Funded by Debt: Since 2012, share buybacks totaled $5.5 trillion, corporate debt soared by $4.7 trillion.

By Wolf Richter for WOLF STREET.

They’re back big time. Three of the big four banks are back – while Wells Fargo keeps getting slapped on the wrist – after all four were out of it last year due to pandemic-rated financial restrictions. Intel fell out of it. But the rest of Big Tech is in, and Apple bigger than ever. Warren Buffett’s Berkshire Hathaway, after rightfully dissing share buybacks for years, has become one of the largest share buyback queens. And Charter Communications has jumped into it massively.

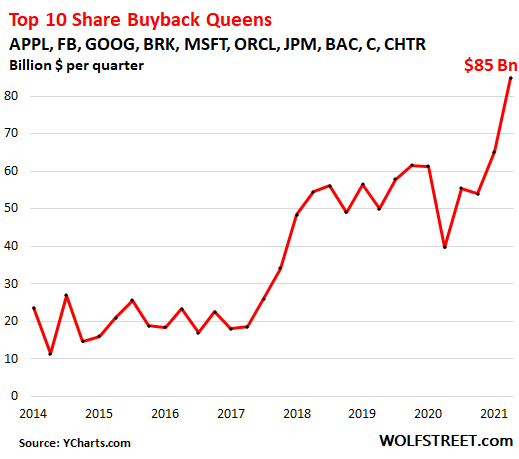

The top 10 companies – ranked by their cumulative buybacks over the past five years – bought back more of their shares than ever in Q2: $85 billion, according to S&P Dow Jones Indices this week, accounting for 43% of the total share buybacks by all S&P 500 companies. Since 2014, these 10 companies bought back $1.13 trillion of their own shares.

The two surges in the chart below – first after the corporate tax cuts in 2017, and second after Q2 2020 – quadrupled the quarterly rate of share buybacks for these 10 companies from around $20 billion a quarter in the four years through 2017, to $85 billion in Q2 (data via YCharts.com):

The top 10 share buyback queens, based on their share buybacks in Q2 2021:

| Top 10 Companies, Share Buybacks in Billion $ | |||||

| Q2 2021 | 12 months | 5-year total | |||

| 1 | Apple | [AAPL] | 25.6 | 89.7 | 334.1 |

| 2 | Alphabet | [GOOG] | 12.8 | 40.0 | 87.7 |

| 3 | [FB] | 8.4 | 19.2 | 51.1 | |

| 4 | Oracle | [ORCL] | 8.0 | 21.6 | 93.8 |

| 5 | Microsoft | [MSFT] | 7.2 | 27.4 | 92.4 |

| 6 | JPMorgan | [JPM] | 6.2 | 11.0 | 81.5 |

| 7 | Berkshire Hathaway | [BRK.A] | 6.0 | 30.5 | 43.5 |

| 8 | BofA | [BAC] | 4.2 | 8.1 | 78.5 |

| 9 | Charter Comm. | [CHTR] | 3.5 | 14.9 | 42.8 |

| 10 | Union Pacific | [UNP] | 3.1 | 5.2 | 28.1 |

Rounding out the top 20 are, in that order: Lowe’s, Home Depot, Morgan Stanley, P&G, Citigroup, Walmart, HCA Healthcare, Visa, Chubb, and Mastercard. Wells Fargo and Intel, which used to be in the Top 10, have fallen off the list entirely.

In total, 294 of the S&P 500 companies reported buybacks in Q2 of at least $5 million, down from 335 companies in Q1 2021. But the top 10 did the lion’s share of buying.

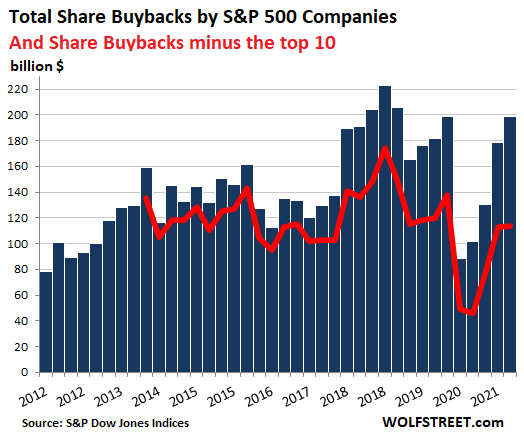

Combined, they bought back $199 billion of their own shares in Q2, the fourth largest amount ever, behind the records in the three quarters through Q1 2019, following the corporate tax cuts (blue columns in the chart below).

Since the beginning of 2012, the S&P 500 companies have bought back nearly $5.5 trillion of their own shares, with the top 10 share buyback queens accounting for 25% of it.

But in recent years, this has gotten a lot more top heavy. In Q2 2021, the top 10 accounted for 43%.

But without the Top 10 share buyback queens, the share buybacks by the remaining 284 companies amounted to only $114 billion (red line), roughly flat with Q1, and below most quarters in prior years – that’s how top-heavy this scheme has become:

Even today, as crazy as this sounds, the $5.5 trillion that the S&P 500 companies incinerated on buying back their own shares is a lot of money. They could have been invested in expansion projects in the US, and in labor in the US, rather than in cheap labor overseas, and in training, or god forbid, the companies could have tried to somewhat less aggressively dodge US income taxes, and pay a little more, given that the US government deficit has been horrendous for years, and has become more horrendous with the corporate tax cut of 2017, and has become a lot more horrendous starting in March 2020

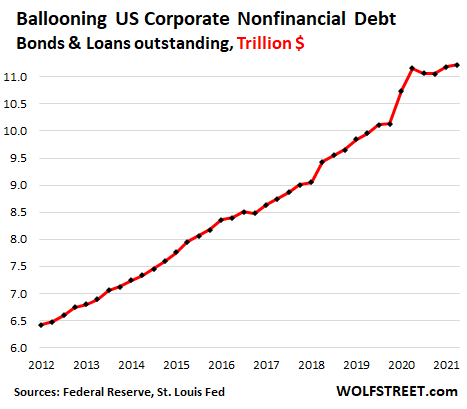

Along with share buybacks comes the corporate debt, and it has ballooned as many companies borrowed heavily to fund the share buybacks.

Nonfinancial corporate debt (bonds and loans outstanding, owed by companies other than lenders) spiked in the first half of 2020 and in Q2 reached a new record of $11.2 trillion, having soared by 73% over the past eight years. The $5.5 trillion incinerated on share buybacks played a large role in creating this debt:

The primary purpose of share buybacks is to undo the dilution of their EPS metric that occurs due to massive executive stock-based compensation packages. These share buybacks hide the cost of stock-based compensation on EPS; and many of those share buybacks are funded with debt, but debt doesn’t impact EPS.

