Raging mania house-price inflation.

By Wolf Richter for WOLF STREET.

House prices spiked 16.6% from a year ago, the biggest increase in the data going back to 1987, according to the National Case-Shiller Home Price Index today, which was for the three-month moving average of closed sales entered into public records in March, April, and May. But in some cities, the raging housing mania produced far wilder results. The metros here are in order of the biggest house price inflation since the year 2000:

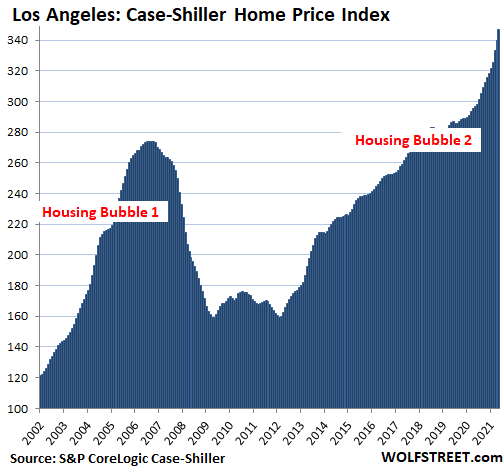

Los Angeles metro: Prices of single-family houses jumped 2.1% in May from April and 17.0% year-over-year. The Case-Shiller Indices were set at 100 for January 2000. With the index value for Los Angeles at 347 in May, house prices have soared by 247% since January 2000, despite the Housing Bust in the middle, which makes Los Angeles the most splendid housing bubble on this list.

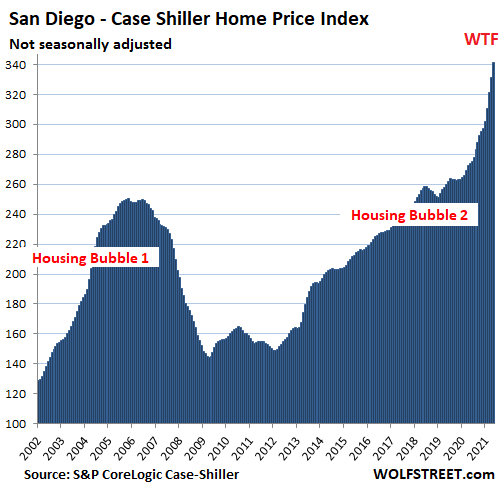

San Diego metro: The Case-Shiller index spiked 2.9% for the month and 24.7% year-over-year, the impersonation of the raging mania in the housing market. The year-over-year spike is the second hottest on this list, behind Phoenix. Prices in San Diego have skyrocketed 241% since 2000:

Sizzling “House-Price Inflation.” The Case-Shiller Index uses the “sales pairs method,” comparing the current sales price of a house to its price when it sold previously, and it includes provisions for home improvements. By tracking the amount of dollars required to buy the same house over time, the index measures the purchasing power of the dollar with regards to houses; it’s a measure of house price inflation.

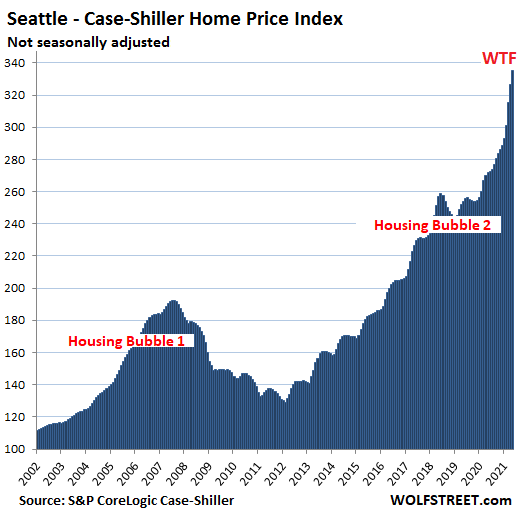

All charts here are on the same scale as Los Angeles to show the relative heat of house price inflation in each market since 2000.

Seattle metro: House prices jumped 2.8% in May, and 23.4% year-over-year year, the third-hottest raging-mania annual house price inflation on this list. Since January 2000, house prices have soared 235%:

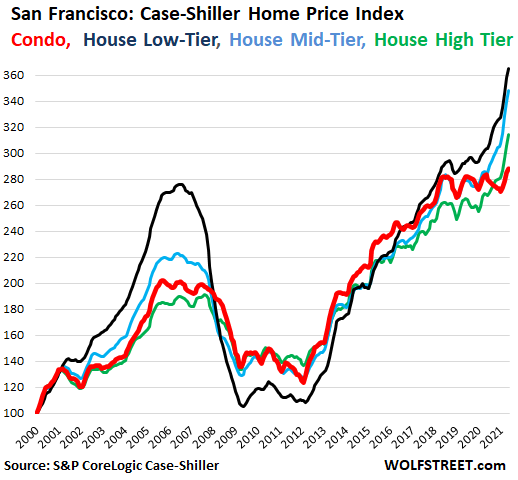

San Francisco Bay Area Houses and Condos: The Case-Shiller Index for “San Francisco” covers the five counties of San Francisco, San Mateo, Alameda, Contra Costa, and Marin.

Overall house prices spiked by 2.6% for the month, 18.2% year-over-year, and 218% since 2000. But by price tiers, prices in the “low tier” spiked by 20.2% year-over-year and are up 265% from January 2000 (black line). Prices in the mid-tier jumped by 22.1% year-over-year (light blue line); both far surpassed the increase in the high tier, up 17.1% year-over-year (green line).

Condo prices, however, have been waffling along since April 2018, not going anywhere. Here’s my detailed look at this split in the San Francisco market. Condos are denoted by the red line.

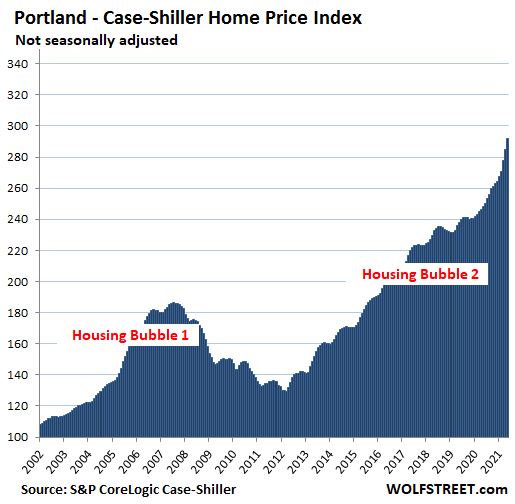

Portland metro: House prices spiked 2.4% for the month and 17.5% year-over-year, and are up 192% since 2000:

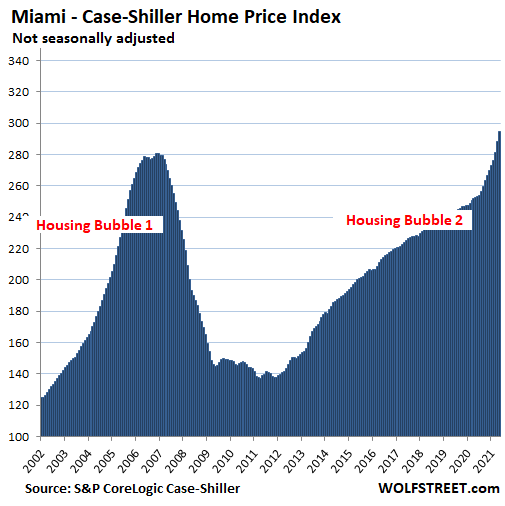

Miami metro: House prices spiked 2.4% for the month and 16.6% year-over-year. Prices are up 187% since 2000:

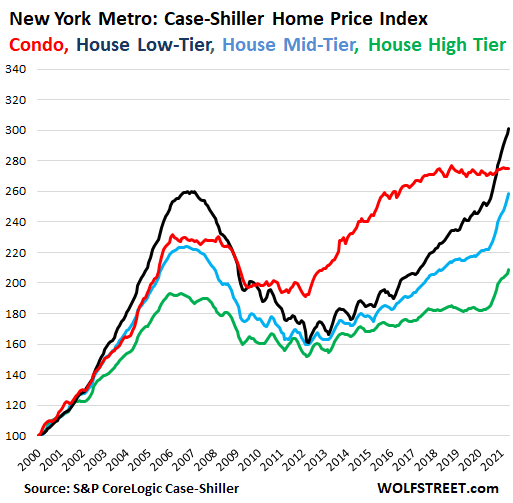

New York City metro, Condos and Houses by price tiers: This vast metro, which includes New York City and counties in the states of New York, New Jersey, and Connecticut, has some of the most expensive housing pockets in the US, such as Manhattan but also much less expensive areas.

Prices of condos – heavily concentrated in New York City, particularly Manhattan – were flat for the month and have been at about the same level since February 2018. The high was in October 2018 (red line).

Low-tier house prices have spiked since last summer, and are up 20.0% year-over-year.

