Yellen was right to brush off “transitory” factors of “low” inflation.

Consumer prices, as measured by CPI for October, rose 2.0% year-over-year. A month ago, CPI increased 2.2%. The Fed’s inflation target is 2%, but it doesn’t use CPI, or even “Core CPI” – which excludes the volatile food and energy items. It uses “Core PCE,” which usually runs lower than CPI, and if there were an accepted measure that shows even less inflation, it would use that. But it does look at CPI, and there was nothing in today’s data to stop the Fed from raising its target rate in December.

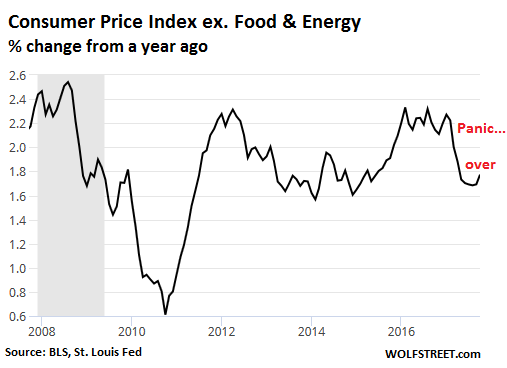

The Core CPI rose 1.8%, up a tad from September’s 1.7% increase. Core CPI has been above 2% for all of 2016 and through March 2017. In the history of the data going back to the 1960s, Core CPI had never experienced “deflation.” But when Core CPI rates retreated in the spring through August, along with other inflation measures, a sort of panic broke out in the media:

But the retreat was repeatedly brushed off as “transitory” by Fed Chair Janet Yellen and other Fed governors, starting in June, when they vowed to continue raising rates “gradually” and proceed with the QE unwind. Yellen had specifically pointed at a few of those “transitory” factors. These factors are now turning around. Core prices have re-accelerated their increases.

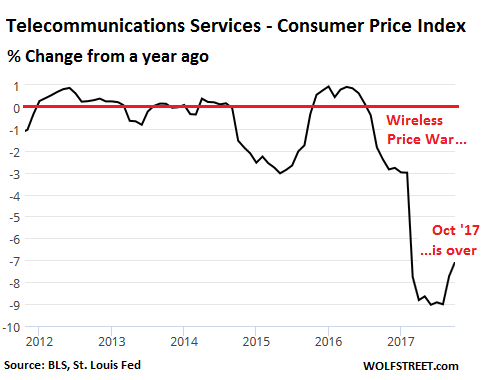

One of the “transitory” factors Yellen had pointed out specifically was telephone services, which includes the monthly costs that consumers pay for their smartphones and landlines. Those costs had plunged as a price war among wireless carriers broke out in 2016. This summer, the CPI for wireless services plunged as much as 13% year-over-year. Consumers loved it, but it couldn’t last.

Telephone services matter, with a relative importance of 2.2% in the overall CPI. The index is still down 7.1% from a year ago, with wireless down 10.8%, but the price-war-plunge has stopped, and wireless services prices increased 0.4% in October on a monthly basis, after having already risen 0.4% in September. The price index has now made a sharp hook after a hard plunge:

The auto industry is another “transitory” contributor to “low” inflation this year. Combined, new and used vehicles, including leased vehicles, have a relative importance in CPI of 6%.

The CPI for new vehicles has declined 1.4% in October year-over-year. But consumers haven’t seen these declines.

The average new vehicle transaction price, despite all the incentives in October, was up 0.3% from a year ago, according to Kelley Blue Book. Since December 2013, in less than four years, the average transaction price has risen 7%. In dollar terms, the average transaction price in December 2013 was $32,890. In October 2017, it was $35,263. An increase of $2,373 in less than four years!

This is based on what consumers are actually paying for their new vehicles. But it doesn’t enter into the price index for two reasons: one, the average transaction price is impacted by changes in mix, as consumers might buy more or less expensive models; and two, the price increases within models are whittled down in the calculation of CPI by “hedonic quality adjustments” and other adjustments. According to the Bureau of Labor of Statistics:

Quality adjustments are based on resource cost provided by manufacturers in categories such as: reliability, durability, safety, fuel economy, maneuverability, speed, acceleration/deceleration, carrying capacity, and comfort or convenience. Adjustments are also made when equipment is added or deleted from the tracked model.

This has created the phenomenon where consumers shop for a new vehicle and get sticker shock, while the CPI for new vehicles has been tame or even declined. That $2,373 or 7% surge in the average transaction price since December 2013 translates into a decrease of the CPI for new vehicles over the same period of -1.0%!

