More milestones amid the mind-boggling milestones of our crazy times.

By Wolf Richter for WOLF STREET.

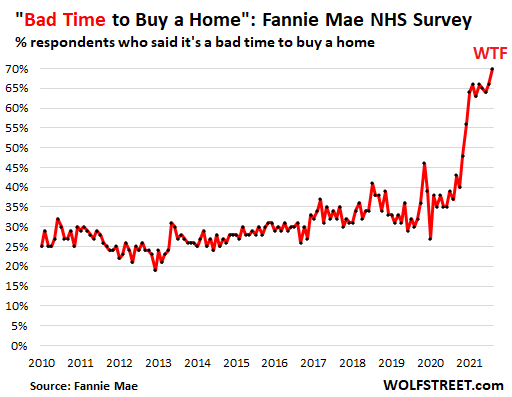

In Fannie Mae’s National Housing Survey for January, released today, the percentage of people who said that now is a bad time to buy” a home jumped to 70%, a record worst in the data going back to 2010. The “bad-time-to-buy-a-home spike started in February 2021.

Particularly younger people were getting frustrated: Of respondents between 18 and 34 years of age, a record 83% said it’s a bad time to buy a home.

“Younger consumers – more so than other groups – expect home prices to rise even further, and they also reported a greater sense of macroeconomic pessimism,” according Fannie Mae’s press release.

“Additionally, while the younger respondents are typically the most optimistic about their future finances, this month their sense of optimism around their personal financial situation declined,” said Fannie Mae.

“All of this points back to the current lack of affordable housing stock, as younger generations appear to be feeling it particularly acutely and, absent an uptick in supply, may have their homeownership aspirations delayed,” said the report.

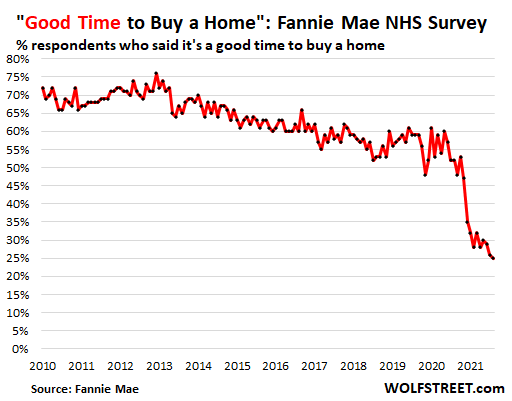

And the National Housing Survey hit another milestone: The percentage of people who said that now was a “good time to buy” a home dropped to a record low of 25%.

Of respondents between 18 and 34 years of age, a record low of 15% said it’s a good time to buy:

The results of the survey “are consistent with our forecast of slowing housing activity in the coming year,” said Fannie Mae.

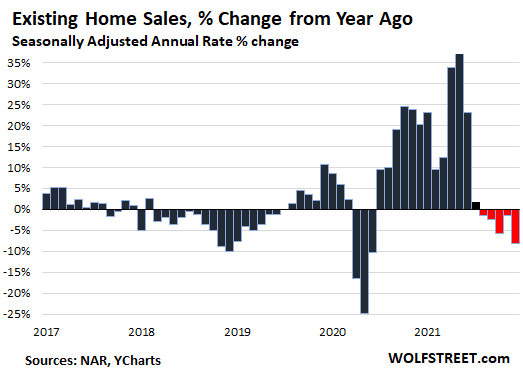

That’s already happening. Actual home sales, even on a seasonally adjusted basis, have been dropping for months. Sales of previously owned houses, condos, and co-ops in December fell by 8.3% year-over-year, according to the National Association of Realtors, the fifth month in a row of year-over-year declines, amid tight supply, rising mortgage rates, and lots of frustrations:

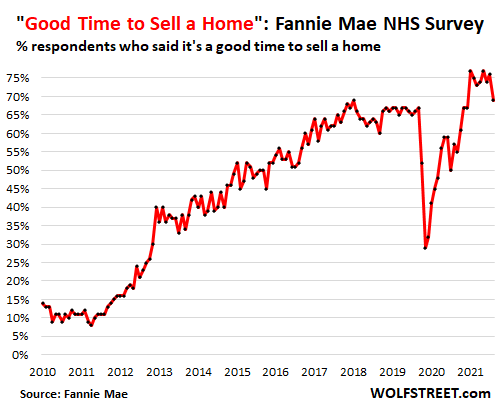

But it’s a very good time to sell a home. The percentage of respondents who said it was a good time to sell a home dipped to 69%, matching the pre-pandemic record of June 2018:

These are milestones amid the mind-boggling milestones of our crazy times.

Fannie Mae started this survey in 2010, one of the data-collection efforts born out of the Housing Bust when everyone was trying to get a better grip on the housing market. So we don’t know what the respondents thought as home prices were actually declining in 2009, and buyers were scarce, and forced sellers powered the market.

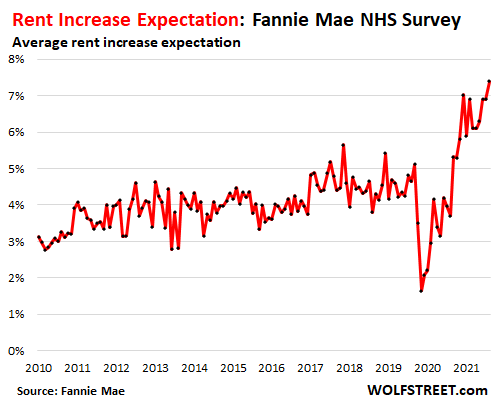

The survey covers a range of housing-related topics. One of the questions is about rents. And consumers are getting the drift.

The respondents expected that on average, rents would increase by 7.4% over the next 12 months, a new record in the data going back to 2010:

The respondents may just be a tad slow. In 34 of the largest 100 cities, the median asking rents spiked by 15% to 28% as tenants are having to pay for the Fed’s reckless monetary policies that made the wealthy far wealthier. Read… Dear Mr. Fed Chair Powell Sir, Rents Are Blowing Out and People are Hurting

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The younger generation is having their future stolen from them (30 Trillion in national debt) due to QE and other Fed policies, and used TODAY to fund the bidding up and away from them reasonable housing and stock valuations.

They might wake up someday and realize this….but now they’re too busy being “woke”

We can understand it and be woke at the same time. In fact, instead of being mutually exclusive concepts they both might point to the same overarching concept.

That is like saying you are against crime and you rob banks for a living.

No more like, I grow Pot and I am opposed to legalization.

Glad you understand part one….your future is being emptied out to ramp up today’s assets, including a home and a reasonable entry point into stocks.

This isnt captialism….it is manipulation by the overly powerful unelected.

A dictatorship of the propertied classes is capitalism.

Stocks will largely continue to split (ironic aint it) with the exception of on BRK.A/B. The rest will split when it becomes convenient to lower the entry price to make it appear more appetizing

it literally is capitalism. what could it be that gives these unelected manipulators their strange powers?

i think what makes it harder for the older generations to see is the memories from a little further to the left on that graph of the purchasing power of the USD ;)

I would really love to find out whose idea it was to get millions of Facebook boomers vein-poppingly angry over a very ill-defined notion of “wokeness.” That person is an evil genius, and they’ve got a big grudging handshake coming to them from ol’ Pea Sea

The other day someone in here was genuinely upset about woke gas pumps.

It’s even more impressive considering the current “woke” crisis is just a retread of the great “PC” crisis of the 90’s.

It seems like a good time make some money on a Falling Down sequel. Anyone know if Michael Douglas is available?

I still have to meet a genuine woke person that still has her head to herself salty garden. When you accept the premises of woke ideology, you cannot accept other premises that are diametrically opposed. Woke and freedom of markets? Woke and freedom of thoughts? Woke and freedom of job markets? Wokeness is about controlling what disgusts you. Wokes are disgusted galore . And disgusting as well. So you got to be kidding. You sound like the young folks I work with. All show no substance with an inferiority complex. Stay on Wolf Street: you’ll learn. : )

Kids want to be stars. It is tough at a young age to be a rising star amongst your peers and be a conservative. The problems are the answers are not on Twitter or Facebook. This is Econ 101. The Govt. spends more than it takes in and prints the difference. Goods are not more expensive, the value of the dollar is just less. Voting in these idiots that promise you free everything, understand that the value of that free everything is eventually worthless. Since the ’70s, the youth have believed some politicians have your best interest at heart. Today, very few have your best interest at heart. If someone promises you something free, run, do not walk to the nearest exit.

