I mean, who would have thought?

By Wolf Richter for WOLF STREET.

How have on-time rent collections been doing in this era of spiking rents? Across the 100 largest markets in the US, in multifamily buildings the median asking rent for one-bedroom apartments jumped by 12% year-over-year. The median asking rent for two-bedroom rents jumped by 14%. In 34 cities, asking rents spiked by 15% to 28% year-over-year.

Turns out, there is a perplexing deterioration of on-time rent payments that started in mid-2019 and has continued through the end of 2021, interrupted only by the months when the big stimulus checks – not the little one – went out that allowed more households to make timely rent payments.

Only 92% of renter households had made their rent payment for December by the end of December, the lowest percentage since April 2019, down from 93.8% in December 2020, and down from 95.9% in December 2019.

What stands out is the down-trend over those 33 months, interrupted by the months when the big stimulus checks poured into household coffers.

What also stands out is that the $600 stimmies that went out at the end of December 2020 and in January 2021 didn’t cut it, in terms of rents. They were likely used to deal with the credit-card hangover from holiday essentials.

Most of the eviction bans have now ended, but rent-and-landlord-support programs by various government entities to deal with the eviction bans, and the end of eviction bans, are still going on. This came on top of the now-ended flows of free money via extra unemployment benefits, PPP loans, stimulus checks, and other programs.

This data is based on actual rent collections from 11.8 million market-rate apartments in multifamily buildings (not single-family rentals) that are managed by corporate landlords. These apartments house about one quarter of the total 44 million renter households in the US.

This special pandemic-era rent-collection tracker was provided by the National Multifamily Housing Council (NMHC), based on data from companies that sell property-management software to larger landlords. This rent collection data does not include mom-and-pop operations, single-family rentals, subsidized affordable units, privatized military housing units, and student housing.

“While the tracker is intended to serve as an indicator of resident financial challenges, it is also intended to track the recovery as well, including the effectiveness of government stimulus and subsidies,” the NMHC said. But the trend has been worsening.

Many of these apartments are in expensive urban centers, offer glitzy amenities, and cater to young people with good incomes and to empty-nesters with good incomes, following an apartment-tower construction boom in those areas. So tenants are not necessarily the down-trodden.

Massive rent increases anyone?

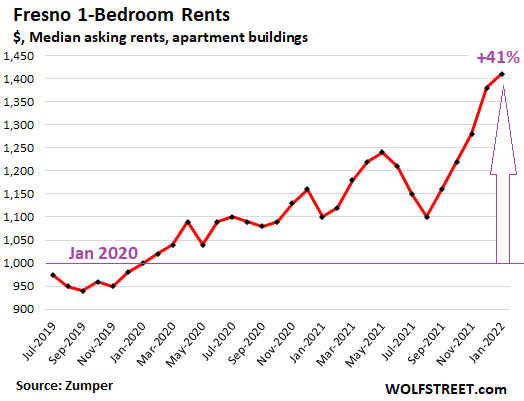

This rent collection trend comes amid a massive surge in market rents in many cities. Across the 100 largest markets in the US, in multifamily buildings – many of them managed by the very landlords in the above rent collection data – the median asking rent for one-bedroom apartments jumped by 12% year-over-year. In 34 cities, asking rents spiked by 15% to 28% year-over-year.

Those are massive increases. A 20% increase of a $2,000 rent payment means the household must come up with $400 per month more just to spend on rent.

Some of them are big expensive cities, such as Boston, Miami, Austin, and New York. Others are in smaller cities with much lower rents where renters now get raked over the coals.

The whole list of those cities and their rent increases are in my open letter to Powell: Dear Mr. Fed Chair Powell Sir, Rents Are Blowing Out and People are Hurting. The winner was Fresno, CA, where the media asking rent for 1-BR apartments spiked by 28% year-over-year, and by 41% in two years:

Could there be a relationship between these stunning rent increases and the deteriorating timeliness of rent payments across the universe of 11.8 million renters in apartment buildings?

Lacking data to prove it, my gut tells me that when rents are raised this sharply, and when rents already constitute a large part of the household budget, then there are going to be issues. These rent increases cannot just be brushed aside. Even in households where pay went up 6%, a 20% rent increase is a tough nut to crack. And a larger portion of tenants appear to be falling behind.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rents are going to be crashing. They are way too high already.

Supply and demand…..maybe if more people who can’t afford rent move in with friends with space.

Have seen that quite a lot already.

If you look at Wolf’s past housing reports, Newark, NJ had one of the biggest rent increases nationally. Now it has given almost all of those increases back. What goes up, must come down. The money just isn’t there in peoples’ paychecks.

Once house prices start falling, all of those people subsidizing their renters while riding out the bubble increases will be rushing to the exits. This includes all of the short term rentals which sit largely vacant. It was worth it when prices were rising, not so much when they’re falling. All of this will put heavy pressure on not only purchase prices, but rents.

IIRC, the Newark thing was a spike in *asking* rents, and probably represented landlords in Newark thinking they could gouge a bunch of affluent Manhattanites fleeing COVID and subsequently finding out they were wrong.

How much do you believe The Fed’s massive money printing is contributing to high inflation? I track the M2 money supply figures published by the St. Louis Fed and they have not let up.

How is the velocity holding up?

Djreef wrote: “How is the velocity (of money) holding up?

DJ you tweaked my curiosity here. So I took a look at the St. Louis Fed Reserve numbers.

It looks like it has been on a steady downtrend from 1.8 after Cheney-Bush blew up the banking system 2007/8.

Looks like it declined all thru the Obama years, and Trump, and was 1.2 in 2021 (the last numbers I could come up with — maybe Wolfe can do better ?).

Forget that measure. As you can see from the chart, it has become meaningless.

When speaking of the Velocity, one must pay close attention to the calculation.

The denominator is the MONEY SUPPLY

SO, as the increase the money supply, the velocity drops..

(here is a chart for Wolf…..money supply laid over velocity)

When and IF the Fed ever starts to pull back their liquidity, watch the velocity turn up

And watch economic activity turn up when rates return to a NORMAL level…

Rates too low are damaging in many instances…

Rates too high are damaging

But FAIR RATES, those that cover inflation….normal from 1956 to 2009….will be a boom to economic activity….

might hurt the markets a bit, but the markets are over pumped…even the longs know it

Household formation stats cratered in the wake of the 2008 implosion and they will again in the wake of genius moves like 40% rent spikes in places like Fresno (even with remote working growth, a 40% hike in agricultural Fresno is just idiotic and will be undone by implosion 2.0 in household formation (ie, people will be compelled to room together/leave Fresno)).

