For retirees, 2021 was a nasty year: Red hot inflation and a stingy COLA. In 2022, they might fall behind more slowly.

By Wolf Richter for WOLF STREET.

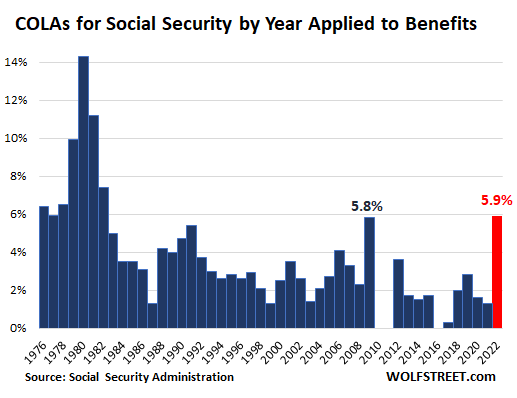

Among the red-hot inflation data released today was the Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), which is used to calculate the Cost of Living Adjustment (COLA) for Social Security benefits. The COLA to be applied to Social Security benefits starting in January 2022 is the average year-over-year percentage increase of CPI-W in the third quarter. And today, the September data was released.

For September, the CPI-W soared by 5.9% year-over-year, after having soared by 5.8% in August and by 6.0% in July. The COLA for 2022 will be the average of those three: 5.9%, the highest since 1982:

A COLA of 5.9% might sound good, and there are hopes that this COLA will allow Social Security benefits to keep up with the actual costs living, and that may be true for some people, depending on how and where they’re situated, but for many it won’t be enough, and their actual costs of living will continue to outrun the COLA.

The big issue now is rents, and many Social Security recipients who rent, depending on where they live, already faced double-digit rent increases this year. Then there’s gasoline, which jumped on average 42% year-over-year in September and utility natural gas which jumped on average 21%. Traveling, now that you have time? The CPI for hotels and motels has jumped by 20% and rental cars by 43%.

And forget buying a vehicle, new or used, because those prices have spiked out of reach for any COLA.

The reason the COLA is still relatively low compared to reality on the ground is that housing costs, which account for nearly one-third of the overall CPI, have been artificially repressed by the calculation method.

The CPI for rent rose only 2.4% year-over-year, while actual rents have soared in many cities by 10% or more, and in some by 20% or more.

The CPI for the costs of homeownership rose only 2.9% year-over-year, while home prices have spiked to high heaven, with the Case-Shiller Index for house prices rising nearly 20% year-over-year (here is my mind-boggling chart on this disconnect, fifth chart down).

And there is a lot of catching up to do by this upcoming COLA. The COLA for 2021 was only 1.3%, even as inflation has been spiking all year. So recipients are already way behind from this year. And next year, if they’re lucky, they might fall behind just more slowly.

Consumer price inflation is often and erroneously equated with “growth.” In reality, consumer price inflation is the dollar’s loss of purchasing power – and of everything that is denominated in dollars, such as labor and Social Security benefits.

That’s why it’s important to not exclusively rely on Social Security because over time, despite the COLAs, the purchasing power of the payments will erode. They might be enough at first, but they won’t be enough years down the road.

A nest egg accumulated over the years is a huge help. And working in some form to bring in some additional revenues for as long as possible will mitigate the loss of purchasing power of the benefits – and if the work is fun and generates some income, it’s a great thing for all kinds of reasons, not just money.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Take it and eat beans.

Amen. When prices surge, workers can strike but retirees have only 3 options:

1) Throw the bums out and vote in leaders who will stop throwing money around and actually address the practical economic issues driving the inflation.

2) Diversify your assets & income beyond Social Security – Wolf covered this a bit. I’d add that we’re overdue for a major economic trend-shift favoring “labor” over “capital”, and this trend is likely to run for the next 20-40 years. Labor scarcity may enable retirees (and students) to once again earn enough to scrape by, at part-time jobs that aren’t too physically taxing.

3) Rework your lifestyle to minimize expenses. Housing: long-term, owning a modest home beats renting a larger one, especially if the smaller place is in a low-tax state. Transportation: live where you don’t need to drive as much, and where you can buy what you need at low prices. Medical: cultivate friends who can help you meet your needs at lower prices than the abusive system offers. And so on.

Did I mention that we need to repeatedly throw the bums out of office until they fix the system?

The supply of bums is infinite.

