This is fast moving now, but the Fed is still pouring fuel on the fire.

By Wolf Richter for WOLF STREET.

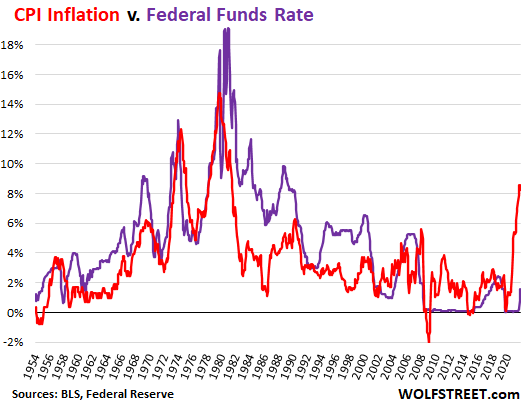

Struggling to re-establish its shredded and ridiculed credibility as inflation fighter, the Fed today concluded the most hawkish Fed meeting in decades. Following the CPI report last week that apparently had blown all doorknobs off inside the Fed’s Eccles Building, everything got moved higher by a bunch: Actual policy rates, projected policy rates by the end of 2022 and 2023, projected inflation rates, and projected unemployment rates. The only thing that got lowered was the projection of economic growth.

The FOMC voted to hike all policy rates by 75 basis points, the most hawkish move since 1994, with only one dissenting vote (by Esther George, who wanted a 50 basis point hike):

- Federal funds rate target range, to 1.50% – 1.75%.

- Interest it pays the banks on reserves, to 1.65%.

- Interest it charges on overnight Repos, to 1.75%.

- Interest it pays on overnight Reverse Repos (RRPs), to 1.55%.

- Primary credit rate it charges banks, to 1.75%.

“Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” Fed Chair Jerome Powell said in his statement at the press conference. But he said that at the next meeting in July, another 75-basis point hike might be on the table.

And the Fed will be “looking for compelling evidence” that inflation is moving down before “declaring victory”, Powell said. This phrase, “compelling evidence,” has been cropping up a lot recently among Fed governors. They’re looking for more than just a little squiggle in the line before backing off.

Expects much higher policy rates, much faster.

This is now fast-moving. Today’s “dot plot” in the Economic Materials showed that all 18 FOMC members who participated in the meeting, expected the Fed to raise its federal funds rate to at least 3% by the end of 2022, with 13 members expecting higher rates. The median projection jumped to 3.4%.

The Fed would have to raise its policy rates by another 1.75 percentage points to get to the median projection of 3.4% by the end of this year.

The median projection for the policy rate at the end of 2023 rose to 3.8%. For 2024, it dipped to 3.4%.

These 3-4% policy rates were unthinkably and impossibly high just a few months ago. It was something the Fed would never ever and could never ever do because of whatever. Now they’re on the table.

Quantitative Tightening (QT) has kicked off.

QT has started this month. The plan was laid out in May. The Fed confirmed today that it is proceeding according to plan. During the phase-in period of June through August, the Fed caps the amount of securities that can roll off the balance sheet at $47.5 billion per month ($30 billion in Treasury securities, $17.5 billion in MBS). Starting in September, the caps will double to a total of $95 billion a month.

If not enough Treasury notes and bonds mature during the month to hit the cap, the Fed will make up the difference by allowing short-term Treasury bills to mature without replacement. In other words, the cap is essentially a fixed amount that will come off the balance sheet.

The Fed will not sell securities outright at this point, but will allow them to mature without replacement. Most of the reductions for MBS will come from the pass-through principal payments that are forwarded to MBS holders when mortgages are paid off (when the house is sold or the mortgage is refinanced) or are paid down through regular mortgage payments.

Still pouring fuel on the fire.

With the Fed’s target range for the federal funds rate at 1.50% to 1.75%, the effective federal funds rate (EFFR) will be around 1.6% going forward.

But CPI inflation is now 8.6%, and the “real” EFFR is now a negative 7%, which represents the amount by which the Fed has fallen behind inflation. Its slowness in reacting to inflation is unprecedented in modern times:

Kiss that “Labor Shortage” goodbye.

Higher interest rates are supposed to slow demand, which is supposed to remove some fuel from raging inflation. As a consequence of the reduced demand, unemployment is expected to tick up.

The Fed raised its projections for unemployment rates, with the median projection rising from 3.7% at the end of 2022, to 3.9% at the end of 2023, and to 4.1% at the end of 2024.

This is the first time in this cycle that the Fed is projecting that unemployment will increase as a result of its crackdown on inflation. In the May meeting’s statement, the Fed still expected its magic to bring inflation down to its target of 2%, while the labor market would remain strong. That line went out the window in today’s statement.

And Powell confirmed in the press conference that the Fed is unlikely to be able to get inflation back to 2% without deliberately slowing the economy and raising unemployment.

Rising unemployment would obviously end the “labor shortage” and untangle some of the inflationary and supply-chain issues that came with it.

Expects higher inflation rates.

The Fed has been ridiculously far behind reality over the past 15 months in its projection were inflation rates would be. But it has been raising them, and today it nudged them up further. Its median projection for the PCE inflation rate rose to 5.2% by the end of 2022. But it’s still hoping that by the end of 2023, PCE inflation will be down to 2.6%, and that by the end of 2024 it will be down to 2.2%.

But this projection too could go out the window as “participants continue to see risks to inflation as weighted to the upside,” Powell said at the press conference.

Expects economic slowdown: Avoiding a recession “not going to be easy.”

The idea is to slow demand growth by some amount, just enough to bring down inflation, but not enough to trigger a recession. But achieving that soft landing under current conditions “is not getting easier” Powell said.

“What is becoming clearer is that many factors that we don’t control are going to play a very significant role in deciding whether that’s possible or not,” he said. “It is not going to be easy.”

“The events of the last few months have raised the degree of difficulty” of getting that soft landing, he said. “There is a much bigger chance now that it will depend on factors that we don’t control. Fluctuations and spikes in commodity prices could wind up taking that option out of our hands.”

He thereby acknowledged implicitly that the risk of a recession would be the price to pay for bringing this raging inflation back down.

Expects markets to figure out their own landing.

After past sell-downs of 20% or so of the S&P 500 Index, the Fed would start putting phrases into its communications that indicated some sort of pivot. This was the Fed put. But that too has gone out the window. The S&P 500 Index is down 21% from its high, and the Nasdaq is down 31%, and yet there was nothing in any of this that indicated that the Fed is worried.

On the contrary. The market sell-off, if sustained, and sustained price declines in the housing market, could do some of the heavy lifting for the Fed, so that the Fed might not have to raise its policy rates toward the rate of inflation, or even above the rate of inflation — above the red line in the EFFR-CPI chart — to knock down inflation, which would be a real rug-pull for the economy. Seems markets are going to have to figure out how to stand on their own two feet amid rising interest rates and QT.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What a 1 to 2 punch.

Powell and the bidas touch.

Fed can fool all the people some of the time and some of the people all the time. Fed was trying to fool all the people all the time.

End Result: Complete loss of credibility!

Loss of credibility… So what?

more like ”the bidet touch”,,, eh?

same place, ”BEHIND” and still full of poop though, so def need more higher interest rates sooner to accomplish any needed cleaning out

“These 3-4% policy rates were unthinkably and impossibly high just a few months ago.”

Then the Fed is totally clueless. A monkey could have determined the FFR would need to be above 3% by the end of the year, while any backseat economist knows it should already be at 4%.

“But it’s still hoping that by the end of 2023, PCE inflation will be down to 2.6%, and that by the end of 2024 it will be down to 2.2%.”

Sounds a lot like that “transitory” thinking we heard a lot about last year. June inflation will most certainly tick up to 9%. Maybe by then, the Fed will have to consider a 100 basis point increase. Or who knows, they’ll pull out the bazooka and go ahead and raise rates to 4%. With inflation approaching double digits, I don’t see how in the world the FFR shouldn’t be at 5% today with 100 basis point increases on tape for the remaining meetings.

