Biggest buyers of US LNG: South Korea, China, Japan, Brazil. But Mexico bought more US natural gas than all four combined.

By Wolf Richter for WOLF STREET.

There has been a lot of talk about the US supplying more liquefied natural gas (LNG) to Europe to replace a portion (a small portion) of pipeline natural gas from Russia. Tankers with US-produced LNG are already plying that route. But LNG export terminals along the Gulf Coast are running near capacity, and it takes time to build new liquefaction trains at existing export terminals and to build new export terminals and the pipeline infrastructure to supply them. So those ideas, as good as they may be, are getting complicated in a hurry.

The Status of US Natural Gas.

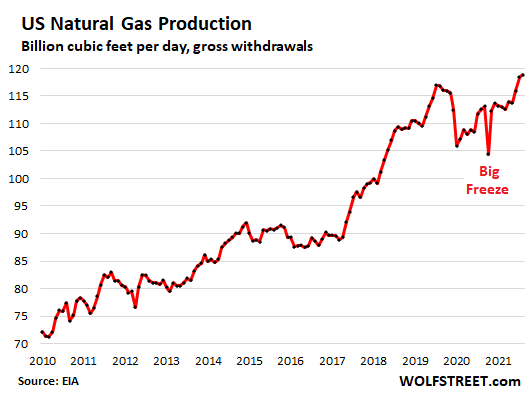

The US is the largest consumer of natural gas in the world. For decades, natural gas production in the US wasn’t enough to meet demand, and so the US imported natural gas via pipeline from Canada, and via LNG from other countries. Fracking changed the equation, natural gas production began to soar, and along the way the US became the largest producer of natural gas in the world. In December, US natural gas production hit a record 118.8 billion cubic feet per day, according to EIA data:

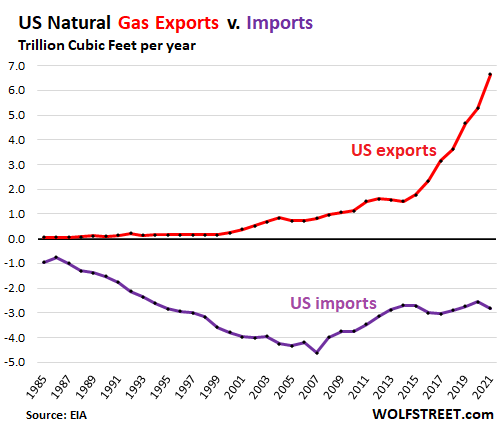

As the price of natural gas in the US collapsed in 2008 amid surging production from fracking, the industry tried to find an outlet. Companies invested in building more pipelines to Mexico, and exports of pipeline natural gas to Mexico rose. And companies invested in large-scale LNG export terminals along the Gulf Coast, and LNG exports from the first of those terminals took off in 2016.

Total exports of natural gas via pipeline and LNG (red line) spiked by 26% in 2021 to a new record of 6.65 trillion cubic feet for the year. Total imports of natural gas, denoted by a negative number (purple line) has remained in the same range since 2013.

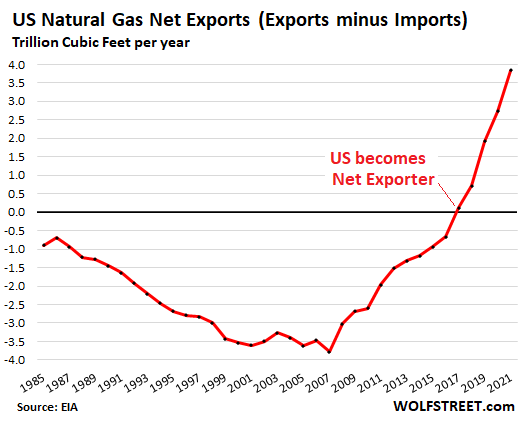

In 2017, the US became a “net exporter” of natural gas, exporting more natural gas to the rest of the world than it imported:

LNG imports essentially ceased, except during the coldest months in the winter in some New England regions that are not well connected via pipeline to producing regions in the US.

The Canada trade: The US exports natural gas to Canada and imports from Canada due to the regional pipeline infrastructure in place. About 30% of US pipeline exports go to Canada. On net, the US imports more from Canada than it exports to Canada.

The Mexico trade: The US does not import natural gas from Mexico; this is a one-way trade, with the US supplying Mexico with ever larger amounts of pipeline natural gas. About 70% of US natural gas pipeline exports go to Mexico.

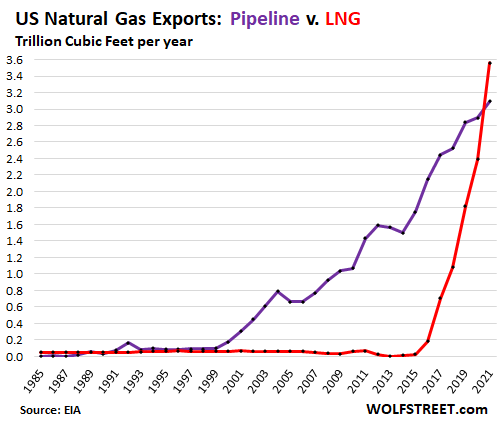

Exports via LNG (red line) in 2021 exceeded pipeline exports (purple line) for the first time:

Here is our look at The Huge Ships for the Booming LNG Trade: Designs, Technologies, and Challenges for liquefied natural gas carriers.

US LNG exports by country.

The list below shows the largest 25 recipient countries in 2021, in billion cubic feet per year, according to EIA data. South Korea has been the largest buyer of US natural gas. China has now surpassed Japan as the second largest buyer. China was a large buyer but in 2019 essentially stopped as part of the trade war, but recommenced in 2020. Brazil has emerged as the fourth largest buyer in 2021.

By comparison, in 2021, the US exported 2.16 trillion cubic feet of natural gas to Mexico via pipelines. This is about as much as the US exported in LNG to the top eight countries on this list combined.

