Global revenues, deliveries, market share, income, and for your amusement the WTF stock prices.

By Wolf Richter for WOLF STREET.

General Motors reported its results today, the last of the three US automakers to do so. Those three are GM, Ford, and Tesla. And we can compare their global revenues, global deliveries, and stock market capitalization. Chrysler no longer counts as US automaker, though it still has some plants in the US. Purchased out of bankruptcy by Fiat years ago to become Fiat Chrysler, it has now merged with Groupe PSA, which owns Peugeot, Citroën, Opel, and DS. The whole schmeer is headquartered in Amsterdam and was renamed Stellantis. So this is a foreign automaker.

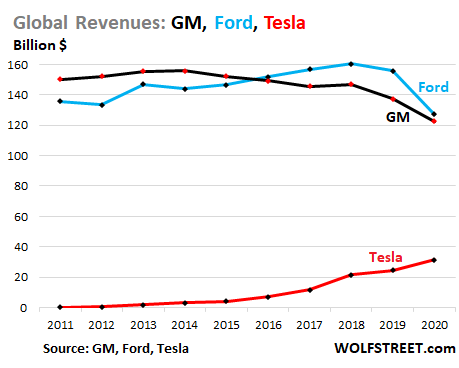

GM reported today that its global revenues in the year 2020 dropped by 10.8% from 2019, to $122.5 billion, and by 16.7% from 2018, and by 21.5% from, well, 2014, because GM’s revenues have been dropping since 2014. Part of this long-term drop was a result of GM selling Opel/Vauxhall to Groupe PSA.

Ford reported earlier that its revenues in 2020 plunged by 18.5% from 2019, to $127.1 billion, thus maintaining its lead over GM that it had obtained when GM sold Opel, and by 20.7% from 2018, which had been Ford’s peak year. And Tesla’s sales in 2020 jumped by 28% to $31.5 billion:

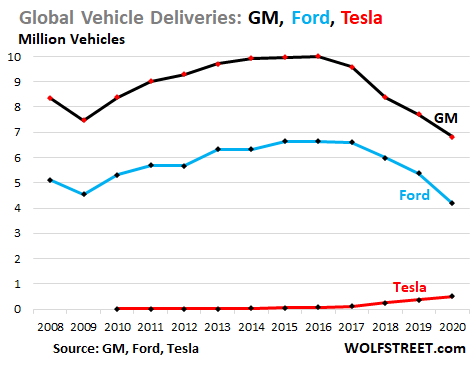

GM’s global deliveries dropped by 11.5% to 6.8 million vehicles, the fourth year in a row of declines. Since 2016, its deliveries have plunged by 32%. Ford’s deliveries dropped by 22.6% in 2020 to 4.2 million vehicles, the third year of declines, and have collapsed by 37% since 2016. And Tesla’s deliveries jumped by 35.9% in 2020 to 0.5 million vehicles, the red line near the bottom:

Deliveries in the global auto market by all automakers plunged by 14.3% in 2020, to 78.6 million vehicles. Tesla’s share of this global market surged to, well, 0.6%, a tiny fraction of GM’s global market share of 8.7% and Ford’s global market share of 5.3%. Tesla is still just a small automaker.

GM made $6.2 billion in net income in 2020. Ford lost $1.3 billion. Tesla was profitable in 2020 for the first year ever. It made $721 million in net income, thanks to its only profitable business, selling pollution tax credits it obtains from various governments – “regulatory credits” – to other companies. In 2020, it sold $1.58 billion in regulatory credits to other companies. Without those regulatory credits, it would have lost $860 million.

And for your amusement in these crazy times.

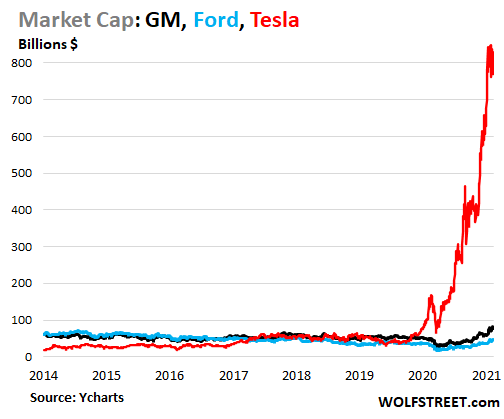

Here’s how the ludicrous stock market, so to speak, reacted to this situation: GM’s market cap (shares outstanding times share price) – despite six years of declining revenues and four years of declining deliveries – jumped inexplicably by 58% from a year ago to $77.6 billion.

Ford’s market cap, despite two years of revenue declines and three years of declining deliveries, and a $1.3 billion loss, jumped by 46% year-over-year to $46.7 billion.

Tesla, of course, isn’t an automaker but a supernatural phenomenon, and its CEO walks on water, and its market cap spiked by 450% over the 12-month period to $770 billion, about 10 times the market cap of GM and 16 times the market cap of Ford, though its revenues and deliveries are just a tiny fraction of GM’s and Ford’s, for a class-act ludicrous-mode WTF moment:

And here is another irony for your amusement: Tesla’s shares have quietly given up $78 billion in market cap in the 11 trading days since January 26, which is more than the entire and already ludicrous market cap of GM.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

In a world were everything is created out of thin air, trying to produce real things is clearly a value losing proposition!

Only companies that produce nothing real, have value!

Vanity of vanities, all is vanity

TSLA ==MIC

“Only companies that produce nothing real, have value!”

It’s an absolutely sickening, disgusting indictment of the FED and their policies. They’ve destroyed the economy and price discovery. They’ve made a charlatan the world’s richest man.

Can someone write the history of these mad times? Extra terrestrials will some day benefit from it.

The previous article dovetails nicely with this. The money wasn’t printed out of thin air, it was demand for stock shares and loss of purchasing power. At least Yellen isn’t committed to a weak dollar policy…

How much is Bumble.. the Dating app.. worth just past IPO?

Insanity..

And pigs can fly now.

What are they going to say when Tesla triples this year?

Those companies which have no earnings have vastly outperformed the last 6 months

For the life of me I can’t figure out why the Tesla lovers think that all the other car companies which already have huge research and logistical advantages are not positioned to be competition. I think Tesla was great to force the EV direction to take off but now that it has are you telling me that Mercedes, BMW and Lexus are not going to build better cars than Tesla!? I bet the next round of cars or maybe one after that will completely embarrass Tesla’s offerings.

You can lie to and fool some of the people some of the time but you cannot fool all of the people all of the time— unless you are with the banksters “Federal” Reserve cartel. I think that part of the reason why the banksters and their cronies were able to avoid huge stockmarket losses is now clear. Companies in trouble, over-leveraged, and unlikely to survive probably have the banksters’ share of those stock purchased using the treasury ESF. Banksters must never lose a cent, no matter how recklessly they act! See “Janet Yellen’s Slush Fund to Meddle in Markets Got a $490 Billion Haircut” in wall street on parade’s site.

3 Questions; Since I see them all over lately.

Where did this automotive “chip shortage” talk come from and is there any truth to it? Or maybe, is it of any major significance to anything at all?

What is “WFH”?

What do these “==” coding things mean as far as instructions go? Language optional.

Thanks

I recently bought some puts on Bitcoin and then with Tesla’s announcement the price jumped 20% in one day. Thanks, Elon. As if Bitcoin doesn’t have enough fanboys, now there’s gonna be Tesla fanatic crossover.

Why on gods green earth would you bet against math?

And logic? Simple, as GME, but really that’s just the latest example in the stock market. Anything in terms of investing is not tethered to reality right now.

The put is not a bad hedge in the short term, because Bitcoin could literally drop $5k plus on a day. These days, everything can get turned upside down with less than 120 characters.

If you ask me, the first step to getting back to reality is to shut down Twitter, it is more instantly destructive than anything else. If the last four years was any indication of the danger of that one company, if any of our leaders had any degree of sense on proportionate danger, they would shut down Twitter today.

Twitter is unique in this respect, Facebook is dangerous also, but the destruction they bring is slower and more systematic. If I were to compare these two social media companies to WMD, Twitter is a nuclear bomb, and Facebook is a biological weapon. Both are dangerous, but one brings instant carnage, and the worst thing about Twitter, it has no safe guards in spite of all of the bullshit they tell everyone. Its safeguards are after the fact, and does about as much good as whatever measure one would take after a nuclear bomb goes off.

