My 13 whiplash-charts by retailer category.

By Wolf Richter for WOLF STREET.

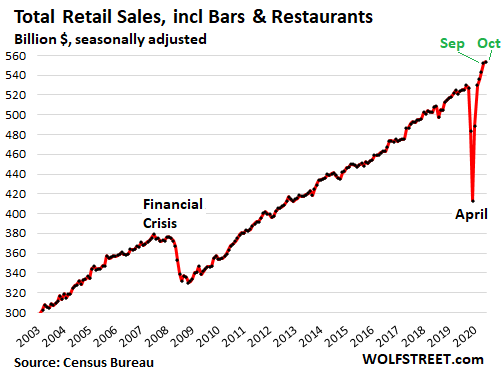

First signs of exhaustion after a blistering Pandemic-inspired weirdest-economy-ever spike to new records? In October, total retail sales – sales of merchandise in stores and online, but not including services such as doctor’s visits, insurance, airline tickets, hotel bookings, etc. – ticked up by just 0.3% from September, the smallest month-to-month increase since the trough in April, eking out a new record of $553 billion (seasonally adjusted), according to the Census Bureau.

Without the boom in online sales, retail sales at brick-and-mortar stores would have been down from September. Compared to October 2019, total retail sales were up 5.7%. The signs of exhaustion show in the details, as we’ll see in a moment. But there are also signs of power-spending particularly by those with money. Ecommerce sales surged to a new record, while department store sales made progress toward ultimate zombiehood:

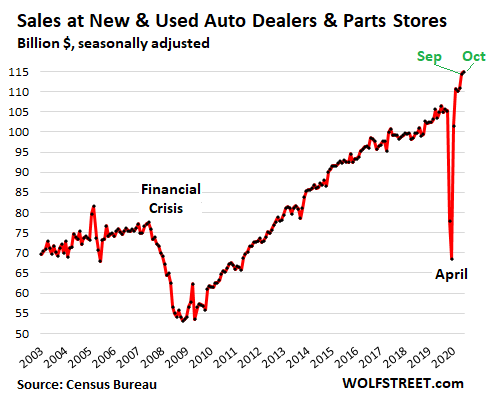

Sales at new & used auto dealers and parts stores ticked up 0.4% in October from September, to $115 billion (seasonally adjusted) and are up 9.5% from October last year.

In July, August, and September, used-vehicle prices spiked by 15%, even as unit sales remained below last year’s numbers. In other words, Americans bought fewer used vehicles but paid more for them. The higher end was white-hot, with pickup truck prices surging 25% in that three-month time frame. It was truly nuts. But in October, price fatigue seems to have set in, and retail prices ticked down a bit.

New vehicle sales, in terms of number of vehicles sold, have now returned to about where they’d been a year ago. But average transaction prices in October jumped 7.3% year-over-year to a new record of $36,755, according to JD Power estimates, as consumers with money or credit are buying more higher-end vehicles such as trucks and SUVs, and fewer cars.

Retail sales, as measured in dollars, at new and used-vehicle dealers and at part dealers, reflect higher prices and a shift to more expensive vehicles. This is the largest category of retail sales, accounting for about 21% of total retail sales, including bars and restaurants:

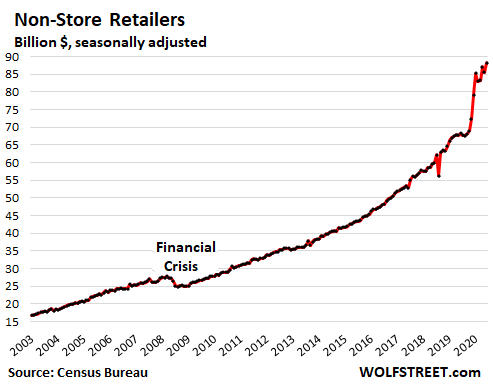

Sales at ecommerce sites and other “non-store retailers” (mail-order operations, stalls, vending machines, etc.) in October jumped 3.1% from September, to $88.2 billion, having spiked 29.1% year-over-year. Ecommerce has become the second-largest category in retail sales, behind auto and parts sales, accounting for 16% of total retail sales. October’s results blow away speculation that ecommerce sales would fall off after brick-and-mortar stores reopened:

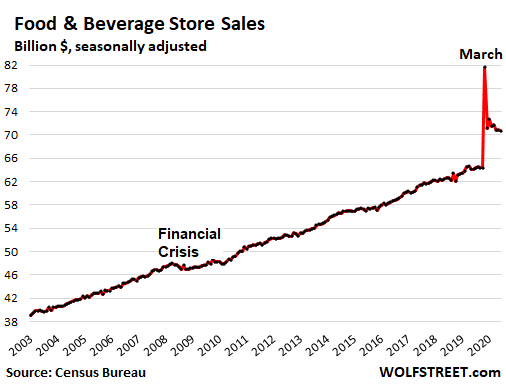

Sales at Food and Beverage Stores edged down 0.2% in October from September, to $70.7 billion, but were still up 10.3% from a year ago. There has been a massive shift in where Americans consume food and household supplies. Work from home has shifted lunches, breakfasts, coffee-before-work, and that liquidity injection after work to households, and thereby to the retail store, and away from restaurants, bars, and cafes and from companies that supply cafeterias and offices. But the panic-buyers’ portion of the spike in March has been unwound:

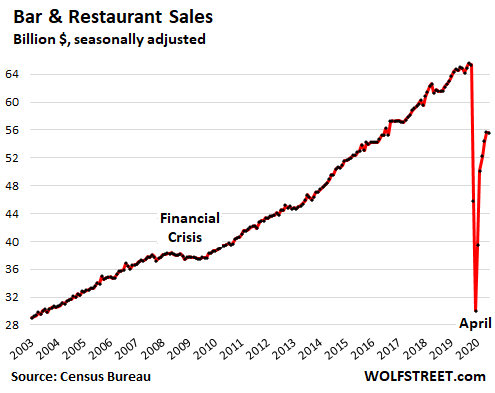

Sales at Restaurants & Bars edged down 0.1% in October from September, to $55.6 billion, down 14% from a year ago. This includes sales at eateries and watering holes of all kinds. Many of them never closed during the Pandemic, such as drive-throughs, but others remain shut down, and many of them permanently, unable to deal with capacity constraints, outdoor-only requirements, and the like. At restaurants that take reservations, foot traffic was still down 44%. Through 2018, this was the second largest category. It is now in seventh place.

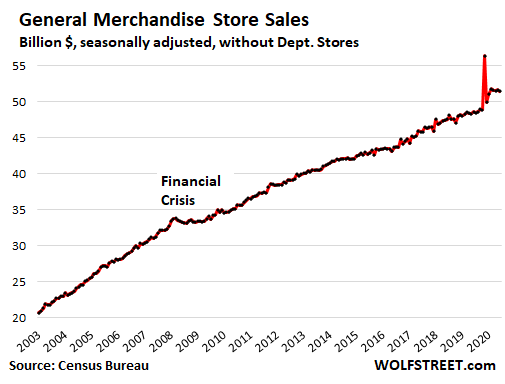

Sales at general merchandise stores (minus department stores) fell 1.1% in October from September, to $51.4 billion, and are up only 2.6% from a year ago, having just about completely unwound the 15% panic-buying spike in March. Walmart, Costco, and Target are in this category, as are many smaller stores. But Walmart’s, Costco’s, and Target’s booming ecommerce sales are not included here but are included in ecommerce sales:

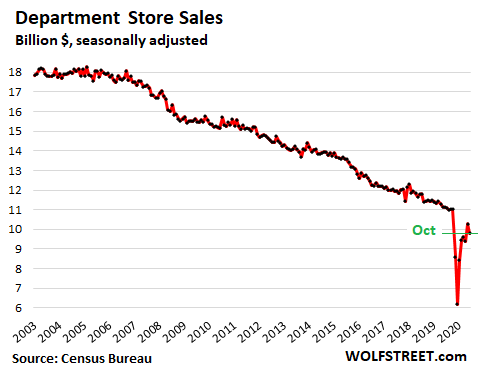

Sales at department stores fell 4.6% in October from September, to just $9.8 billion, and are down 11.9% year-over-year. This does not include ecommerce sales of department store brands, such as Macy’s – the tenth largest ecommerce site in the US, according to eMarketer – which are included in the ecommerce category.

