Well, they do pay higher rates, but not to their own clients.

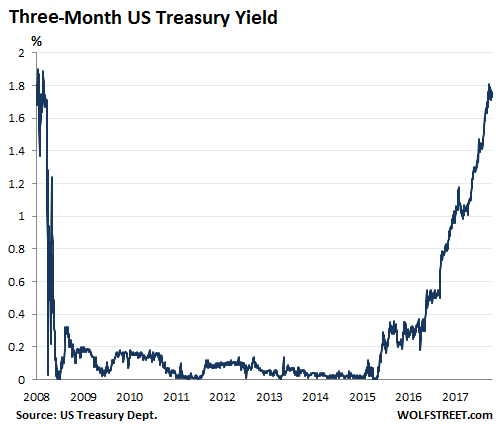

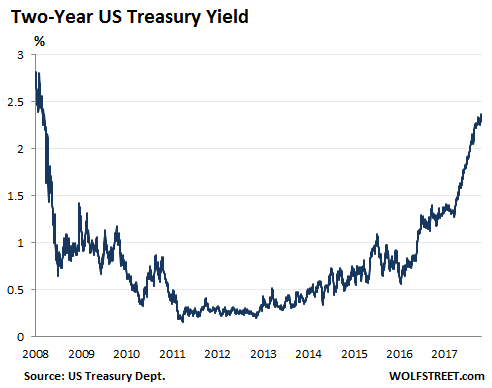

Interest rates from the very short-term through two-year maturities have surged since the Fed got serious about raising rates. In terms of the Treasury market, for example, the three-month yield is now at 1.76% and the two year yield at 2.37%:

And the interest rates that banks offer on deposits should in theory be about in line with Treasury yields in a competitive market. For example, a three-month FDIC-insured CD, which is roughly equivalent to a three-month Treasury bill in terms of risk, should offer a rate similar to the 3-month treasury yield of 1.76%. A one-year CD should offer around 2.1%, a two year CD around 2.4%.

Do they?

Well, no. Case in point: The bank, one of the largest in the country, where I have my personal and corporate checking accounts and other accounts and services – though I use other banks as well – offers on its website a 9-month CD with a rate of 0.3%, a 19-month CD with a rate of 0.70%, and a 36-month rate of 0.80%. These are piss-poor rates, given where Treasury yields are today.

The interest it pays on checking and savings accounts is so minuscule it’s not even worth looking at. Clearly, the bank doesn’t want to pay its existing clients more for the money they already have in their accounts at the bank.

But here’s the thing. The very same bank currently offers a 13-month CD at 2.2% and a two-year CD at 2.6%. But not on its website. And it didn’t tell me about it. I found it when I checked CDs at my main broker. Then I checked my other broker. Same CD offers from my bank, same rates: 2.2% for a 13-month CD and 2.6% for a two-year CD.

Brokers sell so-called “brokered CDs” like they sell bonds. But it’s a lot easier to buy CDs than bonds. And my broker doesn’t even charge a fee for selling CDs, which is not the case with bonds. And you can sell these “brokered CDs” in the secondary market through your broker – as you would sell a bond – if you need to have the cash, though in an environment of rising interest rates, selling CDs and bonds usually involves capital losses.

At my brokers, all kinds of other banks offer CDs in the one-year range at a rate of 2.1% or higher, including Morgan Stanley Bank and UBS.

And banks at my broker are offering two-year CDs at 2.6% or higher, including my own bank, plus a slew of others such as Morgan Stanley, Citibank, Goldman Sachs, Ally Bank, and so on.

And five-year CDs are offered at 3.1% by Sallie Mae Bank and Synchrony Bank, and at 3.05% by Citibank and Discover Bank.

I also know that Citibank offers its own clients ludicrously low rates on their deposits. To get Citibank to pay up for your money, you have to go to a brokered CD.

