“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff”: Jerome Powell

By Wolf Richter for WOLF STREET.

Amid continued reports of container shortages, shipping capacity constraints, port congestion, and blistering global-stimulus-fed demand for goods – in part the result of the Pandemic-related shift of consumer spending from services to goods – the cost of shipping those goods from Asia to Western countries has exploded to new highs.

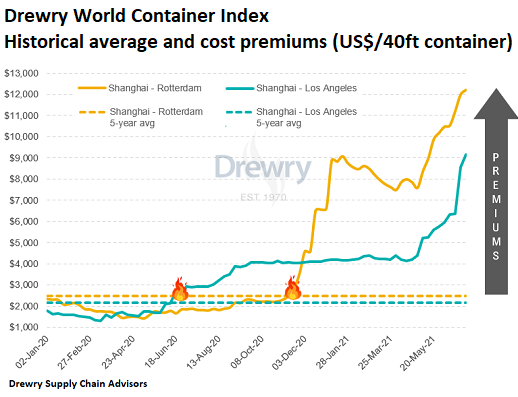

Average port-to-port spot rates from Shanghai to Los Angeles soared from around $1,500 per 40-foot container in early 2020, and from a five-year average of $2,177, to $4,000 in September 2020, to $8,000 in June, and to $9,631 in the week ended July 8, according to Drewry Supply Chain Advisors. This would be an increase of over 500% from early 2020 (green line in the chart below).

But it’s even worse: “We have heard reports of $15,000 from China to the West Coast and are aware that carriers are charging additional premiums on top to prioritize the loading of a late booking ahead of normal FAK [Freight All Kinds] rate cargoes,” Drewry says.

That would be a ten-fold increase from early 2020!

Rates from Shanghai to Rotterdam have skyrocketed from below $2,000 in early 2020, and from a five-year average of $2,486, to over $12,000 in July (yellow line).

Drewry calls this phenomenon a “market shock” that started in June 2020 for the Asia-US trade, shortly after the stimulus money started flooding into commerce; and that started in December 2020 for the Asia-Europe trade. The two starting points are indicated by the flames. The five-year averages are indicated by the dotted lines (chart via Drewry Supply Chain Advisors):

With the approaching peak season on the Asian routes, Drewry said that it expects “spot rates and underlying capacity shortages to become even more acute,” and it expects rates “to get close to $20,000 on some lanes.”

“The difference between this year’s container shipping market and that of the last 5 years has become stark, as spot rates broke inflationary record after inflationary record,” says Drewry in its Logistics Executive Briefing.

Freight rates from Shanghai to New York reached $11,708 per 40-foot container.

Freight rates in the other direction, from Los Angeles to Shanghai have also risen, but only to $1,326 per 40-ft container in the week through July 8. And from Rotterdam to Shanghai, rates have risen to $1,740.

The amount in spot rates over the five-year average, the “premium” in the chart above, has reached $7,000 to $10,000 per 40-foot container from Asia to the US, Europe, and other major lanes.

“For low-value products, this unexpected premium cannot be absorbed by shippers, and we know from Drewry shipper customers that some export business is being lost due to these extreme transport costs,” Drewry said.

In terms of 2022, Drewry expects that rates will be “substantially higher than 2019” and that “there will be a softening of extreme spot rates, but no return to ‘normal’ freight rates overall.”

So the extreme peaks of the spot rates, some of which are still expected to come in 2021, will be transitory in terms of 2022, but the remaining portion of the higher rates will be persistent.

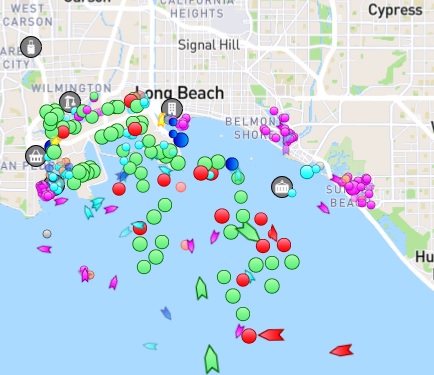

Part of the reason for the container shortage is that container ships are tangled up in port congestion which continues to dog the shipping industry. Marine Traffic shows this image of the Ports of Los Angeles and Long Beach. The round dots offshore are about two dozen ships that are waiting to unload, though that is down from peak congestion in early February of about 40 ships.

According to Port of Los Angeles data, the average number of days at anchor and at berth for today was 8.5 days and on many days is in the double-digits, including on June 29 (10.7 days), July 2 (12.2 days) and July 7 (13.7 days).

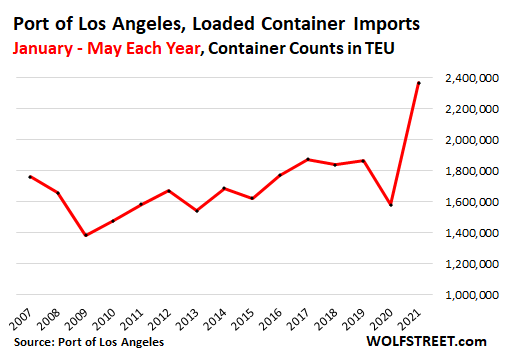

The Port of Los Angeles has been setting records in terms of the volume of imported loaded containers. The container volume is expressed in the standard measuring unit of TEU (Twenty-foot Equivalent Unit), where a 40-foot container counts as 2 TEU. For the five months from January through May, the port imported 2.37 million TEU in loaded containers, according to data from the Port of Los Angeles. This was up 26% from the prior record period of January-May 2017:

As Fed Chair Jerome Powell observed with brilliant insight, after $4 trillion in QE since March 2020, accompanied by an increase of $5 trillion in federal government debt, caused by deficit spending – $9 trillion in total fiscal and monetary stimulus – in addition to similar stimulus in other countries around the world: “Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

With fond regards to KL, I really and truly thank you from the heart for keeping me on the true path to financial safety:

NO debts,,, playing the CC game as several on here commented on your last,,,

Just continuing to Want to ”invest” in SM, as did successfully prior to getting out of that mkt in 1980s..

Thanks again for your clear reporting.

If you don’t have your giant molded Christmas yard decorations, or cheap backyard furniture it is probably too late this season. I would guess high volume low value goods will take a beating.

der TEUfel is in the details!

?

Just think! I can now convince my wife that the plastic Santa and all those crappy string lights we usually buy are going to cost more than the Xmas dinner for 12!

Maybe I’ll just make a Xmas door wreath out of a hand shaped metal coat hanger, some thin wire, some creeping vines, cut pine tree branches and pine cones like I did 60 holiday seasons ago (as a teen who sold them door-to-door).

Hahaha!

Nooo Anthony Nooo!

China is counting on YOU, to keep up the demand going , for you to contribute to the $200 Billion trade deficit that’ll surely suffer from your untimely desertion ??

