Rate hikes seem to be more effective in Canada than in the US in slowing the economy and bringing down inflation.

By Wolf Richter for WOLF STREET.

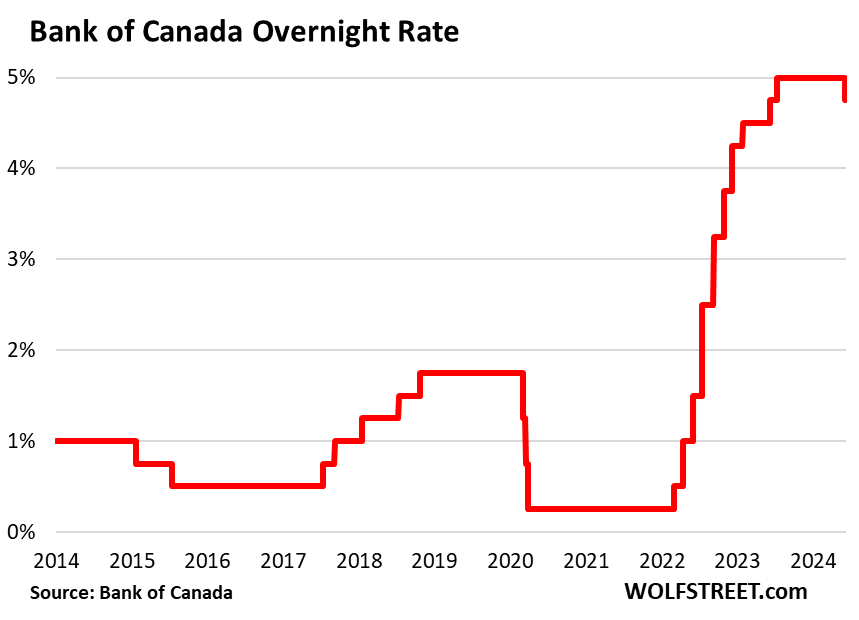

“With continued evidence that underlying inflation is easing,” the Bank of Canada said today that “monetary policy no longer needs to be as restrictive,” and it cut policy interest rates by 25 basis points, as widely expected.

But QT will continue, the statement said. The BOC has already shed 64% of the securities it had added during the pandemic.

It cut the target for its overnight rate to 4.75%; the Bank Rate to 5.0%, and the deposit rate to 4.75%.

“Recent data has increased our confidence that inflation will continue to move towards the 2% target,” it said in the statement today.

Employment “has been growing at a slower pace than the working-age population,” the statement said in a reference to the huge wave of immigrants that has flooded the labor market. “Wage pressures remain but look to be moderating gradually,” it said.

Due to the huge wave of immigrants, per-capita GDP declined in six quarters over the past seven quarters (the exception was a tiny uptick in Q1 2023), as economic growth stalled in the second half last year, and was too slow in the remaining quarters to keep up with population growth.

“However, shelter price inflation remains high,” the statement said. So there’s that. If it weren’t for rents. Rents spiked because that huge wave of immigrants needs rental housing, and no one was prepared for it.

“Risks to the inflation outlook remain,” the BOC said. It’s “closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior.”

Two IFs for more cuts: “If inflation continues to ease (#1 IF), and our confidence that inflation is headed sustainably to the 2% target continues to increase (#2 IF), it is reasonable to expect further cuts to our policy interest rate,” BOC governor Tiff Macklem said at the press conference.

He outlined four risks to the lower-inflation outlook:

- “If global tensions escalate”

- “If house prices in Canada rise faster than expected” (house prices are down 14% from the peak in February 2022, but not all markets are the same: from Toronto heading south fast, to Calgary surging to new highs)

- “If wage growth remains high relative to productivity.”

“We don’t want monetary policy to be more restrictive than it needs to be to get inflation back to target. But if we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made. Further progress in bringing down inflation is likely to be uneven and risks remain,” he said.

“We’ve come a long way in the fight against inflation. And our confidence that inflation will continue to move closer to the 2% target has increased over recent months,” he said.

He said that “indicators of underlying inflation increasingly point to a sustained easing” of inflation. He cited these four metrics:

- “CPI inflation has eased from 3.4% in December to 2.7% in April

- “Our preferred measures of core inflation have come down from about 3.5% last December to about 2.75% in April

- “The 3-month rates of core inflation slowed from about 3.5% in December to under 2% in March and April

- “The proportion of CPI components increasing faster than 3% is now close to its historical average, suggesting price increases are no longer unusually broad-based.”