High-tier house prices also spiked recently and are up 14% year-over-year, after stalling for three years (green line):

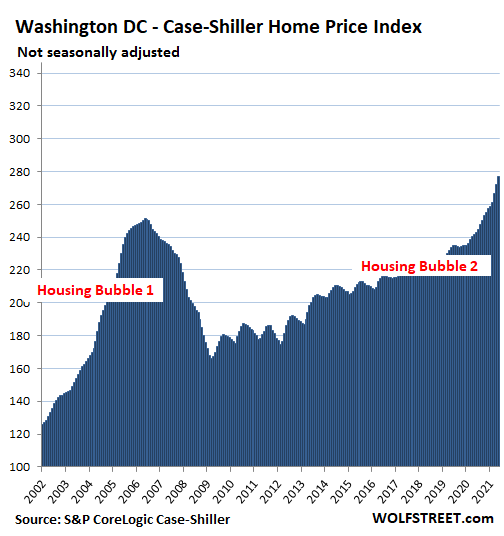

Washington D.C. metro: House prices jumped 1.7% in May and 14.8% year-over-year:

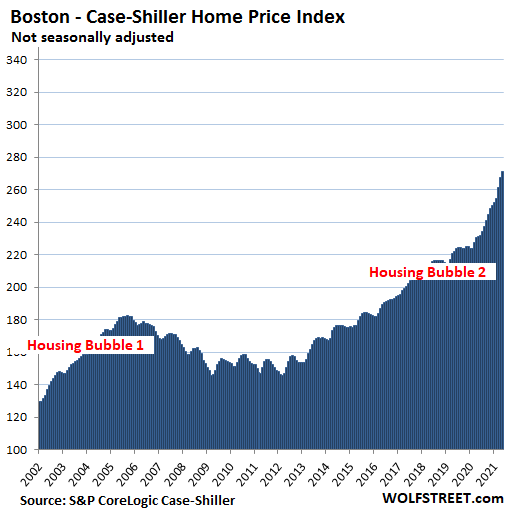

Boston metro: House prices jumped 1.4% for the month and 18.0% year-over-year.

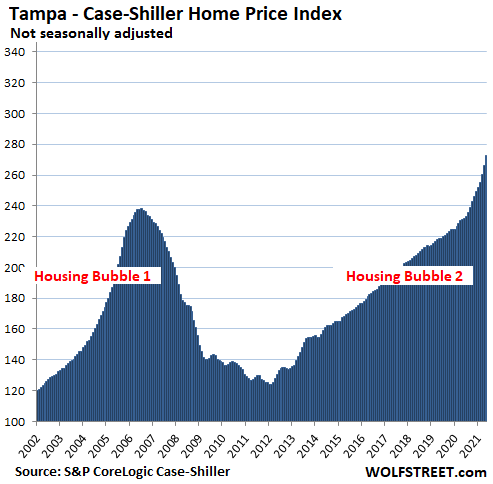

Tampa metro: House prices jumped 2.5% for the month and 18.0% year-over-year:

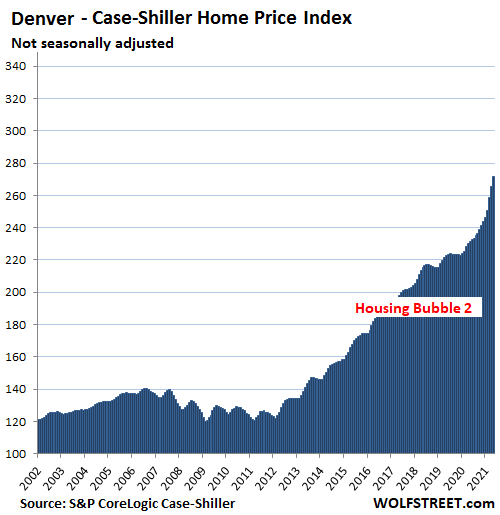

Denver metro: House prices jumped 2.2% in May and 17.4% year-over-year:

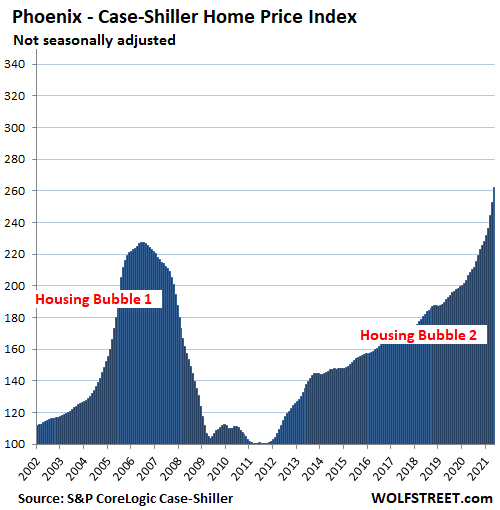

Phoenix metro, raging mania exemplified: House prices spiked 3.7% in May and 25.9% year-over-year, and the hottest annual house price inflation among the Most Splendid Housing Bubbles here:

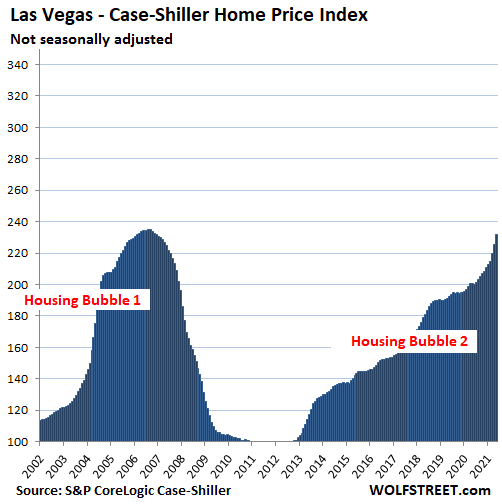

Las Vegas metro: House prices jumped 2.9% for the month and 15.5% year-over-year:

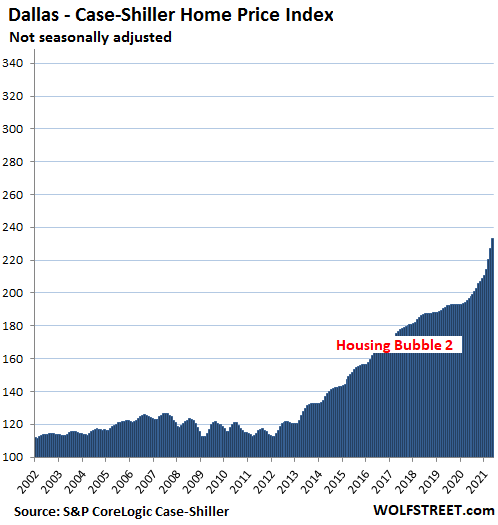

Dallas metro: House prices spiked 2.9% for the month and 18.5% year-over-year. The index is up 133% since 2000. In the remaining cities in the 20-city Case-Shiller Index, the two-decade house price inflation has been less hot. While house prices in Los Angeles jumped by 247% since January 2000, and in Dallas by 133%, over the same period, the Consumer Price Index, one-third of which pretends to cover housing, rose by 61%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Here’s what’s going to happen. Keep a cash reserve so you can weather any storm. But 10 years from now prices of everything will be much much higher. If there is a hiccup the fed and fed gov will run to the rescue and make prices go much much higher. You think the critters in the house or senate are going to let their investments go to crap? Get over it people. We’re on a one way trip. Play how you see fit.

Resjudicata,

I deleted your first comment — which was the first comment here — because it was designed to hijack this comment section. You posted the comment seconds after I posted the article. You had no chance to even look at the article. So it was adios.

In addition, you quoted me totally out of context and used that quote to say I don’t know what.

Consider the source.

Is this a Realtor?

Cash?

Inflation is not problem?

Since last year I have tracked prices of items:

COSTCO:

Peanut Butter was 6.99, now 9.99

Bird Seed was 5.99, now 9.99

Eggs were 5.99, now 6.99

HOME DEPOT:

2x4x8 was 4.50, now 9.50

Rustoleum Quart of paint, was 9.99, now 23.99

Potters Mix 6.99, now 9.75

Redwood 6 foot fence paling was 4.25, now 6.50

FAST FOOD

Was about 16 without drink, now usually around 20 w/o drink

TYPICAL DINNER at cafe now 30-40 with tip

Home inflation does no one any good until it is realized and most live day on cash earned.

Your cash will shrink in value…NOT SMART

You reveal your belief that the fed will come to the rescue?

What are you even doing here on this website?

Mediocrity, I “salute” you….

On a semi related note, it would be great if there were a online, non government (read, honest) archive of prices/sizes of a wide array of consumer goods going back decades.

(Something like this might be cobbled together from old supermarket and other ads in microfilmed newspapers from the 50s and 60s. There are some online product specific inflation databases already but most only go back a limited number of yrs. Inflation is like compound interest…it takes a couple of decades to really soar).

DC’s systemic fiat devaluation relies heavily on the gradually boiled frog technique…showing people how much they have been ripped off since 1970 or 1980 fights against this.

cas127: I’ve been looking at this off and on for a few weeks, since 2021 is the 50th anniversary of Nixon’s taking the world off the gold standard in August 1971.

There is data for certain items that have remained consistent for a long time. Some examples: 12 oz of Coca-Cola, Kelloggs Corn Flakes (per ounce), Big Mac, Campbell’s Tomato Soup (can size hasn’t changed). And of course 1 oz of gold, 1 barrel of oil.

Typically consumer prices today are 10-20x those of 50 years ago, i.e. the dollar has lost 90-95% of its value.

Also typically prices today are 2-3x those of 20 years ago.

The purchasing power loss vs. housing is a little more extreme since house prices have been goosed by declining interest rates.

Sears and Radio Shack catalogs are available to peruse.

Good ideas and good work, everybody.

I vaguely recall something called the million prices project or some such…in was in the context of the latest Argentine hyperinflation.