In terms of actually lowering the share count: Only 5.4% of the companies that did share buybacks reduced their share count by at least 4% year-over-year, according to S&P. This 5.4% share was down from a 17.8% share a year ago, and from the 28.2% share in Q1 2016.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Wolf,

The chart detailing growth in Corp nonfinancial debt is useful…is there a parallel chart detailing revenue growth in the same nonfinancial corp universe?

(I’d ask for Net Income, but GAAP games make NI less reliable in the short term)

In an economy dominated by cash (via the low interest rates) the Revenue can be a puzzle to most everyone except the ceo/cfo. GAAP games are designed to turn the puzzles down to some mysteries that more people could potentially see through.

Share buybacks are one part of that same puzzles.

In a cash economy the cashflow is the only reliable metric, I suppose. But whose’s tracking that!?

Public companies are required to publish audited Cash Flow statements, along with Income & Balance Sheets; 95% of people simply haven’t the faintest clue how to read any of them.

Specifically, the financially ignorant are flummoxed by GAAP income because THERE SIMPLY IS NO SUCH THING – AND THERE NEVER HAS BEEN – A SINGLE NUMBER FOR A GIVEN YEAR THAT “ACCURATELY” REPORTS CORPORATE INCOME (however, I’d agree cash-flow generally comes the closest). Government and regulators mandate several “non-cash expenses” to flow through the income statement; some of the most significant “NON-CASH EXPENSES” included in GAAP:

1) depletion, depreciation & amortization

2) annual valuation changes for un-sold corporate investment portfolios

3) changes in required management judgements (estimated future changes in legal liability)

4) changes in reserves for future bad debt

5) changes in goodwill for prior acquisitions

6) valuation of non-cash compensation (stock & options)

Most deliberate management attempts to obfuscate earnings (changing timing or classification of expenses; off-balance sheet financing) are less significant than the 6 items listed above.

You don’t have to be a CPA to understand all this. However, if you’re too lazy to even try, you should be buying mutual funds or lottery tickets.

they all play the DEVALUATION of fiat $dollar game now

more for 1% of course

nothing new here

Amortization, depreciation, valuation, balance sheet…. Arrrrrgh…. OMG. Please stop using those big words…. You are perpetuating inequality cause I can’t understand any of it…. Equity is about using words everyone can understand so that no one gets an unfair advantage.

Stop putting your incomprehensible words in my safe space and tell me everything will be ok…. 😭

This is the expectation you should have for the kids today after our educational system is done with them.

Oh and one more thing…. You really mean 99% of the people can’t read those right? Stop perpetuating the agenda of the 1%…

We 99%ers are onto you…. 🤪

@JC

I gave up studying individual shares 50yrs ago when I realised I had no time for a life through trying to run a reasonably diversified portfolio for myself.

Ever since I have reckoned that 0.5%pa for professionally managed closed end funds was the bargain of a lifetime and have used nothing else. I would pit my safe, sleep every night, record against all comers and can’t understand individuals who spend hours and hours trying to analyse stocks to a much lesser degree than expert teams can achieve.

Agree with you totally JC, and when I realized that it was damn near impossible to trust any of the GAAP based numbers coming out of the vast majority of the stocks in the 1980s was when I got out of the SM, and have remained out so far.

RE has been a good market since, most of the time, in spite of the very clear lack of liquidity; however, that market too is coming to a crux point during which I would prefer to be in the more liquid stock or perhaps even the commodity market…

Keep on studying and trying to stay current in spite of having to sleep now and then, eh

Nobody claims “accuracy” only that financial statements present “fairly” the financial position of the company. No wonder you and others are so confused and frustrated. BTW, also as noted in all publications, the footnotes are an integral part of the financial statements.

Auldyin

“…I would pit my safe, sleep every night, record against all comers…”

Ok, big boy, you’re on.

o 42 years ago I bought BRK/A at %250/shr

o BRK/A current FMV is $418,100/shr

o APR on BRK/A investment is 19.3% – and I didn’t pay anybody a dime to manage my portfolio (however, I am a retired CFO who can read financials)

How’d you do?

not to get too far off topic, but i’m generally up 20% or so in my speculation account over the last 3 years. i mostly bet on mining stocks.

i know, i’m not a certified expert. perhaps knowledge is fungible, same as cash.

@JC

So you’re a dollar millionaire then?

Well done! 19.3% is good, I’ve never bothered with that, so long as I have enough eating and drinking money.

I sometimes read an annual report for fun, just to keep my hand in.

I could argue that BKH is actually a managed fund with old Warren and Charlie buying up companies run by others.

Does he state his management fee in the accounts? Is it < 0.5%?

Auldin

Yup, Buffett states his management fee – it’s been the same $100,000/year for over 30 years. Disclosed in the 10K.

@JC

So how’d he become a multi billionaire then?

I retired at 53 what value do you put on that?

Not sure if I understand you 100%, P Rao, but from my perspective, it is easier to use opaque GAAP rules to game Net Income (earnings) numbers more so than top line revenue numbers (although GAAP can also game revenue numbers…just not in nearly so many ways).

I agree that cash flow is king (screaming creditors only want cash as things head towards bankruptcy court) but as you point out, the cash flow statement (third financial statement) tends to be the most ignored – by far – despite the fact that it is the key to (maybe) deciphering all the absurd accounting games that public corporations play.

At best, the income statement and balance sheet are “realities” manufactured by the corporations, using the justification of convoluted GAAP rules.

Without incorporating the info on the cash flow statement, investors can and will be badly, badly misled.

CAS127

As I’ve tried to explain above, OF COURSE unsophisticated investors are frustrated GAAP income bears zero relationship to their definition of financial reality.

GAAP IS NOT, NEVER HAS BEEN, AND NEVER WILL BE AN ACCURATE STATEMENT OF CORPORATE INCOME. THERE SIMPLY IS NO SUCH THING.

The problem is every investor has a different expectation for what “CORPORATE INCOME” is, and for the overwhelming majority of investors, cash flow comes much closer to what they expect.

The logical question is “So what is GAAP INCOME?”: GAAP is a highly technical attempt to “accurately” map expense and revenue to “appropriate” time periods, as well as incorporate unavoidable management judgements (eg: reserves for yet to be decided legal settlements; reserves for future bad debt; valuation of non-cash compensation) as well as various government/regulatory requirements to include various non-cash expenses.

GAAP’s concept of standardizing financial reports so companies can better be compared apples-to-apples is good; like all things human, the devil is in the detail.

Learning to read these financials is a lot like learning to ride a bicycle: both take a few weeks to master, both may result is a few unpleasant mistakes, but once mastered, it does get easier & more productive. I my experience, most people never even try.

The details are always buried in the notes. The risk section is both required reading and could be extremely tedious, especially if it’s the same usual legalese , every now and then, there is a nugget if one pays enough attention to the variations from quarter to quarter.

The footnotes can be extremely useful, but is also tedious to delve through.

I remember the good old days when companies bought back shares because they thought the shares were underpriced.

“The primary purpose of share buybacks is to undo the dilution of their EPS metric that occurs due to massive executive stock-based compensation packages.”

