Yields and rate-hike expectations spike. A rate hike now?

By Wolf Richter for WOLF STREET.

The probability of a 50 basis-point hike at the FOMC meeting on March 16 spiked to 90% this afternoon, based on CME 30-Day Fed Fund futures prices, after this morning’s hair-raising inflation data for January, and after St. Louis Fed President Bullard’s talk on Bloomberg. The spike in inflation is now infesting services and has spread deep and wide into the economy. A 50-basis-point hike would bring the Fed’s target range for the federal funds rate to range between .50% and 0.75% (Fed Rate Hike Monitor via Investing.com):

“There was a time when the Committee would have reacted to something like this [the hair-raising inflation report] with having a meeting right now and doing a 25 basis points right now,” said Bullard, formerly biggest dove in the house. “I think we should be nimble and considering that kind of thing,” he said.

“I don’t think this is shock-and-awe,” Bullard said about the 50-basis point hike, as markets are already pricing it in. “I think it’s a sensible response to a surprise inflationary shock that we got in 2021 that we did not expect,” he said.

All kinds of economists are now being cited in the media – this started a few weeks ago and has intensified since then – saying that the Fed will raise rates by 50 basis points on March 16, such as Citi economists today; or that the Fed should raise rates by 50 basis points, or that the Fed shouldn’t even wait till March 16.

In terms of quantitative tightening (QT), Bullard said that the Fed could essentially reduce its balance sheet at about the same pace that it had added to it, that pace having been $120 billion a month.

And this should include a “second phase” when the Fed sells bonds outright, rather than just letting them run off the balance sheet when they mature, he said.

“As a general principle, I see no reason why you can’t remove accommodation just as fast as you added accommodation, especially in an environment where you have the highest inflation in 40 years,” Bullard said.

And all heck broke loose in Treasury yields.

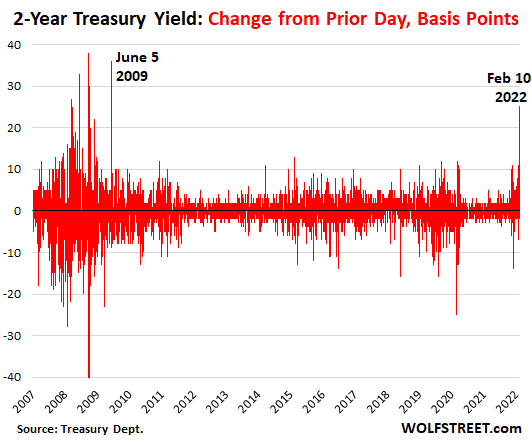

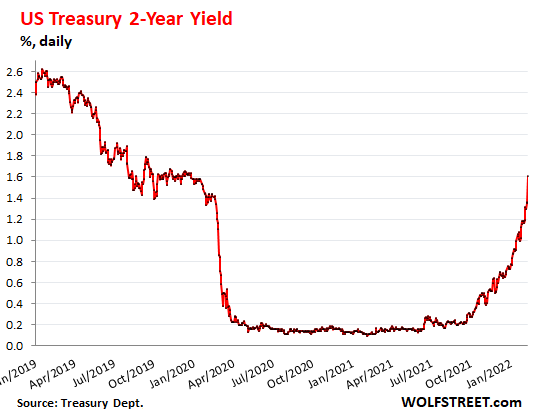

The two-year Treasury yield spiked by 25 basis points to 1.61% at the close, the biggest one-day leap since June 5, 2009 during the freak moments of the Financial Crisis. Now it’s not a crisis. Now it’s just the bond market, which had been in total denial until November, coming to grips with inflation and the Fed’s efforts to crack down on inflation. Jawboning by the Fed is finally working, at least a little bit:

With this 25 basis-point spike, the two-year yield reached 1.61%, the highest close since December 24, 2019. In real terms, adjusted for CPI inflation, the two-year yield is still hugely negative, at -5.89%. So despite the spike, it is still a terribly mispriced bond given the huge amount of inflation:

The one-year Treasury yield spiked by 23 basis points to 1.14% at the close, the highest since February 27, 2020:

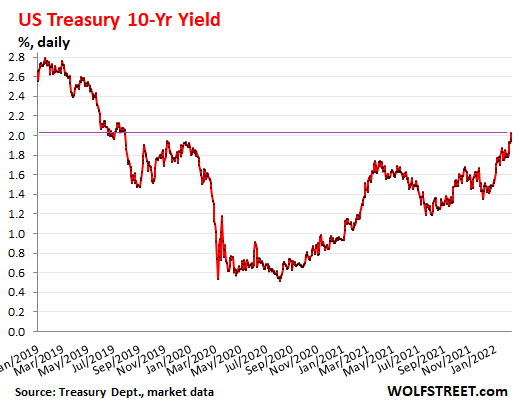

The 10-year Treasury yield blew through the 2% line, jumping by 9 basis points to 2.03%, the highest close since July 2019:

And mortgage rates, good lordy.

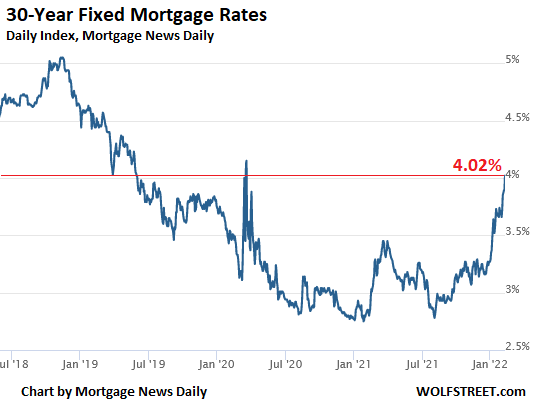

The average of the 30-year fixed mortgage rates quoted today spiked to 4.02% in the top tier scenario, above 4% for the first time since May 2019, according to daily data from Mortgage News Daily, with lenders quoting between 3.625% and 4.375% at the top tier.

This is fast moving: Freddie Mac’s weekly measure of the average 30-year fixed rate, released today, at 3.69%, was based on surveys that most mortgage bankers filled out on Monday. The Mortgage Bankers Association reported yesterday that based on surveys earlier this week, the 30-year fixed rate rose to 3.83%.

The most reckless Fed ever.

The Fed has compounded policy error with policy error ever since March 2020, with its interest rate repression and massive QE that it maintains even today, despite 7.5% inflation. Anything it would do to tighten going forward would just be feeble efforts that are too little and too late, to mitigate the effects of 22 months of massive policy error after policy error.

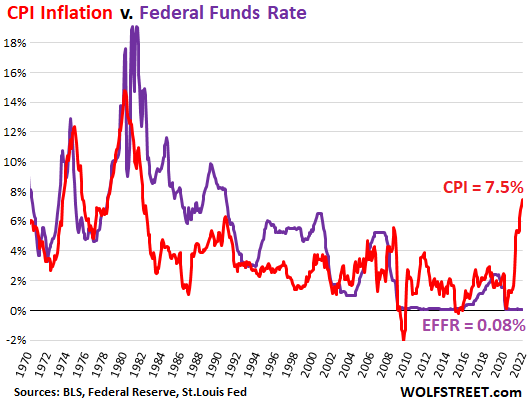

So now the Fed has created this crazy situation where the interest rate that the Fed is repressing with its policy rates, the effective federal funds rate (EFFR), is a near-zero (0.08%), while CPI inflation is 7.5%, producing the widest spread between the two going to 1955.

Back in the high-inflation periods in the 1970s and early 1980s, the EFFR was nearly always higher than CPI inflation and in some periods much higher. In fact, until the Financial Crisis, the EFFR was nearly always higher than the rate of CPI inflation. The radical monetary policies of interest rate repression during the Financial Crisis changed this relationship. Blue line = EFFR, red line = CPI.

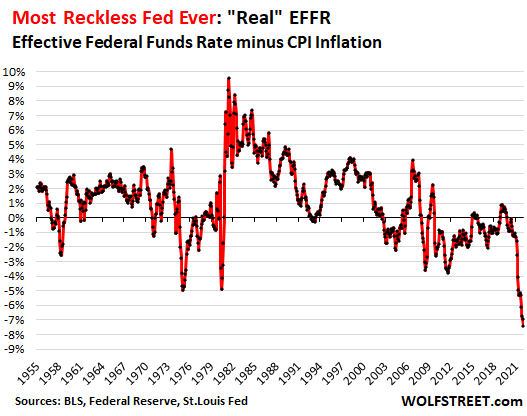

In “real” terms, adjusted for CPI inflation, the “real” EFFR is a negative 7.4%, the most negative real EFFR in the data going back to 1954. This is the result of policy error after policy error:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“I don’t think this is shock-and-awe,” Bullard said about the 50-basis point hike, as markets are already pricing it in. “I think it’s a sensible response to a surprise inflationary shock that we got in 2021 that we did not expect,” he said.”

