These are getting to be serious amounts.

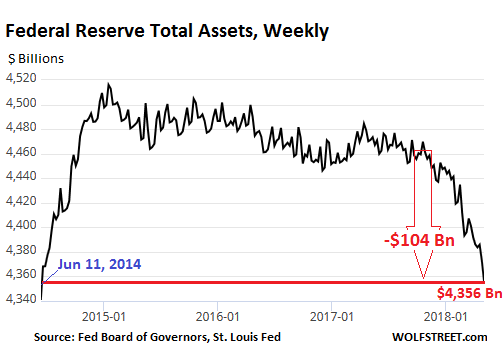

The QE Unwind is ramping up toward cruising speed. The Fed’s balance sheet for the week ending May 2, released this afternoon, shows a total drop of $104 billion since the beginning of the QE Unwind in October – to the lowest level since June 11, 2014.

During the years and iterations of QE, the Fed acquired $3.4 trillion in Treasury securities and mortgage-backed securities. The mortgages underlying those MBS are guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The “balance sheet normalization,” as the Fed calls it, was nudged into motion last October. But the pace accelerates every quarter until it reaches up to $50 billion a month in Q4 this year.

This would trim the balance sheet by up to $420 billion this year, and by up to $600 billion in 2019 and every year going forward, until the Fed considers the balance sheet to be adequately “normalized” — or until something big breaks, whichever comes first.

In April, the scheduled maximum pace was $30 billion (up from $20 billion in January, February, and March): $18 billion in Treasuries and $12 billion in MBS.

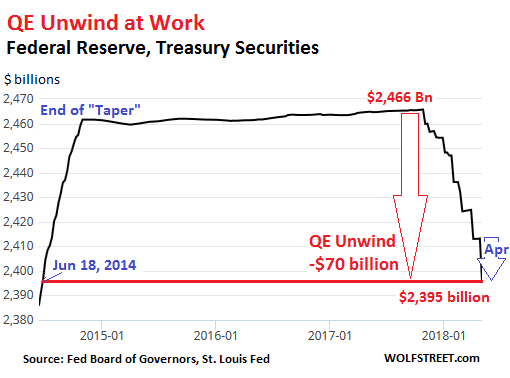

Treasury securities

The balance of Treasury securities fell by $17.6 billion in April. This is up 60% from March, when $11 billion “rolled off.” Since the beginning of the QE-Unwind, $70 billion in Treasuries “rolled off.” Now at $2,395 billion, the balance of Treasuries has hit the lowest level since June 18, 2014.

Just like the Fed “tapered” its monthly QE purchases in 2014 before ending them altogether in October that year, the Fed is ramping up the QE Unwind in a similar manner, but somewhat more slowly:

The stair-step pattern in the chart above is caused by how the Fed unloads securities. It doesn’t sell them outright but allows them to “roll off” when they mature. Treasuries mature mid-month or at the end of the month. Hence the stair-steps. In April, no Treasuries on the Fed’s balance sheet matured mid-month. But at the end of April, $30.4 billion matured, and that’s when the action took place.

The Fed replaced $12.8 billion of the maturing Treasuries with new ones directly via its arrangement with the Treasury Department that cuts out its primary dealers and Wall Street. In other words, those $12.8 billion were “rolled over.” But it did not replace $17.6 billion of maturing Treasuries. They “rolled off.” The blue arrow in the chart above shows the April 30 roll-off.

Mortgage-backed securities

Residential MBS are different from regular bonds. Holders receive principal payments on a regular basis as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. Over the years, to keep the MBS balance from declining, the New York Fed’s Open Market Operations (OMO) has been continually buying MBS.

But settlement of those trades occurs two to three months later. The Fed books the trades on an as-settled basis. The time lag between the trade and settlement causes the large weekly fluctuations on the Fed’s balance sheet. And it also delays when MBS that “rolled off” actually disappear from the balance sheet [my detailed explanation of further complexities is here].

These timing mismatches cause the jagged line in the chart below. So we’re looking for lower highs and lower lows. Today’s balance sheet reflects MBS that matured somewhere around January and February, when $8 billion in MBS were supposed to have rolled off per month.

Today’s balance fell by $9.5 billion, to $1,744.9 billion, from low to low over the past month. This “roll off” pace is up 70% from March, when $5.6 billion rolled off.

In total, the balance of MBS shrank by $25.5 billion from low to low since the beginning of the QE Unwind. So the roll-offs from earlier months are starting to show up on the balance sheet:

The Fed’s total assets

The QE-Unwind only relates to Treasuries and MBS. Since the beginning of the QE Unwind, they dropped $70.3 billion and $25.5 billion respectively for a combined decline of $95.8 billion.

The Fed has other roles that can impact assets and liabilities of the balance sheet. For example, it acts as the bank of the US Treasury Department and holds “Foreign Official Deposits” by other central banks and government entities. But these and other activities are unrelated to QE or the QE-Unwind.

