One more reason “transitory” and “temporary” have become a silly joke. Even the Fed is backing off promoting it.

By Wolf Richter for WOLF STREET.

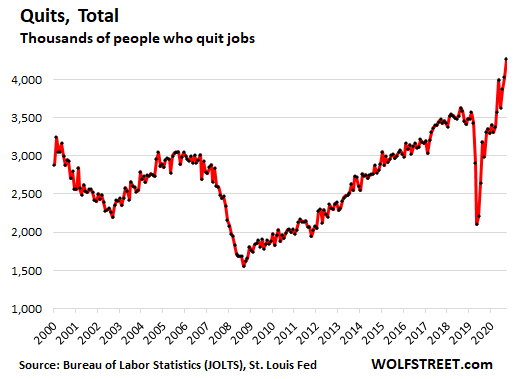

The number of people who quit jobs voluntarily – to work for another company that offered higher wages and benefits and a signing bonus; to change careers entirely; to stay home and take care of the kids; to spend more time with their money; or whatever – spiked by another 242,000 people to a record of 4.27 million in August, up 19% from August 2019.

This is what the Bureau of Labor Statistics reported today in its JOLTS report, based on a survey of 21,000 nonfarm business establishments and government entities.

The spike comes amid a very tight job market, with labor shortages cutting into sales and production, and contributing to transportation bottlenecks, amid record job openings that have been spiking for months, and amid aggressive efforts by companies to hire people away from other companies, which creates this spike of quits.

This enormous number of quits is the hallmark of a tight and competitive labor market that encourages workers to switch jobs to seek the greener grass on the other side of the fence.

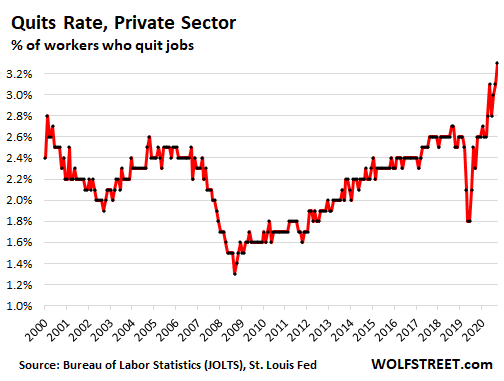

The total quits rate – the number of quits during the month as a percent of total employment in the same month – jumped to a new record of 2.9%. But the quits rate at federal, state, and local governments was only 0.8%.

The private-sector quits rate spiked to a record 3.3%, with the highest quits rate in leisure and hospitality (6.4%) – which includes accommodation and food services (6.8%) – retail (4.7%) and professional and business services (3.4%):

Accommodation and food services is a huge industry, with relatively low wages, often crappy working conditions, including split shifts, night-and-weekend shifts, and during the pandemic, higher risks of infection than other jobs.

In total, 892,000 workers in accommodation and food services quit in August, 6.8% of all workers in that sector. Quits are always high in this sector. In August 2019 during the very tight labor market at the time, 5.1% quit, which had been the highest since before the Financial Crisis.

At higher-end restaurants and bars, waitstaff and bartenders can make good money from tips, and some chefs can make good money, but that is a minority in the sector. Most restaurants in the US are chain restaurants, fast-food joints, delis, and cafés, and for those workers, the income is mostly based on their low wages.

The quits rate is a measure of confidence among workers. It indicates that workers feel empowered to chase after higher wages and better and safer working conditions, better schedules, and the like, perhaps in a different industry.

It’s a sign of very strong demand for labor and aggressive hiring practices by companies to find labor, and a sign that they’re hiring workers away from other companies. When those workers quit to change jobs, they count as “quits.”

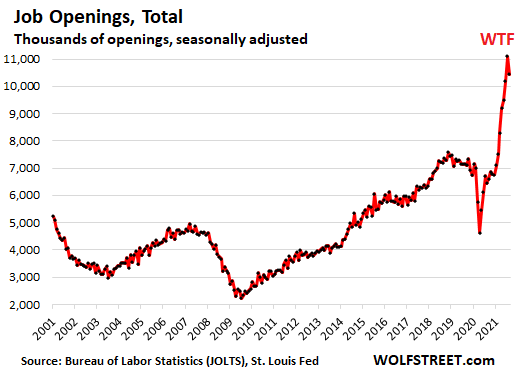

The Labor Department also reported that there were 10.4 million job openings in August, the second highest ever, after the upwardly revised record of July. This was up by 46% from August 2019:

The high number of job openings push employers to offer higher wages, better benefits, signing bonuses, and similar enticements to bring qualified people on board. This has the effect of attracting people who’re already working, and they quit their jobs to take a new job.

Workers are now seeing that they have pricing power. When they leave a job to get better wages and working conditions at another company, they create a headache at their old employer who now, in competition with other employers, has to find a new employee by having to offer higher wages to find qualified people.

This is a sign that inflationary pressures from higher wages are building up in the economy and are spreading through the economy. Higher wages and pricing power by labor are among the factors that give inflation more momentum and staying power. And it’s one of the reasons the terms “transitory” and “temporary” to describe this inflation have become a silly joke, and even the Fed is backing off promoting that silly joke.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nice.

Wonderful news – quit rates are a pretty perfect metric for judging the strength of the labor market. The best case scenario is that this is the new normal, meaning employers who are currently having trouble finding workers will never be able to find them until they bite the bullet and start offering higher wages.

