Despite the Fed’s proclamations, the dollar lost purchasing power at a good clip.

By Wolf Richter for WOLF STREET.

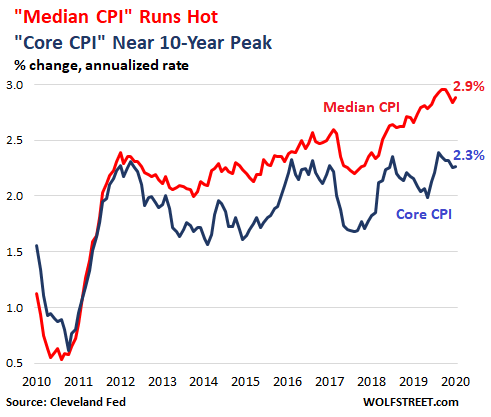

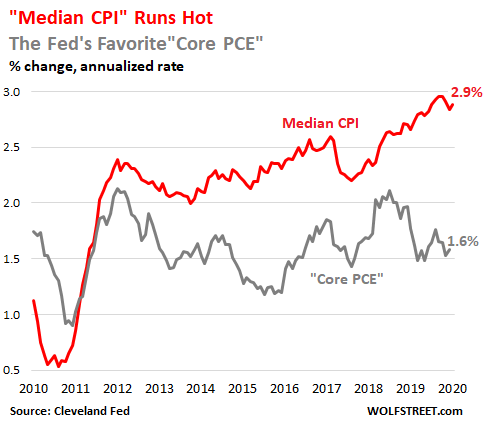

The inflation measure by the Cleveland Fed – the “Median CPI” – rose at 0.3% in January from December. This translates into an annualized rate of 3.7%. For the 12-month period, the Median CPI rose 2.9%. Since July last year, the index has ranged between 2.9% and 3.0%, the highest in the data series launched during the Financial Crisis.

The Median CPI is based on the data from the Consumer Price Index (CPI) but removes the extremes of price increases and price decreases, that are often temporary, to reveal underlying inflation trends. The chart shows the 12-month Median CPI, and for comparison, the “core CPI,” (CPI without the volatile food prices and the extremely volatile energy prices):

The re-collapse in oil prices pushed down inflation in gasoline and fuel oil, with the price index for motor fuels dropping -1.6% in January from December, which translates into an annual rate of -17.3%. Fuel oil and other fuels dropped at an annual rate of -15.8% in January, and used cars and trucks dropped at an annual rate of -13.5%.

At the other end of the spectrum, the price index for miscellaneous personal goods soared at an annual rate of +41% in January from December, watches and jewelry at a rate of +27.0%, footwear at a rate of +17.0%, car-and-truck rental at +15.0%.

These extremes at both ends of the spectrum, often brought about by temporary factors, skew the CPI and make it very volatile, where it jumps up and down. To obtain a measure of inflation that is not skewed by the often-temporary extremes on either end, and to show the underlying inflation trends, the Cleveland Fed’s Median CPI removes the extremes at both ends.

The Median CPI tracks the mid-point (median) of the 45 major components of the Consumer Price Index. This midpoint changes every month. Each component has a weight in the index – the “relative importance” (%).

For example, motor fuel (gasoline, diesel) has a relative importance of 3.5%. Housing – rent and “owners’ equivalent of rent of residence” – has a relative importance of 32.5% in total but is split by major region in the table below; and note the different increases, ranging from 2.3% in the West to 5.4% in the Northeast.

The midpoint of these 45 components, from the biggest price declines to the biggest price gains for the month of January, shown as annualized rate, is the first item where the cumulative importance is 50% or more. In January, this item was Education (bold in the table below), whose annualized rate of inflation was 3.7%. This marked the midpoint for the Median CPI (if your smartphone clips the four-column table, slide the table to the left):

| Component | 1-Month Annualized % Change | Relative Importance % | Cumulative Relative Importance % |

