But the dividends are so sweet – until they get cut or “suspended.”

By Wolf Richter for WOLF STREET.

We’ve talked a lot about the debt of commercial real estate’s office sector defaulting and hitting lenders, mostly holders of commercial mortgage-backed securities (CMBS), namely bond mutual funds, pension funds, etc. So far, banks have been spared the big hits. We’ve talked about the first sales of office towers finally happening in the new era of working-from-home and office-footprint-reduction, at huge discounts, some of them in foreclosure sales at brutal prices. You can see all this stuff here.

Today we take a look at office Real Estate Investment Trusts (REITs) that own some of these towers, and whose shares have gotten crushed.

Hudson Pacific Properties cut its dividend in half today, to 12.5 cents a share to preserve about $18 million in cash this quarter.

“We’re a visionary real estate company focused on epicenters of innovations for media and tech,” it describes itself ominously on its website. It specializes in office and studio properties in some of the hardest-hit office markets in the US: Los Angeles, San Francisco, Silicon Valley, and Seattle, with office market vacancy rates, per Savills, between 23% and 33%.

It had preannounced a cut of this magnitude in its earnings report on May 8, when it disclosed a drop in revenues and another net loss, in a series of quarterly net losses that started in 2020. Just four days ago, it promoted an investor presentation in which it explained how, despite all the issues out there, just about everything was either hunky-dory in its corner of commercial real estate, or would soon become hunky-dory again.

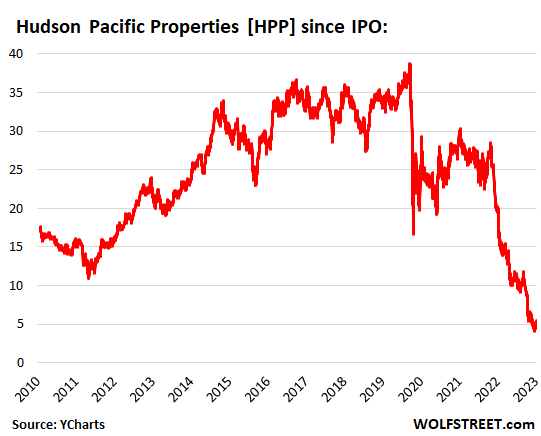

The shares have collapsed by 86% since the peak in February 2020, and are comfortably ensconced in my pantheon of Imploded Stocks. Shareholders of record on June 20 will be paid the new dividend. At the current share price of $5.20, that pencils out to be a dividend yield of just under 10%.

Investors who’ve bought the shares over the years to get the fat dividends have gotten crushed by the plunging share price. At $5.20 today, shares are less than one-third of the IPO price of $17 in 2010 (data via YCharts):

It’s in good company.

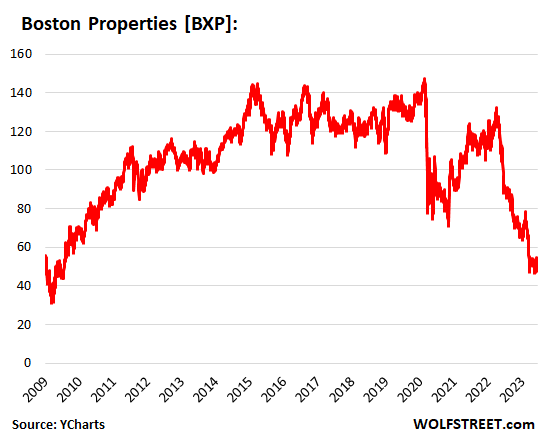

Shares of Boston Properties [BXP], the largest office REIT by market cap, have plunged by 63% from the peak in February 2020, to $54.11. It owns the Salesforce Tower in San Francisco, where two older office towers just sold for 70% off the original listing price, the first two sales in the new era of working from home:

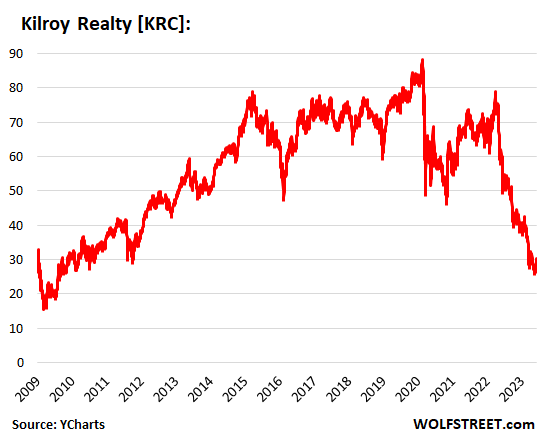

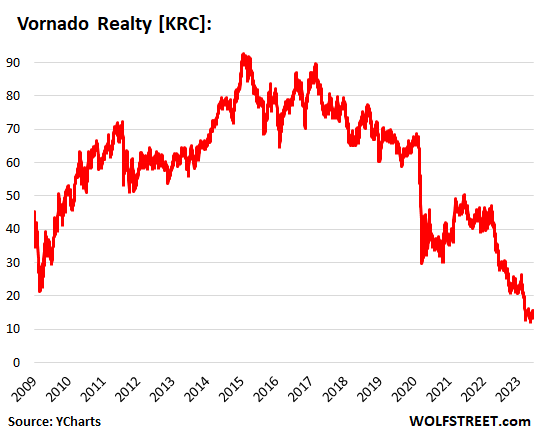

Shares of Kilroy Realty Corp [KRC], the second largest office REIT by market cap, have plunged 66% from their high in February 2020, to $29.94 currently:

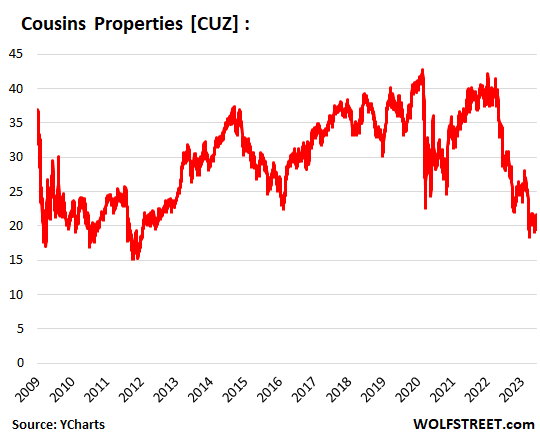

Shares of Cousins Properties [CUZ], the third largest office REIT by market cap, have plunged by 50% from their recent high in February 2020 and by 82% from their all-time high in August 2000 while the Dotcom Bust was going through a sucker rally, to $21.50.

Share of Vornado Realty Trust [VNO], the fourth largest office REIT by market cap, have plunged by 77% from their January 2020 high, by 83% from their January 2015 high, and by 85% from their January 2007 high, to $15.43. Also a member of my pantheon of Imploded Stocks.

Vornado suspended its dividend altogether for 2023. It said it plans to re-start paying dividends next year, but maybe in stock or cash or a combination of both, it said.

It wants to raise cash by selling some of its office properties. So it’s the second largest office landlord in New York City. In Manhattan, there have been three sales of office towers recently that serve as benchmarks for the new era: respectively at 50% off the 2016 valuation; at 38% off the 2020 refinance valuation but not including renovation costs since then; and at 41% off the 2020 asking price. PE firm Blackstone, rather than trying to sell its 26-story 1950s tower in Manhattan, walked away from it and the $308-million loan to let CMBS holders worry about selling it. So raising cash by selling office towers in this environment is not going to be fun.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

who knows. Fed might bail them out. Post 2008 anything is possible.

The Federal Reserve bailed out junk bonds in 2020. Anything is possible. Especially if they’re in FOMC members’ personal investing portfolios.

The reality of Real Estate!

the REITS will be fine

they have NO LIABILITY when defaulting

other than plush management fees they grifted

CMBS is one getting the EQUITY out of the debt

—

General growth(malls) has been handing back keys for few years now

If a REIT defaults on all its office tower mortgages and lets the towers go back to the lenders, in the end the REIT will be a shell with no towers and no income, but still lots of expenses, and it will go to heck in a crooked line.

Spot on!

Many of these office REITs issued unsecured debt so if there is a default, the unsecured issuer gets in line behind the secured loan. In a dire scenario if the reit needed to sell assets even at a material discount, it’s easier to execute if they have more unsecured vs secured. Some secured lenders will inevitably get the keys but my bet is these stocks will cut dividends, preferred dividends and work with bond holders both secured and unsecured to stave off default.

Yeah, just one more shot of monetary heroin might not kill the host. Who knows?

Not even the slightest chance as to that.

Yes, I also think there’s no chance of that because the Fed is only concerned with financial institutions of systemic importance. What do they care if some REITs go bust? It would only matter if major banks had exposure to them. And generally they don’t anymore (although they did have a lot of CRE exposure in 2008).

No chance? They said they wouldn’t do helicopter drops. They said QT was temporary. They said there wasn’t a RE bubble in 2007.

Fed will pay top dollars for these properties, then they would claim that the buildings are impossible to unload at “current” market prices and then then they would sell them at the lowest price possible to the usual suspects, and if it’s not obvious Fed will also loan the purchase money at 0% interest.

All in all it will be just another day at the Banana Republic.

I totally agree with everything you wrote – unfortunately.

I also unfortunately agree. They’ll make some reference to propping up the CRE market to help retirees and pension funds.

Of course, their “help” comes by stealing the purchasing power of dollars from others. The last 15 years has led people to think the Fed/government can provide free help. It can’t. It provides help with wealth expropriated from non-politically favored groups.