Even with this decline in CPI for new vehicles, consumers face these higher prices on the lot, and they go into a sort of rebellion. This is what started to happen last year and came into full bloom this year: consumers backed off, and automakers had to throw record incentives at their models to overcome consumer resistance.

On a monthly basis for new vehicle CPI, the low point was in July, with a monthly decline of -0.7%. Since then, the price declines have retreated. By October, the monthly decline was only -0.1%. I expect the price index to be flat or rise on a monthly basis in November. And that too would mark a turnaround from the “transitory” factors of “low” inflation.

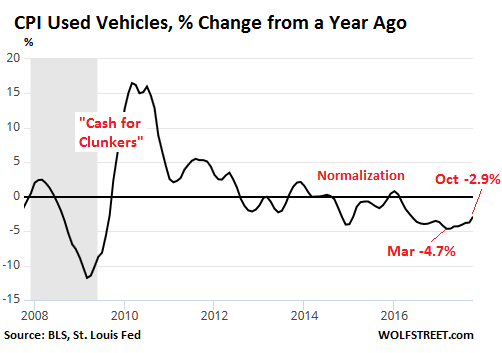

A similar scenario has played out in used vehicles. The CPI for used cars and trucks has stopped falling. I already pointed at underlying industry dynamics, including surging whole sale prices and sharply rising retail prices at the older end of the used-vehicle spectrum.

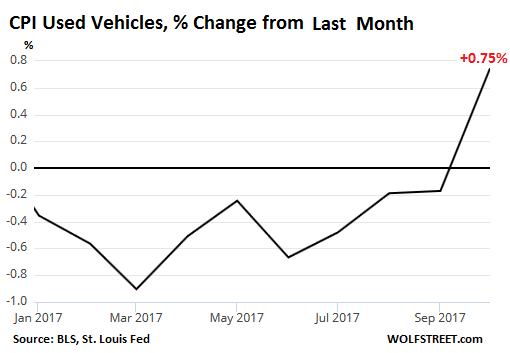

The CPI for used vehicles is now picking up these price pressures, with a jump of 0.7% in October on a monthly basis. The index remains down 2.9% from a year ago. But in March it was down 4.7%:

The chart below shows the monthly changes in the used vehicle CPI so far this year:

The Bureau of Labor Statistics today named used cars and trucks for the first time in this cycle as one of the pressures points in price increases, after the “shelter index” and “medical care,” while it still pointed at new vehicles as a source of price declines, but that too will change soon.

There is no Financial Crisis now. These are the boom times in the US economy, with the unemployment rate at the lowest level since March 2000, but subprime auto lenders see a different world. Read… Auto-Loan Subprime Blows Up Lehman-Moment-Like

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Oh what a tangled web we weave when first we practice to deceive” Sir Walter Scott.

The Fed is becoming entangled in its own web of fraudulent numbers.

“But my how vastly we improve our style once we practice for awhile”. J.R. Pope

We the little people all know that inflation is higher then stated. Food and shelter are up significantly and heating oil and gas are predicted to be rising. Add this to the increasing debt of consumers and we have a recipe for 2008 – 2009 chapter 2. Wolf is right in that the fed will most likely raise rates in December.

When CB rates are raised credit card interest will go up. Based on current rules placed on credit card interest after the financial meltdown, interest can be increased on purchases after consumer notification of the increase. Purchases on the credit card prior to the increase cannot be increased. This is a good rule to protect consumers. It is one of the rules that will be repealed if the consumer financial protection bureau is eliminated. This could be another big hit for consumers if this rule is eliminated.

Not true. Changes in the prime rate will automatically trigger an increase in your overall apr if you are on a variable rate and there is no need to inform you ahead of time that it will change as long as your rate said prime + x%. This applies retroactively to all purchases made under the variable rate.

When the CPI smokescreen is used to set short term interest rates, it guarantees to nurture another crash. If the so called media were in a “panic about low CPI”, why the same media didn’t have the curiosity and intelligence to question why LIBOR is good for medium-to-long term interest rates, while the short rates need a panel of mostly academics using said CPI.

Hmm, maybe because in a too-big-to-fail environment, everything is purely artificial?

I never understood people worring about prices not rising.

What is the benefit to society of rising prices?

As far as I am concerned, 0% inflation is ideal and if we could have prices declinig, that will be real progress.

Why are we so happy to condem deflation and applaud when prices go up? Are we brainwashed beyond repair by the media or am I stupid?

From my selfish perspective, it looks better when my hard dollars can buy more not vice versa.

Inflation has several beneficiaries.