Or the flip side: borrow money to buy back stock, goose EPS to hit a price target where the executives’ stock options can be exercised.

The outcome is the same. Stock goes to the executives, EPS still looks good but the debt leaves the company like a hollow chocolate Easter Bunny that only looks good on the outside.

I also wonder sometimes if the buybacks are simply because they don’t have anything else to do with it, like capital investment. I think that’s why Berkshire finally caved. They had a mountain of cash but no acquisition targets.

And allow these executives to borrow nearly free money against these options to fund their lifestyles tax free…

Meanwhile, let’s own the stock AND hold the bonds used to goose the stock…

Nice circle…

Nice rant, but I bet you haven’t looked at interest rates for margin debt (it’s over 7%). You don’t have to be a rich executive to borrow against unrealized stock gains – anybody can do this & it’s not illegal (somewhat risky & stupid, but not illegal).

Most people achieve the same result by “cash out refi” on their house…and mortgage debt is a less than half as expensive as margin debt.

I suspect that someone like Satya Nadella can borrow against his $500 million in MSFT stock for much less than the 7% we would pay, especially if it’s a rather low LTV.

Rates determined by risk and volume.

I bet Starbucks can get beans cheaper than the local coffee shop.

My learned friend,

Please avail yourself of the difference between to rail vs to rant…

The above is a rail, not a rant…

I see your point with your example…

However, it’s like comparing a chopstick to a railroad tie… they are both indeed made from wood…

OK English major CowGirl.

Thank you for your service to society today of explaining the fine differences between ranting and railing. You didn’t even let the fact that this is an economics blog and not a Language Arts class get in the way of your excitement.

If I have learnt correctly, the above is known as sarcasm.

Javert, you should shop around for margin rates. Interactive Brokers is at about 1%. Fidelity advertises a range of rates that would include the 7% you mentioned, but I called them last week and they quoted me 2.05%.

Jeff

I am never a user of margin funds, and admit to being rusty (aka wrong) for giving a quote for illustration purposes.

However, the much lower than I expected margin rate makes it even easier for Joe-sixpac to do stock loans, which was my point (I still avoid them like the plague)

I was going to mention BRK. I find it hard to believe that Buffet has to buy back stock because of a tie to profligate exec pay etc. A notoriously conservative investor, he has said that everything is overpriced, so few acquisitions.

So, what to do with BRKs profits? (I’m assuming the money is not borrowed)

Maybe this is the good old time reason for BRK to buy BRK. No better use for the money. Including treasuries.

Nick,

BRK mostly buys businesses that will feed his other businesses, with emphasis on insurance holdings for the float…

An example is aviation insurance… they will write you a great policy for your jet, as long as your pilots go to training at Flight Safety, owned by BRK…

Another is Fleetwood mobile homes… Geico has great mobile home insurance, as long as you don’t have a claim…

BRK also happens to own Forest River RVs… and while you are cruising the country, Geico has great RV insurance for you… and if you happen to need fuel, they can help you out at Pilot Flying J..

Etc, etc…

Conservative investor, nah… more like cutthroat capitalist…

COWG

Those are your examples of “cutthroat capitalist”…companies that provide some of the best & lowest prices on products/services freely available to all comers?

You are indeed a delicate snowflake. I recommend putting your head back into a warm, moist dark place and just ignore the savage world.

(disclosure: I’ve owned BRK for over 40 years)

BRK market cap is currently $630B, with a PE of 6.2, and about $140B in cash on its balance sheet. One of the reasons for the low PE is the $140B of essentially dead money (it earns a puny 1-2%).

Buffett has been pretty clear that he cannot find enough investments to productively employ that money. There is definitely some shareholder pressure for either stock buybacks or a dividend, and Buffett has always chosen buybacks.

Dividends (100% taxable as income) and buybacks (only the capital gain is taxable) both return cash to shareholders. Buybacks are more tax-efficient & return money to targeted investors who want the cash (at BRK, shareholders actually phone the company & surrender their stock for buybacks). Dividends return (taxable) cash to all investors, some of whom (including me) absolutely do not want extra taxable income.

During the annual meeting, Buffett updates the calculation of BRK book value, and generally only does buybacks when this number is lower than desired (aka the stock is priced too low).

Needless to say, not all companies use this stock buyback model.

Javert Chip said: “with a PE of 6.2, and about $140B in cash on its balance sheet. One of the reasons for the low PE is the $140B of essentially dead money (it earns a puny 1-2%).”

—————————————–

$ 140B in cash earning 2% = 2.8B

$ 140B in cash earning 10% = 14B

Buying an ownership position in the cash by valuing the 2% earnings at a 6.2 PE multiple costs $ 17.36B ……. sounds like a great deal; At a given PE it seems much better to buy cash earning a low yield than to buy cash earning a high yield; greater margin of safety and more upside with a large book value cushion.

What am I missing?

I’ll take that $140 billion of Dead Money and give it a good, uh, burial.

RIP Dead Money.

cb

What you’re missing is that Berkshire Hathaway (excluding the dead money) generally earns 20% or more.

I’m a long term BRK shareholder & have benefited wonderfully from Buffett’s genius. However, given the current problem of not being able to find a fairly-priced “elephant” (Buffett’s term) to buy, why not split BRK into two smaller companies so each could efficiently invest in more available smaller “elephants”?

…and still deliver 20% returns…

@ Javert Chip –

Thanks.

I went on the Fidelity website to look at BRKB. They did show the TTM (Trailing 12 Months) Price Earnings ration at 6.16. Exciting. Who wouldn’t buy Berkshire at a 6.16 PE? It’s like free money. Yet, in a comparison of competitors section, they showed this years Price Earnings ratio at 23+. I spent an hour on the phone with them trying to resolve the disparity (I know there is a difference between TTM and current or estimated). No luck.

For what it’s worth.

Well, if Jeremy Grantham is right, Warren Buffet will likely be able to buy BRK at a lower price in the not to distant future.

… and I remember the good old days when it was illegal for companies to buy their own shares …

I’m going to say that Intel is off the list because of the massive move they are making in capacity increases via plant / facility expansion. The Fab Tool suppliers have got to be licking thier chops regarding the new sales💵👍💵

Yes, that’s likely the reason. They announced something to that effect a while back, if I remember right. Which is a good thing.

Only in the Universe of Fed funded liquidity is this possible.

Rather than funds being invested in the future, the future is being mortgaged and hypothecated.

Rome had nothing on the Circuses we have created for going on a generation now.

“Are you not entertained?”

But remember the federal subsidies for the building of the fab.

@MG

Who said too little too late?

It is also because Intel switched CEO’s and traded a guy with a business degree, who trained at the devil’s knee ( GE) for a farm-boy with three degrees in engineering who started out on the factory floor at Intel.

More the other way around: the board appointed Gelsinger because he is the right man to execute the new policy.

Fab ?