On a serious note though, one look at the disparity in ports capacities of the four largest economies to handle shipping by ETU’s from 2019!

China. 225 million ETU

US. 55 million ETU

SINGAPORE. 36 million ETU

KOREA. 28 million ETU

that alone tells you the stories of vain expenditures vs strategic planning!

“China is counting on YOU, to keep up the demand going , for you to contribute to the $200 Billion trade deficit”

Hey, that’s the least a hedonistic idiocracy can do for them as thanks for their wonderful gain-of-function laboratory products.

Stop being such a pessimist, according to the White House, the average cost of 4th of July BBQ has gone down $0.16 from last year.

?

It’s too late for me. Although my HOA will not allow a plant in a decorative container in the front yard, it allows one house on my street to put on the most gaudy tasteless spectacles during holidays and other occasions such as Halloween. I think it’s the Steckman place.

HOA’s exist for the sole purpose of people going to war with them.

Will you stand up and fight, or get run over?

We can buy all we want on neighborhood app cheaper been doing that

So China unleashed COVID-19, a virus that came out of their labs and the world didnt ask for compensation for the damages to our health or economy, and then, we went and stimulated the heck out of their economy with deficit spending to reward them for it?

The brilliance of American leadership is breathtaking…

Right now, everyone globally has to keep mouth shut until the pandemic is over and wean their economies off of China.

China’s economy is always fake numbers, right now their economy is stagnanting, just like everyone else (everyone was pre pandemic too). Household debt is very high there too.

The CCP humiliated alot of politicians and business/rich people globally, there will be a reckoning for that, but it will take several years.

As long as the Dollar can be used to but Chinese goods, it will retain some value.

“there will be a reckoning for that”

Don’t count on it. Read the outstanding book, “Stealth War: How China Took Over While America’s Elite Slept.”

You both greatly overestimate china’s importance.

China does produce a lot of simple things like steel and plastic stuff. But it lacks the raw resources internally to produce it, and must import those resources. Anyone can make that stuff. For things like electronics, the vast majority of valuable parts are made in other countries and simply assembled in China. Some rare earth minerals and cotton are the only internally sourced resources. Right now, new mining techniques are being successfully developed which greatly reduce pollution from rare earth mining and many new sources of rare earth minerals are being discovered. China took over rare earth mining for certain minerals, because it was very polluted and most countries like America didn’t want to do it. There are many sources for rare earth minerals.

It also has been destroying all is international relations, most of all it’s neighbors. Because it’s destroying it’s relations with neighbors like Russia, it instead has to do things, like buy resources from unstable countries like Irran, which it doesn’t neighbor and these distances make it very easy to be cut off from.

The real GDP of China is under $10 trillion, less than half of America’s and a large part of that is construction, which is in the world’s biggest RE bubble.

There’s nothing from China that can’t be made elsewhere and factories are fleeing China. Once, the RE bubble in china pops, businesses will flee China at an incredible rate, because the China market dream will pop at the same time.

Every year having stuff made in China gets more expensive, as new rules which control what you are allowed to make and other things such as CCP factory seizures make it less desirable; to top it off the CCP is now kidnapping foreigners and businessmen who travel there. This sounds like a great place for final assembly of your products.

Just in case you didn’t notice, the article about container freight rates is all about CHINESE made goods flooding into the US. The US is incapable of producing these goods or sourcing them elsewhere, no matter how hard they try, and how many sanctions they impose on China. China’s economy is a resounding success while the US economy is an abject failure.

Because there’s no “Reply” button under Thomas Roberts’ comment, I’ll post my “Right on!” reply here.

Last time I checked there’s $1 Trillion of rare earths sitting in a war zone: Afghanistan. I’ll leave the politics alone. Just something that crossed my path in reading.

Dave,

Once again, just because something says “made in China” doesn’t mean China is solely responsible for creating that item. Parts from all over the world get shipped to China and then assembled there with some Chinese parts.

When looking at trade balances, you have to find reliable value added measurements instead to accurately see real trade. You also have to see where the money is actually going.

Quite a lot of those factories also depend on foreign machinery and Japan has announced that they are not going to send their good machinery there anymore. Other countries might soon follow suit.

The wealth income gap is huge and growing in China, it’s far larger than any developed country and among the worst in the world. The average work week is 72 hours, 12 hours a day, 6 days a week. Alot of people (especially young people) often have to work unpaid overtime, resulting in work weeks exceeding 100 hours a week, as their norm. Yet, the vast majority of those actually making our stuff there, are poor and getting poorer. Meanwhile, their bosses and the CCP get rich. Because of terrible decisions the CCP has made, those making that stuff, also have daily commutes frequently totaling more than 2 hours a day.

The Chinese economy has stagnanted since about 2015 and it’s getting worse for the bulk of the population each year. The GDP growth they claim since then, comes from massive loans feeding the biggest ever RE bubble.

There is nothing that can only be made in China. China wasn’t a significant part of global trade in the year 2000, it’s stagnanted since 2015 and has trended downwards ever since. Over time as I notice those made in stickers on many things, fewer and fewer things say “made in China”.

Since the Xi faction took over China, things there have gone in a very dark direction; the pandemic they caused and then exploiited is a point of no return. It’s very clear that the new model for China and it’s economy, takes influence from North Korrea.

Okay Wolfstreeters, how does a fellow go about investing in this? Or am I already too late?

MiTurn

“Or am I already too late?”

The biggest container shipping company is the Danish outfit A P Moller Maersk. Its shares have tripled since March 2020. Like so many other stocks.

One might even say that that ship….

*lowers sunglasses*

…has sailed.

It is never too late.

There is always a great investing opportunity somewhere.

There is always a wide political impact that comes out of the blue.

But worked for the last 12 months probably won’t work for the next 12 months.

We all have our theories and WR even let’s us know when he is shorting the market.

There are very few assets other than physical precious metals I could in good conscience recommend someone invest in today, at today’s prices. Valuations are so obscene right now that, unless we somehow have miraculous economic growth, or the Fed can manage to print $4 trillion every year in perpetuity, stocks won’t grow into their valuations.

It’s a game of hot potato at this point.

It’s going to be at least $4 trillion per year now. Get used to it. Normal is gone, can’t return. When the economy starts tanking under the weight of inflation and less stimulus, the printing must go on. Only the dollar value matters.

Except that the printing makes the inflation worse.

“Except that the printing makes the inflation worse.”

Exactly. All of these people who think you can just print your way to prosperity are blithering idiots. Every. Single. One.

How is it that the Fed that is ALLOWED to exist with the proviso that it “promotes stable prices”, outwardly promotes the opposite….INFLATION….and not a word?

File this with riots in the urban areas and calls for less police.

Did I fall through some rabbit hole vortex window?

Coming bankruptcies from zombie companies will be deveistating is this the great reset when bonds tank nothing left not so hard to figure out

All, welcome to the Twilight Zone, where north is chicken and 3+5= Dumbos are crazy. And common sense has been taken out to the back and shot.

