Price reductions of existing homes jump to 31.7% of active listings, highest since 2017.

By Wolf Richter for WOLF STREET.

Sales of existing homes always jump from February to March. And closed sales rose this March as well but not nearly as much as they normally rise in March, and year-over-year they were down again, and month-to-month on a seasonally adjusted basis, sales also fell.

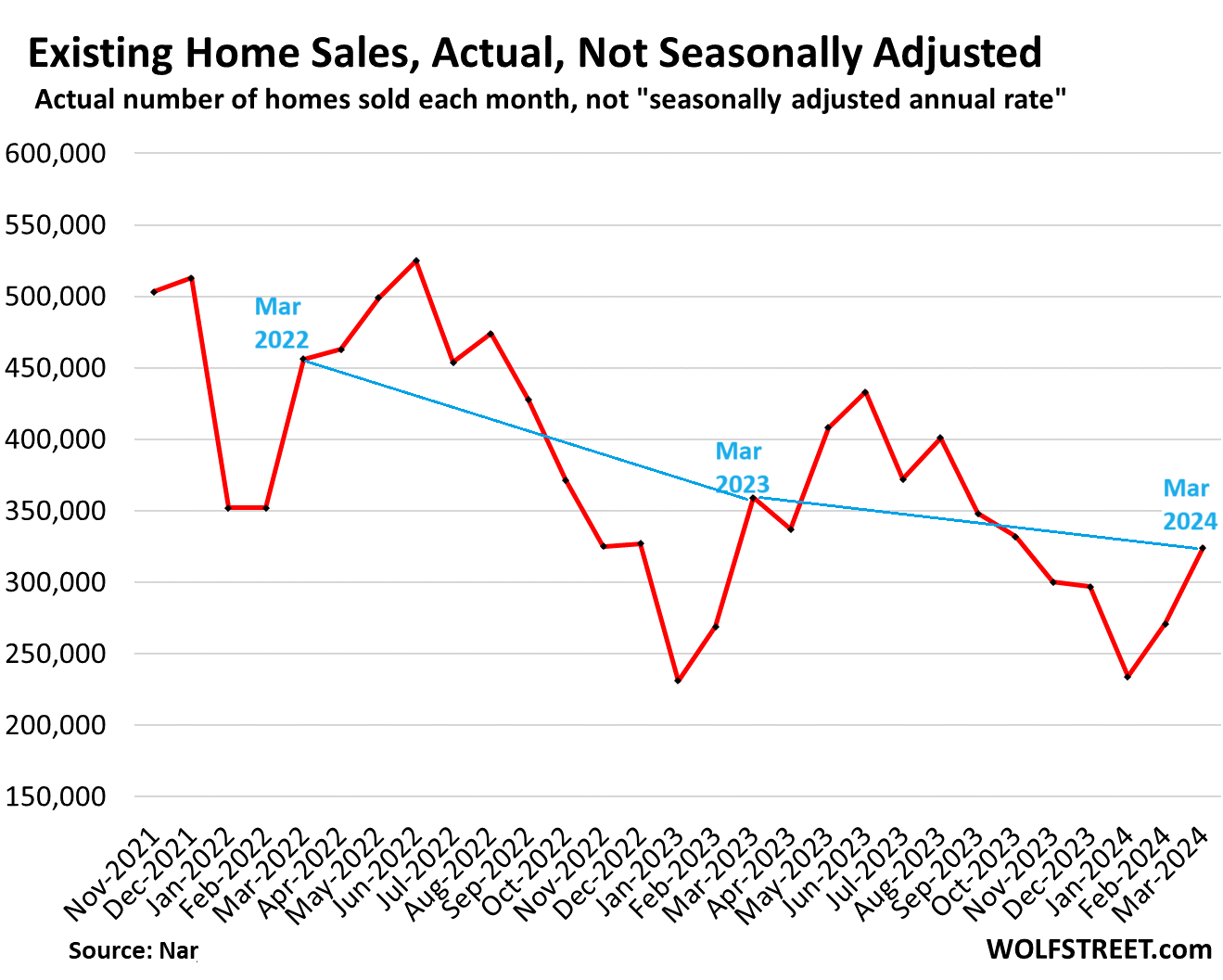

Actual sales, not seasonally adjusted, rose to 324,000 homes in March, according to data from the National Association of Realtors (NAR) today. This was down by 9.7% from March 2023 and by 28.9% from March 2022:

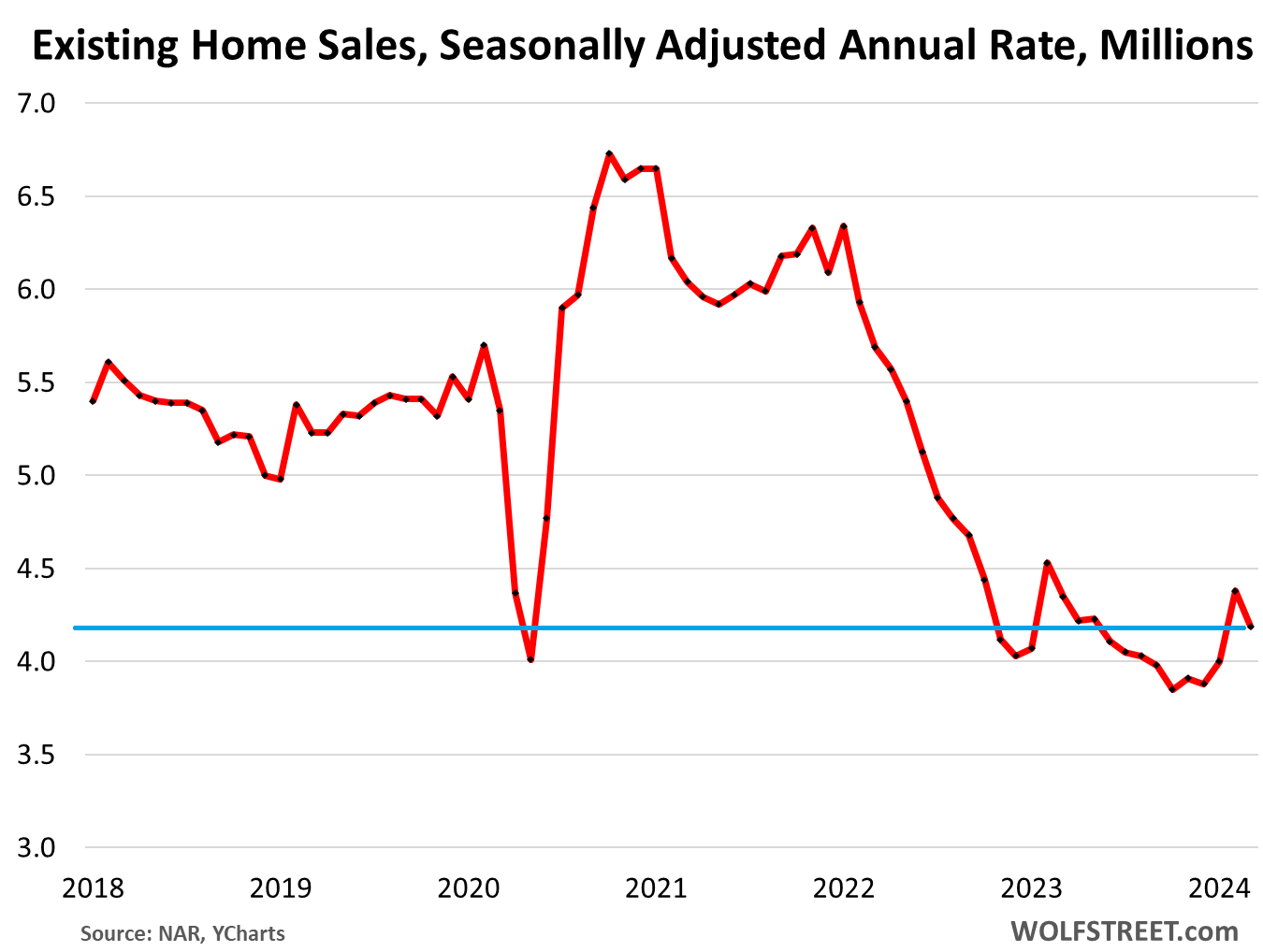

The seasonally adjusted annual rate of sales fell by 4.3% in March from February, to an annual rate of 4.19 million sales.