Total assets on the Fed’s balance sheet dropped by $30 billion in April, and by $104 billion since the beginning of the QE-Unwind, to $4,356 billion. This is the lowest since June 11, 2014. Note that total assets are now down by $160 billion from the peak in January 2015:

The pace of the QE Unwind has accelerated sharply in April, as planned. And it’s unlikely that the Fed will try to prop up the stock market by pausing its QE Unwind machine, even during a sell off. The Fed is targeting “elevated” asset prices, and sell-offs are part of the deal, as long as panic doesn’t freeze up the credit markets, as it did during the Financial Crisis. But currently, credit market conditions are ultra-loose as a result of years of QE and zero-interest-rate policy. So the QE Unwind has a big job ahead to reverse part of what QE has done, which is what “balance sheet normalization” ultimately means.

The Fed’s favorite inflation gauge spikes, as employment costs surge the most since 2008, and consumer spending holds up solidly. Read… Rate Hike Ammo

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think QE-unwind is definitely is starting to affect the stock market. High-flyers like AMZN, GOOG and MSFT (amiong others) are no longer defying gravity like they have been the last two years. More to come.

I don’t necessarily disagree on the whole, but…

These figures are year to date, including today:

AMZN: 35%

AAPL: 9%

GOOG: -1%

MSFT: 12%

NFLX: 66%

S&P 500: -1%

Google is the only one not ‘defying gravity.’ Netflix is up 66% this year!

Boris say “up to now,” yes, but not for long.

It will take 4 years for QE to unwinds at this rate. What are the odds of a major stock market crash or some other economic disaster to occur during the next 4 years that will cause the QE unwind to stop? Not to mention the current political situation in the U.S., which looks, shall we say, Stormy?

As far as Stormy, dream on Gandalf.

At roughly $300 billion/year, I get more like 10 years to unwind. And what does unwind mean? What is the appropriate number for Fed assets?

By Oct 1, the pace reaches $50 billion a month, or $600 billion a year. This would take the balance sheet down to about $2.2 trillion by the end of 2021.

The Fed’s balance sheet grew steadily before the Financial Crisis. It gained $160 billion in five years till 2008. So even if there had been no QE, the balance sheet would be much higher today than it was in 2008, and it would be much higher in 2021, that it would be today. So it will not go back to $800 billion. That wouldn’t make any sense. If it drops below $2 billion by 2022 that would be pushing it.

Wolf, what is “an appropriate level” for the size of the Fed’s Balance Sheet? It was ~ $900 billion prior to 2008, ballooned to ~ $4.5 billion with QE…, and some commentators see it falling to $2.2 billion, or $2 billion in your example above.

So, what is “appropriate”, and how does this compare to the ECB and BoJ, which seem able to counterfeit to infinity and buy up any and all manner of assets?

I don’t think anyone knows. This is all experimental. Something big is going to break somewhere, and it will show that something didn’t work as expected or hoped, and then lessons will have to be learned. I just hope this won’t happen here. I’d rather write about it as observer than be tangled up in it :-]

I meant TRILLION in my last post. Sorry…

” If it drops below $2 billion by 2022 that would be pushing it.”

Please!

There is NO magic balance sheet number for the Fed or any central bank. None. There never has been and there never will be unless the goal of central banks changes from managing the lubricant of the economy to printing the capital that used to come from productivity and savings.

Open market operations are for short term goals. QE is a monstrosity. Everywhere. It destroys capital and replaces it with printed money which has little value, but is useful for ancillary objectives that have nothing to do with monetary policy, unless monetary policy has evolved into using asset bubbles to replace income from earned capital, aka actual wealth.

The fact it appears like QE has established itself as a normal thing is like someone tells 10 lies, 9 are discovered as lies but the last one survives as the new normal. This is, BTW, a negotiation strategy. The bad guys win. Everyone believes the last lie, which may have been the original goal. That is QE.

To assess what’s the appropriate level, you’ve got to define why the balance sheet is maintained. To my knowledge, it is used to maintain the “target rate”; e.g. to sell securities when it overshoots. Then again, I could be wrong.

I’m very pleased the Fed is unloading.

The question is: Who-is buying?

Are other CB’s divesting or accumulating?

I suspect it’s: Here’s a buck and buy the stuff that I’m selling.

I would say somewhere between 30 days and 90 days sales of Treasury paper. That is several hundred Billion dollars; more or less where we are now.

Actually, it will take 20 years to unwind the MBS

Naw, about 7 years, once the roll-offs reaches full speed in October, and IF they take MBS to zero, which they may not.

The current pace is part of the acceleration phase, just like the taper was the deceleration phase.

When will the Fed refuse to buy any more Treasuries, because, you know, the U.S. is falling apart and they would be a bad investment and waste of money?

They sell government paper to their owner banks and use proceeds to prop up G.F.and F. By owning your deed in mortgage bond form , the fed owns you? And as always two hands on the bag!

