NIRP is systematically rotting out basic brain functionality.

Amid rampant market expectations of another and even bigger and grander round of QE by the ECB, which would also be buying corporate bonds and old bicycles, the total amount of bonds with negative yields has risen to nearly $13 trillion, according to Bank of America Merrill Lynch.

The perversion of negative interest rates imposed by central banks such as the ECB, the Bank of Japan, the Swiss National Bank and a slew of others, and the even bigger perversion of negative-yielding corporate debt apparently does a job on investors’ minds.

In a negative-yield environment, you can no longer buy bonds to hold them to maturity because you’d be guaranteed a loss. You’d have to buy them solely on the hopes of even more deeply negative yields in the near future that would allow you to slough off these critters to the next guy before they eat you up.

And this type of thinking has now completely wiped out whatever was left of investors’ capacity to act rationally. Once you start getting into central-bank mandated negative yields, rationality no longer applies because negative-yielding debt is irrational by definition: Why would you pay someone to borrow money from you?

And this type of intellectual short-circuit has now spread to euro-denominated junk bonds. These are risky bonds that are too risky to be considered “investment grate.” They were issued by over-leveraged companies with iffy or negative cashflows and a considerable probability of default, especially during a downturn.

And yes, you guessed it: there are now 14 junk-rated companies with euro-denominated bonds that have negative yields, according to Bloomberg:

- Ardagh Packaging Finance plc /Ardagh Holdings USA Inc.

- Altice Luxembourg SA

- Altice France SA

- Axalta Coating Systems LLC

- Constellium NV

- Arena Luxembourg Finance Sarl

- EC Finance Plc

- Nexi Capital SpA

- Nokia Corp.

- LSF10 Wolverine Investments SCA

- Smurfit Kappa Acquisitions ULC

- OI European Group BV

- Becton Dickinson Euro Finance Sarl

- WMG Acquisition Corp.

What does it even mean if you buy a junk bond with a negative yield?

If you’re lucky and the company does not default, it will redeem the bond at face value, and the company will pay you the face value of the bond on the date when the bond matures, plus accrued interest. Face value and the coupon payments over the term of the bond are all you’re going to get if you hold till maturity.

If the company defaults on the way — which is not unlikely, given its precarious financial condition that led to the junk credit rating in the first place — you’re out part or all of your principal investment. For taking this considerable risk, you’re being rewarded with a big yield, in theory.

But if you pay a lot more for the bond than face value, and if this premium you’re paying is bigger than the remaining interest payments, you end up in the hole, with a guaranteed loss unless you can sell the bonds to someone else at an even bigger premium and even greater negative yield before the bond matures.

But the closer you get to the maturity date of the bond, the closer the value of the bond will be to its face value, because on maturity date, face value and the interest that has accrued since the last interest payment are all you’re going to get.

What causes these junk bonds to have a negative yield is not some kind of magic but benighted investors whose brain is malfunctioning to the point that they bid up these bonds to such levels that the premium they pay over face value guarantees them a negative yield.

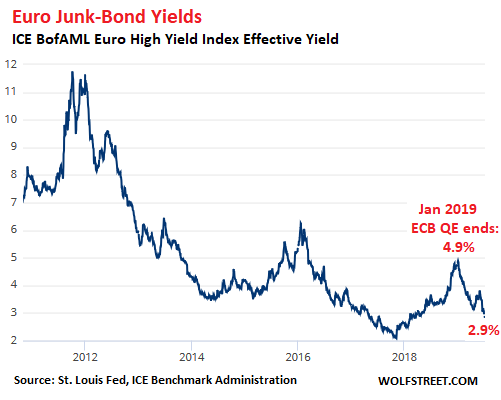

Not all euro junk bonds are adorned with a negative yield just yet. According to the ICE BofAML Euro High Yield Index, the average yield of these critters is 2.83% at the moment – down from 4.9% at the start of the year, when the ECB’s QE program ended:

Obviously, investors who’d bought euro junk bonds when euro junk bond yields were 10% or 6% or even 4% made out like bandits if they sold the bonds at current yields to some newcomers.

And these newcomers look at the above chart, and they see the trend that you can keep making out like bandits by buying junk bonds even at negative yields because surely yields will even be lower and more negative in the future, no matter what. And after years of central bank shenanigans and scorched-earth tactics, you can’t really blame these investors for having lost their minds and playing this idiotic game.

Where is the Fed’s “U-Turn” that Wall Street promised us? Read… Fed Sheds $38 Billion in Treasuries and MBS in June, Dumps MBS at Record Pace, Exceeding “Cap” for First Time

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Just read this on Bloomberg this morning.

