Chicago rents collapse, New York’s swoon, Southern California’s boom. And the US average hides all the drama on the ground.

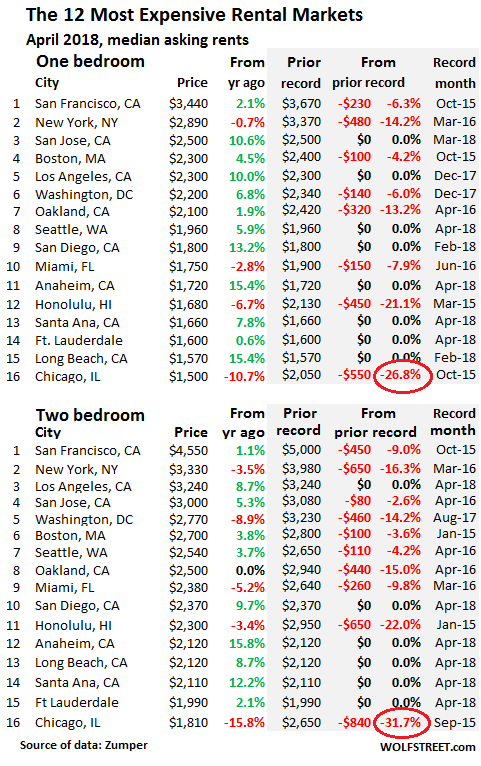

The situation with rents in the most expensive US rental markets can be summarized like this: Free-fall in Chicago, where the median asking rent for two-bedroom apartments has plunged 32% from its peak, a similar collapse in rents in Honolulu, double-digit declines from the peak in New York City and Washington DC, mixed movements in the Bay Area, a blistering boom in Southern California, and everything in between.

Watered down into a tidy nationwide average, the median asking rent for one-bedroom apartments in the US rose 1.4% in April compared to a year ago, to $1,185. And for two-bedroom apartments, it rose 2.2% from a year ago to $1,422.

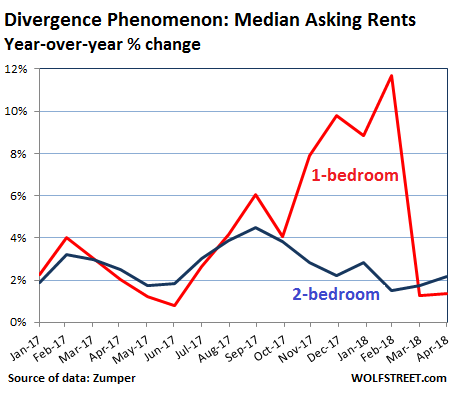

A peculiar phenomenon cropped up last November: The median asking rent for 1-BR apartments suddenly surged by the double-digits, even as the median asking rent for 2-BR apartments was barely edging up. This phenomenon endured for four months but has now collapsed (the phenomenon remains unexplained, though some suspects have been lined up):

The data, provided by Zumper, is based on asking rents in multifamily apartment buildings, including new construction, as it appeared in active listings in cities across the US. Single-family houses and condos for rent are not included. Also not included are studios and units with more than two bedrooms. Zumper releases the data in its National Rent Report.

In San Francisco, the most expensive major rental market in the US, the median asking rent for 1-BR apartments rose 2.1% year-over-year to $3,440 in April, but remains down 6.3% from the peak in October 2015. For 2-BR apartments, it rose 1.1% year-over-year to $4,550 but remains down 9.0% from the peak in October 2015.

There is no shortage of apartments in San Francisco. Far from it. For example, Zillow lists 1,851 apartments for rent at the moment, up from 1,581 a month ago, and up 61% from the 1,149 listed in August 2016. This is a result of the construction boom. The City is not large, with a total of 387,000 housing units. But almost all the supply is high-end – and I mean “expensive,” not necessarily “luxurious.”

The cheapest studio with a bath (not counting rooms without bath) listed on Zillow today has a asking rent of $1,250. There are only 424 units listed with an asking rent of less than $3,000. In turn, 1,427 listings sport asking rents of $3,000 and over, with 1,281 listings wanting over $4,000 (including 3-BR and up that are not reflected in Zumper’s data). In other words, there are plenty of units for rent, but most people cannot afford them. Our local term for this phenomenon – “Housing Crisis” – describes a crisis of rent inflation. There is no crisis of availability.

In the second most expensive major rental market, New York City, the median asking rent for 1-BR apartments edged down 0.7% year-over-year to $2,890 and is down 14.2% from the peak in March 2016. 2-BR apartment rents fell 3.5% to $3,330 and are down 16.3% from the peak in March 2016.

These are serious declines, but they do not include incentives or “concessions,” such as “1 month free” or “2 months free,” which reduce the effective rent for the first year by 8% or 17%. Concessions have reached record levels In New York City.

The table below shows the 16 most expensive major rental markets. The shaded area shows peak rents and the movements since then. Upon popular request, I have asked Zumper for the rental data on Orange County in Southern California, which hadn’t been included. Zumper has now added Anaheim and Santa Ana to their data for the 100 most expensive rental markets. Both made the list of the top 16. Now there are eight major California cities in the 16 most expensive rental markets. Across the nation, markets diverge, with a number of double-digit decliners from their respective peaks, and a number of new records:

Seattle rents are seesawing between a vibrant economy and the onslaught of new supply from its dizzying housing construction boom that focused on the high end. So the median 1-BR asking rent edged out by $10 the record set in August 2017. But 2-BR rents remained nearly 5% below their peak of April 2016.

Chicago rents are in free-fall, with 1-BR asking rents down 27% from the peak in October 2015 and 2-BR asking rents down 32% from the peak in September 2015. Chicago has had plenty of new construction, but the population has been declining as tax burdens are growing and as the city is gingerly and ever so slowly tottering toward what may ultimately become the largest municipal bankruptcy filing.

Rents in Honolulu, after having plunged for three years straight, are struggling to find a bottom, with asking rents for 1-BR and 2-BR apartments down over 20% from their respective peaks in early 2015.