This was maybe 5 or 6 yrs ago and I vaguely recall that while the concept sounded good (using computer automation to create an archive of prices from around the world), the website itself didn’t seem that useful (yet).

I only ask because an archive of product prices seems like the exact sort of fundamental, detailed empirical work that academic economists would engage in.

Well, it turns out that the million prices project is actually the billion prices project (inflation, I guess…)

http://www.thebillionpricesproject.com/datasets/

Unfortunately, it doesn’t look to be interactive…you have to download likely large ass data sets…

Get a New York Times digital subscription to get access to their archives. Long ago their weekend papers had supermarket sales ads. Some other ads also had prices.

JM,

I don’t know if online digital archives (even those that use images rather than text files) include the shopping circulars…historically I think the papers thought the supermkt inserts too trivial to bother to scan.

Ads inside the various feature sections of the paper would be captured though.

The problem is that I think that things like mkts, most car dealerships, appliance stores got segregated into their own insert sections that newspaper writers thought too trivial to scan for posterity.

Crap! The old lady buys the bird seed ?.

Crap, Djreef buys the adult diapers…..

It’s all about when you need the money. You can tell by looking at Wolf’s charts that a home can be under water for a decade. Stocks have taken as long as two decades to recover in the past. Got to have cash to cover next week, next month, next year. If you want to lose big, being forced to sell an asset at a loss is a good start.

Find Buffets opening comments to the 2020 Berkshire Hathaway annual shareholders metting. It was just Warren via Zoom. Likely available at the Berkshire website and worth your time to listen. Not intended to be ominous but certainly speaks to valuation and timing. The wisdom one gets through years of life is immeasurable. Remember, in theory, there is no difference between theory and practice, but in practice there is. Fall is coming, I think we start to see the ramifications of massive debt, low interest rates and asset inflation.

I was a gung ho Realtor, investor, and flipper in the Eighties in CT. It was my religion .In February of 1988, it all started to revert to the mean (translation: go to hell).My condo dropped more than 50% in value. Home prices dropped 50% in many towns and did not regain their early 1988 level for a decade. I had sold all of most of my relatives and friends homes near the peak. Many, like me, went upside down in their mortgages. Buying in a bubble ever ends well.

OS,

Excellent point, mentioned far too rarely.

Asset prices usually recover…but it may take many years.

So if you *need* to liquidate on short notice (see health care) you can be thoroughly screwed.

And the worst off are the last to the overvaluation party…they face the biggest percentage declines and the longest road back.

@Roddy: Tons of people had their lives destroyed in the oil patch in the late 1980s oil bust plus the local Savings-and-Loan banking scandals (e.g. Keating Five). Lose job, everyone wants to sell house, house price drops -> Lose everything.

Same thing happened to millions of people in 2006-2010 and they have not forgotten, which is why the corporate political partisans face increased resistance now.

Is Potter’s Mix and jelly the new PB&J substitution?

Yep. 25% REAL inflation this year.. Gov’t says its about 1.5%… Of course if they admitted it was 25% they default on SS and pensions and the Country goes bankrupt overnight.

I wished someone had asked Powell directly if housing keeps going up 1 – 2% a month is he going to stop suppressing rates. I heard all I needed to hear. They have the excuse to run inflation at 10% for a rew months because employment has reached their target. In other words our policy is to still 10% of your money and then get back to 2%.

Thanks for keeping track of these items.

Where do you live and shop?

$16 and $20 for fast food? LOL, what are you buying? Chick-Fil-A where I live is about $8 with drink for numerous combos. I can buy dozen and one-half (18) large brown eggs at Kroger for slightly over $4. Bought peanut butter slightly over month ago. You didn’t state the size but I paid maybe $8 for the largest Jiffy Kroger carries.

I don’t buy the rest of the items in your list.

Same. I live in Denver which was on the list above as one of the places seeing insane housing increases. Chik-Fil-A is 8$ for a combo. Rustoleom is still $10. Sit down restuarants charge $16-$17 for a full meal plus drink. $30-$40 is higher end meals.

This guy has to be in SF or NYC

> Rustoleum Quart of paint, was 9.99, now 23.99

It’s only $10.98 in my non-NIMBY area.

Are NIMBYs having to face higher costs than the rest of us?

If so, is that actually a problem?

I just put “quart of rustoleum paint” into google.

I got a dozen hits for prices from $9.24 to $9.99.

I imagine the rest of your post is probably exaggerated as well.

I don’t know why people insist on posting factually incorrect things that are easy to check in 2 seconds.

This is why I posted. You guys are complaining about paying $3 more for peanut butter. Do you even know what anything costs? The cash burn on a small business with less than 10 employees is easily $50k plus’s per month. And your complaining about spending $3 more for a months worth of peanut butter?

there is no such thing as a one-way trip in economics. the housing bubbles have been blown with easy money, but there is a price to pay for easy money. right now, it is pure FOMO, with people “investing” in real estate. it is simply an imbalance in supply and demand. things just need to reset.

the past 5 months we had a one-time situation where the Treasury balances were being spent down, so interest rates were crushed due to a lack of supply of Treasuries. a temporary starving of the market. we already saw that the first auctions of longer dated Treasuries met tepid demand.

sure the Fed is still involved in massive yield curve control, but it gets real difficult for them to justify this when inflation is persistent.

I’ve hear all of this before. I’ll bet you a beer everything costs double in ten years. Don’t say I didn’t try to help you.

Banks create money out of thin air when they issue loans without any need for deposits or reserves. When a borrower gets a home mortgage loan from a bank, the money being lent is brand new digital money that didn’t exist before the loan documents were signed. The Fed is privately-owned by banks and operates in the same manner as private commercial banks. Government has no control over the money supply and inflation (Governments COULD take back control of money from banks, but they haven’t even tried). Your predictions about rising prices in ten years are probably correct, but the Congress is not responsible.

Did you get all that from Google and ZH?

Nah, he just made it up. People have lot of fun with it. Come up with some great hilarious stuff.

Off topic, but just to poke you:

Amazon deliveries to homes down over 15%. E-commerce will eat the world?

gary,

“E-commerce will eat the world?”

Yes. Brick-and-mortar retail sales, puffed up by stimulus, are also unwinding. This is the long expected shift from pandemic goods-buying to services buying. We knew this would be coming. I covered it here. Nothing to do with ecommerce but with the unwinding of stimulus and the shift to services (travel, hotels, restaurants, etc.). Travel is going nuts. So dream on if you think ecommerce is going away somehow.

And thanks for trying to hijack the comments with this totally unrelated tidbit. I had two of those comment hijackers back-to-back. Must be something in the air.

Since this is about housing, on one of my standard bicycle ride routes, there’s an old vacant brick-walled small movie theatre. (top of a hill, south of St Paul & the Mississippi with a great view and a big flat roof top)

It would be the coolest place for a young person or couple to live and also work out of. Small towns in the midwest have tons of these types of buildings, and many of them have apartments above the street level retail areas.

Is there any trend going on with these pieces of real estate?

By the way, when I was a boy, Grandpa advised me to do my rides into the wind and come home fast with a tailwind. I’ll live by his words ’till my last day in the saddle.

Dan Romig,

“Small towns in the midwest have tons of these types of buildings, and many of them have apartments above the street level retail areas. Is there any trend going on with these pieces of real estate?”

I hear and read stories here and there about it. I have not seen any numbers yet. But I also know that lots of young energetic smart people are drawn to big energetic cities for the opportunities they offer.

Sure, there are young people who last year switched to working from anywhere and moved to a ski area. But what will they do during mud season or the summer? Maybe this will stick and form a trend. Maybe it won’t.

Moving to a small town in the Midwest because there is a cheap cool building? Not sure if that’s really appealing to a lot of young people. But maybe it is. I guess we’ll find out :-]

I’m 73 now. I worked very hard when I was younger. Now I ride the tailwind.

I tried the move to a small town in the Midwest about ten years ago. Didn’t work out very well.

Admittedly, at that point, getting any company to agree to hire somebody for remote work was an uphill battle. Even if you could negotiate partial remote, you still needed to be close enough to the office to be able to show up on demand. The gotcha was that the technology companies in the Midwest paid a fraction of what you could make on the coasts, but the cost-of-living wasn’t quite low enough for the numbers to work well.

I gave up fairly quickly and moved back to the East coast.

What nobody knows today is if 100% remote work is a passing fad or the new normal. Until that question is answered authoritatively, going deep rural is risky.

Moving an extra hour away from the big city where your office used to be is the compromise, and housing in those areas is going berserk.

After experiencing multiple businesses online while selling in traditional brick and mortar I have seen first hand how brick and morter is being eaten alive. I manufacture different products and sell retail and wholesale in Southern California and my pricing is more than competitive with Chinese pricing. Even though my pricing on smart phone stands and animal grooming products I have found that people are conditioned to think the best deals are online which has been amazing to witness.

When selling on Amazon, Ebay and like ecommerce platforms you must pay to play buy paying extra to get in front of others, you must compete with Chinese competitors selling below cost to gain market share so for many more reasons than I can list here IT IS THE CASE THAT ECOMMERCE WILL EAT THE WORLD!!!!!

I find most like you have no clue how the real world works on the ground. I have spent years trying to defying this reality of e-commerce and I hope you are directly affected by your snide attitude about the impact of the realities that Wolf covers in this website.

What I do is read the WSJ then compare it to what Wolf Says and consistently I find that Wolf is like the brother who works at the auto dealer and tells you the truth about the sales and service dept.

