It’s a tough job, but someone’s doing it.

Consumer debt – or consumer “credit” more euphemistically – includes auto loans, student loans, credit-card debt, and personal loans, but it excludes housing related debt, such as mortgages and HELOCs. Growing consumer debt helps prop up the US economy because it means that consumers – they’re called “consumers” not “people” for a reason – spend money they don’t have. There is always a reckoning in the future, but to heck with the future, and so here we go.

Revolving credit

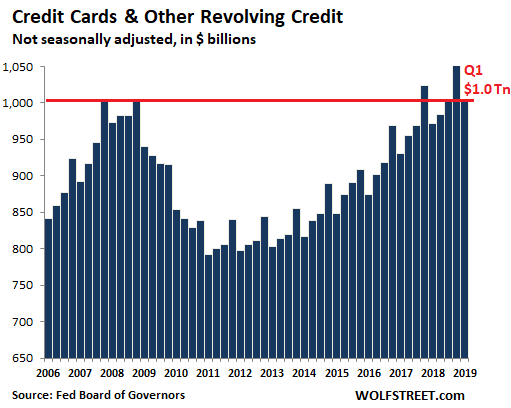

Credit card debt and other revolving credit, such as personal lines of credit, in Q1 rose 3.4% compared to Q1 last year, to $1.0 trillion (not seasonally adjusted), according to the Federal Reserve Tuesday afternoon. This was a record for a first quarter, when consumers cut back while they try to dig themselves out from under their shopping season debts. But it wasn’t good enough. Credit card balances in Q1 were flat with Q4 2008, despite a decade of inflation, population growth, and economic growth. Our debt slaves are lackadaisical:

The thing is, over the same period, nominal GDP rose 5.1%. And in terms of GDP, credit card debts actually fell, which explains the soft-ish retail data in the first quarter. In a very un-American way, consumers were again lackadaisical in charging up their credit cards to the max.

Credit cards are a key element in the banking industry’s profits. At commercial banks, the average interest rate on credit-card plans is 15.1% and the average assessed interest rate is 16.9%, on $1 trillion in outstanding credit balances. This amounts to around $150 billion to $169 billion a year in interest income! These banks rely on consumers to spend money they don’t have. So why don’t they consume with sufficient energy? That’s a baffling question for economists.

Auto loans and leases

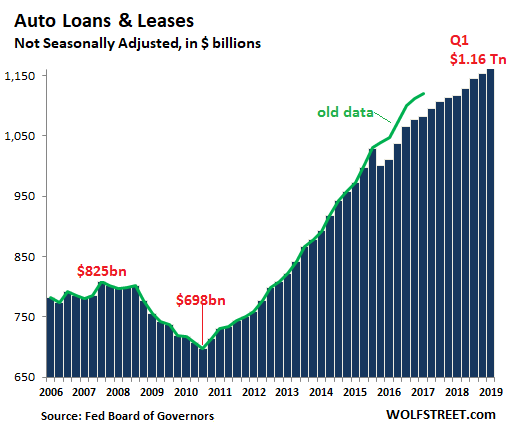

Total auto loans and leases outstanding for new and used vehicles in Q1 rose by $44.5 billion from a year ago, or by 4.0%, to a record of $1.16 trillion, despite new-vehicle sales that declined in Q1 by 3.2%, though there was some strength in used vehicles sales. The increase in borrowing was due to higher transaction prices of new and used vehicles, the rising average loan-to-value ratio, and the lengthening average duration of loans:

The green line in the chart above is a reminder that this type of data gets revised as new data becomes available. In September 2017, the Federal Reserve adjusted its data of consumer credit back to Q3 2015, based on the new five-year Census survey, and auto loans got the bulk of the revisions. The green line shows that the car business didn’t collapse in Q3 2015 but that the drop in outstanding auto loans was due to a revision.

The student-loan economy

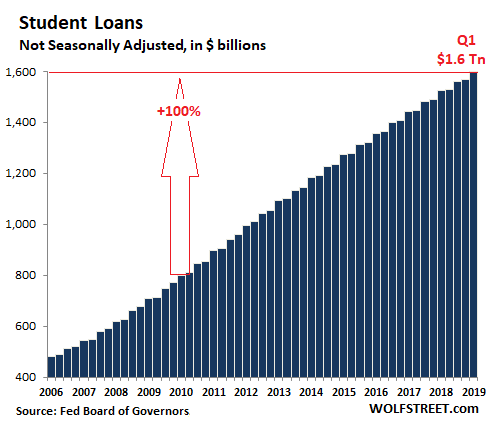

Student loans rose by 4.9% year-over-year in Q1, or by $74 billion, to a new record of $1.6 trillion (not seasonally adjusted). It has doubled since the beginning of 2010. Confusingly, enrollment in higher-education, based on the latest data available from the National Center for Education Statistics fell by 7% between 2010 and 2016.

In other words, fewer students are enrolled, but all combined they borrow more as tuition continues to rise, and as the entire industry feeds on those government-guaranteed student loans. This ranges from device makers, such as Apple, text-book publishers, concert-ticket sellers, and commercial real estate investors specializing in student housing. Every dime a student borrows is spent, and it props up Corporate America, the university financial complex (UFI, my term), and the US economy overall – with heck to pay later:

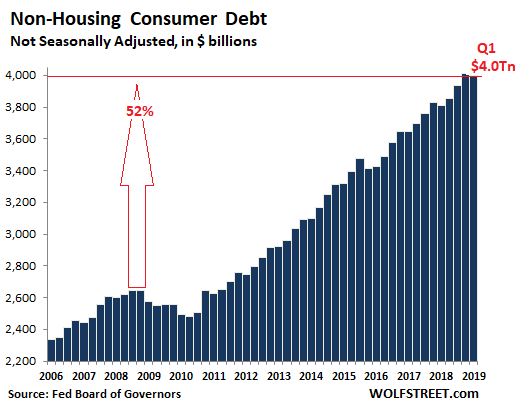

All three forms of non-housing consumer debt combined – revolving credit, auto loans, and student loans — rose by a respectable $191 billion in Q1 from a year ago to $4.0 trillion, carried by surging student loans and auto loans:

Every dime of this $191 billion in new debt was plowed into consumption, and therefore into GDP. This increase in consumer debt over the 12 months added nearly 1% to GDP, and that’s why consumers have to spend money they don’t have. It’s their job. Everyone depends on them. The other side of the coin is that these debt slaves now owe $4 trillion that they must pay interest and principal on for all times to come. And inflation won’t help them because rising inflation will cause these rates to rise, and our debt slaves will just have to work that much harder to deal with their debts.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

all i can say is YIKES!!!!!!!!!!!!!!!!!!!!!!!!!!!!

great eye opening article.

nobody is as blind as he who will NOT SEE.

This is not quite as bad as it seems because these charts are in nominal figures.

In real terms there has been a significant reduction in real consumer credit since 2008.

Yes, total outstanding debt in absolute terms now equals what it was back in 08 but that’s not a fair comparison because combined median household income and population have grown by about a quarter since.

