SEC, did you look at the story two months ago that Amazon “is set to win unconditional EU antitrust approval,” which caused iRobot to spike 39% in one day?

By Wolf Richter for WOLF STREET.

Amazon’s acquisition of iRobot for a ridiculous price of $61 a share – announced in August 2022 and now likely getting nixed by EU competition regulators, whew, Amazon sighs – was a deal made in heck from get-go.

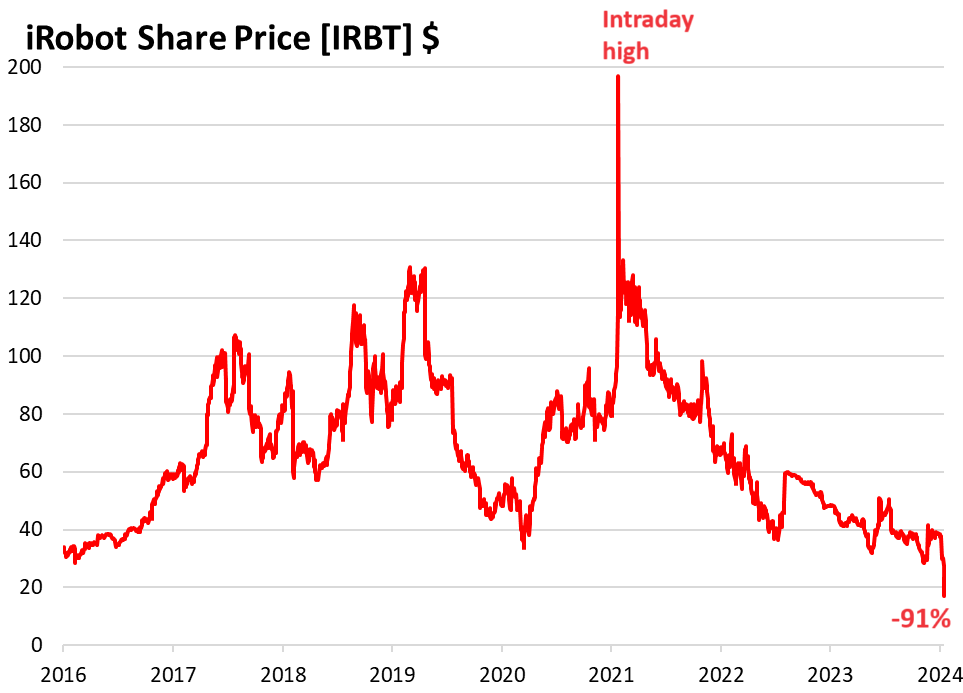

iRobot had become a meme stock around 2017 with huge spikes and plunges that were driven to the next level during the meme-stock mania in 2020 and early 2021. On January 29, 2021, iRobot shares [IRBT] spiked to an intraday high of $197, giving it a market cap of $5.5 billion. Consensual hallucination is what we have come to call this phenomenon. Oh dear, to the moon!

But after that spike came that infamous February when this kind of stuff started coming apart, and iRobot shares went to heck. By now, they have collapsed by 91%, including a 45% kathoomph over the past five days, to $17.26. The company is now a shining hero in our pantheon of Imploded Stocks.

The misbegotten takeover announcement came just months before Amazon made another announcement, this time of mass layoffs, including at its hardware division that makes consumer devices such as the Echo, Alexa, Fire, and Kindle. The iRobot consumer gadgets would have fit right in there. And Amazon had a change of mind about its strategy with these gadgets.

Alas, after the takeover announcement, iRobot got busy disclosing stuff that had gone wrong at the company, including declining revenues and big losses.

In July 2023, Amazon lowered the purchase price to $51.75, which caused iRobot’s shares to plunge. Doubts about completing the deal started spreading, and the shares kept sliding.

