Here’s why: New house prices -18% from peak, back to Nov 2021, further sweetened by mortgage-rate buydowns.

By Wolf Richter for WOLF STREET.

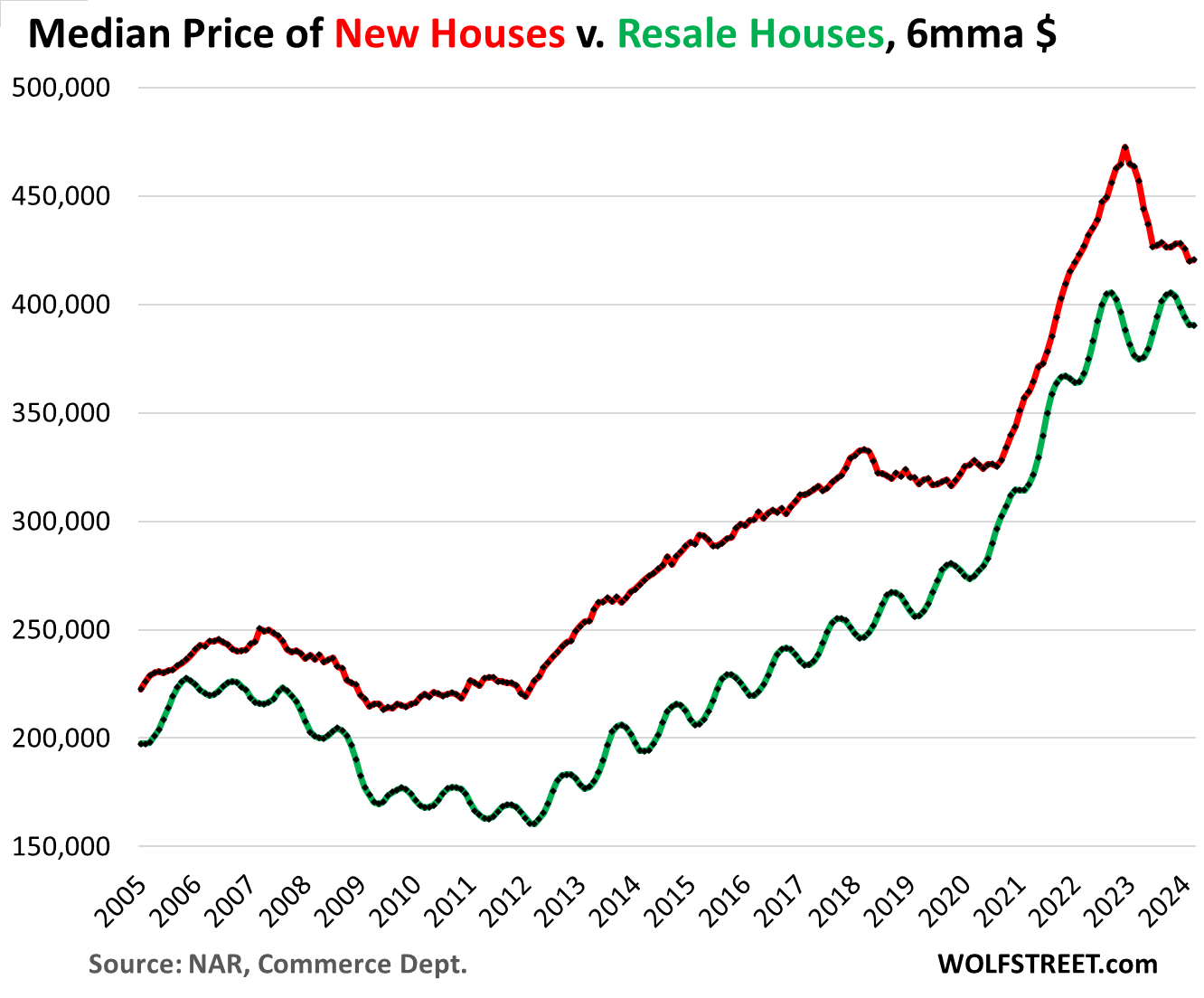

The median-price of new single-family houses at all stages of construction that were sold in March rose to $430,700, which was down by 1.9% from a year ago and by 18.2% from the peak in October 2022, according to data from the Census Bureau today (blue line in the chart below).

The three-month moving average median price – which irons out some of the very volatile data and includes all revisions – edged up to $419,500, which was down 3.5% year-over-year, down 2.7% from March 2022, down 11.8% from its peak in December 2022, and back where it had first been in November 2021 (red).

These are contract prices that do not include the costs of mortgage-rate buydowns that homebuilders use to stimulate sales in this market of 7%-plus mortgages. Mortgage-rate buydowns lower monthly payments but do not lower the contract price of the house. Prices also don’t include other incentives, such as free upgrades. And homebuilders are building smaller homes at lower price points, with less expensive amenities, to meet the market and make deals. And it’s working; as we’ll see in a moment, sales have been decent, while sales of existing homes are still getting clobbered by high asking prices and high mortgage rates.