Of the three Bay Area cities in the chart above, rents are down from the respective peaks in two: San Francisco and Oakland. The drop in Oakland (13% and 15% from their peaks) is significant. But in San Jose, the situation is mixed. The median asking rents for a 1-BR set a record in March and stayed there in April, but for a 2-BR, it’s still down 2.6% from the peak in April two years ago.

There are five cities in Southern California on the chart above: Los Angeles, San Diego, Anaheim, Santa Ana, and Long Beach. Rents in all five are surging to new records, in some cases by the double digits.

Across the US, every rental market has its own dynamics, and the sanitized version of a national average of rent increases doesn’t apply to the local tenant and landlord, who may find their market in a steep rent decline or in a breathless boom. The table below shows Zumper’s list of the 100 most expensive major rental markets in the US, by median asking rents for 1-BR and 2-BR units in April, and their percentage changes compared to a year ago (use browser search box to find a city). Also compare these cities to The Most Splendid Housing Bubbles in the US.

| City | 1 BR Rent | Y/Y % | 2 BR Rent | Y/Y % | |

| 1 | San Francisco, CA | $3,440 | 2.10% | $4,550 | 1.10% |

| 2 | New York, NY | $2,890 | -0.70% | $3,330 | -3.50% |

| 3 | San Jose, CA | $2,500 | 10.60% | $3,000 | 5.30% |

| 4 | Boston, MA | $2,300 | 4.50% | $2,700 | 3.80% |

| 4 | Los Angeles, CA | $2,300 | 10.00% | $3,240 | 8.70% |

| 6 | Washington, DC | $2,200 | 6.80% | $2,770 | -8.90% |

| 7 | Oakland, CA | $2,100 | 1.90% | $2,500 | 0.00% |

| 8 | Seattle, WA | $1,960 | 5.90% | $2,540 | 3.70% |

| 9 | San Diego, CA | $1,800 | 13.20% | $2,370 | 9.70% |

| 10 | Miami, FL | $1,750 | -2.80% | $2,380 | -5.20% |

| 11 | Anaheim, CA | $1,720 | 15.40% | $2,120 | 15.80% |

| 12 | Honolulu, HI | $1,680 | -6.70% | $2,300 | -3.40% |

| 13 | Santa Ana, CA | $1,660 | 7.80% | $2,110 | 12.20% |

| 14 | Fort Lauderdale, FL | $1,600 | 0.60% | $1,990 | 2.10% |

| 15 | Long Beach, CA | $1,570 | 15.40% | $2,120 | 8.70% |

| 16 | Chicago, IL | $1,500 | -10.70% | $1,810 | -15.80% |

| 17 | Philadelphia, PA | $1,450 | 6.60% | $1,650 | 4.40% |

| 17 | Providence, RI | $1,450 | 7.40% | $1,510 | 7.10% |

| 19 | Denver, CO | $1,440 | 15.20% | $1,960 | 15.30% |

| 19 | Portland, OR | $1,440 | 7.50% | $1,670 | 5.00% |

| 21 | Minneapolis, MN | $1,430 | 11.70% | $1,890 | 15.20% |

| 22 | Atlanta, GA | $1,410 | 8.50% | $1,800 | 11.10% |

| 23 | Baltimore, MD | $1,390 | 14.90% | $1,560 | 12.20% |

| 24 | New Orleans, LA | $1,380 | 7.00% | $1,480 | -6.90% |

| 25 | Nashville, TN | $1,360 | 15.30% | $1,450 | 10.70% |

| 26 | Dallas, TX | $1,300 | -1.50% | $1,740 | -3.30% |

| 27 | Houston, TX | $1,260 | 15.60% | $1,560 | 14.70% |

| 27 | Madison, WI | $1,260 | 9.60% | $1,430 | 15.30% |

| 29 | Scottsdale, AZ | $1,240 | -0.80% | $1,910 | -8.20% |

| 30 | Orlando, FL | $1,220 | 15.10% | $1,410 | 14.60% |

| 31 | Charlotte, NC | $1,210 | 3.40% | $1,350 | 7.10% |

| 32 | Sacramento, CA | $1,200 | 9.10% | $1,400 | 7.70% |

| 33 | Austin, TX | $1,170 | 11.40% | $1,450 | 8.20% |

| 34 | Irving, TX | $1,160 | 5.50% | $1,590 | 11.20% |

| 35 | Plano, TX | $1,130 | 6.60% | $1,500 | 4.90% |

| 35 | Tampa, FL | $1,130 | 14.10% | $1,370 | 14.20% |

| 37 | Aurora, CO | $1,110 | 12.10% | $1,460 | 7.40% |

| 38 | Fort Worth, TX | $1,090 | 13.50% | $1,280 | 15.30% |

| 39 | Pittsburgh, PA | $1,080 | 3.80% | $1,340 | 2.30% |

| 40 | Durham, NC | $1,070 | 15.10% | $1,230 | 13.90% |

| 41 | Richmond, VA | $1,060 | 7.10% | $1,270 | 11.40% |

| 41 | Salt Lake City, UT | $1,060 | 15.20% | $1,320 | 10.00% |

| 41 | Virginia Beach, VA | $1,060 | 15.20% | $1,200 | 4.30% |

| 44 | Gilbert, AZ | $1,050 | 5.00% | $1,360 | 5.40% |

| 44 | Henderson, NV | $1,050 | 8.20% | $1,210 | 5.20% |

| 44 | Newark, NJ | $1,050 | 8.20% | $1,310 | 12.00% |

| 47 | Buffalo, NY | $1,040 | 11.80% | $1,210 | -6.90% |

| 47 | Chandler, AZ | $1,040 | 10.60% | $1,270 | 9.50% |

| 47 | Chesapeake, VA | $1,040 | 8.30% | $1,200 | 4.30% |

| 50 | St Petersburg, FL | $1,030 | 14.40% | $1,630 | 9.40% |

| 51 | Raleigh, NC | $1,000 | 0.00% | $1,150 | -4.20% |

| 52 | Kansas City, MO | $950 | 8.00% | $1,090 | 16.00% |

| 52 | Phoenix, AZ | $950 | 6.70% | $1,170 | 6.40% |

| 54 | Jacksonville, FL | $930 | 4.50% | $1,100 | 3.80% |

| 55 | Milwaukee, WI | $920 | 12.20% | $1,040 | 15.60% |

| 56 | Boise, ID | $910 | 9.60% | $950 | 0.00% |

| 56 | Colorado Springs, CO | $910 | 13.80% | $1,100 | 0.00% |

