And now the biggest boom of all.

The Nasdaq has dropped 8% from its intraday high on October 1, and now the real estate industry in the San Francisco Bay Area has its collective eyes fixed on it because there is an uncanny dependency on tech stocks.

The cause-and-effect relationship between tech-stock prices and real estate in San Francisco is not perfectly agreed-upon. One thing is sure: when the Nasdaq surges for an extended period of time, office rents shoot sky-high, and when the Nasdaq plunges, office rents plunge along with it. But when it comes to home prices, it’s complicated, as they say.

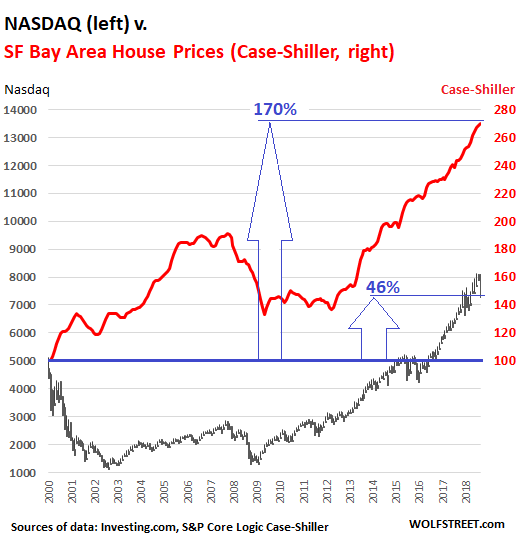

We’ll start with the relationship between the Nasdaq and home prices as measured by the S&P CoreLogic Case-Shiller Home Price Index for “San Francisco.” The Case-Shiller covers house prices (not condo prices) in the five Bay Area counties of San Francisco, San Mateo (northern part of Silicon Valley), Alameda and Contra Costa (both in the East Bay) and Marin (North Bay). This area is home to a lot of tech companies and near a lot of other tech companies in the South Bay.

The Nasdaq, now at 7,449, is up 46% from the crazy dotcom-bubble peak of March 2000 (5,132). Over the same period, house prices in the five-county Bay Area have surged 170%.

As a reminder for those who’ve graciously forgotten: The Nasdaq plunged 76% from that bubble peak to 1,192 by July 2002, and as measured from that low, has since soared 524%, but remains far behind the home-price increases.

This chart shows the monthly Nasdaq ranges (black) and the Case-Shiller index for “San Francisco.” The horizontal fat blue line depicts the starting point for both:

In the year 2000 and in early 2001, the Case-Shiller index soared 34%, still boosted by the Nasdaq gains of pre-March 2000 and the hope that the tech-stock collapse was just a regular sell-off. Also, the Case-Shiller, by the way it is designed, lags several months behind actual home price changes.

But by mid-2001, both headed south together, with the Case Shiller dropping 12% over the next 12 months.

By the end of 2002, the Greenspan Fed’s low interest rates started to inflate the San Francisco housing market with a vengeance. Tech stocks followed six months later.

From mid-2003 until October 2007, both surged: The Nasdaq 126%; the Case-Shiller 58%, but off a much larger base, and thus continued to run away from the Nasdaq.

At the end of 2007, both headed south together: the Nasdaq plunged 53%. The Case-Shiller plunged 30% from super-lofty highs.

The Nasdaq bottomed out in March 2009 and began to skyrocket, gaining 440% since then. The Case-Shiller began to skyrocket at the beginning of 2012, gaining over 100%, but from a much higher base.

There are other standouts from the chart:

- This – the Nasdaq being up 46% in 18 years – is in part what you get when you measure a volatile stock market from its bubble-peak: It just doesn’t do that well on that basis, and that’s why it is rarely measured that way.

- The housing market in the SF Bay Area has been totally crazy over the past 18 years: up 170%. Over the same period, inflation as measured by CPI rose 47%.

- The Nasdaq would have to surpass 13,700 to catch up with the Case-Shiller home price index for San Francisco.

- The Case-Shiller index only goes back to the year 2000. Hence the limits of this chart.