As Wolf mentions, within the categories of growth, the only substantial increase has been in student loans and to a lesser extent in autos, but even then, in real terms we are still about 25% less than 2008.

Of course, that’s not to say that there hasn’t been explosive real growth in other sectors of the economy because there definitely has been (govt. and corporates).

Read R Heinlen’s futuristic prophetic short story called The Midas Plague.

I just looked for it, THE MIDAS PLAGUE by Fred Pohl.

“In the future everyone has to consume products like crazy to keep their wildly overproductive society going. (They have invented cheap energy and they have lots of robots.) To enforce this, everyone is on rations. The fun is that you’re given targets to consume per month – umpteen five course meals, many suits of clothes, more tvs, etc. ”

Sounds like a good read.

It’s not quite as bad?? IT’S actually a disaster! This is truly fiddling while Rome burns. You cannot sugarcoat those graphs.

CPI increased 20% over the past decade. Anything that increased more than 20% over the same time period is up in real terms. So student loans (+100%) and auto loans (+55%) are way, way up in real terms. Credit card balances (+0%) are down in real terms. And total consumer credit (+52%) is also up in real terms (due to student loans and auto loans).

Not shown here, mortgage debt (flat with 10 years ago) is down in real terms.

Makes sense… housing is unaffordable. People are spending that money on something else, or–conversely–housing is unaffordable BECAUSE so much of that money is being funneled somewhere else.

You need to adjust by population growth too since the debt is div’ied up across more people. That’s why I figured CPI (or income) + pop growth = 25%.

Peak-to-peak auto loans are up 40% which is 15% more than the above figure. Bad but not atrocious.

Student loan growth on the other hand is simply ridiculous. Especially since so may of the jobs being filled by graduates who don’t really require college degrees. A complete waste of time and money.

Wolf, How does higher tuition, new and used car prices, housing costs, and other consumer plus government debt that directly contribute to GDP not do the same to CPI, which is always “on target”?

If GDP could be corrected by a more common sense CPI, what would it end up being?

Higher prices contribute to “nominal” GDP. In Q1, nominal GDP was up 5.1% over the past 12 months. But “real” GDP is adjusted for inflation and is always a lot lower than nominal GDP. In Q1, real GDP was up 3.2% over the past 12 months.

By my calcs using 2% annual inflation and 8% population growth over the period, total consumer debt per capita has increased from $10,641 in 2008 to $12,165 in 2019, a 14% increase. Everyone buckled down for a few years and then levered back up even more than before the crash. That should not give anyone a good feeling. Personally, I’ve eliminated all debt except for my mortgage which I’m working on.

I cannot wait to get my chillrens college expenses and tuition refunded. Two masters degrees including one from Haaavard plus one went on to graduate from law skool and 4 international internships at $15k each. Put it on the taxpayers bill! Six years for one, 8 for the other as daughter did UC undergrad in 3 years, plus the internships in London, Sydney, Washington DC/Peru and Costa Rica. Will I get interest on the money too? :)

https://wolfstreet.com/2018/06/12/inflation-by-us-metro-red-hot-to-lukewarm/

Hi Wolf. Would you be so kind to expand on this topic you covered back in 2018? Thank you!

Thanks, good idea. Will do when the new data comes out in a couple of days.

Looking forward to it!! Thank you.

Wolf, Great article. I would like to see you do an article on corporate debt.

I do. Here are some examples…

https://wolfstreet.com/2019/04/09/how-a-stock-gets-hit-when-an-investment-grade-company-tries-to-dodge-a-downgrade-to-junk/

https://wolfstreet.com/2019/03/23/countries-with-most-monstrous-corporate-debt-pileup-u-s-wimps-out-in-25th-place-debt-to-gdp/

even a podcast:

https://wolfstreet.com/2018/12/30/the-wolf-street-report-how-the-corporate-debt-bubble-crushes-the-stock-market/

Not to mention that 2008 was the virtual peak of the bubble (a bubble that was reflected most prominently in housing-related debt, but was certainly present in the other categories other than student loans).

I agree. Sometimes it is better to look at things in real terms. Also we added 21 million people in the U.S. since 2009. So the average per person has not gone up at the same rate as total debt increase.

Who said college degrees are supposed to be job training programs? We have trade schools and apprenticeship programs for that…or at least we used to…

Tom Jones – USED to. Now, if I want to become a barber or an HVAC tech, or any of a number of things it’s gonna cost me $10k – $30k or more.

The minimalism movement is building up steam and it is one reason why a severe recession may be coming soon.But look at nature! Isn’t it cluttered.

‘Minimalism movements’ naturally happen when people realize they haven’t a hope of joining the party, so suddenly (re)discover the fact that they’re not materialists.

The REAL test comes when the same people are presented with the chance to make quick, easy cash, or advance themselves at the expense of someone else.

That’s the part 95% of human beings struggle with.

Not having much is NOT the same as not being greedy.

The minimalist movement has its basis in the realization that most of what we buy is crap. I include food too. Minimalism is not just about having less, it is about refining your needs and then buying the best that fills those needs. It makes you think about what you buy.

MD – Disagree with this. My family earns big and spends little. It’s a growing trend among high income workers. The ones that have no chance are the ones that spend beyond their means to look more successful then they are.

High income individuals can see the light at the end of the tunnel so they start to cut consumption and save. Everyone else just assumes they have to work forever so why not leverage up and enjoy their 5,000 sq ft house and all of the toys to fill up the emptiness in their lives.

ED, watch those who spend beyond what they earn and they will vote to TRANSFER all the savings your high income family have saved. They out number you. There is no light at the end of tunnel. You are delusional. You sink with everybody else. This is what THEY designed.

JZ

That is why we need recessions. Our debt fed system needs to be restrained by practical consumption. We might call them ‘minimalists’, and their reasons might cover a broad range, but we apparently have far too few of them!

Recessions clean our dirty laundry, but unfortunately the detergent is no where to be found.

I know there are too few “minimalists” and I know they will go extinct until the whol nation’s wealth is consumed. Scratch that, if USA’s wealth is consumed, there will be wars(financial or shooting) to transfer other nation’s wealth into USA to consume. Until that day, there will be NO recession allowed. Jay Powell is talking about printing money to fight climate change. There will be full employments under money losing businesses sustained by FED printing.

Used to be corruptions at the ruling class. This is corruption at the democracy mass and this will NEVER stop until all wealth of the world is consumed or destroyed.

I just want this process to happen fast on me so that my kids can grow up in a wealth creation environment as opposed to wealth transfer/consume/destruction environment.

I don’t know if the minimalism movement will ever become significant but it is definitely not about people who realized they can’t afford the materialist lifestyle. In fact, the movement is predominantly with the wealthier, more educated and sophisticated people. Generally, these people value experiences more; they travel more for example.

I’ve noticed a trend among my fellow boomer friends to downsize their stuff, even if not downsizing their residence.

But it’s not just getting rid of stuff we no longer use, it’s also not buying new stuff to replace the old. We are sick of storing, cleaning, or moving stuff.

