Leverage is why the Fed has been worried about the bubble in CRE.

Commercial real estate loans in the US reached a record of $4.3 trillion. This amount is now 11% higher than it had been during the crazy peak of the prior commercial real estate bubble before it imploded during the Financial Crisis. In CRE, leverage is everything. Banks, particularly smaller regional banks that specialize in it, are on the hook.

Fed governors have pointed at CRE as one of the places where “elevated” prices threaten “financial stability” because of leverage and the connection to banks. CRE loans were in part responsible for the near-collapse of the financial system during the Financial Crisis, after CRE prices – the value of the collateral for those loans – turned down.

And now, these bubble prices have started to turn down once again.

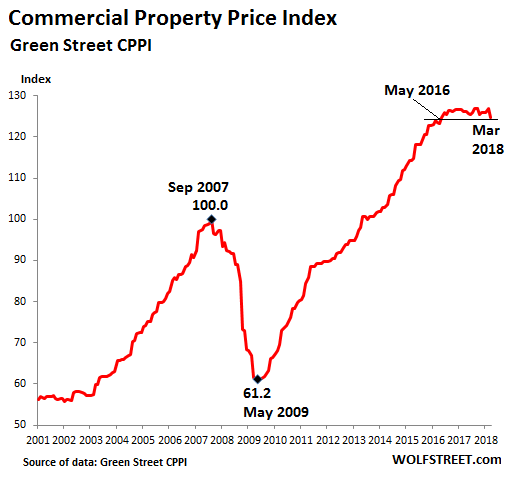

Commercial real estate prices collapsed nearly 40% during the Financial Crisis, according to the Green Street Commercial Property Price Index (CPPI). Then prices more than doubled from the low in May 2009 and peaked in September 2017, when the index was 27% above the crazy peak of the prior bubble.

But since September 2017, the index has dropped 1.7%, including a 1% drop in March from February. It is now down 2.1% from March last year and back where it had been in May 2016.

This chart of the CPPI shows the phenomenal eight-year boom that has turned into a decline:

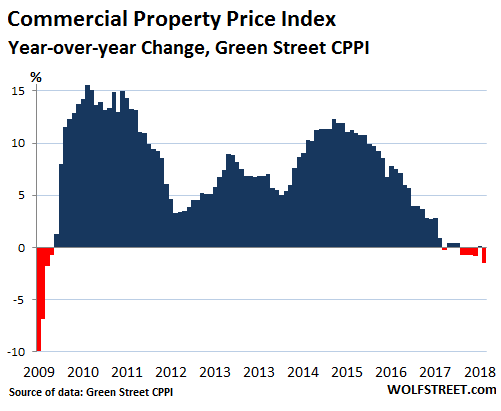

The chart below shows the percentage changes of the CPPI compared to the same month a year earlier going back to the Financial Crisis. Note the trend since 2015 of diminishing year-over-year price gains that turned into actual price declines late last year (red columns) and took a bigger dip in March:

“Over the past couple of years, commercial property pricing has cooled as investors take stock of record prices, slowing fundamentals, and higher Treasury rates,” the report said. “But the ho-hum performance in aggregate is a bit misleading….”

Turns out, one of the five major CRE sectors that make up the CPPI is red-hot, three are middling to declining, and one sector is plunging:

Industrial: Up 11% in March from a year ago. The sector includes warehouses and fulfillment centers, which are getting built, sold, and leased around the country as the retail industry, with Amazon at the top, is building up the infrastructure to handle the surge of e-commerce. This is the brick-and-mortar component of e-commerce.

Multi-family: The index for apartment properties has been flat for the past two years. It began to drop in 2017, but has recently ticked up a little, to where in March is was up 4% from the dip last year but remains below its peak two years ago.

Lodging: Hit by Airbnb, it took a big dive in 2015 and has not recovered since.

Office: The index dropped a steep 2% in March from February and is down 1% from March a year ago.

Retail: This is where the biggest issues are. The sector can be split into two categories – strip malls and malls.

- The sub-index for strip malls dropped 5% in March compared to March last year. It peaked at the end of 2016 and has since dropped 8%.

- The sub-index for Malls dropped 14% over the past 12 months, after plunging 5% in just one month, in March from February. It peaked at the end of 2016 and has since dropped 16%.