Also note the European countries that bought US LNG in 2021.

| US Export Volumes, by largest recipients in 2021, in billion cubic feet per year | ||||

| 2019 | 2020 | 2021 | ||

| 1 | South Korea | 270 | 316 | 453 |

| 2 | China | 7 | 214 | 450 |

| 3 | Japan | 201 | 288 | 355 |

| 4 | Brazil | 54 | 112 | 308 |

| 5 | Spain | 167 | 200 | 215 |

| 6 | India | 91 | 124 | 196 |

| 7 | United Kingdom | 118 | 160 | 195 |

| 8 | Turkey | 31 | 124 | 189 |

| 9 | Netherlands | 81 | 86 | 174 |

| 10 | France | 118 | 90 | 171 |

| 11 | Chile | 90 | 81 | 122 |

| 12 | Taiwan | 27 | 64 | 99 |

| 13 | Argentina | 39 | 15 | 83 |

| 14 | Portugal | 53 | 37 | 66 |

| 15 | Poland | 38 | 37 | 56 |

| 16 | Dominican Republic | 10 | 26 | 53 |

| 17 | Pakistan | 27 | 37 | 46 |

| 18 | Greece | 15 | 48 | 40 |

| 19 | Bangladesh | 3 | 11 | 38 |

| 20 | Croatia | 0 | 3 | 36 |

| 21 | Kuwait | 10 | 17 | 34 |

| 22 | Italy | 69 | 68 | 34 |

| 23 | Lithuania | 3 | 29 | 31 |

| 24 | Jamaica | 14 | 17 | 25 |

| 25 | Singapore | 31 | 28 | 25 |

In terms of the US as a bigger supplier of LNG to Europe, well, at the moment, there is not a lot of excess capacity left in the US to export more LNG to anywhere. Major additional LNG shipments from the US to Europe would largely be a shift away from other customers. LNG export capacity continues to be ramped up in the US, and even though it’s already in progress, it still takes time. And ramping up export capacity further than is already being planned will take even more time.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Impossible solution for several years. Europe has oil/NG reserves, put in a plan to start using them. Nuclear also. Stupid decisions get stupid results.

That is when solar wind comes in handy. And corn ethanol. Also, Tesla 3 from German factory is obvious choice.

They will definitely help, but they make a terrible source for baseline power requirements.

Ethanol requires corn,corn requires fertilizer, fertilizer requires natural gas.

The role of natural gas in producing nitrogen fertilizer needs serious attention.

Nitrogen in the air, 80% of the atmosphere, is a very stable molecule, unavailable to many of our important crops in that form. Some crops such as soy and alfalfa have symbiotic bacteria in their roots that enriches the soil by breaking down the stable nitrogen. Other crops such as corn need added nitrogen.

Farmers used to rotate crops with corn being planted every 4 years. Today, both high prices and the availability of chemical fertilizer have farmers practicing a corm mono-culture. Corn production has spread into regions in the US such as northern Michigan which has naturally sandy infertile soil.

The Haber-Bosch process developed a over a century ago uses high pressure and high temperature from natural gas to catalyze atmospheric nitrogen into a form used for fertilizer. Today it is fair to say that we are literally eating fossil fuel when we enjoy corn-fed meat or drink a high-fructose Coke.

Russia is a major exporter of nitrogen fertilizer. The black soil regions of Ukraine and southern Russia are also a major exporter of wheat, ~25% of the world’s wheat exports. We can expect major increases in world cereal commodity prices and likely food shortages in many poorer countries in coming years.

Ukrainian success on the battlefield aside, the effects of this war are only just beginning.

Plants and all living things, require at least three elements: nitrogen, phosphorus and potassium.

The latter are mined, while nitrogen is produced by Haber-Bosch process.

The H-B process produces ammonia, a rather smelly product i.e. would ideally be located in sparsely populated places.

Ideally, farmers would want to apply fertilizer in one go.

I believe, crop rotation is the thing of the past. Too many hungry mouths to feed to waste agricultural land.

“Europe has oil/NG reserves”

More or less agree.

(I don’t share the 100% certitude on *oil* but my fairly casual review of most European nations’ oil exploration and exploitation histories indicate a strange…lack…making me wonder if a modern, 100% committed effort would not find significantly more European oil. I think the source of the problem historically may have been gvt ownership of all mineral rights in Europe, gutting entrepreneurial incentives for exploration (*huge* contrast with US)).

(Btw, my guess is that the above does not apply to Germany…which in WW 2 went to massive lengths to secure oil supplies from any source).

Also, certain historically large Euro oil producers (Romania) saw a *lot* of Russian backed political lobbying to greatly limit hydrocarbon development under the mostly phoney baloney rubric of “Green” concerns (Russia being the #2 oil supplier in the world, at 10 million barrels per day).

In WW2, Germany really went into great length to secure supplies: all of them from Romania, which are now historic. When Romania was lost, it was over.

Forger about finding untapped oil in Europe. What do you think it is, Saudi Arabia?

Every square kilometer is either urbanized, cultivated or nature reserve.

Europe indeed has oil/natural gas reserves*

*If you count Russia, Azerbaijan or Kazakhstan as part of Europe.

“in 2021, the US exported 2.16 trillion cubic feet of natural gas to Mexico via pipelines.”

In 2021, Mexico flared off more than ten percent of that, nearly 230 bcf.

Reuters reports that Pemex has stated in recent quarterly filings that it is flaring ‘too much’ because infrastructure to deal with gas associated with oil production is inefficient, outdated or nonexistent. Apparently they’ve tried nothing and are fresh out of ideas.

If you ask why, the conversation will be continued in Spanish, and if you speak Spanish, the conversation will be discontinued.

I’ve been to many Pemex facilities over my 30+ years in the oil/energy business. They are falling apart and, in many cases, won’t spend the money to fix them using qualified technicians. I stress the word qualified.

In my 30+ years as an overpriced consultant I have seen very many instances of deliberate and systematic mismanagement at all levels. Thusly, it is in the interests of other producers that Pemex be systematically mismanaged. Cui bono.

