Something is moving beneath the surface.

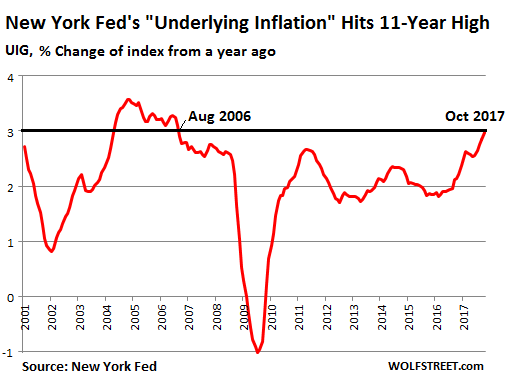

Today is inflation day. After the Bureau of Labor Statistics released its Consumer Price Index for October this morning, several other inflation gauges were released, all based on rejiggering in some way the minute disaggregated details of the BLS data pile. This includes the Atlanta Fed’s “Sticky-Price CPI,” which ticked up 2.2%, and the New York Fed’s “Underlying Inflation Gauge,” which hit the highest level since August 2006.

Inflation – when defined as increase in consumer prices – is very much in the eye of the beholder, or rather of the spender. Every household has its own inflation rate, depending on whether they have kids in college, have high medical expenses, or rent an apartment in a city where rents are high and soaring at double-digit rates.

And now that the New York Fed’s Underlying Inflation Gauge has hit an 11-year high, in a sign of things to come, we better take a look at it.

The UIG comes, like most inflation measures, in two forms: The “prices-only” UIG, which is based on 223 disaggregated price series in the CPI and is comparable to a “core” inflation measure; and the “full data set” UIG, which incorporates all the data of the “prices-only” UIG plus 123 macroeconomic and financial variables.

In October:

- The “prices-only” UIG rose 2.3% year-over-year.

- The “full data set” UIG jumped 3.0% year-over-year, the highest rate since August 2006.

This chart shows the “full-data set” UIG. Note the recent surge to 3%.

“Both UIG measures continue to indicate a firming in trend inflation,” the New York Fed says. They’re both currently estimating the CPI inflation trend “in the 2.25% to 3.00% range.”

How did they get there? The New York Fed explains its gauge:

The UIG provides a measure of underlying inflation and is defined as the persistent part of the common component of monthly inflation. The design of the UIG is based on the idea that movements in underlying inflation are accompanied by related changes in the common persistent component of other economic and financial series.

Consequently, we examine a large data set and apply modern statistical techniques, known as dynamic factor models, to extract a small number of variables that capture the common fluctuations in the series. These summary factors serve as the basis for constructing the UIG.

The “full data set” UIG, in addition to the 223 price categories in the CPI for urban consumers (CPI-U), includes 123 data sets across these different groups:

- Other inflation data, such as the PPI of finished consumer goods, capital equipment, or home health services, plus the Dallas Fed’s “Trimmed-Mean 12-month PCE inflation rate, export and import prices, etc..

- “Real Variables,” such as the new orders index, employment index, inventory indices, supplier deliveries index, and the like.

- Labor measures, such as various unemployment rates, employment-to-population ratios, average weeks unemployed, etc.

- “Money” measures, such as M1 and M2 money supply, adjusted monetary base, reserves of depositary institutions, etc.

- Financial indices, such several measures of the prices of gold, oil, and other commodities, the effective federal funds rate, Treasury yields, corporate bond yields, Libor euro dollar rates, foreign exchange rates, stock indices, and the like.

Here is the complete list of the 346 data sets.

The idea is that consumer price inflation at the surface is a result of complex interrelated dynamic processes, and if you can measure these dynamic processes, you might be able to get a better handle on the trajectory of consumer price inflation.

There are still a few Fed governors running around out there, proclaiming, inexplicably, that they’re worried about “low” inflation, such as Chicago Fed President Charles Evans today. He belongs to those whose personal income always rises faster than any inflation rate, and so no big deal for him to wish even more purchasing-power destruction upon American workers whose incomes are stagnating, and for whom the destruction of their purchasing power is real and painful on a daily basis. Maybe he should take a look at what his colleagues at the New York Fed are digging up.

