Chinese corporate defaults this year through April are 3.4 times the amount last year.

By Don Quijones, Spain, UK, & Mexico, editor at WOLF STREET.

Since the global financial crisis, the total value of outstanding corporate bonds has doubled, from around $37 trillion in 2008 to over $75 trillion today. But the growth has been far from even, with non-financial debt growing much more rapidly in certain jurisdictions. As the volume and price of this debt has grown, so too has its riskiness. And that could be a recipe for disaster, warns Sir John Cunliffe, deputy governor for financial stability at the Bank of England.

In the US, non-financial debt is up 40% on the last peak in 2008. Cunliffe expressed even greater caution concerning emerging markets, where corporate debt as a proportion of the global debt pile has grown the most over the past 10 years. “Emerging market debt now accounts for over a quarter of the global total compared to an eighth before the crisis,” Cunliffe said.

Before the financial crisis, emerging market companies were issuing a total of $70 billion per year in bonds, according to OECD data. That was before the world’s biggest central banks embarked on the world’s biggest monetary experiment, in which companies the world over were invited to participate.

By 2016, emerging market corporations were issuing ten times more money ($711 billion) than before, much of it in hard foreign currencies (mainly euros, dollars and yen) that will prove much harder to pay back if their local currency slides, as is happening in Turkey and Argentina right now. Although bond issuance by emerging market companies declined by 29% in 2017 and remained around the same level in 2018, it is still approximately 7.5 times higher than the pre-crisis level.

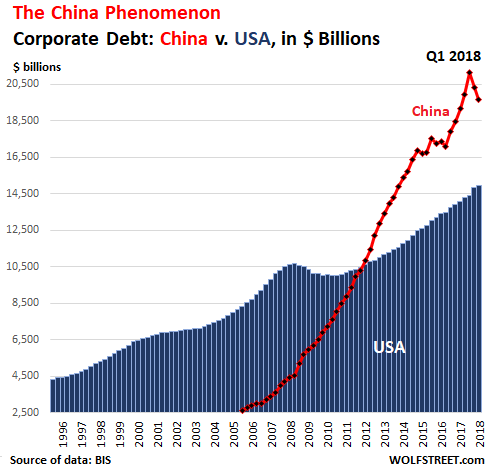

Much of the increase has been driven by China as it transitioned from a negligible level of issuance of corporate debt prior to the 2008 crisis to a record issuance amount of $590 billion in 2016. During that time the number of Chinese companies issuing bonds soared from just 68 to a peak of 1,451 and the total amount of corporate debt in China exploded from $4 trillion to almost $17 trillion, according to BIS data. By late 2018 it had reached $19.7 trillion.

“There has been a persistent buildup of private debt to record levels in China,” Cunliffe said. Much of this increase took place in the direct aftermath of the financial crisis. The largest increases have been in the corporate sector, mainly in state-owned enterprises. At last count, China’s corporate debt-to-GDP ratio was 153%, enough to earn it seventh place on WOLF STREET’s leaderboard of countries with the most monstrous corporate debt pileups (as a proportion of GDP), 18 places above the US. This chart compares the rise of non-financial corporate debt in China and the US:

The rate of growth and level of debt in China have passed the points where other economies, advanced and emerging, have experienced sharp corrections in the past, noted Cunliffe citing research carried out by the Bank of England.

Since early 2017 the Chinese authorities have been scrambling to deleverage its corporate sector and shrink its shadow banking system, with a certain degree of success (the hook in the chart above): corporate debt-to-GDP ratio has fallen in the last two years by almost 10%. However, in the face of slowing economic growth, the Chinese government has dialed back some of these reforms as concern rises that a sharp slowdown in growth would make China’s elevated debt levels even less sustainable.

And if things get seriously sticky in China’s debt markets, it won’t take long before they’re felt elsewhere, Cunliffe cautioned:

The Chinese economy is now pivotal to regional growth and one of the main pillars of world growth and trade. As well as the economic effects and effects directly through banking exposures, it is likely that there would be a severe impact on financial market sentiment, [as happened] in 2015 when a period of sharp correction in domestic Chinese financial markets sparked a correction in US financial assets.

