QE Unwind continues via the sharp drop in MBS.

In August, the Fed shed Mortgage Backed Securities (MBS) at a rate that exceeded its self-imposed “cap” of $20 billion for the fourth month in a row, but added some Treasury securities, with a new emphasis on short-term Treasury bills.

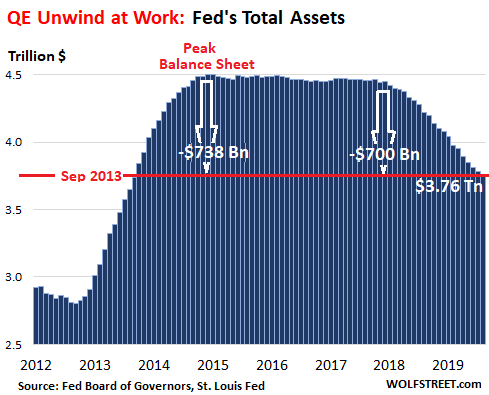

Total assets on the Fed’s balance sheet fell by $20 billion, to $3.76 trillion, as of the balance sheet for the week ended September 4, released this afternoon. This brought the balance sheet to the lowest level since September 2013. So far this year, the Fed has shed $314 billion in assets. Since the beginning of the “balance sheet normalization” process, the Fed has shed $700 billion. Since peak-QE in January 2015, it has shed $738 billion:

Treasury Runoff turns around.

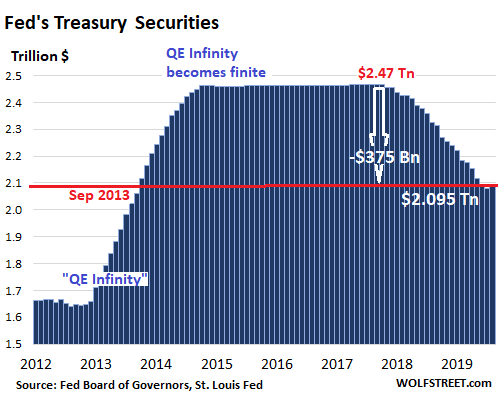

During the month of August, $70 billion in Treasury securities in the Fed’s portfolio matured and were redeemed by the US Treasury Department. The Fed replaced all those with new Treasury securities. This replacement would have kept its holdings level. Per its new plan to replace its MBS securities with Treasury securities – more on that in a moment – it added about $15 billion in Treasury securities, bringing the total to $2.095 trillion.

This was the first monthly increase since the end of 2017, bringing its Treasury holdings back to the level of last July, and just above the September 2013 level:

As part of its new regime to shorten the overall maturity of its holdings, the Fed’s holdings now include $3 billion in Treasury bills (maturing in one year or less), up from zero a few months ago.

After “Operation Twist,” which was layered between QE-2 and “QE Infinity,” the Fed had not held any Treasury bills. About four months ago, it started dabbling in them again, but in August it got serious. These T-bills replaced some of the MBS that ran off its balance sheet.

MBS run off exceeds “cap” for fourth month in a row

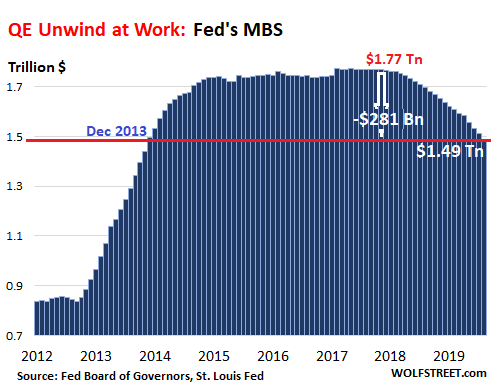

In August, the balance of MBS fell by $22 billion to $1.49 trillion, just below the December 2013 level. The August run-off exceeded the self-imposed $20-billion “cap” – its rule that it would shed “up to” $20 billion a month – for the fourth month in a row.

Over the last four months, the Fed has shed $94 billion in MBS, the fastest four-month pace ever and above the theoretical $80-billion cap for a four-month period. The sharper run-off of its MBS is in part responsible for the continued shrinkage of its total assets:

Holders of MBS receive pass-through principal payments as the underlying mortgages are paid down through monthly mortgage payments and are paid off when the home is sold or the mortgage is refinanced. Any remaining principal is paid off at maturity.

Currently, $1.41 trillion, or 94.6%, of the MBS that the Fed holds mature in 10 years or more, and the runoff is almost exclusively due to pass-through principal payments.

The drop in mortgage rates since November has triggered a surge in mortgage refinancings. And as homeowners paid off their old mortgages, the pass-through principal payments to holders of MBS surged as well. And it appears that the Fed is eager to get rid of these MBS.

It’s not getting rid of them because of credit risk. Credit risk of these MBS is not with the Fed, but with the federal government, since these MBS were issued and guaranteed by the government agency Ginnie Mae, or by the Government Sponsored Enterprises, Fannie Mae and Freddie Mac.

Instead, the Fed wants to get rid of its MBS because they’re cumbersome to deal with, in terms of conducting monetary policy. The Fed has also stated that by holding MBS, it is giving preferential treatment to housing debt over other forms of private-sector debt, and it expressed its desire to exit this business of assigning preferences.

