Fed or no Fed, people suddenly notice fundamentals again, a scary thing at this altitude.

By Wolf Richter for WOLF STREET.

The stock market hype and hoopla since December 2023 was focused on the Fed cutting rates, the Fed was going to cut six times, seven times in 2024, and then at Fed meeting after Fed meeting, these cuts didn’t happen, but it didn’t matter, the Fed is going to cut sometime, and to the moon, and these predictions and hopes of rate cuts continued to fuel the huge generational rally in the stock market, ever higher, to ever crazier valuations.

And then suddenly, on July 10, as if someone had flipped a switch it all turned around, and now the screaming about Fed cuts is louder than before, now it’s emergency cuts, it’s 50-basis point cuts, it’s everything the market couldn’t even dream about earlier this year, and so stocks should be spiking because of all these huge rate cuts raining down from heaven, but stock prices have tanked.

And recession fears aren’t new. The recession has been forecast to hit in the second half of 2022 after the yield curve inverted, and then in 2023, and then in 2024, and the yield curve has been inverted for two years and is still inverted, and there’s still no recession.

But something did happen. We got some so-so to lousy quarterly earnings reports from the big players, including from Tesla, Microsoft, and Amazon (oh dearie, it plunged 8.8% today upon its earnings release).

And Intel made a huge mess with falling revenues, narrowing margins, a big-fat loss, pausing its dividends, and a dreary outlook, with the cherry on top being the announcement of big global layoffs. Investors puked. Its shares plunged 26% today, worst day since 1974, to $21.48, lowest level since 2013.

Intel lost its way two decades ago when it became a powerhouse of financial engineering, ultimately wasting and incinerating $94 billion on share buybacks as its main strategy, while its competitors ran all over it. In 2021, the CEO was pushed out and Pat Gelsinger, an actual engineer, returned as CEO, and came up with a turnaround plan, etc. etc., and the stock surged on a wing and a prayer, but reality is tough, and it has set back in. And not just at Intel.

So Fed or no Fed, stocks had soared to ridiculous highs, and now someone started paying attention to the fundamentals suddenly? That’s the problem with fundamentals. They ruin the high-altitude party once people pay attention to them.

So let’s start with our drama queens, the Mag 7.

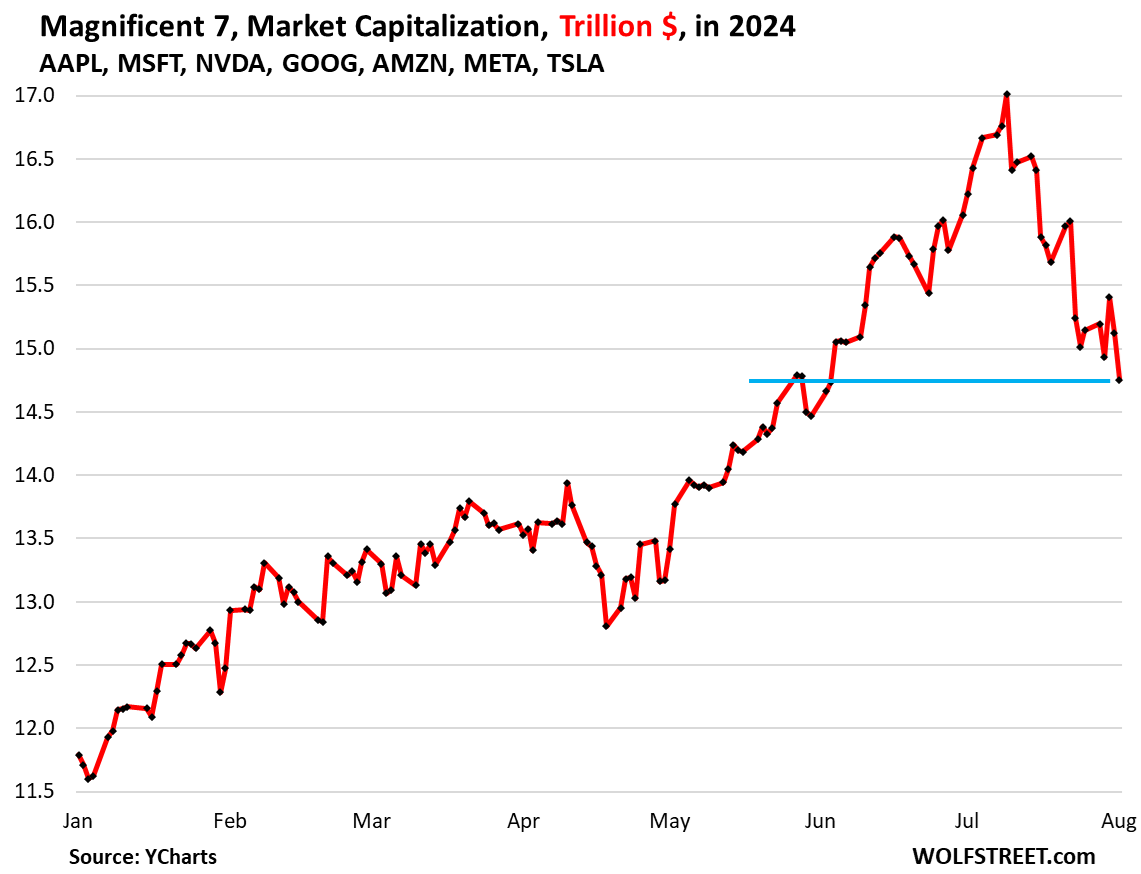

On Friday, shares of the Magnificent 7 combined – Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla – dropped another 2.4%, or by $369 billion in market capitalization.

Since the peak on July 10, they have given up 13.3%, or $2.26 trillion, in market cap, which has now fallen to a still ridiculously high $14.7 trillion, where they’d first been on May 28.

We’re still having trouble here in our little corner wrapping our brains around the concept that seven companies could be worth $14.7 trillion. Sure, it has come down from $17 trillion, but when we think about it, it gives us the willies for all kinds of reasons.

The seven stocks have taken 17 trading days to come down to here. But on the way up to the July 10 peak, the same distance took them 29 trading days. Escalator up, elevator down (data via YCharts).

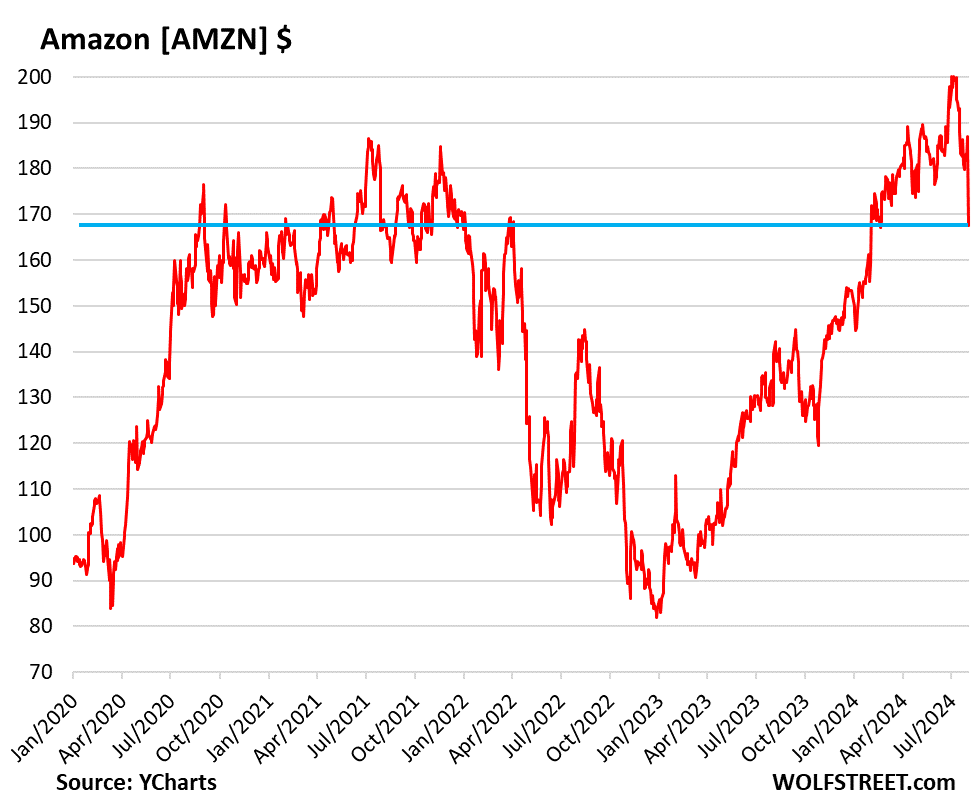

The Mag 7 du jour was Amazon, whose shares tanked 8.8% today, to $167.74, after it reported earnings yesterday evening; revenues disappointed, the outlook disappointed even more; and there were other quibbles.