On November 8, 2023, iRobot reported a huge loss and awful revenues. By November 20, shares were trading in the $29 range, amid doubts that the EU competition watchdog would approve the deal. And then, a miracle happened – actually no miracle, just the normal market manipulation that we’ve become so familiar with.

Someone seems to have planted a story, published as an “exclusive” by Reuters – citing “three people familiar with the matter,” as these things usually are – that Amazon “is set to win unconditional EU antitrust approval” for its acquisition of iRobot, which was then repeated by CNBC and others, and shares spiked 39% that day, from $29.83 at the close on November 22 to $41.48 the next day. SEC, did you take a gander at this?

So then on January 18, Thursday evening, the Wall Street Journal reported that competition officials at the European Commission “met Thursday with representatives from Amazon to discuss the deal, one of those people said. Amazon was told during the meeting that the deal was likely to be rejected, the person said. Amazon declined to comment.”

“The plan to reject the deal would still need formal approval from the commission’s 27 top political leaders before a final decision can be issued. Historically, that process is unlikely to overrule a recommendation from the bloc’s competition commissioner, Margrethe Vestager. The commission has a Feb. 14 deadline for its final decision.”

Shares instantly tanked 40% in afterhours trading on Thursday. On Friday, they closed at $17.26, down 27% for the day and down 91% since the meme-stock peak in January 2021.

Lots of people lost lots of money on iRobot. But some people made lots of money, including from the fake approval announcement if they got out in time. There are no victims here. It’s all part of the fun, part of the consensual hallucination that people had been so eager to participate in. And there is still plenty of consensual hallucination going around, people are still eager to be part of it, because this time, consensual hallucination will not fade, it will just keep going?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

All they had to do is rename it to AI-Robot and stock would be back to $200.

RobAIt.

“It’s in the Name”.

The Nasdaq is up 50% based on expectations of Fed Pivot, soft landing, and Davos narrative.

On ground, the only positive I’d deficit spending and explosive debt increase. The whole market seems like a ponzi scheme.

The chart above is what Nvidia stock is going to look like.

Except Nvidia is the backbone of AI. So maybe not?

This is precisely why indexes crash so hard when the recession hits. Expecting Goldilocks, when the last 2 times caused massive crashes, is ridiculous. This time won’t be any different.

Leo you’re correct except none of it is a ponzi scheme, it’s called a ZIRP induced everything bubble. The stock market isn’t a Ponzi scheme either it’s a big casino. Get your scams termed properly, lol. 😆

AI will go the way of stemcell stocks, dope stocks and wind power stocks. Airheads get suckered in every time.

The name iRobot is itself a play on the Issac Asimov short stories (the Three Laws of Robotics…). I remember wanting to buy the stock 25 years ago. And I did purchase the first roomba edition and warned my wife she could be replaced. Just kidding. But the only money the really made was in roombas used to deal with bombs.

THe SEC ganders only at little people.

That is because whenever the SEC goes after the big people, the big people fool the masses to defend them. They yell over-regulation and market interference and the sheple come calling complaining about the lack of free markets.

Sadly this won’t stop or slow down Bezos on buying another mega yacht that might not fit under a bridge or going to Mars, Uranus or whatever…

If there’s a price to pay for these foolish money burn it will just be more layoff time at good ol Amazon..

Bezos has this obsession with phallic form. Look at any Amazon box, or Blue Origin. Come out already, it’s 2024.

A real dick likes to display his wealth with phallic form object, no surprises there

I don’t like rich people but having interacted with him directly, I can tell you that he is a very considerate person, mercurial and a value minded person himself.

Among all the rich folks, he is the least flamboyant, humble (never hear him have an opinion about everything) and surprise surprise a follower of Munger and Buffett. He got the idea of long term orientation from his chance meeting with Buffett in 2000 (he told me that himself)

I guess the man is entitled to some luxuries for having worked extremely hard all his life.

Sorry but credit should be given when due.