Not sure if this is minimalism or old age.

Paying down all debt as we edge into retirement is the other big thing.

We have paid off our condo, car, and most debt, and I know lots of other folks doing this too….so are we still consumers?

These charts make me nauseous , especially that studen loan chart. I imagine a healthcare spending one has a similar trajectory. But what can you do when people keep voting for these self-harming policies? Is the US destined to default on its debts at sometime in the distant future, like a developing economy in South America? …. What is clear, slavery is very much alive and thriving in our post-global world. Most of the slaves are not bound in physical shackles, but a monthly interest due statement.

Voting has very little to do with this as both parties have pretty much been perpetuating the ridiculous student loan monster.

In other consumer debt categories there has been little to no growth in real terms in the past decade or so.

When there is only one party ( The War Party Of The Rich), what good does pulling either lever do ?

The totalitarian oligarchy owns both levers, just like in Russia, China, etc. And owns all the media ( to “inform” the voters).

Yes, at some point taxes are going to have to go up! Or there will be a domino effect that will result in most or ALL countries worldwide defaulting on debts.

Taxes going up on the average debt slave will guarantee a massive default on debt. The ‘median’ in the US has a net worth close to zero, and unless increased taxes result in an equal value in services or more (like national health care, for example), the collapse will only be triggered sooner. As they say, ‘You can’t get blood out of a turnip’.

>healthcare spending one has a similar trajectory.

Healthcare inflation is not nearly the boogeyman it was in the 80’s and 90’s

https://fred.stlouisfed.org/graph/?g=nRYc

Now the actual spending is going up a lot, mainly because of the aging of the population.

The reason healthcare and student loans look the same is because the cause is the same…. government money funding consumption by a third party who is not directly paying the bill. It’s a kind of market failure. When Medicare came along healthcare organizations had guaranteed revenue streams against which they could borrow and expand. They could also increase prices pretty much at will early on (just like higher ed). If anyone suggests reining in spending, the experts (doctors and higher ed officials) scream, “Oh, no. Quality will be lessened.” And so it goes, and so it goes.

It’s amazing that average people are still dumb enough to go to college in America at the current costs. Unless you are smart enough to get into an elite university, you are better off dropping out of high school and learning a trade.

There is a myth out there that trades people are dumber than university educated people. I’ve worked with PhDs I wouldn’t hire to cut my lawn, they were that dumb. However, they did well at one thing in their lives, going to school on someone elses dime; doing research and writing papers. Not all, obviously, but many.

Then, there are trades and there are trades. Hanging drywall is a trade. However, it is a few light years away from commisioning a billion dollar plant control system or rebuilding a multi-million dollar autonomous EV (diesel generated electric drive system) heavy hauler. Having said that, I know a drywaller that can go into a room with his tape measure and hold up to 40 different measurements in his head, cut the board so fast and in sequence a crew of three cannot keep up to him. (He was also caught counting cards). He makes $1,000 per day paid by what his crew completes.

Yesterday, I paid a deposit on some auto parts at an import mechanic shop. They were working on 3 different vehicles, a newish BMW, a $100K + Bentley, and a 38 year old air cooled Westfalia. The owner is my age and I tried to comprehend the wealth/breadth of his knowledge and experience that spanned such a technological range? This is someone who learns something new, everyday, with each and every problem he has to solve. Yet, people think less of him than a uni grad. Go figure.

But in response to Ed, most companies worth working for require formal specific trades training and some specialized post secondary course work. You cannot get into many trades programs without high school and basic competancies. In this case, my PhD co-worker would not make the cut. In short, best not to drop out of high school, rather take the free public education and direct efforts and course work into a chosen field. Take shop courses and math….nix the fluff and phys ed extras. Then, be a paid apprentice to learn your trade, going forward. I made it through a masters program with my trade, as did my boiler maker compadre. Boilermaker? Union job, union dispatched, 200K per year doing specialized welding on pressure vessels. Fitters do the ugly prep work.

regards

After years of using subcontractors, I can tell you CONCRETE is one of the best trades to get into. A young man or woman could dive in learning the trade in their late teen years and be off to the races.

As for TRADES generally, you should learn your craft well, but just as important is being dependable and honest. Work will find you.

That’s some of the worst advice I’ve ever seen here.

Agreed.

This is some of the BEST adivce I’ve ever seen here

I’ll just go with what I know and achieved including retirement at 57…thanks to being a dumb tradesman. Beats sitting in a cubicle and worrying about the economy tanking. Maybe it’s just better in Canada for working folks.

I think that’s the best possible advice for any young person who doesn’t have a specific career in mind – too many attend for a year or two, rack up the [non-dischargeable] student loan debt, and then never get a degree.

Second best is to encourage them to attend a state college to minimize the cost, and then transfer to their desired college after they’re truly in the saddle.

Paulo, trades can be rewarding for many people. I trust you aren’t defending Ed’s advice to drop out of high school. That’s just stupid.

Do both. I did shop class at school, and higher math. Did an engineering degree 35 years ago when they were much more value than a trade. Left full time work 10 years ago and am now effectively a tradesman, building and fitting out my own properties, foundation to roof, plumbing, electrics, the works.

Flexibility is the key. Right now, having recently done some University lecturing, I think trades have made more sense for about 5 years, and will do for at least another 15. And another thing is that, doing your own building work, I cut out 93% of the taxes involved in the process, legally.

This Oh so much this. The time I spent in college was utterly wasted, and having gone depressed my earnings for life. I paid off my loans, did my bit, and the only difference between it and a decade on meth and felonies is, I still have my teeth.

Learn a trade that can’t be outsourced to India and you’re golden.

Next up: a credit crunch that makes 2008 look like a minor inconvenience. This story won’t end well.

Depends on which side of the trade you are on…

I look forward to “asset” prices coming back down from low earth orbit and wiping out folks like an outbreak.

I do wonder how long the plates can be kept spinning for in terms of currency crises.

I assume that a large part of the credit cards, auto loans and student loans are already 30+ days late but haven’t yet been written down to 0 as bad debts. They are trying to keep the fake Potemkin economy running for a little while longer.

All those kids who were 8-9-10 years old during the crash, remember that things were difficult for their parents and the fun time they got to camp in their car. Now they’re 18-19-20 and racking up debt like there’s no tomorrow.

I just can’t believe it. I’m scared to death of debt. To the extent that I’ve actually not been doing things to re-build my credit like I should, like getting a secured credit card and showing I’m responsible then getting a real one again.

Back in Hawaii I’ll be renting a single room or at best some kind of tiny mother-in-law cottage, and my credit will be my verifiable Social Security income and (hopefully) being able to pay a year’s rent up front.

I wonder if credit checks will be that powerful a thing in 10 years? I have a feeling my track record in the local Buddhist community will count for more.

Debt is a tool, like any other tool it can be used well or it can be used badly. If you never learn to use it, you are not better off than someone who uses it well.

