What would the Fed do if economic factors were all it looked at?

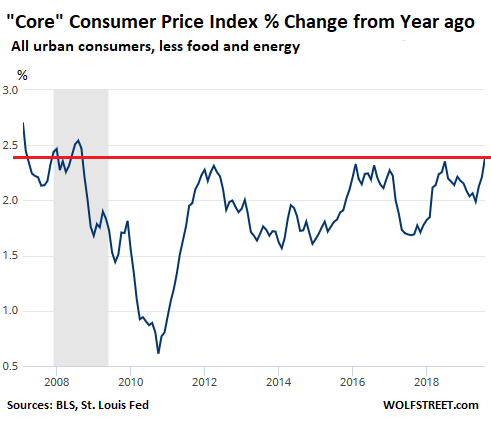

Inflation as measured by the “core” Consumer Price Index, which removes the volatile food and energy segments, jumped in August at the highest rate in 11 years, by 2.39%, a smidgen above the prior peaks of July 2018 (2.35%), February 2016 (2.33%), and April 2012 (2.32%). The last time, it rose at a faster rate was in September 2008 (2.47%):

The US is currently undergoing the second oil-and-gas bust since mid-2014, or same oil-and-gas bust, with two parts separated by a sucker rally. And so energy prices, which have a weight of 7.8% in the overall CPI, dropped 4.4% from a year ago, with gasoline and diesel prices falling 7.0%.

These declines in energy prices reduced the overall CPI’s year-over-year increase from 1.81% in July to 1.75% in August, the Bureau of Labor Statistics reported this morning.

Inflation in services

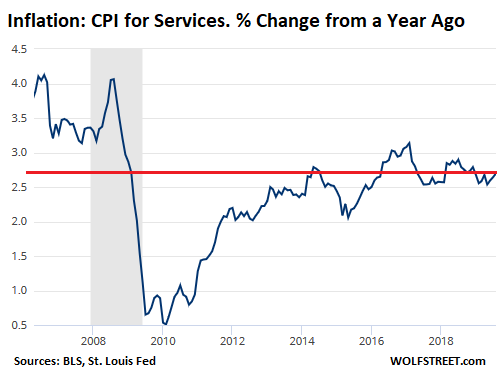

Consumers spend 70% of their money on services, which include everything from financial services and healthcare services (not medications) to broadband and cellphone services. It’s the biggie. In August, the CPI for services rose by 2.70% compared to a year ago.

“Inflation” as expressed by CPI attempts to measure the loss of purchasing power of the dollar, and not price increases due to higher-quality products.

When your broadband speed goes from 2 Mbps to 50 Mbps in the span of 10 years, but the price you pay remains the same (as was the case with our Comcast connection), you’re getting 25 times higher quality of services for the same price – meaning you’re getting more for your dollars, though you pay the same.

Inflation measures the loss of purchasing power of the dollar, and not quality improvements. This is why quality improvements are removed from the index (via the infamous “hedonic quality adjustments”). On this conceptual level, “hedonic quality adjustments” make sense.

Price changes can be divided into two portions:

- The price of quality improvements,

- The loss of the purchasing power of the dollar.

Your life gets more expensive, driven by both factors, which combined account for the overall increases in your “costs of living.” And there is a never-ending debate over the hedonic quality adjustments being purposefully applied too aggressively.

So the 2.7% increase in the CPI for services measures the loss of purchasing power of the dollar, after the impact of any improvements in your cellphone service, broadband services, data storage services and the like has been removed. The services CPI has been relatively stable since 2012:

The peculiar case of durable goods.

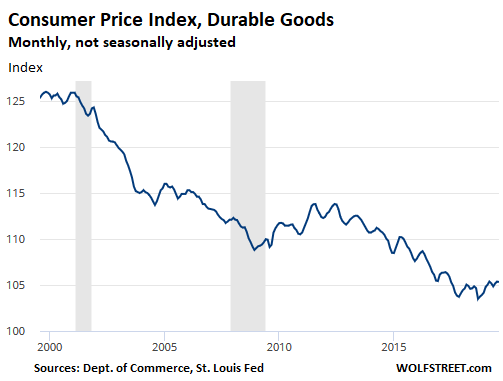

Durable goods are things like cars, washing machines, furniture, cellphones, and the like. Automation and other efficiencies in manufacturing, along with globalization (transferring production to cheap countries) have pushed down the costs of making goods.