We need a serious discussion about how inflation is actually defeated – which parts of the CPI can we slow down – but this is only just entering the Overton Window.

1) Housing prices have to come down (~30% of CPI) no matter what. That requires higher interest rates to shock the market (done…) and a bit of time for the data to catch up to the market and for the Fed to recognize it. In the Great Recession that process took about a year.

2) Energy prices – these are going to be hard to stop, because demand massively outstrips supply… and supply requires infrastructure that takes a long time to build, but isn’t even being started because of global warming concerns. Toss in Russia/Europe, Saudi Arabia, etc. and there’s not much help here.

3) Food prices – dependent on energy prices. The wiggle room for consumers is in “food away from home”, which is more of a luxury choice and has higher wastage too… but restaurants don’t have enough margin to cut prices meaningfully and stay in business, unless they can pay lower wages?

4) Employment – there’s a lot of chatter about layoffs in marginal businesses, but still a ton of job openings in the more-stable parts of the economy. I see more job-churn but I don’t think we see a meaningful rise in unemployment for a while yet. In the meantime wages are going to continue to go up, and that will keep driving up prices for many services. It could be a year or more before unemployment dents wages and spending enough to slow demand in a way that slows the inflation enough for the Fed to notice and react.

5) Vehicles – Maybe? Huge pent-up demand due to the ongoing supply chain issues (geopolitical trade wars), but consumers have revolted against high prices on gas-guzzlers. Work-from-home doesn’t seem to be increasing further? Interest rates will help a bit to cool demand on the margins, maybe enough to put a dent in CPI for vehicles?

6) What else is a meaningful fraction of CPI and how can the Fed bring it down?

Basically I think this is going to take while longer, since housing costs need to come way down for any “inflation-killing” policy to work. Interest rates will have to come up more “just to be sure”, and given the lags in the way data gets reported and digested into policy changes, a Fed overshoot is inevitable.

So, banana-republic Jerome is going to continue to rob you for years via inflation!

Why aren’t the bond rating agencies downgrading American and Western sovereign debt to junk status as they are doing an inflationary default! Oh yeah… they under threat of dismemberment!!!! Oh well they can still do a number on Turkey and Argentina!

Bond ratings are a lagging indicator. Not even worth using in anyone’s financial decisions.

The credit and currency markets will tell you when someone is in trouble. Look at market interest rates, FX rates, credit spreads, credit default spreads, etc.

Interest rates set by edict (the Fed) and money/credit creation (the Fed) was always designed to steal from the poor to enrich the Rich. Today’s billionaires, politicians and government employees will not be paying today’s debts – it is saddled on the unborn.

My clients, all big tech across healthcare, it, industrial automation have started their spending and hiring freezes. Deals in the pipeline are drying up. Those “open positions” are gone. Adjust accordingly.

The bluntest instrument to reduce aggregate demand is cutting government spending.

No, I don’t think it is going to happen and most people don’t even want it, not for their pet programs.

Government Employees never see a Recession. The fattest leeches are the important (bought) voting block. It is everyone else that pays the tab, until there is no one else left to pay.

Sound money is the only real answer. But sound money “robs” the state of its power, so there’s no way the real solution will get implemented any time soon.

Sound Money?

MMT is based on “Maff is so hard”.

Like arsenic, excess money and credit doesn’t kill the real, beating heart of an economy until many years of internal destruction later.

Excess money/credit destroys true price discovery, which kills an economy. Including many viable businesses that didn’t have the political channel to the feeding trough.

Wisdom…

We dont just need 2% inflation now…we need a rollback of the 8% spike. The citizenry and small businesses cant handle a baked in 8% gain like this…

In one short word, it’s called a “recession”.

The only question is, on a 10 point scale, is it a 3, 5, or 8 that really does the job?

Keep in mind Joe Biden is still in office for another 2.5 years. About 60-70% of the current inflation is a direct result of his policies.

Support please. Show your numbers.

It doesn’t matter how much percent it is Biden’s fault or not. He’s gonna be the one that gets the blame.

If the inflation issue is really supply chain and the Fed kills growth then the supply chain issues will never resolve.

The inflation issue is dollar creation.

Good point, but I don’t think we’ll see a rate hike overshoot from this Fed leadership. They are dovish to the core. Currently they have their hawk costumes on.

But I don’t think they are dumb enough to restart QE and reduce rates for a long time. What I predict is a reduction of the rate hike path in the not too distant future. They’ll have convincing evidence that inflation is decreasing in the next few months.

A DAMNED good article and some good thoughts by Wisdom Seeker. Things have indeed been set in motion.

Greg, as they would say on South Park, “You are so 2020”. It’s time to quit cursing and wish the Fed good luck. Unfortunately an awful lot of your type have been media and preacher created.

A LOT of HELP and GUTS from our two Political Corporations wouldn’t hurt either.

PLEASE Google “Barry Goldwater Religion” quote…….that was some REAL good future predicting. Starts with “Mark my words”.

That’s my hopeful side…..it IS getting harder, though, as a Comprehensive Green New Industry should have been started long ago, along with a Constitutional max net wealth, banning lobbyists, and reigning in Corporations in other ways.

They need to tack on 700 more basis points onto the FFR!

Today the real or true inflation rate is already in double digits. Back in 1980 they didn’t lie about the inflation rate they told you the true or real inflation rate.

Agreed 100%. If rent & housing were accurately captured, CPI would be at least 12%.

The Baby Boomers weren’t on Social Security and Medicare in the 80s

rankinfile

True that on Baby Boomers. The first Medicare beneficiaries were Ex-President Truman and his wife on July 30, 1965. The first Social Security recipient was Ida May Fuller on January 31, 1940.

Do you all think they are that stupid or this is all done intentionally? I think everyone knows that putting rates at 0% and handing out money would lead to a boat load of inflation.

Well, with inflation at 8.6%, I’ve loaded up a measly 10K in 9.6% I Bonds that will only hold that rate for 6 months.

To me, this is sanity.

Meanwhile, my savings account just pays 0.3% in a 8.6% inflationary environment. My bonds are paying 3% and have lost value if I want to sell them. Fortunately, my stocks have lost ONLY about 20% but the average dividends are rising to about 2-3%.

This is not your father’s inflation in the 1980’s when he purchased 30 year Treasuries paying 13% and held them for 30 years (2010) during mostly a 2-3% inflationary environment.

My father did not experience a massive stock and housing bubble.

There are 2 ways to eliminate a bubble:

1) Pop the bubble causing a recession with job loss (The Fed wants this. wages are creeping too high), and/or a housing bust (The Fed has to control this). If it is too steep and fast, 2008 will repeat itself with millions of homeowners handing back the keys to the banks (or to the government Fannie or Freddie).

2) Let inflation rage. If the stock market dips 20% and inflation at 10% over 3 years eliminates 50% of the value of stocks, they will become a bargain again and sanity will be restored. Similarly if housing dips 10% and inflation takes 30%, a 40% effective drop will be achieved with no foreclosure pain on the banks (who are the Fed)

When 10 year or 30 year treasuries top 9%, I am going all-in on treasuries. I’ll let them crank out interest for the rest of my life.

Just like my father did. I don’t think that will happen but one can dream.

The second option will also cause the housing bubble to pop.

Wolf did you change the font on the website?

Their understanding of economics is flawed. Four hundred PhDs on the payroll and no common sense. Nothing they have said as come to pass so you can be sure they are wrong again.

They are just too selfish. The only reason they are raising rates now is because we had started hyper-inflating and their loot would lose value amid the political change it would bring.

They do as they’re told

I think he changed it about a week ago.

Peanut Gallery,

Do you ❤ it?

I changed the font of the text a few days ago, which triggered a rebellion in the comments, so I changed it back to the old font.

I changed the font of the headlines because the old beautiful font was causing problems with loading in some browsers, and I have not changed it back, and it stays.

I also changed the color of the headlines to black. And now when you hover over the headlines on the front page, they turn blue. Which is very fancy.

The site now loads faster with fewer problems. And Google is happy.

