A home enters inventory when it’s listed for sale and exits inventory when the sale closes. Technology sped up the clunky processes in between.

By Wolf Richter for WOLF STREET.

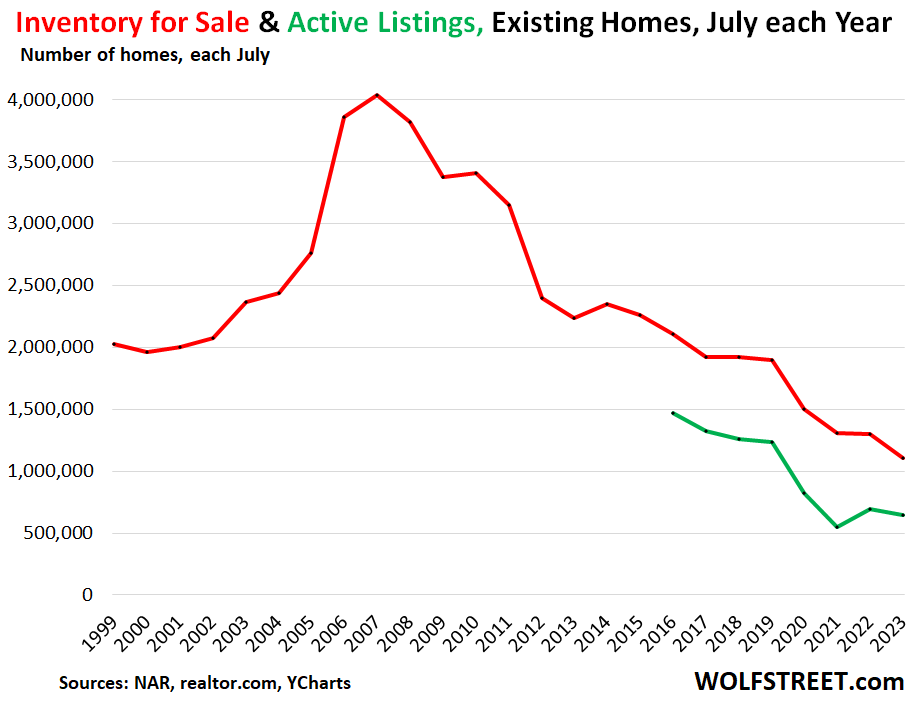

There has been a lot of noise about how the inventory of existing homes in July, at 1.11 million, was the lowest for any July on record. It wasn’t actually the lowest inventory on record; that was in January and February 2022, with 850,000 homes in inventory. (July sales also dropped about 25% from the the last two Julys before the pandemic).

But each one of the last seven Julys – 2017 through 2023 – was the lowest July on record. Inventories have been declining ever since the inventory peak of the housing bubble in July 2007. Of those 16 years, inventories rose year-over-year in only two Julys, in 2010 and 2014.

The chart below shows the inventory each July (red line), according to data from the National Association of Realtors; and “active listings” (green line), according to data from realtor.com.

Inventory tracks homes from the moment they’re listed for sale in the computerized listing system to the moment the status in the system is changed to “Closed,” or when the status is changed to Cancelled or Expired after it failed to sell (homes getting pulled off the market when they fail to sell is another factor the reduces inventory, but isn’t the topic here).

So “inventory” includes homes whose sales haven’t closed yet and are pending, waiting for mortgage approvals, etc. Homes with pending sales are no longer being marketed, but still show in inventory until the sale closes.

Active listings represent the inventory without the homes that have pending sales. These are the homes that are still being actively marketed (the publicly available data of active listings from realtor.com only go back to 2016).

Unlike inventory, active listings rose in July 2022 from July 2021. While they dipped in July 2023 to 646,700, they were still 18% above July 2021:

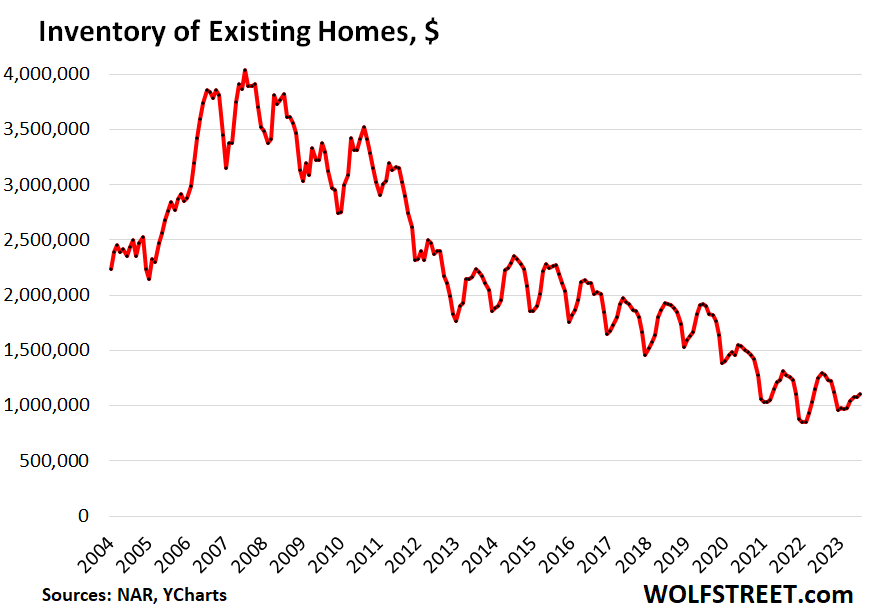

And here is inventory for every month, according to the National Association of Realtors. Julys are in the tops of the seasonal peaks (historic data via YCharts):

The big reason: technology finally sped up clunky RE processes.