The overall rule in a non-inflationary environment is that durable goods that are not improved get cheaper over time as manufacturing and distribution becomes more efficient and costs are pushed down.

But under fierce pressure from global competition, manufacturers are constantly trying to improve their product. These improvements allow them to charge more for their products, but since these improvements give you value for the increased price you pay, they’re removed from the inflation index (you know the drill, “hedonic quality adjustments”), so that CPI for durable goods just measures the purchasing power of the dollar with regards to durable goods, not the quality improvements.

So your cost of living goes up because the car now has a 9-speed transmission and better safety features, improved performance, fancier electronics on the dashboard, cameras front and back, automatic braking features, and the like. But when the costs of these quality improvements are removed, the car should have gotten cheaper due to the impact of manufacturing efficiencies and globalization.

And this is sort of what has been happening. The chart below shows the CPI for durable goods – the actual index not the percent change of the index. Note what might be the beginnings of an uptick in recent months, after years of declines:

The trend of durable goods price declines in prior years has been a topic in the discussions by the Federal Reserve, also conceding that these price declines may be the normal condition in a competitive world with a constant drive to make production more efficient.

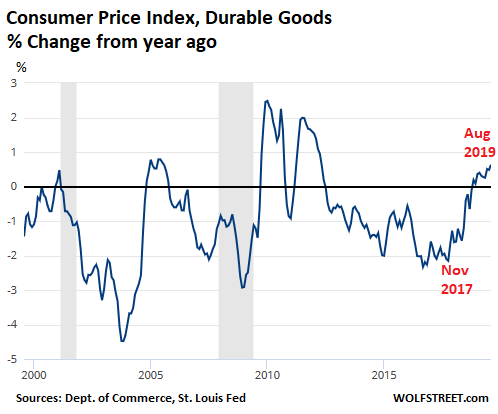

In terms of percent change, the CPI for durable goods in August ticked up 0.6% — the fastest increase since May 2012. The turnaround in the CPI for durable goods trend started toward the end of 2017, as price declines got smaller and smaller, until November 2018, when there was finally the first price increase since 2012:

So the inflationary forces continue to be active in services, as they have been. But now these inflationary forces are also starting to push up durable goods prices for the first time in recent years.

Durable goods and services form the bulk of “core” inflation measures, including the “core” PCE measure that the Fed uses as its yardstick for its self-selected inflation target of 2%. And by the looks of it, its “low inflation” scare earlier this year, when the dollar failed to lose its purchasing power fast enough, is in the process of reversing, removing one more economic reason for further rate cuts.

Services are hopping. And the #1 Biggie is hopping the fastest. But it all adds to GDP! Read… The Financialization of the US Economy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If the Fed has to continue a process to ramp down rates towards zero, that has to be viewed as a total policy policy failure of the trump election and anything he’s done related to the economy. If liquidity and credit is so frozen, then banks are about to fail and that’s happening under trump — so why doesn’t the Fed step up to the plate to be supportive of how well the economy has apparently been doing,versus getting caught in trumps pathetic game?

The way I understand it is the major fuel for the economy now is not income, but debt expansion. Trump was screwed when he took office, because the FED was going into a tightening cycle. It was creative to cut taxes and blow the deficit out to a trillion plus at the top of the market as that was the only way to keep the expansion going. Was it the right thing to do long term, I doubt it.

There is a chance with the labor participation rate historically low that there actually was a few more million people you could bring into the labor force and grow at 2% plus a few more years if you ran the economy hot.

We could be in a new trend with demographics and debt and central banks fighting hard to prevent recessions that expansions are going to be weaker, last longer and the asset price drop in recession is going to be bigger.

Old-school – Agree, in general.

What we need around here are two things:

-An admission by the Establishment that a problem exists.

-Some creative thinking about alternative arrangements.

I see no evidence that anybody in Washington DC is thinking about this correctly.