Wonder what covenants, if any, exist with this horse manure. How silly of me to ask, I know.

Have we reached peak stupidity yet?

Yes but what company would ever default on a bond with negative yield?

LOOOOOOOOOOOL

You made my day… Maybe even the week!

Maybe a company whose bonds started with a positive yield that were then bid up to a negative yield?

If the bond originally sold at $1,000 with a 5% coupon it probably pays $25 every 6 months or so no matter what the current price is.

BTW the above is based on YTM. If you pay $800 for a $1,000 2 year bond with an $8 coupon that’s a great return. If you pay $1200 you’ll be way below zero YTM.

Then monkey business could issue new bonds at lower negative yields to meet its prior debt obligations. NIRP refinance is like putting on weight while bungee jumping like there is no bottom!

Actually, isn’t that dependent on the frequency of the coupons?

I don’t know anything here, but there are CDs that pay out monthly, I assume there are bonds that do the same, except of course for NIR bonds, they would just deduct the money off the top.

Then when they default, you would technically have less than the face value anyway. Right?

Bonds pay coupons twice a year.

No company would default. In fact, these companies should be taking out an infinite amount of debt.

You can take out tons of debt with a negative yield, hide the cash proceeds for a while, pay back the debt, what remains is your cut for doing nothing. Who really needs to produce anything when you have this guaranteed income stream?

The WolfStreet comment section should band together to create junk-rated companies and sell the next 13 trillion in negative-yielding debt. The problem is finding someone who knows a little about corporate finance and legalese. Maybe we can recruit or blackmail Wolf into joining up. And SocalJim for marketing! Brilliant.

Ambrose Bierce,

That’s hilarious….

But the yield is only negative for investors, not for the company. If the company issued the bond last year, its interest cost for the duration of the bond is the yield at the time of issuance.

It’s only investors selling the bond to each other that are driving yields into the negative.

At least for now… so far, junk-rated companies have not yet been able to issue a bond with negative yield at the time of issuance. That may be the next chapter :-]

Are these really “investors”?

This is old national lampoon cover seems to better describe what’s going on…

“Buy this bond or else…”

Financial repression? Better, Extortion?

https://images.app.goo.gl/dofCJF7R58ASScqV8

So a dumb question here. These bonds are not at a negative stated interest at purchase right? Rather, the tiny interest payable, minus any premium paid, nets a negative return? Is this correct, or are there actually bonds with a negative interest. Sorry if this is such an elementary question, but I just don’t get putting money at risk like this.

The bonds were not issued with negative coupons.

The Yield to Maturity is (based on secondary market pricing) is now negative – strictly due to rampant ECB bond buying and resulting interest rate suppression.

At least corporate has some opportunity to raise revenue, government has none. State governments can pass bond issues which garner revenue; transportation, highway, etc. They can tag on use taxes to pay for them. Feds run a deficit and spend on zero revenue agencies like DOD, while cutting taxes. (like they have any choice). A rebate from a car maker boosts revenue, while a rebate on a government bond boosts spending with no revenue.

Thanks Wolf, that’s what I was trying to say. The bonds aren’t issued at negative yield. It’s the secondary market that drives the yield negative.

But the fact remains the company has to make coupon payments and thus could default on those payments. H

I see said the blind man….. Apparently, bond interest no longer reflects the underlying risk.

There is just so much excess wealth at the top 1%. It’s only natural to have negative rates.

Interest rates are artifically pushed up by the existence of cash.

If it wasn’t for the existence of cash, the markets for money and capital could function properly and interest rates could go as low as needed to reach equilibrium.

QE is about giving investors cash while the equilibrium rate is negative.

Europe does not want high deficits. Even Italy, which is a “problem country” only has a 2% deficit, half the rate of the US.

So, if you don’t ‘spend your way into prosperity’, this is where interest rates go

@Amrose Bierce

Negative yield has no effect on the likelihood of default. The bond issuer pays the same coupon interest (fixed income) and face value regardless of yield (or market price). Negative yield may increase the chance for a bond to be called (redeemed by issuer prior to maturity), if debt can be reissued at a lower yield.

Brave New world, EUssr just put rating agencies out of business!

It’s all Investment Grade now in EUssr la la Land.

Default on the last day.

Keep the insanity going oong enough and everything will attain junk status.

The only 2 scenarios where one can make a profit when buying a negative-interest rate bond are:

1. As Wolf describes, if the rates on those bonds become even more negative, as then the value of the bond increases (capital appreciation).

