Where are the foreign investors in this phenomenon?

Declining home sales in the US is a phenomenon that baffles the industry, given that mortgage rates have dropped sharply from the recent peak in November, and home sales should have jumped, logically speaking. But no.

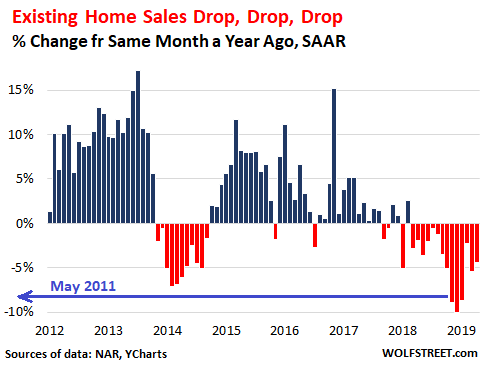

Sales of existing homes – single-family houses, townhouses, condos, and co-ops – in April ticked down from March and fell 4.4% from April last year, to a seasonally adjusted annual rate of 5.19 million homes, according to the National Association of Realtors, after having dropped 5.4% year-over-year in March, 2.3% in February, 8.7% in January, and 10.1% in December. The drops in November through January had been the largest since Housing Bust 1 (data via YCharts):

One culprit of declining home sales is that student loans “hinder millennial homebuyers,” according to the report. And yes, they do. But they did so before too. That is an ongoing factor in the US economy, and not a thing that suddenly popped up out of nowhere.

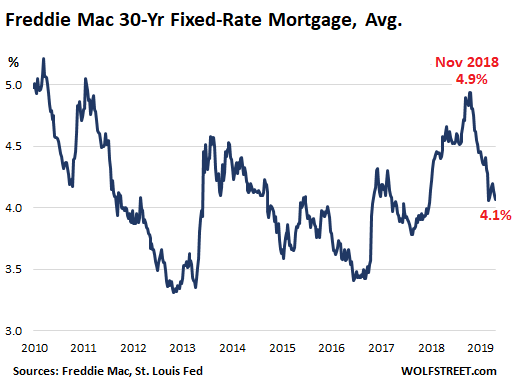

But mortgage rates have dropped. And that should have boosted sales. The average commitment rate of a 30-year conventional fixed-rate mortgage, as per Freddie Mac, fell to the 4.1%-range in April, the lowest since January 2018, down from the 4.9%-range in November 2018, and down from the 4.5%-range in April 2018.

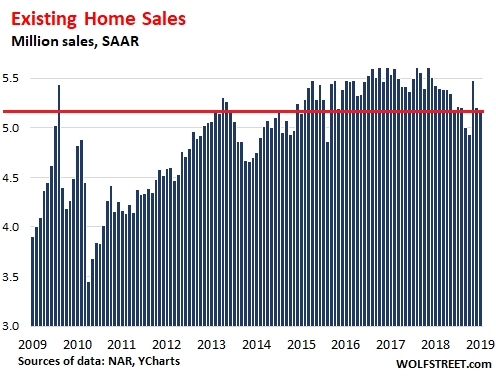

Just how little impact these lower mortgage rates have had, is apparent in the chart below. Even the one-month-wonder in February was still 2.8% below February 2018. And in April, the seasonally adjusted annual rate (SAAR) of sales of 5.19 million homes was not only 4.4% below April 2018, but also 6.3% below April 2017, and 5.3% below April 2016 (data via YCharts):

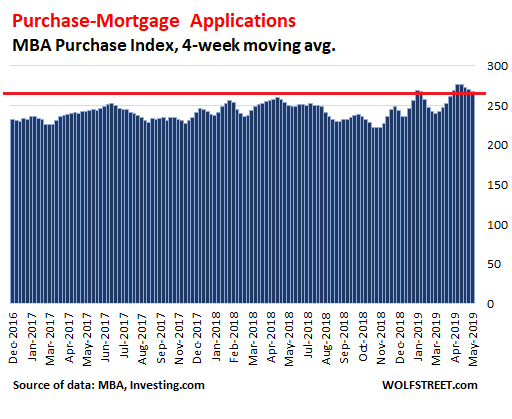

But here is the thing: purchase-mortgage applications, as reported by the Mortgage Bankers Association on a weekly basis, have been rising. These are mortgage applications by potential homebuyers to buy a home, rather than mortgage applications by homeowners to refinance an existing mortgage. Purchase-mortgage applications started rising on a year-over-year basis in January, as would be expected, given the lower mortgage rates.

From late March through early May, the four-week rolling average of purchase-mortgage applications jumped by the double digits compared to the same periods last year, with gains ranging from 10% to 21%:

So this poses an interesting situation: Months of falling sales of existing homes vs. surging purchase-mortgage applications.

This may mean that people who borrow money to buy a home are out there trying to buy, while some people or entities that do not need a mortgage – such as cash-rich households, or investors that can borrow at the institutional level via bond sales and the like, or investors sourcing their funds from overseas, including those needing to launder some dirty money – are retreating from the market.

According to the NAR’s report all-cash sales as a percent of total purchases inched down to a share of 20% of the transactions in April, down from a share of 21% in April last year.

This pencils out to be a seasonally adjusted annual rate of 1.04 million all-cash transactions in April 2019 versus a rate of 1.14 million in April 2018: a decline of 8.8% or 100,000 on a SAAR basis, pushing down overall sales by about 2%.

So this points at weak demand from cash buyers, as reported by the NAR’s Realtors. But it explains only a small part of the difference between rising purchase mortgage applications and falling sales.

Under some circumstances, tightening lending standards might cause more mortgage applications to be turned down at a greater rate, but lending standards are not tightening; and for non-qualified jumbo residential mortgage loans, banks eased their lending standards in the first quarter, according to the Senior Loan Officer Survey, released by the Federal Reserve earlier in May.

And new house sales are picking up only a tiny part of the slack from existing home sales. The data for new house sales in April has not been released yet, but in March they ticked up only 3% from a year ago, and the numbers are small: The seasonally adjusted annual rate of sales of new houses was 692,000 in March, compared to existing home sales of 5.21 million in March. So a 3% uptick in new house sales doesn’t impact the overall home sales much.

Something else is going on here to create this gap between rising mortgage applications and falling home sales. So I’m going to piece a theory together, going back to the opaque nature of many residential real estate transactions, and how payment methods are reported.

A couple of years ago, the US Treasury’s Financial Crimes division started selectively cracking down in some regions on money laundering schemes by imposing reporting requirements on real estate transactions in those regions. Late last year, it expanded the program, lowered the thresholds for reporting requirements to purchases of $300,000 and up, and included payments with cryptocurrencies to “further assist in tracking illicit funds and other criminal or illicit activity, as well as inform FinCEN’s future regulatory efforts in this sector.”

The “Geographic Targeting Orders” now cover certain counties in the metropolitan areas of Boston, Chicago, Dallas-Fort Worth, Honolulu, Las Vegas, Los Angeles, Miami, New York City, San Antonio, San Diego, San Francisco, and Seattle.

So it is possible that these government reporting requirements, in addition to capital controls in China and other factors, have reduced real estate transactions funded by dubious cash or money transfers, and that home sales have slipped in part because of this, and that, given the opaque nature of these transactions, they may never have been fully reflected in the “all-cash” transactions reported by the NAR, so their decline wouldn’t be reflected either.

A slippage among investors, including foreign investors, would explain why sales of existing homes have been falling, while households, induced by lower mortgage rates, are still trying to buy, as shown by rising mortgage applications.

Money laundering in Canadian real estate is a widely accepted fact of life these days, but the impact isn’t. Read… How a Little Money Laundering Can Have a Big Impact on Real Estate Prices

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

My base case is slower economic growth with inflation. Real estate is following this pattern. Home sales are dropping because of slower economic growth as well as many buyers sitting on the fence because they are scared of a price crash. These fence sitters are pushing rents up at a rapid rate. At the same time home prices are rising because of inflation.

Fence sitters must be wrong. Socaljim must be right.

Here is the thing. Nobody knows what the future is.

Let’s say 50% probability we get stagflation. 50% we get deflation.

How do you make decisions?