Problems once again appear to be on the rise in China. Chinese companies defaulted on 39.2 billion yuan ($5.78 billion) of domestic bonds in the first four months of 2019, 3.4 times the total for the same period of 2018, according to data compiled by Bloomberg. For the moment, there’s little sign of the problems spreading far beyond Chinese borders. In most advanced economies, as well as quite a few emerging markets (Turkey and Argentina excluded), bond spreads — the amount charged for risk, be that credit risk or liquidity risk — are still at or near historically low levels.

But conditions can change on a dime, as the short-lived drama at the end of 2018 amply demonstrated. Between mid-October and the end of the year spreads on investment grade bonds widened by around 50 bps, all on the back of “relatively modest amounts of news,” Cunliffe noted. “Since then, these moves have fully retraced – spreads at the start of May were the same as they were in mid-October last year. Bonds in other currencies and high yield bonds went on a similar round trip.”

When it comes to expectations about the value of debt, the market can be highly susceptible to changes in sentiment, meaning a “correction can come very quickly”. As Cunliffe warns, given the “current compression of risk pricing,” not to mention the sheer abundance of poor quality, mispriced bonds out there, “such a correction could be a sharp one.” By Don Quijones.

“Zombie firms,” kept alive by low interest rates, account for up to 14% of UK companies. Read… Businesses in “Critical Distress,” Bankruptcies Surge in the UK

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

China has much much more then 6 Billion in defaults this year… What they do since every bank is government owed, is allocate bad loans and defaults to specific banks to try and contain shock from becoming systemic by limiting exposures, also gives illusion to outsiders that things aren’t as bad as they really are, little paid advertisement to a Bloomberg editor and voila! Only 6 Billions defaults… Reality is they had close to 120 Billion Yuan or 17.88 Billion US of Defaults just in January 2019 alone!

https://sbr.com.sg/financial-services/asia/chinese-banks-suffer-heavy-losses-delinquencies-hit-1788b-in-january

Losses appear on bank sheets, goes into some hidden section as loss and other state owned bank who originated the loans gets made flush… Transferring Fiat from one state owned to another.

The realllll problem is US Issued bonds, and all those dollar swaps with 1 year expiry they have been doing, it’s a time bomb for real! Imagine the chaos when China starts defaulting on US denominated, meaning they would have to start floating RMB… Sorry for rambling, but I am obsessed with China’s Ponzi Economy, never seen and never will see anything like depression that is awaiting that country… 25 % + of GDP is derived from Construction alone, which doesn’t increase debt servicing at all. Debt keeps sky rocketing while servicing capabilities are doing down

From 08 to 2018, 70 % of the world’s debt was created by China’s Corporate Sector alone!!! With Local governments and Central Government, China created 85-90 % of the world’s debt in the past 10 years. Look into earnings last Thursday and this week, it’s insane how many companies claimed profits for 2018 then revised it this past week to substantial losses for 2018, insanity and greed has over taken that Country, there is no morality left in China, sadly…

With all of that USD denominated debt there explains the rotten performance of gold and other comedies and the grab for USD that has jacked the DXY.

You make another quality comment.

Armstrong has some historical precedent, What he means by “reforming the monetary system”, who knows? He makes the point the stock market will explode, and while the market is down a couple percent here, the AD line is pushing ahead, this market is under Accumulation which normally happens at the beginning of the cycle. The Fed will be forced to raise rates to tamp down asset inflation and that hastens the problem of foreign investment. If the US is in that time period like 29-31, we are in a depression right now and just don’t know it. (complete with tariffs)

“we are in a depression right now and just don’t know it”.

Agree.

CLO’s and CDO’s making a big come back.

In the US there is more than $4 trillion of junk bonds and leveraged loans, that will mature in the next decade, with the peak maturities arriving in 2024.

Risky corporate debt has seen an explosion of low quality, triple B rated bonds which have less protection for lenders and investors. Non bank (shadow banks) lending has globally exploded and has now become a $52 trillion bubble.

ZOMBY Corporations and companies are those whose average operating income, has fallen short of covering the average interest rate expense over 3 consecutive years.

These are the corporate walking dead. Loaded with debt.

When this humongous pile of odiferous manure defaults, the resultant debacle will make 2008 look like a mild correction.

“insanity and greed has over taken that Country, there is no morality left in China, sadly…”!!!