2. If bonds are held for recurring income (possibly through maturity), there would need to be so much deflation that the deflation rate will be higher then the negative interest rate. i.e. while the nominal interest rate is negative, the real interest rate is still positive.

Who in their right mind, believes though that given current conditions, central bankers will let deflation occur?

So the only alternative left is the greater fool theory – i.e. option 1. But how much more negative interest rate can get? Eventually investors will start caring about real interest rate which are getting into more and more negative territory as well.

Option2? Automated buying by sector as required by some gov rule or fund prospectus that never anticipated the possibility of negative rates at the time? 401Ks on autopilot? Zombie funds don’t eat brains, they eat pensions…

Not a gold bug, but wow! If there ever were a case to be made for actually having possession of some, this seems to be it! Please, somebody tell me I am an idiot for thinking this way?

You’re not, gold and silver are often criticized for the lack of yield, which is a valid observation, but fails to understand precious metals in one’s portfolio. With that being said, no yield makes more sense than negative yield!

Yes, looks like holding physical gold and silver would be a much better option than negative bonds. Especially now with recent upward movement in metals.

Buy arable land in a decent country has been my mantra. – bonds? haha Gold? And when times get weird, if it goes sideways, you can try and protect your gold….and if you never use it, what’s the point of having it?

Gold like OIL is just a trade. Except small amount for long term, most of the money is made in call/put options. With Powell ‘bending over’ and openly willingly bend some MORE in the coming months. GLD will be sought after!

For Oil there are many companies/ETFs with a respectable dividend, as a cushion for rainy days!

I’m trying to think what the catalyst for this blowing up would be. Obviously it will at some point, but what triggers it?

* No deal Brexit?

* NIRP rate going below some value that results in acute (as opposed to chronic) pain? -2%? -5%? At some point there’s going to be real carrying costs just for owning these things, similar to margin calls, no?

* A spike in inflation (possibly due to trade war)? That would put pressure on EU central bankers to raise rates, possibly resulting in the insanity of govt bonds with higher rates than junk bonds.

Is it just me or are we in the final stages of this? I can’t see this getting beyond the end of the year without an explosion.

Markets can remain irrational longer than…

Words to live by.

NO one rings a bell for the arrival of BEAR mkt! Recognized only retrospectively!

In 2008, pundits said ‘ No one saw this coming’

Jeremy “Is it just me or are we in the final stages of this? I can’t see this getting beyond the end of the year without an explosion”.

I have been thinking that logic since 2007 and have lost out big time as a result.

I just don’t understand how anyone would contemplate buying these corporate bonds or even keep money in a bank account with NIRP.

The basis being that the banks are all technically bankrupt, why risk leaving your money in a bank (look what happened at Cypriot banks) or risk your money in a company that might go bankrupt.

In Switzerland we have negative interest rates on savings. But not only that we get taxed on capital at 0.2% per annum.

It therefore made sense to rent a safe deposit box for CHF 80 per annum and fill it with CHF 1,000 notes (CHF 1 is approx. US$1) and not declare the capital on your Swiss Tax Return.

There is now a shortage of 1,000 CHF notes and a waiting list of 2 years for a bank safe deposit box.

In the UK, it is illegal to keep cash in a safe deposit box and if a bank sees you keeping cash in such a box have to inform the police under money laundering rules.

On the basis of the above, why aren’t people buying gold bars and just hiding them.

In Thailand, where I also live we have Thai bt gold bars that can be bought and sold at shops with government buy and sell prices based on the US$ gold price with a very small spread.

https://xn--42cah7d0cxcvbbb9x.com/

However, it looks to me that this fiasco of just printing money can continue as long as all the Central Banks cahoot in it so currencies don’t devalue against each other.

“why aren’t people buying gold bars and just hiding them?”

they are, of course. Remember, gold sells out every year. Plenty of paper. But every ounce that comes out of the ground is spoken for.

Jeremy “Is it just me or are we in the final stages of this? I can’t see this getting beyond the end of the year without an explosion”.

No one rings a bell for the arrival of BEAR mkt!

Topping a process. Nobody can call a top in advance, tops are only clear in hindsight. Not the day after, but often only months later.

S&P has already zoomed over 300% since the trough in ’09! Those who stay invested (most of their money) are the ones, who have NEVER experienced a BEAR in the life time – those in the early 40s or younger.

I have been in the mkt since ’82 and this is the most surreal mkt of my life time! Since I am retired now, I am 60% cash with the rest, both short/long in the mkt.