In spite of the possible First Amendment ”issues”, I agree with you completely re the shutting down of these various and sundry not properly supervised website, including face hook, fake hooks, or whatever is the actually appropriate name(s) mch.

And IMO, the first amendment stuff should be dealt with just exactly as is done for all other common carriers, etc., per long established laws, rules, and regulations, subject to updates as they all are.

So, my answer is not to have anything to do with them.

On the strong recommendation of a younger biz associate, I did sign up for the linked one, and even though it lead to touching base with some respected former biz associates, after a bit it was clear that the purpose of that site too was the same as the others: more advertising, more unwanted emails, more nuisance by any name…

Not only NO, but no thank you to any of this extended theft and control stuff.

OK, another thought, How do you trade delusion, dysfunctional delusion? … The problem for me I overthink it, it’s all varying degrees of delusion in the good old days of rational investing … putting that aside, only thinking 1 or 2 layers down this rabbit hole, How do you trade extreme delusion

That move was clearly running in front of a crowd and calling it a parade.

If the SA man was so prescient – he’d have had Tesla buy in in October.

But puts are a mistake. SA man’s actions may be flamboyant but the analysis of where the crowd is going isn’t wrong even if the crowd is the wrong one.

I don’t see any real companies ever buying into Bitcoin as its hard currency reserve – but the crowd was never going to be those.

The crowd are all the hedge funds and what not – every bitcoin spike equals greater pressure for every hedge fund to have significant bitcoin exposure.

This isn’t trivial: bitcoin is both liquid and visible enough that fund limited partners will, if not are already, asking hard questions as to why any given fund doesn’t have it.

Bitcoin has gone from 13K at the end of October to 48K today – that would leave a (positive) mark on an overall fund’s performance even with a 5% allocation.

As I’ve noted before – and repeatedly since 3rd quarter last year – Harris Kupperman has been spot on via his web site and has been talking about bitcoin since COVID started.

Forget Bitcoin, the other shitcoins are where the real money is being made. 50% moves in a day, in an environment where the banks are paying less than .5% in a year on savings.

With this latest Biden stimulus orgy, I’m starting to think I should be putting $10,000 aside for crypto speculation. How else am I going to keep up? Houses, cars and everything else are running away from me in price. If anything, the moment I buy in it will all come crashing down. Maybe it’s worth it to pay $10,000 for that to happen.

The free float of the useless bitcoin ponzi scam isn’t that large that many funds can invest money into it

Bitcoin will fail after the whales finish eating the circling schools of minnows who haven’t bailed out by now.

It’s the blockchain that is failing, purposely.

Added:

Blockchain technology is near its demise. It’s to little to late.

-k

You’ve got the first part right, you just have to execute step two. Elon probably bought calls on bitcoin before announcing it on Twitter. Good for him that it’s all legal, and there is no market manipulation involved.

Musk can come out tomorrow and say that he likes some particular brand of beer and I’d put my money on the share price of its vendors, at a bare minimum, doubling the next day…

His BTC move was sort of a no-brainer. A post facto announced move that is completely guaranteed to result in a huge gain. I bet they’ll also be quite clever about how they eventually divulge the future sale or reduction of that position as and when conditions change.

To be honest, I’m not quite sure why Tesla would even worry about that dirty business of making and selling cars any more. Just issue TSLA stock and move anything with the proceeds, and we have a never-ending carousel of self-reinforcing returns!

I suspect Tesla made more return on BTC in a week than in a decade of doing car stuff.

By investing in bitcoin, Tesla is a bigger polluter than ever. But I get Musk’s thinking: Tesla may now sell the “pollution credits” to itself! Brilliant!

Do you think GM or Ford could buy large amounts of Bitcoin, without giving the Fed a slap in the face? Should there be such a thing as corporate loyalty to the United States, being able to move your assets around without controls says something different. In a repeat of 2008, collateral would shift offshore, pulling out the pins from the economy, and Musk could probably shift assets out of Tesla, to the tune of his entire market cap and leave the company a shell.

The powers that be want the carbon tax thing to pass and expand. Musk is a hired gun to help that job using some of the debt driven liquidity he has available for such uses. The more carbon tax assets are purchased and sold, the easier it is accepted as a new tax revenue stream for politicians with an agenda to make up for the falling revenues from the terrible economy.

Implicit, I don’t know who you think the “powers that be” are as if they aren’t quite fragmented. If “they” wanted a carbon tax, they would have implemented one sometime in the last two decades.

As it is, thinking on the efficacy of a carbon tax to reduce CO2 emissions has shifted over the last decade.

YES! I think blockchain has tons of potential but don’t see why any of the coins are worth anything. I also don’t see why blockchain based gold isn’t all the rage and the most obvious solution to an alternative currency.

In any case it’s amazing that no one really talks about it but Bitcoin is an environmental disaster and really should be outlawed until it can be done without using a large country’s worth of electricity, it’s obscene that it’s being done and now that the “leader in green tech” is using it.

I hope you bought some time. Trade around the position.

So Tesla could easily buy GM AND Ford and almost monopolize the entire US car production? An opportunity to force everybody to go electric.

Question is why Tesla doesn’t and buys bitcoin instead.

MarMar, CVR, I wonder if this isn’t a classic “pump and dump” by Tesla maybe in need of funds? They probably already acquired the coins serendipitously, made the announcement, knowing their mob and the BC mob would flock in and jack up the price. After a time they slowly back out and take their profits. I don’t know, I’m just putting on my tinfoil hat here.

Antitrust.

I know the questiin is probably sarcasm, but my sarcasm meter is broken when it comes to anything Tesla… and US antitrust enforcement is kinda lax these days too?

I’ve always just ignored Tesla, and strangely enough life has continued on. It’s kind of like those scientific news reports about an asteroid passing within 2 million km of earth, and…….

Going to town today in my 19 year old 2WD pickup. Probably won’t encounter a Tesla, in fact I would bet big money on that situation. But would you even notice if there was a Tesla around? Except for the logo on the front of the hood, most cars look the same. I simply do not understand the hype? The new Prius looks quite distinctive, but Teslas? As for the pickups, they would be laughed off the job site.

Teslas don’t have grills (think the stately, classic Rolls Royce grill, or the abominable Lexus ‘open-mouth Predator’ grill). Grills were historically used to adorn and protect fragile radiators, which otherwise were tall, black monoliths, and were many brands’ signature identifiers. Teslas don’t have/need radiators, and they’ve never really figured out what to do with their front ends; early Teslas just have a big slab of black plastic where a grill would be, later versions have what can (charitably) be described as a “bent up duck’s bill.” Their rear ends are fairly conventional. They can be positively identified by a large ‘T’ where you’d expect a conventional logo, like the Chevrolet ‘bowtie’ or the enduring, script ‘Ford’ oval logo from way back.

Side note: Most modern ICE (Internal Combustion Engine) powered cars don’t have functional grills anymore, either; cooling air is mostly sucked-up from apertures below the front valence (they don’t have visible bumpers anymore, either).

California Bob,

You touched upon the fascinating topic of EV design. The thing is, they don’t need a hood anymore. Look at the current platforms for EVs put together by Ford, VW, Rivian, etc. They increasingly have two or more small motors, and a big battery in between. You can put anything on top, from a sports car to a van.

Here is Volkswagen’s modular electric drive matrix MEB platform:

So how do you design an EV that people will buy? And there are safety aspects (crumple zones, etc.) that dictate the shape as well. For example, a new version of the old VW Bus could easily be set on top of VW’s MEB platform, and I think it would be adorable. But do people really want their feet to be the crumple zone?

Eventually, EVs are going to change the way vehicles look because of the flexibility of their platforms. But you need to get consumers to accept the new shapes, and that’s not easy. Lots of cars have failed because the change was too radical. That’s why Tesla stuck mostly to the conventional look, minus the grill.

Possibly, this is why Ford chose to call its new EV entry the “Mustang Mach-E” (much to the chagrin of many Mustang owners; I own a Mustang GT but don’t really care one way or another). The Mach-E could be a generic electric CUV, but it has Mustang styling cues, notably the triple tail/turn/stop lights, to ease the transition to what will likely be a crop of electric, four-wheeled blobs. Maybe we’ll see a ‘Camaro SSElectric?’

What they really need, is an entire front ‘battery’ of HazMat apparati pointed directly backwards .. for those, uh, events when a conflagration might flare up!

Yes, and as mentioned before, in terms of form and function, the Tesla has a range based on how successful it is slicing through the air. Franz von Holzhausen is the person behind the shape.