| Motor Fuel | -17.3 | 3.5 | 3.5 |

| Fuel Oil and Other Fuels | -15.8 | 0.2 | 3.7 |

| Used Cars and Trucks | -13.5 | 2.5 | 6.2 |

| Medical Care Commodities | -6.4 | 1.7 | 7.9 |

| Processed Fruits and Vegetables | -6.3 | 0.3 | 8.2 |

| Cereals and Bakery Products | -4.8 | 1.0 | 9.2 |

| Tenants’ and Household Insurance | -3.1 | 0.4 | 9.5 |

| Motor Vehicle Insurance | -2.5 | 1.7 | 11.2 |

| Leased Cars and Trucks | -1.9 | 0.6 | 11.9 |

| Household Furnishings and Operation | -0.6 | 4.6 | 16.5 |

| Meats, Poultry, Fish and Eggs | 0.0 | 1.7 | 18.2 |

| New Vehicles | 0.4 | 3.7 | 21.9 |

| Personal Care Products | 0.9 | 0.7 | 22.6 |

| Motor Vehicle Maintenance and Repair | 2.0 | 1.1 | 23.7 |

| Women’s and Girls’ Apparel | 2.1 | 1.2 | 24.8 |

| Lodging Away From Home | 2.2 | 0.9 | 25.7 |

| West: Owners’ Equivalent Rent of Residences | 2.3 | 6.7 | 32.5 |

| Dairy and Related Products | 2.3 | 0.8 | 33.2 |

| Other Food At Home | 2.5 | 1.9 | 35.2 |

| Fresh Fruits and Vegetables | 2.7 | 1.0 | 36.2 |

| Communication | 2.7 | 3.7 | 39.9 |

| Water/Sewer/Trash Collection Services | 2.9 | 1.1 | 41.0 |

| Public Transportation | 3.0 | 1.3 | 42.3 |

| Recreation | 3.0 | 5.8 | 48.1 |

| Tobacco and Smoking Products | 3.2 | 0.6 | 48.7 |

| Alcoholic Beverages | 3.6 | 1.0 | 49.7 |

| Education | 3.7 | 3.0 | 52.8 |

| Midwest: Owners’ Equivalent Rent of Residences | 4.1 | 4.2 | 57.0 |

| Motor Vehicle Fees | 4.1 | 0.6 | 57.6 |

| Medical Care Services | 4.2 | 7.2 | 64.8 |

| Rent of Primary Residence | 4.4 | 7.8 | 72.6 |

| Nonalcoholic Beverages and Beverage Matls | 4.5 | 0.9 | 73.5 |

| Food Away From Home | 4.5 | 6.2 | 79.7 |

| South: Owners’ Equivalent Rent of Residences | 4.7 | 8.2 | 87.9 |

| Motor Vehicle Parts and Equipment | 4.8 | 0.4 | 88.3 |

| Northeast: Owners’ Equivalent Rent of Residences | 5.4 | 5.0 | 93.3 |

| Energy Services | 6.8 | 3.1 | 96.4 |

| Misc Personal Services | 7.9 | 1.0 | 97.4 |

| Men’s and Boys’ Apparel | 7.9 | 0.7 | 98.1 |

| Personal Care Services | 8.5 | 0.7 | 98.7 |

| Infants’ and Toddlers’ Apparel | 14.9 | 0.1 | 98.9 |

| Car and Truck Rental | 15.0 | 0.1 | 99.0 |

| Footwear | 17.0 | 0.7 | 99.6 |

| Watches and Jewelry | 27.0 | 0.2 | 99.8 |

| Miscellaneous Personal Goods | 41.1 | 0.2 | 100.0 |

As reflected in the table above, inflation indices track a large number of items whose prices are all over the place, some soaring, others plunging, for reasons of their own, including temporary factors that will soon reverse and drive prices in the other direction. An inflation index combines these movements into one measure that attempts to indicate how fast the overall purchasing power of the dollar is shrinking with regards to consumer goods and services.

However, it has been the Fed’s contention – and that of many economists whose pay is more than adjusted for inflation – that the dollar’s purchasing power with regards to consumer goods and services is not shrinking fast enough.

The fruits of labor are denominated in dollars, and by extension those fruits of labor are not shrinking fast enough either, especially if wage inflation, a different inflation measure, is driving up wages.

Consumers vigorously disagree with the Fed’s contention that the dollar needs to lose its purchasing power faster. Unless consumers can figure out how to make more money, they’re getting the short end of the stick. And if they make more money, price increases just eat it up.

In turn, the Fed and many economists counter that consumers should make up for the loss of purchasing power by borrowing more vigorously and increase their spending that way.

The Fed’s 2% inflation target is based on the “core PCE” inflation index, which generally tracks lower than any other inflation measure, which is why the Fed holds it up as its thermometer. The core PCE price index rose at a 12-month rate of 1.6%, compared to the 2.9% for the median CPI. So maybe the Fed should get a new thermometer and declare victory, no?

Consumers have not been entirely deaf to the Fed’s pleas. Consumer debt – student loans, auto loans, and revolving credit such as credit cards and personal loans but excluding housing-related debts such as mortgages and HELOCs – jumped by $187 billion in the fourth quarter 2019, compared to a year earlier, to $4.2 trillion, and reached 19.3% of GDP, the highest ever. Read… The State of the American Debt Slaves, Q4 2019

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think Wolf’s distinction between inflation and cost of living is very useful. What really matters for most is cost of living, and most people have been slowly cooked frog-like since the 1970s. Pixels, data storage, and screens might be in a truly deflationary segment of the economy, but education, housing, and medical care have far surpassed wages. And retirees and savers haven’t been doing much better than the lowly hand-to-mouth wage earners, either, with these abysmally low interest rates. When the average worker looks back fifty years and sees what the median wage could buy with respect to housing, tuition, and medical, it’s a surprise that our politics have been as tame as they have been.