At a national level, a similar, parallel development is the absolute gutting of birth rates…when people are seeing home prices/rents spike and their incomes lag far behind/cease, they stop reproducing…just like rats in a stress filled, overcrowded lab maze.

If people are so financially stressed that they have stopped screwing, ratifying absurd rent hikes via new household formation is the last thing likely to be sustained.

I thought birth rates drop (globally) when education goes up and women have options beyond just having children. You speak as if low birth rates are a problem, as if nearly 8 billion people isn’t enough. Agree with your rats analogy.

If rising rents motivate more people to have less children and do other interesting things with their life I think that’s a good thing. In fact, my decision 4 decades ago to not reproduce was in part due to rising costs across the board including rent, healthcare, and other necessities.

I am in Fresno, and I can confirm, people are already rooming together. Our next-door neighbor have four 20 somethings living in a 3 bedroom home with a weekly random couch surfer or two. They park in front of all of our houses because parking in front of their own house is apparently really hard for them… so they are hard to not notice. I call it the frat house… I’m not a fan.

Population didn’t increase a lot in last 2 years or so

Wondering where is the demand coming from

A big chunk has to be investors, CA diaspora and FOMO millenials. The latter will be the ones really raked over the coals if this rightfully corrects.

At some point people just can’t pay. Then maybe a big rent strike can get started.

If there were that big a “CA diaspora,” rents and house prices in California wouldn’t also be spiking.

No but is increased 100 million since 1980. Housing did not keep up.

Very economical if done right:

“Seven of us, (two couples and three individuals), live together in what might be considered an ideal living situation. We share a two-story 3000 square foot house in Oakland, California. Our per person cost for living very comfortably is very inexpensive. (Less than $22 per day per person for housing, utilities and food–2021 prices”

From verdant.net a 100% ad free ancient site

Rents can only come down to where there is still some profit to be made. Since most apartments go merry go round ownership to other investors, those new investors cant bring prices down much because the purchased at the top of the market. They will have to go bankrupt and that is the fastest way back to slum lords. The only possible solution is wages need to catch up asap before things get worse.

You are correct that buyers overpaid for the properties since after all, we are in a mania. It was made possible by a flood of cheap money and the lowest aggregate credit standards, ever.

So yes, many will eventually end up going bankrupt, the property will be auctioned at a (much) lower price, and a new landlord can then make money at lower rents. However, it may (likely IMO) be financed at higher rates.

There is little prospect of wages catching up to rents, absent a declining real estate market. I live in metro ATL, in one of the better municipalities, paying about $2,000 for a 2BR in a complex which opened in 2019.

According to the prior articles on this site, the average rent in ATL for a 2BR is slightly below mine, something like 5%.

I’m not sure what area is defined as “metro ATL” in the survey but whatever it is, there is no possibility of the typical person being able to afford this kind of rent longer term. It’s not like the median household income here is anywhere near enough to sustain it. I can only guess that people are already doubling or tripling up to cover it. That’s what I see in my complex, often. Either that, or they pay an outsized proportion of their income.

ATL isn’t even considered a high-priced market. It’s no longer cheap but only somewhat above the national median.

“The only possible solution is wages need to catch up asap before things get worse.”

Given the history of the last 20 years, I’m betting on the slumlords.

No “Fresno Economic Miracle” has occurred that could possibly support 40% rent hikes.

Idiot buyers paid idiot prices and are now desperate to pass the consequences onto their renters…who almost certainly will not/cannot ratify such spikes (they will room together or leave).

Those idiot buyers/landlords have an appointment in BK court.

I think a lot of those idiot buyers are the REITs & investors who who have been buying lately at top prices, and often with cash. This may be a good time to divest of REITs….

Not coincidentally, in formal econ the term is “rent-seeking,” charging excess “rents” for just such a position in a pecking-order.

Fresno renters are already rooming together. We have a frat house of twenty somethings next door. Multiple people to one room even. They are annoying. Clearly there’s no “economic miracle” here but A LOT of WFH people moved here from the Bay Area, Los Angeles and San Diego. Many who grew up here and have been gone for a decade moved back during COVID due to WFH. Have a few people from as far as Seattle as well in the neighborhood.

No prices can fall and landlords can lose all their money and sell up.

DC

Rents are not going down here. In fact, we’re seeing bidding wars on rent contracts for the same property. Realtors sitting in the living room, eating popcorn, taking 10 or more leasing contracts each for a different price, essentially auctioning if off to the highest bidder. Happened to me once a long time ago when I first landed my sorry a$s here in the Swamp.

Hey sailor, have to look at rent to income ratio. Is the rent consuming a greater percentage of household gross income ? And gross income includes government payments and subsidies like stimulus checks.

Rent may be going up also because of defaults or delinquencies with rental payment. The landlords of apartment buildings may be increasing rent to cover for rent not being received for those set to be evicted. That may be a major reason for rent increases.

Also, I look at how medical costs go up. Hospitals have to charge more in order to cover for costs associated with bills that don’t get fully paid or paid at all.

And how are landlords going to find ways to deal with their own rising costs, including interest, taxes, repairs/mainetnance, insurance, etc? No, these burdens cannot be addressed by simply passing the cost increases on to the tenants. If you can solve this dilemma you should get a Nobel prize.

First they will try to charge costs + ‘fair profit’ of 10%, then they will learn how prices are really set.

Assuming the Chinese don’t start buying up all the residential real estate. They drive home prices sharply higher no matter what the price is and a lot of them sit empty putting even more upward pressure on rents.

It feels like consumers/renters are on borrowed time in this economy. Stimulus, ZIRP, and QE brought the home team back to tie it up in the bottom of the 9th (Q1 2020). Who knows many extra innings there are, but the away team wins this game at some point.

Our apartment complex in the southeast recently upped the rent for our 1 bedroom 28% over 18 months. Rents have skyrocketed in our metro area. That said I feel very fortunate, my wife and I make pretty good money; we have been living well below our means as a way to pay off student debt and save towards a down-payment… I don’t know how lower income workers are dealing with these increased costs. Life is getting so expensive, especially for folks without assets.

Similar position here. I really don’t get it. The bottom quarter of the country has to be hurting. I honestly think this is gonna get a lot worse before it gets better.

It’s a lot more than the bottom quarter. They often get subsidized by government programs which others who are actually poor but higher on the income scale don’t.

The median income household isn’t really middle class.

It depends upon household size, net worth, and location but @ about $67K, that’s often actually the working poor or working class, regardless of profession.

A median net worth of $121K often isn’t middle class either, especially since the government includes consumer items and what used to be depreciating vehicles and “toys” in this number.