My favorite pizza place closed and now our local Mark’s Work Warehouse has closed as well…

No matter how hard we want to believe that the Fed won’t cut next week, it ain’t gonna happen.

They will drive interest rates to zero and possibly into negative rates slowly over the coming two years.

I stand by my prediction that Dow will cross 30 before the election.

The last Fed chairman who was a true public servant was Volker. I don’t think we will ever get another like him since public service nowadays is just a revolving door to serve moneyed interest and expect pay back later on through consultancy arrangements etc.

This will eventually blow up sky high, but I have difficulty understanding how the end game might look like. I hope Wolf and the enlightened commenters here take on this gigantic speculative task so we the plebs can prepare for the future better.

Exactly!

I think many come here to try to make some sense of how this all will develop. WRT “blow up sky high”, I had such feeling before GFC but that time I accidentally found Robert Prechter’s predictions appealing and followed the EWI, even subscribed for some time. They turned out to be right then (for a change :).

Yes but this may be “the unkindest cut of all”, if the Fed withdraws liquidity.

The FED uses PCE

No. The Fed’s yardstick for the 2% target is “core PCE,” not PCE, as I pointed out in the article.

But it looks at all inflation measures: CPI, core CPI, Trimmed-Mean CPI, and others. Each adds some nuances to the story. Powell has been specifically mentioning the Trimmed-Mean CPI, which cuts out the outliers (it has been above 2% since May 2018).

Nothing to see hear. According the internets experts, having inflation means there is no inflation:

“Healthcare is important; medical care services surged 0.9% in CPI but that won’t happen in PCE,” wrote Neil Dutta, head of U.S. economics at Renaissance Macro Research, in a note to clients following the CPI’s release. “CPI covers out of pocket expenses only while PCE covers payments made on behalf of you.”

I’m on the HOA Board for our HB community and during a recent budget review for 2020 was informed that our labor costs will rise 15% next year, and by double digits for the foreseeable future.

Labor accounts for 65% of our budget – gardening, etc – and is being pushed up by large minimum wage increases. This in turn is forcing up other costs. Has anyone noticed how many restaurants are adding an additional service charge to cover wage increases? Of course, tipping is still expected.

So, how long before Fed money printing, aka counterfeiting, starts a new inflationary cycle well in excess of its mythical 2% goal?

“…and by double digits for the foreseeable future. ”

“…is being pushed up by large minimum wage increases.”

Looking at the CA law it looks like minimum wage increases tick up every year until 2023, but its less then a double digit increases (2018 to 2019 is ≈ 9%, 2019 to 2020 is ≈ 8.3%, and the % change gets less every year stopping in 2023) Your 15% labor cost increases this year plus double digit YoY forevermore can’t all be minimum wage increases, something else significant has to be going on for the costs increases especially the future expected ones to be so large.

The employer paid portion of healthcare costs is probably why the cost is rising double digits. If a low wage employee is already paying 10%+ of their income to health care, there is only so much more they can afford before they drop it.

Amazon just announced they are cutting healthcare benefits for part timers under 30 hours per week. The minimum wage at Amazon is $15HR.

But Petunia, according to the Fed’s Inflation Fraud Report, health insurance is only increasing a teeny weeny itsy bitsy amount.

And if you talk to people who apparently never leave them home, care insurance isn’t going up, either.

You must also calculate the additional payroll tax the employer incurs,another 6.2% if I’m not mistaken, plus Medicare and futa.

Seems to me that manufacturers and sellers of durable goods are affected by the rise in services inflation as well (labor,insurance,IT etc) and will need to pass that on to consumer eventually. Wolf’s charts look like a breakout could be on the horizon. God help us if we ever get a mayor spike in the Oil price. i still think Stagflation may be the ultimate outcome in the next few years,i hope i am wrong.

But will inflation manifest itself? Inflation = too much money chasing too few goods. We definitely have “too much money” (ample liquidity at dirt cheap rates). But modern supply chains can pump a lot of crap toward the consumer without meaningful pressure on costs/prices. And at some point consumers just don’t need a 7th TV.

1) Paul Volker recommended to divorce gold in 1971. Ten years later he was fighting “hyperinflation”, lifting O/N to 19%.