You mean why would the government refuse to buy bonds from itself because it is falling apart? Sounds like that scene in Blazing Saddles when the sheriff holds a gun to his own head.

randoff scott! (Hank paulson)

I hope the FED knows what it’s doing. I suppose unwinding now will give it a little dry powder (thank you Phil Orlando) when the next recession starts. Unless, somehow, the FED loses control. After all, they are just men (humans).

The FED criminal enterprise knows exactly what they’re doing, “rinse and repeat”.

Lather rinse repeat?

There are MANY women humans in voting slots on the FOMC. Here is the long and exhaustive list. Get a cup of coffee, get comfortable, and start reading:

Lael Brainard, Board of Governors

Esther L. George, Kansas City Fed

I know. When I said men I clarified (humans). It’s a weird language thing I picked up from Spanish- for example if there is even one man in a group of “humans”, it’s referred in the masculine.

By men, I meant men/women. Mankind. Humankind.

How about herbal tea? If I have coffee now, I’ll never get a decent night’s sleep. :-)

I sleep next to my inverted yield curve converter, as the CEO of ASDA put it, “we are in the money now”,?

Your comment excerpt: “I hope the FED knows what it’s doing.”

BY DEFINITION, the FED most certainly does not.

It is a truism that no Central Planning Committee knows what it is doing.

Why Americans — and their elected representatives in the Senate and House — do not vehemently revolt against any form of Central Planning in the USA is a mystery to me?

Interest rates do not need to be determined by an “all-knowing committee” — and money supply growth could be managed by an algorithm, as Milton Friedman once stated some decades ago.

Americans have been hornswoggled by the idea of a (i) necessary & (ii) all-knowing & (iii) omnipotent FED — that most citizens (NOT ‘consumers’) are no longer capable of independent thought.

END THE FED !

This is is the first intelligent comment I have read in a long time.

Central planning is anathema to a free market, true capitalist economy. The whole concept of capitalism revolves around using real wealth to create more wealth. How does one receive interest payments on a debt instrument like a federal reserve note?

A democracy is not a republic. A liability is not an asset.

If the fed governors were so smart, why has the federal reserve note lost almost all of its value?

Right on Robert

“Americans have been hornswoggled by the idea of a (i) necessary & (ii) all-knowing & (iii) omnipotent FED — that most citizens (NOT ‘consumers’) are no longer capable of independent thought.”

Most Americans know very little about the Fed.

I would say the average American’s knowledge base is fairly concentrated around sports and celebrities/media/pop culture. More Americans can name the Three Stooges than the three branches of government.

I would call us (Wolf readers) a special interest group. It would be a mistake to assume the average American knows as much about the topics that are posted on here, or perhaps more importantly cares as much.

Even among people who care, it can be hard to put in the time to understand how topics as esoteric as the Fed Reserve balance sheet runoff affects us or the world at large.

I don’t always agree with Wolf’s conclusions, but I definitely appreciate the effort he puts in educating us about some important but ‘unsexy’ topics.

One thing I don’t like about the age of the internet is it has given too many of us the ability to cobble together an ill informed opinion about everything.

I think it is one thing to rightfully have a strong opinion about a lack of good paying jobs, a lack of affordable housing, and an abundance of unhealthy debt.

But it is entirely another to think that even a remotely small fraction of us are expert enough to meaningfully be critical of the Feds actual methods.

Getting a majority of people educated enough to understand the current systems failing is a lost cause.

What we need is a handful of savvy economists to mount a viable alternative to the Fed. That way something new can be tried.

Its fun for us to try to follow the shit show at varying levels of competence on this blog but a viable alternative has to be mounted to change the Feds role.

Or we could wait to see if the whole systems crumbles and see what swoops in to take its place in the aftermath.

“What we need is a handful of savvy economists to mount a viable alternative to the Fed. That way something new can be tried.”

Yeah, sure.

‘savvy economists’……………………….I never met one or knew one!!

What’s a savvy economist?

You wouldn’t be the first person to suggest the Fed does more harm than good.

I don’t think we will see it go away until our government either collapses or someone manages to replace their function with some sort of AI or algorithm.

The Fed, under volcker, tried to use Friedman’s ‘algorithm’. The algorithm failed and the Fed returned to managing inflation indiirectly via the fed funds rate.

Volcker’s FED jacked interest rates to near 20% which was definitely not in Friedman’s algorithm as I remember it. Money supply growth is managed in several ways, and the foremost is Open Market Operations. Again, there is no evidence that Volcker adopted Friedman’s (i) Money supply Growth algorithm, or Friedman’s (ii) tighter range, and more constrained approach to interest rate management.

In any case, Volcker had the misfortune of becoming Fed chair — late after the OPEC oil embargo (73-74) — and right as America was enduring a significant oil price increase, during and after the second oil crisis/shock in 1979.

The American economy at the time performed well under a cheap oil regime. The two exogenous shocks to our economy, triggered by the oil embargo and second price shock were precisely the kind of events where Friedman would have said a direct and firm hand on the tiller would be the preferred approach.