Bunks (and others):

Your post a good example for “….staying ‘woke’” (LOL!)

historicus

Blaming on ‘WOKE’ or being wokish is so fashionable and easy to deny the real culprits- our law makers of both parties. Neither of them have any desire to reduce deficit spending or the national debt, nor they are serious in campaign contribution reform!

They are beholden to US Multi-National Corporations especially military industrial complex. America is an oligarchy and democracy in name only!

Those who vote have TWO choices: elect those who favor policies in the PUBLIC ( Jane & Joe in the main street) interest or keep electing those favoring vested/PRIVATE interests from whom they get campaign contribution!

If the younger generation cannot discern the their choices, nothing will change for any one including the old! The top 10% who own 90% or more wall street wealth, will keep the reign of the country.

woke adjective (Mirriam-Webster)

: aware of and actively attentive to important facts and issues (especially issues of racial and social justice)

Making this as a ‘joke and cynical turnaround’ speaks itself the irony of those using the term!

The emotional crowd of the “woke” fixiates on issues they themselves blow out of proportion. These types are placed into the heart of academia, media, and political offices, and are funded by the oligarchs to keep the national discussion focused on the least concerning issues.

They have degraded scientific inquiry, military toughness, and personal freedom with their constant emotional bellowing and preening.

Well said. Too bad we have to discuss this topic on Wolfstreet, as everywhere else.

“woke” is a right-wing pejorative that can be applied to everyone and everything you disagree with or don’t like or don’t understand, neatly summarized into four letters. No further thought required. It’s a breeze to make comments out of it too. Anyone can do it.

Wolf, many members of the “woke” community apply this label to themselves. Its a mechanism to virtue signal.

Many “right-wing” individuals used to be affiliated with non “right-wing” causes and concerns before policy the CRT/cancel culture/ cultural marxists/post-modernist crowd siezed power.

As someone who is engrossed in economics, do you not find the “woke” movement distracting to larger more impactful issues? People used to protest globalization and Wall Street. Now the larger national discussion is on feelings.

Hard times make strong men.

Strong men make soft times.

Soft times make soft men.

Soft men make hard times.

(If this posted elsewhere, my apology)

Love that response, Wolf.

So, by this logic, soft men created the mess that we are in. Not the ‘WOKE’ crowd.

More of us than you think understand what is happening. We just don’t know how to fix it, and we are all a little too comfortable to start rioting.

“Of respondents between 18 and 34 years of age, a record 83% said it’s a bad time to buy a home”

Bad demographics in this particular cohort to poll. Maybe 26-34 would be better. Anyone younger is unlikely to be in a position to buy anyhow — so why ask?

The demographic divisions have been the same since 2010. They divide the respondents into age groups, from the youngest group (18-34 olds) to the oldest group (65+). The 65+ aren’t exactly big home buyers either, and they’re the least pessimistic, maybe because they’re unlikely to have to buy another home.

I’d like to know the income level of those 25% who think it’s a good time to buy. If I had to guess, it would be the top 5% of the country. Even that 7-9% has to be feeling the pinch such that they’d join the NO crowd.

Or people who haven’t paid attention?

Hi Wolf,

I’m definitely well past 65 and am not quite so pessimistic as implied by 18 to 34 year olds in the charts. A good part of that attitude is that I am old enough to have been “put through the wringer.” Numerous cycles between then and now. Did I think about whether it was a good time to buy a house or a bad time to buy a house way back then? Nah. Not really. I was too self-centered. I only saw my hardships and did little thinking on the general situation of others my age. Are our youth actually that much more mature these days? I certainly do not know. The truth is as it has always been. If: 1. you have enough money saved for down payment.

2. You have a job in which you are reasonably certain you will be staying in your current area.

3. The mortgage will be less than 3 times your take home;

then you should probably buy. Number 2 is a tough one and requires some serious thought/soul searching. However, worrying about a short term market downturn will get one nowhere. There is a lot to be said for optimism. It allows you to focus on what you do and not to be overcome with fear over things you cannot control. My other take on this is what are the expectations? Since I grew up in a barn, my mind wasn’t poisoned by images of lavish lifestyles of people. What does this young cohort have in their minds when assessing housing costs? The first house I bought in 1976 was a 3 bedroom one bath cape cod in Manassas Park, VA. $34950. (And the third bedroom upstairs had the sloping ceilings and was hot, hot, hot in the summer. ) How many of todays young people would buy that house for an inflation adjusted price of around $200k – $250k? I contend that the problem facing our youth is not so much the inflated house prices, but the stagnant wages caused by globalization. Our youth are literally competing with over 3 billion people for wages. And they are competing with a handicap of over-regulation and a byzantine network of laws. (Some good, some bad, some terrible.) It is tough, but the issue of whether or not this is the time to buy is only partially driven by the house price itself.

I agree that now is a tough time to buy a house but….what if it is an even worse time to buy a house next year? 5 years from now? 10 years?

The only solution I can see to increased demand is increased supply, but there are so many obstacles to that it may never happen. So demand will keep outstripping supply.

Bad time to buy, but a good time to sell (!?) — to me this signals the beginning of a general decline in prices. And it’s needed. Like I mentioned in a post a few weeks back, the “price reduced” signs are beginning to appear on the ‘house for sale’ signs in my area.

The demographic divisions have been the same since 2010. They divide the respondents into age groups, from the youngest group (18-34 olds) to the oldest group (65+). The 65+ aren’t exactly big home buyers either, and they’re the least pessimistic, maybe because they’re unlikely to have to buy another home.

The 65+ have much more equity in their properties. High leverage spawns booms. Booms spawn inflation. The more equity one has in their investment, the better they care for it. Less turnover, less lending loss, lower rates, fewer boom and bust cycles. The young do not realize that when someone gains perceived value because of inflation, someone also loses an equal amount somewhere. People on fixed income suffer, lenders, lose, and politicians win.

And even if the older folks do wind up buying a home, they’re more apt to be selling one at the same time. Kind of a leveler. The biggest burden is on folks who are buying for the first time or buying a much more expensive home than they’re selling.

The older generations should pay it forward by selling exclusively to the 18–34-year-old for a small % over what they originally purchased their properties for. That could be the start of replacing the opportunity gone missing for so long now.

George,

My wife and I did something like this. We went in “halves” with my son and his wife on a single property with two homes. We provided the down, they help with the mortgage. All names are on the deed. Otherwise, they would not have been able to afford to buy. Plus we get to see our grandkids ever day!

georgist:

I’d rather pass that profit on to my own children so the one who currently doesn’t own a home will be able to.

If more people took care of their own, there would be less angst in the world.

You will not have a meaningful decline in home prices unless there is an economic crash. In real terms, the value of the dollar is down 30%+ over the last 3 to 4 years. With a little work, you can calculate real estate value when you plug in inflation.

Why not simple supply/demand econ 101.

Price rises so less are willing to buy . They want to buy so the argument will be it is a bad time. Less buyers, sellers keep same price but thanks to high inflation, that amount is each month 1% less.

In the mea time. Mortgage rates are going up making buyers more interested to jump in before those hit the ceiling as well. Besides, as long as mortgage rate is less then inflation, “you can’t go wrong” some will be thinking.

Bring back:

20% down payments

No government guarantees or backed mortgages

Banks eat their bad loans

Interest rates above the rate of inflation

Fraud and GAAP enforcement

And you will have affordable houding

to add to your great list, remove deductibility of mortgage interest. if renters can’t deduct, neither should owners.

and while this would have to be done on a state by state and local basis, rental properties should be taxed as commercial properties, not residential.

Rental property owners fully deduct the property taxes when figuring out their yearly taxes.

Are you saying a business can’t deduct business expenses?

If so, this new cost will be fully forwarded into the rent.

no. in most places, commercial property is taxed at a higher rate per $1,000 of assessed value than residential. so, a $1 million restaurant building pays more in taxes than a $1 million home. i’m saying that a rental property should be considered a commercial property, not a residential property.

Income tax vs property tax. 2 different animals.

@ 2Banana –

current market rents are influenced by money creation and government subsidies, but not by costs ……….

just because a landlords costs go up does not mean he can pass it to the tenant

The ability to deduct 100% of interest, 100% of property taxes and to depreciate cost of housing are all reasons that commercial interests can outbid individuals for property.