We are NOT presently seeking new clients. Most don’t qualify anyway.

I am delighted to have recently been informed that no, I do not actually need an outrage gland to replace the original that detonated, and have had myself removed from the waiting lists.

Been there done that. I have brought this up before but I cannot get Wolf to discriminate between P@L of core business transactions and overhead that includes the cost of incompetent middle and senior management. Lots of times the discussion is about commodity market pricing and business P@L, but when I had to price a job it was a chore to keep overhead under 110% of direct charges.

Zombie corporation comments gloss over this and everybody talks about markets and financial shenanigans, but overhead is just as good a representation of corporate condition.

dead on assessment…the monopoly is a joke…

unamused,

Yes, it’s very costly to capture and use the associated gases from oil wells. You in effect need to have two pipelines that connect the oil well to the crude-oil infrastructure and to the natural gas infrastructure, one for liquids and one for gases. And it requires additional processing equipment at the well. This is why in the US, flaring is also a huge issue.

But if the price of NG gets high enough, there is incentive to build the take-away infrastructure that allows producers to sell the associated gases. There are also some state laws that regulate/limit flaring, but not nearly enough.

Concerning your last paragraph: 🤣

“Concerning your last paragraph: 🤣”

Quiero decir, como, santa mierda.

I’m over my limit. My apologies.

Wolf, I’m sorry but all your work here is wrong. I know this because at least daily I hear that Biden shut down the energy industry.

LOL, yes, I keep hearing that too

That is why I only get my news from wolf street. Even the BBC is awash with BS .

Unamused,

With regard to the NG flaring issue more broadly, what do you think of the Houston startup that places on site equipment near wells and uses the otherwise flared gas to run bitcoin mining computers?

I am a bit surprised that raw NG can be converted to electricity via a small, cost effective eqp package on site, but apparently this is a real thing and not just a pre-prototype idea. The bitcoin aspect adds another layer of uncertainties, but cost-effective NG-2-electricity on site would seem to open many productive doors for otherwise flared gas.

The NG-bitcoin setup is apparently pretty small and relatively easy to set up.

Sounds like fuel cells. Efficient fcs are expensive and only cost-effective in certain situations.

We don’t engage clients that are into crypto because we don’t want to get into the business of extricating morons from scams, and there are hundreds of those, or have any involvement with money laundering.

That said, as for using ng for cc mining, save yourself the equipment cost and just flare it. It’s not as if catastrophic climate change can be avoided anyway, so have at it.

Beginning to sound more like the old “Unamused”.

Perhaps it took you a while to warm up.

Where’s all the fancy font and “greyscale” changes, though?

I am really interested to see if the “un-friendly to Russia ” European Countries will have to pay for Russian Gas in Roubles . Russia has declared that they do so by 3/31 if the un-friendly countries wants Russian Gas. If they do not pay will Russia follow through on the threat and cut off their gas? Getting paid in your own currency is an out-right act of war. Every one knows you can only use dollars to buy things. Who the hell does Russia think it is?

The Golden Rule clearly states that He who has the gold makes the rules, or, in this case, natural gas.

Another good reason to try to avoid economic dependence on despots. Not that it’s actually possible these days for most people no matter what you do.

The new golden rule is 5,000 rubles per gram, Russia has reintroduced the Au standard.

The hope in the west is that similar to conjuring up endless amounts of money on a keyboard, they can pull the same trick with all that glitters.

My guess is that European countries will use some form of barter with Russia. Russia is sanctioned and can’t use dollars or euros, and European countries don’t want to use Russian rubles. Russia will not supply gas unless it is paid in some form, this much is clear to everyone involved. This leaves some form of barter, like X amount of gas for Y number of BMWs, or something along these lines. Another likely possibility is that Europe will have to buy LNG from other suppliers, and Russia will sell LNG to China. This would have an effect of raising costs of NG for all consumers around the world.

It doesn’t matter what Europe want. If Russia demand payment in Rubles, Gold or Bitcoin, then that is what Europe will have to use. They’re in no position to make demands here unless they want to freeze next winter.

They will be paying in Rubles.

It’s winter there.

The game is hard ball.

The official end of winter in Europe is March 20, 2021, or about eight days ago.

Russia timed this invasion very badly. Besides winter ending and everything in Europe getting warmer, the spring thaw means their poorly maintained trucks with the cheap Chinese tires will get even more stuck in the mud of the Ukrainian Rasputitsa

Rasputitsa – is a Russian term. Not a Ukranian. Dear Gandalf – I can asure you – Russian military equipment idealy fit to this sort of roads. And who told you that Russian trucks are poorly maintained?

Europe uses gas not only to warm inhabitants but to produce goods on it’s facilities.

Are you sure that your vehicle doesn’t have tires manufactured in China? Also – by humiliating Chinese production – what goal you are trying to achive?

It’s not about this winter. It’s about next.

KB,

I tried to look up the Ukrainian term for the mud season, but that’s all I could find. Most Ukrainians do speak Russian, you know.

The business about poorly maintained and probably cheap Chinese substitutes for Russian truck tires comes from one Trent Telenko and his Twitter feed. I would post every single reference that he has posted, plus the Youtube video of his interview on ABC, but that would get snagged in the filter for this website and delay this post.

So just Google “Trent Telenko tires” you can read his Twitter posts where he explains his observations, based on his years of experience working for the Dept. of Defense as a civilian auditor with a specialization in damage assessment of all the trucks and heavy equipment returning from the US’s various wars.

Essentially, he saw all the photos and videos from this war in Ukraine (this war is one of the best visually documented ever) of Russian trucks stuck in the mud, many with flat tires, and he was even able to recognize the tread patterns of some of the tires as being of Chinese make.

From the very large number of Russian trucks with flat tires, including some on these very expensive and sophisticated Pantsir truck mounted AA systems, he concluded that the tires were going flat from a combination of being cheap substitutes (due to Russian military corruption) or lack of proper tire maintenance, resulting in severe sun damage and dry rot in the rubber.

