pretty obvious that the devaluation in the Yuan is driving this. Chinese want their money out before the coming trade war or real war comes to a head.

This is about preservation of capital, not prudent investment.

https://www.dailyfx.com/usd-cnh

I made a call last time that the Chinese were going to reply to this “trade war” with a Yuan devaluation.

Heck this gives them a reason to do so. If this is taken to its conclusion, there will be short term to medium term pain in China, but the US position will be worse.

The Chinese will just use this as an opp to rebalance their economy under the disguise of fending off imperialist attacks.

As of May 2018, Chinese exports to the US stand at 20.1% 205.1 billion dollars. US exports to China stand at 7.7% or 52.9 billion dollars. So you are wrong, it’s going to hurt China more.

https://www.census.gov/foreign-trade/statistics/highlights/toppartners.html

It definitely feels like prices in SF have slowed down. We rent in an expensive area of the city and we have been keeping an eye on the market for a good time to buy. We were looking at a one bedroom in a nice part of old SF that listed for $860K and sold for $820K, which is still insane for a one bedroom at ~850 square feet. It’s true people here make a lot of money here – I know a lot of professional couples making between $500 – $600K (not unusual at all) – but even most high earners are wincing at the prices knowing the risks. One recession could wipe out 30 – 40% pretty easily, and if you are buying it at $1.2 million for your first condo (or even less), that’s a huge loss. For the couples that make the plunge, most either have some help from their parents or push all of their chips into the investment, leaving them horribly exposed.

“professional couples making between $500 – $600K (not unusual at all) ”

I guess if they are both 40 year old neurosurgeons than that makes sense.

And assets continue the inexorable march higher.

$1.176 million for a condo won’t seem like a lot to have paid if it roughly equals a week’s wages for a janitor in the near future.

People are not seeing what’s going on here. We live in a trickle-up economy. The framework for this economy was constructed by Greenspan and was put on steroids by Bernanke. The way the trickle up economy works is wealthy individuals collect rents and other forms of income from wage earners in the form of currency. These wealthy individuals take the collected currency and buy hard assets from which they can collect more and more currency from the wage earners. Over time these wealthy individuals own most of the productive assets in our society and wage earners are serfs who toil for the aristocrats who own everything.

Welcome to dystopia and don’t risk complaining about it because, as everything becomes more automated, time spent toiling is worth less and less to the aristocracy – what do you think becomes of you when they no longer need your serf labor?

I know most cannot afford a couple million for a house in San Francisco, but why don’t more people pool their savings to buy hard assets. If you can’t afford real estate in a desirable city maybe at least put your currency in the market and for god sake don’t hang on to currency. Well that’s the way I see the world – if I’m wrong I will have only lost a lot of money but that’s fine because it would also mean dystopia has reversed. I would rather be poor and free than just surviving in dystopia.

I think the system is broken and the ‘informed’ rich are all expecting a monstrous dystopia in the near future. It’s funny that our only hope as a species is that the yellowstone super-volcanoe, or some other catastrophe will cripple humanity just enough to slow it all down.

https://medium.com/s/futurehuman/survival-of-the-richest-9ef6cddd0cc1

The Silicon Valley billionaires who are building AI to displace human workers know the pitchforks and torches are going to be coming for them when it all comes crashing down.

https://www.youtube.com/watch?v=K1zVAfE0YdA

Maybe because the “hard asset” of real estate comes with the following characteristics (for most people):

1. Massively leveraged investment, often 10 to 1.

2. High and variable carrying cost of maintenance, taxes, and insurance

3. Exposed to local economy to greater extent than other investments (NOTE: This can also be a positive, such as current SF or Seattle)

4. Heavy carrying costs due to interest

5. High exposure to governmental policies with a non-liquid investment

6. The housing market fundamentals have become overvalued compared to history. Of course… fundamentals are not a timing tool but they do predict long term return rates.

7. The asset itself loses value over time without significant maintenance/upgrades

Real estate has a place in a portfolio. Sometimes #6 screams “buy” and the other issues become relatively less important. However, that time most assuredly is not now.