These price declines in the retail sector are starting to coalesce into a serious move – and it’s just the beginning. The mall sector will provide ample pain to lenders and holders of commercial mortgage-backed securities as this washes out over the next few years. There are always some winners anytime there is a major structural shift. And if not here, there is always Cayman Islands real estate for sale. In terms of the shift from brick-and-mortar retail to e-commerce, CRE is benefiting in the industrial sector and is getting crushed in the mall sector. But this shift is happening within the overall downturn of CRE, after a most phenomenal seven-year price surge, funded by cheap loans that are now getting a lot more expensive.

March was also a busy month for the brick-and-mortar meltdown. And private equity firms were at the helm. Read… Brick & Mortar Retail Meltdown, March Update

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Apartment buildings in Southern California are as hot as ever.

Cap rates are in the 3 to 4% range.

Any reasonable investors would consider the alternative of buying a close to 3% ten year treasury vs buying an apartment building with similar cap rate, yet lots of investors think apartment buildings are better investment, why?

The reason apartments are still roaring and resi is still roaring is because the structure to fund both is still, ultimately a put to the federal gov’t, moreso today because the GSEs are still in conservitorship and the gov’t has drained them of all their capital so any losses they take requires draws directly from the Treasury under the terms of the PSPAs. (note that the GSEs have paid back far more than they ever borrowed and it is debatable that they ever needed to borrow from the gov’t is now in question if you’re following the information coming out of Sweeney’s court which you should be. And by you I mean literally everyone, however no one is covering that in the media, shocker I’m sure.)

All of this is tantamount to massive gov’t overreach and fraud in favor of banks who now operate with impunity as since 2009 post bailout they are now the ones that control the country. If you have an industry that can hold your gov’t hostage financially, you have an industry that runs the gov’t. That’s what we have today thanks in large part to no indictments post 2009 meltdown. Systemic moral hazard with no checks and balances, the cheapest debt of all time, leads to the obvious outcome of overheated values in dollar terms. Now if you talk about the fed blowing bubbles they do it so people feel rich and spend, but it’s all a house of cards which will fail again… this time might be the last time barring massive QE program. however if rates continue to go up and the fed prints again, eventually all other countries will balk at the risk/reward when the debt/GDP ratio goes farther above 100%.. which it will. It’s a structural debt trap.

The only question is when.

What most people forget is that we have liabilities owed by our government that are not owed by the governments of other countries. Those liabilities may not be shown in the admitted “debt” that is used for debt to GDP calculations for other countries.

They are enormous. “At usdebtclock.org, federal unfunded liabilities are estimated at near $127 trillion, which is roughly $1.1 million per taxpayer and nearly double 2012’s total world output.” See link: https://www.forbes.com/sites/realspin/2014/01/17/you-think-the-deficit-is-bad-federal-unfunded-liabilities-exceed-127-trillion/#9ef19b19bf8a

We can just laugh at the stupid foreigners that foolishly lent us such sums. Unfortunately, a huge portion of those liabilities are owed to Americans. Forget about your social security and other payments in future years, unless you are lucky enough to die soon. At best, the government will engineer inflation to decrease its liabilities: thus, your social security payment may be enough to get a coffee by the time you get it.

Moreover, those liabilities ignore the debts that the government will have to assume due to our massively corrupt banking institutions. People forget that banks have a capital that is smaller than the skin of an onion, compared to the total assets that they hold.

Thus, since the assets that they hold are owed to their depositors, etc., if the bank’s investments decrease a small percentage, that decrease will make the banks insolvent: they will have investments say worth $100 billion, but they will owe their depositors and others $110 billion. Thus, the government, which has been captured by indirect “bribes” paid to U.S. politicians, will step in and pay for all of the bank’s losses, if it can.

Eventually, this whole house of cards will come down, when the world realizes that the U.S. will never be able to meet its obligations and is like the borrower that borrows from one creditor to pay another. The gig is up.

When I think about the U.S. financial situation, I am amazed at the naivette of foreigners. I guess that they really are assuming that, because we paid our debts in the past, we will be able to do so in the future.

Commercial Residentsil investors can easily lever up on their “bets” and also earn appreciation on their real estate – mostly in hot cities. Using cheap debt to to buy real estate is a great hedge against dollar devaluation thanks to tax-cut induced deficit spending.