If the Fed deems a national CRE crash to be a systemic threat it will form one or more SPVs, lend them whatever amount of money it takes (created out of thin air), and the SPVs will buy CRE and/or CMBS in major markets. Systemic threats, however, are judgment calls that can be influenced by political pressure. Powell seems especially pliant.

The Fed could bailout CMBS holders, but they cannot print office workers. So all that would do is leave the Fed holding the bag on empty towers.

Maybe then they could demolish them and replace them with a Taco Bell.

The Fed will step in if the market doesn’t clear in an orderly manner (e.g., no contagion).

And these upcoming rescues will NOT include reduction in interest rates (due to my earlier thoughts on international developments against the dollar)

I’d say the likelihood of an orderly clearing is close to nil. So expect further “rescues” this year and next.

I feel sorry for the retirees who bought these investments to supplement their retirement income in an era of suppressed interest rates. Looks like the investments were good for awhile.

My wife and I are people of modest means. Our retirement money is in IRA CDs. What I have witnessed since interest rates have started to go up is that their is no longer a ratcheting up of CD interest rates the way their was in my father’s time back in the 1980s. In 1983 my dad was able to get CDs at 10-13% return. No way banks will ever allow that to happen again. It’s like productivity. From the 30s into the 70s as productivity rose, wages rose. Then the rich figured out how to decouple those two things, and to the point where productivity has risen vastly more than wages since Reagan’s time or perhaps Carter’s. Rising interest rates are unlikely to mean much to small-time savers like me.

Is there a way to change your CDs into Treasuries within your IRA?

I was buying CDs in ’83, and I highly doubt your dad got 10-13%. Mine topped out about 8.5%. I still have the passbooks. As for CDs today, we’re up to 5.5%, I predict we’ll get to 7% before we’re done. And you can buy them through E*TRADE as brokered CDs, you don’t even have to open a bank account.

A lot depends on duration. The average rate of a 6-month CD in 1983 according to Forbes was 9.28%.

Even in 1989-1990 you could get 10% CDs. But right now people lose their minds when someone talks about rates going to 7%

“Average six-month CD rates remained high, at 12.57% in 1982, but dropped to 9.28% in 1983 as inflation remained low and recovery began.”

Source: Forbes

Not sure re CDs, but you can look at the 50 year graph of Treasuries, and some were going for 16% in early 1980s era.

We paid 18% on first mortgages IIRC from then.

Still made $$ when prices shot up after we did nice ”rehab” works.

Might have been a bit of inflation too, eh? LOL

S&Ls in the oil patch did offer CD rates north of 10%, wrote mortgages between 18-21%.

Did not end well

My parents locked them in for 5 years as part of their IRA. So I think my memory is pretty good on this front.

Why? People get wiped out because of poor financial investments every day. Normally because they were overweight on a specific asset class or company. Boomers have voted themselves bennies (Medicare, SS, Medicaid) most of us will never see that will be paid for by us. We have to live with the debt ridden, over-inflated economy they created via ZIRP and asset bubbles, so I have the same amount of sympathy for retirees as I have for crypto bros who went bust — NONE.

“Boomers have voted themselves bennies (Medicare, SS, Medicaid) …”. These are all Democrat programs, implemented prior to when most boomers were born or could vote. Social Security was FDR’s program instituted in ~1937. Approximately 15 years before boomers were born. Medicare and Medicaid were part of the Great Society legislation pushed by LBJ. Boomers weren’t old enough to vote in the 1964 election.

I’m a boomer and when I started voting at 18 medicare, SS, and medicaid had been going on for decades and decades.

Naive at best JD. We didn’t vote on SS or Medicare. It is a payroll tax.

Medicare Part D- instituted with George W. Bush.

So, there’s that.

You voted for the politicians that will ‘fix’ Social Security and Medicare by raising age to 70.

JD:

Ummm…. Social Security was enacted in 1935…. a bit before the “boomers” time. Medicare was signed into law in 1965 as was Medicaid….. Most boomers weren’t of voting age. Boomers are defined as those born from 1946 to 1964.

But never let facts get in the way of a good argument.

He never claimed that they created the system. But they certainly didn’t take any real steps to fix it while they’ve been in power (from the mid-90s through today)

I love all the comments about “fixing” social security. What exactly can be done? Only one thing, spending less on it, which means benefit reduction one way or another. Don’t you think it’s already pretty modest? And the inflation adjustment is largely wiped out by Medicare increases.

4 choices:

– reduce the payout

– means test it

– raise the eligibility age

– steepen the discount for taking the benefit early

Means-testing and raising the age limit are pretty unfair, since benefits are directly proportional to what recipients have paid in.

