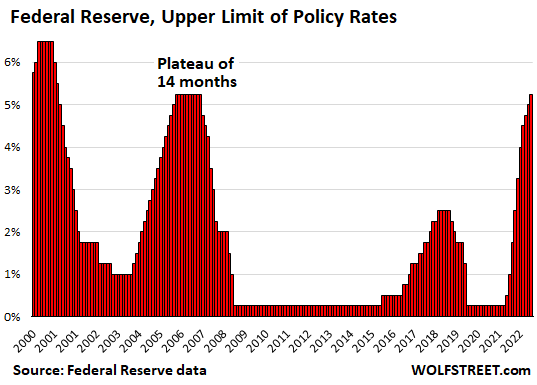

The rate is now where it last was during the 14-month-long pause from June 2006 to August 2007.

By Wolf Richter for WOLF STREET.

The Fed’s FOMC raised its five policy rates by 25 basis points today, which pushed the upper end to 5.25%, having now hiked by 500 basis points in 14 months. The vote was unanimous. It hiked:

- Federal funds rate target to a range between 5.0% and 5.25%.

- Interest it pays the banks on reserves to 5.15%.

- Interest it charges on overnight Repos to 5.25%.

- Interest it pays on overnight Reverse Repos (RRPs) to 5.05%.

- Primary credit rate to 5.25% (what banks pay to borrow at the “Discount Window”).

With today’s policy move, the upper end of the federal funds rate target is now where it last had been during the pause of 14 months, from June 2006 to September 2007. Plateaus after a series of rate hikes are the rule. In 2018, the plateau (at 2.5%) lasted seven months. In 2000, the plateau (at 6.5%) lasted eight months:

But now there’s the worst bout of inflation in 40 years, amid doubts that the Fed has hiked rates enough to bring inflation back under control, and all bets are off about the length of the pause, or if the Fed will end the pause with a rate cut or a rate hike. The Reserve Bank of Australia just un-paused its policy and hiked out of the pause by another 25 basis points. So there’s that.

Language in the statement did not lock in the long-awaited pause. The statement didn’t mention “pause” at all, but instead said:

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

This gives the Fed room to move either to a pause or another hike at the next meeting.

In the March statement, the phrase on the prior statements, “ongoing rate increases will be appropriate,” was replaced by “some additional policy firming may be appropriate.”

On today’s statement, the March phrase, “some additional policy firming may be appropriate,” was replaced by, “In determining the extent to which additional policy firming may be appropriate…”

QT will continue on track, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, same as in the prior months.

Today’s rate hits the “dot plot” projection for year-end. Near the end of each quarter, so in four of its eight meetings per year, the Fed releases its “Summary of Economic Projections” (SEP), which includes the “dot plot,” Today was one of the four meetings a year when the Fed doesn’t release a SEP. In the March SEP, the median projection for the federal funds rate at the end of 2023 was 5.125%. With today’s rate hike, which put the federal funds target range between 5.0% and 5.25%, reaches this projection.

On the banking crisis and its impact on inflation, if any, the statement said: “The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.”

And here is how Powell did in the post-meeting press conference: Powell Swats Down Rate Cut in 2023, Purposefully Leaves “Pause” for June Meeting in Doubt

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s amazing how much bile has unleashed in the last 20 minutes, now that the Fed funds rate slightly exceeds inflation.

The ZIRP addicts are continuing to blame the Fed for the recent bank failures, the upcoming bank failures, and Hurricane Chicken Little that is headed inbound for the economy. And they won’t stop complaining until the free money comes back to finance their insanity.

Yep, the only thing for sure it that wall street and the MSM will be out screaming bloody murder for rate cuts. No matter how hawkish Powell was after each meeting, the screamers came out reading the same script.

The fed owns the dollar. That is very powerful and they aren’t gonna lose it without a fight. They know markets rise and fall, politicians come and go. Those are all secondary concerns. Inflation has to be stopped or they lose that which makes them kings, and they know it.

rates, rates, rates.

what i want to hear about is the pace of QT. why not pick up the pace and sell off assets?

the Fed is not the only actor in this area, nor even the worst. the ECB and BOJ have purchased a much larger portion of the outstanding treasuries for their respective economies.

why is noone still talking/asking about the size of those balance sheets? the answer is that the financial markets know what an immense problem this is and how it continues to keep their asset bubbles intact. I’m going to try to find out if there is a projection of how far underwater the ECB’s unrealized losses on bonds are currently and what they could be if long term interest rates blow out further.

You’re very much right about QT.

Just to provide some back-of-the-envelope math regarding housing that is very telling.

Between March 2020 and March 2022, the Fed printed $1.35 Trillion exclusively to buy mortgages. That is $1.35 trillion *poof* out of thin air and handed to people at rock bottom interest rates exclusively for housing loans.

Now, a large portion of that cash was juggled around for the purpose of refinancing mortgages, but since no net money changed hands, and there was no transaction to “lock in” a valuation increase, it absorbed none of the printed money. Remember interest rate manipulation was one action by the Fed, but QE was another.

There were about 12 million houses transacted during the same time period, roughly 8.5% of total US housing stock, which means there was about $112,500 in printed money earmarked for each house transaction. During the same period, median house prices increased by $150,000. You can come to your own conclusions about this.

Every used house salesman (ie. realtor) will tell you that prices are based on “comps” and are “set at the margin,” which means that if only the 8.5% sold inflate in value, then the other 91.5% that weren’t sold will also inflate in value. This means that the printed money could have a leverage effect on total asset prices that is at least 10x for every printed dollar injected into mortgages.

And this is precisely why the concept of “appreciation” needs to be thrown clear out the window. It is all an epic bubble, leveraged more than 10x with printed money.

Yep and because housing is utterly detached from wages, everyone has stopped doing productive activity and has instead moved into rentier activity.

Productive activity: you have to actually create something using time and/or materials.

Rentier activity: by definition, nothing is produced, you just put your hand out.

Why would anyone want to do the former when the Fed are seemingly *guaranteeing* the latter?

It’s too late to pick up the pace of QT. Inflation is entrenched now. The pace of QT should have been large from the start, where it would have had an impact. Had they made QT $40 billion a month larger from the start, we wouldn’t be where we are today. QT is doing next to nothing at this point, concerning inflation. Its value was squandered.

PS The Fed will be forced to restart QE within the next 24 months, as they knew from the start, making their decision concerning the initial pace of QT even dumber. As El-Erian has noted, the Fed has failed at every decision point.

Increasing the first three month QT of 47 billion a month to 95 billion probably wouldn’t have made a huge difference. Even with their stated target of 95 billion a month since September, the actual QT was only around 70 billion because of lower amount in MBS. If it was 200 billion per month, however, they would have reduced the balance sheet by 2.4 trillion in one year.

El-Erian said we have to add a new term “Triflation” for the current economic situation. Previously, Inflation + Recession = Stagflation. Now we have to add the bank failures and financial instability to the equation and call it “Triflation”.