If interest rates rise enough, mortgage refinancings will slow again, and the run-off of MBS will slow to a trickle. In this case, under its new regime, the Fed has indicated that it may sell MBS outright to keep the runoff process going.

In terms of the Fed’s overall assets, under the latest new-new regime announced at the July meeting, the runoff of its MBS holdings is supposed to be counter-balanced by the increase in its Treasury security holdings, including T-bills. So far, the increase in its Treasury holdings has fallen short of making up for the sharp drop in MBS holdings, and so the QE unwind continued in August, but at a slower pace than before.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What a mess. It’s like watching an old Laurel and Hardy film, or maybe the Three Stooges trying to let go of flypaper. Let this go, replace with that, but if this happens, then………..

Free Market Capitalism. No Socialist meddling here, just let the Market decide. Righhhhhht. And next week is infrastructure week.

Just because you don’t understand the details of what they’re doing and why doesn’t make it a bad thing

No matter if you understand, and no matter if THEY understand, it’s how you think about this thing. The question is, how much of a GSE is the Fed for holding onto this stuff? If Fed (see Dudley on this) would refuse at some point more debt underwritten by other GSEs? When SHTF is SM shouting in his phone “Pick up Jay, I know you are there..”?

A. Bierce:

Thank you!

“We” gave the store away in the GFC and now it’s just the walnut shell game. It’s like “cleaning out the manure form the stables.” That’s the only way I can understand the whole process.

SM = Steve Mnuchin, Treasury Secretary

No matter who understand what, the thing is NOT how you think. It is whether the decision maker have any skin in the game. There is none. There is only one outcome for people have power but no skin in the game. They got rich and we die for the country.

The problem is “they” the central bankers don’t know what they are doing. I truly believe “they” are scared poop-less, so they keep doing more of the same. As the old saying goes, the only tool (again here is that word) “they” have is a hammer, so all the problems look like a nail. “They” have messed up the financial system with all their antibiotics. At some point the economic body will go into a very serious coma. “Their” actions prove my point. “They” think that this can be engineered away – but will soon become 50 shades of ugly. What “they” are engineering will be an epic crash. What a disgrace being perpetrated upon humanity!!! Dante places these folks in the lowest levels of hell.

Why don’t people see that economic decision making by committee is Socialism?

And Central Bankers have morphed into Central Planners…making economic decisions by committee.

Central Banker/ Planners are an exercise in Socialism and Globalization…

here, we have decided…the rates will be negative till further notice.

Lot of people do see it. Their voices just don’t have enough power though.

Most seem engrossed with the minutia of what Fed is hinting at, what it will do etc. while completely missing the questions on why this entity has such enormous power or if it should even exist.

JZ said correctly, there is no skin in the game for central planners (er, central bankers). It’s all ego-rush and God complex.

Surely you forgot to mention that the “socialism” is solely for the benefit of banks and hedge funds.

Exactly. Whether it is the BIS, IMF, FED, World Bank, any part of our Constitutional Government, a Board of Directors, the C suites, Heritage Foundation, or any other damned committee or super PAC, it is a small group of increasingly dubiously “selected” people playing with other people’s lives and fortunes.

The “free market” only begins to really exist as one gets closer to the bottom, i.e., Can you pay my asking rent? No? I will find someone who can. Can you walk out of this store with this after paying the asking price we want, No? Well, if you still walk out with it, I will call the police and you will be referred to “our justice system”. Can you pay for a good attorney? No?, then you are looking at more jail time and fines.

But you are ALWAYS FREE to decide what to do, that is what counts in this “free market” economy.

(EXCEPT sleep under a bridge in the Hamptons, Hilton Head, etc, etc.)

Every nation deserve the government they have!

and the people of the US deserve their current government well and truly.

What you need here are brave souls like ( Garet Garret) who saw the results of this “ mess” as Paulo, historicus, GP and the vast majority of this forum sees it.

Seeing Falsehood though great start to mend things is NOT ENOUGH, the average US citizen need to develop ( or rediscover) a pair of (los cojones)! :)

Only then you’ll see the difference between your system and the communists in China .

[ when you gather in the streets to demand] and save your CONSTITUTION.

Many decades ago congress and the president granted a private corporation the authority to issue our currency. Who could have predicted they would one day use their privileged position to outrageously, openly manipulate asset markets.

I everyone ok with this? I’m not ok with this. I think Bernanke should be thrown in jail – not earnings 10’s of millions at a figure head position at a high frequency trading firm. Bernanke openly admitted to using his privileged position to manipulate markets. The guy needs to be prosecuted, his manipulation created dangerous distortions. If the Fed gets away with constant, corrupt meddling there will no longer be a middle class.

What we have now is not Socialism, it is Fascism – the melding of government with private corporations. Corporations control the government and the government controls corporations – they become one.

Looking forward to the infrastructure bill. It will be written by corporations for corporations. People are asleep at the switch and wonder why their living standards are in decline.

Bastiat said it eloquently in his famous work “The Law”.

Quoting a paragraph from the book (link in the username):

The law has been used to destroy its own objective: It has been applied to annihilating the justice that it was supposed to maintain; to limiting and destroying rights which its real purpose was to respect. The law has placed the collective force at the disposal of the unscrupulous who wish, without risk, to exploit the person, liberty, and property of others. It has converted plunder into a right, in order to protect plunder. And it has converted lawful defense into a crime, in order to punish lawful defense.