Gattopardo,

SS has run a massive SURPLUS every year since at least 1987, with the exception of a TINY deficit in 2017, a larger deficit in 2020 due to the lockdown-caused unemployment, and a tiny deficit in 2021.

The accumulated surplus is in the Trust Fund, which stood at $2.7 trillion at the end of the last fiscal year.

https://wolfstreet.com/2022/11/08/status-of-the-social-security-trust-fund-income-and-outgo-fiscal-2022/

For the fiscal year through Sep 2022: Total income from all sources (green line in the chart below) jumped by $105 billion from the prior year, to a record $1.04 trillion in the fiscal year ended in September because more people were working and they were earning higher wages and contributing more than during the pandemic year.

Total outgo rose by $82 billion to $1.07 trillion (red line). Nearly all of it was in form of benefits paid.

The deficit (total income minus total outgo) of the fund narrowed to $32 billion, down from $55 billion in the prior year.

When the green line (total income) was above the red line (total outgo), SS was in SURPLUS and the Fund accumulated assets. When the green line fell below the red line, SS was in DEFICIT and the Fund shrank. Have a look. I know it’s shocking, after all the BS rhetoric out there:

Uncap the payroll tax and SS will run a surplus again for many years. High earners will pay the price but they are a minority at the voting booth and Reps like Romney who want to “reform entitlements” will go for it along with all Dems.

Occam, I don’t doubt that some Reps might go along with that proposal, but in my view, saying we can fix SS by uncapping contributions is in bad faith. This is because SS was designed as an insurance system, where premiums paid it were commensurate to benefits paid out. Uncapping premiums without uncapping benefits turns it into a de facto welfare system.

If that’s what people want to propose, fine, but say so explicitly.

You don’t have to have any sympathy for retirees , but I do want to be payed a lump sum compounded at a reasonable rate , like 7% for all the money I put in over 47 years. At that point I’ll say we are even and no hard feelings.

Love it or hate it, in a market economy prices are bound to go up and down cyclically. Unless these firms are heavily indebted, I don’t understand the panic selling. Chances are the physical assets they hold are almost certain to go back up in price at some point. The problem again seems to be securitization, not the underlying asset price. These secondary markets will be the death of us.

Most RE firms are heavily indebted. The business model only works with leverage.

Yes, they are leveraged with short-term mortgages that will be refinanced at 5pts higher than currently holding, they’re all insolvent.

Sometimes real estate assets don’t come back; they go to zero or negative. Is the trend cyclical or secular? Take a look at downtown Detroit for the result of a secular trend that caused owners to abandon many beautiful buildings and turned parts of the city into a wasteland.

Yep, this is something that isn’t talked about enough in my opinion. There are so many places in this country that peaked and have been declining for decades.

Would like to know if the preferred bonds also suspended dividends.

I think you mean preferred stocks and bonds? Dividends on preferred stock can be suspended, however, if they are cumulative, the dividends accrue.

So what’s the ‘survivability ratio’ for these REITs? The ones who are more diversified may be able to renegotiate or otherwise muddle through long enough for things to stablize. 40% office is too high maybe? Hard to say. Meanwhile if you don’t need the income might be worth a flyer reinvesting the dividends for the long run if u think they’ll make it.

Residential does not have the WFH accelerant that commercial office space has to burn that bubble.

It will be more like a slow hot air balloon leak for residential.

How is this possible when corporate executives appear to be decisively winning the war against work-from-home, despite the low unemployment rate?

Amazon, Google & Facebook are now mandating 3 days per week in the office, joining the rest of Big Tech. Starbucks, Disney, Walmart, and pretty much the rest of the Fortune 100 are now hybrid or mostly in-person.

Where are all these permanent-WFH, remote-forever jobs that are pulling down office values?

Denver, for one.

I know of several. I was WFH before the plandemic, company structured it that way to get high value people to work for them from around the country. Owners set up equipment in a condo theyve owned for years. Company I worked for prior closed its office during covid, didnt renew the lease and workers that remained with the company are WFH while the ones that left went to another company that is WFH. Both are Fortune 500 companies whose names you would recognize.

I even know a guy who is civil service who planned to retire and moved to another state, his place of work needed him so much they waived all sorts of restrictions so he would keep working, albeit remotely from thousands of miles away. So even uncle Scam is letting WFH expand.

“Where are all these permanent-WFH, remote-forever jobs that are pulling down office values?”

Answer: These jobs are going to offices in India. For example, my employer developed the infrastructure so that most office workers could work from home during Covid. This not only included more IT infrastructure, but also developing more WFH training, in-boarding, and work product review. After working out the kinks, the company realized it could outsource to an Indian contractor. The cost savings was phenomenal. Not only did this lead to lower compensation cost, but also lower rent, utilities, HR and payroll processing costs.