ENJOY

Inflation is entrenched. When I see cans on tuna or beans at a reasonable price in Canada I buy 20 cans.

I’m handing over script that I *know* will be worth far less in 12 months time for real goods that my family will use.

And nothing the BoC say can change my mind because I only believe actions and they have always weakened the currency when landlords need bailing out.

Good show, gametv. It is the over-abundance of money that causes inflation, not interest rates.

The Fed can let the dollar settle into equilibrium at its eventual lower value based on the larger number of dollars in existence or they can remove dollars at a sufficient rate to stop inflation in its tracks. They’re aiming somewhere in between while showcasing interest rate hikes as a diversion, but their crosshairs clearly favor a new normal with sort-of high inflation.

Let’s face it, the plan was never to pay directly for costs incurred during the pandemic. The plan was to pay indirectly by inflating the currency. We couldn’t afford the Vietnam war either, so how did we pay for it? We printed money at a rate that would cause an inflationary decade to follow. We printed a lot more this time around, so here’s to hoping that we have ONLY a decade of hot inflation ahead.

Like prince sang “this is what it sounds like when doves cry”.

The rate increases so far might upset Wall Street but are not yet enough to tame inflation. The oncoming recession in China (which is now intimidating foreign firms that might reveal its dire predicament) might decrease the growth in the world economies dependent on it (e.g., its suppliers like Australia) so that much inflation might be tamed.

I still predict that US inflation lets the bankers reduce the real dollar value of their liabilities (their depositors’ money deposited in their banks) too much (by over a TRILLION dollars per year) so that all their “Fed” cartel’s half-measures so far are just “pretend” efforts— like the SEC’s prosecution of a certain celebrity to pretend it was doing its job after it ignored the Bernie Maddoff frauds for decades.

The Fed IS TO BLAME, IMO for the bank failures….

They slammed long term rates, irrationally so, by buying up massive amounts of long term debt….inverting the yield curve …to force more risk taking. And the banks followed. They lent money to the federal govt (bought treasuries) long term at RECORD LOW rates.

Essentially, the banks shorted interest rates at all time lows….

and who drove them to this idiocy?

Yep, the banks were so stupid withe their investments in LT securities. I’ll bet they were equally stupid with their loan portfolios. I’ve had it with banks. I just went to Wells Fargo, a criminal organization masquerading as a financial institution, and withdrew drew all my money and left just enough to pay expeneses through the end of May

Wells Fargo is the one bank that puts your complete account number in bold print on their monthly bank statements. You can read the account number while it is still in the envelope without opening it using a 25 cent toy flashlight. I recently had my entire account with them compromised. Some scumbag stole my account and charged a new AAA membership on my checking account. I called the Wells Fargo fraud department and the told me it was my fault. Truis bank does the same thing, but at least the account number is in normal print vs bold print.

Hour and half before market close….wonder how the glue sniffing market will somehow interpret Pow Pow as saying tightening is done soo and cutting is coming between today and tomorrow…

Gotta do anything you can to lure those guacamole dip buyers back in right?

Stocks are up and oil is down.

Gold and silver up too.

Dollar is falling.

It’s almost as if the market doesn’t believe him

Yes, it doesn’t make any sense to me either. The DXY just went down, down, down all day while Gold and Silver popped. Maybe it’s opposites day.

This is because they don’t. The Fed lost what shred of credibility it had with the word ‘transitory’.

The Fed continues to raise rates and signals it may keep going .. and the market goes up.

Iran seizes a 2nd oil tanker, and oil goes down.

This market is insane!

This post didn’t age well.

It’s AI Algo’s doing their thing.

Microsoft “news” which pops up on my computer without my consent…

Powell hints “pause”.

The control of perception is at work.

I think the Federal Reserve has done a reasonable job this tightening cycle. Especially not caving to market pressure.

Unfortunately a whole generation of Wall Street money managers, who’ve only known ZIRP & QE till now, keep trying to fight the Federal Reserve & front run the pivot (which, like a broken clock, they’ll eventually be correct on.)

Your definition of “reasonable job” is transitory interesting…

I disagree.

What marker pressure: stock market is going up and up and little bit below all time high.

I think FED is wrong that it didn’t purse more aggressive QT.

UNless the asset market crashes, inflation won’t be tamed. Still too much money sloshing around the economy.

The Fed shouldn’t need to pursue aggressive QT.

Because they should *never* have done QE.

i disagree and will say why. the Fed should have been liquidating their asset purchases when interest rates were still low. they cant sell them rapidly now because that would stick them with losses, so instead they hold onto them.

the Fed is doing the exact opposite of what it should be doing. it shouldnt be attacking the real economy with higher interest rates and trying to cause a recession. it should be pulling the rug out from under the markets by selling off all those assets, thereby putting the trickle-down “wealth effect” into a stunning reverse gear. as markets melted down to normalized valuations, it would cause asset bubbles to burst and inflation would come down rapidly. but it would be the rich who suffered, not as much the poor and middle class.

and the Fed will continue to have the back of the rich.

I agree. While I think the Fed needed to raise rates and has done so at a reasonable pace (any faster and we’d probably see more things like bank failures), they’ve been way too slow with QT. They could have rolled off an additional $1Tril in assets this past year without causing market stress (aside from deflating asset bubbles which is the whole point).

Banks still have a large amount of money parked with the Fed as excess reserves. That’s literally money that the banks have no economic use for (they’re not buying anything, or making loans with them). No real tightening will occur until that excess is mopped up and then money starts to drain from the actual asset markets.

Lune they can’t sell there assets,the whole world is dumping treasuries ,rates are up because they need CASH .to payoff china

I almost agree with you.

Then I realized there has been a total of 20% inflation over about the last 3 years….

and short rates average what, over those three years? 3 %?

Theft.

Yellen came out to say the banking system is sound. Get out now!

When the government says all is fine they are just buying time to get out first. By the time they acknowledge the massacre it’s too late for the plebs. Just a PSA – you have been warned ⚠️

Honestly, I can’t recall a time when Yellen has been correct.

Yellen, a few years back:

– the banking system is “very much stronger” due to Fed supervision and higher capital levels.

– because of the measures the Fed has taken, another financial crisis is unlikely “in our lifetime.”

LOL.

She’s another idiot, regardless of her resume and academic wall paper.

How many govt pensions you got?

She’s got at least THREE ….Uof C, Fed, Treasury

Yep.

She’s gotten stinkin’ rich off her speaking fees – which in any ethically sane world would constitute a conflict of interest.

Yeah. As everyone knows ONLY the best rise to the higher levels of the Corporate and Business world…aka “the REAL world”?…In fact, it’s the main reason for wanting to abolish most of government, right?

Don’t your own damned rules say she is smarter and works harder than you merely because she is richer and can buy more stuff than you can?