A couple of years ago I read that the fiscal cliff for a single parent was $68k per year. Meaning if they didn’t find a job that paid at least that, they financially were better off using welfare programs.

If this keeps up, living in a van down by the river will be a status symbol.

It already is. Check out #vanlife forums online. Some decked out Sprinter vans are over $100,000. That’s more than I paid for my first house.

I could have bought 5 houses

Maybe that’s why van prices increased more than any other vehicle type!

Not quite down by the the river, but RVs are popping up in driveways around Huntsville, AL, plugged into water and electricity, where parents are parking kids or their parents. Even if you could afford to add on it would take 1 1/2 to 2 years just to get a room added.

Are there rent increase maximums in most of these cities? Does the past 2 year period have any effect on these maximums? Retribution on past renters that differed or are catching could be an ominous foretell of things to come, but will they last? Sounds like a two edged sword.

Our government is doing a great job, aren’t they? LOL.

I guess one reason for people getting late with their rents, is when inflation on other goods, smashes through their disposable income.

Food,phones,more important

Don’t forget Starbucks

Did you snicker a bit when you wrote this trite comment?

Agree, and it’s going to be a factor in house debt slaves – I mean home owners – making their mortgage payments too.

Yes, inflation is a bitch for most people’s budgets.

Wages == energy + food + rent

Energy costs are up, so are food costs. Rents are a function of wages – ( energy + food)

Ergo rents will fall unless wages rise above food and energy inflation.

In Canada where I live it certainly doesn’t work that way. The local Chinese and foreign Chinese bid home prices to the moon, rents follow and soon everyone is priced out of the housing market completely except the Chinese. Then they have many homes, apartments or townhouses sitting empty indefinitely putting more upward pressure on rents. Immigrants coming to Canada now have to live in basements with at least a dozen others just to get by on minimum wage.

Paging Jimmy McMillan.

Almost every week for the past year, there has been an article in my local paper about some “DYFK Capital Management LLC” buying out an apartment complex for 50% more than the selling price just 2-3 years earlier.

This is gonna be a bloodbath.

Inshallah.

A very similar situation happened after WW2 for a very different reason. Truman set up a nationwide system of rent control boards that had to approve EVERY single increase in rent. Senators were filibustering (real filibusters back then) to force the rent control board to loosen up, and finally it was eliminated. Rents didn’t skyrocket after that, because mass-produced cheap housing developments finally caught up with the demand.

The big difference now is that the bankers have tied up all sides of the package. No way out. Levittowns can’t be built because all the supplies are locked up, and existing houses have all been bought up by the hedge funds.

Does the on-time rent payment decline portend a corporate bankruptcy wave and a resultant bank write-off episode?

And if the tide drops further, which corporations and finance providers are “swimming without a suit?”

Just trying to gauge the magnitude of “systemic risk” associated to this data…

Het wolf tell people about Spain,s squatter,s and how black rock lost there ass on rental property

In the first wave of the upcoming major bear market (which should be one of many), I still look for the government to at least attempt another mortgage moratorium. If the credit markets don’t revolt.

As for rents, sounds like a candidate for more corporate welfare through rent subsidies.

One or both may be tried since most everyone continues to pretend the country isn’t already broke.

Just in the nick of time…I think we will see the 40 year mortgage launched as the new industry standard to keep realtor commissions, house prices property taxes, rents, and the like propped up higher. The government is not going to allow any major price deflation in house prices this time around. Look at the auto industry…they have trucks that sell for $100K, but hey you can get an 8 year car loan to afford it!

Jimmy G

Doesn’t Argentina have 100 year mortgages? We’re headed that way.

No, but Argentina’s government raised money by selling 100-year dollar bonds which it defaulted on something like two years later.

What people can afford is going to dictate what is going to be built in the future. If people can only afford $100,000 home somebody is going to build them an RV, a single wide trailer or a tiny home to live in and local governments are going to have to figure out how to deal with it.

You have to show you comprehend the cost is land+ build cost to have credibility on this.

Japan had the 90-100 year mortgage, which could be passed on to the children……..it was really a way of avoiding inheritance tax for the rich (70%) but it did exist….

A 40YR mortgage isn’t going to offset noticeably higher mortage rates and it will provide no help to people who don’t even have a job when unemployment is noticeably higher later. The monthly payment isn’t that different.

I hope your real life experience accelerates during these troubling times.

We have quite a few units and rents are clearly moving up. Lots of people moving from paying to on assistance as rents increase.

I woudl agree, stopping the assistance is going to make for a bit of a mess and it’s going to bring rental rates down.

But that said, we put up a 1242 square feet 3/1 house without a garage in a reasonable area at $1,545 a month on a one year lease. Had about 50 inquiries in 4 days, set a showing for Sunday, and then leased it on Friday to someone on a short term rental at $1,805 per month plus $60 pet rent plus a $1545 termination fee if they leave earlier than one year.

That was a $895 a month rental not so long ago.

There is just an awful lot of demand. Though the flip side of that is that 10% of our rental income is coming from assistance, and our pawn shops are really busy with loan demand.

Feels a lot like the peak, but as mentioned — I got to rent, and the immediately rent for over what even my high number is. There is no inventory.

> paying to on assistance as rents increase.

How is life on the government teet?

Right. Getting rich off of pawn shops and Section 8. Does he have a payday loan store, too? Kind of gross, to be honest.

Comments that claim rents will fall are amusing. Rents will keep rising instead. The folks who are behind on rent will be evicted and some of them will become homeless, some will start doing two jobs, some will downsize and some will get help from Govt., section 8, low cost housing etc. Govt. in one way or the other will take care of the folks who are behind. But rents will never drop. Fed and Govt. will not let that happen, anymore because it will affect the rich asset holders net worth.

Also keep in mind that its not just the property prices that are up, insurance, taxes, labor, construction cost, material cost, electricity cost, water cost, gas cost, plumber, gardener, cleaner, maintenance cost, everything is up and still rising. None of these are falling due to inflation, and all this cost will be passed on to the tenants.

“Comments that claim rents will fall are amusing. Rents will keep rising instead.”

What’s amusing is when people like you pipe off without even paying attention to Wolf’s expert charts and analysis. Not only will rents fall, they already have in many of the places where they spiked. Go back and read his articles instead of laughing foolishly with egg all over your face.

Maby that’s Not Egg ?

Per Wolf:

“Rents didn’t spike in all cities…In Newark, rents plunged 25% year-over-year, but just back to normal from the ridiculous peak a year ago when landlords got drunk with the notion that Manhattanites who could work from home would flee to Newark, and so they jacked up their asking prices to fleece those Manhattanites, and it didn’t work. Now rents are back where they’d been in 2019.