Since the July 10 peak, shares have dropped 16.5% and are now back where they’d first been in August 2020 (data via YCharts):

The stocks in the Mag 7, from the July 10 peak:

- Tesla [TSLA]: -21.1%

- Nvidia [NVDA]: -20.4%

- Amazon [AMZN]: -16.1%

- Alphabet [GOOG]: -12.6%

- Microsoft [MSFT]: -12.4%

- Meta [META]: -8.7%

- Apple [AAPL]: -5.6%

Semiconductors got whacked. Intel was the standout today in that bunch with its 26% plunge. But the biggest of them all, Nvidia, dropped “only” 1.8%.

The PHLX Semiconductor Index [SOX] plunged 5.2% today and is down 22.0% from the peak on July 10. The drivers in the drop since July 10 have been the big ones: Nvidia -20.4%, AMD -28%, Intel -43%, etc, etc. It has been rough.

But the gains before July 10 have been gigantic, and so the 22% unwind of the SOX only took it back to February 2024, and the index is still up 10% year-to-date:

![]()

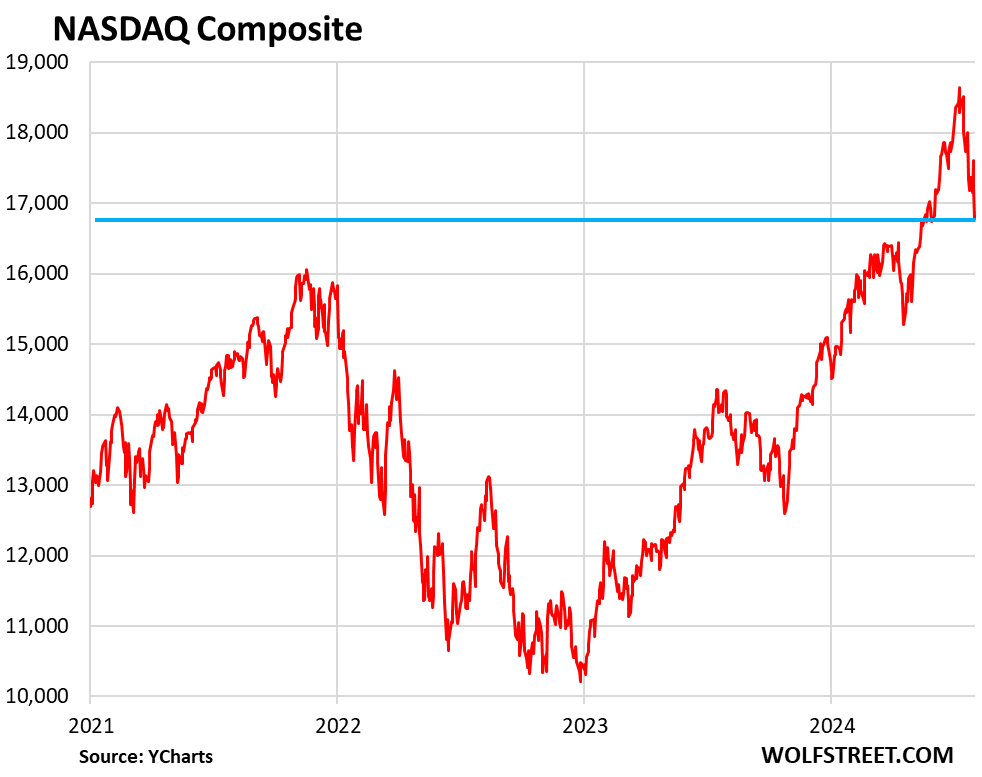

The Nasdaq Composite dropped 3.3% on Friday to 16,776, is down 10% from its peak on July 10, and back where it had first been on May 20, 2024.

After the majestic rise to the moon, the index is still up 11.8% year-to-date, 20.6% for the 12-month period, and 39% since the beginning of 2023.

But it’s closing in on its prior all-time high in November 2021. Another 5% drop will push the index below where it had first been in November 2021.

The S&P 500 Index lacked this kind of drama. It dropped 2.1% on Friday to 5,346, is down only 5.6% from its peak on July 16, and back where it had first been on May 29, 2024.

And it’s still up 12.1% year-to-date, and 19.4% for the 12-month period. In terms of the sell-off, no big deal so far. Twice over the past 24 years, the S&P 500 gave up 50%, so this little dip is nothing.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: 74% of the S&P 500’s components fell Friday, and Amazon’s plunge was among the most dramatic

INTEL is a failing company because it’s executive suite is full of entitled but incompetent.

Nah, the primary issue is this – defective CPUs:

Intel’s crashing CPU nightmare, explained

Intel’s rapidly dying CPUs mark the biggest hardware scandal since the Pentium FDIV bug.

Aug 2, 2024

Intel’s 13th- and 14th-generation Core desktop CPUs have been the subject of controversy for months now, with instability and performance issues resulting in crashes and permanent damage for many users.

The bottom line is that if you have a 13th- or 14th-generation Intel Core CPU with a TDP of 65 watts—that includes all Intel CPUs from 13400K/F and 14400K/F and upwards—then your processor has been operating with this faulty microcode up to now.

Depending on how often and how heavily you push your CPU, the Core processor could have aged so much that it may not even last the warranty period. (Intel grants a 3-year warranty for boxed processors and a 2-year warranty for CPUs without sales packaging.) And Intel has confirmed that if this issue already causes your processor to crash, the updated microcode due in August will not repair the issue — so you’ll need to file a claim to get things fixed.

It’s way more than this one CPU issue. Intel has been executing badly all around the past few years.

They’ve had great difficulties getting their in house foundry on the latest and greatest process nodes and AMD has been churning out more attractive and better performing products. They also still can’t get their GPUs to match not only Nvidia but even AMD.

And yet this terribly executing company who is light years behind other chip players and also TSM on the foundry side has gotten billions in tax payer money over the last few years.

Defective CPUs are a big deal, but this failure is not even priced in yet, ignored by mainstream media…

I think Wolf was onto something with his comments about $94,000,000,000.00 in stock buybacks. Those executives weren’t incompetent, they clearly knew how to game the system to make money (so smart in a fraudulent, thug kind of way). They lacked the vision, skill and thought processing to create long-term solutions to the company’s problems. We should praise them and offer snowflake certificates for their ability to profit while harming a company and its investors.

Let’s hope the party is just getting started. Looking forward to a recession and seeing my TLT move up to about 130’ish. I’d love to buy QS @ $4 or less, SLDP @ $1, SMR @ $4, URA @ $15, PLTR @ $10. That would be SWEET!

And the upside is we get to see what Congress does or hopefully does not do with rent & mortgage relief.

It’s ALL about employment & housing.

I have TLT and BND as well.

Fun fact, you’re not going to see 130 on TLT, ride it to about 105 tops and bail out.

We’re at a point where long term is going to get expensive with $35 trillion in debt and growing.

Um, we’ll easily see $130 with a real recession. The high 4 years ago was $155. I’m not looking to take short-term profits. I’m into TLT until we hit the next real recession, even if it’s 1, 2, 5 years from now.

By expensive do you mean yield wise? If so, don’t worry the Fed’s MO is now to flood the market with liquidity, so there’s tons of money to buy treasuries in the good times. What everyone needs to worry about is when do the bond vigilantes arrive on the scene and stop buying treasuries? That’s when the yields shoot through the roof. The problem is that no one has any idea when that’s going to happen. But, I’m pretty sure it’s not going to be 2025. Next year is when the Fed may be forced to start buying treasuries again, including bonds, pushing the yield down like what happened during the profuse spending of COVID. America / Congress is now addictive to heavy government intervention.

Remember what happened to long bonds the last time they rallied from rate cut hopium? Hope you’ve taken some profit from this recent TLT rally.

As Wolf has pointed out: at some point, rate cut predictions will be correct.

This is crap. So, you got some long term bonds. You have been losing lots of $ by not investing in productive stuff.

And now you wish that your country will hit deep? recession? Just to have your TLT to tick up a bit? How about your kids, family, neighbours sufferings? You are not serious I hope.

do you consider buying nvda or tsla shares at idiotic valuations to be productive stuff? just trying to understand the ground rules here.

@ FG

I have never bought NVIDIA or TESLA whoever did should deal with the consequences, if any. But somehow I would cheer up if cryptos going to hell… :)

I do consider chips to be productive stuff.

My take in that area is mostly years old VGT and SOXX stake. Got them looong time before AI. As 21 century realignment for technology to get more mainstream. I only invest as “never sell” long term, and very broad indexes. But this is my personal situation.

But I do not wish that because of my situation I wish others to suffer. Wishing that the world goes to hell, because lousy TLT stake, is in my opinion a greed greater than bankers’. Should we be better than them?