If you buy a house, stagflation happens, you win, deflations happens, you bankrupt.

If you do NOT buy a house, stagflation happens, you get rent squeezed but you will live. Deflation happens, you have savings because you did NOT blow it on down pay, you will live.

Using fear-of-being-priced-out-forever-if-you-sit is what moves the crowd. If you make decision based on those emotions, there is 50% chance you get killed.

Is this the time to worry about that nagging emotion of being priced-out-for-ever, or is this time to stay safe and try to survive IN CASE THISIS LATE CYCLE, and Ford style lay off is dead ahead?

Buy in a market that is appropriately priced….or under-priced. You can’t lose if you do your research.

That market is long gone since about 7years ago when they started doing ZIRP and WE.

Yeah, I agree. The problem is, I’m not really in a position right now to pack up and move to the Donbass Region or to the Chernobyl area because that’s about the only places left not in “one big fat ugly bubble” according to one who probably has forgotten more about RE than most Folks on this Site.

In reality it is not a coin flip, market changes don’t happen in a vacuum. So it’s not really 50/50. I’m one of the new applicants for a first home. For me it’s definitely a fear of being priced out down the road as well as insane rent costs. Homes in the affordable areas near me jumped up 100k in the last year. At that rate it’s rising faster than I can save up for a down payment. Meanwhile I’d like my “rent” to not all go down the toilet and I have a stable job, so it’s not high risk for me to buy a reasonably priced home now.

If you are buying near the overpriced city, make sure you get the 3% down government guaranteed mortgage for first-time home buyers. That way you have the choice of walking from the mortgage in the event home prices plummet, which they could. That’s a rational plan for an overpriced market, and the government is incentivizing that plan. Like it or not, this is the government’s solution to high home prices.

In SF, this is where rent control tips the balance for many. Your rent isn’t going up more than a percentage of the CPI, so you don’t have that threat; you look at housing prices and man, it takes some stones to jump in and buy now if you are a rational resident looking for a fairly-priced home. Obviously offshore money just fleeing somewhere skews the equation, as does a financial cushion to absorb some downside, be it from the bank of Mom/Dad or RSUs that look frothy now.

But someone who has patiently ground out a down payment and is sitting in the buy vs rent chair; every chart staring you in the face is telling you the next leg has to be down. It’s a slow march; seeing units on the market longer, some laughable price decreases (i.e. unit in Russian Hill sitting there unsold for 3 months, listed at $1.8, and the seller drops the price to $1.795), but kind of a standoff here. Time will tell, you know the current administration will do anything to prop it up until next November.

So you have a bunch of Boomers with no real retirement except their meager SS checks along with the pittance that they may have in a 401k & with all their real “wealth” wrapped up in Residential RE all trying to punch out simultaneously and sell to the Millennials who can’t fog a mirror financially…uh, yeah. That’s gonna end well.

The only upside for Buyers now is a 30yr fixed rate and Hyperinflation for the “win” and a very Pyrrhic Victory.

Zoaea, individual case of being able to “afford”is different. What’s the definition of over priced? It means it takes double income house hold and spend every last penny to pay for the mortgages.

What’s the definition of reasonable price? single income that pays the mortgages and every year can still save 30% so that every 3 years, he/she can save 1 extra year in case shit hit the fan.

If your income is high and stable, and you meet the reasonable price definition, then there is no bubble.

My neighborhood is the first kind.

Bobber has a point. In this country, the set up is always head I win, tail somebody else lose.

For wall street, it is the bailout. For average guy, you offset the risk to government insirance. After this risk mitigation is set up, nobody is going to be responsible for their own behavior, there will be no skin in the game, let’s consume everything and party baby! Amen to that!

One thing is certain. FED will print humongous amount of money and all of that will go to billionaires. Make your decision based where that money would go from billionaires onwards

SocalJim – where are you seeing rents “rapidly increase”? California and Northeast have a glut of high quality rentals and rates have dropped 15%-20% in multiple prime areas that I monitor.

Do you know he writes like a computer bot.

Where in the northeast have rents decreased and where in the northeast is there anything resembling a glut of inventory for rent or sale???? The rental vacancy rate is under 3% in nyc alone and under 5% nationwide.. NY STATE, Massachusetts and New Hampshire are also gaining Residents due to the strong job market

SocalJim is a bubble-monger that posts bubble-blowing propaganda. Rents are not rising at a “rapid rate”. He is just spouting lies. Every post I have seen by SocalJim is plain propaganda.

These people always have a “base case” that says you can never loser money on buying a house, no matter what. Wrong!!

Rents are rising? ROFL – I keep hearing this lie since 4 years. My landlord has never increased. Rents are very cheap compared to buying. Once we get a nice crash I buy.

SocalJim has been wrong for years. He is a realtor who has too much time on his hands due to declining sales volume.

My base case makes sense. The debt levels are so extreme that a bout of deflation would blow up the financial system. That is a fact. So, the central banks will do what ever it takes to avoid deflation. That is why real estate makes sense. Decades ago, debt levels were much lower and some deflation could be tolerated. No more. In 2007, a bout of deflation nearly blew up the system. Since then, the debt levels have increased. So, in my opinion you have to invest with the assumption that the central banks will do what ever QE is necessary to avoid deflation. That is why I am a real estate bull. Of course there is a chance that the central banks are not able to rig the system to avoid deflation. Fact is if deflation happens, we are all screwed. Major screwed. Everyone. The currency will be destroyed. Everything. In my opinion, the trade war may help the world avoid the deflation chance since China exporting deflation may be a thing of the past so I am less worried about deflation. Make no mistake .. if deflation hits, I am wiped out. So are most others.

I respect SocalJim’s opinion and there is a sense of “you-will-be—prices-out-if-you-do-not-hold-a-bag-now” propaganda in his personal bias. But that’s him. Free speech.

But his analysis is exactly my point. Head I win, tail, I got wiped out like everybody else. I will never allow myself to play this game. I want head I live, tail I can still live.

Central Banks will do what ever it takes and yet, there is, ladies and gentleman, the yellow vest and the likes.

I really have no idea what will happen. Maybe you can use game theory like SocalJim, but “head I win, tail I got wiped out” is NOT investing. This is what speculation means and this is what bubble and systemic risk forces people to do.

By the way, fuck central bankers.

If we believe you then –

1. Why did Japanese real estate still in the dump after 30 years? Japanese FED puts our FED to shame in printing money

2. FED will print but you and me will not get that money. It will all go to billionaires only. Are you getting 0% zirp loan ? of course not. Most people are not getting any loans at all !! Just to test my theory I went to Wells Fargo to get a personal loan. They quoted at 13% and even then they declined! I make 6 figures salary, have zero debt and perfect credit. So imagine that.

3. This time FED will have to print more like 10 trillions rather than 2 trillions Bernanke printed. Junk bond and Corporate bond market alone may be 10 trillions. If they try printing such amounts, people making $10 per hour, will be lucky to buy a piece of bread because no matter how much they try to keep trillions of dollars in the hands of a few to prevent the velocity of money, it will escape and hit the poor guys like a thunderbolt. Then it will be impossible to bring the inflation under control.

4. Don’t think we have key technology like 5G so we can print. Chinese or other countries can easily buy the scientists and engineers from USA dirt cheap. Scientists are pissed off. Out of those trillions printed by FED, how much went to NSF (National Science Foundation) and how much went to bankers ?? Not even 0.1% of those bail out money went to science.

JamesJim: Just a thought but you might be happier spewing your political invective over on ZeroHedge. Just a thought.

If you really want to know what is going on in China, just read Jeff Snider’s “China’s Big Stimulus” at Alhambra Partners.

Folks, stimulus=desperation. That is the case everywhere in the world, including U.S. Don’t be such a miserable dupe that you believe anything else.

I said some time ago that the world is moving toward autarky. That is exactly what is happening, which means each country starts at an economy which equals 0.

Think it over–but not for long.

but there is one thing. Goladman / JP Morgan may get several trillions from the FED at zirp or even at negative interest rate in the future. It means FED pays them to get the loan like it is in Europe. Then they may take those trillions and buy all the real estate especially when they know if this investment goes awry, FED will bail them out anyway. So they may buy all the real estate in the world and due to negative interest rate, FED pays them.