In any event, the second oil price shock was definitely A RESPONSE TO RUNAWAY AMERICAN INFLATION, brought on primarily due to BAD FISCAL POLICY (LBJ, “guns and butter”) and the resultant inflation caused by the FED monetizing the debt incurred by the guns/butter fisc.

Fed monetization of debt incurred, by THE CHOICE to conduct two simultaneous wars, one against Vietnam and the other against poverty, was not a situation that Friedman would have endorsed. A “war on two fronts” if I may evoke an older memory.

What Volcker inherited in 1979 — the current FED Chair, Jerome Powell, is in the same position, but now it is literally “a war on many fronts”.

Monetizing the debt, brought on by unwise and inflationary fiscal policy (Read Stockman for details) — will place the FED Chair in another untenable position — that will necessarily invoke a large round of debt monetization at some pont . . . . .

No one has really followed Friedman’s advice — and perhaps no one ever could — because of exogenous shocks to the system — or really really unwise fiscal policy.

Completely agree!

Wasn’t the mess in the 70’s caused by Nixon de-linking gold from the dollar? I am so tired of the lack of management and actual mis-management of our elected officials to allow their overspending and then allow (or encourage) the Fed to try and give the politicians and Wall Street what they want. See the Mises Wire from the Mises Institute from 5/3/18: ” The Fed as an Instrument for Disaster”. Trump is following the bad train unfortunately. I witnessed my husband lose millions in 2009 from the fed, banks and government policies that were corrupt or not followed (like regulators not doing their job). Then there was Greenspan who was treated like God, but could’t even see the train wreck coming, and the WSJ which never really reported what was going on. My husband had a stroke, and our life changed for ever. Thanks guys for creating an environment where the honest, hard working people get screwed big time and the people at the wheel just go buy their new Rolls. My faith is gone with respect to the management of our country. I have no confidence in them or the system. The value of a share of stock is a joke. Pretty sad that this is now America.

AKA: The frog boil.

Wolf, I really want to say thank you for all the research and time you put in to come up with such high quality articles as this one.

There is a light bearish bias on some of your real estate posts but overall I am impressed with the quality and insight you provide here for free. Thank you, where do I send my $10 contribution?

Memento mori,

Thank you for your kind words. Music to my ears.

There’s actually a Donate button on this site (hard to find if you’re using a smartphone). It leads to this page:

https://wolfstreet.com/how-to-donate-to-wolf-street/

Thanks again.

Stiil no real change in new junk issuance, yields, and rates????

Foreign QE still filling that gap??

+1!

Thank you for the high quality articles you provide for free. As a renter keeping an eye on my local RE market, Seattle suburbs (for rent as well as hopefully be able to buy some day), your articles give me a broad perspective. I immensely appreciate it.

btw, my attempt at a small contribution was unsuccessful. 3 times, and I gave up.

Try using a different web browser. Chrome or Firefox might work.

Pelican,

Can you contact me by email and let me know what didn’t work? There may be a problem on my side that I need to know about. You can get my email from the “Contact Us” tab. Thanks.

@Pelican – If you’re following the Seattle housing market, also check out seattlebubble.com – it’s a nice blog and commentariat that’s been around since the last bubble.

Somewhat tangential…

It’s hard to believe just how frothy it is out there. I constantly get contacted by people promoting the latest startup, ICO, or whatever. And many of these things are getting money. So here’s a “whatever” that I just got in my inbox — ICO to fund flying cars on the blockchain:

“For the last 9 months we’ve been working on XYZ [name redacted]: an incubator for startups building technology for flying cars. We’re building the infrastructure for flying transportation on the blockchain.

“We have more than 10 companies in our incubator now, and entrepreneurs from 27 cities working in our chapters. Here’s a feature on us by The Next Web.

“Passengers will pay for flying transportation using XYZ. Our token launch is already live, and we just launched Phase 1.2 in April.”

I hope the Fed sees this (some of their underlings are reading my stuff).

You got ‘flying cars’ and ‘blockchain,’ throw ‘AI’ and ‘autonomy’ in there and I’ll fund ya.

Harvard costs big to repay?

Is the Internet bubble all over again…. only with way more money cause inflation.

Where do you think they are going to get the pilots to fly these flying cars?

No pilots needed. They’re self-flying cars of course. Since they’re on the blockchain. Or something.

You people just don’t get it :-]

How come the (St Louis adjusted) monetary base hasn’t been going down much?

This is an entirely different measure — and it’s VERY volatile. It plunged $700 billion between Sep 2015 and Jan 2017, then jumped $600 billion by Sep 2017, then plunged $250 billion. Here’s a definition:

“The Adjusted Monetary Base is the sum of currency (including coin) in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks. These data are adjusted for the effects of changes in statutory reserve requirements on the quantity of base money held by depositories.”

Thanks. So I guess the volatility in the MB is dwarfing the reduction in reserves that should occur during QT.

From the definition you gave, “deposits held by depository institutions at Federal Reserve Banks” are just bank reserves, and they should decline as the Fed effectively sells debt securities and retires the money it receives.