In the same fashion, I rather bike than driving a big pickup taking away future of my children.

Always remember someones loss is someone else’s gain. In this casino your objective is to enjoy yourself at the expense of the house and hopefully come out on top.

When I was younger, I would eat all the meatballs out of the spaghetti leaving others without.

Now that I’m older and wiser I still eat all the tasty meatballs, but my older relatives know of my evil ways and are on the alert.

You picked a fine time to leave me Lucille…4 hungry children and a crop in the field… “Kenny Rodgers”

3 morsels for your enjoyment.

I just don’t subscribe to the idea to get rich by any means, without considering the health of the society. And then get guns to protect it. I’m not American.

Yes, I have kids, 28 & 24, and I want them to be able to buy a house. Without a recession, they really might be able to and home ownership will continue its shift towards the top 50% and worse towards more investor-owned rentals.

THE ONLY SOLUTION FOR SKY HIGH HOME PRICES IS A RECESSION.

That’s it. We’ve had them before and they’ll happen again, so get off the MMT train and make sure you don’t vote for Congressmen who will vote for rent & mortgage relief.

@GuessWhat,

There are many “safe” ways to bring down or stabilize home prices in a way that positively impacts the economy, none of which will ever be implemented.

Hey, GuessWhat, you CAN’T “get off the MMT train” because it left the station over 50 years ago with the collapse of the Bretton Woods agreement and the Nixon shock. Nothing but floating fiat currencies now, so better get used to it …

I wouldn’t get too bullish on TLT. with the yield curve significantly inverted, long rates will not fall proportionally to short rates as the fed begins loosening policy, if history is any guide…

Plus the fundamental back drop is terrible, no chance to reign in government bond issuance anytime. Fed hamstrung on restarting QE too soon as well. so no tailwind to this trade except recession fears.

This.

Um, when the Fed has to jump in and start buying trillions of treasuries again due to a recession and the over reaction by Congress, then this FAKE demand will, just like in COVID, push yields of ALL treasuries down as they’re dropping the FFR in tandem. Do, I think a moderate recession will force the Fed to drop the FFR all the way down to .25% again? No, but a sub 1.5% FFR is very likely.

Add the uber low FFR and profuse Fed buying of treasuries and yields will drop like a rock. Someone suggesting cashing out at $105 is hilarious. TLT has dropped from $180 at the very beginning of COVID.

2020 wasn’t a REAL recession. GDP only dropped for about six weeks and then it shot up. If this downturn turns into something meaningful, then at least a 12-month recession is a REAL possibility. That’s a lot of Congress approved helicopter money falling out of the sky, most of which will be bought AGAIN by the Fed, pushing yields down & prices UP UP UP!

“sub 1.5% FFR is very likely”

“cashing out [TLT] at $105 is hilarious”

I’ll gladly take the other side of that trade.

Nvidia is still $2.75 Trillion. Top 3 are still $10 Trillion. This is just the beginning of the start.

NVDa went from 60 dollar low to 1400. Most insane ever. Even a 50 percent haircut not enough. But it’s coming

Amazon has a bright future as a business. Wolf has chimed that ecommerce bell over and over. If anything, you can get Amazon at a discount and ride future earnings into a happy retirement.

There will be a time when they have trouble expanding more. But that is prob 15-20 years away. And perhaps they get real strong internationally then.

I say buy and hold that sucker.

Bull market

Good news = great news

Bad news = good news

Bear market

Good news = bad news

Bad news = disaster

How will Powell be historically evaluated?

I was thinking today about the time in 1987 when the stocks dropped 25% in a day’. Thankfully, most of us were too late too get hold of a stock broker too sell, because the magnitude of people with the same panic instinct clogged the telephone lines.

The small fart, emitted by the bloviated market was trivial. The worst is yet too come as the stock market retraces the path that the recent bull has demolished on it’s mindless ascent to absurd valuations on assets that QE enabled.

dang,

I take it you never looked up the gamma squeeze stuff on TSLA, or the failure of Long Term Capital Management in 98.

The reason TSLA and NVDA are down so much is that people stopped chasing call options. If you track the deep in the money, near the money and out of the money strikes against the underlying you see exactly how the gamma squeeze caused the parabolic move up and down.

You might also look up certain stock options trades (deep in the money calls) made by family members of people in Congress– maybe then this will make sense to you.

Those options are the embedded leverage, but they are based primarily on theta, delta and gamma (options mathematical components) rather than than interest rates and margin debt.

Long Term Capital Management was started by 2 Nobel prize winners in economics who developed options pricing models, which worked well until it blew up. Now a lot of those strategies are running wild in the market as a whole, and if this actually goes sideways it may be too big for the Fed to bail out.

You need to keep your eyes open so you can identify who the real charlatans are in this game.

I think I will purchase the short term treasuries as opposed to buying overpriced assets with my hard earned cash.

Your smugness is off putting.

Thanks Tulipmania, very interesting information on usually rather hidden details of what could be called dark trading, driven no doubt by algorithms. Not something for individuals, but unfortunately we are affected by the consequences. However, one glance at the parabolic

share price graphs is enough to ensure that my money mostly stays in 5%+ cash deposits for a while yet.

Im up up about double on otm Nvidia puts that go as far as Jan 2026. Planning on 20-bagger. Will settle for 15.

People who wrote those puts will be waking up with negative balances at their broker.

Geriatric,

> “my money mostly stays in 5%+ cash deposits for a while yet.”

Same here, but pretty recent history says this is a constituency the Fed will throw under the bus to save (1) employment, and (2) more ominously, though perhaps unavoidably given our odd financial plumbing system, those upper-tier financial fat cats being referenced in this thread.

Andy,

Well done!

It helps to show people that you can actually protect yourself from what the financial system has turned into, and use that knowledge to outrun inflation.

Bravo and best of luck on future trades!

TulipMania,

AAPL still offers otm puts that go as far as June-Sept ’25 for under 1% of strike price. That’s when VIX is already at 25+. MSFT and LLY are other good choices imho.

Just need to get transition phase timing right (happened in the last two weeks it seems), and then not sell too soon (the hardest part).

This will be akin to shorting long treasures when they were yielding 0.5% (I never actually tried this one).

TulipMania,

Thank you.

Andy,

Great catch on the AAPL OTM strikes– setup looks really tasty.

Given that Apple is now a hedge fund hotel, the unwind will be fun to watch.

Have you thought about running duration into 2026 to capture second year of presidential cycle? Need to balance liquidity dynamics but with AAPL or QQQ likely enough liquidity to go that far out.

Also, how do you place odds on vol crush once stock buybacks get started next week/following week?

TulipMania,

I try to go for puts where strike is 30-40% down and 12 months out that I can buy for under 1% of the strike. You could get those into Jan ’26 (and I bought some in AAPL, MSFT, and LLY in the last few weeks when VIX was lower).

And variations of above in duration and how deep otm it is (e.g. NVDA I went for 50-70% down in strike).

I compared ussual suspect stocks and etfs for liquidity. For example LLY has very low liquidity in otm contracts and those are thinly traded. SMH had so so liquidity compared to XLK or QQQ.

Another example – SQQQ calls have much better liquidity than TECS calls, or SOXS calls. But I have all three with different durations for diversification (and so that I can roll them over as time passes).

Also, keep in mind they will change rules on you when you least expect it (e.g. suspend levereged short etfs “for public good”). So you have to have puts (probably harder to block such contracts).

As far as buybacks, I suppose they can bail out their stock over shorter term. But overall picture is too large. Nvidia and Eli Lily have cash that is miniscule compared to their market caps. Apple and Msft may last a little longer.

At the end one can’t cover all bases, but we can try.

Andy,

Great write up.

One of the talking heads on CNBC was about how his firm had been selling NVDA and putting a portion of the proceeds into NVDA calls (OTM).

If this is a widespread practice (which it appears to be), it provides a mechanism to dump NVDA stock while still maintaining the stock price and the options premiums are just a transactions tax.

Have you done any workup on when the bulk of the calls expire?

PS Had a bit of a good and then bad experience with SOXS calls– 2022 made a mint and then gave about half of it back to the house later. I think sticking with puts in the stocks themselves is a much better idea.

I agree with you Tulipmania . What’s your best data source for these ? I have had no doubt about the manipulation of the underlying stocks based on what the options are doing as more and more non institute players are 0DTE these indexes. Where is Elliot Spitzer when we need him . He rooted out lots of Rats in the early 2000s on wallstreet but there should have been life sentences for their theft .

TulipMania,

Re: Have you done any workup on when the bulk of the calls expire?

No, I have not. Would not even know how to go about it.