Isn’t that in place to encourage home ownership? Taxes aren’t always about fairness, but achieving desired outcomes or disincentivizing behavior through the taxation.

Vice taxes, for example.

yes, but it doesn’t encourage homeownership. all it does is increases the price of housing.

Just as in the Savings and Loan debacle, when the rules changed and S&Ls could venture out into the country and back housing developments far far away…

Yep, local banks would balk at lending for these real estate prices…but mortgage securitization, and backed by QE that bought 40,000 MILLION DOLLARS A MONTH of MBSs (40 billion) for years….idiocy.

In 2006 the Fed owned NO MBSs…..now 24% of all outstanding. WHY?

Oh for some honest questioning of the Fed and Powell.

Exactly correct. This is by design.

Me thinks they did it to protect the banks and the system. Using the rear-view mirror to guide their strategy. If “jingle mail” were to do a repeat the impact will have been reduced by ~25%. Which is a serious reduction is failed banks that just have to be bailed out. Since letting banks fails was so yesterday. But what of what could they have let out of the bag that will become the next cataclysmic failure? Unknown.

Lenders should be free to determine their own lending standards but at their own exclusive risk. That is, at the risk of those who fund them.

By “at lender risk”, I am including bank deposits. I prefer getting rid of this insurance entirely but since it exists, the limit should be limited to a nominal amount for all accounts.

A very low proportion of bank retail customers have $250K at a bank. Those that do, the government already provides an insured option. It’s called USG T-Bills, notes, and bonds. You can buy it with no custodial risk directly through Treasury Direct.

If this happened, low down payment loans would end with this mania. With it, actual housing affordability will return, as opposed to fake affordability based upon the monthly payment where many house debtors are effectively debt slaves.

Depending upon market conditions, anything less than 10% potentially puts the buyer in a zero or negative equity position once they close.

Deposit insurance is actually a welfare program for management who cash in on stock awards, stockholders, depositors (who are actually not depositors at all but creditors of the bank), and borrowers, all at taxpayer risk. If it’s an insurable risk, the private sector can provide it.

banks don’t get fdic insurance for free. they pay premiums for it, and the office of the comptroller of the currency regulates what they can do with their deposits.

there is an easier way. Just remove all tax deductions for real estate and mandate that the government balance the budget. My rule of thumb has always been, to pay cash for my investment property and no more than 40% debt on housing. There is very little leverage used in my investment strategies. However, I sleep well.

AF

To speak to your last sentence…..

So private sector insurance companies insure private sector nuclear reactors ?

You really think that ?

Twenty percent of ALL USA electricity comes from nuclear .

That would make sense ,but then we have very slow economy

Slow or realistic???

I prefer realistic. How much shit do people *actually* need? It’s the people who benefit by a fast economy that want a fast economy.

Entrepreneurs and executives are terrible stewards of the public good. Government institutions should be a counterforce to their interests, but both parties are under the servitude of their corporate masters.

Let’s throw the elimination of junk mailers and robocallers to the list of pipe dreams.

Addendum: Let’s face it, people strive for power for them and theirs. That’s the real driver — climbing up via the economy. The world as one giant poker game for those players.

I can’t recall where I read about how some religious communities encourage investment strategies to slowly claim territory / property in service of their God and to expand their reach. Organized Religion, the original MLM.

If even half of that happened we’ll be living in caves. The deleveraging will be denied once again, we can’t have everyone living in caves.

In California, zoning, building permits and assorted other regulations and fees add a huge amount to the cost of a house while providing little value added and taking forever. The cost of those can double the cost of new construction and make construction take years longer.

You are providing the most logical proposals to put a lid on this out-of-control housing market outside of raising rates and a massive increase to new home builds. The tools are there to do it as you point out. I would also add restrictions against foreign investment and hedge funds.

It should be added it also a terrible time to build as well and I going to guess probably a terrible time to repair as well. This leads me to believe that maybe is all probably a terrible time to sell, as you can’t buy, you can’t build, can’t repair,…better keep what you have and if you rent hope you have a good landlord?

Yes, there’s some of that.

This combo of asset price bubble, consumer price inflation, inflation in materials, and the labor shortages have really gummed up a lot of things.

I punched in numbers into a rent vs. buy calculator and get it’s a great time to buy a house if the following three things email constant:

1. You can borrow at 4% (5% down)

2. Alternate savings rate is 1%

3. House inflation is 7%

Buying a $400,000 vs. renting for $1000/ month break even is year 4. Anything after my that you are ahead of the game.

I wouldn’t do it unless I was a gambler as you don’t know rate of inflation, but if you can stick Fannie with the downside, maybe it’s worth the be risk.

You are also hoping property taxes, insurance, utilities and upkeep doesn’t burn through the sweet “appreciation” you are counting on.

No slow down in Southern CA. It’s a red hot market with bidding war but utilities prices are increasing like crazy.

Second that, out utility bill went up 70% MOM largely due to the rate increases.

And I was noticing the property taxes in some towns in San Diego have been edging up…

And bidding wars on homes is the craziest I’ve seen since we started looking 2 years ago.

Wild times.

Interest rates are still really cheap. Anything below 4.5% is still a great interest rate as homes over time have appreciated at 4.3% per year.

If you can borrow money at a rate that is less than what the asset appreciates….why not? If inflation is at 5% to 6% does that mean an interest rate of 5% is still cheap?

Of course….you do need to worry about the timing of the purchase. LOL

I just read an article on Doug Shorts website. The PE/10 ratios. PE averaged over 10 years, is at 37. What is interesting the only times when the PE/10 was over 30 was when inflation was in the 1% to 3% range. We are in new territory here….hmmm. Also,

Also….during the housing bubble one. Inflation was much lower and was around 3%, not the 6% we see now. All I am saying is high inflation drops the nominal value of housing prices. What I mean is a $990k house today is the same as a $100k house in 1967.

He had one other interesting chart that takes the average of 4 valuation indicators. Based on his calculations going back over 100 years, we are 157% above the mean which is……drum roll…… 3 Standard Deviation. wowza!

Is a $1000 monthly rental really a comparable alternative to a $400,000 property?

I live in the ATL area and wouldn’t live in any area where 1-BR rents are $1000. In these areas, the property can be bought for less than $400K.

I’m renting now but a townhome complex on my short list is $350K- $400K. My estimate of the monthly cost @4% with 20% down is around $2200. This includes P&I, taxes, insurance and a monthly HOA fee of $225. I am paying about $2000 monthly rent for a 2-BR in another part of town with about half the square footage.

No I just wanted to demonstrate when you have financial repression things get crazy and it encourages people to gamble on asset inflation.

Augustus Frost, what areas of ATL are you looking at?

I used to live there shortly after GFC. Today prices in ATL are actually not that bad, compared to many other parts of the US!

A 1% increase in rates will wipe out all of those assumptions and it would quickly wipe out 5% equity. I don’t know about you but I wouldn’t bet on real rates staying this negative.

Rule of “thumb*”: +/- 1% change in rates will evoke -/+ 10% in house price.

*conveyed by well seasoned mortgage brokers/RE agents. Ymmv

sam

Perhaps.

But the question is…What’s the starting point?

Didn’t equity firms already buy up houses with their extra dough, leaving far fewer houses on the market to start with?

Betty

Yep

Blackrock and Blackstone…..and likely hundreds of smaller operations ..highly leveraged, and some likely pyramiding.

VRBO and the like are fairly new factors in the viability of buying and renting….especially in weather friendly areas.

And I have read that of the corporate buying of residential properties, 1/3 is foreign activity. So much for “trade deficits dont matter”. The dollars return to bid housing away from citizens…..like it happened in spades in Canada.

“Blackstone got back into the SFR market last year. Its non-traded REIT, BREIT, made a $300 million preferred equity investment in Tricon. That entity is now investing another $45 million into Tricon, giving it a nearly 12% stake in the company.

Meanwhile, BREIT made an even bigger bet on the SFR market by agreeing to acquire Home Partners of America. It’s paying $6 billion for the company, which owns more than 17,000 homes across the U.S.”

millionacres.com

It is said that Blackrock owns $60 billion in real estate. Now, the real estate market is HUGE and much bigger than that paltry amount, but sopping up what is on the market can have a large impact. IMO.