With treasuries you generally don’t lever up and don’t benefit from appreciation and worse you’re exposed to dollar risk. So you’re stuck with your coupon rate till maturity. Not as sexy as real estate albeit with out the risk of your initial loosing value with respect to the nominal dollar , but heavily at risk to inflation. Pick your poison..

You can’t compare cap rates to treasuries. It’s not remotely the same. One is levered the other is not. Real estate in the right market has asset upside, treasuries have asset downside if dollar weakens and interest rates rise.

Talking about the leverage. Lenders can loan you 4% to find you buy houses collecting 3% rent. But they can NOT lend you 4% to find you buy treasury. You, yourslelf would NOT borrow at 4 and collect 3. This is NOT about leverage. This is you think house price will go up, and treasury will be destroyed by inflation. This is inflation trade.

“tax-cut induced deficit spending”?

In fact, the deficit spending was already there in spite of the fact that the U.S. collected more in taxes on personal income than any previous year in U.S. history.

Really now.

Great research Wolf, thanks.

I grow up in the LA area and our family owned residential income properties. The general area is built out relative to demand for SFR’s and prices are stratospheric given demand and cost of money in the general sense…how far are you willing to commute to work. For many, including the younger set and some members of “the Geritol generation”, the only viable substitute is multi family units or said another there’s up side here and perceived risk can be measured and somewhat minimized or rationalized. The other benefits are related to taxes during the holding period of and capital gains at disposition…the Greater Fool Theory applies to the latter.

The ten year “T” theoretically has no risk except to be eaten away by real inflation during the holding period in my opinion.

Something else to consider, the green back is fiat money with no intrinsic value, “in God we trust” and in the dollar we hope, as money is basically defined as, “ a medium of exchange and a unit of measurement”. Why hold a facsimile of fiat money with no intrinsic value when you can own a wealth producing assets that have utility to a growing segment of the population?

When I was valuing muti-res for a bank in LA in the late ‘70’s Caps on good properties ran 7 1/4 to 8 1/2. There’s a reason we fled California never to return.

Industrial is also getting a boost in some states from cannabis legalization.

yes , in canada also . This will be a growth area.

https://therealdeal.com/2018/02/17/canadas-pot-industry-will-need-8m-sf-of-industrial-space-by-2020/

Canada only as Sessions is not supportive of it.

The unseen risk.

DERIVATIVES.

So-called asset backed securities. These weapons of mass financial destruction have been eagerly snapped up, by the very entities that can ill afford a crash in value. Such as pension funds, insurance funds, etc.

The problem being these asset valuations are much too high. The assets supporting the debt are no longer worth the loan balance!

Unseen? The derivative sector operates outside of the normal course of regulations, without oversight. Brooksley Born while CFTC Chair attempted to regulate the derivative insanity, but was shot down by Alan Greenspan, Robert Rubin, and Larry Summers. She resigned in disgust on June 01, 1999. We all know how well that turned out!

Now it seems that round two has begun, when a tar paper shack in the Bay area is listed for over one million dollars and there is a bidding war for ownership! Residential property values have skyrocketed in the one hundreds of percents, yet real wages have grown only 2% over the same time frame. Insane valuations? You tell me!

Thank you for the Brooksley Born reference in your comment OutLookingIn.

That particular time and those others referenced created the economic world we now inhabit. The GLB-Act was in the works, but President Clinton vetoed an initial Senate Bill in May of 1999. Next, Rubin and Summers lead the way to repeal Glass-Steagall. By November that year almost all was wrapped up, but a few tidbits that needed attention still remained.

A nice gift to help finish the job was delivered to Wall Street by Congress and President Obama, when in December 2014, the ‘Cromnibus’ Spending Bill was passed. A piece of this monstrosity was written by Citigroup and it basically puts the taxpayers’ FDIC on the hook for trillions of dollars of derivatives.

Brooksley Born is a hero to me, and nineteen years ago she was trying “To Keep America Great!”

Would also applaud your reference to Brooksley Born and how horrible she was treated by those referenced above…I still vividly remember that C-Span congressional hearing when she was dealt such verbal violence by those losers….there are few in the financial world more despicable than Robert Rubin, Larry Summers and that, “…..oops! I was wrong, Alan Greenspan.” It makes my blood curdle just thinking about those idiots. It is good to see that she is still remembered.