2) Bershire Hathawy is the US economy.

The US economy is doing great, while Germany, – the export queen, – on the cusp of recession.

3) Druggie drag the US10Y down in order to weaken the Euro relative to the US dollar and save the German export. That was the Queen order.

4) NR finance European gov entitlements without raising

taxes. Druggie promise is the continuation of NR downtrend deeper in negative territory.

5) From the bottom of 1982 pit, BRK/A rose from 500 to

335,900 in Oct 2018, or x672, much better than the devaluation of the US dollar.

6) Warren Buffet, a genius, is the best investor in the world. Today BRK/A was a shooting stars,

failing to exceed July highs TR.

7) BRK/A monthly, linear, on the other hand, is Head & Shoulders.

BRK/A might fall between 2015(H) and 2016(L), taking

the US economy with him.

8) WB is not in China, neither the Europeans.

I am intrigued by what you say, although I don’t understand half of it.

‘The US economy is doing great, while Germany, – the export queen, – on the cusp of recession.’

Germany has the world’s most successful economy. It is currently running about a 2.5 % budget SURPLUS! How long since the US heard that word? One thing is for sure, it’ll be a long time before you hear it again. The US deficit for 2019 is up double digits from this time last year, hitting a trillion before Fall.

Yes, German manufacture exports have slowed. When you are operating at close to capacity it’s easier to slow down than to pick up.

Did everyone see those pics WR posted of the power poles outside his apt? How many like that do you think are in Germany?

Compared to Germany and another favorite target, Japan (the latter a bit more understandable re: debt) the US is starting to resemble a failed state. Residents of Newark told to drink bottled water. People dying because they can’t afford insulin, or travel to Canada where it’s one- tenth of the price. A President in a verbal (so far) war with the Federal Reserve, shades of Zuma the former head of South Africa who loved to fire ministers of finance.

BTW: in Germany the independence of the Bundesbank is in the constitution. A politician is not supposed to contact it.

A lot of people are predicting the end of the euro, wherein Italy and Spain and Greece can solve their problems by issuing their own currency and lots of it!

Maybe, but if Germany returns to the D-Mark it will solve what some in the US feel is the problem of an overvalued dollar.

I think you hit on something there. Some smarty PHD thought Germany going off the Dmark was going to unleash the economic machine, but it just allowed a Frankenstein economy to be created in Europe.

Most citizens of countries in Europe didn’t realize that giving up their local currency meant turning a lot of power to people outside your country to make the policy you were going to abide by.

I’m not. I can easily go to CNBC or Bloomberg and their talking heads will crank that stuff out almost 24/7. It would be neat if he could digitize it so we could all install it in our home trading computers (when they are available), and see if it makes money, though.

Oops! Forgot to address commenter…to Zanetsu.

As far as I know, the FED wieghs core cpi heavily in its policy decisions. So it appears you are stating they will not be cutting in september?

And as far as I know the only reason the S&P rallied up from 2775 was because of the expectation for multiple rate cuts in 2019.

Mister Ed,

I’m stating the Fed shouldn’t cut in September. They have no reason to cut. Here is my series on it: https://wolfstreet.com/tag/not-a-rate-cut-economy/

But they might cut anyway, for reasons that have nothing to do with the economy.

Yes and draggi just tried with p45 to force their hand.

The fed should not cut it should start action to restrict who can buy US T notes.

The Feds are keeping up with the Joneses across the pond. Dammit, if Mario and Christine can cut, so can we. The July cut shouldn’t have happened, but it did because we need to support the stock market. It feels like we just keep finding shovels to dig the holes deeper at this point.

Fed perhaps reads tea leaves index to make policy decisions. Many of the inflation indicators it refers to have hit current levels in the past decade and we know what rate Fed had settled on.

There is no consistent rationale behind its decisions. Fed’s decisions at times were even designed to ‘shock and awe’ the markets. What a racket.

Politically there is nothing unusual about the president asking for low rates – done in the past here and in other countries too. He might even be feeling entitled to it due to the unchained roaring economy.