1) Everything from GDP to corporate revenues look so much better without any real effort.

2) Higher inflation actually means an even “looser” lending environment.

3) Wages get effectively cut.

Of course if inflation, regardless if production, consumer or whatever, were honestly reported pulling these stunts would be far more difficult: there wouldn’t be much growth left after adjusting revenues for inflation and workers with CPI-tied contracts would need to be adequately compensated.

That’s why production price inflation underreports energy costs (severely so I may add) and consumer price indexes do not include food, officially because these prices are “too volatile”, an excuse which apparently doesn’t work when protesting with the utility company about the ridiculously high cost of natural gas in face of the record low costs they pay Gazprom.

You are spot on and there are is no doubt – we have been brainwashed.

What is not to like about falling prices if you are a consumer.

They say it causes people to defer purchases because things get cheaper, but I like that idea too.

The only people that don’t like falling prices are sellers and lenders who see lower revenues, and governments that have 1) already borrowed and spent at higher past prices, and 2) see lower tax revenues in future.

Deflation can also be a problem for people who pay fixed costs such as a fixed rate mortgage if their salaries are also deflated and they still need to pay those costs.

While it’s true that people resist pay cuts, they may not have much choice if the labor market is tight and you only have a choice between a pay cut or being fired.

When shopping for the kiddies this holiday season watch out for video games with micro transactions. These games can cost $80+ but the kids can’t “win” without buying stuff in the games. I’m told that the cost of “winning” can be from hundreds of dollars to thousands. Research this before buying these games for the kids.

Can be the lower dollar? The US is importing inflation from abroad.

Based on the pre-1990 official methodology, CPI-U is running near 6%.

Based on the pre-1980 official methodology, CPI-U is about 10%.

It’s nice to have measures of official data falsification so you can estimate how much the Fed is screwing you to feed their hyperrich clientele. Even though there’s really nothing you can about it.

Governments will lie to their people, but up until the late 1970s, they rarely lied to themselves. With exceptions like Russia during the first Five Year Plan or, more egregiously, China during the Great Leap Forward, states may have kept the truth from wide dissemination, but they knew what was going on. Even when no one in authority in Japan would dare, in the 1930s, mention what was actually being spent and how much in debt the nation was, the stats were kept and were known to bureaucratic insiders. It took Reagan and Thatcher to launch the age of massive self-deception in government. Today, the people who run America wouldn’t know the truth about the real conditions here if they fell over them. There has been a bipartisan escape from reality now for decades. Why it hit at that time, and why it was perpetuated by so many political parties in so many countries, historians will be arguing over (if we survive the coming crash, that is) for centuries.

“Based on the pre-1990 official methodology, CPI-U is running near 6%.

Based on the pre-1980 official methodology, CPI-U is about 10%.”

No, neither of these are remotely true.

And if you’re citing ShadowStats, which I suspect you are, they’ve been debunked too many times to count. To get “pre-1990s” numbers they take current CPI and add a flat adjustment (almost 4%). That’s NOT using “pre-1990 official methodology.” It has literally nothing to do with it.

And just on the face of it… if you believe those numbers, if EITHER of those figures were even remotely true, then our economy has been actively shrinking for decades. If the pre-1980 number is true, then our economy today is, on a real basis, about 50-60% of the size it was during the first Gulf War. Do you really believe that? To believe those numbers defies any notion of common sense.

“And if you’re citing ShadowStats, which I suspect you are, they’ve been debunked too many times to count.”

Never happened, which is why you are unable to offer any citation, and ranting about it on a blog proves nothing. It’s only natural that those who have bought into the official pretences would have a problem with it.

American Business Analytics & Research LLC might be persuaded to prove their research valid to you personally, but you will be required to pay their consulting fees and would have to concede reality besides.

“if EITHER of those figures were even remotely true, then our economy has been actively shrinking for decades.”

The shrinking of the Real Economy explains a great many things about the US. Perhaps your job will be the next to be exported.

“Never happened, which is why you are unable to offer any citation, and ranting about it on a blog proves nothing.”

https://www.usnews.com/opinion/economic-intelligence/2014/10/17/shadowstats-and-the-alternate-inflation-myth

http://econbrowser.com/archives/2008/09/shadowstats_deb

http://globaleconomicanalysis.blogspot.com/2015/04/deconstructing-and-debunking-shadowstats.html

https://azizonomics.com/2013/06/01/the-trouble-with-shadowstats/

https://voxrationalis.wordpress.com/2011/05/15/the-absurdity-of-shadowstats-inflation-estimates/

https://traderscrucibledotcom1.wordpress.com/2011/02/01/why-shadow-government-statistics-is-very-very-very-wrong/

“It’s only natural that those who have bought into the official pretences would have a problem with it.”