In terms of savings accounts, American Express Bank offers 1.55%. Marcus, the new retail bank Goldman Sachs launched, offers 1.60%. Both are trying to attract new depositors, and they advertise those rates on their websites, and their existing depositors get the same rates, unlike at my bank or at Citibank and others.

So it’s a cat-and-mouse game.

Clearly, banks are interested in attracting new deposits and are offering competitive rates in competitive market places. Those competitive market places are the brokers. At my two brokers, there are dozens of CDs on offer from all kinds of banks. The CD with the highest rate in a specific maturity, for example one year, is listed at the top and will sell the quickest. And no one looks at the bottom CDs that offer lower rates. That’s a competitive market.

But when your bank already sits on your money, it doesn’t feel like it needs to compete. It just wants to keep its funding costs low. And it is doing that by paying insultingly low rates on existing deposits. It will continue to do so until clients are starting to move money out of this bank to greener pastures.

Credit unions and smaller banks might offer higher rates if they feel they need to compete with the big boys for clients and deposits.

So for people hunting down higher deposit rates, the time is now to start looking for competitive market places. The fact is even the biggest banks offer competitive rates because they want and need to attract new deposits, but they’re not offering those rates to their existing clients.

Leverage – the risk it poses to banks – is why the Fed has been worried about the price bubble in commercial real estate. Read… As Malls Get Crushed, Commercial Real Estate Prices Fall to Lowest in Nearly Two Years

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Banks don’t pay higher rates because they don’t have to. Their customers are too dim to realize that better rates are available. Treasury Direct allows you to buy T-Bills in US$1000 increments. T-Bills are state and city tax exempt and pay nearly 2%.

Series I Savings Bonds through TreasuryDirect currently pay an aggregate ~2.5%, and you can buy in $50 increments (IIRC). These are also inflation-protected. In fact, I think the fixed amount of interest out of that 2.5% is 0%.

Only downside is the $10k/year purchase maximum..

But yea, either way, inflation protected savings bonds, or t bills through treasurydirect are the place to be right now. Also, they’re not vulnerable to FDIC getting wiped out.

Popular Direct (online account from Banco Popular) pays 2% on a minimum $5000 balance and accounts are FDIC insured. You can only access your money through ACH transfer but still accessible without penalty unlike a CD.

Don’t accept zero interest from your bank. Your money is getting crushed by inflation, you should get something to offset this loss.

Too few banks now a days.

Wolf,

Marcus, the Goldman Sachs retail bank doesn’t have the standard brick and mortar foot-print. They’re digital only or does Goldman plan to change that?

I’ve noticed the same thing as well, when googling FDIC-insured CD you get the really low rates (current searching for Chase) but my parents just bought the 1 year CD at 2% rate, a few months ago, when 10y Tbill was close to 2.95%

is there a fundamental difference between the FDIC-insured CD from the online search to the one offered to my parents through their personal banker at the same bank? Is one riskier then the other? How do the products differ? I don’t think they went through an outside broker per say, it was done within the bank, using their personal bankers.

ps. your topics have a scary amount of foresight.

Wells Fargo offers 2.2% on a 13-month CD today at my broker. It’s at the top of the list.

Thanks. That’s really good to know, Hopefully Fed stays the course and i take advantage of the Wells Fargo option when i get back to the states. And sorry for insisting on an answer, but is there a difference between these CDs offerings?

If they are both FDIC insured, does the interest difference reflect risk or just taking advantage of uneducated and uninformed costumers not knowing any better?

All the CDs I mentioned are FDIC insured.

The difference between a brokered CD and one offered by your bank is that you can sell a brokered CD via your broker but you’re stuck with a CD till maturity if you bought it at your bank.

FDIC limits apply to all these CDs. Read the rules and limits carefully on the FDIC website:

https://www.fdic.gov/

https://www.fdic.gov/deposit/covered/categories.html

Wolf, pardon my ignorance, but do the brokered CDs carry interest rate risk?