Gandalf, one photo is just one photo. It doesn’t prove nor the bad maintenance of Russian military equipment niether allegedly “bad” quality of Chinese tires.

If you find 10-20 of the similar cases – may be.

Does the explosion photo of the Challenger say to us that US rocket equipment is bad? Obviously not.

From what I have been reading this is something of a dance going on. The natural gas contracts with Russia are long-term ones… and as such cannot be broken without MASSIVE penalty payments to the Russian oil firms. That is why Europe is still buying oil and natural gas from Russia.

BUT… those same contracts dictate what the payment terms are… and as you might guess, no one has EVER wanted those payments to be in Rubles. One simple reason… no country ever has enough Rubles to pay with since other trade with Russia is so anemic. A more difficult reason… it is easier for the oligarchs to steal the medium of exchange than the actual Rubles.

So if Russia dictates new payment terms (rather than Putin just saying that will happen) then the European countries will be able to get out of the contracts (since it is not THEM breaking the terms). That is NOT in Russia’s best interest so I doubt it will happen.

IMHO it is very simple, really. Russia will not ship gas/oil/minerals/etc to EU unless it gets paid. It can’t be paid in USD, this is clear. Currently it can’t be paid in euro neither. I believe gold transactions with Russia are also sanctioned (and EU doesn’t have enough gold – at least at the current gold price – to cover this trade). So what EU can do ? Can it buy all these goodies elsewhere ? Can it do without these goodies ? If answer to last two questions is “no”, then they will paid in rubles (or yuan, or crypto, or whatever money isn’t sanctioned).

I also can’t help noticing that Russian ruble has recovered nearly all the losses that occurred since the start of this war. This gives me an impression that I am not the only one who allows for a possibility that EU will pay in rubles, perhaps in the near term only.

I think your take on Euro land use is exaggerated.

And Europe doesn’t have to be Saudi to put a real dent in its oil/gas reliance on Russia…in addition to perhaps being insufficiently explored themselves, there is a world filled with oil exporting nations, and many other poorly explored/utilized nations.

The normally very tight demand/supply ratio in oil is at least partially due to very large hydrocarbon delivery infrastructure costs (in addition to the costs of *finding* lowest marginal cost elephant fields).

But…if Europe is serious about moving away from Russian oil dependence, they have the money to start to do so (subsidizing infrastructure and exploration, domestically and abroad).

Like NATO spending, it is a function of will and priorities for Europe.

Comment was directed at Maximus…my tracking of threads on this post hasn’t been great.

How does Europe get the Rubles to pay Russia with?

I pretty much completely disagree. First off, Russia will continue to ship oil and gas to Europe as long as it thinks it will get paid eventually. You can’t just stop petroleum from coming up out of the Earth once you have drilled for it… unless you cap the well with tons of concrete… which is expensive.

Moreover, why do you think oil and gas can’t be paid for with dollars and Euros? That is exactly the dispute right now. Petroleum has been exempt from the sanctions (thus far) and the Europeans want to pay in those currencies rather than Rubles.

All of this is just a gambit for Putin… and is mostly for internal consumption. The Europeans are just going to call his bluff.

Cas helps keep commenters with unamused’s style in business….in more ways than on WS, evidently.

Jesus (as viewed from the likes of Joel Osteen) probably helps out a lot, too.

If he isn’t the same guy, he’s becoming a damned good replacement.

Does anyone have any recommendation on the fastest cheapest and easiest way to buy/sell currency?

I was going to buy Rubles at 150…

Look for the easy way to spend rubles. Then do reverse.

It doesn’t make sense for Russia to sell energy to Europe using euros or USDs, since the foreign exchange gained from those transactions would certainly be frozen or seized in some manner. It would be tantamount to giving away energy free of charge. It was the US and NATO vassals who committed an act of war in February by freezing Russia’s foreign exchange reserves held at Western central banks.

I see this basically as a force majeure. The contract cannot be performed due to the freezing of Russia’s foreign exchange reserves. Russia cannot perform the contract without meaningful payment. As it stands right now, the euro or USD payments would end up in foreign banks where they would not be accessible to the Russian oil and gas suppliers such as Gazprom.

It would interesting to see gas prices in different parts of the world. The gas will tend to go to the highest bidder. Can you tell if Mexico is paying as much or more for gas than US consumers ? Clearly proximity to the fields in Texas is a factor for the Mexican market.

Figures from 2021 indicate Mexicans paying 50% more per unit than US consumers for natural gas. https://www.globalpetrolprices.com/natural_gas_prices/

how many mexican ‘customers’ have gas lines to a home heater? Honestly, I don’t know, but doubtful. A propane tank connected to an oven? Definitly. Please advise. I’d like to learn.

All of the iso-butane camping gas in little cans are made in South Korea no matter who the maker is, and what a trade. We ship the gas there and they ship it back.

Soon natgas will be converted to bitcoin prior to shipment, and beamed over the Starlink. Can’t stop technology.

You could see this coming way off. Next winter will be the deciding moment, who gets what. Is LNG going to be the workaround that allows NG to be a viable energy source?

The only reason we liquefy natural gas is so it can be transported in something other than a pipeline. It is very, very expensive to build a liquification plant. That’s the only way it can be sold to countries that are not connected via pipe. The shipping vessels are very expensive also. And if you are to receive LNG, you need a very, very expensive plant to get it back into gaseous form. NG is a viable energy source and will be for a very long time.

Can you explain how NG is measured AA?

While I get the cubic foot or whatever part, how is the density or weight per CF measured, etc.? And then how does this affect the pricing?

Similar with LNG, is there a specified density?

And how do both of these compare with ”propane?”

(thinking this is in your wheelhouse, eh)

thanks,

US Natural gas market is measured in therms or decatherms. One therm is 100,000 BTUs.

As RobertM700 said, natural gas is measured/valued in therms like BTU content and sold to consumers like us in cubic foot increments. Propane is a by product of natural gas processing with a different molecular structure (C3). It is a gas at room temperature and liquid by compression. Sold to you in a small pressure vessel for your BBQ or to heat your winter cabin!