Why was your time here?

You already know it all =)

Retail isn’t dead but it is sure different. The concept of branding seems to be over. It’s the Trader Joes retail model, everything is good, but you can’t always find everything you bought last week. The PBOC might have thought we can tighten credit and hurt everyone, or just crackdown on the monopolies. US analysts are talking up the move toward smaller companies. A large number of small companies is more difficult to regulate and more prone to corruption. If China is promoting small companies competition will keep prices low, and quality will be a problem. China is playing the command economy better than US “free” market synergies. They won’t be able to beat us on tech as long as we win the global brain drain.

They don’t have to beat us on tech, as long as they still produce everything. Tech, on its own, doesn’t make money. It just facilitates it. You still need a real economy around it for tech to prosper.

Tech is a pretty mature industry these days. China has the same, if not more, tech knowledge after allowing our manufacturing companies to use there “facilities” for decades.

I just shopped the yearly Nordstrom Anniversary Sale. The package was delivered by a local delivery service, not UPS or FedEx. This may signal a shift to cheaper more local delivery services.

I get Amazon deliveries from:

Amazon branded vans

UPS

FEDEX (well, not lately)

USPS

Females driving SUV’s

Males driving pickup trucks

Everybody is a delivery service these days.

Amazon is even using XPO now. *shudder*

WalMart has a deal for their employees to make a few extra bucks on their way home by dropping off Walmart.com deliveries.

Judging by pending sales volume, which is now below pandemic levels in most areas, this lunacy has ended. Should show up in price data in a few months.

There’s very little available to put into escrow.

More might be coming on the market as the foreclosure moratorium/forebearance are ending soon.

I’m in the market now.

It didn’t take long to get “buyer exhaustion” after being told I might get “lucky” & “win” if I bid way over asking, cash of course & without inspection. Well, I didn’t.

I’m signing a year lease on a rental house tomorrow. That was hard to get too, I lost my first few rentals against the 20 others that applied.

Brutal in Florida now.

Florida ?

Wait a minute…..

Ah yeah !

“The market’s in an itsy-bitsy little gully right now…. This couple bought it for 650.000 last year. He’d let it go for that. It’d break his heart, but he’d let it go.” “Why is he selling ?” “Neither one’s working right now”.

“Wow. A lot of people seem very motivated !”

“Oh, it’s just a gully”.

The Big Short (2015) – FrontPoint Partners’ investigation in Florida & first trade

Maybe in some places, we can hope.

Location X3 has been and still is THE key, and that includes very localized as well as very wide spread deltas.

In our small local hood of 7 x 16 blocks in the saintly part of TPA bay area/metro, that we try to walk or ride bikes in for exercise every other day or so, there are now some listings that appear to last more than a couple of days, but looking on pillow(z), they mostly are listed as pending even though the sign is still up.

Old tearer downers are going for around $200/SF for less than a thousand SF, the new replacements at least $300/SF, and some much more toward and in the ”high rent” end of the hood…

Existing in fair to good shape somewhere in the $200-300/SF range.

One recent rehab, with several challenges but good work inside, reduced asking from $425K to $375K for 1450SF in two weeks, sold they day of the final reduction.

We paid $84K in Aug of ’15, now at $280K per zillow,,,

Obviously crazy, very similar to late ’06-07, and I suspect the crash might come with just about the same timing from here…

Even with all the nonsense from the fed, hedgies and PEs.

4 rental homes, 2 paid for. Should I sell and walk away with$$$ or ride the slum load train?? What to do with the proceeds with Uncle Sam getting his cut? Thoughts?

If they cash flow positive I wouldn’t worry too much about the current market price unless you don’t like being a landlord. Of course Dave Ramsey would say sell off one so you can own all three debt free.

Less debt =less problems

That is my mantra for the next decade as I try to pay things down.

Debt can be a killer but there is good debt and bad debt. Bad debt is cars, boats, vacations, credit cards etc. Good debt is rental properties or investments that are actually investments.

If you cover your costs you are golden. If you make more than costs then pay as much of that as possible towards principal and get the debt gone.

Keep in mind that tenants are paying for your house and you get the tax benefits of owning it. Even if the value of the home never rises (unlikely) you still make money because eventually your house is free!

Doug P, until the government seizes it with no compensation under the guise of “public health.”

@DougP – the great thing about owning real estate is that no matter what happens to your income you will always pay taxes on each property each and every year. Rain or shine. And, it seems that the taxes only go up.

I would do the opposite. Refi them all and load up on fixed rate mortgages. That’s what works best in inflation.

Keep in mind renovation and repair cycles for older buildings and make sure you have funds available for when the big ticket items hit. Sell before renovations works too these days but I’d hold for income personally. With decent tenants being the key of course.

Work hard?

It won’t make much difference.

Time the housing market correctly: you win.

Rentier economics. Exactly why people fled Europe to the USA.

First as tragedy. Second as farce.

I feel this way almost everyday now. It’s almost depressing.

This is what 20 years of Fed easy money gives you. Look at LA. House prices rise at 6% annualized over 20 years, wages rising 3% and the lie is inflation is running to low. You don’t get these kinds of price swings in a healthy economy.

I thought everyone was bailing out of CA and heading here (TX).

Yes, I’m still waiting for that moment. It’s been a long disappointing wait. For now, it’s just stragglers that are bailing out instead of everyone. And it’s still way too crowded here (San Francisco, CA).

I’ve been in Texas 29 years now. I came here from Thousand Oaks, Ca (lived there 12 years) and Connecticut before that. Most of the folks I have met here in Texas are from somewhere else.

I have two close friends who are native Texans. Their families have been here since Victoria was a port of entry. It seem like Texas gets a lot of new people on a regular basis s it’s really nothing new.

That’s my experience too.

My nephew and his new wife just bought a condo in Chelsea, next to Boston, for $380k. Bidding war and all that for what is effectively a quarter of an old house. A nice old house, but still a house that was renovated into four condos. Nothing like buying at the peak.

I fear he’s gonna regret it, sooner than later. But she had to have it…

Despite the fancy name it’s not exactly the best neighborhood around Boston even though it’s just a mile or two from downtown. Virus hit Chelsea the worst among Boston area and the most job lost happened to Chelsea residents, mostly immigrants which low pay jobs & they needed the most help from food banks…. You get the picture.

Same with my wife. I’ve had to reel her in – no patience. We’re shopping, but not being stupid about it. I refuse to be under water on a property in 6 months.

Regret the house or the wife? or both?

When the Eighties unwound I ran the Trifecta of Failure: Foreclosure, bankruptcy, and divorce. Going through something like this is good. It makes most of life’s problems seem trivial. I lived to fight another day. Now safely and comfortably retired, with 20/20 hindsight. Of course nobody listens to my warnings. I get to say “I told you so” a lot.

“When the bill collector comes knocking on the door, love goes out the window”

I’m so glad I bought my first home in June 2019, I spent much less than I could afford because the housing market has scared me for a while. I also bought in a gentrifying neighborhood to shield myself further. Honestly, I should have just bought a nicer home lol.

Now, I want to buy my second. And, no way. Sucks. I don’t see how this housing bubble pops, but realistic inventory would at least be nice.

I wonder what will happen to housing prices in California if the drought were to continue for a couple of years.

The FED would move on that and send in water followed by more money. All will be good. Oh, Nancy would blame Trump for the drought.

I would say probably not much, as California has been in a drought for somewhere between 20-30 years depending on how you want to measure it and which location specifically you’re referring to.

However, California is the largest agriculture producing state in the US, and the second and third order effects of rising food prices nationwide will most certainly have to cut into other expenses for Americans; namely housing being one of them.

Better look at lake mead almost empty then no water no people ask mayans

Desalinization is always an option. It sure is expensive though. The last thing California needs is more expensiveness.

Turtle, desalinization is not really feasible until we have cold fusion, which basically means free electricity.

Used to be. Not so much anymore. The democrat love for a smelt pretty much finished that.

If you count cannabis

I wonder how critical California’s agriculture product really is for the rest of the US. When I check labels, it’s Mexico way more often than California. I’d guess that Mexico is our real produce lifeline.

T

Don’t know about US but we love Californian wine in UK and hope we can get it cheaper now that we’re free of the the EU market riggers.

Tell your politicians to do us a deal.

The SF Bay area was in a drought the first time I visited the area in 1976. That’s when I learned the ditty, “If it’s yellow, let it mellow; if it’s brown, flush it down.” The State has had periodic droughts since then. But they have not put a permanent dent on house prices.

State residents use only a small portion of the state’s available water supply. Most of it goes to agriculture. When the water situation becomes dire enough, some farmers and cattle raisers will be forced out of business.

Israel has largely solved its water shortage problem with desalination.

A

Jack Nicholson got the most painful movie injury ever (a knife slit of his nose) when he stumbled into the SF water wars in ‘Chinatown’. He wore a band aid for half the movie.

Now I’ve just got to watch it again!

Cheers

This is going to be a big deal if the drought continues for 2 more years !!

80% of CA water is used by agriculture. Almonds alone need 1 gallon of water to produce one nut. If we just stopped almond production that would give us enough water to supply all of LA. So big Agra is just going to have to suck it.

You’re just parroting something you read. How could they possible measure how much water it takes to produce an almond? Trees vary in production and don’t produce until mature. Further, how much water goes through the soil and ends up back in the water table? There are plenty of other questions that logically destroy this nonsense but I’ll leave that to others. The whole notion is absurd and appeals to fools who don’t bother to critically think about what they’re propagandized.