[Via my Fidelity account, I see a 2-year one from Morgan Stanley yielding 2.65%, which seems a decent compromise between yield and not locking up the money for too long.]

If it’s not “callable,” your coupon payment is fixed for the duration of the CD. If you don’t sell it, you will get face value at maturity. So you know exactly how much you make and what you get at the end. However, if you want to sell next year before maturity, you will likely take a capital loss because interest rates will be higher, and two-year CDs will be offered at higher rates, and so the price of yours will have to be lowered before you can sell it. But if you hold it to maturity, that won’t be an issue.

Reason for the rate difference banks like CITI firewalled off their bank deposits from their investment firm. Prior to that all assets were pooled, if the firm gets into trouble ALL assets are impaired. It’s not the product it’s where it’s held.

We got a loan offer from Marcus. They offered us up to $35K at ~24%+. There is no way we could every afford to make those payments. That should give you a sense of where your money would go.

We moved 500K from Bank of America to Marcus one year CD

when banks see this kind of movement you would think they would raise their rates but nothing seems to have changed. Oh well I don’t care as I expect to move my money next year as well.

These days, 500K is small fry. If you had several million, they’d roll out the red carpet.

How are banks making money in this environment? If they pay out over 3% on a 10-year CD, but collect only 4% on a mortgage, they only capture 1% rate spread. I think they need a 2% spread to make money. Those bank branches cost a lot of money to operate.

This suggests mortgage rates will be going up soon. We know the Fed isn’t going to stop rising interest rates on the short end.

Yes, bank interest-rate spreads are getting squeezed when the yield curve flattens – the scenario you described. This will change when long-term rates move up. But long-term rates/yields nearly always move on a delayed basis.

So if the yield curve Inverts then does a rise in the yield curve constitute Flattening? The semantics of this thing are Orwellian.

Yeah, I get a headache when I think about it too long :-]

They collect fees for originating mortgage loans and then sell the loans to Fannie and Freddie (and other suckers). I don’t think most banks hold much of a mortgage book anymore – too much money to be made shuffling papers.

If there’s an ETF for it then someone else is buying it? Banks are like public utilities, where the downside is government regulation of rates. At this point in time the Fed is setting rates, (subsidizing rate hike policy), My power company would love to buy cheap and sell dear but the PUC won’t let them.

Seems as though banks are heading for a macro S&L event, but long term rates will have trouble overcoming government supply. Remember when they sell a CD at XX% they have somewhere to invest that money at XXX%, the degree of risk is often hidden to you the buyer, or the security carries government guarantees, and the risks are hidden to them.

Honestly I really wanr at least one of these banks to go broke thwbks to their clients leaving in masse.

Since I opened a money market account with capital one last year to keep home savings and emergency savings the interest rate went from 1% to 1.5% over the span of 6 months. And there are savings accounts now offering as high as 2% plus cash incentives to deposit large sums of money.

So I agree it seems competition is alive and well for interest rates. However only for online banks.

Brick and mortar banks at this point offer nothing worth having in my opinion except warm bodies to talk to you in person and the ability to deposit large sums of cash. But even with real people to talk to, they aren’t allowed to sell you anything competative.

My local credit union is just as bad however they did offer me a far better auto loan back in 2016 than almost anywhere else.

It makes me wonder if traditional style banks will survive once the older generation afraid of online banks dies. I encourage everyone that hasn’t to open a ln online savings account for their emergency or short term stash. The next step is some CDs since most emergency savings are a bit large to give up that extra percentage point and you can probably afford to keep most of it in CDs.

This is my experience. Online banks are offering the same rates as brokers.