I think it’s too late to invest in the shippers. Or bonds for that matter.

I’m not that smart at all following these ups and downs, and WTFs. So I’m also here on this site to learn something. But I am quite sure that the correct word for all of it now is not investing, but speculating. Or, gambling, for those who prefer smaller words.

You ain’t seen nothin yet. At the next hiccup the fed will make what they did in March 2020 and since look like child’s play. Then you’ll be wondering why you didn’t buy now.

What ability will they have next time? Print another $20 trillion?

50 if they see fit. Don’t look at the situation I n a fair market vacuum.

what stops them to print say another $30T ? It’s just adding some digits somewhere.

You’re assuming that doing so doesn’t completely destroy the currency. They’re not all powerful. At some point, market forces take over.

20 quintillion. Stop thinking in small potato terms. Dream big.

Remember how people were complaining because five months or so ago I said the cost at my sushi joint increased noticeably? It’s a sign of the time, wait until the Happy meal costs $33.99 each.

You’ve lost your mind.

Yeah true, but the reason I will not buy in the future is the same reason I will not buy now; no value in the investment. Spending a Saturday afternoon at the track is probably a better investment now. C’mon Phar Lap!! That’s how Aussies got through the Depression. If it was good enough then…

I am not sure about that. If they keep printing they keep putting home prices higher and that’s going to feed back into inflation rate.

You are never too late. This is what I learn from my 20 years of investing.

Humans are wired to have FOMO but patience is usually rewarded :-)

Be it stock trading or housing :-)

Equally true for gambling. ?

$bdry

I forgot to add, that the exemption from estate taxation is now over $11 million, so those assets would not be subject to estate tax and would get a step up in basis, which would insulate them from capital gains taxes. See Forbes’ “IRS Announces Higher Estate And Gift Tax Limits For 2021:”

QUOTE FROM ARTICLE:

“The Internal Revenue Service announced today the official estate and gift tax limits for 2021: The estate and gift tax exemption is $11.7 million per individual, up from $11.58 million in 2020. That means an individual could leave $11.7 million to heirs and pay no federal estate or gift tax, while a married couple could shield $23.4 million.”

Of course, having to actually pay taxes and facing stock market collapses without help from their privately- owned “Fed,” if its funnelling of money to the billionaires were finally stopped by outraged Americans, would threaten the billionaires’ control over our governments. Pity them.

I suspect there is still some potential in putting something into marine scrubbers. At least I have something still riding on that, so I’m talking my own book.

Supposedly Chinese stocks are really cheap right now and their economic situation is far better than our own in the USA. Many emerging market ETF’s have a good chuck of their holdings in Chinese and other Asian companies. There are also ETF’s 100% dedicated to the Chinese market. That’s one way to play this for the long haul.

The Chinese stocks is hard for me to figure out.

The FXI has been flat for 10 years while their economy grows at 6% to 8% during this time.

In the U.S. market. SPY is up 300% and Nasdaq about 500% on 2% to 3% growth.

Maybe China does not allow stock buybacks. LOL

It seems like most of the stocks that do very well in the U.S. always have stock buy backs. This can increase the stock price even though revenue is flat or decreasing.

Buy AAPL for the next 10 years. They have some secrets up their sleeve’s. (psst…they’ll be getting into healthcare). Pays a little divi also.

I sit here working from home. Watching delivery vansup and down the street. Delivering packages to my neighbors… (The packing waste stream coming out of some of these houses is insane.)

When I go online to buy the occasional thing, it’s almost always with “free” shipping.

I can’t square free shipping with what I am reading about container freight rates in articles like this.

When is it all going to come unwound?

Hint – it ain’t free.

Someone is paying for it.

Either you in a higher unit cost for the widget you are buying or the ever losing money “tech” company with investor funds or in ZIRP borrowed funds that will likely never be paid back.

Absolutely. That’s kinda what bugs me. Lowes wants to ship it to me “free”. If I drive over there and pick it up, I should get a break… right?

Nope. Price is the same. Which bums me out. Because the entire thing comes across as a scam…

Not neccessarily. I used to have a shop, and when a bunch of folks showed up, there needed to be someone on hand (being paid!) to service them. But shop activity is very variable, so free shipping is a useful way of keeping turnover up because it means the order can be processed when shop activity is low. Spreading the overhead. Shipping costs are cheaper than labour costs. I think Amazon worked this one out some time back.

Interesting. Never thought about that aspect. I was assuming the brick & mortar presence was a sunk cost. Not factoring in the staffing cost all that much.

free shipping to home address is a worthwhile trade-off for business’ because they get your home address, which goes into their permanent-forever -computer files . .

the MOST valuable monetary gain is the consumers phone number.

BCPDX-‘free’ shipping a component of ‘low’ earnings? (…and ‘free’ anything becomes a ‘norm’ tragically in the mind of the commons…).

may we find a better day.

I almost always go for the free shipping. It’s taking a lot longer to get the packages, you seem to go to the end of the line. But it’s ok with me.

One nice thing about free shipping is that once you decide that what you bought is not what you really wanted, you can send it back in the same box it came in. Very convenient.

Some item traveled a hell of a long way to be found lacking, and then returned. That is not cost free, it takes quite bit of energy to do that. And I recall seeing some revelation by an employee at a UK Amazon warehouse, reported by a major UK TV channel (search for it and you’ll find a heap of results), where they basically just destroy huge amounts of returned and unsold products. The resource waste we engage in seems quite amazing to me….

Salt-have often wondered if the vast amounts of resource waste somewhat persuades a population that is actually not that prosperous to feel that it is?

may we all find a better day.

Interesting.

What do higher shipping and supply interuptions do to amazon? And $4 gas?

Gotta hurt them

Read the article. These container freight rates are simply what it costs to get the goods from a Chinese port to a US port.

Have you heard the drug curter bust in North of Los Angeles (High Desert), confiscating 7 ton of grass worth 1.6 B ?

Still wondering where the cash buyers came from? this is one of them.

Yeah, it was, uh…confiscated.

Were they also selling goofballs, reds, tea, bennies, and other stuff from the fifties?

Shirley thus is bullish for domestic production?

China, Taiwan, Vietnam etc are screwed for making bulky/low density items at these shipping rates?

Bloomberg had a bit on patio furniture prices going sky high; everyone is buying it now that the pandemic is over; the stores are all on backorder……oh yes, most of it is made in Vietnam.

We bought patio furniture this year, to replace our Big Lots table and chairs, long ago rusted out. We actually got a good deal, not super cheap, but a lot better than expected. Free shipping and they put it together too.

So this is what J Pow called transitory. I didn’t know he was monitoring the shipping rates from Asia, too.

So much to do when you engineer a financial calamity.