Im a fan, Wolf. This is an increasingly awesome site. Very grateful.

@Wolf Richter

Any chance for an update so we could get email notifications of reply to a thread and/or subscribing to a thread and getting notified of a new post?

Maybe one or more of the Wolf Street regulars has an IT resource they could loan you?

At any rate the articles and boards are an excellent balance to the other so called “news” out there!

I disabled that function years ago because it triggered endless arguments by a some commenters which ruined the comments.

You can just search for your screen name on any article. This will pull up all your comments and their replies (Ctr F in any browser).

@ Wolf –

Too bad there’s not a function to send all arguments to a side board, with a vote up or vote down feature. Some arguments need to be had, for clarification purposes and the identification fact versus fiction or myths.

I think the new font is more readable. I love it!

Fonts are like GUIs and product documentation. Youcan never make everyone happy.

I actually preferred the previous style. Just my preference.

This is not about style but about load speed in some browsers.

Only the headline font and color has changed.

Makes sense.

I didn’t notice. But this gets me into trouble with my wife, too.

Ask her if she’s put on weight.

Yeah, I ate one of those too: “Do you like my new hair color?”

I swear it was the same, just refreshed. Dead man walking.

I can’t imagine having a job where you are rewarded for failure. Such is the case with the FED.

You basically just described the entire Senate and Congress, along with majority of Corp America leadership..

LOLZ

Long back, one of my uncles told me that he had not seen a single person, who held a top post in a government, and has not made deals with the Devil!

I did not believe him, still searching for exceptions.

@Raj

And this scales. I present my HOA!

Most people believe in two standards of conduct, one for the private citizen and another for the public official.

I’m not talking about in the context most think either. Most of the time, most people are in favor of this dual standard when the government is doing something they like.

Most people believe in 1+1 = 3 political math.

It’s another major indicator of substantial social decay.

What failure Corporate America leadership?

They managed to destroy unions,outsource jobs for increased profit,and enriched shareholders.

and destroyed American lifestyle as it was once known in the process

Any school system in any major city?

I was going to make that exact point.

BTW Lew Rockwell over at LRC the other day had a long-ish and interesting thought experiment about what might happen if public education were simply eliminated. There would be some initial pain — he suggests — but in the long run students and society would benefit. As it stands, bright kids in public schools are dragged down and many kids are learning nothing useful, all at great cost.

Yes, making America dumber is the answer.

I’ve done my own thought experiment and asked who benefits from having a lousy education system. Only one I could think of is the political class.

Harrold,

It’s not just the answer, it’s the program. Or just train them in a presently Corporate/dynastic needed specialty…..and nothing much else.

And that program is also quite lucrative, asK Betsy De Vos.

You can also profit from private “let them all go to hell” schools, Victorville has some, and they can’t switch back….although class action lawsuits against them might fly in CA and a few other places not totally run by old landowners and corps.

The Fed hasn’t failed. They have succeeded spectacularly.

You seem to be going by their mission statement, which says they’re going to keep inflation low, employment high, and promote ‘economic growth’. It’s true purpose is to help maintain a regime of economic domination and extraction for the benefit of the FIC, whose machinations have been documented in detail by historians, economists, and politicians since the 19th century.

It’s not exactly a secret.

“I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a moneyed aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs.”

Thomas Jefferson

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.”

John Emerich Edward Dalberg-Acton, 1st Baron Acton

“It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Henry Ford

“The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole.”

Quigley, Carroll. ‘Tragedy and Hope: A History of the World in Our Time’. New York: Macmillan, 1966. Print.

“We are not to be hypocritical judges, yet we must be able to discern the swine, lest we cast our pearls before them.”

Yeshua. “On the Mount”. 31C.E.

(but nice try, Unamused)

unamused-

Great Post !

If you can’t beat them, join them. The simple truth is that debt is slavery.

I teach youth that the goal of saving money is to lend it. Start early. Your education is in relationships and collateral.

Little has changed, especially since the fourth estate, newspapers, has collapsed .

Banking, insurance and real estate. These are the three estates which have consistently delivered family wealth. Lend money, self insure, and buy real estate low and sell before the peak with seller financing. Humans who are counting on their current leveraged real estate holdings to sustain them are going to get wiped out as prices crash. They simply do not see it coming. Markets do not care what you paid for your asset. The fact that we are at a peak in costs to develop property does not insure that this peak price will last. On the contrary, a free market opens opportunity to buy well below replacement value.

This advice is so timeless that it should be added to Solomon’s proverbs.

Forced sales in real estate (such as divorces) will drive the market down as bids disappear.

buy RE and NEVER sell it is what the old old money did and does HH

just look at the real ”rich” folks, some of whom own most of London, etc.,

and others of whom own most of the farm lands, etc., etc.

and BTW, one almost never sees the names of those old money families because they do not own stuff in their personal names, etc.

My uncle who died very rich a few years ago started buying Long Beach real estate in the 50’s with the $25,000 he inherited from his father.

Hi motto was, “Buy cheap and keep.”

Same here DK,,, but earlier:

Uncle had a delivery biz in the 30s all over Pacific Coast, and spotted RE and bought for dimes or less on the dollar.

He and his wife made the stuff to deliver, and they and their children did die rich, but they all also lived relatively modestly though owning many millions of RE, etc.

If debt is slavery, why do you seek to enslave others by lending to them? Unless you think you’re better 😏

Fed’s actual mission statement is

“Pursuing maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy;” (from St Louis Fed)

It is the disregard for the 3rd mandate, the “moderate” (not extreme) long rates” that led the Fed to pummel long rates and “Force” (their word) the investor to take “more risk”. How’d that work out?

In so doing, they intentionally altered traditional risk return ratios, price to earnings calculations, and other metrics of reasonable investing. And here we are.

“And here WE are”

The Okie Logger response would be, “Who is WE? You have a mouse in your pocket?

@unamused

I’ve enjoyed/learned from the comments you have posted – that I have read.

—

Seems to me the only way of correcting corrupt centralized authorities is to create small groups of self-governing communities where people know one another or at least OF one another. Add regional layers of centralized authorities on top of these as needed.

We have a culture that creates divisions between people because we’re easier to control that way. This starts with minor dysfunction which seems reasonable then compounds over generations, etc.

This the short version anyway! [cite: Junger: Tribe, Freedom & Huxley: BNWRevisited]

Maybe, but only by radically shrinking the size of government.

Look at history, there has never been an expansionist activist government that isn’t ultimately controlled by elites.

You’re trying to find some middle ground around it and it’s never going to happen.

The other solution is to split the US into dozens or even hundreds of countries so that each one can be more accountable and governed consistently with the worldview of the population.

The country is too divided because there is no common culture and worldview. I’ve read comparisons to countries like Denmark or Sweeden. Those are countries with small homogenous populations which presumably mostly see the world the same way.

Nothing even close to that describes the US and it’s too late for that.

@Augustus Frost

(I hope you see this, there was no “Reply” button to your post)

“Maybe, but only by radically shrinking the size of government.”

—

Ok. :-)

I agree that there would have to be a “common culture” amongst the smallish communities and one that would dictate etiquette on how the groups interact and exchange members regardless what rules they have for themselves. Also, educating these small groups on the benefit from being part of a large country.

As for rule by the elites, this is inevitable and not necessarily a bad thing as long as there are checks and balances. If they have more stature in the greater society and a little more bling we commoners won’t care much as long as we’re able to feed ourselves and are part of a socially cohesive community. Sure we’re grouse about them and some of them will ‘roll their eyes’ at us but that will be an acceptable(necessary?) tension.

“Seems to me the only way of correcting corrupt centralized authorities is to create small groups of self-governing communities where people know one another or at least OF one another.”

Welcome to my world, Mark.

Unfortunately, the group (with paid for programming by oligarchs) that are being trained to hate their own government, uses the same phrases, and screams “end the FED” or “audit the FED”. We have several of those here. Probably one of Wolf’s greater contributions is teaching people the FED is just BARELY quasi-government….it’s the bank corp’s super-lobby with their OWN “government” building in DC and a shitload of power.