“This all means restrictive monetary policy is working to relieve price pressures,” Macklem added. “And with further and more sustained evidence underlying inflation is easing, monetary policy no longer needs to be as restrictive. In other words, it is appropriate to lower our policy interest rate.”

Why higher rates may be more effective in Canada than in the US.

There has been a lot of discussion about why the rate hikes seem to have been more effective in Canada than in the US in slowing the economy and bringing down inflation.

Part of the reason may be how mortgages are structured in Canada. The dominant mortgage rates in Canada are either variable-rate mortgages whose rates adjust for existing borrowers as rates go up, or fixed-rate mortgages whose rates are fixed for shorter terms such as two years or five years, and borrowers are facing renewals at much higher rates. So it’s existing borrowers that face higher mortgage payments on homes that they’d living in for years, which puts a damper on spending for other stuff, thus slowing demand growth.

In the US, with the typical 30-year fixed rate mortgage, only new borrowers face higher mortgage rates, and existing borrowers with their 3% mortgages are laughing all the way to the bank.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

i think much of the answer is right in your article. the bank of canada shed 64% of the securities it added, the u.s. fed shed 33% or so?

also, the u.s. is running incredible deficits that other developed countries aren’t.

Re deficits

Canadas gross govt deb/gdp is about 113% vs the US at about 140 pct as per OECD debt dara base. In contrast Mexicos is in the mid 50 pct range’ Germany is also low. So no we are not doing so hot up north in Canada despite what Tiff McClem says.

Add in food prices jacked up by Canadas Dairy Marketing Board, Trudeaus rapidly escalTinc carbon prices, clean fuel standard and lets not forget their proposed fertilizer ban for farmers—-all of which will continue to jack up already sky high food taxes. Our overindebted citizens are already tapped out and even our booze has an automatic tac increase built in just to make our booze more expensive than Justins cannabis (not that i indulge ever). Like places in the USA, we also have tent cities for the homeless, often opioid addicts in Vancouver, Calgary Lethbridge (now informally referred to as Methbridge due to federal safe supply laws, Toronto, Montreal etc. Our economy also sucks with low productivity and declining incomes compared to our US neighbors. But we do have socialized medicine where you have 12 or more hours waits to see a doc in the hospital and several years to wait for knee and hip surgeries. So yeah, things are really great up in the Great White North LOL. with surging immigration to add to our inflated housing woes. i could go on—-but you should get my drift on things, not to mention that our federal govt is not paying its two pct of Gdp for our Nato defense agreements.

Loading up a moving van right now, sounds like paradise lol!

Probably wouldn’t let me in, third worlders only need apply as in the US, UK, and Australia.

Plus it’s cold, like the ass of a bear, a white bear.

I can’t figure why everyone wants to cut. What’s wrong with a nice number like 5. Now they’re playing with fire again, for what?

The white bear is not pleased.

Sorry my CA neighbor. You govt is screwing/has crewed you guys a lot and believe me, things won’t get better for you all.

Yes, I know.

Inflation in Canada fell when the Fed forced the BoC to raise rates, because the Canadian “economy” is mostly based around your house going up and then going out for dinner, plus state deficit spending and unsustainable levels of unfunded immigration.

Exactly the Canadian way. Get a mortgage then top it with a HELOC. Count on your house value going up every year. It’s a built in expectation here. Plus we are way more interest rate sensitive because house prices are ridiculously high.

I agree with this. If the Fed had cut another $2-3 TRILLION inflation would look a lot different. But Powell isn’t going to take that money away from his friends, he’d rather devalue the dollar and make the middle class pay.

Bingo. They easily could have rolled QE back to 2019 levels, it’s almost criminal that they didn’t.

Also the US had sequestered its QE into band deps and reverse repos, which were available to unwind, in other words more qe being let free than the fed was Qting. WHich is why we rallied so.

Seemed like a good reason to inflate the stock bubble some more

What you call a “stock bubble”, they call “the wealth of the people who matter”.

You can bet its priority.

yep nvda up another 5%. nobody can say that this is about ai earnings, this is pure bubble mania. i was around in 1999 and 2000 and heard all the same arguments. times change, but human nature doesn’t.

The corollary is the Fed can keep rates higher for longer without needing to cut, unlike Canada, because monthly housing costs aren’t directly pushed up by higher rates.

“easing” That’s a funny way to say changing our metrics to gaslight the public even more to provide more backing for cutting interest rates.

easing……………

the only thing easing is wage growth which is already massively behind.

Stagflation inbound.

Here comes all the Wall Street crybaby pressure for the fed to cut now too.

Fed Pivoteers about to come out of the woodwork.