Rick-in that case, an “Active vs. Effective Bum Index” would be useful (okay Britophones, i already hear you taking the mickey…).

may we all find a better day.

“The supply of bums is infinite.”

LOL! Exactly. And informed (via personal, objective research since what we are fed is mainly BS) voters are in the minority.

“The masses have never thirsted after truth. They turn aside from evidence that is not to their taste, preferring to deify error, if error seduce them. Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusions is always their victim.” – Excerpt from Gustav Le Bon’s “The Crowd” (1895)

That’s just human nature which hasn’t changed for many thousands of years.

wolf – can we get some up and down buttons for these comments

so many spot on while others seem to come from wokeville

When you go into the voting place, only bums have made it through the primaries to be on the ballot. The lever in the voting booth iserves the same purpose as the small steering wheel on a child’s car seat. The illuson of control.

Sounds nice in theory.

In reality: food is not the major expense. Housing is.

And while you can buy a cheap house in the boonies, living in the boonies means worse health care, higher transportation expenses (no buses in the boonies), less social infrastructure in many cases (senior centers etc). Plus you still have to pay utilities and property tax.

And thanks to decades of asset price inflation, even houses in the boonies aren’t cheap.

I said nothing about “boonies”. There are many smaller cities and suburbs with low-cost housing. The housing is sometimes low-cost because the cities are struggling economically, but that can be attractive for a retiree who doesn’t need a high-paying job.

@Wisdom Seeker

The smaller cities are the ones where rent has shot up and so have housing prices.

Beans and rice are underappreciated. You can get a bulk bag of Black beans, Pintos and Garbanzos for about $1 a pound maybe more now; Rice is maybe that as well. Throw in Tabasco (I’ve been to Avery island, but not Japan) and salt and pepper make a delicious meal complete proteins. Good for the planet, too.

Flatulence is good for the planet?

LOL!

Dawns Early Light. Decent film. Just substitute China for the Soviet Union. Of course, any modern reboot (unlikely) would have North Korea as the bad guys as in the Red Dawn reboot so as not defend the real enemy’s domestic market.

“defend” -> “to offend”

Winston, you are the first to correctly state the origination of my username! 👍

Well, maybe not the methane.

But an ancient astronomer. John Dobson, lived an active life past 95 on rice, beans, and eggs. His words, not mine.

As I said in a previous post in the last WS article, we, at past mid 70’s of age here, are thankful for the 5.9% increase in our SS checks as those funds are responsible for most of our living expenses. Now we need to cover the medical stuff and taxes.

So it looks like one of us will look for work next year. Since I take care of the dog around here, my wife will need to get down to Walmart and see if she can be hired. What can go wrong? LOL

Average lunch meat prices last year…$2.98. today $4.42 and climbing…that’s 48% increase. With your 5.9% increase you’re still down 42%. Just one example…pick anything will be the same story.

Abolish the Private Fed.

I’ll post my favorite price increase:

Walmart – common bleach, 1/2 gallon.

2019 – $1.00

2021 – $2.84 (this was as of 10/12/ 2021)

One of the “investments” I have on my list is to buy all the necessities I can in advance, potentially for the rest of my life. Little opportunity cost now with ZIRP and ridiculously overpriced asset markets.

AF,

Us too! Food!

We are stocking up food and preserving it to last years, if necessary. Some would say that we are hoarding, but no, we’ll eat it. And the way things are going — fixed income and all — it’s an ‘investment’ that will never go bad and always have a positive return.

:)

If you are looking ‘lifetime’…

Liquid bleach has a shelf life of about a year. Solid chlorine compunds last indefinitely in dry storage and can be mixed up into bleach as needed. The most convenient form is chlorine pucks for swimming pools and hot tubs.

Lots on the interweb about this.

@AA

Maybe shrink-flation has some good.

I’m getting quite thin!

Anthony,

Ever heard of Dollar Tree? Bought a gallon of bleach yesterday for a buck. As it was said in the movie, “Trading Places”, “ONE DOLLAR”.

Good show! We have one of those stores nearby. I’ll check it out!

J

Sure…..why not?

Let’s let every single bank in the USA issue their own currency.

Won’t that be special.

You’re not much on real history, eh ?

Not such a bad thing. Only the banks that have trustworthy backing for their currency would survive. What passes for “trustworthy backing” today would not last long in that environment, just as it should be.

Unfrozen fresh Cod fish, 11.99 two weeks ago. 14.99 today

That 5.9% is before any additional income taxes to be paid on the increase.