Milwaukee -16.7%

Richmond -12.6%

Minneapolis -8.5% …”

And on and on. The point is, rents can and do easily fall. Greedy landlords are going to get screwed, blued and tattooed. It doesn’t matter what they owe, what matters is what the market will bear.

Of course they can fall,,, and since it is ALL OPM

(( other suckers money )) it follows that it can all be tax loss carry forwards that will, somehow, allow all future profits to be tax free

OR, some such deal where the ”investors” get to take their losses against their current income, thus paying no taxes, etc., etc.

And then WE the PEONs will step in and cover the fatcats ”theoretical losses” anyway, eh

“Greedy landlords are going to get screwed, blued and tattooed.”

Why do you villainize landlords who are really impacted by the rising costs and rising RE prices and rising interest rates when practically everyone is raising prices and making money by the boatload. How about big tech monopolies which are going gangbusters and screwing Americans in every possible way. How about Apple which is selling a $250 item for $1000. How about Google which is sucking fat ad money from small business like a leech.

“Why do you villainize landlords…”

I don’t. Just the Johnny-come-lately speculators like yourself, who are all hubris and chide people who don’t own houses. You’re filthy, devoid of empathy and compassion for the young who have no hope of affording shelter.

“Rents are supported by incomes, not by the fantasies of housing speculators. Sounds like you’re levered to the teeth and shitting your pants right now. I expect you will disappear like a fart in a tornado after house prices crash by 70%.”

Wrong. Rents, asset prices and the entire economy is supported by Govt. and Fed who are in bed with the rich and elites. Its unfortunate reality and the sooner you understand it and accept it the sooner you will join the gravy train. Do not fight the corrupt Fed.

Yeah there will be many outlier cities where rents will fall in short term. That’s not the point. The point is about macro trends.

Average rents will keep growing and in fact will accelerate faster than inflation as the RE cost and landlording cost and taxes are passed on to the tenants.

Sorry that you do not own assets and have to rent, it sucks.

“Average rents will keep growing and in fact will accelerate faster than inflation as the RE cost and landlording cost and taxes are passed on to the tenants. Sorry that you do not own assets and have to rent, it sucks.”

Rents are supported by incomes, not by the fantasies of housing speculators. Sounds like you’re levered to the teeth and shitting your pants right now. I expect you will disappear like a fart in a tornado after house prices crash by 70%.

DC – you are right – “Rents are supported by incomes” – and when I did rent many years ago, that was the deciding factor.

The HUGE asshole RE speculators think – “it’s different this time” – same with moron BTFD stock investors, will be the “bag holders” with all the defaults and BK.

I actually watched a landlord in March 2020 raise his rates to a outrageous amount, and he didn’t care if they payed or moved into a tent, – but there will be a threshold when there won’t be people who can rent, and prices will drop, history repeats.

Some things never change, – the high-roller partiers at the back of Titanic casino tables is over.

Good job the Fed have little helpers like you Kunal, it wouldn’t work otherwise.

What happens when the tenants can’t afford the unfair rent increases, like what happened in Uganda in the 1970s when the Gujrati Indians were robbing the local and the “dictator” Idi Amin had to expel them for looting the economy?

“ Good job the Fed have little helpers like you Kunal, it wouldn’t work otherwise.”

If you cannot fight them join them.

https://fred.stlouisfed.org/series/CUUR0000SEHA

Try this chart. Rents rarely if ever fall

That’s the national average. As landlord, you don’t invest in the national average, but in specific locations. Rents fall in one city but rise in another, and it averages out. Same with home prices. That’s why it is not common to see the national averages drop, while it’s very common to see the local rents and prices drop.

I was looking at that chart and I was trying to find the outcomes all the other times that over $10 TRILLION was dumped on the economy in less than 2 years, but I came up empty.

Right, they go flat and are inflated away.

are you kunal singh of jpmorgan cmbs land? do you have a vested interest in selling these crappy bonds?

Hey Wolf,

Would you have historical data that shows mortgage or rent costs per income over the last 100 years or so? I am curious to see if, in the realm of percentages, if we have ever been here before. Thanks for all that you do! I remember the late 70’s was rough on my parents. They worked one full time job and one part time job each to afford the inflation. They both were skilled laborers in the rust belt before it was rusty.

Careful with that, some of the people who are struggling with rent for their own apartment right now, would have been sharing 5-10th floor walk-up rooms in firetrap tenement houses in city slums 100-120 years ago…

Thanks Wisdom Seeker. I remember those stories from my great grandparents and the quality of life for my ancestors. We have created some great laws to help others, but if we look at the homeless population it looks like history maybe repeating itself. Are we as bad as 1970 or worse like 1929. Some days our grocery store looks like the Great Depression more then inflation of the late 70’s.

Sorry, but I’m not a historian. 100 years is way too distant for me to be interested in it. In my CPI charts I have to go back 40 years. But that’s already pushing it big time :-]

“…too distant for me to be interested in.”

While rent rate history might be hard to find or uninteresting, historical info on debt/interest rate markets is more accessible.

Consider Homer & Sylla’s History of Interest Rates. It’s readable and highly informative to today’s predicament.

E.g.: the 100 year bonds issued by several railroads back in the late 1800’s, just as the railroad boom was cresting (railroads were today’s “tech” Stock equivalent back then).

This is NOT A HISTORY website!!!

Thanks Wolf! I was curious if we could see any past data that correlates with current trends. Only reviewing percentages between the two. I have access to the OCLC world catalog and could pull data. I just don’t know what variables to look for or reporting agencies that would have reported the data. Any suggestions on what I could look for?

1. In swamp area, moratoriums are placed for too much rent raises. Most counties placed ~3% not more than that.

2. Poor house-lords have a hard time living with inflation and property taxes. Property means it has to be kept proper.

3. If drug lords come together to fix the prices, its called a cartel. Don’t worry, if you are bank, then they call you fed. If you are oil producing nation, they call you OPEC.

4. Dont worry about the fed rates. Worry about the traffic jams in the major arterial roadways by the big mutha tuckers.

5. If you are concerned with obesity? Fast during the coming food shortages.

6. Oil will hit $100 soon. Anyway its only $70 now because the value of money is so low.

7. Rookies are not going to invade. They will do peaceful voting and annex the parts they need. Ballot box is stronger than a StugIII

8. I was very charitable today. Gave $10 to a panhandler outside the liquor store. God Bless my good heart.

Back in the 70s, while going to school, a wino asked me for 25 cents so he could get “straightened out”. I gave him the quarter simply because he told me the truth!