Pathetic planetary parasites wear me down…..sorry.

Sorry, that comment intended and would be better placed under longstreets….but not a whole lot.

She was right when she said “The theories we chose to follow were flawed”.

But she failed to say “we were wrong to follow them”…

you see, it was the theories that were wrong, not us

That doesnt fly in the real world….only in government and bureaucracies

….and Yellen is the quintessential government bureaucrat, who has fabulously prospered by the peter principle.

remember when she told Powell to “go big”? Was she got was big inflation.

Real inflation at 10%+++

Still lots of work to do…

At this rate it will be 3-4 years before inflation gets back to 2%.

Nah….

The 2022 “Inflation Reduction Act (IRA)” is gonna kick in any day now.

Let’s hope higher rates for the next decade, free $$ at next to nothing rates is what caused this in the first place.

Im certain the fed will drop rates to nothing again the moment the recession begins in earnest, and we can all play the “numbers go up means good” game again. Expect sub 1% by December.

Nope. We may soon have 45%+ interest rate as the federal governments defaults in a few days!

At this rate, core CPI inflation might never go back to 2%, or anywhere near 2%. And if this is the case, higher interest rates for much longer.

A large-enough recession is what resets inflation expectations, and resets changed consumer behavior as a result of prolonged high inflation. Throughout history it’s always been possible to bring inflation down eventually.

Of course, if deglobalization continues, it will be harder to reach 2%. But it wouldn’t be impossible.

I wouldn’t get too hung up on Fed Governors talking about a 2% inflation goal. I have always thought the 2% target for the inflation rate was the “talking goal” for when inflation was too LOW in the Fed’s estimation. They were trying to jawbone it up. Now they are trying to jawbone it down… but if it stalled at 3% to 4% they would break out the champagne. After all, that is where it was for a quarter century after Volcker tamed inflation in 1981-1983… a period of time when the Fed was seen as the smartest Central Bank on the planet.

My feeling also……it’s related to “growth”, fractional banking, and profits……I betcha.

Simple, the Fed will now say that 4% is the new acceptable core CPI inflation. I mean, why is 2% the right number? Why not 1%, why not 3% ?

Nothing magic about any of these numbers. But if you want low long-term interest rates, the market MUST have the confidence that inflation will be low over the term of the bonds. If the Fed raises the target to 4%, suddenly the bond market is going to reprice every long-term maturity to reflect the higher expected inflation. So the 10-year yield may be 6% and mortgage rates 8% or so.

=> If the Fed raises the inflation target, rates will go UP, not down.

I discuss this issue here in detail:

https://wolfstreet.com/2023/04/16/what-would-happen-if-the-fed-caves-to-4-5-core-pce-inflation-and-gives-up-on-2-as-some-folks-are-clamoring-for/

> higher rates for longer

RIP Canada

“…clowns to the left of me, jokers to the right, here I am (stuck in the middle with you)…”

-gerry rafferty (r.i.p.)

may we all find a better day.

So Obama’s gang of Goldman Sachs experts handed out trillions of dollars under QE. The MBAs in the banks all figured the 0% interest rate party was never going to end. Unicorns appeared everywhere because the brilliant folks on Wall Street needed high ROI. Then COVID came along and suddenly it was the hundred dollar cheques to families that caused inflation. Moral hazard only works when it involves the poor. Now interest rates are skyrocketing because that’s the only tool in the box to crush inflation. Except high interest rates also cause inflation, when the cost of borrowing goes up for businesses. Also, the banks run by those MBA experts put all their money into 1% 10 year bonds, so now they’re going belly up. But they will be bailed out by the Fed because there’s no moral hazard when it involves rich people.

Am I getting this right?

Wolf should be charging a vanity license plate fee for many of these screen names.

…dammit, NBay, sprayed my coffee!

may we all find a better day.

What I really wanna know is…

When Powell said “(regrets) I’ve had a few”, was he thinking Old Blue Eyes, or Jonny Rotten?

Sid Vicious. The murderer.

That was a scary time of doldrums and resentments in the UK, deep stagflation. That fed the nihilism. Many attitudes (such as those of US auto workers as well as execs, same era, a time of substandard US cars), gave an awful feeling of decline. But it passed.

We mean it, yeah.

If Chris Whalen is right, net interest margins have been destroyed. Assets (mortgages) averaged around 3 1/4% for First Republic and their cost of funds was 2-3% (?). The net interest margin was less than 1% and that cannot cover overhead. Banks that own long term assets paying ~ 3% are functionally bankrupt since the Fed drove their cost of funds to about the same rate (if they continue paying 1/2%, they face withdrawals seeking higher rates).

The only solution to the broken business model of regional banks is to cut interest rates. If the bank failures continue (I expect they will), the Fed will be forced to cut rates (the discount window doesn’t help, as the the primary credit rate for the Boston Federal Reserve Bank’s discount window is 5.00%, i.e., cost of funds still way too high)

The other solution is to let longer rates drift higher. Right now 3-6 month treasuries are over 5%, but 10 year are only 3.5%. If QT continues and Powell doesn’t cave to wall street pressure, over time longer rates will adjust higher than short rates. It could take years.

What we have now is a generational shift from the easier and easier money of the past 30 years. Nobody believes they will follow thru. I think the fed knows they must or they will lose the dollar. The fed is playing the long game.

there is a simple way to push up long term interest rates – sell the balance sheet and take away the punchbowl from the markets.

Your “only” solution is just a plan to keep bad bank management in place.

In reality, there are many solutions. For example, those banks that took on interest rate risk and lost can raise equity capital and take a hit to the stock price. They can fire all the executives that got them into the mess. They can layoff excess employees to cut costs and cut out the free Starbucks coffee. They can cut dividends to shareholders, and claw back bonuses from executives.

As a last resort, they can get taken over by the FDIC, which will sell the assets to more competent management teams that care enough to manage interest rate risk and maintain adequate capital levels.

Buying long-term assets that pay 3% was moronic, and anyone who did so should suffer for it.

Obviously, somebody had to buy those US Treasuries.

Nobody HAD to buy them at those rates. For over a decade, people were calling for the bond vigilantes to return and to refuse to buy long-term obligations at 3%. Had the banks and other institutional players done that, the federal government would have had to rein in its spending. But it didn’t, and the Fed provided this illusion that it would always keep rates low, so people took the risk.

@Einhal,

Found on the web:

“The Fed doesn’t mandate that every Primary Dealer bid every time the Fed wants to sell. However, if a dealer consistently refuses to bid on Fed bond sales, they may lose their status as a primary dealer.”

So, about as voluntary as deciding not to get a Covid vaccination if you wanted to keep your job.

Mike,

“The only solution to the broken business model of regional banks is to cut interest rates.”

LOL. No, the solution is to let the stockholders and bondholders of stupid-ass banks get wiped out. If you put your money on stupid-ass CEOs … on utter morons that bought 30-year securities in the summer of 2020 when they yielded 1% … you deserve watching your investment get wiped out. I’m so sick of this stuff.