Down from March in prior years (from the prepandemic Marches in bold):

- March 2023: -3.7%

- March 2022: -26.4%

- March 2021: -30.6%

- March 2019: -19.9%

- March 2018: -24.0%.

Home sales remain at crushed levels as the entire housing market has shrunk by about 20% because homeowners with 3% mortgages are neither buying nor selling, and have vanished as demand, and have vanished in equal number as supply, and due to them, sales are down and supply is down in equal measure, and so churn is down. Realtors are fretting about the drop in market volume because they make commissions off the churn. And for Realtors, this situation is really bad.

The seasonally adjusted annual rate of sales in October, November, and December last year had been the lowest since the worst months of the Housing Bust in 2010: (historic data via YCharts):

Active listings rose to the highest level since before the pandemic, to 695,000 active listings in March, according to data from Realtor.com. Compared to March in prior years:

- March 2023: +23.5% (green)

- March 2022: +96.3% (black)

- March 2021: +57.7% (yellow)

- March 2019: -37.7% (purple)

- March 2018: -34.9% (brown)

New listings rose by 16.6% from the prior month and by 15.6% from a year ago, and were down 17.2% from March 2019, according to data from Realtor.com.

But since sales have dropped off even more (-19.9% since March 2019, see above) than new listings, active listings continued to build. This growth in new listings and the sharp drop in demand is what is fueling the continued growth in active listings.

Remember, this entire market – demand and supply – has shrunk by about 20% as the 3% mortgage holders have left the market both as buyers and as sellers in equal number (data via Realtor.com):