Are you on something stronger than coconut beverage Lemko?!

Are you suggesting that morality has a role when the article is about corporate debt escalation?

Did you forget that the last major world financial crises originated in the Us?

Do you remember Mike Molden’s ( a mortgage broker) comments :

“I can get a ham sandwich a home loan if the sandwich has a job. Or ,” To obtain a mortgage, you only needed a pulse or to be able “to fog a mirror!

Even being alive wasn’t that important as dead people were approved for loan in the state of Ohio!” ?!!

Are you talking morality now?

I suggest you stick to straight (milk) preferably ( soy) since the Chinese that you so despise for their corrupt morals might stop importing your soybeans! :)

Cheer up though Uber the centre of morality has floated and might rescue the flailing Dow ( for now)!

Sounds like China is ahead on the curve when it comes to MMT.

What’s a default when you can just create money on a ledger entry to fill the shortfall?

We already followed Japan’s QE/cheap debt path on the search for free money, we’re bound to follow China’s MMT path at some point as well.

The question becomes will the central banks bail them

out or will they let inflation run and let rising rates

sort it out.My guess is they will allow rates to rise

in an attempt to protect currency value.

$6 billion in defaults is miniscule considering the amount of debt. Three hundredths of one per cent.

Don,

Thanks for the piece and the charts.

Of the $70 trillion in corporate debt outstanding, how much is rated junk?

As for China, fuhgetaboutit. They’re burnt toast. Zombie companies propped up with Ponzi financing. $20 trillion is likely understated significantly.

Yet the lack of concern amongst so-called “investors” is breathtaking. The charts of JNK, BKLN and LQD demonstrate the complacency amongst those hunting for yield.

As always, those holding the credit default swaps on this mess shouldering the biggest risk of all (cough, cough…Deutsche, cough).

I have to give credit to the Chinese government where it’s due: they are managing to hide this debt fiasco in rather successful fashion. Or perhaps us Westerners are just so gullible we unquestioningly believe any piece of propaganda originating from Beijing, no matter how laughably false.

But while Chinese authorities can hide their domestic shenanigans without much fear of being found out (remember their economy behave according to a variation of the Quantum Zeno Effect), they have had less success hiding said shenanigans abroad.

I’ve written before about HNA Group, the Chinese conglomerate which went on an amazing buying spread abroad culminating with the purchase of a massive 9.9% share in Deutsche Bank in 2017 which had many declare that “China would buy the world”.

Since then a lot of changed: HNA Group has effectively collapsed under the weight of its own debts and the asset purchases abroad have ceased overnight. But according to the Chinese government HNA Group has not entered administration. Neither it has been nationalized. Or bailed out. According to the press release, HNA Group is merely being “advised” by a gaggle of ministries and government agencies on how to reduce its debt load. Apparently authorities in Beijing have entered the bankruptcy consultancy business as well. ;-)

Since HNA Group has so many assets abroad, authorities in Beijing cannot merely sweep them under the rug and pretend nothing happened. And after the oBike and Milan AC debacles even our perpetually hibernating regulators have to pretend to pay some attention.

HNA Group, or the government “advisors”, has started to shed whatever assets they have abroad in return for hard currency, which is then propmptly repatriated. And they need that money because as of January 2019 HNA Group sat on a rather phenomenal $100 billion in debt, a large of part of which foreign-currency denominated.

The stake in Deutsche Bank was completely liquidated by the end of 2018, effectively removing a desperately needed prop from underneath the scandal plagued banking behemoth.

Last year HNA Group had a row with Airbus over six A330 the company had paid only in part. This crisis was only defused by diplomatic efforts by the French and Chinese governments.

In December 2018 HNA group sold Amsterdam-based TIP (Europe’s largest trailer leasing company) to a PE fund for a little under €1 billion. They had bought it from GE in 2013 for about €1.2 billion.

In March 2019 low cost carrier HK Express was sold to Cathay Pacific (part of the British-owned Swire hong) for less than HKD5 billion, about 25% less the previous valuation. And I could go on for a while.

Everything is for sale: up for grabs are all HNA’s foreign assets including Dufry (duty-free shops), the 48% share in French airline Aigle Azur, SR Technics (aircraft maintenance etc)… if you have the cash and the will to deal with companies that may have been used for shady accounting purposes or not the local Chinese embassy will be delighted to hear from you.