The big problem this country now has is INFLATION. And I don’t give a rat’s ass about bank stockholders.

Smartly run banks will do just fine in this environment. They’ll thrive because of the higher interest rates they can charge. And moron-banks need to be taken out and dumped into a ditch.

Look at the stock of Republic Bank, that’s not a bank stock chart but a crypto chart. It’s the chart of a scam! The stock multiplied by 10 over a decade since its IPO. Well-run banks don’t do that. Investors who believed in this moron-scam-bank correctly got wiped out. That’s how scams should work:

Fully agree. Weak links in the system need to be taken out. Rate hikes are helping to clean them out of existance. Inflation fight is needed in a full on mode. So sad Powell’s so weak a communicator and can never make the straight point across.

Very apt reply WR.

My thoughts exactly but well put out.

The Fed isn’t worried about banks because it stands ready to fill any holes it blows in bank balance sheets that might cause a run. Wall Street will keep probing weak banks and the Fed and FDIC will keep doing what they have to do to resolve them without a run. The Fed could also cut the rate at the discount window or otherwise provide direct aid to banks (e.g. the BTFP). Nobody cares about bank bondholders or stockholders except Wall Street so the Street needs a new strategy other than bank runs to try to force a pivot.

I am a stockholder of all of these banks. My retirement is invested in low cost index funds that own a large portion of all of these banks.

If you seriously believe that stockholders have some sort of way of impacting management decisions, you are living in some 1700’s fantasyland of past history. More specifically, you are just not being honest because I know that you know that there is no connection between most stockholding Americans and the management of these banks. You either know that or you are not a serious person. And be careful which bank stockholders you don’t give a rat’s ass about because some of those rats are your (former) readers.

By investing in a passive fund you abdicated your right to management decisions to the fund owners. These fund owners choose to support these banks (mis)management and have power disproportionate to their investment (risk) because people like you freely give it to them.

My Name is August West,

You SELL the stock. That’s how you vote. That’s the classic way.

When enough people sell, the stock crashes, and then either the bank will fix its problems or disappear. After it fixes its problems, and it looks good to you, you can buy it again. That’s how it should be.

Propping up scams with rate cuts so people’s retirement accounts can continue to balloon is not how it should be done.

If you’re invested in funds, well, then, that’s the price you pay for trying to do something that is easy and convenient.

If you don’t like the risks of the stock market, don’t play in it. If you still want to be in the stock market, but don’t like the risks, well, then fine, but don’t ask the Fed to bail you out if something doesn’t go your way.

You liked making 10x on First Republic, and then you complain when it goes to zero and want the Fed to bail you out with rate cuts? LOL

You’ve got to be an adult about this stuff.

For over a year, we here have been discussing buying short-term Treasury securities, brokered CD, ibonds, money-market funds, etc. to sit all this out. That stuff worked very well.

My feeling is, from what you say (obviously I could be wrong), that you’re too young to have been through the Dotcom bust when the Nasdaq plunged 78%. Many of the companies vanished. Many of the survivors, including Intel and Cisco, never went back to their Dotcom bubble highs. That was a real learning experience. There are learning experiences this time around too.

Venkarel, Wolf +1

Unfortunately, the adults left the room long ago.

The problem is the passive investing mindless robot, that has taken over what’s left of ‘markets’. It’s going to get ugly for the passive investors, they’re going to learn that equities are not risk free and stonks do not always go up. Despite the profligate Fed and Treasury arsonists.

My Name is August West,

First a question: why didn’t you respond to Wolf’s response ?

I agree with you for the most part.

Wolf thinks we should all be individual investors… but my degree is in compsci not business nor finance. I’ve learned a bit over 30 years in the market but prefer someone like a Tillinghast, Romick, or Giroux to invest my money.

They have vastly more knowledge, algorithms at their disposal etc that I dont have. Wolf should understand that, hard to believe he doesn’t.

The last 10 years index funds have gained in popularity for good reason. They have outperformed active managed funds (over 10, 15 years) by all studies I’ve seen.

Will they continue to do so ? Long term, probably yes.

Wolf ought not make assumptions about you, August, such as being young.

Whatever.

Index funds are typically quite diversified so one holding going bust won’t affect it too badly. Typically a top holding in an index fund is less than a 10% stake in the fund. Many other holdings only make up one to three percent of the fund’s composition.

Randy,

You got lost in the comment thread (this was a long and confusing one). So let me walk you through.

My replies in this thread were to a line by “Mike,” who wrote the first comment in this thread:

“The only solution to the broken business model of regional banks is to cut interest rates,” he wrote.

In other words, Mike wants the Fed to bail out investors in regional banks with rate cuts.

This triggered my first reply — no, the Fed’s job is not to bail out investors; badly managed banks need to go under, and investors need to lose their shirts.

Then along came “My Name is August West” who is an investor in regional banks. And HE wanted the Fed to bail out his investment in regional banks.

This is what “My Name is August West” wrote:

“I am a stockholder of all of these banks. My retirement is invested in low cost index funds that own a large portion of all of these banks.”

And so my reply was based on that. Your investments are YOUR decision, I said essentially. No Fed rate cuts so that your retirement fund can continue to balloon. That shit has been the problem since 2008, and that’s one of the reasons why we have this raging inflation now — and the greatest wealth disparity ever.

So stay focused on the thread.

If YOU want the Fed to cut rates in order to bail out your stock fund, or your stocks, and if you advocate for those rate cuts here in order to enrich you, despite this raging inflation, you become a troll here, and you go on my list.

Interestingly enough even shitty websites like yahoo finance are on top of their game when it comes to removing all the data related to scam stocks the instant they fail. I guess the “sweep under the rug” process is well oiled and thought out.

Somethin’ – …it’s a grand ‘Murican tradition…

“…and that old house we lived in, the roof is cavin’ in, like every other one along the block. Took twenty years to pay and ten to rot. Now Dad says it’s all better just forgot…”

-rodney crowell, ‘Home, Sweet Home (Revisited)’

may we all find a better day.

Survivorship bias risk is the risk that the reported returns for investment funds is overly optimistic because failed funds are systematically selected out of the available data.

Speaking of stupid banks, Wells Fargo must rank near the top of the list. I was in there today to do a routine transaction and had to step over a homeless bum who was squatting inside the bank with a shopping cart next to them. There were no tellers manning their stations. The one there was waiting on the drive in lane. I stayed 15 minutes and then walked out.

Did the homeless guy get tired of waiting, too?

Agree 1000%

Hi Wolf,

You are talking about banks, okay.

But outside the banking (and other less volatile sectors) it doesn’t have to be a scam to multiply by a 10 factor. Well, scam in the usual sense I suppose.

FSELX, Fidelity Select Electronics, in the early months of 2000 had a 10 year annualized return of just over 30%.