Crumple zones are good things, but hell, I say go for a roll cage too.

They won’t be laughed off the job site when they have 1500 torque and do 100mph as fast as a sportbike. All the rednecks will come around then and make up some reason why their reasoning is different now. I can’t wait until they see all the cool electric toys of different kinds and change their tune.

The one thing that needs to happen is China driving the price down like flat screen tv’s. Soon they could easily build a truck or car similar in capability to current ones but for say $15K, not $75K … and even make them much more reliable for longer and modular to just upgrade things. I see a whole new industry developing but the old one will get wiped out….it’ll happen much quicker than current estimates too.

I think Ford will go all-electric anyway. It’s heading that way now.

If it’s not too late.

CA can’t even keep the grid up with the majority of people buying ICE vehicles. Imagine their whole population charging EVs at night. The stupid – it burns.

Just do like the CCP.

Keep cranking out coal plants to power the EV’s. Give the west a date when you will be carbon free, and keep a straight face when you do it.

Depth Charge,

Just hot off the press:

“In California, electricity sales to end users have been falling since 2008, driven in part by the widespread change-over to efficient florescent and LED light bulbs and other efficiency measures. In 2019, the latest data available from the EIA, electricity sales to end users in California — such as households, businesses, government offices, schools, and, well, EV charging stations — fell to 250,378 gigawatt hours, the lowest since 2003:

https://wolfstreet.com/2021/02/11/demand-for-gasoline-and-jet-fuel-refuses-to-recover-diesel-fully-back-powered-by-trucking-boom/

The idea that ICE cars are going away is just silly.

They are here to stay for long term, even though EV will gain more market share over time.

I’d like to see natural gas vehicles become the transition phase alternative considering natural gas is the largest electric grid provider.

This portion of the pie for natural gas will only get larger as EVs become more popular over the next 10-20 years.

ICE cars are more expensive to build (development costs need to be paid so true from 2025). More expensive to operate and a lot dirtier. I doubt that many will be sold in a generation. I doubt you could even operate one in California in 2040 without a lot of red tape.

Implicit, the last data I saw indicated that the US had 400 years of Natural Gas reserves, and that was a few years ago. Plus of course, all the stations are available, or readily available by addition or conversion of existing facilities.

Propane is also an option; I had a dual-fuel propane car 40 years ago. Dual-fuel was for cold climates – at that time, you started on gasoline and switched to propane when underway because propane/natural gas was difficult to start in cold weather. Maybe the technology is different, i.e better, now.

It was a lot cheaper than gasoline, too.

A lot of vehicles all over the world run on nat gas/propane.

Yeah, you sound like the floor traders that thought they would never go all electronic.

As a national green new deal infrastructure project create electrified roads for charging vehicles that are being driven on them.

Leave your battery charging extension cord at home.

Super simple to charge the EV driver for miles driven.

Phase out internal combustion vehicles through attrition.

Tax the oil companies out of existing other then to produce life saving products such as heat (warmth), air travel, military applications so on.

“As a national green new deal infrastructure project create electrified roads for charging vehicles that are being driven on them.”

That would be a boondoggle.

I don’t think it is even remotely economically or technically viable. Not to mention the health hazards of driving through powerful electromagnetic fields.

@Heinz

Those induction roads already exist in test phase. Are not a health hazard anymore than your wireless iphone charger (less in fact) and could easily operate as a toll road

T’s market cap is not the same as cash on hand or available. It couldn’t buy GM and or Ford with cash it likely have to be all- stock transaction. Like when AOL bought Time- Warner and thousands of other all stock buys then and now.

I think T’s investment in BC is about as close as we’ve come yet to the milestone (headstone?) of peak insanity. The cherry on top now has its own cherry. A car co that can’t make money selling cars, lays out 1.5 billion for some 0 s and 1 s stored in computers.

Because their valuation would then be crushed AND their scheme exposed.

You can’t justify a huge valuation if you have no growth – and buying GM and Ford would make the combined entity’s growth zero to negative, which in turn crushes the multiple.

Tesla buys those companies only when they believe the jig is up in their financial fan dance…

Well you say you can’t justify a huge valuation without growth… in an article where everyone mentioned has had huge valuation increases based on negative growth.

Anything can happen now. Which is probably a very bad sign.

The energy waste issue is being solved with proof of stake instead of wasteful proof of work.

Not for Bitcoin, not yet. Until every coin is mined, it will be a continual proof of work. Eventually, they will have to transition to proof of stake.

But that’s not how the system works right now. Every time with Bitcoin, if there is a transaction, you need several modes to verify.

Please understand I am no big Fan of Tesla. (Nikola excepted lolol) However,I have always thought it a kind of ‘ethereal’ Proxy for all the Future endeavors/profits Elon might have a finger in..lol aloha amigos

The hypocrisy from the left has reached epidemic proportions. Crypto is a disgustingly wasteful endeavor. The cheap Chinese manufacturing model of producing products that end up in a landfill in a matter of months is myopic GREED at its finest. Destroying perfectly good ICE vehicles in the name of “cash for clunkers” was sinful. Clear-cutting the world’s trees for biomass plants is completely unsustainable. These people are about as green as a dead lawn.

Why do you think anyone from “the left” has anything to do with it? I guess in a conservotard’s empty cavern of a skull, anything not agreeable to them comes from “the left”. Yet, if anyone ever tried to shut down bitcoin that would be an attack on business from “the left “.

Just say no to the suicide economy ;•{)

I wish we could just strip out this left and right stuff… it does get really tedious.

And nothing is ever accomplished because of it… prime example, just look at Congress… a bunch of do nothings whose only care is how to get re-elected. And that’s the best of them….

Oh well, so much for idealism.

“Why do you think anyone from “the left” has anything to do with it? I guess in a conservotard’s empty cavern of a skull, anything not agreeable to them comes from “the left””

So merely saying “the left” triggered an emotional reaction, leading you to construct a Strawman argument which included a derogatory and insulting term? Hah! Truth hurts, huh buddy?

WHAT Does Ford and GM have that Tesla wants to buy? Nothing.

Why the hell would Musk (or any sane individual) want to buy GM, Ford and a century of UAW labor trouble?

Tesla builds & announces new and exciting products (including flamethrowers & satin shorts) that lots of people want. GM & Ford haven’t done anything exciting (well, GM did go bankrupt 10-12 years ago) in a LONG time; the last exciting automotive thing GM did was the Corvette in the early 1950s – that’s 70 years ago.

I’m an old retired CFO geezer (who drives a BMW M8), but even I can see who has today’s zeitgeist…and it’s not GM & Ford. Sure it’s a big slice of irrational exuberance, but that tells you the hole GM, Ford and the UAW have dug themselves.

Consumers buy Tesla because they WANT to; people buy GM/Ford because they HAVE to.

Up until a year or so ago, all the “knowledgable” commenters on this blog were laughing & predicting Tesla could NEVER MAKE A Profit. Well, ever last one of them was dead wrong, and that same crowd will probably be dead wrong about Tesla’s mid-term future.

Tesla hasn’t made a profit without government credits.

RightNYer

So what? You play by the rules in the game you’re playing. You’re just moving the goalposts.

One way or the other, Tesla will someday revert to financial normal; if Musk continues to delight his customers, that could be a while. On the other hand, a couple big FUBARs and it’ll be a cloud of dust.

Maybe because GM and Ford are not for sale?

The car industry looks terrible to me. Massive investments are needed, on top of already massive legacy debt, to transition to electric. But it doesn’t create new business, just replacement of old business. And I think EVs are more prone to commoditisation and will be lower margin. EV needs less maintenance and last longer.

Tesla stock may have seen the top already. So many others are selling cool EVs now and much more is coming. A few years ago a Tesla car was seen as super cool. Now it’s becoming just another EV. Tesla will lose its aura.

“EV needs less maintenance and last longer.”

Teslas are a right-to-repair nightmare.

EVs don’t have to be like that. On the contrary, they could be the best thing to ever happen to the RoR movement. But there’s a good chance the auto industry will follow Tesla’s footsteps.

I’m still recovering from the GMC Torx screwdriver bits. GM tail light cover removals are the only application and damned if you don’t have to use one? When I swap the bulbs out I quickly replace the cover screws with Roberston heads self tappers. Fixed. Can’t do that with software.

Paulo,

I concur…no computers, no software.

And when it comes to dyi, all hail Rockauto.com!