I didn’t learn to drive until I was 24 — it had a limiting effect on my life, and it also possible kept me out of an accident. When I did learn to drive, I drove badly for a while, and got better. If I hadn’t, my life would have had severe and possibly crippling constraints. Trying to live in America without using debt is similar.

I didn’t learn to drive until I was 30. I did have a motorcycle license from about the age of 25; this is because m/c’s are about 1/3 the cost of cars and at least in the 80s you could do all your own wrenching.

This is the nature of the new economy. The days of mowing lawns over the summer and buying a few-years-old muscle car and hanging out with your buddies at the malt shop were long gone by the time I came along, and I’m old, being in my mid-50s.

I’ll trot out again, my “halving theory” that except for a small elite, the average person’s going to have half the wealth each decade. I had a car once, more recently a motorcycle, now I have a bicycle, and in the next decade will be fortunate to have a decent pair of shoes. I theorize that credit will become irrelevant, that what will matter more is your personal network. You’ll travel less, and if you’re smart you’ll be a member of a church or some sort of house of worship/fellowship, maybe the Masons or the Elks, and you’ll be using actual social networks more than “social media” (as the internet is going to decay also).

“So why don’t they consume with sufficient energy? That’s a baffling question for economists.”

The costs of living (housing, food, shelter, education, childcare, transportation, taxes and healthcare) take the lion’s share of people’s income. After paying for those expenses it’s a miracle people have any money left for discretionary spending.

There is plenty of disposable income but there is deflation in consumer goods and experiences. Fewer people overpay for things because everything is impossibly cheap at Costco, TJ Maxx, Amazon, etc. It’s also a lot cheaper to sit around your apartment all day watching Netflix and playing on social media then doing just about anything else.

Inventing new ways to bury people in debt is becoming increasingly difficult. Student loans and inflating housing values is the best they can do but it seems even high end housing has peaked.

It’ll be interesting to see what the breaking point will be in attending college. Certainly there is a price where people are no longer willing to attend.

Deflation in consumer goods? I don’t think so. I own a small chocolate shop, and we have seen huge price increases, over 10% on all goods this year. We have not been able to raise consumer prices to match. 95 % of our sales are on credit/debit cards. These carry interest to the consumer. Those points/rewards on your cards are paid by the merchant. Trust me the hole is getting deeper. Education…. take a look at the courses offered. Not enlightening.

Wait for Trump 25% tariffs

‘Every dime a student borrows is spent, and it props up Corporate America, the university financial complex (UFI, my term), and the US economy overall’

The situation is similar here in the UK.Kids borrowing £50,000 at RPI plus 3% (yes that’s right,student debts compound at nearly 7% per annum) so 70% of them can get a job they could have got without the £50k debt.Crazy.

Demographically,it’s an economic disaster that’s going to happen in the next ten years as these new ‘uber’ student debtors(annual tution fees went up from £3000 to £9000 four years ago) head into their twenties and want to settle down and have kids-one the traditional drivers of economic growth.

Terrifying.And that’s without the hit to taxpayers being considered

Adjusted for population the total UK student loan balance is bad but is still less than half of what we’ve got in the good-‘ole USA.

That said, I found the following statement on the UK parliament site quite shocking: “The Government expects that 30% of current full-time undergraduates who take out loans will repay them in full.”

Whoa! What about the remaining 70%??

Hey, at least the UK govt. admits there’s going to be a huge problem with repayment. Here our govt. seems to think that the $1.6T is money in the bank.

It is in the bank, because even if student loans are pardoned, the taxpayer will be billed. Wait until the bill comes in for our military budget and for the alphabet-soup spy agencies that mostly create the problems they are supposed to solve!

Move on! Nothing to see here!

No debt jubilee for student loans. But the discussion of it by politicians keep em borrowing!

I like that term “university financial complex.” Is it OK if I use it?

I am happy to let everyone use a phrase that I like: “medical industrial complex.” (It is certainly possible that other people have come to this phrase on their own.)

How about political-industrial cartel? After all, just about everything that has money in it is, and has been, starting with railway and oil investments merging in the 1860s and ending in 1913 with a private bank, the Federal Reserve, granted the exclusive right to issue dollars (well, JFK tried and look what happened to him).

It is estimated that 70% of jobs in America don’t really need a college degree!

Why do students going to college go into a trade or take an apprenticeship!

They can live the American Dream without student loans that enslaves them!

Beats my mind!!!

Wolf-is there knowledge of where the population of students attending college fit in employment/unemployment figures as part of the workforce? If not considered, ref:Willem’s comment on borrowing large amounts to get a job they could have obtained without a degree (or even with), would the competition for those jobs be greater, and thus unemployment figures worse, if that part of the workforce wasn’t being ‘warehoused’ via student loans at university? (Sorry not to be able to attend the do in the City this time, it looked great-). May we all have a better day.

91B20 1stCav (AUS),

The New York Fed reports the unemployment rate for recent college grads and college grads in general on a monthly basis and compares them to those without college. Unemployment is always A LOT lower for those with college degrees. These are averages. But there are specific situations that deviate widely from the average: for example, if you’re a history major, you may have have a harder time finding a job than a trained electrician. But this is on average. The bottom blue line is college grads — click on chart to enlarge:

https://www.newyorkfed.org/research/college-labor-market/college-labor-market_unemployment.html

Hard not to be a debt slave when I owe $2000 a month for health insurance thanks to the Affordable Care Act. Then my kid got into college and they wouldnt give us any financial aid at all because we dont fall into a “favored category”, so we had to turn down a prestigious $75k a year college and go to a third tier school on scholarship. America has to be the worst country to live in, would love to get out of here before I am broken financially.

Well, be glad you are not living in Saudi Arabia, where people have been beheaded for saying less against the government.

The Affordable Care Act that passed was the best that Obama could do at the time, given that even conservative Democrats like Senator Max Baucus of Montana would not support a low cost single payer option. In 2000 and even more so in 2004, many Americans voted against their economic interest and for their religious beliefs. Voters in about 30 states, including “liberal” California, approved Republican sponsored ballot initiatives banning gay marriage during the first decade of the new century. As the Good Book says, “As ye sow, so shall ye reap.”

Money spent on the Iraq war might have gone to finance a better health insurance program for debt slaves like you. But that money is gone and in coming decades, senior and disabled Americans will be competing with wounded warriors for Federal government subsidies.

There are three categories of ‘good’ schools:

1) the prestigious schools that are so rich that they aren’t stingy with financial aid: Harvard, Yale, etc.

2) the prestigious schools that are either not so rich or a lot more stingy: Duke, Brown, etc.

3) the state universities that are first tier.

It sounds like your kid got into Category #2, which is a giant rip-off. People mistake places like Vanderbilt, Duke, or NYU for Harvard, but they aren’t. You are FAR better off choosing University of Michigan, University of North Carolina, over these. The education is just as good (honestly, usually better), the price tag is cheaper, and you get to associate with intelligent students from all backgrounds.