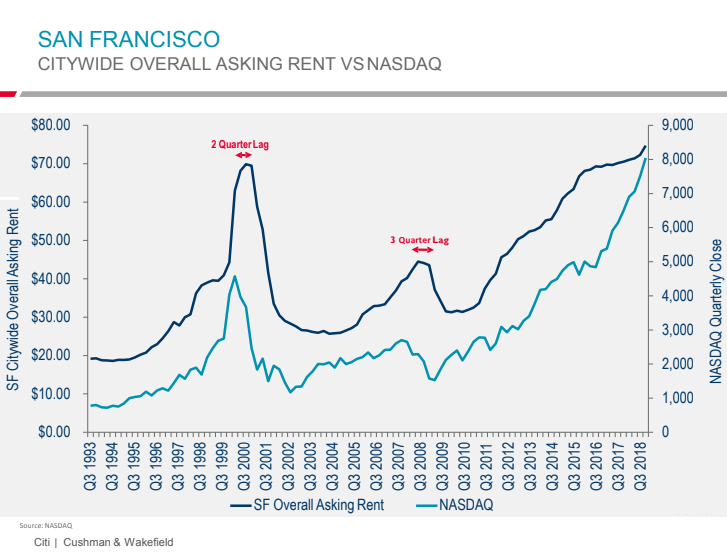

In terms of the Nasdaq and office rents in San Francisco, the picture is a lot clearer. Reza Musavi at the San Francisco office of Cushman & Wakefield provided this chart showing the quarterly close of the Nasdaq and quarterly office asking rents per square foot per year in the City of San Francisco (not including the surrounding counties; click to enlarge):

The chart depicts overall asking rents for the city of San Francisco, from the super-high-dollar rents downtown to the somewhat less breathtakingly high rents in other areas of the city, across all classes of buildings. Turns out, San Francisco office asking-rents move in-near lockstep with the Nasdaq, but lag two or three quarters behind.

Since the chart goes back to 1993, it covers the mega-bubble leading up to 2000, the smaller office-rent bubble leading up to 2007, and the greatest-of-all bubbles currently underway. And real estate pros who’ve been through this know where this is going. Boom and bust, always in San Francisco.

It has finally happened – a line in the sand has been breached. Read… How Will 6% Mortgage Rates Deal with Housing Bubble 2?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Easy come, easy go.

->Easy come, easy go.

I can live with ‘go’ pretty easily.

With all due respect, RE in SF is for people who do not understand economic reality. Something you could actually live in and not be miserable is for the 0.1%. There’s a whole word out there where you could live pretty decently without the stress of having to come up with tens of thousands of dollars all the time so you can live comfortably. Money doesn’t grow on trees, it grows on weeds so you can smoke it.

A million bucks for a shack? Are you crazy? Americans aren’t all millionaires. For reasons I am fully prepared to prove, most people really are not in the 1%.

Can we talk about Manhattan, or maybe Miami. Man oh man, are those people bleeping bleeped up the bleep.

“RE in SF is for people who do not understand economic reality.”

Agreed.

The driver of the above is that a large segment of the tech industry is for people that do not understand economic reality. And….

The driver of that are the US financial wizards that pump and over-promote “anything tech” as the hopeful/potential new savior for our low to non-existent productivity economy. Those too are largely people that do not understand economic reality.

Many of the large tech firms are making billions in revenues and profits, but I wonder if that can last. The business models don’t seem all that sustainable.

For example, many of the companies depend on free access to personal and private information to sell advertising. I don’t think this is sustainable in the long term. This type of access will be off limits in the not too distant future. Also, even if they do get everybody’s data and have the rights to exploit it endlessly, what can really be done with that data in 10 years? Everybody has a finite amount to spend. The advertising growth will soon be over and then the P/E ratios will crash.

Finally, the entire stock market is dependent on a debt expansion complex that will be crashing soon. We have 20 years of austerity ahead of us. I’d hate to be in high P/E stocks at that point.

I’m really hoping degenerate pot heads aren’t the majority.

Use your insight. The herds are to be sedated and distracted while the new order is established; opioids cannot be similarly legalised to facilitate diversions like cell phones, social media, natural disasters, and football. Your insight should further inform you that high RE cost is a technique to reclaim excessive compensation, for similar reasons and not merely out of greed. With simple tweaks in the laws it occurs automatically and everywhere, in proportion to the degree of overcompensation. SF rates only seem high because overcompensation is so high.