Company has no loyalty to you. Why should employees be loyal to their companies. Be loyal to the job not to the companies. When companies layoff their employees, their stock goes up because now they have to pay less people. Some jobs are now difficult such as food, restaurant and hospitality jobs (Apart from the nature of job, such as trouble dealing with customers). Anyone has to be mad to quit a federal, state job which are permanent and pay generous benefits.

Nobody’s quitting for that…

Jen Psaki said so.

Very interesting take on quitting. I get it, having quit a few jobs over the years. I always caution young people not to get a rep as a job hopper, because when circumstances change those are the first to be let go unless they are protected by seniority provisions.

Some industries rely on quitters and expect it. I know quite a few helicopter pilots. It is very very common for them to take a new job every year, and play one company’s contract offer against another. And when times are tough the companies do the same right back. Aviation has to be the worst industry in the World for that. One friend of mine told me he knew they wouldn’t ask him back when he didn’t get an invite to the staff Christmas party. Ya think that was a solid clue? :-)

Union construction is a good gig. A company can only reserve so many call outs as permanent staff, then they have to go with who is dispatched off the job board. There is a continual cycle of employees to match the work. It is a fair process that allows change for both sides.

Not true al all. My company just let go of a few people, one who was there 40 years! And now wants us to work holidays for regular pay. I am hoping everyone quits. These companies don’t care about anyone!

Never mind the ”seniority” part P : “not to get a rep as a job hopper, because when circumstances change those are the first to be let go unless they are protected by seniority provisions.”

What ensures you can stay as long as you want is the Quality of your performance as measured by results.

Anything else is just some social BS, of which we certainly have and have had enough.

Having ”quit” dozens of ”jobs” and never having had any problems with that practice, I finally found a really competence oriented company who would ”lay me off” for the last couple of months of their fiscal year when they could not bond any more work,,, with FULL PAY AND BONUS,,, because they knew I could walk away and be hired the next day anytime I wanted to do so.

And quite sure that exact same practice is going on all over in every industry today, as the 20% who do 80% of the work has found their real value…

I disagree i was a mason all my life mostly self employed but when i worked for somebody if the boss just said hello to me wrong i was down the road and problably took his crew with me. I had pricing power because i was extremely good and fast. No place i ever quit wouldnt hire me back again and for more money. I had 20 jobs in one year alone. If you want power with the employers quiting is the way to move wages. Why do you think they destroyed unions in this country? Because a union could shut a company down with a strike.

And as far as those numbers go i dont buy that. What the headline says and real life are 2 different scenarios Wolf don’t sound like the guy that ever labored for anything. Wages are still low compared to the cost of living in this country. Thats why kids are still living at home with parents at 30 years old.

Immigration and visa’s has screwed the working stiff in this country for decades now. We do 2 things great import workers and export work.

Most places like restaurants are still under panic mode. With every other table being used, now how can a waitress make any money with no customers for tips? And im in the freeest state there is Florida. Wages have barely moved so now instead of minimum wage they pay $10 to start. Thats poverty wages i made 40 years ago. Construction is just illegal immigrants who dont even get paid minimum wage. Real life and Front page numbers dont agree.

It might be like that on the west coast where they are stll giving money away. In what i classify as fantasyland.

Don’t hate the player, hate the game

Without players there’s no game.

Without games there’s no players

Self employment up, quits up.

Posted on a older thread.

These are the folks keeping me buried in work out in flyover.

Good for them. Need their energy & creativity. Corporate, administrative, or Govt. employment would just suck the life out of them.

Good for them. I also advise them to get what they can while this fake economy lasts.

An underrated statistic that may be worth a mention here is the average age of employees by company/sector. Many young talent leaves big corps. after 2-3 years simply because they can’t stand the control-mania managers have after they see risk and volatility in the economy, like right now. Mature industries have a maturing workforce and sometimes they just have a panic moment which can upset the dynamics of the whole labour market.

Oil&gas is my favourite example: big oil companies introduced dozens of early-retirement programs during the pandemic in order to hire younger talent as a replacement: the perfect opportunity for them to make sure the industry won’t die simply because all the employees deceased. I must say though that sending away the olds is just as challenging for them as attracing the youth.

Former employees moving into contractor roles can also impact these kind of measurements.

My wife manages a county-wide public wastewater district. Before the pandemic they were always losing employees to other cities and agencies because they have the best training programs but not the highest pay. During the pandemic they had a very sensible and fair approach to the virus with the mindset that the ratepayers needed to be served and the employees kept safe while getting the job done. The agency encouraged the vaccine but was insistent that it remain a matter of personal choice. My wife had to butt heads with county and state leaders on many occasions to fight the pressure to mandate the jab. She even repurposed a section of their lab to process covid tests quickly and cheaply in-house in case it comes to that. Now the district is flooded with employees wanting to work there from other agencies despite lower pay. Treating employees fairly and honestly goes a long way

Great story. Too much common business sense though

I dated gal at the sewer, she was way over paid, way over entitlements pensioners, time off, sick and tardy leave.

This gal had a base pay of 40$ per hour, plus time and a half after 8 hours daily. Typical of state and local do nothings.

Gosh, maybe it would have worked out better if you had taken her on dates to the movies or a restaurant, instead of dating her at the sewer?

An interesting feature of the wastewater treatment business is that at each plant and the ,agency as a whole if they have several plants, the EPA designates a jailable official. So if the plant violates its discharge permit it gets fined, but if it violates it negligently the designated official goes to jail. Wouldn’t it be a better world if we had the same thing at the big banks and the Fed?

That’ll never happen. It isn’t ONLY Fed governors who make out like bandits from Fed policy. Congress critters get to the trough pretty fast as well. So invite them to testify, throw some soft pitches, bloviate for a few minutes, and laugh your way to the nearest Swiss bank.

