Everybody called it “Housing Bubble” after it imploded. Crazy things had been encouraged to happen to drive home prices into the stratosphere. Risks homebuyers and lenders took were enormous. Shady dealings everywhere. Everybody loved it. Governments at all levels incited it because tax revenues soar during housing bubbles. The housing industry did whatever it took to get there. Lenders got rich funding it. The Fed was looking down upon its creation with a divine sense of satisfaction. Then….

But that’s like so 2008.

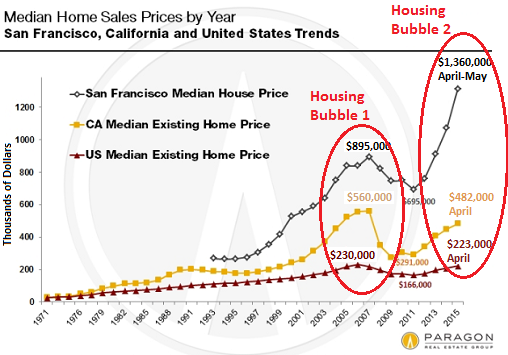

What’s going on today isn’t a housing bubble, of course. Nationwide, home prices are now finally close to where they’d been at the peak of the prior housing bubble. Still not totally there, but almost. During the peak of the prior bubble, the median price of existing homes was $230,000. In April 2015, it was $223,000. Just $7,000 shy. 3%! With a little effort and luck in 2015, home prices will finally exceed the crazy peak during the mother of all housing bubbles. Thank you hallelujah Fed for recreating the housing bubble, version 2.

But real estate is local, so prices vary. In San Francisco, something peculiar has been happing. Since January 2012, the median price for all types of homes has shot up 107%, according to Paragon Real Estate Group’s June 2015 report. Now 42% higher than during the peak of the prior all-time crazy bubble.

The median house price – not home price, thus excluding condos and TICs – has shot up 96% since January 2012, to reach $1,360,000 in May. Condos have hit a median price of $1,142,500.

Just how crazy has San Francisco’s housing market become? Here is Paragon’s chart of home prices going back to 1971. It compares San Francisco median house prices to the median prices of existing homes in California and nationwide. I circled in red Housing Bubble 1 and Housing Bubble 2, the latter being now in majestic bloom:

At the peak of Housing Bubble 1, the median house price in San Francisco was four times higher than the median price of existing homes in the US. It is now six times higher.

Is the median household income in San Francisco six times higher than in the US? Heck no! It’s $77,700; in the US, it’s $51,900 (2013). Incomes are 50% higher, home prices are nearly 500% higher. Go figure….

The US housing industry is still talking about the market not having “fully recovered yet.” The crazy peak of Housing Bubble 1 has now become the base line. The industry lives for housing bubbles. That’s when its actors get rich – and damn the torpedoes.

California overall is still not quite back at the tippy top of Housing Bubble 1, as some of the areas have been shameful laggards in this craziness. But the national median price of existing homes is only 3% below where it was during the craziest days of Housing Bubble 1. And the industry is hopeful to breach the old record soon.

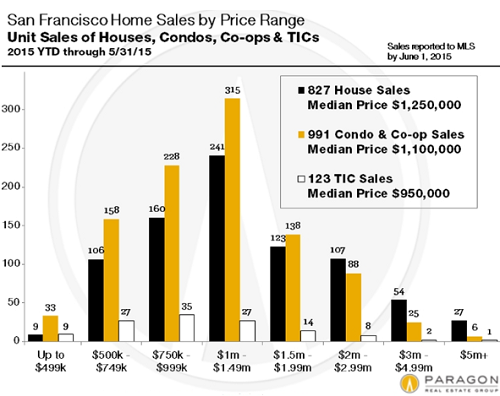

Housing Bubble 2 has shifted the dynamics, with the “sweet spot” moving ever higher on the pricing scale. During the first five months of this year in San Francisco, a total of 1,941 homes were sold, but only 51 were in the under-$500K price range, or about 2.6% of all sales. You don’t even want to know what less than $500K buys in San Francisco. And only 342 homes of all types, or 17.6% of total sales, were in the under-$750K price range.