And the increase in Medicare Part B….. and the 11% increase in Medicare Part D (as quoted in the latest “update” from the insurer).

I expect the Medicare increases to swallow up the Social Security bump.

One wonders when the people, including seniors, will demand to know how and why our worthless politicians/government can provide billions if dollars in foreign aid, millions in social welfare to those crashing our boarders and continue to lavish themselves with hefty raises and perks while hard-working Americans struggle to make ends meet? This COLA is a joke. If in fact the average SS check is $1,200, the raise will be $70.80 a month, which will gobbled in one trip to the grocery store.

Gian, you have to factor in that the SS raise is permanent. You don’t just get an extra $80 a month next year. You get that every year going forward. If you could sell it at today’s interest rates, the present value of that incremental raise is about $15k to $20K.

Even still, all it does as keep us up with “published” inflation. It’s not a windfall, no matter how long it lasts. Plus, if you have additional income (RMD, pension, etc) you may end up paying taxes on the SS money.

Defense Budget Foreign Aid

2019 $731.55B

2018 $682.49B $ 46.9B

2017 $646.75B $ 47.9B

2016 $639.86B $ 49.4B

Where oh where could we look for savings?

Outsource to India. On their Mars orbiter:

“This is a mission that has been budgeted at 4.5bn rupees ($74m), which, by Western standards, is staggeringly cheap.

The American Maven orbiter that arrived at the Red Planet on Monday is costing almost 10 times as much.”

I think they look at old folks as takers now that we aren’t in the labor market anymore and debt spending is behind us. Young people flooding the boarder can be educated and trained to be an economic debt slave if given enough time.

No I imagine it gets gobbled up by health insurance increases which are taken out. Maybe the COLA increase keeps ups with health insurance increase. Maybe not.

But there sure as heck is not 70.80 left over.

Laugh even louder at the joke……

The part B premium increase can’t by law exceed the COLA, in 2022 it will be about $10. Our Medicare advantage plan is going to be significantly cheaper in 2022, the $75 high cost option will be $55 and the -0- premium option is pretty comparable to last years $75 plan so we’re going with that. Our net monthly increase will be about $250.

Net monthly income increase, that is.

“A nest egg accumulated over the years is a huge help”. Yes it is, if we could just get some kind of return on it. The beatings will continue…….

Retirement on social security / state pensions, in comfort, is perfectly possible IF you can get your bills signficantly below that of the average pensioner. Those methods would include:

Energy – insulation, corrctly sized property, low cost heating (e.g. firewood)

Food – growing some of your own

Property Taxes – find somewhere cheap

General costs – live in an area with a generally non-wealthy population. All sorts of costs like haircuts and auto repair are cheaper as most must be able to afford them, but in my experience the standard is rarely lower and often higher.

Essentially, the government can’t reduce benefits or increase taxes below that which would cause most of their voters would tolerate. If you can live at a lower cost level than that by being smart, then you are secure.

As a further point, it would be prudent to discover what your local government counts as assets, and shift as much of your savings and income into items that don’t count, and which you will either use or won’t lose value.

In summary – look poor, because sooner or later if you look rich the government will make you poor.

I had to pay the city $50 for a permit, to replace a $17 fence post!

Sorry …But there are 2 problems here.

1. You have a property in a place with such BS rules.

2. Sounds like you actually paid it.

😂😂😂😂

Yes, total BS.

The city caught me repairing the fence. Pay the permit fee, or the 200 dollar fine!

Living in Thailand outside of tourist centers, all of these are pretty much very low cost:

Energy – insulation, correctly sized property, low cost heating (e.g. firewood) … [AC is the cost here, but we live mostly in a small mother-in-law cottage behind the big house, which keeps it manageable].

Food – growing some of your own … [wife has a mini-farm, she grew up in a farming family, although her father became a teacher].

Property Taxes – find somewhere cheap … [property tax that wife pays on her property is insignificant compared to what I pay on the house I rent out in Oregon].

General costs – live in an area with a generally non-wealthy population. … [It’s somewhat amazing that so many Thais are such hard workers, and make do with limited income (“Thailand Annual Household Income per Capita reached 3,707.218 USD in Dec 2019”). Thailand has one of the largest wealth disparities in the world, yet in my experience, outside the tourist areas Thais are angel personalities compared to Americans.