(“legalised” with an “s”! no wonder you’re so smart funny and brilliantly earnest heartbroken AND glib; you’re not american! i thoroughly enjoy your posts, Unamused. thank you. i’m finally entering the phase of Sublime Nihilism regarding the Death of Everything. i’ll let you know how it goes. the “sublime” part is the new interesting, albeit necessary, wrinkle. like trying to kick up your heels and giggling til you pee as the astroid comes…)

Ah, that would be degenerate pot heads with substantial inherited assets.

Known locally as “Trustafarians”.

There is a development that I often drive past that has for me come to embody this real estate cycle. The project was started around the end of 2008 and then went dormant, half constructed, for almost a year due to economic problems. When the project was restarted, my brother worked there as a union plumber. He said that due to the project sitting fallow through our (so called) rainy season, there was a bad mold infestation. Apparently plywood was flipped over and extra paint added to hide the mold as the project rushed to market. Additionally, sub-standard sized water pipe was used that led to low water pressure on the upper floors. Poor schlubs rushed fill up the residential units as soon as they were available.

However the retail space on the ground floor is what has most interested me. Many of the retail units sat vacant with for-lease signs for years. In the back of my mind I always thought that when the last retail unit was leased, it would mark the top of this cycle. Well, I’m happy to report that the last unit has finally been occupied in 2018, after sitting vacant for at least six years. You can see for yourself by scrolling through the timeline on Google street view, 1363 Treat Blvd, Walnut Creek, the space on the south-west corner that now has a banner “Hop & Scotch”

I have a feeling that commercial real estate is in a much more precarious position than residential this time around, at least around here.

The retail space on the first floor of Bay Area multi-unit housing is faith-based-real-estate-economics at its “faithiest.” Most of it sits empty. Don’t know enough about the situation elsewhere to comment

There are more empty store fronts here now than in 2012 when we were ostensibly coming out of the crash.

The top 10% have come out of the crash just fine; for the other 90% of us the crashing has slowed but not stopped.

Nah, it’s just another form of “open space”. Central Planners are under this delusion that people won’t drive to big-box retailers, so they mandate this wishful-thinking. Builders treat it as a write-off, just a cost of doing business. If anyone is actually dumb enough to lease it that’s a windfall.

I like the picture of our “new economy”. A kick-boxing place and a Wells-Fargo ATM machine. Nice.

It certainly looks like a market top. My guess is that the business failures start just after Christmas. . .

It looks like there’s a pretty tight correlation between stocks and real estate. If stocks drop hard, I expect real estate prices will drop hard too. At a national level, you can clearly see that RE prices dropped roughly in line with the stock market during the 2007 to 2010 time frame. I don’t see why this correlation wouldn’t hold when the next stock market crash occurs.

You can’t make a judgement based on one event (late 2000s real estate crash) or one metro area (SF Bay).

Currently we are in an “everything bubble” mode where pretty much all asset prices have gone up.

Also, correlation does not necessarily mean causation. Stocks and housing may both go down during an economic downturn but it doesn’t necessarily mean that one causes the other to drop.

Like most assets, both will tend to go down in a downturn. I haven’t looked at the data but I suspect that the uniformity you mention of the downturn event (on a national average basis) between stocks and bonds in the late 2000s was probably an exception rather than the rule from a historical perspective.

Also, since then, the stock market has risen way more than the real estate market (in national average terms). Peak to peak the housing market has yet to reach its previous peak in real terms. The stock market on the other hand has greatly surpassed its late 2000s peak in real terms.

Yes, I understand correlation versus causation. I have a masters in statistics.

The key point here is that he is only taking about the Bay Area where the top 10% of the population who is buying up all the houses also is paid in stock 30-60% of compensation. It’s also where many people see large windfalls when sticks skyrocket which allows them put large down payments. I strongly think there is likely a causal relationship in the area between the two. This is absolutely not the case in other localities.

Anecdotal I know of a few houses and condos that fell through and we’re not purchased when Facebook stock tanked (down 40% from its peak). There stock become worth much less than they thought and they couldn’t put the down payment down.