Didn’t Jeff Bezos get seed money from his already upper-middle class parents to start up Amazon when PCs and the internet were in their infancy?

How many people work hard, but don’t have rich parents?

Gen Z:

Yes, life absolutely has big helpings of randomness in it, i.e., luck. Unequal paths and outcomes. We cannot devise a system that would “perfectly” eliminate that, if we wanted to. (See hall of failed experiments, prominently communism). But also there is a saying, luck is when preparation meets opportunity. Bezos made a LOT of what was handed to him. So I try for myself to never give up hope, and be prepared. Best wishes!

phleep, true indeed. Some people are lucky to seize the opportunities while some do not.

But I find it strange for using Bezos as an example of bootstrapping and a rags to riches story.

Our generation has been aware of these PR campaigns where some offspring of a well-connected Hollywood mogul is portrayed as a grassroots personality who started from nothing.

And when we look more into the story, their entire life is based on connections and access to money. Money makes money.

There’s no such thing as a self made person. Every one has advantages that were passed on by genetics, due to family connections or financial means. There are also those who live to comment on blogs about how incredibly successful people are losers who don’t deserve their success and excuse their own lack of success because they didn’t have the same advantages.

I can sure devise a system that would work better than the one that’s enabling Amazon to do what it’s doing. You can’t have a society that’s in a second Gilded Age, with high and rising levels of economic immobility and inequality. Then have someone who happened to get “lucky” go on to create a company that is perhaps doing more than anyone else to create a monopoly and monopsony, push down working conditions and send everything offshore, take advantage of tax shelters and rely on the current Fed and FTC mismanagement to buy up the competition and operate at a loss to starve out any that remain, and generally enjoying a lot of advantages that our miraculous system has only made available to those who are already ahead, and then turn around and say it’s luck, it’s hard work, and he is entitled to “some luxuries” for it.

“The [Material Power Index] for the 400 highest American taxpayers is many magnitudes greater than the indices even for the top of the Athenian trierarchy, and is nearly identical to the concentrated wealth of Roman senators. The degree of material concentration in the US is vastly greater if the estimates are based on wealth rather than income. Depending on whether home equity is included, the MPI of the wealthiest oligarchs in the US ranges from 21,000 times to 108,000 times that of the average household in the bottom 90 percent of society. Based on income, the asymmetries in material power resources in the US are enormous. Based on wealth, they are simply too staggering to fathom. Moreover, it is impossible to operationalize precisely how much more political influence oligarchs have if they command 1,000, 10,000, or 100,000 times the material power resources of the average citizen. What can be said with confidence is that this does not look like garden-variety pluralism.”

-Winters, “Oligarchy” p216

“Then have someone who happened to get “lucky” go on to create a company that…”

Yeah, it’s just luck, you see. No sacrifices, no hard work, no intelligence. No, no… just luck.

“…and then turn around and say it’s luck, it’s hard work, and he is entitled to “some luxuries” for it”.

So, it is not luck now? Ok.

Envy is such an ugly feeling.

Yes, the world is far from perfect. But, I personally know quite a few cases of people who came from poverty, almost ZERO formal education, busted their assess through life, and amassed pretty impressive amounts of wealth. The keyword here is: busted. You have to give up quite a lot of things during a LONG period of time. And it is a sacrifice not many are willing to do. No saying all and every rich person gained wealth this way, just in case.

So no dude, I am sorry. If your goal in life was to make a lot of money, nothing outside yourself stopped you from achieving it.

“SEC, did you take a gander at this?” Haha as if good ol Gary actually have a spine to go after balant stuff like this…looks at how much slap on the wrist they do to Musk…classic SEC

It is appalling why SEC would not investigate or why the journalist who planted the story was not asked to explain.

Have we become a country that doesn’t care anymore or have we given up all hope of fairly functioning markets.

I moved to the US from India. This kind of stuff is normal there. But would have never believed it to be true for the US….unless of course you see it for yourself.