All they’re doing is shuffling investor-owned portfolios of SFR around. For tenants, the only thing that changes is who they write the check to.

Thanks historicus.

I guess a person would need a process to estimate how many houses were “on the market” for purchasing, at a given time(s). And then categorize (aggregate) types of purchasing (?) and run that against the available houses, to portray how many houses were sold this way, and how many

And then there would be a proportion of “young” people would be financially available to buy.

I’m just trying to understand why people “aren’t buying homes” and those “who buy”.. It’s not at all clear to me.

Replying to Wolf.. big institutional investors are also buying up whole subdivisions not just shuffling investments

They’re buying build-to-rent subdivisions. This makes perfect sense. These houses are designed and built as rentals, and management is easier since the entire subdivision is rental with an onsite leasing/management office etc. Hottest trend in real estate.

Hi Wolf…. I do agree with your comment. Yes….there is a lot of shuffling of investor owned property. FYI…. Blackstone over past couple of years bought 300 homes in a neighborhood I would not think about wanting to be a landlord. This is a low income, high crime neighboorhood with houses that are 70-80 year old homes. 10 years ago 70% of the homes were owned buy individuals who lived in them. Now only 30% of the people own their homes and 70% rent.

Smart move by Blackstone as they bought the majority of the houses in this area for under $50k. They upgraded the homes and add nice appliances. Houses are now selling above $160k to $200k. Average rents went up from $600/month to $1400/month. Low income people had to move out and a higher class of tenants moved in. This also resulted in less crime. Now the local paper is complaining about where will the low income people live as they cannot afford the new rents in this neighboorhood.

My thoughts, which could be wrong, but even though Blackstone is buying some of these properties and doing the shuffle. I have to believe that some of these investors who sold the properties to Blackstone plan on going out and buying more?

That being said….everything feels like there is a housing bubble and a stock market bubble? It just does not rhyme with the HB1.

I have no idea what the needle looks like either. At least not yet.

@historicus You are correct….this amount is paltry….but these purchases are focused on where it hurts the most. Blackstone is not buying houses in small towns out in the country. They are buying the mid-priced homes in good school districts in big cities or suburbs. Putting pressure on the 1st time home buyer or new families with kids looking to find a good school district.

There are still plenty of cheap homes in flyover land but in the big cities, the inventory for 3 bedroom or 4 bedroom starter homes below $300k is very low. All the new construction starts at $450k which means it is really over $500k. That is middle class move up range for someone in their 40s.

Somehow it will work out. Eventually the builders will have a hard time finding enough buyers in the $500k or $800k price range in a city where the average family income is $70k . The builders will then maybe start to build duplexes or homes that can fit multi-generations into one home. Building a SFH for the medium family income will be challenging in the future. The price of land and the material put most SFHs out of range for the 50% of the people who make less than the median family income.

Asking young people (with short backward AND forward-looking time horizons) to assess this, is bound to get this answer. It reminds me of asking a mortgage packager in 2007 about the housing market: the trend will continue, right? (I have some old issues of Business Week, and it is hilarious to listen to the prognostications about real estate, the Fed, etc.) It seems like a replay of Benjamin Graham’s character Mr. Market, who overshoots into being morose in hard times and elated in a boom. Patience, youths! The boomers will die off anyway. The best practice is always the best practice; prudence, work, thrift, and wait for opportunities. It paid for me — I bought my house at age 37.

And, I bought my house in a year of rising rates (1994). Never underestimate the power of inflation over large time horizons either. Mine went, since 1994, $90k to $400k now, but with a huge dip in ’08-’09 (and I owe less than $10k). I can afford some pretty drawdown in the prices, or increase in the costs. All from patience.

yeah, you benefited from the 40 year decline in interest rates. the current generation won’t.

Over the years in which I have built 3 homes, the lowest rate was 6.5% Rates are still extremely cheap, and will be for awhile. We to work on those overpriced homes!

As crazy as it sounds rates may go lower. If you are not going to deal with bad loans, you got to keep rolling the debts over at lower and lower rates. 10 year treasury has about 2% to go before the gig has to be up.

I bought 4 houses in Edmonton, Alberta Canada in 1990 and have just doubled my money 32 years later non-inflation adjusted. Apartments there today are worth about 40 percent more than they sold for back in 1990.

Good time to have a home paid for. I have seen the value of homes I owned go up and down. Still better for me to have owned than rented. I would not sell my paid for home to go join the renter crowd. I bought this home in a 55+ gated community. The average owner stays ten years. It is the end of the trail for some. Others will move again.

We have all had to deal with patience! We just need to stop making boneheaded overpriced purchases.

Good ethics indeed!

We sold our house in Northern California in Sept. 2021 as we started seeing the writing on the wall. That and the vivid recollection of the stench that preceded the precipitous drop in home values in 2009.

One evening, my wife said “your not going to believe what our house is worth on Zillow. It was soon thereafter that we went from our plan to pay off our mortgage in 2026, to her retiring from her nursing career and “damn, it’s time to get the F out of Dodge”. And we did so in very short order.

Our property sold in 2 weeks but we only had 1 offer for $10,000 less. One offer. But it was an all cash with all contingencies waived. At first we balked but our real estate agent reminded us that 1) the deal was solid and 2) you never know when the casino may be shutting down. So we took the offer & ran to greener pastures.

You could sense the slowdown after months and months of frenetic buying activity with buyers bidding up properties well over ask. Our house was a nice, well maintained 4 bdr./2 bath on a culdesac in a great neighborhood. But all of a sudden it was…”where the hell did the buyers go?”

Another interesting tidbit is maybe a lot of these 18-34 year olds remember what their parents went through 13 years ago. The smart ones will have heeded the warnings that economic collapse was not an illusion or abberation, but a slight-of-hand. And one day it would all come home to roost.

DD,

Did you stay in N. Cal?

There are so few homes for sale around here that people are getting over asking still. It’s not crazy bidding wars but still several offers per house. It’ll be really interesting to watch a slow trickle of sales push home prices even higher. Seems we’re just setting a higher bar to fall from come the next serious recession, and on that Ed the Fed policies seem to just create more instability.

I’d like to buy a home but we’ve been essentially priced out of anything I would buy. If we settled we could find something for sure, but spending that much on a shitbox…forget it. I’d rent forever. There’s no way this is sustainable in the long run, but how long is that? Just glad I’m a little older and not a young millennial. They’re screwed for sure without a return to the mean…we need a recession bad to clean house.

It’s a terrible time to buy but I don’t want to retire as a renter in a period of persistent inflation. If it comes to that, I’m retiring outside the US though don’t know where, yet.

Buying into a mania is bad enough but if I ever do it, I’ll do it with full knowledge that I might take a big hit and have to be willing to suck it up. I’ll treat it as a consumption expense.

But I’d never do that for a property I don’t even like.

“But I’d never do that for a property I don’t even like.”

Exactly. But that’s the problem. If you’re a first timer in a super hot market like ours (one of the top y-o-y increases last year), you have to settle if you want something now. Going further out gets you a bigger house but now your paying way more in gas and the quality of life takes a big hit. It’s a no win situation really. With rates going up, we have to really buy more than we should or buy in an undesirable area. I really don’t want to rent forever but I don’t want to get stuck upside down in a city that was super boom/bust last time and in the long run has water issues…

I saw earlier there are only 271k homes for sale in the US. Crazy

There are a huge number of places in the world where you can live safely and economically as an ex pat. It’s just a question of picking a place that suits you.

Please tell us of a couple, maybe several or even a huge number where ”you can live safely AND economically” E?

Haven’t been everywhere, yet, but have been many places over the last 60 years or so, and have found very few places where both those parameters are even a slight possibility.

Thank you in advance.

Vintage,

It may not even take being an expat (although affordable sunny beachside life does tend to require intl living).

But mere affordability…hell, move to Wichita, KS (no crime waves as far as I can tell).

The dubious NAR puts out lists with median prices for 250+ US metros…look at the bottom 100 and get prior years’ editions (via Google) for negotiation leverage (“No, Mr. Seller, I am not paying 50% more than 5 years ago even if IN/KS/MO/TN etc is 65% cheaper than CA…”).

As insane as prices are now, it is hard for them to be insane *everywhere* in US.

Can also use Zumper/AptList monthly rent surveys (with hundreds of metros) as a proxy for lower home prices (can’t spike SFH prices if apt rents lag way behind). This method won’t give you actual SFH prices everywhere but it will ID the cheapest housing mkts).