To ensure this, FED has to play the cards right. They have to yell loud that there is no inflation no inflation no inflation and give all the trillions to 0.1% of the chosen few. Then there will be no inflation because how much those 0.1% can eat ? how many cars can they buy ? There will be deflation in that case and at the same time real estate will keep going up.

I understand this is tantamount to juggling multiple balls for FED but they can do this for a long time. Eventually something will crash and it will come crashing down but in the interim music may keep playing and fat cats will keep dancing

Uh no likely they don’t have the MONEY for down payment + closing costs + PMI + moving expenses vs 1 month rent + 1 month security deposit. And in Nassau county on Long Island or in north jersey you are spending over $1,000 per month on taxes & insurance before touching principal interest every month

Could it also be not only what you mentioned Wolf in the article ,but also a lot

of non credit worthy applications and appraisers lowering apprasels because they are seeing the market soften? Therefore, creating a gap between applications and actual sales.

I have been viewing the same dynamic looking for some explanations. I think you may be on to something. The recent developments uncovering massive money laundering activity in BC real estate offer some clues. Hard to believe that Vancouver is the only place we have large illicit flows of funds in the real estate sector. With China having poured some $30 billion per year into U.S. residential real estate, it isn’t a stretch to think that the trade war could be manifesting in the real estate sector as well.

Aside from diminished investor appetite for inflated real estate, there is still an issue of affordability with the current stock of U.S. housing. Plenty of sellers who can’t or won’t lower their expectations to sell. I suspect there is a sizeable new crop of underwater borrowers in various U.S. submarkets.

ok, but let’s be clear most of the “money laundering” is people trying to evade capital controls not drug money, etc.

I agree it might be fence sitters. Why buy at the top if there is no particular reason to buy, trade up, or move?

The logging continues here on Vancouver Island at a blistering pace, so while new home construction has dropped, repairs due to weather and calamity continues with a hurricane season on the way.

As long as treasury yields are above 2% buying is questionable unless you really really have to.

I can tell you why I traded up. Went from one of the most expensive houses in old neighborhood to one of the cheapest houses in the new one. Relative loss in any downturn will be lower. Better schools too.

drg1234 – Why not rent if you are anticipating a loss? Unless a house is going to appreciate at 4% a year doesn’t really make sense to buy. Hard to imagine even the best school districts will get the required 4% over the next 10 years.

We are fence sitting because I’m very confident there is little price appreciation left in this cycle. Either the stock market or housing market is going to drop within the next 18 months and we want dry powder to scoop up bargains.

I wanted to rent for a while. My wife said no way to moving twice. This was the next best option.

There once was a man with a demanding wife

Who shouted “Go catch that falling knife”

So reluctantly he bought near the top

Just in time to see it all go “plop”

Now sadly trapped as debt slaves for life

With the Chinese seemingly out of the Vancouver market thanks to Trump its a long, long way to the bottom since Vancouverites make less than $40,000 a year on average. We see the fallacy about low and falling interest rates proven in Australia today. Something real estate agents dreamt up to sucker buyers into the market.

“So it is possible that these government reporting requirements, in addition to capital controls in China and other factors…”

Could it just be that China, on top of cracking down on capital flight, stopped creating a thousand millionaires a month?

Any report from the “People’s Republic of made up” is dubious at best but today’s behavior in the US Real Estate smacks of Japan’s sudden loss of appetite for RE in 1991.

And you believe US government statistics? And coming up on an Election Year?

I’d like to draw attention to another thing.

By percentage the largest group of foreign real estate buyers in the US are Canadians (about 23%). While one may think about Snowbirds, the average Canadian buyer spends about $335,000 to buy property in non-resort areas, chiefly in the suburbs of big urban areas such as Buffalo and Bellingham, where he/she doesn’t reside. While this average is much lower than what Mainland Chinese buyers (about 15% of total) spend, it’s also far higher than the $275,000 US citizens spent.

This hints at a very strong speculative behavior, albeit on a different scale from that typically associated with Chinese buyers.

Given what we are learning about the Canadian real estate insanity it’s possible (possible) at least part of these Canadian buyers are actually fronts for Chinese buyers: China has a huge middle class besides large numbers of ultra-rich and these people have been at the forefront of capital flight. For example they are very involved in retail and imex in several European countries. You can build a mountain out of grains of sand.

Other mostly non-resident nationalities with a passion for US real estate include Germany, Brazil, Australia and, rather unsurprisingly, Argentina and Venezuela.

Nationalities tend to “cluster” in some markets: for example Brazilian nationals have always favored Southern Florida while Australians love Los Angeles.

Each and every one of these nationalities have their peculiarities: it’s not just Chinese buyers that influence the US market.

In south Florida there were almost no Chinese buyers worth noting. The largest group by far were Latin Americans.

The Canadian presence was huge too. I always wondered how Canadians could afford to spend half the year in Florida with an average job back in Canada. Some sold RE part time while there.

Most are retired, which can be much earlier in Canada than US, albeit with lower Govt pensions. CPP is designed to replace just 1/3 of one’s income, mind you…it is solvent. :-) People return to Canada for 6 months to remain qualified for the single payer medical coverage.

I know some families that travel south, then rent their home to folks from the interior who consider the west coast a tropical vacation spot. Plus, there had been hefty profits made in the Air B&B market. Rent out your place here for 2X what you pay down south.

I knew one guy, who didn’t have a pot to piss in, lived for 6 warm months on Cortes Island and six in Mexico. He just lived a cheap lifestyle.

Personally, I don’t see the appeal of living in a travel trailer for 6 months in Lake Havasu. I would rather be shot and just get it over with.

Old dog – This is certainly a part of it. The Chinese stock market crashed last year and hasn’t recovered much. Losing a third of your paper wealth makes it more difficult to purchase foreign real estate.

Niche ponzi’s inside one gigantic overall ponzi which encompasses everything in China.

I follow a real estate agent out of Florida that says the increasing foreclosures and short sales are never getting to the market, they are being bought out by the reits. He said he lost out on two short sales because even though his buyers had a deal with the bank, the bank sold out the homes to reits before the closings. This would account for higher mortgage applications than actual sales.

Excellent comment!

Petunia,

Not sure if I understood you correctly… But I doubt the person submits a brand-new mortgage application every time he tries to bid on a house. That would be nuts — way too much work. He likely got pre-approved for a mortgage before bidding on anything. And knowing what kind of mortgage he can get at what rate, he starts bidding. So if he bid on 9 houses unsuccessfully and then finally gets the 10th house, it would involve just one mortgage application.

A lot of people apply for a mortgage then give up and rent after being unable to get a home. Under 1M is a tough market for a buyer. I know people like this. After a year of renting, they start the cycle over again.

Real estate is going to the moon, right Jimmy? Case Shiller is a lie. Boston and SF are a steal at $1m, in 5 years, everyone will be priced out forever!

The agent was explaining why buyers shouldn’t bid on short sales in Florida. He had two deals that fell through because the banks reneged on the deals they had already made with the buyers. The buyers bid on the short sales, eventually a price was accepted, but when they buyers tried to close the house was no longer held by the bank. The bank sold it to a reit, out from under the short sale buyer, before they could close.

The reason there might be multiple applications for the buyers is that the short sale bidding process may take weeks or months. When you add the time to closing the application may already be at the point of expiring. When they lose the opportunity to buy, they may have to start over.

The agent went further and explained how all foreclosure sales were being swept up by reits at the courthouse steps as well. He said this time there are no deals from the foreclosure mess because the reits are outbidding everybody.

And why are they out bidding everybody this time but not “last time”?

Story fails to add up on several levels. Maybe you left out the part about the aliens probing your anus?

This makes no sense and does not align with how RE sales are done. Once you sign a P&S agreement, the home cannot be sold to someone else.

Sounds like more shillery from another 6-month educated liar, I mean… REALTOR(R)

sc7,

The realtor may be lying, but prices and rents in Florida are rising, all while foreclosures are going up. His story rings true to me because the guy is also an investor and he is not finding any bargains.