Yellen was right to brush off “transitory” factors of “low” inflation. Read… Why Core Inflation is Rising & What it Means for Fed Rate Hikes

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wow. Inflation is running higher than the 10-year bond. This is very tough on anybody thinking about retirement in the next decade, anybody saving for kids education, or anybody trying to save for a house (which keeps going up in price).

Add to that, many pensions may go belly up. Social security will be cut.

This Fed will be marched over if they don’t keep up the interest rate increases.

This Fed will be marched over if they don’t keep up the interest rate increases.

The Fed will be marched over by who? ‘Muricans have sanctioned the swindles being perpetrated against them by the Fed by voting for the Republicrat duopoly’s Wall Street water carriers. The Fed has a free hand to defraud savers and pensioners with impunity, and that’s exactly what they’re doing. You reap what you vote.

For higher income retirees, Social Security benefits have already been cut by the back door through increases in Medicare premium surcharges. I am expecting my SS benefit to go DOWN next year by about $80 per month because of an adjustment to the Medicare surcharge formula which will affect hundreds of thousands of retirees. The law was passed in 2015 to take affect in 2018. I guess it is easier politically to raise Medicare premiums on “the rich” than to cut SS benefits outright. The income level at which premium surcharges start to kick in has not changed since they went into effect in 2007, in spite of significant inflation in the real economy.

Pensions and retirement savings can invest in cryptocurrencies and high-tech stocks. Problem solved.

If the FED numbers are there what are the “REAL” numbers???????

The FED has justification and then some for 50 not 25 BP in its DEC Hike.

According to that ‘UIG % change for a year ago chart’ above there will be at least several more years of rising inflation before the FED raises rates substantially (that is, if past actions match future actions).

As the Donalds ran casinos that handed out free booze, I doubt his picks for the Fed board will be against handing out free money.

There is ZERO accountability here ( as seen in the last crisis), so the party will continue, the crash will eventually occur and then excuses will be made.

Buying stocks is the only real investment for at least the next two years.

The Fed gets a lot of good press from the cheerleaders at CNBC and Bloomberg when they print stories about how great the economy is, which really means their viewership is up because of rising stock prices, which is the only kind of inflation they really care about. It’s the same principle as realtors who say it’s ALWAYS a great time to buy.

And yet commodity prices in general are quite deflated. I think you have a problem with management taking the whole pie.

++And yet commodity prices in general are quite deflated. ++

My wife and I have a small rubber farm and whereas at the start of this year the rubber price was up by well over 20% compared to the previous year (admittedly from a very low base) as of today it is now at -7% at the same time from 1 year ago.

Yet the Rubber Board keeps telling rubber farmers that there is a short fall of natural rubber compared to what the world needs. That should make the price increase but it hasn’t. Then they tell us the price is governed by the oil price. So price of oil has gone up but the rubber price has decreased.

The best price for rubber was about 11 years ago and it has never got back to those heights again but I expect there have been many increases in the price of tyres (tires if your American) for example in the past 11 years.

It just seems like constant smoke and mirrors.

Food and fuel.prices are indeed more expensive than eleven years ago.

I still cannot understand how there can be sustainable inflation when wages are stagnating. Yes, households can borrow, but then will have to pay back the loans. At the end, they will have to back off from spending. Householdsd would need old Ben’s helicopter money.

Here is why, it least for now –

household debt in the third quarter surged by $610 billion, or 5%, from the third quarter last year, to a new record of $13 trillion

Yes. And this is happening because banks are taking higher risks in issuing credit to debt-strapped consumers. And as long as banks are willing to issue ever more poorer quality debt, the party can continue. Once that stops though, watch out below. (Of course the treasury will bail out the bankers).

Yeah, that is what we thought in the 1970s when going through that newfangled Stagflation.