My lobbyist uncle’s wet dream!

Although he had free run of the Pentagon, Capitol, and not a lot of problems getting in the Whitehouse, just no official title, powers, or office there….e.g., unelected. But owning a Senator and a few Congressmen makes for a pretty powerful home office.

Compared to the FED, the P/O is private industry.

Constitutional Max Net WEALTH, with militarized bounty hunter style IRS.

Every game has BOUNDARIES, Capitalism should also….and they are all fast disappearing and “legally”.

Keep these “invisible hands” in a fair range if you want to play it, it is more democratic and that’s supposedly the effort that is being made in this country, yes?

Maybe we could get a Green Party and partially (or totally) gut both the existing pair…..one thing almost EVERYONE agrees on is that it’s been the “lesser of evils” choice for a long time.

On the P/O, I meant totally Gov’t, as in ELECTED.

Awwww..shit…..just ignore it…stupid remark, anyway…..piss poor effort at sensationalism………

Post office for 50 years

That’s a life sentence!

Any Democrat in a policy decision role.

The Fed has been very successful, along with Washington, District of Corruption, at destroying the heart of the American economy.

“It is absurd to put important decision making in the hands of those who pay no price for being wrong.” T Sowell.

Inflation protected pensions will be their reward. Yellen must have at least 3 (UofC, Fed, Treasury).

“Round up the usual suspects” and line them up in 5 posts!

As inflation rages at over 8%, the “Federal” Reserve bankster owned cartel is charging banksters now: “Primary credit rate it charges banks, to 1.75%.” Some cynical people, like me, might conclude the “Fed” is giving its bankster owners gifts each year of about more than 6% out of billions or more likely, trillions of dollars that it lends to them as it secretly lent them trillions of dollars after their issues in 2008-2015. While on the subject of parasites, I must give kudos to the CCP, which is doing to China all that I expected and more. Keep it up, please! Watching news about China now is one of the real bright spots in my life; its better than SNL.

Nonsense. Who is still spreading this BS out there? Primary Credit is barely used. Banks can borrow more cheaply in the repo market and in the federal funds market.

Just look up the data on the Fed’s balance sheet. Primary Credit on the balance sheet of Jun 8: $1.19 billion. Which isn’t even a rounding error on the Fed’s $8.9 trillion balance sheet.

“YouTube is loaded with stock market bears. – YouTube . . .

3:12 drop in reserve assets on the books of

3:14 the banks

3:15 and that’s allow the banks to create

3:19 more loans not less loans . . . “ ?

Youtube has been loaded with bears since 2009. The markets were rigged and manipulated and did the opposite of what they should have done which is fall after a dead cat bounce in 2009. It was/is factual information but the bankers and Fed must watch a lot of youtube videos.

Nonetheless, Wolf, the Trillions that feed WallStreet Banks, were birthed by the Fed. And that alone, represses interest rates.

completely agree

That’s like pouring gasoline and lighter fluid on a raging fire and saying that the cup of water also poured on it will help.

“But CPI inflation is now 8.6%, and the “real” EFFR is now a negative 7%, which represents the amount by which the Fed has fallen behind inflation. Its slowness in reacting to inflation is unprecedented in modern times:”

Right. And all of these fake narratives purporting “inflation has peaked” and talking about how a couple chintzy rate hikes will snuff it out soon are insulting to the intelligence of people not devoid of common sense. The fact of the matter is that the FED is so hopelessly behind that it will take years to slow it down.

Well, I’m a pessimist…but even pessimists can have hope :)

Look at the large percentage hit the monstrously engorged equity mkts took even after just 2 or 3 months of unZIRP.

Basically, everybody and their dog knew it was only near zero rates holding the hyperactive valuations up – once the Fed took some *small* *actual* steps away from its twenty years madness – a non-trivial amount of air was let out of equity valuations (residential valuations soon to follow).

Many other prices are likely to follow, as the “eternal ZIRP summer” mindset has been squelched.

Those living a lie on borrowed time frequently know it intimately – they always have one eye on the door, because they know their financial survival depends on being the first out of it. This means asset values can fall very fast…with spending soon to follow.

And banks’ appetite for inflation-goosing, risky lending? When they are now being much better paid by the Fed for idled reserves?

And this time (unlike 2018) real world inflation might be terrifying the Fed/DC into intestinal fortitude (continued rate hikes/at least no rapid retreat).

I think they’re going fast enough to get us into a recession with a very hard landing.

That’ll be inflation dealt with.

It’s moving fast enough in my view.

Good, it’ll crash housing prices. I have to pay a tax on assessed value, which has doubled in the past year. I would like that assessment to be halved again.

Not all of us see our houses as investments, but as homes.

“Common sense is a collection of prejudices, usually accumulated by about age 18”

-Albert Einstein

I think they’re going to lean hard on QT to do a lot of the heavy lifting. The Fed didn’t have a $9T collection of anti-dollars in the 70s/80s, but this time they do. It’s arguable that they may not have to lift the fed funds rate very high with QT. Remember that QT kills a lot of cash burning fake businesses and the fake jobs they provide, which in turn kills revenue for non-fake businesses as well. QT drives up yields on Treasuries which have a much bigger impact on the economy than the FFR since yields drive the cost of of loans from mortgages to commercial debt. Reducing employment and making debt more expensive destroys demand.

The measly .75% hike is just a diversionary tactic to grab your attention while they sneak a full blown recession in behind your back via QT. When the smoke clears, the big boys will have swooped in to buy up the rubble of the middle class at bargain prices. Rinse and repeat every decade or so until there’s no middle class left.

To Not Sure:

The pace at which QT constricts will be painfully slow compared to the whopping $4 trillion addition during 2020/COVID.

It would take nearly four years to reverse that dollar amount given the $47.5 billion graduated to $95 billion per month schedule.

The slow QT administration will be more like boiling a frog, it seems.

Agree, the addition of long bonds to the balance sheet is where things really got out of hand. Exerting force up and down the yield curve is sure to have unintended consequences as the force gets removed.

In a free market people can use the price of debt over time as a barometer and make investments accordingly. Why would anyone invest in long term projects (say, refineries) when a room full of bankers are playing God with the markets? Noone knows up from down anymore. Cost of capital can change on the whim of a few “governors”. Risk aversion is at least starting to become a thing again, which is healthy.

The ugly truth of it is the mechanism by which QE (and thus QT) exerts it’s influence. And that is simple: asset prices. If qt doesn’t end for 9 yrs, that’s 9 yrs of sailing into the wind for asset prices.

The best Financial Engineers all have yachts and tacking is second nature with wind, and merely more fuel with power.

Strongly disagree. The Fed’s QT plan isn’t serious at all, if it’s supposed to stop inflation. The plan to drain that $9T balance sheet has a max speed of just $1T/year, and even that doesn’t kick into full gear for a few more months. That’s a long time to leave inflation festering – there will be riots in DC long before QT does anything significant to anything other than shadow banks’ balance sheets.

Yes, QT hasn’t really gotten going in my opinion because it’s a last resort. They don’t want to lose control of the plumbing.

WS, but you can’t deny that a little jawboning about QT, and the simple absence of QE has already gone a long way… Stock indices already down 20%-30% erasing 2021’s gains, tech companies starting to choke, home sales hit a wall with inventory now growing fast, and the 10 year yield has more than doubled since January. Imagine what a little actual QT will do.

This inflation has been caused by monetary policy and the economy has become absolutely dependent on QE. Anybody with half a brain knew that the outcome of ZIRP and QE was going to be inflation, it just turned out to be mostly geared toward asset & stock prices and has only now spilled into CPI more aggressively. After over a decade of dependance, the patient is so hooked that even talking about taking the drug away slowly is already causing withdrawal symptoms.

The Fed has only taken a few tiny baby steps and the system is already creaking and groaning. If the Fed moved any faster, there would soon be riots in DC and everywhere else too.