DebtAhole,

What the RE agent didn’t say outright, but was apparent is that the banks are colluding with the reits. The banks have learned from the last debacle that they can unload all their bad loans to the reits wholesale and fast. This took them a while to learn in the last $$$htstorm. I hope this enlightens your tiny brain.

So we are talking hedge fund money? Blackrock? Confidence in the stock market may be putting a bid under real (income generating) assets. The next crisis there will be a lot of reallocating but not much deleveraging and bonds are death, though maybe not corporates?

sc7, Short sales are not like ordinary sales. The buyer and bank do have a contract but the contract says that the bank is not obligated while the buyer is. So a purchaser does what they have to do. They fill out the mortgage app, get an appraisal and inspections and in the end, the bank can and often does sell to someone else. We had banks stall for 4, 5 and 6 months before closing. Some just never closed. Sold to someone else. Buyers are made aware of this but in a tight market, buyers often choose to take the chance anyway.

This type of dealings with the banks should be illegal IMO but it isn’t. Realtors have good contracts but the banks most of the time refuse the Realtor contract and force prospective buyers to sign a contract giving the bank all the rights and leverage or there is No Deal at all.

If the buyer “had a Deal” with the bank then how did the bank get out of the deal and sell to a reit. Obviously your story is messed up.

Often there is a clause in the real estate contract that says the Seller can continue to market the property until the closing date. I can see how they sell it out from under the original buyer.

we’re reading through this story and comments and James said, “uh oh, they got your Petunia angry over here!”

and i said, “yeah but she’s from the Bronx; she covers herself well.”

everytime someone tries to snark you on here i forget that’s the nature of internet grouchy trollery and get ready for an actual physical fight with hair pulling.

James knows i think you and i are Thelma and Louise waiting to happen at our own “End of America Adventure” without the suicide part at the end (that’s already happening on an existential level).

and yeah, the REITs are an interesting new wrinkle in all real estate because they can wait things out and regular folks cannot afford to retro-fit commercial spaces in SF for earthquakes.

unintended consequences are FASCINATING.

x

If the current rates dropped, expect re-fi’s from last year.

Also I read there’s a lot more down payment assistance programs now.

I don’t think anyone who is stable and is all set need to buy a new house in this crazy environment. Unless you are forced to move, then you can rent.

Iamafan – Exactly. The only FOMO I see is working class people competing over low end housing. The $75K households are scared of being priced out forever.

Anyone with stability and a flexible budget is probably balking at today’s prices. We will rent until there is some clarity for the true market value of house with investors exiting the market and tax reform fully priced in. Hard to imagine prices will be higher next year or even 5 years down the road.

In a recent article about home flippers starting to book losses they highlighted the point that many home flippers took out ,”hard money loans.” to finance these fixer upper purchases for which they pay relatively high interest rates. My question is, are these “hard money loans” counted as mortgages? If not, could another partial explanation for the sales drop in the face of rising mortgage completions be due to the purchases by flippers drying up and cutting off the flow of homes in to the “flipper pipeline.”

If things are still like they were when I lived in the US, hard money loans are not technically considered mortgages but a category of asset-backed loans.

Hard money loans are generally used in two situations: when a distressed financial situation occurs (for example during a bankruptcy) or for speculative purposes, such as home flipping.

Interest rates are usually far higher than corresponding mortgages (300bps used to be common) but these loans are easier and much quicker to obtain.

The problem for flippers is, of course, that things are getting dicey for them.

Hard money loans are usually calculated against the ARV (After Repair Value), meaning how much the property will be worth after renovations and/or repairs. This means those costs need to be kept under ferocious control, easier said than done given how quickly and easily repairs can spiral out of control, not to mention the amount of rascality associated with some businesses.

It also means a prospective flipper needs to take into account the local market, not right now, but when renovation works will be over, something that may take anything between a couple months and the better part of a year.

Hard money loans don’t stretch over decades like mortgages. They stretch from six months (sometimes less) to six years (very occasionally longer).

If a flipper takes out a hard money loan against 75% of an ARV of $500,000 with a three years duration at 7.5% interest he will have to pay back $403,125 over 36 months, not including fees and other costs he must bear. But that’s not the plan: the flipper aims at a quick sale at a large profit once the property is repaired, use the proceedings to pay off the loan, get back his downpayment and pocket a profit.

Some flippers know what they are doing, some don’t. Right now I say the vast majority of those using hard money loans belong to the second category.

Unless the flippers live in magical countries like Spain, where property prices go up in face of declining sales and increasing unsold stock, the key to a quick sale is to offer a discount. The alternative to a quick sale is, of course, being forced to pay off the whole loan out of one’s pocket, meaning booking a loss.

This means margins for flippers are becoming thinner and thinner: Americans rediscovered that by walking away, or pretending to walk away, they may get a discount. Rationality is attempting a comeback and rationality is the worst enemy of real estate bubbles.

Hope this answered your question.

A friend living in Palo Alto told us recently that they have two friends in there 70’s living in Palo Alto who purchased homes out of the area as part of a move down plan and then put there Palo Alto homes up for sale. No interest, no offers, open house ignored. Lennar in Sacramento reduced prices on several new developments in the 500K to 700K range. I notice in the Sacramento areas I was looking to buy the 500K+ homes tend to be on the listing service long after the <500K homes have sold.

Its all about price…

Same in LA. Prices above 3M, especially 4M, discounts. But, below low 2Ms, decent. Below 1.8M, very string in good areas. Realtors give two reasons for this ..

1) New tax law

2) Younger buyers prefer less sq ft with better finishes and more yard

Yup 1.8 M is a steal….young buyers buy buy buy

Or the younger buyers are interested until someone pulls out a calculator and computes what is 5% down on $1,800,000? For those who are genetically limited and can’t do such math quickly in their heads, that’s a check for $90,000 down. But hey, find a way to put an extra $500 aside from that paycheck every month, and pray that by some luck you can go a stretch without being laid off, you can have that down payment saved up in only 15 years! Hmmm, maybe the Realtors need to redefine “young buyers” so that it includes 40 year olds who’ve had that time to save?

Loco Lei, spot on, best comment of the day.

No, if you can afford the monthly mortgage on a 1.5-3 m home you have more than 500 a month to set aside. California wages are higher too. But still you need a stable well paying career to buy a house there (but you can still be in your 30’s).

Someone who can only save $500 a month should probably stick to something in the $300K range. But it’s nice to dream.

Loco Leo – A 30-35 year old consultant, lawyer, senior tech employee makes $300K+ per year. If they are married to another highly paid professional, the income can easily exceed $500K+. There are tens of thousands of couples in a city like LA that are at that income level so it doesn’t surprise me that houses priced under $1.8M are selling fast.

The problem is $1.8M is pretty much the max that a young high income household can afford and there is a massive inventory of houses priced higher than this. The $2M houses are going to have to slash below the $1.8M mark to find buyers and that in theory should compress prices all the way down to the bottom tier.

LA has a ridiculous amount of modest houses priced over $2M. The extent of the losses in LA county is going to be staggering once the recession hits and the population starts to decline even more than it already is.

Oh the horror! Real estate only goes one way. To the moon! Right Jim… All buyers prefer to buy at the peak so they can brag about there million dollar shacks while they Uber on the weekend and Airbnb their spare room. When they max all their cards they can simply hand in the keys. It’s all about the experience and bragging rights and the clock is ticking for this sucker to go down.

This here is the actual best comment of the day. Bvca you’re doing the Lord’s work.

Sorry Jim, but the on the ground data does not reflect this. Inventories are way up across the board. Prices are soft. Transactions are down.

https://www.movoto.com/los-angeles-ca/market-trends/

https://www.movoto.com/beverly-hills-ca/market-trends/

https://www.movoto.com/santa-monica-ca/market-trends/

If you are a small mom and pop investor and already have 4 or so properties, you cannot get a normal bank loan. You have to go to hard money lenders. Those loans might not be on the radar for purposes of this article.

Everybody wants out of Palo Alto, too noisy!

https://www.sfgate.com/local/article/plane-noise-palo-alto-peninsula-woodside-sfo-oak-13867265.php

I’m currently renting in Palo Alto for about one third of what it would cost me to buy. But every house I see for sale under $3 million still sells very quickly. I’d be curious to see how much they are looking to get and where they are located because I’m seeing a different reality. Houses in old Palo Alto are still selling quickly for twice as much as other neighborhoods.