CP:

#6. Oil (WTI and Brent) is over $90/bbl now, not $70.

If money is loosing value, then $100 in 2007 is completely different from $90 now. We have only $70 now. The equivalent of would be like $140. On the other hand, people have less money now, which means the $90 is too much high already like $140. Sometimes I dont make sense to myself. Anyway, as a high IQ guy, I call you are wrong.

For a “high IQ guy,” your grammar is awful.

‘Sometimes I dont make sense to myself the charts. Oil is over $90 now.”

I have to agree with your assessment.

Read the charts….oil is over $90/bbl now.

WTI is almost $94 per barrel at the close today.

Cobalt Programmer

I heard a convoy of truckers is heading here just in time for the State of the Union event.

Cobalt Programmer

Are you another Swamp Creature???

I carry a second wallet with small bills to hand over to thieves in case I get robbed. Also, occasionally use some small bills to give out to some poor dudes to get breakfast at MacDonalds. Once I gave a dud $5 to watch my car for a few minutes while I went into a property near Nats baseball Stadium.

Suburbs of swamp indeed…Most of the times the panhandlers are harmless and be happy with what ever they can get. It may be a guy with severe multiple sclerosis standing on the road for the past five years or a veteran near a 7-11 on a Saturday morning. I am OK with poverty and beggars. Thieves and violence are completely different and I do not agree with them.

Tuckers can end the infection and inflation. Two birds in a row..,Tuckers are to be feared. Unlike the kids thrashing windows of a small businesses and looting a big box retailer, logistics can wreck havoc on the economy. A working man can hurt more by not working. Just think about Gas trucks not running. (NG will step in at that point, unless those reservist are also protesting)

Grammar= Gram + error…

I blame this Kentucky moonshine…

I carry a Smith & Wesson because robbery is an unacceptable behavior.

Swamp Creature

It won’t be long before they refuse the small bills but take the wallet

Anthony

They can have the whole wallet. Screw em. My life is worth more than this f$ckin wallet.

The Wallet has nearly all One dollar bills, except for one $20 bill on the outermost bill.

=are in my open letter to Powell=

Is it a proper thing to do – to look heavenward and start questioning Our Lord of Easy Money ?

Especially now, when He is about to raise rates by Earth-shattering 0.00000001% ?

Because the answer will be,as usual, deafening silence.

The one and only exception to this rule happened just once.Adonai provided THE ultimate answer:

“For my Thoughts are not your Thoughts, neither are your Ways my Ways,” declares the Lord.

“As the Heavens are higher than the Earth, so are my Ways higher than your Ways and my Thoughts than your Thoughts.”

Amen.

“The rent is too damn high!”

Who should set the rents…. And to whom are they accountable?

Who guards the guards?

The left-wing progressive solution: enact another eviction moratorium! That will solve the crisis.

Every single move politicians make leads to worse and worse outcomes. We need to shrink the size of the government by 2/3. It’s gotten much, much too large. This doesn’t have to be accomplished by firing anybody, it just eliminates positions permanently as people retire and leave through attrition.

DC

Shrinking ain;t gonna work. As David Stockman once said, you need to eliminate Agencies in total or they will grow back again.

Lets start with the Pentagon. Closing 800 overseas military bases would cut expenses by (a guess) half a trillion every year.

Pentagon has yet to pass an audit. They don’t even have the capability to perform one, last I checked.

I can think of a dozen Agencies that all need to be zeroed out. I worked in one for a while.

By now though, the situation is so far down-river, whatever one does (or not), one might get what is termed in natural sciences, a die-off (alluded to by Malthus). A milder form is still severely not pretty for anyone. But that is the sad fate of over-promising (and reaping short-term political rewards) without actual value in the till. In my world, everything has a cost, the question being, who (or what) will wind up with the dinner check.

@Trailer Trash

“Lets start with the Pentagon. Closing 800 overseas military bases would cut expenses by (a guess) half a trillion every year.”

I agree with you, but you may be surprised to know that the deployment of U.S. troops abroad has been declining since Vietnam. During the Vietnam war there were over 1,000,000 troops deployed abroad. In 2021 it was down to less than 180,000 troops deployed abroad.

McQueen’s Ghost-now extrapolate that into the general U.S. zeitgeist’s perception as to how mighty our conventional (nukes excepted) carbon-based forces are…

may we all find a better day.

What do we need 35,000 troops on the border with N Korea? The only purpose they serve is a tripwire in case of an invasion. and to keep the hookers in Soeul employed.

Swamp-don’t disagree, in principle-but (sorry, Wolf) human nature/history is rife with current generations misunderstanding/forgetting and then dealing poorly with the causes of those tripwires laid by past ones (who were the current generations at the time of placing…). (…’cui bono?…’, and for how long?).

may we all find a better day.

The right wing conservative solution: let the market decide.

That’ll definitely solve things, good call. It’s worked so well for the last 40 years, keep on keepin’ on!

if you think what we have now is emblematic of free markets, I’d like to have some of whatever you’ve been smoking.

I’d like you to review the last 40 years on your next smoke break

> “the … stimmies …. … were likely used to deal with the credit-card hangover from holiday essentials. …”

Anyone who has such weak, loser priorities can’t blame it all on government. My parents before me, and I in my turn, prioritized shelter. So this Christmas me and mom got together in nice paid-for houses with minimal tinsel and junk exchanged, and no credit involved. Just love and honest helpfulness and serious, wonderful frugality.

@ phleep –

A lot people prioritize shelter. They just can’t afford it.

Today is not yesteryear.

Try looking outward sometime.

The market didn’t decide. Central bank currency debasement has nothing to do with the market. Neither does a fake economy where “growth” is dependent upon government deficits. We have both today.

The actual objection most who express your sentiments to an economy based upon private markets is that it doesn’t provide the universal minimum living standards which everyone supposedly has a “right” to receive.

There is no basis for such an expectation.

Maybe he just meant serious deficit spending started in 1980?….and of course we still have it…….As my conservative businessman stepfather yelled every time the corporate programmed Reagan-bot came on TV,

“Balance the budget, you dummy!”

And there’s no basis for an expectation of a free market. That’s a utopia that has never existed and will never exist. Every “a true market will solve everything” comment is moronic. What we are currently experiencing is capitalism in its intended form and how it will always manifest

The last 40 years are what happens when you have a centrally planned economy (with extra credit to the past 14 years).

“The Market” ain’t deciding rates (repressed by a central committee of unelected bureaucrats). If “The Market” had been permitted to function properly, money wouldn’t have been so artificially cheap and the asset bubbles we know today wouldn’t exist.

