Spiking prices for new and used vehicles under the microscope.

By Wolf Richter for WOLF STREET.

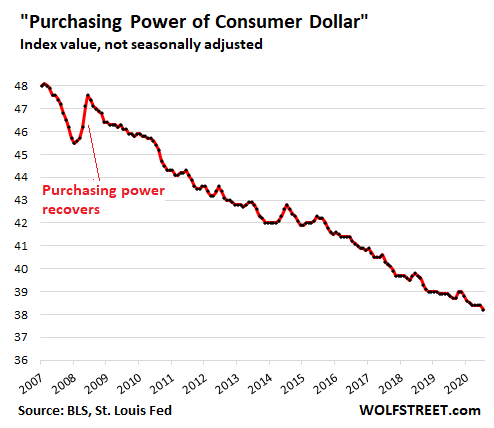

The “Purchasing Power of the Consumer Dollar” – part of the Bureau of Labor Statistics’ Consumer Price Index data released today – is the politically incorrect mirror image of inflation in consumer prices, as measured by the Consumer Price Index (CPI). By wanting to increase consumer price inflation, the Fed in effect wants to decrease the purchasing power of the consumer dollar, to where consumers have to pay more for the same thing. Thereby it wants to decrease the purchasing power of labor paid in those dollars.

And that purchasing power of the dollar in January dropped by 1.5% year-over-year to another record low:

Note how the purchasing power of the dollar recovered for a few months during the Financial Crisis, when consumers could actually buy a little more with the fruits of their labor. The Fed considered this condition a horror show.

Inflation in durable goods, non-durable goods, and services.

The overall CPI for urban consumers, the politically correct way of expressing the decline in the purchasing power of the dollar, rose 1.4% in January, compared to a year earlier.

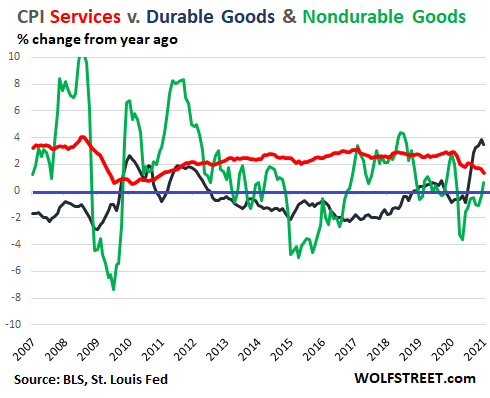

Each product that is in the basket of consumer goods tracked by the CPI has its own specific CPI. And all these products fall into three categories: durable goods (black line), nondurable goods (green line), and services (red line), with services accounting for 60% of the overall CPI. Here they are, with discussions below:

The CPI for services (red line) – everything from rent to airfares – increased mostly between 2% and 3% year-over-year for the last decade, but dropped during the Pandemic as demand for services such as hotels, flights, and cruises collapsed. For example, in January, year-over-year, the CPI for:

- Airline tickets: -21.3%

- Hotels: -13.3%

- Admission to sporting events: -21.4%.

The CPI for nondurable goods (green line) is driven by the volatile categories of food and energy. Energy prices, such as gasoline, plunged in earlier in 2020 as demand collapsed, but started to rise months ago. Food prices too are rising. In January, the CPI for nondurable goods was up 0.7% from a year ago, after having been down 3.6% year-over-year in May.

The CPI for durable goods (black line) has spiked in recent months on a year-over-year basis amid a surge in demand for some durable goods. In January, it was up by 3.5% from a year ago The past three months have been the steepest year-over-year increases since 1995.

The ironic element here is that CPI for durable goods declined for much of the past 20 years though new cars and used cars and smartphones and a million other things have gotten more expensive. The decline was in part due to aggressive “hedonic quality adjustments” – we’ll get to those in a moment – which remove the costs of quality improvements from the CPI.

New and used vehicles and “hedonic quality adjustments.”

New and used vehicles account for 16% of the CPI for durable goods.

Prices of new vehicles have soared over the years. The industry measure of “average transaction price” indicates how much money consumers spent on average per new vehicle, a function of price increases and a greater percentage of high-dollar vehicles in the mix. In January, per J.D. Power, the average transaction price soared by 11% from a year ago (to $37,165).

But the CPI for new vehicles in January ticked up by just 1.3% from a year ago.

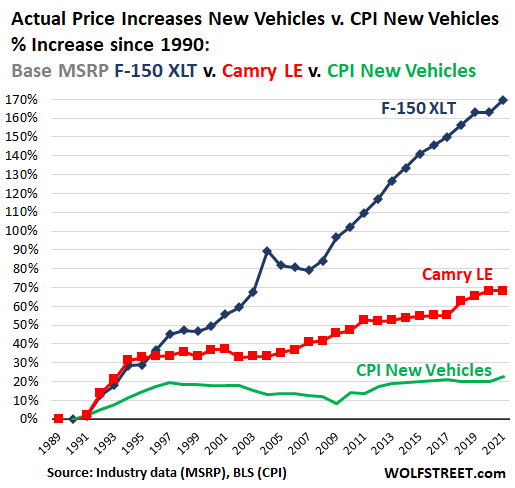

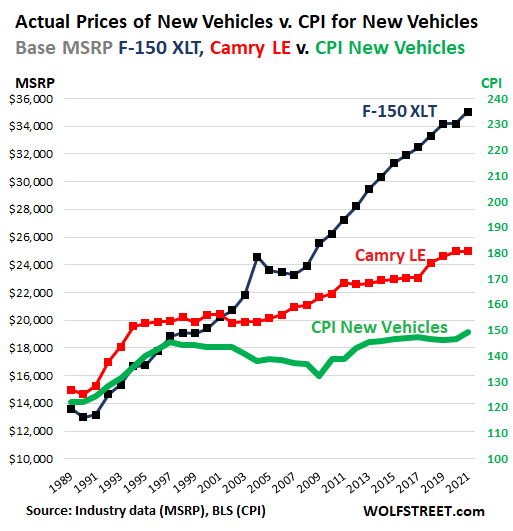

To demonstrate how silly the CPI for new vehicles is compared to what consumers actually pay for new vehicles, I constructed the WOLF STREET “Pickup Truck & Car Price Index,” which takes the Manufacturer’s Suggested Retail Price (MSRP) by model year of the best-selling truck and of the best-selling car over the decades and compares them to the CPI for new vehicles. The discounts and incentives are there every year and so cancel out when comparing year-over-year price increases.

Since 1990, the CPI for new vehicles has risen by 22.5% (green line). Over the same period, the base MSRP of the Toyota Camry LE has soared 68% (red line); and the base MSRP of the Ford F-150 XLT has skyrocketed 170% (blue line):

In dollars terms, since 1990: The Camry LE base MSRP rose from $14,658 to $24,970; the F-150 XLT base MSRP rose from $12,986 to $35,050; and the CPI for new vehicles rose from an index value of 121.9 to a value of 149.4, and stunningly is today just a tad above where it had been 23 year ago in January 1997:

A big part of the difference between actual price increases and the CPI for new vehicles are the “hedonic quality adjustments” that started to be applied with increasing aggressiveness in the late 1990s through today. The logic is that vehicles have gotten a lot more sophisticated over those years, for example, going from three-speed automatic transmissions to 10-speed computer-controlled transmissions. The hedonic quality adjustments remove the costs of these quality improvements from the CPI.