There’s one potential problem with going to an elite state school. Do you live in the state or are you out of state? If you live in state, you can probably get some tuition relief, but if you’re an out-of-state student, you may be paying elite private school tuition levels. Schools like Cal-Berkley, U of Michigan, U of Texas, and U of North Carolina are already the most sought after state institutions and as a result are hard to get into. So the schools charge tuition likewise.

@American debt slave – “would love to get out of here before I am broken financially.” —

To where? I’ve travelled extensively and haven’t seen anyplace I’d consider. From what I’ve seen, you’d be trading one set of problems for a different (and possibly MUCH worse!) set of problems. Not trying to be contentious and don’t disagree that things are bad here…I just got nothing when it come to “where”?

Dos Tacos Mas: I thought about returning to Argentina to live out my days as a pensionado when the Argentine peso took a dump vs the USD. That drop would’ve boosted my monthly income by 3x when converted to pesos.

The Problem : with their annual inflation running around 40- 50% & my North American based fixed income only getting an annual COLA of 3%, I would be reduced to pauper status very quickly.

Would be a great party while it lasted though. ;)

Yes America must be the worst country to live, that is why multiple scores of immigrants want to move here.

Have you ever lived anywhere else? Maybe your perspective would change.

America is still the greatest country the world has ever known. Period.

“America is still the greatest country the world has ever known”

I’m just curious, but why? I mean, by comparison, Canada never had slavery like the US did — slavery was evil. What is it about the US that makes it so much more amazing than Canada? And why do you think it’s important to brag that your country is better than Canada? Or the Netherlands? Or Italy? Or anywhere else? It seems kind of weird to want to say that.

Must be the health coverage in USA, the one where my sister has had to take out a supplemental policy at $800 per month to cover what medicare doesn’t/won’t. Sounds great. Plus, she has had to sock money away in case she will have to one day go into a ‘home’, aka long term care facility.

This is what is hilarious, though, and it applies to an anti-trades comment above. Canada has a selective points based immigration system, the kind DJT is hankering for. You won’t get in with a university degree unless it’s something like medicine. Trade? Top of the list. Like an old employer of mine once said, “I don’t care what you know, show me what you can do”.

We don’t have slavery, as in the type of indentured slavery you speak. Once we did, no longer. To suggest that because we had sinned in the past, we can never be forgiven is nonsense. To have national pride, much like a Canadian, Italian etc. and embrace your country is healthy. We pull together as a community, city, state. We invent, pursue to better ourselves, and the world, to provide for our family a life that is not simply void, to educate ourselves. We strive to be great, to do better. We have freedom to speak our mind, just as you did here. The United States is a fantastic place to live, even with all the flaws, including the aforementioned in the article. If you don’t live here, I bet you would like too. If you do live here, you need to research our history, and understand why and who we are. Perhaps then you might see the greatness.

Why is your sister paying this much for a supplemental policy? Did she not sign up upon becoming Medicare eligible?

A relative of mine of lives in Florida recently became medicare eligible. She got a “G” supplemental policy as soon as she turned 65 (the G policy is basically like the F policy which is the most comprehensive one available, the only difference being that the G policy doesn’t cover the ~$180 annual deductible for part B). She only pays about $170 a month.

People who have never traveled anywhere worth going and are brainwashed to believe that the place they were born by the localized geography lottery is the best, can’t be reasoned with. You don’t see people from Europe wanting to move here in droves, just the places that globalism and neo slavery have decimated and the refugees want to move here.

Ed — I’m an American, I immigrated to Canada and am a citizen of both countries. I lived in America for all but 5 years until I was 30, and that includes Kansas, Oregon, North Carolina, New York State, and Vermont. My post had nothing about ‘forgiveness’ in it — it raised the question of what about America made it the ‘greatest country the world has ever known. Period’. Your assumption that I’m envious of people who live in America could not be further from the truth — just yesterday my best friend (from high school) reported that there was a school shooting at the school where their two kids go (Denver).

Presumably, America wasn’t the ‘greatest country the world has ever known’ before 1865. Was it true in 1866? 1918? 1930? Is it the election of Donald Trump as President that makes the United States great? Does the greatness apply to everyone, and someone who is black, Native American, Hispanic, would they see it too? I’m curious.

Sorry I should have prefaced the comment with “In my heart”.

Americans are dying from not being able to afford lifesaving insulin….insulin that costs 10x less in Canada.

Paulo @ 1:30 My Medicare supplement including the prescription drug benefit is $98 per month and includes foreign emergency coverage. Perhaps your sister’s coverage includes much lower co-pays and deductibles; but so far my plan has worked for me. My maximum out of pocket financial exposure per year is about $6,500 under the plan, an amount which I could handle if it became necessary. Do you remember reading about the death of Jerry Yanover in July 2009? He was scheduled for heart surgery in Ottawa in September of that year but the Grim Reaper claimed him at age 62. I asked an American doctor friend of mine if people who had decent health insurance would have to wait so long in the US. He said no, that it could be scheduled in a few days.

It is interesting that you got to retire at 57. That is the year when I was forced into early retirement and decided that I had enough saved up to not bother looking for another job. For most Americans, the upcoming Memorial Day holiday will mean just another day off work. For me, it will mean the start of my 15th year of retirement. Not every American is only a $400 unplanned repair bill away from insolvency.

“America is still the greatest country the world has ever known “.

Maybe the America of 50s-60s, baby boom, lots of work, world’s greatest manufacturing. Reasonably uniform social morals, reasonably uniform colours of the street people.

Today, all of that is gone. Financial trickery keeping its value afloat. Nuclear weapons keeping its hostages quiet. “Diversity” burrowing from within.

Relatively small disruption is all that is required for a domino type disintegration of the hollow empire. Watch it burn baby.

Nothing against Yanks as folks, don’t get me wrong, met some blazing brains, met some real dummos. But, the system, the leaders, the giant parasitic squid on the top of it, they will ensure bad ending.

No way out, mate, no way out.

Social mobility has pretty much ended in the US. If you didn’t get yourself into the top 10% by the 90s, or have your parents deposit you there, forget it.

The 1945-1965 years were great. 1975 the cracks were beginning to show, and we’d just been beaten by a bunch of rice farmers. I call the 1970s the “starving seventies” and my main problem as a kid wasn’t who to take to the sock hop, it was how to get something to eat.

The 80s were a bit of an improvement, except there were some sharp recessions during that decade too. The 90s were what I call “the last good time”. It was just possible to … maneuver. Gas was cheap, you could start a business, seemed like anything was possible.

Since then it’s just been, “Oh shit, when’s the foot gonna drop”.

“America is still the greatest country the world has ever known. Period.”

Data does NOT bear that out in the health care realm — and most other realms.

“The OECD has compiled data on dozens of outcomes and process measures. Across a number of these measures, the U.S. lags behind similarly wealthy OECD countries (those that are similarly large and wealthy based on GDP and GDP per capita). In some cases, such as the rates of all-cause mortality, premature death, death amenable to healthcare, and disease burden, the U.S. is also not improving as quickly as other countries, which means the gap is growing. ”

AND the US spends 8.8% of GDP compared to 2.7% on average for other nations.