| 58 | Fresno, CA | $900 | 8.40% | $1,080 | 13.70% |

| 58 | Mesa, AZ | $900 | 15.40% | $1,060 | 11.60% |

| 60 | Las Vegas, NV | $890 | 15.60% | $1,100 | 12.20% |

| 61 | Anchorage, AK | $880 | -1.10% | $1,100 | -8.30% |

| 61 | San Antonio, TX | $880 | 7.30% | $1,140 | 8.60% |

| 63 | Corpus Christi, TX | $870 | 4.80% | $1,050 | 5.00% |

| 63 | Louisville, KY | $870 | 6.10% | $980 | 11.40% |

| 65 | Baton Rouge, LA | $860 | 0.00% | $950 | -4.00% |

| 65 | Omaha, NE | $860 | 14.70% | $1,020 | 12.10% |

| 67 | Cincinnati, OH | $840 | 15.10% | $1,080 | 14.90% |

| 67 | Syracuse, NY | $840 | 15.10% | $980 | -2.00% |

| 69 | Rochester, NY | $830 | 13.70% | $980 | 15.30% |

| 70 | Laredo, TX | $820 | 10.80% | $970 | 15.50% |

| 71 | Reno, NV | $810 | 14.10% | $1,210 | 15.20% |

| 72 | Des Moines, IA | $800 | 12.70% | $840 | 3.70% |

| 73 | St Louis, MO | $790 | 12.90% | $1,110 | 11.00% |

| 74 | Arlington, TX | $780 | 14.70% | $1,040 | 11.80% |

| 74 | Chattanooga, TN | $780 | 13.00% | $820 | 9.30% |

| 76 | Glendale, AZ | $770 | 5.50% | $940 | 4.40% |

| 76 | Knoxville, TN | $770 | 14.90% | $910 | 13.80% |

| 76 | Norfolk, VA | $770 | 11.60% | $950 | 5.60% |

| 79 | Cleveland, OH | $760 | 15.20% | $840 | 15.10% |

| 80 | Augusta, GA | $750 | 15.40% | $810 | 6.60% |

| 80 | Bakersfield, CA | $750 | 4.20% | $900 | 5.90% |

| 82 | Lexington, KY | $740 | -7.50% | $950 | 2.20% |

| 83 | Winston Salem, NC | $730 | 7.40% | $800 | 15.90% |

| 84 | Tallahassee, FL | $720 | 14.30% | $850 | 6.30% |

| 85 | Indianapolis, IN | $710 | 14.50% | $800 | 14.30% |

| 86 | Columbus, OH | $700 | 2.90% | $1,050 | 5.00% |

| 86 | Greensboro, NC | $700 | 11.10% | $810 | 0.00% |

| 86 | Spokane, WA | $700 | 9.40% | $900 | 7.10% |

| 89 | Memphis, TN | $690 | 13.10% | $750 | 15.40% |

| 90 | Oklahoma City, OK | $670 | 11.70% | $800 | 3.90% |

| 91 | Albuquerque, NM | $640 | 6.70% | $800 | 5.30% |

| 91 | Lincoln, NE | $640 | -5.90% | $850 | 7.60% |

| 91 | Tucson, AZ | $640 | 1.60% | $850 | 2.40% |

| 94 | El Paso, TX | $630 | -1.60% | $770 | 2.70% |

| 94 | Shreveport, LA | $630 | 10.50% | $680 | 4.60% |

| 94 | Wichita, KS | $630 | 14.50% | $720 | 10.80% |

| 97 | Akron, OH | $610 | 15.10% | $730 | 10.60% |

| 97 | Tulsa, OK | $610 | 7.00% | $750 | 2.70% |

| 99 | Lubbock, TX | $600 | 5.30% | $750 | 5.60% |

| 100 | Detroit, MI | $590 | 11.30% | $660 | 6.50% |

Prices of houses and condos across the US surged 6.3% from a year earlier, according to the Case-Shiller National Home Price Index. The index is now 6.7% above the crazy peak of “Housing Bubble 1” in July 2006 just before the hot air hissed out, and 47% above the bottom of “Housing Bust 1.” Everything spikes. Read… Update on the Most Splendid Housing Bubbles in the US

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wow, $660 for a two bedroom apartment in Detroit. Can the job picture in Detroit be that bad? Maybe rentals in Detroit are low because in the crisis you could pick up a decent single family home for $30,000. I imagine lots of investors piled in at that time.

In 2017, Detroit again made Wikipedia’s Top 50 list for murder capitals of the world. Street crime is a big deterrent to potential renters and home buyers.

Rent control in some of the country’s most popular cities keeps large sections of the rental housing stock in those cities off the market for many years at a time. New York City has had rent control since WWII; San Francisco since 1979. Former NYC mayor Ed Koch kept his rent controlled apartment in Greenwich Village when he moved into Gracie Mansion and returned to the apartment when he left office.

So why does so many people wanna live in “Frisko” aka Sanfran aka San Francisco anyway?

Adam Smith noticed something interesting when he took his de rigueur “Grand Tour” of the continent. As he moved from England to Holland to France and then south and east across Europe, at every step, things got cheaper. Problem was, people got poorer. So although the cost of living in England was higher than, say, Dalmatia, the standard of living in England was way higher. In short, people want to live in San Francisco because you have access to jobs there that pay wages way above the national median. Whether or not the housing market has overshot the number of high wage jobs is a real question, but the underlying dynamic I think is the same as the one Smith saw over two centuries ago. Or would you rather live in Scooba, Mississippi? Low taxes, low cost housing, lousy services, and scant low-paying jobs.