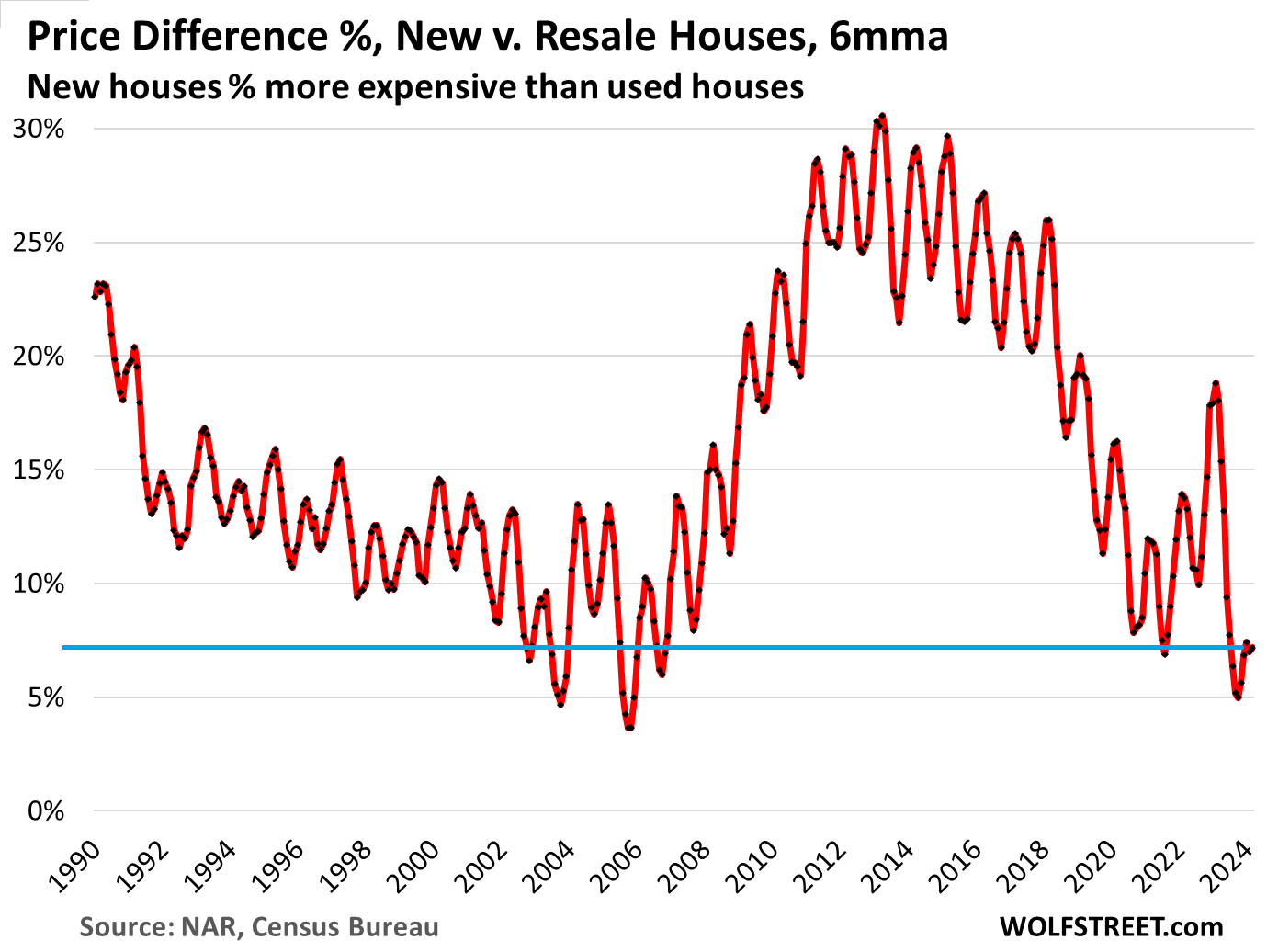

Price difference between new and used houses.

Homeowners have totally opened up the market for homebuilders by clinging to their hopes that mortgage rates will “soon” drop back to 3% (good luck!), and that therefore prices will soon start to spike again, and that they can ride up this market with their vacant house they’d moved out of some time ago but haven’t put on the market yet.

So prices of new and resale single-family houses have moved close together, they’re within a hair. And with mortgage-rate buydowns, the monthly payments can be lower on a new house compared to an existing house, as homebuilders have been aggressively competing with these homeowners, and have said so in their earnings calls.

The price difference in dollars. The national median price of new single-family houses has fallen much more than the national median price of existing single-family houses (via the National Association of Realtors).

To iron out the large ups and downs and some of the seasonal differences, we look at the six-month moving average of the median price of both, new single-family houses (red) and existing single-family houses (green).

The price difference has shrunk to a range between around 5% and 7%, the lowest since 2006, just as the Housing Bust was taking on momentum:

The difference in percentages. The median price of new houses in March was only 7.2% higher than the median price of existing houses (6-month moving averages for both), not including the mortgage-rate buydowns and other incentives.