VintageVNvet

have you been to Bulgaria? Check out the Golden Sands area.

VintageVNvet –

I tend to agree with you about the realistic options for going expat.

In addition to cheapness and safety, a significant factor is that a large portion of people don’t want to be so far from the U.S. that it is a major effort to go back and visit family or friends, or for other reasons such as medical, business, and so on. If those ties are minimal, and someone has issues with U.S. culture (like me), then the potential for finding a comfortable and pragmatic place is greatly increased.

The last few years before retirement (during which I was working overseas), I kept an eye on various organizations and publications that rated which were the best countries for expats. There always seem to be trade-offs. For example, I had my eye on Cuenca, Ecuador, but it’s pretty cold up there in the mountains and a long trip back to the U.S.. Columbia was also described as very retirement friendly (e.g., easy to get into the fairly decent national medical system), but one would have to live there for awhile to assess stability and crime issues.

I got lucky and married a retired Thai woman who has her own pension and owns a big house (no property tax or insurance costs) in a safe, laid-back area. One of the biggest benefits, for me, is I can’t remember dealing with an angry or significantly offensive Thai in the five years I’ve lived here. Internet is great, and everything is cheaper. I’m on the insurance of my wife’s cars, which is cheap. And also get her extremely low cost retirement medical, which is better avoided if possible.

But expat visa rules have changed and are in flux here in Thailand. If I wasn’t married, a standard retirement visa here would probably not be feasible because of new health insurance requirements (gets extremely expensive for older people). My intuition is that most other places on earth are being monetized in the same way.

If I was single, I would take a serious look at Portugal. But basically I agree that the realistic options are very limited for most people.

Living where most of the local population does not speak English and you do not understand their language is not terribly smart.

+1

it doesn’t look a good idea to retire in the US, at least now

Millennial generation will inherit,all assets anyway why worry ,unless your parents weren’t responsible people ,

^ Exactly.

Help others, but your priority should be your own.

Eh I suppose… but I am tired of hearing that. We millennials don’t want to wait until we are 60+ for our finances to get easier when our parents die. Rearing kids to adulthood is an expensive part of life. How about work producing adequate income during those years?

That also assumes the parasitic healthcare system doesn’t suck up every saved dollar our parents have before inheritance time anyway.

The mania will be long over before the transition is complete. The amount inherited won’t be anywhere near what is advertised, at current purchasing power.

“There are so few homes for sale around here that people are getting over asking still.”

Abomb,

I think that your comment supports the axiom that ‘all real estate is local.’ Where I’m at they’ve peaked and prices are starting to tumble. Potential buyers have moved on (no oun intended).

Yes. All the way of asking for the past year is very abnormal. Eventually the economics catch up. Either more homes are built or people move to lower costs cities. (that is why a lot of California based companies are moving to Texas).

Part of the housing price increases are low interest rates, easy money, but also supply and demand is a factor.

Where on earth are you that prices are actually tumbling?

Wolf,

I don’t know if you have posted about the incredibly low “for sale” inventory recently (maybe 20% of 2019 peaks, 33% of equivalent seasonal troughs) but it would be interesting to get your take on why owners (particularly investor-owners, who are much more common today) haven’t started putting up for sale signs as rates rise and the Fed at least jawbones about ratifying said increases).

A decent amount of housing is also “under construction” – another reason why you would think flippers (big and small) would be pumping up “for sale” inventories.

Maybe because home prices are still going up. I think to get it going the other way people got to start losing their jobs. Gonna take a black swan as far as I can tell at this point.

Actually, mortgage rate hike would dampen the market. Bunch of my friends wanting to buy homes 6 months back are now feeling the pinch ( they were already stretched out ) and they are backing off as the rates have gone up .

BTW, home prices are set by the homes selling in the margins.

It should dampen the market for sure. But there are a lot of stupid and/or desperate people out there. We are pretty tapped out now due to the rate increase so practically speaking our home search is over. We backed out on an overpriced (well aren’t they all atm) place a few weeks ago that needed a lot of work at a much lower rate.

Abond and Jon. Good info to know from the front line. Inflation and rising rates should put a pinch on everyone’s budget going forward.

I have a question Abomb. If house prices do start dropping because of the rising interest rates, how far do prices have to drop for you to move ahead and buy a home?

Maybe this is a trick question because if interest rates rise while the price of the house falls, you mortgage payment may stay the same.

But if you were looking at a $350k house and it dropped to $300k. Would you say lets do it even if interest rates were at 6%? A 20% down payment would drop from $70k to $60k. I am curious what would constitute a good deal?

During Housing Bubble one, there were some really good deals if you had the guts to buy low but every one was worried it could go lower.

Every basis point hike in mortgage rates eliminates some number of buyers from qualifying…and with home affordability at all time lows, every potential buyer disqualified causes the home price jet engine to stall out (lower demand due to disqualification for mortgage = lower prices).

And…there are still 2 to 4 million fewer people working now vs. Jan 2020 (before the latest stupid price hike started).

So prices at the margin may be very high…but with fewer and fewer qualifying for loans (as rates rise) and a pretty high amount of new housing supply in the pipeline.

The only thing really propping the housing monstrosity up (to me) is the historically low amount of existing inventory being offered (causing bidding wars).

But can’t investors/flippers see what even slightly higher rates will do to monthly mortgage pmts/affordability/demand?

It’s that plus the fact there are no other investments offering reasonable returns without big risk. If I sell one of my rentals, where do I put the money?

Well, even with poor-ish re-invt alternatives, it would still seem smarter to sell RE near the top rather than cling to rental ROI’s and endure potentially huge capital losses in home prices.

Can’t happen?

Prices collapsed just 12 years ago (and for the exact same reasons…long period of faux low interest rates creating doomed price bubble, followed by price collapse as soon as interest rates even twitched upwards towards legitimacy).

Capital Gains

Looks like RE skyrocketing in one place is compensated by RE plummeting in another.Third Law of Newton in action.

Virtual tour anyone ?

N Brice St & Edmondson Ave, Baltimore, MD

Prime location,Colonial History everywhere,one has the impression that Lord Baltimore and Anne Arundel are your neighbors,cushy Gov jobs in Washington,DC just 30 miles away…

Yet 90% of the whole Edmondson Ave is boarded up.

_____

As I walk this Land of Broken Dreams

I have visions of many things

But happiness is just an illusion

Filled with sadness and confusion

What becomes of the Broken-Hearted

Who had love that’s now departed ?

_____

What is particularly inspiring – even the Broken-Hearted are wearing masks.Google Street View managed to capture this sign of revival.

I recently read in the WP that Afghan refugees are refusing to be placed in Baltimore. I spent two tours in Afg. I lived in Baltimore for some years and I liked it and the people. I know the building they are refusing and it is a lot nicer than anything in AFG. I realize the people in AFG, especially the richer ones that got out, are racist but really?? We could have given every Afghan man, woman and child 200,000 in cash and required them to move to Baltimore, Detroit or Buffalo and saved a ton of lives and money and our economy instead of what we did. When we started there were 15 million Afghans now there are 40 million. The real problem in Baltimore is that it is an industrial city that was built on the backs of low information, poorly educated workers and then we outsourced the industry to China and third world. Only half the population has an IQ over 100, by definition. Should we be providing jobs for the half of the population that has an IQ under 100? Not everyone can get a job at an investment bank or law firm.

I drive thru there often and I don’t know… DC money is in W Baltimore now. $5k burnout rowhomes in 2018 are now selling for $20k. I see infrastructure projects and dozens of future rental properties being renovated in that area.

“N Brice St & Edmondson Ave, Baltimore, MD”

Nice area! Looks like a lot of retirees just enjoying the weather sitting outside next to closed shops with art deco plywood windows. Welcome to America.

– These data are consistent with, but not as terrible as, the U. Mich. survey data (Dec., ’21). The Fannie Mae data only goes back to 2010, and so is missing the critical Housing Bubble 1.0 data for comparison.

U. Mich.:

Exhibit A: CHART 41: BUYING CONDITIONS FOR HOUSES – Worst since “That 70’s Show.” 50 year data.

Exhibit B: CHART 42A: PRICE REASONS FOR BUYING CONDITIONS FOR HOUSES

(%LOW PRICES – %HIGH PRICES) – Worst conditions ever, going back 50 years.