Even if this is calculated properly, without a political agenda to distort CPI downward, it puts the consumer in a bind because at the lower 60% of the income scale, wages have barely kept up with the overall CPI, but have not nearly kept up with the price increases deemed to be due to quality improvements.

Consumers have responded to these price increases by buying fewer new vehicles, switching from new to used vehicles, driving vehicles for longer, from 8.9 years on average in 2000 to 11.9 years in 2020, and financing them for longer, with seven-year auto loans now being all the rage.

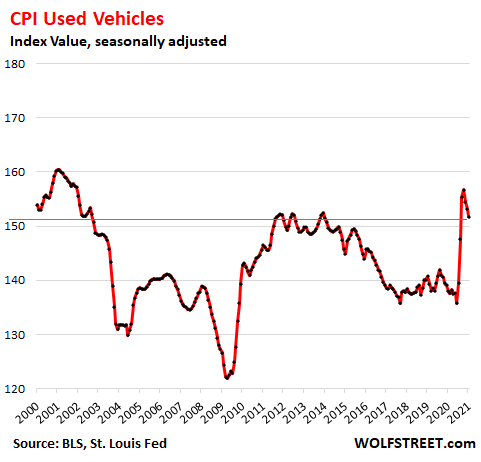

The CPI for used vehicles is also subject to these hedonic quality adjustments. So the same scenario is playing out here. But, but, but… among the distortions of the Pandemic was a sudden and historic spike in used vehicle prices over the summer that couldn’t be removed with hedonic quality adjustments. In January, the CPI for used vehicles was still up 10% from a year ago. Despite the huge spike in the CPI, the index level is still below where it had been 20 years ago in 2000-2002:

These aggressive hedonic quality adjustments make sure that CPI, and particularly the durable goods CPI, do not reflect actual price changes that consumers face. Consumers understand that they’re getting a better product that costs more to manufacture. But that doesn’t mean that they have the money to buy a new truck, when years earlier consumers with an equivalent income did have the money to buy a new truck.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m sold. I’m locking in a house, bought a truck and kayak; I’ll get some nice furniture, weber bbq, and smoker. Get my kids college fund tucked away. Buy some platinum and gold. And get rid of this worthless paper in the bank.

Then, I’ll just hang on bareknuckling the storm.

So I’ve been watch a great “hedonic” “adjustment” (literal) on car commercials. It’s a knob (surprised they spent money on it, could be on LED screen dash “much” cheaper). In one setting you are blasting carefree through roadless snow, click, now you are blasting through desert off road, click, blasting up narrow coastal 2 lane. Don’t show what other hedonic settings are. Wonder what this “feature” ups the price by?

Wonder if it is connected to anything?

Damn, someone is stupid, or trapped, if car shortly doesn’t come without “feature”, due to “popular demand” for it.

Hedonic’s are Vodo economics. Simply a way to lie about inflation. The fact is the dollar has lost 95% + of its value in the past 50 years and will probably lose much more than that in the future. Soon giving your 2 cents worth, will cost a dollar.

Since the Fed is printing money up the yingyang and turning it into toilet paper, it’s best to hedge with some physical PMs.

Actually, car and drug makers play a similar game. Having nothing genuinely “new” to cheaply offer, that “new” knob merely tweaks the engine, trans, and maybe even power steering maps a bit. Then they claim better performance (efficacy) in different driving situations. No proof, no regulation from gutted and more easily bought off Gov’t agencies.

With drugs, they take recent off patent drugs, make slight adjustments, or additions for greater efficacy (performance), give it a new name (and of course an equally enticing commercial ad), and charge on patent higher prices. Or just invent new medical problems, or new uses for an old med. (so called “off label” uses, which they aren’t supposed to advertise to Docs, but they do…again, no regulation). Maybe it’s even for uncomfortable side effects for something you are already taking, e.g., Tardive Dyskinesia (IIRC).

And since Medicare, Medicaid, and the private insurance companies pick up most of the tab, most people think, so what?

Rinse and repeat, endlessly. And your inflation becomes somebody’s increased profits or increased wages, bonus, stock options, etc. And of course the legal and banking and advertising bunch take their usual cut.

At bottom it’s simple wealth transfer, of what little wealth is left in an almost all “services” economy”.

Was reading recently that side effects actually create a slight boost to the placebo effect. Since it’s unethical not to warn trial patients of the potential for side effects, turns out that side effects cause people and their doctors to make pretty good guesses as to who is on the actual drug and who is on a placebo. This violates double blind trial efficacy and distorts the placebo effect, leaving the medicinal value of many drugs never truly proven. Of course the drug companies will never admit that and happily market their “science” through the bought out fda. It’s just another instance of people not caring about truth or reality and just wanting to make money regardless of the means.

Double blind actually means blind in both eyes – the drug companies’ and the FDA’s.

rhodium-

If you want a real treat, check out how they set the “endpoints” or “bio-markers” for “proof” of efficacy.

Even the “endpoints” when you have your blood or urine lab tested, and the battles over whether a “therapeutic intervention” is necessary or not.

And you might want to go to different country’s “end points” and “bio markers” for even more questions and doubts about this highly profit corrupted “science”.

Erlich’s “magic bullet” is swallowed (literally) hook, line, sinker, pole, and part of his dead rotting arm as well by most everyone.

It’s much easier than diet and exercise.

I don’t deny they have some winners, and as always, hats off to the trauma folks. And imagery is much better. And there still are some good scientists out there, but they don’t generate profit, just knowledge.

Bottom line. Thinking they can improve on 4 Billion years of trial and error in a year or two, is both arrogant and profitable.

Is there a setting for a crowded mall car park on a wet Tuesday afternoon, with three kids and a soggy dog on board? That at least would be realistic. (We get the ’empty coastal 2 lane’ stuff in Europe too.)

You might want to read about Executive Order 6102, if you plan to actually possess, physical, precious metals. Do not count on being allowed to keep any of the precious metals, if the economy goes down the drain, you hoarders! LOL. (On behalf of other Americans, I will be grateful for your “donations” of precious metals to our government and not laugh or chuckle as the government hauls away your precious metals for cents on the dollar.)

As to the college fund, leaving aside the issue of whether many of the majors and other degrees are worth it or just designed to suck away wealth into the pockets of the “educators” (ultra-rich institutions dedicated to feathering their nests), if you have that college fund in the stock market, watch out. I saw some recent interviews, one with Harry Dent and another with Drunkenmiller. I recommend you search for them.

They actually sounded like posts that I have written. Errors might be made, and some have been wrong in predicting stock market collapses before, since even competent analysis and comprehension of the key facts can be negated by enough market manipulation by the “Federal” Reserve. Nonetheless, the “Fed” is running out of room for its manipulations: in part due to what Dent referenced as demographic issues: older Americans will spend less.

I anticipate that older Americans will also have to divest sooner or later, i.e., when they die, even if claimed, longevity treatment were to really advance. The baby boomers still make up most of the wealthy: “Boomers spend $548.1 billion annually, a figure nearly $200 billion more than the next highest spending generation (Gen X) [reported in 2019]” in Baby Boomers Possess the Majority of US Household Wealth at marketingcharts.com. What will happen as they spend less and less?