The narrowing price differences also occurred during the early phases of the Housing Bust, as homebuilders slashed their prices, and homeowners were slow to follow. But eventually they did, until prices of used homes fell so far that they became competitive again with new houses as the difference widened again.

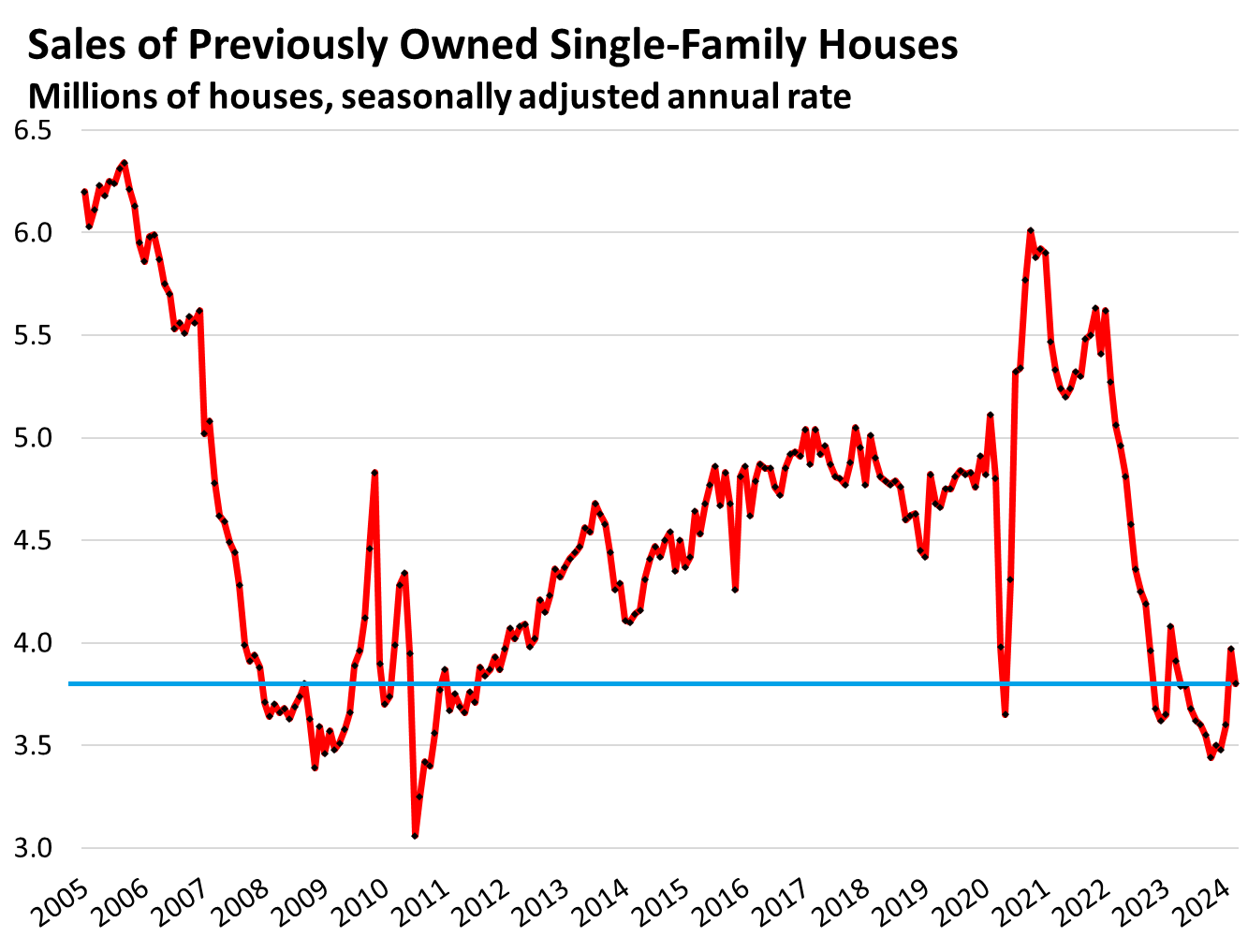

So sales of new houses held up while sales of existing houses plunged.

Sales of new single-family houses: The seasonally adjusted annual rate of sales rose to 693,000 new houses in March, up by 8.3% from a year ago and down by only 1.3% from March 2019. So not anything fancy, but decent given the environment of 7%-plus mortgage rates.

But sales of existing single-family houses plunged by 19% from March 2019, according to data from the National Association of Realtors.

This divergence of sales illustrates the effectiveness of lower prices and mortgage-rate buydowns that homebuilders have pursued though it squeezed their profit margins from the big-fat levels during the free-money era.