– The current Housing Bubble 2.0, as part of “The Everything Bubble,” is consistent with a serial arsonist central bank (aka the Fed) blowing asset bubbles to keep the Ponzi scheme going a little longer. Stonks + housing = the Fed’s “the wealth effect,” which is now rapidly becoming “the negative wealth effect,” due to the liquidity tide going out.

– Not to mention the bond market, but I will, junk credit spreads are starting to blow out: a) Zombie Cos. soon to start the default cycle, b) 2’s/10’s yield curve is (not yet) inverting, but moving in that direction.

– The Fed represents capital (corps.+the banking cartel+Wall St.) and not labor (workers+middle class+Main St.). There shouldn’t be any surprises about the current financial free-for-all, where the top 1-10% are Hoovering-up/strip-mining all of the wealth. The social contract is broken.

– Reality bites. Inflation is now ending the party as the Fed must now remove the punch bowl, else “social unrest” becomes even more pronounced. The Fed is not clueless; the Fed is evil. Congress does nothing. Perfect recipe for further “social unrest.”

If it doesn’t exist, it can’t be sold. WE HAVE NO UNITS TO SELL.

We have lots of units to sell here. I even see them in my neighborhood. When they don’t sell right away, they get pulled off the market, and then they reappear sometime later. No problem.

Hi Wolf,

In Monterey County, as of this morning, we have 196 single family residences listed for sale in the MLS that are not in contract. Not all of these are available for all buyers to see, either. This is down from a norm of north of 1,000 houses at any given time. When things come on at market price, they are gone!

JWB

Many comments here are hilarious and wishful thinking. If anything asset prices will continue to rise in USD terms and people who think it is bad time to buy now will find it even harder to enter. This rampant corruption and money printing will go on till there is debt overload, massive wealth gap, and a resurrection (which has already started at smaller scale) which liberal media will continue to blackout and criminalize and brainwash young wokes.

No way out from this train which is about to crash and burn in slow motion. In a couple decades USA standard of living will go below Asian countries and in relative terms we will be the new third world with rampant homelessness, creaking infrastructure, drug addict and obese population.

A couple of decades? The US already has “ rampant homelessness, creaking infrastructure, drug addict and obese population”. The empire is finished and like the Titanic it’s just a question of when it sinks completely. The time to get in your lifeboat is NOW.

I am in USA for last 25 years and generally have seen drastic decrease in quality of life for people in my city.

Easy there, Nostradamus.

:)))

Best laugh and smile this morning (I live in Thailand).

It’s not far fetched.

US standard of living is artificially inflated because of USD reserve status, artificially cheap financing, and the loosest aggregate credit conditions ever. This exists worldwide but it’s particularly evident in the US.

It’s not like US living standards are due to the country being so productive anymore.

Unfortunately…..the kids are wrong as usual. Housing is usually reasonably stable but the 09 crisis caused by bad lending is now the pattern everyone thinks will occur. It will not.

Due to commodity inflation that will not be stopped til the fed gets really serious (which will not happen for a long time) the price of housing will be relatively stable. The commodity increase will balance the speculation that will be rung out due to marginal buyers being priced out and unable to afford slightly higher rates, speculators that will dump properties and weak hands…….

As rates increase more buyers who were waiting will emerge in panic to catch the last of low rates and most importantly the supply of housing, while increasing, will still be barely equaling demand. Lending standards this time were and are reasonable so some weaker hands and speculators will supply housing but the vast supply from foreclosure will not exist. Millennials (largest generation in history) will be moving into the housing market by the millions during the next ten years. IMO the recent move to price millennials out was a permanent reduction in US standard of living. Therefore a marginal slice of them will not own a home but some may get a little parental help and buy, lots of the educated ones (this generation is highly educated) make attractive salaries and there are some that actually saved enough to overcome the price issues or cut back on non essentials to buy what they want. The theory that the boomers were all going to down size as they aged is nonsense. Lots are retaining or upgrading into more modern facilities that are bigger than anything in the past.

“Lots are retaining or upgrading into more modern facilities that are bigger than anything in the past.”

I can confirm your comment where I live. So many out-of-state boomers have come here to buy their dream home — a 4000 sq. ft. ‘cabin’ on 20 acres — that demographically the county where I live has more 65+ year olds than 18-and-under. I once heard a local realtor refer to these old boomers as salmon — they’re on that one way trip up the river…

Where are you? I’ve been looking for this idyllic location.

Gomp,

I’ll give you a hint. In the Miss America pageant, the contestant from this state must identify herself as the ‘ho.’

lol. i didn’t know that lawrence yun posted here!

‘ The theory that the boomers were all going to down size as they aged is nonsense’

Good point but wrong reason.

Many Boomers will have capital gains over the 250k or 500k on their home. Moving to a smaller home will not free up that much after paying taxes. So why the hassle to change everything?

I don’t mind contrary views but….My God man…..review the tax code. No tax.

What?

My brother bought a brick starter home right around 1972 for under $20 / sq ft. We then went through inflation and before you knew it cost doubled and never went back. Kind of thinking we might be there again. Cost to build has shot up and don’t think it’s going back down.

The panic you reference has already started. I also believe this has more to run, but even the realtors (or at least my realtors organization) has admitted in a mailer that another year like last year isn’t sustainable here in this red hot market.

There is no panic. Its only on few honest channels like Wolf Street, RT and Perma bear’s mind and so far mostly wishful thinking.

– Dow is still near all time high.

– Home prices are still rising.

– In Bay Area, there are still 100+ buyers for every home that come on market and overbidding by 1M of 2M homes.

– Fed is still printing.

– Fed rate is still near zero.

Everything else is just talk so far. No actions. Raising rates to 0.25% is laughable when real inflation is 15% and CPI is 7+%.

the moment i hear someone use “perma bear” is the moment I disregard everything he has to say.

“In Bay Area, there are still 100+ buyers for every home that come on market and overbidding by 1M of 2M homes.”

Good lordy. Did you get that from a ZH headline?

Getting zillion buyers does not indicate anything more than that the initial asking price was low.

The only thing that matters is the price increase and adjusted to real price inflation, about doubling every 11 year (7%)

A 500k house bought in 2000 is now in the Bay Area about 2M.

House did not get more expensive. 4x more dollars printed so price in dollars also 4x.

Note : prices are a bit sticky so short term that 11 year is sometimes more or sometimes less. And some things go slight faster or slower. But for longer periods of 40-60 years, it is amazingly accurate.

Fun Project: Check the price of the new york times since 1900…

I see it every other day. The house next to my friends house in Los Altos came to market listed at 3.99. Sold within one week for 5.4. A few weeks ago.

It’s an old 2000 sqft ranch house.

Same in Sunnyvale and Mountain View and Cupertino and everywhere else in Bay Area. Just go see Zillow recent sales.

Kunal,

This is happening all over the Bay Area. I have posted charts about it for San Francisco many times. So here is a chart from Compass about Santa Clara (southern half of Silicon Valley). House prices (black line) started rising again but condo prices (blue line) have been in a slump for years. In San Francisco, condos dominate the market (click on the chart to enlarge):

These sentiment aggregate survey numbers don’t mean jack. Worst sentiment since 2010???? Give me a break. All those people thought it was a bad time to buy in 2010 to 2012 actually meant anything if they saw how prices and money printing until today?? They’d be buying hand over fist.

Look at the chart.

Only 25-30% thought it was a bad time to buy in 2010-2012.

Maybe because they were laid off during the great recession or worried about being laid off or they’d recently been foreclosed or something.

65-70% thought it was a good time to buy in 2010-2012.

Jan CPI is due out this week.

Wouldn’t it be amusing if just when the Fed is pivoting to fighting inflation, inflation starts decelerating?

I mean recently the Fed has been totally wrong about everything e.g. transitory inflation that will go away on its own. So maybe their pivot, taper completion and liftoff will coincide with inflation falling on its own as covid goes endemic?

“Wouldn’t it be amusing if just when the Fed is pivoting to fighting inflation, inflation starts decelerating?”

Yes, it would be amusing. It would be equally amusing if WHOOSH!!

Inflation is off it’s highs, isn’t it?

Not in the US. CPI = 7.04% in December, worst in since June 1982.

We’re going to get January CPI later this week, and we’ll see.