What you just described “one third of what it would cost me to buy” is a textbook sign of speculation, which explains the sales. Won’t last much longer.

I would like to know were and how much they were asking myself. I have a friend living on Middlefield rd in an old 50’s rancher maybe 1400sq ft and Zillow has it over 3.5M compared to Barron Park which also has older but interesting homes around the same price. I would buy in Barron Park but it could be that Palo Alto has lost some of its charm at 3.5M!

I have a hard time comprehending that the real estate market in Palo Alto is dead.

Unless that 70 year old couple knows what they got and ain’t gonna sell it for a song.

It seems logical that when the housing market changes the first to leave the housing market would be the speculative money.

It also seems logical that the modest price dip combined with an interest rate drop would bring those simply looking for housing back into the market.

Only time will tell if these remaining buyers are wise or catching a falling knife.

How can one tell the difference between the two when central banks have removed free market price discovery?

I vote catching a falling knife. This is happening while unemployment is at record lows, and the rest of the economy (at least to Main St.) appears good. If the economy slows, goodnight housing market.

We’ll start seeing posts from socaljim saying the “losses are contained” and we are going to “level out” at 10%, then 15%, then 20%…

If the economy goes into recession, house prices will fall. In some locations, they will fall a lot. That is how the game works. If you get unlucky and buy just before a recession, then you are screwed. Possible we could go into a recession. But only about a 40% chance in the next several years. Life happens. And, if we do not go into a recession for many years, and this is possible because of central banks QE policies, then you will wish you bought in 2019. That is the game. It is like poker. The only way to win is buy a good property and hang on for at least 10 years … better 20 years. Over the long term, inflation is your friend.

Historically, housing has only barely outperformed inflation, and that’s not accounting for transaction and maintenence costs. The reason you’ve seen the appreciation you have over the last 30 years is due to ever-decreasing interest rates.

I don’t think anyone is going to end up wishing they bought in 2019. Rates are lower than this time last year, and yet the market is still faltering.

I like property for wealth building, and I think everyone should try to own their own home when they’re ready to settle down, but now is a horrid time to buy. Real price discovery has been manupulated away in an effort to keep the 2008 bubble burst from finding its real bottom.

Central banks can screw up history and become new history.

You do NOT want to play? Central bank will force you to play, or you get hurt, every day for the next 100 years until central bank is burnt.

Declining home sales in the US is a phenomenon that baffles the industry

Well, gosh, it’s a good thing the US economy is doing so great or this could be a real problem.

But since the US economy is doing so great, it’s not a problem at all.

Same goes for all the other problems the US economy is having. Make your own list. They’re not actually problems because the economy is doing better than it’s ever done, best in history. No wonder it baffles the industry.

Apparently reality must be mistaken again, because it contradicts official policy.

It’s a question of inequality. Wealth disparity is greater now in the US than during the roaring ’20’s. If you’re in the top 10%, which most of us here are, it’s a new golden age.

nicko2 – Exactly. Things really are better than ever for the top 10%.

For the rest of us, wow, the disparity is staggering. Bum camps everywhere, and keep in mind they’re 10% of the homeless, most of whom you’d not guess are homeless. Most homeless people work.

You don’t see the long breadlines (a) because welfare’s on a card now, although the mothers with young children using WIC are noticeable because they have to check off ration stamps like it’s WWII or something.

Most of the soup kitchens are out of the way now, and if you’re fortunate enough to have a job, you’re working while they’re feeding people so you don’t see ’em. You’re at work.

Maybe this is why opiates and so on are being pushed on people, and weed’s legal now, because opiates kill people and weed takes away their ambition. With such a huge underclass, you’d not want them to get organized.

nicko2 – It really is the best time to be alive. Tech innovation has driven down the cost of goods and eliminated virtually every single inconvenience in my life. At the same time, the Fed’s free money policy over the past seven years has provided financial security for the rest of my life.

Ed, I came out of college in the early 90s, and life was better than. The small SoCal 1950s beach close homes with small back yards that go for north of 2M were 250K in the early 90s. The senior engineer or mathematician who makes 200K today made 125K when I graduated. So, professional wages less than doubled while that SoCal beach fixer went up nine times. Then, there is the skyrocket in food prices and health insurance prices and tuition and … since 1990s. Fortunately, I was able to recently retire in my late 40s. There is no way I could do that again. I tell my wife that if I was 10 years younger, odds are I would be working until the day I dropped. I see people 10 years younger than me and they are struggling even though they made the right moves. They did not have the same opportunities I had in my 20s. I feel sorry for them. I worry about my kids.

Socaljim – I call the 90’s “the last good time”. It just seemed anything was possible. We had a Democrat in the white house, hence we weren’t starting little wars all over the planet. Gas was cheap, used cars easy to get, housing just wasn’t anything you worried about. Our biggest worry was a blue dress, not if we’re gonna nuke Iran.

I think those times may have been good because we had enough honest to goodness New Dealers still alive. They voted.

@nico2–

> it’s a new golden age.

Especially for the self-abused. The disability checks are deposited to your account, section 8 housing, the dialysis treatments are provided with a smile, cable-tv, etc., a lifestyle better than most of the planet’s poor.

NoEasyWay – Really? How about reading some articles etc from the other side?

Section 8 takes something like 10 YEARS to get into housing. The dialysis treatments – or any other medical procedure – for Welfare patients is not provided with a smile.

The powers-that-be, especially since the 2016 election, would really like our underclass to die off. Why do you think opiates are all over the place and you can buy “fent” through the mail? Why do you think pot is legal everywhere now, and it’s being pushed as a cure-all-diseases snake oil?

I hate to sound a bit puritanical, but if you smoke pot, you really *are* more likely to try harder stuff. That’s the idea. Most of the underclass has pretty much no access to health care – that’s also calculated. Wealthy people get regular health screenings, the poor only have access to a doctor when something’s really wrong, often things that would be trivial if they were caught early.

I take a dim view of drug-taking, smoking (anything), being overweight, tattoos, etc. But I also recognize that most of the underclass didn’t grow up in a house fill of 1000’s of books, with nice middle-class expectations. I’m now in the financial underclass, but I’m miles from the cultural underclass.

So: Help the adults in the underclass because the damage is done. And educate, educate, educate, the children of the underclass – this is what public schools used to do – so they have a chance to, if not rise into the middle-class because social mobility is nil now, at least have a chance at being healthier, happier, people.

No sign of real estate distress in the Boston area.

My boss who just sold his house in Taunton day 1 with multiple bids over asking, got into a bidding war in Westport. Seller asked for last and final bid. My Boss submitted second and got the house.

I was relieved, thinking he was lucky. If he didn’t get it, he and his wife and recent child would have to move into his Portuguese family who are mostly taking care of his kid during the day, when his house that he sold closes.

Every house in my area…as in in every house, all of them…I see listed or sold in my area, is well above what I paid 3 years ago.

Oh but wait…but Case Shill-er….oh my.

You know, you might be the least-educated poster here. Case Shiller is showing a slight decline MoM, but still positive YoY, and still far above three years ago. So what exactly about that well respected index is false? And your one anecdote and observations makes it true?

Prices are still above three years ago, the market doesn’t turn on a dime, never has. Boston stalled out in 2005, started slightly declining in 2006, but didn’t really accelerate until 2008. That’s a three year span, it will take a long time to turn around if we really are headed into a downturn.

Anecdotes are fun, too. I’ve been watching the North Shore and metrowest. Waltham, Natick, Needham, Wayland, Burlington, Stoneham, Reading. All I am seeing are days on market much longer than last year. Price cuts, no offers after open houses, and homes taking offers modestly (3-5%) below asking. The occasional gem still gets a bidding war, but it’s not the norm at all. It may not be “distress”, but it’s definitely cooling off, and like last time, Boston tends to lag the west coast by a year.

timbers – The low end of the market (probably where you live) is still strong because working class people still have FOMO. The high end of the market in Boston is absolutely dead. Tax reform alone should deliver a 15%-20% haircut on Northeast real estate before all said and done.