That is why restaurants are having a hard time buying soybean oil. That, and the restaurants who are selling French fries

Question for Wolf. How about the other way around? Say I want to ship something from the US to China. Would it be very expensive as well?

The only thing the US is shipping to China these days is intellectual property, 1s and 0s don’t take up much room.

Don’t be ridiculous, at the very least we are still shipping agriculture and machinery over there. Maybe the later has gone down quite a bit because of the trade war, but the Chinese have been buying our soybeans among other things.

The majority of the containers loaded onto a typical Asia-bound containership in the port of Los Angeles are empty.

As of April 1, China has purchased 2.6 million metric tons of US soybeans, smashing the previous record of 2.4 million tons for new soybean crop sales in 2015. In total, the US soybean industry is expecting about 36 million metric tons in soybean exports to China in the 2020/21 marketing year, according to Sutter.

Maybe those are shipped from some other port.

And our cash

Corn

Soybeans

Pork

They own packing houses

“The top five suppliers of U.S. goods imports in 2019 were: China ($452 billion), Mexico ($358 billion), Canada ($319 billion), Japan ($144 billion), and Germany ($128 billion). U.S. goods imports from the European Union 27 were $515 billion. The United States is the largest services exporter in the world.” USTreasury dot gov

That should be ustr(.)gov

Office of the United States Trade Representative, Executive Office of the President

It would be a lot cheaper. From the article (kind of hidden in the middle):

“Freight rates in the other direction, from Los Angeles to Shanghai have also risen, but only to $1,326 per 40-ft container in the week through July 8. And from Rotterdam to Shanghai, rates have risen to $1,740.”

In a past article I thought you also mentioned that it is so profitable to ship from Asia to the US that the shippers aren’t bothering to fill the containers before they send them back to Asia. The quicker turnaround is worth more than the time to fill the containers with US products. I thought the agricultural sector was crying foul and someone was looking into this.

Josh,

Yes. That price differential is one of the reasons:

https://wolfstreet.com/2020/12/20/breath-taking-spike-in-china-us-container-freight-rates-triggers-mad-possibly-illegal-scramble-for-empties-us-farmers-twist-in-the-wind/

They don’t “bother to” fill them because there’s very little export product to fill them with. This is not even remotely new. It’s been like this for decades. Ships arrive from China loaded with mostly full containers and then sail for China with mostly empties.

Standard practice in the port of LA for at least 20 years.

(To be clear, the phenomenon of farmers in the Midwest being unable to obtain empties is new, and results in there being an even larger than usual majority of containers on a typical China-bound containership being empty when it sails.)

Ship coal back to China

Coal is now up 140% yoy and China is building more of them and they need to be fed.

With current prices, putting it in a shipping container may actually be profitable.

‘’Prices are going up at same rate as currency is devaluated by printing of the ECB and Fed”

China needs to fill the void in CO2 production from Biden’s very expensive CO2 cuts. After all, our brilliant economists think that as long as we cant see it, it doesnt exist. They learned this brilliant tactic hiding inflation with hedonic adjustments.

Moosy…

India and China building coal plants…

and what of the Paris Climate Accord? Remember Trump said it was a bad deal……and China only promised to maybe someday ten years from now start to cut coal usage. Yet Biden re entered the meaningless arrangement with the “pretty” name for political imagery.

Actually, the mismatch of where empty containers are located has made the sea lines prefer to bring back empty containers immediately to port rather than wait for them to be reloaded. We are seeing issues with getting empties for esport from the Midwest.

Michael Mathis,

Yes. Huge issue. Been a huge issue for months:

https://wolfstreet.com/2020/12/20/breath-taking-spike-in-china-us-container-freight-rates-triggers-mad-possibly-illegal-scramble-for-empties-us-farmers-twist-in-the-wind/

Similar problem to what companies like U-Haul experience in high population growth regions like here in Phoenix. Gotta get those empty trailers out of here.

I’d fill the dam things up with coal if nothing else to send back. Why ship back empty containers? Pulpwood, garbage, etc.

First: time: under these rates it isn’t worth the delay for a lot of bulk stuff. Re: garbage coal etc.: would you want yr high value stuff going in a garbage container?

Old addage in shipping: Time is money.

SS Emma Maersk-7500 boxes at $10k per box = $75 million

Transit time Shanghai-LA 15 days = $15 million/day.

You take the empties and run. No waiting.

BL

China caused chaos in UK re-cycling a while back by no longer accepting plastic or paper, etc. waste from other countries. That used to be how the empty return container problem was solved to a degree, long before the current new problems. Story goes China stopped taking other’s waste because they now have enough consumers of their own to meet recycling needs.

Funny old World innit?

I think you are on to something. Maybe we send back all their crappy products and garbage they sent over here in the first place. This cost in container stuff is ridiculous.

I renewed my CT driver’s license online, and they FedEx’ed it to me in Qingdao. $122 to send a small piece of plastic in an envelope. Took over two weeks.

Because you can’t print (create out of thin air) food, machines, commodities, labor, ships or finished goods.

And because the only thing that the FED and Government can create out of thin air is more and more debt and devalue the dollars already in circulation.

Yeah – it’s going to be transitory.

“As Fed Chair Jerome Powell observed with brilliant insight, after $4 trillion in QE since March 2020, accompanied by an increase of $5 trillion in federal government debt, caused by deficit spending – $9 trillion in total fiscal and monetary stimulus – in addition to similar stimulus in other countries around the world: “Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff.”

If only he had gotten a PhD in Economics, I am sure we would have gotten smarter pick up lines!!!

That’s the problem, he probably does have a PhD.

No he doesn’t. He only has a Masters Degree.

Jerome Powell is an attorney…he has a J. D. (Juris Doctor) degree.

“If only he had gotten a PhD in Economics”. At first I thought that you were being sarcastic. I have been assuming that a minimum requirement for being a Fed chairman was a Ph.D. in economics from from some prestigious IVY league school. So I looked the guy up in Wikipedia, he has a B.A. in politics and a law degree. WE HAVE A LAWYER RUNNING THE ECONOMY. The guy running the economy is somebody that not only doesn’t understand numbers, he doesn’t understand economics. This certainly explains a lot about what is going on now. And I say this without any sarcasm, we are screwed. There is no doubt in my mind now that we are facing a 1929 scenario.

While I agree that Powell is not qualified to be in the position he is, Yellen DOES have a Ph.D, and she’s as much of a buffoon as Powell is.

My guess is that as soon as the Fed is forced to begin selling bonds to finance the deficit, there is going to be a crisis in bonds.

Bond yields have been on a 30 year decline (so the inverse is a 30 year rise in bond prices). When those incredibly long term trendlines break, do you think there will be some selling pressure? I do. Since that probably comes at the same time as the Fed needs to finance with more issuance, and coincides with a significant decrease in bond purchases by central banks, like the BOJ, we should have a nice perfect storm coming up.