How is it that Bullard “did not expect” it, but little old me did? I may have been born on a Wednesday, but I wasn’t born yesterday. These guys are lying through their teeth the whole way.

Because Bullard is lying.

The Fed is hoping the market will raise interest rates so they don’t have to.

WES

“The Fed is hoping the market will raise interest rates so they don’t have to.”

That is kind of happening now, but so late, …. damage irreversible. Powell wants the market to be the “bad guy”, not he.

Wake me when the PURPLE LINE is at or above the RED LINE…in the Fed Funds vs. CPI chart offered in this article.

I tend to agree with you.

Recently resurrected opinion, familiar to many and probably true, reminding readers that if the inflation methodology used in 1982 was applied today, the actual CPI level would be approximately double the published headline figure. This is quite pertinent to the “CPI Inflation v Federal Funds Rate” chart above.

Contingent on persistently high forward inflation, if the market takes control of interest rates, it will steamroller over any contrived inaccuracies and push rates to a level in excess of the ‘true’ inflation rate; circa 15%. A dramatic form of price discovery and mean reversion may lie ahead. Presumably, the Fed would have to follow the market and increase the Fed Funds Rate accordingly. Not to do so would magnify a lack of authority, control, credibility and relevance.

I have no idea whether in 1982 Volcker led the market or was actually forced to follow it. In today’s context, it’s difficult to see how even the most broad-shouldered leader, operating in a committee structure, could voluntarily and independently act so proactively and decisively.

@AB, “if the market takes control of interest rates, it will steamroller over any contrived inaccuracies and push rates to a level in excess of the ‘true’ inflation rate; circa 15%”

This is impossible, much of the US debt is short-term duration now (median under 5 years, IIRC). Suppose within several years 1/2 the US federal debt had to be rolled over at 15%, that’s 0.15*15T = 2.25T per annum. And that’s just federal debt, not to mention the rest of the bond market.

The Fed would simply monetize all issuance before letting that happen. I think the currency and therefore country is on its last legs, something like the USSR before it collapsed. I hope I’m wrong and just being foolishly hysterical.

How is anyone surprised that 11 trillion of money printing, with Powell running down the street shoving bags of money in anyone’s hands who will take it, would cause inflation?

Exactly!

exactly

exactly

Just for fun I plugged a 7% 10 year rate plus 3% equity risk premium into a dividend discount calculator and get S&P worth about 700. It’s not going to take many rate hikes to blow up the wealth effect. Zirp makes valuations grow to the sky, but it’s a bad policy.

Wow. We all know the effects but to see the actual number has a profound impact.

Another aspect, how much carry trade financed leverage is there in the stock market. Those guys take their ball and go home at the first sign of a fair market. The Fed has got to be worried about what price discovery looks like.

The 10 year is not going to 7%. The consumer is feeling inflation and we are going to enter a long slog of reduced spending. Lower profits will be what drags down the S&P.

You never know what is going to happen but 10 year going 3 or 4% is all it’s going to take to chop market in half.

Been several times in history that it takes about 90% equity loss to clear the rot out. Once in US, once in Japan, at least once in France.

How about $800k loan at 2.7%

Fannie, fredddie and other crack headed government agencies love them.

Grab your seat and some popcorn. The show will be great, the tears will be real. No acting.

Bullard made “immature and unprofessional” comments = modified limited hangout = ‘Bullard makes gaffes’ = let’s see what happens, then we can back out of it, the market will take the .25% times 7 as ‘what a relief’, not so bad etc etc.

Someone has to float it; I guess it was his turn to sit on the naughty step.

DC…..In the best English my foreign born mom taught me……Yep…..the bastards.

what did they expect, please print that expectation. It might be the meme of the decade…

flying into fog is never good, especially at full speed

The federal reserve is a slave to wall street .

Main street, bonds, and commodities can go die. Wall street can stand competition.

Who would want to loan for 30 years at 4%? Only a sucker would take that bet in this environment.

Why?

Because math.

And yet six months ago…they were lending at under 3%.

The Fed has spent the last 20 years trying to centrally manage the economy using a tiny number of incredibly imprecise tools (which amount to printing gobs of money unbacked by any new real assets).

This is the equivalent of trying to steer a supertanker through the Suez using your dong.

I could do it.

LOL 🤣, by reckin!

Damn it Djreef, only after you have finished holding my beer… We had an agreement!

Remember reading about 20 years ago that all future economic growth had already been spent by promises Congress had made. Since then it’s been mostly a banana republic with the Fed trying to keep the illusion going. Politics is going to get uglier than ever.

If you are old you have to store your nuts somewhere.

Wife’s purse

Old School:

Couldn’t resist:

“When you get old you’re lucky if u can find your nuts!” LOL!

(They seem to disappear just like you’re bank balance!)

You would if you got the funds to lend from the fed at 0%.

Well if you can just originate and sell, then sure why not?

If you don’t have to portfolio your loans then the math DOES make sense.

Banks who can sell the loan on to Fannie Mae and let the government take the interest rate and default risk.

Thank you.

When it is other people’s money being lent? Anyone without morality. And that describes *a lot* of people today.

Wolf, can you resurrect your Sunday podcast? Our whole family would listen to it around the dinner table.

‘This is Wolf Richter of the Wolf Street Report, bringing you the stories behind business, finance, and MONEY.’

It has not been buried. I just haven’t had time in a while. It takes all Sunday.

easily solved!

Delegate it to (djreef)!

He’ll do awesome job of it!!

Provided , he doesn’t use his ummm

Dong 🤣🤣🤣

Your financial writing is 10 on a 10 scale. Your Podcasts were high quality as well, but I think you are gifted as a writer. Excellent niche market. Plus all the graphs. Always about the graphs.

Definitely agree about the graphs…they provide historical perspective and highlight correlations in a way that simply cannot be done as well using verbiage (the big picture – and key details – can easily be lost in an avalanche of words).

Wolf is a fine writer too…it is simply the nature of communication.

Yes .. the graphs. Where can i get those?

Thank you for beeing a beacon in this strange times.

The Fed needs to print more Sundays then.

I second that wish. Love the Sunday shows. On a separate note, we have discussed the 1970s inflation here. What about the 1950s date you mentioned as far as the spread between inflation and the Fed rate? What was the context of that situation and how did it play out?

Nothing special happened as far as I know. That’s just the beginning of the data.

The data for the EFFR begins in 1954. The monthly data for CPI begins in 1947. There was CPI before 1947, but I think it was either quarterly or annual, not monthly.

You spend a TON of time editing. That creates a perfect final product but, there are diminishing returns in terms of our enjoyment and your time. If you spend half as much time editing I bet we would still enjoy 95% as much. I learned this is my last couple years being an online professor. A sneeze is something I have learned is no worth editing out.

Planning, preparing, doing it, editing, uploading for podcasts, converting it for YouTube and uploading it to YouTube, getting it all posted and polished and done, and then doing the transcript. I think my record was 6 hours.

Wolf,

Why doesn’t the Fed focus on running off the balance sheet as opposed to raising short term rates? Wouldn’t this get rid of a lot of bond market distortions and make their job easier going forward?

This would have the added bonus steepening the yield curve rather than flattening, too.

Thanks,

Kevin

I think they’re focused on it alright. Bullard was pretty clear about that today. I think they should get aggressive with it to push up long-term yields, so they won’t have to raise their short-term policy rates by all that much. They have this tool (selling assets), and they should use it.

When do you think the banks will start offering attractive interest rates for savings accounts, or do you think the Fed will actively delay this help for few-to-no-stocks-fixed-income folks?

It seems to me that, from the Fed’s point of view, herding as many people with cash out there into stocks instead of CDs and savings accounts has been an integral part of their modus operandi for at least 20 years. So, I expect they will cling to that MO order to avoid a vast stock market selloff as long as they can.

What do you think?

I don’t think the Fed is now going to worry about that. It has plenty of other worries on its hands. But here are some additional thoughts:

Many big banks sit on huge amounts of cash which they deposit at the Fed to earn 0.15%. They’re in no hurry to pay savers more than they get from the Fed.

But other banks need some cash, and they already offer more: American Express, Goldman’s Marcus, etc. already offer 0.5%, hahahahaha, but that’s better than 0.001%. Some credit unions and smaller banks might offer more too.