My bank sneakily (without any notifications during the xmas holiday period to avoid media attention) put the rate on their internet account down 25 basis points to 0.8%. Needless to say all my money was long ago put into another (australian government guaranteed) internet 90 day rolling account paying 2.7% so I didn’t really care. My money had left them ages ago when they showed just how much they cared about customers who had been banking with them for decades. They are “banking” (deliberate pun) on the fact that most customers are very “sticky” (I think the term is) and would never bother to whore their money around, so the bank is treating them like whores. Eventually the free money will dry up in a few years and the competition for deposits will be on again. It always goes in cycles. One just has to be patient. It might even become fashionable to be a “saver” again: or is that pushing credulity just a little bit too much?

And those same banks in Oz do the same thing to borrowers.

New customers get discounts on their loans at rates much lower than existing customers.

The cost in terms of fees, time, and effort to move your mortgage really isn’t worth it for most people and the banks know it so they don’t do anything.

It’s the same with Australian banks, there is no benefit in having money in the bank, so I buy gold and silver coins with extra cash, they are easy to cash in if needed, and no account keeping fees, or risk of a haircut by the bank.

It’s the same reason that cellphone service providers won’t offer their existing customers a new cheaper plan offered to new customers. They are counting on inertia and ignorance to keep existing customers at a disadvantage. Same with the banks.

Brokerage firms etc offer brokered cd’s but also marked linked CD’s where you can capture upside market potential while also having FDIC insurance on deposited amount. Good for someone wanting opportunity for market like returns without risking principle. Not good for someone who needs income as hold periods are usually multiple yrs and payout times vary. There is, however, a secondary market for these too and most are callable to a degree. And yes, these offering are usually from big banks.

As far as regular branch FDIC insured bank CD’s go, principle is often NOT at risk even if you cash out early. The “penalty” for early withdrawal is usually against the interest that would have been paid. Banks don’t want you to know that either. As far as profits go, banks make a lot more money on lower credit quality customers. Credit card rates, higher rates for auto and personal loans, variable rate HELOC’s, variable mortgage etc. 30 yr fixed mortgage rates are trending at about 4.5%.

If you want one step up the risk ladder, there are callable yield notes linked to market performance. Not FDIC insured, but simplest would be something like 15 mth paying a 8-10% rate where principle is partially protected. Meaning you get 100% principle back + coupon as long as, SP500/Russell 2000 don’t fall below 30% of initial level. Pays coupon monthly or qtrly and usually callable after either 3 mths or 6 mths if both indexes above beginning level at purchase. You are subject to principle loss if either index breaches that 30% level on a dollar for dollar basis….ie once it breaches 30% your principle takes hit for whatever index is down at maturity. I’d stay away from more exotic CYN linked to commodities etc

Wolf: You know as well as I that the survival of banks is dependent on one word: spreads. They borrow money a cheaply as possible and lend it out for as much as the market will bear. Simple. In their marketing they portray themselves as servants of the public. They are nothing of the sort. They are counter parties whose investment objectives are directly opposed to those of their “customers.” And there’s nothing wrong with that as long as its out there in the open for all to see. And it is. e.g when interest rates rise, banks take their time raising CD rates and depositors are stuck until their CD matures. But their response to declining interest rates? Generally instantaneous.

Don’t mistake me, I realize our amazing economy could not survive without banks. But they are lenders and facilitators – profit making enterprises first and foremost and definitely not partners with their customers as they would like to make us think. So if you are upset because CD rates have lagged rising interest rates during their recent spectacular rise, well, you shouldn’t be. As yields rise and the yield curve flattens banks see tough times ahead so of course cost control becomes paramount.

However, the average investor has an alternative. How does a 1.49% 7 day yield in a treasury only moneymarket fund with a weighted average maturity of 36 days sound? Not bad? And in terms of risk, which sounds better, a highly liquid IOU from the treasury which is marked to market on a daily basis or an insured fixed term bank account where the insurer has the right to delay payment at its discretion? Point taken?

This article was about how big banks are paying near-zero rates to their existing clients while offering competitive rates (in line with Treasury yields) to people who have their money elsewhere in order to attract their money. And the article showed some examples of the disconnect.