Actually, the research is pretty clear and takes a few seconds:

direct quote:

While the earlier reported almond water footprint relied on global averages, the new research analyzed California-specific conditions and crop yields. This fine-tuned analysis found almonds’ total water footprint is less than previously estimated, though the components of that footprint have shifted, with a higher percentage of blue water than the global average (1.7 gallon per almond).6

Blue water is managed water…like irrigation as opposed to relying on rainfall.

This is from the Almond Board of California, the organization of almond growers.

Sometimes, there are no nefarious conspiracies behind facts.

That 1.7 gallon yield metric doesn’t only grow a single almond. 1.7 gal per almond also grows and sustains an entire tree with roots and leaves and branches.

There is a seasonal waterfall in the fruit loop of apple orchards outside of Hood River that is entirely agricultural irrigation runoff. It flows the greatest in the no rain summer season when apples grow and becomes a trickle when the non stop rain starts in the fall.

A 15-20 foot wide continuous thick sheet of water becomes a dribble in the rainy season. That’s just for a tiny corner of the growing region. This is all glacier fed water that would end up in the Columbia anyway but it’s amazing to see it if you know what you are seeing.

Just to balance things, it takes 700 to 1200 tons of water to grow a ton of wheat. So it’s not just about nut trees. Usually, the plants pass a lot of the water into into the atmosphere or it evaporates, and if conditions are right, it fall as rain somewhere downwind. The rest goes into the water table. Water is not destroyed, it just goes elsewhere.

However, it’s going to be difficult to maintain any kind of agriculture in areas in long-term drought. The fight between urban and rural interests continues and urban tends to have more money.

I know right!? This guy probably thinks he can figure out how cell phone magic works…or how taking a pill makes your manly part stiff!…. it just does!

(Big ag can suck it and should be made to stop unnecessary farming like that when it’s using up an absurd amount of a needed resource so people can have almond butter and trail mix)

It takes well over a gallon of water to make and ship a plastic pint bottle of spring water for your drinking comfort.

Yes, this fool reads. I admit it. What do you do besides be so desperate to show off (but ultimately be wrong) that you can’t be bothered to look up the many articles (from many sources) that might actually inform your comments.

You should see how many gallons a pound of beef or cheese requires, or any animal product really, it makes almonds look like the most environmentally friendly food that exists.

LA is the one sucking it. half the population lives under bridges and along concrete rivers.

You’re in Mobile, AL, right?

Bill Gates will sell the water rights he bought for a profit.

Well you can look back to the mid 1970’s for a historical view. Back then CA was in a major drought. Water was rationed. You could not wash your car. You could not water your lawn. you could not fill your pool. Households were limited on volume. We’d see riots if they tried that now.

But nobody is taking into consideration the population growth of the last 40 years, and that’s also impacting the usage as much as the agricultural growth.

One good thing about back then, it changed skateboarding when all those pools were dry and urethane wheels came out.

Yeah and a few common sense measures should be put in place right away…especially when it comes to the farming … but also if you choose to live in the desert you don’t get a grass lawn, that’s it.

It’s amazing how greedy and short sighted humans are with so many of these problems. We can fix all of these things right now but no one is willing to accept any solution that either costs more or inconveniences them. If it does then we just keep doing it until it’s too late and get cheered on by the people and companies who want to sell it to us. Only in this case we’re literally destroying the world, sad.

Cars are a great example too. First of all I love gas cars and driving fast like no one else….but no one needs more than 300HP. Regular cars don’t need more than 150-200 to still be about as good as they are now and if you want to go faster, have them make a lighter car built for speed instead. We could mandate that 2 years from now all cars need 100mpg and we could meet that…we just don’t.

I need 600+ HP.

People must be spending their money on real estate. These charts show that. There has been a mass departure of people out of several states during the pandemic. Other states are gaining new arrivals. The housing market will be different in different places. Illinois has been losing people for ten years. The Illinois June unemployment rate is 7.2%.

There used to be over 20 homes for sale in my subdivision, now there are no homes for sale that are not under contract. People are using a community Facebook group to try to find homes here for friends and relatives before they are listed on realtor dot com. It does not feel like a housing crash. Maybe there are unsold homes to the north of me.

Nah. If you look at Google’s result today, clearly people are spending their money on ADS. You would think that with things somewhat returning to normal, people would spend more money flying, dining out, etc, but nah.

In couple of years they go back to whining about high taxes and the fact houses don’t appreciate in Chicago as much comparing with other metros & government debt…. In 2019 prices were going down in parts of Chicago to the west of Logan Sq, I wonder what happens when the hype is over!

Ghassan & David

Illinois prop taxes are abhorrent. My Bro lives in Antioch (near WI border). Beautiful home on a lake. Put $30K into upgrades and though it sold quickly, he got what he paid for it 10 years ago.

He (and others) cite the cesspool of corruption in Illinois politics / gubment. Tax $$ goes into various greasy palms and it’s become accepted. CHI metro homes are appreciating as well as rents, but folks like my Bro are not benefitting from the bubble.

In summary, real estate is, and will always be affected greatly by local / regional factors.

Because normal people don’t want to live in a s***hole like Chicago. There was less corruption when Al Capone owned it.

Your childish Faux “news” right-wing echo-chamber whining is really getting old.

Chicago is the 3rd largest city in the US, with over 2,700,000 residents.

Please just rant about how wonderful rural Alabama is so we an hear something different.

Yes , indeed it sounds like 2005

@David: Suggest considering the bias in your comment that “People must be spending their money on real estate.”

We could equally say that people must be getting their money from selling real estate!

An individual can “spend money on X” but when you go from person to people, and look at the whole economy, that’s not true.

For every buyer there’s a seller. The money never goes away, it just changes hands in the opposite direction of the item purchased.

We did. Cleared $330,000 on a property we lived in for only 3 years. We’re considering buying raw land now and building our own if we can find a reliable builder.

Joe Biden paid a builder to build his 7,000 sq ft home, bought a 4,000 sq ft beach house and a house in an expensive DC suburb.

Sorry, not sold. New home starts are well below historic highs.

real estate is all local. there are still many hot markets that are not slowing down. once we end the stimulus money and unemployment, we will have a much different economy.

noone said there was a real estate crash happening now. real estate takes a really long time to reverse direction. it will take 5 months of buyers strike to build inventory and force price drops in alot of the homes that are just sitting there. by that time we will be back to pre-COVID pricing, and that is where the real fun begins. assuming we have higher interest rates due to persistently high inflation, that will be the time that home prices really get whacked.

Saying that houses are “too expensive” is like saying stocks, which are levered up on borrowing, are too expensive. That’s certainly true if price is determined by an asset’s free cash flow. But, in our modern oligarchy, price (houses, stock) is determined by access to credit rather than income. As Blackrock buys more houses, those houses increase in value and become the basis for getting yet more credit, and so on. The rents are nice, but that’s not what’s determining the assert price. The same is obviously true for stocks.

Unless the organization of credit changes, I don’t see why the stock market or the housing market should crash. With US rates headed negative, I suspect this regime could last a very long time.

With all due respect, the “Blackrock buying houses” meme is really getting old.

The meme doesn’t care about your feelings. Corporations borrow at a lower rates than families. Therefore corporations can pay more for the same asset in a competitive market. They are targeting middle-income family areas — Atlanta (22 percent of home purchases), Charlotte (22 percent), and Phoenix (20 percent). This buying with cheap money puts a constant upward pressure on price.

Fair enough…but DC has been telling us (and expropriating us) for 20 years that interest rates have to be ZIRP’ed in order for any US job growth to exist at all.

I don’t know if making housing horrifically unaffordable is such a great trade off for marginally less awful job growth.

DC seems blinded by their own blinkered vision.

Not sure that is true. I think a lower rated investment grade company can borrow money at around 3% about the same as a 30 year mortgage.

You might be right, but I am anticipating another GFC type crash. Why would it be different. Much more leverage in the system. Yes banks in better shape, but that just means risk has been transferred to hedge funds and pension funds.

How can there not be? In hindsight they call it a Black Swan, or whatever, but there is always something that roils and boils.

Insurance collapse due to___________? (Fires, floods, unrest, maybe all of the above?) Something else? This is not a stable time, imho. We’re just used to the mayhem and news cycle. Our leaders are maybe a whole lot dumber than just about everyone commenting here. Scary stuff.

The -regulated- banks are in better shape, supposedly.

That’s what they say, yes, but how strong a bank is at any given time is a function of the value of its assets, and thus, its reserves. If a bank has to start rapidly writing down the value of its assets, it can go from “strong” to “weak” very quickly.

And additionally, “they don’t make any new land” !

Fascinating how you hear the same BS every time. On the other hand, it gives you a chance to place your bets.

As Mr. Jared Vennett from Deutsche Bank said when the Jenga tower had collapsed: “This is America’s housing market !”

joe – all you see is one direction. the housing market is based on affordability. what we have right now is limited supply at the same time some short-sighted people have hot money in their hands and are willing to pay anything. that is the very definition of how a bubble occurs.

the price gains are simply unsustainable. interest rates will eventually move higher because inflation has set in. the past 5 months was an anomaly, as the supply of Treasury bond issuance was restricted while they spent down the 1.8 billion balance. but the recent results of the Treasury auction showed that as the Treasury must increase supply to finance the debt, there is going to be a demand problem for Treasuries, and that will drive rates much higher.

if rates go higher, the prices will tank. a big part of the price momentum now is people thinking that prices can only go up. once prices reverse a little, that thinking will die and more rational decisions will be made by a reduced group of buyers.