Agree. During the late 1990s, many people commented that an increase in the NASDAQ was followed about 4-6 months later by an uptick in Santa Clara County housing prices. This was followed about 4-6 months later be an increase in Northern California house prices generally (as people from Silly Valley moved to Placerville). After another 4-6 months, housing prices in Nevada and Oregon would have an uptick.

I watched this happen two or three times. It was quite predictable.

The difference today is that San Francisco and San Mateo are also correlated to the NASDAQ.

True but there is no denying high stock values pump a ton of money into the local market in the form of yearly RSUs. If a stock gets cut in half that is at least 1/4 of someone’s yearly pay in the form of RSUs vanishing over night.

And it may delay big purchases as people hording company stock wait to sell. Company stock sell off probably makes up a large portion of home purchases….

It will be especially correlated in the valley where everyone’s compensation is in stock. In our group of friends 30-50% of comp is stock based.

Since my husband’s compensation is not, we’re holding out for a stock market crash. When others have a 20-40% decline in compensation, we’ll be sitting pretty. I’m waiting for my 50% discount on Peninsula housing.

If all the tech workers sold their RSUs yearly and filled up savings and or reinvested in diversified holdings a few bad years would still have them way ahead. Since their base salary typically matches a normal software job. The extra half of their pay is just icing on the cake.

I suspect though their is a nontrivial number who hold their companies stock. Or even worse don’t have them cash out enough to pay the taxes right away running the risk of coming up short on a tax bill in a crash…

People can be amazingly poor at understanding risk with stock. Even engineers who you would think might take the time to understand basic investing. Some of them probably overestimate their ability to pick stock too…

These people will probably hunker down in a recession. Even though at half value they probably have a lot of money.

Yes, we know quite a few PhD engineers who have held hundreds of thousands of dollars in tesla and apple stock instead of diversifying. Instead of selling now, there still holding because the ‘believe’ in the companies. This will get interesting on the way down.

Some are definitely smart about it. Others not so much.

Brilliant article Wolf. It is refreshing to see this true view of the high tech stock market and real estate in the Valley. There’s so much of a smoke screen on 99% of the stock market articles these days. I finally cashed out of a miserable wretch of a high tech mutual fund from 2000, in Jan 2018, I broke even. I was determined to hold the fund until i at least got my $$$ back. The fund reincorporated in 2002, and you couldn’t find any data on the fund prior to 2002 if you tried. Many companies in the original fund went completely bankrupt.

I live in the Valley, and I am smirking at the prices people are paying for little huts.

Things are way way out of wack right now, We are long overdue for a massive pop of several different bubbles,,,,,,long overdue.

Charts can show correlation, but they can’t prove causality. They are something like the story about the three blind men describing an elephant by feeling the trunk, tail, and sides of the animal. They believed that an elephant was like a hose, a rope, or a wall. A chart might be 100% accurate, but it is just a small part of the entire situation.

Or it might be just a case of

“Post hoc ergo propter hoc”, a logical fallacy.

7% interest rates are the only thing that I can think of, that will bring this

puppy down.But do we really want that.

Yes bring it on

We do.

Do you have the same charts for Detroit RE and Dow Jones Industrials in the 50s and 60’s?

No, but it would be interesting.

I know of a software engineer whose visa expired and family going back to india. Their home is on the market at a very good price. Made me wonder if visa expirations are becoming a stealthy way to do layoffs in tech…

Trump policies has definitely made people on h1b Visa lives very tough

New rules for h1b are coming in few months

Its gonna be interesting

I was in h1 b few years back

This is one thing I’m really in favor of.

I think the rules ought to be that if you hire an H1B you have to pay at least the going rate; no housing them in illegal dorms and paying them $20k a year. And also, you have to also hire an American at the same pay. Said American could sit around and play Angry Birds all day, doesn’t matter, you have to hire them.

I hope the H1B scam is really cracked down on.

I may not personally like Trump but really applaud the policies he is touting.. basically try to bring jobs back ( which is very difficult ), tightening H1Bs as I am very well aware of H1Bs abuse, stopping illegal immigration etc etc

But at the same time… not a fan of his tax cuts to big corps..