Just before the dot comm bust.

Calculator yields (1.3)¹⁰ = 13.78.

So almost a 14 times multiple.

It did crash badly during the tech bust, off about 75% max drawdown. But it also recovered relatively well. My memory not too good but I believe it came back faster than the NASDAQ in general.

Anyhow… while the First Republic Bank chart may have the look of a scam (just looking at the runup; of course the plunge to zero provides additional info) not every such chart need represent a scam.

Some might argue inherent in any 10 year 30% annualized return must be a scam of some degree somewhere. That I can’t say. But FSELX didn’t invest in the internet stocks as far as I know, mostly semiconductors.

Again you did constrain your comment to bank stocks.

Correct. Let’s (finally) have some accountability.

Everyone who leveraged up at 2%, betting rates would go lower should be removed from the game. Thanks for playing. Goodnight.

Get rates up, keep rates up.

Anyone whining about not being able to start a business returning 3% should get a job at McDonalds instead of trying to waste precious resources for a near flat return.

I hope ZIRP never, ever returns. It’s cancer.

Or option 2: the Fed induces market conditions that make those loans get paid back early.

For example, a recession will force many people who overextended into a 3% 30-yr mortgage on an overpriced home to sell or be foreclosed on when they lose their jobs.

And commercial loans and other asset-backed securities can get restructured as commercial real estate gets shellacked.

Yes, these will all involve loss of principal. But banks are supposed to keep reserves to protect against losses from their holdings. What’s that? None of these banks held enough reserves because holding such reserves is “capital inefficient” and Federal regulators looked the other way even as they knew of the tsunami of losses coming their way? Gee, looks like it’s not interest rates that are the real cause of bank failures, but CEO incompetence and regulatory capture. Those won’t go away by tinkering with the interest rate.

The real solution to bank failures is to string a few CEOs up on the walls of their banks when they fail, for everyone to see as the crows pick at their corpses. Or, since we’re not that barbaric, wipe out their entire net worth and throw them in jail for decades due to violating numerous banking laws that were passed after the last crisis. All of a sudden, you’ll find CEOs manage to run their banks without needing bailouts, regardless of interest rate moves.

CEO,s need to be held accountable,but then they would spill the beans on their masters.

Nothing is more clear than “For every action, there is an equal and opposite reaction.” In physics and economics.

Housing prices soar….and home owners feel great, doing well.

Those who bought paper with low yields, the banks, not so much.

I really hope the Bank of Canada unpauses. But, maybe it won’t be forced to? I am surprised by the (sort of) strength in the Canadian dollar. Well, “strength” is the wrong word. I really mean “unexpected lack of major weakness”. I would have guessed the CAD would have suffered more after the Federal Reserve raised their rates above the BoC’s rates the last time, and even more today. But, instead, we (i.e., Canadians) are now two increases behind the Fed’s curve and the CAD is still not totally pooping the bed. Is this temporary? I don’t get it – I thought the CAD/BoC would have totally been squeezed by the Fed by now.

Real estate here is having a tiny bounce (the scale of which is wildly exaggerated by various pro-real-estate media outlets, of course) which I assume is at least partly comprised of the Pivot Cult. Just middle-of-the-road stuff selling, though. Expensive places, which in my ugly medium-sized town on the coast of BC means a million and up (depending on the quality of particle board and glue) are getting no love at all. Still, some sort of fever is back in the air, and I caught a lecture from an over-housed Boomer recently about me needing to get on the property ladder- this hasn’t happened since the speculative frenzy of late 2021/early 2022. I didn’t miss it.

Anyways, it will be very interesting to see what the BoC does next and what that does to sentiment here.

TEMPLE

BOC did one large raise awhile back, can’t remember, was it a full percent? They seem to be setting the stage for another raise. A good analog of Canada seems to be Australia and we seem to be ahead of them. They had a “sudden unexpected rate increase” this week. I should take a look at CAD/AUD pairs and see what the impact was.

“Real estate here is having a tiny bounce (the scale of which is wildly exaggerated by various pro-real-estate media outlets, of course”

No doubt just as it is being wildly exaggerated in the US.

Canadian rates are lower than the US, but that is because Canadian inflation is lower, so these factors offset one another.

Inflation in Canada 3-month moving average has been within the BoC target range since October, we are just waiting for Q2 of last year to roll off before the headline annual figures reflect this, and also waiting for food prices to come down, but even they are starting to come down from their peak.

I’m not expecting a rate cut, but hard to imagine another rate increase from BoC unless something major changes (eg inflation starts going back up again or the dollar crashes).

Real estate is selling at higher prices because of the combination of extremely high immigration and inadequate construction and few houses being put up for a sale (nobody with a fixed rate mortgage will be willing to move until their term is up, because they would have to give up their low rate, so the market remains pretty frozen, with sales volumes near all time lows). But you always need to be wary of price strength on thin volume, no matter what asset you are talking about.

> Canadian rates are lower than the US, but that is because Canadian inflation is lower, so these factors offset one another.

Not how it works. If you have 500bn to invest do you want to give it to the USA at 5% or to Canada at 4.5%.

Now, having said that, why hasn’t CAD tanked? Debt ceiling? I am surprised.

I would love it if Wolf would opine on this. It makes no sense.

Still a long way from 1970 rates. My wife bought CDs at appropriately 13 percent and we also financed a sale of our house at 10.5 percent rate in 1984.

Powell has been consistent throughout this hiking phase, so I give him credit. He is data dependent, as he should be. Fed has two mandates, employment and inflation. Employment is strong, no problem. Inflation is horrible, big problem. He wants to get it down to 2%. That’s going to take a long time, imho. What he said today is what he has always said.

As for banks, the big problem is deposits are leaving for better paying money market funds. I have been moving my money out of banks and into 3, 4, 6 month T-bills for over a year now, so that I am getting an average of just over 5.2% on my assets (I have a lot of old I-bonds that have a fixed rate of 3%, so I am a little different from most people). I will continue to move money out of banks.

No reason to keep money earning .01% in a bank when you can get 5.21% on a 3-month T-bill. Schwab and Vanguard (the ones I use) charge no commission to buy and sell Treasuries. Keep only enough in a bank to pay your monthly bills.

A problem no one is talking about: As bank failures increase, the FDIC is going to have to raise insurance premiums. The highest now for the most risky banks is .42%. This will likely go higher. That may not sound like much but banks make their money off the spread, which is usually around 3% or so . These increasing FDIC insurance premiums are going to eat into the spread more and more. Sell bank stocks.

Speaking of selling bank stocks, PacWest just dropped 51% after hours today. It was around $30 last December. Today it is around $3.

“What he said today is what he has always said.” What about the whole, “inflation is transitory” storyline?

First line of that paragraph “Powell has been consistent throughout this hiking phase”. The transitory rhetoric was before this hiking phase. Context is important.