I agree with you that puts are better choice if I had to pick one aproach. I did pretty well during the covid panic (got into puts too early and was bailed out by the unexpected). Did very well with puts in first half of 2022, but sold too early (sold some AMZN puts for $5K each (bought them for $500-$1000). A week or two later they sold for $20K each (that was about top of the panic). Still kicking myself.

Anyway, this is generational opportunity coming up to short this bubble. The opportunity cost is too high to miss it. I will go heavier on the puts if there is good bounce.

“Intel lost its way two decades ago when it became a powerhouse of financial engineering, ultimately wasting and incinerating $94 billion on share buybacks as its main strategy, while its competitors ran all over it.”

This. And please add Boeing to your comment: 121 billion dollars in buybacks, more than enough to have replaced the 737, but Airbus is now killing Boeing because they invested in new airplanes while Boeing fattened the pockets of Wall Street.

The stock market is nothing but a fraud and Ponzi now: selling hype and overpriced shares to the public on rate cut hopes. But who is going to buy our gargantuan debt if rates fall back to 0 again? The Federal Reserve is complicit for financializing the economy with its endless cheerleading of the stock market market. Only a currency crisis will wake this nation up, and looks like Japan has gotten there just ahead of us.

The stock market, IMO, is grossly overvalued but not a Ponzi scheme because our industrial base is rapidly retreating to an authority position, the prison system writ large.

You can add General Electric and Ford Motor to your list: engineering devoted to finance, not products.

“But who is going to buy our gargantuan debt if rates fall back to 0 again?”

That’s exactly why the Fed won’t do that. Their job is to defend the Treasury market and ensure there is demand for USG debt.

If they have to throw the stock market under the bus in order to do that, so be it.

Who was buying the debt when interest rates were zero? That’s genuine question not sarcasm.

Same as now. There was much less debt that needed to be sold back then.

Fools and insurance companies who needed to fund future actuarial liabilities.

There will always be government debt buyers unless everyone in the world piles into gold or corporate debt. Which is the least dirty government shirt?

IBM was the first company that I noticed decades ago that switched it’s business to financial engineering. Bought lots of competitors and destroyed their products. Truly scum.

Ummmm nah.

Pick up some books on the stock market

A random walk down Wall Street is really good

Guessing I should buy the dip :)

Yeah, as they say: what comes down will go up even more.

Someone has to be willing to catch the falling knife.

Many here could take all their marbles, “go home and relax”, knowing they are financially secure for life.

I have no clue how this market works, but I imagine it’s as simple as it is complicated..ever changing.

It must be that it’s fun, challenging, like climbing a dangerous mountain, looking at the corpses below that have fallen .. the thrill to get skillfully to the next summit.

From what I read here, the era of free money is gone.. over. Does this not worry the sane investors?

Guess nobody wants to go home and relax?

Heard similar comment in movie Limitless last night.

We already have France and Poland, and big Swiss account. Perhaps we should just grab a beer and not unvade Russia in winter.

Yes, if someone has a lot of free time, the market provides some extra excitement, besides biking, skiing, kayaking etc.

If market goes up, refreshing the balances, getting some good feel. If down then not checking because at the end it does not really matter.

andy-

Operation Barbarossa was launched in June, not the winter.

Yep for every seller there is a buyer just not me

But Intel!

But Grandma is watching!

lol Reddit

I think we need to look at the role the options complex has had in all of this. Call buying is a cheap way for investors to participate in the upside of these stocks with limited downside.

Problem is that like Gamestop, when the party ends, it turns out that it was a bunch of gamblers betting against each other only putting up 1-5% of the nominal value and when the music stops, the prices just collapse.

The issue for the stock market in general is that it raises the odds that we have a crash that the Fed simply will not be able to cut rates enough to ameliorate without reigniting inflation.

I have seen estimates that to replace the leverage built into the stock market via the options complex it would require around 300 basis points of rate cuts.

Doing that amount of rate cuts would almost guarantee reaccelerating inflation that would be very hard to get rid of (not to mention the destruction of what remains of the Fed’s credibility).

This may create the first time that the Fed put is actually tested, and the Fed may finally get into the position of telling the equity markets that they need to sort through this without intervention.

The options market has gotten so out of hand that even regular brokerages are offering classes on “stock replacement strategies” and “why own the stock when you can rent it”– this is code for why buy these crappy stocks at obscene valuations when you can just buy call options and roll them. And then the whole thing feeds on itself, until it doesn’t.

Stock buybacks are masking the problem, but ultimately it is simply a question of when the whole thing blows up.

Has anyone done any work on this?

Shoeless Black Scholes

“but ultimately it is simply a question of when the whole thing blows up.”

It is also a question of what the Fed is going to do when it does.

It would be sensible to leave the market to sort itself out rather than ride in like the knight in shining armor as the Fed is likely to do. Since Greenspan time market has been offered this lollipop and has never quite learnt to stand on its own feet. It is time it does.

That’s why how many basis points of cuts are necessary to replace the options market sports gaming style leverage is critical knowledge.

If it requires so much that inflation reignites and the bond market panics, equity markets will finally be told they need to fend for themselves.

This shell game has been going on since the crash of 87 and the Fed has just kept feeding it– at some point this will end.

The question is what that threshold is.

Not sure how to calculate. Maybe Wolf has some ideas.

Not so simple. Pension funds will go insolvent

I simply have too relate what my FIN said after I explained too him what the government is likely too do (2008) since the corruption was so blatant, like now. He said, ” they’re not going too do that”.

He is a lot richer than me.

i’m not understanding your comment. what is fin and what did you say the government was going to do?

“Fed may finally get into the position of telling the equity markets that they need to sort through this without intervention.”

Correct. Because at the end of the day, the bond market is more important than the equity market.

The USG and banking system cannot handle 5% rates much longer. What do you think happens when enough banks start collapsing and the FDIC cannot cover deposits? There will be events that will force the Fed to cut and bring back QE or else the government collapses.

Options seem unnecessary to me. Either own a share of the company or don’t own a share of the company. So many layers of gambling are added atop the simple concept of fractional public ownership. The whole stock market seems needlessly complex.

…smoke constantly popped, recon constantly necessary (thank you Wolf and all…).

may we all find a better day.

The first book describing options titled “Confusion de Confusiones” was written in 1688. They traded options since first stock exchange opened in 1611. I’ve read that book actually.

Andy,

You are on fire today!

Any other book recommendations?

TulipMania,

Yes, my favorite, and best of them all – “Reminiscences of a Stock Operator”.

If you’ve read it, I would still recommend re-reading chaper 8 for today’s times.

Another rare gem – Speculation as a Fine Art, by Dickson G Watts. This guy was president of the NY cotton exchange.

The main rules are in the first eight pages.

I’ve you’ve ever prepaid for a product or service in advance to get a better price, you’ve used options.

Michael Green has done some excellent analysis on this. Check him out on YouTube.

Best Wolf Street Headline ever.

Agreed.

Just the right amount of appropriate emphasis on the swoon in stock prices news.

That is a bit of word smithing that evokes emotion

Yes the market rises and falls.

The best returns are from the dead and the inactive.

Why?

Because they do not make stupid decisions. They just ride the tide.

Anti stock market people are not going to gain any money from it. And the average gain from the market is 7.7% every year. That sucks to miss out on that much.

Just bogle it baby. Stick it in the market in low cost index. Then cost average your deposits in each month. And bam, you are doing well.

That was before, I think this market is different, it isn’t even a market anymore, it’s some weird franken market, lowering rates might send the creature into town, killing the villagers.

And T bills are yielding 2/3 of the 7.7 % stock market return with 0/3 of the volatility.

Daffy, the market took 25 years to recover from the ’29 crash. I borrowed this from Gemini (who borrowed it from other sources…)

“The Dow Jones Industrial Average (DJIA) began to recover from the 1929 stock market crash in 1933, but it didn’t return to its peak close of September 3, 1929 until November 23, 1954, which was 25 years later. The crash, which lasted until 1932, caused stocks to lose almost 90% of their value and led to the Great Depression. The DJIA saw its largest percentage increases in the early and mid-1930s, but there was a sharp decline in late 1937”

There are ways to measure the relative “value” of things. A mortgage should not require payments in excess of about 3x someone’s household income. That’s a pretty durable ratio, give or take a bit. The S & P over both the last 50 yrs. and since 1870 has had a median of 15. It is now 27.9. Another measure, the price/sales ratio has historically (only last 24 yrs.) had a median of 1.56 and is now 2.62. Book value (yeah, it’s bad) has a median of 2.83 and is now 4.83 (last 24 yrs.)

Back in ’82, when people were scared sh*tless, the S&P p/e was 8.

The mighty dollar is still in control. The Fed can still stretch all this out a long way. What direction will the mag 7 take, up or down? There is money to be made here. Place your bets.

Sleep easy.