You’ve got Bernanke pegged exactly right. Bernanke should be behind bars because it was him in 2012 who said we need to backstop the U.S. stock market because all the suckers will throw their money into it because of his (Bernanke’s) zero interest rate policy. Market rigging (backstopping is rigging) is a criminal offence.

The 2-yr treasury suggests the FED’s Effective Federal Funds Rate will be around 1.5% this time next year — so, with lots of volatility ahead up and down, we’ll be fairly close to where we are as the election kicks into high gear, with a recession effectively phasing in while people vote.

https://fred.stlouisfed.org/graph/?g=oMGU

Let’s see, the Fed is on AutoPilot. That means the FFR is now at 3.25% on it’s way to over 4% in 2020 when the Fed will assess the economy before deciding on further rate increases. And of course the balance sheet is now under 4.5T. This was the plan the Fed announced and, because the Fed does not lie, we must be well on our way to “normalization”.

Here in the real world the facts are less pleasant – we are riding a fast rocket to negative rates and a balance sheet that will soon enough be over 100 Trillion. Just the facts – invest accordingly.

The dollar was a currency last century – not a good idea to hold it this century. Hot Potato!

The only way the dollar will become irrelevant is if the US army gets beaten on the battlefield by a stronger country. That well educated people cant grasp this simple fact , shows they have no clue about the reality of things out there and they keep living in their bubble.

“The only way the dollar will become irrelevant is if the US army gets beaten on the battlefield by a stronger country.”

Garbage.

The Global financial system has been looking for a cleaner dirty shirt ever since the repeal of glass stegal. That does not say CNY/RMB ccp china or RBL Former Soviet Russia. Or (unstable) currency union without fiscal union EUR.

When it finds one it will grab it, as the world does not like the way the US plays post Glass Stegal.

The global financial system will find a new reserve currency when a winner emerges on the battle field and US army loses. Otherwise they will be stuck with the usd for a very very long time.

Throughout history, the reserve currency was always the currency of the dominant power.

While many others currencies can be used as “reserve currencies” today, as is the case of euro, pound or yen, they are not true reserve currencies in the way usd is. USD is a reserve currency because commodities are denominated in it, and that is it.

The power of a reserve currency comes from the barrel of a gun, same as always, all the rest is intellectual masturbation at best.

Memento, I don’t think our ‘mighty’ military is the reason our dollar’s future is assured, I think that has more to do with the fact that it’s the reserve currency — the world’s most owned currency and the most OWED currency.

Baring some sort of natural disaster which wipes out humanity, the dollar is likely to out live us all.

Why do you think USD is the reserve currency and not the British pound or the yen or euro? Do you understand the exorbitant privileges of being the reserve currency issuer?

Memento mori,

All currencies you mentioned are reserve currencies. The dollar is the dominant reserve currency with a share of 61.8%. The euro is the #2 reserve currency with a share of 20.2%. The yen is the #3 reserve currency with a share of 5.2%. The pound is the #4 reserve currency with a share of 4.5%. There are other reserve currencies too, each with a smaller share, including the RMB.

https://wolfstreet.com/2019/07/01/us-dollar-status-as-global-reserve-currency-q1-2019/

Umm…please name a war the U.S. has won in the last 50, 70, 80 or so years?

Then ask yourself what you’d like to call that bubble you’re in.

Like Afghanistan ? We’ve been “winning” there for :

Longer than the US Revolutionary War, US Civil War, World War 1, and World War Two COMBINED !

Nothing like victory over sheepherders, right ?

Gulf war I

Iraq War II.

Everything after that has been a police action, and there is no winning or losing a police action.

Timbers

“…Umm…please name a war the U.S. has won in the last 50, 70, 80 or so years?…’

Try WWII. Try reading some history.

Do you actually think the ‘intent’ of these conflicts was to ‘win’?

@Timbers, The deck chairs were arranged in the aftermath of WW2. Europe and ME especially would look very different had the outcome been different. The other wars were not fought to be “won” in a traditional sense. Ask any soldier involved.

I do share your skepticism with talking about the US winning on a “battlefield”. The big war is an economic one for now and many Americans simply prefer cheap electronics assembled by enslaved laborers without regards to whether their job ultimately disappears beyond their field of vision. Many in the US (on both sides of the aisle) have been operating in a post-US paradigm. Large corporations are a very visible example, though pol’s don’t spend time talking about it for obvious reasons. To wit, look at major tech co involvement in oppressive regimes, while they talk to us about inclusiveness, equality, etc.

The original US leadership decentralized power in a way that was beyond the imagination of most people at the time. It was a revolutionary idea and it took hold in other places as well. We take the outcome for granted today, but a post-US paradigm has been well underway for about 3 decades.

The U.S. has won the war against its middle class.

The US dollar almost collapsed in 1978. Tourists around the world were asked to pay in local currency. One manager in Italy was overjoyed when a couple offered to pay in lira!