Yes, Ms. Born should be remembered by all, along with Sheila Bair. Rubin, Sanders, Greenspan, Bernanke, Yellen- amazing. It’s easy to find their statements on Youtube videos saying that there is not RE bubble (mid-2000s), subprime mortgages are not a problem, etc. Multiple horrifically wrong statements.

Anybody who thinks the profession of economics is anything but very thin gruel should re-think.

Amen

Can someone explain how this relates to inflation being “hot”? I don’t get it at all.

Don’t know what you mean by “inflation being hot”, please don’t explain

Having a bad day with the flue. Should read “please explain”.

Sorry about that.

It’s not part of consumer price inflation, as measured by CPI or PCE. It didn’t add to them during the bubble, and it’s not subtracting from them as the bubble deflates.

Just some thoughts…

One would think this could be an area where Buffet selectively swoops in. He only invests in “things he understands”.

As opposed to being the GE savoir. I don’t think GE understands what GE does.

I don’t buy that the Fed is worried about bubbles. These boom-bust cycles created by Fed “stimulus” are, after all, the most efficient means to transfer the wealth and assets of the 99% to the Fed’s bankster accomplices. What the Fed IS worried about is being correctly blamed for the financial collapse that is coming, and worse yet, being held accountable.

They’re building like crazy in Denver this year. Between industrial buildings, data centers, hospitals, delivery centers, office buildings and apartments they’re seriously worried about finding enough skilled tradesmen to work all these jobs. At a site I’ve been at recently where they’re building a slew of office buildings in a rundown high crime part of town I’ve had a good chuckle watching these guys in suits march up and down the street taking pictures of these dilapidated businesses and houses probably trying to figure out how much to offer for them. I saw the conceptual plans and developers are out in droves looking to buy up property to turn entire areas for many blocks into fancy offices, condos, and apartments. I get a chuckle out of it as I’m not on that side of things and I wonder how much these investments will be worth in a few years as it all seems highly speculative to me partly based on the hope that the local government will expand a commuter rail line through the area. In this soon to be yuppie paradise when the wind blows just right some days you can quite easily smell the sewage treatment plant only a couple miles away. I find it an appropriate metaphorical headwind for the direction of our economy.

Retail bank branches take up a lot of commercial RE space and I wonder how long they can go on. It must cost a lot of money for Wells Fargo and BofA to carry all those branches and when I go in I rarely see more then one other person in there and lots of employees just standing around. And they have to compete with Ally, Everbank, etc…that have no physical branches. Especially now that you can take a photo of a check and deposit though phone, less need for ATM’s. Also, I was in a car dealership the other day getting my car serviced and there were few other people in there and a lot of employees standing around twiddling their thumbs. Dealerships take up a massive amount of commercial square footage.

Retail bank branches always take the best real estate. They were all overpaying for ground leases a couple of years ago but are not expanding at all anymore. Unless these banks go out of business, they are going to be paying this rent for the next 15 to 20 years. When they close, it will be easy to repurpose as they take hard corners on the busiest intersections.

And about commercial RE in the last bust in 2008. You heard and saw much more distress with residential single family houses & condos during and after the 2008 crash. Tons of foreclosures, short sales, etc… – but it seems like commercial RE didn’t get hit quite as bad even though the chart shows the dip. Residential rents actually stayed pretty strong during the crash as so many people got foreclosed on and moved out of houses and condos into apartment rentals. I did not hear about massive defaults on apartments last go around (unlike say the mid 1980’s in TX where apartment owners were mailing the keys back to banks and investors were losing their shirts). Apartments even today after their big run up seem pretty strong. I endlessly hear about shortages in affordable rental units around the country. They are building a lot of class A luxury apts in certain select cities (Seattle, Denver, Dallas, etc…) , but NO affordable stuff at all. I know a lot of apartment building owners are taking on 10 yr fixed rate loans since they are cognizant of potential for rising rates, so they can ride out a downturn. Will be interesting to see how it all plays out.

I wonder how many malls can be converted into office space? Because some of the ones going down have quite nice locations. Those with lame iocations are out of luck.

Wolf, I am a real estate developer and reached out to you about Mattress Firm prior to you writing articles on the parent company. I do not disagree that there are malls that will need to be repurposed but I still believe that commercial real estate is still one of the best investments. There are so many reasons including long-term capital gains, tax deductions, 1031 exchanges, estate planning and so much more.