Hi Wolf, tnx again… any thoughts on the long term impact on society of the buybacks ? E.g more concentration of voting rights, companies who don’t have any owner anymore (the management’manages’ the voting rights), sensitivity to societal opinions and pressure etc?

Interest rate will never rise under the corporate assumption that debt is cheap and remain low forever. What happen when rate rise? FED needs once again tame it down else many of these corporations are facing difficulty to earn $ to service their debt. It is clear the corporate America is building on flaw system to made their earning matrix looks good. At the end of the day, too big to fail problem resurface but these corporate executives just easily off the hook. By then, new rules enacted by CONGRESS once again to prevent future recurring of same problem. It is obvious now we could see the problem but no one screaming now because the party is on going.

The amount of debt, and the amount of stock created by the private sector in response to the idiotic rate policy of the Fed, is larger than the Fed could ever support.

This is why the market is always larger than the Fed….

and the Fed can only tweak and control perceptions….but when they lose that ability, reality will be shocking.

Stock buy backs designed to kick in executive stock option strike prices…

Bill sits on Jim’s board, Jim sits on Ralph’s board, and Ralph sits on Bill’s board….a “daisy chain” and they vote themselves large packages and aggressive stock buy backs.

This is the Fed’s power base. Meanwhile 5% inflation digs into Mr and Mrs America, and the Fed doesnt lift a finger. See who is doing what for whom?

Exactly right historicus. The Fed printed $4 trillion since March of 2020, and household “wealth” is up about $30 trillion since that time. All the Fed has really done is convince people that it can solve any problem with the U.S. economy by printing. This causes people to run up asset prices, cementing people’s belief in the Fed’s omnipotence, which causes people to run up asset prices even more.

Classic self-fulfilling prophecy.

The problem is that none of it is real. If $4 trillion in printing led to 8 times that in “wealth” that just means that the asset prices are set at the margins.

I don’t know what the event will be by which central banks, including the Fed, lose control of interest rates, but I don’t think it’s nearly as far off as many think.

You illustrated how prices are set at the margin. It’s the whole reason this buyback slo-mo pump and dump works.

AAPL @ $25.6 billion per quarter in buybacks with 60 trading days per quarter = 0.426666667 billion or $426,666,666.67 per each and every trading day. Compare to the average daily volume in dollars to figure out the percentage of all sales in their stock the bought themselves.

Ok, I’ll play your silly game:

Actually, 13 weeks @ 5 days/week = 55 trading days (ignore holidays) per quarter, so:

o FMV of daily AAPL shr purchase = $25.6B/55 days=$465M per trading day

o avg shrs/day bought by AAPL @ $150/share = $465,000,000/150= 3.1M shares/day bought by AAPL

o Total daily shares purchased by AAPL divided by average daily AAPL share volume = 3.1M/79.6Mshrs EQUALS…

o 3%! WOW! AAPL, with 137,000 highly compensated employees (much of which is stock options) BUYS 3% OF IT’S OWN SHARES!

HOLY CRAP! WE MUST IMMEDIATELY SEND EVERYBODY TO PRISON!

And where will those executives be in 5-10 years’ time……around to watch the debt be inflated away or to deal with rolling it over in less benign environments?

Probably not.

Probably not either way I mean.

Is a buyback a reverse dividend?

Just asking.

Share buy backs are actually slow motion company liquidations. In the begining a company had a good idea to make profit with a new project ( build a new plane model, invent ready-to-eat breakfast cereal etc.) They then sold shares to raise capital which they could invest in projects to create growth,jobs, and profit. Now they are saying they have money but nothing profitable to do with it so they are giving the shareholders their money back and winding down operations. Like an old guy paying off his loans and selling off all the inventory in his hardware store before retiring .

So what does retirement look like for a giant multinational corporation?

Sears.

Nice one Petunia

Good point about it being a slow liquidation. Dividends paid out over actual earnings are also a liquidation. Most equity holders don’t understand this about dividends.

“Like an old guy paying off his loans and selling off all the inventory in his hardware store before retiring ”

More like an old person borrowing heavily against the assets of a long owned hardware store then selling out personal equity with the proceeds to the now fabulously indebted and doomed business.

Kinda like the Sears / PE model… mortgage every asset, pay yourself with loans, bankrupt the company, then laugh the haughty laugh of high flatulence up on the poop deck of a starter yacht in Jacksonville Beach.

Yes, you are correct, my retirement analogy Is from the old days of mainstream capitalism. But as you have described big business has moved on to a retirement model they cribbed from the bar takeover scene in “ Goodfella’s”

Not always. As I alluded to earlier, there was a time when a company might think they could buy its stock at a bargain price.

Peter Lynch talked about buybacks being a POSITIVE sign in his book – a signal that the people running the company felt the shares were a bargain. But that’s ancient history.

Here’s how a good buyback works.

XYZ has 100 million shares outstanding.

Price is $0.50 per share

Company estimates book value at $1 per share

Book value of $100 million.

Management buys back 5% of shares.

Shares outstanding 95 million

Book value $97.5 million

Book value per share $1.03

3% increase in book value.

But this can only be done when shares are underpriced. Back when Lynch was running Magellan the S&P p/e ratio was about 10.

So buybacks can be a positive. Just not right now. When’s the last time you heard book value discussed? What a quaint archaic concept. Actually back in 1985 Buffett said buybacks were a good indicator that a company was undervalued.

Now you hear about how the latest hot unicorn is still losing money but it has a “long runway”.

“Share buy backs are actually slow motion company liquidations” is pure nonsense.

Dividend payout and buybacks are totally at the discretion of company boards, and either can dispense the same amount of money.

Borrowing money necessary to pay either one is a danger signal, and, if continued, will indeed, serve as a slow liquidation.

Borrowing to fund pay outs because earnings don’t fund the payments is especially common (as are bankruptcies) in leverage buyouts (which generally use “special dividends” not buybacks, to get money out of captured companies).

Lets say for a hypothetical example that the value of all the company assets is 100 million and the market value of all the stock is 100 million. So to make things simple lets say each month the company sells off 10% of its assets and uses the money to buyback 10% (retire) of the outstanding stock. Lets say they could do this for 10 months without the market noticing. So at the end of the 10 months they would have zero assets and own 100% of the stock. But the next day the market notices there is effectively no assets or value left and the stock value drops to zero. Thus they have no assets and no stock value and are effectively liquidated.

Zephyr Stoves

The problem with hypotheticals is it’s trivially easy to absolutely prove you own infinite herds of beautiful unicorns.

It’s wonderful to be blissfully ignorant of laws, regulations and market forces. Litte children do it all the time.

Among other unicorn-killers with your scheme, the market would quickly (couple of days) detect the buy-backs. Public corporations also must immediately & publicly disclose, in writing (called an 8K) , material changes to the SEC. Yes, there are people who do nothing but read daily filings…

We won’t even get into the freshman economics issues with supply-demand.