One indicator how upside down I think the current unstable disequilibrium is I would point to the most risky asset. The “risk free” treasury bond.

Buy duration and get your head taken off.

“The market may be bad, but I slept like a baby last night. I woke up every hour and cried.”

Anonymous.

I think I’m going to wet myself, well done

Still a loong loong way to go to bring any of the mag 7 back to fair value. Quite funny to see all the usual market pundits now screaming as if we’re in the middle of great depression and warning Pow Pow to better cut rate 2 to 3 times before the end of the year….oh but when market was rocketing up the moon none questioned if this might be a bubble perhaps?

This played out in 2022 and maybe it will happen again, between BTFD crowds and PPT, who knows, we might see hopium flood back in next week and rocket back to the moon again. I give that a 50/50 chance of happening. Just wish home price correction can happen this fast too and will follow right behind.

Interesting to bring up 2022. The decline then was arrested by the euphoria over AI. What gem will Wall Street dream up this time to keep stocks from returning to sane valuations?

I also agree this is a nothing burger so far.

This. According to the financial media, all roads should always lead to a rate cut. Or several. Impartiality in their Fed policy coverage is non-existent (which is one of the reasons I read Wolf’s content.) The financial media’s persistent bias is actually kind of sickening.

Fair value on the Mag 7 is also non-existent. Prices now are less ridiculous instead of completely ridiculous. But prices have a long way to go to become reasonable valuations.

> “Just wish home price correction can happen this fast too and will follow right behind.”

OK. But on the possible far side of that, nobody I know has a realistic comprehensive game plan or model of personal experience/paths for deflation if it happens (and the Fed’s put finally fails, or does something new and weird and unforeseen). I think the chaos that could ensue will make home prices barely a blip on the edge of the radar screen. Maybe immigration police and detention system converted to homeless camp dispersal domestically? It is not peaceful 1932. How many soft landing tickets do we get before something big actually breaks, and the fire department doesn’t have the pressure to put it out?

They’ve been crying for rate cuts as the market was going parabolic. F**k these people.

The most sensible trade was buying TLT when rates were 4.5 to 5%. We knew the recession would arrive eventually, causing rates to drop. We knew the Fed and Treasury would fight like mad to keep long rates below 5%.

In the long-term, TLT is probably a bad idea. Market forces will likely take over at some point.

Quality preferred are paying 7 pct. There are closed end funds that diversify any investment in this sector which should not exceed 7 pct of any portfolio.

The peak always feels invulnerable, like hitting a home run.

The problem is that the economic foundation of our society has been handed off to fools too manage. IMO

The yield curve will have to un-invert eventually… so the question is, bull or bear steepening? You can probably guess my money’s on the latter.

P.s. TLT is also a bad idea right now because bond funds that do 4-12 week Bills are yielding ~5.2%. The actual 20 year is a full 100bps lower at 4.2% and TLT is 3.9%.

Do you really think the long bond will keep rallying with short yields as high as they are?

P.p.s. if you bought TLT on 2nd January, you’re down 0.6% YTD and underperformed the risk-free rate of return.

I’ll wait until inflation is back to 9% to draw any conclusions. Just saw prices on olive oil doubled in the last 3 months at the local groceries store.

Still ridiculously huge gains YTD, as mentioned. There are still five months left in the year.

The reason that it is likely too keep going up is because it has had huge gains YTD or not ?

In my opinion, the acceleration of the economy is a function of the growth of the money supply. Which was the great insight of that lunatic, Milton Friedman.

WR cranking out 8 articles in the last 3 days, great work when there seems to be a lot going on.

Wolf is my go to for real data. He has been working overtime.

Thank you Wolf!

This could be good time for the commemorative beer mug with “You are here” pointing to the top of the “Nothing goes to heck in a straight line” chart.

…mebbe: “…how did we get in this mug? And WHERE are we going???”.

may we all find a better day.

The tech rally in 2000 ended when Intel warned. Interesting similarity today but some tech companies may still post rising sales and earnings. Cisco’s had am amazing surge in the 1990’s that ended at the same time because sales were going lower and income was boosted by accounting creativity, It took at least 10 years for Cisco to recover. IMO, abandon tech companies whose earnings growth has peaked and let’s hope that are enough left to prevent a collapse in value like occurred after 2000 in the famous Tech Wreck.

Greenspan jacked up reserves for Y2K defense, then drained them until Oct. 2002.

In 2000 Broadcom was 750. It went to single digits. I was day trading it at the time. Aether was 1500. It went to 0. I’m guessing what people lose in Nvidia alone will wipe out a lot of greedy investors(margined options) out and then help crush the housing market because of the liquidity crisis and forced sales. On a side note, as I was driving down Harbor boulevard in Santa Ana where car dealers just line the street for miles, the other day I noticed a few of the largest used car dealers, blocks huge, ones that have been around for 10-20+ years even through the last recession, have packed up and moved out. I shook my head in amazement. I thought I must be lucky only down 70% in business calls(20 yrs in bus) but still around. Looks like I will be dropping prices another 25% soon.

My shorts are making money finally but lost much money shorting the market

Wile E. Coyote finally looked down…

There is a share buyback blackout period. During every earnings report deliveries, companies stop buying back shares.

Currently, around 40% of buy-side constitutes of share buybacks. So ~40% of buy-side is missing. This is why you see pull backs every earning season. Once companies will resume even bigger buybacks, it will turn around.

It’s a Ponzi scheme, you need ever more capital inflows to sustain bull side.

If buybacks stop or are lowered, you will see pull backs. As buybacks increase in size, you will see even more volatile pull backs during buyback blackout periods. That’s how Ponzi’s work. The bigger the Ponzi, the more inflows you need, otherwise Ponzi starts blowing up.

yea but the capital inflows needed for the buybacks must either be earned or borrowed. higher interest rates makes the latter unappealing.

Interesting. Buybacks do increase EPS even when profit/income does not rise. Look at Dillards stock. (DDS) Flat sales growth for 7 years and really no income growth for 9. Yet EPS grew 48% over the past 5 years and the stock is up 500% (from 50 to 360) on zero sales growth. Stock appreciation and EPS growth is all buybacks and nothing else.

The only word that matters:

D E G R O S S I N G

As the DC crowd continues to pump more and more fiat into the system, assets, including the NYSE and real estate, will appreciate in nominal terms.

In real terms (purchasing power) in the long term maybe not so much…..but we are talking short term right now.

Depends on how much fiat……recently lots of fiat from the huge deficits and the yet to unwind fed balance sheet……which in my opinion will never get fully unwound.

so…..expecting the stock market to collapse when a fed is salivating to pump even more cash in is fantasy. If the dollar ever reflects reality that is when the real fun in the markets will commence.

The old ways of valuing the markets are dust……because the deficits and balance sheet are historic. It’s just supply and demand……how many dollars vs how many stocks……….yes it can still decline……but not long term unless a hyper inflation develops or DC stops the press.

And the asset inflation only gets worse as inequality increases, resulting in a pernicious cycle — because the richer you are, the lower a proportion of your spending goes to goods and services and more of it goes towards the purchase of assets.

And on and on it goes until something in society breaks …

You’re right! Let’s start QE 3.0!

i don’t think the fed will be able to get away with the printing it did in 2020 again. not without killing the dollar’s reserve status.

Intel is down because it ran out of guacamole to go with that $8.5 billion in grants and $11 billion in loans from the wonderful CHIPS Act. It takes a long time to build new semiconductor fabs. But stock buybacks are instant fun!

The list of errors Intel made is very long and goes back a long time. Totally missed the move to more energy efficient processors, the mobile device market, and SIMD chips for GPUs and AI. Nobody wants Intel Inside anymore. At least the Harvard Business Review will get a lot fuel for a bunch of “what went wrong “ papers. Funny how the stock market just woke up in a day.

I guess you might still be rich if “you got Intel at 6” if you just ignore the last 26 years.

As my favorite financial analyst Mister T always says “I pity the fool”.

Intel reached an ATH of $65 per share in May 2000.

It hasn’t reached that level since. Now it is $22?

Thank goodness for the dividend. Oops…

I pity the fools. Which is me who believe in Dow and S&P index funds

The Class-Action Lawsuit trade is setting up nicely for Intel. The technical catalyst will be the filling of that massive downside gap, hence, a short-term rally in a long-term downtrend is pending. The trader patiently awaits a short-term bottom, buying stock on the way up and flattening the position on the close (or near close) of the gap. That should qualify the trader for a class-action notice in the mail at some future date. The mother of all CALs cometh.

RE: That’s the problem with fundamentals. They ruin the high-altitude party once people pay attention to them.

I always wondered that if this is the new reality (i.e. fundamentals no longer matter) does this mean that the ‘fundamentals matter’ grad school textbooks and the CFA exam have to be thrown away and replaced with something else? Decades of finance theory abandoned and into the Twilight Zone we go.