Bought various ETFs of several kind and variety -domestic/global/sectors/Country/Region with at least 2.5% dividends. Trading most of the ETFs at Vanguard costs zilch!

Volatility has been reduced! My aim is for the ‘risk adjusted return’ not absolute return or compete with indexes. If I can replenish my MRD with drawl, by the end of the subsequent year, I am happy!

I sleep well, care little for the ‘collective insanity and cognitive dissonance’ affecting the Fed/CBers. Try to enjoy little things in life!

NO country in human history has prospered by spending debt over debt!

At this point, why don’t lenders just hold cash? Seems like a fair risk vs reward proposition.

Yield had always been a misnomer. Until now. Ask not how much your bond yields but how much you can yield to your bond!

LOL

All I have to say is F***ing European and Japanese central bankers, this is all their fault for causing this crap. This in turn make the Fed think about depressing the interest rate when there is no need. This has in turn driven down the yield on CDs. Heck, I’m just turning over 3 month and 6 month CDs now, the rates have collapsed so fast that I wish I had the foresight to have locked up more of it at 2.6% rate.

I also noted that those CDs that could be called back are having that happen right now. Cause why not, why pay at a higher interest rate.

The thing that gets me though, who the hell is stupid enough to buy these NIR bonds. I mean at that point, you’re better off stuffing the money under your mattress. I heard this bit which makes me somewhat jealous of these NIRP jerkoffs selling bonds, they sell they bonds, and buy US treasuries. Talk about instant arbitrage.

This just can’t end well. At some point, all of this is going to blow up in somebody’s face, and it wouldn’t surprise me that this end in a shooting war. If there is anyone that should go to jail, it’s that damned Mario Draghi.

And to replace Draghi, the EU has chosen Lagarde. She is of course eminently qualified:

1. She is an advocate of NIRP.

2. She is a convicted financial criminal. (I mean, in addition to being pro-NIRP.)

What could go wrong?

I think widespread inflation is coming. Young people I know

just received 10% raises.They have good but not over the top

jobs. i know this is anecdotal but I pay attention to that.

#2 and #3 is my Internet and Cable Provider. Awful service. Truly junk.

You’d think they will stay across the pond. They bought Cablevision here in the NY-CT area from the Madison Square and NY Knicks owner. They should have stayed in France.

Altice France SA has been downgraded by Standard & Poor’s from B+ to B back in January and was slapped with a negative outlook on it in March for good measure: this is the typical company whose growth came at a terrible price, a truly crushing debt load which is getting harder to service even with extremely favorable finacial conditions.

Now: those yields are not what Altice pays on their securities. Altice has a bunch of bond issues coming due in 2022-2025 yielding in the 6.25%-7.25% range and those bondholders expect to be paid down to the last penny. But those negative yields reflect the insanely high prices these bonds trade nowadays.

To be honest I wouldn’t touch anything Altice-related with a 10ft pole (I already own far too much financial junk): besides the bad service (sometimes people joke Altice is the best advertisement for their direct competitor, Iliad) this is a company marching quickly towards a default. Their growth model is too expensive to be sustainable and the only way to reduce debts is to sell off the family silver, meaning hitting revenues on the head… again it’s a circular logic that is becoming harder to break the more Altice can get in debt for next to nothing.

Globally, Altice Europe saw EBITDA fall 10% in the second quarter to 1.32 billion euros, slightly above the 1.30 billion euros estimated by analysts surveyed by Bloomberg. Net debt was stable at 31.7 billion euros.

https://www.jornaldenegocios.pt/mercados/bolsa/detalhe/altice-afunda-14-apos-baixar-estimativas-de-resultados

Debt/EBITDA Ratios higher than 4 or 5 usually set off alarms because they indicate that a company is likely to face difficulties in handling its debt burden

How Altice is not yet out of business with Debt/EBITDA Ratio of 24 !!!

French corporate debt ratios are extremely high, and Altice is no different. Expect them to shoot even higher from here to the next Presidential election, together with a host of fees and taxes, in yet another wave of GDP goosing which will ultimately cause the Fifth Republic to collpase under its own weight.

Oh, and the funny thing is France is the only European country with the exact equivalent of US GAAP: le Plan Comtable Général.

Yet EBITDA and “ex-bad items” are freely used to put apply makeup on less than stellar corporate balance sheets. But as the saying goes “A pig with lipstick is still a pig”…

Let us assume at some stage the NIRP music stops i.e. investors stop buying bonds that have negative yield today since it will be more negative tomorrow. What happens then?