While I mostly agree, I don’t seem to remember the past in such rosy terms. There were still lots of poor people (even back then). Perhaps more are now to be considered “poor”. But I would argue that a lot of it has a lot to do with money management. It was very uncommon to borrow money for aspiration items. If you didn’t have the money, you simply didn’t buy it. The housing situation, which is definitely worse now, has been something that the public has done to themselves by willfully overpaying. And I have been to many auctions and seen this first hand! The health care crisis (and costs) has largely been self inflicted as well. In the 70s hardly anyone was fat. Now, because of deliberate (and bad) food choices we find many obese people clogging the system (as reported by a few nurse friends of mine) with lifestyle related medical problems. I don’t deny that there are entities exploiting the (largely self inflicted) situation and this is causing a “trickle up” effect. I can’t fix it but I can choose eat only what evolution intended and not chase “aspiration” crap. And if I can’t afford it with *cash*, I don’t buy it! In another of Wolf’s items, he mentions the usurious interest rates on credit cards that people are willfully and happily paying. Whose fault is that? Put your head in a lion’s mouth… what do you expect? And we have “education costs”… I would argue that as Peter Theil (like or hate him) has said: “a degree is a dunce cap in disguise”. Further, I would argue that in most jobs, it is eminently possible to learn (or be trained) on the job without useless “academia” getting involved. So, I’ve addressed housing, health & education: the biggest costs mentioned, and how the problems are mostly self inflicted. The answer to all of this is (non academia) practical life skills education.

I agree with a lot of this. I do think that a degree can be very useful though, but only if it is earned for a specific purpose and with a specific financial plan in mind.

If you are eighteen out of HS the better choice might be grab the hammer and not the diploma. The first candidate (who promises) to end the endless wars in the ME will get points. Get your job before all those GIs come home.

It’s not self inflicted when you have the FED driving property prices and rents. If you were born a renter, in what has been becoming a rentier society, it can be a tough pull. Debt slavery, rent slavery, wage slaves.

It’s no fun being uncapitaled in a capitalist world.

Rising home prices benefit the boomers who had purchased a while back. Also the boomers’ heirs, assuming anything is left over. We may be on the road to having the returns from a rising stock market replace or at least substantially augment Social Security. And so the no asset class acts as a sink to keep inflation at bay. Recall that Yellen said to get into assets ahead of the Fed’s ZIRP. Them’s the rules in our Roller Ball.

remember when avg house cost 2-3 times annual wages(only had 1 worker per family)

my 1st semester tuition was $452 at Madison, WI

I had save $5k for education(parents didn’t/couldn’t help) by age 18

try that today

I agree with Michael that the true cost of living has been increasing much more than 2% per year. I believe the government sets a phony inflation index so that the fed can keep interest low. Why would they do that? Imagine trying to pay 5% or 10% on T-bills when you are running a trillion dollar deficit every year just so the hyper rich can have their tax cuts. And I weigh the same as I did 40 years ago when I was in high school. But yes, most waistlines are also inflating faster than 2% in this country.

Much of what you say is correct, however there are many professions that require licencing, which can only be obtained by having the necessary academic qualifications, e.g. medicine, law, nursing, physiotherapy, librarian, teacher etc.

I did the “grab the hammer” approach straight out of high school and found my earnings cap to be relatively low. Now, at age 30, I’m enrolled in college with this being my only real chance at earning real wages outside of venturing into entrepreneurship.

Just in the short time I’ve been enrolled at my local community college, I’ve watched my tuition jump 15% semester after semester and the housing market jump almost 85% in the past 6 years. I’m located in a small suburb of DFW and things are shaping up to where if you aren’t earning 6 figures, you’re living hand to mouth.

If this pace keeps up, we’ll all be struggling millionaires. Just keep borrowing those dollars and it’ll all work out in the end, right?

And there are the hedonic (is that the word? Spell check doesn’t like it) adjustments to CPI based on ‘improvements’ in the item being purchased. These began with TVs and had some justification. For a long time all had a picture tube. Then new techs arrived and for $500 the consumer got more for his money: so the nominal increase in price disappeared for the CPI . He was paying 400 for X units of pleasure (root word of hedonic as in ‘hedonist’) but if he gets 25% more pleasure (or utility) for a 25 % increase in price, there is no increase per unit of pleasure. In its simplest parallel it’s like saying the 25 % larger size costs 25% more.

In TVs and undoubtedly computers… OK.

But when they apply this alchemy to autos…the real miracles happen.

That vehicle’s sticker price that’s gone from 21 K to 32 K ? No inflation here folks. Look at how much more you are getting! Sure it’s the same platform but with improved styling. Note that the trunk lid now has rear lights! Essential.

And with Blue Tooth, rear wiper, back up camera, 4 speakers, spoiler, 10 speed auto trans…this vehicle is actually CHEAPER than that totally dated, obsolete thing you paid 21 K for all those 7 years ago.