Americans fled the dollar for anything, and the govt made it illegal to buy gold. When silver hit 50 $ and the Hunts announced a silver- backed bond the Chicago exchange was ordered to accept only trades for liquidation not accumulation. The main currency favorites were the Swiss franc and West German D-mark.

As the US Fed desperately struggled to stabilize the dollar, it drove the Fed rate over 15% but on top of that it had to sell bonds denominated in Swiss francs. No one wanted promises of future payments denominated in US dollars.

The conflation of military power with financial strength made more sense in the pre- H bomb era. Britain conquered a lot of the world with black powder muskets and cannon. Germany was almost bankrupt in 1939 and largely ran the first 2 years of the war with plunder, especially gold from the central banks of Europe.

Although the Soviet Union could have destroyed any country with its military, in the H bomb era that power was moot. Even the nuclear deterrent of France or Britain could have taken out Moscow, and Petersburg etc.

But the cost of its military was a factor in its collapse. Strangely it’s one Russia under Putin seems to imitate. He has fired minister of finance Alexei Kudrin for telling him Russia could not afford a 500 billion dollar arms build up and largely proceeded with it. When the ruble had a near- death experience Kudrin was rehabilitated as an adviser but one of the many clouds overhanging Russia is excessive military spending.

Is the US in the same boat? No one wants rubles but the US can print dollars until 1978 repeats itself.

@nick. All relationships between countries are a matter of power play, there is no mister nice guy out there. If you keep this basic fact in mind, your analysis will be different.

People will always have a preference for a strong currency, if the euro starts appreciating against the USD more people would like to hold it. But that doesn’t make it a reserve currency in the sense that commodities are priced in Euros.

The USD draws it reserve status because we won WWII and have the strongest military for now. It will remain so for as long as we have the strongest military.

How long do you think South China Sea or Hormuz shipping lanes will remain opened to free trade without the backing of the US navy? The reason international trade is priced in USD is because the power and might of US army can make sure those shipping lanes remain open.

Nick Kelly

So in 1978, Italian shop owners (experiencing 13-13% inflation in the Lira) were happy when Americans paid in US$ (experiencing 8-8.5% inflation.

That’s a good story

oooops

“…were happy when Americans paid in US$ (experiencing 8-8.5% inflation…”

should have read

“…were happy when Americans (experiencing 8-8.5% inflation) paid in lira…”

Re: lira and run on the dollar. You have to be a high flyer to crash. No one including Italians used the lira as a store of value (as distinct from medium of exchange) but mattresses from Moscow to Timbuktu were stuffed with dollars. Everyone was used to Italian inflation it was predictable. The US spike took the world by surprise and it ran for the Exit.

Re: Example of change due to nuclear weapons. There can’t be Round Two of the US Civil War ( as WWII was round II of WWI)

The US military split in the Civil War with both having access to all existing weapons.

Today the Union could not be preserved by force of arms.

a few things:

it’s only in our world of floating currencies, that anything other than gold was a true reserve currency. currencies were only valued based on their convertibility to gold.

wolf uses central bank holdings to measure the status of currencies. while this is technically correct, the true measure of a currency’s status is what percentage of trade is denominated in that currency. by either measure, the dollar is way out in front and likely to stay there for at least another decade.

As a trade currency, the dollar and the euro are nearly on par. But as a financing currency, the dollar is way ahead.

“As a trade currency, the dollar and the euro are nearly on par.” correct me if i’m wrong but i believe that’s only true because that includes trade between euro zone countries.

Dollar index has been surging this year. I’m not worried.

Likely because all the money flowed into the U.S. dollar the last recession back in 2008. It looks like a repeat of 2008.

I’ve been hearing end of dollar talk for as long as I can remember. And usually from the same people talking about peak oil and gold. Some day the US dollar will cease being the world’s currency, just like some day the world will run out of oil. But that some day will happen long after everyone reading this is dead.

That’s what you think It can happen pretty quickly actually if trust is lost I’m not taking any chances and hedging my dollar investments with gold and silver You do what you want

Likely one world currency within the next ten years.

I read like many of you that world interest rates are the lowest in 5000 years. Don’t think that could have happened without politicians and central bankers. What is the end result? Rich are richer; middle-class going no where. Oh by the way, I will believe in global warming when the elite turn in their jets and downsize to one home without a swimming pool. A large pool uses more energy than the typical typical persons home.

What does the selfish and hypocritical behavior of elites have to do with whether global warming/human-induced climate change exists?

One doesn’t cancel out the other, and they exist quite predictably with each other.

Duke, People don’t like to follow hypocritical leaders. They don’t have credibility when they fear monger and then act “above” it all. So those leadership types tend to rely on ignorance and/or force.

Actively reducing our impact, while credible people prove whether there is an impact or not, does seem like a wager that can’t lose. Of course, this involves giving the ability to choose which provides no grist for the political mill.

I’ll believe the elites take global climate warming change seriously when they all abandon their 10K st ft homes on the beach and move to high elevation. The Obamas just spent $15M on a beach home on Cape Cod. Hmmm…really? I mean think about it, if you truly believed the oceans were rising, would you own oceanfront property? No, of course not. No sane person would spend that kind of money to own a home that will be under water in a few years. None of them believe in climate change, it’s all the typical virtue signalling. And this goes for Hollywood types, musicians, you name it.