I am starting at a new PE shop this month and they hired a CFO in India for one of their portfolio companies that is HQ in the US. My jaw hit the ground. If that’s the future, all the 500k+ salaries for c-suite in PE backed portfolio companies could go poof. I can’t wait to see how it works.

I will say that I worked at a big 4 accounting firm years ago and they outsourced a lot of grunt work to teams in India. Honestly, it was awful. The work was not good, the communication was a massive challenge, and it just didn’t make my life easier as a junior… I could do it faster myself and know that it was done right. We shall see though.

Jackson Y

Those permanent WFH jobs are heading for India. They will NEVER go back to those high rise dinosaurs. Insurance claims adjusters will be the first to go. A dude told me he had to file a claim using State Farm, the company of the guy that hit his car. The claim was answered by an adjuster in India. The adjuster told him to go to a doctor, even though he had no injuries. Service was terrible. This is the future. Get used to it.

That’s a benefit of living in one of the 15 states that does not require insurance adjusters to be licensed.

At least he saves a lot of money on his insurance.

That’s been my experience so far with customer service overseas too. Tried to get info on my mother’s insurance policy and it took me 5 tries to get the answer I needed, from someone who was apparently sourced in the States, or at least had English as a first language. Took me several days off and on. :(

George Jetson complained about his grueling 3 day work week. No flying cars yet, but that part came true…

>(…)Google & Facebook are now mandating 3 days per week in the office

This is just not true. Just spoke to a friend who works for one of these two and has been WFHing since joining the company last summer. What the company does is reviewing its “assigned office” policy, that, to be honest, was dumb and created skewed incentives from the very beginning. Lots of folks were joining the company and opting for a “hybrid” mode, being assigned to a specific office with a lot of perks coming from it (including a slightly higher pay vs full WFH). The only thing the company seems to be doing now is reviewing if those folks were indeed working on a hybrid mode and not just coming to the office once a week to grab a free lunch for the whole fam from one of the exquisite on-site catering vendors.

The only real risk for most of the folks would be to lose some of these perks (and a certain percentage of their pay) that they were not really entitled to initially. That’s not even close to “mandating X days in the office” as the choice is still their.

That hasn’t been my experience, at least anecdotally. While the executives are making a big show of it on TV, it seems like the really high performers can get away with whatever they want, including working remote most days per week.

The “We want everyone to come back in,” again, in my anecdotal experience, seems to be targeted toward the people who were screwing off all day.

The whole idea of big company is to be not dependent on any 1 or few high performers

A big company just can’t have luxury of depending on few high performers.

No one is indispensable by design.

This is per my experience working for top tech companies

Agreed. Daughter 43 was with fortune 500, now independent. Long conversation a few days ago. She keeps in contact with vast number of former cohorts and other independents. Summary – Lots of talk by co’s about forcing back to office, but co’s getting finger from employees, especially highly valued ones. Too many marginal ones hired and slowly being released as co’s adjust to new realities. Below the surface high demand for high value, no demand for low value. Quarterly reports showing record sales, marginal or declining profits. Sales increases due to pushing up prices ( inflation ) are pushing the limit. So to improve profits the slow squeeze in employees which will continue for some time. Got to dig deeply to see.

“…corporate executives appear to be decisively winning the war against work-from-home, despite the low unemployment rate?”

Sorry, but as can be evident from the many anecdotal reports to this post and other posts, the notion that ‘corporate executives are “decisively” winning the WFH war’ is nonsense, at least so far. The reality is that corporate leadership have to talk the tough talk but down in the trenches they can’t walk the walk.

As long as the job market remains really tight they’re going to have to succumb to the fact that if they push too hard on this issue, they lose high performers. And besides said anecdotes, the result is also evident in “hard”metrics like Castle Systems’, which show that daily physical office occupancy is still waay below prepandemic. Moreover, this issue may be suffering from selection bias. You hear a lot about the corporate executives that are trying to nudge their employees back to the office, but what about all the many executives and companies that you don’t read about as much which are continuing the same WFH policies they instituted during the pandemic?

So no, “on the ground”, corporate executives are not winning the WFH war and as a result office REITs are on the rocks.

The big question as far as WFH is concerned is what’s going to happen if and when the job market softens considerably? How successful will the silent revolt against return to the office be then?

That said, don’t get me wrong, I understand where those executives are coming from. Recent economic productivity figures are, quite honestly, horrendous. Especially when one considers all the hype around AI and automation that’s supposed to be increasing productivity markedly at this time. One hypothesis is that WFH may be contributing to the lower productivity figures. Is it really the case? Hard to tell. Deciphering all what really drives economic productivity has been one of biggest challenges in economic science in the past few decades (do a search on “productivity paradox”).

3 days a week in office – or anything less than 100% for everyone – means hot desking or hoteling is feasible. Meaning no one has a permanent desk or office space. Reduces total seats needed. Usually only 50-75% of staff need a seat at any one time if some remote work is permitted. Real estate can be sized accordingly.