Hey, wait a minute. I live very near Scooba, Mississippi. Granted, I would not want to actually live in Scooba itself. I agree your choices for schools are poor, but living a short distance away there are adequate options. I work in health care and my income is 4 times what I was offered in areas like San Francisco. I have a week off every month which far exceeds anything offered in major metropolitan areas. I have spent my career here and have few regrets. There are places I would have rather lived, but an expensive area like San Fran is not one of them. Life is what you make of it. People like to believe spending a lot on taxes and living expenses makes it all worth the cost by quality of life. Not necessarily. Middle class poverty will be more pronounced in the future. Local governments have no intention to lessen your tax burden when you retire.

Well so far even with all the cuts to benefits and changing the rules, if and when you make it to retirement age in Australia it is still one of the better places to retire.

I should put two qualifications on that……………

One you have to have bought your home a while back because rents are high as a % of retirement income and it is very difficult to buy a home at today’s prices.

Two, you have to have something put away – too much and you won’t get a penny from the government and too little and you won’t be able to have a decent life.

A retired couple here can make a combined income of around A$60,000 a year and not pay any income tax. (If only one partner is retired you both get royally screwed. ) A huge break when compared to a non-retired working single person or one income household.

And each person can make about $10,000 a year from working and not see their government pensions cut. If one person makes too much and has to pay income tax and the other doesn’t, you can transfer tax credits between each other. (Only if both are retired though!!)

One area which is causing concern is that as RE prices here have soared in value and so have RE taxes. Some retired people are being forced to sell their homes as they don’t have enough income to pay the huge RE tax bills on what income they get.

Asset rich and income poor.

If one perceives oneself as being exceptional, and does what the average exceptional person does for the same circumstances – is one really exceptional?

The answer is “no” – one is just average.

I can always find a plurality of humanity to which I can compare myself and claim a higher “score” – but is that really the measure of success?

In 100 years – we will all be dead.

In 2 billion years – the sun will eat the planet.

Just perspective I suppose.

I don’t judge folks who do “less” by some measure because how I can know they are happy (or not). I can’t. I just tend my garden so to speak – and grow what I can with what I got.

All that said, I am happy – and thankful.

Regards,

Cooter

Ty, what did you shoot today?

Oh, Judge, I don’t keep score.

Then how do you measure yourself with other golfers?

By height.

Because there are two forces at work. The immediate need for a job and the acceptance that people in cities make just about to survive. The first is short term need and ever present. The second requires accepting that one is not getting stupendously rich working for a start up or even starting one. This is what leads to people just accepting their fate. They grow roots and relationships and let lack of energy and mental acuity do the rest. Some will even weave a story about how they love the weather, culture, or anything else they can think of.

Give them a few million dollars and they’ll gladly move to Timbuktu; screw the weather, culture, and whatever else you can think up.

There are too many reasons to list. If you cannot think of any or enough reasons, then clearly SF is not for you :-]

But the biggest negative – a HUGE negative – is housing cost. The amount of money you blow here on just a basic roof over your head is astounding. But then again, many units have gorgeous views of the Bay and the City (advantage of building on steep hills), and if views are important to you, and you live in a place with view, it lowers the pain every time you look out the window.

Wolf, nailed it again.

I think that housing cost has started to impact the companies directly.

Two summers ago the “top” company in my field offered me a freelance contract for 6 months with possibility of extension in SF. It was a tough decline but financially it didn’t make a lot of sense for me. They put you up but after that first period ends.. the extension and housing falls on the individual.

The few guys i know who took it, left SF immediately when the contract expired. No one stayed. The housing cost now is being incurred at the company itself, but in order to attract senior freelancers they have to pay competitive rates as well. And I’m applying this to childless millennial. imagine having to relocate families? Its not going to be a sustainable business strategy for a lot of SF firms in the long run,

Unless of course, Le Zuck adds platonic bed sharing when he unveils this hot new dating option on Facebook. Tech to the rescue as always.

Basing a (tech) company in these fairly liberal towns (cities) is also a way to bias your employees towards a political book end.

I am not judging, but as a libertarian, there is no way in hell I would EVER live in New Your, Chicago, or San Francisco – unless my only other option was homelessness.

Personally I think these companies are digging a hole they don’t realize by pushing the envelope so hard – they are one (legislative) act away from having their business models crushed – and they are fairly abusive to their (ignorant) customers.

Or maybe they win and get to do whatever they want to do and chose sides without consequence.

Will see – place your bets!

Regards,

Cooter

Problem is, is That “view” might well turn to liquefacated gunk, if Mother Gaia decides to shake off a few ‘fleas’ …

IMO SF has to be one of the worst places in the USA to live and at the top of the list of worst places in the world as well as far as cities that are considered to be ‘very liveable’.

The biggest problem with SF is that it is in California. The second biggest problem is that it in California. The third biggest problem is that it is in California.

If you want views there are a lot better places for views. If you want culture there are a lot better places for culture. If you want good weather there are a lot better places for weather.

However if you want high property prices, high taxes, high prices, a nutter for a Gov (Hey, Mr. Moonbeam), a bunch of worse than average whacko Senators and Reps in Washington all mixed in with a high risk earthquake zone along with the famous fruits, nuts, and flakes………………

Well……………what can I say!!!

I wouldn’t live in San Fran if you gave me an apartment for free; the most frequent scenery in San Fran is homeless people and drug junkies. And it doesn’t matter where you live, you will see them. I’d rather have some green scenery than crowded markets and streets.

And of course most of San Fran has had no planning; so you get narrow streets with huge number of cars. I call San Fran a death trap; if any natural disaster happens in that city, expect many people to die.

And if you drive to San Fran in the middle of the day and you need parking, then expect to pay something around $30 if you want to park even for 2 hours.

We should all list our best places to live…………………….

If I had the money and big bucks Maui would be at the top of my in the USA.

The Caribbean is nice and Barbados and BVI would top the lists.

Australia – well – it is ok, but was a lot nicer 25 to 30 years ago. Cheaper too!!

Sydney – no way; Melbourne – ok if you don’t have to use the roads or trains that often.