I cannot believe that later generations have done well in this pandemic economy with so many businesses closing and generally letting go junior, less qualified employees. Thus, what will happen as the baby boomers are retiring or mentally incapable of working further or dying and their RE holdings and shares also have to be sold.

Printing enough US legal tender to funnel to cronies to buy all of that out by the “Fed” banksters would just create hyperinflation that would be distressful even to foreign investors. Thus, while I cannot predict when they will lose control and it may not even happen in 2021 given the vast powers of the “Fed” to manipulate and the debts owed to it by foreign banks (since it has bailed them out before), the stock market will crash.See “The Fed’s $16 Trillion Bailouts Under-Reported” by Tracey Greenstein in the excellent Forbes Magazine. See in seekingalpha.com, “Fed Bailout Of Wall Street And Foreign Banks Dwarfed TARP.” (Some value or high quality stocks may be less affected.)

A lot of companies are running on fumes, are over-leveraged, and/or had few, real future prospects even before the pandemic. Even the stock prices of good companies will likely crash because of reverse multiplier effects as their customers lose wealth and spend less and the retailers servicing them have less income, and their suppliers have less income, etc., etc., albeit many will later recover to some extent.

Thus, there is no safe harbor. I just hope that some analysts are correct and this crash will cause Americans to finally lose faith in and end the “Federal” Reserve bankster cartel, the biggest parasite and impediment to Americans’ future welfare.

Thanks Wolf for the awesome reporting. It’s ridiculous that govt refuses to compare based on the same model of cars and trucks and does these funky adjustments.

Food prices, gold prices, commodity prices, have also skyrocketed. Not sure what adjustments can be made there. It’s so sad that our govt is cheating it’s own citizens.

Listen you. What gives you the right to question these numbers. We created them to mask the obvious. So move on as you cant do a thing about it.

“It’s so sad that our govt is cheating it’s own citizens.” Naw …

It’s only cheating 98% of its citizens. The oligarchy and their Fed is gorging and laughing at the serfs.

Occasionally they’ll sweep a few crumbs off the table, onto the floor, for the rest of us to fight over.

“It’s only cheating 98% of its citizens. The oligarchy and their Fed is gorging and laughing at the serfs.”

^^Exactly this. And they are toasting each other at Davos and Jackson Hole for what an excellent job they’re doing. They meet with the media every few months to assure us that there is more on the way – A LOT more.

Thousands of years ago, man learned he could domesticate animals. Very soon after that, he realized he could also domesticate other humans, and the psychopaths among us have been doing so ever since.

the great reset, ” You will own nothing and you will be happy!”

Jdog,

It occurred to me that having a mental illness prevents the “Pursuit of Happiness”. So an argument could be made for a maximum net wealth (that being my suggested $10M, possibly upped to $15M to please a concerned commenter here) to reduce their psychosis and increasing the quality of life in these unfortunate diseased psychopaths. Would solve an immense amount of socio/economic problems as well as the medical ones.

How To Rewrite Economic History

The Boskin Commission’s attack on the Consumer Price Index is weak on the merits and scary as policy.

APRIL 1997 ISSUE

https://www.theatlantic.com/magazine/archive/1997/04/how-to-rewrite-economic-history/376830/

See also:

Mark Baum: “It’s time to call b******t.”

Vinnie Daniel: “B******t on what?”

Mark Baum: “Every f*******g thing.”

– “The Big Short” (2015)

“It’s so sad that our govt is cheating it’s own citizens.”

Your social credit score has just taken a massive hit for such anti-government talk. You are now restricted from travel anywhere aside from the grocery store and perhaps work, if you’re still participating in that antiquated lifestyle. You are no longer permitted to post online until after your official “review” which you’ll need to show up for, in person. Your government issued IP address is blocked everywhere with the exception of Amazon and Walmart. The FBI will be in contact with you regarding the aforementioned appointment.

Very nice depth charge.

How very nice of you to freely share your own fearlessness of the Covid virus and dislike of the democracy effort with everyone else.

And here I was thinking you might be one of those selfish types.

The “sad government cheating” is controlled primarily by our “oligarch party”. No different than the CCP, or Putin and pals, just maybe not as organized, yet, luckily, hopefully. The government IS still supposedly “us” or “ours”, but lacking lobbyists, Pacs, etc, we have lost control of it to big money, dynastic money, corporations, etc.

I wish people would quit cursing it and instead curse those who have corrupted the original democratic effort made over 200 years or so. Tax schedules actually show this the the most clearly. Other “issues” are just fluff. It isn’t Trump undoing Obama, or Biden undoing Trump. Actually, I’d say in modern history, the goal has always been to completely undo FDR, e.g., Heritage Foundation, and it seems pretty much completed, and heading back towards the Gilded Age again. Think “trickle down” and “job creators” BS is bad? Try the “horse and sparrow” notion of those times. Pretty graphic and undisguised imagery.

Corporations are the most evil economic/legal construct the financial bunch have ever put together. And they are stronger than ever.

I also don’t think there is much difference between using the terms “inflation” or “austerity”.

You know, the old IMF game played when a country got into financial trouble and certain “IMF conditions” had to be met to get bail out money, like reducing social services.

But now it’s getting turned inward more, and we are most all aware of what I’d call “creeping austerity” instead of inflation, and it only affects the lower income classes. And it’s not just prices, but services, i.e., long phone waits to settle problems with corporations, long lines, inadequate answers or solutions to problems, etc, etc.

And the further down the net worth scale one is, the worse it gets. Nobody likes to say”class warfare”, but that’s exactly what it is, and you all know who has had the greater ability to start it.

NBay-word.

may we all find a better day.

“And that purchasing power of the dollar in January dropped by 1.5% year-over-year to another record low…”

I shall promptly be contacting real estate folks in my neighborhood to re-price their listing accordingly.

If the purchasing power of the dollar is going down, should not the value of used vehicles be going up? Why do KBB, Edmunds, etc…, show the resale value of the same vehicle going down, much more than dealers are asking?

You think home prices are going up about 1.5% year over year?

well all you KNOW-IT-ALLS

I just bought 5 year old TRUCK

paid PREMIUM because stuff $10k less was JUNK – ie 2011

so I paid up to get PLATINUM product

we’ll see soon enough

going on trip tomorrow – just 200 miles to look for lots to build on in mountains

price for 5 year old F350 diesel – $50k

I put my MONEY$$$ were my mouth is

how about you

“…price for 5 year old F350 diesel – $50k…”

I saw you mention before that it has over 100,000 miles on it. I hope it serves you well, and that you bought an extended warranty. That is an eye-watering price.

It’s certainly apparent that the dollar’s purchasing power and how valuations are calculated, are not applied equally, especially on goods for resale.

100K isn’t all that much on a diesel, right?

Extended warranty are a scam.

Not sure if you know but KBB is in cahoots with the industry.

Just do a search and see how many of these ‘independent’ businesses are connected, it’s incredible. They claim to be competitors but they are not, they all belong to the same company. I don’t use them.

I just test them, now and then, with ‘current value” verses “trade in value”. It’s perfectly apparent ‘in cahoots’ is the proper term of their ‘unbiased’ opinion!

CPI=Caustic Political Influence. Wolf brings it to light.