We ARE the worlds leader in incarceration rates.

And we do have highest level of illegal drug use in the world.

The US is #45 in World Freedom Press Index.

US is #28 in mobile internet speed.

The U.S. ranked 30th in math and 19th in science among the 35 members of the Organization for Economic Cooperation and Development

I’m American. I’ve lived in three countries for longish periods of time. What’s so special about America?

@Ameican Debt slave… don’t be greedy, be a good humane person. If you’re paying for things, then you have more than enough. Look at all the ghettos and people working 3 jobs to pay rent, with their kids going to schools that there’s shootings…

Come on.

So consumers adding about $800 billion (at an annual rate) to debt. The federal government running at close to $1 trillion annually of new debt. I wonder why the economy is doing well and unemployment is so low …. I really really wonder!

Going to look pretty ugly one day.

How do you figure that? Based on Wolf’s chart above, consumers have been adding about 170 billion a year, not 800.

These numbers look ominous. Just wondering if the population has changed much since say 2011? Maybe that skews things a little?

Interesting less students and still higher debt…even scarier!

As I mentioned above, since 2008 median annual nominal income has grown by about 20% while population has grown by about 5%. As such, in real terms there has actually been a decrease, not increase in total consumer debt.

Sorry, I meant without student loans. That’s where most of the growth has been.

If you exclude student loans, total consumer debt has grown from about 2T to 2.4T between 08 and 19. That’s less than the 25% income and population growth during this period.

When are these idiot college kids going to figure out that Canadian and European universities are much cheaper and provide a much more enriching experience? If I had the choice of spending 1/4 as much money and living in Munich, Berlin, Montreal, etc. for four years versus some redneck American upstate college town the choice would be pretty easy.

American universities are a goddamn joke. 4 years of morons shotgunning beers and smoking pot because there is nothing better to do at a school that is in middle of nowhere USA.

When I was applying to college back in 1989, I put the University of Toronto on my list just for the hell of it. Canadian universities then didn’t look at grades, only SAT scores, so that was the only place I was admitted . . . amazing school, international tuition was cheaper than out of state tuition in the US, lived for 4 years in the heart of Toronto paying $200/month for rent, had a great education, and 20 years later, made it easy to immigrate to Canada. Now I’m saving for my kid’s school, and I’m going to tell them that they have to go to Canada for that (4-5 thousand a semester for tuition tops), save the US for grad school (if they want it).

Going to UofT was the best deal in the world, the only thing I could have done better is chosen McGill instead, and gone to Montreal and learned French to boot. The lesson, clearly, is don’t worry about your grades and do well on the SAT.

And go figure UoT is now one of the best universities in the world.

The numbers are ominous for student loans and to a lesser extent for auto loans. Credit card balances are ok.

Over the last decade there has been about 20% inflation per CPI. The US population grows at about 0.8% per year, so about 8% in a decade. So inflation-adjusted per-capita, the ominous two categories are student loans (+100%) and auto loans (+55%).

Elizabeth Warren makes everything okay. No worry.

What about the Chapwood Index? That shows an effective inflation rate of 9% per annum. So over say 10 years, all prices are likely to have more than doubled.

It seems to me the population has gone much poorer in terms of buying power over the last 10 years – wages did not keep up that pace.

The Chapwood Index is a bad hoax. Just do the math. 9% a year for 10 years means that your cost of living goes up by 136% in 10 years without doing anything different — FOR THE ENTIRE US POPULATION. That maybe true for the one renter whose rent gets jacked up every year. But 63% of the households own their own homes and their housing costs don’t move much, and rents are flat in other parts of the country, and our health insurance premiums haven’t really moved at all over the past few years, and electronic devices are much cheaper and much better than they were 10 years ago, gas is about flat with 10 years ago, and down from 11 years, and on and on. The Chapwood index and similar indices are just a joke. Take them seriously at your own risk.

The GFC was a painful lesson to a large number of people. I think that those who can minimize debt do. I use a high rewards credit cards for most purchases, but they are paid off in full automatically every month. The problem with this is probably more of the debt is concentrated in those who will have difficulty paying in a slowdown. It would be interesting to see the income percentiles for who is carrying the debt and how it has progressed in the last ten years.

Wolf is the soothsayer!!!!

And at the national level we’ll be in the same boat with interest payments set to exceed current debt issuance totals by 2024. The end game begins there while we continue to blow our future efforts and resources on military games w the rest of the world because we still think we are in charge.

See https://www.treasury.gov/resource-center/data-chart-center/quarterly-refunding/Documents/q12019CombinedChargesforArchives.pdf

Let’s not mix forgivable and unforgivable debts.

Unsecured depts are forgiven every once in a while through bankruptcy, but even without bankruptcy, they provide next to nothing for collection agencies, but that only takes money out of circulation, working against inflation, which allows for the issuance of new debts, which drives the sick economy that maintain our unsustainable living standards.

Unforgivable taxpayer’s debts, such as military, security, and close-to-defunct pension funds are orders of magnitude worse than consumer debt and once the petrodollar goes down, those debts will come back with a vengeance and we will become one of the proverbial countries that our President so eloquently ingled our for a particular adjective.

The problem, as I see it, is that those with money have lost interest in investing in America, they are in their last phase of looting before bailing out.

$4T in consumer debt sounds terrible, and it is. But what about the $29T in financial business and nonfinancial corporate debt (loans + debt securities). And another $5.5T in nonfinancial noncorporate loans? (According to the BEA.)

We all — consumers, businesses, and government — need to do our part to spend far more than is reasonable.

Used car prices soared in the early 2010s thanks to the Cash for Clunkers program. Millions of cheap used cars were taken off the market and literally destroyed.

And class, what happens when supply suddenly shrinks, but demand stays constant or grows?

No more credit card payments for me. I jumped on that $99 per year deal at my gym and never looked back. And free pizza & free bagels on top of that deal. My gym doesn’t offer that deal anymore lol.

The story is, you can buy a 3 or 4 year gym membership at for that 24-hour gym, at Costco. You have to pay up front, to the tune of a few hundred dollars, but it works out to about $10/month.

“university financial complex” is apt. All of the debt statistics beyond student debt reflect the prudence of the consumer through this cycle.

And yes, the students burn this cash quickly. However, when they no longer have access to these loans and are left with the student debt hangover, it is a DRAG on GDP. They can’t buy homes, transportation or other things associated with earning a living and forming a household.

A very basic financial principle is apparently not being taught – the time value of money. What is being taught on the campaign trail is that you should not have to pay your debts. That free lunch would be very expensive for everyone. For the supposed beneficiaries, it will ensure their servitude to those who are trying to dupe them.

“nominal GDP rose 5.1%”

GDP figures are fraudulent. New federal debt should not be added to GDP. The difference in federal debt between March 30th 2018 and March 30th 2019 is $938 billion. The difference in GDP between 1Q 2018 and 1Q 2019 is $1,022 billion. The real change is not $1,022 billion, it’s $84 billion or 0.42%.

https://market-ticker.org/akcs-www?get_gallerynr=6757

“New federal debt should not be added to GDP.”