The problem for savers is that the Fed has created too much liquidity. Until that liquidity is largely unwound by the Fed via QT or burned up by the markets, banks are in no hurry to pay you more. So this will drag out.

But once the Fed raises rates a few times and has started QT, savers should start shopping for higher rates on CDs. Right now, the better 1-year CDs are still only in the 0.8% to 0.9% range. Six months from now, that might be 1.5% or more.

In addition, savers can open an account with the US Treasury (treasurydirect.gov) and very easily buy Treasury bills, Treasury notes and bonds, and I-bonds. One-year T-bills already yield over 1%; I-bonds, which a very unique inflation-adjusted variable-rate savings products, currently yield over 7% ($10,000 limit per year per entity).

As the Fed raises its rates, savers need to keep their eyes open.

Made me grateful to lock in a dedicated savings at 2.8% for 5 years before this whole thing went haywire.

You can get bonds that pay the CPI inflation rate by buying US I-bonds. And you can open a Treasury Direct account to get better rates than all but a few banks are paying on CDs.

Seems like to me you would try to reverse what you did. Fed went Zirp and then QE. Seems like if you were rational you would QT and then when done raise rates. They are making it up as they go. They will not run balance sheet down far, as that debt has been monetized and will stay on balance sheet forever.

The Fed is flying the plane while they are building the plane.

NEVER has this happened….and all decided by the unelected, and more importantly UNBRIDLED.

How can an unelected committee sit behind closed doors and WHIMSICALLY decide to expand the money supply, of the United States of America, as they did? (40%)

Decades of restraint and responsibility cast to the wind by the Fed people of the era 2008 to present.

It is time for HARD guard rails for the Fed ala the Taylor Rule.

Money supply expansion tied to GDP

Fed Funds tied to INFLATION

or something in that vein. Too much latitude for the Federal Reserve, and too many insider games.

End the Fed. Let markets decide interest rates.

No they arent making it up. Its the plan.

By raising rates first, they will be paying billions in interest to the banks for the reserves which is criminal.

Makes sense what you say, Fed should unwind QE first then raise rates but there is nothing in it for the banks. Fed is a criminal syndicate.

“In “real” terms, adjusted for CPI inflation, the “real” EFFR is a negative 7.4%, the most negative real EFFR in the data going back to 1954. This is the result of policy error after policy error.”

Is it really an error or was it intentional? Jerome Bowel stood up before the country, repeatedly, and told us he was going to “let inflation run hot for a while.” And he did just that. How in the world was the head of the FED able to stand up and tell us he was going to ignore his mandate and engage in such an outrageous act of malfeasance with nary a question from anybody?

Folks, we’ve just been had. This was the greatest ripoff of all time – the biggest wealth transfer in the history of the US, and maybe the world. This is the stuff of banana republics. And several FED officials were caught day-trading – front running the markets on inside information. Heads need to roll. Perp walks need to happen. “Something is rotten in the state of Denmark.”

We have been had for decades.

Yes, and gold fell 1% today because real interest rates are becoming more negative. Gold stocks fell over 4% today. Guess we live in a virtual world now.

Wes, not sure where you’re getting your data, but gold did not drop 1% today.

For 2022, stocks are down, bonds are down, cash is flat at 0%, cryptos are down, but gold is up, not much, but up.

Wonder how long before folks notice GITA has knocked over TINA?

(Gold Is The Alternative vs. There Is No Alternative)

Gold (as WS points out) has also gone up in the face of rising rates recently, so I wouldn’t get too caught up in it going down a bit here.

Myself, I’ll likely add to both gold and US treasurys on dips as things stand (Miners not so much, as they’ll likely go down significantly too if stocks tank properly). Knock another couple of percent off gold today and I’ll probably be a buyer in this environment.

Please use “Powell.” Bowel was cute once, but we need to stick to the guidelines of not calling people names.

So, we have to refer to a change in interest rates as a Powell Movement?

zing!

Zap! Ouch! POWell!

Dave, love the “Powell Movement” concept!

The Fed typically moves in multiples of 0.25%, but the Fed prefers small moves.

A true Powell Movement will have to be larger, and to keep the math simple it should simply be a 1% change. (I tried writing about recent rate moves using 0.25% as the unit, and my head started to hurt.)

So now we can say “The 5-Year Treasury has had a full Powell Movement since September,” and “The 2-Year Treasury’s first Powell Movement of 2022 is nearly complete.”

Hmm…

Wisdom seeker,

you’re on to something here!

That was hilarious – Thanks Dave for the concept and DC for the seed idea!

This Powell Movement concept deserves to go viral after all the cartel has done for the last decade and a half.

I think so. It’s basically a sophisticated flim flam ponzi Mississippi bubble scheme so that wealth flows where DC wants it to and citizens can’t really figure out all the ways the goose is getting plucked.

Fed is probably going to try to super manage situation by eliminating leakage in their model by tightening up on cash, crypto and gold. Can’t have too much leakage out of the system.

Old school-

Good post, but…

“Film-flam” yes, but “sophisticated” NO!

Governments have been fleecing the populace through money manipulation and capital controls for millennia.

It’s more like a B-class movie rip-off.

Inflation is a RACE TO THE BOTTOM…

How can it be anything other? It is a steady decline…..

and the Fed promotes it

And they are a valuable institution?

the “real” EFFR is a negative 7.4%

Hidden tax rate on savers, and transfer to debtors and bailout recipients. To date, I got taxed more by repression and inflation than I got in stimmies by a long shot. Some folks were legitimately caught wrong-footed by the pandemic, and got some relief. A bunch of high fliers dipped into that pot, at scale. As in ’08, and in other postwar examples, a badly designed playing field was exploited rapidly and bigtime.

One thought I have is during last full stock market cycle the average 401K holder did very poorly. If I remember correctly they would have been better off just buying CDs.

I have to believe by the time this cycle is over it’s going to be much the same. The early investors in all the trash floated in IPOs will be in the mansion on the beach while many retail investors get wiped. Heck, might happen to me as it’s very difficult time to invest.

I have zero faith in any numbers coming out of the financial sector or their puppet overseers. Down here in my world, interest rates are 20-50%, food prices have doubled in 5 years and are still rising, rents are rising beyond wages, terminated workers are charged $18K for COBRA, and even the more affluent middle class is cutting back. So, do I believe the fed or my lying eyes?

The recounting of fed policy is a waste of time to me. They will tell the lies they have to tell to protect their interests. I would much rather hear boots on the ground information, whether it’s from someone buying their third sports car or struggling to buy food. That’s the economy I want to know about.

A couple with two work from home jobs moved into my 55+ community. Not everyone is cutting back. Hotels are booked solid for the winter tourist season. A waterfront restaurant parking lot was full. Doctors are booked six to eight weeks in advance. Remodeling contractors are booked six to eight weeks in advance.

Petunia,

Then why do you come here? It seems you’re in the wrong place — because all the things you’re not interested in and have zero faith in is exactly what this site is all about.

I don’t engage as much as I used to anymore. The degree to which people still believe in the markets is what I find fascinating.

Maybe Petunia is so upset, because you do such a great job in revealing the facts, and laying bare reality for all to see. I certainly at times, feel her pain!

Many of us are really frustrated, and in different ways. You can see that among many commenters here. I totally get that.

I didn’t get the vibe that Petunia was discounting you, Wolf, more like the nonsense that the government tries to pass as fact. I like reading Petunia’s comments.

Depth Charge,

I get really tired of “the data are all lies” comments. Those comments are silly, boring, and thoughtless. If that’s the only thing on a commenter’s mind when they comment here, I think they would better off not coming here. And I might start deleting those comments. On second thought, I think I will delete them, I’m becoming enamored with that idea.

The metrics posted here can be used as a reference to accurately interpret the heinous level of mendacity coming from the Fed. Their lies have a certain consistent method to them. We-the-people in the real world must interpolate the numbers as they come in. I am certain Wolf is helping us do that. Nobody here was born yesterday, Petunia.

@ Petunia –

“Food prices have doubled in 5 years” – Wolf covered that, at the national level. A lot of people here have been saying their costs are rising faster than the official average. I guess I’m doing okay since a gallon of milk is still cheaper than a gallon of gas, but a lot of the fancier “processed” foods, and meats, are definitely way up. Never thought I’d live in a world where hot dogs got too expensive!

“Rents are rising beyond wages” – Wolf covers that, for a lot of cities too. Personally I’m lucky to own a home, so I watch the market price estimate, and I know that when my home is “making more money than I am”, like it did back in 2005, there’s trouble ahead for the whole country. High rents and high prices aren’t sustainable but you gotta endure the squeeze until something cracks and things get better. I do wish they’d put “rising property taxes” into that CPI statistic though, dammit!