Torx is a way around Robertson ( square), a Canadian invention.

Anecdote: I went to Home Depot to buy deck screws. I get home and put one on Robertson driver. It falls off. Gee, a defective screw. Try another one, same thing. Now I look at it and it’s that friggin torx. I go back to HD and return them and head back to screw section. There an older guy is stocking shelves so I ask him what’s with these screws. “Oh they are new and have a better grip”

Really. Well the old Robbie is good enough for me so I grab the usual deck screws when I see a younger guy. obviously a contractor in overalls. I go over and say ‘excuse me but do you ever use deck screws that aren’t Robertson?’ He is puzzled so I show him the box of Torx along all the other screws. ‘Oh, I’m so glad you told me!’ he exclaims. “I might have grabbed those too!”

I don’t believe in embarrassing clerks but the employee has heard all this and changes his story to : ‘They never tell us anything, we just

stock what they give us’

Trivia: Henry Ford I, tried to buy Robertson when it came out but Mr. Robertson only wanted to partner, to sell part of it. It fell thru and the world has suffered ever since.

Ok, maybe not suffered, but imagine only needing 4 screw drivers (one type, 4 sizes) for all screws. No slotted, no Phillip’s and NO Torx.

Not sure what brand you bought, but every box of deck screws I’ve purchased come with the corresponding bit in the box, and have for decades.

Torx….

Was doing brake job on around 2000 Buick with friend (his mom’s car) and needed a female torx socket! Didn’t even know they existed! Anyway, we found a regular socket that fit kinda tight, tapped it on and finished job.

(“Creative misuse” of tools, as my mechanic buddies say…)

BTW, I replace everything I can with Allen head, and when working with screws spend extra for hex heads. Trick I learned when doing shutters and drapes, where there is a lot of in and out readjusting. Absolutely hate butterheads…phillips.

Right. EV will be just like your disposable smartphone. Manufacturers will make it less appealing to you for wanting to repair your EV. The EVs will come with a two-year warranty; so you’ll have to shell out a few thousands more for a longer coverage. Then, once that expires, you fell compelled to “buy” (more likely renting/leasing) a new one.

But consumers in general are, as usual, short-sighted and dumb so they’ll happily accept this as long as they can get their hands on the next shiny toy.

and this is how we will own nothing, yet be happy.

“EV needs less maintenance and last longer”

I respectfully disagree. Gasoline engines are much more complex than electric, but they are a very mature and optimized product, and the best can run 15 years and about 200K miles with nothing more than oil changes and air filters. The major maintenance expense on automobiles are the brakes, tires, body work, etc. Basically everything except the engine and transmission. That maintenance will be the same on electric cars as it is for Gasoline powered.

Agreed in general, but on brakes, there actually is an advantage to EVs/hybrids. Since they have regenerative braking, the excess energy is converted back to battery power, and not heat, so the brakes actually last a lot longer than a stupid ICE car.

I got 120,000 miles out of my brakes (pad wear) on our 2013 Hyundai Santa Fe. Pretty common these days.

Brakes should last a long time if you don’t ‘ride’ them, and especially if you know how to properly engine brake with a manual transmission (an almost extinct skill, unfortunately).

I for one get annoyed driving behind someone who appears to be tapping out Morse Code on his/her brake pedal.

Ever hear of compression braking/ You don’t get that woith your stupid battery car.Tttt

Ted,

With an EV, you get something far superior to compression braking. You get “regenerative braking” where the electric motors turn into generators and charge the battery when you hit the brakes. The tech has been around forever. Trains have used it for decades. Tesla uses it. With an EV, your brakes do almost no work. This is why EVs and hybrids are so efficient in stop-and-go traffic – because every time you hit the brakes, it charges the battery instead of heating up brake pads and rotors.

That was supposed to be *standard ICE car.

Many no clutch cars have as many as eight gears so you don’t have to use your brakes as much. The transmissions seem to hold up to the task.

The key is not to tailgate, and it’s pretty easy not to use your brakes except during total stopping. They put all those gears in there for a reason

Don’t know nothing ’bout these newfangled electric and ICE and so forth, but always have held even the least expensive diesel fuel engines will go at least 400,000 miles without a ”major.”

And have heard some of the really meticulous maintaining big truck owner operators routinely get over 600,000.

One MB diesel owner allegedly got over 1,000,000 miles on his early version, likely before MB did the ”value engineering” thingy to remove the value while charging the same…

Also heard from a former dealer that the original AMC 360 V-8 was released before the VE could be completed and many of those engines went over 400K without any work at all,,, to the chagrin of most dealers who rely on the service work for most of their profits.

Though very likely true in the dim past, before CAD and other types of upgraded engineering fine tuning and manufacturing, since then, the 120K or 200K engine life expectation likely just another sales technique.

Diesel is a filthy fuel. It stinks–even with proper emissions mitigation, which many engines don’t have/won’t fix–and its exhaust contains particularly unhealthy/dangerous/toxic fine particles (even when the backward baseball-capped driver isn’t ‘rolling coal’). Just say no.

Body work is not maintenance.

Tesla has lost it’s market share big time in the EU. And they need those sales because the cars are mostly delivered from their China plant. VW and the French EV are eating Tesla’s lunch in the EU.

From a rcent article: “…. with industry analyst Matthias Schmidt stating that Tesla’s Western European (this includes the EU plus UK, Iceland, Norway and Switzerland) market share has fallen from 33.8% down to just 13.5% over the last year.”

And yet the stock price has gone parabolic. If I ever bought an EV, it would not be a Tesla based upon principle alone.

I wouldn’t buy a Tesla based on the fact that Musk thinks it’s appropriate to smoke weed on TV.

Same way I want nothing to do with Facebook by virtue of the fact that Zuckerberg goes in front of cameras wearing a tshirt and jeans. I’m a big believer in that you wear a full suit if you’re going on TV or to any important meeting.

And when military leaders make speeches, it should be in full dress uniforms. Not the ACUs

No.

Tesla sells EVERY car that it can make.

The only way that they “lose market share” if they ship cars somewhere else.

You read the bait click articles “Tesla is down in market share in _____.”

A month later Tesla is #1 again.

“A month later Tesla is #1 again”

Really? That is NOT going on in the EU. They have been losing market share all last year.

Anthony A

It depends on how you define #1.

It’s possible for Tesla to lose market share while still being #1 in sales.

Many articles are so poorly written that you can’t determine what is being talked about.

This is one of the basic lessons of business and also something Warren Buffet stresses. The best investment is owning the only bridge across a large body of water. Then if people don’t want to pay they have to waste time and money taking the long route.

The worst business is one you have to keep dumping the earnings back in marketing and capital just not to lose sales. Those are not owner earnings.

Little noticed fact:

‘A recent IHS Markit Report has noted that a large number of EV batteries are approaching their end-of-life stage…,’ From Oil Price

A guy who bought a 2013 Nissan Leaf with only about 20 K on it, recently tried to buy a new bat, only to be quoted 15 K$, IF they had one. He was quoted 5K $ to replace when he bought the car.

He mistook miles on the car for newness. A 20 year- old, in crate, never used ICE engine has all its life remaining, once installed. This does not apply to batteries. They age, used or not.

Plus, a tired ICE can be completely rebuilt. An EV battery can’t be.

I am predicting a major shortage of Tesla batteries in the next 2-3 years as old ones expire.

re: “A 20 year- old, in crate, never used ICE engine has all its life remaining, once installed.”

Not necessary. Seals, hoses and other rubber components dry out, and can be expected to fail immediately or soon after being put into service. Internal corrosion–of cylinders, for instance–can be a problem as well, even with proper ‘pickling.’

Not ‘necessarily’. True. Not much is necessarily true. But in the case of hoses, it would be take a very picky or paranoid buyer of a never used engine to change the hoses ( ex. aviation where max shelf life is strictly mandated)

Following is from Specialty Hose Corp

When Is An Old Hose OLD?

All Hoses/Hose Assemblies have three (3) Phases of Life: Acceptance, Shelf And Service. PTFE (Teflon®, Dupont Trademark) is non-aging

RUBBER (except AQP) Acceptance: Shelf: Service: Total can be 20+ years (8+5+7) All hose, including PTFE, takes a “set”, that is, it becomes formed to the installed configuration (bends, etc.). Moving a “set” hose, in order to remove some other unit for example, may cause damage, thus terminating the life of an otherwise properly functioning “live” hose.