I guess if you have more money than you really need, then having a beach front house to spend a few weeks a year in is just an place to go and relax away from the intense life of an elite. I’m sure I would if I was one. Along with a few in others places like the Caribbean, or Florida, or the coast of Mexico. Maybe one along the Oregon coast or even the NW woods where wild fires are becoming as prevalent as tornadoes and hurricanes.

For you and I it is a huge unwarranted risk but then it would actually mean something to you and me to lose a 15 million$ home.. For those at the top.. chump change. They own the world and really have no real risk.. Think those inside the walls of the Hunger Games..

How low can (rates) go?

I have a theory that the Fed is in no hurry to drop rates as it makes it far easier for the USG to sell UST’s without the Fed having to go to outright monetization. With the strong dollar and rates that haven’t gone negative (yet), I see the Fed lack of rate action akin to hoovering up investor cash from around the world.

The last country standing with positive rates gets all the ‘action’. If the ECB goes to outright monetization will it scare even more capital our way? Hmmm…

This is simply not factual. Foreign bond investment is negative, because FX-hedged rates are negative.

https://tradingeconomics.com/united-states/foreign-bond-investment

This is a big story and I’m feeling encouraged to hear this. Maybe the Fed is going to remain fairly hawkish and will not capitulate to Trump as they seemed to be doing in the past few months. Maybe the Fed does want to do something right for the country, long term. Could it be?

Anyway, I had noticed a tweet from Peter Schiff to his followers just a day ago, expressing his belief that the Fed was embarking on QE already because they purchased 14 billion in US Treasuries in the past couple of weeks. I immediately knew he was omitting what they had sloughed off. Schiff has done this a couple of times before in the past, cherry picking information to shore up his case for hyperinflation and gold to 10k. It’s disturbing and sad that he has so many followers. He’s targeting the very people who’re being most victimized by our corrupt system and it’s a shame to witness.

Yes, I noticed the same thing. But all the players, left, right, conservative, liberals, protectionists, climate change, solar flarist etc…; well I made up the last one, that I just invented for myself and my opinions at present. That could change too.

Everyone talks their book, and bends the facts. For instance, climate change people are correct the weather is changing , but it always has. Are they wrong ? No. When they discovered the first black hole recently, it was stated that it took the light (various wave lengths) that left the black hole to reach earth from the black hole that they were seeing 7,800 light years to reach earth. At that time it was the Pleistocene era on earth, post apocalyptic meteorite strike that wiped out the dinosaurs, and the first mammals. The weather was changing then too. We have had about 10 ice ages since then, and many warming periods.

Time keeps rolling, a very dependable variable for change that wrongs rights and rights wrongs.

Weather changes on its own, but that does mean man cannot permanently change it as well? The existence of one change agent does not preclude the other.

I don’t know if man-made global warming it true or not, because I haven’t been through the research yet and I don’t rely on anybody to provide a logical legitimate opinion. If people are talking, they are selling. Good research comes from print, not a talking head.

All research is time dependent. The basic elements of life on earth show a long time frame of existence, but the birth and death of suns longer. Climate changes have been going on forever, some decades more volatile than others. Many physicists theorize that solar flares are the primary weather patterns determinants. The sun’s life cycle undoubtedly has a primary short and long term influence on everything on our little rock.

Talk about bending facts! In 5781 BC the Neolithic Revolution (farming/domesticated animals) had been going on for 6-8K years.

Civilizations were forming everywhere! And your ice age and “warming” notions are too ridiculous to even address. I could tell you more about that era, but it frankly isn’t worth my time.

The climate is changing and it is manmade, and we may be too far along to do anything about it.

A Green New Deal should have been started yesterday REGARDLESS of who’s job or portfolio it trashes.

If there is a future for humans, I am sure they would much prefer mere financial problems to deal with.

And from what university did you get your PHD in Climatology Science that you can claim climate change is man-made? Same one as Al Gore?

And by the way cows don’t fart they mostly belch. Just the way they work.

Lisa, Schiff’s timing may be off but his fundamental message concerning the value of gold and need to own physical gold is spot on.

Fed banksters have debased the value of the dollar since its inception in 1913 to such an extent that a 1913 dollar is now worth 2 or 3 cents. Gold, on the other hand, has gone from ~ $20/oz in 1913 to over $1500 today. It would likely be much higher were it not for the actions in the paper gold market of Fed proxies such as the JP Morgue, HSBC and the Plunge Protection Team.

The dollar may be the “ least bad house” in the neighborhood, but it really doesn’t matter because the entire fiat money neighborhood is a sh*thole. The neighborhood we should all want to live in is the one that’s held its value over time, i.e., gold.

Is that $20/oz priced in 1913 dollars and the $1500/oz priced in 2019 dollars?

If so, then gold has roughly doubled in value relative to the dollar in that time frame. That is an absolutely insignificant growth rate over 100+ years and from the perspective of any person’s financial lifetime, irrelevant.

Looks to me like Gold is about to explode to the upside That might change your outlook on the metal

Zantetsu, thank you for proving my point: gold has more than held its value over time, while the dollar is essentially worthless.

That gold has gained in constant value at all is a bonus, as it’s a store of wealth, no one’s liability and can’t be debased or counterfeited by Fed Banksters.