“Terminated workers are charged $18K for COBRA” – that’s obscene and would be worth covering. Healthcare expenses vary widely from person to person, but the damn system is so complicated you can’t understand it except by hearing what other people tried and suffered. Healthcare also isn’t covered properly by the inflation statistics either.

“Middle class is cutting back” – Wolf’s been covering that, particularly for autos and housing. I don’t have a big story of my own here, other than it sure helps to have a hybrid when gas is $4.90, and my best investment of the past 10 years was probably a water filter, so the water tastes good at home and I’m not so tempted to buy drinks.

The Fed policy thing matters because the prices and rents have finally gotten so big that the elites are in political danger. When that happens, they take action. Some of those actions are helpful to some, but usually they have hidden costs to others, and anyway we all know that usually politicians and economists are clueless, so they’re going to just flail around. Eventually, most likely thanks to the real folks who actually do work, things will get better. (Sure wish the government would let those folks get on with it, instead of trying to tell them they can’t work because of some so-called “Science” which the gov’t don’t follow themselves and no one understands all that well anyway!)

But in the meantime it’s important to me, and I guess to others here, to anticipate the political flail-around and try to get out of the way! Other people here run small or medium businesses, or work for larger ones, and they need to know what’s coming so they can plan ahead and not get smacked down by a Flailing.

Yesterday we had a guy post here, wondering if he was ever gonna be able to buy a house. If the Fed finally raises rates, house prices will come down, maybe he gets a chance?

Retirees here are wondering if they’re ever going to get any interest again on their savings. If rates go up, they won’t get much, but maybe they’ll get something?

As for me, I know I’m lucky, I’ve got a good job and can work hard without too much BS in my life, but I’m trying to save for retirement and I really don’t want to have my savings get run over (again…) by a market crash. If the Fed doesn’t raise interest rates we’re screwed, and if they do raise ’em we’re screwed, but what we gotta do in each case is different, so it matters what they’re gonna do.

I’d tell you about buying my 3rd sports car but I’m frugal! But thanks to Wolf I saw the car shortage coming so I bought that hybrid earlier than I would have, and saved a bunch of money.

My struggling-to-buy is now about finding the right thing. This supply chain crap pisses me off because it’s damn hard to find a good pair of shoes, when the old ones wear out, because the old kind’s always backordered and I’ve got wide feet so most shoes are useless. I just did my bit for the inflation by pre-ordering shoes I don’t need yet, just to make sure I’ll have ’em when I need em. Now I’m asking myself “what else am I gonna need, that i won’t be able to get when I need it, and what am I gonna do about that?” That’s a long list… and a good reason to simplify life so we’re not so dependent on stuff that maybe we can’t get easily.

The place I work is short on good people, but I know that job security is only good until the next recession, and the Fed tends to trigger recessions by raising rates, so I kinda wanna know what they’re gonna do with the rates.

Actually, I think we all know what they’re going to do, it’s just a matter of when and how much and how fast and what else does that Big Flail break in the meantime?

Besides, if the Fed doesn’t raise the rates, the rates will go up anyway because no one with any brains will lend their savings at 2% when they can make more money buying shoes or cars or whatever and selling them for 10-50% more in 6 months… and hopefully a few of the smarter ones set up factories so we have more shoes before my next pair wears out!

Good post, Wisdom Seeker. I’m at the stage where I’m investing on behalf of my children (and yet unborn grandchildren). Other than that, my interest is purely academic — I’m still grappling with basic questions about how all of this works, and I find Wolf’s perspective and data useful in that triangulation.

Maybe it’s very location specific. I live about an hour outside of Raleigh in a town of about 20,000. Housing has really went up in the last year so that something I consider decent is $250,000 instead of $200,000.

Rent for very nice one bedroom apartment up from $800 to $830 this year according to a friend.

I have just stayed seeing inflation at my discount grocery store Aldi’s, but it’s still reasonable imo.

Several people I know work for tech firm’s or are engineers and are doing well.

Nearly everyone is looking for workers in retail and manufacturing. Those working are doing a lot of overtime best I can tell.

Petunia

King Crab claws, $49/lb at Safeway

You know Fed has goofed up when digging gold out of the ground has a higher net margin than 90% of businesses. It’s at about 17%. I think Apple is only at 23%.

True. But then, it is part of their religion/ideology to consider anyone but their owners among the wealthy to be “disposable”.

The celebrated social theorist and geographer David Harvey explains that neoliberal ideology serves the following principle:

“There shall be no serious challenge to the absolute power of money to rule absolutely. And that power is to be exercised with one objective: Those possessed of money shall not only be privileged to accumulate wealth endlessly at will, but they shall have the right to inherit the earth, taking either direct or indirect dominion, not only of the land and all the resources and productive capacities that reside therein, but also assume absolute command, directly or indirectly, over the labor and creative capacities of all those others it needs. The rest of humanity shall be deemed disposable.”

If the above isn’t Capitalism = Social Darwinsim, I don’t know what is.

We don’t have “Capitalism,” we have “Crony Capitalism.” They have nothing whatsoever in common. In fact, “Crony Capitalism” is like a Socialist/Fascist hybrid.

@Depth Charge

The adjectives to Capitalism change and some variants are less socially destructive than others, but the basic ideology of Capitalism, which cannot be rationalized as ‘invisible hand good for society’, is as follows:

The purpose of any and all Capitalists is to concentrate wealth in the fewest hands in order to dictate product prices. That is de facto concentration of wealth. That is de facto support for central control. That is de facto monopoly. The Fascist version, like the Crony version of Capitalism, is a more extreme example of this price dictatorship.

The claim that Capitalists are “against” anti-competitive government central control conveniently ignores the fact that it is the Capitalists that corrupt the government to stifle competition AND game the tax code so Capitalists can play their corrupt “unearned income” low tax game. All this is evidence of a morally bankrupt Social Darwinist ideology.

Read the following and tell me Capitalists do not think that way, regardless of any lip service they give to “ethics”:

Social Darwinists believe that ethics based principles are ‘limitations pretending to be virtues’. To them, ethics are ‘feel good illusions’ that humans invented to pretend our species has empathy. To Social Darwinists, empathy is irrefutable evidence of inexcusable weakness. To them, all who are guided by ethics are deluded fools that should be eliminated from the human ‘apex predator’ gene pool for the “good” of our species.

The reason I say all this is that too many otherwise objective and decent people are all too willing to sugar coat those greedy invisible hands out there corrupting our government and each other.

“Capitalist ideology claims that the world is perfectly ordered and everybody is in their place (i.e. everybody gets what they deserve). This self legitmating aspect of Capitalism is Socially Catastrophic. This is the Victorian view of the world.” Rob Urie – Author ” Zen Economics

DC

Wait till you see the three new Fed governors coming in to replace the losers that are now departing. They are worse. Say goodby to the USA.

that started in 2007…..all the vanity sheep of America never cared….its more important to load a fight video on tik toc….

I protested the fed in San Francisco with about 250 others in 2007, even got my youtube fame when it was a young video channel, we had permit walked down market to union square from fed building. No one cares, its a vanity nation of sheep…We are screwed

the 250 was old and aware of what was coming, the sheep were blind and dumb

As long as we’re teetering over the edge of The Falls at 1929 Mullholland Drive, perhaps Bullard can give us his best Al Jolson impersonation…”There’s a rainbow around my shoulder, And a sky of blue above, And I’m shouting so, the world will know, That..I’m…not a dove!”. Notice to Patrons: This theater is closed for repairs. Soup line forms at corner.

Wolf on the mortgage rate graph did you mean May 2019 not May 2009 for hitting the 4% mark?

Side note: When does the reality set in for the average person? House prices and their insane increases are not sustainable, PE ratios of 50+ are not sustainable, goods price increases of 10%+ are not sustainable, vehicle price increases in the 30% range are not sustainable.

I am a millennial who has no debt and would love to buy a house, or car that isn’t 25 years old, hell start a family? The figures you provide point to nothing but looming disaster, I don’t know what to do other than keep my debt low, drink like my liver is made of steal, and keep working my day job while building my cafe racer to keep my mind off this insanity.

When something breaks and prices drop, or maybe the other way around. Homebuyers in my neck of the woods haven’t responded to raising rates. I think the assumption is that prices will keep going up, and when prices are going up, people can afford to make mistakes in the market. Sooner or later something breaks though, and the economy becomes a bizarre game of musical chairs.