Do you think the Fed even realizes that it has effectively been stimulating the economy with both $100 billion in purchases plus $250 billion in reduced supply of issuance, at the same time?

I don’t follow what you mean by $250 billion in reduced issuances. Can you clarify?

The reason they call Economics the Dismal Science. Advance degrees in this only empower ever more dismal actions.

Don:

“WE HAVE A LAWYER RUNNING THE ECONOMY.”

He isnt running the Fed anymore than Biden is running the United States. The REAL power is always one click down.

Look to who is “advising” the Fed, who they are “partnered up” with…

Let’s face it a PhD in economics is mostly a degree in central planning the economy by government policy now. A lot of theories that can’t be verified through back testing.

Regarding the Lawyer comments… I most of the people running the government tend to be lawyers and Political Scientist. Was that Obama, GW Bush, Biden degrees. Most of Obama cabinet were lawyers. That is why Obama Care technology rollout was so bad. They had Sebeluis running it and not a tech person.

If you compare this with China, most of their cabinet is comprised of engineers, scientist, and finance people. Almost no lawyers.

D

All these ‘heads’ are running the show, only in the sense of a ‘Figurehead’ on the bow of a ship, they are intensely briefed on every word they say by hundreds of minnions. In the case of the Fed, it strikes me the PR Dept does most of the briefing.

As an engineer I have had occasion to try to brief non-technical ‘Figureheads’ on technical matters. It’s not a job you would want, some of them are so innately ‘thick’ you can wonder how they ever became a lawyer or whatever, never mind the position they have managed to manoevre themselves into.

I’m glad I’m only a spectator, it’s all a TV soap.

Auldyin,

Got your Siemens book. Thank you! Started reading it already.

The era covered in the book ends about when my life began (close enough). Like my father, my grandfather also worked for Siemens (Nuremberg Works), after he got out of the Austrian Navy where he had served on a submarine. Yup, late 1800s and early 1900s, Austria was still an empire and had the port of Trieste and a navy. He served in the Austrian Navy because he (and that whole branch of the family) was from the Kingdom of Bohemia (now the Czech Republic) which at the time was part of the Austrian Empire.

So as a child I thought somehow that I too would end up working for Siemens, because, you know, someone in the family always had to be an engineer and work for Siemens. But eventually I grew out of those ideas :-]

Wolf

Glad you got it eventually.

I sent it overland because the PO woman convinced me they still did that. She estimated 42days so that seems you got it quicker.

I couldn’t resist the idea of the book leaving Liverpool for New York, Then rolling across US on the Union Pacific to California.

On the book, I wonder how the brother’s phone-call went the morning after the Luftwaffe bombed the Greenwich factory?

Enjoy the book.

Just one note, $4 trillion of that QE was used to buy $4 trillion in government debt, so it probably shouldn’t be counted twice. Unless I totally misunderstand this stuff.

The Fed’s QE is monetary stimulus. The Government’s deficit spending is fiscal stimulus. They’re separate and accomplish different things. In terms of stimulus, they do not cancel each other out.

However, you’re correct in terms of $4 trillion in debt not having to be absorbed by the market.

I think JP is a lawyer.

Yes, he worked as a lawyer for a couple of years before getting into investment banking. His undergrad degree is a B of A in politics and has a law degree.

I think he’s an idiot.

Somebody has their hand up his back

We covered this before in the lumber price discussions. You can hit a few keys on the keyboard and whip up a trillion dollars but re-opening mills, mines, factories, etc takes time.

I suppose the moral of the story is that the real economy lags the fake economy.

It’s the other way round, I reckon. The real economy has been going to hell since the 80s. The fake economy is on an exponential path making it go vertical.

The real economy is real capital investment and real labor. Force feeding dollars into the system is a huge distortion.

I wouldn’t be so sure about printing finished goods. There are 3d printers coming online which are print manufacturing a ton of parts we currently import from other countries, and they can even create 3d printed houses now. It’s still early, but 3d printing gas gone beyond the infancy stage and in on the early adopter curve.

Now just print us up some lumber and lithium and we’re in business!

Maybe this helps forward the ‘buy American’ nationalist ideology that our previous political movement so wildly embraced. That is… until they go to Walmart

When is some Official political body or MSM going to hold the Federal Reserve to account for their blatant incompetence and failures ?!!!

Never, I would suspect. People who make money while producing nothing of value are worshipped here.

High shipping costs may become the new normal. This could trash certain business models that have sprung up over the last 20 years. Getting bulky low value items from overseas could be a thing of the past.

That suggests shorting companies who are adversely affected by these usurious shipping rates … but which ones? Oh wait, they’ll probably only pass the cost along to we consumers. We’re screwed.

Junk Bonds now yielding BELOW inflation…

the list of “never happened before” is getting longer..

as wolf’s charts so often point out, it’s a WTF world and we just live in it.

Remember once upon a time in capitalism when we did faux recycling, which really meant filling up TEU’s full of sorted goodies and the Chinese seemed grateful for the effort, sending us more loads of doohickeys guaranteed to fall apart in 6 months?

Years ago I read a great article about the “inventor” of the shipping container concept. He was a farmer from NC that took bales of cotton to the NJ docks before WWII, and hauled back roofing material. At that time everything was hauled pretty much loose. He got tired of sitting and waiting for the longshoreman to unload him, and came up with the idea of shipping the entire trailer. After the war he purchased surplus ships and started the concept. I googled and found his name, Malcolm McLean but could not find the article I remember. It was in the quarterly report of a mutual fund company, Columbia Wagner. Every quarterly report had a “Squirrel Chatter” article that was always interesting. (Squirrel chatter because one of their mutual funds was the Acorn fund) Anyway, this poor farmer bought an used truck during the depression and started hauling to feed his family, and brainstormed this whole idea. I kept that investment just to read the articles.

Alaska Steamship Company led the inter-coastal pathway on pioneer containerized shipping (ref. Alaska Geographic editions). [They also had early useage of radar, better than ringing a bell to hear the echo.]

Or throwing potatoes trying to hit cliffs in english channel fog..

BS

UK railways had containers for furniture removals late 1800’s. Pickfords became national brand.

Much smaller than shipping containers but same basic concept.

Some say canal barges had even earlier containers but I have never seen any pictures.

Just like when Nixon took us off the gold backed dollar. You don’t do one thing in economics. Things started getting crazy with inflation, price and wage controls, Volker hammer time, Savings and Loan regulation changes to handle higher inflation, Keating five, S&L bailout, Resolution Trust bailout, Tech bubble and bust, Fed put, Housing bubble burst, Zirp, qe,qe,qe, tantrum, not qe, covid, qe on steroids, inflation, supply chain screw ups. No telling what tomorrow brings.

Those long gas lines and the energy crisis were so long ago now. But I’m old enough to remember. In it’s own way that time was as scary, strange and tough as the whole planet 3/4 shutting down for a month with Covid.