Perhaps the lesson here is: with enough humility, you can be dead wrong and still hang onto your job.

Employment is too strong from the perspective of the fed and the rich. Powell has had MANY things to say over the last 12 months about rising labour costs.

After five years as Fed Chief, JPow has finally learned how to communicate with a bit of circumspection. The market should NOT know what the Fed’s meeting announcements will be with near certainty. Even Greenspan figured that out.

The economy of 2023 is far different than 1980. I believe the Fed has done a reasonable job with interest rates so far. Inflation will continue as more employees demand wage increases, but that too will wane in the coming months as more jobs are lost.

The Fed is likely believing they can manage through bank troubles. And seriously, the US wouldn’t miss a beat if 1/2 went away.

The big news though is that the Fed is not going back to anywhere near the ZIRP conditions of the past. The Fed will keep the dollar strong at all cost.

Smaller banks are a big part of the real estate ponzi.

They hold 70% of CRE.

So they are increasing the cost of *everything* in the USA.

Buildings that already exist cost more to rent, increasing costs to deliver services, etc.

“They hold 70% of CRE.”

NO THEY DO NOT. They might hold 70% of the CRE debt THAT BANKS HOLD.

But the majority of the CRE debt is NOT HELD BY BANKS. It’s held by investors, bonds funds (CMBS), insurance companies, private equity firms, mortgage REITs, etc.

People need to get this straight!!!

Read this. I wrote it just for you:

https://wolfstreet.com/2023/04/10/banks-and-commercial-real-estate-debt-a-deep-dive-investors-and-the-government-on-the-hook-the-majority-of-cre-debt/

Okay fair correction, I misspoke.

Wolf, question: Let’s assume the Federal Reserve pauses for a few months. What happens then? Does inflation just continue to heat up until the Fed resumes raising?

In the past — meaning 40 years ago — inflation of this type didn’t just go away by hiking rates to 5.25%. Rates eventually reached 20%, triggering the really bad double-dip recession, which finally knuckled inflation under. I don’t think this is needed now; 5.25% seems like a good first step, then wait and see. And if inflation resurges, go knock at it some more. Powell is fully aware of that possibility, from what he said today.

QT continuing to tighten will have the same effect.

Powell learned his lesson from 2018 when he tried to do too much at once… QT and interest rate hikes simultaneously were a disaster for the markets because the Wizards of Wall Street were having trouble understanding what was going on. They know how to say the words “multivariate analysis” in a prospectus… they just don’t know how to do it. NOW he has interest rates at a nice sustainable height so he can pause those for a moment… AND incrementally accelerate QT.

Crude oil and oil stocks took a tumble here…

that could influence inflation metrics for a while

Here is a question for Wolf.

Everyone seems to be lazer focused on Banks. How about Insurance Companies? They also make loans.

Thanks

If I understand your question correctly: Insurers don’t take deposits. Therefore, they cannot have a run on the bank. The money they have is locked in. They can and will hold their assets till maturity.

Inflation will not come down with these rate increases. They are just costs that are passed on to the consumer in the form of higher prices. I don’t see anything on the ground here that indicates any abatement in inflation. My local pub where I go twice a week is packed with young and old people spending like there is no tomorrow. Every service I buy is up 15% or more YoY. The “Gas station from hell” nearby is keeping their price fixed at $4.69 for regular gas even though the price of crude has dropped. RE rents are going up double digit, and homes are selling like hotcakes at outrageous prices even in crime ridden neighborhoods. These quarter point rate increases aren’t doing Squat. END OF STORY.

Driving from SoCal to Vegas last week the freeway is jammed with giant RVs, people towing boats and jet skis, every other car is brand new with temporary tags, and casinos so packed with tourists you could barely walk in a stright line…saw one woman feeding a big stack of 100s into the slot machines.

5 percent might as well be 0.5%

So what’s next?

I guess “higher for longer” was transitory.

“So what’s next?”

Higher for much longer?

Ironically, not raising rates means the current rate will be held for much longer. I’m not sure what’s worse for markets: a brief but deeper recession and market turmoil from higher rates kept for a shorter time. Or a longer, more drawn out but less severe recession and asset market unwinding from keeping rates lower but for a longer period. I see Japan raising their hand to answer this question for us…

Market ain’t buying the ‘pause’ narrative. It’s pricing in cuts. The 1 year Treasury yield dropped today to 4.67% and the two-year dropped by a quite lot – to 3.84. Not sure who the market believes but it ain’t the Fed.

The markets are ZIRP junkies. That’s why they keep asking and asking about pivots and cuts, when inflation is raging. Like any junkie, the markets can’t believe the free ride is ending. Powell is trying to do an intervention, with zero success.

It’s been 40 tears of low inflation ,most of Wall Street workers ,have no ide how to handle it,they will be bungee jumping from windows. As I applaud

Ever since the QE started, there has never been a low inflation.

The inflation was hiding in assets.

“The time to buy is when there’s blood in the streets.” – Baron Rothschild.

I am buying aggressively at Dow 3,000.

“It’s criminal

There ought to be a law

Criminal

There ought to be a whole lot more

You get nothing for nothing

Tell me, who can you trust?

We got what you want

And you’ve got the lust

If you want blood, you got it

If you want blood, you got it

Blood on the streets, blood on the rocks

Blood in the gutter, every last drop

You want blood, you got it

Yes, you have”

The question I wonder about was posed by Russell Napier last October, but with interest rates rising, it becomes more troubling.

The USA has $31.5 trillion in debt. The economy is slowing down to a bit over 2% real GDP growth. So, how the hell will this debt be reckoned with? As it looks now, the deficits will continue, and the debt will climb up steeply. At the same time, the cost to finance the debt will be greater and add to it — on top of each fiscal deficit, year after year.

Will the debt to GDP ratio climb to 2 to 1 from where it is now? If so, what are the consequences going to be?

Napier states that the only way for the debt to be dealt with is to have a nominal GDP growth of 6 to 8%. But if the economy flat-lines, that means inflation at 7% for a hell of a long time is a likely scenario. And high interest rates to boot!

Wolf, you’re much more savvy on this stuff than I am. Is Napier’s forecast correct? Does a soon to be $40 trillion debt for the USA make no real difference? Or, will we see 15 to 20 years of high inflation plus high interest rates on the horizon? To me, it looks like the latter is in the cards.

“Blood on the rocks, blood in the streets

Blood in the sky, blood on the sheets

If you want blood, you’ve got it!

I want you to bleed for me”

-AC/DC

Pathetic chancers and cheap money junkies. Who gives a shit what they believe. What is to happen will happen anyway. All they can do is „having expectations” plus some talking heads yapping.

PacWest might have something to do with these flight to quality moves.

First Republic was no surprise, it was on death watch for weeks and gave folks time to adjust to the realization, but perhaps PacWest was a little less anticipated?