Maybe prices will go up forever, that would be odd though.

That’s all you can do. It’s essentially what I did in the late stages of the 90s dot.com bubble when I was your age. How this one ends, who knows? It’s a never ending series of bubbles blowing up and bursting.

Cem, I was in your shoes many years ago. What worked for me was to keep expenses low, stockpile cash, and be in a good position to buy when prices returned to sanity. You’re fortunate to have no debt. Drink water and save $1000/year. Cultivate hobbies that are cheap, or even slightly profitable, rather than expensive.

Odds are good that within a few years you’ll be able to buy a fixer-upper house or condo with a credit card (i.e. under $20K), at least in some parts of the country. Detroit, Phoenix, Vegas, Miami all went that way in 2009.

Good point WS!

Friend in ”flyover” was buying small 2br, 1ba houses at the courthouse steps for $3-4K,,, yes, three to 4 THOUSAND dollars TOTAL at that time.

He usually had to put in another couple THOUSAND, then either sold them around 6-10 times his costs, or rented them out and mortgaged them, then went and bought again.

Retired guy with lots of time on his hands, but started with just a few thousand cash, from SAVINGS.

Heck, here in Spring, Texas in 2010 when things were in the tank, I bought a 3 year old 2,000 SF brick and Hardiplank, 3 BR, 2 Bath house in a nice neighborhood for $64/SF (paid cash).

These deals were everywhere then. Daughter and her husband are living in it now.

Unless the real estate market goes bust in China that can never happen. Too much foreign money coming in from China. Prices are irrelevant to them.

Keep doing the right thing and try to build your net worth a little every year and try to enjoy life along the way. Sometimes tide goes in and sometimes out, but keep paddling.

We have had fantasy valuations based on temporary Zirp. Eventually things will get repriced based on true cash flows at sustainable interest rates.

Same here. I just stack the paychecks in the bank and let em sit. Renting a tiny bedroom for 600/mo and the rest of the bills total up to under 1k a month if I don’t eat out much.

When it goes tits up I’ll be set to have a house paid for by 35 easy. If it doesn’t go tits up and we become a renter society, I’ll have plenty of money for drugs. Who wants to live past 40 anyways amirite?

Stacking checks in the bank. Those checks, money become the property of the bank to use as they, see fit. Preserve your wealth outside banks control. Au, Ag.

LMAO love this.

Cem,

Master compound interest.

Don’t lay your bike down.

The unsustainable won’t be sustained.

Now is not the time.

Consider moving to a younger country.

Don’t listen to old farts.

As a boomer, I kept the house and passed on the rest of that crowded trade. Why aspire to be a drone pulling a cart, I wonder, to spawn workers and soldiers and tax farm serfs. Cynical but my liberties are grand, my horizons still open. I’m out for a run, just now! And if you want a friend, get a video game. And not one that will nag you for more money. Dogs are too clingy and expensive. Being ambidextrous in aspirations can be a revelation.

Cem-

You’re asking the right questions… the above comments are good.

I’d add the reminder that with the same house payment you’re better off with higher interest rates but lower purchase price due to fact that you effectively get a do-over (re-finance) on mortgage rate if/when rates decline at some future date. So the insanity of today’s market rate increases work for you.

Also, as you’ve seen repeatedly on this sight, Rates don’t go in a straight line.

Of course there’s no guarantee that higher rates immediately transmit to lower house prices…

Good luck/hang in there.

Oops

Meant to say “market rate increases work for you.”

There are two realities that have been suspended.

The first is the one you mentioned, asset prices.

The second one is mostly ignored here. It’s the future deflating of inflated American living standards from the same artificially cheap money and loose credit standards.

There isn’t one without the other.

“The figures you provide point to nothing but looming disaster,..”

How would a 30% decline in home prices be a disaster for you, a potential buyer sitting on cash?

The existence of the FED itself is a human policy error reigned down upon us by some very corrupt and evil people.

There should be no monetary policy at all. There is no correct price of money (interest rate) any more than there is for anything else.

“. The printing press allows the government to tap the property of its people without having obtained their consent, and in fact against their consent. What kind of government is it that arbitrarily takes the property of its citizens? Aristotle and many other political philosophers have called it tyranny. And monetary theorists from Oresme to Mises have pointed out that fiat inflation, considered as a tool of government finance, is the characteristic financial technique of tyranny.”

mises.org

That is one negative EFFER.

And last time after negative EFFR, it required significant positive real EFFR to bring inflation back down. Do you imagine the Fed has the backbone to raise rates above 7%? Markets will puke before then.

If the 10-year rises to just 4%, the S&P 500 is worth about 3600 assuming flat earnings in 2022.

One way or another the Fed is going to impale itself on its reckless , criminal and immoral policies. Independent my ass ,The Fed has been a dutiful bitch to Congress but now shit has hit the fan. Congress will give a twist to the sword and push them off the stern of the USS Repression . The Congress will blame we the people and the Fed but they will not take any blame themselves. This is one of the main reasons Congress created the Fed. We the people have let ourselves be divided by these devious and manipulative bastards . We the people have to agree on sound money or we lose the republic. We can resume going after each other’s throat after we fix our money. People of modest means all need sound money.

DR DOOM

“The Fed has been a dutiful bitch to Congress”

and to Wall Street, let’s not forget. Both feasted off of unrealistic policies…

the Fed was HIJACKED and morphed from holding to their mandates to answering to a different power. (I have my guess)

There was little outcry when the Fed blatantly PROMOTED INFLATION…2% seemed so inane. But even 2% rips 22% off the dollar in ten years….stable prices? NO.

It is inconceivable that an unelected body could have the power to expand the money supply as they have…..and those who are charged with overseeing the Fed, the Senate Banking Committee, enjoyed every dollar! Sherrod Brown, in the last hearing, focused on Social issues rather than the crucial events and decisions of the Fed. Senator Brown also had a big spending project in Ohio named after him, funded with……QE money.

So, in a system built on “checks and balances”, where is the “check” on the Federal Reserve?

Thanks sl mjuch Wolf for coming out with the answer to my question re “How Bond Mkts reacted today”…at the close.

I had no idea, but because you really jumped on it & nailed it, NOW I

KNOW exactly what I need to know for tomorrow going forward to next Weds, 2/16.

You see, I have a stock whose ex-doivodend date is 2/16 so I think I’ll sell it before then, take the higher tax on capital appreciation & forget about the dividend!

This mkt is getting way to volitile and risky! Time to play defense. In a bear market it’s not how much you gain or lose, but losing less than the norm.

By the way, Wealthion just had a fantastic interview with a Swiss multi billion $ mgr. named Felix Zulauf that anyone with $ in the mats would be well to listen to! It really lays out the MACRO-view with v very specific timelines.

Thomas Sowell@ThomasSowell

Tweet: One of the biggest, and one of the oldest, taxes is inflation. Governments have stolen their people’s resources this way, not just for centuries, but for thousands of years.

11:26 PM · Feb 10, 2022

Tweet: Income taxes only transfer money from your current income to the government, but it does not touch whatever money you may have saved over the years. With inflation, the government takes the same cut out of both.

Tweet: It is bad enough when the poorest have to turn over the same share of their assets to the government as the richest do, but it is grotesque when the government puts a bigger bite on the poorest. (2) This can happen because the rich can more easily convert their assets from money into things like real estate, gold or other assets whose value rises with inflation. But a welfare mother is unlikely to be able to buy real estate or gold.

~I get it. This guy is just too smart, too rational, and says too many inconvenient, yet easily understood, truths, to ever be put into a position of real power where he could do the most good. But I mean, darn!…we can at least dream, “Wouldn’t it be great if…”, right?

10/10, like this website’s long-time insistence, in spite of all the naysayers, that rate hikes ARE coming, and soon…

This guy WAS too smart……rich in common sense. Would have been a great Fed Governor…ala Hoenig.

He also said…

“It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.”

like the Federal Reserve.

The Fed needed to hike in late 2020. All this sturm and drang about shock and awe rate hikes in early 2022 wouldn’t be necessary. After behaving for years as if there are only consequences to rates being too high, the Fed is belatedly discovering it was wrong.

Wolf, can you resurrect your Sunday podcast? Our whole family would listen to it around the dinner table.

‘This is Wolf Richter of the Wolf Street Report, bringing you the stories behind business, finance, and MONEY.’

In a smart country like China where they do care about common prosperity and not just the prosperity of 1%ers, all Fed members would have been thrown in Jail for the blatant crime and lies and corruption. Their key mandate is stable prices and they are so far off from even the cooked up CPI number that it is shameful.