Fredrick: I have no outlook on gold. I just don’t like misrepresentations.

HB Guy: Gold has *not* “held its value over time”. For the sixty or so years from 1913 to 1973 its real value decreased. It’s been up and down since then, mostly up I will admit, but since 1973 it’s hardly been a good investment vehicle. Right now it’s trading at what, 2.5x its inflation-adjusted value in 1973? What a pitiful return a 40+ year investment in gold would be.

Gold is not a currency, so you really should compare it against other assets with regards to investment return. It’s terrible compared to the S&P which is up 5x in the same time frame.

Oh and I forgot to mention: gold doesn’t pay dividends, but many stocks do, so the S&P return is actually much better than that 5x figure.

Not this nonsense again with the devaluing of the dollar since 1913.

Yeah if you put $1000 under a mattress in 1913, the purchasing power in 2019 would be a lot less. But that’s not how the real world works. $1000 invested in 1913 in virtually anything, stocks, bonds, real estate, sugar, whatever (and then reinvested along with reinvesting dividends/interest)…..would today have a higher purchasing power than in 1913. The median income earner in 2019 is exponentially richer than the median income earner in 1913.

That’s what counts not some ridiculous notion of a dollar “losing” value.

They must pay you well to attempt to discredit “real money” with 5000 years of track record behind it preserving wealth random troll

You are saying the dollar isn’t being horribly debased because if you had invested your money you would be fine?

The point is you must be invested in productive assets in order to avoid the currency. The currency is confetti, unload for whatever you can get and be greatful.

His points holds true – the dollar has been horribly debased (I can’t even buy an apple at my local Fred Meyer for $1) and we are entering a period of accelerating debasement.

Everyone is happy to get free stuff from the government – Aircraft Carriers, oversees bases, border walls, countless bureaucrats, TSA, military parades, FBI investigations – the list of free government stuff goes on endlessly and Americans are lapping it up because they don’t pay for any of it. It is all paid for with T-bills (printed money – T-bills are backed by the Fed, where does the Fed get the money). This spending flows from the government into the hands of individuals who don’t do productive work but compete in the market for goods and services – inflation.

Everything seems to chug along just fine until one day there is a loss of confidence and everyone wants to unload their currency at the same time. There is not enough goods and services to buy with all the money created and prices rocket higher. Trust me, I have already lived through this once, I’ve heard the idiots assure us everything was fine and we could just keep printing money and there would be no consequences – needless to say the idiots were proven wrong. What will you give me in exchange for my Brazilian Cruzeiros? That is what I will give you for a dollar in the future.

Just Some Random Guy, I wish you well after the coming reset since you seem blind to the obvious long-term debasing of the dollar.

If you have $1 and it costs $1 to buy product X or you have $100 and it costs $20 to buy product X, which is a better option? To hear the Ron Paul types talk, you’d think option one is better because the dollar is “STRONGER” and $1 is less than $20 so it must be that the dollar has lost 95% of its value. But you guys always forget to account for the fact that you have $100 instead of $1.

But whatever, there’s no changing your minds so we’ll agree to disagree.

‘FYI, I have estimated those dividends based upon another index; based upon those estimates, I calculate that one dollar invested at the beginning of 1900 (end of 1899) would have been worth over $25,000 at the end of 2012. An investment of $100 would be worth over $2,500,000!’

From financial blog ‘Observations’ This is based on investment in the Dow with dividends reinvested.

Obviously gold is a very very poor investment.

However it has certain emergency attractions. It can be hidden from the good guys as well as the bad guys. It is universally accepted as money.

Please, before anyone says you can’t buy a Big Mac with it: you can’t buy one with a T bill either. But unless you are way in the woods, a gold buyer will be an hour or two away. He will exchange your gold for any currency at rate better than for most other currencies.

Maybe your desire for gold should depend on your expectation of catastrophe.

BTW: taking 1500 for gold is kind of cherry picking. Gold has spent a lot of time far below that. In 2000 it was $272, in 2005 it was $513.

Canadian govt unloaded at 400.

Nick Kelly, I was using today’s approximate value.

Or I could have hypothesized it’s approximate value based on a 40% gold standard (i.e., what the US was on until St Franklin stole everyone’s gold in 1933) and what would be needed to back the US Gubment’s $21 trillion debt (plus another $16 trillion the Fed gave away to foreign banks during the GFC). Jim Rickards estimates that the price of gold needed in such a scenario is north of $38,000/ounce.

Just sayin’…

Back in 2010 Peter Schiff was saying 30 year treasury bonds were going up to 6% in the next few years. The top in 2010 was 4.8% and that has not even been tested again in over 9 years.

I would not take what he says to seriously as his track record is not that great. I am not surprised by this as many so called forecasters get it wrong.

1) Seventeen Tons of negative rates tied to JP neck.

No inflation insight. Until it come.

Gravity with NR are pulling the US yield curve down.

The yield curve is defective.

It cannot indicate inflation.

When inflation will rise, JP will be dragged down by $17 Tons

on his neck.

Zero rates will inflame inflation.

When JP will wake up ==> it will be too late.

2) Gold have peaked and will turn down.

When a resistance line drawn from Sept 2011 peak to Sept 2019

peak will be breached, gold will shine.