I will try to play devil’s advocate, but it’s getting harder to do:

I see a lot more For Rent signs (and parking spaces, silver lining) in the more traditionally desirable neighborhoods (Russian Hill, Nob Hill, Marina, etc.) than I remember in the past 7-8 years – and the retail vacancies are bordering on blighted in some areas; it’s an odd disconnect from what this article is saying. Anecdotally, it seems like a rising number of millenials see SF as too expensive, played out, choked with traffic, and not worth paying that amount of rent (even given starting salaries around here) for the ‘privilege’ of saying they live in SF. They are leaving for Denver, Portland, Austin, Salt Lake City (which I never thought I would say, but it is hot right now) instead if they can.

That being said, there is still a ton of hot Chinese money looking for a home. When a buyer doesn’t know the next move the Chinese gov’t will make to keep yuan or even USD inside the country, they aren’t going to quibble about inventory levels, comps, and the other details; they will bid to win. At this point, IMO a Chinese financial bomb or stumble in their levered house of cards would cause more harm than a shallow domestic recession around here.

Also; worth noting that the source of this data is from a real estate company. The inner pragmatist in me can’t help but think there was some cherry picking of data (is this inflation-adjusted?) to keep the headline “wow” factor. All of these companies have significant presence in China, and bring busloads of mainland clients straight from SFO on home-buying tours. They will cater to the FOMO hysteria any way they can.

It’s really getting nutty, and every chart seems to scream

unsustainable…To enter this market at these levels takes some stones, but I said that a year ago, too.

GSW,

The source of data is Multiple Listing Services (MLS). Everyone who has access to MLS gets the same data. I don’t have direct access to MLS data, but Paragon does, and Patrick there sends it to me.

GSW…here’s a reality check regarding your comment on ‘the business of Chinese..’

An arrangement had been arranged 10 to 20 years ago, behind closed doors among the Developers of these Phallic style condos in SOMA, Market Street, NOPA areas, the FUND pool of private money and immigration lawyers navigating the Legal EB-5 immigration provisions, visits to China by the City Mayor and much more.

The invitation by City Mayor for tech companies to establish their headquarters in SF is intentional. Remember, San Jose used to be the major hub of tech world. SF had to reinvent itself.

San Francisco’s REAL TRADE is and will always be TOURISM. SF will always maintain an AURA of prosperity to lure more wealth. This is SF’s simple BUSINESS and Income model.

That’s good color. I don’t know why such a liberal and progressive state government would not at least acknowledge that foreign nonresident money is a key factor in making CA untouchable for its own residents, and that we should think about how to handle the issue. Methinks the demographics of the area (SF is 35% Chinese already) makes this a third rail that no politician wants to touch. That being said, every other first world country has at least addressed it as an issue, if not put curbs/taxes on it. You would think dangling more tax money in front of CA politicians would get a response.

If SFs main industry will always be tourism, then we should start seeing cleaner streets and fewer deranged people using downtown as an outpatient insane asylum now that conventions have been cancelled and visitors have swamped the city with complaints about not feeling safe.

I won’t hold my breath. Well I will hold my breath on certain blocks (especially the one that had a twenty pound bag of poop on the corner)…but I digress.

“I don’t know why such a liberal and progressive state government would not at least acknowledge that foreign nonresident money is a key factor in making CA untouchable for its own residents”.

Perhaps California politicians are taking cues from their oh-so-very liberal / progressive politician buddies in Vancouver, Canada on how to handle the unpleasant little business of the local populace being increasingly unable to afford local RE. First silence, then when evidence mounts, insist that foreign ownership plays no significant role and respond with charges of racism…end of discussion, they hope.

http://www.vancouversun.com/business/douglas+todd+there+nothing+racist+about+metro+vancouver+housing+study/11515012/story.html

“That being said, every other first world country has at least addressed it [foreign nonresident money] as an issue, if not put curbs/taxes on it. ”

In the Bay Area, the voters have decided to bypass the capitalist system and impose restrictions on rent increases. If we can do this, I don’t see why we can’t put government controls on the purchase of US real estate by foreign non-residents (or even US non-residents).

Foreign money diverted from Canada and Australia needs to go somewhere.

– Unless I have some better information I blame the recent federal tax changes for the “deceleration” of home prices.

And when the the big one hits off the coast all the new construction gets flooded and gutted. Insane!!!

I’m worried about the damage it will cause to the ocean.

LOL. I agree. These greedy bastards deserve everything, but marine life in the Pacific is already impacted by Fukushima. Having West Coast monkeys pollute the ocean with debris is unacceptable.