And only in US would they re-elect the crooks.

If the Fed really does go for surprise 50 point hikes, and the bond market goes from bearish into genuine panic mode, I wonder whether some prime mutual funds will be forced to “break the buck” in the next month?

Curious that stories are now floating that Banks will not raise the savings rate if the Fed raises Fed Funds.

The hits just keep on coming.

“A banker is a fellow who lends you an umbrella when the sun is shining, only to ask for it back the moment it starts to rain.”

Or some such.

> whether some prime mutual funds will be forced to “break the buck” in the next month?

My understanding is, these funds are short-term funds lent to strong credits. So why would this happen, unless there is a full scale run on major parts of the financial system? Yes, some debtors have to roll their paper and will be exposed in time as poor credits. But I don’t see it happening there, now.

“…these funds are short-term funds lent to strong credits…”

Don’t be so sure. The same was true in 2007. It turned out that the huge PRIME fund had invested in Lehman debt which became worthless. A run on the fund resulted. Well connected people got out in time, the little guys got stuck. Their money was locked up for 2+ years and they got back 96c on the $.

phleep,

Money market funds are bond mutual funds that invest in short-term investment grade securities.

What might cause money market funds to break the buck?

1. Potential credit risks, but they’re low at the moment.

2. When short-term interest rates fall below zero, such as the one-month Treasury yield. This was starting to happen in the spring of 2021, until the Fed started the reverse repos and paid interest on them. Money market funds are the biggest counterparties of the RRPs.

3. Most importantly — and this is structural: Money market funds are at risk of “runs on the fund,” when investors, having been promised daily liquidity, pull out their money, and the fund then becomes a force seller of its assets, which will cause prices to drop, and the fund will break the buck, which can trigger a panic.

Regulators and the Fed have for years pointed at the structural weakness of money market funds. This weakness is that they promise daily liquidity but are invested in securities that are often not that liquid and cannot easily be sold in large quantities in a short period of time.

Regulators, which have been dragging their feet, will eventually come up with new rules for money market funds, that will likely include a provision of either valuing the fund however its value goes, where it can routinely sink below the “buck,” or regulating “daily liquidity” to where investors cannot draw their money out at will. Or both.

I’m just a regular guy with some savings. Finally, the turn…

Wolf, I know you don’t consider ZH as reliable source. However, everything is possible. How likely does the Fed raise the interest rate as an “emergency”?

I was kind of thinking Sunday afternoon. Wishful thinking, probably. I don’t think it will happen. That would be a bridge too far for this Fed. But I’m nevertheless going to check Sunday afternoon :-]

Let’s have a contest as to what the EFF rate will be by December 31, 2022. Winner gets a free Wolf Street mug personally signed by the Wolfman in permanent ink. The kind that the Fed uses for policy changes. Backlogged until June of 2023, but smart readers are patient.

One can almost smell panic in the air at the Federal Reserve.

Since I forecast a 50 basis point rise in Fed Funds at March meeting weeks ago, and won a trip to Buffalo in March, I think the EFF will be 2.75% by year-end and over 5% by 12/31/23. Still way, way, way below the reported inflation rate most likely coming to a venue near you and me, but much higher than even the Pennsylvania Groundhog saw on January 1st.

Would not be surprised if an emergency RISE occurs before March meeting, and, drumroll or eggroll, please, the balance sheet will be frozen immediately and then run-off by 25% before the bond holdings mature. Since I am also rooting for the Chiefs in the Superbowl this Sunday, I am really going out there.

The bond market has pulled back the curtain at the Fed, saw that the Wizard really has no clothes, is self-dealing in front-running personal account trades, and is much more interested in Wall Street than certainly Main Street. But the political winds on Pennsylvania Avenue are blowing hot at the Fed’s handling of inflation via Monkeytary Policy, and we all know who or what holds the puppet strings even on the Fed. About as independent as the credit-rating agencies.

Inflation will top 10% via watered-down CPI by September, 2022. Only going to get worse before it even thinks about getting better. Very messed up economy out there, and won’t even mention our Government.

David W Young said, “Since I forecast a 50 basis point rise in Fed Funds at March meeting weeks ago, and won a trip to Buffalo in March, I think the EFF will be 2.75% by year-end and over 5% by 12/31/23.”

If your predictions are accurate, the run on the dollar, staring this year, will be uncontrollable and it may lose its enviable status as the world’s reserve currency by 2023.

If the Fed wants to get real about preserving the dollar as the world’s reserve currency, then they need to get rid of their “prime” rate baloney and get banks to offer all of us a minimum of 10% (or more) interest on savings and CDs by the end of THIS year.

Yes, that will tank the ridiculously over inflated stock markets. So? That is a small price to pay for preserving the dollar.

I’ve got Cinn in the Super Bowl. 42 total points scored. $800 in the kitty

Wolf

“I was kind of thinking Sunday afternoon”

Half time at the super bowl…..and Snoop Dog makes the announcement…..

and the crowd fell silent.

FYI the ZeroHedge people are hyping a Fed Board of Governors (not FOMC?) meeting on Monday, but it’s a regularly held meeting.

On the other hand, the recurring agenda for many of these meetings happens to be “Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.”

So it could be more than just routine this time.

From the FederalReserve.gov website, “The Board of Governors of the Federal Reserve System is responsible for the discount rate and reserve requirements, and the Federal Open Market Committee is responsible for open market operations.”

“The Federal Open Market Committee (FOMC) consists of twelve members–the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. The rotating seats are filled from the following four groups of Banks, one Bank president from each group: Boston, Philadelphia, and Richmond; Cleveland and Chicago; Atlanta, St. Louis, and Dallas; and Minneapolis, Kansas City, and San Francisco. Nonvoting Reserve Bank presidents attend the meetings of the Committee, participate in the discussions, and contribute to the Committee’s assessment of the economy and policy options.”

So the Board of Governors isn’t the FOMC, it’s a subset of 7 but they’re the ones that control the rate setting.

Perfect…have Powell announce it at halftime of the Super Bowl…

You need steel balls to do that but this Fed has only displayed rubber balls, since Mar 2009. But then a good tight slap by inflation on the Fed’s face may help it develop them!!

“The Fed has compounded policy error with policy error ever since March 2020, with its interest rate repression and massive QE that it maintains even today, despite 7.5% inflation.”

It is nice to see that something (inflation) is able to twist the Fed’s arm (and squeeze till it hurts). I am glad the Fed is being taught a much needed lesson for the interest rate repression and QE policies followed since March 2009 (increased manifold in March 2020) thinking it can get away with anything. Not to mention the moral hazard, the pain inflicted on prudent people, making risk-taking a national and international level hobby and making the financial system fragile and forever addicted to the Fed’s money spewing tits.

I am glad that there is something man enough to squeeze the Fed where it hurts. Feels great!!

KPL

Who is getting squeezed?

Everybody but the Fed.

The holders of dollars, savers, earners are still be harmed at the highest level EVER! Note the chart Effective Fed Funds rate vs Inflation.

The Fed only has their reputations to worry about……for they have their wealth and inflation protected pensions……securing their future.

But what of the rest of us?

These Fed people are unabashed, and the three that got caught front running Fed policy is proof.

The candidates to fill vacancies is frightening in their focus OFF of the real problems, and focuses on Social issues.

They can kicked when the Taylor rule told them to tighten. They will do anything to delay a recession. Minsky law will catch up to them and unfortunately us

The Fed was loose for an incredibly long time and it did not manifest as excessive inflation. The dollar did not collapse. Their scheme worked in an equilibrium for a long time, priming the economic pump and distributing the disruption of the GFC across many backs. I finally complained they were bringing the punchbowl far too long, in 2017 and since, in a rising, repaired economy, tempting fate. But it is only finally exposed as vulnerable to this magnitude of shock (pandemic, where it kept the booze flowing and jacked it up). It worked somewhat, I think, until it fell apart now.

> it did not manifest as excessive inflation.

Inflation include full house prices until the 1980s. If they said red was blue from tomorrow would you go along with it or think for yourself?

It was not only the deceptions involving land and improvements. It has been very easy to hide true inflation by simply lowering quality of work and materials, or destroying durability. Prices may seem to hold on item descriptions, but you are not holding the same item. And since you have to replace it on a repitious cycle, the economy gives the false notion of real growth. Production may increase, but wealth becomes fake. So you dump your seed fund right back into this corporate farms game. After the rich remove all the ears of corn and sell them back to you as canned giblets, your investment is now in a field of dying stalks which are unlikely to yield much. And when was the last time you saw someone who was celebrating adding a thatch roof on their house?