The H1-B regulations have required that immigrants be paid the “prevailing wage” since the 1990s.

The problem is massive corruption. The law is simply not being enforced.

In fact, the law is being mocked: Anyone who gets replaced by an H1-B and laid off is not allowed to sue. The courts find that they “do not have standing”.

It is my opinion that corruption in the Federal government is the biggest National Security threat which we fact, and the H1-B program is a symptom.

Guess it’s time to short those siicon-plated goldpans ..

‘Silicon’ plated ..

“Sigh” .. Must be all the potato-chip grease on my ‘touch-screen’ keyboard.

H₂SiCl₂

H6.Si2 works a lot better.

Pick another time interval and it tells a another story. Analysis based on a single interval doesn’t mean anything.

Going back to 1993 is pretty long time interval. It’s a quarter century.

SF Home prices look more akin to the Russell 3000 when looking at the FRED plots 1987 to date. The Nasdaq is much more exciting. When the techies crash and burn someone else will move in. It’s San Francisco.

Seems a bargain to get a good view of used needles and the homeless shitting on the sidewalks with reckless abandon. Add the sanctuary city motto and it really sells itself imo

I don’t always shit, but when I do it is with reckless abandon.

When we see NFLX, TSLA, UBER, WeWork and similar cash burning entities receive their appropriate valuations, I suspect we’ll see the same in the real estate markets – both commercial and residential.

That said, navigating around San Francisco this past weekend was eye-opening to see the number of open houses and houses for sale.

When that happens, it is hard to tell.

The Bay Area is home. I was born here, have lived in five of its cities, spent my whole working career here. It has long amazed me that so many people can make so good a living producing mainly a bunch of crap that nobody needs. This place is always ripe for a bust.

Yet it has been going for decades without an end in sight. Even the dotcom crash didn’t take it down.

The dotcom crash caused extensive layoffs at the company where I worked at the time, and frozen wages. Two companies did rather well, with offices on every street. One was called “For Lease” and the other was called “Available”.

The 2008 recession caused layoffs and a 15% pay cut at the company where I worked then.

I was fortunate enough to survive both reasonably intact, but a lot of us little people were taken down pretty hard.

The only reason we didn’t go into a much more severe recession in post dotcom crash in 2001 was because of the fake real estate bubble based on subprime easy money that started in 2003, and blew another bubble. Without that fake RE bubble starting in 2003, the tech crash in 2001 could have been a depression and Bay Area RE would have taken a much bigger and more sustained price hit.

Also, 2008 would have been a depression had the fed not bailed out the bankrupt banks, kept rates a 0% for 8 yrs, and printed $4 trillion.

Question is, can “they” pull another rabbit out of the hat again after the next crash to prevent a depression? And blow some other fake bubble? Kick the can down the road a little further?

if the FED can avoid 2001 and 2008 being more severe or worse, why can’t they do the same this time as well.

They have increased the interest rates many times in last 2 years and have started QT. it means if the push come to shove, they can decrease the rates and start QE again.

Everything would be merrier then

It delights me that the young (mostly) men [males?] who pay ridiculous prices are supposedly the grunts who weave the data chains that enclose us and our freedoms!

And along with that, those H1-B folks jump into inflated markets while cursing their monopolist exploiters! Living in SF is wonderful. The dregs from the Beat era are nearly all gone. The hippies? Either bureaucrats or truth tellers and spoilers of their children (not very plural). Disco queens, male and female? A-gays own the Castro, collecting 5000/mo rents while cursing the system. Yuppies? If not bust, they are aging not too gracefully in the surrounding bathtub ring suburbs of SF. Quants, coders, programmers, ambitious foreigners and a host of bright but unattractive financial parasites landed later and are munching their way through the remains of the City.

Very entertaining. Expensive? Yes! the ten dollar hamburger is more or less the low end. Cantonese stir fry used to be a few bucks. Nothing under $10. Mom and pop stores? Whazzat? Try 20k/month commercial rents. ‘Gourmet’ quesadillas, gourmet beans and rice, gourmet hand sorted (by whom?) salads?

Come out and visit. Look me up. I am usually at the golf course or watching the sun rise or set from the great Pacific.