These zombie companies are not getting the next round of funding. People know the gold rush is over, so they’re taking whatever they’ve managed to save and are heading back to Rochester to live like kings. Did the same thing in 2000. Did the same thing in 2008. Plus ca changera, plus la meme chose. SF housing is the real canary in the U.S. coal mine. You are on notice.

As they say, you have to be crazy to live in Frisko!

More seriously, this kind of stuff is very common when a bubble is close to crashing.

I call it the “Suckers spike”.

As in, a spike that sucks idiots out of their money when smart people already left.

I mean they have even made comics making fun of stuff like this this.

The most recent one I remember before this one is Bitcoin… it had a rise after a down and then it went down down down down abd it has been losing for several months. Although those who bought Bitcoins a few years ago still have more than their invested in… for now.

I’m introducing the Byte coin next month, it’s eight times better!

With the world awash in trillions of Yellen Bux chasing tangible assets, the Fed’s Ponzi markets and asset bubbles, much like Bernie Madoff’s rackets, can go on beyond all logical limits. But the implosion, when it finally comes, is going to be epic.

Hey Sidera, did it ever occur to you that maybe Wolf is quite content in his present digs, views his house as his home, not an “investment,” and is okay with surveying the lunacy and coming train wreck from his current vantage point at Ground Zero?

One reason SF RE is NUTS is the entire US economy has been tipped towards a few internet platform monopolies (FANG’s) making a lions share of the money. It is INSANE how two freaking companies (Google and Facebook) rake in the MAJORITY of ALL the Ad spending in the USA! Two companies! Get it ALL! Zukerberg is a bit over 30 and worth more than Buffett who is 89! And all Zuck did was start a freaking simple web site at the right time!

Ad spending used to be so much more massively fragmented 20 years ago. And more people got a piece of the pie. But now Google and Facebook get the WHOLE pie. And they are both headquarted in the Bay Area.

The other factor is foreign Chinese. I read a story the other day that 40% of Chinese millionaires want to leave China. Due to air pollution, lack of freedom, better educations for kids. And in this poll, the USA was their #1 choice to flee to.

I suspect ad fraud and overcharging.

– There’s another impact on the housing market from the recent tax changes. People, families in high taxation states (like California) who want to move to a house with a higher price simply won’t be able to do that any more. Because these tax changes make it much more difficult (read: expensive) to move to a house with a higher price. And that has an negative impact on the entire real estate market, it becomes more difficult to sell one’s house and move to another house.

– And that could freeze up the entire real estate market with a predictable outcome.

Unless and until there is a wide and deep recession I don’t see home prices going down in bay area or anywhere in USA in a meaningful way

Let’s wait and see

Prices and rents are falling in my neck of the woods

The most facinating thing I’ve seen over the past 27 years (the post-Soviet-collapse era of US history) is the desperate behavior of the US federal government to invent enemies for the US’s vitally necessary MIC to fight, along with the desperate behavior of the congress and Fed to fund them; then, since 2008, while desperately trying to keep the perpetual wars going, the increasingly desperate behavior of the Fed in very careful coordination/concert with other central banks and “financial authorities”, doing “whatever it takes”, to try to meet the mandatory, IMO INHERENTLY-IMPOSSILBE goals of section 2, the “Purposes” of TARP:

=====

SEC. 2. PURPOSES.

The purposes of this Act are—

(1) ………

(2) to ensure that such authority and such facilities are

used in a manner that—

(A) PROTECTS HOME VALUES, COLLEGE FUNDS, RETIREMENT ACCOUNTS AND LIFE SAVINGS;

(B) PRESERVES HOMEOWNERSHIP AND PROMOTES JOBS AND ECONOMIC GROWTH;

=====

IMO 2A and B of the above REQUIRE that the “treasury” PREVENT private “home values” (presumably, prices) and the “value” (prices) of shares in the private stock market from falling, as well as, presumably, preventing the “value” of “life savings” in banks and “retirement accounts” (whatever that means).

We can now see with 20/20 hindsight that, as a direct result of the actions of the Fed and other central banks over the past 10 years, that, indeed, those 2A and B goals have been marvelously fullfiled. Great accomplishment, right?

(Now, just exactly WHERE does “inflation” fit into this well-thought-out plan/mandate to maintain “value”?)