Japan – I’d put Sapporo in spring, summer, and fall as the best place in Japan. Fall – Yokohama or Kyoto. Winter I’d want to escape to a warmer place.

Lee,

Winter in San Francisco is beautiful. It’s sunny most of the time and warmer than in the summer. No a lot of fog. There’s a little rain every now and then, so things are green, and the dust is gone. I still swim in the Bay, and skiing is only three hours by car away. Second thoughts about your aversion to San Francisco?

No Wolf; no second thoughts :). I prefer mountain view or Sunnyvale to San Fran.

Wolf,

Nope.

IF I “had” to live in the USA and had no choice, I’d pick Maui. If continental US then I’d pick the Marco Island, Florida area.

Really, really, really rich then the Caribbean with a couple houses spread around the world.

IF in Japan I’d have one house in Sapporo and another one in Honshu – probably Chiba, Kanagawa, or Shiga Prefecture in that order.

Australia is ok if you can make it to retirement and have a few bucks. Forget Sydney though.

Again, Melbourne is ok if you don’t have to travel too much on the roads or use the trains. Just this week we have already had chaos on the trains a couple of times.

Yesterday a couple of hour delay on one of the lines and the City Loop as a result of a ‘suspicious package’ – luckily I wasn’t affected when I went to the CBD to shop. First time in a long time.

And the day before a passenger died on the train and my kid was delayed for about an hour getting home.

In US Dollar terms places probably haven’t changed much in price over the past five years as the A$ has fallen from US$1.10 at the peak to around US 75 cents now.

The Peninsula is nice but too distant from city jobs, plus traffic’s a nightmare and it’s hot.

Marin County is where it’s at.

Half an hour to S.F.jobs by ferryboat or bus, 45 minutes by car from San Rafael. Public schools here on par or far better than S.F.’s. No busing across town in parent’s cars or on MUNI. Other Marin school districts are outstanding.

Marin County’s air is cleaner than S.F., the streets are immaculate, tiny number of “homeless”, healthiest, wealthiest and best educated county in America, best county in which to raise children because they can have the same kind of childhood that we and our parents did elsewhere in America.

Expensive? Yes, but not as much as S.F. Subtract the cost of mandatory private schools in S.F. from your Marin rent and you are coming out way ahead of S.F. No car break ins, no piles of feces, few bad neighborhoods.

Don’t aim for the top in Marin it is of course expensive. The Canal, in San Rafael, the next “Mission District” has lots of industrial spaces and thousands of apartments it’s an area where illegals once lived and has lots of apartments for rent near bus lines. Other areas offer the best of small town or suburban living.

To my fellow San Franciscans who are still renting or suffering civic decay in the city, I say come on over to Marin.

One answer is San Francisco for some particular jobs/careers offers opportunities that other areas do not. Researcher graduates for example in medicine find UC Med Center one of the best places to allow them to do the kind of med research that matches their “abilities”. Despite the homelessness problems it is also a vibrant center for general arts. An example of rents: In the Dolores Park area, one bedroom “flat” (A real old pair of flats that have been subdivided into one bedroom apts: $3900 month. This is current to Jan. 2018.

Wolf, thanks for breaking out some cities in Orange Co, which is a very different market than LA.

The Anaheim results are somewhat surprising, as there are literally hundreds, if not thousands, of new rentals around Anaheim Stadium and the Platinum Triangle. I would have expected the average to be higher, especially given the high rents in LA.

Rents in the coastal areas, e.g., Huntington Beach, are again dominated by a large supply of new, high end units. Studio units are ~ $1900/month, one bedrooms ~ $2500/month and two bedrooms ~ $3300/month, plus parking and utilities. Two bedroom units adjacent to Fashion Island in Newport Beach on the top floor of a new 7 floor building are renting for over $9,000/month.

Your readers will shake their heads and say who can afford that??!! The answer is that coastal OC, as with coastal LA and SD, has a very large population of foreign-born residents, many of whom live here only a few months of the year. Their businesses often lease the units. Some markets, in particular Irvine, have a very high proportion of Asian residents, none of whom have much trouble affording the rents. Compared to the Bay Area and Hongcouver, So CA still seems reasonable by comparison.

One other comment concerns supply. Since you reside in the Bay Area, you’ve probably seen estimates from various groups claiming that California has “under-built” new homes by a large number in the past 15-20 years, so much so that we’re close to 1 million home short of what’s needed. Add in a large population of illegals who are no doubt renting the least expensive units and the upward on rents is hardly surprising. It wouldn’t surprise me if they approached Bay Areas levels before long.

I just don’t know how they sustain those prices, given that wages are the same as they were in the mid-90s.

Are people putting in bunk beds and stuffing 4 people in a room?

Yes.

Some occupations may have the same wages as the 90’s but there are very many that are much higher these days. To generalize and repeat that tired line of same wages is disingenuous.

Me and most of my friends are making more money than our parents ever did. Also, when you have dual income household (which is very often today); the ability to make a 4k-5k mortgage payment is significantly easier.

A lot of tech jobs pay *less* than they did.

And tech companies get away with it because they can.

Once in a while one of them forgets to pay their bribes though:

https://www.mercurynews.com/2018/05/01/h-1b-abuse-bay-area-tech-workers-from-india-paid-a-pittance-feds-say/

Broker Dan

No, they are not. In 2000, I had been out of college only for 2 years, and back then I could have charged at least 40% more than now I am far more experienced. When you consider my current experience, I should be making at least twice what I was making back then. True 2000 was tech bubble, but so is now. So, wages do keep going down. It makes even more interesting that I have the kind of skills that all large companies want.

Drive around Anaheim neighborhoods after work or on the weekends. It’s amazing how many cars line the streets, and how many cars they cram in driveways and front yards. I can only imagine how many people they’ve got crammed in each of those places.

Wolf, I noticed these lists don’t usually have Irvine, CA, though it has other Orange County cities (Anaheim?). Any particular reason for this? I think it’s an important market to include, given its size and concentration of wealth.

Hey look, give me a break! I just jumped through hoops to get the Anaheim and Santa Ana data included for the first time.