Background on Zero:

The goal of negative-interest-rate policies is to encourage banks to stop hoarding money and, instead, to lend it and stimulate growth. This was one reason that the ECB made its deposit facility rate — the rate that banks receive for depositing money overnight at the ECB — negative in June 2014. With a negative rate, banks pay interest rather than earn interest on their deposits, and therefore should be motivated to lend more to consumers and to businesses, in turn boosting the broader economy.

The initial negative yield can be considered

an insurance premium paid to the government for protection

against future inflation

==>

The Implications of

Ultra-Low and Negative

Interest Rates for Asia

2018 Asian Development Bank Institute

What about reducing lower bound interest rates so they can be

negative? First, what creates a zero lower bound? Currency pays a

nominal interest rate of zero. If the central bank lowers the interest rate

on bank reserves below zero, then this bank and its customers have an

incentive to switch from their electronic funds to currency.

Miles Kimball of the University of Colorado Boulder has discussed

many ways by which central banks can disrupt the substitutability of

bank reserves in currency.

Switzerland is an exception because it

has a safe haven currency. But, having a negative risk premium is the

counterpart to that safe haven currency and the buyer of such insurance

that is safe haven currency must pay a price—typically a negative interest

differential.

Levying a fee on cash withdrawals at the central bank could

discourage wholesale paper currency hoarding

Let me now briefly touch on the features of negative interest rate

policy. The BOJ said that quantitative easing with the negative interest

rate would continue for as long as necessary to achieve the 2% target in

a stable manner. The BOJ would not hesitate to add monetary easing in

three dimensions. More quantity meant a monetary base beyond ¥80

trillion, and correspondingly with JGBs, more qualitative easing and a

more negative interest rate.

It is difficult to know whether the announcement of the negative

interest rate policy will depreciate currency, cause it to appreciate, or

not have much effect. Exchange rates are not just about an uncovered

interest parity condition and interest rate differentials, but also forward-

looking expectations of future policy as well as a policy response function.

Why did the central bank lower the interest rates to negative, to begin

with? That may signal a very weak economy or a weak financial sector.

These things are considered when forming market expectations of what

actually happens to an exchange rate.

https://www.adb.org/sites/default/files/publication/403236/adbi-implications-ultra-low-and-negative-interest-rates-asia.pdf.

A couple of thoughts. 1) Congress created the Fed so that govt always has funding in the least painful way 2) This leads to money spent by the individual as being precious, but money being wasted by government to buy votes. I will give one example. I worked hard and burned myself out by 50. I saved and invested and can spend about $4000 a month, but right now I am happy spending $900 per month or $30 per day. Thanks to Congress an immigrant crosses the border and most be taken care of according to legal requirements. Last I heard the cost was $750 per day. For $30 per day I have 500 sq ft apartment, a nice car and and eat too much. I am happy, but austere because I might want to buy a beach house or leave money to my children. The Fed enables Congress to borrow for free in real terms and that is what Congress is doing. If the system blows up Congress can blame it on the Fed. Are we really all that far from the John Law monetary way of thinking?

Maybe the ECB is trying to get (force) people to go back to buying stocks. After all, even Germany’s DAX has gone up 39% over the last 5 years, despite their continual bad economic data. And the UK’s FTSE has increased 12% so far this year, despite Brexit worries.

Ah, yes: the noble art of picking pennies in front of a steam roller.

There’s a whole bunch of these folks right now buying Norwegian Air Shuttle stocks. Up 21% in one week.

The reason is last week a rumor was spread by persons unknown that IAG (British Airways/Iberia) was again “interested” in everybody’s favorite money losing airline. In just six working days IAG has already issued two official communications to the tune of “No, we are not interested in Norwegian and we are not negotiating anything with them right now”.

Using Wall Street logic these two communiques were taken as confirmation that IAG will buy Norwegian in the near future, forgetting that IAG is a public company and hence subject to close regulatory scrutiny for such official communications. This is not Musk taking to Twitter in a “private capacity”.

Another bunch of these folks were flattened by the steamroller Wile E. Coyote style when they tried exactly the same trick last year, only Norwegian stock price was over 4 times what it is today.

And let’s not forget those who bough Euro banking stocks this year: how is Deutsche Bank doing folks?

Deutsche Bank, I heard that is a deal of a lifetime right now.

They are cutting costs, reinforcing their balance sheet, and has the backing of the German government. Also keeping their prized research section, the core of their business.