But..isn’t civilization always in a crisis/emergency, almolst everywhere? I can’t think of a place, other than maybe 50s middle America lucky land, where it hasn’t been so. Seems to be the very nature of the beast, of the thing we built.

I get a little nauseous every time I hear some dope on the radio/TV pontificating about “these uncertain times”. When were “times certain”?

Trailer-just long enough post-WWII to convince two generations that they always were. More humans than you would believe think the world didn’t exist until they did…

may we all find a better day.

All of the above

The economic results of the MASSIVE COSTS of the Vietnam war. Still unknown to this day, but I’ve heard estimates of 2/3 of WW2 in today’s dollars…but even if it was only half that, that’s a lot of money from “somewhere” just blown to hell, burnt up, or still rusting/rotting over there.

Deficit spending was still a strict no-no then….so SOMETHING had to get weird in “free market land”. Like you said, “You don’t do ONE [BIG] thing in economics”. But we did.

NBay-guns ‘n butter and a Great Society-with that newfangled revolving credit we can have ALL of it…(…or as my Brit friends called ‘hire purchase’, “…the never-never…”).

may we all find a better day.

That’s got to be the most concise recap of major U.S. econ moves I’ve seen yet. Well done.

Maple Int makes these things, 2017 quote of 2650 for 20′. I would gather that its not a container supply issue, ships in port of LA wait over a week to unload. More containers won’t fix that. Part of the backup is probably haulers who move these things. The drivers are independent contractors mostly. Last thing I read the were getting squeezed pretty badly. Nobody wants to make capital investments in a business that has these issues. What driver would spend 40K on a tractor when he might not have a load next month, and the port is beating his chops on rates. What bank would lend to him, or her. Sidebar on bond yields coming down, means business is pulling back on growth estimates.

‘Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff”: Jerome Powell

I can hardy believe he said that and frankly I thought the panel would be all over it by now and I’d be last!

Jerome, are you actually telling us it’s a heck of a lot easier to create the money needed to buy stuff than it is to make the stuff AND deliver it?

Imagine a guy talking to a house builder. They agree on a price and the buyer suddenly hands over a check for the full amount.

‘Gee, sir, we don’t need it all at once.’

‘That’s alright, the check is good. But I want to move in tomorrow’

I’m a defender of the Fed at least compared to all the conspiracy ideas: ‘the Fed is controlled by a secret world elite to enslave us’ etc. etc.

But Powell’s blunt statement proves he is not in complete touch with reality. He can, and has, conjured up a billion dollars a hour. To be surprised that the credit can’t be turned into real physical stuff as fast …..is surprising.

Maybe let’s not make his next gig Sec Def: ‘where are those planes I ordered last week?’

Went back and watched Neil Ferguson’s video on the first stock company in 1599 in the Netherlands, John Law and Enron.

Seems like the Fed is making the same mistake as John Law by using money printing to support confidence in the financial asset market. Stock markets are prone to boom and bust by their very nature of trying to value the future. Last thing you need is a central banker facilitating an asset bubble.

Fractional Banking seems predestined to….well,….fracture?

Damned Dutch.

So in essence, Powell’s explanation for the rampant inflation will be…

“We dont make anything here anymore, what did you expect?

Rates will stay at zero because this really isnt inflation, it is just supply issues.”

But wait. Isnt “too much money chasing too few goods” (a definition of inflation) because the too few goods are a lack of supply?

Free markets were great…anyone remember them?

“Free markets were great…anyone remember them?”

I suspect not, as I don’t believe any such thing has ever existed. People with power and wealth use it to concentrate power and wealth.

I’m more of a believer in that societies function like beating hearts in that respect ; I.e. they contract and expand in the sense that power and wealth concentrate until the concentration becomes untenable, and then it redistributes itself through some type of violent reaction, and then those who subsequently find themselves possessing an advantage in power and wealth once again begin to concentrate it.

Salt-it might be said that the definition of Smith’s ‘well-regulated’ markets finely-fit your observations (at what cardiac point was the British society/economy at when ‘Wealth of Nations debuted?).

may we all find a better day.

I am smelling a rat. Run inflation hot and get real interest rates highly negative for a few years confiscating a lot of savings as inflation eats away. Don’t think rates can rise much or it all goes to heck.

I think things are really bad or Fed wouldn’t be running such crazy policy. Maybe they are just buying time hoping for miracle.

“I am smelling a rat.”

You’re smelling Jerome Powell. He’s so full of sheet that it is emanating from his every pore.

And the lack of hard questioning is ……..sad, I guess.

I fish the Huntington Beach area from time to time and notice the uptick in the number of tankers and container ships in the distance. It’s crazy – I’ve never seen that many out there at once. Usually I might see 1 to 3 and most. Every time I’ve gone in the past year though, it’s not uncommon to see *at least* half a dozen if not more in the distance.

1) China will build a port in Bremerton Wa, next to Puget Sound, to ease the long lines in La La and Long Beach ports.

2) Most American are waiting for their next stimmi to get their regular fix.

3) They will do everything for another hypodermic high of fresh dollars from the Fed. Without it, they cannot afford to buy stuff, with higher prices cause by Long Beach.

4) Importers and mfg will have to absorb the higher cost caused by inflation and higher wages.

5) When wall street analysts will realize in the next reports profit margin will fall, due to the rising inflation, stocks will tank.

6) Against all expectations & predictions the Fed will refuse to give another hypo fix.

7) The wasted Americans will get under the skin, but the gov will

cont to shrink debt in stepping stones.

8) Life will be very difficult for the Fed front runners, but they will have to adopt, to correct their mistakes.

9) Falling RE prices along with inflation reduce real value.

Historical p/e is around 16 now @ 44 don’t fall off the cliff prepare

Given the ugly and I mean long term ugly chart for FXI……. and today China cuts the rate by 50 basis points……something pretty ugly is happening over there…..in the old days no problem…….today……I wonder.

The PBOC has kept its benchmark lending rate, the loan prime rate (LPR), unchanged for 14 months

The reduction mentioned is the bank reserve rate

Around 1983, I was in a toy manufacturer and wholesaler on Cook Street in the Bushwick section of Brooklyn. I was there on a wage matter but the owner showed me a telegraph he just received from a wholesale customer in France. The telegram canceled all the customer’s pending toy orders because the Reagan administration’s policy of a strong dollar had driven the dollar up so high that the Cook Street company’s toys were priced out of the market in France. Also around that time, I was at a wholesaler of machine tools in Brooklyn. He told me that he likes to always have available machines made in America as well as made from foreign suppliers, he was unable to get a combination lathe/milling machine from any American manufacturer. They weren’t made here but they were made in Belgium and in Australia, as I recall. While the market for stuff like nails was gone, Brazil dominated that market, lathes were a basic machine tool. So while the Reagan administration was spending money on a 600-ship navy and Iran-Contra and allowing share buybacks, these guys were also wrecking American manufacturing to a point where the United States would be unable to compete with China when it joined the World Trade Organization in 2001. And China’s winning the trade war is why we have so many containers now entering the USA full and the containers leaving empty.