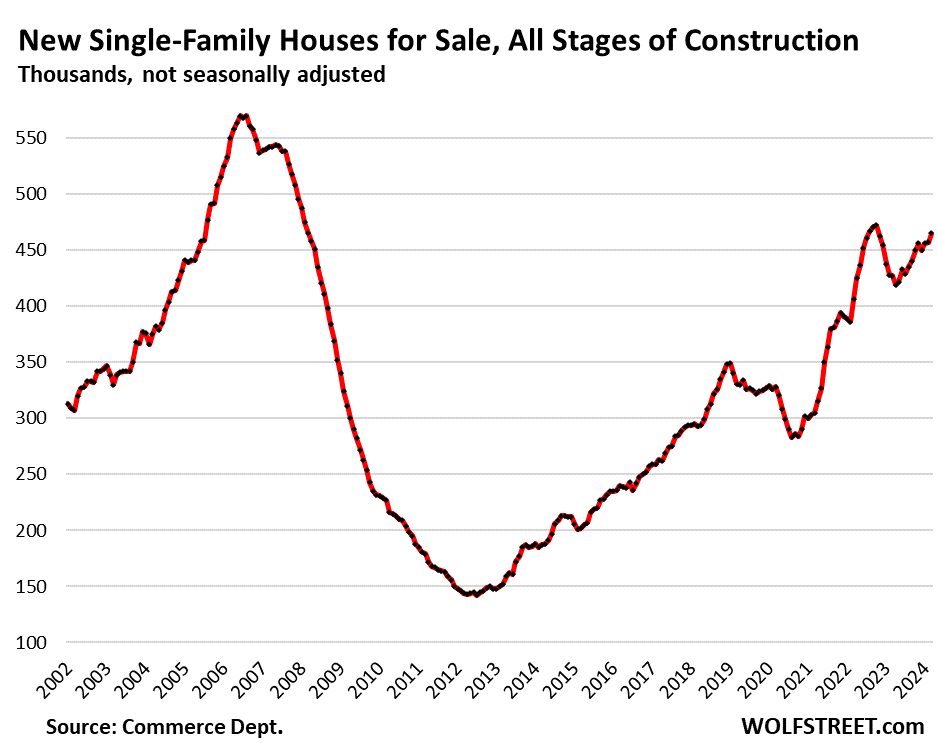

Inventory for sale of new houses at all stages of construction rose to 465,000 houses, the highest since August-October 2022, and beyond that the highest since 2008. This amounts to 7 months of supply at the March level of sales. There is more than plenty of inventory for sale:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

I just don’t get it. I am seeing more and more existing properties that are disconnected from reality. As an example, look at the property listed at this address (public information):

44410 208th Avenue SE, Enumclaw, WA 98022

Who is buying these?

For the love of sanity, please stop.

It feels very 2005-06 ish so you aren’t far from sanity starting to come about. The insurance and HOAs and prop taxes will bite more and more and prices will have to adjust.

TerraHawk,

“Who is buying these?”

Not many people. Existing house sales have plunged by 19% compared to March 2019.

Buyer strikes are mentioned here as a fix to rising prices. It appears the opposite has happened!

Existing homeowners sitting on lots of equity, or on debt free homes, or who simply don’t HAVE to move or sell are on a SELLER’S strike.

Homebuilders don’t have that luxury. They have to sell homes to stay in business and generate quarterly profits for shareholders. So they’re lowering prices and building smaller cheaper homes that are selling, because existing homeowners are on a seller’s strike.

@ CCCB

“You didn’t break up with me! I broke up with you!!”

While I agree, there are some markets that feel a bit like 2005-2006, today’s housing market is based on demographics, not easy credit. If you’ve shopped for a mortgage in the past 10 years, it is not easy to get to the closing table. There are certainly some overbuilt markets, like Austin and parts of Florida, but foreclosures will be minimal because homeowners have built up so much equity. Remember, the average mortgage rate is still below 4%. Also, the national HB’s have pristine balance sheets. $PHM has less than 2% net debt. That figure was 55-65% before the GFC.

I’d love to see some statistics from Wolf on where mortgage payments + insurance + property taxes are at relative to income compared to the past. That probably matters more in figuring out how the avg homeowner is coping. Yes a lot of mortgages are at 4% but that doesn’t necessarily matter when people were bidding $100K+ over asking and maxing out the amount they could borrow. While I don’t necessarily think there will be a housing meltdown that takes out the whole financial system this time around – most historic bubbles have deflated so I can’t think of any reason why this would be different. Also I’d be curious to see how many airbnb’s there are nationally and how many of those owners could cover their mortgages in recession like scenario with a significant drop in travel that was a factor that we didn’t have in 2008

“…where mortgage payments + insurance + property taxes are at relative to income”

You are “affordability” measures, and there are a few out there. I don’t cover them. The issue to me is price. Prices need to come down – that’s the way to improve affordability.

The Atlanta Fed’s “Home Ownership Affordability Monitor” hit an all-time low in Oct 2023 as mortgage rates were near 8%. When the Rate-Cut Mania pushed down mortgage rates in Nov, Dec, and Jan. But January is the last entry. In Feb, March, and April, mortgage rates rose again, which will show up in the Affordability Monitor over the next few months. The tracker also allows you to search by metro

Wolf, 100% prices are currently too high. I was curious about how current homeowners are doing as an overall measurement of financial stress in the housing market. Too expensive to buy means fewer buyers, financially stretched homeowners means potential sellers/increase of supply in any sort of mild economic downturn. People arguing over half the market has a mortgage of 4% as a reason we won’t get another housing crash doesn’t seem like a good argument to me, because just because a mortgage is at 4% doesn’t mean the borrower can afford the payment.