A big reason for those declines in inventory is that “inventory,” the way it is defined, has finally been visited by technology after the Financial Crisis, and technology in RE was taken to the next level during the pandemic.

A home enters inventory when it is initially listed for sale in the MLS, and it exits inventory when the sale closes or when the home is pulled off the market. So the time it takes to do all the processes from marketing the home to getting a mortgage approved, getting inspections done, to shuffling documents around, and closing the sale determine how long a home sits in “inventory.”

Over the past 15 years, the real estate industry digitized. So now when a home is listed, the listing can be seen immediately by a potential buyer 1,000 miles away. In the old days, you had to submit the listing to the local newspaper which would print it in its weekend RE section. Papers made spades of money doing that, now many have gone bankrupt.

All the clunky processes that go on from when a house enters inventory and is being marketed to the public until it exits inventory have been sped up by the internet and digitization.

Zillow, Redfin, realtor.com, and a gazillion other real estate tech firms have sprung up over the years to make the listing itself and all kinds of info about it instantly available to potential buyers. No one has to wait for the paper to print the weekend edition, or whatever.

Within moments of the home getting listed, someone might be watching the video tour, scroll through past listing and sales prices, look at when the listing got pulled and then relisted, etc., look at market data, get estimates of mortgage payments (“get pre-qualified,” the Zillow button says) and apply for down-payment assistance (“check eligibility” the Zillow button says). Info on property taxes, insurance, homeowner association fees, etc. is right there on the smartphone.

Marketing the property has turned into an instant sound-and-light show that people can see while at work, instead of having to wait for the weekend to dig through papers, make phone calls, and worse, go places.

The tech includes video tours of homes that cause people to buy a home without ever setting foot in it. You can get mortgage approvals in hours or days, not weeks. Electronic documents and signing of electronic documents, long a staple in other industries, are finally common in RE. Remote online notarization (RON) is allowed in many states; the RON system makes eClosings possible, where all or most documents are viewed and signed online.

All processes that go into marketing homes and making and closing deals have sped up dramatically. The time that a home sits in inventory includes the time spans of these processes, and these time spans have shriveled. Back then, inventory seemed huge because the processes were clunky and slow with long wait times. But all that has changed. And that’s one big reason why inventory has continued to shrink over the years.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Excellent article Wolf but what you’re saying is that true inventory is low? Is this why housing has yet to come down? All I know is that I really want to buy a home but can’t at these crazy prices. I need to hear good news Wolf, lol. Maybe I’ll eventually be able to buy a shack somewhere near old beaten down Phoenix, where every drug addict is on a corner asking for his daily fix. I really hope that’s not the case and I pray for those lost souls but I don’t want to raise my family in an environment I used to grow up in and be in myself. That’s no way to live.

I need good news Wolf lol

Thanks again for looking out for us peons. Wolf, I true man of the people.

1. If it took 3 months from listing to close to sell a home in 2005, and now it takes 1.5 months due to technology having sped up the processes, the inventory today would show to be HALF the inventory of 2005, and everyone would scream that there is no inventory, though all that happened is that the sales processes sped up. That’s what the article is saying.

Every company that carries inventories knows that they can reduce their inventory by speeding up the processes that go into inventories. Same in real estate, it happened about a decade or two behind other industries.

2. What has been driving up home prices over the past few years is younger people (the hugest generation ever) trampling all over each other to buy a home, and shoving each other aside, and outbidding each other. Younger people should gang up together on the social media and organize a total buyers’ strike of 4-5 years, and let the older people shuffle homes around between each other and their Maker, LOL.

3. Gen Xers and Boomers went on a buyers’ strike in 2005-2012, and it caused prices to crash by 50% or more in many markets. It worked.

4. The Fed is now trying to prod younger people into going on a buyers’ strike; so it’s raising rates. We went on a buyers’ strike that started out in 2005 with higher rates and continued through 2012 with very low rates. A buyers’ strike is a very powerful thing.

No way younger buyers would wait out with one another to strike against the prices. FOMO gonna FOMO.

Prob why the fed decided to jack up rates make the decision for people. “Sit on the sideline dumbs dumbs, Powell Gazoo will fix things”

No generation would go on a voluntary buyers strike together. The prices don’t crash because of voluntary agreements they crash because of mass involuntary agreements.

Porcelain Economist,

During the housing bust, the buyers weren’t in trouble; they just didn’t want to buy because prices had started falling, and who wants to buy a falling knife.

The selling was pushed because homeowners got in trouble (often investors), and they were forced to sell. But the buyers were on strike, so prices crashed until they pulled in buyers.

A buyer’s strike might not be necessary.

The resuming of student loans will create a giant sucking sound of liquidity draining from the economy to the tune of $15-20 billion per month, almost all coming from the age range of young people who would otherwise want to buy (or to continue living in) those overpriced houses.

“The resuming of student loans will create a giant sucking sound of liquidity draining from the economy to the tune of $15-20 billion per month”

Yeah, I’ll believe that when I see it. The free shit army party is in charge. They are doing everything in their power to buy votes by shifting (not canceling, SHIFTING) the student loan debt burden to the taxpayer.

Very true. Just ask the Bud Light boys (or was it girls?).

I’m in no hurry

have plenty gainful employment at $new non-pandemic rates

about $10 an hour higher

will get to flipper I bought in march

made my $$$ already just waiting on collecting

haven’t decided what to do

take 25% ROI

or turn into rental for $$$

likely want $$ for next buy

2005: housing is financialized quite a bit.

Now: housing is financialized like we are in a nightmare.

So yes people are buying faster now we are in a nightmare.

Tend to agree with the financialization argument.