No, I have a problem with it because it’s so laughably wrong it’s hard to believe anyone with an iota of critical thinking skills could believe it.

“American Business Analytics & Research LLC might be persuaded to prove their research valid to you personally, but you will be required to pay their consulting fees and would have to concede reality besides.”

I don’t need their research proved– it’s demonstrably false. But nice try.

And here’s a quote from John Williams himself: “I’m not going back and recalculating the CPI. All I’m doing is going back to the government’s estimates of what the effect would be and using that as an ad factor to the reported statistics.”

Some proprietary method! But thanks for the laugh, Walt. I’m sure it took everything he learned with his BA in economics to come up with that methodology.

“The shrinking of the Real Economy explains a great many things about the US. Perhaps your job will be the next to be exported.”

So you think the size of the US economy has shrunk– not on a per capita basis, but on a total, real basis– from 1990 to today? You think, as ShadowStats explicitly states, that we’ve been in recession every single year since 1988?

And you have the gall to say that I need to concede reality? You make Donald Trump seem humble.

According to ShadowStats, inflation ran at 380% between 1990 – 2010, while CPI was about 70%. Now, 380% is almost 5x.

A $3.30 gallon of milk cost $0.70 in 1990?

A $2.80 gallon of gas cost $0.60 in 1990?

A $7 six-pack of Budweiser cost $1.50 in 1990?

A $500,000 house cost $100,000 in 1990? (<— that's not even true in San Francisco, let alone in aggregate around the country)

Please, name me a handful of big ticket items that have gone up five-fold since 1990. I won't hold my breath. Heck, healthcare cost $2800/person in 1990. It cost $8400/person in 2010. That's 200%, which is an annualized rate of about 6%, and it's by far the biggest outlier, and it STILL doesn't come close to anything ShadowStats says.

By the way, a subscription to the research from "American Business Analytics & Research LLC" cost $175 in 2007. Guess how much it costs today? $175. Can you spell I-R-O-N-Y? All that massive inflation, and his price hasn't budged a single dollar.

I will reconsider.

Wages are flat and commodity prices are not surging so, to use the old terminology, this is not ‘cost push’ inflation. It may reflect, at last, monetary policy, given that Draghi has cut in half his QE and other CBs are tightening monetary policy.

I guess the risk is that CBer’s long sought ‘inflation’ might be nothing more than the final ‘transitory’ effect of 10 years of ‘temporary emergency measures’ to be followed by a collapse into debt deflation as the bottom drops out of the global economy.

Who in this forum believes that the only way money is created id via debt issued by banks, ,money supply changes by the Fed and QE?

Does the Treasury or US government create NEW money in any form or fashion?

How does the Fed/US Government engineer constant and regular price inflation?

I agree with Walter Map’s summary above. General price inflation is much more than 2%. Been to a Home Depot or Lowes lately? Priced building materials? Priced groceries, deli meat, etc. lately? Of course we all know about medical and college costs continuing to rise. And government seems to keep getting their regular tax rate increase. And utilities the same.

Inflation is probably what is driving the stock market. Money “in the know” is seeing inflation starting to accelerate. If you don’t own income producting assets (factory, rental units, etc.), the stock market is the next best place for protecting your wealth.

What about the bond market. Why isn’t it tanking? Because someone/somehow is keeping it propped up. “They” can do this in the short run as long as selling doesn’t get crazy. But all bets are off when everyone realizes how much inflation we really have.

“Priced groceries, deli meat, etc. lately?”

Interestingly enough, the basket for “meats, poultry, fish, and eggs” is about 25% higher today than it was 10 years ago.

Do the math. 1.25^(1/10) = 2.2% annualized inflation… what do you know. Pretty darn close to what the Fed has stated. And nobody ever has any evidence to the contrary. There’s no evidence of manipulation. The Fed publishes their data. It would be quite easy to prove they were manipulating the data… and yet… nobody has done it. Kind of like voter fraud– it’s just so prevalent according to the GOP that there’s virtually no real evidence of it happening at any scale, anywhere. Huh. Funny how that works.

“What about the bond market. Why isn’t it tanking? Because someone/somehow is keeping it propped up. “They” can do this in the short run as long as selling doesn’t get crazy. But all bets are off when everyone realizes how much inflation we really have.”

You’ve got this 100% backwards. It’s the stock market that is being propped up. The bond market isn’t tanking because inflation taking off is a farce. It’s not going to happen.