Actually a better way of phrasing it, I’m just curious factors out there might up supply without demand also skyrocketing, and thus deflating this bubble.

That house is on 14 acres of land in a booming region and listed at about twice its 2007 price. Is that unreasonable?

It’s more like 3x the 2007 assessed value (1550k listed vs 519k) which was the last peak. It’s also 3x times the 2017 assessed value.

But hell, the Zestimate ™ is 1,576,800 so the asking price must be right.

Terrahawk

Travel 3.5 hours north and your in Vancouver, avg house price 1.2 million.

The proud people of Enumclaw, should except nothing less.

59.4% of mortgages in US are 4% or lower.

New homes cost about fifty percent more than resale homes in Vancouver.

44410 208th Avenue SE, Enumclaw, WA 98022

Sold NOV 02 2007 for $515,000 House and 15 acres.

Now asking $1,550,000 after a series of unsuccessful sales attempts over the years at increasing prices.

Here is an owner who is likely to holding the bag all the way back down.

I would auction it off now.

People who need to have their head examined. That’s who.

The Fed got us into the mess via buying $2.7T in MBS since February 2009, but they’re unwilling to do what’s necessary, induce a recession, to get us out of the mess. In December 2022, Bullard predicted a 7% FFR might be needed to return price stability to 2%.

He’s about the ONLY person who foresaw the uninterrupted, post COVID deficit spending that was going to skew labor & inflation to the upside, and he knew that the FFR needed to go WAY higher than what JPowell had the stomach for.

The 4-Week moving average of continued unemployment claims have been stuck @ 1.8M for 7 months now. WHY IS THAT?

It’s because since COVID ended we’ve been spending on avg $1.5T more than what we’re taking in over the past 3 FYs once ’24 is completed.

The economy IS NOT going to fall off the cliff until government spending is forced to slow down. And that could be at least 12-18 months from now and that’s extemely optimistic that Congress has evne a minor “come to Jesus moment”.

filthy scary disgusting…..with owners insane and a buyer more so

Agreed….The whole lot of them should be turned into dung beatles.

It’s that money….the root of all evil, or the lack of money could also be the root of all evil.

It is the “love of money” that is the root of all evil.

You could be like me.. a sane buyer

Except as a sane buyer your keep waiting for the moment the market becomes more sane.. yet all it does is go up and up and up.

And then it just feels like you’re the insane one for not buying earlier

$1.55M for a fixer upper. Wow.

That’s about the price of a fixer upper where I live. They were almost 2 million at the peak.

I guess he thinks the distant view of Mt Rainier is worth a million. Some people are suckers for views. I can park my car on the side of the road and see Mt Rainier from lots of viewpoints, for free. Better yet, I can camp right under it and stare at it until my 12 pack is gone. No need to to see it every day and pay a million for it.

Views aren’t worth more than $100k in my book. I’d rather live next to a fun neighbor if I had a choice. These places in the middle of nowhere with no neighbors around are not attractive to me. Opinions vary on that.

No idea why anyone would buy in a place with such unimaginative street names, even in the middle of nowhere.

That can’t be a real for-sale offer.

They want the younger generations to pay for their retirement. Because the only smart thing they did was to listen to their WW2 parents and purchase a home.

Once you give them their kings ransom they will go buy jet skis and every collectible known to man.

2 bed 2 bad, LoL, I always when I read these real estate ads the only thing I could think of is people are sitting around smoking crack and are higher than a kind and just coming up with these crazy Numbers.

The same people lining up to buy the 1 million dollar averaged sized and very aged Bhargava home featured in the WSJ article about them. Nobody.

“These Home Sellers are Done Waiting for the Fed to Lower Rates.”

Lol, it looks like something you could buy in countryside Japan for 1/100th of the price.

Who is buying these?

Go here and search for the businesses:

https://projects.propublica.org/coronavirus/bailouts/

The owners of their businesses that got 700 Billion for free.

I know multiple business owners that received millions.

Good luck starting a business today when the competition received such a large sum of “free” taxpayer money. You can’t compete anymore.

you are getting 15 acres with the crappy house in this listing ;jbt

Looks like they just playing with data.. increasing price on junk houses.. so market price stays up..

Home builders have more inventory to sell. However, the cost of selling a home is rising and the median price is contracting. There is a recent pullback on home builder stocks but the uptrend is still very strong. Any thoughts on when lower profits might sink stocks?

Good article and I can verify that new homes are selling at a good clip. I bought a 1,459 sq. ft. one level (brick and Hardiplank) house last year in Texas at $169/sq.ft all in. I’m a retired widower living alone.

It came with all appliances, window blinds, upgraded countertops (quartz), upgraded cabinets, upgraded sinks and faucets, two car garage w/opener, all landscaping and energy efficient double pane windows. The lot is small, but that’s OK by me.

It has a gas furnace, gas water heater, and high SEER Lennox A/C unit.