Between basically 20 years of ZIRP and TV shows (tv shows!!) about home flipping, an entire generation has been bred to view home buying/selling more more speculatively than any prior generation (ditto the technological tools Wolf mentioned).

All this leads to price volatility (housing becoming a sort of ancillary interest rate futures market…)

Such is the power of hyper financialization that Americans believe they can get rich by trading shitcoins to each other, with crisp new printed $$ from the Feds and Congress. Everyone forgot that wealth is built through labor and sweat, not speculation. Nature doesn’t allow such aberrations for long, for they deviate from the Laws of evolution.

A buyers strike is needed badly.

Wolf – very interesting – thanks!

To what extent do you believe current buyers are ‘striking’ or beginning to strike? What data points would you use to estimate this?

Thanks!

There is already a bit of a buyers’ strike. You can see that in the sales volume which is down 25% from the 2018-2019 period. In some markets, sales are down a lot more, and prices have dropped sharply. In other markets, it hasn’t been that pronounced. In some cheap markets (Omaha, Tulsa, etc.) prices are now soaring.

Unfortunately most didn’t get that memo and most don’t want to wait. Their fine with overpaying, I guess and dealing with any consequences later on. As for the rest, nobody knows at this point.

How are big investor homes inventory doing? Like redfin and others who invested to sell homes some day? Any possibility of them increasing the inventory in market to help their sales? I hear their stock is down 40% this month.

Thanks,

Hopeful buyer sitting on the side :)

Zillow almost got killed by its home-flipping. Redfin did too. They both shuttered those operations and got out of them at huge losses.

Foreign buyers have massively increased, domestic governments allow this to soak up the deficit to avoid inflation.

Yes tech has made it easier for the Chinese to buy Canada, but the main problem is North America has nothing to offer in exchange for goods except land.

Let the nightmare roll on.

RTGDFA, 🤣😍 That’s not at all what this article was about.

Here it is:

https://wolfstreet.com/rtgdfa-coined-by-wolf-street-in-feb-2022-mix-of-humor-exasperation-with-commenters-who-clearly-didnt-read-the-article/

I disagree with your thesis that the primary driver is tech.

Local papers were fine when buyers were local.

Now buyers are international/national. That’s why inventory is low.

Inventory low because buyers are international instead of local? Do you have any data to back that up? Just listen to yourself, it doesn’t even make sense.

RTGDFA and re-think what you’re doing here please.

He is not saying inventory is low, he is saying technology makes the inventory look lower than it is.

Stegelberg

“He is not saying inventory is low, he is saying technology makes the inventory look lower than it is.”

Let’s be more precise in what Wolf is stating. It is not that technology makes inventory “look lower than it is”. Rather, technology has sped up the entire process due to which the inventory it shows is close to the “real” inventory. In other words, inventory in the pre-technology world was higher, i.e., higher than it was.

Only one buyer in my neighborhood in the past five years was foreign based and she bought her home as a place to stay when she visited her parents who live only a few miles away. It turned out that that the home was too small for her and her husband, even as a vacation pied a terre, so it became a rental unit. Some neighborhoods in major cities have a higher percentage of foreign buyers.

Improvements in technology also also sped up the settlement process for stock trades from five business days to three and drove down commission rates to literally zero for buy side trades and almost zero for sell side trades.

It would be great if your theory proves to be true and foreign buyers are left holding the bag.

This happened 30 years ago when the Japanese were buying US commercial real estate at the top of the market. Think Rockefeller Center. Of course we know what a disaster that turned out to be for the Japanese…

The driver is always tech. It doesn’t matter what humans want. All that’s important is

WHAT TECHNOLOGY WANTS, by Kevin Kelly.

Late response…

Yes Mechmacho22 makes sense.

Todays inventory has less overlap than in the past from already sold homes that are going thru a prolonged processing period.

Example: Suppose it takes 2 to 4 weeks for a sale to occur and be processed.

Then inventory can include homes that went on the market from today to as much as 4 weeks ago (and everything in between).

Now suppose 30 years ago it took 6 to 12 weeks (3 times longer) for the sale to occur and be processed. Then inventory can include homes that went

on the market from today to as much as 12 weeks ago (and everything in between).

So even if there was no greater supply of sellers 30 years ago the inventory will be larger, on average 3 times larger it would seem.

M22 – speed of information processing may be meeting/has met its human limit (analogous to prox. 250mph being the upper limit for effective human input on ground-level closed-course competition without extensive autonomous assistance…).

may we all find a better day.

Good observation! Faster lap times are going to have to be computer assist and in G-suits!

But many fans want speed……..and crashes….fortunately so far a lot value a good overtake and strategy. NASCAR excepted.

Explains popularity of coke in “high finance”….which was a sort of/ sort of not, a “joke” here a while back.

Can they multitask with the machines? How far will they go for that “speed advantage” and more $$$$$s?

That’s an interesting concept regarding the speed of sales. If it’s true though, it also means buyers are taken off the market twice as fast, since they can find, buy and close much quicker. Therefore, the result would be increasing inventory not decreasing inventory, because there would be half as many buyers at any given time, also. There would also be a much higher number of sales since they’re processed much faster. Sales volume (number of homes sold) has been headed down, not up. Am I missing something?

Personally, I believe the decrease in inventory is due to a combination of the shortfall in new construction between 2008 and 2019 and then the shortfall in resales (2020-2022), due first to covid and fear of having potentially infected buyers coming through your house or having to move in the middle of the pandemic. It’s easy to forget how paranoid everyone was for those two years. After that (2022-2023) came Powell’s interest rate Armageddon so now no one wants to move at all. All of these have combined to reduce inventory from 2008 on.