Started long before the pandemic. The pandemic accelerated it.

I’ve said this several times before, but here it is again.

I work in a health care business. We have about 11 employees in customer service and IT roles. Prior to the pandemic, almost all work was in office. Now it is all from home, with the exception of occasionally having monthly training and on boarding meetings. We let the lease expire on our former office space and, leased a new space 1/3 the size. We will never go back, our employees are happier, multiply our experience by every business in the country and you can see that commercial office space is headed for a massive reset.

Some centrally planned authoritarian controlled economies use 5 year plans; our Federal Reserve central planning/control appears to use a roughly 6 week plan between FOMC meetings.

Perhaps a Federal Reserve 5 year plan for the economy would give a baseline to control against the wild swings of real estate in both directions; a well as unmasking the US Constitution “commerce clause” impacts of local & state government “zoning” policies. In addition, actual democratically elected Federal representatives would have an input into the nation’s economy and development; i.e., the President and Senate through the Secretary of Housing and Urban Development (HUD), would be able to carry out their duties in this aspect of the nation.

However, this might be a relapse to the High School & College civics taught to students, and time to get back to surviving in the real world of monopoly game style real estate.

Just wait until AI hits the workplace!

I know an office worker subject to the 3 day per week in the office rule. 60% of the people hit the 3 days. 90% of the people who hit those 3 days are in the office for less than 4 hours of work per day.

it’s “Interesting”

Google’s HR chief said the company will start enforcing office attendance by tracking badge swipes & adding it as a metric on performance reviews.

Bab management ,first step fire worry performers . Word gets around quick

I went to golf course at noon Tuesday to practice some putting, instead of lunch. I wanted to get in and out quickly. The place was packed, the course was full, and so was the parking lot. I thought to myself I wonder which tournament is playing today. How did I miss such an important event? I asked at the golf counter what was all the excitement about. He said it’s like this all the time. They jokingly called the “work from home” tournament every day.

Or 100 million retired . Dah

100 million??? Suddenly??? Excess retirements?? LOL. 3 million maybe.

I take a walk everyday in a nearby park, I’m seeing more dads with their kids, they look miserable.

Who looks miserable? The dads or the kids? ;-D

Great volatility, where great fortunes are earned and lost. In 10 years we will celebrate the winners as visionaries and will have forgotten the losers. Someone will figure out how to make money out of this mess.

Greed is easy, math is hard.

Hudson Pacific Properties has some unique problems, most noticeably the writer’s strike that has shut down production in Hollywood, that are distinct from those facing the office sector in general.

The companies they work for, or worked for, are on the leases, not the writers. And those are commercial leases with years to run, and the companies cannot get out of those leases without default. In terms of the landlord, this is no different than working from home: the building is empty, but the company has to pay for the lease.

Wolf – How have the banks avoided so many office tower defaults? With as many CMBS and REIT issues, I don’t understand why we have not seen data on regional bank loans to office towers going bad yet?

My theory increasingly is that banks securitized the highest-risk mortgages (such as interest-only, variable-rate backed by overvalued properties) and kept the lower risk mortgages.

That’s what CMBS are for: they allow for garbage to look good, be rated AA, and sold to bond funds and pension funds, so other people’s money (the ultimate dumb money).

Banks are exposed to office CRE, but it seems they kept the best parts and sold the crap.

I worked in CMBS origination for years. That’s absolutely the case. The best properties are kept on bank or insurance company balance sheets.

Everything else, including many of the ones you’ve listed as taking huge write-downs, were put into CMBS.

I suspect they loaned them more money to make “the payments” then booked the income and the new loan business. I don’t know this for sure, but I worked for big banks and saw lots of accounting magic tricks.

The dynamics of this are all the same for everybody in every stock in the entire universe of stocks. Every single stock, including especially Tesla, Apple, Google, etc. has been driven up to insanity level prices, what makes every so confident that every other stock in the market is not going to take a 60 to 90% haircut from their all time highs. Even Nividia, and look at Bitcoin. It’s recovered well from its 69000 price. Now trading around 26000. The next leg down for a massive remaining chunk of the market is just about to kick off, and we call this wave 3 of 5. It’s the doozy, the big kahuna. This is the fun one bc so many stocks that have escaped gravity thus far, get kicked really hard in the cahanoes. Suddenly not so many boomers are going to be too confident about their sky high 401ks that they feel j poo poo Powell has navigating them quite well for their retirements. Soft landing about to go splat.