That’s niblets, with a bit of “gads!”. (I gave the spellchick her pink slip…I can screw up just as well without the need of her inputs.)

The enraged bunny finally awakes and pees on the forest fire.

Does this pack of imbeciles really believe they have any credibility with anybody….except the media that pays them for their periodic updates of doing virtually nothing while Rome burns.

It must be a standard furious toothless gumming and laugh riot to go to work and just flap your lips and watch markets do what your mouth sounds tell them to do.

Some animals are more equal.

Let’s have a Me Day together, get a pedicure, and talk about equity.

Bullard, don’t talk about it, be about it! More fucking blather.

If they want the market to take them seriously, all the voting members should do a joint press conference where they declare they’re raising interest rates to 6% in 5 months, 1 percent a month, starting with a 1% increase today so that everyone gets the message, and then leave without taking questions.

Edit – better if it was 0.25% every week so that there’s a constant reminder and confirmation of their resolve

Exactly…telegraph the engine room to hold at quarter speed ahead and prepare to ram the bow straight into this damn icy “rock”. A collision that anchors you is a whole lot better than drowning in all their trillions of printed liquidity on your long journey down to the “hard place” at Davy Jone’s locker.

This

2019 housing prices were a disaster for young people.

From all your graphs we aren’t even getting back to that level.

Policy is still accommodative for wealth appropriation, not wealth creation.

And this is the only true “policy error” by the Fed.

yea rates are going up but at some point the fed buckles to Wall Street. The Volker fed ain’t returning! asset prices are all they have left. The top 20% keeps this economy going and if their precious stock market and real estate market collapses then the ” wealth effect” dries up. I know a lot of y’all are rooting for main street as I am too but our “leaders” go where the money is and that’s Wall Street.

The “wealth effect” is a lie – a propaganda tool created by the moneyed special interests to pretend their reverse Robinhood policies, which steal from the poor and give to the rich, are actually beneficial to society. That’s the way this den of rapaciously greedy vipers operates. They figure out ways to steal, then concoct wild fallacies as cover to perpetrate the fraud under the guise of doing well. They’re sociopaths.

1) The DOW, a shishlick on a stick. For entertainment only :

2) DOW monthly log. There is an uptrend line coming from Apr 2011 high to Dec 2013 high.

3) Jan & Feb 2020 were two failed attempts to reach that line.

4) June 2020 close was > Feb 2020 close. It was a good sign.

5) Apr 2021 crossed this line for the first time since Oct 2018.

6) Jan 2022 low took nine months SL, under Apr lows, when it breached June 2021 low.

7) Jan spike down might be followed by a spike up, for better cooking.

8 ) There are 27 months from Jan 2018 high to Mar 2020 low. The next high might be about 27 months from Mar 2020 low.

9) By mid year, Bon Appetite.

Perhaps Powell and Bullard can provide insight into how they are going to trade their personal accounts prior to any Fed announcement? That would provide some guidance, eh?

Great Charts!!

These charts demonstrate how the Fed has shirked their duties, taken a completely different course than previous Feds, and apparently was HIJACKED by some outside force.

It is with fond nostalgia that I look at the CPI vs Fed Funds chart and remember a Fed that kept the holders of dollars protected, that answered with rate hikes to do that AND tamp down inflation……..and NEVER PROMOTED ANY INFLATION!

We are in the bottom of the FIRST INNING in this game of dealing with inflation…….but I fear we might get a “rain out” ala the BOJ that vows to put a ceiling on rates at all expense.

The certitude of these central bankers/planners is BLINDING. They will risk the entire ball game to make CERTAIN they are proven correct…..and they arent. They refuse reality, and have no faith in free markets.

Double-header. Lost game one to Team China after a bad stretch against Team Japan. Winning game two will keep us in the running, but it’s a long season with all these new teams admitted to the league. Even if we get out of this one, we’re going to need to fire the manager and replace the entire line-up to stand any chance of being a contender. Anyone seen the peanut vendors?

Wolf wrote:

“The Fed has compounded policy error with policy error ever since March 2020, with its interest rate repression and massive QE …. 22 months of massive policy error after policy error.”

In Q2 2020, the US economy experienced its deepest GDP contraction ever by an enormous margin and the unemployment rate spiked close to 15%, a 70+ year high.

The Fed has a dual mandate – full employment – and stable prices.

If there was ever a situation calling for the Fed to use ZIRP and QE it was Q2 2020. If they weren’t going to use it then, then they should never use it ever under any circumstances.

However, by Q1 2021, it was clear that unemployment was back in a healthy range and falling rapidly towards NAIRU while inflation was above target and rapidly accelerating so QE and ZIRP should have ended in Q2 2021 and QT should have begun in Q3 2021.

So IMHO more like 11 months of obvious policy error not 22 …..

Dazed and Confused

“The Fed has a dual mandate – full employment – and stable prices.”

The Federal Reserve Act 1977 states that the Board of Governors and the FOMC should conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices,

and moderate long-term interest rates.”

They leave out the THIRD and play the dual mandate game….for the third mandate, moderate (not extreme) long rates prevents the game they have played since 2009. Don’t fall for the “dual mandate” misdirection play.

Yes the Fed needed to act. And Yes the Fed overdid it.

But just like Bernanke who said QE would halt when unemployment dipped below 6.5%……it never happened. The Fed only knows the “Entrance” …never the exit. Exits are “hard”….and exits should be considered prior to entry, IMO.

Dazed And Confused,

In a crisis, it’s the government’s job to step in with unemployment packages and other support measures. And this happened.

It’s not the Fed’s job to create the biggest wealth disparity ever by enriching the asset holders and thereby create the worst inflation ever.

The Fed should have just used repos to calm the Treasury market, and that’s it. Let markets do the rest. Markets are quite capable of working this stuff out, if they’re allowed to. Investors from Buffett on down were sitting on a combined hundreds of billions of dollars — trillions maybe — to deploy and buy assets during a crisis. No Fed needed. It would have worked just fine. The asset holders might have lost some of their wealth, and so be it. They had it really good for the prior 10 years.

Ever since the Financial Crisis, all kinds of red herrings have been trotted out to rationalize why it’s a good idea to make the already wealthy even wealthier during every crisis, at the expense of everyone else who has to pay for it one way or the other. Those rationalizations get really tiring after a decade of hearing them, and seeing the societal damage that these Fed policies have caused.

This. The best comment I have read in a while. Absolutely Wolf. FED is not supposed to act as market maker for the entire risk complex MBS , Munis, Corp Bonds. Threatening to buy junk bond etfs with the infinite magic money fountain is a staggering moral hazard to prevent fair price discovery. The magic money fountain is not free, there are immense societal costs involved..it has led to the greatest increase in inequality in living memory. If the top 1% were given immunity to go ahead and physically rob the bottom 90% people, I doubt they would have been able to accomplish such wealth transfer in this short period of time. Food, rent, fuel, heating the very basic essentials of life have become beyond reach for so many who did not or could not participate in this FED sponsored orgy. The inevitable negative wealth effect to come out of this orgy will wipe out not just asset owners but severely dent the economy and labour market for some time. We would have been far better off with Bufett using all his money to buy cheap companies, with homes being bought by people to live and not by institutions for speculation/flipping, with zombies and perpetually cash burning “startups” losing access to capital, with savers getting a return on their savings (prudence, sacrifice discipline and hard work), with government’s bearing their cost of borrowing and spending in bad times and not being allowed to drain prosperity from future generations through debt…there is so much wrong with debt monetization and engendering asset bubbles that it is hard to pit it into words ….

Asset bubbles are great – while they last. But the core problem is that we now have a much worse situation than if the Fed had allowed portfolios to get hammered and real price discovery to happen.

The problem now is that the government debt is so huge that really higher interest rates will destroy the federal budget.

This all comes down to whether inflation stays high. If so, the monetary system is in for a wild ride, because there is only one thing that props this all up – the endless bank account of the Fed.

@gametv: “The problem now is that the government debt is so huge that really higher interest rates will destroy the federal budget.”

No, they won’t. Higher rates will force some discipline in Washington and shrink the bloated government. That will free up millions of workers to return to the production economy, which is currently short on workers. Those workers will be far more productive (in terms of products and services), helping to alleviate the bottlenecks driving the current inflation. Furthermore, the increased production will make everyone more wealthy because there will be more of everything for everyone. And those productive workers will even pay more taxes for the government!