I was thinking that the lack of a noticeable decline in the MB was due to the Fed’s reverse repo facility, currency swaps, or some other esoteric reason.

Velocity may also be a factor because it has been dropping in recent years.

After thinking about it some more, maybe the reason the monetary base hasn’t dropped much, is because bank reserves held outside of the Federal Reserve banks has been repatriated back into the U.S.

$ted has been going down since the tax cut meaning corporations are taking advantage of eurodollar market and signaling the eurozone is being bleed dry of funds at a faster rate than in U.S. (,remember most of QE went to overseas units in Europe?),and interest on excess reserves being deposited at the Fed will give American banks a cushion to rob everyone all fairs and squares like? What a wonderful over valued and in debt up to its pretty blue eyeballs world?

I don’t know how many hundreds of billions in MBS will be ultimately ‘rolling off’ but you don’t sound very concerned that the decline in Fed sponsored MBS will utterly destroy our lofty housing markets.

Why shouldn’t the Fed expect a major crash from the elimination of their MBS buying down the line?

My understanding is that the Fed wants the froth to come out of the housing market because a housing bubble poses systemic risks to the banks. But it does not want a crash. “Gradually” is its guiding principle.

Did the Fed acquire commercial MBS as well (not just residential)?

And if so, are they part of the current unwind?

Only residential. That’s my understanding.

Also, there is only a relatively small amount of agency-guaranteed CMBS (only for apartment buildings) outstanding… I seem to remember in total about $500 billion. Since the Fed buys only agency-guaranteed MBS, it would be limited to that. But the Fed needs a big pool.

“But mouse, you are not alone, in proving foresight may be (in) vain: The best laid schemes of mice and men, go often askew, and leave us nothing but grief and pain, for promised joy!” — Robert Burns

And many of these things are getting money.

I should started a tech company and get some paper money. It’ll be useful for awhile- a little while.

I think Elon Musk is losing it. He is so far backed into a corner, he’s like a caged animal. One could say he is past his prime, or his “use by” date. And we had such high hopes. . .

If the market sees a key story stock like Tesla get pounded, maybe that will take the whole market down. Who knows what will trigger the drop.

All we know is it will be something.

Many of the consumer staple stocks are getting pounded lately – General Mills, AT&T, Proctor & Gamble, to name a few.

And now we’re threatening to go below the 200-day moving average on the S&P.

I have to say, it doesn’t look good for stocks. Bad news is starting to be treated like bad news. Good news is taken with a grain of salt.

On the reverse QE, I agree the Fed will continue this until stocks plummet a good 20%. But when it causes a recession they’ll put the program on pause. That’s my opinion and the market’s opinion. This is why long-term rates are not budging much yet. The market doubts the Fed will have any resolve when faced with even a mild recession.

“The market doubts the Fed will have any resolve when faced with even a mild recession.”

Yup!

‘Courage to act’ (as in buying up everything when market swoons)-Plenty!

‘Resolve’ (when market swoons)-None!

Reason- all for us as we would all be worse off but for this ‘Courage to act’

In other words “ Don’t fight the FED” and buy the flipping dip No thanks

The Fed has to prepare the bond market or USG will go off the rails, so they RAISE. Their motto is Reallocate or Die! Now getting those stock gamblers to buy stodgy old bonds is a trick, and a lot alot that money is funny smelling foreign money, printed out of thin air. When the Fed hurts a few of them, so be it, and to American retail investors, this is not your fight. American? corporations got a gift, (tax repatriation) now they get the bill. So long buybacks. This market can lose five years of gains and still be in decent shape. The important thing is borrow and spend, making it work. And the bonds they are selling are akin to the old war bonds, which is making America great. Remember there is a populist in office.

A populist in our dreams only.

Don’t underestimate the good ol’ Elon; one call to his Martian friends, and they will provide him with blue prints of an amazing flying car.

Cheney ‘s p.r.guy?

Hope … mankind’s greatest curse.

“The FRB/US model is a large-scale estimated general equilibrium model of the U.S. economy that has been in use at the Federal Reserve Board since 1996. The model is designed for detailed analysis of monetary and fiscal policies.”

Gentlemen;

You may use the same analytic tools FED uses to make decisions.They even provided download link:

FRB/US Model:

https://www.federalreserve.gov/econres/us-models-about.htm

Works like a charm with MATLAB Econometrics package-Datafeed Toolbox.

https://www.mathworks.com/products/datafeed.html

https://www.mathworks.com/products/econometrics.html

Plug it into FRED datafeed and enjoy !

Thanks for the links, but I don’t think its valuable for economic prediction, as evidenced by the Fed’s clear pattern of blowing then popping bubbles. The model gives them a courage to act when they shouldn’t.

That is the only model there is.It was designed by God himself (who,while visiting Earth,temporarily assumed the human form of irreverent polymath scientists Johnny von Neumann).

The only reason Fed blunders so often is their ongoing use of IBM 360/370 with punch cards and magnetic tapes.