I love this CRE one though. 3 years ago in March, when Chicago offices started emptying, I told a colleague. That all these buildings were going to implode financially. Every last one of them, many owned by German firms, for companies like Samsung, and yes these REITS. He disagreed vehemently and said Covid would blow over, and in 2 years these downtown streets in chicago would be hustling and bustling again. Well 40% of small businesses are now gone. Vandals are wiping out most city level storefronts or chasing them away. And even Walmart has shuttered 4 chicago proper of its stores due to theft. Theft is so big in many of these cities primarily now bc the police are overwhelmed, and there are no suburb to city office workers still coming droves to keep the local business afloat nor enough tourists rushing in between the daily workers that used to be in such large numbers you felt safe. Those numbers are gone. Forever. These big cities are going to be completely reshaped. To what who knows. But they are all demoncratic heel holes, former shells of themselves, 3 years after Covid. There are not enough musks in the world to order these people back into offices. More and more remote work will continue to evolve. We saw this trend coming before Covid, as there many similar drivers. Go into the office buildings in Chicago. There are more than 600 of them 10 stories and higher. Their ventilation is rotten to the core. Their insulation is terrible. Furnishings outdated. Layouts a mess. Many have been tried to be revamped but they can’t for how everyone works, which is different. I sold into these buildings snd know their crap hvac, designed with archaic pneumatics. 100 year old controls designed by Johnson controls. Digital stuff is worse and less reliable, and many were built with super expensive electric heating elements, bc they were all going to be powered by nukes that were too cheap to meter. Comed gave them all space heating rates at super cheap in the 60’s,70’s,80’s etc. those cheap rates long gone. Not a one of the buildings is affordable to run. All the building LEEd scores by AEee, are bogus. They are energy pigs. Go around the country and it’s the same damn lie in every city. Trump tower in chicago is the worst for energy pig. All glass, non insulated, and just bull crap design. These pension funds and anyone owning these chicago hi rise dinosaurs, has the equivalent of cinder blocks tied around their ankles and they are all being dragged down into the chicago river or Lake Michigan itself.

All of these statements about these aging buildings makes so much sense to me. Office buildings and homes both with office buildings energy inefficient and I can’t imagine the cost to operate when occupancy is less than 80 percent .

Well said ! The energy footprint because of higher energy cost for the foreseeable future regardless of the sources will forever be stamped on these buildings and the future of the service sector supporting these will suffer as well.

People forget that these big buildings are energy hogs. A company I worked for in the past would mandate everyone take time off between Xmas and new years, didn’t want to pay to keep things running and a security staff for the few employees who wanted to work during that time. Was told by a finance director that their buildings generally had a 20 year lifespan.

“Vornado suspended its dividend altogether for 2023. It said it plans to re-start paying dividends next year, but maybe in stock or cash or a combination of both, it said.”

Sorry for stating the obvious, but a dividend paid 100% in stock is no dividend at all. Stockholders would receive stock in proportion to their existing shares, so they each end up holding the same proportion of the company that they held before. It would just be a stock split in disguise.

The same applies to the stock element of a dividend that is paid in a mixture of stock and cash, if all stockholders get the same mix. It only makes sense if stockholders are given a choice of stock or cash.

I did not look up the short interest on these stocks but looks to me like these could be poised for an epic short covering as the current shorts cover. I personally wish shorts did not exist because I don’t wish ill will on anyone and I don’t like betting against business . I like capital to be invested efficiently. Just like governments they usually do not know how to allocate capital in efficient manners.

Outsourcing continues having worked for the energy business global outsourcing has been ongoing for decades and will continue as we become a global workforce even quicker than before. Jackson Hewitt a PE owned tax preparation company decided to offshore their software and back office support for 2024. Just another example of global IT and Financial support headed to the lowest cost structure available. Good or bad I don’t know strictly human nature in my not so humble opinion. A force of nature for human race is to seek out the most efficient means for one’s livelihood. Efficiency has driven the creation of so many advances in society with a cost to society as well . Available inexpensive cheap energy I think has disappeared on the margin (Saudi still has resources that can be developed low cost) with an example the USA energy business thriving only at 50 plus usd a bbl anything lower and volume plummets . These 50 usd volumes will diminish quickly 3-10 years or even faster because the technology was developed with ZIRP money . Higher energy higher costs less quality of life as we know it (big SUV) and society changes (WFH)

Schumpeter’s gale.

This is the GOSPEL:

https://fraser.stlouisfed.org/files/docs/meltzer/bogsub020538.pdf

And we knew this already:

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7-year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Monetarism has never been tried.

Wolf…is there data on how long ago these older office towers were acquired? Let’s say a pension fund purchased into an office tower 15 years ago and the office tower appreciated 80% over that time; yes they may have lost 50%-70% on paper but they didn’t really get taken to the cleaners on their principal investment and then there’s also the return they have been enjoying all of these years …or am I not seeing the big picture?

The story I wrote about Wells Fargo selling its towner in San Francisco included the purchase price in 2005 and that it sold the tower for 60% BELOW the purchase price.