Double post sir

Lower pay instead of a vaccine? Not very bright are they?!

Probably the smartest. Willing to think critically and look at both sides of a debate and form an opinion based on knowledge and personal experience. I would say that waste-water district is a great place to work. Money isn’t everything. Being treated with dignity goes a long way to job satisfaction.

So anti vaxx are flooding to apply? Sound scary.

I work at an employer on an on-call basis, but mostly, I’m booked in advance. I cut my hours per week to 0-24, but try to keep it at 8-16 per week. I do independent work too and it’s more agreeable when it pops up.

I just don’t need to work as much as I did before. I deal with welfare recipients frequently and pretty tired of it especially when I see all the blood sucking i.e. our tax dollars. Sick of it and been looking at this for over two decades. Also, insurance companies pay less and less and this causes my employer to cut assistant help which creates more stress. So, I’m going to be a slug like the welfare bums and let someone else be the tax donkey. I’m blessed to have alternative income which are rental properties. All paid off, hallelujah.

I definately think those of us older who have assets should work less at crappy jobs or conditions. Let the younger one’s with school loans pick up the hours. Let the employers suffer if they don’t get it.

All of this will just inevitably lead to a situation where automation gets pushed a lot harder, and a lot faster. Easy service jobs are poised to go the way of manufacturing jobs.

The motions for the robots are repetitive, there is functionally only so much difference between welding, turning a screw driver vs brewing a cup of coffee or flipping burgers.

If you look at McDonalds, there are already self ordering kiosks, the trend that you see with Starbucks and Chipotle style take out is just going to keep accelerating. Today’s unskilled labor needs to figure this out. This spike of quitting may sound good and feel good now, but in the background it’ll force businesses to get more focused on productivity, automation, etc, and when the inevitable crash comes, those jobs will no longer be there. And depending on government largess seem to be a poor substitute for a plan.

I totally get that companies would rather blow about 15 million US dollars and a few years to (maybe) develop robots that can change the bedspread and clean a room rather than paying 5 bucks more an hour now to some Mexican lady.

But. It’s not going to work out.

Capitalism is going to be found dead in its dilapidated mansion, presumably choked on its own vomit, before we know how to build that kind of AI.

AI is merely…..

Another Silicon Valley lie

Taco bell’s kiosk is a great improvement over the old way for me. I can hit the vegetarian button and see everything available that way. The software is intuitive and easy to use.

And they replaced two employees taking orders.

With this said, I have seen older folks come in , stare at it, and leave. So, automation is not without risks.

I used a fast food kiosk once a couple years ago (I rarely partake). The greeter guy kindly gave me a tutorial. I got the order in and the kitchen produced something entirely different.

AI knew you really didn’t want what you ordered…

When I see the automated kiosks, it just reminds me how processed the food is, and how processed the environment is. It’s too much.

I have a question for them. Is dining out a social experience, or a redundant chore to be mechanized? Which one will earn a higher margin?

McDonalds may be accelerating it’s demise. Who wants to be treated as a number and have their dinner be a couple squirts from a stainless steel box?

“Who wants to be treated as a number and have their dinner be a couple squirts from a stainless steel box?”

Answer: those who frequent McDonalds….:)

Maybe we run in different circles, but I’ve never known anyone to go to McDonald’s as a social experience after the teenage years, It’s more for a quick bite.

Right. That’s a thing of the 70s and 80s until they dropped the creepy clown, fry guys, Birdie, and Hamburglar. Wow, that was a weird crowd. Surprised they survived that marketing nightmare back then.

Safeway has complicated system for redeeming on-line coupons. I got some in the email and the cashier didn’t know how to cash them in on products that I bought. I went to customer service and got the answer. Automation is great when is easy to use.

I don’t have a problem with any of the automation at these establishments. Let them automate, let them get rid of all their customer facing workforce.

However, be aware the ultimate end to their automation is their businesses become mere vending machines in a public space. This is a highly deflationary outcome. They will have lower labor costs, lower rental expense, and very little to differentiate them from other providers.

Can’t wait! It will be as splendid as telephone answering automation. Here are your choices 1-through-9. Would you like to repeat the list? We’ll play you some worn out looped 15 second cassette tapes of bad elevator funk jazz while you wait. Thanks for calling!

@Bead:

LOL! I was just on hold for an hour with the DC tax office and that is exactly what kind of music was playing! Hahaha

PETUNIA

I think you are on to something. I have noticed I go to the kiosk dispensaries in airports for salads / wraps etc instead of dealing with front line worker demeanor, cleanliness issues etc.

I am appreciative of those who do those jobs because they are unappreciated and lower compensated (I over-tip when I have table service), but I agree we are moving in a robotic direction where wait / server staff duties will become something different. It may be for the better….who knows ?

The Japanese are probably on the forefront of vending machine technology. They already sell hot meals and underwear on vending machines. The vending machines also have facial recognition and serve as both news disseminating and intel gathering systems. They can keep track of your favorite drink and financial information. And they never take a day off.

In America you need a lot of security to go along with this technology.

Petunia,

Yep, I agree, there has to be a human element to it. My guess is McDonalds or whatever will still have humans there, but those humans will likely be paid higher wages, and there will be fewer of them. The humans will be broadly split into two categories, the customer facing to basically help you when things go wrong with the order. And the backend, when you maintain and service the machines that’s making the fries and the burgers. But for our purposes, you can just group them under the same lot (which we call servants to the robots).