AQP (AE701) should be considered “essentially non-aging”; silicone exceeds 20 years shelf life.’

Re: cylinder corrosion. No doubt this could occur without proper storage.

If I was going to install a 20-YO crate engine I would replace all hoses and seals–esp. those that will be difficult to access after installation–as a matter of course (but that’s just me).

Your specs don’t mention storage conditions; an engine stored in a hermetically-sealed, temperature- and humidity-controlled location will be in better condition than one stored in the back of Uncle Ed’s shed in upper Minnesota.

There is NOW a battery shortage. They could be making the semi and others.

EV battery can be recycled. (Redwood Materials.)

How Much Does It Cost to Replace a Tesla Battery? Tesla batteries are designed to last between 300,000 and 500,000 miles, so replacement shouldn’t be a major concern for most drivers. It’s estimated that the cost to replace a Model 3 battery will be in the $3,000 to $7,000 range.

AND battery prices keep getting cheaper. Try again.

It is estimated???

WHY can’t this outfit tell us what is costs NOW? This is not an estimate on a construction job with contingencies or an overhaul with unknowns. The question is: How much does it cost to buy this part? Why would it be an estimate?

Given the innumerable quality and maintenance issues with this

most flaky auto outfit, the word ‘estimate’ is major red flag.

BTW: reminder. Tesla only guarantees 70 % of battery range from day 1 mile 1. Yet the 30 % is most of the range advantage T claims over competitors.

Poor Tesla ..

POOR TESLA ..

Maybe if we stood at the rear entrance we’d get to see a few apparitions ??

?????

Tesla is a puzzle to figure out !!

If we are going to EVs … and the direction looks pretty clear – Ford and GM are toast.

Tesla will have new plants geared to producing at a lower cost. They are much further along the declining cost curve than anyone else and with 50% growth per year for at least the next few (new plants coming on board) they will be able to produce for far less than late comers. Then add in no ad spending and no dealer costs and they have a pretty nice runway.

Watch Sandy Munro and his take aparts of the Tesla models and see how Tesla is constantly innovating and incrementally improving (with a legacy factory) – not waiting for annual or every 4 year refreshes. Then see how painfully slow GM and Ford move and that is about all you need to know.

Does that mean the stock price is not crazy? No. But I’d bet on Tesla surviving over GM and Ford by 2030.

“If we are going to EVs … and the direction looks pretty clear – Ford and GM are toast.”

I wouldn’t think so. There is a lot of brand loyalty. I would wager that by 2030 the big players in the electric automobile industry are the very same players today: GM, Ford, Toyota, MB, Subaru, etc.

If fact, I would be surprised if Tesla doesn’t collapse by then.

Don’t know about any collapse(s) mit, mainly because of the ”suspension of disbelieve”, as is very clearly a very important con founding influence of more than one market these days.

But IMO you are correct about the brand loyalty.

It’s been a huge factor since for eva, especially with regard to vehicles that are SO similar that it would be hard or impossible to tell them apart without the ”badges” for any but the most fanatic of fans.

Still remember the 1940s Buick convertible my parents would drive, straight though, from FL to NYC on a Friday, see a couple or three current Broadway plays/musicals and drive home to go to work Monday morning…

Both thought it was the very best car ”eva” and continued to buy that brand if at all possible the rest of their lives.

How much do you know about GM and Ford EV product plans? Have you read any reviews of the Ford Mustang Mach E? Have you seen GM’s Super Bowl ad with Will Ferrell and featuring the Cadillac Lyriq and Hummer EV?

GM will introduce 30 EVs globally by 2025 on their world class Ultium platform. Ford and GM also have something that Tesla does not. The F150, Silverado and Sierra pickups which are the cash cows that will fund their transition to EVs.

The only things Tesla has are fanboys and Bitcoins.

GM and Ford also have a dealer network with repair facilities. Huge benefit.

Wonder how easy that will be with EVs though. New training required and new infrastructure. I think EV will upset the traditional dealership model, but Wolf can probably tell us way better. The servicing component will be significantly different, will the dealership be able to make money through EVs on that?

MCH, my neighbor has a son that works for a local Mercedes dealer. He is sent to class on a routine basis to be trained on the latest electronic and mechanical systems on their new models.

I would guess that all major car manufacturers have robust training programs for their in-house techs. These new cars are too complex for the average mechanic. And service techs are not “true” mechanics who can troubleshoot a problem and make a repair based on their knowledge. All problems are now related to the onboard computer in each car and codes are pulled to see what system has the malfunction. Then techs throw parts at the issue until the code is gone (for good).

These high paid techs don’t do oil changes…those are usually done by the wash rack guy.

LOL! GM hopes to make a million by 2025.

Tesla will make a million in 2021.

With production rising 60% every year.

Legal tender and heritage brands are toast. Paying with swift is 3 days, reams of paperwork and outrageous extortion fees to all the banks. With crypto send an encrypted email or text with funds immediately available no charge + no taxes . Even Stevie Wonder can clearly see the competitive edge. The epic battle is raging right now not in some far away distant future. The dinosaurs will shut down the internet and blackout the planet to for their obsolete blood money. Youths blame the past for destroying the planet. Now they will destroy the past. The weather is changing and a couple billion ICE can’t be helping.

They all three will get bailed out by taxpayers to go green with credits to ditch the fossil fuel autos for EV’s. When you are blowing your budget by $4 trillion a year you can hand out a lot of credits.

I think I saw eliminating the Keystone pipeline was going to cost the economy $4 billion a year in GDP. Those geniuses in DC are running deficits 1000 times that big. Who needs a real economy when you have a printing press. Government’s just can’t be trusted with the money. Proven over and over again.

So what’s the problem armchair financier?

I kind of see the Tesla car as the Edsel for the 21st century.

It’s not the car in question it’s the man.

TSLA stock is high because its about to decimate the legacy automakers. Investors finally caught on in the last year which explains the WTF charts.

Tesla has a great product NOW, and is improving faster than the automakers.

Tesla has vertical integration. They make their own seats, batteries (kind of), solar panels, CPUs, software, motors, etc. They got rid of 100s of parts in model 3 refresh. Giving it leaner, quicker , cheaper manufacturing . This iteration, in addition to falling battery costs, gives Tesla per vehicle margins that top Toyota!

Tesla is positioned with a better product, higher margins, and end to end control of manufacturing. Its almost like a cartoon where raw materials go in one side of factory and cars come out the other. No legacy supply chain.

With the rumored $25k Tesla in the works(includes self driving capable hardware), the Camry’s days may be numbered.

Tesla can drop the prices of its cars whenever it needs to sell more. Basically they can sell as many as they can produce.

What other automaker has all the data to start their own insurance company?

Wolf’s carmaker marketshare charts show JUST the beginning of Tesla dominance. Extend the trend lines.

Did we fail to mention TESLAs are the safest cars on the road? Can be powered by sunshine and wind?

What other company is planning to launch a robo taxi business and already have 2 million capable cars on the road?

Car and driver says cybertruck can challenge the pickup market.

Lookout F150.

Ford and VW have battery supply issues.

Germany and Texas factories coming online quickly. Tesla ramping up actual EV production at scale quickly while other manufacturers are still in prototype stage.

Model 3 blowing Nissan Leaf out of water by almost every measure.

Tesla… first car in space! Hahaha

Probably teslas will be only cars allowed in Boring tunnels.

Tesla….all sales done with no paid advertising. Word of mouth and free hype all it needs. Dismantled PR department. No need.

So you can remain bewildered by stock price based on unit sales. Or you can read TSLA as early stages of tech disruption slamming into dinosaur auto industry.

Tesla has 20000 superchargers worldwide and is about to produce 10000 v3 supercharger stalls per year in China. Maybe Tesla will let a eF150 use one if they aren’t occupied.

Duke,

There is a charging station in a Walgreen’s parking lot down the block here, not owned by Tesla, which follows the standard model in California, where all types of EVs can charge their batteries, from Teslas to BMW i3s.

These types of charging stations are now everywhere I look. It’s a good business opportunity for a landlord of a strip shopping mall to put a multi-unit charging station into a corner of the parking lot for 4-8 slots. While the vehicles are charging and the landlord is making money on it, the drivers can spend money in the shopping center, and the shops are making money, and the landlord is happy.

I still to this day have never seen an EV using a charger. They all sit empty.

Why not just charge the EV in your garage at night?