What will be the catalyst for mass selling and huge inventory growth???? Nobody knows, especially all those predicting another real estate crash for the past 5 years that hasn’t materialized.

As for July being the lowest inventory month, that’s simple. Most folks want to move during the summer, when school is out and when weather is better for moving. I can’t imagine moving during a snowstorm, but then I live in Miami.

“As for July being the lowest inventory month, that’s simple.”

Opposite 🤣 Re-read the article. The Julys are the HIGHEST inventory months. The lowest are in January and February.

CCCB,

“Therefore, the result would be increasing inventory not decreasing inventory, because there would be half as many buyers at any given time, also.”

Good lordie. Think this through. When you speed up processes, all it means is that the wait times shrink.

“Inventory” used by the NAR is a construct with a definition that causes the number to be inflated when process lengthen and be deflated when the processes shorten. The definition of the NAR’s “inventory” (explained in the article): A home enters inventory when it’s listed for sale and exits inventory when the sale closes.

So within this definition of inventory, the length of the processes is hugely important. But the actual number houses that come on the market is the same.

What the article said is that the inventory number 10 years ago and 15 years ago was INFLATED by long processes.

Forgive me, but I stopped reading after that line.

BTW, no one counts “buyers.” There is no chart of “buyers.” No one has any idea how many “buyers” are out there. There is an inventory of “buyers” and a shadow inventory of “buyers,” but no one tracks that, but it would be a hoot. If I in my mind decide I want to buy, I’m a “buyer,” without ever having told anyone, but I’m still in the shadow inventory of buyers. Then when I start bidding on houses, I’m now in the active inventory of buyers. You’d have to be God to know how many buyers there, LOL.

I’m sure this gets us into Zen, but not being a master, I don’t have the right Koan for it.

Mortgage rates were too low for too long and fueled the real estate market into a frenzy. It is healthier to have a medium rate for loans and a decent rate on savings. I am 82 and usually paid about 8% mortgage and can remember when you bought a house to live in not to use as a piggy bank. Although I did enjoy making $75,000.00 in 7 months recently. I didn’t flip it on purpose just needed to move away.

Excellent observation on data for listings. Going forward I don’t know if we will get a flattening curve or not but technologies may not be a reason for future changes in inventory. I think I have read that there are some more recent multi family home complexes becoming available but there lots of multi family complexes that may disappear completely as debt and lack of interest by renters because of better choices .

Reminds me of a condo I and some friends rented in London recently. Photos/videos looked awesome. Once ensconced we quickly understood we had been misled. It wasn’t the pits, but not the “aura” created by the professional photos and videos.

So the landlord for the place I was recently renting decided to sell. It was a townhouse. Wasn’t a total dump but it wasn’t nice either. It was built in 2006… had the ‘finest of furnishings’ from that era.

Actually, it kinda was a dump. Just not in the ghetto.

The pictures of it after I moved out for Zillow are amazing (plus they painted and some new carpet). This stated, there’s absolutely no way they’re getting the money they are asking. That ship sailed in 22’.

When I was looking at homes some years back, I vividly remember one for how much bigger it looked in photos than it actually was. The photographer had used a wide lens and the right angles to make the rooms appear larger.

Oughta be a law…

bul – putting the tongue firmly in my cheek, would say it wouldn’t be that hard to do. (We ‘Muricans LOVE enacting laws! Effectively/equally enforcing/reviewing/revising/’sunsetting’ them, not so much…).

may we all find a better day.

I am always amazed at this, but even more amazed with how lazy and/or amateur these photographers must be. You expect them to use the wide or the elongated lens now and then, but then they don’t even switch it out with the other or a regular lens when it would be prudent. One picture will make a kitchen look all nice and deep, but then the next pic – with the same lens – will make an otherwise normal hallway look narrow and half-scary.

I know nothing about photography, but this is just lazy.

Ever heard of dating apps? Same concept, different commodity. It’s exactly like “view on Ocean”. Doesn’t matter that property is located a block away, but as long as you can peep through bushes and see actual water, your property has “Oceanview”.

I wonder how much this affects buyer & seller psychology, i.e. feeding into the ‘historically low inventory’ narrative.

That does explain why the month’s supply also has been trending lower over the years. With the recent 20ish percent shrinkage of the housing market, Wolf’s months of supply chart is better for understanding the recent trends of the last year than the inventory for sale.

Go Places?! How dare you!

Right, over the past 15 years, the real estate industry digitized though I think it still has a way to go because it is still a little bit clunky compared to many other buying experiences, but most other purchases are not the single largest purchase for the average Joe’s life. With how many realtors are dropping out of the field lately, I wonder how long it is going to take until real estate tech to be the primary facilitator instead of real estate agents?

All my real estate experiences have been sitting at a bank branch and then lawyer’s offices. Sign 47 documents with (as patton Oswald puts it) my magical signature!

One time an apartment complex wanted me to sign my contract thru some proprietary e-software. That contract was so ridiculously binding I had to nope out of that.

I thought that “for sale by owner” sellers would someday be a larger part of the market with tech and easily available standard contracts, but no. In the four Western states I’ve sold property in, I have always sold it myself whether the buyers had a buyer’s agent or not. It blows my mind that people still waste money on commissions. There are even agents who will post on the MLS for a flat fee. I have had to hold the buyers’ hands on many things, and it worked out fine.

My point is that tech could save a lot for people who bother to educate themselves, but maybe the MLS advertising and bidding frenzy are what people want.

Categorically, real estate agents are absolutely useless and totally unnecessary even if they were only paid $1.

MountainTime,

Great comment!

I feel some folks use RE Agents for the same psychological reasons they use Financial Planners.