Looks that way Was dropping this morning and I missed the low by being too pessimistic The poor employment numbers is lifting the metals again Looks like gold and silver will continue the long slog to new record highs before too long

Exactly 90 years ago today, were they thinking–What could go wrong? Then Oct 1929 happened. The buildings are a lot higher to leap out of.

“The buildings are a lot higher to leap out of.”

That’s why it was called “A permanently high plateau” by the experts…..

Considering that the FED has been outed as a left leaning partisan hack organization.

The question is what is the political reason they have for thier every decision.

Considering:

– more MBS balance is being sold than than short term bonds bought

– the fed is trying to disengage from Fannie and Freddie guarantees

-fed fund rates (ffr) do not correspond to the 10yr bond as much as usual with the ffr being relatively higher.

Low rates are not the primary imperative for a robust economy. The majority of people working at decent wages producing things that other people want , and can afford because these other are doing the same is the key required.

The Fed is propping up the short term while investors are grabbing safe haven bonds across the board. It has been an amazing and complex recipe for short term fixes to keep things rolling across the whole world. It has never been done before on this scale. More than likely it is doomed for failure. Too many variables for any scientific experiment to contend with. Experiments like this fail when the one variable, one piece of sand doesn’t balance correctly- the inflection point, and there goes the Humpty Dumpty world economy cracked into little bits that has to be put together again. is this like a planned psycho-history long term event analogous to the science fiction great Isaac Asimopv’s “Foundation” trilogy? Will fiat currency not exist in 10-15 years, and be replaced by one world digital currency; Is this the ultimate goal? Tune in to your grand kids life in 20 years to find out, or not. Place your bets.

“Will fiat currency not exist in 10-15 years, and be replaced by one world digital currency …?”

Billions of people who use money will have something to say about that – the worse things get, the more they will pay attention.

They may elect that which has stood the test of time – gold.

Exactly. The great reset is coming for all fiat currencies. The dollar and IOUSA’s debt, backed by the “full faith and credit of the United States” will be shown to be worthless, given that its unfunded liabilities exceed the US’ GDP by orders of magnitude. In fact, they’re close to Greece, the only difference being the Fed can continue to counterfeit IOUs that has the illusion of being useful.

Before there is any kind of move to install gold as the next currency, wouldn’t we simply eliminate central bank meddling in fiat currencies?

Fiat currencies are a problem only because central banks are manipulating them. Take away the manipulation and fiat currencies should work as intended (i.e., a store of value).

Bobber, you’d also have to force politicians to live within their means. Once the dollar’s link to gold was broken, and silver removed from circulating coinage, the US Gubment was able to run deficits to infinity with little regard for the consequences. The Fed willingly aided and abetted them, and more recently entered the realm of MMT.

SMH…

Hmmm…. if they elect gold, will that not be a one world currency? Is that a good thing or a bad thing?

Curiouscat, interesting point. That said, since gold is no one’s liability, I’d venture to say it’s a good thing, unless or until the Fed and other Central Banksters engage in more MMT…

Laws can change to make fiat currencies palatable again. If meddling with the money supply were treated like counterfeiting or murder and central bank interventions were limited by law to short-term liquidity provision , you’d see fiat currencies and the economy do quite well on a consistent basis. The changeover, of course, would include the pain associated with reversing 30 years of nonsensical central bank intervention and debt buildup.

Gold is not the only “true” money, as many people boldly proclaim without any backing. Money is what people say it is. Gold seems to me like nothing more than a tradition, which has become a financial religion to many people.

I fear holders of gold will lose a lot of money, and quickly, if fiat currency reforms ever to go into place. Central bankers are pressing their luck. Three strikes and you are out, they say. This next financial crash would be the third in two decades.

Simplict

“…Will fiat currency not exist in 10-15 years, and be replaced by one world digital currency…”

Why would anybody want this? Look at the EU-one-size-fits-all damage that is being / has been done by the euro.

I certainly don’t want this; voted for Ron Paul back in the day. But I just can’t imagine why they are doing this, unless there is some comic book like hidden evil agenda, Been told that these are smart people in charge, but they are short sighted, evil or both.

Smart perhaps, evil and greedy definitely

stick a fork in the fed, they’re done.

We can hope right?

A headline said, “Treasury discussed hiring Houlihan Lokey for Frannie restructuring…”. Gives a reason why the Fed doesn’t want to hold MBS.

My understanding is that buying short term Treasuries in quantity will lower short term Treasuries yield. That implies buying short term Treasuries is a strategy to un-invert the yield curve.

Wolf, in previous articles, you have said that the Fed limits the net roll-off of maturing Treasurys by buying fresh ones directly from the US Treasury. Do its purchases suppress rates as suggested by Anon, such as by having to out-bid other buyers? How is the rate determined?

Fed should call the purchase of Treasuries to offset excess MBS roll off QR for Qualitative Replacement.

I’d support it even it they ran the roll off to $100B a month and bought $80B in Treasuries. But I’d rather they allowed the self imposed limit to run a bit higher or start selling the MBS outright now. Why wait for rates to rise and Re-Fi’s to slow??

Great post Wolf, thanks for these Fed Balance Sheet Watch updates, you’re the best.

Ninety years ago on the DJI :

Sept 1929 peak to 1946 peak.