@Not Sure – yes, but I think the main cause of market changes so far wasn’t QT, it was the jawboning about raising rates (and then actually raising them a little faster than the initial jawboning suggested). That has reset market expectations and cranked up the yield curve… we now have >3% rates for all bonds >1 years, 6% mortgage rates, TIPS yields that are actually positive, etc.

Curious that the Fed still speaks of ANY inflation target (2%)

4 years of their “target” has been packed into one year of inflation (8%)…

Shouldnt they encourage some “rollback” of that spike? Shouldnt the new “target” be 0% or negative? Or is it their position that the 8% is “baked in” and never to be retraced?

If it is, then the curtain has been pulled back on what they are really rooting for.

Agree with your comment on the “2% inflation goal by the Fed”.

Inflation goal should be 1/2%.

How does inflation help? Assets go up. Which means the buyer needs to come up with more money….for the same asset. GDP numbers go up, tax receipts go up, but it’s just a game. A coke used to cost a nickel or dime. Now over a buck for the same product. And this helps how?

Remember they’ve redefined inflation so many times to skew it lower the real inflation rate that the average person endures is higher than their stated rate.

As much as the contempt/disdain I have for Powell, to hear that Esther George only wanted .50 rate hike..F$$$ her. I know it’s asking a lot to ask an arsonist to try to put out a fire they started but do a better job pretending please.

As you said with even a .75 rate hike, it’s still pouring fuel on the fire, if he wants to put in a reputation as a real inflation fighter he would’ve gone up somewhere closer to what Gundach suggested close to 3pts, although the mayheim and carnage that would cause, but if you want reverse wealth effect to happen fast, can’t go turtle pace and expect result.

My remaining fear is that, what happens when unemployment gets uncomfortably high and inflation is starting to roll over a bit but still higher than 2%, will King pivot, pivot again?

Well, once that happens, Biden will surely be tossing

the Fed/Bankers Cabal ™ in with the Oil Industry in the Ye Olde Designated Villains/Fall Guys bin at DNC/MSM HQ (after the Fed/DC spent the last 20 years energetically fondling each other).

The Dem dinner party circuit is about to turn into the Donner Party.

It still makes you food……or did you think you were actually along for the ride with the other bunch of our oligarch/corporate controlled political corps?

I’d say you have a slightly better chance with the Dems….slightly

Or what about getting us to an interest rate that actually is positive in real terms? We would’ve needed an eight-point hike for that, but at least the Fed truly would have stopped pouring gas on the fire!

(Granted, that 750-point drop the Dow took today would’ve been 17,000, but still…)

This whole miserable few years might just be worth it if it puts an end to the ‘fed put’, let alone excessively easy monetary policy.

Wolf how much farther down do you expect stock market to go and also for the housing market ?

I’m looking at long-term charts of markets that had a huge gigantic bubble, such as we had. I’m looking at China, Japan, Spain, Italy, even Germany’s DAXK (not the DAX which is a total return index), etc. And I’m thinking, this is going to take a very very long time to get back to the high, and I have no idea how deep it will go first, and how long it will take to hit bottom.

The Japanese stock market has yet to reach new highs…30+ years later.

Japan seems to be the harbinger for the rest of the economies in the West. They seem to be ahead of the rest of us by about 10-20 years for financial, demographic and social trends.

That’s because they were the first to have an aging society where the people over 60 start to outnumber the people under 60. Their zero interest rate policy has done nothing but destroy all the retirees so every retiree stayed broke or went broke after they retired. Fewer people have money to buy anything with. It can only get worse as the birthrate keeps falling and more and more people over 60 outnumber more people under 60.

MF

the BOJ started this ZIRP nonsense about the yr 2000

I recall Krugman was an advisor..

that is my recollection

Japanese have a very low birth rate and do not allow immigration.

Historicus,

You sure it wasn’t Friedman?

Those Central Bank Prize winners can get a bit confusing.

Depends upon the timeline and which bear market someone has in mind. The one lasting the next five minutes or the one lasting multiple decades.

US stock market is roughly as overvalued as dot.com peak (same mania) with more speculation and far worse fundamentals. Only competitor for being more overvalued in 1989 Japan.

Few would have guessed that when the Dow peaked on February 9, 1966, that it would be 23% lower 16 1/2 years later and about 75% adjusted for price changes. The fundamentals in early 1966 where leaps and bounds better than now.

Fundamentals look disproportionately good at peaks for a reason. That the fundamentals are already relatively widely acknowledged as being mediocre to bad is a hint of what’s coming later.

Just wait years later when the bear market has ground on for years. There will be counter cycles with rallies, but the fundamentals will be acknowledged as noticeably worse.

I’m one of those savers who’s been fishing close to shore in Treasuries since 2008. Can’t wait to cast out further in the future. It’s about time.

Yes it is.

Isn’t a recession sort of a prerequisite toward lowering inflation? How is anything but a hard landing possible?

A soft landing would be a slightly softer housing market while leaving major stock indices around their current 20%-30% drop without a major drop in employment. That isn’t going to take much heat off of inflation. Demand needs to cool waaay down AND the wages (jobs) that support spending need be choked off as well.

Honest question… Has high inflation ever been corrected without a recession?

“Isn’t a recession sort of a prerequisite toward lowering inflation? How is anything but a hard landing possible?”

Very very well stated. Perhaps mild inflation could be corrected with a soft landing. But massive and surging inflation like this, feeding on itself, with a massive housing bubble and uncontrolled asset bubbles in other areas–all fed by short-sighted Fed policy on interest rates and QE? The only way to cure it is with a deeper recession and hard landing. That’s because the “wealth” from those bubbles was fake wealth, unconnected from economic fundamentals, and the inflation fuel from it requires a correction. The recession, temporary and manageable, is just the term we use for that necessary correction. And JPow and Federal Reserve, while moving in right direction, need to be much more aggressive to bring about the correction, as Paul Volcker realized. Tepid moves lead to runaway inflation that becomes uncontrollable, and unlike a temporary recession, to collapse of the dollar, society, its institutions and confidence.

Agree, and I don’t think the Fed really believes in a soft landing anymore either. Lots of phrases from them this time about how other factors outside of their control might make it impossible. They’re already setting the stage to skirt blame.

And it’s unbelievable that Powell, who is responsible for this inflation, just got re-elected for another term to fix it. We truly do have a bunch of morons running this country.

Re “Has high inflation ever been corrected without a recession?”

Answer: No.

The mechanics of how inflation is actually defeated – which parts of the CPI can we slow down – are only just entering the Overton Window.

1) Housing prices have to come down (~30% of CPI) no matter what. That requires higher interest rates to shock the market (done…) and a bit of time for the data to catch up to the market and for the Fed to recognize it. In the Great Recession that process took about a year.

2) Energy prices – these are going to be hard to stop, because demand massively outstrips supply, demand is inelastic, and supply requires infrastructure that takes a long time to build, but isn’t even being started because of global warming concerns. No help here.

3) Food prices – dependent on energy prices. The wiggle room for consumers is in “food away from home”, which is more of a luxury choice, but restaurants don’t have enough margin to cut prices meaningfully and stay in business. Unless they can pay lower wages?

4) Vehicles – huge pent-up demand due to the ongoing supply chain issues (geopolitical trade wars). Interest rates will help a bit but on vehicle loans, interest isn’t as big a factor as it is for housing.

5) Employment – there’s a lot of chatter about layoffs in marginal businesses, but still a ton of job openings in the more-stable parts of the economy. I don’t think we see meaningful unemployment for a while yet, and in the meantime wages are going to continue to go up, and that drives services prices. It could be a year before unemployment dents wages and spending enough to slow demand in a way that slows the inflation enough for the Fed to notice and react.

6) What else is a meaningful fraction of CPI and how can the Fed bring it down?

Basically I think this is going to take while longer, and housing costs need to come way down for any “inflation-killing” policy to work out.

Great post! I firmly believe housing is equated to inflation more than the Fed rate. I recognize that mortgage rates are tied directly to Fed funds rate, but the Fed funds rate has already been raised. Housing expenses are still at record peaks just as inflation has continued rising. When housing starts to fall I believe inflation will follow. But so will the markets.