I can’t help but think of Greenspan, Bernanke, Paulson, the FOMC and the Congress (of morons) as Wicked Men of La Mancha. They dreamed …….the impossible dream. They fought a defenseless foe (US taxpayers). They ran where ethical men dared not go. That was their quest. To follow their greed. To follow that (death) star, no matter how far. They fought for the Elite, without question or pause. They were willing to march every common person into hell for that hellish cause.

Think of Richard Nixon as the original “plate spinner”; the petro-dollar as the sticks and the post-TARP central banks around the world as other plate spinners trying desperately to keep more and more debt-plates spinning while dropping none (preventing loss on investments, homes, savings, etc.). Here they are and what’s going to happen in the near future:

https://www.youtube.com/watch?v=tzkLq2cgXL8

Yes, “push” is finally coming to “shove” in the USA, folks. For just one example among many, an extremely-civil war II in the US is being fought as I type. But, unlike the Civil War of the 1800s, the Elite warriors in today’s war are impeccably-coiffed and richly-dressed in custom-tailored suits and dresses. THESE warriors are “educated” in the “finest” schools.

Never in history has so much been spent by so few on personal appearance and dental hygiene.

Not only are many careers at stake in this war, but so too is the future of the USA’s “place” in the so-called “international community”.

For another example, the US’s vitally-necessary war industry has got to some how, by “whatever it takes”, start generating much more profit, so the US has to decide in the near future whether it’s going to escalate its attacks on Syria and Afghanistan and whether or not to attack the DPRK and Iran. However, the latter two potential conflicts could lead to all-out nuclear war, so the Elite’s tried-and-true, normally-straightforward, profit-based decision process is getting a bit bogged down on the issue of survival of the human species. No doubt saving face and protecting the reputations and “legacies” of very old, astronomically-wealthy people and their TBTF banks will finally decide those matters.

And speaking of TBTF banks, there have been several fatal errors in US history, but IMO the most egregious was the recent de facto creation of, or at least the official recognition of, the so-called too-big-to-fail (AKA “systemically important”) banks.

Carefully ponder how dangerous that single act/acknowledgment truly was/is to humanity’s future. Start off by answering the simple question “What happens after a TBTF bank repeatedly, irresponsibly makes bad decisions and repeatedly loses a lot of money?” Only Answer Allowed: The US government, purportedly on behalf of US taxpayers, will do “whatever it takes” to keep any TBTF bank “in business”.

AFAIK, the ONLY things in the world that the US government considers to be TBTF are itself and those banks. Human beings and even the planet itself can suffer and die, but that government and, by extension, its banks (of herd-control) must be rescued, no matter what. Therefore, they, not us, will be the last men standing.

The math of SF housing is rather simple.SF has the highest ratio of housing prices to median family income anywhere in the US.

I just moved to the Bay Area from NJ.The town that l moved from has a median family income of ~ 125,000 and an median house price of 700,000. Short hills NJ, rated among the 5 richest towns in the US has a median family income of over 250000 and a housing price of ~ 1.4 m.

The conclusion is obvious.The only groups which can afford SF housing are current homeowners,those few who have received a windfall from their parents or from their job or foreigners who pay all cash.

People who rent in the Bay overwhelmingly want to move from th Bay Area , because of super high housing prices and unbelievably bad commutes

Everything goes up up up until it does not

My local realtor in san diego sent me email stating that although recession is imminent but housing price correction is not and he stated many instances of recession in the past where no housing price correction happen

US housing prices are so high, young couples can’t afford to have kids.

Heckova job, Ben & Janet.

http://www.businessinsider.com/real-estate-housing-prices-high-declining-birth-rate-2018-7

Foreigners laundering money.

> What the Heck’s Going on in San Francisco’s Housing Market?

Turdburglary. On a grand scale.

@kitten lopez Wolf, how come her long screed does not have a reply button? AFAICT it is the only post in that case.

Anyway, what I wanted to say is: yes the conversations we have on the internet are fraught and stunted but without the internet would we be having them at all? I am not really looking forward to the return of the age of the printed samizdats and quasi-masonic networks.

Oliver,

Concerning the missing Reply button: Threads only go four levels deep on this site to avoid the narrow-column syndrome. Kitten Lopez’s comment happened to be on the fourth level, hence the missing Reply button. This happens quite a bit normally, but under this article, most threads were less than four levels deep.