HNA Group is a private company with a purposedly murky structure (the system called in Swiss French boîte à secret and in Italian scatole cinesi), so finding out exactly who owns what for us foreigners is hard to say the least. The “advisors” in Beijing seem to have no such problems and move with what seems like perfect knowledge of the superficially complicated structure of HNA group. I am not making accusations, but he that hath ears to hear, let him hear.

Lengthy comment but wall to wall full of information. I seek your comments because they are well reasoned and expose me to information that I would not otherwise get.

Thanks.

Mate get a grip!

Nothing, I repeat Nothing that the Chinese corporations are doing now haven’t been done by the US corporations or the British or the German for that matter!

So they might be just good students of the shonkey teachers that the West keeps producing ( in mass)!

and No the Chinese are Not toast ! Something that can’t be said for your valued stock markets.

Cheers

King Dolla my friend!

Fiat currencies are backed mostly by faith!

Who to believe most?

Commie Mandarin numbers?

Ex: Alibaba WT Hell

EUssr eurocrats?

Ex: Douchebank WT hell

It’s better to trust USA chaos, but at least everything there’s widespread of info for good or worse.

At the cost of sounding boring I’ll repeat myself once again.

What HNA Group has been doing since 2009 is without precedent.

There are some similarities with what several Japanese companies (chiefly part of the now defunct DKB and Sanwa keiretsu) did in the 80’s but not a single one one of them had the seemingly endless amount of cash HNA had at its disposal.

I know what I am about to tell will probably sound like a long-dead language to some, but HNA Group not merely ended up grossly overpaying for what they bought, but bought assets without any logic.

In August 2017 HNA bought an 82.5% share in the Frankfurt-Hahn Airport for €15.1 million. At the time the airport had €125 million in debts and to this date it has no railroad nor highway connection to Frankfurt (which is 120km away!). On top of that money HNA pledged to finance an improvement to the existing infrastructures for an undisclosed sum. Now HNA cannot even keep on covering losses, so the minority partner (the Land of Rhineland-Palatinate) got approval from the EU to cover “up to” €25.3 million in losses, effectively a subsidy.

My skepticism about HNA Group’s ability to keep up this level of spending was met with derision, just like those who questioned the ability of Corporate Japan to keep on buying overpriced real estate and large equity positions at a premium back in the 80’s were met with jeers and laughter.

The arguments are always exactly the same: it’s different there, these people are the future, failing everything the Chinese/Japanese government will just print money… the only difference is that HNA Group appear to have an even more cavalier attitude towards book keeping than many Japanese companies had in the 80’s.

In the end, here we are in May 2019 and we still don’t know exactly how HNA debt is structured. Allow me to say I also have serious doubts about the $100 billion figure I quoted above or the average 5% interest HNA pays on it but that’s all we have to go by right now.

Most Chinese companies have a financial situation every bit as murky as HNA’s. Perhaps they are highly profitable, perhaps they are not, but it seems they purposedly want to hide their true financial situation from outsiders and for me that’s one reason to be suspicious.

I have dealt directly with Mainland Chinese companies since 2010 and even invested directly in the local stock market and while I can say I have never run into a downright scoundrel (differently from other countries), their business approach is completely different from ours. That’s why having a good “feet on the ground” middleman with a solid handle on local economics and politics is paramount. Let me tell you these folks really earn their keep…

Won’t make a habit to linking sites but this explains HNA situation… Use outline.com if hit Paywall

https://www.caixinglobal.com/2019-04-29/hnas-25-billion-fire-sale-fails-to-ease-crisis-101410054.html

Kings of bad investments is what they are labelled

Need a map for how a Chinese Corporation operates?

Try the Canadian, once publicly traded, Sino-Forest.

C$ 3.5 billion shares and debt sold to the public, based on China based forest land. The forests did not exist.

Smoke and Mirrors. A five year scam.

Yes, China is not alone in the scam department, but everything inside China is opaque.

And things are never designed as opaque, if the truth is better than the public story.

Print yuan convert it to EUR use EUR to buy stuff. If needed sell stuff for EUR at a loss and put EUR in EU bank. Rinse & repeat.

Problem?

Perhaps…