Letting someone else worry/think about “the details” is comforting to them.

Chhers!

There has to be a reason why there are real estate laws and real estate attorneys.

I’m not sure we as the American people can just pinball around whacking each other without some sort of order to it. Enter the realtors, sure they seem useless and prob are pretty useless but people would just steal your stuff if no laws were in place.

It seems like a pretty regulated field to be in. Maybe realtors are just property customer service? Lol

I have been waiting for the rise of DIY RE as well, and I was actually thinking that the RE industry may have purposefully put off digitalization to protect their hold on the industry.

Counterpoint: in my experience, MOST for sale by owner sellers highly overvalue their homes and seem like complete shysters; I wouldn’t trust them more than a broker.

I am the king of not paying for services, but I bought in 2020 when the market was getting insane. Got my dream house out of it, but I could not have done it without a very crafty agent, at least not with the knowledge I had then. I had previously been operating under the falsehood that sellers might appreciate an offer that didn’t require paying a buyer’s realtor. Just had to play the game that time…

Interesting.

So if the amount of time a listing is counted as inventory has shrunk due to the computah, this current low inventory might have little to do with higher interest rates?

Correct. If you look at the charts of the Julys, you see a fairly consistent decline, no matter what the mortgage rates. This kind of pattern is typical for a structural change — in this case the introduction of technology.

Wolf:

This is just to wit.

One would presume that by now technology has essentially diffused through the RE system in the sense that most RE transaction processes (marketing, selling, recording, etc) are technology-based. This would mean that the direct effect of the structural change has already happened and has settled down. In that case, shifts in inventory – either upwards or downwards – would now be a result of market (i.e. interest rate) and/or buyer/seller psychological (e.g., FOMO) conditions, no?

1. those tech changes continue to be implemented. They’re FAR from finished and universal. For example, not all states even allow RON yet, but eventually will.

2. The comparison is from the last few years to the prior years. Those old inventory levels were inflated by the slowness of the processes. So when people claim that inventories are low compared to 2005 or 2010 or 2015, or even 2018, they’re comparing them to the inventories that were massively inflated by slow processes. As you get closer to the current year, the slow processes were being weeded out, and inventories were less and less inflated by them. But the process will continue.

Try an “RE Technology-Adjusted Real Duhinventory” graph for the reading-challenged.

There has been a general trend to want to keep the demographics in areas the same as in the past. However, the nation is changing, certainly in California. Local officials apparently have found that zoning to prevent new housing construction is the best way to hold onto the status quo; that is essentially the essence of the NIMB (Not in my Backyard). The net effect is the same as happened in earlier times in America. Some of those problems were eliminated with the use of the US Constitution’s commerce clause; perhaps a Federal Government application of the Supremacy clause and the Commerce clause could assist with restrictive local zoning ordinances.

We can use technology to a sell a house in record time but we can’t put a man back on the moon or build a compact pickup with an 8 foot bed.

Call me when either of those make large financial institutions billions of dollars.

All good factors enumerated in the article. One more that may be a factor is that people have been waving inspections and other contingencies to make their offers more appealing which must be cutting out a few days I imagine.

I think a trend of number of houses sold per year would help the argument in this article.

If the theory is that tech allows homes to sell faster and thereby reduce inventory, would you also not expect total sales to go up?

Long term inventory trends would seem to mathematically settle to seller minus buyers. Tech that increases sale speed would seem to add noise to the data. It makes buying easier but also makes listing readier.

Marketing tech increases the buyer pool, and I think that fundamentally alters the seller vs buyer balance

“If the theory is that tech allows homes to sell faster and thereby reduce inventory, would you also not expect total sales to go up?”

No. The question is illogical. Your whole comment is illogical.

Sales are driven by demand, not by how long it takes to process them. If 100 houses are sold in one month, every month, month after month, in terms of the number of annual sales, it doesn’t matter how long it takes to process them.

Super-simplified example: If you suddenly cut the processing time in half, say, from two months in June to one month in July, May’s sales (100 homes) would still show up in July, but also June’s sales (100) would still be processed and show up in July, all in one month (=200). But then in August, you’d process July’s sales (100) and you’re back to the normal flow of 100 per month, but you cut out one month of wait time. So this scenario would be 15 years of technology changes all crammed in one month, which is illogical and silly.

In reality, the changes have taken place over 15 years, so they didn’t shift sales in any measurable way and didn’t impact the sales data.

In terms of: “Tech that increases sale speed would seem to add noise to the data” — that’s total BS. The opposite happens.

Here is the sales data:

https://wolfstreet.com/2023/08/22/home-sales-plunge-further-as-demand-vanished-at-these-prices-even-cash-buyers-pull-back-supply-keeps-rising/

“Sales are driven by demand, not by how long it takes to process them.”

Yes sales are a function of demand. I won’t disagree.

That said….

If there is huge demand and realtors ability to process transactions acts as a bottleneck, then improved technology (or methodology) that addressed this shortcoming could increase sales (throughput). I’m no operations research guy but don’t need to be.

The realtor, week after week, fails to process some buyers… s/he simply doesn’t have the capability to process them with the resources and processes at hand. Those buyers go to another real estate company for business. This could go on for a short time or long time so long as demand overwhelms this realtors processing capabilities.

If you simply say that no matter what changes there are in technology or methology there will be no additional sales per unit time… well there’s really not much point in thinking about it. The issue in some sense has been over constrained.

There are still a finite amount of folks in the market for a house (and that can actually afford one).

Another technological advance – the nanny cams and ring doorbells hear what the prospective buyers are saying when they are in the house.