The builder has been in business for 65+ years and right now is buying down the mortgage to 5.99%.

The houses range in size from 1,200 to 2,200 (Approx) sq. ft. and sales of unfinished houses are selling like cold beer at an Astros game.

This phase of the development will be all built out by the end of 2024. The “builder grade” stuff is not bad but it is not too fancy.

I lived in California years ago and this house would cost over $500K in the L.A. area, maybe more. these days.

“I lived in California years ago and this house would cost over $500K in the L.A. area, maybe more. these days.”

If I recall, you lived in Thousand Oaks. A comparable house in Thousand Oaks would be 650,000+ I am thinking.

I’m thinking well over $750,000 right now in Thousand Oaks. Only one SFR in TO is listed on Zillow under $750,000. It’s 1,015 sq.ft., built in 1963 on a 4,400 sq.ft. lot. The description starts out “Welcome Home to the last remaining affordable single-story home in Conejo Valley…”

I believe sales and inventory are way down, but the prices are absurd.

I should have mentioned it’s listed for $745,000.

I guess I was too conservative with my Ca house estimate.

I’m just not used to the absurd pricing out there. And, yes, I lived in T.O. for 12 years (1981 – 1993). And it’s a beautiful place but I paid $219,000 back then for a NEW ~2,600 sq. ft. home in the early ’80’s.

I visited Sacramento last week. Very nice, and so close to Lake Tahoe. I didn’t even bother to check housing lol!

The funny thing about time and inflation, is that nobody ever truly, really, actually processes it. $219,000 in 1981 plugged into a CPI inflation calculator is $786,215 today. The dollar can’t devalue (relatively speaking) fast enough–down 25% since 2020 is truly mind boggling. Even when we talk about the brutal side of affordability, in pure purchasing power, average wages have statistically outpaced inflation through this stretch. The metrics are gross, but this is how compounding works. The numbers and balances have gotten astronomically larger and the snowball can roll faster.

Depends where you live. In Florida we are still getting cash buyers from New York and other Northern states. Prices are pretty stable for now and they keep building.

I’ve heard the opposite. Guess it depends where in Florida.

Same here in the North Georgia mountains. And we have a ton of people who have left Florida for various reasons. For the last fifteen years, over 60% of sales have been for cash so the mortgage rates and crazy home prices are only slowing the local working class down, which isn’t good. They are still building owner-funded custom homes as fast as they can build them but not as many as in 2021, which was sustainable.

They are four-laning the N/S and E/W state roads in my county because the state projects the population will double by 2050.

A strange time and a strange market. I live in the Idaho panhandle and down the road from me an independent home builder built a beautiful 2500 sq. ft. home on five acres (but not usable acres; two under the house and near it, three useless on a steep slope with a boggy slough in the back). It has been on the market for five months and he’s already dropped the price 10%. He still wants about $1.4 million for a house that would have sold 7-8 years ago (I know, I was in the market then) for maybe $450k.

He’s selling it himself; not going through a realtor.

He better hurry.

Or rather, he’s NOT selling it himself … /snark

Mortgage Rate “Buydowns:” Those “buydowns” usually have an enticement with a limited period of lower payments. During the 1970s it was worse with interest only and the negative amortization increasing the principal with time. While not as extreme, a good percentage of these “buydowns” are going to generate a new pool of purchasers equivalent to last housing cycles subprime borrowers.

Most of the rate buydowns are now permanent rate buydowns, as per homebuilders.

Hopefully the distortions that buydowns introduce into the reporting of “median home sale prices” isn’t misleading too many regulators or buyers this go round.

IDK, but the implications of those buydowns reminds me of the distorted price reporting that preceded the 2008 implosion.

Excessively “creative” (and secretive/opaque) financial engineering seems to more and more quickly render historical metrics obsolete/misleading and the regulators/buyers seem dangerously slow to catch on.

Howdy Prisoners. Thanks for supporting new home / multi residential construction, which will be just fine in the coming years. Still a long long way to go. They may actually keep the housing bubble from popping????? We shall see…..

“They may actually keep the housing bubble from popping????? ”

I think this is already popping. Still up though on life support.

Howdy jon, YEP, it is hissing and the Lone Wolf charts show re peaking a bit. The hissing is there for sure. No BIG pop is what they want to stop……..

It all boils down to what kind of property you want to live in.

Old, established: larger backyards, more trees and greenery in the neighborhood, richer social connections.

New: cleaner, more technologically advanced, tends to be larger than the earlier versions.

My money is for the old.

I love old properties and it looks amzong/romantic on paper.

But it takes lot of money/effort with the upkeep.

As I a getting older, I’d prefer Condo.

Yes, your money goes into the old ones, all right. /snark

At least in my experience the market tends not to price in a house’s age very well. The maintenance costs on aged houses are much higher; they should therefore cost less. Instead, the old-neighborhood charm keeps the price up, but that comes with the hidden price of high maintenance and repair bills.

I’m finally set to close in a few weeks after waiting years…

Took Wolf’s non-advice of getting on with life. Had choices between new but opted for the 25-year old with an acre. I’m paying too much, but whatever.