I am sure Mr. Bobber you can do better ;-)

I would do anything at all. I would let the free market do the job. The only exception would be short term emergency liquidity.

> until the Fed considers the balance sheet

> to be adequately “normalized” — or until

> something big breaks

Admirable journalistic modesty… but let’s be blunt now: we all know which one it’s gonna be folks.

“And it’s unlikely that the Fed will try to prop up the stock market by pausing its QE Unwind machine, even during a sell off.”

That likely depends upon the level, severity of the selloff. Pretty obvious who the Fed is working for, and it’s certainly not mom & pop, middle class America.

That $104 billion decrease sounds impressive…until you consider they were piling on $85 billion per MONTH during the entire year of 2013. It’s taken them 7 months to get to this point and the markets are already wobbling when we haven’t undone two months of QE3.

In April, the roll-off was $30 billion. By October, the monthly roll-offs are $50 billion, or $600 billion a year. “Gradual” is the key.

We’re already 2.5 years into the rate-hike cycle, and rates have gone up only 1.5 points. During the last rate-hike cycle, rates went from 1% to 5.25% in just 2 years. So it’s really important to understand that this will be “gradual” — as the Fed has said from day one — and that it will take years, and that there won’t be the kind of sudden reaction in the markets. The reaction will be “gradual” too — and will drag out for years.

“Gradual”

A very Important word the FED is slowly coming to understand.

After 100 years they are finally starting to figure out how to mange the monster that is the US economy. Forever disrupted by global conflict, and so many other deliberate disruptions orchestrated by aggressive anti American administrations. Like the deliberate abuse of Breton Woods, by a supposed US Allie, leading to its implosion.

100 years sounds like a long time until you factor in how long gradual adjustments can take to play out and start to factor in: WW I, WW II, Cold war, Korea, Vietnam, Iraq I iraq II. All of which, had huge long term disruptive influence on the US economy.

As those who understand even a little know, unless a new POTUS dose something REALLY RADICAL, which p 45 has yet to do. (Although some of his actions against china could head into that category)

The economic changes in the first 2 to 3 years of the administration are caused by the actions of the previous administration.

Contrary to populist conspiracy theories. P 44 and “dammit Janet” do not appear to have fed P 45 a financial poison pill. (it would have been quiet easy to do so) as we know if it wants to teh FED can upset the apple cart, VERY quickly.

The CCP is already playing P 45 with “give, and bow to us” or we disrupt you in 2020. So the Question/Bet remains, will P 45 do, what is good for America, or good for P 45? going into 2020.

I know where I would put my $10 in that bet.

This Fed chairman inherited a set of chains even Houdini would have shied away from.

However, in this part of the cycle where the Fed is tightening, and in this case also unwinding, we don’t normally have a large stimulus package and major cut in tax rates. Lot’s of $ being repatriated.

The old adage about not fighting the Fed will prove true and markets will respond, but wondering how all the stimulus may impact the timing??

By “rolling off”, I assume that means that the Fed is cashing in the bonds with the US Treasury, causing the Treasury to scramble for funds to pay for the bonds. Is that (along with tax cuts) why the Treasury is currently issuing a record amount of new debt?

The Treasury can just use the interest remitted by the Fed to roll off the bonds. Let’s review. the Fed creates money out of nothing, and lends it to the Treasury. The Fed earns interest on this debt, that was created out of thin air. The Fed then gives back that interest to the Treasury, who was the borrower in the first place. The Treasury can then give back this remitted interest to roll off the bonds. “Capitalism” at its finest. Money from nothing and Interest for free.

Interest is not the issue. The Treasury issues pieces of paper called bonds for currency (in the case of the Fed, printed from thin air currency) for the face value of the bond (say $10,000). The Treasury must pay interest on this bond, say 5% plus the face value to the holder when it matures. Yes, the Fed returns all interest over and above their operating expenses to the Treasury but technically, now the Treasury must also pay back the $10,000 face value. So, the interest is a minor cost to the Treasury compared to having to choke up that $10,000 (times many bonds). In the past, the Fed would just replace this $10,000 by buying another bond (rolling it over), again with counterfeited money. So, it seems to me that as the Fed just lets bonds “roll off” without buying replacements that the Treasury is now in a position where it has to try to find new buyers for bonds to pay back the Fed. It appears that the big buyers of bonds, China and Japan (well, maybe Belgium too) are tapering their purchases which would seem to put the Treasury between the rock and a hard place.

Belgium!

Look at the Fed as just a big investor that is losing its appetite for these securities and starts shedding them. So other investors will have to step up to the plate to buy them. These investors will have to be enticed by higher yields (lower prices). So this what that means: prices will go down and yields will go up.

But it doesn’t impact net issuance of bonds by the Treasury Dept. It just needs to find other investors for its bonds.

The surge in bond issuance by the Treasury Dept is solely related to the money the government spends minus the money the government takes in — the deficit.