Then there is going to be a second layer, I will exclude your typical corporate layer here, but this second layer are who we will call the boss for the robot, their jobs are going to be to tell the machines what to do, and as shown in case of Amazon, the machines will also do the firing, see category one.

I don’t think the final outcome will be a bunch of vending machines, you’d have to get very very sophisticated for that. Because ultimately, humans will still want nice service every now and then, it’ll be expensive, but they’ll pay for it. But McDonalds, they are here to stay, and even in Japan, there are loads of places to eat in spite of the vending machines.

The problem with automation is it requires an elaborate parts network and skilled techs. I share a building with a company that has two metal cutting lasers. One has load/unload automation, which basically a large simple robot. The automation part has been down for a month because of a part shortage and the traveling repair techs being backlogged. Luckily it still operates with old fashioned humans doing the heavy work.

Seneca,

Yeah…..anyone with even a little experience with automation knows about this problem.

Automation is inflexible and always much more expensive to run and maintain than advertised.

Not to mention being hostage the patents and proprietary info of the automation company.

For example, McDonalds is a hostage to their automated soft serve machine which has EXTREMELY frequent breakdowns.

The situation is not surprising, but we will see an evolutionary process here, automation is a capital expenditure, you eventually get more expenditure to offset things like breakdown in equipment and outsourcing of support for those expenditures or have in house support depending on size of the company.

Automation is here to stay. I don’t dismiss that there will continue to be a human component, but the amount of humans needed will continue to decline over time. It will just take time.

One of the drivers for replacing workers with automation is tax policy. The transfer of funds from employer to employee is heavily discouraged by federal, state, & local tax authorities all extracting a chunk of the flow. In effect this subsidizes automation to replace workers.

In quite a few other countries there is much less financial overhead to utilizing labor, so you see a lot more employees working at businesses.

VERY GOOD POINT IMHO Z:

What is needed soon,,, but will very likely be fought ”tooth and nail” is a global and globally ”balanced”

LAW to make sure that anyone any where who WANTS to work CAN work,,, and similar Requirements that those that want to work can get ”training” including far shore OJT…

Otherwise, WE the PEONS might just as well go ahead sooner than later to ”OFF”,,, how some ever one wishes to specify that,,, all, repeat, ALL,,, the ”non workers”…

That is EXACTLY what Mao and company did in China some years/decades ago when they lined up every single adult and just looked at their hands…

Callouses, OK,,, no callouses,,, Not so good,,, etc… (Refraining from actually reporting on WolfStreet.com what was the actuality, but will say it made the Nazis look tolerant…

OK, heard that it was approximately 20 MILLION dead in a few weeks, similar to when Mao said similar for the ”opium addicts.”

We want more capital investment — it’s called rising productivity.

We are entering a period of higher sustained inflation. The only way out is austerity and QT. The markets rely on loose fiscal and monetary policy to fuel their advance to the sky. QT is the end of the earnings growth narrative. We will enter the long slow unwind starting with the end of bond purchases all the way to balance sheet unload. Main Street is back and they are raising prices and forcing the government hand to stop printing dollars. The supply chain situation could normalize during QT and further fuel the downward price pressures. The growth story is based on government debt that went to PPP and bailouts, its a sham and a half.

QT and any tepid rate hikes will NOT be enough to fight inflation….

but they will likely try…

But those weak rate hikes with little impact on inflation will very likely be enough to roll the stock market over…..

So, being out of the stock market and in cash will be harmed by inflation that still exists OVER the interest rate environment.

Being in stocks slipping off of all time highs will also be a wealth destroyer.

And this is the DYSTOPIA created by the geniuses of central banking…who just couldnt take their foot off the accelerator …

h,

I think most people aren’t really in stocks but more own FUNDS that own stocks…

So depending on the haircut and the funds ability to handle a stock crash based on the funds investing purpose, may actually wipe out your entire investment , not just a percentage of stock price decline…

If I were in index or active managed funds ( ~ $10T right now) , I’m gone…

Say hello to Petunia’s contagion…

Ah, but you can’t time the market. Assuming the bull runs forever, you’ll recover within a decade or two. After all, the market fully recovered a quarter century after the Great Crash. And that was before Greenspan discovered the Magic Money Tree and hired the Plunge Protection Team.

The biggest unknown over the next 3-4 years is the FED’s unwinding of its balance sheet. Once they’ve fully tapered the $120B a month bond & MBS purchases, the FED’s balance sheet will be approaching $10T.

The last time the FED tapered its balance sheet from the Great Recession was in late 2017 – Sept 2018. After selling ~ $600B in assets, the reverse REPO market freaked out and had a massive tantrum. For months, the FED pumped tens of billions of dollars into that facility. I believe the FED recently made an adjustment to the process that may help this unwinding which, most likely, won’t start until 2024 at the earliest.

The problem, of course, is that the FED has to sell off trillions in assets which have to be bought by someone: big banks, big investors, & big foreign investors. So when this all starts to happen, our national debt will be at least $35T. Yields on current bonds at that time should be notably higher than those of the assets the FED will be selling. Whose going to buy that?

And, even if the FED is able to unwind 1/2 of its balance sheet, that’s approaching $5T that’s has to be sucked out of cash, equity & bonds markets. And, all the major central banks have to do this, right?

So my real point is this. Has the FED’s balance sheet already grown well past the point at which it can reasonably unwind its balance sheet without causing great harm to the banking industry & financial markets?

It’s all a guess, but I don’t see Fed ever getting below 6 or 7 trillion.

I agree. And if I’m right, the FED unwinding its balance sheet will certainly lower the money supply which should help reduce inflation. And you’re right. This part of the equation is definitely a wild guess.