Kids would end up being parents themselves by the time this housing sheist ends. At least one day I’ll get something back instead of just waiting each year for the next landlord to raise prices as a rent-slave.

These interest rates will come down when the national debt starts coming down, which will be the same time the flying pigs take flight.

Same with two of my kids. Waited for a correction and life caught up with them. Probably paid too much, but they financed their purchases with a private loan from us at AFR (3.6 and 4.1%). Both in very nice neighborhoods.

Need more of this. The less money just sloshing around on thr sidelines, looking for a pit to get chucked into to, the better.

I have noticed more than half of the listings marked pending on Zillow in my town are listed with “accepted offer with contingencies”. Is the average amount of time that homes are spending in contract tracked?

It seems 2 years ago no one would accept a contingent offer. Now lots of sellers are

DM: California loses TWO MORE home insurers in growing crisis – as shock new report shows half of residents have seen coverage dropped or premiums jump

Thousands more Californians will lose their home insurance this year as two more insurers flee the state. They are the latest of a line of insurers to leave – many blaming climate disasters.

“richer social connections…”

Doubtful. American communities are increasingly atomized; there’s a loneliness epidemic and our score on the happiness index is in the toilet.

I’m with you on the trees, though. A nice bit of visual respite through the window when taking a breather from your ass-grinding WFH gig.

A quick math check for the new home sellers. Assuming a $400k mortgage, 30 year fixed, 7% rate, the monthly P&I payment would be $2,661. Buying the rate down to 6% would result in a monthly P&I payment of $2,398, a savings of $263 per month or roughly 10%. Now, take the lower monthly payment of $2,398 over 30 years and use the original 7% rate, this would amount to a loan value of roughly $360k compared to the $400k mortgage balance with no rate buy down, and the resulting discount is $40k or roughly 10%.

On paper, the home builder appears to be accepting a 10% discount from the asking price to close the deal. I’m not saying all home builders absorb this type of discount as they probably have different hedges, derivatives, etc. established to help manage this discount and absorb the rate buy down in their financial statements, but it does provide some insight as to the price flexibility and wiggle room they have to continue to sell new homes.

Between rate buy downs, home floor plan/foot print reductions (to smaller square feet), adjustments to home’s features (e.g., different/cheaper appliances), warranty plans, etc., new home builders have tools in their arsenal to continue to sell homes. For existing home sellers, well either drop the price or get stuck holding the property. If the calculation above represents any gauge at all, existing home sellers really need to think about 10 to 15% price discounts to remain competitive and begin to move their products.

Assuming the FED doesn’t rescue existing home sellers with a significant rate cut (unlikely), existing home sellers need to wake up and smell the coffee, or remain delusional in hopes of a significant rate cut(s). Of course if the FED did have to move quickly and cut rates significantly, this would indicate another economic crisis is upon us, which would mean that demand for homes should be depressed (as unemployment rates would most likely be much higher).

So pick your poison existing home sellers as you can either discount your price to move the property or wait for rates to drop to 4+/-%, but with reduced demand. Maybe abiding by the simple rule should be more than enough. That is, “those that sell first sell best”.

TT, You forgot another option, which a lot of non-home sellers like me are choosing. Stay put and don’t sell.

Right now, there’s no monetary benefit to upsizing or downsizing or swapping one neighborhood for another. I can afford to wait, and that’s exactly what I’ll do. I love my house and my neighborhood.

I bought new in 2014 in Colorado. $2500 sq. Ft. Real hardwood floor and lots of upgrades, 3 car garage. Besides the 2.65 mortgage rate, the new construction is smaller square footage foot print and a bunch of synthetic vinyl flooring, which matted grey and black seems to be popular or cheaper. Getting a ranch home with finished walkout basement and decent lot runs almost 1 million dollars now. Thanks too California and Texas residents who keep moving here fanning the flames of wealth and exuberance. At this rate we will get a new Broncos Stadium out by airport.

(Ahem) In this Bravest & Newest of all possible Worlds, lettuce please not be remiss in always prepending any references to vinyl flooring with superlatives such as luxury or gorgeous.

bul – contemporary vinyl recordings, though?

may we all find a better day.

In my town of near 25,000 people in southern NH, any given week only has a handful of existing homes for sale, most of which are selling in less than a week at price ranges in the 550-900k range. New construction is few and far between and generally in the 1-2.5 mil range. Diametrically opposed to some of the graphs and charts in this article. If you’re looking for a glut of inventory and a buyers market in the Greater Boston area, stay the hell out of the housing market.

I’ve been speculating that the lack of new builds (and entire subdivisions like those out west) are the reason why mass/nh housing prices have remained stubbornly high. There’s just nowhere to build.

P.s. I think I live on the opposite side of the Merrimack from you… have you seen all those mansions going up on the southwest side of town over by 111A?

Your speculation is correct – most buildable land around here has either already been built on or is conservation land. Just look at Hollis where the entire western border with Brookline is owned by Beaver Brook.

