They’re hot, price inflation is building up.

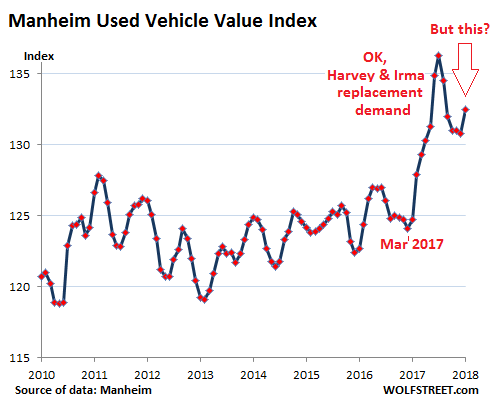

Wholesale used vehicle prices jumped 6.3% in April from a year ago, according to the Manheim Used Vehicle Value Index. At 132.5, the index is at the highest level since last November. The index had spiked as a result of replacement demand after Hurricanes Harvey and Irma. The price spike peaked in October, then reversed course. But in April, prices took off on their own, after the replacement demand had long been satisfied:

New-vehicle sales hog all the attention, for a good reason: They support a large part of the US economy – manufacturing, transportation by rail and truck, port operations, new-vehicle dealers, the finance and insurance business, the whole auto subprime industry, and so on. But with about 17 million vehicles sold a year, the new vehicle market is dwarfed by the used vehicle market.

About 40 million used vehicles will be sold in 2018. The 16,800 new-vehicle franchised dealers will likely sell about 15.5 million used vehicles, and the 23,000 or so independent dealers will likely sell over 25 million used vehicles.

The used-vehicle market forms the foundation of the new-vehicle market. Nothing works when the used-vehicle market gets gummed up. High used vehicle prices are essential for high trade-in values, and high trade-in values are essential for high new vehicle sales.

But the used-vehicle market is where rental cars and lease turn-ins end up. These usually recent-model and low-mileage vehicles compete with new vehicles, often on the same franchised dealer’s lot. Low wholesale prices make them very attractive to dealers, increase their used-vehicle margins, and cut into new vehicle sales as customers get switched from new to used. And so the used-vehicle market is a double-edged sword for the new-vehicle market.

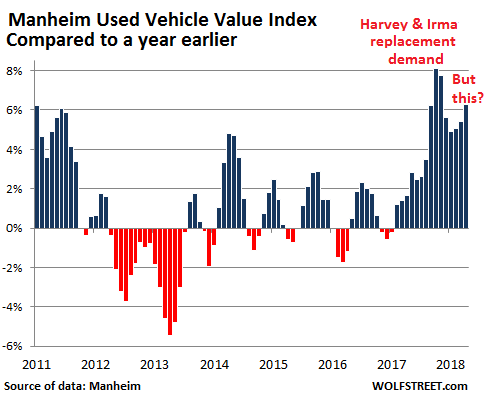

The chart below shows the changes of the Manheim Used Vehicle Value Index compared to a year earlier. Year-over-year price gains started timidly in February 2017, then surged, spiked to 8.1% in October under pressure from Harvey and Irma replacement demand, then backed off but remained high, and in April, the index rose to 6.3% year-over-year – and it wasn’t replacement demand:

Manheim, which runs millions of vehicles a year through its auction sites spread around the US, bases its index on the transaction prices at its auctions. The methodology – it adjusts for vehicle mix, mileage, and seasonal factors – makes this wholesale price index “independent of underlying shifts in the characteristics of vehicles being sold.”

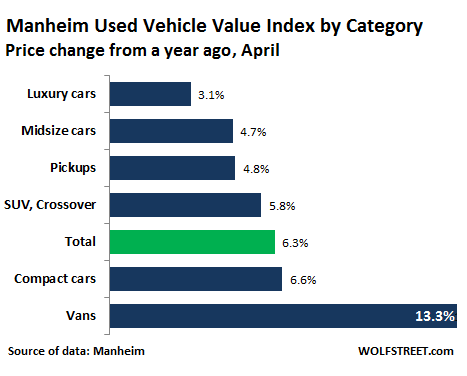

Manheim reported some interesting twists, on a year-over-year basis:

- Van prices soared by 13%!

- Prices of compact cars, a mainstay in the fleets of rental car companies, jumped 6.6%. They’re hot as used vehicles. But they’re duds in the new-car retail market; Ford, GM, and other automakers are cutting production and are scuttling entire model lines [Carmageddon for Cars: “Cars” Are Scheduled to Die]

- SUVs, compact SUVs (crossovers), and pickups – all of them white hot in the retail market – “underperformed” the overall wholesale market.