“We are entering a period of higher sustained inflation. The only way out is austerity and QT.”

Why do you jump over all the intermediary steps? You don’t go from massive stimulus to austerity. It’s a inflation/deflation war with many battles.

In my opinion, the Fed’s taper plan will cause stocks to drop 10-20% over the next six months, and then the battlefield changes again. The concern will switch back to deflation, and the Fed will be stimulating again, or at least ending the taper.

These battles could go back and forth for another five years, until the hard-working population gets tired of being manipulated by blood suckers of various forms.

If you ain’t easing you’re tightening, right? More debt is needed to service the exponentially growing debt that we have from running this massive deficit. So anything other than increasing QE and govt spending is tightening in my mind.

It doesn’t quite add up though.

If you look at the labor force participation rate, it is still well below pre-pandemic levels. If the job market is so good, why are people staying on the sidelines? This is not consistent with a tight labor market so there has to be something added to the story to make the numbers add up.

I don’t know if it is just that old people left the job market and aren’t going back, if people are just working under the table more now or if it’s people who can’t get/afford child care and are just staying home or just a mismatch of people and jobs due to the pandemic dislocations (don’t need as many people staffing tourist traps, need more people working at the docks, etc.) or what, but it must be something, and the evidence so far doesn’t seem to point to pandemic benefits being the answer.

On the one hand, all these job openings going begging. On the other hand, all these people who were working before the pandemic but aren’t now. Why aren’t those people taking those jobs?

It seems obvious what is really happening and it’s just going to get worse.

The closest thing the USA will ever have to a general strike ?

I posted what I thought above but Wolf decided to delete it.

Brian,

I deleted it because it was antivaxxer BS and antivaxxer wishful thinking. I now have zero tolerance for spreading this BS on my site. I’ve had it.

The daughter of one of my best friends just lost her anti-vaxxer mother to Covid. The mother was her mid-40s, a healthy small-town Oklahoma gal. And her daughter just started college. My friend divorced the mother years ago, and now she died for her believes after two weeks in the ICU, a horrible way to go, but fine with me. Her believes were formed by the antivaxxer BS on the internet. That’s all she read. I don’t care about her.

But I do care about the daughter, and she just lost her mom.

You can believe whatever you want. But if you spread antivaxxer BS, you’re responsible for people that believe this crap and then get infected and die of Covid, and you’re responsible for the girl having lost her mother.

I lost my parents just after I started college. This is a life-altering experience, and lots of kids are needlessly going through it now thanks to the insidious BS posted on the internet.

Hence ZERO TOLERANCE here.

Some Guy,

“If you look at the labor force participation rate, it is still well below pre-pandemic levels. If the job market is so good, why are people staying on the sidelines?”

You’ve got it backwards: The labor force participation rate EXPLAINS the labor shortage and it EXPLAINS the spike in job openings and in quits. People are not wanting to return to work, for many reasons, as we have discussed for many months here, which creates the widespread labor shortages, and therefore the very tight job market.

If the stock market crashes by 40% you’ll see people coming off the sidelines super quick.

Right now there’s plenty of people thinking they can get live pretty well by doing the following:

1. Making content on Youtube.

2. Playing the market.

Superquick to what?

Remember 2008 and 2009, people weren’t busy sitting on the sidelines waiting for things to get better, they tried to get jobs, and the problem, there were none. People were busy hanging on to what they had.

To say that right now looks a lot like 2006 or early 2007 is quite apt. The only difference is that most of the public was still fat dumb and happy at that time. Today, people know a tsunami is coming. But it’s not obvious that they are prepping for it.

MCH, I only said they would come off the sidelines. Never said there would be a 100% certainty that there would be jobs waiting for them. They are all thinking this good life will continue, but we have the everything bubble now including a Youtube bubble. Everyone seems to think that they all can get rich watching each other’s content, but that’s just ridiculous.

I’ll disagree with the “people know” part of that statement. Everybody here on Wolf’s board may know, but overall I’d say we’re in a very small minority in this regard.

Not to mention, their basic needs ( food, clothing, transportation, shelter) and conveniences are met by others…

Doesn’t cost a lot to live when you don’t have to pay those…

MB & MCH,

The problem with both your outlooks is a lack of historical perspective. Just tried to look at the Dow going back to the 1960’s and found their max period only goes back to the 1980’s.

If you had been around in the 1960’s, the economy was booming. Then the oil shock of the 1970’s and the bill for Vietnam put a big damper on the party. I knew someone in the 1970’s who kept waiting for the stock market to come back and lost his whole account while he waited. The market came back in the 1980’s, but not the blue chips he had once owned.

The GFC was totally different from the downturn of the 1970’s. And the next one will come, but it will be different as well. I admit the stock market bounce back from the GFC was amazing, but it too was based on different stocks than before the GFC.

My point is a downturn will come, but don’t look to the past to define its contour. It will be different than before. Look at what is going on now. Keep your arrogance in check, because even Kansas isn’t Kansas anymore.

Petunia,

It won’t be the same. Mainly because the politics have shifted so dramatically, so the response are going to always be different.

I also agree the contours will be different, but I if you look into the past, what you’ve seen is sharp drop offs, followed by long periods of not going anywhere before resumption of upward trajectory, that has been typical. The timing will differ, and the amount of pain will vary. But given the funny build up we had, I’d say it’s more likely we see more pain than less.

MB, 56% of Americans are invested in the stock market (see Gallup 2021). Of those, the top 10% own 84% of the share value (see Forbes). I don’t think these are the same people who are quitting bad jobs.

