Huge month-to-month jumps for second month in a row as businesses jack up their prices for new fiscal year.

By Wolf Richter for WOLF STREET.

The producer price index for services that Japanese businesses buy jumped by 0.82% in April from March, after a similar jump in March from April, according to data from the Bank of Japan. On an annualized basis, both those jumps amounted to just over 10%.

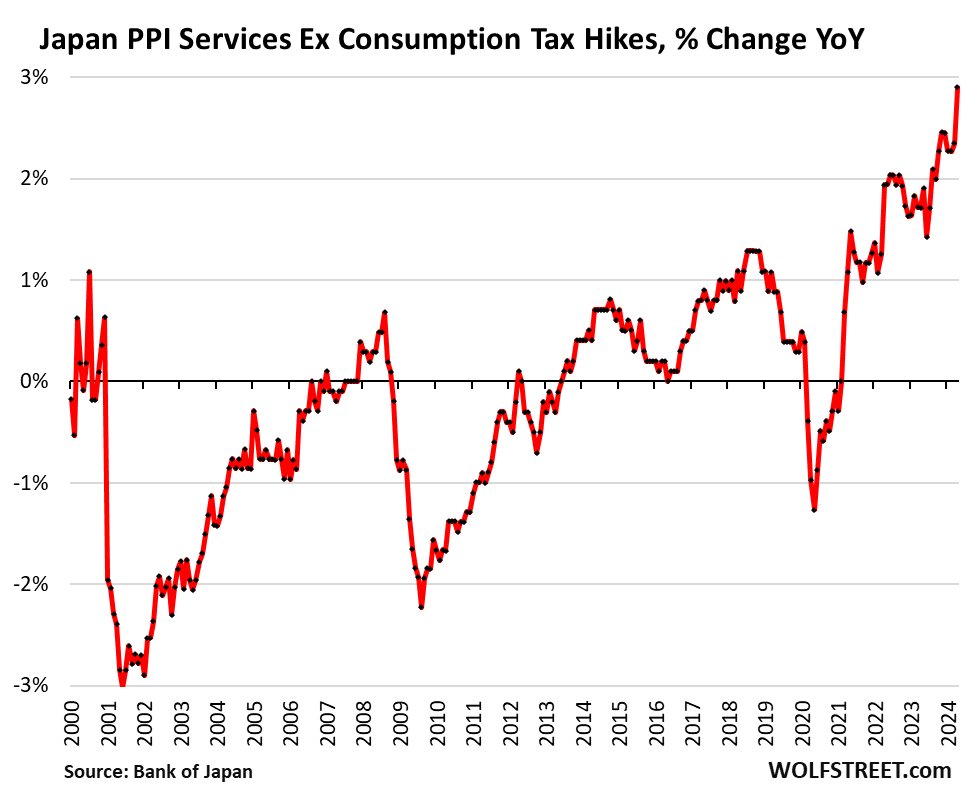

In the data that exclude the consumption tax hikes in the past, the April spike boosted the year-over-year increase to 2.9%, the worst jump going back to 1991.

The fiscal year for Japanese companies begins in April, and many of them adjust their prices at this time, and a big portion of the month-to-month price spikes in March and in April were a result of companies jacking up their prices on services they provide to other companies. They’re now passing on their wage increases.

The services that contributed the most to the year-over-year surge in prices were:

- Civil engineering and architectural services: +7.5%

- Other technical services: + 5.9%

- Training and development services: +6.7%

- Machinery repair and maintenance: +5.5%

- Waste and industrial-waste disposal: +5.1%

- Software development: +4.5%

- Commodities inspection, non-destructive testing, and surveyor certification services: +5.4%

- Leasing of computer and related equipment, communications equipment, motor vehicles, etc.: +5.3%