In this cultural-financial “star” system, several of the current billionaires’ personalities are warping along with your markets unrealities. Not good signs. It is like “reality” TV collided with the previous reality, producing a caricature, with cartoon physics and so on.

…because now, it’s: ‘this time is ALWAYS different’, or: ‘cheap money will ALWAYS be here’ (aren’t they?)…

may we all find a better day.

Again with the bit about share buybacks “incinerating” cash. Transferring cash from being beneficially owned by investors (via the company balance sheet) to being actually owned by investors outside the company (via distribution) destroys nothing…

Pulling oneself by bootstraps destroys nothig either. Buybacks however destroy the optionality of cash. Wolf has many articles on this (ussualy after a company filed for bankruptcy).

The optionality of cash includes the option to waste cash on unwise investments or empire building. Some investors prefer to keep management on a short leash.

“…destroys nothing”

Except the company.

And thereby the value for ALL shareholders. See Intel, see Conn’s, see Boeing, etc. Shareholders got crushed. Not sure why that’s so hard to understand.

If the company is swimming in cash and has little/no debt — the situation Apple USED to be in — then share buybacks are fine.

A company such as Intel will always find cash if there are profitable investment opportunities. And management of a company with gobs of excess cash will usually find a way to waste it.

that’s true for government, but not all private companies.

if cash you need for reserves or capex is being used for buybacks, that’s very bad.

my feeling is that buybacks are hidden dividends. if you don’t have enough money to have cover for dividends, you shouldn’t be doing buybacks either.

In a few cases ok…….in most cases it’s very simple…….

CEO and his/her cabal issue millions of stock options, warrants or direct shares at pennies on the dollar or free to themselves with a wink and state that it aligns their interests with shareholders……..then they goose the share price by buying back shares……in the old days this used to be called crooked behavior……now its called capitalism…….did someone invent something?, motivate anybody?, work long hours?…….nope……just as crooked as robbing a bank.

and you wonder why the common folks hate the rich……

Steve Jobs was owed every penny he made and more…..and people like hime….these modern day administrators are just crooks.

fred f. – the irony being that the hard products of Jobs and those like him have made the machinations of the modern-day administrators that much easier…best.

may we all find a better day.

A company that announces that it is using cash needed for capex to fund share buybacks will likely see its stock price fall rather than rise as its earnings growth will suffer.

What is your opinion of Buybacks vs Dividends ?

If dividends were not so inefficient tax wise, it seems like dividends would be the most appropriate and honest means of actually giving value to stock certificates.

The idea that I somehow own anything when I buy a share of stock seems odd. I have zero influence over anything at the company. Wall Street tells me that I own a share of the company’s assets and earnings but If I call them to ask that they send me my share of the earnings, I can’t even get past the receptionist.

The market of lies within the Empire of lies.

Paying out part of its cashflow in dividends is what a company is SUPPOSED to do. Dividend payments go directly to shareholders and are income for shareholders.

On the other hand, shareholders don’t even know there are share buybacks, they don’t go to them. Their purpose is to pump up the share price. But if the share price crashes — see Intel — shareholders get wiped out on their shareholdings, and got nothing from those share buybacks. All they have is a crushed stock.

Share buybacks are typically authorized by the board of directors and announced publicly before any purchases take place. The actual trades are usually done pursuant to the safe harbor rule 10b-18 to minimize market manipulation.

But who decides what is “fine”, educated management, activist hedge funds with high minority interests positions, politically interested Board Members ? Buybacks were illegal before Reagen and were considered as “stock manipulation” by the SEC.

There’s a reason open market share buybacks were illegal until the Reagan era — it used to be understood that they were a form of market manipulation. Like so many other aspects of the history of economic thought, that’s down the memory hole except for those of us old enough to remember …

Hello Kramartini, Hope that my comment will not appear rude as I mean no insult. What’s taking place at the C-level of U.S. corporations with the full knowledge and consent of complicit B.o.D, is nothing short of criminal. In fact prior to 1982 (i believe), stock buybacks were outlawed. Financial engineering at its worst. Failing to invest corporate profits in product development and improvement will always result in tarnishing of a brand, and for obvious reasons. Your position that these reckless actions destroy nothing is probably correct from a short-term view, but long-term I concur with Wolf completely, ultimate destruction of all things that put the company’s products in demand in the first place.

Regards,

—Geezer

Actually, the concept of financial engineering is older than that. For example, in the “good old days” before share buybacks became popular, companies would invest excess cash in unrelated businesses to create conglomerates with an allegedly lower beta. This did not end well.

Current asset prices look like a ponzi scheme to me. The prices are absolutely diverged from the values and tied to “stories”: housing boom, EV boom, rate cut boom, AI boom. People make a story, others and themselves believe it and inflate asset prices. Other people buy these inflated assets; the initial story happens to be false and another story is made, prices inflate even more. And the cycle goes on. When the cycle breaks, everybody waits the fed and treasury come to the rescue, devalue the dollar and resume this infinite ponzi scheme.

yep. Ponzies work because a human nature, greed, fuels them thtough irrational thinking. It’s a cycle. But then comes fear and panic sets in. Greed and fear. We now enter the fear and panic side. But with so much unprecedented risk and leveraged over investment, I refuse to even imagine what’s probably coming.

Imagine greedy short sellers making billions.

The sophisticated and informed will take advantage of the uninformed and naive, This is an economic equilibrium in free markets.

Phishing for Phools by George Akerlof and Robert Shiller. A great book in my opinion.

If you think about it, the mag 7 really has run on a single theme for the last year+, and that’s AI. And that, I submit is mostly hype that will produce little of value for at least the next few years.

This. AI as currently hyped is mostly BS.

I think the chances of a Fed cut in Sept are certain and of more than one cut in 24 near certain.

To all of us trying to imagine ourselves in Powell’s job, one huge difference between inflation and deflation is their speed. Inflation is insidious but in the early and middle stages, operates at a regular relatively slow pace. The human tendency to adjust, ‘homeostasis’ enables us to accept that prices rise. It’s only when inflation feeds on itself and runs away that we at first notice it. Our experience of this in the last 2 years, deemed catastrophic, is actually a relatively mild case. In Argentina the PA in a supermarket announced that sticker prices were now up by 50 %.

The speed of deflation can be compared to the speed with which an overinflated balloon bursts. After Black Monday and Black Tuesday in October, Twenty Nine, optimism didn’t slowly evaporate, it turned like a car that had been moving forward, thrown violently into reverse. Which broke the drive shaft. If anyone was in any doubt as to the greater of the two great forces: greed or fear, those in the market knew right away.

Some not in the market welcomed the Great Crash. One anecdote from the next year, early 31: “My dad had a hardware store. When the market crashed he was glad ‘the parasites finally got it in the neck’. Six months later we lost the store.”

A lot of people think Powell has been far too timorous raising interest rates. Maybe, or he’s taking the approach when correcting a precarious imbalance: ‘easy does it’.

And the comparisons with Paul Volcker? Volcker didn’t just have an inflation problem, he had the central banker’s nightmare: a currency crisis. The only treatment is a drastic increase in rates: See Turkey, Russia, etc. that have done multiple percent increases overnight.

There is nothing like a sure thing in this world. If inflation surprises to the upside, especially in a biggish way, from now to Sep meeting, then the Fed is in a pickle for sure

“There is nothing like a sure thing in this world.”

Yes, you can be sure of that.

The chances of any rate cut in September are right near zero, and what is likely far more appropriate is a rate increase by November.

You said gold was going to 0 and it’s near all time highs, your crystal ball is more like a bowling ball that keeps going into the gutter.

Whole lot of wishcasting. That said, I’ve been selling the last of my precious metal etfs and some physical as I expect a liquidity crunch will hit them too and hopefully annihilate crypto, making it a footnote in history.

If WR will hold the money, how does $1000 sound to you? Or 100?

Or, instead of money and with no need for WR, how about the loser simply posts here: ‘how could I have been so stupid?’

JPM’s top guy thinks .50 in Sept. Others want emergency cut this month.

Wall Street has been dead wrong about rate cuts every day since mid-December 2023. Dead wrong, ever single day. So why should it be right, suddenly?

We’ve had these discussions here since December.

There will be a rate cut some day, for sure. And then these people will finally be right. But there’s a lot more data to come out before September. The Fed backed away from rate cuts earlier this year because of the data, blowing those Wall Street rate cut expectations to pieces. It depends on the data. The next jobs report may well be a big bounce, and then what? Two more CPI reports, one more PCE price index. The data may all point toward a rate cut, and then the Fed will cut in Sept. But if the data points the other way, there will likely be more wait-and-see.