Mortgage interest rates have nothing whatsoever to do with the advisory interbank overnight Federal Funds Rate, but are keyed off the yield (interest rate) on 10 year US Treasuries.

Mr. Richter, it seems like they’re trying to restore their credibility. The Fed has no control over the supply side, except for the supply of money.

The Fed has lots of impact on DEMAND, and that’s the goal. When you lower demand by making borrowing more expensive, suddenly you have over-supply, and to meet this lowered demand, prices might not be able to rise, or they might have to come down, which ends inflation. This is specifically addressed in the article.

sorry, a bit unclear:

…not WW2 being a war on the West: rather thinking about the current conflict in Eastern Europe.

So, the plan I guess is to crater real estate?

Perhaps and if they want any shred of credibility, they better go faster to tank that market. Even 20 to 30% down they will just barely back to 2019 level and house price is extremely sticky but have the biggest impact on wealth effect.

The housing cheerleaders and shills are getting more rampant with their why housing won’t decline narrative. The biggest shills of them all Lawrence Yun is now telling people to go consider ARM..so the desperation or seeing writings on the wall is there.

My thought was, beyond wealth effect, shelter costs unlike energy and fertilizer costs can be reduced by fed action.

Saw a CNN article the other day advising people to get ARMs to fight inflation. Seems grossly irresponsible to advise that in an environment of rising rates, but I guess that’s why I don’t have a job at CNN.

It is interesting that he basically ended the q&a by telling prospective homebuyers to wait. I didn’t like his suggestion therein that the punch bowl would return, but I do find it interesting that he essentially told people to avoid the market right now. At least that is how I interpreted his words. Please feel free to disagree with me… I’m never confident in my interpretation of the swamp monsters.

I interpreted it the same way. He basically told potential first-time home buyers to wait it out until inflation is under control and home affordability is better.

In a different thread, SeattleTechie put up a link for two comparable homes by the same builder in the same neighborhood outside of Seattle. One appears to have sold a couple weeks ago for $1.6M, but now the builder is asking $1.2M for the same thing, a few weeks later. How would you like to be the person who lost $400k market value in a few weeks? That’s a high price to pay for FOMO and impatience. I think Powell is warning people that these things are going to be happening more and more.

Anybody that wants to buy a new home should realize builders are starting to panic, and prices could be dropping fast.

In China when developers cut prices like that and put a lot of recent buyers underwater, they riot inside the developers’ offices and demand equal treatment, their money back, etc…

WS, In the US as the housing prices and homeless increase the peasants start sharpening their pitchforks and buying matches.

Well you can’t please everybody so you’ve got to save yourself..

I imagine they have bullet proof glass and metal detectors at any existing FED public interfaces nowadays..

Years ago, a friend and his wife were buying a house from a builder. My friend negotiated a most favored nation clause that would earn him a refund if the builder cut its prices within a specified period of time.

Because housing costs are a function of available credit.

They are not a function of build cost.

They are not a function of “worth”.

Many readers on this site should learn this lesson well.

Tax the unimproved value of land!

That’s not a high price to pay if he has sufficient income. A high price is losing the house because he can’t pay the mortgage. For most people a house is somewhere to live, not money.

He said that to get housing prices to fall faster.

You need rents to go down if you want to lower CPI. Housing is not in the basket of purchases monitored by the Fed. Landlords have been raising rents in my area. U.S. rental vacancies are low. New car prices are rising. Some auto parts are back ordered delaying auto repairs. Fertilizer shortages may cause food prices to rise. Nitrogen fertilizer is made from natural gas; that went up in price. A British nitrogen fertilizer plant shut down. Potash fertilizer exports were reduced by sanctions.

Immediate plan as with any bureaucracy is to deflect political “blowback”.

Second factor is to maintain or restore their credibility, as it’s only human to dislike being unpopular especially by your peer group (Wall St and the economics profession).

Third factor is longer term, supporting the USD which is the basis of the FRB’s institutional power. It’s not at risk now but will be if the DXY approaches 70, the 2008 low.

Good article.

As a ratio of CPI, a 0.75% hike would place it on the far lower end of historical norms. The 0.75% hike in 1994 was About 29% of CPI. The current 0.75% hike is about 4.2% of CPI.

Whoops. Messed up my arithmetic. Fat finger. My bad. The current 0.75% hike is 8.7%, which puts in in the “reasonable” category.

This time the Fed has an overstuffed balance sheet that they can use as well to fight inflation.

“ Whoops. Messed up my arithmetic“

It’s okay…

Maff is hard… :)

Great article. In a nutshell, you have to crack some eggs to make an omelette it would seem. Sad that they admit that unemployment has to trickle upward.

Now we know what monetary policy can do. What can fiscal policy do now to help lower inflation?

I think it can do a ton, based on the over inflated salaries and pensions delivered to government workers.

Maybe cut those by half, and see what happens.

I don’t think many of those people have an equivalent alternative in the private sector.

“What can fiscal policy do now to help lower inflation?”

Cut government spending noticeably, something which isn’t going to happen. If anything, it will be increased to attempt to mitigate tighter monetary policy.

Re QT, for every Fed-held treasury bond that matures/rolls off, the US Treasury will have to come up with the cash, right?

The treasury bonds are like anti-dollars. So, once QT is in full swing, where will the US Treasury get the $720B (12x$60B) in cash a year. Of course, the US Treasury will try to sell more treasury bonds to cover that, but with the Fed out of the game who will buy them? Sounds like a problem to me.

Hardigatti,

“So, once QT is in full swing, where will the US Treasury get the $720B (12x$60B) in cash a year.”

I asked this question a few articles ago and Wolf’s answer was, and I quote:

“Taxes, fees, and borrowing.” Same as always.

Wolf also says (though I’m not sure if it was in response to your question), that with respect to borrowing higher yields solve the problem. That makes perfect sense to me.

The way I understood it was that the $720B would come from investors. To get the investors to buy treasuries the yield would need to increase. The money to pay for the higher yields would come from “Taxes, Fees, and borrowing”.

QT doesn’t change anything for the Treasury in terms of cash. The US Treasury doesn’t care who holds its Treasury securities, whether it’s the Fed or me. But it changes everything for the markets in terms of cash.

Are we being played? Larry Summers and Steve Hanke both seasoned economists predicted the excessive inflation. Both said it is simple arithmetic. I can’t believe the Fed is so stupid with all their PhDs so it must have been intentional policy to run up inflation rate. Truth is:

1. Fed is not bothered by negative real rates.

2. Fed does not like to discuss gold as it is a worthy competitor to their fiat money system.

First off, the Fed has fine economists… but even economists can engage in “herd mentality.” The reason that people point to Summers and Hanke this time is because they were outliers in the economic community. Same as “permabear” Nouriel Roubini fifteen years ago before the Great Recession.

Secondly, the Fed is more constrained by politics than people want to believe. Even Volcker had to back down in April of 1980 when Carter forced his hand. As soon as the election was over in November 1980 he restored the Fed Funds Rate to almost 20% and began the final assault on double digit inflation that he became famous for.

In this case, Powell needed to get his renomination completed… which only happened on May 12, 2022. AND (to a lesser degree) the Fed needed the fiscal policy to stop pouring gas on the fire… which only happened when Sen. Manchin yanked the punch bowl from the party in December.

Gold? The powers that be along with their lackeys make sure that the price of gold is suppressed. How? By constantly selling gold contracts for gold which does not exist – paper gold which they conjure out of thin air.

Wrong, for every seller of “paper” gold (or silver) there is a buyer. Short interest does not automatically suppress the price.

Moreover, most buyers of the “paper” metal don’t want physical, or else they would (try to) buy it.

Look at gold’s relative value, now and historically. It isn’t cheap, it’s expensive and relatively overpriced.

That’s not what metal advocates want to hear but there you have it.

I agree. Peter Zeihan has been talking about this breakdown of the “International Order” for years now. COVID and the Ukraine war have just accelerated the process.

What a week!