Actually just read this article

https://ec.europa.eu/commission/presscorner/detail/en/IP_23_5990

which explains that the regulator has raised objections. None of these objections are insurmountable. Amazon could easily provide guarantees that highlighted objections will no occur. Unless of course Amazon no longer wants this deal (which is likely the case)….who knows it may be an example of a big tech company leveraging regulatory action to back out of the deal.

It feels odd to me that EU is concerned about monopoly in this product segment. The fact that existing players barely make money is indication enough that there is either sufficient competition or the market itself doesn’t exist.

Could this be another price manipulation tactic?

But your point about hallucination is indeed true. Irrespective of the outcome of regulatory probe, the stock is doomed because of stock valuation…Amazon’s involvement is just providing it more visibility.

Wait a minute…

That press release you linked was dated Nov 27. And it got some publicity back then, including reporting that Amazon would not contest the objections because it wasn’t interested in the deal anymore.

It helps to look at the dates 🤣

Nov 27 was five days after Reuters’ “unconditional EU antitrust approval” came out.

The informed and sophisticated will take advantage of the uninformed and naive. This custom is considered a form of economic equilibrium by two Nobel laureates, Akerlof and Schiller, in their book Phishing for Phools. A very good read.

As an example is the latest California land grab:

The Farmers Had What the Billionaires Wanted

Caveat emptor Not for government to regulate but for the buyer to beware of what he buys

@andre: Oh really..? Well, guess we can get rid of all investment, financial, and customer protection regulations and everything should work well. SMH!

“Fake it, ’till you make it” was coined in the US. So don’t be surprised when people are actually doing just that.

@Aman: All I can say is that you seem to be awfully naive about “planted stories”.

Watch Jon Stewart’s interview with Jim Cramer on Comedy Central where the latter openly talks about a “hypothetical” short-seller could spread rumors in a “hypothetical” Apple short-sale situation.

Cramer repeatedly uses the word “shenanigans” when he refers to the half-truths and misrepresentations in interviews and reporting at CNBC.

These “shenanigans” have been happening all through the world from time immemorial – and the reason is pure, unadulterated pursuit of money at all costs without any scruples.

I don’t see this ending any time because of our Wall Street dictum “Greed is Good” and greed is worshipped on Wall Street.

Guilty as charged :)

Wolf Richter: “SEC, did you take a gander at this?”

SEC: “Mmmmmm, nap time…more hot milk please….ZZZZZZZZZZ”

The AI stocks will crash this year or next. Same as the rest. No profit cash furnaces. No more nirp makes it hard to hide the trash.

My thoughts too.

There is always the next pot stock.

I’m in healthcare and we have used AI for a while in certain fields. It makes money for companies that provide the service for sure, but imo it just adds costs and doesn’t change outcomes. IBM had Watson for a while in healthcare and I think their partnerships ended at places like MD Anderson among others. Today I know ai is used a little bit in radiology. In mammography for decades now (called CAD) and all the mammographers I know said it never helped or changed their reports, but they tell me always make sure to document CAD was used in the report for billing purposes as it pays extra. AI has been used in CT heads to detect head bleeds for years now, but again it’s not accurate and doesn’t learn or if it does it doesn’t learn correctly or way way too slow to notice any improvement. Also same deal with CT chest exams for lung nodule detection. All of those get billed extra so healthcare costs up and also takes more time to review extra data, but all for same outcome. Oh well…it’s a money maker so it will stay that way until people realize they’re paying more for the same outcome.

The question that didn’t get answered, is iRobot a EURO company that needs regulatory approval there?

But honestly, naming a company iRobot sounds like a scam in the making.

Normal robotic companies have a humdrum names like Kuka, Fanuc and so on.

My understanding is that approvals are based on selling markets and not on region of incorporation.

Which is why Activision transaction had to get approval in EU even though MSFT and Activision are US based companies.