These numbers use be true although I find it hard to believe that there was ever millions of high end service personal employees out there.

In my experience at least since the start of the destructive union busting decades (1980’s) my car at risk (bad valet) inferior bell boys, (snot nose brats), non linguistically able wait staff and over eager janitorial personal.

My take on it sir is that quite frankly it’s al a grand illusion.

Seen evidence of money printing for some time now. Walk in a local park and see abandoned child’s cycles, clothes, bottles of water and fruit drinks unopened. Printed money goes on benefits so people value nothing. Stop the money printing and people will have to work for a living.

I’ll call your bluff! These ‘games’ no longer apply to these people. You don’t get out much, do you?

How many people quite government jobs?

I’ll bet very few.

I remember a time when you couldnt get a job in the private sector, you tried government/municipal.

Now, everyone wants the government job with the benefits and 20 yr pension.

Maybe working in the private sector, in many instances, has become uncompetitive with govt employment. Govt is sucking people away, maybe.

And maybe the Fed’s game of pointing to unemployment as a reason to keep rates low is being exposed.

The Fed keeps rates low, thus allowing the Federal Govt to borrow at nearly no cost, and dole the money out to thus encourage people to stay idle.

The Fed points to the resultant unemployment numbers as reason to keep rates low and thus money cheap for more payments to the idle at little cost. Round and round.

In the meantime, the stock and real estate markets are supported by this little game of reasoning for low rates.

If the Fed really cared about “the People”, they would not encourage inflation, and they certainly would not turn a blind eye to a damaging inflation running “hot”.

Keeping rates low to cure the employment situation when there is record job openings is absurd. Powell pointed to COVID, childcare, looking for better jobs all as reasons for the predicament. None of which are affected by low interest rates.

I was initially sanguine about inflation. I posted here that I’d wait until July or so to see if all the knots got untangled. Well, they didn’t get untangled, they got worse.

This will culminate in a wage-price spiral that will ultimately collapse into recession, if not outright depression. Yes Volcker ended inflation but only by bringing rates up to the appropriate level for inflation, followed by a recession.

I know Wolf doesn’t publicly espouse a particular economic philosophy but I sense he’s neither a Keynesian nor a monetarist. I suspect that he, like myself, tends toward an Austrian POV, and that means there’s no escaping the consequences of what has been done. And the damage will be proportional to the extent and duration of the distortion. IOW, a shit-ton.

I’ve been allocating my resources to both inflationary and deflationary scenarios since 2008 since I think we’ll see both. Right now what I see is inflation killing the dollar until everyone is depleted of dollars, followed by deflation, where the dollars you no longer have are worth a lot.

If you want a preview watch old episodes of The Waltons or read Sol Levinson’s Everything But Money. If you get a chance visit the Barter Theater in the tail end of Virginia. It’s not named after the Barter family. It got its name because there was no money but there was “stuff”. The theater charged admission priced in barter, eg, a ticket cost a certain amount of eggs, potatoes, etc.

John Maynard Keynes must be the most misunderstood person in history. Most people referencing him don’t know what he said.

What they think is Keynesianism is actually the abuse of his ideas by politicians.

His ideas and theory were formed by the Depression. The Fed may be overactive now but it wasn’t then. It did nothing. Even conservative Harding called it a ‘weak reed’ in times of trouble. The US economy seized up, not for lack of labor, material, or need, but for lack of a means of exchange. The idea that the gov could create a means other than gold is his key idea.

Example: the Panic of 1907 occurred just as the US was beginning large scale electrification. But GE and Westinghouse had harnessed Niagara and built out a grid BEFORE having customers. GE’s stock lost 80% of its price. They both ran of out credit and their banks tottered, as did the banking system.

Government loan? Are you kidding? The gov was low on money itself. Next you’ll be saying it should just create money and debit itself. Or maybe just forget this electricity thingy, which might never pay for itself.

Only the intervention of JP Morgan, acting as central bank (there wasn’t one) saved the day. He assembled the largest financiers, told them the size of the loan needed and physically locked them in.

Twenty years later in the Panic of 29, Morgan Junior tried to stabilize the stock market and failed. But Keynes said the Crash need not have led to a decade of misery. The Fed should have acted. It didn’t. It might as well have been O7, before there was a Fed.

Keynes believed in balanced budgets but balanced over the economic cycle. The gov would spend in recessions using the SURPLUS accumulated in good times, smoothing out the boom/ bust cycle.

Heard the word ‘surplus’ lately?

Keynes wasn’t misunderstood. He was hijacked. The political class only adopted the “overspend” part but not the “save during the good times” part. He was basically a long-winded version of Aesop’s Ant and the Grasshopper.

Government got what they wanted which is a fiat currency that means it’s possible to make any promise knowing you can borrow at negative real rates and run a big scam that most complain about, but don’t fully grasp. It will go til we have a Minsky moment.

Hey Wolf, did BLS track this by metro area or any other geographic measure?

Wondering if this is a regional phenomenon.

People are not quitting their jobs. People are quitting on America.

Something has gone really really wrong in America and everyone knows it.

Most businesses quit on Americans long ago. They are owed little.

Finally, a comment I agree with, American workers have had enough.

This has been a long time coming, but accelerated during the pandemic. Too many good people were pushed out of the system. You can see it in the comments here. Doctors that can no longer practice ethically or financially. Techies working on contract or not at all. Older workers retiring and working part time at anything. The system no longer works for most.

Punishing saving, the avenue always open to people to help them with majior purchases and getting on their financial feet. is UNAmerican!!