You can’t fight demographics. Although Covid surely pushed this here quicker. If I had a time machine, I’d literally purchase every home I’d ever put an offer on, at the inflated price, or so I’d thought.

The home I sold in SW FL is just now above the price it fetched for me in July 2005.

Around 2009 it sold in a short sale for 40% of what I received.

Timing is everything and you can’t ever be sure of timing. The only thing you can be sure of is whether or not you got a good deal.

Hey Wolf, thanks for all your hard work.

I’m curious and forgive me if you’ve commented on this before, but how did Denver avoid the first housing bubble?

I think I should let someone from Denver speak to that. Dallas kind of avoided it too. Many cities did.

Dallas had a housing bubble that collapsed in the 1980s and took down a whole bunch of banks, including M Bank, the biggest bank in Texas, the bank where I banked, and the second largest bank failure at the time in FDIC history. I think everyone learned a lesson that lasted for about 30 years and was then forgotten.

The longer ZIRP goes on, the deeper into the hinterlands that yield starved speculators will go.

Bubble 1 was centered on the historically hypertrophic coastal housing mkts.

Bubble 2 saw the sickness spread inland and widen as speculators learned to diversify.

Also, price appreciation (divorced from justifying cashflow) tends to feed off itself due to momentum buyers.

So once the disease gets a toehold in a given metro, it can accelerate quickly.

I lived in Golden. Had to short sale. Bought at 174k in 2006 sold at 94k. Now worth 410k. Totally worth 94k

Sold it in 2012

In 2001 paid cash for a co-op studio apt in DC for $18,500. after numerous murders in a 30% white neighborhood. Sold for $106,000 in 2005.

Bought a Falls Church, VA 1 BD 1 BA in 2007 for $160,000. with cash after a disagreement with my landlord. Sold it for $80,000 in 2012. Two homes later I have net gains since 2001and lower monthly fees than if I rented.

I’ve lived in Denver for about 25 years. Denver had a housing collapse in the 80s (supposedly triggered by the oil crash), and in the late 90s it was just pulling out of that. I had a friend living in a rented condo at the time, the owner had bought in the early 80s and by ’99 was back to break even. In addition, there were several large tracts of land coming on the market: the old Stapleton Airport, Lowry Air Force Base, plus the Reunion and Green Valley Ranch developments, putting a lot of new housing stock into the market in the early 2000s.

Also, I recall from the time that Denver was almost a year ahead of the rest of the country in foreclosures – for whatever reason, people got in trouble with their mortgages earlier here than elsewhere. I was reading stories about a coming foreclosure crisis at least 9 months before things started to come to a head in Florida and Vegas.

The last thing is that the peak here in the 2000s was lower. Denver just wasn’t that big of a draw prior to about 2010 – coming out of the 2008 crisis, the local tech scene started to take off, multiple silicon valley companies either opened offices here or bought companies based here, and outside VC money started showing up in the tech scene, and TBH, marijuana legalization probably made CO more attractive, it certainly attracted investment interest. Back then Amazon wouldn’t even interview people in CO, they’d hold job fairs in Cheyenne, WY and Raton, NM because they were trying so hard to keep from paying CO sales tax. Now all that is forgotten and Amazon has a major presence.

Between timing on the 80s housing crash, the job base improving, and a trend of people leaving the west coast for less expensive cities, Denver is a much hotter market than it used to be.

Fraud was behind the Savings &Loan scandal in 1980’s Texas.

One prime example was Sunbelt Savings was known famously as Gunboat Savings. The CEO was a guy named McBirney who spent millions on airplanes, limos, yachts, cocaine and women of questionable morals.

If you ever watched the documentary on Bhagwan Shree Rajneesh and wondered ‘who on earth would give a loan to this cult leader to buy a dozen Rolls Royces?”, it was Sunbelt Savings.

McBirney received 8 years, no parole.

Bring it on. The more parabolic it goes, the harder it busts when the tide turns… hopefully

There is no good ending to parabolic spikes in prices of any product. Sheeple moving here, there and everywhere, but still inside the locked pen.

With crypto, these dirtbags have created a poisonous game that can go parabolic over and over again.

I remember the day when DOGE went parabolic 3 times in one day. Man that was fun! It was in May I think. It went from 12c to 45c, in three power moves and I doubled my money on that day.

British “Economist” publishes in every issue tidy charts “Economic and Financial Indicators”

2015=100 (new baseline)

July 23,2021-

Dollar Index:

All items:184.3

Food:130.8

Industrials:

All:234.1

Non-Food Agriculturals:146.7

Metals:200

Which means the prices of basic stuff whence everything else emanates doubled in the past 5 years.

And commodities are just that-commodities.None of us buys sugar paying 23 cents per pound because CBOT says it is the fair market price of sugar.More likely it is $4 for 2 lbs bag.

There is no reason why every 2″×4″ frame wrapped in Tyvek,no matter how small and pathetic, should not reach that magic $1M threshold and keep surging,soaring & skyrocketing at a pace of 18% per year thereafter.

At least for the stock market maybe not real estate because stocks are liquid. The adage what goes up hard and fast , comes down harder and faster. Gravity is a tough mistress …..

up here on the Olympic peninsula, I see price drops daily on houses . A bit greedy much. If priced right, move in ready with a bit of acreage , pending in days.

This is playing out just like Mississippi stock bubble. Asset inflation first, but when real goods inflation kicked in John Law was forced to tighten and as they say the rest is history. They must not read much history in economics classes.

Old School,

Except that raising rates (tightening) probably won’t work this time.

Much of the overseas demand for dollars that finances this mess exists because there are certain assets (e.g. US-issued equities for stocks like Facebook, Google etc.) that foreigners want to hold and that can only be purchased in dollars.

If raising rates causes the prices of those assets to fall – foreigners won’t want to hold them. This could cause the value of the dollar to drop against other currencies. Remember that – right now – the dollar is more than holding its old against the Euro, Yuan, Yen, etc.

The historical norm is that raising rates would increase the value of the currency – but this time it may not.

It’s also worth noting that many farmers, small producers, etc. are very much hand-to-mouth when it comes to financing their operations. So, in effect, raising short-term rates would be like raising the cost of the inputs of production.

Heard an interesting guy today saying western world is so debt laden and real economy so offshored that it keeps having crisis when Fed has to step in with bad debt to tide system over, digging a deeper hole for future. Good debt is for productivity that can service the debt without stealing from the future.

The S&P 500 is up over 3200% since 1981.

If you would have bought the S&P 500 index in 2000 at the peak of the tech bubble, you would have been down more than ten years, but nearly tripled your investment in 2021. Am not sure if they added in dividends or not.

I diversified some as both stock and home values seem high, but the growth in M2 money supply is high too. Interest rates are low.

Nobody gets what “the market did”. There are innumerable taxes and fees that reduce the yield to the investor. For example, the market went up over 10% a year from 1985 to 2015, but the average investor made just 3.66 % in this period.

r6

I always wonder about this for for so-called ‘Day Traders’

What part of the OP are you located? I live on the west side and don’t see any falling prices, only up, up, up>

Once the central planners acknowledge a housing bubble, the solution will be a rapid infusion of monetary stimulus so everyone can afford a house again.

easy solution,

You make this sound like a joke, but they have been doing this for years with fiscal measures: all kinds of subsidies for housing, from government guaranteed 30-year mortgages to various state and local subsidy programs, 3% down-payments via the FHA, etc.

easy solution

That’s what W said in 2004. Everyone should own a home. And Greenspan said using the house as an ATM machine was a good thing, after he consulted 150 Phd (Piled high and deep) economists on his staff. We saw where that got us.

I’m starting to believe housing data should not be

included in any inflation reports.I realize it’s

rent they look at but it’s tied to the price of

housing that is so speculative they might as

well include the increasing cost of barbie dolls

in their original packaging.

Changes need to be made and the folks with

all the data have brains to do it.

Gorbachev… comparing housing/rental prices with barbie dolls is silly. You can do better…

Now the Fed is screwed because the higher rents are going to feed into CPI which is 1/3 of CPI and ate going to be sticky. Asset prices are going to come down if Fed really tries to keep inflation at 2%, but sounds like they are going to let it run hot for a long time. They are trying to shape narrative by telling market it’s transitory and by buying TIPS.

Someone tell me again … why is the Fed buying $40B a month in mortgage securities?

Let’s see if the announce a stop to that tomorrow.

They’re going to have to at least acknowledge it. Even some of the FOMC members have floated the idea of dialing back. Even if they decided they needed to keep the total QE at $120B a month, they could still change the mix.

Personally I think the QE should be dialed down, given the inflation picture, but am even more concerned about interest rates. Although QE is widely perceived as more aggressive than interest rates suppression, it’s more for historical reasons since interest rate policy has been done longer and is seen as more mainstream.

To ensure the next wave of fools have ample credit to buy homes at inflated prices. If they stop buying MBSs the whole house of cards crumbles and then the economy collapses.

You see, in order to keep the game of musica chairs going in the economy you need new participants that are willing to fight for the fewer seats of prosperity that remain in this weak economy.