:-]

As you can tell, price movements are similar. The list stops making sense if it just gets stuffed with neighboring cities in the Bay Area (there are lots of cities in the Bay Area and only three are included) and Southern Cali. There are already five cities from Southern Cali on it. I might actually take one or two out to get another part of the country represented.

True, but only NY-NJ-CT has a population density similar to So CA’s. I also agree that data from Irvine is more representative of higher-end OC communities: Anaheim and Santa Ana are down-market.

Exactly. I’d love to see the data in Newport Beach but Irvine is probably the most representative of Orange County in general, as it is the business hub.

I have a theory that a large number of females in real estate also has some effects on real estate prices and rents. Women in general in my view are in the habit of overpricing anything they have, and the real value of what they are selling doesn’t matter. I’ve been dealing with a few property managers all of whom were female, and they don’t any idea what deal making is, and don’t seem to understand that the customer will make deal with someone else. On the other hand, most men negotiate, and take it easy. I personally prefer to deal with men in any deal than women. Call me whatever you want; I refuse to deal with anyone who is so rigid and wants to say my way or highway.

Oops, this was supposed to be a general reply and not a reply here.

Meanwhile in Canada

The Canadian housing market has hit an all-time (historic) high, but gains are rapidly decelerating.

http://www.betterdwelling.com

No luck with the link so I just googled the website. Just a heads up to anyone wanting to look into it.

Yes, sorry about the link. Just google ‘Better Dwelling Canada’ and follow the story. They report just facts gathered from statistical analysis, with multiple sources.

this works:

https://betterdwelling.com/

Note the article is discussing the “benchmark price” by the Canadian Real Estate Association. That “benchmark price” is based on an algorithmic theoretical home. The various real estate associations in Canada do it this way, but it’s not done this way anywhere else I know. This data is contradicted by the “average price” as well as by the Teranet Home Price Index, which operates on “sales pairs,” like the CaseShiller in the US.

I think the measures used in Canadian real estate are part of the problem. Realtors have no clue how to price anything they are selling. When I mention the prices are inflated the response I get is “as long as people are buying the price is right.” (right now my area of the nation isn’t moving any houses anymore)

A very short sighted mind set in a long term investment. Now no one knows what the Canadian market will bottom out at, because they never knew the market in the first place.

The blog post says this, “The table below shows Zumper’s list of the 100 most expensive major rental markets in the US, by median asking rents for 1-BR and 2-BR units in April, and their percentage changes compared to a year ago (use browser search box to find a city).” — obviously NOT data from Wolf.

Seems suspect to me. New England is a medium-sized and varied region. Boston and Providence, RI are all that I see on that 100 city list that are in New England. That cannot be the whole story. Cambridge, MA comes to mind, or is that included in Boston by some peculiar logic ? Or Worcester, MA ? Parts of Connecticut and some cities in ME, NH and VT come to mind too.

Yeah — I am being parochial — but that’s what it’s like being from Boston. Still, the list seems deficient to me by including places in WI, but not larger spots in New England like Hartford, CT.

Robert,

I know Hartford (pop 123K) well, we had an offices there I visited many times each year. I but I am originally from WI. I lived in NYC 30 years and finally for out. I found NE people are often intolerable.

There are ONLY 3 NE cities in the Top 50;

NYC #1,

Boston #23 (677K) and

Baltimore #29 (622K).

Milwaukee WI is #31 at 600K (1.7M metro).

Madison WI is 252K. (2x Hartford)

Dispute the east coast arrogance, the truth is that your towns are small, just your egos that are large.

http://www.politifact.com/largestcities/

There is an aspect of your criticism of my post that has much merit. Still, I am not sure that evaluating metro sizes and relevance has much, if anything, to do with ego or arrogance . . . .

Nevertheless I will restate my point with what I hope is greater clarity . . . here goes :

NEW ENGLAND is geographically small ( look at the map ) and yet has 15 million people in this small corner of our nation. That makes it denser, population-wise, than most of the geographically large mid-western states and western states. To reduce New England to merely Boston and Providence is to reduce this distinct part of the country to a caricature.

The greater Hartford area is 1.5 million people, and is dense, and is hardly comparable to Madison which you listed above.

https://en.wikipedia.org/wiki/Greater_Hartford

A population density map of the United States argues effectively that the northeast corner of the USA is under-represented in the list. And I remain unsure of how to measure ego and arrogance and include those attributes in population comparisons.

https://mapofusa.net/us-population-density-map.htm

Everyone gripes that their favorite cities are not on the list. The US is a big place. For example, there are many expensive cities in the Bay Area, but only three are on the list. And for a good reason. If every city in the Bay Area were on the list, the top 15 to 20 cities would likely be Bay Area entries. Look at the three Bay Area cities on the list as samples of the Bay Area.

The list goes by amount of rent AND by city size. For example, Cambridge, MA, which you mentioned, has a population of only 105,000 (sez Wikipedia), same size as Wichita Falls, TX, where I went to college. Wichita Falls is not on the list either.

In general, if I request that the data of a specific city is added (which I did to get Anaheim and Santa Ana on it, to get a feel for Orange County), another city will be dropped since this is a list of 100. So look at this as a sampling of the rental markets in the US. It gives you a feel for the different dynamics.

Wolf, Thanks for including San Diego on this list. As a home owner I was a bit shocked to see a 13+% YOY increase in one bedroom rentals. Here they are building lots of high density housing complexes. One in particular sited in the ‘ritzy’ Mission Valley area in named Millennium. Wonder who they are trying to attract? : ]

Wonder why the socal boom?

Several hundred thousand illegals, lack of sufficient construction for many years and a large number of temporary foreign residents in many parts of the Southlsnd.

Indeed. If you drive through formerly nice middle class single-family neighborhoods in the flat areas of Orange County, it’s not unusual to see cars parked in driveways, down both sides of the streets, and on front lawns. It’s a good bet several families are pooling their incomes and renting those homes. No wonder inventory is so tight and rents so high for SFRs in the OC.

I wouldn’t say there is a lack of construction in OC. Have you seen all the new buildings in Irvine; the “luxury apts”? Drive by John Wayne and they are everywhere.