San Francisco is a city of apartments. Some have garages, others don’t. When you rent or buy and you look through the listings, it says, “easy street parking.” Which means total hell if you come back from work after 7pm. People without garages need to charge their EVs at work or while at lunch or whatever. It doesn’t take long to top off a battery that you put 30 miles on.

Yes. That is great. And I hope all automakers succeed in an EV transition. Just saw today,, All EVgo chargers are being retrofitted to allow teslas to charge. Tesla may allow other EVs to charge at superchargers as well. Good business for TESLA to sell their solar power!

If Tesla’s opportunities are so great, why is the CEO focusing on Bitcoin and Dogecoin?

He’s on a Twitter ego trip.

Bobber

Unlike some people, Tesla management can apparently work on more than one thing at a time.

TESLA sitting on lots of cash. 20billion? And government is devaluing it. So a small portion in bitcoin as a hedge on USD . Its a risk. But has a good track record.

Duke,

In what department of the Fremont plant do you work?

No tesla affiliation. I just read a lot. I do have a $50k awd 300mile range cybertruck reservation though. Hopefully it drives itself and comes with a million mile battery. And pays for itself when I’m not using it on the robotaxi network.

why not hope it comes with a sex robot you could marry as well? these actually exist, apparemtly. you’re as likely to see a functioning, profitable fusion plant.

We’ll see about that shortly out here in the real world.

The nation’s roadways.

Just sayin from what I seen so far.

-k

Traditional automakers are very much optimized for development and production of much of what goes into EVs.

I think battery tech is a wildcard here. 1 big battery/supercap breakthrough would largely level the playing field.

Another is in-car software and computing hardware… thats more about GM, Ford, and everyone else getting their **** together, and rumors suggest Apple (and maybe the Koreans) will make waves in that dept.

*that was meant to be a reply to james

How much do the screens cost to replace and is that part of their model? If you’re going to try and sell a car like an iPhone or iPad, it seems like the consumer tech stuff should last longer than a few years.

You can buy tesla screens on eBay for $180to300. Factory more like $1500 from tesla. But all automakers putting screens in cars with similar life and repair costs now. You can’t go into a dealership without losing serious coin now. I had a dumb electric fuel pump on Mazda cost $1500! Because it had to be proprietary programmed to match my car!

LCD replacements should be generic and cheap, barring anything nutty like the Mercedes MBUX Hyperscreen.

Also, the backlights don’t burn out like they used to. Emmisive tech like OLED shouldn’t be too short lived either, by the time it actually comes to cars.

Also the towers and salvage yards want nothing to do with them.

There is zero scrap value including the ones sitting in pristine condition.

Some say the timelines to go EV are absurd. Can’t be done without running into real world capacity issues.

As an aside I enjoy U-tube show ‘Traveling Robert. He is somewhere out west I think Nevada. Takes time out to go visit a solar boondoggle the government funded from the past. It was the biggest Rube Goldberg looking thing I had ever seen. Looked like a cross between a giant umbrella and a bicycle all along the road that the desert winds had blown all to heck. Hundreds of them. It looked like a middle school science project. When you are blowing other people’s money there is no such thing as a bad idea.

Spiro is that you,

Back to haunt us with written “deadening monotone”?

Poor Greek Americans still can’t believe their eyes.

U get it ej!

Glad to see someone other than Wolf commenting on here up to speed on this kind of up and coming ”stuff”,, as opposed to the old stuff that is being replaced sooner and later, and, in fact, as soon as possible due to both the cost of manufacturing as well as the cost of maintenance/long term overall lifetime cost.

Of course Apple and likely many other up to speed digitally focused companies will come on board with the legacy auto makers all over the world, because, or possibly in spite of their long long records of success.

When you think about the successes of Ford, GM, etc., around the world, it was mainly due to superior management AND [[GOOD]] union participation, so, more or less, top to bottom coordination and sharing of the pie…

Somehow, USA got way out of whack with that sharing and the responsibilities of labor and management both to the shareholders, but also both to each other to keep the entire process cost effective and totally quality oriented.

Very Very bad when American statistician, Deming, realized what is now known by the name, “Total Quality Management” or similar, went to USA auto cos mgmnt, , and was thrown away, so went to Japanese cos and was honored and his concepts lead to obvious excellence of Japanese auto quality, continuing today…

USA continues to struggle with those concepts from the mid 20th century, but also continues to do better, so long term outlook is good.

Hope you didn’t think to hard here nor spend much time typing that.

Gee not one comment here other then ej!, wolf and yours can get it?

Oh we get sir

We get it loud and clear.

I have a way for you to win.

Quit playing the casino!

As well as that nothing more worth noting within tirade.

Wolf,

Thanks for the charts and stats, they are useful info. (Maybe next time, you might include Toyota/Hyundai/whatever…it would be nice to get comparative stats from one or two healthier/better run auto companies).

As to the insanity of soaring mkt caps as sales/earnings crater (essentially recasting of PE ratio craziness), I think a big chunk of crazy can be laid at the door of indexing (which is otherwise very beneficial).

The thing about traditional indexing is that it tends to create relatively unintended momentum trades (1 – once you are in a popular index, you are going to be carried along by membership if not individual performance and 2) larger cap stocks get more new index money poured into them, creating an amplification effect divorced from actual financial perf) and the increasing death of small/medium business in the US might be channeling more funds into publicly traded equities.

I think the “momentum pathologies” of traditional indexing definitely bear looking into.

Just because an army of diversification seeking investors want in to an SP 500 etf/mutual fund…that really isn’t much of a valuation opinion on Google, GM, Ford, etc individually…investors want the whole diversified (altho cap wt distorted) schmear and individual stocks are just along for the beneficial ride…primarily by virtue of index membership alone.

Equal weight indexes (of which there are some) help to mitigate the “momentum” problem of cap weighted indexes…but until the SP 500 capsizes due to Google/Apple/Amazon PE bulk overloading, equal weighting will live in the shadow of fairly illogical cap weighting.

The “membership distortion” problem will still remain, since any diversification oriented grouping of stocks will benefit members and punish outsiders. But diversification away from a tiny number of popular indexes (SP 500) will help mitigate that problem.

Indexing is beneficial but some of its operational structures and their implications have not really been closely examined enough yet and therefore certain distortionary pathologies have been entered into the financial system.

Right, and that means that when the bubble implodes, the reasonably priced stocks like Intel with P/Es of 10 get dragged down by the falling of the 50-100 PE stocks.

Oh gee a senior college analyst

Quick Betsy take a memo

On second thought …

Is there a mr. Betsy mrs Betsy?

Not much new in the ball park Cass hey can I paraphrase you?

Powell’s claim that rising asset prices and bubbles (he says they don’t exist) are because vaccines, is especially disingenuous given that the US’s privatized profitized commercialized corporatized performance on vaccines and vaccination is being shown to all the world to see to be an inferior almost 3rd World bottom of the barrel to so many other more socialized and mixed healthcare systems.

The game since we went off the gold standard in the seventies has been to keep expanding the financial ‘paper’ faster than the GDP. It’s a one way trip as we have gotten it up to 6.2 times gdp. That’s why all the talk of the reset or the endgame. I think the most likely scenario is a panic and trying to sell financial paper especially low quality stocks and bonds before they hit zero, but I could be wrong.

I barely understand the stock market, but it seems to me that your company being more valuable on paper than in real life is not a good thing for the long-term.

But that’s the entire U.S. economy. We hardly make ANYTHING. All we do is print dollars to buy Chinese manufactured goods, and then provide services to and from each other. Many of those “services” are ads (for those very Chinese goods that we don’t make).

If you strip out the inherently unproductive parts of our economy, you have very little left.

At this point, we’re not a rich country anymore. We’re a poor country that is still fooling everyone else into thinking we’re rich.

Financialization! We make hedge fund billionaires! What else do we need?

I disagree, this article is about 3 US manufacturers who make vehicles here… :-)

We actually still do make a lot here, and we have many skilled tradesmen and women, as well as engineers, etc., but his point is valid. We need to do a u-turn from the current path.

As long as we have Mr. Nimitz, Mr. Eisenhower, Mr. Vison, and the rest looking out for our interest… which is keeping the dollar as reserve currency. We will always be rich.

Besides, didn’t you get the memo earlier, we have high paying service jobs that beats out low wage manufacturing work any day.

If someone thinks otherwise… well Mr. Roosevelt and the rest all happen to carry big sticks.

?