Javert, at its core ,nearly every economic activity is simple. Pay the grocer money and get an apple, sell stock to someone and they own a part of your company. Use the money from the stock sale to build a lemonade stand and distribute the profits in the form of dividends. Get tired of selling lemonade, sell the stand and give the stockholders their money back (liquidation). It is only when some people would rather conjur up games of obsfucation and swindling ( because it is easier than real work) that things get complicated with the things you believe to be the real world. Swapping stock ownership around like three card monte has nothing to do with the creation of value or wealth, in the grand sweep of history it is little more than the farts of unicorns.

Zephyr Stoves

Yup, it’s absolutely true that some managers lose sight of the main reason for corporate existence (selling products at a profit that customers want), and decide to overdose on financial engineering.

The technical term fo this is “shit happens”; as an engaged investor, this may take some time, but it is relatively easy to see & avoid (it does take discipline).

You have a dystopian view of a system that has made America, in particular, and the world in general, a MUCH MUCH wealthier place. I suspect I’m older than you (I’m 74.8), and have traveled enough to see about half (86 of them to date) the larger countries in the world; this gives me context to better appreciate what the American system has delivered to its citizens.

Obviously we disagree and have little prospect for changing each other’s minds.

Bob Hoye,

A buyback is very different from a dividend. But in both cases, cash leaves the company.

A dividend is paid directly to stockholders of record on a certain date. It’s cash paid to specific stockholders, and it’s an income stream for those stockholders. That is what companies are supposed to do.

A buyback pays zero to stockholders. Their hope is that share prices will rise, or least not fall, given that buybacks are mostly used to buy back shares issued via options or grants to executives and employees, which dilute existing shareholders. Share buybacks are a form of financial engineering to cover up the dilutive effects of share-based compensation plans.

@W

I love dividends, that’s what I follow. The current UK champ has increased it’s dividend every year for 55years I think it currently is. Some co’s have even got through lock downs and still maintained or increased their dividend. That shows true commitment to the owners ie the shareholders.

Re-investing dividends is a surer growth profile than gambling on the market price at any particular point in time.

IMO

Wolf

I generally agree with what you’ve said about share buybacks where transactions are executed as a normal market trade.

Berkshire Hathaway may do some of this, but the company has a history of doing buyouts from specific individual (usually very large) shareholders wishing to cash out. Buffett encourages such parties to directly phone the company & arrange a sale (I’m ignorant of technicalities ensuring the transaction is legally executed). Plainly, the money goes directly to a known party, with appropriate adjustments to outstanding stock for all other BRK shareholders.

I have no idea how many other firms follow Buffett’s model.

Buying out large minority shareholders is not uncommon; but I don’t think that this would be considered “share buybacks” in the classic sense, which happen in the market. And I agree, there are lots of good reasons for buying out a specific shareholder in a mutual deal.

Buybacks are mostly the result of government and Fed policy:

1. Buying back shares is more tax efficient way to get money to stockholders vs. dividends.

2. With corporations able to borrow money at 3% it is a no brainer to financial engineer earnings.

3. The correct move by corporations and consumers has been to operate under high leverage since 2009. Fools like me that use no leverage have been left in the dust with a Fed put. That’s ok I sleep at night.

4. Shareholders don’t hold stocks anymore, but turn them over on average every month or two. Why would a CEO worry about long term results?

> 4. Shareholders don’t hold stocks anymore, but turn them

> over on average every month or two. Why would a CEO

> worry about long term results?

You’re right in that speculators and gamblers will trade stocks frequently. But there are plenty of investors who buy great businesses and hold the stocks for years.

Companies like Apple and Berkshire Hathaway have way more cash than debt, and invest into their great businesses for the long term.

@OS

With you on low rates being the source of all evil.

If cost of borrowing is lower than the cost of sales it is cheaper to get money via the bank desk than it is to get money via the sales desk. In extremis, why bother with all the hassle of sales at all?

On turnover there are algorithms trading at the speed of light every second of the day making returns of micro dollars as they run.

This type of dry, apolitical reporting, on this financial skullduggery that can’t be found in Bloomberg or the WSJ, is why I keep coming back.

Keep up the good work, Wolf. ;)

Regarding who votes the shares…

“BlackRock Starts to Use Voting Power More Aggressively

Asset manager signals it is boosting its support of shareholder-led environmental, social and governance proposals”

I would imagine they could also control buyback proposals at the board level if they can also control “environmental and social” attitudes at these companies. Mutual Fund shares, ETFs and the proxy arrangements when managed by mega entities allow a tremendous concentration of voting power.

from a WSJ article April 2021

This is most evident in stocks such as CRM (‘sales-force’), whose revenue is 80% hot air (commensurately, cost of goods is 95% hotter air; leaving 1% net profit hot hot for stock traders to wholly unhinge the stock price from company fundamentals; it is a stock case of fed-driven ponzie if there ever was one.)

The company’s stock is mostly held by financial entities, with a tiny minority in the ‘public’. The fin entities set the target price, and the collosal entertainment ensues via the tiny minority. A spectacle to behold, day in and day out, while wondering what magics are there yet unseen.

These companies are good for the U.S. economy, creating jobs and tax revenues for communities.

If a company takes on debt to buy back shares, there is risk. If a company uses earnings to buy back shares, it is legal.

“If a company takes on debt to buy back shares, there is risk. If a company uses earnings to buy back shares, it is legal.”

It’s technically legal in both cases.

In the second case, if the company has a high debt to earnings ratio, using earnings for stock buybacks could be more risky than a company with low debt to earnings taking on low cost debt to buy back shares.

Even if the company has an okay debt-to-earnings ratio, burning cash earnings for buybacks could be quite risky due to a resulting loss of growth and innovation needed to compete with other companies.

This was a good, clearly explained, and readable article in which I learned something more about corporate stock buybacks. Real national productivity has atrophied, and paper profiteering seems to be the main theme of American capitalism.

It’s not really that risky if you can count on a federal bailout when things go wrong. Which is exactly what these companies are figuring.

The Evergrande episode may be a case in point….

Go big, and you will be saved….

Capitalism without bankruptcy is like religion without Hell

I thought the Chinese government only saved its own investors, not foreigners?

Google buying back shares does not bother me. If they need capital, they may reissue the shares, if they did not cancel them.. Google is like a library at my fingertips. They reinvested billions in improving their products. They may return capital to shareholders.

Evergrande borrowing money to build partially empty towers becomes a problem when they can not repay their lenders.

LOL. I can’t tell if you’re being serious. Bigtech hasn’t been “good” for the U.S. economy in many years. All they do is skim from the top. Tell me, how is it “good” that Apple limits access to its phones for software developers through its own store and charges a 35% commission for the privilege? How is it “good” that Apple insists on proprietary cables and non-user serviceable batteries so that you need to pay Apple for these things?

How is it “good” that Google has a quasi-monopoly on advertising and crushes businesses that rely on those revenues?