This must be a screaming buy buy buy… don’t miss out on the opportunity of a lifetime.

Anyone like my Cramer impression? I think we can do it again in a few months when there are a different set of facts, and it’ll be still a screaming buy all the way until they enter receivership.

Cramer… as in Jim Cramer? The perfect contrarian: buy when he say “sell” and sell when he says “buy. ;-)

of course the ECB is trying to get people to buy stocks, as is the FED – try to remember that there was massive QE in the USA.

The “wealth” effect I believe it is called.

@OldSchool

If you are irritated now with the FED and Congress’s spending then you need to try to relax because when Bernie Sanders wins in 2020 there is going to be a whole lot of government spending (“MMT” brothers) which is going to annoy you a awful lot more!

Brace yourself.

I checked some of the bonds. Yields are negative only in the very short term. And these negative yields are still better than those of safe government bonds (e.g. German).

Government bonds with negative yields? Nothing new here.

Point being missed is that weaker corporates are now issuing paper in the primary market no longer at a discount to face value but at a big and growing premium. In other words, at a hefty price not justified by their financial risk profile.

At maturity, only the bond’s face value is ever repaid, rolled over, or defaulted on.

The secondary market price (where jobbing is happening) is merely sentiment driven – no intrinsinc basis.

Thus

1. bonds have become trading instruments (not buy and hold) and highly speculative.

2. Rubbish companies now command premiums (over face value) rather than discounts for risky paper because of perception of QE era being here to stay.

3. Unless you are holding long duration paper, capital appreciation potential (or loss) can only be negligible.

4. Any sudden reversal in interest rate direction will decimate capital gains and coupon payments may not be enough to rescue investors who overpaid.

If corporates are being subsidised by investors, rather stick to stocks and benefit from reduced finance charges which will feed into corporates balance sheets.

Seems to me there’s much confusion as to what negative yield means. The trouble being there’s more than one definition of the term yield[1]. There’s ‘current yield’ and ‘yield to maturity’ (and likely others I don’t know about).

If a bond starts out with a positive rate and is later sold at a higher price then the rate it pays, relative to the higher price, drops but can never go negative (as dividing one +ve number by another +ve number can never go negative). But the over all profit on the bond (held to maturity) can be -ve, it depends on the price it is resold at. See [1] for details.

[1] https://www.investopedia.com/ask/answers/06/negativeyieldbond.asp

The loop dynamic of ever falling interest rates is as follows:

1) Deflationary impulse at least partly structural

2) Easing CB:s

3) Pick up in bank financed debt issuance –> increase money supply

4) Idiotic inflation targets keep CB:s easing

5) More bank financed debt -> increasing money supply (at a rate higher than GDP growth)

6) Back to 4

Loop between 4 and 6 means that liquidity grows faster than GDP (real economy is also getting more capital efficient due structural deflationary forces), which means liquidity flows into real-estate and financial assets that’s where you get the inflation. But that (“the financial economy”) is not big enough part of CB:s inflation measures to have an impact on policy…

Pretty basic relationship for everyone except PhD-idiots.

This stupidity will not end until the PhD:s unlearn their wacked theories – and that will surely take longer than any of us can stay solvent.

So be an idiot, play the game and buy some gold.

Or?

Negative yielding PRIVATE debt? Isn’t that legally technically GIFTING? What are the tax issues?

You put it in your IRS under the “Negative Capital Gains” section.

This is plain Joke!

Can’t believe we’re living to see this kind of Moral Hazard.

https://www.ecb.europa.eu/mopo/implement/omt/html/cspp-qa.en.html

God protect good Ol USD, where I went Galt!

That’s limited to $3,000 a year, correct?

That is correct! But you can carry over the remaining “Negative Capital Gains” to the next year!

My guess is a lot of capital is flowing out of China via Hong Kong. Junk bonds are one transmission medium. Lots of smart capable people in Hong Kong. Hold onto your hats if the Hong Kong situation goes south.

Ah, this is where a lot of people don’t get it. Think about a MAINLAND Chinese wanting to save. How does he or she do it without getting eaten by inflation or currency depreciation? They buy a house or a part of a house (partnership) in Canada or the USA and hope the rising prices lifts all boats.

Unfortunately, they are accused of money laundering. Tough love.