All presidents support a strong dollar. Trump backed away from that a little, Yellen made the statement after she was Treasury sec, “The US does not support a weak dollar..” China dropped the peg and the Yuan has been gaining against the dollar. They took advantage of the Covid slowdown to gain market share, now they need to pullback on the surge in demand. Despite all the banter these policies are calculated symbiosis and there is no incentive to harm the host. China/US trade has been an embarrassment of riches to both countries. ESG is the blueprint, business and consumers should be plugging that into their plans.

.

Very insightful.

Too strong dollar killed a lot of companies.

Charisma does not compensate for idiocy.

“Comparative advantage” was just a rationalization for failure.

.

It just shows how much Walmart and comrades are making on this cheap made junk. Where would container rates have to go to make retailers buy in the states? $25000?

Something is a little suspect here. How much is this junk marked up on the retail shelf? 500% ??

About ten years ago, a coffee maker that cost less than $4 to Chinese manufacturer was on sale for $25 at Macy’s (%50 off the regular price)

The Chinese made Schwinn 270 exercise bike I ordered last July is still available at the same price at Schwinn’s website. But delivery time is much shorter. Scalpers on EBAY are trying to unload their inventory at higher prices so it pays to shop around.

This is all going to come crashing down spectacularly. When all of these people who blew all of their stimmies are no longer getting checks to sit on the couch, get high and shop, they are going to be selling all of those toys and junk for pennies on the dollar.

The US and the world NEED a recession, badly. All of the malinvestment and bloated valuations and asset prices need to be washed so we can get back to sanity. Zombie corps need to die, millions of households need to go BK, etc. It’s healthy.

Depth…

The central bankers decided in 2009 there would be no more cycles or corrections….all charts would flow low left to upper right.

Corrections are called corrections because they “correct”. They flush excesses and sort out the well capitalized from the poorly capitalized, the well operated from the poorly operated.

When not allowed to occur, excesses become pent up, and the eventual “flush” becomes systemic threatening.

Enter the same central bankers to wield new powers, expand their purview, self author new mandates, accrue greater control.

Almost by design.

All true about recessions…but why have they disappeared?

People wanting Congress i.e. political oversight of Fed have it exactly backwards. Politicians have one overriding concern: to be reelected. Who wants a recession on their watch? There is a reason the Fed chair is appointed, not elected, to make him immune from politics. That was the hope.

Did any of the Trumpets posting here notice the constant barrage directed at the Fed after 2016? During the good times?

If the head of the Bank of Canada or of UK was yapped at by a politician including the PM, there would be a storm of criticism from conservatives. We have our MMT gang here too, they would luv to have the BOC be at the mercy of politicos.

IMHO that was decided circa 2000 when Alan Greenspan decided that shrub Bush should not have to deal with the business cycle any more and lowered rates for no good reason.

The rest have just been following his lead.

Depression!!!!

I learned at a young age growing up on a farm that eating the corn drew a crowd but planting and growing the corn did not. Jerome Powell is like the sovereigns of past history where effort of production is not in their calculation. Just like the refrain from the old ditty that was sung by his soldiers during the Napoleonic Wars .”King Charles commands and we obey.”

Duh…. King George.

I like your name! signore Doom,

But blaming our pal J Pow , is like blaming the buzzards which steal the food you left for your pet dogo!

It’s his job to stay in his job!

Your blame should be squarely directly at his bosses, the professional political class that inhabit the swamp, and No I am not referring to the Everglades .

Jack

“It’s his job to stay in his job!”

Absolutely NOT!

His job is

promote max employment

promote stable prices

promote moderate long term interest rates

and to assuage temporary banking liquidity issues.

let’s review…

Mandate #1 The Fed is supposed to promote maximum employment yet what they do with rates has had the OPPOSITE EFFECT. The free money to promote inflation is borrowed by the federal government and paid out in a fashion that discourages employment. Fail.

Mandate #2 The Fed is supposed to promote stable prices, yet they promote just the opposite, INFLATION. Fail

Mandate #3 The Fed is supposed to promote moderate (not extreme) long term rates, but we have near record lows, 30yrs almost 2% below inflation. Those rates are IMMODERATE and EXTREMELY low. Fail.

Powell is a puppet for the oligarchs, IMO.

historicus

All good points if you’re arguing to a “sane” man/ woman that a “ public position “ must be taken by only “ consciousness and responsible citizen “, a person that holds dear the Values of freedom and prosperity of his/her country to heart.

Not this mob!

Not this mob as far back as I remember, but let’s just stop at Mr. “ irrational exuberance”!

Do you remember him?!

Yeah, I thought you do, these people, Mr helicopter money! Is another one , they’re there to F$@)k the country up for the chosen few.

Oh historicus, you’re talking too much sense mate, too much sense for someone who’s dealt with slippery creatures that can’t be hold with clean hands.

Change will happen, when your compatriots grow some cajones , and stop consuming too much BS and accepting leftovers.

If the banksters’ privately owned “Federal” Reserve had not been manipulating the economy and growing bubbles, e.g. by buying bonds, MBS, etc., the collapse would have already come but would be much smaller. Americans need to understand that we need banks but we do NOT need the utterly corrupt, connected banksters that control them now and through them our politicians. See Simon Johnson’s “The Quiet Coup” in The Atlantic.

Instead of gifting these crooks more and more TRILLIONS EVERY OTHER YEAR,the US government should demand that in exchange for the REPEATED,TRILLION DOLLAR BAILOUTS of their banks and cronies, they have to give over 99.9% control of their banks and institutions via giving convertible bonds in exchange for bail outs. The coming, enormous crash would then be from the last ginormous bubbles. The banksters blew up these bubbles.

I dont think anyone wants a collapse.

But, a bullet proof lock on ever increasing prices of real estate and stocks…

promoted by policy rather than hard economic activity is bothersome.

Free markets have corrections and cycles. To deny them is to store up excesses, promote misallocation of resources, and to allow massive irresponsible leveraging.

The Fed has stolen Congressional Powers IMO.

Minting……when did the Fed be the controller of the Money Supply? M2 up 27% in less than a year, by the decision of one man? What power.

Taxation….openly promoting inflation when charged with “fighting inflation”, and nary a word of objection.

Minting and taxation (promoting inflation) are Congressional powers per Artilce I sect 8 and CAN NOT BE DELEGATED.

You are right. Most importantly, the bankster-owned “Federal” Reserve keeps taking regular Americans’ savings, funds held in dollars in accounts, and cash by creating inflation then gifting those funds to be meters in violation of the just compensation requirement of the US constitution: e.g., the $2 TRILLION IN GARBAGE mortgage backed securities (“MBS”) the FED bought from their banister owners at sums way over FMV, at FACE AMOUNTS IN 2019 TO 2020 plus $40 BILLION A MONTH in MBS purchased at way over FMV values in 2021.