- “Collectively, non-luxury vehicles outperformed the market, while luxury vehicles underperformed. This is not unusual for the spring, as the observed bounce occurs only in non-luxury vehicles.”

The strength in the used-vehicle market was already building up in March, according to J.D. Power’s Spring Perspectives, which covers the broader used vehicle market:

The used vehicle market performed exceptionally well in March. Wholesale prices of used vehicles up to 8 years in age increased by an average of 2.5% (from February). While prices were expected to increase in March, the outcome was better than anticipated.

Mainstream car segments performed extremely well in March. Compact and Subcompact Car prices were the strongest in the industry and saw prices grow by 4.3% and 4.6% respectively. The pair’s result was about 2.5 points better than each segment’s previous 5-year average for the period.

The Mid-Size Car segment also experienced a healthy 3.5% increase in price, followed by the Large Car segment which saw a bump of 3%.

SUVs were the only “mainstream” segment with declining prices (-0.1%). “While miniscule, this does mark the third month in a row that Large Utility prices have slipped,” the report said.

This comes after a tough price environment in 2016 and early 2017 in the broader used-vehicle market as measured by J.D. Power. While volume was very strong, the supply from rental car companies and lease turn-ins was enormous, applying downward pressure on prices in the overall market. For 2017, the J.D. Power Used Vehicle Price Index for units up to eight years in age had fallen another 2.9%, ending the year 6.9% below the peak year of 2014.

Used vehicle prices contributed to the low-inflation scare early and mid-2017. But this phase seems to be over. Official consumer price inflation data takes a while to catch up with market movements on the wholesale side since units bought at auctions then need to be retailed, which might take a couple of months on average, before they even come to the attention of the data gatherers. But that’s already happening.

A revolution is taking place in business ground transportation. Read… Uber Loses Share to Lyft. Both Crush Rental Cars and Taxis

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I believe part of it has to do with the new US Tax law. Specifically the limit of $10,000 in deductions for state and local taxes. Many jurisdictions levy a personal property tax on vehicles. Thus the incentive to NOT buy new vehicles.

You could be onto something with that theory.

What happened to the flood of subprime repo’s hitting the market? Wouldn’t more supply depress prices?

Here’s the deal: the person whose car is repo’ed still needs a car to go to work and buy groceries in most cities in the US, and so they lose one car and get a crappier car to replace it. So one car comes on the market, and another car is taken off. And just the mix has changed.

And when they hit rock bottom, like Mat Foley on SNL, and live “ in a van down by the river”, they will need ….. a van. All joking aside, are van sales spiking since they are a form of tiny housing for the less fortunate or are sales rising since there are more small businesses being formed as America becomes great again?

Used van ( and mini van ) sales are and have been ‘ hot ‘ for well over a decade ever since the height of the beds of new full sized pickups have become all but inaccessible to anyone under 6’4″ .. with even those of us 6’4″ or more having a damn hard time reaching anything placed in the bed without stepping into it ( ALD AW WSJ Reuters etc ) compounded by the excessively high prices of new full size pickups due in part to the general publics addiction to owning one … with many businesses trading in their worn out pickups for used vans … including a preponderance of mini vans

I recently bought a used mini van for my biz. They aren’t as cheap as they used to be.

Seriously, a car of any kind for me is as affordable as a Saturn V rocket, but if I were to buy something it’d be a van because you can live in a van. You can transport things for people for pay with a van. You can sell stuff at a swapmeet or just by the side of the road with a van. I’m looking at going from trumpet to drums and a van is very handy for transporting drums.

Any stats on average age of the U.S. vehicle fleet, number of used vehicles exported, or vehicles sent to scrap? It stands to reason that the younger the fleet is, and the more that are removed from the used market, the stronger prices would be and the more vehicle loan debt is out there.

The average vehicle on US roads is 11.6 years today. This is up from 8.5 years in the mid-1980s when I entered the business. As cars are getting better, people are keeping them longer. That trend shows no sign of reversing.

Is it because they’re becoming ‘ better ‘ in light of the fact that newer cars are more difficult and expensive to repair … or because the cost of a new vehicle has simply become out of reach for many consumers despite low interest / subprime etc loans ?

Personally having watched the trends along with the economy over the last ten years ( automotive has been an avocation of mine since the 60’s ) .. I’d lay serious odds on the later …

We bought our car 11 years ago and put 120,000 miles on it, most of it stop-and-go city driving. No mechanical problems, just maintenance. Interior looks great (leather seats in perfect condition), exterior looks great… There is simply no reason to get rid of it. And we’re not the only ones. Turns out, we’re “average.”