If Powell cuts, it’s as good as admitting he’s Trumpy’s sock puppet. Stock market battering at the record highs again, unheard of high employment levels, economy ticking along nicely… what possible reason is there to cut? Because if he doesn’t, the market will crash, and he seems to think it’s now his job to prop up companies on loony P/Es. Rock and a hard place indeed.

One thing you will have to say about Trump is he controls every relationship by his erratic behavior and his threat to blow things up. The Fed was going to be in control by tightening, he took that away by running huge deficit at top of cycle to overwhelm monetary policy. Now with the negotiations with China the Fed doesn’t know what conditions will be in place next week so they are boxed in. Trump unnerved Dudley and got him to do the opinion piece proving the Fed is somewhat political.

Trump will probably go down in history as the best or the worst. It’s too early to tell.

In the absence of inflation, consumer prices should decline. If due to advances in technology a worker can produce eleven widgets in the time it used to take to produce ten, these are real price declines, not deflation. Inflation is a monetary, not technological, phenomenon. Backing out technological improvements from inflation calculations is tantamount to the government claiming for itself the all fruits of technological advance.

Indeed. Inflation means that monetary expansion has eaten all of the productivity improvements and then some and that that purchasing power went into various beneficiaries’ wallets – it didn’t just disappear.

Bill:

“Backing out technological improvements from inflation calculations is tantamount to the government claiming for itself the all fruits of technological advance.”

ZeroBrain:

“Indeed. Inflation means that monetary expansion has eaten all of the productivity improvements and then some and that that purchasing power went into various beneficiaries’ wallets – it didn’t just disappear.”

This is exactly why they devalue (and also why taxes only go up).

Inflation (and higher taxes) is the confiscation of society’s innovation by the government.

Bill – It depends on what you use for money.

If you use rocks for money (gold) and have both population growth and economic growth, then you are going to have long-term deflation.

If you have fiat money, then your inflation rate is whatever the Central Bank says it should be.

When you factor in population growth, real economic growth, and technology advance, it is a miracle that anybody can figure out inflation.

Cheap loans led to an overheated economy. Pity the poor widow whose savings are drained by inflation and the devaluation of currency.

Negative interest rates in Europe went lower. Eurobond real GDP growth flatlined.

Powell’s mandate is to fight inflation not listen to Trump’s crazed rants about zero Fed funds rate.

If inflation is meant to track the cost of necessities, why doesn’t it include the rising costs of investments as part of the basket. It’s obvious that most people want to save something for retirement. As the Fed lowers rates, the cost of securing a safe future cash flow go way up. So why not have a modest amount of savings in the index? Is retirement not a necessity in the government’s view?

This is a gaping hole that makes inflation stats very deceptive.

There are different types of inflation and different measures of inflation. Here we’re talking about consumer price inflation. But there is also wage inflation, producer price inflation, home price inflation, asset price inflation, etc. For example, I run a big series on house price inflation every month. Here is the last one:

https://wolfstreet.com/2019/08/27/the-most-splendid-house-price-bubbles-in-america-august-update-western-markets-see-the-dip/

What is the effect of higher US tariffs on Chinese made imports? Doesn’t that give competitors selling into the US market the ability to raise their prices as well?

Absolutely. And that is the intent. American competitors (and other exporters) who aren’t subject to tariffs will raise prices, typically due to a rise in demand. Even with out a rise, they still tend to raise prices.

Anon1970,

This is an excellent question. I’ve been trying to see the tariffs show up in the inflation data for over a year. The Fed has been saying that they’re not seeing the Tariffs in the consumer price data yet. What we’re now seeing is a tiny 0.6% year-over-year increase in durable goods. But some of the things that rose — such as the CPI for used cars, +2% year-over-year — have nothing to do with imports from China. So the jury is still out.

If the giant finance book I bought at the thrift store for a quarter is correct the cost of the tariff will be born by all people in the chain from producer to retail customer depending on who has the best ability to eat it. The net affect is the govt gets it’s slice of the pie and everyone else gets less.

I do think it is a good thing. China was brought into the world market thinking it would throw off the communist party. To prevent a war in 20 years Trump is going to play tough and get the supply chain distributed to other countries and knee cap China while we are still able.