It’s NOT added to GDP. No debt is added to GDP.

Is that really true? Sure, the debt isn’t added ‘as debt’ but when the gov’t spends the money it borrowed its purchases are added. Sounds like a manner of semantics to me.

They even calculate the ratio of government spending to dollar of growth in GDP, it used to be four was the number considered to be counter productive.

bemused,

Yes, spending and investment are added to GDP no matter how they’re being financed, whether from income, drawing on equity or savings, or going into debt. So spending that is financed by debt — any form of debt, business debt, consumer debt, and government debt — is added to GDP. Debt leads to spending (and investment), and the spending (and investment) is added, but the debt is not considered.

Critics of GDP (me included) say that by not considering where the money came from, the GDP measure distorts the view of the economy.

But if anything, debt would not be “added” to GDP anyway, but “subtracted” from GDP.

For example, you spend $2,000. Half of that is funded by your savings, and half is borrowed on your credit card. The $2,000 is now added to GDP as spending. But there is no consideration of how it was financed.

An alternate to GDP would be to subtract the new debt. So the $2,000 in spending would still be added to GDP but the $1,000 in additional debt would be subtracted. And the net addition to GDP would be $1,000. This formula has a lot of problems and may be impractical, but it would give an alternate — and I think useful — view of the economy.

But there is no movement underway these days anywhere to incorporate this formula into our economic data set.

I’ve long been a proponent of having the balance sheet play the primary role on the national level. It’s the balance sheet that we pass on to the future, and it would hopefully help shift our focus from consumption to preservation when we reflect upon what we call ‘wealth creation’.

Not only should the change in liabilities be accounted for in terms of providing a figure to reflect changes in aggregate wealth, but changes on the asset side, such as e.g. depletion of natural resources should be accounted for.

Maybe an expansion of NDP or something, to provide a figure that is intended to reflect an approximate change in domestic equity?

The results would probably be too shocking, though…

What Winston means is that the increase in debt ( 938 billion ) between March 2018 and March 2019 is caused by government expenses for which new debt had to be issued. And these government expenses are an integral part of GDP ( tx to Mr Roosevelt ). Without making additional debt ( for funding these additional unfunded government expenses ) the GDP increase would effectively be almost nothing ( 84 billion ).

I think Winston has a point here. Speaking with the “average Joe”, NOBODY feels his standard of living improved by 5+% last year. Nobody – on the contrary.

One could argue, hey, well, lets add another 5 trillion in federal debt and spend it all through expanded nice-to-have government programs. Then, nominal GDP would take a 25% spurt. But this debt does NOT add any sustainable ROI. Once spent, it’s gone, but the additional debt remains.

Debt is not added to GDP per se, but the spending that arises from debt added each year is reflected by the GDP, is it not?

For sure, not all debt leads to spending. For example, the debt from unfunded tax cuts for the wealthy leads to much more financial speculation but only a little portion gets spent on goods and services, so not much increase in GDP (unless bidding up stocks is counted as “investment”, but I think it is not).

Is anything I said here incorrect?

Is 90% of the country wealthy? Because 90% of the country got a tax cut.

This helps me define education as an “experience” expense, is the old “liberal arts” education about to make a comeback?

That is what never seems to get attention. Students are spending these loans on the “experience” and not on the “education”. As with anything in life, one needs to compute the Return On Investment. These multitude of liberal arts degrees that allow frivolous party, party, party in college are not valid anymore in the modern technology world.

Not wanting to spend a lot of time explaining why the educational experience is more valid, why do you assume Liberal Arts majors party more than Scientists?

The numbers above indicate that consumer debt has grown at a rate of 4.8% per year, a little less than nominal GDP growth. And government deficits are growing in line with nominal GDP growth.

So no problem, right?

Wrong. We should be reducing debt loads, relative to GDP, when the economy is peaking. Also, what about growth in debts not on the books such as unfunded social security and medicare? Meeting these obligations will require larger government outlays in the future under our pay-as-you-go system.

Government debt is about to explode. There will be massive outlays for scheduled items such as interest expense, SS, and Medicare, BEFORE consideration of the unknowns such as recession, infrastructure investment, student loan forgiveness, wars, medicare for all, bank bailouts, tax cuts, etc.

While debts may be growing roughly in line with GDP now, I believe it’s the calm before the storm.

You don’t understand. Underfunding the future obligations is a feature, not a bug. Certain groups of people dislike the obligations, especially SS, so much that they’d be deliriously happy for them to go insolvent and go away.

Then the administrators of these programs would be forced to turn out their empty pockets and say, “Sorry, no money, we need to reduce or eliminate benefits now.”

Some people would love nothing more than to “drown the govt [debts and obligations] in a bathtub” by simply eliminating the obligations as much as possible–even though people have paid money in their whole lives, with every paycheck, towards the benefits–and they deserve to get what they’ve paid into and have been promised. Yet some psychopaths enjoy stealing from retirees and orphans so long as it will make them a quick buck.

Ideally, the looters would love to do the wealth transfer from *future* retirees to themselves *right now* since they won’t be around to deal with the any consequences in the future and will escape responsibility.

In addition, there are those who don’t plan the obligation funding well or have optimistic expectations and it’s not hard to nudge people into planning poorly for the future since it’s human nature to overvalue what you want right now over what you’ll need in the future.

The other part of the plan is to privatize the payments to & benefits formerly administered by the government so that money can flow directly to their pals in the finance and insurance industries so that those industries can siphon off a bigger and bigger portion of it in fees. Not to mention increases in funds under management if there were govt-mandated withdrawals directly from everyone’s paychecks. Private education and prisons (and defense and healthcare) have made tons of money with govt support and now it’s the finance and insurance industry’s turn (again).

The future is bright if you can siphon enough money and resources now and hide it away until later, so that the people you’re taking it from don’t notice. Or if they eventually notice, be sure to put it someplace out of reach so they have no recourse or way to get it back.

– An economic expansion Always comes with a expansion of credit. And an economic recession Always is the result of a credit contraction.

– One has to look at “change in debt”. In a recession this metric falls and in a economic expansion “change in debt” rises. And for the first time since (at least) 1950 “change in debt” actually went negative.

– When one looks at the Debt-to-GDP of the US ratio since say 1950 then you will see that this ratio kept rising EVERY year. Even in EVERY recesssion this ratio kept rising.

if I may, good analogy ‘free’ pizza and bagel’s and we pay to work it off, the near perfect income stream, allegiance to master, divisiveness in tact, disneyland and just add math.

oh my, how did we get here

Beautiful pictures. I hope we can continue to make America great for at least my lifetime, and I was shooting for at least another thirty some years. Heck I stopped worrying and learned to love the bond years ago. Everyone loves us right? Right?

Whose buying 10yr treasuries considering our current levels of debt?

Retail Mortgage rates have dropped almost a point since December, and asking home prices in the IE are 50k higher in the last 3 months, and a lot of sellers are getting the higher price.

Buyers just going deeper and deeper in to debt for crappy old housing stock because of lower rates.