Sales at department stores had been boosted briefly by liquidation sales from store closings and bankruptcies. But they appear to be winding down. Sales are now down 50% from their peak in 2001, having gotten crushed by ecommerce. Department stores have outlived their usefulness. Americans have moved on, abandoning department stores to zombiehood, and mall landlords that still haven’t figured this out will do so over the next few years:

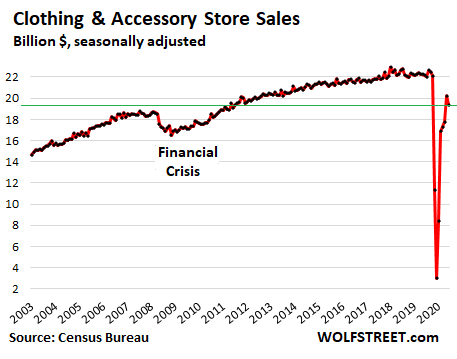

Sales at clothing and accessory stores fell 4.2% in October from September, to $19.4 billion, down 12.6% year-over-year. Even before the Pandemic, sales wandered off to the internet, with Americans figuring out how easy it is to buy clothes online – ah, yes, free returns, just like at the store, but unlike at the store, there is an unlimited selection of brands, styles, sizes, and colors online. Clothing store sales were stagnant for two years before the Pandemic, even as online clothing sales surged. The Pandemic sped up that process. Sales are now back where they’d first been in 2011 and just barely above where they’d been in 2007:

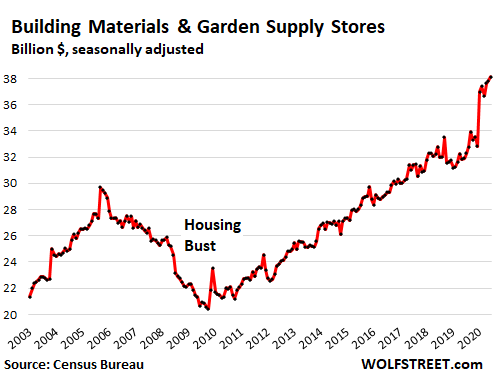

Sales at building materials, garden supply and equipment stores rose 0.9% in October from September, to a new record of $38.1 billion, up 19.5% year-over-year. Home Depot and other big-box stores are included, as are neighborhood hardware stores, garden supply stores, etc. The Pandemic performed miracles for them, with people improving and expanding their homes, decks, and back yards, and planting things, and growing herbs and vegetables and what not, now that they’d be spending a lot more time there, working and vacationing:

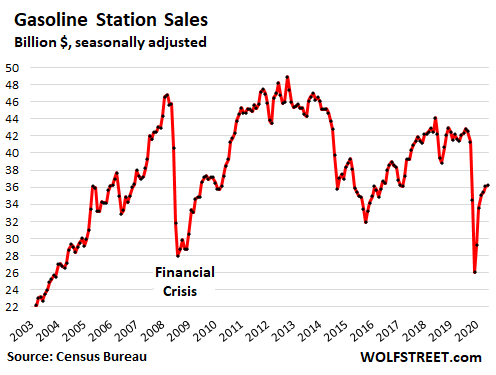

Sales at gas stations edged up 0.4% in October from September, but were still down 14% from a year ago. This includes snacks, drinks, motor oil, and other stuff people buy at gas stations, and where gas stations make much of their money. Sales are impacted by the highly volatile prices of gasoline. The average price of gasoline in October was down 21% year-over-year, according to EIA data:

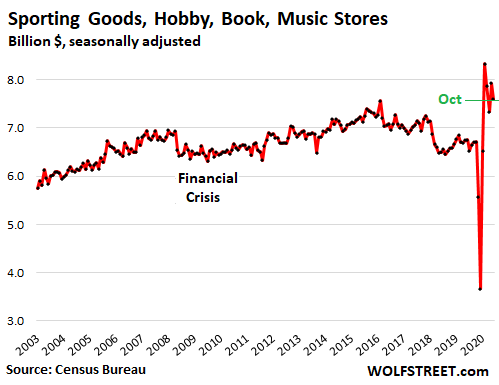

Sales at sporting goods, hobby, book and music stores fell 4.2% in October from September, to $7.6 billion, but are up 12.4% year-over-year. Gyms have been anointed – along with bars and restaurants – as mass-spreader venues. And folks work out at home. The business of Zoom exercise classes, Zoom coaching, and YouTube exercise videos is booming, bicycles are hot, and someone has got to sell the requisite equipment and doodads. This does not include what is sold online, only what is sold at brick-and-mortar stores:

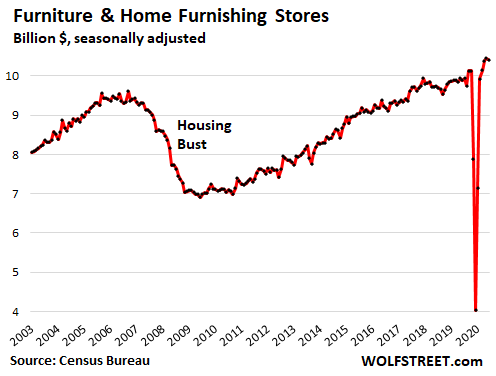

Sales at furniture and home furnishing stores edged down 0.4% in October from the record in September, to $10.4 billion, up 5.2% from a year ago. This merchandise has long been sold in large quantities online, by the online sites of brick-and-mortar operations, by manufacturers directly, by everyone and their dog, including by relative online-only newcomers such as Wayfair, whose sales in the third quarter skyrocketed 66% year-over-year to $3.8 billion. But brick-and-mortar sales in October were up only 8% from the range in 2007. Americans are buying a lot of this stuff, but not at brick-and-mortar stores:

For mall landlords, even the best ones, after years of brick-and-mortar meltdown, there comes the Pandemic. Desperate measures are now required. Read... Why Simon Property Group & Brookfield Property, #1 & #2 Mall Landlords, Bought J.C. Penney and Other Collapsed Retailers out of Bankruptcy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am keeping my chiropractor busy with my whiplash from all the charts over the past few months !

On line or not, this is a train heading for and picking up speed toward a major canyon and the engineer doesn’t realize the bridge it out !!! Most people have no idea of this, except of course many of the fine folks from this site !!!

Driving to that chiropractor after hurting one’s back loading up the new pickup with stacks of toilet paper. As a truck (oldie but goody Ford) driving deplorable, I find it amazing that both these items are seen as emergency requirements. It’s the 21st century version of a beleagured population following Horace Greely’s ‘Go west, young man’ in a modern Conestoga wagon. On the other hand, it’s these truck sales that keep the South and industrial Midwest hanging on.