What percentage of single family homes in the US are owned by private equity firms having turned them into rentals? E.g. Blackstone but others as well. Does this impact the long term trend?

#1 Single-family housing REITs are bigger landlords than PE firms.

#2. All combined, they’re all tiny in the huge US housing market. There are 82 million single-family houses in the US. Single-family investors with 100 houses or more own only 574,000 single-family homes. Less than 1% of the total.

3. Mom-and-pop investors and other small-scale investors dominate single-family rentals. They own 14.5 million single-family rentals.

4. ALL investors combined, dominated by mom-and-pop, own 15.1 million single-family rentals.

5. This does not include the multifamily rental market (apartment towers and apartment complexes), which is twice as big with 31.5 million rental apartments. Mom and pop play a very small role in that. These are big and expensive properties owned by big landlords, including insurance companies, pension funds, and all kinds of private and public companies.

Data from Urban Institute.

Here is more for you:

https://wolfstreet.com/2021/06/22/no-blackstone-didnt-buy-17000-houses-out-from-under-desperate-homebuyers-and-blackrock-didnt-buy-a-whole-neighborhood-but-built-to-rent-is-a-h/

As Einstein said: “Math is nature’s playbook”.

Dozens of “We Buy Houses” signs, fliers, and advertisements. Rent up, evictions up.

Bernanke’s “wealth effect” creating the highest GINI coefficient in decades.

The economy is being run in reverse.

Very informative. Thanks!

Debt to income is the problem. The new mortgage rates absolutely destroyed this, so either prices fall, or the absolute number of transactions falls. Technology allows a much faster market, which benefits sellers who price well. If you overshoot the market now the punishment of relisting or lowering prices is brutal. All these instant options quickly reveal this.

The technology speed up since 2000 in real estate is amazing. And, this same speed has hit almost all of the economy in some way. But, while information is power, so is disinformation. Hence those lovely.fresh paint pics.

As a former realtor I hate those distorted pictures. I was always trying to build trust and to be trust worthy. I saw some properties with a realtor recently and either would not go in or only saw the living room and left. They were too unkempt and dirty for my consideration. What a waste of time.

I think you are correct that technology has sped things up but closings themselves have gotten considerably longer. Standard closing used to be 30 days now they are 60 and 90 days because mortgages take longer.

Paul, that’s not what I’m seeing. I just witnessed a young couple buy a house with 3.5% FHA mortgage AND a local government mortgage program for down payment assistance, so the buyers put nothing down. This is about as difficult as it gets from a mortgage approval standpoint, working with two different loan programs.

Even so, the home closed less than 1.5 months from offer date this summer.

“buyers put nothing down”

Wow… seller must have been desperate

There wasn’t much buyer activity in the zip code. The sellers have to take what they can get, unless they are prepared to sit on the property for what could be a long period.

Paul,

“Standard closing used to be 30 days now they are 60 and 90 days because mortgages take longer.”

Jeeesus. What kind of BS is this?

Paul,

That is not remotely true. As a mortgage loan officer in the DC metro market, the longest contract in the last year I’ve had was 35 days from contract to close. I have a loan closing tomorrow that is a 15 day close. Typically, we’re seeing contract-to-close periods of 25-30 days.

My wife and I are casually looking to buy. We are not sure if we are going to get a mortgage or just pay cash (lots of variables in the decision). We have talked to a couple of mortgage companies just in case (gotten pre-approval though them just in case). Both have indicated that it shouldn’t take more than 21 days.

We also talked to a couple of real estate agents we have been using. Both have said that getting a mortgage should only take 21 days.

From what I understand, banks can take longer, but there is no reason for us to use a bank to obtain a mortgage. Generally their rates are higher and there is nothing that would make them more desirable.

When I was a realtor.closings were 60 to 90 days. How can anyone close o

In 30 if you have to find a home and close in such a short time?

How do you have a slow down when there are no unemployment claims…….you don’t.

Hilariously enough, this coincides with the failure of Rapattoni’s MLS network. I wonder how big of a dent it made in housing transaction volume.

Increased trade velocity potential is great. Ultimately, it’s a competition not a race. Too many buy the wrong house every day. If average trade involves 103% to buy & nets 95% on sale – 8% spread makes exit of a bad buy tougher in a flat or sliding market, eagerly searching for a greater fool. An experienced agent’s local knowledge can provide valuable perspective on the buy side, less relevant on the sell side. Experienced buyer agent’s paid for perspective regardless the seller – owner & lister, REO, FSBO or new home. Solo civilian buyers know it all until they realize they didn’t, then seek someone to sue for their error(s). Land records reveal numbers of trades never in MLS – doesn’t mean an agent or two weren’t involved & paid, just that the trade wasn’t reflected in MLS data. And regardless a buyer’s nationality, likely they can still smell the upwind sewage treatment plant TFS

Wolf,

I don’t know about other areas of the country but here in the “collar” counties of Chicago RE agents list things on a ‘private’ network just for them.

As far as I know those types of listings sometimes get purchased while never getting to Zillow, Redfin etc.

That might be another technical change that reduces the inventory number.

NYC doesn’t use MLS at all.

I sold my condo without ever listing it, and without broker, 22 years ago. This has always happened a lot. Today, the property would be on Zillow as not for sale. And after the sale closed, it would show up on Zillow as sold, based on the transaction records (but only after it’s sold), with the transaction price. Back then, there was no Zillow, and Zillow data doesn’t go back that far.

My condo would not have shown up on the MLS inventory data, and it would not have shown up on the MLS sales data.

There are also pocket listings, where brokers market the property privately, without listing it. They’re also not showing up in inventory. My understanding is that this is mostly high-end stuff.