I think the ridiculous situation where the Treasury (the borrower) receives the interest back on what it issues deserves note. This adds up to hundreds of Billions of dollars over the years. It’s understood that the primary motivation of the Fed was to artificially reduce the supply of Treasuries, thus keeping interest rates lower than then otherwise would have been in a free market.

Over the last 10 years, the Fed has remitted $800 Billion in interest back to the Treasury, who was the borrower in the first place. The Treasury is borrowing the money AND receiving the interest on the loan. Pretty sweet deal. The Treasury has almost a Trillion dollars to give back to the Fed, to help with the roll off. It’s comical.

And lets not forget that half of the “roll-offs” are really “roll-overs”. So a $50 Billion roll-off, is really only $25 Billion coming off. The total collected remitted interest can pay for that for years.

I do not understand how $4.7 Trillion of assets and 10 years of QE has netted only $800 Billion dollars? And I know it was not always $4.7 Trillion. Can someone explain this to me?

And why won’t the FED let themselves be audited?

The remittances have ranged from $80 billion to $110 billion or so every year.

So if you have $3.5 billion in securities that yield on average 2.5%, they will produce income of $87.5 billion a year.

Forgot to mention. The banks do get their slice of this pie: interest on excess reserves. Last time I reported on it, for 2017, it was about $25 billion if I remember right.

Look at if from the bright side: At least the taxpayer got that $800 million the Fed remitted to the Treasury, and not Wall Street :-]

Wolf, maybe you should teach a course on the U.S. Federal Reserve Banking System.

So what’s this do to the corporate bond market? A lot of zombie corporations could go under if rates move higher, and those bonds were part of a swap. The 3 month T Bill auction went off at rates last seen in 2011 and at a discount to par. Forget the rolloff, what if they can’t sell their paper?

>>The 3 month T Bill auction went off at rates last seen in 2011 and at a discount to par.

All T-bills are auctioned at a discount and redeemed at par when they mature. The difference between par and purchase price is the interest. The above quoted statement is therefore both wrong and confusing.

Remember that money is not wealth. It is accounting for the wealth. The embezzlement of wealth has already occurred and was spent on the military armada to invade the middle east. Just like Enron, it is an accounting that does not accurately reflect reality.

Also like Enron, when the accounting gets fixed to be accurate, then we will know whose wealth was spent. And we will find out it was our wealth, as the money we spend loses value. It’s an old trick.

US FEDERAL BUDGET:

62% entitlements

17% defense

+2% interest. So about 20% of the budget is discretionary (depending on the definition- they put defense into discretionary, but it gets funded basically fully all the time.)

There isn’t much there for discretion. Most people have no idea about that.

My personal opinion is that US should wind down defense spending by cutting administrative overhead: bases, civilian support. That would not be difficult.

For every T note on the market there are still more than three buyers.

What you need to be aware of , is that IT IS NOT in the interest of Americans for non Americans to increase their % shareholdings of T notes.

Defense spending is not teh problem, paying for everybody elses defense, whilst getting nothing but a kick in the teeth for it, and spending to much on other department administrative costs is.

Biggest combined govt expenses, Salaries and PENSIONS.

I think Wallstreet is unwinding and unloading. I see signs of distribution.

The elephants want to buy lower, and they finally have the muppets to be bagholders for them. The banks look especially bearish. I am not expecting a crash, but I can see a move back to 2016 levels, which prolly for some is the OMG THE word is ENDING!. I look to be a heavy buyer there.

For now…creep up into mid May then we will see how it starts to shake out.

just my WAG

“So if you have $3.5 billion in securities that yield on average 2.5%, they will produce income of $87.5 billion a year.”

$3.5 Trillion @ 2.5% = $87.5 Billion

…but whats a few trillion among friends…

Well sure, they must crash the economy, so Trump can be blamed……

Amazing how interest rates rose practically as Trump was sworn into office……

But, 8 years of Obama never saw one iota of interest rate increase……

During the campaign, Trump blasted the Fed for the low interest rates. So he must be happy now.

Presumably he had to divest some of his holdings when he became president. Why wouldn’t he be happy? Becoming president gave him an excuse to get out at the top. Once the Fed has raised interest rate high enough to cause some of his rivals to tumble, he can quit being president and scoop some premium property at bargain prices.

Now I am not saying that’s how it really happened since his boy Kushner might have to declare bankruptcy over his 666 real estate once rates reach the top.

√

Amazing.

Give p 45 what he wants and the anti fed, anti democrats, still spew conspiracy theories.

So, who is paying to redeem these bonds the Fed is rolling off. Also, who is now lending the US government money if the Fed has stopped QE?

They are slowing down the anti-gravity device. This way they can hike at most 3 times as the market planned for going into goldilocks. Coming out of Goldilocks we thought maybe 4 (no way, personal call). But if the unwind is on autopilot they can justify 3 or less hikes. They can fiddle with the bond, real estate and wall street markets fairly coordinately. This is all pending any black swans ( I hit my head in the shower, I’m an hour late for work, I miss an hours wage, unless I have paid time off).