JPOW has a backbone after all

SAILOR lays himself off for bit-dog margin

FOUCHEE forgot his mask and gets the Coronas

and it is only Wednesday …

US industry coped with the shockingly-unexpected, disastrous flu pandemic that we hadn’t encountered in a hundred years and hadn’t expected in a million years(!!!); and so now US business and free market capitalism will again cope with the aftermath as long as Joe Manchin & Kristen Cinema hold the power of the purse. The US economy will somehow unwind this massive debt and get thru this . Buy-Buy-Buy…PJS

Manchin and Sinema will only be swing voters until the end of the year. The November election will change the political balance in Congress.

Right. And millions of people will lose their jobs, homes and livelihood in the process. But who cares? They are just a point on the dot plot right to the Fed. JP casually states unemployment needs to go up a point and is not questioned about it. So maybe 3MM people lose their jobs. Oh well. Adjust accordingly.

A

Do you mean the one that killed over one million Americans ?

Do you mean the one that replaced the flu ?

You’re either being sarcastic or have no idea what you are talking about.

The debt will not be unwound without an economic depression, a real one with noticeably falling living standards for the majority.

I don’t think they will ever get to 3% before starting QE again.

You want to bet? QE may be done forever. It is a massive failure.

So does QE actually work for the real economy, or is it all just smoke and mirrors for funneling wealth to the already wealthy? Has there ever been a a Wolfstreet article dedicated to this topic? Why would we ever bring QE back if the direct effects on the economy are just to increase risk levels?

QE did exactly what it was designed to do…

The only unintended consequence was the ones they gave it to, kept it….

QE would have worked well in the baby boom era but as the birthrate keeps falling today it helps younger people at the expense of older people meaning things would probably get worse under quantitative easing due to the falling birthrate and less younger people and more older people or retirees. Going forward in time it probably would hurt more people than it helps.

QE will never work well in any era because there is never something for nothing, ever.

It’s somewhat equivalent to being a little pregnant.

The only reason (literally) it appeared to work for over 10 years is because of maniac psychology which collectively led so many to believe such a dumb idea would actually work.

It’s complete economic quackery, just like MMT.

Just because it is a failure doesn’t mean they won’t try it again.

I agree with the sentiment about doubling and tripling down on failure – that is the MO of these despicable vultures – however the veil has been lifted on their “wealth effect,” and too many have started criticizing it, including billionaires who benefited. It’s been an embarrassment of riches for a select few, with the rest of us paying for it.

“ Just because it is a failure doesn’t mean they won’t try it again.”

They already did…

The first iteration ended at the end of 2018… Then Trump removed Powell’s spine and he collapsed then restarted it…

Wolf, so for the time being, there will be no selling of treasury securities as has been the plan. A couple of questions for you:

1. Why the caps? What is the Fed afraid of? There’s all that excess liquidity out there so why not remove the caps? The economy is “robust.” Is it that hidden leverage that you’ve pointed out in your stock market margin article that they’re afraid of? Perhaps they don’t want to peel the onion back too fast for fear that something might blow up that they’re not aware until is does?

2. When a treasury bill, note, or bond matures and rolls off the asset side of the balance sheet (principal payment is not reinvested), what is incinerated on the liability side of the balance sheet? Is it the Federal Reserve Notes?

Thanks.

1. I don’t think the caps are needed, but the Fed wants this to be smooth. The Treasury maturities are predictable and are disclosed and everyone knows how much matures every month. Some months it’s a huge amount, and some months it’s a smaller amount, so caps block the spikes you would get during the huge months.

With MBS, the whole thing is very unpredictable and no one knows how much they will shrink the next month through these pass-through principal payments. This is dependent on rates. If rates get cut, this turns into a tsunami that reached $120 billion a month in 2020, which could be destabilizing. Hence the caps.

2. When a Treasury security matures, the Fed gets cash from the government for the face value. At the Fed, this cash just disappears. It gets “destroyed,” just like it was “created” during QE. On the liability side, you will see the “reserves” account go down, and the Treasury General Account (the government’s checking account), and even the overnight reverse repo account. And there will be some shifts between these accounts, and we have already seen some of it, from reserves (down) to RRPs (up).

Thanks!

Another question for you, regarding the treasury security cap:

If, for a given month, when the cap is met and the Fed receives principal payments in excess of the cap, it sounds like the Fed will reinvest those principal payments into more treasuries. If true, why? Why not let the market (not the Fed) be the purchaser of treasuries going forward?

Thanks again.

I would like to see the dot plots as forecasted by Wolf Street commenters.

“The Fed raised its projections for unemployment rates, with the median projection rising from 3.7% at the end of 2022, to 3.9% at the end of 2023, and to 4.1% at the end of 2024.”

I agree with that progression on unemployment but instead of 2022, 2023 and 2024 substitute August, October and December. Everything has happened so fast and yet going forward everything will suddenly react very slowly? That’s not how balloons deflate when they are popped.

There are so many excess jobs out there that unemployment will go up slowly even as millions of “jobs” are “eliminated.” People will either hunker down in whatever job they have right now or they will continue to be able to get a replacement job for a while. I agree with you that unemployment will happen faster than they think… 3.7% to 4.1% isn’t much of a rise at all… but it will be in the middle of 2023 when we get to that level.

I am glad I just stocked up on more popcorn to watch this show. All I hear is the McDees theme song “I’m lovin it.”

There is finally a cost to borrow and the greedy pigs at the trough are ready for slaughter. Maybe the price of bacon will come down with so much about to be added to the supply side.

Unless the government starts issuing ration tickets, I think you will see food prices increase for at least another nine months, possibly at an even faster rate than before.

Go long on vittles. People say “you’re hoarding!” I say that I’m beating inflation as best I can.

Unlike bonds, some stocks you can eat.

Having just remarked on May 4 that a 75-basis point hike was not a possibility, Jerome Powell is completely without credibility at this point.

Things are going to get tight: we’ve had more than 20 years of good living thanks to easy money. But we’ve just seen the limits of that. It’s either inflation or contraction from this point forward.

Tough economic times require firm leadership. And that’s not our current Fed Chair. He will need to be removed before confidence can be restored.

“Having just remarked on May 4 that a 75-basis point hike was not a possibility, Jerome Powell is completely without credibility at this point.”

I can forgive him for this. To me, it’s really not a big deal. What is a big deal (to me) is when he caved in to Trump’s bashing in 2019 and started lowering interest rates again.

I agree with you on this. Two CPI reports came out since May 4, with the most recent one during the quiet period before the Fed’s June meeting. Powell has said they need to be nimble as new data becomes available and this was just such an occasion.

That said, I don’t know why Powell seemingly took a 75-basis point hike off the table on May 4. Why box yourself in? Was it worth a one day rally that reversed the next day?

Powell is not going to be removed… he was just reappointed. I advise you not to underestimate him. He knows that his place in history rests on breaking the back of inflation in the next four years.

He’s toast. A long depression is on the way.

They are not stupid, they are guilty and Fed should be held accountable. This Inflation happened by design, as the Fed in August, 2020 adopted , surprisingly against his mandate, a brand new pro-inflationary bias policy which was announced in Jackson Hole, to allow the inflation to run hot above target in a negative real interest rate environment.

“with only one dissenting vote (by Esther George, who wanted a 50 basis point hike)”

Esther George obviously wanted to become the first Fed Chairwoman.

Was Janet Yellen not already a Chairwoman?

Do trolls count?

My bad, totally forgot about that.

So when can I expect my savings account to start offering an interest rate over the Fed Funds Rate?

LK,

Never. Because it already has your cash. You’re a captive customer of your bank. It’s not going to pay you anything on your cash.

Shop around for a CD at your broker or any broker. This is where banks want to attract NEW cash, and so they sell their CDs through brokers – hence the term “brokered CD.” Even your bank may offer CDs through various brokers paying 2.5% or more for a 1-year CD in order to attract new money. Rates on brokered CDs have jumped. You’ve got to start shopping around if you want your savings to earn anything. This is now happening again. But your own bank will screw you for as long as it can, until too many customers start yanking their cash out.