I will concede that they create some jobs, but they also create enormous housing problems where they are located, as their highly paid employees price everyone else out.

RNY,

Not to defend Apple, per se, but I went to Apple across the board from any Android except for a couple of Win machines needed for proprietary software…

Two things…

1) I think Apple has a higher standard overall for its hardware and software…

2) Their stuff works really well together seamlessly…

I have had Android phones from Motorola, Google, LG, etc… so aggravating to get woke up at 3am by my phone wanting me to sign in to my Samsung account… too much, way too much garbage for me on the Android platform… I will pay more to be much less annoyed..

I also pay for the developers subscription because on Apple, it just works and works great… plus I hate those annoying ads which mostly come from Google…

I get that Apple is a huge monolith and has price monopoly on their ecosystem apps, but if you want to fly in first class, you gots to buy the ticket… plus most developers go cross platform, so I don’t think the revenues are hit that badly…

Not to start a debate, just one mans opinion…

COWG, you just have to set the Do Not

Disturb feature on an Android/ Motorola phone for a time period that you are likely to be sleeping. You can set the Notifications setting within DND such that only numbers in your Contacts list will ring, like my ADT security service when I am away. My Motorola phone cost $150 vs. $850 my G5 Samsung phone with T-Mobile (used Stimmie check, whoopee), and I only pay $17 per month for one-line service on the Motorola via TING.

My hiking phone is the Motorola, which I can drop it in a poorly forged stream and not look back. The Samsung S21 is my go-to-meetings phone, that should be able to fix breakfast for what it cost. Will never pay that much for a cellphone again.

re: “My hiking phone is the Motorola, which I can drop it in a poorly forged stream and not look back.”

So, you leave electronic garbage in the wilderness?

Nice.

California Bob,

Do you know how many electrons you killed to feign moral superiority in a (very) stupid cause?

If you were joking, you gotta give us an ellipsis…or sumpthin.

COWG,

I agree with you that Apple has excellent products … AND product support.

We have an essentially useless iPad. It’s about 10 years old. But it is a great platform for eBook reading.

The problem was it hadn’t been used for a couple of years and would not boot.

On a whim I called Apple Tech Support. The CSR worked with me for over an hour to make it usable. A 10 year old, very out of date, device. Apple stood behind their product.

I was impressed.

I wasn’t joking. I understand not caring about losing a cheap, low-grade cellphone, but not caring about leaving electronic garbage in the wild–and OP was clear he wouldn’t care–is reprehensible. Apparently, you’re of the same mindset.

You do know, I hope, that electrons can never be killed–except possibly in a superconducting super-collider–and to my knowledge no one has ever tried (nuclei are much more interesting). Electrons are doomed to be circulated from from the earth and back in perpetuity.

California Bobbie, was a Life Scout, Order of the Arrow, and I can assure, though defending myself to a Californian where brush fires, due to poor vegetation management practices, create more carbon emissions in a week than a coal fired power plant probably emits in a year, you, Exalted One, that I have practiced Leave No Trace Hiking and Camping for the 62 years of my life I have engaged in these activities. But be advised, CA Bobbie, that most recycling programs create more carbon emissions in the collection to disposal/ conversion process than you would hate to imagine.

California Bob

We are now officially way off topic, but…if you’re resorting to particle physics to argue ecology, you’re going to get critiqued on your particle physics.

o When an electron & positron collide, they annihilate each other

o when protons & electrons collide, they form neutrons

o when electrons collide, they produce 2 (very high energy) photons

o there are other examples

A more accurate statement would be “under current near earth-like conditions, the overwhelming number of electrons hang around for a long time”. However, resorting to flawed knowledge of particle physics is a pretty novel (aka silly) way to argue about ecology on a finance blog discussing stock buybacks.

Just saying.

‘that Apple insists on proprietary cables’

EU has just mandated that all phones must be chargeable by UBS port. Apple not happy, nor with EU telling it to pay Ireland 14 billion. (A had booked all EU sales thru Ireland at something like 1 % tax) Under appeal.

EU also nailed MS on tied sales.

The US has a lot to learn from the EU’s moves against Big Tech’s anticompetitive attempts at monopoly.

Yep. It’s ridiculous that it’s taken this long. The problem is not Apple’s dominance, it’s the fact that it uses its “ecosystem” to push into areas it’s not already in. The definition of anti-competitive behavior.

Nick Kelly

These are classic examples of bureaucrats demanding to control trivial piddly-ass every day choices. My predictions:

1) Apple will quickly develop a (more expensive) EU iPhone compliant with EU mandate; rest of world will buy current Apple technology (which appears to be migrating to wireless).

2) In the year 2030, EU will still be stuck with 2021 technology as EU (as always) lags further and further behind.

3) It’s rumored the EU is concerned about all the different wines sold in Europe. The EU is expected to decide on one single wine that will be the only one allowed to be sold all over Europe.

This is the kind of crap bureaucrats love to do.

“Apple insists on proprietary…”

1) The “hipster doofus” commitment to Apple products (“style matters more than substance, and price never matters to the elite…that’ll be $800 for an $80 product, “elite”…) has long been something to behold.

2) By the early 90’s, PC standardization and vast cost advantages really started to gut Apple’s desktop market, driving their share down to the single digits.

3) Eventually, the same thing is likely to happen in smartphones. Spending $800 for a product more-or-less also available at $80 ceases to be “hip” at some point and simply becomes, “dumb”.

And there ain’t nothing hip about dumb…

@C127

Yup! I always tell folks it all comes down the same line at the factory and gets a different badge stuck on.

Anybody can make a watch for $50k but it takes a genius to make a watch for $1.

I used to walk past a car hubcap factory and in the yard were pallets of Audi, Ford, Merc, BMW. When I told folk, they would never believe their BMW could have any parts the same as a Ford.

Just sayin’

Looking a the charts, how long does this bump in the stock price last after a share buyback? Is it a prudent financial move that benefits the shareholders in the long run, or is it just a hit off the crack pipe?

I worked for J.C. Penney back in the day. In 2011, they announced a stock buyback of almost one billion dollars. It was touted as “increasing shareholder value”. My limited research at the time indicated that the rise in stock price from a buyback is only temporary. It mostly serves large shareholders who then dump the stack to cash out. Sure enough, in a few months, the billion dollars spent was wasted. The stock was back where it had been before.

I think things need to be simplified. Straightforward and open to shareholders to understand. Keynes again: “The divorce between ownership and the real responsibility of management is serious within a country, when, as a result of joint stock enterprise, ownership is broken up among innumerable individuals who buy their interest to-day and sell it to-morrow and lack altogether both knowledge and responsibility towards what they momentarily own. But when the same principle is applied internationally, it is, in times of stress, intolerable–I am irresponsible towards what I own and those who operate what I own are irresponsible towards me. There may be some financial calculation which shows it to be advantageous that my savings should be invested in whatever quarter of the habitable globe shows the greatest marginal efficiency of capital or the highest rate of interest. But experience is accumulating that remoteness between ownership and operation is an evil in the relations among men, likely or certain in the long run to set up strains and enmities which will bring to nought the financial calculation.”