When that resistance line was breached, the the DOW was on road to 19666.

Only because they never locked up the crooks and criminals that rigged and manipulated the markets in America. The markets today are trading at 6 to 10 times the true valuations.

It only appears to the “losers” that they were crooks and criminals. To paraphrase p45, they just used the laws of the land to their benefit, and that is being smart. All the “winners” do it.

Just exactly what the laws are for people operating at that level, seems open to debate, and also quite lucrative for those whose “job” it is to debate said “laws of the land”.

It seems the US Treasury wants to re-privatize the GSEs while keeping the taxpayer backstop. This may be why the fed is getting out of the MBS business. I don’t blame them, since the GSEs will only screw the investors and taxpayers again.

It’s unbelievable how blatant they are, they tell you to your face they are going to screw you over before they do it.

I have been thinking the same, that Fed is worried that the housing bubble 2.0 will implode soon. And with it, the mortgages and the Mortgage Backed Securities. So Fed is trying to unload the MBS. See also below my link to the latest version (Sep 5) plan for re-privatizing Fannie and Freddie.

(one SM acronym comment landed in the wrong place, BTW, can be deleted)

LIBOR has been dropping so maybe the Fed is behind the curve on this. Some think the Fed merely follows the market, and this may be one of those times. Investors don’t fight the Fed and the Fed can’t fight global NIRP.

I was working really hard in 1998,1999 and commuting an hour each way. Four kids. It was a tough time. I remember wondering how long the bubble could go on and it went longer and longer but one day the tide went out. It will happen again, but it will be different enough for it to take us to the cleaners if we are not careful.

A lot of us thought the recession should have been 2015, but I think Fed thought the world couldn’t handle it then so the can was kicked. Europe looks toast to me. How can Italy borrow cheaper than US? I can’t believe Germany is letting environmental narrow mindedness destroy their car industry which is their industry. It’s a giant roll of the dice to make a product that is not market driven. You already have a shortage of savings and you are going to recapitalize your transportation industry and the country isn’t exactly Arizona.

They wouldn’t let the stock market collapse in August of 2015. The cavalry came riding over the hill at 9:45am instead of letting the DOW collapse to 5,000 or less. This must of prevented the recession that never ended from 2008. More government interference just like the bank bail-out.

The cavalry as you put is the global monetary base, and the wave of liquidity steamrollered the selloff. The real question is this time different?

Here is the plan (from Sep 5, yesterday) to re-privatize the profits of Fannie and Freddie, while still keeping taxpayers on the hook for guaranteeing mortgages, for a much-too-small insurance fee.

https://home.treasury.gov/system/files/136/Treasury-Housing-Finance-Reform-Plan.pdf

Privatize the profits and socialize the losses. Crony Capitalism. Socialism for the wealthy. It’s how things are done in America.

Mr. Richter:

Again a good column. The more I read about what the FED is doing and their actions, the more confused I become, but in “between” the confusion I do get bits and pieces of knowledge. That’s important!

My overall view is that the FED has just been building a wall against further disaster since the GFC.

Good read on the trucking industry. Maybe it is also a representation of business greed like farmers: A good year in particular crops seems always for them to plant much more of the same the following seasons and the results are always, “glut”.

From my view in the western Sierras, retired, and with large family living in the Bay Area and surrounds I see a large dichotomy in the economy. The greater Bay Area is seemingly always “booming” while the outer fringes of the CA counties are really suffering for revenue.

State highways are being upgraded with large state $$$$; while the county roads and other social services continue to suffer and degrade or be degraded.

I have three close relatives (daughter, granddaughter, retired friend) living and working in SF. (I grew up there). I see the kind of housing differences between the three. The sharing of an old (Dolores Area) two story flat that has been converted to two apartments renting for +or- $3000 (more plus) each; the others living in a outer avenue home with lots of upkeep and taxes. Both make about $70,000 annual salary to more and get by ok. Both use the good public transportation that is available there.

Most of the others live in Santa Clara Valley and are thankfully long term well employed mostly in the trades where I’m told that they have never been so busy. Working in management up from the “floor” for more than 30-35 years.

Other working the mortgage world for more than 30 years and have never been as busy as in 2006 in refi’s.

Enough.

Thx again for a good read.

People are buying real estate instead of T-bills. The Fed fuels the housing bubble by buying back their own T-bills and buying up mortgages, then puts it on the national debt tab. Highest debt/GDP since WW II. They used to print money, now they extend credit. There are lots for sale in the middle of nowhere, Florida. I think people will flip those too. Low income ranchers will sell to those who subdivide pastures. Survey lines over sod. Trailer for sale or rent.

Wolf is a brave analyst, and wants to believe that the Fed will do the right thing. Let me assure you, it wont.

From his speech today in Switzerland, courtesy of FT, the man is talking about make-up inflation. Forget any near future tightening.

….Talking about the challenges of easing in a potential downturn when policy rates are already close to zero — something he has called the “pre-eminent monetary policy challenge of our time” — Powell offered one specific strategy: make-up inflation.

When a central bank undershoots its inflation target, Mr Powell explained, it can promise to the public that it will overshoot in the future. As it makes up for lost inflation, the bank would also be making up for lost growth…