The inflation factor in Thailand is iffy, with possibility of ballooning. But in the last 5 years it has averaged about 1 percent. If it starts ballooning, the poor masses will rise up and bitch slap the oligarch puppet politicians.

I have a friend now living in Northern Thailand with his Thai wife, who says the same thing.

Good choice on your part – I just don’t like hot and humid.

I was in Bangkok a couple years ago. Very hot and humid in March. It’s one of the hottest cities on the planet, with temps exceeding 90 F. every day of the year. I don’t think it’s much cooler in Chiang Mai, although we will visit as soon as we can. In December or January.

I’m not the Bangkok type. I don’t like hot and humid. But I worked for years in the Middle East and got used to hot. One can acclimate to a certain extent.

I love nature back in my original haunts so much, from Colorado westward to California. It’s a sad sentimental feeling that I don’t feel comfortable in U.S. culture so that I can enjoy that relatively benign natural beauty.

PS Social Security is a Ponzi scheme, always was. Only wages are taxed, and they were ridiculously low for decades. Anyone over about 80 is a rake, working stiffs are the marks. No tax paid on LTCG and ceiling is only like $125k a year. I call BS. Tax it all, cap LTCG 20% max rate at $5 million lifetime or something and otherwise tax it at marginal income tax rates. Let Tom Brady, Jaime Diamon, that turd Fink at Blackrock et.al pay 13.8% of their income on SocSec like the rest of us schomes.

A ponzi scheme you say ?

Much like the stock market ?

Real estate ?

Every single investment can be classified as a ponzi scheme.

I hear this dishonest argument a lot. When people call for abolishing the SS cap, they’re not calling to increase benefits commensurately. This means that they’re advocating turning SS from a retirement system into a welfare system. As it is, what you get out partially depends on what you paid in. Why remove that?

Ponzi scheme? Thank goodness for all those Congress critters who bought votes with the scheme. Pension was a nice idea before the pigs discovered the candy jar.

COLA – Medicare increase = ?

The average SS benefits in 2021: $1,565. This is going to rise by 5.9% or $92 per month. Medicare Part B = $144. If it rises by 5.9%, it would increase by $8.50 per month. So in this case, the increase after Medicare Part B would be $83.50 per month.

Well said!

I couldn’t disagree more. The fact that Medicare part B will only increase 5.9% does not agree with the facts. I have been on SS for 17 Years and each January first, my monthly SS check is less than the year before caused by the increase in Medicare premiums which are greater than the increase in SS.

I have not found that to be the case. A lower monthly SS payment and lower past COLAs might support your situation. Part D also takes a good chunk.

Most Social Security recipients find that the lion’s share of every COLA disappears into what they pay for Medicare.

The average SS benefits in 2021: $1,565. This is going to rise by 5.9% or by $92 per month. Medicare Part B = $144. If it rises by 5.9%, it would increase by $8.50 per month. So in this case, the increase after Medicare Part B would be $83.50 per month.

Well said, again!

Part B is actually $148.50 right now, expected to rise to $158.50 next year. That would make the medicare increase 6.7% not counting the increase in the deductible. They haven’t announced the real part B increases yet.

Thanks. Correct. I was going off memory. Always a mistake.

Yes, the increase in the deductible is not often stated with the monthly increase.

Many many people are not average. And a lot of them are hurting. Observing current trends they are going to be hurting a lot more.

“Most Social Security recipients find that the lion’s share of every COLA disappears into what they pay for Medicare.”

Maybe you meant the net amount they pay for medical care in general.

Whoa! Deja Vu!

Must be a glitch in the matrix. Hahahaha

It’s an insidious and inescapable current we find ourselves in, where people are preponderously pledged to personally participate in the risky rat race of ridiculously rising financial markets just to try to fetch some feeling of future security as remuneration regresses relative to the ratcheting cost of living.

Awesome and admirable applications of alliteration!

An appreciated and assuaging acknowledgement, yet an unusually undeserved and unbecoming upvote…

Wise, witty words!

Frankly finding it flippant and facetious, but I too care to casually clown concurrent with your concensus…lest I lose my loose language in limbo.

Salt/WS-had to review all of that in my Funk & Wagnall’s…

may we all find a better day.

Hey, 91, hopefully it cleared up my funky and woeful verbiage…

Browsing battered books, what a babbling brook of bedeviled braniacs be between these beaten boxes.