My first car was a 1968 Mustang that I bought in 1976 (8 years old). It had 70k miles on it and was a worn-out piece of crap, with stuff falling off the inside, the outside, and from the engine. The quality of the stuff that was sold back then and today cannot be compared.

OK, it was also a lot cheaper. I paid $700 bucks for it :-]

They also do a much better job of rust-proofing cars nowadays. Cars from the 60s and 70s would turn into rust buckets if left outside in a climate where it rained regularly.

Marc D. – I grew up in Hawaii and yes, the rust … Hilarious TV commercials for rustproofing though! “Hi, I’m Rust, and I’m eating your car, because you didn’t treat it with Dinol … Ooh! Filet of fender! My Favorite!”

And it was even worse in places with bad winters. All that ice, snow and road salt would really eat up those old cars.

I would assume that a fair number of used cars are culled from the market by either export to 3rd world countries or sent to scrap before their useful life is fully exhausted. I imagine banks and automakers would love to see an increase in export and scrap rates.

My understanding is the US’s junkers tend to end up in Mexico and Middle/South America, and not long ago there was a kerfuffle in the news about so-and-so’s used truck, with the plumbing business, say, lettering on the doors, being used as a battlewagon by unsavory Middle-Eastern groups in, well, actually in the Middle-East.

Alex – yes I remember that! The poor plumber from Texas’ former work truck ended up in the hands of ISIS, being used as a battletruck, with a big gun mounted to it. His business name and phone number were still plastered across the side. He started receiving angry phone calls from around the world, after a picture of it made international news. He ended up suing the dealership where he’d traded it in, as they had allegedly assured him they’d remove the lettering before selling it.

Dude, it would really suck to know that my vehicle was being used by unsavory groups.

However, I have to say, knowing that my vehicle went on to a second life as a

*** B A T T L E *** W A G O N ***

pretty much nullifies that downside with sheer awesomeness.

Junkers don’t end up in Mexico. Used cars must be between 3 and 8 years old to be eligible for importation into Mexico.

I just read an article that reported 96 month auto loans creeping up in the market. When they get to 10 years, can we call them mortgages?

Many will be calling them “ Home equity loans”

Homeless Equity Loans I think you meant to say

Van-By-The-River-Equity-Loans.

That uptick in van prices looks a lot to me like housing demand, rather than car demand.

I am honestly surprised at the price increase for luxury cars: there’s no shortage of them and zero problems of supply if the JLR (Jaguar-Land Rover to the uninitiated) dealership I drove by last week is anything to go by. Rows and rows of very expensive cars, both new and lightly used, mostly ex-leases with low mileages and at most two years old. JLR is very hot on short term leases these days.

Used luxury cars are what an acquaintance of mine calls “Dead body in the house”: you cannot get rid of them fast enough. They lose value far faster than ordinary models, are considerably more expensive to fix and usually even a small hike in fuel prices and insurance costs is enough to hurt sales. Really rich people may not care about fuel prices but they buy brand new cars, not ex-leases.

Could it be the good folks at Manheim work with raw, non-inflation-adjusted data? Or perhaps is inflation flaring up like it seems? For all the people with 18oz steak appetites and Big Mac budgets out there I cannot see any other explanation to this phenomenon.

Buying one that is 2-3 year old, i.e. you are the 2nd owner, would seem to be the highest value proposition. Owner #1 took a large depreciation hit and owners # 3 or higher will have to deal with repais expense. I’m not a car guy so maybe my thinking is off?

Apologies …meant Repair expense

MC01,

Look at it this way: according to Manheim, the price increases in luxury cars were less than half the increases for the market overall. And they were the lowest on the list.

And yes, the index is not inflation adjusted — it’s a measure of inflation at the wholesale level in the auto industry.

And another thought: On the new-car side, luxury cars (not SUVs) are singing the car-blues like all cars, and sales are skidding. But you can buy a 2-year old luxury car for a lot less, and it looks similar. So that’s a deal, and people are going for deals. These auction cars might be in part responsible for the terrible retail sales of new cars.

Here in Oz cars are still expensive compared to the USA.

We have luxury car tax, GST, stamp duty, registration, and dealer prep.

The price of a 3 year old Porsche Macan will be able the same as a brand new one in the USA.

Prices of car parts here ridiculous compared to the USA.

Car dealers charge per hour of work is also ridiculous with Holden (GM) having a rate of A$145 per hour in 2017…………..