Fear not Jack. The Right Wingers have a solution of their own: hand out stimmies to the peons so that the One Percenters can collect their rent. /s

1) Larry Summers : there is no need to raise interest today, do it in March.

2) US 10Y minus DET 10Y = 1.6%, in March, after the hike : 2.1%, on the way to 3.5% – 4%. Gravity with Germany will pull them together.

3) US 10 – US 2Y = 0.4%. After raising interest rate by 0.5% : a minus 0.10%. That signal recession. The old signals are defective.

4) Hiking, while providing enough liquidity might prevent recession.

5) JP will ram inflation by raising rates, but liquidity will keep it alive with negative rates.

6) JJ need inflation for higher tax collection, negative dividends and debt reduction in real terms.

7) Smallness thrive on higher interest rates. Cut debt, collect more taxes.

8) Zero rates are good for perks and buybacks.

9) JJ lox economy.

“Larry Summers : there is no need to raise interest today, do it in March.”

Larry Summers today: stop QE today. Stop it now. Don’t kept it going until early March.

Yours is the quote I saw from Larry. I didn’t see the one about not raising rates until March.

Everyone says Fed is making a mistake, but the Fed has been doing experimental policy for more than 10 years and blown the biggest asset bubble ever. Stock market on most basic price/sales level should be in the 1400 – 1500 range. What difference does a few weeks make it n them trying to fix a screw up.

“Yours is the quote I saw from Larry. I didn’t see the one about not raising rates until March.”

I heard Larry say both quotes yesterday.

“I heard Larry say both quotes yesterday.”

None of it actually matters. Larry is part of the problem, not part of the solution. He has a hand in all of this going way back. He’s a crackpot just like all the rest.

1) Old Larry Summers is behind the curve. Don’t panic today, panic in

March. Dehydrate today, because adding liquidity to a raging inflation is insane.

2) Different ideas will be crushed by Larry’s mechanical jaws.

3) US raging inflation is 8%. In Germany 4.5%. US 10Y minus 3M in a trading range between 1.2% – 1.7% had an UT at 2% this week.

4) Both 3M & 10Y are in deep territory. Raising rates will accomplish nothing.

5) Adding 0.50% will cut this ratio to 1.50%. No recession.

6) Dehydration during hiking can cause death.

7) Larry should lecture 17Y – 20Y kids about the old economy.

Greenspan and Bernanke flipped the real economy, after flipping Japan.

8) Raise interest rates in moderation, cut liquidity in moderation,

don’t shock a fragile economy.

and to his credit, he opposed the march 2021 stimulus bill because he said it would cause the exact inflation we’re seeing today.

He deserves NO credit or negative credit for lots of unforced errors. Yet he continues to be heard and discussed like he had some good ideas at one time.

If they raise a full point that will blow (mainstreet) inflation to double digits, (wall st inversely) and they will have to follow that number up the ladder (Volcker like) to its conclusion. We’ll have a decade of deflation at least while we work down the numbers. Deficit spending is a nonstarter so don’t go there.

1) % On Time Rent is down by 6%, from 98% to 92%, but the average rent

is up 14%. Not On-Time means late payers, not default.

2) Zero rates, higher RE values, higher rent.

3) Higher rates humble phony billionaires largess.

ME, can you maybe tell all this to your therapist instead?

ME is welcome therapy

Maybe you could get a group rate and get a break from inflation

One of these days I expect the headline will read, “ rents hit new high but on time payments drop to 10% with an average number of months overdue approaching 6. The RE pumpers will crow “ See rents never go down.” But in reality we will enter a new era in the residential rental market that mirrors the old Soviet Joke. “ They pretend to charge us higher rents, and we pretend to pay them.”

A lot of landlords got BBQd over the past two years, and still are. You can see the rage on this site. They brag about raising rents and really sticking it to people, but in reality they wait for that check to come every month, but it never does. I feel bad for some of them, but for others I laugh in their faces. It serves them right. They’re getting a taste of their own medicine.

i feel for the small mom and pop landlords who were taken advantage of by unconstitutional moratoriums and opportunistic tenants.

i don’t feel bad for the idiot “investors” who are ruining the housing market by driving housing prices up.

if someone buys a $300k home for $500k, expecting to rent it out and make a profit, and he loses his shirt, i’ll have some real schadenfreude.

That’s it in a nutshell, Jake. There are a lot of good people who are old time landlords who treat their tenants well, maintain their properties, and earn a small amount every month based upon sustainable numbers.

These Johnny-come-lately speculators who, like you said, pay anything then try to jack the rents irrespective of market fundamentals, while screaming that real estate only goes up, deserve to get their asses handed to them. When you ask them about cap rates they tell you they don’t wear baseball caps.

Pay rent later. Inflation decreases debt. People should get back into massive debt ASAP. Just give the borrowed cash / late rent to a family member and let them buy TIPS for it.

Actually, consumer staples may beat TIPS, but then you should probably buy an ETF.

The funny thing is that tapering will cause more inflation. I’m not sure the Fed needs to taper right now. There will be foreign money seeking shelter and armament in the near term at least.

uuid,

“Inflation decreases debt.”

That’s wrong.

Consumer price inflation increases consumer prices and increases the burden on consumers and leaves consumers less money to spend, including for debt payments.

Only wage inflation decreases the burden of debt — and not the debt itself. Nothing decreases that debt itself except default, debt restructuring, and bankruptcy.

And if it’s variable rate debt, such as credit cards, the rate goes up with inflation and just gets costlier with inflation. So charging more expensive consumer items on your credit card with higher interest rates is going to be a double whammy.

“So charging more expensive consumer items on your credit card with higher interest rates is going to be a double whammy.”

I fall down and thank the gods or whatever, I have been spared that. For me it came from staying an ant, not a grasshopper, through all these WTF times, and now too. The next turn of the wheel I foresee for folks with all that debt may be yet another WTF wave, and a harrowing one. And so few with good collateral, now. My mailbox is till filling with credit card offers: headed straight to the landfill.

I am a small landlord. Own 15 SFHs in a booming military town. We use E-5 w/ dependents BAH rate to price our rents. Increase 1 April for 3br, 2ba, bonus room, 2 car garage from $1150 to $1400. We stay 10% under market. They should be $1600. $250/mo increase for our tenants is big, but there are hundreds waiting to pay full price. If they move out, we raise to full market. They all stayed and are happy we only did $250. They understand what’s going on. These houses were renting for $900 four years ago and have tripled in value in 7 years. I think I may liquidate them all and sit on 3 million.

PD

Good job on doing it the right way.