Connecticut, Mass, New York should all get clobbered within the next 3-5 years. Massive real estate decline paired with population loss.

He is right. I have said this before. Boston is very strong, much stronger than anything in California. Higher price ranges are also strong. In my opinion, it seems to be the only strong high priced market in the country. From what I can tell, the strength is from a large number of job transfers into the Boston area. The only fly in the ointment is the massive building of new condos in Boston. Sooner or later, all those new condos will kill the party … but that has not happened yet. In the NYC, they built too many new buildings and killed it all. But, that has yet to happen in Boston.

I suppose the situation might be related to the disappearance of Chinese all cash buyers. There might be an uptick from the locals who require a mortgage ( for lower cost homes ) but the larger factor of all cash buyers is down. So, overall home sales are down.

RoundAbout – This is my theory also. This country has been a safe place to park cash smuggled out of China and India, etc. but it’s not too far afield to imagine these properties seized under some new made-up law, as the country becomes more xenophobic.

The Chinese buyers were fueling the Irvine, Ca market. That market slowed down rapidly with the reduction of the Chinese money. What is funny about the Chinese buyer is they bought Irvine like crazy. In the meantime, they refused to buy Newport Beach or Laguna Beach which are very close to Irvine. The point is Chinese money is so focused on particular zip codes that it is easy to see if the money is gone or not. And, it has slowed down.

According to the St Louis Fed (FRED), the median price of a US home is dropping. https://fred.stlouisfed.org/series/MSPUS

Looks eerily just like the top of the last cycle. I see 12-18 months of stagnation, slow decline before real declines set in. You’d have to be a fool to buy a house now.

This is a great chart.

“One culprit of declining home sales is that student loans “hinder millennial homebuyers,” according to the report. And yes, they do. But they did so before too. ”

student loans have kept me (and many) out of a property for 10 years – and likely will until I’m 40 in the later 2020s and that’s if things go well. That and the FED deliberately trying to price me and my peers out by reflating the housing bubble. No monkeying with rates will change that reality and I’ll never catch up with the downpayment.

We need student loan reform – I say – freeze all the interest at 0% and let payments be pre-tax. Offer nothing but Pell Grants and basic Stafford loans. Non-dischargable debt is a violation of the 13th amendment. The whole thing should be void.

Really,,, you want taxpayers to subsidize a student loan You were Foolish enough to sign up for. A POX on you and the rest of your freeloader friends,,, get a job, stop buying Starbucks coffee, live a tight lifestyle and pay off your own loans…

Go away, troll.

There is no reason for student loan discharge to be treated differently from every other discharge.

Bankruptcy is bankruptcy.

Why is no one who is advocating for student loan “relief” looking at the half-trillion dollars the colleges have racked up in endowment funds? Maybe because the colleges are indoctrination camps for the left? Having the public pay for college would make demand explode and let the party of 250k gender studies degrees continue for years.

Let the market figure it out. At this point it is the same as someone smoking 2 packs a day. If you are going to sign up for 25-50k a year to get your liberal arts degree, enough information is out there to make an informed decision. Caveat emptor.

The only personal debts that are never discharged in Bankruptcy.

DEBTS to the STATE.

A student loan, is a debt, to the state.

anybody taking out student loans needs to be made aware of this.

Unless there is legislation that stops those with Debt’s to the state forswearing citizenship it really is an option for many student loan debt victims in America. They cant take the qualification away simply as you haven’t paid the state.

Depending on the qualification there are other ways around the issue that dont involve forswearing.

Debt to the state can be negotiated away.

Willie Nelson paid the IRS with a country album.

Congress decided I could not discharge my loans while I was in school – they changed the terms behind my back. Then the economy crashed right as I finished. I’ve had a job or a check pretty much every week of my entire adult working life. I am living a Debt snowball total war lifestyle for nearly 2 years. It will still take me nearly a decade because I went to grad school in a misguided attempt to improve my career and society. Engineering jobs are mostly contracting these days and you are competing globally so there is major downward wage pressure.

A pox on me? You know nothing about me. I pay more in loans than I do on rent and food combined. All my extra pennies go to loans or saving for a rainy day.

Society pushed incredibly hard for people to go to college – and if you think the trades in America are a viable alternative you live in a la la land. Sure making $20-$30 an hour is nice (average trade pay), but only if you have no debt. There is also no schools or training. Home Ec and Trades were removed from high school in 1979. They have started to exist, but 10 years ago – Nope. I know.

Meanwhile, rent and healthcare costs have gone up – insurance used to be maybe $1k a year – now it’s more like $7k. Rent doubled or tripled, and every time I move to a cheaper place they raise the rent too. CPI excludes all that. Regular inflation in food and necessities just keeps getting worse. Real wages are flat for decades. You can’t get stock or real estate gains if you can’t get on the train to begin with.

It’s people like you that helped cause this problem – taking some sort of joy in the suffering of many. It’s not a car or a house – you can’t sell your brain and walk away. You can’t just let the bank repossess your brain (though they do seem to anyway). All you have is your labor.

I studied engineering and economics, have always had a budget, and haven’t been to Starbucks in years. I haven’t been to any restaurant in over 6 months. Freezing the interest rate at 0% seems more than reasonable – they did it nearly 10 years for the banks, and allowing pre-tax payments seems like a nice incentive. The gov owns all the debt anyway (by yet another act of Congress) so they’ll keep getting the money.

Oh, I forgot – Student loans are the biggest gov “asset”. The only thing propping up the already out of control budget is fleecing the youth who cannot escape. That’s indentured servitude – that’s why it violates the 13th. I guess that’s why defaults are skyrocketing, homeownership, family formation, and births plummeting, society breaking down, and Socialism fever is sweeping swaths of urban youth. If you don’t allow young to accumulate capital and know only debt – that’s a recipe for disaster. You let me stop paying social security and I’ll keep this depressing slog. Society is eating the young.

@ Dreamer, I agree with you regarding proposing student loan interest to 0%. It would be much less costly to the fed than Ms Warrens proposition for loan forgiveness and allow for our future generations of educated working class to progress and contribute as the generations before have done. The snowball effect the interest accumulates on all these student loans can be quite discouraging for many. I do not advocate a “free pass” but I do support a reasonable action plan to help our future generations

@TheDreamer–

I had student loans of $22k at 8% twenty years ago, and I repaid them while also raising a family with two kids and a stay-at-home wife. This was only possible because we moved away from California into a small-town rural community where the cost of shelter was more closely aligned with income.

@TheDreamer–

> Society is eating the young.

Odds are you would have disliked the military draft.

No one forced you to take out massive student loans. If you find yourself struggling to pay them off either you invested that borrowed $ in a unwise degree or paid far too much for your education. Either way, it was your decision & you received the education. Now it’s time to pay the piper. No sympathy at all from me. You are not entitled to a public bailout my friend. Perhaps your education is still underway?

I think your comment fails to consider the many “surprises” that were put on Millennials. If you told a Millennial the economy was only going to offer him a restaurant job, he likely would not have taken out the loans. The rules of the game were changed behind closed doors.

The government stood by as CEO’s outsourced most good manufacturing jobs to China, Asia, and Mexico over the past 30 years. This has reduced the availability of both manufacturing and trade jobs. An American citizen can’t pipe fit a plant that is in China.

Decades of tax cuts for the wealthy have reduced overall growth and demand in the economy, while concentrating wealth and increasing home and rent prices. Education costs have skyrocketed at a 5-10% inflation rate for decades. Pensions are no longer in existence, so now Millennials are expected to save for retirement with a 0-2% 15-year expected return from these extremely elevated stock prices.

Jobs today aren’t really good jobs. They give you a way to eat and live in a modest dwelling, but the prospect of any career growth and increase in wage has been largely taken away.

This may correct itself over time, but it will take many years. The changes will be significant though. The country’s financial situation is dire, so there will be massive wealth taxes and bailouts. No way around it. Some of that will be warranted given the wealth concentration that was allowed to build and a continuous misguided attempt at wealth effect, which has greatly eroded the long-term health of our economy.

Regarding student debt: Decades ago ordinary young had opportunities to get a public college education that was more within the commons ability to pay.