The first flag that CPI-E shouldn’t be used to determine people’s social security benefits and wages is that it removes food. The actual logic is “food prices are volatile so we aren’t going to give you money for food when it costs more.”. As if food is some luxury humans don’t need to live.

My favorite is the twisted way they deduce that the price of steak is listed as going down. “Steak costs too much now, so people are buying hamburger instead. They are now spending less money, so the rise in steak price is actually deflationary,” WTF?

War is peace, freedom is slavery, and ignorance is strength.

Well put!

Bottom line is that we are now living in a fake world. Statistics are fake. The news is fake. Economics are fake. The Stock Market is fake. Elections are fake, therefore, the Government is fake. Most of what you think you know is fake.

All you can do at this point is to refuse to believe any of it, and concentrate on your own personal life and becoming as self sufficient as possible. It is insane to believe in, or participate in a fake game.

What is real, is that we are heading for a very dark time, and those who are not prepared when that time comes are going to be in a bad situation….

What comes next is when most realize the currency debasement taking place all at once and their rush to spend those soon to be worth less dollars now before prices rise even more. This subtracts from an already weak supply chain creating shortages and scarcity of some items, not unlike the origins of hyperinflation.

which is WHY I STOCK UP today – USUALLY BUYING SEVERAL of same product when available

I’ll need it in future and will charge OWNERS(I’m manager) current price when used

JIT is BS as it always has been

I said back in 2000 when I was doing MRP/ERP systems how DANGEROUS it was to depend on ANOTHER COUNTRY for products NEEDED TO produce product in merica

AMERICA was and has now been GONE

merica – it today what MEXICO was 50 years ago

The FED keeps telling us 2% inflation rate is awesome.

And has made it their #1 priority.

Did they lie to us?

wow – were have you been – in woke moment

since 2000-2019 avg CPI(old 1980 one) has said we have avg 8.5% inflation

(ie devaluation of our ALMIGHTY $dollar) – ie govt stealing

2020 – 20-30% devaluation of $dollar

2021 ?? – 30%+ devaluation of $dollar

see 1% stock market HIGHES – 10000% devaluation of $dollar and FREE MONEY – which ends up in 1% hands

pay up – I’m charging late fees/raising rents 7.4%+++ each and every year

BTW – YOU CAN MOVE IF YOU DON’T LIKE IT – I don’t care as I’m 100% FULL

You boast a lot about raising rent I’ve noticed. Don’t you see how you’re a part of the problem? You seem very hostile towards people just trying to survive who may not have a lot of choice.

There’s no humanity left since the country started leaning left.

Pretty soon the libs will cry seeing the prices soaring and and their purchasing power diminished.

“You seem very hostile towards people just trying to survive who may not have a lot of choice.”

Predator is the word I would choose …..

@GW

leaning left? this country has never leaned left. absolutely ridiculous comment from someone who I’m willing to bet my life savings isn’t a day younger than 60. This site is great but the comment section is full of out-of-touch dinosaurs

@phoenix – you might consider that most of the dinosaurs here are more up to date and savvy than 95% of the kids these days.

Wolf,

Any chance of getting median household income changes plotted against F150, Camry, and Gamed CPI price changes?

I think the results would be eye opening (best guess, median HH income “amazingly” tracks hedonic CPI rather than actual ID’ed cars)

I’ll check it out. Sounds like an interesting idea. Thanks.

WOLF – do you have PULSE

great – YOU QUALIFY for our loan – only 96 months now at 21% interest

get in line

I wonder how often the BIS applies negative hedonics adjustments such as low quality products coming from China. Is there some data about that? My guess: Never.

The other questionable adjustment is substitution. It’s questionable in itself to assume that the consumer will just shift to what is cheaper, no questions asked, where is the hedonics adjustment in that? In addition, as I understand it, if you change from Big Mac to Chicken Nuggets because BigMac became more expensive in year x, and then back from Chicken Nuggets to BigMac because Chicken Nugget became more expensive in year x+1, then both of those price increases have been removed even though it was a roundtrip substitution.

Years ago, I bought an essentially identical Hoover vacuum cleaner to replace one decades old.

The first time I used it, it died and I could not get it to start again. It caught a thread in a hall way rug matt which stalled the motor. Happened all the time on my old one, I just pulled it out, worked fine. But not the new one, couldn’t handle such a thing with crapping out.

So I returned it, and found a place to order online any and all parts to replace existing parts existing model.

I still use my decades old vacuum clearer. Am afraid to purchase a new, crapified one.

Ditto exact same story for a toaster (handle broke first time I used it). Just put on some touch up paint on my old toaster, it’s still chugging along.

Makes you afraid to buy new stuff, it can be so junky.

Hedonic that, Mr. Fed.

Young people nowadays never had “quality” appliances. They assume that these things are disposable and just by the new one when the existing one craps out.

“The Fed in effect wants to decrease the purchasing power of the consumer dollar…” The consumable dollar to buy consumable (not quality) things and consume their limited life to buy more consumables. Sounds like a vicious cycle that may require the services of a good shrink or therapist. For those young college kids out there looking for a sustainable career, I think I just found one that may be around for a while….LOL. How depressing are these Fed Reserve goals? Geez.

Yah. Gave up the iPhone thing years ago for a budget cell phone. When I ran with a younger crowd, buying every new iPhone was what everyone who was someone did. Me…got tired of spending $1K for a self spying device with apps and features I mostly didn’t use, especially once I got off FakeBook.

Since my first apartment… I learned to buy refurbished appliances.

Look for a place with a one year warranty.

My last set I got a 2016 Kenmore signature french door fridge for $700 delivered in Cali. The MSRP on that model is $6k

FYI 2016 was the last year Kenmore was made in the USA. So try to buy 2016 or older.

My washer/dryer are 6 years old from the same shop no issues paid $450 delivered.

You can also feel goid supporting a local business.

You need a decent phone now a days. At my company, you check your schedule, adjust your W-4, view your pay check, apply for a job, etc., all via app.

The days of being like Chuck Schumer and using a flip phone are gone.

I’m still using the 1970’s Miele S180 vacuum-cleaner that my parents gave me in the late 1980’s when I was a student, after they upgraded to a newer model. It just won’t die. I only replaced the hose around 2000, which costed just a few $.

My oldest appliance is a DeLonghi toaster oven, about 40 years old and made in Italy. I was going to replace it a few years ago but noticed that even DeLonghi toasters are made in China these days. So I kept the old one. It shows sign of surface wear and the numbers are hard to read but it still works.

My gas range is about 38 years old and it is going to the knackers’ yard on Saturday. Its replacement is a Samsung range made in China. It might be last year’s model, as it is marked down quite a bit in price. I used some of the savings to buy a 3 year warranty with it and hope I don’t have to use the warranty.

A few years ago I bought a 4k LG TV from Costco. It came with a 1 year warranty from LG and an additional 1 year warranty from Costco. The mother board failed after 21 months and Costco replaced the board at no charge. Had I bought it at Amazon (my second choice retailer), I would have had to buy a new TV set.

DeLonghi… I bought an AC unit from them a few years back – I just run it as a dehumidifier in the basement (so it only runs half the year). Within a year of getting it it’s internal plastic fan blades had all started breaking themselves off. Seriously – how does this even happen? Is making fan blades that don’t break themselves off really so hard?