- Hotels: +22.3%

- Ocean freight: +16.7%

- Domestic air passenger transportation: +10.1%

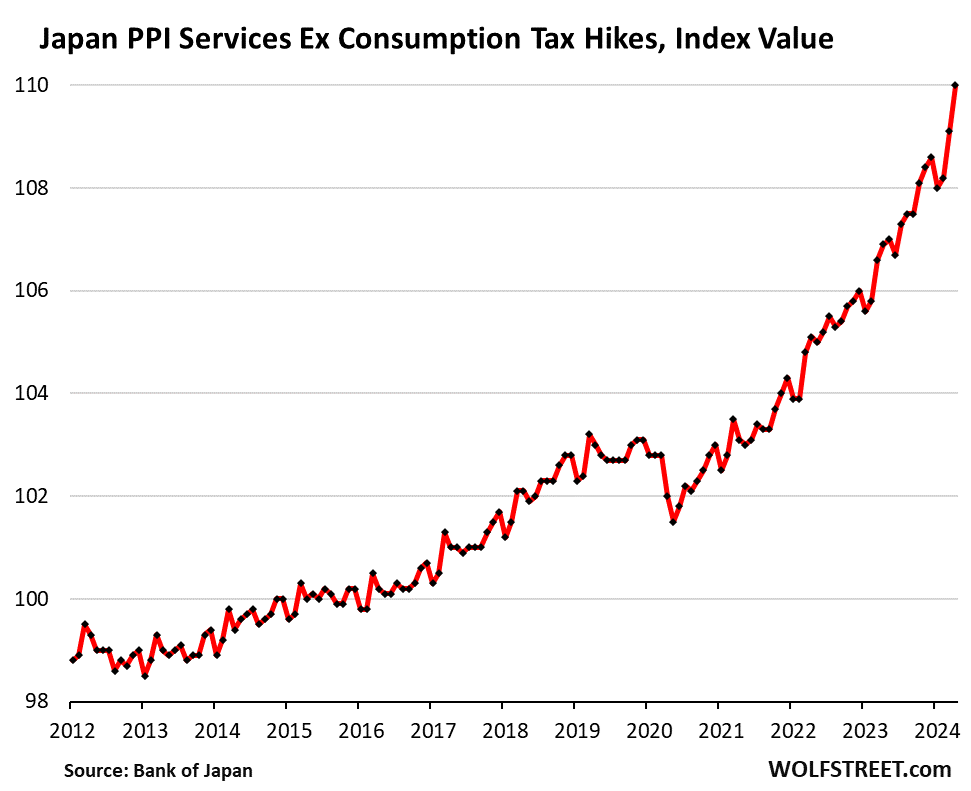

The recent acceleration can be appreciated in all its glory in this chart below of the index value of the services PPI without consumption tax hikes, showing that all kinds of heck is breaking loose, while the Bank of Japan has its policy rate still at 0%, after one microscopic rate hike in March and indications that it would slow the bond purchases:

Businesses that pay for these price increases in services will pass them on to their customers. Wages are a big factor in services inflation. The BOJ has been pointing at inflation in services as a sign that inflation has been spreading throughout the economy – and it has been.

The Bank of Japan has more than enough inflation-related reasons to hike its policy rates with substantial rate hikes, not minuscule-type hikes of the kind it performed in March from negative 0.1% to 0%. Its refusal-to-hike policy in the face of rising inflation has caused the yen to plunge to about ¥157 to $1 currently, as it’s ultimately the currency that ends up dealing with these kinds of monetary sins.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

MW: Kashkari says ‘many months’ of good inflation data needed before a rate cut

Kashkari used to be the most dovish of all FOMC members btw. He’s changed his tune a lot in the past three years.

They’re playing Jay Powell’s “transitory” game.

Apparently you’re right. But Powell’s game continued by raising rates sharply and keeping them there for a long time.

Howdy Julian. Don t forget POW POW lowered before.

Other way around?

Powell was playing the “transitory” game in 2021.

The BOJ is now playing the “sustainably” game.

BOJ wants inflation to be “sustainably” rising to its 2% target, meaning it wants inflation to be certain to remain above 2% before it acts. Core CPI in Japan has been above 2% since April 2022, but it wasn’t sustainably enough just yet or whatever.

Wolf,

It would be interesting to hear theories about why Japanese inflation is happening now after decades of deflation/price neutrality.

Plenty of efforts were made over 30 years to little avail – what has changed in the macro sphere that hasn’t happened before (or multiple times before?).

I suppose at some point a falling population (itself a partial product of economic decline/stagnation) meets enough printed fiat and…voila’ inflation.

I’m just not sure that such inflation is a herald of better times (perhaps being the result of long bad times) and quite possibly just the latest input for worse times.

In the end, growth is about increases in productive efficiency and I think too little attention has been paid to that for a long, long time.

Howdy DC. YEP

Hitobito ni taishite shiyō sa reru tan’naru tsūrudesu.

I like to look at the “real” interest rate (interest rate – inflation rate) and for Japan, is still quite negative. That means it has to print new money to roll over existing debt and incur new debt.

I look at this QE explanation as a kind of “intelligent design” approach for explaining Weirmar economics.

What I’m waiting to hear about is, how much dollar holdings did Japan have to sell in May to keep the Yen in the 155-160 range.

“That means it has to print new money to roll over existing debt and incur new debt.”

LOL, no. It means the government doesn’t have to pay real interest on its debts. It’s getting a freebee, at the expense of investors holding yield products, such as JGBs, bank CDs, CRE, etc.

The biggest holder of government debt is the central bank. So, the government owes the interest to themselves. They are, however, imposing an asset tax on savings by a negative real yield.

The problem I see is, to maintain this regime, they must print. So, I see Ponzi in the sense that new money is always required to keep the scheme (negative real rates) going. Unlike a conventional Ponzi, since the new money rolls off the central bank’s printer, that new money doesn’t dry up.