This is being done now so banksters would not suffer the TRILLIONS IN LOSSES — ORDINARY AMERICANS WOULD albeit indirectly THROUGH EVENTUAL, HIGHER INFLATION DUE TO THE FED creation of those trillions.

The Fed gifted funds by buying the MBS to its b a n k s t e r s, who own it by owning the banks that own its district banks and their cronies. This Amazon tablet changed every instance of my use of that word: e.g., e.g. to banister.

The flaw in the system is that Congress LOVES the free money the Fed is delivering……Trillions from thin air for Socialistic endeavors and vote buying schemes.

It is as if the Fed is “buying off” Congress.

Hey, we’ll keep the rates at zero, you guys have your fun, (Trillion dollar programs) we’ll have ours (stocks and real estate).

Vote buying schemes that go mostly to the wealthy, check your income level increases by wealth class.

Good news, more import taxes and more expensive transport means less import and more orders in the country.

Or am I too optimistic?

I think it will mainly benefit Latin America, but that’s not a bad outcome.

First hand experience here. Rates for 40′ to East Coast. Even at the exorbitant cost, the 2021 bookings were a miracle to get.

2019 and before: $3,500

2020: $5,500

2021: $18,500!

I’m shocked that consumer prices have not gone up more. This ocean freight madness alone should represent a 10-20% increase in the retail price of many durable goods.

I can’t think of any durable goods I really even need right now. The stimmie demand is eroding as I type. These shipping prices are going to resemble the lumber price meltdown going forward.

I was looking at something on alibaba. It was about $3k which was a decent price for the item. Shipping was $11K! I wondered about ordering more to fill a container, and upped the quantity. To my surprise shipping remained at $11K per each, no matter the quantity.

So I would guess a lot of products are not leaving China due to costs of shipping right now.

Sounds like you are talking to a computer. If you talk to a human at the co I would be very surprised if they don’t get involved.

Ah…wait. Christmas is coming! I prebook orders from Europe 8months in advance. That product is expected to arrive in sept. And Oct. We have been quoted higher prices, as well as higher domestic shipping costs. And importers are absorbing some, trying to keep a lid on retail prices. But….don’t be surprised at lack of inventory, or low consumer prices. Labor costs have also risen. My prediction, the 4th qrt. Will be good, but come Jan…..all bets are off.

Should be higher consumer prices this 4th qrt

Little Holmes Harbor on Whidbey Island has 4 huge container ships sitting in it, waiting to unload in Seattle or Tacoma. Been going on for weeks. Islanders are fed up with the noise and other pollution. But it doesn’t look like anyone has stopped ordering from Amazon in protest.

Here is a novel idea.

Build an automated or semi-automated plant in the US and ship direct to customers right from the shipping dock.

We do it all the time.

And then there is overland shipping. With the driver shortage, one can only wonder how much more it’s costing to ship gasoline to service stations.

Do you mean to say that stuff doesn’t just magically appear out of the ether because authority demands it to do so? I’m shocked.

The family of Senator Mitch McConnell’s wife, Elaine Chao, owns Foremost Group–a shipping company. She was, until recently, Secretary of the US Department of Transportation. Foremost has corporate offices in NYC, but it does business mostly out of China. Funded in part by the CCP central bank. She resigned after allegations she abused her position. Today?? Mo money!

Elaine Chao’s father James Chao owns Foremost, a NYC shipping company. They are from Taiwan. Many U.S. companies are doing business in China including Apple, Starbucks, KFC, Pizza Hut, Nike etc.

Hi Wolf,

In the end if shipping prices stay this high, isn’t the net effect on Chinese producers the same as a substantial increase in the yuan vs the dollar? I think of factories injection molding cheap children’s toys or other low density, low value added items. Now wholesalers in the US have to pay 25 or 50 cents more each to cover the transport costs. Us customers have to pay more and therefore buy less. So now does the PBOC print more to devalue the yuan to make up for this?

Yes, if shipping rates remain much higher long-term, there will be some shift in production from Asia to the US because high transportation costs will reduce cost advantages in Asia.

But it’s a slow process.

For some products made in Asia, there are ready alternatives in the US. But for other products, not so much. The US has offshored production of many goods for so long that there are now neither ready-to-go plants nor even the expertise to manufacture those items here. This includes certain automotive components.

So it will take a while to rebuild that capacity in the US. But I think that would be a good thing, requiring investment, high level jobs, and all the things that come with highly automated modern manufacturing.

But Orange Man Bad for wanting that….

I’m glad he had the gumption to put the issue on the table. But his big mistake in this situation was that he never went after Corporate America. That’s the driving force behind offshoring. You’ve got to take the incentives away for Corporate American out offshore production. And that might result in lower stock prices. Given that he took ownership of the Dow, he never even proposed that.

I don’t know, Wolf, I seem to recall him publicly shaming GM and many other companies for offshoring plans. That’s “going after” them in my book. As the President, what else could he have done? CONgress has the power.

“Shaming” on Twitter gets brushed off in 24 hours. No consequences. Nothing changed. Except he stopped doing even that after he watched a couple of their stocks tank.

Uh, no.

The Chinese will build factories in Mexico as their industrial economy transitions toward higher value products.

Freight by rail from Mexico to the US is far less expensive than Asian ocean freight. And Mexican labor economics work better than for the US for low-value goods.

A few years ago there was a plan for a port larger than LA in No Baja. TJ is second largest city in Mexico

1) Fred : China GDP is : $14.7T, with a slowing ROC.

2) To keep growing in USD, China need a strong RMB (weaker USD/CNY), during a slow down in their economy.

3) China stomped Didi to reduce the flow of USD to Chinese cos.

4) A strong RMB export inflation to US.

5) A strong RMB to prepare a divorce case with US.

6) A strong RMB to profit in the barter trade.

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff”

That deserves it’s own T-shirt.

.

Just wait for Amazon to start its own shipping line and build their own ports.

Then they can sell the spare capacity as they do with AWS.

Just more of the logistics they are already great at.

.

I think Amazon already has this built out. If you join their FBA program you can ship direct from China to Amazon’s warehouses in the United States. Amazon also has airplanes, etc.

One gets the sinking feeling that things are flying apart right now.

On my daily shore walk (UK NE) I haven’t seen a container ship for nigh on 2yrs. They used to be fairly common here.

Plenty of tankers to petro-chem terminals. One or two laid up cruise ships but they’ve gone some months back.

Funny how container rates multiply up the trade deficit on the assumption the customer pays the transit fees.

Rates to the Midwest and north east have been $20k+ for the last 3 weeks. Even at those prices, there is limited capacity.

I am surprised that anyone is surprised at this. Just in time logistics also creates just in time capacity. any disruption and you have trouble.