“The Basket” changes often in order to remove those items that exceed the forecasted estimate of fake “inflation.” Not arguing that American Business Analytics is correct in methodology, but likely closer to the truth than you and others would like to admit.

The former Iraqi propaganda minister, Baghdad Bob, would blush with shame if asked to put across the whoppers the Fed expects us to believe, such as the so-faux inflation rate. Anyone who pays rent and utilities, needs health care, sends a child to college, buys insurance, etc. knows real inflation is running much higher than our Soviet-style official statistics indicate as the Fed’s debasement of the currency destroys the purchasing power of the 99%.

And of course the end of cheap credit does causes costs to rise and helps companies to fall faster.

Raising interest rates increases CPI, Yellen knows it and she kept raising rates, knowing the outcome. There is now a tangible FED policy, she is Paul Volcker in drag, and with far less needed (at this point) to achieve her goals, she will raise until interest rates until rates and CPI are correlated which historically is around 5%. I feel this stock market and the economy will have been vaporized at 3 1/2%.

There is rampant inflation as evidenced by a half billion bid on a questionable DaVinci. We live at the moment in a universe with two separate economies – assets and labor – that share the same money. But asset prices have nothing to do with labor cost anymore – share prices are decoupled from profit and houses are decoupled from construction costs. This is corrosive and undermines the foundation of the economy e.g. it is becoming increasingly harder to build seed capital from labor and start a new business.

Considering the wide and increasing gap any correction will be painful.

“There is rampant inflation as evidenced by a half billion bid on a questionable DaVinci.”

Right, but how does high priced art inflation affect the consumer? It doesn’t. How about that gallon of milk, which has not seen these dramatic spikes of inflation that everyone says are everywhere?

“Yellen was right to brush off “transitory” factors of “low” inflation.”

Reads like clickbait! The charts you posted don’t really support the idea that the “transitory” factors have disappeared– ex food and energy clearly shows a downtrend that has had a brief halt (the ‘hook’), and you’re extrapolating that to suggest everything has all of a sudden turned around and will reverse course.

“Telephone services matter, with a relative importance of 2.2% in the overall CPI… and wireless services prices increased 0.4% in October on a monthly basis, after having already risen 0.4% in September.”

So let’s round up and say 1% over October/September. That translates to a 0.02% increase in CPI. I laughed when this was the excuse the Fed used in the fall. A 10% drop is a 0.2% drop in CPI. If there were no drop, instead of Core CPI running just under 2%, it would be running right around 2%… still significantly below the Fed’s target.

“The Core CPI rose 1.8%, up a tad from September’s 1.7% increase.”

Five straight months of 1.7%, then one month of 1.8%, and we’re off to the races?

“Core CPI has been above 2% for all of 2016 and through March 2017.”

It was above 2% for all of 2012 as well…and then spent most of 2013, 2014, and 2015 below 2%. Oil bottomed around $30 at the beginning of 2016, before climbing ~50-80% in 2016 and trading between $45-55 for most of it… which is the reason CPI was able to stay above 2% for that period. Oil dropped again this year in Q2, driving CPI below 2% again, and now it has recovered again trading at a two year high of $57, and that was barely enough to budge CPI back above 2%.

If these factors were “transitory” inflation would already be running PAST their target, and accelerating FURTHER.

If Core CPI runs at 2%, that’s still only about 2/3rds of their target (they need Core CPI to run about 3% to hit a 2% PCE deflator).

“But the retreat was repeatedly brushed off as “transitory” by Fed Chair Janet Yellen and other Fed governors, starting in June, when they vowed to continue raising rates “gradually” and proceed with the QE unwind.”

“Transitory” was first used as an excuse by the Fed in 2015 when describing the factors that were causing the Fed to miss their inflation target, after years of QE and trillions added to the balance sheet. “Transitory” was used again in 2016. And again in 2017.

You and the Fed are using “transitory” exactly wrong; the increases in CPI have been transitory, not the other way around. You’re using single data points to suggest a turnaround despite years of the same thing happening routinely, only to disappoint every single time.

I don’t doubt Yellen will raise rates, though. She’s itching and reading tea leaves to justify one– the data doesn’t support it, hasn’t supported it, and likely won’t support it.

Autos and telephone services combined weigh 8.2% of total CPI and 10.4% of Core CPI. If CPI for autos and telephone services rises 5% over a year, it would move core CPI up by 0.5 percentage points, from currently 1.8% to 2.3%.

Yellen, keep raising them rates, the higher the better.