Time to outlaw stock buybacks. Not much more these days than a strategy to goose the stock price and enrich the senior executives compensated in stock and options. Maybe invest the profits in the company or pay out excess profits in the way of dividends and maybe even share some of the largesse with middle income employees. But that would be too much to ask for.

CA,

Right track, wrong process…

Don’t outlaw, just tax the crap out of the buybacks…

30% would be about right… how bad do you really want to do that stock buyback…

Additionally, when a CEO exercises his “ gifted option”, 30% is paid off the top as taxes , then go do whatever you want with it since you no longer have to worry about tax avoidance…

Then, tax every public stock transaction at 10% for everybody… if you can afford to buy $100 million or even $100 in stock, then you damn sure can afford to pay $110 million or $110…

Mandatory 30 day holding period for stocks… might want to do some research before you plunk down the coin…

That would stop a lot of this crap we see everyday and claw back some of the money the government has showered these people with…

Sigh…back to daydreaming…

You mean tax all this crap to penalize the exec/shareholders so that the GOVERNMENT can squander the new income from the taxes paid?

Kind of like throwing the tax money in a deep black hole.

I’m for outlawing share buybacks….period.

I toned it down a little…

Didn’t want Javert on my a$$ …

I am sensitive…

OK, I hear ya….

@CA

I seem to remember that buybacks were illegal for many years and I never really figured what the point of making them legal was. I’m guessing Clinton but don’t quote me.

Mirror mirror on the wall street

Who has the cleanest dirty balance sheet?

I understand Elon Musk pays no taxes. He receives no salary or income from his companies. When he wants money he borrows against his capital, thus creating a liability. The gist of the article was that other rich people could do this too.

or….

you could set up a Foundation like the Clinton Foundation that pays for all your expenses, all your travel, etc.

Lots of big shots in politics do this….Rahm Emmanuel, Hank Paulson, et al…

If my knowledge of history serves me right, wasn’t one of the causes of the bubble in stock prices in 1929 before the crash was the shortage of shares of stock.

It would be interesting to see what dollar value of company stocks were purchased via the exercise of stock options since 2012 and how that compares to the value of total stock buy-backs. The primary purpose of these buy-backs is to take the heat off of company executives to not have to work too hard and obtain higher stock prices (so they can exercise their options and buy a third home in the Hamptons) via a bump in Earnings per Share when a company retires these bought back shares as Treasury Stock. Granted, it is a component of executive compensation that is not insignificant, but it does not equate to higher total financial performance of any given company at the cashflow or after-tax profit line.

It is a total racket to enrich the already rich, and have the crowd go wild with applause at artificially goosed stock prices. Adds no real economic benefit to the company aside from increasing interest expense per annum, borrowing still is not free in U.S., and creating debt service of principal which does not go away even as the shares disappear and stock prices go to lala land.

Do not think, offhand, that the exercise of stock options for executives, creates a sea of new stock supply that could significantly dilute the all-powerful E.P.S. metric for valuing stocks. Would think that buy-backs are of such a magnitude since 2012 that Option Exercise Supply is dwarfed by Stock Buy-Back Retirements.

But be advised yea who chase this record balloon of a bubble in stocks that in the real world of corporate finance, eventually these self-served executives or more likely their successors, are going to have to refund the current debt burdens they have heaped upon their companies at higher and higher interest rates. Oh Spot, Oh Sally, see the stocks prices sink as the companies drown in red ink. Free lunches not here yet either. Throw in a severe recession ahead and these guys will be retiring in droves.

AAPL has had five stock splits followed by share buybacks.

Date Ratio

06/16/1987 2 for 1

06/21/2000 2 for 1

02/28/2005 2 for 1

06/09/2014 7 for 1

08/31/2020 4 for 1

An original position size of 1000 shares would have turned into 224000 today.

Without the stock splits and buybacks AAPL stock would around $55,000 per share AND have a staggering amount of cash in the corporate treasury. Not a debate point, just an observation.

Satya mardelli,

Share buybacks have nothing to do with stock splits. All a stock split does is double the share count and cut the share price in half. The end result is the same.

Apple could just pay taxes instead of shifting its income to offshore mailbox entities in Ireland and elsewhere, and it could pay big dividends, and it now has $122 billion in short and long-term debt with which it financed the share buybacks because it didn’t want to pay taxes on its income channeled through the mailbox entities in Ireland and elsewhere. And it could have built more plants in the US instead of relying on contract manufacturers in cheap countries.

According to a story on CNN.com, the Biden administration has proposed, and the Senate has passed a bill, to spend $52 billion to incentivize businesses to produce more computer chips. After taking many courses in economics and finance, I thought that the profit motive under the free enterprise system was supposed to incentivize businesses to engage in this activity. Having watched the Fed manipulate our financial markets to the point of destruction, I must have missed the memo about ending the free enterprise system, too.

Confused,

“I must have missed the memo about ending the free enterprise system, too.”

You sure did. Long time ago. What we have had for decades is a corruption fest where Congress has codified most forms of corruption, and if you just stick to those rules — please, no shrink-wrapped cash in the fridge, that’s very tasteless — everything goes. Subsidizing big companies that have lots of lobbying clout has always been done.

Capitalism without bankruptcy is like Religion without Hell.

The lender is now slave to the borrower…..if you go broke, be sure to go broke REAL BIG…they will save you.

@C

They’re only at least 20years too late and the money will be burned, like most Govt money is.

But never mind they’ll just print some more for the next Bampot scheme.

Incinerated? More like: “recycled”. There are sellers on the other end of these repurchases. Its conceivable they reinvest that cash in promising new ventures.

As for the tax efficiency argument: arnt the sellers also triggering a taxable event on their side?

The socialists who peddle these tired proposals would get a better reception if they instead conditioned repurchases on common sense protections to the public: fully funded pensions, leverage limits, full health insurance coverage, bailout moneys full repaid with interest, no subsidies, no employees on medicaid/food stamps…

FinePrintGuy,

“There are sellers on the other end of these repurchases. Its conceivable they reinvest that cash in promising new ventures.”

Nah. They buy other stocks with it. Most of it is done in ETFs and mutual funds and pension funds and insurance companies on automatic pilot. And a bunch of it is done by traders. The creature that sells his Apple stock back to Apple to then use the proceeds to start a company or increase his payroll is rather rare, I’d say.

….’they buy other stocks..’ I was thinking more along the lines of the big venture capital pools assembled by the big wall street banks. Fidelity, Vanguard, Blackrock, in additional to all the VCs.

Share repurchases provide that exit liquidity for investment pools to form.