‘Uh, could I just get the basic vehicle for the old price?’

No.

I don’t blame the sales team for this but I don’t think the gov should play along.

Well I think what you’re talking about is that consumer tastes have changed and the average cost of a car has increased to match those changes.

If expensive suits become the fashion trend and many more people start buying them, and as a result the average cost of clothing goes up … is that inflation or a change in consumer preference? Obviously it’s the latter but … how do you account for it in CPI adjustments? It’s complicated …

Yea well the modern 20k car today seems like it will last a lot longer than the earlier car.

There have been no fundamental changes in ICE car tech for going on a quarter century.

The basic GM 250- inch six ran from intro in 1928 (bad timing) until the 1990s. It got electronic ignition, a cheap easy big improvement and in the 90 s fuel injection.

GM had a phony cheap FI for a while until proudly announcing (on the car! ) that it now had ‘multi-point’ FI like everyone else had already for decades.

The idea that ICE cars have basic, real fundamental improvements in the last 20 can only belong to those with limited technical knowledge. I am driving a 19 yr old

Civic. It has no fundamental differences from a friend who has a 2018 Civic.

One thing I luv about it: no spoiler.

Yup… right up until it breaks down… then it costs about one third of the purchase price to get it repaired. Under warranty, you say? Well, yes… but the most costly items aren’t included in the warranty… such as the computers (multiple) that drive the transmission, ignition system, and other components… and then there are the substandard components (how many recalls for air bags in the last 10 years?)…bodies constructed from plastic, that in the event of a bumper tap in a parking lot, result in totaling the entire car

What really matters for most is cost of living, and most people have been slowly cooked frog-like since the 1970s.

Agreed.

Some time ago I assigned a couple of guys to research the brick-‘n-mortar meltdown. The results show a pattern larger than the emergence of online retail can account for, dating to the 1970s. Hundreds of retailers went down between 1980 and 2000, including many well-established and distinguished stores and chains. These were either consolidated or liquidated, in no small part replaced by a relatively small of number big-box discounters like Walmart and Best Buy. Even retailers which embraced online retail early, like Service Merchandise in 1990, eventually succumbed. So have most of the big-box discounters, which have been targeted by PE firms for asset-stripping besides. Retailers in Europe show similiar patterns.

They did not succumb to online retail, but to non-retail cost of living increases, like housing, transportation, insurance, and medical costs. At the same time, as many readers here know, median US worker compensation has been stagnant since the mid-1970s. Both are the result of rising corporatist influence in the economy and in government.

Just as discounters crowded out the established chains, now online retail is crowding out the remaining discounters, and for the same reason: consumers just don’t have the money, and they’re going to continue to not have the money. So online retail can also be expected to decline and consolidate as well, so in the future you can expect all retail will be Amazon and all restaurants will be Taco Bell.

‘Demolition Man’ came out in 1993. The above effects on consumer purchases were widely recognised even then in the popular culture. We have detailed files.

I am going to disagree with a part of Unamused’s comment.

“and for the same reason: consumers just don’t have the money, and they’re going to continue to not have the money.”

For some this is true, but I know many in my age bracket (I’m 64) that have the cash to spend, but simply choose not to buy in (pun intended). My wife and I have plenty of cash in the bank and our newest vehicle is an 11 year old sub-compact. New clothes at 64, what on earth for? Jewelry? I don’t think so..and on and on. Dinners out? Well, pretty hard to beat what we make at home, in fact, we have never had a better bought meal than what we cook ourselves.

How much crap do people really need? It’s the old needs vrs wants and looking for happiness and life meaning in buying stuff. Nuts.

Personal opinion, but a country that has 108% debt to GDP has no business being the World’s reserve currency.

“In the fourth quarter of 2019, the U.S. debt-to-GDP ratio was 107%. That’s the $23,201 trillion U.S. debt as of December 31, 2019, divided by the $21.734 trillion nominal GDP. This ratio is a useful tool for investors, leaders, and economists. It allows them to gauge a country’s ability to pay off its debt.”

If GDP is really a factor of velocity as opposed to wealth, seems like a little waste is going on; probably into the chose few’s pockets.

I do find it interesting that restaurants are getting both more expensive and lousier quality.

Fine dining at home can be hard to beat at home if you know how to make your own pasta, and fresh bread; Making your own sauce with fresh tomatoes, better yet to grow all your own produce. I even make my own bacon, and cure/smoke my own pork to make ham/prosciutto; Nothing outside compares what you can make at home, if you bother to study ‘cooking’

Also of course with the draconian DUI laws in USA, who wants to go out for dinner, and have a wine/beer and dread the drive home for fear of being taken to cleaners. In my state the cost of a DUI is over $50k between fines/lawyers, …

Food has gone up 100% in the past 2-3 years that what’s I see, but I’m just talking the stuff I have to buy, most stuff I grow my own, and I brew my own beer.