The carrot the fed dangles is low interest rates to keep them sedated and hopeful that they can keep up with the decreasing real wages and rising asset prices. If you believe in this system and you take the risk to stretch your finances to get on the ladder the fed “promises” to keep inflating away your debts. This will work until it doesn’t and then all hell will break loose.

Exactly.

Might be just the calamity that is needed to justify $4T spending on “infrastructure” if the threat of the new double novel novel corona isn’t up to the task /s.

If you believe some people loan growth is too low so they are trying to pump it up with lower rates on treasuries and mortgage back securities that are very similar.

When the housing market crashes, the rest of the economy goes with it. That’s the reason the Fed keeps buying 40B/month. And according to Wolf they are buying more than the 40 billion, more like 100 billion when you consider refinances and mortgages that get paid off or retired.

I keep reading about “real estate market crashes” and think to myself that it seems more like people WISHING there will be a market crash.

Having spent many years in the California Construction industry I was made fully aware of the nature of construction as a young man going from a union carpenter job to making 10K a month building wood patio covers in Southern California.

Young and stupid I had no idea what a recession was and learned in the most brutal way as in moving in with my in-laws in their giant home in the hills.

Thereafter had a few more big cash run-ups and down again a number of times with the last construction endeavor running Bobcats to develop horse ranches all over SoCal. The Great Recession ripped that business out from under with me coming close to losing my ranch on three separate occasions.

Now, my ranch is at 700K which is double of what I owe. Wanting to escape to Tennessee or Texas turned out to be a bust due to remote workers and California escapees buying up everything that used to be cheap.

Bottom line, the government will not let the past real estate price variance happen as in my being able to, in retirement with a solid and high income, benefit from the stupidity and misery of others (like I was in years past). I point to the forbearance policies and the imposition of free housing for those paying rent to small real estate investors who foot the bill for government.

I see only one way out for most of us:

Buy a small acreage property CASH and put a small compound on it especially in places like Tennessee with no state income tax and a property tax of only 25% tax appraisal value for acreage of 15+ more acres. Once you, buy this amount of land you put animals and crops ( couple of horses and a garden) on it to get access to no sales tax on purchases related to your farm/ranch.

You beat sales taxes with used items prices are amazingly cheap if you can put up with Southern culture….

No mortgage is the only way I see most people doing well no matter….

As I commented a couple weeks ago on the $40B every thirty days:

That equals the Fed buying the paper on 2,000 homes @ $666,667 each and every day. But, doesn’t that distort the market?

“Not at all.” – J. Frank Parnell

Would anybody care to comment on this?

His charts show that when you adjust for interest rates, prices are now lower than they were in 1990. Yes, 1990 was a high water mark, but the 2000 Wolf uses was a relatively low one. Both seem arbitrary:

Best way to measure assets is at the same point in the cycle. Peak to peak or trough to trough.

Everyone seems so confident the FED is in complete control and they will bail out housing and the economy. I’m the contrarian that believes we’ll see a deflationary crash in the next few years. Recall how quickly asset prices (mainly equities) plummeted in March/April 2020? You’ll see a repeat of that scenario paly out soon. For many reasons, from wages not keeping pace with home prices to bond market forcing higher rates. There will be a crash, then a hyperinflation scenario, and lastly the USD collapsing to nothing. Diversify your portfolio; cash, stocks, real estate, and lot’s of AG/AU.

Agree with all but the hyperinflation part.

We are are just a few short years from a major crash in asset prices. It will be longer and deeper than the Great Depression. I expect no bid for housing when this goes down and houses will turn into illiquid liabilities as millions lose their jobs. Buying gold and silver is smart move as they will go down the least and recover faster.

Sentiment Speaks: This Pavlovian Market Is Training You Well – But Prepare To Pay The Piper https://seekingalpha.com/article/4404217-sentiment-speaks-this-pavlovian-market-is-training-you-well-prepare-to-pay-piper

Eye opening charts. Didn’t realize that some regions had such diverse bubbles. Did some Zillow home viewing in my So Cal neighborhoods and was not pleased with the limited number of listings coupled with the sky high pricing and Zestimates. Sigh

With total home values in early 2019 at $31T it would be good to see how that total value tracked through 2021. I know infinity and beyond

It seems to me that with all the money being pushed into society there’s only so much the market could correct (down). I think what we’re in is the new norm. We’re gonna tell our grand kids that we remember when you could go see a movie for $20 and they won’t believe their ears.

Also, to the two comment hijackers. usually it’s me getting moderated here. I need to step up my game.

Not sure. If you take bottom of SP500 in GFC and increase it by GDP growth you get about 1000 as the possible bottom this time. You could take the last housing bottom and inflate by about 4% annually to forecast a new bottom. Eventually it’s got to be supported by real economy unless the Fed is going to be a street corner crack salesman.

Their incredulity will be toward the fact that you had to “go” to see a movie, rather than watch it in peace from the comfort of your own home living room/movie theater.

EXACTLY jmg!!

Reminded me of the whole family driving 50+ miles to see the first release of the movie, “Around The World In 80 Days.”

The screen was larger than either of the two local theaters, though don’t remember how much,,,

It was a BIG BIG day for all of us, and included lunch at the original Columbia,,, and then after the film, a brief meal at the Wolfies near the theatre in Saintly Petersburg…

This was before the Sunshine Skyway bridge was open, so had to go through TPA anyway, and then take the Gandy Bridge…

Still love that movie, and it was a great exposure for the first time to Cantinflas, one of the greatest all round actors of the era, not to mention Sir David Niven, an equally great actor and war hero.

“50+ miles to see Around the World in 80 Days”

Man, that is a lonnng way to go to see Cantinflas.

They will say, “What’s a movie, Grampy?”

Or they will say, “What’s a $20”, Grampy?

Or…what is a $?

Was it like the Yuan is today?

Money and debt do not equal wealth. I equally expect government to creatively implement additional stupid economic polices but it is destined for spectacular failure.

It ultimately will not prevent declining or crashing living standards for the majority of Americans, whether prices are nominally higher or not.

This “new normal” is a belief in something for nothing. There is nothing unique about the United States or it’s economy which gives (most of) the population in this country a birthright to live beyond it’s means essentially forever.

A price without a buyer isn’t a sale. Are we measuring asking prices or closed sale prices?

The most recent news on housing is that sales volume is way off. If the buyers are going on strike, these prices are going to soften a bit over the winter. They should anyway, just due to seasonal variation, but the summer sales window might have closed early this year due to prices.

Case-Shiller is closed sale prices, looking at repeat sales of the “same” property. As close to apples-to-apples as you can get and averaged over large numbers of properties in large metro areas.

The main issue people generally have is that it’s a 3-month moving average of closed sales, and therefore lags the current market bid/offer situation by a couple of months.

The other issue is that averaging over large metros leaves smaller cities out of the picture, and also neglects the potential for variation within metros (e.g. urban core vs. suburban prices can move differently).

Closed prices where I live have been around 10% over asking. The odd property is listed way too greedy high, but then someone buys it and we never hear what the final price was? Shame, most likely. :-)

We’re becoming a renter nation. I can’t speak to building and supply in other counties, but in San Diego, there simply isn’t enough being built, combine that with all the crazy laws here that incentivize houses to become rentals with multiple ADU’s and you have less and less inventory. So much inventory was soaked up by Wall Street after 2008 and has continued to this day. Sales volume is down because supply is down.

I think it is the sign of a larger problem. If you want to do something productive in the USA you are going to jump through a lot of hoops, take risks and pay a lot of taxes and insurance. It’s just easier to sit home and not be a target, so there gets to be a shortage of real stuff unless it is imported.

@Bob: The data don’t show a rise in rentership vs. ownership recently. They show the opposite.

Homeownership peaked at 69% in 2005-2006, slid to 63% at a trough in 2015, and has been rising since. Currently near the midpoint, 65.5%.

Data source: Census.gov, “Quarterly Residential Vacancies and Homeownership”, released July 27, 2021 (yesterday).

Good god, what could go wrong?

What started out as a trip to the corner store lead us to an odyssey.

What I’ve read about household balance sheets does seem positive though. Certainly compared to the last housing debacle. Maybe enough to counterbalance the unwinding of the wealth effect when it happens.

In come the waves.

Most of the housing “wealth” in household balance sheets (such as reported by FRB quarterly) is fake resulting from the biggest asset bubble in the history of civilization.

Yes, the one we are in right now.

Wolf,

If you compare the various Case-Shiller-HPIs to their respective “Average Weekly Earnings for All Employees”, Seattle & Denver appear to have seen the biggest bounce from their lows.

In contrast, the ratio of Chicago’s CS-HPI divided by Chicago’s Ave. Weekly Earnings is basically flat since 2009. The ratio of Denver’s CSI to Denver-area weekly earnings has nearly doubled from its prior low.

So, Chicago is “cheap” — when comparing shelter cost to ave. weekly earnings — compared to Denver, Seattle, and San Fran.

Here’s Denver’s CSI divided by Denver’s average weekly earnings:

https://fred.stlouisfed.org/graph/?g=FIap

Viewed this way, Dallas, L A, Charlotte, San Diego, & Washington DC don’t look nearly as impressive as Denver, Seattle, & San Fran.

Wolf,

2xWTF charts in one article… back to back. Record??? You should have a WTF chart index…. ?

Seriously though, Case Schiller only goes back so far, I wonder if someone went back and collected data for let’s say the top 25 cities in the US stretching back 100 years. Wonder what they will find.