” I was thinking more along the lines of the big venture capital pools assembled by the big wall street banks”

————————————

collectivizing capital …………….. within the backdrop of government protection ………..

socialism for the rich

Is there one segment of the country borrowing at .05%….

and another segment dealing with credit card interest rates of 15% and higher?

Seems tilted…yes?

I would urge you to watch the 60 minutes Australia interview of a Chinese tycoon, whose wife was disappeared by the Chinese communist gang governing that dystopian country. If you still think that China is a place to create wealth, read about the Canadians who were essentially kidnapped by the CCP, held hostage in horrific conditions in Chinese prisons, and were just released after Canada released the daughter of Huawei’s CCP connected founder.

Watch also Wealthion’s recent interview with Jim Bianco, part 2, on youtube wherein he discusses the corruption that we all now know exists in the “Federal” Reserve and enables Wall Streeters and banksters to grow wealthier each day, such as their leaders’ recent insider trading: e.g., one was day trading, in which he could have used the secret information that he obtained from working with the “Federal” Reserve. The link is that the banksters, Wall Streeters, and CCP is that they are all a bunch of gangsters and criminals, who are only interested in getting power and money, not in any code of ethics which they do not feel obliged to follow.

Rh…..

and watch a softer revelation of the Fed on PBS “The Power of the Fed”

…can catch it via their web site.

The central bankers have taken over the world…..

and here we thought it would be the Communists.

In Capitalism ………… Capital does rule

however you get it, or manufacture it

Dear cb and historicus,

cb, you are confusing capitalism, which may have laws that are enforced with anarchy or a kleptocracy. As to the PBS documentary, while it is better than others in at least daring to critique the banksters’ private but misleadingly named, “Federal” Reserve, bank cartel, it still operates from the presumption that the “Fed” banksters are operating for the good of ordinary Americans.

The latest reports, which finally revealed the insider trading that they have been engaged in, demonstrate that they are in it for themselves. They just want to retain power, so that is why they try to make it APPEAR as if they are interested in the welfare of ordinary Americans. They also must hide or limit their actions, because they do not want Americans to get so angry that they end the “Federal” Reserve: e.g., by disclosing more of the secret, TRILLION dollar bailouts that they gave the banksters and their trillionaire cronies from 2007 to the present.

Class C shares are for idiots and short sellers to gamble on. Not so if you are a CEO . Its cash out time for the CEO. If I were a CEO set to gain directly on stock buy backs I would load up. It’s legal and I could donate a wad of it to Congress Members who could help me keep the gravy train going. It’s cash and carry time in the USA if you are lucky enough to be compensated for buy backs . If you are a lucky one I say buy,buy,buy. They ain’t no down side other that the company might need the cash to survive on down road. But why should that be a CEO problem? Short term,is all that matters. If the company gets in trouble the Fed can hook them up with junk bonds that can be kept afloat with more junk bonds. The 99% ain’t gonna do jack about it other than flap their beaks because they don’t know how to get started without a poltical leader. Ha! the political “leaders” are already in bed with the CEO and the money.

What is a “class C” share in your discussion?

I’ve never seen this subject reported in that much detail before, so Kudos for that W.

Personally, I only invest in closed end funds and I’ve noticed a big increase in share buybacks recently, sometimes every day. Some say money has been draining out of UK value funds to growth funds, good luck to them.

It’s a different case for closed end funds because their share price can be at a discount or a premium to the market value of their portfolio. So if they do a buyback at a discount, they are adding to the value of remaining shares and also reducing the cost of dividends due to fewer shares to pay out on. Exiting shareholders can also normally gain a higher share price in the market. Similarly, if shares are trading at a premium it is beneficial to existing holders to sell new shares or shares from treasury, in which case the cost of dividends rises. These activities are very carefully managed and subject to specific shareholder authorisation at every AGM. 15% tends to be the upper limit for trading in any one year.

From the point of view of a long term dividend investor I feel that buybacks marginally increase my percentage ownership of the company and also lead to fewer shares sharing the revenues of the company but I’m only talking about closed end funds.

Wolf said: ” and many of those share buybacks are funded with debt, but debt doesn’t impact EPS.”

—————————————-

How does debt not impact EPS? Does not debt have a cost, interest, that reduces earnings as it is expensed?

Yes, interest is an expense and impacts EPS. But debt is a liability (on the balance sheet, not income statement) and doesn’t impact EPS.

If Apple sells $20 billion in bonds at an average rate of 1.5%, it gets $20 billion in cash that don’t impact EPS, and it has to pay $300 million a year in interest that do impact EPS. So Apple can buy back shares worth $20 billion in that year and only get a $300 million hit before taxes, and maybe $240 million after taxes.

Wolf said: “Nonfinancial corporate debt (bonds and loans outstanding, owed by companies other than lenders) spiked in the first half of 2020 and in Q2 reached a new record of $11.2 trillion,”

——————————————————–

What is the significance of separating nonfinancial debt from debt to include financial debt? Isn’t the totality of nonfinancial and financial debt an important metric?

Double-counting of debt. Banks borrow money to lend money. So if you count bank debt, you’ll be counting at least part of that debt twice: Once as the bank’s debt, and a second time when a customer borrows this money from the bank, and then it shows up as the customer’s debt. This is OK too, but we often separate it out.

Give me the power to define accounting rules and I care not who controls a nation’s money and I care not who makes the laws.

It’s sad, depressing, and a blot on humanity that some stalwarts hold out for fundamentals and principals but eventually give into the pressure of the greedy herd. It’s pure addictive gambling. The pressure to take the needle of free money is irresistible. Even the giants are torn down by the masses demanding profits. What happened to the giants raising the masses and inspiring then to their higher angels? Gone. What does that say about humanity.

I have always maintained that bankers and trash collectors are of equal importance to civilization. Both serve a function – one to allocate free capital to the most productive uses for society and one to collect the refuse and make the best possible use of it for society.

So why is one royally privileged and rewarded 1,000 times the other? Why has that one been allowed to destroy the financial structure that underpins business and commerce to their own selfish advantage? And why has the other been prevented from saving the environment from pollution and disease?

Shit, Musk is afraid of artificial intelligence, Bezos thinks he controls it, and bankers are too stupid to know what it means. But maybe we need someone or something to save us before we return to the nasty brutish and short lifestyle of survivability of the deadliest “nature”.

This is the corporate “buy low, sell high” strategy. At the end of a market cycle when stocks are at a top and companies are flush with cash they start buying back shares at a premium to keep the ride going.

When the market turns and they need cash to operate, they sell shares at the new, lower price to fund operations if they aren’t able to extend their line of credit.

Market manipulation by any other name smells just as rotten.

Just before the 1929 stock market crash there was a shortage of stocks trading on the NYSE. Today, These stock buybacks have created the same dynamics for another crash. Look at Radio Shack for an example of how a once prosperous company canabolized their balance sheet with stock buybacks, and went bankrupt. What is really sick is the level of debt accumulated by these companies in order to buy back their stock and push up the prices.