“Sluggish westbound volumes have brought about the worst spot market rate collapse that this trade has experienced.” That’s how Drewry Maritime Research summarized it in a report a couple of weeks ago. Since then, the collapse of the rates for shipping containers from China to the West has gotten worse with clockwork relentlessness.

In mid-April, there had already been a lot of handwringing. The Shanghai Containerized Freight Index (SCFI) tracks spot rates of shipping containers from Shanghai to 15 major destinations around the world. At the time, rates from Shanghai to Rotterdam had plunged to $399 per twenty-foot container equivalent unit (TEU), down 67% from a year earlier, the lowest rate ever, and half of what was considered the break-even rate for these routes.

It seemed that there would have to be some kind of uptick – that efforts by carriers to impose higher rates would stick. But nothing worked. So a week ago, there was a lot of handwringing because rates to Rotterdam had dropped to $243 per TEU, which wouldn’t even cover the cost of fuel of about $300 per TEU.

But now, in the week ended June 19, the spot rates from Shanghai to Rotterdam plunged another 15.6% to $205, a previously unimaginable low.

And it’s not just to Northern Europe.

On the routes from Shanghai to the US West Coast, carriers also tried to implement rate increases effective April 1. But after an ephemeral uptick of $300 to $1,932 per forty-foot container equivalent unit (FEU), spot rates re-swooned. By the beginning of May, the index had dropped to $1,783, about back where they had been a year earlier.

But look what has happened since. Last week the index plunged 5.4% to $1,268 per FEU, down 29% from the battered rates at the beginning of May.

Spot rates to the US East Coast are also getting beat up: down 3.3% last week. Of the 15 destinations in the index, rates dropped for 11, remained flat for Taiwan and Hong Kong, and rose for Korea and East Japan.

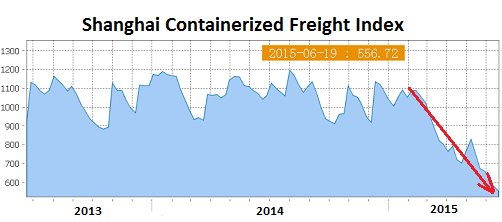

The overall SCFI dropped 4.3% for the week to its lowest level ever: 556.72. It’s now 44% below where it was during the Financial Crisis, on October 16, 2009, when it was set at 1,000, and down about 50% from February. This is what the terrible plunge looks like:

The phenomenon has impacted other ports and contractual rates, not just spot market rates.

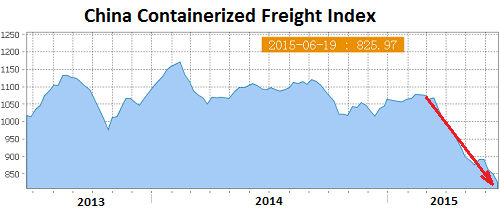

The much broader China Containerized Freight Index (CCFI), which tracks contractual rates along with spot market rates from all major Chinese ports to major destinations around the world, dropped another 3.0% last week, to a multi-year low of 825.97. The China-Europe component plunged 7.9%. Rates to the US West Coast dropped 1.8% and to the US East Coast 0.2%

The CCFI is now 23% below where it was in February, and 17.4% below where it was in 1998, when it was set at 1,000! This is what the chilling trajectory looks like.

The total collapse of shipping rates from China to much of the rest of the world is driven by two factors:

Crummy demand for Chinese manufactured goods around the world, a result of lackadaisical economic growth, if any, in the developed markets.

And a breath-taking and ballooning oversupply of ships to transport these goods. The resulting losses for carriers have sent executives to tear out their hair. But not everyone is screaming.

The largest carriers, fueled by cheap money central banks have made available, are purposefully adding enormous capacity to drive up their market share and destroy the price so that smaller carriers with less money to blow would be forced to exit the market, allowing the top carriers to build a global shipping oligopoly.

“I don’t think it will backfire,” explained Nils Andersen, CEO of the Danish giant A.P. Møller-Mærsk, whose Maersk Line is the largest container carrier in the world. Read… Top Carriers Wage Price War to Form Global Shipping Oligopoly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“I don’t think it will backfire”

Said the guy flipping houses in 2007.

Said the Hunt brothers in 1980.

Said LTCM in 1998.

this article equates shipping rates with the volume of shipping from East to West. They are not the same thing. The shipping business is in trouble more from too many people rushing into it. Too many players, too much capacity.

There is a vague reference to shipping volumes, but, it is in another article and it is not referred to after that.

Alarmist, misleading article.

I have no idea how you come up with your interpretation. Did you even read the headline or the rest of the article? This article is about shipping rates, which collapsed. The indices too are about shipping rates. This article then presents two causes for the collapse in the shipping rates: so-so demand for Chinese goods (volume) and terrible overcapacity.

Wolf this guy is most likely the president of one of the top 5 carriers. These idiots cannot comprehend what they read either. You above point is spot on. Lines have been losing an average of $50/teu (twenty foot equivalent unit) since 2008 on average.