LNG is a gas compound containing mostly methane and a few other similar gases (ethane, propane butane, etc) and once cleaned up (water, etc removed) is compressed and stored very cold under high pressure. It’s a good fuel but needs to be blended with air to burn. As we all know, this fuel is used everywhere. We are lucky here in the states that we have an abundant supply and manage it well.

Paging Hank Hill…

The U.S. is lucky to have so much of it, relatively speaking.

Europe can convert there Euros to Rubles and the Russians will convert some of it back to Gold, the standard that they have been on since 1897.

AA

Being an old retired refinery worker I beg to differ with you about Propane. It and it’s relative Butane are refinery by products. They may also come from NG as I’ve been out of the business 22 years. Propane is lighter and vaporizes easier, so is used during cold. While Butane is heavier, more dense, and is used during the summer.

One question you may could answer, what is the difference between compressed NG and LNG? I always thought one could compress a gas(vapor) into a liquid. I read somewhere it must be kept cold.

I also remember therms as being the heat value Xs scf of a gas/vapor. My utility company uses therms.

You can make propane from either crude oil or natural gas. Refineries make it from crude as it’s part of the cracking process. A natural gas processing plant will make it from the natural gas input stream. Same stuff chemically.

CNG is natural gas compressed into 1% of its volume and stored under pressure and used as a fuel in its gaseous form. LNG is made by supercooling natural gas into a liquid (-260 F). The differences are in the processing, storage and end use, although both are used as a fuel.

Hope this helps!

For all you smart guys :)

Ref a pipeline…

Is it owned by the same company end to end?

Or is it a third party build that collects flowage? What would the flowage rate be if so?

Thanks for the clarification Anthony A.

Anthony/Softtail Rider/Robert: This! Thanks so much for sharing your knowledge. I always learn so much from this site!

No next winter all hell might break loss.the great reset

I do agree that pipeline exports to Mexico is a relatively hidden story, considering that 70% of Mexico’s Nat Gas is supplied by the U.S.

Even more interesting is that Sempra Energy is building 2 LNG exports plants in Mexico….

Think about that for a minute… A country that is importing 70% of the Nat Gas they use, has permitted a U.S. company to build 2 LNG export facilities.

I do NOT think that most Wall St. ANALysts are factoring in how much more Nat Gas will be flowing to Mexico when both of these plant are online in a few years.

Please read: https://www.naturalgasintel.com/u-s-natural-gas-production-growth-said-pricey-efficiencies-needed-in-pipeline-permitting/

“demand is growing in the Lower 48, especially for pipeline exports to Mexico and liquefied natural gas (LNG) exports. Sempra earlier this month noted that it is seeing a “dramatic increase” in market interest for its LNG export projects under development. The company is developing the Energía Costa Azul Phase 1 and Vista Pacifico projects on Mexico’s Pacific Coast, ”

“Sempra for years has cautioned that an LNG capacity shortage was looming by the middle of the decade, and now “is coming sooner than we thought.”

EDP, AM and SHLX should do well in this environment

EDP? Do you mean EPD (Enterprise Partners, LP)?

AMLP gives you yield, no schedule k of mlps

72 price target

NG is in super cycle, bullish for next couple years

spike to 12 going to happen…

I’ve been loving it

PAA, GEL still decent buys here

FLNG

BPNP

A large LNG export terminal construction project in Kitimat, B.C. is 60% complete.

The Golden Pass LNG terminal in Sabine Pass, TX is being expanded to allow the export of 16 million tons of LNG per year in 2024. The terminal was originally built to import LNG until after shale fracking technology was improved. The Barnett Shale in Texas was one of the first natural gas shale fields to produce commercial quantities of natural gas.

There are LNG terminal projects all over the world.

A new LNG plant has opened in Louisiana (Venture LNG). Over the past 5 years several have come online along the gulf coast….Maryland opened Dominion Cove. Most were planned around 2011, 2012 when an LNG building boom happened worldwide. But since then several projects have been abandoned. Coos Bay LNG in Oregon could not get past the red tape. One of several was abandoned in Kitimat, BC. It takes years to plan and build a large LNG processing facility. They are quite similar to oil refineries and work along the same principles. The costs are enormous. Gorgon LNG in Australia spent 50 billion on a 3 train plant that took a decade to build. Meanwhile up till the Ukraine conflict, oil and gas was not looked on favorably. Why should companies invest in huge oil and gas projects when the era of carbon taxes is here? New oil and gas federal leases are being blocked or stonewalled. Why would companies want to start multi-billion dollar, decade long projects when they might end like the keystone pipeline? It is very expensive liquefying and then shipping gas around and it requires costly regassification terminals. The Euros shouldn’t expect any real relief from LNG in the short term….or probably ever.

This is really eye-opening information. I’d like to comment, but I’ve already started drinking, so use your imaginations, and since dark cynicism is my light humor, please be ever sarcastic..

“But LNG export terminals along the Gulf Coast are running near capacity…”

Yeah… about that. One reason that they are running “near capacity” is that the owners have not invested in expanding the USABLE capacity to the fullest extent. In my county on the Gulf Coast we have TWO such LNG facilities that sit absolutely idle. They were built in 2005-2007 to IMPORT natural gas because the world was awash with cheap LNG… but then fracking took hold and the good ole USA became awash with cheap LNG.

So the owners of these facilities went to the FERC to get permits to turn them into EXPORT terminals for natural gas. A lot of the LNG terminals on the Gulf Coast did the same thing. As you might guess, those permits were on the “Slow Boat to China” program under the Obama Administration. But even once they got approval under the Trump Administration (in 2019 here in my county) the owners of these facilities didn’t want to spend the money to bring them online. LNG was just too cheap at the time… and it cost less to simply pay the property tax for an idle facility than to compete in the global marketplace.

The CEO of the facilities here said the market situation is not right at the present time for making a positive final investment decision. “I think that’s just not a likely thing to develop in the near future.” That was in 2020… I wonder what he is thinking right now.