I suggest you read the article instead of just the headline. At least read the subtitle.

And you didn’t mention the interest on excess reserves the Fed pays the banks to not lend, a taxpayer-funded giveaway introduced in 2009 and enjoyed by banks the world over.

That was topic of another article, in January, what that data became available…

https://wolfstreet.com/2017/01/11/fed-pays-banks-12-billion-in-taxpayer-money-for-2016-excess-reserves/

“Why Aren’t Big Banks Paying Higher Interest Rates on Deposits though Rates Have Surged? ”

Because they don’t want anyone to pull their money out of the Rigged Stock Markets.!!!!!

Where you have a Greater Chance of Extreme Losses.!!!!!

for a friend of rick’s, i have a very special deal.

wednesday, 8pm, tmc.

some things never change.

Banks, with the cost of money between 1% and 2% are still

ripping off credit card accounts, charging 18% to 25% and

more on card balances, even to cardholders with excellent

credit. Bah humbug !

I remember the days when my parents got 6% interest on their CDs. Those days will never come back. The FED (really, all central banks) has painted itself into a corner (borrowing words from Peter Schiff) with ZIRP and money printing schemes.

anyone noticing how the central bank(s) keeps suppressing the price of gold?

Remember the days when utility preferred shares were yielding 15% plus?

For example, Ohio Edison Preferred Series E.

Most selling way under par value too……………….

It’s been that way forever and when I threaten to change banks

I feel like a heel.Online is easier as the emotion gets taken out

it.

Why?

Because a millisecond after a rate rise the rate on borrowed funds goes up, a week/month or so after a rate cut on lent funds goes down.

Same tactic with petrol companies!

I never understand people who have cash in the bank earning nothing and have credit card debts-loans outstanding. Win win for the banks. Pay them down and make the banks have to work harder to earn money.

I never understood that either. It’s like paying interest on your own money. It makes no sense.

Actually, in aggregate the money folks have on “deposit” IS the SAME money the banks loan out on credit cards, so it literally IS “paying interest on your own money” if you have both a running credit card debt balance and a bank savings balance.

Unlike some here, I think there’s more to saving money than just shopping for the best rate, term and federal guarantee. I think it makes a big difference WHO you lend to, and what THEY are going to do with YOUR money. I totally avoid the big banks and eschew the “prime” money-market funds which are all wrappers for loans to big banks as well. But as a lender I still require a competitive return. Between Treasuries and the local banks and credit unions, Treasuries and brokered CDs have been winning as Wolf points out, but I see that some credit unions now have floating-rate CDs with competitive rates, so we have some funds there too.

Strange yes, but the money in your bank is still your money, no matter what and your credit card debt is still THEIR problem. You can use your CC to buy physical gold and have it delivered to you and Central Bankers can print fiat money out of thin air and buy gold. Is it starting to make sense?

“Credit unions and smaller banks might offer higher rates if they feel they need to compete with the big boys for clients and deposits.”

My credit union gives me 0.1% on 200K in a savings account. I would note that JP Morgan sends me offers of $300 to open an checking account with them.

The markets are not not competitive and obviously these banks are flush with cash. Or it could imply they arent lending anyone money and that the new ‘recovery’ is a sham.

CIT online is offering 1.75 on a totally liquid insured money market account (not money market fund which is not FDIC insured). A no brainer. And their rates go up automatically as the Fed raises rates.

As others have referred to, there is no reason to “save” with a bank, just use a Treasury Direct account, you can choose the duration and earn the interest directly from the U.S. Treasury. If you don’t roll it over, Treasury will just put the money back into your bank account with the interest, using the magic of keystrokes. Might as well get the higher interest direct from the Print-master itself, and bypass the middleman. No more worries about whether FDIC will cover it.

Stop enabling bank speculation with your money.

1) Treasury Direct creates a lot of tax hassle.

2) Do you really want to be funding the ongoing shenanigans of Congress and Trump by lending to the U.S. Government? Isn’t there someone worth lending to who is closer to home?