Come to think of it EU did not see any issue with that transaction but iRobot they think will create market power

As a researcher, program manager etc. in emerging technologies, my mantra had been,

The half life of technologies keep shrinking and shrinking. Only few would survive for some decent period. 2008-2023 guyhas been an Aberration, Tulip maniaed by Financial engineering. We have to wait and see how this ends.

By the way, I let my original Xiomi MI robot bought in 2016 or so to roam around my home. It still happily keep s__k_ing.

My company’s client is iRobot.

iRobot orders were busy in summer and early fall last year, and then the company laid off a bunch of staff.

Then they instead re-hired international students while those who worked through the former temp agency are unemployed and looking for a job.

This is in some operation of iRobot in Canada, right?

iRobot is headquartered in Bedford, MA, USA.

I’ve seen a ton of iRobot merchandise in the warehouse, and displays and stuff, so I’m guessing that iRobot has operations in Canada, or uses Canadian companies to “offshore” some of the jobs.

There were like thousands of those spinning discs packed in boxes ready for shipment to the States.

Armed with a copy of “extraordinary popular delusions and the madness of crowds”, and a copy of a couple of Warren Buffett and Charlie Munger essays, and realizing CNBC is a free entertainment show and not an investment advisor, a person should do well in the investment world. otherwise, not so well.

And, forgot to mention, the WSJ being the print version of FoxNews.

WSJ editorials sure, but the WSJ (minus articles that start with “OPINION”) is fairly middle of the road politically.

Has the WSJ been sued successfully like Fox was for 700 million by Dominion Voting Machines? The basis of Fox’s defense, essentially that it was just repeating gossip. amounting to admitting it is not a news source. There is a reason real journals employ fact checkers.

Fox and Tucker Carlson defended themselves in defamation-like suits by arguing that the viewers did not expect truth from Carlson and that his statements were opinions for entertainment value. Same for Bill O’Reilly, no slander, he was just being an entertainer.

S & P and Fitch got off on similar charges after the financial collapse in ’08 claiming that their advisory service – rating the solvency of companies – was just their opinion; they weren’t accountable for truth.

Just another reminder that I have to be grateful for sites like this one, from Wolf Richter.

How – quintuple check.

may we all find a better day.

Love that chart. That spike is an aye-opening spire of folly!

Wolf wrote, “There are no victims here. It’s all part of the fun, part of the consensual hallucination that people had been so eager to participate in.”

“It’s all part of the fun” should have been the headline on October 30th, 1929… and perhaps, “Just Some Consensual Hallucination, Folks” in September 2008.

I see similar fate happening to lot of tech companies riding the AI hype.

It’s a matter of time.

Did anyone see Coinbase (COIN) the past two months?

$75 on Oct 30 to $186 on Dec 28. Major collapse to $125 now.

How about NVDA? It was $475 on January 3, closed Friday at $595, a gain of 25% in 11 trading days (!!!!!) On Jan 3, a $580 call option for Jan 19 was .12 with a Delta of .01 and an OTM of 99.27%. It was a 125 bagger.

I am seeing stuff that I didn’t even see in 1999/2000.

It will probably be another up year, the calls are much more expensive than the puts, which is very unusual, and the same condition as last year.

I expect a lot of volatility with individual stocks.

The Russell 2000/S&P 500 divergence is the greatest it has been since 2003. The IWM historically trades at about 50% of the SPY, it is 40% of the SPY now. In 2014 the IWM was 62% of the SPY. Microsoft is now valued at about the entire Russell 2000.

Tech mega cap mania won’t last. Coming into the year, it was widely expected for the market to broaden out, so far it is not happening, but I think it will. I expect the small caps to play some significant catch up.

Or the tech Mega Cap would catch down to small caps.

All these.mega cap gains are based on fed pivot to zirp .. rate cuts.. deficit spending .

If you look beneath the surface their earnings can’t justify the gains they have .