Nothing goes up in a straight line. If you look at the high inflation period of the 1970s and early 1980s, there were huge up and down movements in the YOY CPI rate, from high to extremely high and back down to just high and back to even more extremely high.

There is no good or bad times to buy a home. If you need a home and you can afford it, just buy it. Who cares what it cost on paper. If you can’t get a mortgage, build a house and pay as you go. In reality nothing has changed. Houses used to cost 200k and now they are 400k, but your hourly wages went up also. The number of work hours needed to purchase a house didn’t change. Just don’t be lazy and you will have everything you want.

“The number of work hours needed to purchase a house didn’t change”

Wrong.

Hah! What a crock.

My wages have never come close to doubling ever under any circumstances. Houses double in a few short years? Yeah totally easy to compare that with the 10% wage increase I’ve had in a few short years.

You’ve got to be trolling.

Gee, what a wonderful time to buy a home and be under water for the next 10 years plus. All time high prices, low volume and most of the market cannot afford a home. Even Fannie Mae is fessing up and telling the truth. Wow.

Being underwater is still better than renting. How much will rents be in 10 years? You buy a home to live in and will likely stay in it for 7-10 years, so who cares if you didn’t buy the bottom.

If you listen to these people here you would never own a home. The amount of people waiting for a correction along with the amount of investors willing to pay cash for any correction should tell you all you need to know. My rent went up from $1825 to $2200 this year. That told me all I needed to know to buy. If you want to rent the rest of your life listen to these people.

My UK grandmother lived to 100yo and would often tell how buying (or renting) a marital home in England during the 1930s was “unaffordable”…

Plus ca change, as they say.

Funny, you always hear how the next generation, Gen Z and millennials will power this market up higher and higher, yet survey like this counter that mainstream and Lawrence Yun talking point.

Will this be enough to crash this housing bubble? I sure do pray and hope so but who knows, there are still plenty on here that said SoCal market is red hot and people bidding over left and right so it must be true. Think I will temper my expectation and prepare for a reality that it will just stabilize and not crash. After all, SoCal are full of special kind of stupid so it wouldn’t surprise me people out here still bidding over while rest of the previous red hot market cools down.

I read that Gen Z and Millenials will inherit Trillions of dollars from the boomers over the next 20 years. No worries….be happy. Oh wait…most of that will go to the Walton , Bezo Family, Gates, Buffet, Blackstone, and Musk families.

From WSJ:

Baby boomers and older Americans have spent decades accumulating an enormous stockpile of money. At the end of this year’s first quarter, Americans age 70 and above had a net worth of nearly $35 trillion.

Older generations will hand down some $70 trillion between 2018 and 2042, according to research and consulting firm Cerulli Associates. Roughly $61 trillion will go to heirs—increasingly millennials and Generation Xers

Here’s who owns that wealth and whose kids are going to get it:

That’s depressing.

As the “Everything Asset Bubble” normalizes, all assets will decline in price.

Advice to youth:

1) The most you can extract from the average citizen is a monthly payment.

2) The three estates (time tested paths to wealth accumulation) are banking, real estate and insurance. Newspapers (the ‘Fourth Estate’) has evaporated with the internet.

3) Insurance, being highly regulated, is best participated in by self insuring and avoiding insurance in all real estate and banking endeavors, pocketing the equivalent ‘would be’ premiums and accepting the risk.

4) Timing is everything. Buy into fear and sell into greed. You make your money by buying at the right price.

5) Expect mistakes and learn from them; Jesse Livermore’s dictum is you have to pay for your education.

6) The success of all parties you deal with is crucial to your success.

7) Start lending early and often.

During the pandemic, 3% mortgages were not uncommon. On a $400,000 house, a 30 year mortgage payment was $1682.41. But when mortgage rates match the CPI, say 7%, the house price will need to be $255,000 to have the same mortgage payment. We know when humans are hopelessly upside down, with mortgage debt far in excess of the value of their property, they stop making payments and just box up their stuff and camp out until the Sheriff gives them 24 hours to leave. The chances of a Covid moratorium on evictions and foreclosures going forward are not likely. Forced relaxation of the lending standards (just like last time) ensures the boom – bust cycle. It is amazing what people will strip out of a structure which they are returning to the bank. This process ensures the the buyers must have 100% cash and prices go much lower than you would imagine.

You can shake your head and blame the Fed, or you can get rich. Let’s get rich.

“You can shake your head and blame the Fed, or you can get rich. Let’s get rich.”

Sorry, some of us aren’t degenerate gamblers blinded by greed. Your whole mentality is what’s wrong with the system.

Depth Charge-

I did not run the Fed. I did not create the boom and bust cycles. If you think intelligent investing is “degenerate gamblers blinded by greed”, I wish you the best of luck. I have the responsibility of providing for my family and my children’s children.

Wealth comes after wisdom, not before.

This year rents in anything over 15 years old and currently rented will go up by 9.1 % per CA rent control laws. Anything newer or vacated and coming to the market will increase as you’ve said above, well over 15%. Thanks a lot Jerome.

We are just in the process of leaving the time when obtaining a 30Y fixed mortgage was the greatest of all investments. A negative multi percent real yield with a reasonably stable item on the other side of the balance sheet. In a perverse way the mortgage was becoming the asset and the house was the annoying liability. I would have loved to load up on many 30Y at 3% if it would not have been for the hassle of owning rental properties. But I have seen neighbors, friends, colleagues, who were less scrupulous and now look like investment geniouses. Except, their genious was not so much prudent investment decisions but to walk to the location where the massive faucet of one of the government’s greatest redistribution programs was spraying.

I’ve been in real-estate/landlord market for a long time. I own about 10 rentals now, and buying and selling every now and then. All in Southern CA and AZ. RE is how I make my living.

I keep my ear to the ground. There is a huge shortage of housing. Buyers and renters are coming out of nowhere it seems.

While I wish this was a repeat of 2009 and prices plunge (I would buy some more), I am afraid it doesn’t look that way.

Politics are different. I remember Hank Paulson in Sep of 2008 and the whole drama over the weekend with George W. What they started then looked like a bank robbery (of ordinary folks) to bail out the bad guys.

But, the point is, the current political class does worse than that in a sedate manner that makes you think it’s just normal. Things have changed.

Because mortgage rates are nearing 4%, the rate of appreciation will slow down. But 2 years from now, 400K house will go for 500K, just because there is too much money everywhere, especially abroad, looking for some yield. And don’t underestimate General Jay (GJ), the Chairman of the Money Castle. Or whoever. They will find a “creative” way to make it happen.

This is such a huge opportunity for the US Gov to get ahead by stoking inflation. No way they will allow prices to fall. Rising prices of homes are VERY important to them.

Why, you ask? To avoid a revolution. Did you notice there are companies everywhere that offer to buy a PERCENTAGE of your house, with NO INTEREST, and NO PAYBACK? For example, if your house is worth 1M, they buy 20% and give you 200K. No interest, no need to pay back. Once you’re dead, they get to force sell your house at their choosing and get 20% out. This beat reverse mortgage by a lot. This will provide means for so many. Houses are getting sliced and diced in ownership, just like stocks, and liquidity is rising.

All this means, if you can afford to buy now, do it. I wish better news were to be had (I would love it to increase my portfolio), but I don’t think so.

There were LOTS more people in 2008 that thought housing prices would never drop. Look what happened to them.

Common sense says, anything that can go up 30% in two years can go down 30% in two years. If home prices have been rising at 10x the rate of median income, they can fall.

Sure they can fall. But not much and will quickly get reversed. I was telling friends in 2008 that prices will crash, and no one believed me. It was clear that unsold houses were piling up.

Now, I see the opposite of what I saw in 2008. No gluts. It’s more about buying for shelter, especially for the COVID-expelled hordes from the big California cities, moving to outer suburbs and states like AZ and TX.

And the biggest factor is … roll of the drum … that builders are still scared of overbuilding, and have been for 10 years. They were scared because of the previous crash. And that’s why there is more people than houses.

Add to that a disrupted supply chain where suppliers tell builders what they can buy and when, and the only conclusion I see is … more price pains.

@DanW. I agree with everything you said. I was the same way in the 2005. I sold all my stock and went to cash in 2007. I started buying puts on anything to do with home building. Unfortunately I was two years early. LOL Most of my puts expired worthlessly but at least my stocks portfolio did not drop.

“Buyers and renters are coming out of nowhere it seems”.