Another $400 AC that went back to Costco, thank god for warranties.

You’re definitely onto something my friend, the new DeLonghi is definitely shit…

Bought a “black and decker” microwave secondhand back in 1985, still going strong.

Timbers (and others)

Last vacuum I purchased in 1988 and is still going strong!

Relative has small business and was visiting; mentioned he needs new vacuum; showed him mine (“upright” model) and he liked so much he bought one (same basic model over all these years) for his business.

“Life” is really not that complicated; we just make it so!

“But that doesn’t mean that they have the money to buy a new truck, when years earlier consumers with an equivalent income did have the money to buy a new truck”

But they have the money to buy a new home?

Medical prices increase at 5% per year

Tuition increases 5% per year

Houses increase at 5% per year

Wolf’s Truck index also, interestingly, increases at 5% per year

Am I crazy for thinking real inflation is closer to 5% than the FED’s 1.5%?

Yeah, but, hedonistically, colleges have cool upscale gyms and gourmet dining halls now…

And hospitals have flat screen TVs in the rooms..

So, you got to adjust hedonistically…

My relatively recent hospital stay was nothing like what I saw my grandma experience less than 20 years ago.

For me it was like a vacation at the Marriott. I guess that’s what you get with a $100,000 appendectomy these days. The best part of all is that insurance covered 97% so I felt vindicated after years of ever-rising premiums and deductibles.

Universities with their “academic” trips to Europe, acronym-shaped swimming pools and artificial ski slopes. Good grief, we’ve lost our minds in this country. Foolishness and greed all around.

“I guess that’s what you get with a $100,000 appendectomy these days.”

Is that all they’re charging? Sounds like a bargain. Mine was almost that much back in 2005. Of course, what was supposed to be laparoscopic turned into the good, ol’ fashioned scalpel and several days inpatient recovery.

Turtle, you know something is wrong with our medical system when your first reaction after having major surgery is that you’re finally getting some value for your insurance premiums. LOL.

Glad you’re doing better.

What’s sad is that the surgeon who possibly saved my life got screwed by the insurance company. Almost all of it went for hospital services. It’s easy to see who the bad guys in the healthcare system are.

“…you know something is wrong with our medical system when your first reaction after having major surgery is that you’re finally getting some value for your insurance premiums”

Right! You also know it when labs cost 2x more with insurance than cash or when a free GoodRX card saves you more than insurance. It’s sad that you can pay $1,000/mo for insurance that actually works against you in some situations.

Nope not crazy at all.

The real inflation is here and just in time for the unloading of all the sitting container ships in Long Beach harbor and off shore.

Giddy up consumers your big box store shelves will soon be over flowing.

-k

MEDICAL PRICES INCREASE 5% year

which is why I haven’t had HEALTH INSURANCE IN 15 years

thought paying MORTGAGE was more important

I will PROTECT my assets via LLC’s before paying for outrageous health care

so sorry – broke/no assets/no income

ISN’T THAT WHAT MEDICAL DOCTORS DO who get sued

put all assets into spouses name

You better pray you never get cancer or have a heart attack.

“why I haven’t had HEALTH INSURANCE IN 15 years thought paying MORTGAGE was more important”

You won’t be able to get a doctor to speak to you or treat you at anything but a walk in clinic. You’re the walking dead as far a the medical establishment is concerned. Even if you walked in with a suitcase full of cash most doctors won’t treat you or they will hit you with a walk up rate that is easily ten times what you would pay with insurance. I learned this the hard way when I didn’t pay into cobra when between jobs many years ago.

I have good insurance (B+) and yet even I get snubbed by the system that exists today. Many doctors are shopping for patients with premium carte blanche type insurance policies which always approve every procedure. This means more visits to doctors to find one who will treat you.

In the end you’ll get a reverse mortgage to pay the medical bills.

@Joe Saba

“ISN’T THAT WHAT MEDICAL DOCTORS DO who get sued

put all assets into spouses name”

Spouses name, are you kidding me? That won’t help one bit. What they do is what you don’t and that is pay out the wazoo for insurance. Much more than the patient pays for insurance.

The problem is emergencies. For that, you must have insurance or you’re bound to get slammed. People go bankrupt all the time over this. Hospitals are E-X-P-E-N-S-I-V-E and you never have any idea what the bill will be (huge problem). It could be $3,000 or $300,000. Look up horror stories about the bills from snake bites.

“so sorry – broke/no assets/no income”

Now I agree that hospital and insurance companies have some ethical issues when it comes to “cost” but you should be paying your bills, at least to the doctor in an emergency. Pretending you’re broke to avoid paying anything at all when somebody is working to rescue you. And it ruins your name. I hope you’re not really playing that game.

@Robert

“Even if you walked in with a suitcase full of cash most doctors won’t treat you or they will hit you with a walk up rate that is easily ten times what you would pay with insurance.”

What? No way! We have insurance and pay cash all the time because it’s often cheaper. We’ve never, ever been refused treatment for cash. We’ve even paid for costly procedures for an uninsured relative and cash has always been welcome. Insurance usually pays jack-nuthin’ until you’ve hit a massive deductible. It often costs MORE than cash in my experience.

Or maybe you’re taking about @Joe Saba. I wouldn’t see him if I were a doctor. But everyone else, yes, doctors do take cash. A lot of people are uninsured and pay cash for appointments.

@Turtle

“What? No way! We have insurance and pay cash all the time because it’s often cheaper. We’ve never, ever been refused treatment for cash. We’ve even paid for costly procedures for an uninsured relative and cash has always been welcome. Insurance usually pays jack-nuthin’ until you’ve hit a massive deductible. It often costs MORE than cash in my experience.”

The rate you get when you have insurance is the NEGOTIATED rate the doctor has with the insurance company. If you don’t have insurance then you are billed at the walk up rate which can be as high ten times the ‘negotiated rate. I know they take cash, but you will pay out the wazoo for basic procedures. I’ve been there, but maybe this rate varies from state to state. Could be much lower in your state.

I am well aware people often pay cash for procedures then later get reimbursed by the insurance company. But treatment is often a process, not a one off even like getting antibiotics. When you don’t have insurance the doctors will ask few questions and there will be no follow up call or visit. So what are you really getting for your money?

“Insurance usually pays jack-nuthin’ until you’ve hit a massive deductible.”

For C grade insurance (co-insurance type plans) that’s true, not A or B grade insurance with no con-insurance. Most of my basic treatments do not even apply to the deductible and I am not charged, except trivial co-pay. I would pay a minor fee for a surgical procedure.

My overall point is the system is not set up for people without insurance.

I am old enough to remember when it cost 3 cents to mail a letter in the US. Now it costs 55 cents. The hedonic improvement is that mail to distant cities is now sent by air without a surcharge; however, slower handling at both ends probably wipes out any time saving from the use of air mail. But if Paulo from British Columbia wants to mail a letter to Toronto, it will cost him over $1 (including sales tax).

Not only do you pay $.55 for that old $0.03 postage, with today’s mail system, it only has a 75 – 80% chance of being delivered where it’s supposed to go.

Yes, this is a more accurate statement of inflation for sure.

…old and occupied RV’s coming to park on a street near you, soon…(if not already).

may we all find a better day.

Must be me… the title at first glance was aggressive hedonistic adjustments.