The NAR reports its “existing homes” series based on reports by its member Realtors. They likely report pocket listings as sales after they’re sold.

The Case-Shiller index goes by county property records, and it would have picked up the condo sale and price, as well as any kind of sale that is recorded in the country property records (Texas is the exception, and the CS had to make a special deal there).

Technology is making the realtor’s job absolutely obsoletely.

I think over time realtor job pool would shrink drastically and only high end homes may use realtor.

Giving 6% of 1 million dollar home ( $60K ) for few hours of work is absolutely unthinkable for me.

Technology enables me to find all the details about the home I want, and I even choose the home I want. I need realtor for some paper work.

My wife and I are casually looking to buy a house. What I mean by casually is that we are looking to buy, but are in no hurry or no pressure to move.

We are currently renting at a very under-market price, yet we would like a place of our own. We can easily pay cash so that is not holding us back. It is just the two of us (no kids) and we have owned/rented many other houses before so we have some definite things we are looking for, but other things we are very flexible on (like school district).

So long story short, we are being extremely picky. We are looking not only for a place that we like and fits our needs, but we are looking for a very good price on it. We are not desperate so we can afford to find a good deal.

So for the past 4 months, we have worked through a realtor. He has electronically sent us 100s of houses to look at, I also occasionally spend some time browsing Zillow, Redfin, and a couple other sites. Most houses I can look online and rule out. Every couple weeks we will get 5-6 houses we think we might like and then spend a couple of hours driving around and seeing these houses. The realtor has access to lock boxes and can get us into them all in one day. Without him, we would have to call and coordinate with each seller (or their realtor) and it would be far more complicated and time consuming. Having a realtor has literally saved us a bunch of time and frustration.

Also, since the realtor knows we are looking for a good deal, there have been 5 or 6 times where he has called us telling us about a house that was a really good deal but required expediency. A couple of times we were not able to see the properties in time to make a bid, but of the other 4 times, we were able to see the properties and actually made bids on two of them (not accepted). Even though our bids were not accepted, it has become clear that since we are looking for a good deal, it will probably come from one of these last second emergency calls. Good deals do not stay on the market very long.

Anyway, in summary, it is quite clear that for us, a good realtor is worth their weight in gold. Staying on top of what is just coming on to the market each and every day would be a lot of work. Throw all of the coordination we would have to do to see all of these places and it would definitely be a full time job.

I don’t know how much he is eventually going to earn when we buy (our price range is wide), but it is something I would gladly pay to avoid all of that work.

6% is not fixed. You can negotiate .I agree that 5 or 6 is too high. Perhaps a set fee would be more fair. I know realtors making $100,000 and more for very little work and very little ethics.

This is the type of insight that is only on Wolf Street. Thanks wolf.

But I would like to throw out another explanation (not that I am challenging the tech angle). Could this also be a result of the rising prices and lower interest rates (until the last year)?

In a rising price environment, where buyers expect to gain on a purchase in the future, wont buyers always be there to snap up homes?

The ability to shop for homes online, like clothing or furniture, undoubtedly has caused this, but isnt it possible that with an extended downturn in prices, we will see a long term uptrend in inventories? Most likely that upturn will never reach the peak of the last cycle, unless the distress is even greater than it was in the last cycle, which is unlikely unless our economy goes into a full out depression, instead of a “great recession”.

Someone might then say, well, why are inventories still stuck so low with interest rates now through the roof, and my reply would be that this is a temporary situation, until prices have dropped for more than one year straight. It takes a long time to stamp out the psychology that has led to the current housing bubble.

A change in government policies might be necessary. Sell all that Fed held MBS into the market – 2.5 trillion (although I doubt this happens given the huge losses it would take , excuse me, deferred assets). Cut or cap the home mortgage interest deduction. Reduce the regulations on builders nationally. Privatize the mortgage industry, eliminate Fannie and Freddie completely. Or Trump’s idea to build 10 new “American cities” that are shiny and new and dramatically increase migration out of cities.

We already covered that sales are down by 20% because the 3%-mortgage people are not buying, and they’re not selling either, and they have left the market as buyers and sellers, but that has no impact on inventories because they’re not buying and they’re not selling either.

https://wolfstreet.com/2023/07/21/entire-housing-market-buyers-and-sellers-may-have-shrunk-by-20-25-because-of-the-3-mortgages/

Higher interest rates reduce sales for sure (fewer buyers), but they don’t decrease inventory. Lower mortgage rates increase sales for sure, but don’t increase inventory.

Sales and prices fluctuate with interest rates (that has been well established by all kinds of research). Inventories don’t fluctuate with interest rates.

Hi Wolf,

It seems some comments are either conflating transaction speed with volume, or the comments are assuming transaction speed would/should affect volume over the same timeframe as the article. Do you have a chart that shows changes in volume of sales for easy reference so folks can invent correlations to argue about?

Nevermind. I see you read my mind and squashed the argument. Thanks!

Hopefully someday there will be some kind of re exchange where sellers could list their homes without incurring the cost of a realtor. Also, a similiar exchange for a mortgage, again, eliminating the cost of the broker/lender. Both seem like areas ripe for disruption due to the high transaction costs.

Doolittle,

I sold my condo without Realtor and without listing it, 22 years ago. This has always happened a lot. You just need to find a buyer on your own and work out the deal on your own. You can put an ad on the internet, you can email to everyone in your address book that you’ll be making a deal on your home, and if they know anyone who is looking, to let them know, etc.

I sold to the first person that showed up, one buyer is all you need, it was a cash deal, and they countered 10% below my aspirational asking, and I said YESSS, and we had a deal. The whole thing, even back then, was quick. But I was lucky.