The chart by Paragon, based on sales reported to MLS by June 1, shows where the action is:

Paragon’s Chief Market Analyst, Patrick Carlisle:

Four years ago, one found the most homes for sale in the $600,000 to $750,000 price segment. Now $1 million to $1.5 million is the “sweet spot” for San Francisco home prices.

So, if you can’t afford that – even if you were born and raised in the city and had no intention ever of leaving – leave; that’s the message of these prices. Make room for people that can afford them. Or shack up with five other people.

San Francisco, while extreme, isn’t the only city with this kind of pricing insanity. It fits neatly into the central-bank scheme of inflating all asset prices into absurdity on a global scale: five-year government bonds in Europe that have soared to such levels that yields have become negative; Chinese stocks that have lost all connection to reality; etc. etc. And well, median home prices that have moved far beyond the reach of the median household income.

But in San Francisco, we know how to deal with this: “Riding this wave while we can, as far as we can, for as long as we can.” Because we know it’s not going to last. Read… San Francisco Home Prices Spike, Exuberance Reigns

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

I am betting that the top of the current bubble is when Tokyo real estate values regain what they’ve lost since last time i.e. the grounds of Imperial Palace having more worth than the entirety of California.

Its all based on access to that FED zero percent fiat. The bay area is ground zero for hopeless IPO’s. If 2007 valuations were due to a bubble, how can we not be in a bubble now. When monkeys play with hand grenades I hunker down.

I’m wondering what will eventually cause this bubble to burst, clearly under Yellen’s leadership an interest rate hike isn’t going to happen in the near future, if ever. Maybe it’s possible the bursting will originate from somewhere else? China seemed like it would be, but Beijing blinked and threw another credit expansion to reinflate their bubbles. Greece blowing up and finally exiting the Euro might do it too, but that’s also a slow moving train wreck. Or maybe the bursting of the bubble will start here once the effects of QE3 has worn off. Interesting times we live in, speculation and uncertainty about.

Some possibilities:

1. Emerging market crisis.

2. Some unraveling of a huge Ponzi scheme. Last time the market brought Madoff down, this time it could be the other way around.

3. Terrorism. One more 9/11, the economy will collapse for sure.

4. Natural disaster.

5. Japan

6. A lot more.

You don’t think this treasury sell off will? Look at housing short etfs, starting to pile in.

San Fran has some heavy off-shore money flowing into it, especially from China.

Look at that chart by Paragon: it tells you all you need to know.

Ultra-rich aren’t interested in $1-$1.5 million housing. PE and hedge funds, if they haven’t been driven out of the segment by high entry prices chewing into their profits, either buy low or purchase condos wholesale.

So who’s been driving that massive bubble in the middle?

The answer is very simple: retail investors and small-middle size firms taking a page out of the zaitech system.

Retail investors have traditionally invested in safe assets. With sovereign bonds yielding far less than real world inflation, gold stagnating (though doing very well against all currencies but the US dollar) and fixed yield not doing so well, all that’s left is housing.

Firms spending their money on housing speculation instead than on CAPEX is a typical phenomenon of times like we have right now, which strongly resemble Japan in 1987-88 and Spain and Italy in 2005-06. Why bother with your traditional line of business when housing offers a potentially greater return? Consumers may be struggling with declining disposable income, but they’ll always need a roof over their heads.

Now: there’s a very good reason why I used that time frame of the zaitech bubble. Those were the peak years of the insane housing bubble in Tokyo and Osaka. Sure, values still inched forward in the following couple of years, but the big gains were already gone.

Much more critically, huge conglomerates such as Mitsui and Sumitomo had started exiting and cashing their checks in while their more ebullient rivals (such as Sanwa and DK) were still stuck into full bubble mentality and the market had started being aflush with video game developers and small shogo shosha eager to jump on the bandwagon, the so called “greater fools” which in 1990-91 were literally slaughtered.

There are two other problems here.