Make sure you self employed don’t deposit any checks for work performed over $600. If you’re smart cash them at some cash checking center where they don;t speak any English. The $600 bank IRS surveilence act is in the latest stimulus infrastructure bill. They will pass it and it will apply retroactively for the past 3 years. All your bank records including deposits for work performed which I use the term “Southern Income” will be downloaded to the IRS servers and checked against reported self employed income. Get ready for a big tax bill in the mail with interest. Enjoy

Won’t work SC:

All checks will be recorded and reported; most already have been for years, and the digital data will be electronically correlated for both sender and recipient.

Best thing to do IMHO after being mostly self employed from early 1970s to late 20 teens is to make sure you document every expense against income, and don’t claim every expense for WHEN, not IF you are audited.

Was very fortunate to run into a professional tax preparer who not only did my biz and personal taxes, but showed me exactly how to do it myself; after that, went to a couple of other ”registered agents” and offered to pay them their ”review fee” and split any savings above my efforts 50%,,, AND they would not have to sign the return…

Was audited 3 times, no penalties.

As government needs more money they will come up with more regs and controls. If it gets bad enough it will be price and wage controls and capital controls. French went so far as to hang someone for buying something with gold instead currency.

The government will have to torpedo escape routes like crypto and gold before they are done.

I do that also. I don’t take the home office deduction even though I’m entitiled to it. If I’m ever audited which I’ve never been then I’ll bring that up.

I can’t say I’m terribly impressed with some new IRS bill.

I work with someone who has received nearly $1M in erroneous checks so far this year: the IRS screwing up and sending checks to the wrong entity/person. And it seems they can’t even tell if checks, erroneous or otherwise, were cashed or not.

The notion that there will be a human intelligence correlating both ends of checks to find income is quaint and wrong.

Besides which the vast majority of under the table work is cash.

I also am working on a case where the owner of an IT firm has not paid in payroll taxes collected since 2011. We’re talking millions of dollars, before interest and penalties.

The only people who get caught are those who are both unlucky and do something so broad and egregious that blind squirrels blunder in it.

“Consumer price inflation is often and erroneously equated with “growth.” In reality, consumer price inflation is the dollar’s loss of purchasing power”

I’ve said before there is a simple cure for this problem!

Each dollar, instead of having a one permanently printed on it, should have a little light powered electronic display with a clock counting down the value. Right now a 100c for a year ago would be showing 94.5c and everybody would know exactly where they stood.

If they kept a dollar for that long, that is.

Merry-go-round!

Instead of putting it on every bill, which would make the electronic updates more expensive than the paper, just have the FCC rule that every TV show has to display the value of a dollar (pick your base reference date) on their screen every hour.

Or, just like an amber/ silver alert on your cell phone/ tv, we could have a Fiat Alert!

Damnable mad Italian drivers! /s

Re: CPI (Consumer Price Index)

With all the games the government plays with this it’s completely worthless. But even if it wasn’t worthless most people would be misinterpreting it. The CPI shows change in prices. The inflation rate is defined to be “The percentage change in the price level from one year

to the next”. This is an invalid definition of inflation. This figure is really the annual average change in prices (ACP). Inflation is one of the causes of changes in price. But there are many things that cause changes in price (inflation, supply/demand imbalances, changes in productivity, etc). Imagine we throw all these causes in 2 buckets: Inflation and Other. We don’t have a good feel on the relative importance of these two buckets so let’s equally weight them. One of these buckets will be above ACP and the other below ACP. ACP was just reported to be 6%. Shadow Stats reports inflation to be 12% or there about. If Inflation bucket is 6% above ACP then Other bucket is 6% below ACP or 0%. Really? All causes of changes in price except inflation net out to zero? That approaches the irrational in my mind. But maybe it takes the irrational to produce all those nice WTF charts Wolf has been providing us lately.

Mommie! Save me!

“A nest egg accumulated over the years is a huge help. And working in some form to bring in some additional revenues for as long as possible will mitigate the loss of purchasing power of the benefits – and if the work is fun and generates some income, it’s a great thing for all kinds of reasons, not just money.”

One of the best pieces of advise I have ever read. I wish more people would do this instead of whining and complaining all the time.

“A nest egg accumulated over the years is a huge help. And working in some form to bring in some additional revenues for as long as possible will mitigate the loss of purchasing power of the benefits – and if the work is fun and generates some income, it’s a great thing for all kinds of reasons, not just money.”

Great piece of advice. I wish more people would follow it.