“When your broadband speed goes from 2 Mbps to 50 Mbps in the span of 10 years, but the price you pay remains the same (as was the case with our Comcast connection), you’re getting 25 times higher quality of services for the same price – meaning you’re getting more for your dollars, though you pay the same.”

Going from a regular truck to one with a trailer attached to it as a standard feature can be seen as a “quality” improvement and would thus be “hedonically” adjusted, but if you don’t need the trailer?? This is why the faster-bandwidth/CPU/storage = deflation argument doesn’t hold water. Also, you likely need the “improvement” to accomplish the same thing as before: eg., bloated internet/apps with features you don’t necessarily need: eye candy, sharper video, more storage for app installation, etc.

“So the inflationary forces continue to be active in services, as they have been. But now these inflationary forces are also starting to push up durable goods prices for the first time in recent years.”

Tariffs – and it’s going to get worse.

By that same standard if websites take 25 times the data to load, are you really getting 25 times an improvement?

You get 25 times the ads… that counts for something :-]

And each ad pays the publisher 1/25th from what it used to pay.

Consumerism is all about bloat, about buying what you don’t need and really don’t want. Without it, we’d be back in the stone ages :-]

Wolf – You made me laugh!

One other thing about Internet bandwidth. You’re limited by the web site upload. Most web sites don’t offer 50 Mbps download unless you’re Microsoft or Google. And let’s not forget your upload speed. Upload has hardly kept up with download speeds.

CPUs: who needs 8 cores? The majority of users benefit from two-to-four tops. After that, there is virtually no benefit. It’s like buying a big rig to haul a few planters. Nonetheless, more cores for the same money will be seen as deflationary.

Well, there is the subset who does use the cores. I *cannot wait* for 64-core/128-thread high-end desktop offerings from AMD. Scientific computing is being democratized in a big way!

But sure, typically cores go towards supporting lazy developers importing huge dependency trees and then the various spyware services that now come included on the standard consumer OSs take up the rest.

ZeroBrain – I figure maybe 1% of the population uses 4 cores, and maybe 0.01% uses 16 cores. At work, I often use 16 (Vivado FPGA compiler).

At home, it looks like this: I use 1 core, and Windoze uses 3. . .

The hedonic adjustment for PCs should be something like the square_root of the number of cores, clock rate, RAM, etc.

Upload speeds are symmetric on my cellphone data plan, 17 Mbps, up and down. It depends on the carrier. If you splurge on a business connection with 1 Gbps speeds, you can choose same speed up and down.

If the fed considered all economic factors the interest rates would be around 5%. The window of opportunity to do this was 10 years ago. The scary thought is that the fed might be thinking that run-away inflation can handle the debt that the fiat system has ,predictably, deliveried. Politically speaking , if gasoline stays cheap, and sports /entertainment (price does not matter)and cheap booze are available we get Trump for a last blast of 4. Bread , wine and circuses is the real currency of end stage empire . It’s too late , the fed can’t save us now.

Wolf you answer your own question with the September 2008 example. Should we have been concerned about inflation in September 2008? Of course not. Much of the Slowdown is already baked in the cake.

The hedonic adjustments are a scam because the improvements in the products that justify the cost increase are not optional – I would like a quality car with manual gears and no electronics, where can I get one at a steep discount from the ‘improved’ cars?

First of all the 2% inflation target is a number that has no theoretical or empirical value. It was selected out of the ether by the New Zealand Central Bank around 30 years ago and other Central Banks said ‘yeah that is easier than achieving zero inflation so we will use it too” and we can claim success for our policies because we can claim to be able to precisely measure inflation down to a tenth of a percent even though we can’t.

Assigning a monetary value to a putative quality improvement is more Central Banker mumbo jumbo. I suppose there is some value to someone in being able to turn their oven or dryer on at home using their cellphone as they drive home from work but is it really work the extra cost to install the capability?