Geo -political considerations

Japan is a VERY important US ally, located near the Taiwan Straits tension point. In addition, the US is committed by treaty to defend Philippines which is having physical contact with Chinese vessels every week.

The Japanese Navy is larger than the Brit and French Navies combined, and is very competent. The US could any day need all the help it can get in this region,

As we all know, the Japanese have been struggling with deflation for over a decade. On Friday the Japanese market had its second worst day in its history, down over 5 %. This is very deflationary.

The Fed is of course in contact with the BoJ. It would be surprising if the latter did not express a desire for easing.

There will always be a rate cut, but not to zero or negative.

Many people are waiting for such a reduction, which will not happen in the next decade

I take that bet and give you two to one odds too.

Well since we all know WR is not taking part in any money holding, you and I can join in my other offer. I will say on WS ‘I was stupid’ when there is no rate cut in Sept. You?

Just thought of something: just heard last nite at poker game there is a US betting site that makes book on ‘everything’

It’s called ‘metro’ something. Wonder if they take bets on this. One thing for sure: if you want to offer 2 to 1, you will have NO problem finding local action.

If you want to bet on rate cuts, just buy some short term notes (1-2 year) or corporate bonds of similar duration.

No need to call ourselves stupid, but if they do cut in September, I’ll admit I was wrong. I still don’t think they’ll cut tho.

For fun and entertainment only of course.

US crude oil down 3 % to 73$. That’s not Mag 7 hype evaporating, that’s a fundamental.

Do you remember the “3 steps and a stumble” rule for market direction from the 70s and 80s? Well, that rule doesn’t apply anymore as the market’s been going up with rate increases the past few years. Now the opposite may happen once the Fed starts cutting rates as reality sinks in that the Economy is in trouble and valuations of stocks are defying gravity.

Hussman regularly comments in his market reviews that when Fed cuts is when stocks really tank. Many examples of that.

Btw, he wrote “Ring my bell” atricle in June.

The Federal Reserve is not going to start cutting their rates at all.

The economy is crashing. The Fed will cut, but like always, it will cut too late, and the rate cuts will be meaningless. Housing is crashing. Unemployment is increasing. Banks are in trouble. Retailers are in trouble. The consumer is getting monkey hammered. If things go sideways in the Middle East, Iran will shut down the Strait of Hormuz and oil will skyrocket. The Biden Administration has done everything wrong it possibly could, and now the reckoning is coming.

How is the economy in any way crashing when GDP and the stock markets are at or near record highs? Please do tell.

Jdogg, U3 just over 4%, GDP 2.8% last quarter, wage growth has exceeded inflation for more than a year, stocks and RE at or within close reach of bubble ATHs. Fox News talking points and wishful thinking don’t make your political fantasies true. Facts and reality are still relevant, even to those who choose to ignore them.

“Economists look for sunrise at 6:40am tomorrow”.

Markets lose 8% on economist’s outlook.

“Sunrise occurred at 6:30am this morning”

Markets rebound well into positive territory.

“Fed hints of sunset at 8:50pm”

Markets hit all time highs on Fed news.

“Sunsets at 8:52pm”

Investors flee to safety.

Investing indeed.

Speaking of finacial engineering.. I’ve seen some reports on interwebs (youtube) alluding that Nvidia invests in AI startups to have said startups buy its (Nvidia’s) chips. Probably just a conspiracy theory. Need to wait six months.

Tether, the shady stable coin that props up bitcoin has apparently funded a company that bought a lot of nvidias chips. Shades of 2000 with Cisco.

If you want to go down a rabbit hole of wtf, read about tether and the people behind it.

Various accounting rules prevent that depending on ownership %. I believe they start at investments the company owns 30% more in.

I mean rules against recognizing revenue/gp from those sales. You can def sell to them, but it won’t show up in your results. The rules vary by % ownership but this sounds like conspiracy theories to me.

The bubble narrative has been beat up a little in the last few months, primarily questioning if ai investments will create actual revenue, for anyone.

The higher for longer resilience theme is also getting parallel pushback with softer growth data.

That general backdrop is slowing down euphoria for buying everything from burgers to Mag 5 stocks — but, with these larger market moves downward, and war drums beating louder — there’s a much greater awareness about risk.

That hesitancy is like people looking to buy a house — a year or two ago, inspections were being disregarded as unnecessary during insane bidding wars — now, people are looking under microscopes to analyze risk.

The Wolf theme of elevator down may not be the right system to describe free-fall — I’m thinking of an elevator brake malfunction — but as usual, there are emergency backup systems that have been designed for accidents — and hopefully these systems were designed with a model that had everyone in the same building all getting in the same elevator at once?

On that happy note, a google search from end of June:

“ Hedge funds have “aggressively” net sold stocks in the technology, media and telecom sectors in the past month, with the amount of monthly net selling on track to be the largest on record going back in data since 2017, a team of Goldman analysts led by Vincent Lin, co-head of prime insights and analytics of global securities lending, said in a note earlier this week.”

There goes all that stock compensation the Intel employees thought they had. If this broadens to other tech outfits, it could have a big impact on demand. Tech employees have driven spending for housing and cars on the West Coast.

Given the ubiquity of stock compensation, wages are intertwined with stock prices. This is why many people think Powell has been protecting stock markets. When stock prices drop, there is rapid deflation in “wages” as broadly defined. The Fed obviously wants to avoid that.

A 30-50% drop in the stock price of the Mag 7 would level the West Coast economy, more so than other regions.

I would say 30 to 50% drop would be conservative this time.

I knew a few people in 2000 who worked at Lucent( formerly Bell Labs) and were nearing retirement. Their stock had soared to 100+ per share. They held stock and options which emboldened them to buy their dream retirement house, boats, RVs.

By 2002, when Lucent plummeted to $3 per share, there were good deals on used boats and RVs to be had.

IMHO, AI, like the Internet will survive and grow but not at these valuations.

Apple shares went through something like this over two decades ago. But Apple then repriced the stock options to maintain the morale of its workforce. This is the example I remember, but there were others.

The C-Suite being part of the “workforce” I’m guessing? Always look to a crisis as an opportunity (for grift).

I worked at Apple at that time. I was about the lowest of the low level employee you could be. Twice, instead of bonuses we got options.

The last time I checked, if I would/could have held after selling to cover ( I needed the cash) the shares would have been worth ~$3MM. I don’t check anymore. Anyway, more than just the C-levels could have made out pretty well.

Tech employees have driven spending, globally…being smart pays…

It is hard for me to be too down on Wall Street… I too have spent much of my life thinking that the next recession is just around the corner. Precious little evidence… just Irish Dread embedded in my bones I suppose.

there is plenty of evidence you just need to know where to look.

Ever true in every circumstance.

“And Intel made a huge mess with falling revenues, narrowing margins, a big-fat loss, pausing its dividends…”

Here’s an excerpt from:

Earnings Call Comments from CEO Pat Gelsinger and CFO Dave Zinsner

“Gross CapEx of $5.7 billion was more than offset by $11.5 billion in grants…”

Geezus.

I live in a local economy dominated by Intel and I’m convinced Intel is, and has been, dying a slow death ever since Craig Barret became the CEO. I prophesize that this first announcement of a 15% headcount reduction is just that: the first. Further reductions will be forthcoming with a final tally in the 40-50% range.

As a mortgage-free homeowner since 2008 (but not property tax-free,) I’m wondering if it is time to rid myself of this anchor around my neck and get the hell of out Dodge while I still can.

Wolf – would you be willing to post articles showing very long term valuation metrics for the market as support for the high valuation assertions? Price/earnings, price/sales, EV/EBITDA, etc? Would be helpful.

Wolf is the best for timely/current data.

If you want historical reference spanning let’s say 1929, check out any one of John Hussman comments. He will have more data than you can process in a day. Hussman repeats himself a lot, so one monthly comment is sufficient.

“If overvaluation was enough to drive the market lower, it would be impossible to reach valuations like 1929, 2000, 2022, and today. The only way the market can get to levels like today is by blowing through lesser valuation extremes without consequence.”

“The present level exceeds both the 1929 and 2000 extremes, and is higher than every point in history except 5 weeks surrounding the January 2022 market peak.”

Market update. Good news.

I have just been Mtn biking. Going uphill, and I my narrow overgrown track, there is a BEAR holding his position. I refused to be stopped. I produced BULL posture with deep roaring. He gave up. And here you go.

I totally kicked ass yesterday, and I owe extra special thanks to ma’ boy Jerry at the shelter for his insight and wisdom in recommending I get out of short term treasuries and throw everything I have into something truly liquid. He helped me buy as much AB InBev stock as I could with what I’ve got.

I should have gotten a clue on my own sooner since I’ve become more dedicated to buying Bud Light in the last year or so since it’s always on sale. If it’s good enough for me to buy their products, I really should have realized that it’s a no brainer to buy their stock.