When we were in the business we followed approx the same script.

👍👍

More like

Good job benefitting from inflation.

Not so good for renters and young aspiring homebuyers.

This what the FED and governnment stimulous does.

9) Larry Summers is an old vacuum tube.

But still at least above a triode….pentode maybe?

I believe this inflation will level off at some point. All of this stimulus was like a pig thru a python. After WW2 housing prices increased 2.5 to 3 times but incomes started to rise with the booming post war economy so it evened out by the mid 50’s. Maybe the same thing can happen again but it will depend on the gov. and the fed. We may be too far down the road. Loss of confidence will lead to hyper inflation wherein all of this debt should led to massive deflation at some point.

“I believe this inflation will level off at some point. ”

Likely.

But not good enough. The talking heads will focus on the RATE, but the accumulated and compounding doesnt go away. THIS is the damage of inflation.

The 7.5% will be “baked in” even if inflation rate goes to zero.

The “2%” target ..the illegal mandate violating target…. will now designate an increment different than just two years ago.

The “2%” will be 2% of a number that is about 10% greater than before.

And, even larger if the rate falls to what will now be deemed as good…like 4%.

The MMT attitude got us where we are, or at least as an excuse, and the MMT answer to inflation is not higher interest rates but HIGHER taxes.

Trump’s corporate tax cuts to expire soon, and that will begin the move toward higher taxes. Capital will be drawn out of the private sector to the government, leaving the government larger and more the spiller and distributor of money. IMO

yeah the difference is, our booming post war economy was due to our not only producing things, but being the only one to do so as europe was decimated.

now, the only thing booming is our debt, trade deficit, and consumption.

we produce nothing but time wasters like instagram and tik tok, and we consume what other people make for our printed dollars.

Hussman has another good article out with a bunch of scatter plots showing how QE did nothing for economic growth or employment growth, but did everything about blowing up the stock market.

According the stock market/GDP ratio the stock market would have to fall 72% to get back where you could get 10% long term returns. Alternate is gdp could grow into current value which would take about 30 years.

Jeremy Grantham ( an old-fashioned Gent with a bow tie who saw it all ) nailed it:

“We are in what I think of as the vampire phase of the bull market, where you throw everything you have at it: you stab it with Covid, you shoot it with the end of QE and the promise of higher rates, and you poison it with unexpected inflation—which has always killed P/E ratios before, but quite uniquely, not this time yet—and still the creature flies”

Even more apt analogy is the last scene of Terminator I:

Legs blown off with dynamite,steel rod driven thru his chest,multiple blows to the skull – yet this Creature keeps skyrocketing (I mean crawling upwards).

Only when crushed by the Press of Reality the red glow in his eye goes out.

Evictions will follow. They hired homeless people to remove furniture and personal items to the curb and changed the locks. A police officer was there to watch and make sure no weapons, medications etc. we’re placed by the curb. Debt collection procedures followed. The apartment was repaired and repainted. It was rented out again as soon as possible.

1) This article is about multi family buildings that are managed by

corp landlords.

2) %On Time is down to 92%. Evictions ….

3) Portion of them did’t pay rent, thanks to gov emergency regulations. They show good intentions to pay and catch up and close the open balance Landlords should give slow payers time, rather than legal means.

4) Some need housing support. There is no housing support without eviction.

5) Large landlords got gov support. Small ones got nothing. Mad and enraged.

One delinquent unit out of 5 apartments is 20% of the ledger in the dumpster.

The $1M property is up to $1.5M, but the tenant is stuck like a bone in the throat. Higher taxes, water, cable, material,… have to be paid.

6) Homeless next to their multi millions properties. Crime, drugs, sex…total chaos, total madness.

7) The gov “Short” smallness.

8) The gov hedged against small landlord.

9) The whales will hunt them…

An apartment manager, assistant and two PT college age leasing agents managed 450 apartments. The company bought a garden apartment complex getting apartments at wholesale prices, collected rent, deducted depreciation, then after some years they sold them.

They made rental applicants show proof of employment and did credit checks. Not many evictions there. The deadbeat tenants were gone the day before the eviction. One tenant had three cats. Their litter box got dirty. The cats pissed the carpet as the litter box stench made them go elsewhere. The carpet started to stink. The building stank so bad they had to evict her. They had to replace the carpet. She lost her security deposit.

So, some some guys made a huge pile of money in a few years, and some mentally ill old lady (among several others, it sounds like) is now on the streets?

What a heartwarming tale.

In Toronto, the median monthly wage is C$2,500 a month, yet rent for a one-bedroom is now C$1,900 a month even in the crappy parts of town where transit is unreliable.

Chinese?

There are Chinese and Hong Kong investors who buy up entire floors of condos with cash in suitcases. Meanwhile, the corrupt Toronto Police ticket the homeless for trespassing and loitering for sleeping in the TTC subways.

Gen Z

So I guess trade deficits do matter … because to have foreigners show up in your town and bid real estate away from the affordability of the citizens is ………not so good.

Any Ivy League econ major wish to debate that with me?

You guessed it and C$1,900 doesn’t include utilities and unlike America the price of electricity in Ontario, Canada is sky high. Rents outside of Toronto as far away as 60 miles are the same about C$1,900 a month for a one bedroom apartment.

And that is “gross,” not net. None of this math makes sense.

GenZ – “median” Monthly wage…

“median” or “average” Monthly rent?

The Feds red glare, bubbles bursting in air

gave proof thru the night, that the bankers were still there

o say does that star lined fed yet wave

ooo for the land of the fee and the home of the easy money grave…….

Get ready little lady, hell is coming for breakfast

The FED went on the most grotesque asset pumping endeavor in history. It is almost unimaginable even to this day. They unleashed an orgy of speculation in all assets never before seen, turning the entire economy into a giant casino-like video game, then when it became evident what was going on, and prices of every started ballooning, they stood up in front of the cameras and announced they were going to “let inflation run hot for a while,” calling it “transitory” instead of doing the right thing and putting an end to it.

Nobody questioned them – they weren’t allowed to. Because the FED controls the narrative and what is even allowed to be asked by reporters in their press conferences. And CONgress stood idly by, trying to pass more and more trillions of “stimulus,” dumping dry tinder on the raging inferno. All of this has had a singular effect – making the rich much richer and destroying the lives of the working class, the poor, and the elderly on fixed incomes.

Nowhere are the speculative excesses more visible than in “cryptos” and “meme stocks,” where there are absolutely zero underlying fundamentals or intrinsic values, but rather numbers based upon 100% hype and what the greater fool will pay. When Wall St. moved heavily into crypto, and pension funds followed, it became clear that the entire system is a dangerous speculative joke.