The only problem with buying a recent used car is that the owner is really limited to the types of repairs and maintenance they can now do.

Remember when getting new car key was a few bucks at the locksmiths? Now you have to get the electronic key, get, it cut, and then programmed by a dealer. (if you are not able to do it by yourself.)

Try multiple hundreds for some of the new luxury cars.

I’ve seen what you people in Australia and New Zealand pay for forestry/agri spare parts… I am literally at loss for words, especially considering these parts cannot be considered luxury goods in any way, shape or form. You need them to keep cotton harvesters, chainsaws, tractors, whatever running.

Considering how important are agriculture and forestry to your economies (OK, nowhere near as important as real estate speculation) I am honestly surprised lobbyists aren’t up in arms.

I saw a statistic suggesting there were about 11 million private non-dealership used car sales per year so is that in addition to the 40 million franchised and independent dealership number?

That’s how I understand it. The 40 million is an industry figure — how many used vehicles the industry sells. The cars that are traded privately would be on top of that. The used-vehicle market overall, including these private sales, is huge.

So 15+ million news cars, plus 40 million used cars sold by dealers, plus another 11 used million private sales, looks like 66+ million in car sales this year.

Must be missing something, with people are keeping cars for nearly 12 years on average and only about 225 millions drivers in US ?

Maybe a lot of sales are from businesses ?

OK, let me just correct one thing: the “average age” of the car on the road is 11.6 years. That does NOT mean that people keep the car that they bought for 11.6 years on average before trading it. How long on average people keep a car that they bought is a very different measure.

The used market in total including private party transactions is just under 40 million. Franchised and Independent retail sales together come to roughly 20 million units or 50% of the market.

800k to 1 million used cars are formally exported from the US. The 15 million units figure I believe is put out by NADA.

It’s incorrect. I know. I used to work at NADA and now work with Manheim.

Wolf,

Wasn’t it around 6-12 mos ago a prominent BOA auto analyst predicted severe downward pressure on used auto prices due to a large # of off lease vehicles returned?

What has changed? Interest rates creeping up, several subprime lenders no longer in business, WF no longer providing wholesale money to subprime lenders.

Some have said excess inventory being held back from auctions.

Last leg of delusion and euphoria by the consumer?

Thoughts?

Bart,

We did see that downward pressure in 2016 and early 2017. It was a big problem for the industry, but it ended.

Different points of data collection agree on this, but differ about when it ended. The Manheim data shows the low point in March 2017. This makes sense because it is based on wholesale, not retail, which would occur on average about two months later. The JD Power data, which also reflects wholesale prices, also puts the low point in March 2017. The BLS data on CPI for used vehicles in the retail market puts the low point in September.

I was wondering the same thing because I had read a number of articles during the last year about the coming supply glut of vehicles being returned once the 3 year leases are up. But I guess if you read the Manheim Used Car Manheim Report (https://publish.manheim.com/content/dam/consulting/2017-Manheim-Used-Car-Market-Report.pdf), the sharp increase in leases is not such a big story because both lease volumes and new car sales have increased strongly since the trough during the last recession. The ratio of new lease originations to new car sales seems to have increased slightly.

Do used cars sales get financing?

Yes. Big business.

Oh yes. When I shopped last year the dealer would have been all too happy to give a loan at 4.9% when a similar loan from a credit union would be 2.9%.

My experience last year (at least when shopping for an SUV) was that used dealers had very little room to negotiate on used vehicles. Exception would be if you took their financing or had a trade-in where they could make some extra money.

I thought we were heading towards a scenario where used car prices were going to plummet from all the new car leases that were ending. I guess that is never going to transpire?

Bobber, see my response to Bart above, who asked the same question.

Apparently it’s common nowadays to roll negative equity from one car loan to the next loan.

SMDH…

The ‘cash for junkers’ obama program seemed to me a vast wealth destruction event a number of years ago. My Jeep is 14 years old and I paid for it used for cash saving $33,000 over new … but I have enough cash on hand to pay for any repairs or maintenance needed whereas most people do not have that luxury of having cash available. Such a screwed up economy … I know a lot of people that buy new because they can’t handle non financed repair costs

It’s too bad the market in existing housing isn’t as efficient as the used car business. These cut rate RE brokers should come with a disclaimer. Buyer beware used to be the car buyers lament, now it belongs to RE salesmen and homes, where the stuff I see makes we want to throw up. Consumers get a better shake in used cars, and that says something.

Hey those cut rate RE brokers are just getting started in Oz. Big savings from the normal RE commission if you use one.