That project alone would add liquefaction and export capabilities of up to 10.85 million mt/year in just a single small port on the Gulf Coast… and like I said, this is not the only LNG export facility that is built, licensed, and idle down here.

If we have so much gas how come or bill of gas is $300 we never pay this much in gas bill .

Having natural gas piped into my home is a pretty remarkable set of events. Quality of life without water, sewage, electricity and nat gas would be so different.

“All things considered, life is good in Minneapolis.” -DanBob

Alaska’s North Slope field contains a real elephant of NG, but the cost of getting it to tidewater are staggering. I live a few miles from a relatively small LNG facility built in the ’60s by Phillips. They made incredible amounts of money shipping LNG to Japan over the years, but the cheap local source of gas is drying up.

For decades, the North Slope producers have made noises about a pipeline to a sit near the old LNG plant, and as recently as 2015 they were making plans for a huge plant, even buying up the necessary land to do it. That went away abruptly in 2017. It will take $50-60B to get the gas here. So far, no one is willing to do that. It could be viable at the right price, and it’s not over the moon high.

I can only post as a semi-ignorant consumer of natural gas for heating, though I enjoy reading and learning from what Wolf is posting here about US exports.

I’m really irritated my natural gas bills doubled compared to last winter

(approx. $950 this winter season vs. $500 last year) even though I’m right in the middle of America which feels the need to export so much NG.

Yes, this is a huge issue. Without exports, the US would be a natural gas island, and prices would be determined within the US. But now there are these growing exports, and they’re priced to deal with the global market, and that additional demand on US production is going to push prices up — and already has.

For my modest two bedroom home this winter, my nat gas bills have hit $170 per month twice now. It’s been a cold winter. Last year they topped out at $130.

My comment above doesn’t translate quite as well as it’s meant, but I do not take having a warm house in the winter for six bucks a day for granted.

My house is warm. My showers have warm water. My kitchen has a gas-fired range and oven. Yup, life is good …

Dan, I’m not sure where you might be located, but here in the Midwest the winter of ’20-’21 (last year) was colder than this winter for me. There were a few days in February ’21 where the temps reached -20F here without the wind chill. In fact when I said my winter cost doubled I used 20% LESS gas this year for the $950 compared to the $500 last year. I keep careful paperwork along with checking the gas meter regularly.

JJ,

At the Minneapolis-St. Paul airport this January it was 10.4 degrees F on average.

For 2021, it was 22.1 degrees F.

Dan,

Hah! Funny you should mention the Twin Cities. I was one of the last few babies born at St. Barnabas hospital in downtown Minneapolis before it closed.

Anyway, I’m in Missouri and it seems these past two winters are reversed in severity compared to Minnesota. Also, admittedly I have a pretty large house to heat, as well.

It’s becoming quite interesting how the warm water driven tropical monsoon storms change as they move into northern latitudes.

One has to live in, say Tucson, for a while to get the idea on those.

Then there’s that the big cold front.

Regarding this other “weather player”; as they said when I was living in Norman OK off and on a lot for years, “Nothing between here and the north pole but a 3 strand barbed wire fence that needs fixing”.

I walked to a bar one Sunday in a t-shirt, watched a football game, and came out to a 30+ degree drop in temperature.

They may have to move the National Severe Storms Lab from Norman….and who knows which way. Or open more.

We had better stop shipping pork to Iowa, etc, in the form of corn ethanol and build tech schools and wind power. Sure, those who worked their way up into high levels of management in the whole “industry” will bitch….but they won’t starve.

And that “small farmer” shit doesn’t hold water….they are as gone as unions.

BTW, good article, especially the old MC01 article as a reference and also other LNG informed commenters who showed up

Wonder what made Italy swim against the tide.

South Stream pipeline, aka. the Mediterranean brother of Nord Stream, more precisely the Trans Adriatic part of it.

Natural gas = dinosaur guts farts. Isn’t it time to ban those, too? I mean, I thought we were getting rid of all this stuff. Stick a solar panel up on the roof and heat your home already, delivered from Amazon by horse and carriage.

Propane = LPG, liquified petroleum gas.

LNG is NG extremely compressed and deeply chilled to remain liquid. Has to stay that way during transport and when transferred at the receiver.

All LNG installations: at sender, during transport and at receiver are very pricey to bild and maintain.

But you can pack a good amont in a small volume – compared to how it is used in gaseous form.

In Inuvik there is an LNG storage facility. The utility displaced much costlier diesel for power generation by installing that LNG stororage facility. Similar one was later installed in Whitehorse. More will follow, in other isolated communities, I’m sure.

Methane is natural gas, chemical formula: CH₄. These methane gas pipelines are connected to power plants. It is also piped to businesses and homes for gas heating and gas stoves.

Propane is C₃H₈.

Ethane is also a component of the gas that is taken out of the oil/gas well, chemical formula: C₂H₆. It is used as a feedstock in plastic manufacture to make polyethylene.

The gases from the well head are eventually separated by using a fractionator. Houston has a huge chemical industry due to its proximity to natural gas liquids pipelines.

Your creativity and wisdom never ceases to amaze me……honest.

It will be interesting to see what Sunni Saudi Arabia and, even more so give the focus here is on gas, Qatar and the UAE, think about Europe and the US rushing towards some kind of end agreement with the Shiite Islamic Republic of Iran?

Though the Ukraine crisis might provide Western leaders with the type of coverage they would crave to finalize such a deal, to expect increased cooperation, and no blow-back to emanate from Iran’s adversaries in response would be naive at best (as would any rosy predictions for Iranian oil and gas production to “ramp up” in a way that would ameliorate the EU’s current dependence, or even an increase in “stability” in Middle East frictions.)

What will be interesting is to see whether Russia follows though on its threats to cut gas shipments to the EU from the end of this month should the latter refuse to alter existing contract provisions and now pay for said gas in Rubles. I’ve seen elsewhere that Russia has already demanded one Indian distribution firm, GAIL, now pay for their LNG shipments in Euros, not dollars, and that GAIL seems to be entertaining this notion.