And now here we are, with the FED trying to figure out a way to not allow these unconscionably bloated “valuations” to fall, when in reality the only way to a healthy economy is for it all to collapse into one big smoldering heap – and stay there. Blowing asset bubbles to juice the net worths of an extremely thin slice of extraordinarily wealthy individuals – which includes the FED chair himself – at the expense of society is not only dangerous, it’s morally wrong. Jerome Powell should have been fired a year ago at least. Instead, he was rewarded by CONgress with another term.

Ranting here is not useful. Do you think they care.

If you cannot fight them join them.

If you want to fight don’t fight on a comment board. Go protest in real world.

I don’t take suggestions from anonymous strangers, EVER, and Wolf’s site is a GREAT place for people to comment on the current goings on in the economy. So kindly eff off, speculator scvm.

OK calm down

Haven’t you heard? Real protest is now threatened with arrest, up to 1 year imprisonment, and 100k fines. Not sure why that didn’t apply to the “mostly peaceful protests” of yesteryear, but that’s another matter.

If you crush skulls, smash storefronts and torch vehicles it’s “mostly peaceful.” If you peacefully disagree with the globalists’ narrative, you’re an “insurrectionist.”

Wait till the vagrancy laws show up…..homeless people are such an eyesore….totally ruin the ambiance.

@NBay – and not even nutritious! They make for low-grade Soylent.

Read “Lords of Easy Money”

everyone

DC…

Insurrectionist…..and a White Supremacist even if you are a BLACK truck driver

I kind of feel these rents can so very easily “just be brushed aside”, Wolf, as easily as high cost workers were brushed aside for cheaper labour in China.

There’s lots of migrants who’d pay more after all.

Putin blocked most of Ukraine’s ports. They are under siege.

1) This raging inflation was caused by higher Crude oil and commodities

shortages.

2) Crude oil reached BB #1 : Nov 19 high/ Dec 3 low, between 99.29 & 85.82. Last week WTIC high reached $95. It’s 0.886 with June 2014 high. That might tag the inflation high.

3) If oil decay to $80 – $60, this bonfire have peaked.

Core CPI – without food and energy — is up 6%.

Core CPI calculations have changed since the 1980s in ways that purposely understate inflation. The calculation has changed from a cost of goods index, which simply measures a basket of goods and services over time, or in other words, measures what a consumer actually sees in increasing prices, to a bogus cost of living index, which measures the effect of people dealing with inflation by substitution when items get pricey (buying hamburger instead of steak) and accounting for increasing “quality” of some goods, as if there were no such improvements in anything before 1990. Real core CPI by a cost of goods index right now is well over 10% and this is why the polling numbers for “are we on the wrong track” and Presidential approval polling looks like 1979, because it IS 1979 for inflationary purposes.

2) Nov 19/ Dec 3 2007.

What I saw during stemmie pretend and extend was long lines buying 1k+’iPhones and trinket buying mania. Amazon, Fedx and Ups delivering it all. Hillbillies quit soaking beans and hit the food delivery easy button. Last thing on their mind was their debts. One thing for sure you will not have to watch them at 6pm on the Boo-Hoo-Hoo woe is me segment on legacy media because it might point to DC and the Fed and somebody might point a finger. Can’t have that at 6pm. No sir. The meme is Covidian Worship, Vlad the Bad and the weather with a fluffy bunny feel good squeeze at the end . They are waiting for and expect another dose before mid-term.

A public affairs program on WRNO last Sunday said that 5000 evictions are going forward in court in Orleans parish this month, many involved the renter’s diverting rental assistance to other uses. There’s less than 400,000 people in Orleans parish.

Twice the number of houses being built along the beach and the adjoining streets as last year on the Mississippi Gulf Coast. They’re going to help with storm surge at my house sometime soon. The ones that used to be there did.

As soon as units stand empty for a rental cycle or two in an average market, most landlords or management companies will lower rents until they’re occupied, for appearance and to remain profitable. I’ve bribed to get to rent an apartment (Munich,1979) and been bribed to rent an apartment (Austin,1980). Purely supply and demand, which can now be modified by public policy, apparently. After watching a stream of rental income vanish because a government health agency decided to abrogate private contracts, who would risk contracting the building of affordable rental housing? These thousands of houses bought by corporations will soon be sold to the renters who qualify, they are going to hate being landlords. Especially in the next few years, normal houses in average markets are going to be a bitch to maintain on a budget. But extreme rent bubbles follow the smell of disposable income, if and when it goes, the bubble collapses somewhat, and vacancies appear and control the new price. Until builders see a stable future under responsible leadership, they’re gonna build and run. If they and their customers can afford it. What’s affordable? 25%max recommended for housing in 1975, by the eighties and nineties a third, lately forty percent seems acceptable, soon half of income will go for shelter. Or compromises must be made. Like finding better repositories for wealth than where one sleeps at night. Piggy bank sequestration of housing is starting to put people out of doors. They’re not all deadbeats. Or maybe it’s been going on for a while and I just figured it out. Or im wrong. 3 1/2 months till storm season. Blessed with a little more rain.

“holiday essentials” – are we programmed or what ? The holiday was intended to stimulate buying. And we fell for it.

Wolf,

What is the typical vacancy rate and how is it measured/reported?

I keep track of how many SFRs and total rentals are listed in my market on Zillow daily. Not a very sophisticated way to measure the rental market but around June we went from ~150 to ~250 total rentals available and been about flat since. In a city with ~500k people. There are several large apartment complexes being constructed around town, one that was just completed is listed as having 97 vacant apartments. There is a couple more of these in construction that are much bigger and will add their listings too the pool in the next 6 months or less. With a flat number of available units for the past ~8 months and a substantial number of units coming online…. Things will turn around on prices rapidly? Or is 250 units available in a city of this size considered “tight”? I have no idea how rent can go up 15% y/y (my market is in your open letter to Jerome) with hundreds of available rentals. Seems like a lot of supply to me.

There is no good measure of the apartment vacancy rate. The Census releases estimates based on its housing survey, but those numbers are off by a large margin in part because when the apartment is vacant, no one responds to surveys. The Census admits that this is a very difficult metric to track.

Thanks. I will stick to my home brewed Zillow numbers :)

And don’t forget that the tiny “uptick” in on-time rent in August and October 2021 could be due to the advanced child tax credits that sent at least $250/month (often more, too) to families with children.

That was a stimulus, too.

“Nothing can come of nothing,” quoth the Bard. Where did these hedge fund landlords think this easy income was going to come from? You cannot get blood from a stone.