I am reminded of a instance where a homeowner who had a 1920ish cast iron porcelain gas stove you had to light with matches traded it for a new stainless steel oven, dishwasher and refrigerator with digital displays because the old stove was now a valuable antique

There’s is nothing wrong with hedonic adjustments as a car today can’t be compared with a car 20 years ago. The problem is that the consumer doesn’t have a choice when he wants to buy a car today, he can’t get the car of 20 years ago, he must pay the higher price for improvements he might not want. When this choice doesn’t exist, hedonic adjustments are nothing but subjective tinkering with the numbers to get the inflation numbers they want. I wonder if the adjustments are not made backwards in relation to a predetermined inflation rate in advance, that would be hilarious.

Coming from frugal parents and working in business I learned a few things about cutting cost.

If you have the time and have an interest you might be able to get your personal inflation to a negative number.

Some markets have nearly infinite choices (clothing, food, furniture). Others not so much. Some people pay up for status which I have no problem with. I was just taught it’s a sin to be wasteful. There are a lot of techniques. I am a researcher and try to be creative in finding close substitutes.

I have a friend who is a fierce negotiator and being a nice looking female she knows how to get a male store manager to say yes to a discount. Here favorite technique is to find a product with a tiny scratch or dent and then go for the jugular on the discount.

I wonder if any one out there thinks inflation is circa 2% except Central Bankers, billionaires and Wall Street. It’s a great excuse for ripping off Savers, Pensioners and Wage Earners-low returns, low CPI adjustments, low wage increases, respectively. A hundred million Americans of working age are not employed, but official unemployment is at all time lows. A glorious time with more suicides, more addictions, fewer friends, fewer kids and more homelessness than, well you get the real picture. All these official stats are simply a representative of our age, that is FAKE.

Augusto – Correct.

The unemployment numbers are total Science Fiction.

“On this conceptual level, “hedonic quality adjustments” make sense.”

An ENTIRELY subjective, pull it out of your arse adjustment. For instance, a car’s ENTIRE purpose is to get you from point A to point B. The fact that a high fidelity audio system and other luxury features come standard and increase the cost provides no added value to that.

Same for the “substitution” adjustment. Can no longer afford steak, you’ll buy chicken.

With those adjustments and improper weighting of CPI inputs (example, IIRC, medical costs are weighted 8%, but are according to surveys 14% of typical expenses), the CPI has become not a measure of what income increase is required to maintain a constant standard of living, it is what fudging is necessary to reduce COLA increases saving hundreds of billions or even trillions over the years. THAT was the actual goal of the Boskin Commission.

And isn’t it funny that that commission just happened to manage to find that the CPI was too HIGH instead of too LOW just as “increased accuracy” in “measurements” always seem to benefit the government?

Winston,

CPI is a monetary measurement. It measures the purchasing power of the money. It doesn’t measure the results of technical, structural, or manufacturing changes. That’s the first thing you need to understand about CPI, or you’ll never understand CPI.

How CPI is used and misused it another issue. For example, CPI is used (in part) to calculate Social Security payment increases. This is a misuseof the index, and purposefully so, because it just attempts to cover monetary inflation, and not the increases in costs of living that come from quality improvements. In the end, you run out of money to buy stuff that you used to be able to buy because the improvements in (perhaps unneeded or unwanted) quality have moved it out of reach. It’s critical to understand how this works so you can prepare for it.

Interest rates have turned. We assume that higher inflation leads to higher interest rates, (as an offset) it works the other way around too. Wolf already documented the bifurcated system of paying savers interest. My FA moved me into an MM with no sweep that pays about 1.5% more. (It trades under a stock symbol so it makes me more than a little nervous). YC has turned, and longer bond has topped. Fed will be hard pressed to drop rates again, like the previous Fed this one follows the market.

It’s kind of funny how we were trained to kind of be in awe of the security of banks. Until I read in a Bill Sharpes modern portfolio theory I never quite thought about saving and lending as two sides of the same coin and if you use the bank as an intermediary the spread should be very low.

Banks make a lot of money because individuals will leave trillions of dollars in banks at an extremely low interest rate. More educated business customers know going rates and alternatives and require competitive rates.

So….no interest rate cuts this month?