The US Petrodollar system is on the line, and on multiple fronts, should such a crack turn into a flood of non-dollar denominated oil and gas deals.

Why would Western leaders need to use some kind of “cover” (excuse being the Ukraine war) for “rushing” to finalize a deal to buy natural gas from Iran?

What kind of “blowback” would Saudi / UAE / Qatar implement that would be a positibe for them geopolitically?

Seems like Israel has a lot more skin in the game of demonizing Iran than the regional Sunni vs. Shia power rivalries.

* would be a positive

The worldwide oil prices are set by the Kingdom of Saudi Arabia. Period… End of Story. Anybody who forgets that in the oil markets will get their clocks cleaned. They have proven that over the past year or so when they restricted their own output by a million barrels a day in order to get the price of oil up from the $40 a barrel it had been sitting at.

The opposite is also true… if you can figure out what KSA will do next you can make a fortune. The Saudis view petroleum as a tool of foreign policy. Once that deal with Iran takes place you can bet your last dollar that they will flood the markets with oil in order to drive down the value of all the oil that Iran has stored right now. My guess is that the oil frackers in this country know that as well which is why they aren’t in any big hurry to invest in new wells to expand their output.

Hm, my memory is a bit hazy, but I believe the Saudis tried to influence the oil market back in 2014/2015 and failed spectacularly when the US was still pumping out shale oil to the very last investor?

I mean the US might try doing the same again in the near future if prices at the pump were to rise to unbearable levels. The Saudis might find it expedient to dump the whole petro dollar arrangement then.

Yes they did. Wolf did a quite a few articles about it as I recall.

In THAT case what the Saudis were trying to to do was three-fold… hurt the Iranians who were just re-entering the oil markets after the nuclear deal was made… find the new “clearing price” for oil at which new entrants didn’t come into the market… and teach the frackers (and their investors) to kiss the ring. It didn’t work because the banks in the American oil patch just let the fracking losers keep drilling with the expectation that they would make it up later. Everyone saw the Saudi move as a short-term thing. So the Saudis let the prices go back up.

But come 2017-2019 it darn sure worked the second time. Banks and investors in the oil patch were not willing to extend further credit to the frackers. I think there were over 600 oil patch bankruptcies as a result… including some big names.

The Saudis have a long history of this. In 1979-1981 they wanted to scuttle the solar industry… so prices dropped. 1985-1986 they wanted to undermine their enemies in Iran and the Soviet Union who were threatening them… they dropped the price of oil from $30 a barrel to $12 in just five months. They are pretty sophisticated at this… and it takes some doing because they need to balance their relations with other OPEC nations as well.

The reason that the US can’t do this is simple… we aren’t a kingdom. When the Saudis announced in December of 2020 that they were taking a million barrels a day off the market, the whole world knew that would happen quickly. But no one person or company has the authority to make such a decision in America… much less make it stick.

Iran knows how to game Saudi….consider the oil terminal attack a few days ago in Jeddah.

That attack was just a few miles north of the Formula 1 race track.

From BBC Sport: “It took four hours of meetings on Friday evening for the drivers to be persuaded they should race this weekend, after a missile attack on an oil facility nine miles from the circuit lit up the night sky on the Jeddah corniche and initially convinced many of the sport’s stars that the grand prix should be called off.”

It did go off, and Adrian Newey was smiling like a Cheshire cat in a pre-race interview on the grid. The Red Bull was set up for straight line speed at the expense of speed through slow corners. But Newey’s tactics worked as a Red Bull passed a Ferrari at the end of the race for the victory.

The switch to E10 gasoline this season has not been good for Mercedes though. The cars with Mercedes power units are now the slowest on the grid.

Ever since Speed channel was dropped from the biggest cable package I can afford, I’ve had to use the website, (which at 768kbps is also all I can afford) and it just isn’t the same. I didn’t mind getting up at 3am, but it’s just no fun now.

I read all the new rules, set-ups, and tech-bitching, but that’s about it.

But I will never forget the sound of V-10’s (rev limited to 19-20, I think) when first coming through those tall trees at Spa ’07.

My ONLY overseas trip, 3 full DAYS and not a bit more. Cost a fortune to me, but worth every penny.

Don’t know what they have now, but I also sprung for what was called a “Kangaroo” then, and was damned glad I did. Sat with 3 generations of a coastal Belgian family at their chosen spot for literally generations. Good folks. On steep hillside just before Bus Stop. Walked track for two days to finally decide on it.

Perhaps Saudi Arabia will indeed try the trick you described, but Iran may have a solution to that – they will use their proxies to attack oil facilities in Saudi Arabia (and its Sunni allies). In fact I think they will do this regardless of what Saudi Arabia does, in order to grab higher share of oil market without causing drop in oil price.

Good point. But that game plays both ways… and with 100 million barrels of oil sitting on tankers tied to piers (or at anchor)… Iran’s oil is a lot more exposed to attack than Saudi Arabia’s. The Israeli’s are not a client or proxy of Saudi Arabia, but their ability (and willingness) to conduct sabotage operations inside Iran is “robust.” The Israeli’s have no more interest in Iran getting a ten billion dollar windfall on day one than the Saudi’s do.

That the US apparently finds a need to strike a deal with pariah Iran to impose sanctions on pariah Russia says everything anyone needs to know about dystopian US foreign policy. Similar idea for pariah Venezuela,

The technology of the LNG ships is pretty amazing as well. Seems like Murphy’s law could have one blow up in a port though. Hopefully carefully thought out safety protocols in place

My dad was watching them offload one of those ships in Boston one time about 30 years ago. The Coast Guard shut down the entire river while it was going on. I don’t know if they still do that or not. But you probably shouldn’t have your LNG facility too close to a major city.

“ But you probably shouldn’t have your LNG facility too close to a major city.”

Which reminds me to bring up another issue…

How on earth can you protect these terminals from all the crazy gomers in the world…

It seems everybody and their brother has cruise or other types of missiles these days…

How many terminals would Europe need… 5 or 6 major ones?