I find it curious that both the corporate insiders AND the Smart Money has been not buying the “cash rich consumer” hype from mid September to today, it has been mostly retail and small speculators throwing money into the market casino. Also find it curious that PFE stock went up 15% on vaccine news and is now back down 15% to the pre-vaccine pricing. And as far as online sales, AMZN just started an online pharmacy today, thus CVS get crushed 9% instantly, yet I do not believe AMZN will take over everything immediately, and if they do, I’m not sure the govts of the world will be fine with a $5 trillion dollar corporate empire taking over the world (and media). At this pace, Bezos will be a trillionaire in less than 10 years. At that point, he can then buy his own country, perhaps a planet or a couple of moons? The universe is his playground, and the rest of us are just visiting…HA

Just today the news announced Amazon is starting its own pharmaceutical company thereby bypassing the need for brick and mortar drug stores.

This dovetails neatly with what you’re saying here. Bezos the trillionaire indeed.

I could imagine, especially with driverless delivery trucks, that the hospitals themselves would be the pharmacy. Would make alot of sense. With pharmacy stuff, there always has to be a local supplier. It’s not exactly the kind of thing that if it gets lost in mail or gets delayed, that you can always wait a few extra days.

I’m sure there are many reasons that pharmacies don’t currently deliver. While it could become a thing, I see no reason why Amazon would be well suited for it, it’s not an original idea that pharmacies should deliver. While, competition is good and hopefully will lower prices, once (if) the floodgates open, I see no reason why Amazon will win. Walgreens and the like and possibly the hospitals themselves could all start delivering and a physical location that has a local supply needs to be mandatory. There would also have to be better higher paid drivers than Amazon’s current drivers, due to seriousness of what’s being delivered. Pharmacy stuff needs an entirely seperate supply chain. Delivery itself will be more complicated, because, if pharmacy stuff was just left out in the open or even put in a locked box, without verifying who’s buying, it would be a recipe for a disaster.

I’m still waiting on those Amazon drones, that I don’t expect anytime soon. Like the drones, it could all be a publicity stunt. The drones definitely are a publicity stunt, maybe every once in a while, those drones would actually show up, but, I still want my stuff even if it’s raining all this week. And I don’t my pills getting stuck in a tree.

Prescriptions via mail has been a thing for many years now.

My healthcare provider has for years encouraged me (via lower co-pays and the like) to buy prescription drugs from its own online pharmacy; and which I have been doing. Haven’t been to a brick-and-mortar pharmacy in many years.

Yes, as does Kaiser Healthcare system. Have been buying and getting mail delivery for many years and purchasing from the on-line Kaiser pharma is at a discount versus going into their pharmacies to pick up. Original prescriptions are first picked up at their pharmacy locations then they can be ordered by mail at that discount.

I do remember many decades ago some local pharmacies had their own delivery services out in the “outer Mission” in SF.

Also heard about Amazon and on line prescriptions. Politicians have to set a fire under anti-trust regulatory agencies for this brazen monopoly plan by Bezos. It’s gotta start and end somewhere.

Amazon is the new Walmart (they had pharmacy too, and still sell more than Amazon).

But Bezos is anointed one (by the Federal Reserve unelected oligarchs). Elections don’t matter.

Is anyone other than me outraged by the fact that Bezos is worth $200 Billion at the same time that some of his Amazon employees qualify for government subsidies to survive.

Without their Amazon job, those employees would be 100% supported by the rest of us.

So, no, I am not outraged at Bezos for creating all those employment opportunities.

Concerned American,

Almost all retailers are like that, right now, Wal-Mart and target are paying an economic wage for the storefront employees at least, but, the bulk of remaining retailers pay minimum wage. This is for store front though, i’m less sure about the Wal-Mart warehouse employees.

In terms of who will be the biggest retailer, A Costco like store will probably reign supreme in the end with Wal-Mart as the number 2 and Amazon or a better replacement for Amazon as number 3. If only a few stores exist, along with grocery stores, it’s hard to say if any of them will pay an economic wage (I could imagine it going either way). It will probably depend on country at large.

Economic wage= paying higher wages than other companies paying same kind of employees (even if very different jobs). This results in better choices for people to hire, better productivity, and many other benefits. Some stores like Wal-Mart can come out ahead (money wise) doing this, most wouldn’t, they would just pay cheapest possible rate that would get employees.

so so many useless eaters for dimwits of DNC to take care of

maybe they can confiscate bezos new found wealth

Good luck getting most people here on board with a realistic perspective. They think they are just like, friends with, the next, etc. etc. Bezos. Enthusiastic participants to their own demise. Good times and an endless supply of winning!

It’s not Bezos, Capitalism is the problem. Parasites thrive until eliminated by the host.

Concerned American- Yes, it is very concerning, outright alarming really. Especially since this past election proved that 76 million people don’t

think that laws, rules, or ethics apply to them. They actually WANT this! Just read the Washington Post, the one also owned by Bezos, they hype failed these failed liberal policies everyday.

Amazon has a big operation in india (1.3 billion people ) delivering to 19100 zipcode groceries , fresh food from restaurents & all the usual mechandise. (not profitable due to heavy discounting to lure people online )

In India online pharmacy has taken off in a big way (20% discount on MRP, free delivery & cash on delivery ) . you have to upload doctor’s prescription (sch-H drugs) They have a batalion of doctors who call you & create a prescription for record if not sure what you uploaded.) Medicines are light weight & sent via courier. Amazon has seen the operation of online pharmacy leaders in India like 1mg dot com / Pharmeasy etc. I buy my all my regular vitamins , prescription medicines online getting some extra discount for pre paying via paypal or amaonpay, debit card (apart from 15-20% discount from retailers ) works cheaper than going to the pharmacy opp to my door. Amazon can easily replicate online pharmacy pan usa.

Maybe, but, America has a prescription pill problem and an drrug adiict problem. This combined with prevalent opportuniist crime like stealiing packages off porches and things of that nature, make the situation potentially very different. Right now, anything like prescriiption pill delivery is very rare, but, if it became common that would cause issues, locked boxes and things of that nature would be a necessity. But, there will still be a lot of problems. Already, in my city this year, I’ve heard package theft has skyrocketed, that’s before prescription delivery.

There are no freezers to distribute Pfizer vaccine on large scale. Maybe for the 1%.

That is a major issue. Sadly, it will not help those now needing care.

As I predicted way back in the first part of this year, our hospitals are getting overwhelmed. The doctors and nurses whom I spoke to are exhausted and mistakes will happen when your doctors or nurses have only slept for an inadequate number of hours for weeks.

This is what I was told was happening earlier this year in Northern Italy. I am just surprised that it took this long, with the initial war on masks, minimization of the severity of this pandemic, and the exponential spreading rate of this virus.

I pray that this flu season will not be severe. I tried to get vaccinated at Costco and they told me that they are sold out probably for the year.

At least that is smart of the early birds who got vaccinated. We cannot handle dual infections of both in many counties.

yah, who was brilliant engineer to think that one up at pfizer

sub-zero only folks

once again – we can’t fix stupid(must have been pfizer PhD) were they pile it HIGH AND DEEP

I can buy dry ice at my local supermarket.

Dry ice sublimates at −109.3 °F (−78.5 °C ).

Why can’t some smart guy figure out how the vaccines can be stored in the freezer with the dry ice?