I am kind of curious to see if some of the secondary cities will make this chart at some point. I wonder what is the shift like away from these major cities.

Shiller’s team did that 100-year study. You can find the key graph from his work online. You won’t like what you see … unless your family owned all the real estate 100 years ago.

You can find 100 plus year charts on housing nationally and house price increase was basically rate of inflation. Once fiat money started in 1970s you start seeing house prices outrun inflation.

MCH,

The Case-Shiller Index only covers 20 cities. It doesn’t even cover the Houston metro. However, it does cover some cities like Detroit.

☹️

You know there is a need to get a Wolf Index for real estate. It would cover lots of gaps.

It’s odd that even Santa Clara county isn’t mentioned in Case Schiller.

MCH

Nigel Farage, Trump’s pal, of ‘Brexit’ fame has a new TV show in UK.

He is using WTF— as his heading for the crazy item of the day!

Either it’s an amazing coincidence, or he is a secret visitor to WS, though how he could be a reader without feeling compelled to comment here I don’t know.

Cheers

I don’t know the statistics but I’d imagine most people who will buy a home will have done so by or before 40. I’d like to know what percentage of certain age brackets own homes. Most people who got into home ownership before the past 2-3 years are probably sitting pretty right now. If everyone is increasing in their home value across the board then only the people looking to buy and aren’t already home owners are being slaughtered as down payment savings and wages don’t track with the run up in prices.

If and I doubt this is the case but if it is different this time and the omnipotent fed can keep a crash from ever happening without also destroying the economy this is a future of millennials and especially gen z being completely locked out of home ownership. Of course until their parents die and they can inherit the homes. I wonder what other older first world nations look like in this regard. I wonder if places like Japan or England have such a structure where home ownership is only possible as an inheritance. Maybe it is an evolution of the us economy and first world nations in general with age.

Of course Japan and England are already well developed and land isn’t abundant like it is in the us. People don’t realize the ungodly massive sprawl of absolute nothingness still across 3/4 of the US.

Or maybe we all go back to whole family living in one house just to eat beware

In SoCal builders are marketing multi-generational homes (single building with separate living spaces and entrances). And then there are ADU’s. I saw one builder in California market their ADU’s to parents with “kids struggling to launch”.

There’s none of this in states with a reasonable cost of living.

This is what I’m afraid of: we have experienced an epistemic shift in financial policy, one as revolutionary as the development of credit in the 17th/18th centuries. This asset bubble will stay inflated forever. It may become a bit soft at times, but the glassy-eyed Bitcoin traders and Snapchat coders, with their lovingly cultivated thigh gaps and blunted emotional affect, will ensure it never deflates completely.

Anyone remember Francis Fukuyama and his “end of history” thesis? That liberal democracy was the final human government that would triumph the world over. Never again would there be a change of government or triumph of alternative ideologies. Perhaps we are seeing the same thing in finance. That MMT is the final financial policy, the one that all of human history has been tending toward. And if you didn’t grab your assets before Covid, you are SOL…

The historian in me says this cannot be so. But in my darker moments I do think it is possible.

Pure poetry:

“This asset bubble will stay inflated forever. It may become a bit soft at times, but the glassy-eyed Bitcoin traders and Snapchat coders, with their lovingly cultivated thigh gaps and blunted emotional affect, will ensure it never deflates completely.”

You’d have to incredibly naive about human nature to reach Fukuyama’s ridiculous conclusion. Or ignorant of actual history.

I have talked to several people I consider to be both educated and reasonably smart who put forth a similar thesis, one where there will be no major military conflict in the future.

I’ll take the opposite side of that bet any time. Same for any idea of an economic “new normal”. When psychology finally turns for good (whenever that is), it will be recognized for the foolishness that it actually is.

When that happens, the negative fundamentals hiding in plain sight which most are ignoring will be ignored no longer and this will be used as the explanation for the next bear market in asset prices.

Trucker Guy

Interesting take. Approaching 60 myself, I have been thinking along those lines (inheritance). My daughter will not really be able to afford a SFH in her younger adult life, so she can inherit mine I guess. Maybe these are the chickens coming home to roost (literally) as we have talking for over a decade about stealing our children’s futures ?

Housing is less affordable in much or most of Europe, certainly in the countries with comparable incomes. Interest rates are lower though don’t know about underwriting standards.

England is smaller than many US states with a population of what? 50+MM?

It’s still mostly empty, at least the parts I visited outside of London which was the rail line to Brighton, Poole and the highway from Poole to Gatwick.

The only way we could utilize the unused land is to keep much of the cubicle employment remote. I am originally from the Ohio Valley near Wheeling, WV and we saw industry crash hard in the early 1980’s. Many manufacturing giants closed plants to open the in other countries cheaper. The prices never reflected the cost they saved, but we saw the executive level branch bring home bonuses that covered all of the income the 200 employees made a year (including benefits). My father, a union worker, said that my generation will suffer from lack of fair paying jobs. He lectured against buying non-American items. He would ask where are your children going to work? China? Vietnam? Are you going to be able to afford a house or car? The reason we survived the 70’s recession was the self sufficient of our supply demands. We still made a lot here. Some say this supply and demand bottleneck is bringing manufacturing back to America. We could really use those jobs that paid a fair income in which the lowest titles employees could afford a nice house, a car, necessities, and vacation. It would take enforcing monopoly laws. What politician will do that? Housing prices will correct. They will not correct the 20% of 2008. However, they will slow when supply bottlenecks ease up. We all can do our part and vote with our $.

Companies left because of over regulation and on global view more customers also unions and I’m a union guy

It’s not a coincidence that most foreign automakers set up their US factories in the South. And now more and more “domestic” brands are building in Mexico.

And, I’m too, a former union guy. But unions have in some ways become their own worst enemies.

This comment is why this country is doomed and the situation will only get worse. Congratulations on consuming the elitist propaganda

Not at all. It’s not propaganda. It’s simple economics. You can either have robust regulation OR free trade, but you can’t have both.

@RightNYer:

I’d argue that you have it backwards. Genuine free trade is fragile: we can only have genuine free trade with robust regulation. But it has to be the right regulation: limiting monopoly formation, for instance. And compensating for overseas dumping and other anti-competitive practices. And yes, not allowing unions to greedily consume businesses.

There does need to be a balance between owners/capital, management, and labor, and we’ve lost that as seen in the historical data of, say, wages as a share of GDP vs. profits as a share of GDP.

Wisdom, I agree with all of that. My point is just that you can’t require your own companies to comply with all sorts of environmental and labor laws and allow free importation of crap made in the third world by companies that do not have to comply with similar rules.

Companies left because a fair profit is never enough and they pander to shareholders before looking after their employees. Those that do care about their employees and Country can no longer compete with the lower wages.

The only regime this doesn’t apply is in areas that they can’t move, like logging. Can’t move the forests. But then in the US they bring in foreign workers to ‘help’ with the logging.

Secondary manufacturing left decades ago.

I have never seen “foreign workers” in the forests and I’ve lived in the Pacific Northwest all of my adult life. Not only do I know a lot of loggers, I’ve worked on their trucks. Never met anyone associated with the forests that was foreign.

And there are mills everywhere, some of the largest employers in the area. Almost every small town around here located near the forests has a mill, sometimes multiple ones.

You must be describing BC or Vancouver Island.

Correctamundo P:

Remember very well the mid ’70s, when we, a combination of anyone local and whom so ever would apply, would work ”can to can’t” in the national forests and BLM controlled lands of very southern OR, doing everything from ”P-Lines” ,, to total removal of all hardwoods, ”Wolf Trees”, and even every stem of dwarf/stunted soft woods within certain designated DBHs.

We were outbid many times,,, enough that we eventually gave up, by organized folks who would ship in foreign workers,,, set up a camp for them on or near the work sites,,, AKA, ”Show.”

And pay them less than half of what we needed to survive, not to mention what was needed even to pay for gas for our chain saws and the equipment required for safety, such as trucks, water tanks, and other fire control apparatus.

As soon as the season or project was over, the foreign folks were delivered by bus right back to where they came from…

The forest based economy of OR and locales in other states have never recovered from that,,, especially after some POTUS, probably Nixon, also authorized, for the first time ever, the export of ”logs” directly from the National Forest, eliminating the work of thousands of primary bread winners from that entire area…

Some of us went to Portland, OR to march and protest to Carter when he visited there, against this and the use of Agent Orange;; from what was said after that,,, he almost certifiably did not know anything about either ”issue.”

Shame on all the politicians of any and every side of any aisle who approved such slaughter of the working folks of the PNW…

Vote with your dollars sounds good.

Labor cost is part of the equation.

Do a few minute search on proposed coal plants for china, asia, africa, vietnam. Cheap electricity will be a determining factor.

Meanwhile the West will chase down the zero carbon dream, while buying from these countries.

When I travel, everyone thinks they live in a special area and that everyone wants to move to just their area. I tell them, their area is not unique in that fact and that everyone wants to move everywhere right now, and that markets are super competitive everywhere.

SOL,

I completely agree, I’ve made that same observation a number of times.

I will say though, some places are indeed more “special” than others. What are truly special are the places where you find people that realize their place is nothing special at all.

These charts look like typical bubble blow-offs, i.e. this is going to end really badly.

My main fear is that prudent people who didn’t participate in this madness in housing, stocks, junkbonds, you name it…. are once again going to pay for this to bail out the reckless.

So perhaps it is now reckless not to be reckless? We have entered a whole new level of moral hazard.