So what gives, Trump make a deal with the Fed?

The more you borrow the less of a future you have. If you borrow long enough you have no future. Then and only then does it make sense to borrow and make it all you can :-)

Speaking about Car debt, and the bubble in those loans, how many came from LYFT/UBER drivers who tooks out loans to strat driving 50-60 hours a week with no benefits, no health care, and continued wear and tear on thier car.

Im glad to hear they are starting to strike across the US. Acording to a few drivers I checked in with LYFT began to cut back thier pay and perks weeks before going public, all to look good for the Stock market.

I talk to the drivers of way they can pick up people and they pay cash. They say if you cancel the ride they will take you for cash, to keep LYFT from taking 38 percent of thier pay.

Kind of like the stunt we used to pull many years ago driving for “real” cab companies. Would get a call to do a short grocery run on Saturdays. Would take 3 fares going in the same direction from the same store (sometimes even to the same apt building…Bonus). Booked the called in fare for the owner of the car and the rest for myself + tips. Made doing those nickle & dime short runs worth the effort. :)

The best part was I didn’t have to “bribe ” the dispatcher to get a gravy run to the airport . Lol

It seems that the AI would eventually figure it out when both GPS transmitters start traveling the same path.

René Descartes came up with that latin phrase, “Cogito, ergo sum”, “I think, therefore I am”, which we should update for modern times to “Consumo, ergo sum.”

Descartes was sitting at a bar finishing his beer. The bartender asked him if he would like another, “I think not” Descartes replied, and then he disappeared.

Outstanding!

LOL

Made my day!

Nicko2, above (I don’t see a Reply button):

WalMart sells a “Regular” insulin for under $25 per vial, before your local tax. This is about what a vial of Regular did cost back in the 1980s. One difference: the old Reguar was a purified extract from slaughterhouse pork and/or beef. They now sell a modern bacterial- recombinant insulin (as I said, for the same price). They sell a long-acting insulin, NPH, for about the same price. Novo Nordisk produces these insulins on contract to Walmart.

Good for Walmart.

Good for Novo Nordisk.

This affordable insulin option has nothing to do with Obamacare, which is an INSURANCE program, not a healthcare program at all. That’s right, some of us buy Regular at Walmart, rather than through our Part D prescription drug coverage, to avoid getting into the donut hole.

Are you laughing by now ??? I hope so….. yes, it’s a dark, ironic laugh…..

I canceled my Part D as it was costing more overall, even though that monthly payment was just $28/mo. The drug I needed was an additional $44/mo. I realized I cold get the same drug for $21/mo. at Costco, by just being a member, no additional monthly fees.

You really got to shop around.

A bit off-topic, but I think perhaps of general interest: I was thinking about buying some GinnieMae MBS bonds with very short maturity (say 2-3 months) on the open market, to get (hopefully) just a a tad more yield than T-bills.

Now, I can find multiple Fannie, Freddie, FHLB etc etc etc GSE MBS bond quotes, but none for GNMA securities as of today. I even dug up some CUSIPS and tried to plug them in. No quotes.

What gives? These are so safe that nobody wants to sell them? I don’t want to buy instead some fund like VFIIX or etf like GNMA because they contain long maturities. Thoughts?

What’s left in a 2-3 month MBS when on the average half of the people pay their mortgage in about 6 years. Due to it being pass through, MBS very difficult to track. My older brother has been doing this for my Dad for a long time, I could never figure it out.

Sorry I realized you meant bonds not MBS.

Even the Fed reduced this a lot.

Vanguard has them, I checked . You can buy Agency Debt maturing June 2019.

But the yield to worst is about 2.4%. That said, I wonder why go through the trouble when the effective yield of short term Treasuries is more than 2.4%

It’s a good point that there may not be large quantities (measured in dollars) of MBS bonds left with short maturities.

Nevertheless, I found no GNMA MBS bonds for sale, but (as you yourself observed) quite a bit of “agency” (Fannie, Freddie, FHLB, etc etc etc) MBS bonds, even with short remaining time to maturity.

But I was specifically NOT looking for “agency” MBS bonds. “Agency” is a Wall St weasel-word that is intended to make the public believe that the bonds are guaranteed by the full faith and credit of the US Government. But they are not. Only GNMA is a true US Government-owned corporation whose MBS bonds are guaranteed by USG.

Anyway, I think the conclusion is that GNMA MBS bonds are not as widely traded on the secondary markets as “agency” bonds are.

For reference about GNMA versus “agency” bonds, the following link has some good reading.

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/gnma-mortgage-backed-securities-a-treasury-alternative-offering-quality-and-yield-retail.pdf

Thanks for the replies.

– I assume Wolfstreet has the data at hand in a spreadsheet / database.

– I have a suggestion: Is Wolfstreet able to calculate a thing called “change in total debt” with this information ? Looking at the “change in debt” allows one to make a judgement whether or not the US economy is in a recession or not.

– In a recession “change in debt” shrinks from say over +2% down to say under +1%. This happened in the recession in the early 1990s.

– And in the second half of the 1990s “change in debt” kept growing (=economic expansion).

– Between 1950 and 2008 the “change in debt” never went negative. It wildly fluctutated throughout the years between 1950 and 2008 but it never went negative. But this “change in debt” went negative in 2008 for the first time since (at least) 1950.

Use FRED, all the data is in FRED. Total private debt dropped in 2008-2009 for sure, because of defaults. Wall St and the press called this drop “deleveraging”. Make no mistake, it was defaults that caused the debt to drop, not that people or corporations paid it down. But calling it “defaults” out in the open I guess would make more people default on their debts, so the media called it (wink, wink) deleveraging.

Willy2,

Are you talking about “total debt” as in “total consumer debt,” or “total US based debt” (consumers, governments, companies). I can do charts of year-over-year change in consumer debt. And I can do the same for federal government debt. But I don’t have quarterly data on all business debts. There is date on bonds and some categories of loans, but business debts are very broad, and I don’t have access to quarterly data that encompasses all of it going back 15 years.

There is data on “total private non-financial debt” which includes everything except debt by the financial sector (banks and the like) and debts by governments. But it is a summary figure, and I cannot split it out by segment.

Here’s a link depicting corporate debt.

https://seekingalpha.com/article/4261970-go-wrong-fed-warns-corporate-debt?ifp=0

Nope. The link just uses “corporate debt,” not “business debts.” This corporate debt data in the link is everywhere, including on my site and in my data base.

But nonfinancial “business debts” include debts by corporate and non-corporate businesses, including the debts of small businesses. This is a much broader and larger figure. The Fed publishes charts on this in some of its reports, but I don’t have access to the actual quarterly data on total “business debts,” on a timely basis.

Great article. Love the comments. I agree with many and disagree as well. I work with people every day to help eliminate the interest-bearing debt they carry. Not by consolidating or refinancing, that just digs a bigger whole. The fact is, most Americans, need to live on credit. Not a terrible thing. The cost of using the credit is the detriment to our society. Interest is the devil for consumers.