Mr Yort…like many people in the world today. Everyone seems to be overlooking the Future Fact that MULTI-National Corporations will become the Governments of the World or others will simply follow in the footsteps of China…becoming State Corporations..! Adam Smith~Karl Marx~Et al must be Apoplectic in the ‘Great beyond’ lolol aloha amigos

When has it ever been different?

East India Company

Hudsons Bay Company

Northwest Company

Dutch East India Company

United Fruit…..mining…. and on and on

Subjugation of all colonial occupied lands for multi nationals and their connected minions, both Royals and Pols. Nothing has changed and never will.

You have to adjust PFE price for its spinoff of VTRS, which started trading this week. Also you have to adjust for shareholder return of investment related to PFE’s transaction. Your confusion is caused by your ignorance of the facts.

Isn’t ignorance of the facts always the main cause of confusion r pig?

While it is impossible to leave out other factors, ignorance in all its many many forms, intentional or because of ”infrastructure challenges, especially communication facilities” is always at least the foundational force of confusion and the violence following many/most of the times.

This is not to eliminate or degrade the power and efficiency of intentional implementation of deliberate ignorance of any and all populations done to enhance, or even start, control of populations, as has been demonstrated many times in the last couple of centuries for political and economic advantage.

I suspect if Congress cannot agree on a stimulus, consumption will fall off a cliff asap and the market with it.

Wolf – can you opine on what would happen if Congress does not grant Powell’s wish to extend much of the Fed alphabet soup of programs after Dec 31? I assume more cliff-falling would ensure?

Given the impasse we will likely face regarding agreement to fund the government by Dec 11 and wide gap between the parties on stimulus, I think the risks here are not being appreciated by the market at all.

Not if Joe has anything to do with it.

Besides, he can always take executive action, start by cancelling student loans as some have suggested.

I wonder if it is too late for me to take a huge student loan to financing a decadent life style for four years, and then have it forgiven.

That bandied step is likely to be much, much, much more divisive than some of the Dems appear to realize (AOC)…given that those who have paid down dramatic loan balances already (at great sacrifice) will be terminally alienated from the G and the USD if that discriminatory treatment ever goes into effect.

And the Right already knows the details of the bullsh*t game that has been played in this area…with immediate R responses countering that any loan forgiveness should be funded by claw backs from the tax exempt, endowment enriched, placement cooking colleges and universities (a key Dem constituency for G funding and related political donation kickbacks).

Would too much Dem/College dirty laundry be hauled out and microscoped for Dem leadership really want to start down this road?

Don’t know why everyone thinks non-recipients of loan forgiveness will necessarily stew in resentment (unless of course this is fomented). After all, farmers got some massive subsidies recently, ostensibly as recompense for increased tariffs, and I don’t see non-farmers yelling about it.

Don’t be a greedy geezer.

If you don’t care that Bezos is fantastically overpaid….then why would you care if the students are off the hook ?

MarMar,

There are a *lot* more people with personal experience of having struggled to pay off loans over many years (and whose tax dollars/gutted interest rates would pay for favored generation) than there are farmers…who are admittedly recipients of long-standing, obscenely high subsidies.

Also, people have caught on to the scam…it is really the colleges (not the vastly underemployed students) who are the primary beneficiaries of the massively dysfunctional college loan system.

Loan forgiveness would not fix this dysfunction, it would perpetuate it.

That is why conservatives immediately invoked huge financial clawbacks from the colleges, in the context of any loan forgiveness.

But my guess is that the colleges really, really don’t want high profile investigations into their tax subsidized financial operations and frequently challenged placement stats.

So Dem leadership (who knows exactly where the biggest bundles of Dem money comes from) will let loan forgiveness wither on the vine.

(They have bigger fish to fry…like trying to quietly get high dollar property tax deductions back for CA and NY, which were already on the razor’s edge financially and also have to deal with public pension nightmares).

I paid off $50,000 in student loans, after 7 years of saving and scrimping, just last year. I readily support some level of student loan forgiveness. People complaining about it not being fair and “I PAiD oFF My StuDENT LoANS! SO CaN YOU!” are missing the point. You cant saddle an entire generation or two with obscene student loans and then complain when they dont have the purchasing power to keep housing and other sectors afloat. Now, Im not endorsing a blanket, wipe it all out, approach, but I think there is some middle ground where lower earning grads get some relief (maybe in the neighborhood of 25K up to a certain income level). It would be a more beneficial stimulus than anything else the federal government could do.

Steve-O,

“Median” student loan is about $17,500 (Moody’s data). Meaning half of the student loans are over $17,500 and half are less. About 10% of student loans are HUGE, and they skew the “average” student loan balance (about $35,000).

People that have $100k in student loans usually have graduate degrees from expensive schools, such as med school graduates. With student loan forgiveness, the kid who couldn’t afford to go to college and is now working in construction (good job, makes decent money) is going to help pay off, with his taxes, that privileged high-income doctor’s degrees.

Yes, because the other side of the student loan is an asset that is owned by the taxpayer, and forgiveness means a loss to the taxpayer that the taxpayer has to make up.

On the other hand, heard on NPR that colleges are in an unprecedented state of financial crisis. With many seeking loans and relief from… Congress. I think that’s almost verbatim.

So, they need more suc… I mean students to enroll, and in the name of diversity, we need a lot more international students… again from NPR. It’s almost laughable, cause what they really want is foreign students who pay full price.

C19 has certainly had an impact on this money train.

Also there’s “Public Service Loan Forgiveness” which seems to cancel remaining balance for borrowers who work ten years in a gov’t or nonprofit job. Those employing organizations, as well as their employees, might object to giving people loan relief without indentured servitude.

@taxpayer

That actually seem like a decent idea. I know someone who finished college in the mid 90s, looked at the cost of his loans and joined the army for four years to get that debt discharged.

Given today’s environment, public service in the form of being a school teacher for four or five years or something similar seem like a workable idea. Especially if you want debts forgiven. The graduate would contribute to society as a whole. And taxpayer gets some advantage of that college education.

After all, we as taxpayers shouldn’t have to just foot the bill for someone else’s choices and not receive some form of compensation. That can take the form of meaningful service or cash if the former is undesirable. Think that would be part of the education for there to be a responsible adult.

And they didn’t even receive an education in the classical sense. At most they got some job training that they paid for or went into debt to get a living wage.

Higher education (HE) is a scam cartel on the order of health care industry/big pharma cartel.

They have a monopoly in their respective economic areas and thus get to dictate accepted standards of qualifications (diplomas and medical care).

It has been said elsewhere that huge growth in HE employment has been disproportionately in administrative ranks (diversity admins etc.)— not front line teaching staff (faculty).

Also, colleges and universities have blown huge sums building first class dormitories, amenities, and sports venues to attract more students.

Also, many of degree programs offered provide very little support to economy in terms of useful and productive career training. After all, what do you do with a gender studies major degree?

Finally, HE today is less about learning facts about how world works and how to develop critical thinking skills and more about indoctrination in leftist social causes.

@ Heinz,

I can think of a few things to do with a gender studies degree. But I can’t mention any of them here, or I’d be considered a sexist, misogynistic, dinosaur. And yeah, if I did gender studies, it would lean heavily to one gender. In fact, it would be all to one side.

Oh nuts, did I just say that out loud?

Student loans will not be cancelled because the interest accrued on them is massive and is used to help pay the interest due on the national debt. Congress knows that, and anyone campaigning on that promise is either ignorant or a liar.