I did see a house rent for $500 more than my PITI just down the street from me in Mission Viejo (and I bought 9 mos ago).

There is a lot of construction in the OC, but the point is, there wasn’t for many years (as well as in LA, SD, SF and other coastal areas) and it’s caught up with us.

In addition, consider the large number of foreign (non-US) buyers/renters, which I have no objection to as long as they’re legal. In 2016, over 20% of the residential real-estate transactions in California were to foreign buyers; I haven’t seen 2017 figures yet, and it’s probably lower, given China’s capital controls, but it’s still a lot.

Many of these buyers, especially Asian, either pay cash or have plenty of money to spend on rent. Many Irvine condos are purchased by parents for the children who are students at UCI and are now being rented. In my HB HOA, a house next to us sold for $900k in mid April, and after the owners moved in at the end of the month. They then left for Vietnam until September.

My point in mentioning this is that many buyers, whether in CA or FL, have lots of money and are paying cash, or can afford to pay high rents. That’s what’s different this time, and as in Toronto and Hongcouver, is driving markets much higher than would otherwise have been the case.

@HBGUy,

Yes I agree with this and see it as well. House directly across the street from my parents in Fountain Valley was bought for 1.2mil cash by an eye doctor from Vietnam. The family was here without him for a year or two and then left. It sits perfectly pristine, gardeners coming, utilities on, etc…..

Asian cash buyers simply won’t care about rates or a dip in the market.

Broker Dan, your comment about the FV home and our new neighbor’s lengthy trip to VN reminds me of the numerous home in Hongcouver that sit empty, especially condos in Richmond and New Westminster.

The BC gubment estimated a vacancy rate of at least 5.0% based on BC Hydro bills (which they own, and can get the data from) that showed little hydro usage. Again, lengthy absences mean little if you have Canadian landed immigrant or US Green Card status and can use it as a get-out-of-jail free card when needed, but remain in the old country to earn bags of yuan or whatever.

I like the list the way it is. I enjoy comparing different parts of the country. I do not need more details on southern CA or New England.

=Chicago,IL $1500=

Gold Coast and Riverdale are located in Chicago but the difference between them is bigger than between US and Zimbabwe.

The funniest thing you’ll see in Riverdale is a small number of picture-perfect houses surrounded with wasteland and ruins.

WTF ?

You look the address up on Zillow.And it turns out that some Chinese guy bought this house for $20K,restored it and now posted for-rent ads on Craigslist and elsewhere.

I don’t know whether to laugh or to cry.

Most likely this stupid Chinese investor will eventually get wise.He will hire somebody to torch his property to collect insurance.

It is not hard I guess.Riverdale is extremely vibrant area.

Where Diversity-Black P Stones vs Gangster Disciples vs Black Disciples vs Vice Lords vs Latin Kings-works !!!

Asian investors do not follow the same dynamics as we do when they buy properties or open shop in the US, Canada, Australia, Italy etc.

Always remember that.

Their main concern seems to be to get their money out of their homeland and spend it as fast as possible, even if what they do seems to us like torching wands of banknotes.

Your Riverdale homeowner reminds me of one not very far from where my grandmother lives in Northern Italy. He bought a semi-detatched house in a rapidly aging and depopulating village, all cash, and turned it into a few apartments.

Nobody is exactly sure if what he did inside is what he declared to authorities (since he paid his fees in time and again all cash authorities could not care less) but according to locals there are people coming and going in large numbers at all times. Since they mostly appear to be Chinese immigrants, generally quiet and well-behaved, nobody really complains, but everybody wonders how many tenants the landlord actually managed to cram in there.

This Chinese chap could probably solve SoCal housing affordability crisis in a relatively short timespan if left alone. Or turn the place into even more of a distopian nightmare than it already is.

> Asian investors … Their main concern seems to

> be to get their money out of their homeland and

> spend it as fast as possible,

That might be a good idea, but it’s not investment.

=Since they mostly appear to be Chinese immigrants, generally quiet and well-behaved=

=Or turn the place into even more of a distopian nightmare than it already is.=

Even their wiseguys (Triads) are quiet and well behaved.And their cases never go to court.There are no witnesses.

Because not only prospective witness but all his relatives turn up dead.

Triad youngsters covered with dragoon tattoos head-to-toe always say “Hello”.And I never heard the sound of Chinese music.

That is what I call being polite and civilized !!!

Triads vs BGD (Black Gangster Disciples).Odds are 19:1.Let’s play horses,folks.I am accepting bets !

MC01, I’m not sure what part of IOUSA you live in, but keep in mind:

1. Many Asian buyers pay cash and don’t want to be in debt.

2. To quote a review of the movie “LA Story” I read years ago, “it depicts a fool’s paradise, but given the Toronto weather, a paradise nonetheless”.

Distopian nightmare? I don’t think so.

I am in socal and we think that housing prices and rents would never go down in socal

We are different

> We are different

This time is different

does seem as rents are deflating, something about supply and demand, i think.

there’s bit of cannibalization going on.

Prosperous cities provide the best dating options for those seeking wealthy or extremely attractive partners. Young people are willing to spend a lot for this. If you do not care about this, move to the most unfashionable, but safe, place you can make a reasonable income in.

I live in Olympia , WA, an hour’s drive south of Seattle. What you say about Seattle is true. There is a forest of gleaming 40-story condo/apt. buildings going up, but all these apartments are high-end. Their target crowd is the Amazon worker making $100 grand. There is nothing being built for the middle market. And the value of homes in neighborhoods has jumped dangerously, bringing high property tax bills for the people who bought 30 years ago. Some are forced to sell because they can’t pay the taxes. When a home is sold, there are multiple bidders. All this is forcing middle-class working and retired people out of Seattle, to the suburbs. The hippies and artists that made Seattle cool are almost gone. The tech economy has changed Seattle, and taken its soul.

… the same can be said about San Francisco , NYC ( I lived in pre-gentrified NYC when Hells Kitchen was hell , a loft was an empty space above a business /factory and just waking up alive in the morning was considered a major accomplishment ) etc with cities like Denver rapidly following suit .