Is that allowed?

hedonism, aggression mode.

But screw it, according to the Fed, inflation is still nearly flat. I suppose if they look at the sticker price of an airplane, there is actually a pricing decrease, but milk and other food stuff must be excluded from this measurement.

?

Medical prices increase at 5% per year

Tuition increases 5% per year

Houses increase at 5% per year

Wolf’s Truck index also, interestingly, increases at 5% per year

Am I crazy for thinking real inflation is closer to 5% than the FED’s 1.5%?

I’ve always had a problem with the CPI. Price is nothing more than a signal. It most often does not represent cost and it definitely does not indicate value. Money represents value without having any of its own. It is not the actual object of exchange. It is a semiotic instance or symbolic cypher and only acquires value when it is interacted with. All of the central banks including the Federal Reserve are working on CBDCs, Central Bank Digital Currency, which actually represents how money works. A medium that has no value but is acquired with the exchange. Go ahead, buy gold, silver, platinum and Bitcoins. Every year you will need to convert them to digital Greenbacks to pay your taxes.

At the the manufacturing cost level, a F150 costs nowhere near the greater difference in the retail price between it and a Camry to manufacture. Ford can price the F150 at a greater price because the buyer is willing to pay it.

Then you need to consider the financialization of the economy. Lower interest rates, longer loan terms and leasing allow buyers to pay higher prices. Most buy on the note they can afford. Prior to GM’s bankruptcy, I would say GM doesn’t build cars and trucks to sell, they build them to finance. Nothing has changed.

Many here are of the Milton Friedman School of Inflation which believes that inflation is always a monetary phenomenon caused by printing money. There are other causes such as demand pull and cost push. CPI does not edify as to the cause of higher prices.

good points.. on a similar thread I recall reading that the advent of pet insurance drove up average vet bills by over double.

My old pooch won’t be much longer for this world. And I won’t be getting another. The veterinarians have gone from caring about animals to the GREED model.

The $220k schools are charging now for the 4 years of tuition (not including fees, living expenses, housing, etc.) is part of that.

Education costs have become as obscene in this country as everything else.

What you just described is a change in relative prices. That is not how Milton would have defined inflation, even though the aggregate price level went up.

1.5% is total BS. I’d say more like double digits especially groceries.

I like ur stuff Wolf… but ur article here is a little like one whose header is ‘Grass is Green, Sky is Blue’… ur kinda explaining the obvious…

Fiat currencies always depreciate in terms of purchasing power over time…

If they don’t, it’s an indication of deflation, a far more difficult problem to correct than inflation – just ask the Japanese…

that’s why the Fed wants inflation modestly higher than it is now, to avoid falling into a Japan-like morass

And I’m not sure what the relationship between the general rate of PP decline has to do with the very strong auto price inflation vs CPI over the last several decades…

You are correct, however, in pointing out that auto inflation has indeed been “hedonic” primarily and not so much cost-push… that said, regulatory requirements such emissions cutting equipment have also been a factor…

Why is deflation (lower prices) a problem? That’s a big assumption you are making.

ONLY lower prices I see today is for DESPERATE PEOPLE needing CASH NOW/TODAY

I have it – you don’t so let’s NEGOTIATE

NO – see yah – good luch

YES – OK THEN WE HAVE DEAL

then I SELL FOR DOUBLE

A problem for whom?

For most of the population, deflation is a boon. For people with a ton of debt?

Just ask the Japanese

I’m sorry but the Japanese yen is not the world reserve currency

The dynamics are completely different monetary science

I have a simple solution to all forms of rising inflation. Healthcare cost: don’t go to the doctor, they’ll probably do more harm than good anyway, so avoid at all cost. Tuition cost: don’t go to school. New car: don’t buy one, mine is probably worth about $400 if I tried to sell it. Appliances: I take off any useful parts when I see old ones on the side of the street. Food: It seems like food keeps getting cheaper and cheaper. With all the discounts and digital coupons, I often marvel at how cheap everything becomes.

The real issue is that saving doesn’t make sense anymore. If you keep money in cash, you have to assume that the current monetary and fiscal policies will dilute the money supply by 10% or more going forward (looking backward it’s been 7% on average). The CPI doesn’t matter because in theory the government could pay for all necessities and in that case CPI would be negative. If you buy investment assets, they’ve already been bid up so much that you are getting too small a share of the wealth pie. It’s not worth it. I suppose you could save cash and hope for a market crash, but what do you do when after 5 more years, you find yourself still waiting?

I think collectively we should just all stop working and demand UBI.

PROBLEM #1

99% don’t get it and ARE PROBLEM

can’t live within means

keep on FEEDING BEAST – with every last penny

so solution is????

“I think collectively we should just all stop working and demand UBI.”

Like an intervention? Take away all his tax dollars. He’d be scared straight!

“The hedonic quality adjustments remove the costs of these quality improvements from the CPI.”

For example, not everyone wants all these hedonic quality adjustments. And I don’t like paying for all of them. All I want to do is to get from point A to point B. That’s it. Why should I have to pay for all this crap that I don’t want and can break down? Cruise control was bundled with my Subaru 15 years ago. Never used it.

The government’s reported CPI has gotten so complicated its becoming more and more difficult to understand how much the dollar is losing its purchasing power.

‘The government’s reported CPI has gotten so complicated its becoming more and more difficult to understand how much the dollar is losing its purchasing power.’

Feature, not a bug…

The notion that value is defined by consumer goods and services is flawed from the get go. You can’t compare the value of a buggy whip in 1921 with the value of a buggy whip in 2021, any more than you could compare the value of an iPhone in 2021 with an iPhone in 1921. The use of “hedonics” to try and compare value of things over time is tantamount to the government claiming for itself all the benefits of technological advance.

I think i have said it a million times here but your F-150 or Camry index is bullshit. Car makers re-use their names for bigger and higher positioned cars. This re-use is not hedonistic just as Unilever asking the same price for 10% less detergent is shrinkflation. They have been doing this for ages as it makes people buy more expensive cars. See for example Golf which was VW smallest but has now 2 smaller cars beneath it. But the Golf MKI is just as big as the current smallest VW

That’s not quite right, VW Golf is a very static class of hatchback, that has fitted in it’s iconic role since the 70ties.

To compare the VW Polo with a Golf from the 90ties, that’s not even remotely the same car.

It still appeals to the exact same crowd of retired supermarket shoppers and teenage tuners as it did back then, too. The smaller cars of VW are city scooters, like the smart or fiat 500.

If you are suggesting Wolf compare a 1990 Camry to a 2020 Corolla, that doesn’t work for me. The Camry is way better. I see your point with the 1990 and 2020 products not being comparable because of class increases, but it is not large enough to warrant comparing different vehicles. At least for the Camry. The 1990 Camry was large and had good engine.

In my opinion, it is arguable that the “name recognition” serves to enhance product consistency. Making the product more comparable over-time.

If carmakers re-use old names to upmarket cars it’s indeed not hedonistic. If it’s the category sizes growing due to added safety/power/comfort features then it’s hedonistic. The Golf was never really the smallest VW (and always belonged in the virtual C segment) – in fact it always co-existed with the Polo (B) while other manufacturers made even smaller city cars belonging in the A segment (Fiat 500, Mini). Of course what happens on the market is actually more a combination of the two, as few manufacturer resists the temptation to not increase the size and weight every new generation, but as it only makes sense to categorize relative to other cars on the market it’s hard to differentiate the two mechanism.