The current narrative that the government or Fed must do something or the economy is going to fall apart shows how addicted we are to the debt cycle. I don’t think we are doing to make it through this decade without the system radically changing.

Current policy has given us 20% zombie companies and probably 30% of citizens depending on government for their existence.

An asset price is not wealth unless you liquidate it today. Real wealth is the ability for the asset to produce income. Both would crater without more crack cocaine. We will take it til we drop over dead I guess.

Tell the whole truth…100% of the population is at least partially dependent upon government expensing to stay in the game. None of this nonsense flies without some form of injections from the public pool, either directly or by a sideshow. These are the people who can’t hire a guy with a shovel and bucket to fill a pothole, but they’ll let out a contract for heavy equipment operations to tear up 10 miles of good road in order to make the problem go away after two years work only to reappear in a month’s time. And it all finances someone’s toy purchases or dental whitening procedures far off the mark. Meanwhile all those Joe commuters are forking out repairs to their vehicles caused by hitting the potholes. This whole thing is nuts.

The next big stimulus will be funded by corporate America…

I doubt that. I suspect funded by more debt.

Walmart bought 1/2B of its own stock back Q3 after buying none in Q2. These guys have money to burn. Former T Sec Sumers says we can raise 7T collecting from rich tax cheats (many of whom volunteered to give the money back). The Fed frontloaded a corporate economic recovery with several T, a private stimulus package would not surprise anyone. Obvious who has the money and what needs to be done and I am certain Sanders is shaking his head.

Look at a 10 year bond chart, look at a WTI crude chart.

The economy has been in the ICU with a morphine drip since 2018. If not for an intermittent bolus whenever the Fed panics the patient would be begging to die.

The economy is a dissipative structure, it isn’t burning enough energy (eating food) to stay alive….but that morphine! ….aaaaaaahhhhh………

Wolf,

The immediate pandemic impact is wild and all, but…

Interesting how non-store retailers (one of the fastest percentage growers) had really plateaued in the 6 or 7 months immediately before Pandemic March.

After yrs of relentless growth.

NSR sales is probably one of the fastest, easiest, and most reliable metrics for the G to be aware of.

As I’ve mentioned before I think there may be a lot of latent info in the year to year historical percentage changes in each sector (which tend to get obscured due to small chart size and variant y-axis scaling).

Not pandemic related, but much more telling about what has been going on in the US since 2000 or 2003.

The Fed’s FRED tool allows for quick and easy changes in chart format, including immediate shifts to yr over yr percentage changes vs annual dollar size.

For these purposes, I would suggest really only focusing on the 4 or 5 sectors making up the significant bulk of all retail sales (auto alone looks to be 20%+).

Also interesting to compare annual retail sales percentage growth to annual GDP percent growth to annual S&P percent growth.

The last one is the real outlier, frequently being 2x to 4x higher than the first two…hard to do at the macro level of aggregation, yr after yr.

Intl sales growth and hopped up corporate leveraging might explain it…or it might not.

Cas127,

Because these non-store retailers shot up so much, the chart doesn’t really show the detail. But the actual data shows it: the initial spike went through May, and then in June, there was a dip, and from the dip, it zigzagged higher. So in total, over the five months since that top of the spike in May, non-store sales have risen 3.2%.

Wolf,

Yeah…but I’m focused on the interesting apparent plateauing of NSR sales in the 6 or 7 months *prior to* Covid March.

(Dots tiny but look pretty flat to me).

What I am intimating (unsuccessfully) is that the G may have had pretty good indications (due to the accuracy and quick reporting inherent in the nature of NSR sales) that retail spending/US economy was stalling out (even at ZIRP) pre Covid.

Info they would have had in hand when formulating nature of Covid financial response.

I wonder if Sporting Goods includes gun sales, not something that you can (legally) buy online.

You can legally make the purchase online, but you have to have the armaments shipped to a Federally licensed dealer in your home town for pick-up. About a $35 to $50 fee to do so (shipping extra), and you complete the required State registration process at the local dealer.

I do think gun sales are included in the Sporting Goods category, but for brick and mortar stores only. Local stores are so competitive with the internet now in this subcategory, that outright purchase near home can beat or match some online prices.

Gun sales are off the charts. I was somewhat surprised to see last week that the largest internet gun dealer is completely sold out of rifles in popular hunting and warfare calibers. I’ve never seen that before.

My husband tried to buy ammunition recently, and the shelves are bare. My first thought was that manufacturing was disrupted by the pandemic, but then I began to wonder if people were buying up guns and ammo out of fear.

MiTurn,

OK, there is a bit of misconception here. These sales are not by product, but by type of retailer. So when Walmart sells guns, it goes into “sales at general merchandise stores.” If an online seller sells guns, it goes into ecommerce. If a brick-and-mortar sporting goods store sells guns, it goes into “sales at sporting goods, hobby, book and music stores.”

THAT’s what I was wondering, Wolf. Thanks for the clarification!

Even in Canada, with our ban/restrictions on handguns and pretend assault rifles, it is possible to buy a gun online. They ship to Canada Post and you show the clerk your gun permit called a PAL, (personal aquisition license…renewable every 5 years through the RCMP, nationwide). It is picture ID, requires a criminal record check including domestic complaints, and if you have a gun without one you lose said gun and get fined. But, I can pick up an online purchased gun at the post office.

No handguns, though. :-)

I can’t believe Powell wants another Congressionally served up alphabet soup of printed money bail-out facilities, but he sees the Sugar High #2 gridlock coming to Washington with a still contested Election that will delay any moola juice from The Swamp. Many of the Sugar High #1 facilities were more jawboning of POTENTIAL FED intervention in specific markets, But received drop in the bucket funding in the end. The Fed’s Bully Pulpit may be missed a leg or two to stand on on this round!!!

Today’s retail sales report was overall disappointing, and it shows that once the free money well runs dry, so does the sharp recovery in sales going into 2021. Many analysts are now forecasting a flat to down 2020 Holiday season, and for traditional retail, if it still exists, this upcoming time period usually represented almost 50% of annual sales.

Not a time to spend, but a time to prepare. Second round of job cuts already being implemented, and Lockdown Two, being proposed by many in power will be the final nail in the U.S. Economy Coffin.

No doubt masking is usefull. Not so sure social distancing can work unless everyone wears a belt that sets off a screaming proximity alert at 6 feet and electroshocks the wearers at 3 feet….dog collar duets. Now the first lockdowns made sense to buy time for retrofitting businesses for Safety First policy in a dangerous environment…most still seem to waste space with those piles of low demand crap that just sit around and thus exacerbate the whole problem. But lockdowns are like carpet bombing…real good to terrorize a population and in turn weaken the command structure. Covid though is like independent cells formed after each transmission and this will not be useful…did The Brits try to carpet bomb the IRA..No! Precision attacks are called for as they are more effective. But after all these months to prepare, squat from our headless leaders. Since when did the public tell these people that they are adjuncts of Twitter, a private for profit business? Where the hell is public information disseminated over broad channels under public control. If they are doing tracking, why are there no warnings of hotspots to avoid. Are they total idiots or just treating us as such? Is this pure political BS that is designed to keep us in the dark? If they continue down this road to failure, we may need the military to take control and implement a forced regimen of science based biological warfare against this threat, and this crazy economy can be damned if it gets in the way.But don’t worry, “vaccine coming to end the war and we’ll all be home for Christmas”…just like they declare every time.