Seems to me we’re going to have to make these European terminals military bases with appropriate protection, or Europe could end up being right back where they are today…

This plan was implemented long time ago:

NYT, January 20,1982:

“ANTITANK ROCKETS ARE FIRED AT FRENCH NUCLEAR REACTOR”

There were no arrests.One KGB defector admitted in 1997 that he carried RPG-7 in diplomatic pouch from Moscow to Paris and gifted it to the French national as instructed by his Chief of Station.

Usually you put the regasification terminal offshore on an island, a floating facility, or something and then pipe the gas to underground storage (caves, salt domes, etc.) onshore.

Wake me up when the EU isn’t funding this “minor incursion” in Ukraine.

Does the notable absence of Germany from the table of LNG customers in Europe illustrate the problem with cutting off Russian gas?

Still a student-

Excellent question!

And a follow-up question: might they be the only real European contender as the next reserve currency?

Yes. Germany has no LNG import terminals.

Germany gets natural gas from Norway (pipeline), Russia (pipeline), and other suppliers. It just hasn’t had to buy expensive LNG yet.

Wolf-

(pull this comment if inappropriate)

Have you seen the short series “Occupied,” which deals with the fictitious Russian, European and American reaction to a decision in Norway to change energy sources?

Great plot twists and acting, and an alarmingly realistic portrayal of the present state of affairs.

Wolf, I’m curious, why didn’t you simply include Mexico in the table, in position 1. The title of the table is misleading if one doesn’t read the introductory text. The title of the table should really be “ US Export Volumes, by largest recipients in 2021, in billion cubic feet per year, excluding Mexico”

The table is for US export of LNG, not natural gas that is moved through pipelines, as to Mexico and Canada.

David G LA,

The table is under the section title: “US LNG exports by country.” So below that section title, it’s about LNG. All the amounts in the table are LNG. And then, to give you a sense of magnitude and perspective, it also says this:

“By comparison, in 2021, the US exported 2.16 trillion cubic feet of natural gas to Mexico via pipelines. This is about as much as the US exported in LNG to the top eight countries on this list combined.”

Thanks Wolf and Mark!

Is there some way to capture cow farts and burps? They’re mean methane machines.

Yes! “Biogas recovery” has been around for decades. A big thing for feedlots, that use it to power generator sets and get some of the electricity to run their operations. Water treatment plants use it too. And even in poor countries on farms that are out in the distant sticks, it gives them supply of cooking gas (rather than scarce firewood).

I looked into it 20 years ago tangentially as part of a fuel cell project I was involved in. Dirty job but someone’s gotta do it :-]

If memory serves well at the beginning of the “Energiewende” the Germans actually presented plans for hundreds of these biogas plants – of course in the end close to none were realized, only a few pilot projects that merely proved the investment into the second Russian gas pipeline.

They work great on a small scale, such as a feedlot generating power it needs (similar to rooftop solar). Once you’re talking utility-scale biogas plants, it gets very complicated because the substances that generate biogas are expensive to transport. But for feedlots, it’s essentially turning a waste product into electricity. It does require some capital investment, but the fuel is free.

When I was playing VB (late 90’s) met a guy with best job in world. Ran Biogas plant at Sonoma county dump. One man show, his boss was back east. Carried a pager. Forget avg power dumped into local grid but it was a lot more that I expected…engine was Cat sized, maybe even made by them.

you’ll note that Germany isn’t even on the list of countries that bought US LNG. that’s because they have no regasification facilities…& that explains the other half of the problem with the plan to send more US LNG to Europe; not only are our liquefaction facilities already running at capacity (sometimes even at 101% of capacity), the European regasification facilities are also at capacity….historically, construction time on both types of plants has run 3 to 5 years and billions of dollars..

US LNG is also turning out to be quite profitable for the Chinese…

i had heard of stories of LNG tankers that had already transversed the Panama canal and were in the Pacific on their way to Asia turn around and go back thru Panama to deliver their gas to Europe, and wondered how that was happening, since most US LNG sales to Asia are under long term contracts…as it turns out, it’s not the American sellers of that LNG who are selling it to Europe, it’s the Asian buyers who own the US production under long term contract…

so i did a quick search, and found the press release on the 20 year contract on Calcasieu Pass gas that’s held by Sinopec: https://www.americanpress.com/2021/11/05/venture-globals-calcasieu-pass-facility-inks-lng-supply-contract/

so Venture Global is taking American natural gas out of our pipeline system at whatever price they’ve contracted it for (probably less than the recent $5 price, and undoubtedly making a fat profit selling it to Sinopec, who then probably stands to triple their buying price selling it back in China….

but that’s not what they’re doing here; they’re selling the US gas (which they own under contract) right from our terminal at Calcasieu Pass in Louisiana and selling it directly to Europe at 7 or 8 times the Louisiana price of natural gas…

it goes without saying the Chinese would appreciate it if we built more liquefaction facilities and pipelines for them…

If Europe decided to use US LNG in lieu of readily available and cheaply priced Russian natural gas, then the costs to Europe would soar about 400% affecting all of its 510 million citizens and there would be massive shortages due to nearly zero facilities to process LNG which would likely raise the price even further than 400%, but if that’s what Europe wants to do, then it would sure help with them going green and abstaining from fossil fuels!

Highly intelligent countries like India and China are saving a huge amount of money on oil costs right now by buying from Russia with price discounts of around $30 per barrel on oil and this will be great for their economies this year!

Russian oil is no bargain. It’s called Urals heavy and needs to be blended with lighter crude to refine it. That’s why it’s so cheap.

Robinhood shares soar more than 25% after company announces extended trading hours HOOD 25.29%

Hahahaha, you’re so funny. The 52-week high of HOOD was $85 (last August). After that 25% bounce today, HOOD is at $16.18, down only 81% from the 52-week high, in stead of -85%, hahahahaha. In the 52-week chart, you can barely see that 25% jump today.