Char,

And I told you a million times that your argument is total bullshit. 500 pounds of extra steel and plastic don’t cost that much. You’re not paying for raw materials when you’re paying $25,000 for a car. A car is not a box of cereal. Why is this hard so understand? The smallest cars can be the most expensive — see Lamborghini.

I follow the bottom end of luxury vehicle market closely, and you are spot on, Wolf!

The price increases are stunning. While the prices were surprisingly stable the last years, they exploded since last year April.

15-20 year old luxury vehicles are now 2-3x in price. I am not even sure who buys them?? People that bought a new Camry last year are now driving 15 year old Mercedes? How does this work??

Who pays $12.000 for a 170.000 mile Minivan that sold for $3000 last year?

Sheep, that’s who.

Look out below! Detonation eminent!

I just bought a used, but totally reconditioned and certified as such with warranty, stackable washer and dryer for my rental. It was 50% the price of new and not all computerized. Very pleased to buy it. And 5 minutes before I read this article the owner of the sawmill I am buying a large order of post and beams from phoned with the price before he cuts. It’s about double what I’m used to paying.

Ahh, the power of currency debasement and the wonder of used appliance repairmen that own their own stores.

It is scary out there for rising prices. Not good.

Great article, thank you.

ACTION

if needed YOU PAY TODAY and CHARGE ACCORDINGLY FOR FINISHED PRODUCT

then HOPE BEFORE NEXT PROJECT – prices stablize

but DO NOT COUNT ON IT – FIAT IS EXPLODING

Paulo, did you continue with the order?

There is no Truth from our government, anyone notice?

sure there is

WATCH COMEDY happening TODAY/next week

total FAILURE OF once great nation – NOW CESSPOOL OF CREATURES from swamp

MEANING – everyone on OWN

good luck and GOD SPEED

we’re gonna need it

On any topic. And no one ever gets fired or goes to jail…………

About the Camry:

{ [ ln (24970/14658) ] } / (2021- 1990) = 1.72% CAGR.

Now do the same for new vehicle CPI!

Also consider the socalled “shrinkflation”: what I have seen is that multple things have less content. E.g. I buy a package of A and it used to have say 20 oz. of content. But when I buy the same thing today then is only has a content of say 18 oz.

News at 11 – the Fed just now admits unemployment in January was 10% not 6%. Wolf and everyone else here has been saying this for months.

Yellen : “I would expect that if this package is passed, we would get back to full employment next year,” Yellen told host Jake Tapper on CNN’s State of the Union.

1.9 T is cheap if it truly gets us back to full employment, but of course that’s just BS, I think she probably meant 19T ;)

Of the $1.9T, I expect about $1.6 trillion will go to buy iPhones and other crap that will be in landfills within two years.

From what I’ve been reading the direct payments yet again are a minority portion of the headline figure, which includes a bunch of other stuff in an ever changing mix as the legislative process moves forward.

If/when it arrives, I plan on using my stimulus to buy some physical precious metals.

Should’ve started hedging against inflation a while ago, but better late than never.

I tried to compare that chart to my wage, but I dont understand what do they use for measure? Is that % on vertical column? 48 % in 2007 and 38% in 2020?

My wage increased 100% in 15 years. 6.6% a year increase. I make twice more $ in 2020 than in 2005. Purchasing Power of $ goes down, but my salary goes up. I just get more money every year. It terms of Camry I am in much better place now, but in gold, i can afford 70% less than in 2005.

We need inflation chart here.

We need some kind of median income chart too, to see where we are, before we jump to conclusion.

You cannot compare an individual’s wage over 20 years to anything. That’s a measure of individual performance, luck, raises, etc. What you have to compare is what the average 25-year old made in that job 20 years ago, and what the average 25-year old makes in that job today.

I am shocked, shocked that inflation is going on here!

Yellen : “”I can tell you we have the tools to deal with that risk”

Just wondering how much a $10 sack of trash is worth after adjustment? Everything has always gotten cheaper but we are still around. When I was a kid a candy bar was $0.25 cents. Any video game was a quarter. And my friends grandpa played golf for a bit a hole. Things have gone haywire but we are still here. And we have some nifty stuff like the internet so we can compare how far we have gotten in this awful mess. But cheers to y’all I love the Wolf Street reports

When I was a little kid candy bars were $0.05, except for the Mars bar which was $0.10 (and worth it on occasion). As for trash, my refuse pickup just increased 20%/month. I weighed my trash and its removal cost more per pound than filet mignon.

We will own nothing and be happy!

What I have noticed is that it appears that it doesn’t matter if your standard of living is getting worse; provided you perceive that you are doing better than others.

If you were forced to eat two spoons of excrement everyday and I only had to eat one spoon of excrement that would be OK because I am doing better than you.

It appears that the fact we are both eating excrement is not important.

No s**t lol

To “Jubilee” America’s 27 trillion $ debt,

the government -must restrict imports &

reduce “production” (GDP).

Consumer demand will remain the same, of course,

but production -must slow down dramatically;

i.e. stagflation, AOC’s “Green New Deal”.

It -must happen… defaults, bankruptcies;

pensioners will be hit hardest.

Printing money just makes it worse.

“Hedonic Quality Adjustments” ( screw the poor, save the rich ).

How do you say that in Chinese / Mandarin ?

Ask Powell

I love Carlyle Group alumnus Jerome Powell’s rationale for keeping interest rates at zero. He has to keep rates low until job losses in the low income groups recover. (Doesn’t explain why rates have been low for a decade now but oh well….) Isn’t this a variation of trickle down economics? Create asset bubbles thru low interest rates which benefit those who own assets, i.e. the wealthy, hope that this somehow benefits those who essentially own nothing. And there seems to be no political will to address the asset bubble problem which is creating even more grotesque wealth disparity in this country during a pandemic no less. (But I would guess that the majority of our politicians and their enabling donors are digging the latest stock market lunacy).

I bought a new Toyota pick up truck including taxes and title for about $7500 in 1989.

According to a Census Bureau chart, the price of a new house doubled in 20 years. That is close to 3.5% inflation compounded annually.

According to Statista the median rent for unfurnished apartments was $308 in 1980.

State university education used to be heavily subsidized by state government. The price there multiplied with declining subsidies.

Wolf,

When you look at the Fed using different adjustments to keep reported inflation low, what do you think about the weighting?

https://www.clevelandfed.org/en/our-research/indicators-and-data/median-pce-inflation/current-components.aspx

Sixteen percent for all of housing. How does that compare to actual spending?

I can’t believe anybody takes those stats at face value.

FROMKS,

You’re misinformed. Housing (“Shelter”) = 33.3% of CPI, not 16%. Everyone who looks at this regularly knows this.

Here is the link to the CPI data on the BLS website which gives you the “relative importance” of each category in CPI (2nd column). Look for “shelter” = 33.3%

https://www.bls.gov/news.release/cpi.t02.htm

The Cleveland Fed (the link you provided) splits shelter into subgroups on its list, but they’re spread across the list. You have to pick them out and add them up. The Cleveland Fed doesn’t publish CPI; that’s done by the BLS. The Cleveland Fed uses the BLS data to come up with its “Median CPI.”