What we have today is the commodification of too much higher education serving the financial world.

Are we to have a society totally based on money/greed??

Are we to crush our young under debt for higher education just because the financial world can’t make any more money in hard, honest money deals?

As a society we have to choose what we consider “progress” and what we consider outright greed. Apparently we have chosen outright greed over our young, our elderly, our education system, our healthcare etc.

And, just because individuals choose to study “liberal arts” over learning how to manufacture more weapons of mass destruction should not condemn them to impoverishment.

We have turned a good public education into a commodity to be exploited.

What a total disgrace!

@sierra7. Well said. I cringe when I read these crotchety comments bagging on young people who took on debt to get an education. All the while never really being taught the trade-offs of such decisions.

So a young person, in their early to late teens makes a decision to take on debt to get an education… Probably when they are the least wise and educated of partaking in our debt society.

I hold the debt and education institutions accountable for this culture. They are taking advantage of mostly young people who are least able to make a good debt decision.

TheDreamer – The goal is to keep you buried in debt so that you will always have to submit to employment. The corporations want cheap labor to do their dirty work, and a large population of heavily indebted people provides a huge pool of applicants. Even if you pay off your student loan, the principal value on your mortgage will be so high that you’ll never be able to pay it off. The gov’t will never reduce your student loan obligation because they need you to work a full time job to keep the status quo in power.

Ed, fully agree, Debt equals Control. And this Government and Bankster associates have been fine tuning this plan since they advertised everyone should own a home and everyone should have a college education back in the 90’s. A lot of young folks bought the dream that they could have the house, the new car, new furniture, etc. before they really could afford such. I was lucky in that when I went to school, no one would loan an unemployed student any money. My first credit card (B of A) had a $100 limit. This helped keep me out of debt trouble.

And if I had bought a new house, new car, and furniture it would have just gone to my first wife anyway.

All good comments, but what is missed is that getting ahead and vertical migration is no longer a ‘given’ with a uni degree. It used to be, but the cachet/value of a degree these days, which probably 1/2 could have been earned/learned in high school, just no longer applies. It’s a tough world out there, and always has been, just not for north americans in our recent past. However, now it is.

I was born in ’55 and am now one of those well fixed boomers, (I guess). This is how it happened. 1st jobs age 13 cleaning up construction sites. 3 nights per week working in a gas station while in high school, and all day Sundays. Married, house and two kids by 24. After all bills were paid I had two dollars left for my spending money that had to last for the next two weeks. Restaurants? What are those? My son, who is now 35, is about as mature as I was in my early 20’s. My nephew, age 21 (and working), is about as mature as kids were in high school (seventies).

When I did return to university for a Masters degree I paid cash and stayed out of the cafeteria. My millenial compadres ate lunches out, always bought coffee, and complained incessantly about their debt. I brought a thermos and packed a lunch.

When my daughter went to uni I told her over and over to limit her debt. I paid for 1/3 of her costs, she worked part-time, and borrowed the rest. Did she listen about borrowing? No, because every student enrolled borrowed money. The all had student loans. She is 40 this year and finally paid off her loans with a refi on her house. She regretted having borrowed.

Those poor years, getting ahead, were some of the best years. They were nothing to be ashamed about. I wish it had been easier but…….

Forget you. Dreamer. Why tax payers should pay or subsidize the ridiculous lifestyle of students and academia.

Those fancy buidlings you study at

Those fancy dorms or student housing you live at

those fat paychecks for marxist proffesors

those cushy jobs for dumb departments at universities.

You want to go there. You pay it… at the cost and with interest.

What do you think of the idea that demographics is driving this?

Younger workers make far less than retirees trying to sell their homes and downsize, even when adjusting for wages and income at similar life stages. Then add student debt as a drag on disposable income.

The clock is ticking on young people who delayed starting families. It’s now or never for a lot of folks. So they’re applying like crazy to see what they can qualify for. Prior to now, it was possible to wait the market out, on either end — better wages or a housing price correction.

Neither happened.

Demographics play out over many years and decades, not months or weeks. So when we look at monthly variations, demographics don’t play a role in them. When you look at a 10-year or 20-year trend, demographics play a role.

I hear you 100% about the short term.

But sometimes you can only see what’s been happening in the long term when the big money washes back out to sea and exposes the underlying instability of a pier that looked nice, solid and bucolic at high tide.

So we’ll have a lot of borrowers stretching incomes to get the oversized McMansion way out in the burbs. Now those McMansions require tons of maintenence as they hit 30 years old. What ever could go wrong with 3.5% down and 45% DTI ratios?

Investors and first-time buyers provide liquidity to the market, so as they withdraw the market starts to seize up as inventory surges. Someone may want to buy a different house and apply for a loan, but until they sell their current shack they won’t be able to buy the new one in most cases, even though rates are low and falling. You can imagine how slow a market would be if it were only existing current owners trading houses amongst themselves without any new first time owners or investors. Houses are highly illiquid assets even in good times.

I am in San Mateo. We have saved up our $400k down payment and have begun looking. Yes have delayed and are now pushing 40. Have to say, completely unimpressed with realtors. They are all used to the easy buck and don’t work. Don’t even follow up. Had one say to us that he doesn’t like representing buyers too much work. Anyway, universally I’ve been told by same realtors that the easy money from China is gone and it is hard to get money out now. On my street we have three empty homes, all Chinese owned. You look them up and usually it is some Chinese name or you walk up to the door and all the landscaping has been removed, low water use put in, and usually some lion and fungshui crystals are in corners and windows. Many you can find on websites that specialize in ‘hard money’s I don’t know what that means but they are all Chinese websites

When I check the assessor records, the homes were sold way under market. There is fraud going on here. I don’t know how to prove it. But I am 100% sure when I see a house I’d be willing to pay $1.7M sell for $1.5 and hitting MLS for 1 day. Something stinks.

All that time and work to save up your down payment, why are you going to buy at what is clearly a market top?

Because my rental cost is huge but it is garbage. My rent goes up each year WAY more than income / raises. Mold on windows, single pane original 1970’s windows. A whole family of racoons living between *interior* walls. But there isn’t a competitive market here for rentals, so it isn’t like I can pay same amount and get better. When it comes to homes in this reigon there isn’t any single 10 year period where realestate appreciation didn’t outpace retirement stock investments and frankly with how much rent is I can +/- pay a mortgage. It isn’t like we are saving for retirement so might as well pay a mortgage.

400k can get you a duplex in a decent mid-tier city. Rent the two units out and use it to pay your rent in San Mateo. Property taxes and maintenance on a $1.7 mn house can eat up all your savings.

Jack Singleton – No way your rent is higher than the mortgage P&I+ maintenance + closing costs + property taxes. Are you paying more than $12K per month in rent? i doubt you pay half of that.

You are a speculator. You think your house will illogically continue to go up at 5% per year despite all of the massive headwinds not even including the recession to end all recessions we are about to enter.

Do as you wish, but what I heard was “housing has followed unsustainable bubble trends YoY, I better get on it before I get permanently priced out”. You described an unsustainable trend that is now showing real signs of stopping and reversing.

I’d encourage you to hold out a bit longer and not be the sucker that makes the speculators rich.

I know it’s tough, I lived the rent cycle outpacing incomes in Cali myself and it sucks. But be careful buying in Cali after a sustained increase in real estate values.

In nearly the same boat as you, but in SF with rent control, which allows a little more patience. That said, I’m not paying these prices to get a cr@ppy house on a postage stamp lot, and a heart attack waiting to happen in the form of a monster mortgage over my head. We have the down payment, but I am just balking at this situation.

We have decided that we will wait and see for the next 12-18 months in our current place, which is cheap via rent control but bursting at the seams with children in the mix. I know 10 couples in our neighborhood doing the same exact thing (most with young families). Prices will either come down meaningfully (not garbage 1-2-5% declines off record highs like we are seeing now) and we will buy something we see as having value, or we will just leave the area. It sucks that it is what it comes to, but it seems like all rationality has disappeared from this area. Maybe Uber/Lyft’s down-round IPOs will sober people up, but they’re still chugging the Kool-Aid.