Doesn’t Canada always lead the FED? Seems like Canada hiked and then the FED hiked the next month. Pretty sure the FED is going to cut in July

93 percent of the time they follow the Fed not lead the Fed. This was the longshot coming in at about 14 to1 odds. With wage gains still at 5 percent in Canada and house prices poised to rise Canada is looking at a wage price spiral and escalating inflation as well as a devaluing dollar.

The answer is, drumroll, America is goosing the economy by deficit spending an insane 8% of gdp while canada is by 2.5%. One day America will pay the price for its insane fiscal policies! Take away 4% of the deficit spending and America is in a deep recession. The piper will be paid!

Sure, America cut interest rates and US$ will be trash and inflation will come roaring back as commodities spike and treasuries are dumped!

Even if the Federal Reserve stays on hold for a while longer, rate cutting by other major central banks can still cause U.S. markets to go parabolic, as foreign capital floods into the U.S.

Canadians and Europeans are out there buying Apple and NVIDIA just like Wall Street.

ECB to follow tomorrow.

“In the US, with the typical 30-year fixed rate mortgage, only new borrowers face higher mortgage rates, and existing borrowers with their 3% mortgages are laughing all the way to the bank.”

You’d think our Fed would have thought about that before slamming rates down to the zero bound for so long, while simultaneously buying MBS into a white hot housing market. But then, you’d think they would have thought about a lot of things. Maybe thinking isn’t their strong suit?

The people who bought in 2021-2022 and locked in the 3% mortgages paid absolute top dollar for their property. It’s not unlikely that the houses they are living in are worth less than they paid since the next buyer is going to finance at 7%. It could be a long time until they can get out clean after the expenses of selling.

Except for all the people who already owned a house between 1990 and 2020 who refinanced a likely much lower balance at a super low rate.

My parents did it, many in my family did it, a few acquaintances did it. In the past couple years they’ve have major income raises and a decrease in housing costs. Of course most of this “windfall” income has went to depreciating assets and ultimately worthless tchotchke

We sold a 2200 square foot bungalow built in 1977 with a few Reno’s but nothing expensive for $780k in 2021. We bought in 2000 for $139k.

They did think about it. Very little of what transpired was unintended

They probably planned it. Unlike 2008, nobody will foreclose on their 3% mortgaged house even if it is 20% underwater if they have a rate and monthly payment that is cheaper than renting or buying another house that is 20% underwater with a 7% mortgage.

Are they geniuses?

They are only if the housing market doesn’t crash 40% like 2008.

I’m buckled in hoping for a soft landing.

I’m buckled in for a 40% “crash,” which in truth is only a reset to its fundamental value.

That’s not going to happen. There is no way the Fed will be allowed to let the banks assets (and that’s who hold those mortgages) devalue that much. Much easier for them to devalue the dollar, call it a rise in pay while killing buying power, and sucker the average citizen into paying for the Gov’t debt.

KGC

Residential mortgages in the US are mostly held/guaranteed/insured by the government, which packages them into MBS that are about as good as Treasury securities, and banks hold those, but there is no credit risk for banks. There are some nonconforming mortgages that the government doesn’t back. A big part of them are packaged into MBS and sold to investors. Banks still hold the remainder on their books. But the mortgages that banks still hold on their books is small. That is one of the biggest changes coming out of the GFC. There isn’t going to be another crisis with residential mortgages for banks.

Home prices still out of reach of common Joe in Canada and this rate cut.

The middle class is getting crewed and screwed :-)

And the people making good money probably do not want to bet if their home prices will go up or down in the next 5-10 years.

I don’t think they want to bet on that either. The gift horse has already won it’s race.

Soo.. is CAD going to take even more of a beating now?

If they cut further, for sure.

Short term the speculators short the Canadian dollar will lose. In the past the Bank of Canada always pumped up the value of the Canadian dollar right before an unneeded rate cut. This time was an anomaly as it didn’t happen right before the rate cut.

Well. Wolf’s bi annual gift size from me is somewhat dependent on the rate, so bad news all around 😆

Is it hyperbole to assume $20 California cherries and $10 Florida strawberries?

Gravy on fries?! Oh the humanity. Why?!

😆 just kidding around

Don’t forget the cheese curds, eh?

the truth is…central bank rates don’t control the economy…though they make it seem as if they do.

it’s actually the exact opposite:

it’s the economy that controls interest rates.

I remember when 2% was the ‘inflation limit’, now it’s the ‘inflation target’. Soon it will be the lower bound I guess.

Already is. Look at the last 40 years.