To me the real measure of the health of an economy is cost of a 1400 sq ft starter home vs wages. If that is getting easier for a young couple to afford, the economy is healthy.

I think this is an area where ZIRP is especially toxic.

By gutting interest rates, DC has really skewed homebuilder interest to the $350k house and away from the $175k house (which almost by definition makes *substantially* less profit, yet still requires a substantial proportion of the same risks/costs).

The $350k product used to be carriage trade, affordable only to the higher end. But ZIRP halved monthly payments, artificially jacking demand, and creating at least a partial affordability illusion (who is buying the $350k house *after* ZIRP goes away? Or even simply stays the same? Doubling the principal on the mortgage because ZIRP will keep monthly pmts flat, is doing no one any favors after a few yrs).

Looking at new home prices among the Builder 100, it becomes pretty clear that 80% of large homebuilders have utterly lost interest in/knowledge of how to build lower end housing…which is just horrible for the country and ZIRP made this 20 yr nightmare possible.

It is a true tragedy that more people don’t realize the profound effect interest rates have upon the realizable value of their homes (by directly impacting the home’s affordability to subsequent buyers).

A friend of mine and his wife just bought a new house in a new subdivision. They are in the $700,000 range, and they are selling as fast as they build them. These are almost 12x median income.

As I drive through the neighborhood during the day (I’m working on a house there) I see lots of new cars in the driveways, with few people even working during the day. I’m sure some are WFH, but it’s a very odd situation.

Depth,

Zip code of these 700k hotcakes? It would be interesting to see MSA trends and nearby employers.

Thank you

@ Cas127 –

The old 175K house is the new 350K house. It’s inflation.

When you add new dollars into the system, the old dollars lose purchasing power. When you reduce the earnings power of a dollar via lower interest rates, the existing dollars are worth less.

Poor like you

At least for publicly traded companies (Tesla), every business day, the market determines exactly what it’s worth.

You are correct about the future issue of a company growing into its valuation, as opposed to the market losing faith and devaluing the company.

@ Javert Chip –

I’ve been thinking it is the money printers and credit creators that have been determining what public companies are worth.

cb

Hard to tell quantitatively where the line is between “enable” and “determine”, but you’re correct: the longer this financial craziness goes on, the more crap there is (eg UBER) floating around in the eco-system

When money is being thrown around like confetti everyone enjoys the party when the hangover comes after 50 years of failed fed policy artificial ballooning of assets always end same way if this happens our pensions investment s and Ssi could disappear everything is digital push one button it all disappears no trail just gone like myannamar figure it out not hard

A little depressing to me that two American icons, the Jeep Wrangler and the Dodge Challenger, are now made by a foreign company.

Is it any different when an ‘American’ car is made in Mexico, Canada, or South Korea?

Nope. Now you’ll have me reaching for the bottle.

To be fair, some of those locations make Fords specifically for markets outside the US.

MiTurn,

Service techs i’ve talked with (irrespective of brand they work on), say Japanese cars made in Japan are highest in quality.

The highest American content car sold in US is Honda (Marysville, OH assembly point ).

Caveat: ymmv.

re: “… made by a foreign company.”

Change ‘made’ to ‘owned’ and you have a point.

ft,

Billboard (on entry to Mack ave. Jeep plt in Detroit) states “Cars assembled here are of the highest quality, designed & assembled by Americans for Americans”.

In small print/at the board’s bottom: “sourced from global components”.

“Motor city” is a shell of what was.

Timeline observation: 10/’17

Sam & ft

I din’t remember Jeep gettin a whole lot of “…highest quality…” awards for any reason, domestic or foreign parts not withstanding.

There are times when you’re hanging out with someone

and you realize they are just not honest. Not crooks but

unbelievable. At that moment your relationship changes.

You still hang out but what you had before is gone.

The market mirrors that sometimes.

VERY good comment g, and agree with you after having experienced that exactly as you describe.

Just for the younger folks on here still in biz or markets or whatever: DO not disbelieve your intuition(s) with regard new biz folks of each and every kind, but put more faith in your own ”feelings” of every kind than any kind of talk, from smooth to blather, from any other person!

I think we are fast approaching a time when personal automobiles will not be able to be manufactured cheap enough for the masses regardless of scale. All the input costs are increasing rapidly, especially the electrical components and now chips are in short supply. The us companies are only able to turn a profit on pimped out trucks and SUV’s with infinite financing. I think secretly Elon knows this, and doesn’t attempt to make money producing cars, instead they are more like the showgirls and caged tigers designed to lure more marks in to his casino.

“instead they are more like the showgirls and caged tigers designed to lure more marks in to his casino.”

So, Seneca when does the circus end?

When the tigers get fed up and eat the ringmaster, and the Mark’s storm the big top demanding their money back.

Since 2016 the price of Tesla batteries has dropped 50%.

Your comment reinforces my expectation that long-term trend towards bigger, more complicated/gadgetry-loaded, and definitely more expensive consumer goods (like cars, houses, appliances, etc.) will eventually reverse and run out of consumers willing or able to purchase these pricey goods.

Like it or not (it will be a reflection of an inexorable decline in standard of living for most of us) the next big thing is ‘smaller, lighter, simpler, and definitely cheaper’ when credit/debt is not flowing freely like today.

Don’t be surprised if you see, for example, more of those simple little toy-like autos on the road eventually, while those new monster pick ups and SUVs (with all their computerized geegaws and baubles) become rather more scarce.

“Don’t be surprised if you see, for example, more of those simple little toy-like autos on the road eventually, while those new monster pick ups and SUVs (with all their computerized geegaws and baubles) become rather more scarce.”

A $300 per barrel oil price spike would make that an immediate reality.

“I think we are fast approaching a time when personal automobiles will not be able to be manufactured cheap enough for the masses regardless of scale.”

When I look at my own income and then I look at the price of a brand new truck, my income has not kept up. I could actually go pay cash for one right now, but I cannot “afford” it based upon my income. Therefore, I don’t buy one. I refuse to participate. At this point I have decided to try to make my old dinosaur last until the end of my life, assuming the lefties don’t make it illegal to drive because it doesn’t fit their agendas.

Personally owned cars are on the way out. Replaced by Robo Taxis.

Nobody NEEDS to own a car.

I sold my car years ago. No expenses, no PITA taking care of it.

Saved money bought Tesla stock. Cash rolling in.

congratulations, you seem perfectly positioned for our schwabian future. your happiness is guaranteed!

The top 6 Technocrats market cap is approx $9 trillion with $1 trillion revenue.

The financial engineering behind these Technocrats create a massive concentration of power as long as the Fed/Treasury continue to feed the system.

I believe we are at war with China and their Allies. Two competing systems are maneuvering their positions on the battlefield. A Globalist Marxist Technocracy of muzzled slaves (loss of freedom of speech and property rights) that closely replicates the system under the CCP Vs A Sovereign Capitalist Technology under Constitutional law.

Are the top 6 Technocrats staunch allies of China?….Tesla too?

People have used strange things for currency throughout history in desperate attempts to maintain negotiable non-perishable stores of wealth: sea shells, beads, pretty rocks, large stones, tulip bulbs, land, paint smears on canvas, government promises, old cars, mathematical algorithms, delayed bribes (speaking fees), corporate promises (South Seas Corp, Tesla). I imagine it will continue as some win and some lose.

But the amount of faith and effort society put into this, strikes me as highly inefficient.

Mr. Richter, as usual, you have capsulized in a clear and concise fashion everything that is wrong with the markets these days, thanks to the Fed. Benjamin Graham must be rolling in his grave. How on earth does anyone explain what is happening using your example with any sense of legitimacy?

I said it many times and will say it again…this entire economy right now is a big giant WTF and FU to pretty much anyone not in the 1% and up courtesy of Uncle Jerome and his infinite wisdom. One has to only look at SoCal housing prices in the last couple of months and the how much it shot up to see the spillover effect these type of WTF market is doing to all asset prices.

I have to admit that I’m a closet Tesla fan! Don’t own one though! There’s a future where their going I’m just not sure how that journey looks as clean power generation will also need to be addressed.

It was Amazon’s incredible valuation that gave them the financial might to go out and buy the world thus assuring them vertical integration of every aspect of their business. My bet is that Tesla will achieve similar results with their high powered stock valuation. 25 years from now they may have integrated true home solar capable of handling most needs everywhere all of the time. I would imagine this might also include a system that stores and powers a national grid in a totally decentralized fashion. The block chain of power. I’m guessing Elon is thinking much bigger than a car company.