The simple fact is that liner shipping companies are staffed by people lacking the sense God gave an earthworm.

Don’t believe me, just ask any liner shipping company customer anywhere.

The issue is whether the __________________________________ companies are making any money. Oil, steel, containers, retail. airlines, bond traders … they aren’t, they really never have. (They all borrow because they have to.)

Rates are down, volume is … meh … more ships are coming into service … nothing bad can happen, right?

I remember a few months ago an analyst for HSBC said China’s economy behaves “according to Heisenberg’s Indetermination Principle: the closer you observe it, the more it seems to change its behavior”.

This analyst didn’t flat out accuse Beijing of coming up with completely fanciful data but came up with a long list of indicators that over the years had become unreliable due “continuos changes in seasonal adjustment not to mention gross overestimates”. Intriguingly enough he clearly mentioned among these the volume of containerized freight goods moved at the Shanghai harbor: the statisticians in Beijing fiddle with it so much we literally do not know how it’s really doing at any given moment.

But one thing these statisticians cannot fiddle with is the cost of moving those containers.

Assuming export volumes are constant (as said, we have no way of truly knowing this right now), it means the bane of modern economies is hitting hard and hitting fast: overcapacity.

Maersk’s new megacarriers may be the most visible part of it, but let’s not forget middle-sized Mainland Chinese shippers have embarked on very aggressive expansion schemes of their own, apparently with Beijing’s full approval and backing. It’s really astonishing Maersk thinks it can drive these aggressive competitors out of business: Maersk may have access to dirt cheap credit, but their Chinese competitors are backed by a ruthlessly merchantilist superpower which has proven itself ready and willing to do literally everything to aggressively promote exports and gain market shares. What if Beijing, like it subsidized energy bills for export-oriented firms, will start aggressively subsidizing fuel bills for freight companies? What if loans to build new carriers get handed out with the same largesse as those which built mega malls in the middle of nowhere? It will be a bloody war of attrition.

These new Maersk supercarriers remind me a lot of Daewoo TI-class supertankers. These were built for Greek shipping company Hellespont around 2003, when oil prices only seemed to be destined to go only upward. Just to give an idea of how large these ships are, they are wider than the Panama Canal and can carry almost 450,000 barrels of crude.

After a few years, Hellespont sniffed the air and sold off all four TI supertankers: two went to a Belgian shipping company and the others to tanker giant OSG.

Despite oil prices catching up after the late 2008 slaughter, these tanks have become uneconomical to operate: in 2010 OSG raised the white flag and parked her two TI-class off Qatar to serve as floating storage facilities where they are effectively dying a slow death. It will be interesting to see how they will broken up when their time comes.

The other two TI-class are still in service but will probably join their brethren in the Gulf very soon.

The new Maersk Triple E container carriers are larger than the already gargantuan TI supertankers. To make matters worse, Maersk ordered twenty of them from Daewoo, with deliveries to be completed later this year, and are all scheduled to be put in service on Asian routes, where Maersk already has over a hundred ships in service.

And apart from Maersk’s aggressive Chinese competitors, other shipping giants have ordered similar colossi: CMA CGM bought seven very similar carriers from Daewoo which are already in service.

All these shipping companies are effectively placing a huge bet on Asia not only remaining the world’s premier exporter, but also to keep on growing at the same pace as the last decade.

While there’s little doubt the XXI century will be “Asia’s Century”, even Chinese President Xi warned time and time again the years of steady yearly 7+% GDP growth are a thing of the past and the future lays in “much slower but more sustainable growth”.

When this happens I wonder what it will become of Maersk’s super carriers. Perhaps they can be anchored off the world’s leading financial centers as floating warnings that massive overcapacity is never a good idea, no matter how rosey the future looks…

Well, yeah.

Since Europe and the US are in RECESSION, is it any surprise that demand has dropped for the useless, overpriced, underperforming junk coming from China?

The US does more trade with Canada than China. We also do a lot of trade with Mexico. It would be interesting to see the Canadian and Mexican Freight Indices along with China’s Freight Index. Those three countries would cover nearly 50% of our total trade.

Noticing the high yields, near 10% for some, in shipper stocks.. Others are big neg EPS values, FREE example plus it’s R/S serial deliveries.

Mergers ahead, worse case they pull out of Greece all at once. Easy enough to do.

China has all these big plans to cut routes thru South America if not also a wider Panama Canal style cut in Middle America. So far only 1 big deep port I think on US East Coast to receive the mega ships. With those automatic slow moving sail powered ships costs can be contained.

Big question will be if US people continue to want ‘junk’ when such a cultural push away from throwaway economy.,

Chinese doing well in NYC buying up condos at record rates. Guess they smell an issue ahead.

DJT took hit today. We’ll see,

Don’t worry Wolf. When they call you names your knocking it out of the park. The pioneers take the arrows. Just since I’ve been commenting here I’ve been called a tinfoil hat, a denier, and a troll. Keep it coming!