It seems like the central banks of the world are flawed entities. 1) The Fed for example started out with limited responsibilities as a lender of last resort, but now the unelected Fed head is maybe the most powerful person on the planet 2) central banks concentrate risk, if they are wrong the system blows up 3) The general thinking by central banks leads to too much debt, inflation of assets and too big of a reward for debt pushers 4) It is my understanding that central banks extreme measures can not be proven to show any benefit to the real economy

this has nothing to do with investing and everything to do with capital preservation in the event of a euro-zone currency crisis. not every entity can hold cash or gold. if you are restricted to euro denominated liquid assets, look at your choices:

1) bank accounts are subject to freezing and bail ins.

2) sovereign bonds are subject to freezing or default with no recourse.

3) corporate bonds are subject to default with partial repayment via receivership/bankruptcy.

Say what you want about a debt Jubilee. The fact is if “our only way forward” is negative rates then we are just doing a debt jubilee in painful slow motion. Just rip off the band-aid so we can get it over with and can try to rebuild finance and the economy on sound fundamentals instead of ridiculous and illogical ones that slowly but surely get crazier over time.

At this point gold would be a better investment though it pays no interest. The potential for fiat currencies to loose value over time is a given.

Re Paulo’s comment, supra: I agree, re arable land.

One kind doesn’t even require tending, automatically reproduces its output and increases your net worth every year: Land with timber growing on it.

Hehe, funny you should say that.

Where I live timber land detracts from the price of a property, since that land comes with legal obligations to maintain a certain tree age and density. That means that timber must taken out regularly. And with current timber prices that essentially makes it an expense, and means that the land owners every now and then have to fork out to pay contractors to come in and take out timber.

Maybe the land owners should issue some negative yielding bonds to cover their expenses? :)

Trouble is – watcha gonna do when a man with a gun decides to take it? Engage him in war? Not a low-stress option…

But the option most recorded in history.

I plan to be be the man with the gun.

Gold, silver, lead. The three precious metals.

The liquidity of junk bond markets is starting to show up in the EU and U.K.

https://www.bloomberg.com/news/articles/2019-07-10/why-liquidity-mismatch-is-scaring-the-bond-market-quicktake?cmpid=BBD071019_MKT&utm_medium=email&utm_source=newsletter&utm_term=190710&utm_campaign=markets

The real crisis kicks off now, and, as usual, it is liquidity.

Blathering about return on capital, instead of return of capital.

The biggest question is going to be how deep is the panic going to be in Canadian real estate, and does it spread to hot West Coast America?

So far, no panic, but everyone forget about leverage in real estate. LoL, underwater basket weaving, in a year or so. Meh

As for the folks continued whines about CD yield, keep parking your money.

Might as well spend it, leaving a big pile of money is futile.

Investment is going to require luck and grit again, but until the global central bank liquidity wave is allowed to recede, the world simply becomes more Japanese.

For nearly 10 years I have been saying inflation is moribund. And until wages really appreciate, meh.

Silver is dead, ag is dead, and real estate is living on a wave of Chinese money that will eventually dry up.

So, at the top of peak assets, what happens when the boomers really start to sell?

Check out the price of stuff in the thrift stores, especially Humane Society/Goodwill, they have to ruthlessly cut price to keep inventory in check.

Nokia Corp still exists? Oh My!

But really, why aren’t European investors just buying bonds from somewhere else that don’t have negative yield?

Pride? After all, they must show the Brits the error of their ways in leaving the EU.

They have to ‘hedge for currency risk’ in buying bonds outside their currency plus risk of reversal of rate (reversal of carry trade!)

The price of aluminum was cheaper during the 1980’s than now in US dollars. Large hydroelectric projects led to more smelting of bauxite. Most people do not hoard aluminum ingots.

Some guy had $3 million dollars worth of gold stolen from his house.

Bonds of companies showing signs of weakness do not always attract buyers. I tried to sell bonds of an over-leveraged company before. Every day I looked for a bid, and got none. One day I sold them. I can imagine when the tide turns some people will be miserable.

Interest rates might be going lower, but what happens if the banks tighten? Then they have less money to lend. Deutsche Bank lost money somewhere, thus the layoffs. Wheelbarrows full of money printing can not save Venezuela.

Aluminium is a good used in construction and manufacturing so if course it shows inflation. Do you ever read Wolf articles about inflation?

NIRP, covenant lite-junk bonds, stealth QE, low growth, low yields, low inflation — why not add currency war jawboning into this mess? The markets are basically run by supercomputer algorithms that play with super-complex on-the-fly portfolios — which are beyond human comprehension. Quantum computing and deeper AI will leave Baby Boomers in a constant state of frozen confusion, while Millennials embrace new hair styles. If you don’t understand the game, you’re not alone!