In reality, decreasing wages and the subsequent diminishing buying power affect whatever has been left of the shambles of the real economy the same way as inflation does.

Interesting entry, Wolf, and thanks for posting this. If inflation – the general increase in prices – hits 2% the European Central Bank is mandated to increase it’s interest rates.

Given the accumulation of sovereign indebtedness, corporate indebtedness and personal indebtedness, an increase in bank interest rates become very problematic. Of course the impact of higher bank interest rates will have an impact on bond yields. And if yields increase this means that bond prices fall – and THAT will be that.

Just remember there’s lies, there’s damn lies, then there’s the CPI. It’s been much higher than they have been saying for a while.

The insidious aspect of inflation is that it compounds over time. I use a lot of rubber bands in my business. In the mid ’90s, 50 pounds of rubber bands cost me $100. Now, same item, same vendor, they are at $349.

Something is moving under the surface…

Reminds me of making bad choices, eating or drinking too much (fed), feeling a rumble in your stomach, then an ache that needs to be released from your system one way or another…..the only thing left to do is flush afterwards……

my my what have all the CB got themselves into and to look forward to….

Inflation is mostly and more importantly about your working hour buying less goods. It means either productivity loss or denand loss for your product.

I am amused to see how the mainstream media, the FED, the government puts a positive spin on credit and also relate it to how people feel wealthy

(like houses) when the price goes up. I always think, can they really afford this? It seems a way to cover up issues of wage growth etc.

I find it interesting how little I read about how consumers, through credit cards, can create money. Am I wrong?

In the American financial system, all money available to main street is created by banks. The Fed and Treasury create money too. But the Fed’s money sits as bank reserves and the Treasury always has to absorb the money it creates back through taxes and treasury bills.

That’s why they put a positive spin on credit. It allows banks to create money which allows room for economic growth, because the cost of money (interest rates) can stay low.

And I wouldn’t say that consumers create money in themselves. More like they direct the creation of bank money by using credit cards.

I like the concept that debt is the monetization of credit. If I have credit (an income, assets, whatever), I can turn that into money (an asset), but I also take on a corresponding liability (debt).

The definition of credit is “promise to pay money”

The definition of money USED to be “promise to pay gold or other commodities”. Nowadays, money is ” what ever everybody agrees”, which is unsound.

You can buy a beer and promise to pay money, and this is buy on credit. Did you and beer seller created money? No, you created a promise and the business transaction. Therefore buying on credit do create economic activities, but promise is NOT money. Even the dollar is NOT money by “old definition” because it is the “FED owes you nothing”. It is still better than the euro which is “who owes you nothing?”. This is how corrupted the system is. If you are asking the question of “how can they afford?” you are asking the wrong question. Everybody else asks “who else will afford this for me through ever increasing inflation and asset prices”. The game rule changes from wealth creation to wealth transfer. Yes, you can NOT afford because you can NOT create wealth, but that does NOT stop you from transferring wealth from others through this unsound money/credit system.

“I find it interesting how little I read about how consumers, through credit cards, can create money. Am I wrong?’

1/2 wrong.

Their usage of the card, uses the money, created by the Card Company/Bank.

Their act of using the card, causes the Company/Bank to create the money. To pay the vendor.

If the consumer defaults, the Card Company/Bank, still has to pay the vendor, with the money it created.

When you take a Loan, the Bank, not you creates the money.

Without your input (Taking and using the Loan) however, the money does not get created.

I’ve been watching the 2s10s steadily decline from 1.28 in January to .64 yesterday. This recession indicator and the NY Fed alerting to underlying inflation surging leads me to conclude the economy is on the verge of an inflationary recession. I’d rather not see another one of those, thanks.

There seems to be some solid evidence that the country is rapidly becoming a tale of two cities, or economies.

https://www.bloomberg.com/news/articles/2017-10-23/dalio-says-fed-should-view-u-s-as-split-into-two-economies

Who will benefit more from continue low rates and rising inflation? The Bottom 60%? Or Ray Dalio?