Well to be honest with you, I think for the same reason that you have the +15 year old car, is why you have money in the bank, and why you can cook a fine meal at home. It’s that not needing to keep up with the Joneses that makes you rich.

Emerson long ago said “A man is rich in proportion to the things he can afford NOT to buy”

Nobody is as poor as a rich man that can’t buy everything he wants, nobody is as rich as a man that has everything he wants, and there is nothing that money can buy that he needs and/or wants.

The problem of course is Insurance ( all auto/med/home ), and Medical eats people alive in USA, and education loans is killing the kids.

Get the hell out, before you can’t leave. Yes, they’re boiling the frog, and most in the USA are too tired to even climb out of the pot.

So granted I live in a HCOL area, but so do millions of other metropolitan residents, and what I see is NOT a case of “you need a budget” Dave Ramsey spending lessons. No amount of NOT going out to dinner is creating wealth. They are struggling just to make rent, insurance, and any student loans. I can’t tell you how many UBER drivers here do it as a 2nd job.

I worked for Service Merchandise back in the day, when they were “America’s largest jeweler”. The couple that founded and grew the company turned it over to their middle aged kids when they retired. It was a race to the bottom after that. The product mix became strange. When a new customer walked into the store, he could not tell what kind of store it was. It was trying to be all things to everybody, I think. They had no idea who their customer was. It was like the buyers were on acid. Their business model (catalog showroom), supply chain and IT were first class, but it didn’t matter. People stopped buying.

My concern is that these two inflation charts reflect inflation for the 99% and inflation for the 1%. NBA players need a COLA? (footwear and jewelry?)

Watches and Jewelry : Jan up 27% above Xmas ==> never !

Watches and brand name jewelry are being used to move money out of countries with capital controls. There are brands like Rolex which are sold out of popular styles.

How does that work? You are in country A, you buy a Rolex, move to country B, and sell your Rolex to convert it back into your new country’s currency?

But I thought that jewelry and watches had terrible resale values. Don’t you just lose a bunch of money?

You are in country A. You pay $50,000 for a Rolex, but are shipped a $10 Canal Street knockoff. The money is held in an account for you in country B. Everybody winks and nudges. Deal done.

Petunia,

Very, very astute – if you look at international trade flows in detail, there occasionally pops up weirdly heavy trade in weird categories in weird places (Switzerland, Netherlands, Singapore all come to mind).

As you say, physical goods trade can be used to work around capital export controls (and to circumvent gvt manipulated FX levels) – so China is a big part of this.

Also, interest rate arbitrage between countries can hedged via standardized physical goods trade as well as financial instruments – another rationale for wacky trade flows.

When gvts make money less money-like, people start thinking about using other forms of money.

That’s part of the brand new “Reverse PCE” methodology introduced to fight the image problem of four decades of replacing items that have gone too much in price with cheaper ones: turns out laboratory mice who had their diet of hard bread replaced with absolutely nothing have a tendency of turning to cannibalism with the survivors finally succumbing to starvation. Not a pretty sight.

“Reverse PCE” replaces a cheap item that has gone down in price (IE: sterling silver jewelry on sale after Christmas) with the most expensive item available in the Fifth Avenue most exclusive stores (IE: diamond studded Cartier earrings). That should teach those slaw-jawed yokels to doubt the US Federal Reserve!

In other news: academics baffled and outraged at people throwing rotten vegetables as they attend prestigious meeting. Professor I.V.Ory of Tower University had this to say: “I am outraged, absolutely outraged! We have just replaced squashes and apples with rotten eggs and tomatoes in the Food Price Index and these ingrates waste all this delicious food! Don’t they know there’s people starving in Africa? Now if you’ll excuse me I am late for my Moet & Chandon and Beluga caviar brunch. Cheerio!”

Looks like I picked the wrong month to rent a car to go buy some watches, shoes and infants’ and toddlers’ apparel…

Picked the right month to fill up your car :-]

“In turn, the Fed and many economists counter that consumers should make up for the loss of purchasing power by borrowing more vigorously and increase their spending that way.”

This sentence couldn’t be more anger inducing. God forbid we plebs practice austerity and good finance practices to advance in society. They want us to dig a hole deep enough to forget what the sky looks like.

>”…Fed and many economists counter…borrowing more vigorously…”

Lol yeah, they can go fuck themselves…

@Wolf

Mugs came through, stuck at customs in holding and hope to pick it up today, wish me luck!

GotCollateral,

I hope you don’t need “luck” to get your mugs out of customs. Let us know when you have the cold hard material in your hand, for a big long-distance Cheers!

RE: Beer mugs, aka oversized shot glasses. Stay below Amazon’s radar.

Every time I see that mug , and worse when someone talks about it I feel minimized . I am tired of the micro-aggression . I am gong to send a check. As a S Corp of one I will deduct it . A pox on you and your wretched mug .