Boris say, QE4 on the way!

In your — and many people’s — dreams.

Anyone holding bonds or bond funds in their portfolio fervently dreams of QE4, as do companies wanting to issue bonds, as does Wall Street in the broader sense, and all stock market investors…. There are a lot of dreamers out there. And they’re “fighting the Fed.”

I’m still skeptical. There’s no such thing as tapering a Ponzi.

“I’m still skeptical. There’s no such thing as tapering a Ponzi.”

Some stock selling listings called markets are Most defiantly “Ponzi’s”. Mainland china with its “State” owned listing’s, that are not allowed to go down. Being one of the better examples.

Contrary to what the FED haters and conspiracy theorists project, the FED, is NOT, a Ponzi.

The FED did assist in propping up a Market that has some “Ponzi” stocks in it. So indirectly Mainland chinese “Ponzi’s”. I assure you would not have liked the results if they had not done so. Think 1929 – 1946 x 10.

Increases in intragovernment debt holdings have almost completely offset the decrease in Fed assets. What government agency is buying all of these assets?

I think you asked the wrong question the right way, if I may be so bold.

Intergovernmental holdings of Treasury debt increased by just $30.2 billion since Oct 1, 2017, when the QE Unwind began.

But “public” holdings of Treasury debt soared by $651.7 billion over the same period.

So the question really should be: Who is this “public” that is buying all these assets? Well, we know some of them: not foreign governments but Americans, directly and indirectly, via bond funds, pensions funds, and the like.

Yields are starting to look much more attractive :-]

Many times the Russians and CCP have dumped their US T’s.

Sometime with much noise and Anti US Rhetoric, and sometimes very quickly and quietly (like the Russians shifting T’S just before they moved into Crimea/Ukraine). To their private holding entities in Belgium.

Which are very opaque regarding ownership details.

Is there any way of finding, easily, how many new sales/transfers, are being registered to Belgium??

The Treasury Dept. reports the amounts of Treasury securities held in Belgium in its monthly TIC data but doesn’t report/know the beneficial owners. There are other havens like that, including Ireland, which is the third largest holder of Treasuries, after China and Japan, and holds about 2.5 times as much as Belgium. Cayman Islands is fourth. I might write about it next time the new data comes out, if this is of interest to anyone.

Ireland is I suspect mostly, Alphabet, Amazon, Starbucks, Etc playing the double Irish and also holding their $ T notes there.

It would be an interesting list to view particularity if there was some detail about which entities held all or some of those notes.

The you could pick out all the Mr nobodies, which would tell a story.

Thank you for your reply. However, from the end of Feb/beginning of Mar 2018, Fed assets have decreased $37B and intragovernment debt holdings have increased $35B. On the surface, it appears that QE is being moved off the Fed’s balance sheet onto another agency’s but remains alive and well which would go a long way to explaining why 10 year yields have remained below 3% for the most part and why responses by equity markets have been muted as QE is “unwound”.

AK,

I see what you’re saying. Let’s start with your statement: “…it appears that QE is being moved off the Fed’s balance sheet onto another agency’s but…”

Response: The Fed is NOT a government “agency.” The New York Fed, which handles QE and the QE unwind, and the other Federal Reserve Banks whose assets these bonds are, are privately owned banks. Only a small part of the Federal Reserve system is a government agency (Board of Governors).

So there’s NO CONNECTION between the Fed’s holdings and intergovernmental holdings; they’re two separate things.

Also the QE unwind destroys money, just like QE created money. In that the Fed is unique. When investors or a government entity buys bonds, they trade and hold assets (money v. bonds), and no money is created or destroyed. That is not the case with the Fed. When the Fed receives money when bonds are being redeemed, it doesn’t hold this money in an account. It destroys it. That money simply goes away. It’s the reverse process of QE.

√

I read him, I think of my answer, and find you have already made it for me.

This is good..

Wolf, i know there is no precedent for this, but how do you think QE reversal will impact bank deposits? Couldnt a decline in the money supply cause a deposit drain, and therefore force banks to deleverage? Or do you think there is enough excess reserves to absorb the QE reversal?

I’m not going to venture to predict the future in this respect, but as I discussed in three prior articles on “brokered CDs,” banks are now trying hard in a competitive environment to attract deposits by raising rates. That’s a first since the Financial Crisis. So the banks might already be preparing for a scenario of the type you envision.

Excess reserves have dropped 24% since the peak in Aug 2014 (just before the end of the Taper), in big zig-zag movements.

Banks have to Get the other Cash now, so when the QE cash goes away, they still have cash.

If a sudden Junk Bond implosion and JUNK BOND Liquidity shortage can be avoided, it is possible for the FED to pull this off.

I expect certain elements to target the US junk market in retaliation for US trade policy’s soon ( Bad Economy into 2020).

Which could become a GLOBAL black swan event. As America will not fall alone which they stupidly believe it will.

Then they Falsely Blame AMERICA, for crashing teh world Economy, AGAIN.