But, at some point, people will deem this approach as a farce. I deem it a farce now. It isn’t like the “debt” that the central bank bought with the printed up yen will ever be repaid. I think characterizing “print and spend” as “borrow and spend” is a bit of a sham, defined as a disguise for concealing its real character. And the real character is “print”, not “borrow”. The amounts represent altered price discovery in debt markets as much as any “borrowing”. That’s the whole point of the exercise, manipulate price discovery.

I think they’re screwed if the rest of the world doesn’t resume printing (QE). I’ll find out if I’m right when I hear of the dollar holdings they had to sell to keep the yen in the 155-160 range. I think that information comes out monthly.

This is such great news for Japan, one of our most important partners in the Pacific region.

Not all inflation is bad, some (about 2%) is actually optimal, and Japan has been suffering from deflation and lower than 2% inflation for far too long.

“….suffering from lower than 2% inflation” 🤣❤️

we USians wish we were “suffering from lower than 2% inflation.”

Wolf, perhaps you could remind us why 2% inflation (or ANY inflation) is a “good” thing.

2% inflation is “optimal”? For whom is 2% inflation optimal? Banks? Governments?

Based on what?

The 2% target was chosen because it’s about as low as can be while being confident that normal variations do not cause it to go negative and become deflation.

Deflation can be ruinous to an economy because people stop buying (“it’ll be cheaper tomorrow”) causing demand to drop and prices to go still lower. Deflation is a dangerous positive-feedback loop.

Do you have a rational explanation of why 2% is optimal, or even good? 0%, 2%, 6%, 12%?? I would argue that when interest rates are centrally planned, there are winners and losers, and the planners get to pick which is which. Central planning generally destroys economic signals, resulting is less efficient decision making by market operators. Society end up with too much of some things and not enough of others (relative to what people actually want(naturally desire to produce/exchange for)).

Japan’s long saga since the start of the bubble in the 80’s has been due to manipulation of interest rates (largely done to benefit the US/USD (in my opinion), resulting in uncalculatable wealth destruction of both of existing wealth wasted and wealth never produced.

I will give you that once economic systems have created significant unproductive debt, the easiest way out is inflation, but this just transfers from the productive/prudent to the unproductive/spendthrift. Hardly a positive outcome.

I am also confused about why 2% inflation is a good thing? And why is the Fed manipulating interest rates in the first place, rather than allowing market forces to determine the price of money? I think a lot of people in the U.S. would welcome DEFLATION in groceries, restaurant meals, new home prices, services, etc.

The rapid advancement of technology and supply chain efficiencies is massively deflationary, allowing your money to go further.

The Fed and the banks have to print money to “reverse” this deflationary pressure. Otherwise, prices would go down and the standard of living of the average person would skyrocket.

Why is it bad? Because it hurts those who own lots of assets, and helps the little guy.

Compressing asset values and helping the little guy is bad, as it closes the gap between rich and the poor, and such a thing is extremely offensive to the rich.

They would welcome deflation by not buying things. Why buy today when it will be cheaper tomorrow?

Deflation is a spiral and can cause serious economic damage. The 2% target was chosen so that normal fluctuations around that target don’t become negative.

Brian

The idea that falling prices (2%) will cause people to delay purchases is often given for the reason for the need for inflation. Common sense and real world experience shows that no one will delay a purchase to save 2% over a year. Over a week, 2% “savings” lowers prices by under 4 cents on a $100 purchase. Not an amount that is going to change behavior. And we see in real behavior people constantly buying things that we know will fall in price (anything technology related). A more probably reason for 2% inflation is that it allows easier control of the flow of money in the economy (central planning), and a mechanism for the theft/taxation of wealth from society by the banking system. But they need a cover story – yours.

– What are japanese interest rates doing ?

0% policy rate. 1.04% 10-year JGB yield.

The BOJ is totally in control of the 10-year yield. It holds over half of all JGBs, and big government institutions and institutions that the government can lean on hold a big part of the rest, and there’s not much of a market to speak of left. If it wants the 10-year yield to rise a little bit, it will let it rise a little bit.

The BOJ however is not in control of the currency, which has plunged, despite big efforts to stop it from plunging.

Is the only check on the Japanese interest rate/inflation dynamic the Japanese voters getting fed up with inflation?

If so, how much longer are they going to tolerate this?

Votes don’t matter, so the younger generations took action by not procreating and dooming their offspring to a life of indentured servitude to a parasitic government. Same as in Korea, Europe and the US.

>>The BOJ however is not in control of the currency, which has plunged, despite big efforts to stop it from plunging.

Yes. Is it a problem right now? No, but eventually Japan will have to roll-over its long-term LNG contracts and might find the Kuwaitis and others might not want to be paid in Yen.

This, more than anything else, has Japan second-guessing its wind down of its nuclear power industry.