Yesterday’s WaPo article re: SF was a bit over-dramatic, but after almost a decade here, the best qualities of the City are frayed and barely recognizable – the amount of Ubers clogging the streets, narcissistic egos, and congestion make the quality of life discussion a lot harder than it was (used to be you looked over at the Marin Headlands and said it was the best place to live – not anymore). Taking my son on a walk and encountering dystopian 3rd world scenes and explaining to him why that guy is “sleeping” with a needle in his arm next to our neighborhood playground gets a bit old after awhile.

My opinion: It’s a fine City, it has some outstanding qualities – the geography, weather, and access are great; it also has a lot of warts – it has significant value, but it isn’t worth what sellers think it is. If that doesn’t become reality soon, we’ll just find somewhere that makes more sense. YMMV.

The dystopia is here in the Valley, it’s just spread out a bit more. I like to go to Mitsuwa Marketplace on Saratoga Blvd and Moorpark, it’s a Japanese mall with a market, shops, etc. There are two ways to go there: Ride my bike along Moorpark, or ride the #23 bus and get off at Saratoga and walk in.

I’ve learned to stick to the N/W side of Saratoga and not walk on the S/E side, because that side is owned by some pretty scary hobos. The point, ha ha, was driven home when I came upon a car that had stopped in the exit of the Harry’s Hofbrau there. Other cars were getting backed up, and some scary old witch was jabbering and staggering around, and I, as I walked around, took a peek inside the car. A couple were “fixing up” and the rest of the world could just wait.

This kind of squalor is all over the Valley, no matter how nice the area.

Today was Jack Singleton’s first post ever. I smell some reverse sell-side psychology and pandering in this post. He is basically agreeing with some popular sentiments among people who do NOT wish to buy, and then grouping them together with an expression of his purported desire to buy in the current market.

It ain’t working, Jack. Seems to fishy.

The upper middle class elite who should get 3.8%, but approved

only for 4.2% 30Y mortgage, because they still have student

loans and c/c to pay.

3.8% is great, 4.2% is not that bad for a couple who earn

$150K to $250K/ y and “for free” in historical perspective.

But when China is ready to march back to Yenan caves, this couple might face default.

While the financialization of everything and the elites rigging of the system to concentrate all wealth and power in their own hands has resulted in “the markets” being an illusory gauge of economic health, the oligarch-pillaged productive economy continues to collapse in on itself in the western democracies. How are all those “redundant” workers in failed industries going to support their families or pay their mortgages?

The French found out in 1789….

There’s no base to the housing pyramid due to millennial’s being worse than broke. Without a base there’s no housing market. Consequently without Chinese buyers the housing market can only fall in price. Most Americans have figured it out so most aren’t stupid enough to buy a house today.

Mortgage applications are like deer tracks ,exciting but you can’t hang’em in the barn.

Id agree it’s safe to assume meaningful tracks are undetectible.

TWO issues:

Prices are elevated – homebuyers are shocked by how much their dollar has depreciated over the years. In Phoenix, $400k is now a starter home (and unfortunately, the FHA limit is only $320k)

Dodd-Frank – mortgage money is extremely tight historically speaking. Originators that are new to the business are impressed that things are “loosening up”, but they are not. Jumbo buyers have it a little easier, BUT if they are self-employed with 25% down, there is a good chance (even with 700+ score), that they are in a 6% to 8% mortgage rates.

It is scary what people get used to. A borrower the other day, had their income verified by bank statements (direct deposit), pay stubs, written verification of employment, 4506T (IRS), verbal verification of employment, THEN Quicken (they are the lender in this example) delayed closing because they needed to get their own “written verification of employment” (they could not use ours). The borrower in question was buying a $400k house with 25% down, 800 fico, 20 years on the job.

We are boiling frogs simmering while our economy is destroyed by red tape and regulation. I want mortgage lending to be safe, I really do. BUT common sense needs to prevail. IF a borrower is putting 5% down, they have to jump through all the hoops mentioned above, but if they put 20% down, give them the keys and move on.

I am not a fan of the current President, but I would love to sit in a room with him and show him some “turn down” loans that I have – a doctor with perfect credit that switched to self employed a year ago – can’t buy a $500k house with 50% down (w/o going “outside” of QM), a speech pathologist with $100k/yr employment contract, 9 years on the job (she went from W2 to self employed-cannot buy until she files 2 years self employment tax returns, we have HUNDREDS of these a year – great loans for great borrowers that would qualify for a house in every Country in the world EXCEPT the U.S. Foreigners, hedge funds, and investors were behind the housing recovery, now that the easy money has been made, they have disappeared – I won’t even get into China and money laundering (see Globe and Mail investigation for that).

Being self employed sucks when it comes to borrowing. The banks will give out credit cards and credit lines without hesitation, but auto loans become a little tighter and housing becomes impossible. Not just in the USA either.

I’m a 1099, so essentially I’m self-employed. It’s kind of the hydrogen atom of the employment/business periodic table; the simplest element.

Since I’m an Amazon/Whole Foods fan and have Prime, I applied on line for the Prime credit card, thinking Great, I’ll use this at Whole Foods and thus make sure I’m getting any Prime discounts coming my way, and just pay it off each month and I don’t care if they only give me say $250 credit on the thing. Welp, I wasn’t accepted.

To re-build credit I’d have to either start off with a gas card, which doesn’t make sense as I don’t have a car, m/c etc., or I can arrange a pre-paid card with my bank.

If I were to buy a car or even a smart phone, it’s cash-in-hand. Not a bad way to live, I think, but “future me” probably would really appreciate my building up some credit again.

@alex–

A credit history with late payments is an issue, but discharged debts in your record is entirely different.

Take a look at taxes. Transfer taxes and property taxes. And what it costs to sell your current place and the cost of moving.

I was about to buy a new car and then I ran the numbers on sales tax, property tax, and insurance. Throw in Obamacare health insurance premiums I’m paying and it made a lot more sense to fix up my old car.

Welcome to Havana.

No wonder the average American does not have enough CASH (or equivalent).

All their money is tied up in housing. Maybe they think the asset inflation will make them rich.

Sometimes I wonder where this thinking comes from. Imagine folks in ridiculous expensive flats in Hong Kong. I thought the difference is in the USA a little cabin was all you needed. Maybe we’re thinking now Hong Kong-wise. Crazy.

The communist party members think it is safe to park their money in Hong Kong. They bought up all the flats in Hong Kong. The Hong Kong government mus ensures the safety of their property. Less and less flat is built every year and the price go up & up.

Please, GTFOOH with the complaints about student loans. If you can’t pay it off, that is YOUR fault and a decision YOU made. Nobody else should be required to pay YOUR loans because YOU are unhappy with the choices YOU made. I paid off every penny of $160K of student loans in 10 years because I chose a profession that I knew would give me the ability to repay, this coming from a broken home and disadvantaged background. Pay for your own shiz and stop trying to freeload off of others.

I too went into a “good” field and I too paid off my own shiz …

What if you’d had a medical problem? An accident? A family member dying and you weren’t a cold-hearted bastard and cared for them?

You spun the wheel and it came up red. All your own effort, yeah.

The big banks killed the geese that laid the golden eggs. The run up to the biggest scam in US history where millions of homes were foreclosed on after the biggest run up in the Mortgage backed securities. (I know a woman who was being foreclosed on by 5 Banks!!) They literally xeroxed the notes and sold that to many buyers and then they got them all the houses back and re-named them as preforming assets at full price. The problem with this was by this time the home was totally destroyed and rotting.

Why in the hell would any Millennial want to buy a house? Might as well rent, and renting they are. Hundreds of thousands of brand new apartment complexes are being built coast to coast.

It will be a long time before buying a home will be part of the American

dream. The big banks destroyed this entire idea. But, hey they made trillions in run up , and government bailouts.

The number of homes falling out of contract in the SF Bay Area is staggering may be the reason for the mortgage apps going up. People get in contrcat do everything then pull out. Every day I get lots of “Back on Market” updates from Zillow and Redfin.

Mortgage applications rise because fence-sitters decide to purchase new tract homes, which are really the only affordable housing option available in most cities. Homebuilders, especially the mega ones, are more able to cut prices or upgrade amenities to move product.