DR DOOM,

LOL. Maybe you’ll feel “maximized” when you have the magic mug in your hands. I’m not sure what that means, though :-]

Because the gov postal system here is a pain in the ass and they interfaced with USPS when it shipped. Dhl or fedex would have been way better, but they werent options on your shipping list for the country im in. But i have them now!

Cheers!

Glad to know that the mugs made it and that you have them. CHEERS!

The Feds think consumers should borrow more??? What a crock of shit. They want the average Joe to go deeper into debt and fail? No wonder our country has $23T of debt and growing rapidly – it is run by these same jokers.

They want the average Joe to go deeper into debt and fail?

Oh darn. Now everybody’s going to know.

Una,

People dependent upon gvt are reliable gvt votes/support.

This gives gvts a huge incentive to increase that dependency.

You can’t say that the past 20 years of ZIRP have not been hostile to the very concept of private savings.

“People dependent upon gvt are reliable gvt votes/support.

This gives gvts a huge incentive to increase that dependency.”

It is interesting how you doggedly refuse to say the same about corporations.

And if someone could educate me on how to increase my dependency on the government, I am all ears. It sounds like a fantastic idea.

This is great news, yes?

After years of concerted effort the measures to raise the cost of living are finally starting to come to fruition. We can all breath a sigh of relief knowing the Fed has the low inflation problem licked and prices should steadily spiral out of control at long last.

Lucky for me I have been unable to afford housing for years, but unfortunately I was still able to feed and clothe myself, lets hope the Fed has, once and for all, solved the problem of working class people being able to afford broccoli and avocados. I hear fasting is great for your health, this is great news!

In the end Jerome proved he also has the courage to act and will soon enough achieve that core PCE symmetrical 4% inflation rate we badly need, I have confidence in you Jerome. He has bravely printed massive sums of money and unleashed the banking system to do the same so, thanks to his courage to act, we can all look forward to a hyperinflationary paradise.

Jerome is priming the populace for more “not-QE but QE”.

https://www.bloomberg.com/news/articles/2020-02-12/powell-suggests-the-fed-may-lack-ammo-to-combat-next-recession

“Federal Reserve Chairman Jerome Powell came close to acknowledging that the central bank may not have the firepower to fight the next recession and called on Congress to get ready to help.”

What CPI are they using to calculate Social Security? Mine went up a whopping $8.00 this year. I guess I can cut one meal per day.

littlebit,

The CPI for Urban Wage Earners and Clerical Workers (CPI-W), measured Q3 2018 to Q3 2019 = 1.6%. CPI-W ran a tiny bit higher than CPI.

Stock Market positive. It’s all they care about.

Money is borrowed into existence. Increased borrowing = increased money supply. That’s going to make the dollar stronger?

Wolf,

Any chance of finding the equivalent year over year figures similarly broken out?

M2M is so volatile and affected by seasonality that it is hard to grasp the bigger picture.

I know you can only publish what the gvt puts out, but most Dpts have yr over yr data buried someplace…

What happens when a Ponzi economy built on unsustainable debt at 0% interest rates meets inflation?

Looks like the check is finally coming due.

Isn’t this what the Fed wants? Inflation.

That and low interest makes it easier to have massive debt.

Low interest is the only thing that makes DC’s enormous accumulated debt-to-GDP *survivable*…for DC…for a while.

What presidential candidates won’t tell you:

— Our work ethic is shrinking;

China puts us to shame.

— Shantytowns, originally called “Hoovervilles”,

are more prevalent now.

Is there any chance those that have ‘aided and abetted’ in the continual growth (Ha!) of the stock market, will be the ones that will ‘bear the burden’ when it will eventually collapse?

It will collapse when rates have hit negative and start to head north. That could be years away. Dow 75-100k is likely before it gets a 30-40% haircut. This looks like the Dow run from 82-2000. Went from 1k to 10k over 18years. Let’s assume ‘09 is the begging. 2027 is where the Dow will likely stumble based on excessive rate manipulation.

Doesn’t mean the Dow can buy more stuff it actually will in all likely hood buy less stuff.

This is the new normal. Markets don’t crash until rates rise. Which could be a very long time.

Markets don’t crash until rates rise.

It’s true that rates cannot rise much or for long for the Financial Industrial Complex without crashing the markets.

But rates are rising for the general population, as is the cost of living, to cover the expenses and profit increase expectations of the FIC. The present system will hold up so long as most debtors can make their minimum monthly payments, but between rising rates, rising living costs, rising debt, and stagnant incomes, that window will be closing soon.

My earlier projection of 2026 seems to have been overly optimistic. In its CFO Signals report covering the last quarter of 2019, Deloitte found that 97 percent of CFOs queried believe either an economic slowdown or recession will occur before the end of 2020. This is up from 88 percent one year ago.

It will be interesting to see where the Fed goes when it detonates. I’m guessing New Zealand.