It’s YOUR money. Lend it where YOU think it will be used wisely!

Wisdom Seeker’s preference list:

1) Local credit union certificates (=CDs)

2) A-rated Muni bonds from communities I want to support

3) FDIC-insured CDs from reputable smaller banks in communities I want to support

20) Treasuries including treasury money market funds

99) Prime money market funds and anything else that smells like MegaBank

T-bills (4wk or 13wk or 26wk) typically pay better rates than the brokered CDs do for the short durations. If you have a brokerage account (can be IRA) at Vanguard, they will let you buy T-bills commission-free at the ~weekly auctions (see link below for recent rates and auctions). Also, Vanguard knows how to do a seamless rollover order for maturing T-bills at auction, which several brokers will not do without a phone call and even a “cash call” or “margin call” and even the potential for margin interest for 2-3 days, which of course is a total scam but they try it anyway. At Vanguard you can roll over a T-bill by entering the order for the next auction online yourself, and the website “knows” that you will pay for the new T-bill with the old maturing T-bill, seamlessly. They call it “trading on projected cash flow”. Heck, BofA/ML-edge will not even let you buy T-bills at auction, they only do aftermarket T-bills with resulting high spreads and costs. Oh, and if you need to sell a CD early, the spread and loss is considerably higher than for selling a T-bill early.

Occasionally, a brokered CD may have a better rate for the same duration but recently not very often. Also for T-bills, you don’t need to worry about FDIC limits.

Caveat: I have not tried a T-bill rollover at Vanguard in a margin account yet. Not sure it will work as perfectly as it does on a non-margin account.

Cash management is tricky because most banks and brokers make it as hard as possible for you to get a good deal. This is a topic near and dear to my heart, so if anyone knows about other “good” brokers out there, please post them. Ameritrade and Etrade are crappy, and Bofa/ML is even worse.

Oh, and Vanguard will give you a debit card which charges against the settlement fund, which is VMFXX, which yields 1.54% as of today. That is only a hair worse than a 4wk T-bill at 1.62% (last week’s auction)

REFERENCE:

https://www.treasurydirect.gov/instit/annceresult/annceresult.htm

and everyone here does appreciate the difference between the rates and the risk involved between investing in a Treasury Money Market Account and a traditional MM account.

Off-topic: Trump nominates Richard Clarida and Michelle Bowman for the FRB board of governors, attempting to fill 2 of the 4 empty spots on the 7-personm board. All governors are automatically on the FOMC, which is the body that sets monetary policy, along with 4 rotating regional FRB presidents. Are these guys in favor of higher interest rates or not? QE or not?

QUOTE:

Richard Clarida, a noted economist who also works for a bond-fund giant, has been tapped by President Trump to be the vice chairman of the Federal Reserve.

Clarida, a Columbia University economist who also is a managing director at Pimco, puts in place an economist as a deputy to Jay Powell, the Fed chairman who’s the first noneconomist in nearly 40 years to helm the central bank.

Clarida, who served in the Treasury Department during President George W. Bush’s administration, is known for expertise on issues including monetary policy, exchange rates and international capital flows.

The White House also said it’s going to nominate Kansas banking commissioner Michelle Bowman

How far we have come…getting all excited about a 1% difference….

I have had an account with B of A for many years, mostly because I’m lazy. Years ago my bank was called “BayBank” and it became B of A. The rest of my savings is in internet banks and a credit union earning between 1.5 and 1.75%. Interestingly (pun intended?), a competitor (Citizens) is offering me $400 to open a new checking account with them and make one direct deposit. The interest rates at B of A are negligible and they are probably not much better at Citizen’s…still, $400 is tempting.

I remember having a CD in the 80’s at BayBank that paid 15%. Sigh.

Not as rosy a picture as you paint for brokered CDs. What are the premiums over face value for the bonds you saw?