5% penalty from pegged rates 5% below reported inflation

Once real rates went negative at minus 5% I bought a big gold miner with about 15% of my savings, something I never was interested in. I don’t really care if I lose most of that, it’s just in case Fed runs negative rate policy for five or ten years. As long as gold is $1700 it will be a good long term investment with 2% dividend and some up side if Fed keeps running loose policy.

The gold price has risen 500% over the last 20 years. In my opinion, that’s a lot of speculation that needs to burn off before gold can really shine.

However, what should be the starting price of gold? Nobody knows. It can’t be proven. If history is the guidepost, then you have to factor in that 500% advance.

It’s common knowledge that the gold price is manipulated by paper gold and other BS. The paper gold market couldn’t survive even 5% of trades standing for delivery. Basel 3 has turned out to be a joke that is ignored by the CBs.

Bobber,

Yep I don’t really think gold is that great of a value at current price and if I owned a home I would probably not have bought the miner. But I wanted to own something real and I am only going to keep so much precious metals in my residence.

I actually expect gold and especially miners to get hit hard if we have stock selloff. But they probably will rebound if Fed deflates again.

Picked up my favorite stock yesterday, which is a no debt dividend payer at 4.57%. Not many no debt public companies around.

Fed has me doing some things I wouldn’t normally do, but I guess that’s their job to influence your behavior.

Buybacks are a kind of “quitting”

Nothing we want to do so take our ball and go home.

Have any of you ever been in a long term situation (job, relationship, whatever) that you felt like you could not get out of? And then something happens to FORCE you out. Like a pandemic.

And then you realize how toxic and unfulfilling that situation was and now that you can look back on it you realize you are not going back to that EVER unless some big changes are made?

That is what I think is happening here.

There’s a lot to that. The pandemic forced nearly everyone to get out of a mental rut, which has a freeing effect.

Yes, but a lot of people don’t realize we are on a sugar high that is unsustainable. Fed was in trouble before covid and now there is even a bigger problem with savings rates -5% negative and wages negative in real terms. Young people got $100,000 further behind on buying a home. Growth rate of economy problem going to slow because of the long term drag caused by covid.

My divorce had that exact effect!

I made a list of positives from the pandemic.

1. Learned how to cook healthy meals at home vs eating out all the time.

2. landscaped my entire yard, front and back.

3. Went on the Mediteranian Diet, lost weigh, back to normal.

4. Fixed a lot of high priced maintenance items on my house.

5. Upgraded all my computers and home tech to the lastest and greatest.

6. Found a new Dentist who was even better than the last one.

7. Had time to boost my knowledge of economics by reading the Wolf Street Report.

The goal is to turn negatives into positives.

I’m predicting that competition for labor will be transitory due to government pandemic supports that are transitory (stimmies, “free” housing, etc.). There’s a lag, of course. I don’t expect commodity price increases to be transitory, however. Some of Reich’s “striking” labor will be forced to return when they run out of money.

It’s funny. They ended the federal spending stimulus only weeks ago, and already the big spenders are out there saying we need more stimulus because people haven’t returned to work.

There is a lag period. If the stimulus ended a month ago, it will take several months for the stimulus recipients to find jobs and show up in the numbers unless, of course, they see clear prospects of more stimulus coming at them.

People need money to survive. If it’s not handed to them, they’ll have to work for it. Simple as that. If they are holding out for higher wages, that’s not saying much when zero is the base case.

@B

“People need money to survive”

Got it in one B!

If they don’t get pay rises to match inflation, they won’t keep up, and $50 steaks will be folklore.

This is boulder in the pond time and nothing will settle for a while yet. The Fed has most data to try to make a call, everybody else is guessing. IMO

Wolf,

Would not be surprised if many simply gave the employer the three finger salute (telling them to read between the lines) when it comes to job or jab.

Maybe you misunderstood. They quit because they have a another job with higher pay lined up. They’re switching jobs. 500,000 more people worked in September than in August, according to the BLS. People are not quitting to not work. They’re quitting to take a better job.

And the losers are holding out while they can. Not everybody will keep their new slot in the Big Sort. Eventually the castoffs will take up their McJobs.

Regarding inflation, I read that Social Security increases might amount to $96 a month for the typical 2022 recipient. Is it asking too much to one day being able to also earn meaningful interest on savings again? It seems its been decades that interest rates have been held down to spur economic growth. (Or if you read between the lines wealth transfer). And please accelerate the plan of shooting sociopaths into space! Can’t wait to wave goodbye to Bezos, Musk, Gates, and the rest.

Banks were were made flush by being able to hold and increase zero yielding deposits after GFC.

Savers are funding the government giveaways right now. It’s easy pickings, but it’s going to get society trained not to save and that can’t be good.

$96? Now I can buy a Big Mac again!

Yes once you pay for the increase in gasoline, natural gas, fuel oil, food, medicare, etc then you might have money left over to buy that Big Mac. But only one time a month.

With what’s left after you figure the Medicare Part B premium increase

@D

A clever responsible Govt would issue to citizens a non tradable savings account with a real rate of interest but that would suck all private cash out of the banking casino so don’t expect it any time soon.

Govt hires is behind the low number of new jobs. Friend in admin staff volunteers in the cafeteria during her lunch hour. The school board failed to hire enough people and this is not some Podunk district. My neighbor is a teacher and she subs on her lunch hour most days. Ditto school bus drivers. Most working vols are typically older. Now they are saying the vaccine loses efficacy after six months and the boosters are under scrutiny. Young people have to step up, get a jab, and get a job, however menial.

Tell it to your Selective Service board.