All I see in that article is a multi-billionaire hedge fund manager talking his book. He’s using faux concern for the poor to mask his real motivation – continued asset price inflation.

If he had any grasp of the relentless erosion of purchasing power experienced by the bottom 60%, he wouldn’t be arguing that inflation is too low. He’d be shouting from the roof-tops that it’s too high.

I had the tv on while reading a WS article on car prices a day or two ago. An ad for Buick came on with their new 17% off MSRP promotion on all cars. I checked a few dealer websites for the deals and found “surprisingly” that the MSRPs are so high even a 17% discount doesn’t make the cars affordable or attractive. Everything discounted is more expensive or the quality is down significantly, so everything is really more expensive.

The thought that stooges could pass tax cuts this week, and add more debt, shows the public still has no awareness of the issues. They trust politicians, Fed, and other officials to act responsibly. I’m starting to think most people evolved from sheep, but some from wolves, and others from spineless worms.

I don’t trust any of them. But if they are going to be handing out goodies, I want some too. The carried interest tax rate is my biggest objection to the whole plan, those guys don’t lift a finger to earn that money. As far as the debt goes, I don’t care. They can’t pay it back without massive inflation and that’s not possible without a worldwide collapse. So extend and pretend is the order of the day/decade/century.

The public is aware. They just don’t know what to do that might actually effect the outcome. When was the last time a protest actually changed anything?

For reasons I dont understand, central bankers have declared th 2% inflation is good for the economy.

Plot 2% inflation on a graph and you will see the mathematical fallacy of this propsoition, it is an exponential growth, over time is doomed to mathematical failure.

Then if 2% is good, 4% got to be better? How about 100% inflation?

“For reasons I dont understand, central bankers have declared th 2% inflation is good for the economy.”

All they know is that it’s good for them. If it’s any consolation, they don’t really understand either.

Reasons you don’t understand? sure you do….the inflation rate helps amortize DEBT…..simple math……as they loot you by sending your kids to wars, you foot the bill, given a certain gdp growth, a certain borrowing requirement, and a certain inflation. just math. Only you foot the bill……for the higher ups debt = revenue. capiche?

“For reasons I dont understand, central bankers have declared th 2% inflation is good for the economy.”

Mori,

2% inflation is insensible…hardly noticed at all. Compounded over 30 years, with a bit of growth in the economy and the concomitant increase in the money supply, the “National Debt” becomes much smaller, functionally, as it is paid with devalued currency.

This worked well after WWII until the mid-70’s…the Debt to GDP ratio shrank by 60+ percent. A great hat-trick, one again attempted.

So its good to have a fixed rate mortgage. Its good to be in a job where wages respond to workers demands or even a COLA. Middle class America has been crying about the 1%/99% now they get something different (to cry about?) Inflation is typically most damaging to those on fixed incomes, because the rise in interest rates always lags the cost of living. Pensioners enjoy a higher bank deposit rate, and it’s never enough.

Core PCE seems to be a fave of the Fed. 1.9 last Decemeber flat or down every month since to 1.3 now. Do any of the inflation metrics trump the other in their minds….educated guess?

The common assumption is that if inflation jumps then so will bond yields. But I noticed that between June 1946 and June 1947 the U.S. inflation rate jumped from 3% to 20% but 10 yr treasury yields stayed under 2.35% the whole time. As long as growth remains sluggish and wages stagnate I dont expect a dramatic rise in yields.

The Fed is already telegraphing its intention to double down on its “No Billionaire Left Behind” policies of QE-to-Infinity and NIRP in the event of another recession – though by any honest measures, the real economy, as opposed to Wall Street’s rigged casino, has never recovered from the 2008 crash. And now the 99% can look forward to the Wall Street-Federal Reserve Looting Syndicate taking its financial warfare against them to a whole new level.

I am Jack’s complete lack of surprise.

http://www.zerohedge.com/news/2017-11-16/fed-hints-during-next-recession-it-will-roll-out-income-targeting-nirp