Unilateral FX intervention by the U.S. would likely spur only a “temporary” dollar sell-off, given that the average daily dollar flow dwarfs the reserves available in the Treasury Department’s Exchange Stabilization Fund, he wrote.

While not CIBC’s base case, a “tinfoil hat” scenario could see the Treasury pressure the Fed to liquidate its balance sheet to provide more dollars for intervention purposes

“This could create a lasting downward effect on USD valuation, given the incredible size of the Fed’s balance sheet.”

https://www.bloomberg.com/news/articles/2019-07-08/wall-street-dons-tinfoil-hat-to-ponder-u-s-fx-intervention

The question becomes WHO and WHY would anyone or any institution bid up the price of bonds, so that the yield to maturity is less than zero

The first are financial institutions which are required to maintain a certain % of reserves in government bonds.

The second are traders who believe that they can lay off the bonds to someone else at even higher prices.Note that these traders almost never will hold the bonds to maturity and that the yield per se is not the reason for purchasing bonds.

The third are those investors who believe that the amount of deflation will easily exceed the amount of negative interest, so that the “REAL YIELD” is positive. For example an investor will gladly invest $1,000,000 in bonds to receive back only $980,000 if prices decline %5 . Smaller investors may have the option of hoarding cash under this circumstance ,but this alternative is not viable for larger investors due to security concerns.

A more complicated reason for buying negative yielding government bonds , especially those of the strongest countries is the possibility of the EU disintegrating with the EURO existing only for past transactions. If this happens each country will issue their own new currency and Euros will be converted to these new currencies based upon the perception of each countries financial strength . The demand for German bonds would temporarily explode while those issued by Spain, Portugal,Greece, and Italy would plummet. This circumstance is far more unpredictable; that is why I describe it as more complicated.

As I have mentioned many times low yields , zero or negative yields indicate commensurately very low returns in the future. The ironic thing is that very low returns discourage investment and act as self fulfilling prophecy in which low investment leads to fewer jobs which increases social unrest which in turn increases the probability of the above scenario in which the EU falls apart

Low or negative interest rates in Europe also will lower interest rates in the US via arbitrage. European bond buyers will buy US bonds instead of European bonds if they can hedge out the interest and currency risk for a specific duration.

I have been searching for a good answer as to why investors would buy negative yielding bonds, particularly negative yielding junk bonds. As the 60+ comments above demonstrate, everyone has a different answer. It is not, insurance companies, pensions, central banks, or even companies going for a currency play. From what I can tell it is European asset managers buying European bonds (negative yielding junk bonds). Most likely, it is the best alternative out there for certain asset managers hoping to trade it. An even simpler answer could be performance measurement. If they are measured by income rather than yield, the high coupon offered could boost the calculation and make their performance look better.

If they simply repress the above ground economy, many thing will move underground. You ain’t seen nuthin yet.

Powell today:

“And there is a risk that weak inflation will be even more persistent than we currently anticipate.”

See, no inflations. Dat Fed don’t see no inflations!

All I know, is, when Powell did his U-turn in December, the internets say my house is now 14% more valuable and assets more valuable too!

But no inflations. Nope, no inflations anywhere. Must have more inflations.

Buying bonds with negative yields is a “greater fool” strategy. The same strategy house flippers used back in 2007.

Point many have overlooked is that negative interest rates encourage investors and banks to buy EU foreign debt at low rates but attractive compared to NIRP debt, ie Spain buying Greece debt and France buying Spain’s debt.

Once you start getting into central-bank mandated negative yields, rationality no longer applies because negative-yielding debt is irrational by definition: Why would you pay someone to borrow money from you?

In the case of debt of a monetary sovereign or Central Bank reserves, those are inherently risk-free. So why should those yield any more than ZERO percent MINUS overhead costs?

Or do you believe in welfare proportional to account balance?

That said, a Central Bank has no proper business buying assets from the private sector but only from its monetary sovereign.

Sovereign debt is only “risk free” in terms of credit risk (getting your money back). But it is exposed to duration risk and inflation. So if you hold a negative yielding 10-year bond, inflation is going to eat the purchasing power of that bond (normally yield would compensate you for that); and the duration risk (yield would also compensate you for that).

The richer, those who can afford sovereign debt, have no more moral right to be protected from price inflation than the poorer, do they?

Just got to know that Robert Prechter mentioned this article in his “Elliott Wave theorist” :)

This is the quote: “Premiums on junk bonds are historically low; in fact, some are now de facto negative (wolfstreet.com)” – EWT July 2019