I am rehabing a rental and people are coming up to the construction people wanting to rent the house. Trying to get first dibs. They do not want to rent an apartment if they have kids or pets.

It is crazy. But…that being said….I am starting to see a lot of rental houses starting to pop on Zillow in my city. They all look nicely rehabbed. I started to check out the companies who are renting the properties and many are big companies with rentals in multiple cities. So a lot of the SFH rentals hitting the market are not mom and pop.

I am not sure how this plays out. As you said, builders are scared to overbuild. So in the past 10 years most of the housing units in my city were big apartment complexes and not homes. A lot of land that was supposed to be housing subdivisions in 2009 ended up being multi-unit apartment buildings. But now these millennials are tired of living in apartments and are looking for a SFH. So as more rental homes hit the market….will the apartments take a hit.

I thought the same in 2008

“I keep my ear to the ground. There is a huge shortage of housing.”

No you don’t. Because if you did you would know that never before in history has there been such a glut of empty houses, held like trinkets that appreciate tens of thousands of dollars per month.

I don’t know where you see this glut of empty houses. Sure there are some, people have second homes. But they always have. Maybe more now than before. But it’s a drop in the bucket compared to demand.

Maybe you’re referring to rentals held by companies like Invitation Homes, they own bunch of those. They often sit empty because IH asks ridiculious rents. But in the end, they lower to where the market wants it, and they go.

I have seen leading up 2009 what a glut of empty houses looks like. I once went in Riverside County on a tour to buy a rental, and I think I saw about 70 empty houses, all bigger than 2500sqft, newer and beautiful, and couldn’t believe it. I looked at regular AND pocket listings. They just sat there for months and months, some over a year.

I do that today too. I barely find 2 or 3 empty houses, and by the time I see more, some of the ones I just saw go pending or contingent. Snap. Simply put, THERE IS NO glut of any kind.

the fact that the population has barely increased in the last two years demonstrates the folly in this argument. depth is right. people are buying houses and keeping them early. i have enough friends who work in real estate, both as appraisers and agents, to know this.

you are right that houses are going quickly, but that’s because people are convinced they only go up, and that inflation will get worse. it’s the same reason businesses are hoarding supplies. the housing market is a consequence of the inflationary mindset, not the cause of it.

DanW

There’s a lot of empty properties here in the Swamp. We do appraisals of them. 100% of them were empty over the last 6 months. END OF STORY

Location might matter DW!

Here in my very local hood in the saintly part of the TPA bay area, there are now about six empty, long term, houses sitting but not for sale, and the for sale numbers keep on growing.

Maybe growing because of the asking price, IDK??

Last time around, 2006-10, things like that were miniscule until the crashes in various areas we were interested in,,, then the crash made a HUGE difference overnight…

“It’s different this time”.

Layoffs could change things.

Higher rents and mortgages will limit consumer spending. Friend just bought a condo, has a roomate, good income for his age. Skipping out on eating out to save money all of a sudden.

I still think a rent strike movement would be fun to watch.

I live in flyover corn country and my friend group is all popping out kids. Naturally we are looking for larger houses with some elbow room.

There isn’t any economic growth in the area but it is still a mad dash for anything decent that hits the housing market. It’s hard to pin down why. Probably multiple factors but I think government backed farming isn’t helping.

They says real estate is local. And around here, there is no land available. Farmers only buy land and never sell it. I am told wasn’t always this way. Farming used to be a rough life until Uncle Sam and John Deere changed the equation.

I love to tease my republican farmer friends for being welfare queens. They are the silent beneficiaries of massive government money that rarely makes headlines. It seems to me that government intervention in the form of farm subsidies has screwed up the land market around here. Add in the silly corn ethanol mandates in gasoline and farming is good work if you can get it.

The prettiest young girls around here all try to settle down with farmers since it’s like marrying into small time royalty.

.gov knows that of all the supply chains, food is one of the most important. The federal moolah gravy train is ugly but I think understandable that they want to keep certain production close at hand.

It’s a speculative mania, that’s why.

Before the wonderful response to the pandemic the high for lumber in the last 5 years was in 2018 at $651 per thousand board feet. Now as I write this its $1115.

It was close to $2,000 at one point. This is what happens when Weimar Boy Bowel shits himself and prints like there’s no tomorrow. It’s like putting out a match with a firehose.

I remember trying to get into the stock market at Dow Jones 1000 in 73…missed it…..it went to 580……I missed it again and finally bought in when it got back up to 1000 thinking what a fool I was.

Right now does it really matter whether it was 1000 or 580…….

Keep that kind of thinking in mind and you will do well.

Possible. Also possible that investing into the US equity market right now is like investing into Japan in the late 80s. It’s 40 years later and the Nikkei is still down. Nominally, lol! For the US pretty much all valuation metrics are somewhere in the 2-4 sigma range and Jeremy Grantham sees a 1920s like super bubble. Whatever happens, interesting times we live through.

There is no comparison between the 1920’s and now, none whatsoever. This mania is far bigger.

Most are ignorant of financial history but even when not, somehow find a way to rationalize what exists today isn’t (anywhere near) as extreme as other past bubbles and manias.

Other reasons for this rationalization include: It’s contrary to their personal preference because of the implications to their personal finances. Two, somehow, someway, they have been convinced that the US is exempt from the reality which applies everywhere else, both now and previously.

This is the greatest mania in the history of human civilization; it’s not even close. It’s the same mania from 2000 (dot.com) and housing bubble 1.

All of it is related by the mother of all asset bubbles, worldwide debt.

It’s not uniform where every market is unprecedentedly inflated, but in the aggregate, that’s what it is.

It’s always a great time to buy a home if you can afford it and want to own the place where you live.

Oxford dictionary definition of “home” … the place where one lives permanently

Wouldn’t people have thought that in 2008? A lot of people lost their financial future in that mess. The current bubble is even bigger.

What’s wrong with renting until its safe to buy a home, to avoid quickly losing 20% or more on the biggest purchase you’ll ever make?

”real definition of ”home”’ :::

When you gotta go there, they gotta let you in…”

has nothing to do with houses or condos or any other physical thing…

OK,,, from long time hard core ”roadie” worker!!!

At my current rate of rent, it would take 66 years to pay for this house I am living in, without interest. Who in the world would buy when rent is so much cheaper? Certainly not me.

What will median rent be in 66 years?

In my opinion the problem right now is speculation, sold 1/10/22 250K, for sale 2/1/22 290K..I hope this is not ending well for them..

Who is more to be pitied than the man who has pre-spent his entire future?

At some point, won’t the price of buying a home have to factor in the cost of insuring it, to a degree that would impact both a sellers profit and a buyers budget? Lose, lose.

My home owners insurance in Florida almost doubled this year, from $4300 to $8000 (w/a $7000 hurricane deductible).

And I wonder what happens if a hurricane hits, anywhere not just FL, and the supply chain failure – already causing huge delays in home building – leaves unrepaired carnage for years.

FIRE FIRE!

After Hurricane Katrina sank the lower side of New Orleans, people migrated to Houston.

One hurricane eye was 10-12 miles wide. The eye wall did the most damage with embedded tornados. Hurricane Charlie tore through this area in 2004. Some homes were torn down due to structural or mold damage. Others were repaired and reused. FEMA set up trailers. Bush was down here handing out Federal food aid to victims. The NASDAQ market crash had already destroyed some retirement accounts.

390 paces or thereabouts to mean high tide from my front porch. upon a time, five feet of Katrina in my kitchen(of a raised house), but on my street there’s seven houses on slabs in between me and the water, two more building. Guess their insurance companies didn’t notice the Gulf down the block. Or they’ll pull the wind/water scam again. Problematic to leave for a storm, since you often can’t return to your property for days (police/soldier roadblocks and curfews). But it’s a pleasant warm place with cheap rent(siblings-owned). Just have to be ready to run north with everything you want to keep when the water comes. Practical for a single man. The big box home improvement places do a decent job of stocking stormed locations now, the utility companies all cooperate to field repair crews fast. The material shortages right now are pertinent to construction, less so to storm repair, unless you’re slabbed and have to start over. Exception for roofing materials, but it’s pretty common for insurance adjusters to reroof a house with very minimal storm damage to a newish roof in this area. I have never seen a time where you couldn’t get standard color asphalt shingles and tar paper and nails from somewhere, as long as the power’s on..

urblintz