Powell has been teaching markets the same lesson over and over again for an entire year, but markets still refuse to learn. The Bond market has been wrong about everything since August 2020 when the 10-year yield was 0.5% and markets thought it would go negative.

Nah. Powell is that kind of pathetic, passive teacher who has an unruly class that is talking over him, and instead of instilling some discipline he just mumbles along and allows it. In turn, nobody respects him and it only gets worse.

If Powell and the FED really meant business, they would have slammed the markets and speculators with a 100 basis point hike today, with stern language. Instead, they went full milquetoast like they always do.

J Powell may be using AI to write his speeches. They sound go clinical and without any substance.

Powell typed in “What should I say today when I raise interest rates 25 basis points to avoid unsettling the markets?” Out came the speech he gave today. Yellen does the same thing.

This is one of the many reasons why consistently following this website is necessary for financial success. Wolf Richter has been very consistent and correct that the bond market isn’t telling us anything since the pandemic. The bond market has been consistently wrong. I just look at it for amusement.

Pure wisdom dispensed daily.

So you don’t think Powell is angling a return to his cushy job at Carlyle after getting ‘retired’ from the FRB? 🤣

Powell is now thinking about his “legacy” — how he will go down in history.

Powell will have no legacy. He will go down in history as another failed Fed Chair along with Burns, Miller, Bernanke, Greenspan, & Yellen,

I look to the horizon, and see an ocean of impaired assets and wishful balance sheets. When real price discovery, mark-to-market happens, I guess that means prices of many assets falling, some doing an inverse of the bubble charts: crater charts. The only thing holding up this levitation, that I can see, is the ever-enthusiastic over-optimistic patriotic American spender. Bless him, his wine spritzers and vacations and recreational vehicles and whatever. Is he benighted, or am, I? Time will tell, and I’m glad somebody’s having a little fun. Maybe the Fed helicopters will swoop to the rescue?

No Landing.

Hard Landing dead ahead.

See Michael Kantrowitz (Piper Sandler) three criteria for a hard landing:

1) Fed aggressively raising interest rates.

2) Banks tightening lending standards.

3) Inflation out of control

When the unemployment numbers go up, the markets will go into a freefall.

What really got my attention was Kantrowitz commenting recently that the decline in job openings is not due to the Fed tightening… it is too soon.

Ut Oh..

Prepare yourself for the dive coaster before the end of the year.

Bud Light has a better chance of getting their problems and credibility repaired than the Fed.

Controlled chaos, Captain of a ship that will never hit the 2.0% shore again. Powell and Fed had one job, price stability, and they screwed the pooch. The nickel and dime press conferences will all play the same going forward, raising rates, backs against the wall, driving down one way street. My neighborhood facebook here in metro Denver is Now having mental breakdowns about there 50% property tax increases, like they thought this day would never come. Just cry me a freaking River, I bet they all got Disney World booked and paid for this summer (Lol). Shock and Awe campaign continues.

PacWest Bank is down 50% after hours, which will undoubtedly bring the crybabies out.

What is the a bigger threat to the economy and social system. The future of a few wealthy bank executives and shareholders, or 350 million people suffering from 5% inflation?

If some people think that is a tough call, they need to visit a tent city.

Prediction: pac w on life support until the weekend before the next FED conclave.

That’s a relatively small bank, $41 billion in assets. Easy to swallow with a big glass of beer.

True, I was reading that Pacwest is only the 53rd biggest bank in the US. But you gotta remember, it was #56 a few weeks ago, so it had been moving up fast…

Is the rate increase effective immediately? Based on this, should I expect the interest rate of say a 13 week treasury bill to be higher now or a bit later? Thanks.

The bond market anticipated the rate hike, and it’s already priced in. The three-month yield yesterday was 5.24% and today it closed at 5.26%.

Just to put things into perspective, even the CBO just announced that by 2040, the entire Federal budget will be spent on retirees and interest on national debt. These projections do not even include a long and protracted recession. Something has got to give. No wonder they want more IRS agents, and are going after tips and any earnings people receive.

I plan on retiring at 62 instead of 67 since I believe that the Trust Fund will be gone 2 years after I become eligible.

P.S. If my research is correct, the BRICS contribute to 32 trillion of world economic output, while the G7 is 29.5 trillion (using PPP). Saudi Arabia and Iran will very likely join after June, with 20 more applications in the pipeline. BRICS are also planning to release their own currency this year or the next. Yeah, the US can print its way out of this.

“Just to put things into perspective, even the CBO just announced that by 2040 the entire Federal budget will be spent on retirees and interest on national debt”

The way you said this is BS. Go to the CBO, get the actual data, and try again.

“Spending on seniors will reach 100% of federal tax revenues by 2040 based on Congressional Budget Office estimates, he said, including interest expense. What’s more, the current $31 trillion US debt load doesn’t account for future entitlement payments. Accounting for the present value of that burden, the debt load is more like $200 trillion, he estimated.”

Would be happy to send you the link

Nearly all of that will be funded by future tax revenues.

Lol the BRICS are going to become the reserve currency? I definitely trust in China that literally makes CEOs disappear and can break up companies on a whim. Of the BRICS only India has population growth. I look forward to you converting all your currency into a brick.

That wasn’t the CBO that said that. That was a hedge fund manager (Druckenmiller) who said that.

There are at least a few problems with this sort of analysis. First, the Federal budget (first comment) and Federal tax revenues (second comment) are two different numbers every year, hence the deficits. Second, and more importantly, extrapolating current trends decades into the future almost always looks silly in retrospect because there are so many assumptions that are bound to be wrong. Interest rates, tax rates, retirement age, retirement benefits, workforce participation, immigration, life expectancy, the interest factor used in the present value calculations and numerous other things will all impact how things play out between now and 2040.

Another problem with throwing out figures like a debt load of $200 trillion based on the present value of future entitlement payments, is the failure to make a corresponding present value calculation of all the taxes collected over the relevant period. These sorts of figures serve little purpose other than to scare people or support a political agenda of some sort.

It’s kind of like the tax surpluses Bush Jr. extrapolated far into the future as justification for tax cuts soon after he entered office. That future never came.

And Druckenmiller doesn’t live on “tips”, contrary to your pathetic attempt at spin on the IRS’ likely agenda, that you fear “THEY” are up to.

The judge brought Jeff Gundlach, the bond king, to send the markets down.

Billy stop bailing the ship is going down! What happened Captain? We took on too much debt!

The whole rotten ship is sinking!

On Bloomberg News. PacWest dropped as much as 60% in the post market session, while Western Alliance fell as much as 32% after it was announced that PacWest was weighing a range of strategic options, including a sale according to “people familiar with the matter” (short sellers?). Here we go again. I’ll say it again, short selling in regional banks needs to be banned now.

PacWest is a relatively small bank, $41 billion in assets last year, probably less now. Goes down easily with a glass of beer.

Anchor Steam?