PS. I did use my lawyer to make sure we got all the paperwork done properly.

Yes, I understand this is an option. I was thinking of something more standardized with lower costs, for the masses. Technology wringing out the cost and inefficiencies in the re transaction and lending businesses. Seems like a disruptive opportunity, or maybe I’m offtrack thinking this is a possibility.

SoCalBeachDude says:

> Categorically, real estate agents are absolutely useless

> and totally unnecessary even if they were only paid $1.

SoCalBeachDude is correct about “some” (actually “most”) agents (don’t ever hire a family menber or friend of your wife when you need to buy or sell real estate). I’ve been tracking real estate sales for 40 years and since in most markets ~80% of the sales involve ~20% of the top brokers in the area (that all know each other) most of the people in this “club” will do whatever they can to keep buyers away from any FSBO property tat is not paying a full buyers comission. Like “43 Year Broker” I have been a licensed CA RE Broker for a long time (“only” 33 years) and other than a couple years out of college when I tried to become an investment real estate broker (and learned I was not as good at lying as the other guys). I have always paid a real estate broker (usually the #1 agent in the area) to “sell” a property for me personally since they typically cover the cost by not only getting more for the property but act as a buffer if anyone sues me for not disclosing problems (and since they are so good at lying they can look people in the eye and say “there was never any unpermitted work done at this property”). Every time I have “bought” a personal property, investment property or vacation property I have used the “listing agent”as my “buyers agent” (basically representing myself but letting them get double the fee) to make sure I will “get the property I want” (a listing agent will really work hard to beat his seller down to my price since on a $2mm property he will opersonally make $60K more if I do the deal compared to the next guy who has his own “buyers agent”.

Your comment highlights why realtors often have such a bad name and can be actively detrimental to their “client.” I give you credit for using a realtor’s lack of ethics to your advantage. Actually though, from what you’ve described, the realtor represented you, not the seller the realtor was beating down for an extra commission on your behalf.

The conflict of interest is inherent in the transaction. I will never, under any circumstance, allow the same realtor to “represent” both sides of a transaction for this very reason.

Most homes appear on the market with “Coming Soon” signs. The trend has been going on since around 2005. It’s used to create competition before the home is active on MLS.

https://www.rockethomes.com/blog/home-buying/coming-soon-real-estate

This article uses raw inventory numbers. Others you have written, and other places use the nebulous “months worth of inventory”. I assume that somehow normalizes for transaction throughput? Or is that metric blind to this trend?

Months worth of inventory takes the inventory in a month and divides it by the number of homes sold in a month to get a rate. It better shows selling vs buying interest compared to raw inventory numbers alone, but it is not immune to this trend of less duration of inventory. It is less sensitive to the drastic change to the size of the housing market and all the complaining about lack of inventory.

This is called “months’ supply,” meaning how many months it would take to sell the current inventory at the current rate of sales.

So this is the SAME inventory data you see here, but expressed as a ratio of current sales. In other words, it too was inflated by the longer processes in prior years, and it has come down as the processes have sped up, same as inventory.

In July, there was 3.3 months’ supply, meaning at the rate of sales in July, inventory would be down to zero after 3.3 months.

Bottom chart in this article:

https://wolfstreet.com/2023/08/22/home-sales-plunge-further-as-demand-vanished-at-these-prices-even-cash-buyers-pull-back-supply-keeps-rising/

Thanks Wolf. Very interesting point.

I highly wonder your comments about the data showing an annual drop of 8.7% for new single-family home prices: https://www.reuters.com/markets/us/us-new-home-sales-jump-july-prices-fall-annual-basis-2023-08-23/. An article about it would be quite interesting.

1. The last two articles here discuss USED homes (previously owned houses, condos, and co-ops). The Reuters article discusses NEW single-family houses.

2. No, it would not be interesting because the sales data of new houses is very volatile, doesn’t include cancellations, and is subject to big revisions, so take it with a grain of salt, and nothing happened…

Sales of new single-family houses were up year-over-year because July 2022 was multi-year rock-bottom. Here is the sales “jump” in July, can you see it, LOL?

And here is the median price:

Thanks so much for the reply. These graphs are very informational, I think. Yes, they seem to fluctuate quite a lot. However, a (imaginary) 3-month smoothed average shows a clear trend, I think. The story I see is this: When the price is topped in 2022, the sales are plunged. The constructors saw this trend and FED’s hikes, and they started to decrease the prices, resulting with a gentle increase in sales. On the other hand, many vacant home owners refused to decrease the price and take it off instead, resulting with flat prices and dipping sales.

When I and others tied to construction are complaining about burnout and back logs, I always remind them the numbers we did prior to the GFC.

We have never come close to that level again. None have the staff we had back then. Our back log exists due to labor. Great time to be a youngster.

The SF-area MLS is back up after a two week outage. Why hasn’t the efficiency of the internet brought down the 5-6% commissions for real estate agents? During the MLS outage my husband and I found properties to look at ourselves, and will continue to do so. Is the value-add for listing and buyer’s agents on a $2M SF property really $50,000 each?

There are brokerages that work for less, including Redfin which charges a lot less. That’s one of RE tech startups and now beaten-down public companies that I mentioned in the article.

If you can’t afford it, don’t buy it. The millions of people giving up their financial futures for instant gratification deserve what they will get, decades of debt.

I recenty bought a car built in this century, and live in a home built in 1984.

Yet, my 1934 Cord still runs and my 1999 GMC truck still carries the mulch.

I think you are virtually nothing but whining clowns.

In that case I suppose homes that sell without making it onto the MLS would not count as inventory either. I’m seeing quite a bit of that. Some of it seems like it may be companies trading properties.