IIRC one place is charging a flat fee of around A$5000 to sell your house and that includes everything.

The national auto dealers — who traditionally relied on new car sales — are making a strategic shift to the used car market, with up to triple the profit per car. They know that the consumer is tapped-out at new car prices and announced those shifts in the last couple of quarters. In the past, they relied on trade-ins for inventory, but now they’re ramping up demand at the auctions. My guess, therefore, is the recent price increase has a lot to do with inventory building and not final sales.

I used to buy new cars, Mercedes, Porsche, BMW and despite claims of retained value, everyone of them lost 25-35% of their value 2 years later (regardless of the low mileage). So now, I buy used and let someone else take the hit. I recently bought my wife a certified 2018 BMW 440i, loaded, with 8,000 miles on it (dealer demo) and 4 year factory warranty and free maintenance for $40K. New, this would easily be in excess $60K.

I always tell people the sweet spot for quality used cars is at the 40-60k miles range. Low maintenance costs still, lower insurance[1], lower capital cost.

[1] Pay cash and you don’t need full coverage either.

Here in Oz, the cheapest 2018 440i (2018 BMW 440i F32/F33 LCI Auto ) I could find on carsales was A$111,998.

The next cheapest was a 2017 BMW 440i F32 Auto at A$87,000 with a little under 8000 kilometers on it.

As I have mentioned before, muppets have quite a bit of money.

I wonder if the spike in van prices are due to people buying them to live in because high rents and property prices?

Simply put, the used car market gets hot when people decide they can’t afford buying new. So this is sign of troubled times.

But this needs to be confirmed by a drop in the new car market. If both are rising, then no, it’s not a sign of troubled times. In fact if both are rising, that confirms that muppets have plenty of strength.

Rising by buying with credit is not a sign of strength. And did you miss the article on this same site about Cars will no longer be build in the US, in the next few years, but trucks will?

Depends on the terms of the credit. A lot of things are no longer made in this country. It’s like saying the i-products in Apple are selling like hot cakes here and therefore they have to be made here, but we know it’s not true i.e. i-products are made in China.

Nothing good Prices plunged Numbers just released

What prices “plunged?”

Interesting info from the April CPI report:

The weaker gain in core inflation in April mainly reflected some sharp falls in consumer goods prices, including a huge 1.6% drop in used vehicle prices, reflecting the fading of post-hurricane replacement demand.

So April WHOLESALE prices jumped a ton (per the above), but retail FELL a ton. Is this just timing, or is something wrong with the data???

Been reading moronic MSM headlines again?

CPI up 2.5% YOY, highest since Feb 2017

Core CPI up 2.14% YOY, highest since Feb 2017

Used vehicle CPI down 0.9% YOY but that’s up -4.6% YOY in April 2017.

And from the CPI report just out:

“The index for used cars and trucks fell 1.6 percent in April, the largest decline since March 2009.”

What is going on indeed.

As Used Car Prices Plunge Most In 9 Years as noted in a Zero Hedge headline

https://www.zerohedge.com/news/2018-05-10/cpi-shows-rising-energy-shelter-costs-used-car-prices-plunge-most-9-years

So let me see if I get this

Wholesale prices are surging yet retail prices are plunging during the exact same time period.

Is this capitalism (tongue in cheek) in 2018 and now the new normal?

Quit reading headlines.

CPI up 2.5% YOY, highest since Feb 2017

Core CPI up 2.14% YOY, highest since Feb 2017

Used vehicle CPI down 0.9% YOY but that’s up from -4.6% YOY in April 2017

Yes, inflation is going up and the market is ignoring it again. One component fell and took down the overall numbers.

Dollar down and stocks up. 10 year yield down.

IMO the problem these days is that very few people actually know how read, think, do some analysis and then act on what the results are.

So what you have is the typical knee jerk reaction in the markets which leads me to believe that with this kind of reaction the FED is not only going to raise rates and keep unwinding QE, but even faster and further as the market shrug it off.

When the market finally manage to figure out what happened there is going to be a huge fall in stocks and the US$ is going to soar putting the world of hurt on a lot of people.

A snippet from the news: “F-150 trucks make up a multibillion-dollar brand that drives profits for the Dearborn-based automaker. An analyst recently calculated that the enterprise value of the F-Series trucks is greater than that of Ford overall. Nearly 900,000 were sold in 2017 at an average cost of $46,000. And January through April sales are up 4% from the same time last year.”

Anecdotal information from Hanford, Central Valley, CA. There are more used car lots here than four years ago. And they’re fuller, especially in the last 3-4 months.