It is possible to dig up when a REIT purchased their office properties. They also disclose some info on it in their 10Ks and 10Qs.

But no, these office towers did not “appreciate.” The land maybe did. But the ultimate value of an office tower = $0. There are only a few iconic towers that will not be torn down eventually. That’s why owners, on their books, depreciate their buildings to zero over 30 years.

What is often overlooked is the outstanding debt may be much more than the original purchase price. Debt May not be maturing yet; many CRE owners refinanced at low interest rates and extended duration. I was told at the time that many borrowers came back rather quickly to refinance again just to extend duration (smart). They didn’t get the lowest rates due to extended duration, but got more cushion. Banks are reviewing where they stand particularly on proposed construction deal as current lease rates are likely well below the projected levels and construction costs likely spiked higher.

The dead bodies are already out ther, they just haven’t broken the surface yet.

That smell, smells like Victory? They just printed 4 trillion more to keep things afloat. I have been surprised at how long this has worked. Are we witnessing our days of reckoning for ZIRP, QE, Lockdowns? Years to go before we know. Maybe THEY know what they are doing? I doubt it.

Federal government borrowing is in no way ‘printing of money’ at all and is just more ridiculous government debt which must be repaid.

So, teach me how Government repays itself.

Taxes. The government could drain a lot of money out of the system by taxing the wealthy.

But as the ballyhoo over the debt ceiling deal showed, no billionaire was harmed. But the poorest of the poors will have new hoops to jump through.

I read where the deal even took money away from the IRS. So no way will any of the .000001% be inconvenienced with having to worry about paying taxes.

I anticipate the next move by Austerity Joe will be to make the Trump tax cut for the wealthy permanent.

Federal taxes.

By printing more money 😀.

Us government can never default as they can print to infinity and thats what they have been doing for last few decades

Only side effect is inflation .

Not a big deal as it only impacts middle and lower class .

Thanks to all answers. YEP to all , a Government shell game of tax and spend.

The Treasury issues debt and the Fed creates money to purchase that debt; it’s called monetization of government debt. That’s part of how the Fed reached a balance sheet of almost nine trillion dollars. It’s also how the Fed pins interest rates at levels it wants and how the government will make good in the future on all of the crazy IOUs it has written.

They just role the debt over. The debt gets repaid with new debt. If it never has to be paid…it is inflationary ?

That’s what REITS are for . To leverage up, to fatten the executives with options, lavish perks, enormous packages, and wrap the bad stuff as investment grade. The real investors keep the good stuff private. What a debacle. This cannot be good for the banks and the economy. Credit crunch will start biting. Everyone.

My theory is the wfh will ease considerably once the economy slides into the toilet and mass layoffs happen like in 2008. Companies will have the upper hand at that point to demand whatever.

FIGHT BACK WOLF!!!!!!!!

This is a critical juncture Wolf….

Have noticed the bot/trolls for a while now.

Am spending more time trying to ascertain what is AI and not….

Because I know some of the regulars that helps.

Otherwise, if you don’t fight back this site will become toast.

Why? because new readers will not see any value in the garbage in garbage out feeling of AI.

Hope you succeed.

Sincerely,

Adam Smith

Folks the writer on this article title “Implicit” is a bot assigned to me because it is “pissed off.”

Check it out on other recent articles using “control find keys)

This is IMPLICIT in this articles comments:

“Residential does not have the WFH accelerant that commercial office space has to burn that bubble.

It will be more like a slow hot air balloon leak for residential.”

Words that effectively mean nothing to human readers

The GSA owns and leases 8600 buildings/370 million square feet. I think that means we’re all invested in REIT.

Be just like the federal government to add all failed CRE to it’s inventory.

PS

On the other hand maybe they have been selling!

‘How can we possibly be in a new bull market? Two words: AI’ CNN Business

Which show how far the lunacy can reach.

For another POV, the Globe and Mail’s Saturday Biz section has Deutsche Bank describing Goldman’s theory of a soft landing as ‘nonsense’. DB is too polite to say that, that was how the Globe’s writer characterized it.

What DB did say was that ‘the US is heading for its first policy- led boom- bust cycle in a least four decades’

Well, we aren’t heading for the boom part are we?

DB’s estimated ETA for Act 2: 2024

We had the boom. Through 2021. It was HUGE.

“It describes itself ominously on its website.”

Great line.

The demographic on “I want to stay WFH after Covid” skews older. When you’re in your 20s or 30s you often live with roommates or alone, not with family. So, they’re boring or you don’t want to be around them all the time. In your 40s/50s you usually live with real family and you prefer to ditch the commute and be home at 3pm when the kids get home from school, even if it’s a little more difficult to get isolated time for concentration.

The younger millenials were stuck at home alone or with roommates during Covid and they were miserable.