US Treasury is issuing more T-bills because they don’t want to lock in these higher interest rates for 10, 20, and 30 years. Their bet is that rates will come down, and then they’ll finance long-term at lower rates. That bet may be wrong. But that’s the thinking. If they’re correct, that’ll save the taxpayer money long-term.

Japan is a HUGE importer and has run trade deficits for years. Even the vaunted Japanese manufactures still manufacturing in Japan are importing components and materials. The weak yen is making those imports at lot more expensive, which is where part of the inflation is coming from.

And most of the Japanese companies manufacture overseas. For example, nearly all Japanese cars for sale in China are made in China, and nearly all Japanese cars for sale in the US are made in the US and Mexico. Those are by far the two largest auto markets in the world. Japanese manufactures also manufacture in Europe and elsewhere. So the weak yen is not even helpful.

Where the weak yen is helpful is when Japanese companies translate their overseas revenues and profits from local currency into yen, but that’s only on paper for yen-investors in Japan. Global investors translate those revenues and profits back into dollars, and that’s not good either.

They will have to reverse that, after adequate, safety measures and more plants. Thorium nuclear waste is radioactive for only hundreds of years and one of those may expensively, burn normal waste. They suffer from sunk costs issues and possible embargoes if an unfriendly neighbor gets frisky. Great engineering, though. Now allow immigrants!

Thus, despite poor conditions and aging, I will bet on Japan, Taiwan, and S. Korea, always. Only danger is if the dying spasms of their huge neighbor get radioactive.

Hope they get their money out of it NOW. Wonder if the more-involuntary, US investors’ funds were able to get out of China? See WSJ : “Wall Street steered billions to blacklisted Chinese companies…”

MW: 10-year US Treasury yield logs biggest daily jump in a month after weak auctions

Hotels: +22.3% !!

Seeing more and more stories on YT about the headaches of “overtourism” in Japan, turbocharged by the cheap yen — and restricting certain attractions in Kyoto to locals.

Yes, and it’s the low quality tourists.

Where I live in Central Tokyo, there is now graffiti all over the place. That was never the case before COVID.

Another great article by Wolf. And why do Americans even care about what is happening in Japan? Well, they are the largest foreign holder of U.S. Treasurys. And if Japan decides to raise interest rates, that may attract capital to Japan and away from Treasurys. And if Japan decides to more aggressively defend the yen by selling Treasurys, that could potentially have a negative impact on Treasury auctions, which are already getting shaky thanks to the flood of new issuance.

“And why do Americans even care about what is happening in Japan?”

They don’t. The readership of articles here about stuff that happens outside the US is small.

That’s a shame, I find them to be some of your most interesting articles because there’s so little coverage everywhere else.

But I’m guessing most of your audience is in the US, and most people are predominantly interested in their own corner of the world.

+1

Agreed. Hard to understand the lack of interest in what’s happening outside the United States. Our daily lives, and our investing, are very much subject to what’s going on outside our borders. Besides, history screams at us that those who ignore what’s happening in the rest of the world do so at their own peril.

Read Japan Today, it will give you an interesting insight into Japan and the East. Today it reports that Japan is by far the biggest creditor in the world, followed by Germany and China. So they own quite a lot of America.

Yes – and keep in mind that Japan is trying to boost its defense spending right now. Lots of datapoints are suggesting an eventual repatriation of their excess savings.

just to expand on Wolf’s narrative:

there is an interest rates arbitrage going on, most of the world jump in to Japan to borrow in JPY near zero interest, then turn around and go outside of Japan, exchanging JPY for USD, to buy assets with interest (or risky ones), for example short term securities in US. It’s free money. Plus as JPY falls against USD you repay less on your loan (USD->JPY). While there is significant arbitrage JPY will be falling behind.

If anyone want to visit Japan and/or Asia, now is a good time. All the Asian currencies are at their minimums except Chinese yuan. Asia is dirt cheap right now, this why Americans should care in what is happening outside US, to use this kind of opportunities for personal/business advantage.

In regards to 2% inflation target. The main reason is CBs FEAR OF DEFLATION. CBs have no real effective tools to fight deflation, so they are trying to keep inflation above zero all time.

Inflation is caused ONLY and ONLY by GOVERMENTs! No matter what they claim, it’s econ 101, read Friedman. 2% is mainly governments’ target though as they try to restrict/self-regulate themselves from overprinting and also helps them inflate away debts.

Cas127,

Why is it happening now after decades of price neutrality?

Well, aging populations tend to eventually be inflationary (fewer people producing goods and services) and Japan is aging quite rapidly.

But basically there are two much bigger things at play in the form of higher energy costs and higher shipping costs. Japan is a resource-poor country.

Hiking rates in Japan could eventually become problematic for the USA if Japan’s excess savings are repatriated.