During the last downturn, everyone was saying that the CMBS market was going to implode but I did not believe it. I had multiple centers with Verizon Wireless, Dunkin Donuts, Wendy’s, etc. and unless they go out of business, they are going to keep paying rent. Most leases in commercial are long-term as compared to residential. In addition, my loans and cash flow are fixed for 10 years.

The issue was in 2006-07, that the tenants and developers were developing A centers with A tenants but in B/C locations with B/C access and visibility. Those centers were not doomed because of the downturn, they were doomed because greed made developers/tenants forget fundamentals. It has always been about location, location, location.

For this reason, I was a buyer during the downturn which turned out to be very good for me. The key was that the banks stopped lending unless you were developing a single tenant or owner occupied (ridiculous in itself). Cash is king during a downturn.

So although I agree that actual value of commercial real estate will go down as interest rates go up, I think the effect is far more minimal due to long terms leases, fixed loans and stable cash flow. Unless you are selling, the value is only on paper.

Yes, during a credit crisis, cash is always king. Good deals are made in bad times. But I don’t see a credit crisis like that in the future. There is too much liquidity. So I don’t think we’re going to get that kind of unique buying opportunity again. I think the downturn is going to be slow and will drag out. You can see that in chart of the CPPI. It has spent two years topping out. Last time, it was very sudden.

That said, retail is a different story. About half of brick-and-mortar retail is doing well in terms of real estate (gas stations, car dealers, grocery stores, etc.). You can also add restaurants and bars. They’re not going to get replaced by e-commerce for now. And then there’s about half that is getting broadsided by e-commerce (department stores, clothing stores, music stores, sporting goods stores, toy stores, etc.).

So a developer might pick up a Toys R Us property in the right location, especially if it comes with a big parking lot, tear down the building, get it rezoned, and develop it as office or residential. There are a lot of opportunities of that kind when an the industry is restructuring as thoroughly as brick-and-mortar retails is right now.

Wolf, check your opening data on amount of CRE debt in commercial banks. The total CRE debt outstanding is approx $4.3 T. Banks are at $2.1 T which includes all non farm, nonresident, CLD and multi. I’m just flying back from speaking at a commercial mortgage default conference in Dallas so the numbers are fresh in my head. Thanks.

Just keep in mind that America is aging and that is where the money is in retail. Was at the mall yesterday and all the clothing retailers catering to the daisy dukes demographic were empty and the ones geared to a more conservative demographic were busy.

Aside from the ridiculous amount of groceries that we purchase, I see almost no need for the immense amounts of bricks and tilt up boxes that currently exist. Consider anything outside of a bar/restaurant as pretty much dead space. I see the need for a few pool company shops to cater to the small pool companies, and the need for a bunch of hobby specialty shops (motorcycle repair places, quad places, the obscure hobby shops (fish tanks!), scooter service places, etc). Seriously, even optical is coming undone- going to be ordering some glasses from zenni this weekend.

The poor and the really rich do bricks and mortar- the rest of the majority don’t really care anymore. I had to laugh, everything is being shipped on demand, movies, entertainment, etc.

Capital coming out the wazoo, yet no need for more of it. The Fed should be sucking money out for the next 20 years to deflate the capital bubble. Meanwhile, newly retired are finding their dollars are not going to stretch well trying to age in place- so the next migration will be old to cheaper living.

Medical inflation is insane, and so unnecessary.

Further, what happens when you have oceans of capital without great return? Yeah, malinvestment.

Game over, boomers, you lose again.

Just a reminder people. Big cities just have way too many restaurants and bars. New York alone could lose half of them and still have more than enough.

So yes, a lot of restaurants and bars are going to close down, no matter how online resistant they are, because not going out to eat or for a drink is one of the first things people does to save money during an economic crisis.

More so considering how many restaurants are barely making it and some even are operating at a loss.

I have pointed it before but since ages ago opening a restaurant in New York is a sure way to lose money.

Do remember cheap credit is becoming a thing of the past and not only retail gets affected by that.

As a friend of mine once said “Sunscreen doesn’t prevent you from catching a cold.”

So yes, being online resistant doesn’t prevent a business from failing from a different reason that online sales.