Whoa! Did you hear there are two virus vaccines almost ready, one of which was submitted today for FDA approval? I think that means economic comps are going to turn around and look good for a while.

That said, stocks and bonds are so overpriced, financial instabilities could surface any minute to derail the whole thing. The Fed has built a skyscraper on a bed of sand. Once it starts leaning……

Just arrived home from BJs (cosco/Sam’s club) in NYC.

I needed an item that didnt require a trip to big box store but I like to get a pulse on the patient.

1 week before turkey day and it’s dead!

Now when I say dead understand dead for NYC meaning still has customers just no lines and minimal foot traffic. Which this time of year and this hour (afterwork) would be lines to the back of the building. Now I know they have online shopping and pick up delivery etc. Forget that for one moment.

Key observations:

1. Clothing is super cheap. If I was in resale bus I would scoop it all up, and it’s been cheap since June so I originally thought pricing had to do with clearing out old inventory that didnt move. But now winter gear is here? And no one looking at clothes and it’s cheap.

2. Xmas decor. Usually has multiple aisles dedicated. Nope less than one aisle.

3. Toys same thing very little merch for sale. Of course they have toys. But not what you expect to see.

4. President Obama’s book an entire skit dedicated to his book.

5. Toilet paper. Here we go again – it’s all out.

6. Paper towels yup you guessed – all sold out.

7. Not as many turkeys plus its free with a coupon.

8. When it came time to leave no line for self check out no line for cashiers which have been replaced with 20 self serve machines. In addition I put some items back, the doomy gloom vibes made me say I dont need this I dont need that.

9. Music. The music was replaced with social distancing and mask requirements which is such a nuisance.

10. Sanitizor Pump stations – I seen two people refilling small bottles with store bottle for consumers to use. Not a bad idea first I seen that one.

11. UPS worker behind me, I said hey what you doing here no packages to deliver. He said they are cutting hours too much help… Hmmm

11. 5000sf Discount store next to bjs – dead. A store that needs to move massive volume.

12. I’ll leave off with the best for last.

The toys r us and K Mart have both been joined together and replaced with a Amazon fulfillment center.

mrwkup,

Here in TPA bay area, it looks like all the folks missing from your NYC BJs, etc., have moved here! NY and NJ accents everywhere!

Streets busy again, pretty much all day; WM and such full of shoppers, at least, if not customers..

Lines at check outs, most days even earlier than usual in stores.

Cashier friend at grocery says they are slammed again, per usually later ”in season”…

Don’t go to my usual ‘watering places’ since January due to very high risk ,,, so don’t know what’s happening for them, but fave pizza place delivery now quite a bit longer wait…

And, for all the folks in the intermountain west lamenting the arrival of the CA,OR,WA big city crowds,,, Get Used to It… been happening in FL for eva.

Mr Wake Up..here’s a call for you. If you truly dont pay attention to the verbiage from the Men behind the ‘mystic’ Economic Curtains and the ‘Great Oz stock market smoke screens’ This country, as well as most other countries,will be in world of hurt come 2021…aloha amigos

It looks like year to date total sales are still significantly lower than last year comparable period. Maybe a lot of the recent spending is just making up for deferred purchases. Stimulus and shifts in spending drive some increase, but another short term push is from

adaptation to changed circumstances (outfitting for home and isolation activities). Several reasons why this could easily roll over …

nevnej,

Yes, still down, but just a smidge:

first 10 months 2019 total sales: $5,163 billion

first 10 months 2020 total sales: $5,156 billion

Down by less than 1%.

Don’t worry.

1. Biden is considering Janet Yellen as Treasury Secretary.

2. A Gold standard advocate has just been rejected as a new Fed board member.

Put 1 and 2 together: money will be printed like crazy and people will be fatigued from buying things.

Dow 100k, S&P10K, Nasdaq 30K, Nikkei 50K, all coming down the pipeline.

“considering Janet Yellen as Treasury Secretary.”

In a way this is hilarious, since it is the *Fed* that is the indispensable part of the fiat fraud operation that keeps DC 2020 out of the tumbrels, not the taxers at Treasury (DC knows what would happen if explicit new broad taxes were imposed…sub rosa inflationary confiscation has been DC’s modus operandi for a while now).

Yellen being floated no doubt suggests that some f*ckery pokery is afoot (circle the wagons of Establishment “reliables”) but it is harder to see how that relates to *Treasury* (coordinated intl depreciations? secret debt to China deal? Petrodollar recalibration? Dematerialization of USD to facilitate further G controlled inflation?).

Of course Biden (et al) doesn’t want a stable value, real money advocate anywhere near DC.

That would completely bugger the only escape plan DC has ever really had.

“(coordinated intl depreciations? secret debt to China deal? Petrodollar recalibration? Dematerialization of USD to facilitate further G controlled inflation?).”

Forgot Federal “wealth tax”.

If you are going to confiscate savings, who better to front the scheme than Granny.

Really, a wealth tax is one of the very few options of sufficient scale/immediacy to unscrew DC’s finances.

Wealth taxes are not based on savings. They are based on income. Granny will be fine.

Fat,

By definition, wealth taxes are based on accumulated savings.

Income taxes are based on income.

And Granny the Proposed Grabber is Yellen, who is “reliable” in the DC sense and would be a benign, matronly face for yet another malign DC policy masquerading as “for the people”.

(Along the lines of those old AARP ads using children to pimp for doomed, unsustainable SS entitlements that Boomers promised themselves, to be paid for by their children).

Two things on Yellen as TSec. While Fed chief she asked for the authority to put stocks on the Fed Reserve balance sheet. Obama hired her, and oh, Trump fired her.

“While Fed chief she asked for the authority to put stocks on the Fed Reserve balance sheet.”

The ne plus ultra of DC fiscal self fellation.

1) Fed prints USD backed by nothing

2) USD interest rates plunge due to soaring money supply

3) Stocks soar because fixed income alternatives have been destroyed

4) Fed “balances” balance sheet (sh*t?) using self-fellated stocks.

5) Rinse/repeat

6) Have Twitter Rasputin censor anyone who exposes the scam.

There is already a supply constraint in equities, due to buybacks and low rates to borrow. Fed takes stock out of circulation that dynamic goes melt up. Companies then begin issueing stock (with new shareholder bill of rights?) Improving growth prospects (post covid recession) counters the damage to stock valuations, never a static number, building a bridge to higher multiples. The rule on buying high PE stocks in their sector is they deserve the multiple, likewise the market. Real question can the consumer carry the market through transition? Rising interest rates are consistent with improving economic growth (substandard last ten years) will tamp down the stock mania (also gold). Forex dollar melts up while new Balkans war and Russia’s second and final collapse and covid fear grips EU. Real dollar drops you can argue. 46 governs with authority, wall of worry for the Bulls.