I don’t often disagree with Wolf, but this is not the “government’s job”. This whole ballyhoo of stepping back to providing monetary incentives and dis-incentives is a load of crap promoted in the 1970’s by the same fools who claimed managing interest rates would take care of everything. Pure B.S.! It is the job of the government to set standards and then regulate and remove bad act-ers before they gum-up the works and cause a crisis to begin with. The government has failed to do this job despite persistent warnings that we were plowing straight toward a field of flow ice. It time to shit or get off the pot! Handing out life vests is no excuse for failure at the bridge. All this derivative crap was pushed with the claim that it would make markets flow efficiently. Wipe it all out now, and get back to sound money persueing sound investment in the future. We need a governing officer class that knows how to steer this freekin’ ship to begin with.

The problem is that the government caused the crisis by its response to the pandemic – extreme total lockdowns that caused economic activity to seize up.

Government forced businesses to close and prevented workers from working. That’s why it became the government’s job to fix the fallout from the crisis it caused.

No. The government failure was to allow for the conditions which ultimately led to opening the Pandora’s Box to begin with. It’s been a long road from the original Diner’s Club card to whiz, bang, throw down the plastic and go see the dark recesses at the end of the world so you can bring back death in a few hours. But it was never unpredictable. I don’t give a rat’s ass if someone misses their chance to visit the pile of rocks left behind by ancient people, it was never worth the price of unleashing this plague upon the world. And make no mistake…by forcefully ignoring what they had and keeping silent about it, that government weaponized this thing to use it to their own advantage. They are an enemy nation and should have been treated as one all along. Commies don’t have outside friends, just future slaves. Surrender is not an option for this Republic, even when dispensed in small increments over decades. Having to dispense money is a sign of a failed policy, not one of the basic responsibilities of the government, but rather a panicked response to a major screw up.

Wolf said

“In a crisis, it’s the government’s job to step in with unemployment packages and other support measures. And this happened. It’s not the Fed’s job”

So your position is that in a crisis, the Fed should completely ignore the record-high unemployment rate and abdicate any of its responsibility under the Federal Reserve Act 1977 to “conduct monetary policy to promote effectively the goal of maximum employment” (thanks historicus) and leave the same monetary policy in place for 14.5% unemployment as it had for 3.5% unemployment.

Can you point us to the wording in the Federal Reserve Act 1977 that says that the FOMC should do that and how a “crisis” is defined there?

Thanks

no one at the fed ever presented any evidence that unemployment due to mandated shutdowns of restaurants and other businesses would be mitigated by printing trillions.

they present it as axiomatic, but never demonstrate why.

because the theory is bs.

Dazed And Confused,

“the Fed should completely ignore the record-high unemployment rate and abdicate any of its responsibility..”

This is the typical type of response from red herring slingers: take it to a ridiculous extreme. Red herring slingers do this all the time, and you fell right into this trap. It’s stupid. And it doesn’t work. You just made a fool of yourself.

READ MY COMMENT. In it, I tell you what the Fed should have done. And note that interest rates were already extremely low before the crisis.

The take off in inflation has been clear for 2 years, ever since the money started pumping.

If anything it is slower that people might have expected.

The change now is not the economic outlook.

it is :

1. that more can see it,

2. that Covid is over and all there is no excuse for more money pumping – indeed austerity is over due.

All it took was a mild late day selloff yesterday & Fraud Reserve officials other than Bullard are coming out saying they don’t support a 0.5% rate increase in March and want to move slowly & carefully to see if inflation moderates by summer.

Dow futures are now positive for the night and only 4% away from a new record.

DOW now negative.

Any comment about stocks will be obviated by events within hours in this volatile market.

Even mine :-]

Very negative 😧

I wish I got more SQQQ a few days ago, alas!

It looks like today’s self-off is all about Russia-Ukraine tensions.

Russian stocks are down about 7% while US stocks are only down 2% and oil is up sharply too.

There’s always some superficial reason stated in the media for a sell-off — it’s always just one thing. The media makes sure of that. Yesterday it was Bullard. Today it was the Ukraine. On Monday, it’ll be Dolly Parton.

Fact is the bull market has fallen apart. Beneath the surface, it fell apart in February a year ago. That’s when many highfliers started to collapse. I covered that. In November the broader Nasdaq, tech, Amazon, the social media, etc. started falling apart. That was before the Ukraine was an issue. Then it started cycling through other stocks.

At any rate, I’m waiting for Dolly Parton to sink the markets on Monday.

Don’t jinx Dolly! She’s a treasure!

It doesn’t matter. The Fed is like a basketball player stopped dribbling and can only pivot or pass. Both roads lead to ruin.

All I can add to this conversation is whether the results will ultimately be deflation. I remember telling my ex-wife in 2008 that we were heading for stagflation. I was early, but when predicting never specify a date. It never occurred to me that policy would drag on like it did. I underestimated the the lengths to which the rich and powerful would go. Remember the results of Volcker’s interventions: recession.

I bought a lot of gold in 2008 and increased my cash. People were very skeptical. Now, not so much. BTW, physical PM and physical cash. If the ATMs go dark you’ll be glad you have physical cash.

Instead of savings in the bank at less than 1% I started staking crypto at 4.5-5% interest. Below CPI inflation but when the stake is unlocked (eg, ETH 2.0) hopefully I’ll see price appreciation. It’s what got me through 2001. Dividends plus price recovery.

Right now my combo of stocks, only I-bonds (no other bonds), cash, staked crypto, PM and raw land has held my portfolio remarkably stable. I’ve lost some money but nothing like the S&P 500. To be fully transparent, this is only a rough estimate since you can only guess the value of your land.

If you can, get some farmland. If you have the know-how (I don’t) buy water rights. Wars will be fought over water. Where I have my rural land the water co-op charges $50/month just to be a member. Water is like gold out there.

I think most people doubt deflation could happen, but I think there’s a reasonable chance of it if money supply drops as a result of higher rates. Remember, what Volcker did was reduce money supply using rate hikes, which is how he broke inflation.

The risk of a deflationary asset crash is a lot higher than practically everyone believes. A combination of the most overvalued markets ever hitting a wall of changing sentiment leading to “air pockets” in illiquid or bidless markets.

Inshallah.

Deflation is a retracement?

no

Giving back to return towards normality is just taking away the fluff and spiking caused by the Fed.

Back to prices 18 months ago is really not deflation but more of a correction

I figure the panic house buying is firmly in place now (to beat coming rate increases). For the last few months total sfr’s for sale in all of 92115 have been hovering around 9-15. Right now there’s 10. A house went on the market last week at 1.16 mil and my prediction was that it would go 100k over and be in escrow by Tuesday. I was wrong. It went into a massive overbid war until it went pending yesterday at 1.35. It was a nothing special flip and a nice clean house in a nice and clean neighborhood. Lately, realtors keep raising the asking price as it’s going into escrow and I think it has to do with some sort of appraisal confirmation.

I’m gonna include the link to it below and expect you to moderate it out but wanted you to see this for yourself. I have no interest in this property of any kind. I have no idea how long this panic buying to beat increasing rates will go on but I suspect it will for a while. These insane prices have gone into overdrive in all of San Diego, probably elsewhere too, but this is nothing like I’ve seen before.

Confirmation: the Redfin link confirmed your numbers.

On a the flip side, in some SF East Bay areas, the average time on market seems to be increasing. Still hot, but cooling a bit. And I’ve seen significant numbers of rent reductions on Craigslist SFH rentals.

Wolf has documented how Bay Area real estate pricing is heavily linked to NASDAQ performance, but with a lag.

The NASDAQ peaked in November … and is currently down 15% from the peak. Perhaps the Bay Area real estate market is starting to react?

My guess is that the NASDAQ affect depends on the specific city and market segment, e.g. affects all of city of Sf market, mid to high end most of Silicon Valley, but the low end (<$1M, ha ha calling that low end) is probably affected more by interest rates & monthly income.

Yes, the highest commissions ever!

Lakewood Ranch outside Sarasota is exactly the same. Bidding wars for lots not yet released by builders. The end is near, however.

“Inflation is what happens when people increase the money supply by fraud, imposition, and breach of contract. Invariably it produces three characteristic consequences: (1) it benefits the perpetrators at the expense of all other money users; (2) it allows the accumulation of debt beyond the level debts could reach on the free market; and (3) it reduces the PPM below the level it would have reached on the free market.”

Mises.org

Expect the political and financial interests to do everything in their power to keep their precious asset bubbles going. If they do raise rates they will counter with some other trick to keep everything up, up, and away. Joe Malarkey will not sit idle. You know, the stock market is the economy! Congress always acts with much urgency when storm clouds form over the “economy” .