Mr. Richter, sorry about the duplicate post, I have a new e-mail address and entered it incorrectly the first time.

Yes, looks like it. No problem. Email typos are common.

Perhaps completely unrelated but massive wealth inequality is more likely to create these situations. The wealthiest of Americans, those owning a significant amount of the equity market, has too much wealth they couldn’t spent it outside of buying small countries or islands. The money has to go somewhere so it goes into everything. It like me going large in a poker game with friends and betting the 50 cent max on the pot except they do it with millions and millions. Sometimes you win, sometimes you lose but in the end just play money for most of them. They don’t make toys big expensive enough when you are worth well into the billions. Then they donate 50 or 100k or even a few million, mostly for tax purposes, and that class celebrate themselves while continuing to exploit the system and the working class.

Twitter was a great toy for a while…

///

Hmmm…Planting incorrect information on the outcome of a (legal) battle…Where did I hear of that…? Hmmm…

///

Not only was this a bad company to “invest” in, but the product didn’t work. My wife received one as a gift from her mother. It scooted here and there and frequently got lost. And it simply didn’t work.

Clever idea…but just that, an idea.

The author- this must be a joke-

Foo Yun Chee

Thomson Reuters

An agenda-setting and market-moving journalist, Foo Yun Chee is a 20-year veteran at Reuters. Her stories on high profile mergers have pushed up the European telecoms index, lifted companies’ shares and helped investors decide on their move. Her knowledge and experience of European antitrust laws and developments helped her broke stories on Microsoft, Google, Amazon, numerous market-moving mergers and antitrust investigations. She has previously reported on Greek politics and companies, when Greece’s entry into the eurozone meant it punched above its weight on the international stage, as well as Dutch corporate giants and the quirks of Dutch society and culture that never fail to charm readers.

Was the whole scene based just on the vacuum?

The shorts should take half profits at the 2 dollar level.

The SEC recently approved bitcon “ETFs” (supposedly not real ETFs), the purveyors of which include the wall street company BlackRot. One wonders if BlackRot likely sees it as an easy way to take money from foolish people and if the SEC may be compromised in their duty. Shame on the leadership in both these organizations for allowing this.

BlackRock’s business model is to extract fees from investors. It doesn’t matter what the investment is. People gambling with cryptos are a great target for fee extraction. They’re sitting ducks.

Wolf, what do you think of SMCI, Super Micro Computer Inc? Price of $436.36 at Friday’s close up $111.92 (35.92%). Part of the AI microchip Consensual Hallucination?

At some point, the entire AI space is going to have its day in reality. That’s what I think.

It is a metal basher. Just assembles IP that they do not own into a full server machine. Low margins and no moat.

They likely benefiting from long term supply agreements with Nvidia. AI enthusiasts cannot get enough chips from Nvidia so SMCI has a bit of an arbitrage.

History is unkind to over investment in new technologies. Let us see if this time is different.

Who knows maybe the Fed papers over the losses by creating more base money. We aren’t living in normal times anymore.

Too much of tinder from preventing wildfires. Now no small fire can be tolerated. But who cares about this stuff anymore. Wall St is having a day with other people’s saving. All the risk is now borne by the US tax payer. Privatize profits, commonize costs.

What I fail to understand is how they make losses on an item that is made up of plastic encased battery, sensors, dc motor and a chip.

The price of them is astronomical. Who or what is bleeding the 1.1 billion income from 40 million world wide sales.

Just like Uber money just gets skimmed away

iRobot’s biggest problem is that their core patents have mostly expired, opening the door to massive competition. The Roomba originally enjoyed a massive profit margin and the company grew accustomed to spending levels based on those original margins.

When the competition floods in, it’s extremely difficult to cut fast enough in the right places for the company to survive.

Most likely, iRobot’s name and products will be picked up by a Chinese company for pennies on the dollar following a bankruptcy.