Maybe not New Zealand. Switzerland is out. So is British Colombia. Islands are inconvenient. Argentina is so last time. Borneo has too many plantations already. Antarctica is off-limits.

Ya know, its getting hard for the ultra-rich to find a remote refuge anywhere on the planet because everything livable has already been overdeveloped.

Isn’t New Zealand just a big island anyway? They won’t be able to “run” anywhere eventually Iheard Draghi and LaGarde are dating I know scary right?

> Antarctica is off-limits.

Says who, bucko?

I’ll have you know I’m the Third Earl of WestArctica. The Antarctic Treaty only prohibits new claims by *nation-states*. Nothing prevents individuals from asserting a homestead claim on antarctica.

The S&P 500 dividend yield is not growing as fast as the price per share.

The earnings growth of the market over the past year has been low. Low interest rates have not done much for corporate profits. Foreign competition is intense. Gilead developed an antivirus vaccine. China refused to issue a patent for it and filed their own patent for the drug instead.

No, because they’re stocking up on gold now.

Why in the world do bond buyers want to invest for a negative real return?

They don’t! Central Banks are the main buyers. That’s why they’re negative to being with.

Real investors are desperately buying up assets that will hopefully fair well in an inflationary environment. Metals, real estate, large cap stocks for example. That’s why there are $1T+ market cap companies now.

The dollar is toast, the rest of the world Currenices are mince meat.

Could not be further from the truth. Plenty of Cash on the sidelines.

They’re hoping rates will go even lower and the value of their bonds will appreciate I suppose

The financial history of this nation is that Fed Funds equal or exceed inflation. Somehow, since 2008 the Fed has convinced people that Fed Funds under inflation is okay.

Is it really…REALLY their decision to dictate how much the buying power of the dollar declines? Where in their mandates or mission statement does that appear?

And it inflation be a defacto tax, as Friedman held, what powers are given the central bankers to impose this tax upon us? AND, while they are sheltered from the ill effects of their policies due to the fact they have inflation protected pensions awaiting them? What of us?

This is the stuff that gives Bernie Sanders traction…

Its France in 1792 and the “royalty central bankers” are saying LET THEM EAT INFLATION.

“LET THEM EAT INFLATION.”

That will be a very, very good political line shortly.

Meme-like – brief, simple, historical callback with shared meaning, encapsulating rage.

Wolf, how about an article about the source of liquidity in the market? With the fed tapering it’s not-qe, where is the fuel powering the bubble coming from?

Who is doing the bottomless buying?

Anmol,

I don’t think there are any definitive answers possible.

But…it would be an interesting post to discuss the tools/info that could be used to make educated guesses.

Trade volume data tells you something.

Trade timing data tells you something.

Insider buys (or lack thereof) tells you something.

Relative sector performance (and PEs) tell you something.

Etc.

Thanks Wolf very interesting and revealing and complicated. It seems to me that the fed is doing more than jobs and money managing for inflation, unless they are letting it run hot, like they said they would, if I remember right. Thanks again.

PCE is a low inflation biased reading.

It allows for items that rise TOO MUCH in price to be substituted with items of lesser cost. This is outrageous.

It is skewed to always read low.

And lets not forget, 2% inflation compounded over ten years brings 22% rise in prices. The Fed hCas said they will accept a higher than 2% reading. Therefore, the Fed is promoting 25% price increases over ten years….and they have a mandate to promote “stable prices”. Yet no one says a word.

Chart after chart of inflation rates of increase, but rarely one showing aggregation and compounding.

And finally, if inflation be a tax as Friedman said, what right or power does the Fed have to impose a tax upon us? (as they sit with inflation protected pensions awaiting them)

Taxes are levied by elected people, not the unelected central bankers.

The 30 year auction just went off at UNDER THE INFLATION RATE.

Central bankers have inverted reality.

so much cash sloshing about. gotta go somewhere I guess. But that sounds like desperation/inverted reality/nucking futs….

Yes, they sure have :-]

The level of liquidity roughly equals asset prices.

People have been trained by history to think that the economy’s growth rate and corporate earnings will determine loan growth and money supply.

No longer. Now the economy and corp earnings mean little. The central banks are going to determine the level of credit/debt/money. And it is only going up. Period.

The shadow knows and so does the mkt.

New highs again this morning.

Get used to it.

I wonder how this inflation can be explained by an older demographics? Where is it coming from? Certainly not from the usual commodities. Are the costs of services overheating?

Yes. Services (financial services, healthcare, education, … down to haircuts) are always a big part of inflation. They account for about 70% of consumer spending. Services are included in the 45-item list above, and some of those are the biggies, such as Medical Services, Rent, etc. as you can see by their “Relative Importance.”

1) China will export the coronavirus to poison our globalist economy.

2) In the battle between Communism and Americanism, the

communist will never give up, even without a gun in their hands (Zou 1948).