“An economy that lives by inflation, dies by inflation”, Peter Schiff. Can’t help loving the man, even though I’m a hodler.

Rocks and hard places – I think the best show wiĺl be Europe and Japan.

Jan de Jong

ECB and Japan more likely

Too low a interest rate for too long juiced the asset markets & resulted in inflation.

Energy prices induced stagflation on common man’s consumption essential items can be resolved fast.

But for that the mititary hegemonists in the current us/uk,/nato have to make peace/ lift sanctions on Venezuela/Iran /Russia . Oil will drop 20$ just on an announcement. Saudi’s don’t like their arch enemy Iran to enjoy the spolis of high oil. They will crash oil price with huge supply. But the administration is talking of windfall profit tax on Energy companies.Environment racket has to be lifted to build refiniries in usa.

Environment racket? You mean the climate change that is already making parts of the globe uninhabitable? Here in Texas we are having unprecedented heat – the hottest summer ever. Actually it’s only going to get worse -as Homer said to Bart, this will be the coolest summer of your life!

Escierto,

“Texas we are having unprecedented heat – the hottest summer ever“

Unprecedented, not really…

In OKC, July 8-21, 1978, everyday was 100F or higher… except one… that one was a massive cool down to 98F…

Absolute misery…

Other days were also above 105F but not consecutive like the above…

COWG, that’s nothing. We have that every summer here. Three weeks of 100+ temperatures is normal in July and August. What is not normal is experiencing this in June. By the end of this summer we will have experienced 100+ degree days for 90 days.

DFW. Texas

Consecutive days at or above 100 deg

1 42 Jun 23 – Aug 3, 1980

2 40 Jul 2 – Aug 10, 2011

Number days at or above 100 deg for year

1 71 2011

2 69 1980

There are life forms that can adapt to most everything. What do you think made DNA amplification (aka PCR machines) so damned cheap and popular, anyway?

Humans, and most mammals….ahhh…..not too capable of doing that. But you are all going to heaven anyway, so WTF does it matter?

BTW Tex, you missed your calling, you should have been a climate scientist…..they’d still let you wear boots and a Lone Ranger hat.

And let you drink Jax and Pearl when it’s hot……they had that at Ft Polk in 67, don’t know if they are still around…..or if it will be quite as cold.

The radiative properties of atmospheric gases has been studied by scientists for at least 170 years. It is well-established chemistry and physics, not religion, politics, or pseudo-science.

Greenhouse gases like carbon dioxide, methane, nitrous oxide, etc. block some of Earth’s outgoing infrared radiation, causing some to re-radiate back to Earth. This traps extra heat in the atmosphere, making the planet warmer. (Most of the CO2 and the heat has been absorbed by the oceans thus far.)

Rising levels of greenhouse gases are primarily caused by the burning of fossil fuels, but also to a lesser extent, natural and man-made changes in the land (agriculture, destruction of forests, wildfires, melting permafrost, etc)

Average global surface temperature is only going to get warmer, that much is clear, how much warmer, not so much.

@Escierto

And yet your “uninhabitable” TX is attracting people from other states more than almost any other state. Climate change is real, but the elite government and media response to said climate change (10 foot change in sea level, American south uninhabitable) is pure unadulterated BS as manifest by where people actually moving (ie betting their life on) and what real estate prices are doing in coastal FL and SC (ie people betting money on). Call me when people aren’t moving to TX and coastal FL because of climate change.

And all this, just before a real nasty looking black swan arrives

The Swiss National Bank just hiked their interest rate from -0.75% to -0.25%. And no, the minus sign isn’t a typo.

The Fed is now paying 1,5% risk-free interest in Reverse Repos to everyone with a heartbeat and some extra cash in hand. That goes for foreign players, too.

This will kill the money markets. It has to. And right quick.

RRP will be going to 3,4,5 trillion quickly now. There will still be people telling you this is “normal”. It’s not.

Got gold ?

Franz Beckenbauer,

“…paying … to everyone with a heartbeat ”

BS. Why do you keep posting these lies here. You’re just wasting my time. Only approved counterparties can participate in the RRPs: Treasury money market funds, banks, and the Government Sponsored Enterprises (such as Federal Home Loan Banks). Look up the list at the New York Fed. Every single counterparty is listed.

Absolutely 100% correct.

Gold is a junk fungible highly volatile speculative commodity.

Behold, I cometh (right?) quickly. No wonder he never married.

Did Powell actually use the words “soft landing” ???

Ok, Jerome, we all know you are gonna lose your job, but now is not the time to practice for your next job as stand up comedian.

Wonder what part of the word recession he doesn’t understand we are already in, and what part of the word depression has anything to do with ‘soft landing’ ?

It’s an embarrassment to live in a country where leaders and so called heads of your banking system, actually think every citizen is that stupid, as to believe all their lies.

Americans are way too passive, and sadly too many generations have passed such that we have forgotten about when it’s time to bring out the pitchforks and take care of some business with these evil “leaders.” Maybe a deep and long market crash will wake up enough citizens to act toward making these evil and destructive leaders accountable for their intentionally bad behaviors.

Where is Bernake, the student of the Great Depression, to explain all that we see.

Yellen from hell, needs to go to jail as well.

Transitory life sentences for Fed officials?

The Federal Reserve is doing a wonderful and very honest job, and the members of the Board are very underpaid for their fine services.

Reinstall the Taylor Rule to attempt to rein in the FRB grifters.

ffr = p + 0.5y + 0.5 (p – 2) + 2 where p is the inflation rate, and y is the % deviation of actual GDP to desired GDP. Plug in the numbers for a shocker. At least the Taylor Rule would require even more blatant jiggering of the laughable y and p input numbers to get their desired ffr.

It’s too little too late, won’t matter now.

Seems to matter to the markets alright.

You know why Roman bridges are still standing? They make builders to stand under them during opening ceremony. Hand over the same median salary to every FED member, no insider trading, no credit. They must survive for years with the money. This will keep the value of our money.

There will be soft landing only if the markets listen to FED. If they still raise up even if the FED raises rates, there will be no soft landing.

Commentary on the Fed is being emotively framed as a fight against inflation. In a broader context, it is a lost fight against deflation.

This is not to deny the existence of commodity inflation, priced in reserve currency. It is evident.

Every action taken by the Fed is a distorting event. Whether the distortions have a positive or negative effect on society is subjective.

The Fed has been wrestling deflation for 20 years. All the Fed has done, and is able to do, is distort prices for extended periods and manipulate the timeframe of the business cycle. Its longstanding efforts to deny a floor in asset prices are breaking down.

The situation we find ourselves in today is one in which the USD and the credit markets can no longer be manipulated to support the fight against deflation.

For the period ahead, the Fed will only have the capacity to mimic or follow the market. It may take some time for the market to fully exert itself. It will seem vengeful and dramatic when it does, but it will in fact be a perfectly normal reversion/unwind.

The Fed has checked out. Follow the ECB and BoJ. They haven’t.

‘The Fed has been wrestling deflation for 20 years’

???

Deflation started after Volcker contained the inflation in mid ’81.

That is over FORTY YEARS! Now, it is erupting like a volcano! This is in response to ALL the ‘easy-peasy’ monetary policies ( ZRP, QEs, stimuli++!) endorsed by politicians both parties, Wall ST, large global investment banks++ in creating this 3rd largest ‘everything’ bubble. Party went on 13 yrs, virtually non stop! Global debt went from 5.1T to 31.5 Trillions since ’08!

Now comes the bill/invoice of that party. Suddenly people suddenly realized, how wreck less this Fed has been. They kept the punch bowel, too long, music and dancing went on & on, and hardly any one complained. Just front run Fed’s policies ad pat one’s self ‘ what great investors, we all are, right?

Well the UGLY ‘other side’ of euphoria and animal spirits has begun.

Piper is waiting to collect!

sunny129,

“Deflation started after Volcker contained the inflation in mid ’81. That is over FORTY YEARS!”

You need to stop saying this. It’s among the biggest lines of BS anyone here has concocted, and you keep repeating it.