🥂

Western Alliance had $67 billion, and there will be more to follow. You’ll need at least a pitcher of beer.

there is nothing wrong with short sellers, they serve a function in the marketplace, to unearth the rot. icahn is getting hammered by a short sellers who saw that his investment firm is paying out to shareholders 15% a year, but losing money.

as long as short sellers are not spreading false information, they are not the cause of the problem. the cause is easy money policies that have festered.

the problem is that the markets have been pumped up by central bankers stepping in at every downturn.

I remember I-CON complaining on tv that his stock was undervalued,and should be priced more like Berkshire stock . Hahaha this was many rears ago

Why ban short selling? That would not correct the bad decisions made by management.

A better move would be to fire all top management and BOD members, then seek equity capital.

In this environment, the following chain of events occur. Market conditions in the regional banking sector are uncertain and its risk off. Short sellers gang up on a regional bank stock driving the price down. Depositors, especially those with deposits over $250,000 see the rapid price drop, get scared and withdraw their funds. The bank cannot fund all the deposit withdrawals, can’t sell its AFS and HTM securities, or use its loans as collateral for loans, because of large unrecognized losses (for the same reason it can’t find equity investors), it becomes insolvent and is taken over by the FDIC. This is exactly the chain of events the Fed tried to interrupt with the BTFP (Bank Term Funding Program) which allows banks to borrow using investment securities as collateral at face value, it hasn’t worked. Yes, management made mistakes and should be punished, but it doesn’t make sense to destroy the regional banks or allow JPM to get even bigger. I know Pacwest is relatively small, but more banks are lined up to follow, including much larger ones I won’t mention.

We differ on that. In my book, if a regional bank can’t manage interest rate risk, it NEEDS to go out of business. Otherwise, it’s a contingent taxpayer liability.

Best to let all these banks fail, raise capital, or get bought out now. They gambled with the entire business, and lost.

Even now, you don’t see regional banks doing large deals to dramatically increase capital. That’s what prudent management would be doing, but these people just want to keep their stock price juiced. They care nothing about the long-term viability of the business. If they did, they wouldn’t have wagered it for the chance to increase stock compensation.

It was completely insane for banks to lock themselves into 3% 30-year mortgages. Why should I pay for that foolishness?

It always amazes me how the markets continue to get it wrong when it comes to the Fed and fighting inflation. They keep looking for a pivot that will never come. Powell and Company have ONE CHANCE to join the ranks of Volcker and other Fed greats… they HAVE to stop inflation in its tracks. Otherwise they join the list of Fed chairmen and governors who spent the entirety of the 1970s FAILING to control inflation.

Which wikipedia entry would YOU want to have for all of Eternity?

nothing changes ! the SYSTEM WORKS for the entities it is supposed to!

When do the long-ish term bonds start to reflect “higher for longer”?

Everything past a 6-month treasury is running below 5%, more or less. I believe that implies that the bond market believes that in ~3 months or so, the overnight rate will be back below 5%.

I don’t see how that’s possible, both with what the Fed is saying, but also with what the PCE and CPI measures are saying. Is this just all mass delusion waiting on an October,1929 moment?

jumbo rates are going to eat into this bubble me thinks

lots of banks failing were jumbo playas.

Fall should tell us a lot

Alert: Beverly Hills based PacWest is now circling around in the flusher-bowl and its share have plunged more than 52% after hours today. Jamie may be able to pick up this baby real cheap by Friday!!!

The regional banks that are in trouble better start talking to Warren Buffet about getting some cash in exchange for 10% yielding preferred stock plus warrants, just like Goldman did.

These banks took on interest rate risk to increase the stock price. They gambled and lost. Nobody should be crying.

Thanks Wolfman. I could have been a rocket scientist if my teachers had explained things as you do.

‘The Reserve Bank of Australia just un-paused its policy and hiked out of the pause by another 25 basis points.’

Well if one looks at the different areas in the CPI in Australia some of the main reasons for the increases one will find that the government or its affliated entities in Australia are often behind the increases and decreases.

The end of housing purchase grants and energy rebates decrease prices when implemented and then result in huge increases when they end.

Energy prices in Victoria will show up as ‘falling’ in the next report as the state of Victoria giving every household a $250 energy rebate. Once the rebate ends, the prices in Victoria will be adjusted upwards in the next report.

Housing costs are now one of the the main driver of inflation here.

Why?

Numerous reasons, but with the RBA increasing interest rates the costs to build housing has increased along with supply difficulties and labor shortages.

This has resulted in numerous houses builders going bankrupt and the supply of houses to the maket falling.

With the supply of housing units falling and the increase in immigration to Australia – maybe some 400,000 plus new arrivals this year – rents have been soaring which also increases the various inflation statistics.

Increase in interest rates results in more cost pressures which results in fewer houses being built which results in higher rents and more inflation.

The RBA will also fail to curb inflation with these rate increases in many areas because the items that are causing the increase in inflation are simply beyond the control of the RBA.

No matter how many quarter point increases they implement it will have zero effect on gasoline prices here as the prices are determined from overeas prices of crude oil and gasoline.

Another is international travel costs. It doesn’t matter how much they raise interest rates they can not affect the price of hotels in Japan or Singapore included in travel packages.

Yes, they can raise interest rates to stop people from buying gasoline or taking trips, but they can not affect price changes in these items and are beyond their control.

And by the way, don’t worry about our banks, they are doing fine with NAB just releasing a good earnings report with higher income, increased interest rate margins, a higher dividend, and increased ROE.

From the rate chart it seems the last three “recessions” happened after they dropped the rate… is it something we should watch for?

My memory is the cause and effect is typically the other way around.

The economy goes into recession, the Fed sees it, and then cuts rates. But by that point, the downward feedback loop has been built, so the markets and economy fall, until the rate cut’s “long and varied lags”, build an upward feedback loop.

Your memory is correct. When I read Wolf mentioning the pause from 06-07, I remember very well what happened to my business & life

following the “pause”. Certainly a horror flick for a some.

Let us hope this time around they can restart the engines before

the nose dive becomes terminal.

I am firmly ensconced in Treasuries, so this whole sh_tshow is entertainment. The twists and turns, experts talking like they know anything, the almost daily disasters, the liars, the idiots, the con men, the government bullsh_t. As for Powell, he doesn’t know what is going to happen. He is the blind leader leading the blind. I think he knows this, he has been wrong often enough. His faith is Economics, a pretty weak peg to hang ones hat on.

Bind faith in almighty dollars is what you are ensconced in, and so far-so good.

Powell is a political hack. He got religeon way too late. Nothing he does now can repair the damage that he has done, along with the failed Fed Chairs before him

DC writes better Fed insults than you do. There is a spot above where one can read you two side by side and see…..it’s pretty obvious.

Numba 10 insult writer.

Wolf you should do one about Canadian banks effectively extending mortgage terms by adding the amount clients can’t pay to the end, thereby extending the term.