3) The buyback campaigns at market top, benefit executives and employees, increase EPS, but reduce dividend rates. The ponzi game will not stop, because the Fed will buy stocks !!

4) SPX produce a new up thrust every day, but all % rate in the US and Germany inverted yield curve, are down. When ROC is red its a good investment.

5) Both the front end and the long duration are sinking, dragging each other in harmony. Gravity between the German NR and US pull them together, making USD stronger.

6) Germany is a proxy of China. All German rates up to 20Y are

underwater. The 25Y = +0.015. The 30Y = +0.12, barely sticking their nose above the waves.

7) China will not waste a good crisis without doing a regime change and a change of character of our economy.

8) USD have the biggest target on its back, under killing fire.

9) Our implants that benefit from both Chinese markets

and labor, might be crippled and implode in the battle between Communism and Americanism.

10) Stay tune, the 2020’s are not 1949…

“If you can’t hit the target, move it!

Semper Fi.

B

The chart is repeating the divergence in 2015 when oil markets collapsed. The result of that was the interest rate hike policy. If they don’t put pressure on corporate high yield (new lows) the energy sector will spiral us into a depression. The monetary answer to stealth inflation should be a tightening of monetary conditions, which is not achieved by allowing REPO to wind down ever so slowly, (like the balance sheet shuffle). The Fed chief directly or indirectly is letting the president run his monetary policy. Either shut down Twitter, or find a Fed chief with a thicker skin. How about letting the markets set rates and then SOFR would not be the joke it already is.

Wolf, offer up a chart of aggregate and compounded inflation. It tells the real picture. These charts of “rate of change” dont take into account the compounding and aggregate impact of small change upon small change.

Regarding the Median CPI…

They take out items that have price moves that are uncharacteristic and “may be temporary”. What if they arent temporary? Do they put those items back in?

This reminds me of the PCE (the Fed’s pet index) which is chain weighted and allows for items that rise too much in price to be substituted out. What are we measuring here? Leave them in. If the price change is an aberration it will correct and be recorded in the next reading . If not, well, there is the price change of what the index was set out to measure, it should be recognized. IMO

forge median CPI , the regular CPI is running 2.50 & YOY. there is inflation and the Fed has overshot its much vaunted 2.00 % inflation target. the corporate press as always is not reporting this .

Brainard, the Fed board member called 2% inflation target too low.

If I was there when she blurted that out, I would promptly ask her if she had an inflation protected pension. Then ask her what of us…

Let them eat inflation…….The Federal Reserve.

2% for 10 years = 22% price rise

2.5% for 10 years = 28%

2.5% for 20 years = 63% drop in the value of the dollar.

So instead of referring to these small numbers based on “2”, lets speak of the ten year impact of that number aggregate and compounded when referring to Fed policy.

Cod Index Update, February 16, 2020:

The cod index is an index that I construct to show the change in the price of cod where I buy it, over the last 12 or so years. (So: from the Crash of about 2008, to the present day) After a relocation in 2007, I have shopped at a grocery under the Kroger umbrella, and have bought cod there typically once a month or more often. Location is the Inland Northwest of the U.S..

No hedonic adjustment is needed, although what was labeled “cod fillets” is now labeled “cod loins”: it is a mostly boneless, sometimes previously frozen, Pacific-caught white fish.

Cod has been caught and eaten by humanity for millennia, from both northern Atlantic and northern Pacific fisheries, and can be considered a longtime high-quality source of protein in the diet. As a rule, it is cheaper than halibut, tuna, salmon.

The initial base price of cod in this index is $4.99 per pound; this is the price at which cod was typically available to me, from 2008 until about let’s say 2018. And those were years in which the Fed mandated VLIRPs, and consistently reported minimal inflation in consumer prices.

In the last few years, I have seen more movement in the price of cod, and always to the higher side. The update: I bought cod on Thursday, February 13, 2020, from the same venue, at the price of $9.99 per pound. So the price of cod is up 100% from the base price at which I could count on buying cod, the base price which held, for more than a decade.

**********

Wow, that’s very interesting. Either we are starting to see real inflation in consumer goods and foods or something is up with cod fisheries. I’m in San Diego so I’m just used to everything being expensive all the time. If a fish is below 9.99 a pound for me that’s a wonderful sale. This is why I’m eating more vegetarian these days.

2% inflation for 20 years, compounded, cuts the value of money IN HALF.

This is the goal of the Federal Reserve.

I repeat, THIS IS THE STATED GOAL OF THE FEDERAL RESERVE.

Yet, they have a mandate of “stable prices”. What world do we live in?

The third Fed mandate is “moderate” long term interest rates. Yet we have a flat yield curve and record low long rates.

Why cant we hold the Fed to their mandates?

New guy here. The Fed will keep this thing going to get Trump re-elected and then all bets are off. Wouldn’t be surprised if the Fed jacks rates to fight inflation and get the correction over with early in Trumps 2nd term. Of course, Coronavirus might do the job for them.