First is extreme prices are their own natural enemies. Even with interest rates repressed like never before, debt loads are becoming unbearable, especially in face of stagnating or, when adjusted for real world inflation, declining cash flow. Janet Yellen has painted herself in a corner here: she cannot raise interest rates to avoid massive hissy fits from Wall Street but she cannot lower them either because Europe has shown negative interest rates work even worse than neutral ones. In short the Fed won’t raise rates but won’t drop them either. It won’t come to the rescue this time.

Second is housing has a big, big problem: it may be “safe” when compared to other investments but is illiquid and is immovable. That makes it the perfect target for taxation by municipalities starved for cash and flirting with insolvency.

Due to political considerations, municipalities tend to cut some slack to residents owning just the house they live in (after all they vote in local elections), but more than make up for it by targeting homes held as an “investment” in ruthless fashion.

Property taxes and especially so called “junk fees” have shot into the stratosphere all over the Western world in the past decade and are still climbing forward. If you look very carefully at where PE and hedge funds invested more heavily, it’s invariably in areas where municipalities are in acceptable financial shape (hence less desperate for cash) or just content themselves with less. But retail investors often don’t take this into account. They just rush in, freshly signed mortgage in hand, and regret later not to have done their homework and picked Phoenix over Springfield or Jaca over Florence.

CA has Prop 13.

If the cargo shipping industry continues to decline, perhaps there will be a lot more shipping containers available for conversion to living space for us regular folks. And probably a new magazine and TV show “Better Carton and Crate”.

What’s the cost of homeowner’s insurance in San Fran? And is earthquake coverage included, or is it a rider? How much does that cost? Is it required for a mortgage? Just wondering.

Hazard insurance is not too expensive, I pay $250 annually for a 1BR condo. Very few people have earthquake insurance here. Mainly the expensive co-ops and some people who own their home outright. It’s super pricey and if there is a really big one, they still may not even be able to pay out.

Thanks for the information. I know after the active hurricane seasons culminating with Katrina, insurance rates on the Alabama coast really jumped. A friend of mine bought a foreclosure there for $100,000 cash that had sold in 2007 for $300,000. Nice place for this area. He said his insurance for it was more than a monthly mortgage payment if he had gone 20% down on a 15 year note. I decided not to move forward with a place at the beach after learning that.

My advice is to stop looking for a specific event to trigger collapse. We are already IN the collapse. Name a county that is solvent? Please? One that matters, I mean, not New Zealand where there are more sheep than people. What you’re watching is the wheels coming off in a series of steps.

Look at the inflection point in 2011 – right around Fukushima. This is all just private equity speculation on the upcoming boom in radioactive cesium extraction. I’ll bet Blackrock is behind all the buying. ;-)

ERG

I think you said it exactly right. The FED and Media narrative does not match reality. Rates continue to be at the zero bound. Traditional thinking would say that rates would rise as the economy improves. The FEDs action speaking clearly to the mess we are in.

If you draw a trendline through the yellow California graph, I’d say we’re about normal right now to slightly above, not bubble. The sad part is that so many hedge funds own the homes, it’s driven up rents. San Francisco is unique in many ways. Rent control, AirBnb, NIMBY planning, and affordable housing mandates are very restrictive on supply. Meanwhile, there are lots of new high paying jobs thanks to loose VC funding, and it’s just a really nice place to live. But the real price increases are driven by the foreign cash with no regard to the principle of substitution. Cash sales are around 25% and these folks are not distressed sellers during a downturn. This should greatly buffer the next crash, I don’t expect to see more than 10-15% drop in SF proper.

During the big crash, parts of SF like Bay View/Hunter’s Point RE dropped by half. But other areas like the Marina fell by 20% and some areas like Cole Valley hardly fell at all. This is during the worst financial meltdown since the depression. The next recession will cause price drops but most likely less than what we saw during the “big one”.

Has anyone done a regional dollar weighted average distribution and a histogram of sale prices (in the US) to see where the home prices have stagnated and where they are booming besides Washington D.C., New York, San Fran (Bay Area)? Where I live prices have not budged for 7 years. So I expect the mean, median and mode have a large divergence