Bingo Ambrose! I have a huge office “wall puzzle” of data and articles in my attempt to solve the world’s biggest puzzle, where does the world monetary authority go from here?????? In the center of the wall is a Yellen article dated Sept 29, 2016 titled “Yellen says Fed purchases of stocks, corporate bonds could help in a downturn”. I have a few ideas what could trigger a future Yellen fed to buy stocks, one being this second covid surge that supresses retail purchases no matter now much stimulus is thrown at voters (savings glut, oh no!). I think the Sp500 2750 to 2850 range can not be broken else we could see 1800 to 1500 range due to margin and liquidity processes, so I suspect the Yellen Fed would go all in (buy stocks) if we breach a few hundred points below 3000. I have automatic buys set to double purchase volume every 50 points from 3000 to 1500 on SPY etf. I was not wise enough to predict they would stop the collapse at 2200 in March. I have left the automated buys, yet with the Fed “put” set around 3,000, it will take something monumental to topple unlimited Fed printing. I actually hope my automated buys never get filled…yet I think the Fed buying stocks ends in tears for the bottom 90% who own only 12% of the markets (note the top 1% own slightly over 50%). At some point, the top 10% need to consider the bottom 90% economically, socially, moralistically, etc. Yellen buying stocks in the false name of “job creation” is financial blasphemy…

@Mr Yort..the Top 10% gets there by IGNORING anything that helps the other 90%…unless of course they Can Profit from it,then of course they will…lolol aloha

MB:

“….and people will be fatigued from buying things.”

I’ve been hearing that refrain for about 4 decades now and I always agree but it never changes. Consumers are supposedly spending their last dollar, day after day, decade after decade. It never makes sense!!

It’s called a job, and then shriveling up or living very modestly in old age for those who didn’t save. Even with housing costs taking up a huge chunk of most people’s budget, there’s usually at least a few hundred a month (that they probably should save but don’t) for them to blow on things. As long as wages mostly track inflation, the consumption won’t end.

I think I wrote that poorly. What I meant was, our friends in DC would give out so much money that people would get physically tired from buying, unpacking, and throwing things away.

Sort of like the infamous digging and then filling in of holes in order to achieve fabled Keynesian full employment/utilization.

Actually, comedy aside, evidence does point towards a demented Keynesian plot for “full employment” via endless gvt facilitated debt.

Now, how DC could fail to recognize its “full employment” failure for decades, as borrowed US funds perpetually leak/flood overseas is another matter.

The economy is obviously slowing due to the end of stimulus. The economy will soon go into decline without further action by Congress which is unlikely. So what is an investor to do? It does not seem Congress will act to increase stimulus with the Republicans supporting 45s legal actions to subvert the election results. But according to Powell the Fed Put will come to the rescue in the absence of Congressional action. So as Dalio says avoid cash and bonds. Stocks rule. The S&P index funds are the lowest risk bet.

“The S&P index funds are the lowest risk bet.”

At 36 PE ratio (long term avg 15).

And Fed Debt to GDP above 100%.

During a pandemic.

Yep.

This will end well.

Fed funds at .1%. 10 year bond at .87%. CPI at 1.2% in October. Fed funds negative real interest rate -1.1%. 10 year bond negative interest rate -.33%. Lowest in recorded history. Get it?

yes, thank you rv:

reality is that a lot of us ”old timers” on Wolf Street do actually ;;get it;; as we have been through at least one, or, more likely and true in my case, many of these kinds of crashes/bear mkts, etc..

mine have mostly been in RE mkts around USA over the last 50-60 years, including when parents were over extended up to the crash of 56-57…I learned a lot of new words that time, when dad had no work for six months.

Anyway, Thanks for the summary!

At such high PE ratios (low earnings yield), there is a massive ‘duration’ risk in the market, which makes stocks much more sensitive to interest rates than they were before.

Everybody now thinks that bond yields will stay low forever, but that is not at all guaranteed. For example, when central banks start moving to direct funding of governments with central bank money, this could change everything in unexpected ways. It’s never been done before in modern times, so nobody knows. It could completely dislodge inflation expectations, leading to much higher yields, even before actual inflation takes place.

Even if this leads to, say, 4% inflation, this would be a massive break of trend that could easily lead to 4% yields to match that. The stocks are toast. Who says that the Fed can counter that? Buying bonds = printing more money = even more inflation. It’s oil on the fire.

Once the old paradigm dies, so does the stocks bubble.

I’m not claiming to know what will happen. I just want to say that we need to be humble about what we can predict and that things can work out very different than what is the consensus now. Who had predicted the current crazy economy a few years ago?

@Rickv

“…Republicans … subvert the election results…”

“…The S&P index funds are the lowest risk bet”

You’re joking, right?

Are these numbers nominal or real, because I am seeing inflation scream in my part of the country, from housing to food to pharmacies.

Sure, I don’t have a commute anymore and don’t spend money on going out, but the staples I buy are going through the roof

Nominal. Yes, some prices are soaring. I discussed this in some detail in the context of used vehicles. A huge price spike. There are other price spikes in some categories.

When I see the ‘Weekly Wholesale Auction Price Index Chart’ you publish, I get a little bit of smug satisfaction I admit as I bought my used car, from a Penske dealership, two weeks after the chart’s bottom @ 85.

Inventory of used performance coupes at that dealership, as seen online, is pretty low these days. The Porsche dealership west of Minneapolis has a good selection, but of course, they run a few bucks more expensive.

A lot of people here must not have access to an Audi store. The two stores in my town are located next to a Walmart and do a thriving business. With good reason, their food prices have stayed low (sometimes half of other stores) and their store brands are great. A trip to Audi and Dollar Tree provides nearly everything I need, with little left needed at Walmart.

I didn’t know Audi sold food; I thought they only sold motor vehicles. ?

2020’s 0.3% is 2010’s 3%, unless you have started thinking inderivatives now?

I guess large parts of the employment levels in the USA,(and here in the UK) will depend on the simple maths of how many people does it take in bricks and mortar to sell a tin of beans, compared to the internet. Come to that, do the people selling the beans, on the internet, even have to be in the USA…or come to that(2), with the internet, is it just a computer programme and the only person employed is the delivery guy…and so on

Shipping a can of beans is not cheap.

PUA and PEUC are both expiring, 39 weeks from March 1 is Dec 1 and some of the claims go back into Feb

Suppose I’m an alien from another planet and I have never visited earth, but I have read many books about how democracy works…

Now I’m really puzzled! Millions of people in poverty, yet a few guys making billions…Hmmm….. How can this be? Because in any elections, Bezos only has one vote. Zuckerberg also has only one vote. Yet every single one of the hundreds of thousands of homeless also have one vote each! So how can you earthlings end up in a situation like this?

Of course we know how corrupt the whole system is. But when wealth becomes so concentrated at just a few people, at some point they become very vulnerable, because they become such obvious easy targets for the angry crowd.

Now Bezos and Zuck can pay every politician $10 million to vote the ‘right’ way, and it wouldn’t be more than a rounding error on their bottom line. But at some point you have to fear a French Revolution or Russian Revolution style event.

It really surprises me that we don’t yet see class war anywhere in the western world. The paupers are too occupied with cancel culture and gender neutral toilets. It’s pure genius of the elites. Divide and conquer.

The problem is that when this goes on for too long, the inevitable swing into the other direction is likely to be not what we want either. 1789 France and 1917 Russia ended in pure horror.

Wall Streets 3rd largest concern in a recent poll, showing up for the first time ever, is civil unrest.

Ive wondered when TSHTF myself many times over the years I keep thinking its coming but it never seens to

I agree to some extent. I chose to drop out and live on savings. Lived five years on a total of $75,000 or $15,000 per year. It was five great years. A market system has a lot stuff at every price point.

I had comfortable dwelling with indoor plumbing, central heating and air, a nice car with air conditioning, a cell phone, access to healthy food. Making everyone the same isn’t the answer.