So aint it ironic that for all the perceived benefits of gentrification the single largest and in my opinion worst consequence is the loss of a city’s culture , character and soul .. eliminated by gentrification’s overt and blatant homogenization .

Part of your post said this : “And the value of homes in neighborhoods has jumped dangerously, bringing high property tax bills for the people who bought 30 years ago. Some are forced to sell because they can’t pay the taxes.”

A sad story — which is repeated in many high-rent areas of the USA.

Surprisingly, MA has a progressive aspect that is beneficial, in this particular case : “Tax deferral for Seniors”

http://massrealestatenews.com/massachusetts-property-tax-relief-for-seniors/

There are several “Tax relief” programs detailed in this article, and “Tax Deferral” is the largest and most effective. As a side note, this has been in effect for a long time — my first neighbor here did not pay his taxes, and they were recaptured when his house was sold after his passing.

I see my home state of Massachusetts as similar to the Accident of Birth, much like Family ( I am too fossilized to ever leave ) — and like Family, you take the bad with the good. There is A LOT I DON’T LIKE about MA, yet I will never leave. But I am proud of some of our more progressive notions and heritage.

PS; And aint it even more ironic that the very reasons people gravitate towards those overtly gentrifying cities are the very thing that is eliminated in the process .

To quote Joni ( Mitchell )

” Don’t it always seem to go

That you don’t know what you’ve got till it’s gone “

Commenters have said that RE taxes are increasing with the rise in home values. If this is the case, why aren’t see seeing huge local government surpluses? Housing prices have increased 50% in the last decade in many places. I don’t see any of that going into government budgets. I speculate there are few cities that don’t put some kind of restriction on RE tax increases.

In localities where mega landlords have a huge footprint their homes are priced for taxation at the initial purchase price. While these homes have yearly tax increases, they are never repriced when sold into another corporate entity. The homes are sold as a bulk sale of an asset class, not a specific sale of a house. This means that mega landlords can sell without triggering a repricing of their homes for tax purposes. They are getting away with avoiding what a normal home owner is subjected to by local law when they sell for a higher price.

If you look at some of the big mega landlords in FL and CA, you will see they change names almost yearly. There are reputational reasons for this, they are terrible landlords. There are tax loopholes, like the one I described. And the pass thru also avoids looking at the condition of the individual homes, which may have multiple code violations.

They are more equal than you or I.

Property taxes are typically calculated in the US and Canada using either market value assessment, or acquisition value. The latter is used in California, Nevada and Florida, among others.

The advantage of acquisition value, at least here in California, is that increases in one’s assessed value are capped at 2.0% annually. I believe it’s 3.0% in NV and FL, but they also have higher “homestead exemptions”. The benefit of this system is that for government the revenue stream is very predictable – even during the 2008-09 recession, property tax revenues were very stable in CA. For homeowners, taxes rise but predictably and not by huge amounts, barring a large addition to one’s property.

My mother lived in DC’s Maryland suburbs and was subject to “market value” assessment. The local gubment’s greed was exceeded only by its incompetence, and her taxes were higher for a home worth half what mine was worth in Orange County.

The worst example I can think of is NJ and NY. Taxes on homes there increase exorbitantly every year, and are typically 2.5-3.0% of market value. Again, comparing co-workers’ taxes to my own, they are easily double or triple what mine are in California. So much for CA having high taxes.

May God forever bless Howard Jarvis and Paul Gann, the co-authors of California’s Proposition 13!

Here is the relevant line from the City of San Francisco’s current budget:

“General Fund property tax revenues are expected to grow from a budget of $1,557 million in FY 2017‐18 to an estimated $1,851 million in FY 2021‐22.”

That’s a 19% expected increase over the coming four fiscal years. Over the past few years, they have been underestimating property tax revenue growth. Last FY, property tax revenues were 7.1% higher than budgeted. This comes despite the limits that California Proposition 13 put on increases in property taxes.

I own a 1br condo in South OC. Rancho Santa Margarita. I just looked online y’day and there’s almost no inventory available and not much building going on in my surrounding areas.

My mom lives in North County San Diego and again, almost no rental inventory and no one is building much.

My dad and I live in Vegas and they are building at every corner until the eyes meet the mountains. I’ve never seen so much building in my life.

I was in Vegas last week for a conference and yes, the amount of new construction is staggering. Then again, so was the heat, and it wasn’t yet May, let alone summer (110-115F daily, or 38-45C).

I was happy to return to coastal OC.

Wasn’t LV supposed to run out of water sometime this year???

Maybe, but there was plenty in Lake Mead last Thu, 26 Apr. And the grass – real grass – was very green in Boulder.

My girlfriend’s apartment building is next to an empty lot in San Francisco on Fell berween Filmore and Steiner (take a look). The lot has been empty since the early 70s because the building that was there burnt down. Behind her building are two empty three storey buildings one with a hot tub shack in the back with it’s roof caved in. I guess they’ve been empty since the 70s as well. If you ask around you’ll find that empty buildings litter the map in San Francisco. Gee, don’t you just love planned scarcity?

Now, I’m sure that there are plenty of empty apartments in the new developments around San Francisco as well. Maybe a major drop in rent prices (that is if we actually believed in market fundamentals for the rich) would fill these empty apartments. However some rich people would lose money and we can’t have that.

For the record, I own an apartment complex in Fort Wayne, Ind. and here rents are even lower than in Detroit.

My frustration with America’s housing policy boiled over when I read a piece about how roughly 80% of new apartment construction was for the high-end luxury market. The government holds huge responsibility for a rising share of our housing problems in low-income situations because its policies avoid dealing with the growing number of tenants that are irresponsible.

Government housing cherry-picks the best of the low-income renters providing them with very low rents and nice apartments and dumps the rest on the private sector. The following article argues the best way to address or level the playing field would be to move away from public housing and give those needing housing aid “rent only vouchers” that could be used with any landlord rather than putting these people into a quasi-government ran project.

http://brucewilds.blogspot.com/2018/02/housing-policy-feeds-and-hides-growing.html