Well…. I think possibly best case scenario, Tiff sticks to his word and has slow methodical cuts that are of course data dependent. Canada and its loonie are beholden to America and the fed and we’re limited to how much we can front run cuts; another quarter point (maybe 2 more?) decrease is easily done without dropping the loonie’s value too much (considering the American economy stays fairly strong).

Possible worst case scenario…. pandering to political and corporate wants and possibly trying to cradle the 2.2 million mortgage renewals coming up between this year and the end of 2025.

There’s the optics of CYA as well. Economically, if things go south – Tiff and the BOC can claim they started to move.

Well, governments are shoveling billions of dollars to expand the housing supply (even bailing out and bank rolling developers) and try to somewhat sustain current price levels – according to PM Trudeau’s boneheaded globe and mail podcast interview. The need to sustain price levels because too many Canadians depend on their real estate worth and equity to fund their retirement. So the boomer (and a good part of Gen X) were the benefactors of ridiculous housing price growth – you’d think most likely to be able to absorb a price correction – but oh well, let’s stick the younger generations with higher debt or just not being able to afford a home. Now, if it was just lip service to retain or gain popularity- it’s still boneheaded. The country is way too dependent on real estate (past price gains aren’t sustainable going forward – how’s the retirement fund going) and the BOC deputy governor is warning of a sizeable productivity gap – but keep pumping real estate and kick the can down the road further.

Alright, rant over.

I thought I read articles earlier this year on Canada alllowing

payment of interest only on the mortage …basically extending mortage length.

The liberal government passed a bill allowing banks to extend amortizations and keep payments the same. Some people we’re seeing 50-90+year amortizations.

Wolf, your last couple of paragraphs are the crucial ones. Canadians are about halfway through a painful mortgage readjustment (it takes about 5 years for the majority of mortgages to reflect the new rate environment) which is presumably going to continue to drag down household discretionary spending (demand) as the percentage of mortgage holders’ income required to service their mortgage increases.

What’s probably contributing to keeping us afloat a little better are the massive US Federal deficits, because when your economy is hot, it helps keep Canada’s at least somewhat warm.

In Cdn, it’s not just housing that is expensive. It’s that a lot of consumer items are 35%, and up to 100%, more expensive. Examples are found by comparing amazon/homedepot websites in cdn vs usa. It’s one of the 4 horsemen consequences of the globalization and deregulation. Goods, especially raw resources extracted in Cdn, (lumber, energy, grains, etc) are priced in $USA. Again, even if they’re produced in Canada. Pre 1990, prices were either ‘local or export’ prices; now it is mostly $USA priced. So with an low $Cdn vs the $USA, (to promote exports; input price support to the USA), then the prices of goods in Canada are 35%, and up to 100%, more expensive. And those Canadians that can negotiate/determine their wages/profits, do so. So all of that flows into housing costs, and the high COL too. And then the Cdn govts, as elsewhere in the West, engage in deficit spending to extend and pretend; which results in cuts in services and higher taxes. ZIRP bought some time too. Recent tsunami of immigration is mixed outcome.

Pre 1990, Cdn was a pretty cool place for most Canadians. Post 1990 has been a shit show. Slow to start. Now FUBAR. Of course, if one has money/wealth, or access to, then Cdn is still a pretty cool place. Otherwise, now, one is SOL.

In USA context, the hegemony of USA, has resulted in lower COL, high GDP, global corporations, etc, etc, etc. And a higher $USA. There are advantages. And vulnerabilities too, as collateral issues eventually become a trend. For example lower wages, unemployment, in the USA; hence deficit spending, etc. And for example, hegemony is expensive to maintain.

History. Rinse & repeat.

Wage gains just came in today at 5.1 percent year over year today but they tell you the inflation rate is 2.8 percent. Canada is looking at a wage price spiral and runaway inflation in the future.

Since COVID huge price increases. The cost of building here now is $400-500/square foot. A mechanic is $150/hr. I paid $53 dollars for a 4 liter can of olive oil. Out local bike mechanic is $100/hr. 8-10$$ for a beer.

My son pays $1800/month rent for a 350 square foot apartment in Vancouver.

We knew that the Bank of Canada would not pass the 5% rate level for it’s benchmark or Bank of Canada rate. It seems that since 2007, interest rates in Canada can’t budge much higher than 5%. We took advantage of longer term GIC rates at a few banks at 5.1%. 5.5% and 5.3%. All these are 120 months or 10 years. These are great for our sheltered and tax free accounts, RRSPs and TFSAs.

The compound interest is really effective over 10 year, 64.4% to 70.81% over the 10 years. By the way, in Canada GICs are your CDs in the US. I personally think they cut rates to soon but we will see if inflation goes back for a sustained period of %+ in coming months, years.