Wolf:

Here is the graph of working age population age 15-64:

Notice a problem here? We are losing workers out of the workforce. We are seeing a situation that business has never seen before in this country.. a shrinking labor pool.

Kurtismayfield,

1. I removed the link because these population data are nonsense if read month-to-month, as you can tell when you look at the spikes that suddenly occurred in April and May last year, and then the plunges that followed. No one knows what the population is month to month. Population estimates are designed to be read on an annual basis at best. This data came from the OECD, not the Census.

2. The definition of working age as 16-64 (OECD definition) is BS. Lots of people over 64 are still rocking and rolling. And not many kids at age 16 have full-time jobs.

But yeah, the US population has experienced 800,000 excess deaths of all ages during the pandemic, but many of the Covid deaths were no longer in that working-age group that you cited.

You need to look at the labor force data. Those are the people who are actively looking for work or are working, and this number is down 3.2 million from Feb 2020, not because 3.2 million people just vanished, but because they chose not to work, and chose not to look for work, for whatever reason. That’s where the labor shortages come from:

Seems like many businesses changed their attitude about employees, from assets ( you know, the people who actually make/provide the profits) to commodities to be exploited. Thus destroying any loyalty to said company. I remember seeing this change in attitude really rolling out during the Ray gun years and it’s only gotten worse—much worse since then. So it’s not a surprise to see what’s happening now with the “labor market.” How do you reestablish trust and respect between workers and business in this environment? After so many years of callous mistreatment by employers?

I think it’s mostly the size and nature of the Enterprise. If you are working for a giant for profit organization you are going to get treated different than working for a ten person operation.

World History 95th Edition Revised-“Seeing how high the pile of shit had become, Butthole Dynamics decided to build a model of robots that could wield shovels. After soon seeing their’s was a crappy job, the bots tossed down the tools and went for a higher bidder. Waiting in the wings with access to the Pentagon’s huge budget, Skynet put out the call for as many mercenaries as could be enlisted. The metal workforce took up arms. The mountain of waste soon got smaller. Win Win became the national anthem. Robots learned to sing and were happy ever after.”

@BS

As a Junior Engineer (19) in the pre-JCB days when ‘navies’ still dug trenches by hand, one day, a Union Card fell out of a worker’s pocket in the trench. The forman pounced on it and told the worker to “take your f***ing shovel and f*** off” He then delivered a full force kick up the a** and the poor guy marched off down the road.

I wasn’t meant to speak to contractor’s employees but I said to the forman, “that was a bit harsh wasn’t it?” He said “if you let these scum in you’ll never get anything done.”

Changed days. Thank God! but the JCB did more for working conditions than years of labour conflict did. IMO.

I see Labour shortages in the absence of a meaningful Bank rate (an essential component for ‘capitalism’) as a good thing. There are so many low value jobs that wouldn’t exist without low wages and subsidies from the rest of us in the form of various benefits. Competition for labour should mean work that creates more value should be able to be paid more. Low value work that can’t be automated or become more efficient some way will simply become untenable and disappear. Don’t be surprised if productivity improves in such an environment making us all richer on average. That’s what we want isn’t it?

That’s what we want…not all, but perhaps on average. Even with humans, you’re still working with nature and that’s a force which relies on the existence of gradients in all things. Stasis is death to nature, and is therefore out of the question. Time is the great leveler which works to ultimately bring all swings back toward an original state, flattened if you will. For the most part, our success has been predicated upon a long decline in other species that were here. In addition, we are land based and will always be forced to return to the question of how best to use that given that it is largely limited and can only be divisible until the population overwhelms any space’s ability to sustain the life dependant upon it. To get to a higher average of each being richer, we may have to adjust something in the mix (perhaps some lose their excess). Continuing to beat up the planet more for our further gains might play well for a “Silent Running” future scenario, but is that a good outcome. A reduction in the numbers of our own species might be a forced part to a real solution. Using space colonization as a pressure valve only exports the problem without dealing with it. (So far, the cost of our trips to the moon have left behind the first offworld junk yards. Time will work on that in the long run.) Regardless of productivety gains, we still have to face the limitations and that means coming to terms with what land really is to us. And a respect for air and water will have to be included. That aside, yes I’m a senior, now give me my damned discount. Time is biting at my heels!

There is a huge difference between working at a job with incentives or a flat hourly rate. In many cases, employees are the face of any company, customers like to see a familiar helpful face and are often the reason for returning.

Corporations like to remain faceless, depending on advertising and promoting their name. Part-time, low-wage employees are very much part of the business model, meaningless and ever replaceable to the upper management. Employees are on the same expense sheet with toilet paper.

We are now working in a mode that I fear will be the norm for the workforce in the future.

Everyone will be a self employed contractor. No one will have a human boss.

Example:

1. Our boss is a computer – we are assigned work as members of a panel of appraisers. No humans involved.

2. Our job is a hybrid model – 75% WFH, 15% in the field, 10% admin errands.

3. Wage price controls – fix fee for service. not adjusted for the real inflation rate nor the cost of doing business. No employee benefits.

4. Total corruption of the entire process in our case involving all the stakeholders, Realtors, Brokers, Loan Officers, Underwriters, Insurance Companies, Home inspectors etc.

This will be the norm as we move forward. If you are not in this mode now you will be . Enjoy

Sounds like Prop22 out in California to me…or, at least, an awful lot like the gig economy. Remove cars from the equation and your “75% WFH” – and it’s pretty much Uber.

You forgot one thing, though…

As a consequence of #4, they can claim our worsening health and living standards and depreciation…

meant: *as* deprecation.