It’s highly doubtful that most people want to make everyone the exact same. But it’s becoming extremely rude to a greater number to have the new pharos with their treasure pyramids being built on top of squalor just to promote themselves as some sort of deity equivalents. Without a rising tide across the whole valley none of them will be safe from the flood of new tomb robbers. Smashing windows to take what you want becomes a lot easier when everyone else is joining in. Not a very healthy plan for maintaining a cohesive society.

I think you are badly overestimating how far 100% confiscation of Pharaohs wealth will go in a nation of 330 million (because you are badly overestimating the number of Pharaohs (many of whom achieved that status because they built some of the few things that actually work in this decaying economy…confiscation disembowels that entrepreneurial impulse)).

America’s decline lies much more at the feet of multi-decade DC policy pathologies that survive because the political class that profits from those pathologies kicks back a fraction of the loot in donations.

Old School

Excellent take. You do not have wealth envy. I responded earlier to Yu Shan’s comment RE what I find to be a bizarre obsession with so many people. Wealth Envy (WE) = Wasted Energy.

YuShan

I agree with you in principle, but “poverty” in America is a joke – $28K for a family of 4 or something like that? Soup and bread lines were real, EBT cards are a slight inconvenience and no shame attached to using them.

Wealth envy is a different subject altogether – and something I have never related to. Money can make you comfortable, yes, but not happy. I have never envied the uber-wealthy. Middle-classers who constantly foment about inequality vs focusing on their own blessings is a pitiful waste of love and emotional energy IMHO. Heck, a huge number of homeless don’t want any help even though free meals and lodging are available to them – they just want freedom.

I don’t suffer from wealth envy at all. I admire Bezos for building such a successful business and he deserves to make a shitload of money out of it.

However, there has to be a reasonable balance and I think we are past that point now. I believe society should be more than just a bunch of individuals maximising their profits whatever the cost to society as a whole.

There is also the problem of monopolistic power, which essentially turns a free market into pure ‘state’ control, where the monopolists become the new state. It then ceases to be a free market and democracy we lost already.

One key point I wanted to make is that the new overlords also have the most to lose when the mob inevitably takes over. Think guillotines and stuff. Not a good outcome for anybody. Therefore we should aim at a better balance to prevent such an outcome. However, I’m not optimistic.

Beardawg

Yeah….I see it ALL the time.

Bezos can make a trillion dollars a year and you, like many others, cheer him on.

But if we even mention a debt jubilee on student loans…oh boy do those protesting raise their voices in protest !

Point is…..be consistent !

Bezos made all those bucks through the unstinting ( and unrewarded ) efforts of his EMPLOYEES.

Student loan debt is there because CORPORATIONS made a degree MANDATORY as a condition of employment. And WE, as society withdrew aid and support to help our young become educated.

So take responsiblity ! Protest this nonsense !

OutBox,

“efforts of his EMPLOYEES.”

If Bezos brought so little, and the employees so much…why didn’t employees simply leave and form Amazon 2…which would be self evidently superior since they brought so much and Bezos so little?

Ditto for every unionized workplace, ever?

If the founders are so unjustifiably enriched, why doesn’t the laboring brotherhood of man set up shop next door and easily put those Pharonic founders out of business (commune style)?

CAS

Because the Bezos of the world anticipate this move….and rig the world in their favor.

Because Bezos can buy the politicians.

Because great wealth writes the rules to favor it and disadvantage those who would challenge it.

Because enormous wealth can move mountains of obstruction to foil opposition.

I’ve justified my position…how about you justify your Bezos worship ?

YuShan:

Oh yes! There has been “class warfare” going on…..the war on the class of organized labor with the vacuum left behind of all the millions of good middle class jobs that have been “exported” by the gazillionaire class! We will be paying the price for that for decades to come……until we reach a “world level class” wage for everyone…..the “rickshaw” economy!

With two Senate races pending, more gridlock on Capitol Hill. Congress is divided.

Still not intending to cut loss on your shorts? Its been 20% up since June.

Xi Ping,

You should ask me this question after the market surged 5% at the open, when I’m full of anguish and self doubt, and not after the market dropped for the second day in a row, when I’m full of false hope ?

Btw, my SPY short is down 12% as of the close today. So, not the end of the world just yet.

Wolf,

I fully sympathize…the weighting is the worst…

Index weighting that is.

For every justifiably slaughtered SP 500 sector, the Robinhood crowd just rotates into a sector so overvalued that even cream skimming insiders are embarrassed.

Marginal buyers setting market capitalizations and mkt cap weighting of indices has made a mockery of index diversification. And ZIRP backstops the insanity.

CAS127,

I agree, but it’s not just the Robinhooders. The “money managers” are just as bad, as they figure “Hey, I’ll pile into absurdly overpriced sectors with my clients’ money. Why not? If the bubble keeps getting bigger, then I’ve made my clients some gains, and if it collapses, well, then everyone’s else collapsed too so they won’t blame me.”

I truly think that’s what’s driving the market, and has been for months.

Wolf, forget all these charts, who cares what the Lumpen are doing. I want to know where this “power buying” is coming from? What are the figures on corporate jet rides and helicopter transport services? Where is SUPER high end housing doing the best? What do they want? These are people with money, the 1% aren’t bigger just fatter, and they are spending! You want to make it market these people. They know the money printing system will destroy any cash, so they buy at a premium.

Probably not related to PandemicMania or online sales:

==> equities on a P/S basis just hit its highest level on record at 2.7X.

Trading in the 100th percentile of its historical distribution over 40 years.

Almost all metrics are showing huge overvaluation.

And yet DC seems pathologically compelled to further gut interest rates (fixed income being the off ramp from equity overvaluation) every time any significant return to valuation sanity even begins (see Fall 18 tiny interest hikes, 20% index dropoffs, and rapid Fed retreat back to ZIRP).

This multi decade madness (made “necessary” by DC’s ruinous failure to police Chinese currency/trade manipulation and resultant US employment destruction) if unchecked must inevitably lead to negative interest rates.

If long term PEs were 15 at 5% short term interest rates and 36 PEs at 0% rates (forever) and 36 is the *floor* that the Fed will slaughter every USD saver on the planet to defend, then worse and worse NIRP and the resultant abandonment of the USD is the future.

Meanwhile hundreds of companies that received the PPP have gone bankrupt. But no worries, I am sure tons of people are setting up new companies now so that they would be eligible for the next round.

Try looking at percent change in:

Personal Consumption Expenditures/E-Commerce Retail Sales as a Percent of Total Sales

It’ll take more than online retail sales to save the recession

Past week or two some of the chain restaurants I go to for lunch have started hitting co-workers and myself with tons of offers. Mostly half-off offers. I assume they are trying to drive traffic, but not sure if there is a decrease due to people cutting back spending or because it has turned cold out.

I was just looking at Fed FRED and thinking about the cost of most stuff going up. Food bills are going higher and higher as an example, but the question I have is, what happens when buying online snacks becomes a total luxury? What happens when stimulus isn’t in bank accounts, but food prices continue climbing? The wealthy will laugh this off, but at some point, even the people at Costco, making $30/hr for looking at member cards are gonna feel the impacts of higher costs.

Employed full time: Median usual weekly real earnings: Wage and salary workers: 16 years and over, 1982-84 CPI Adjusted Dollars, Seasonally Adjusted (LES1252881600Q)

Real Median Household Income in the United States, 2019 CPI-U-RS Adjusted Dollars, Not Seasonally Adjusted (MEHOINUSA672N)

What role will consumption inflation play in this amazing recovery?