Mansions by 111A don’t surprise me – really blows my mind how much big money is moving north from Massachusetts. Not sure the NH economy alone could support all these 1-2+ mil homes. Limited available land and plentiful jobs will keep things humming until a real contraction in the economy occurs, IMO.

Yup 100%. Nashua is building a new middle school in that area too. Seems this migration north is a trend.

Hey at least they’re actually moving here, instead of just coming up to shop tax-free LOL

Checked the report for Midwest #’s.

Matches what we have experienced.

Mild winter, spring rush came in mid feb – mid march.

April has been slower….expected.

For at least the past 6 yrs I could send a job out for bids to

5-6 plumbing shops…hoping to get bids from 1 or 2 of them.

Now I will have 3-4 bids coming back.

Now if I could just get caught up.

If I was in the market I would go with new. I have an older family home and a new one I live in. Neither is or will be for sale, but the new home costs much less to keep up.

My only regret is I should have built much smaller. To hell with a big yard and a great view! Too much work and I almost never sit and stare at the gd river.

I stare out at the river all day long from my rental…

Wolf, this is great information.

We live in North Georgia. We waited to buy/build for a few years from the summer of 2020. We have been in a townhouse waiting.

Everything on the market is overpriced and/or old. We decided we weren’t going to fund someone’s pipe dream and would build. We went to see some of the large builders and their homes were just getting smaller vs. what they had built a few months earlier.

We overpaid and bought our land in January 2023 We finally started building last July. We finish in May. We have overpaid the entire process.

Will we get out of the home what we have paid? I don’t know. But, I believe I have the home I want, where I want to live. if I lose money when I sell the home I will chalk it up to be just like renting for the time I live here.

Joe,cool,you will have the home/land you want.

I agree like most places NC over priced,but for me,looking for a lot of land with small home/may head into hills of WV for that.

I am a carpenter/licensed in a lot of states but personally refuse to build to new codes,way over board on safety/energy ect.,found a good place with unincorporated township(no inspections) would consider.

Best of luck with your new home.

The problem with lower cost new build houses vs. now more expensive used houses is location. In most of the big metro areas the new builds are on the fringes and there’s a cost to that. Either a $3000 monthly payment and 30 minutes a day commuting, or a $2200 payment and 120 minutes a day in the car. This only works if your job and the kid’s schools are also right there on the edge.

@ Ol’ B: I have always thought that good public transportation has been continuously thwarted by the real estate and auto industries.

For example, on a good day, a drive from San Jose to Gilroy would take 30 minutes but try doing that on a weekday on 101. A good metro transit system would whisk people faster to Gilroy and beyond where people can actually purchase more affordable homes and commute easily to anywhere in the Bay Area.

But no! We can’t do sensible things because a few have to become ultra rich and everyone else has to suffer.

Unless we get good public transportation in all the major cities, most of the citizens are doomed to pay through the nose for housing and suffer their commutes. No wonder people are clamoring for WFH and remote work.

In my area, public transit consistently thwarts itself.

When I lived in the city, I took the bus & train at first, but quickly grew frustrated with the lack of reliability. I ended up investing in a little 50cc bike, which cut my commute down from an hour to 20 minutes.

I really like the idea of a train or bus ride home, but not when it takes 3x as long as driving.

Came across something interesting. My school district in Seattle is forecasting enrollment declines in the future. Many young families cannot afford housing here, and that means the population will be aging, all else equal. In 10 or 15 years it might have a noticeably different demographic. Same for other coastal cities, probably.

Also, the astronomical home prices will put employers like Microsoft, Facebook, Google, and Amazon in a pickle. They’ll have to increase salaries to cover the home costs or operate with a big hiring constraint.

This issue just popped up the last few years and will magnify if home price increases cease.

One of the problems with many of these new homes is they are really awful looking and of poor quality. Builders can cut prices, but most of the existing homes are much nicer and better quality.

Lots of existing houses are utter dumps. Some are tear-downs. Lots of them are ugly as hell. But there are some charming ones too. It all depends. Same with new houses.

True. But I still think most of the ugly homes are the newer ones- unless someone wants to pay an arm and a leg to get something with good architectural quality. Most of the new communities I see are McMansion Hell at its finest. There is (or at least used to be) a website devoted to how ugly many of these newer homes are. An architect runs the site.

It appears that new construction has fallen back down towards the “longer term” trend of the housing recovery.

At this point, prices will: Go up, down or sideways!

It seems like a drastic downtrend is unlikely, based on current supply/ demand dynamics. This changes when used home prices begin racing to the bottom.

The 2017-18 period shows a sideways grind, that may have been new homes priced a bit hot, and used homes were catching up.

The huge volatility induced by pandemic era distortions seems likely to over correct a bit more (down)… but the dynamic nature of home building seems likely to adapt to the “new market.”

I don’t know many young people who aspire to have a 1/4 acre+ of grass to mow. The big house/ big yard trend used to be a national pastime. Now it seems isolated to the wealthy, who will pay for the maintenance to be done by others.

I wouldn’t wait for an outright housing crash, but deals on used homes may start to appear as time grinds on.