Wolf,

Doesn’t the Fed FOMC use PCE, not CPI when deciding to adjust rates?

FromKS,

The Fed uses “core PCE” as measurement for its target. The PCE inflation index is released by the Bureau of Economic Analysis (BEA).

I almost bought a new 4Runner a coupla years ago to replace my 15 year old one. It was not the price that stopped me, the final negotiated price was within a few thou of my old one, but the taxes and insurance. Sales tax, yearly property tax, and yearly collision insurance. Those turned out to be 1/6 the purchase price. For nothing.

Pray tell, what is the hedonic adjustment for increased taxes?

That’s what stopped me from my new vehicle purchase last year – the insane taxes, registration and insurance. Almost $1,000 per year to the DMV vs. my current $100 was a dealbreaker. Sure, it goes down slightly each year, but not nearly as low as my 24 year old truck.

You in Virginia or Connecticut?

I note that rents dropped to a 10-year low of 1.62% y/y. How convenient that governments can dictate that rents be deferred nationwide, and then report that rent increases hit a decade low. Landlords have zero leverage, and it’s obvious in these numbers.

Due to mortgage delinquencies (6.73% in Q4) and moratoriums, there is a 3% discrepancy between ‘effective’ rents and ‘asking’ rents. This is depressing ‘rents’ in the BLS’s CPI tabulation.

Michael Ashton @inflation_guy: Yes, it implies that when renters become ‘normally’ current (there’s always SOME delinquency of course), effective rents will rise a lot to catch up.

https://twitter.com/inflation_guy/status/1359873252101935104

It is an extractive economy, and more of the peasants’ steam must be extracted.

You mention that these hedonic adjustments “cost more to manufacture” but those cost increases are not distributed equitably. The factory worker who installs the new ten speed computer transimission might just as well install four on the floor. The engineer who designs the transmission has some wage leverage. The actual construction of the transmission is probably done offshore using robotic tools for the critical components. The mechanic who services the transmission has a new diagnostic tool, and when the transmission fails he sends it back to a facility where it is remanufactured. Hedonics in theory reduces costs to consumers, done mostly on the backs of producers. The concurrent rise in prices may have more to do with the ballooning monetary supply and the offset in wage inflation is the benefit of offshoring to nations with lower standards of living. The Federal Reserve reflation policy is don’t to offset the drop in prices, or deflation. If technology is so great, why are things getting more expensive?.

While I like the chart Wolf created with the F-150 and Camry vs the CPI for cars… I think the Delta is probably closer than those charts show.

My parents buy a new Camry every seven years or so… the differences from three models ago are so vast that a comparison really cannot be made… although they actually prefer the model they had previous to what they have now. Same goes for the changes to the F-150. There really are “hedonic quality differences” in those models that justify higher MSRPs.

But other cars are not like that. The differences between the 2001 Crown Vic that I owned and the last ones to come off the assembly line in 2011 were minimal… as were the price differences… about 20% over a decade. I suspect that lots of other models are like that as well.

I think Wolf is on the right track here. I would just like to see more models included in his analysis. And he is CERTAINLY right that the “hedonic quality” adjustments can be gamed for political reasons. To say nothing of his point that people will delay buying a new car based on the MSRP rising too fast for them to afford one… “hedonic quality” improvements be damned. Isn’t that what we all do? Delay our purchases until we can afford to get what we actually want?

PS: Sadly, Ford no longer makes the Crown Vic or the Town Car… so I will no longer look at Ford for my next replacement vehicle.

SpencerG,

Every automaker has models that they decide to phase out. When that decision is made, they stop putting money into it. It’s just a cash cow. Maybe a few minor changes. But no redesign. And then they run those models until demand just disappears. And they cut it.

The Crown Vic was one of those. What kept it alive for years was demand for the police version, the Crown Victoria Police Interceptor, which was popular with police departments because it had rear-wheel drive.

I agree…

But in the case of the Crown Vic it wasn’t that demand had petered out. They were still selling over 150,000 units per year of all three brand plates as late as 2007. Police agencies still wanted it (and aren’t happy with the available choices even today) and old people would simply replace one with another.

What killed the Crown Vic was that Ford simply couldn’t get enough additional profit out of each unit. Cops want the baseline interceptor model and old folks don’t want the new technology that allows a car company to charge more. In its final year the Crown Vic LX still sold for less than $30,000 MSRP.

Couple that with the additional taxes that Ford would have to pay due to the new CAFE standards and “Sayonara!”

Frankly, Ford misread the times. They are known as the car company that is run by the accountants for a reason. I was still doing my reserve duty in Detroit at the time and the Ford people in my unit told me to not worry about the Crown Vic being discontinued… “get yourself a new Taurus SHO instead!” That “new” model of an SHO was a pale imitation of the Panther platform and it NEVER approached the pre-recession sales figures of the Crown Vic, Grand Marquis, and Towncar trio.

But it STARTED at $38 grand per unit… so I guess the accountants at Ford were happy.

The Fed said Wednesday that he loved his job…something about helping people. At this point, the Fed has seen about a $10M gain in his long only stock portfolio that was listed in public records at around $50M in mid-year 2020. I’d love my job too if I could pretend to help people by flooding the world with printed money, and making $10M in the process…

Today the CBO just stated the projected deficit is $2.3Trillion for 2021, not including the $1.9Trillion in stimulus that will be passed soon. So we have a $4.2 “on the books” deficit for 2021, with other “off the books” deficits not counted.

How could 4-5 TRILLION in deficits NOT increase the price of EVERYTHING at “SOME” point???

Stagflation States of America…Fed Hero will be Fed Zero in 2-5 years after the bottom 99% figure out they have been robbed blink by the stealth inflation tax, compliments of J-Pow and the (M)agic (M)oney (T)rain…choo choo…

Aspirational purchases and travel have been priced beyond what I am willing to pay, and I won’t compete with those heavily indebted consumers who only care about the monthly payment. So, I’ll sit here on my pile of cash and continue to make my own hedonic adjustments. I have adapted to the drop in purchasing power by buying used items in mint or very good condition, appreciating what I have, or simply choosing to go without. My money velocity is near zero, and I suspect there are many like me who have had the same reaction to financial repression.

Right now I am a money velocity sinkhole. Money comes in and it doesn’t go out.

I think the pressure on the ‘average wage earner’ is even more pronounced than this picture paints. If an evaluation of how many hours a person has to work to obtain an F150 or Camry referred to in the article is much more than the price alone, since income tax thresholds have hardly moved, and payroll taxes have increased relentlessly. Thus the potential purchaser has diminished spending power due to increased tax burden as well. The only thing helping is the fact that vehicles last longer than they used to.

Duh! All fiat currency eventually has the purchasing power of its true worth zero. Zero is zero no matter how you add it up. It don’t take a genuis to figure out that something that has no intrinsic value is worth nothing. How this ponzi scheme has lasted this long is nothing less than a miracle. And that’s exactly what it is, a ponzi scheme. Currency reset coming soon to a even more ridiculous currency, digits in a computer. The problem is you can’t fix stupid. And when the lunatics are running the Insane asylum you know your screwed.

Tick Tock goes the clock, the dollar is fixing to be worth less than a rock.