I see the fed cutting 1/4 and then saying the word” patient”, “mid cycle adjustment”( I know Wolf will be counting). I’m going out on a limb here and saying this is the last cut. Trump will have a fit( and so will the stock market)

maybe the reason some of this doesn’t make sense to us is because the ‘official’ numbers are not accurate. there are other numbers out there that may be more accurate, but for the sake of any discussion everyone must use the same set including the fed. here wolf uses the ‘official’ numbers which is a good place to start if those are the numbers that proportedly explain why things are the way they are and how we might adjust for the future, and hold accountable. thanks to the ‘=’ sign in math and paying careful attention to the words people use, (and keeping in mind and that sarcasm, irony and humor can make it entertaining) I think we have the tools for making sense of this. accepting that part of this could be explained w/’weve never been exactly here before’ and understanding that once one starts to make up stories for any reason its really hard to stop w/out pulling ones own covers. I had this daydream the other day, between gms at a dart bar w/jp I ask Jerome ‘off the record’ what his thoughts were on the disappearance of phillips curve? he takes a pull from his ipa, leans forward and says ‘one of two things, either phillips vehicle was hedonically adjusted w/power steering and now he can successfully negotiate the curve.. and I say whats the other? finishing his beverage wiping his chin and leaning further forward he says.. put the 100m uncounted on the sidelines back into the employment equation.. phil gets his curve back..

In my opinion new housing construction cost is a pretty good indicator of inflation. It’s got on average a little over 2 man years of labor, plus a lot of manufactured items plus commodities and some professional services costs. The current gimmick of surveying what people think their house would rent for has been shown to understate housing inflation substantially over a long time span.

New houses do have some improvements over older houses but some of the old wood was better and some of the craftsmanship was better.

Some of the old wood was better? The McMansion today is built of particle board or OSB.

Fact: a while ago I had to re-roof a house built in the 50’s. It had been leaking for a while (yup, buckets in the kitchen) but finally I had to replace it. It had its second roof still on it, so there was no way a third could go over the first two. So they had to come off.

The sheathing was tongue- and- groove planks. There was so little damage the roofer didn’t charge me extra for the repairs.

Today nearly all new construction around here is OSB for everything including roof sheathing. It has to replaced when the roof tiles are replaced. It’s the law as the OSB is not safe to walk on.

Many years ago as a realtor I was showing a new house and only half joking pointed out to the folks that the flooring was ‘genuine plywood’.

As for OSB that crap should be out of the Code at least for roofing.

Old-school – I think you meant to say “wood from prior to 1960 was WAY better”.

As nick kelly points out, the builders are using “Engineered Composite Materials” for new construction, not wood.

I have seen, with my own eyes, actual interior walls made out of cardboard nailed onto studs, complete with the original printing which was on the cardboard box. (To be fair, this was done without any building inspectors looking at it, but still.) I can’t decide which is worse, illegal construction practices or the steady downgrading of “legal” standards.

A Minor Quibble with your language. Please change

“under fierce pressure from global competition, manufacturers are constantly trying to improve their product. These improvements allow them to charge more for their products”

to

“in an effort to squeeze more money from the consumers, manufacturers are constantly adding so-called improvements which nobody wants and nobody asked for. Because the old, easy-to-use products are no longer available, these pseudo-improvements allow the manufacturers to charge more”.

Thank you.

You might not want those improvements, and I get that, but you’re not a big enough of a sample size to represent the 325 million consumers in the US. I want (most) of those improvements. Lots of consumers want those improvements. It’s unimproved products that languish and eventually die. That’s why manufacturers improve their products — to stay alive. And if consumers don’t buy their stuff, the companies are dead. There is no way around it. And it happens all the time.

Wolf, you didn’t mention that the 10x broadband improvement is offset by the increase in consumption by today’s apps such as streaming, which also add their own costs. Replacing cable with streaming is still not very.. hedonic these days.

Computer power increase is offset by software bloat and adds.

As for cars.. electronics are prone to failure and expensive, but hard to avoid. I don’t want a toy, heck I don’t even want to drive if there were other options.

Overall the marginal effect has been minimal over the past 10 years.

Because of our broadband connection, we’ve become cable cutters. We have neither telephone line nor cable TV. All we have it cellphone and broadband. Saves a ton of money. And we’re not the only ones. “Cable cutters” are a huge problem for these industries.