I’m going no brainer more often in the future, it really seems to pay in this market. Love ya’ Jerry. I’ma have you a tall boy on the ready when I see you on Tuesday, one for you, one for me, over Tuesday soup night! Killin’ it out there.

I took that fifty bucks grandma gave me and used it for a come-up. It pays to be a bull when the bears are out. Biker dude, you and me! I bet you had your ball-peen hammer in your back pocket if that bear really tried to mess with you so I know you had it handled no matter how it was going to go. That’s why you don’t mess with the patches and don’t cross the one percent. Back in the day I used to get spun the hardest off your guys’ stuff. Glad to know there are some real ones still out there.

😆

Bears are stupid. He did not know that bulls are not doing deep roaring when attacking.

As a related offshoot of the recent equity decline, the famous 10-2 yield speed inversion is damn well back to zero, from back in julyish 2022 — it’s at -0.08 and rapidly rising. That roundtrip of un-inverting strongly suggests the recession dynamics are gaining momentum.

Sadly, money market rates will trend a bit lower, but safety is crucial during the pending degrossing ahead, which probably takes a lot of assets lower.

Buffet is already dumping Apple and a lot of these must own stocks will eventually become things to buy — if you have cash.

Viva UVXY, up 35.8% on Friday!

Why is it apparently so difficult for so many folks to comprehend the concept of value?

LOL, Value? There is no value in any asset at this time.

Value is always subjective. There is intrinsic value, and there is perceived value. They are very very different.

Intrinsic value is a practical measure, in which the cost of something is in balance with the average persons ability to pay for that with a common wage. For instance the cost of a meal being equal to an hours labor.

Perceived value is a speculative measure based on artificial circumstances such as financing and economic inflation.

When any asset value is based on financing, its value can fluctuate wildly based on economic conditions. When people base value on inflation, they are betting that it will continue, and that deflation will not happen.

There is nothing ‘subjective’ at all about PE (Price/Earnings) multiples which are in the stratosphere these days with many in the hundreds at a time when they should be reasonably in the 5 to 15 range which means priced on value for the next 5 to 15 years. There is nothing at all to ‘perceive’ about that straightforward objective concept in the slightest.

Investing, is buying shares in a company at a price that reflects its value based on P/E in the range you quoted.

Gambling is betting on massive growth that has not yet occurred and that you are speculating will happen in the future.

You can make money doing both, one is probable, while the other is possible.

P/E is only meaningful for shareholders if the company pays a dividend. If there’s no dividend then there’s no objective measurable return on investment, just subjective hope for a capital gain based on market hype.

This is a great time to be a bear.

+1

My US equity exposure is held entirely on behalf of my children and grandchildren (yet unborn) either inside tax advantageous life insurance products or registered tax shelter accounts (in Canada this is known as a TFSA — tax free savings account). As such I am NOT a trader; I only ever buy and never sell. The buying is regular and programmatic and the selling will be my estate’s problem, not mine. So to the extent that I watch US markets it’s mostly for the entertainment value.

As for my Canadian equities, they’re all boring oligopolists — the “Big Five” Canadian banks, the three dominant Telcos and a giant energy utility. Boring as fuck, but the dividends are the most tax friendly form of income available outside of a TFSA and I sleep at night on a fat cushion of high interest savings so that I never have to sell the equities …

Bit in Globe biz section in last year or so: What’s best performing div sector in Canada? Most say banks. Not even close. The 2 RRs with div back in have returned 17 % pa last 5 years.

Boring. Worse than oligopoly, just 2 of them. And what a moat!

You can buy locos, cars, steel rails, but you are never getting a RR right of way thru a Canadian city. The cities would love to get rid of the ones that exist now and truck stuff to rail outside the city. Also never happening. The RR rights of way are ‘great grandfathered’, pre- existing the cities, which are only there because of the RR.

Funny story: when the first RR began building across Canada, an orgy of land speculation also began. Once the thing was begun and onto flat level ground it was obvious where it was going, so buying looked like a sure bet. So thought the farmer who had picked up an acreage dirt cheap and was now dickering for hours with the senior CP buyer, might even have been Van Horne. The bid went up and up because the RR had to have it! Until the buyer said ‘F it!’ and walked out. The RR swerved around the property and today everyone in Canada has heard of Brampton, Ontario, and no one has heard of the village a mile or so away.

Warren Buffet has dumped huge volumes of BOA and Apple stock.

It’s time to short the whole market again.

OR he just read some investments primers saying that having >50% holdings is not advised. He sold Apple months ago when Apple was quite lower.

Missed AI gains, yet still sticks to KO and such with grand company future (I consider virtually all KO products as “not good for you” aka poison).

I just don’t know, just not my style.

first, buffett had enough apple that he couldn’t dump it all at once. second, he sold at prices between 170 and 211, which were the ranges in the second quarter.

did you really expect that he’d sell every share at the absolute peak?

The highly unprofitable process of shorting will be even more interesting in the next several months.

The last few days and weeks have been fairly dramatic and volatility is underway — but Buffett is very representative of what lies ahead with degrossing — he’s actually a bellwether barometer for lot of portfolios that are reducing risk exposure. That process generally can include dumping long and short positions simultaneously — which adds volatility. The shorts and longs are in for serious whipsawing ahead imho — lots of dramatic twisting impacts ahead, like flipping over a rocky cliff.

There’s a lot of stars aligning:

“ Berkshire’s returns from short-term Treasuries should decline once rate cuts begin.

Shanahan said that and revenue headwinds “may make it tough for Berkshire to deliver earnings growth in 2025.”

That — is the future — weaker earnings and less income. The disconnect between earnings and price is an all around lower yield for everything, everywhere.

Dragging Buffett into degrossing is BS. “Degrossing” occurs when short positions go awry in a big way that force the hedge fund to sell their other long-stocks to maintain their risk profile (or they could cover the short, but for some reason don’t want to or can’t).

Buffett doesn’t short stocks at all. He doesn’t have short positions in stocks. He is just selling stocks and buying T-bills to take risk off the table and lock in the gains. Nothing to do with “degrossing.”

I’d like to know what he thinks about gold.

He hates gold, and crypto. Often communicated about it.

Doing fine so far up 13% 2023 now closing on 2500 and riding out this week’s storm like a duck.

Whatever he thinks about gold he for sure won’t file it with crypto which he thinks is a scam, hoax. ponzi.

@ Nick

Yes, I did a shortcut. He does not like gold because it is not productive. And hates crypto for additional reason that it is a scam.

Buffet has been around a long time and for most of that time gold just sat there. So he rightly avoided it. But also for most of that time the US wasn’t adding a trillion in gov debt every 3 months. Gold has only come to life as an investment in the last year or 2. Buffet seeks safety in US$. The gold enthusiast right or wrong doubts the safety of the US$.

Before a lot of folks start on about best military etc. etc. I personally think for decades US$ is safe.

But gold is also money.

I like gold and when it gets to around $20 per pound then I’d consider buying a pound or two to line my koi pond.

Are you saying that there will be a day when a good steak is worth is weight in gold? (“$20 per pound”)

Let them eat gold?

You can already buy gold to eat at http://www.EdibleGold.com and at $20 per pound gold would be a sound value buy.

“This time is different”. This has been used both by bulls and bears.

I assume that it is not (why should be?); and corrections expected. Talking about long term. Still having few years cash-like buffer makes sense to me.

Hey people!!!!!

Good mood and good luck to everyone!!!!!

Wolf,

Off topic but looking for an answer about the NY.Fed. With all the money in the system does this enable them to still knock down interest rates like we have seen in the last few days?

That’s not the NY Fed’s doing, they’re still unwinding the Treasury and MBS holdings in their SOMA portfolio. What you saw is rate-cut mania in action — for the third time since 2023. The other two times got unwound without rate cuts.

Thanks wolf,

Been reading Lords Easy Money, by Christopher Leonard. A very revealing book about the Federal Reserve.

If you want to learn about the Federal Reserve and what it is and what it does I would suggest you read the Federal Reserve Act which is 100% clear and a short 36 page read.

I don’t think stocks will ever go back to trading based on “fundamentals”, unless money printing is removed from the tool box and recessions are allowed to happen.

To avoid economic depressions and other forms of system threatening crisis, the debt-to-GDP ratio must not continually expand. Bad debts and speculation should lead to write downs periodically.

Everything reverts to the norm sooner or later. Every action has an equal and opposite reaction.

They always have. They always do. Ignore that at your own peril.

Anyone have data to show how much money was actually tied up in “carry trades” of Japanese Yen?

And more importantly for the USA, how much of that money was used to purchase US Stocks over the past year?

I’m guessing no one really knows, but I’m definitely interested if there’s a way to at least estimate the total.