Love his rockets!

C

“I have to admit that I’m a closet Tesla fan!”

I’m with you C, but I’m a do-it-yourself’er, so a bit of a dilemma. I’d buy one second-hand, but I don’t think I’d like to wrestle with Tesla for parts or repairs.

“…I’m a do-it-yourself’er…”

So am I, which is why I love my old truck. It is among the most simple of vehicles ever produced – an industrial 5.9 Cummins engine with a mechanical injection pump. At only 170,000 miles, the engine probably has another 300,000+ in it. The things I worry about are the lack of parts for the truck itself, as most are obsolete. I am kicking around the idea of buying another as a parts truck.

In my mind, I can picture the sound and blue smoke coming out of it, as you pull ahead of me at the green light.

Yeh…….probably not as fun as building out that old 71 Camaro I had as a kid.

How do you put headers on a “T” car?

C

The internets say the Fed isn’t going to raise rates until we create 500,000 day trader jobs/month every month for a long time.

Is that what moving the goals posts is?

Powell is so full of sh!t that his teeth are brown. “Subprime is contained” is all you need to know about these swindlers.

Powell should create an SPV just for Elon Musk I mean Tesla. If Telsa’s market value ever became rational, it would hurt the Fed’s “Americans are the mostest awesomest richest in the World Report” and also maybe derail the Fed’s new goal of creating 500,000 day traders a month.

I have to think the age of consumer solutions is about to end. Can Norton 360 protect your computer when a cyber attack shuts down the power grid? Can a video doorbell hold off a lynch mob? Can your smartphone help protect you against Covid? Trick question it can, but it doesn’t. People are wired into their privacy, and we all die alone :)

I never had a computer virus until I started using Norton 360. It actually ruined my laptop and I had to buy a new one. Norton 360 IS a virus.

The only way to win is to not play …

At least for us commoners.

What I mean is to not fully participate in modern consumer society– with an expensive fangled house in ‘burbs, or drive an overly pricey status symbol vehicle, or be completely dependent on grid and other fragile modern infrastructure, or be hooked into wireless IoT (Internet of Things– smart devices all around you that are connected to Internet).

Being self-reliant and independent is not for faint of heart, or those who are queasy about DIY or solving problems with out nanny gubvarmint looking out for you.

Just heard this podcast you will appreciate. About minimalism and dropping out.

On today’s episode, Andrew Keen talks with Robert Wringham on his new book, I’m Out: How to Make an Exit, and the crisis of work today.

Humorist Robert Wringham was born in Dudley, England in 1982 and now lives between Glasgow, Scotland and Montreal, Canada. He considers himself to be among the world’s most indolent people but has somehow written three books, is the editor of New Escapologist magazine and sometimes writes for publications like The Idler, Playboy, and Splitsider.

Norton is crappy. Only AV I’ve ever used that 3 viruses got around. I use free ones now- much better.

Hang on!

There’s more to come for the ‘I don’t read crowd’

Some of the big carmakers are testing the waters to see if they can use a subscription model to turn model features on or off in your car.

Let’s just have a subscription model for everything :)

Maybe you will need some bitcoin to start your car?

That’s why you folks all congregate here….The last place where the old world resides…

Live long and prosper Wolf

WOW M,

We are so fortunate to have you here. I would guess that you even believe your comment was insightful.

If I buy a Tesla for two bitcoins, how can profit be calculated using a wildly fluctuating “store of value “?what did it actually cost to build and if bitcoin tanks the following week I’m a moron, if it skyrockets I’m a faux genius?what about financing? Unworkable, therefore this is churn behavior and profit taking is coming. Nobody’s called him dumb yet.

Markets continue to make new highs because there isn’t really any bad news. How could there be when there’s nothing the MSM can find wrong with the current admin? Something something about it being “difficult to get a man to understand something, when his salary depends on his not understanding it.”

The layman’s definition of inflation is “too many dollars chasing too few goods”.

Yet, when we have “too much liquidity chasing too few financial assets”, we call that appreciation.

Isn’t it obvious that Tesla is switching to Bitcoin operated vehicles with the coin slot on the other side of where you turn on the lights.

This will keep the fan bois happy driving the BubblElon Mk1, as it goes up in value and every mile driven costs a pittance, and too little to meter or matter.

There you go again Wolf……always pointing out when its time to double up on Tesla!

The funny thing I ran across yesterday…..sat in a financial seminar during which the speaker claimed that we were just fine because of the huge amount of assets held by the American people……gee……I wonder how those number would look with 4% interest rates (driving every bond and real estate parcel down in value) and a P/E of 16 (driving the stock market down to historical average). Suddenly without fed hijinks that debt that they just announced of nearly 40 trillion in the year 2031 sounds like close to bankruptcy or hyperinflation.

Fed….you wanted it…..you are going to get it. Maybe in a while but when it comes just watch the movie Perfect Storm to see how much.

Never going to get 4%.

Maybe 15% on the way to hyperinflation .

Tesla is the symbol of current U.S. property, investment, stock market and business: Overblown overvalued luxury dependant on good times excess. 75% not needed for basic living as exposed by the pandemic.

Good analysis Wolf and thought it was odd these stocks were rising considering current events.

The conditions seem like 2000 era dot com bubble, or “irrational exuberance” said in ’96 by Greenspan.

I read something that dovetails what you say and is kinda like what Rod Sterling of The Twilight Zone would say:

“Imagine for a moment that a portfolio manager describes their investment process as follows: they focus exclusively on companies with deteriorating or questionable business prospects, and lots of debt,” – writes Credit Suisse analyst Patrick Palfry in a note to clients published Tuesday.”

Try to find a new tesla owner who isn’t stoked on thir car. Paying 1/3 the ‘go’ cost (fuel) and leaving the garage everyday with a full tank and out excelerating anyone they want.

try finding someone who isn’t stoked on tesla hype who owns one. certainly no one who wants.to get from LA to chicago by car in a timely manner wants any part of a tesla. well, maybe they might want a bumper. but those you can just find by the side of the road – no need to buy.

TSLA, the Carbon Credits Services Company, expanding into a BTC Laundering Holdings Company.

Carbon Credits Sales keep the Auto Ops Afloat.

High Share Valuations allow them to Sell Shares to Generate Billions.

Billions used to Purchase BTC and other CryptoCoins.

Ride the CryptoCoins during this ZIRP/NIRP Bond and Fiat Devaluation Turmoil.

CryptoCoins Holdings will look good on the Books. Cap Gains of Coin Holdings even better. Keeps SharePx High even as Auto Sales Plummet in Mkt Share.

Launder Much of Present Share Valuation into CryptoCoins.

As Auto Sales struggle, Carbon Credits and CryptoCoin Valuations will keep the Books+SharePx Floating.

TSLA are now a Holdings Company. They’ll divest into CryptoCoin Apps and Startups even start a Coin himself.

He’ll ride Private CryptoCoins until the FEDRESV, ECB, and CHN_Central agree to Legislate/Regulate them out of usage in the USA/EURO/SCO_1B1R/PETROUSD+PETROCNY Zones.

Either way Musk should have a Soft Landing as TSLA Auto Sales get Squeezed…

Color me confused… isn’t the sale of “regulatory credits” just another way for Tesla to collapse in the end? If GM, Ford, and the rest start making their own EVs… what will they need Tesla’s credits for?

How does this “market” work?

Correct, that will dry up as a source of revenue for Tesla, eventually.

Well I get that part. But how does it work in the here and now? I thought the Carbon Tax bill got shot down.

They sell them to other automakers, like GM and FCA. The regulatory credits Tesla’s earned are from California and other states, the federal government and Europe.

I don’t think GM’s overvalued. Its forward P/E is only 10. I bought some recently, when it was $41. Now it’s $53.

They downsized the last several years, but that made them more profitable, as they sold unprofitable divisions, like their European operations.

Tesla looks like the GME stock chart before it crashed back to slightly more realistic levels, although still well beyond any normal reality. To the moon you apes ?.

You are throwing the baby with the bath water.

Tesla, is an ok startup. Yes, it’s risky, yes it’s ludicrously overhyped. The technology and strategy are ok though…. only the price is crazy and that’s not Tesla’s fault. The market has completely failed to price in the risk….

Tulips don’t stop having an intrinsic value, just because they are in a bubble, and they aren’t worth a house either.