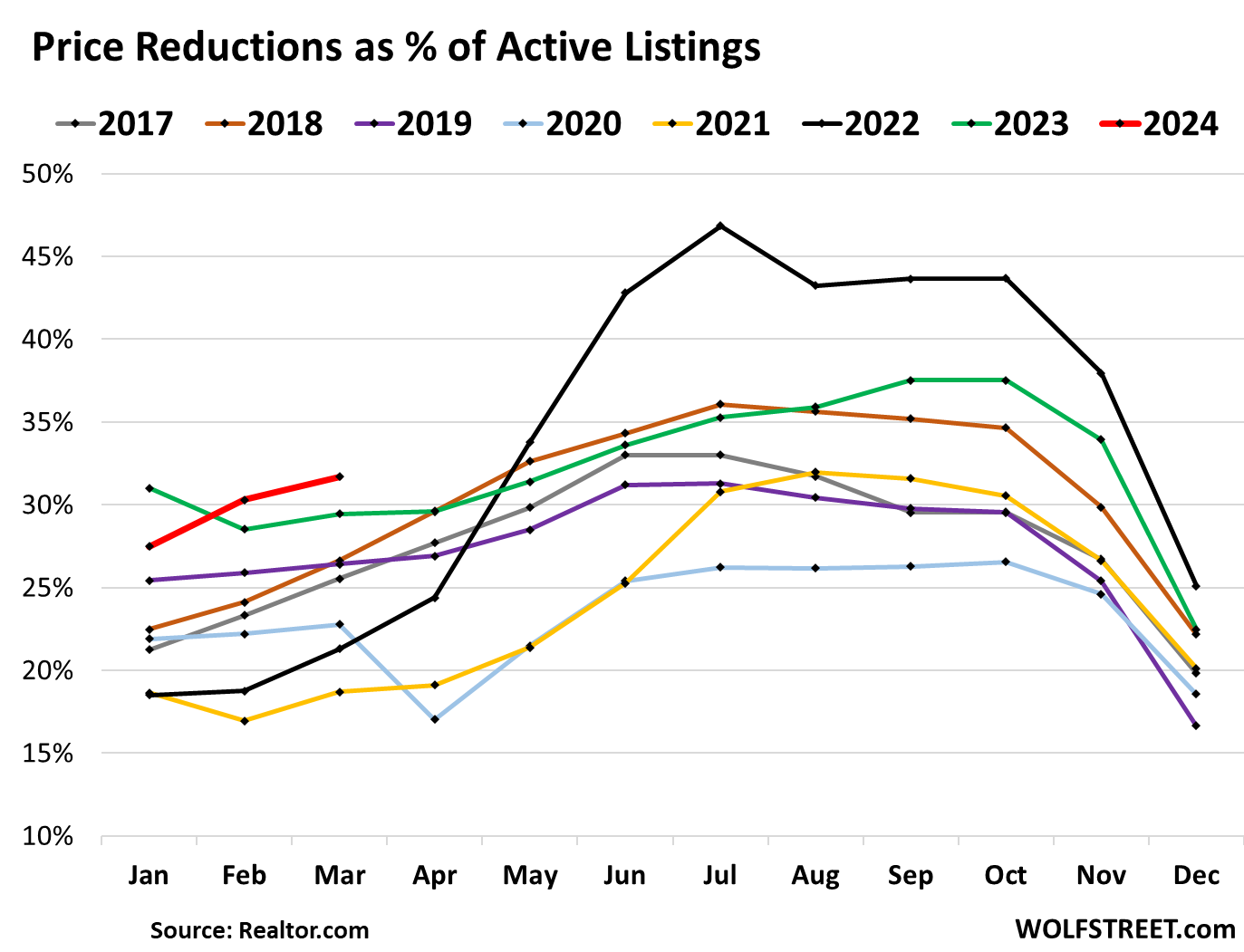

Price reductions jumped to 31.7% of active listings, the highest for any March in the data released by Realtor.com going back through 2017. It indicates that sellers are grappling with reality and are trying to make deals:

The commercial real estate (CRE) market has started figuring this out two years ago, and massive repricing is underway across the board. But with homeowners, it’s a much slower process apparently.

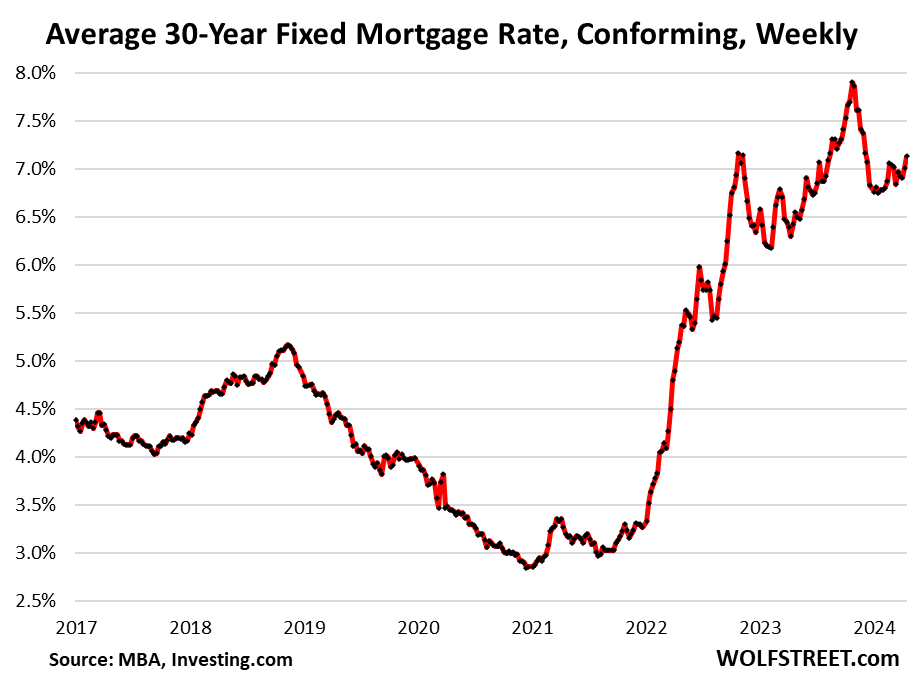

Clearly, many sellers are still trying to cling to prices that are too high, and buyers are not biting with the same gusto of two years ago. Now, mortgage rates have gone back to what were historically-speaking — before the money-printing era commenced in 2008 — normal-ish rates of around 7%. And that brief Rate-Cut Mania dip in mortgage rates is reversing:

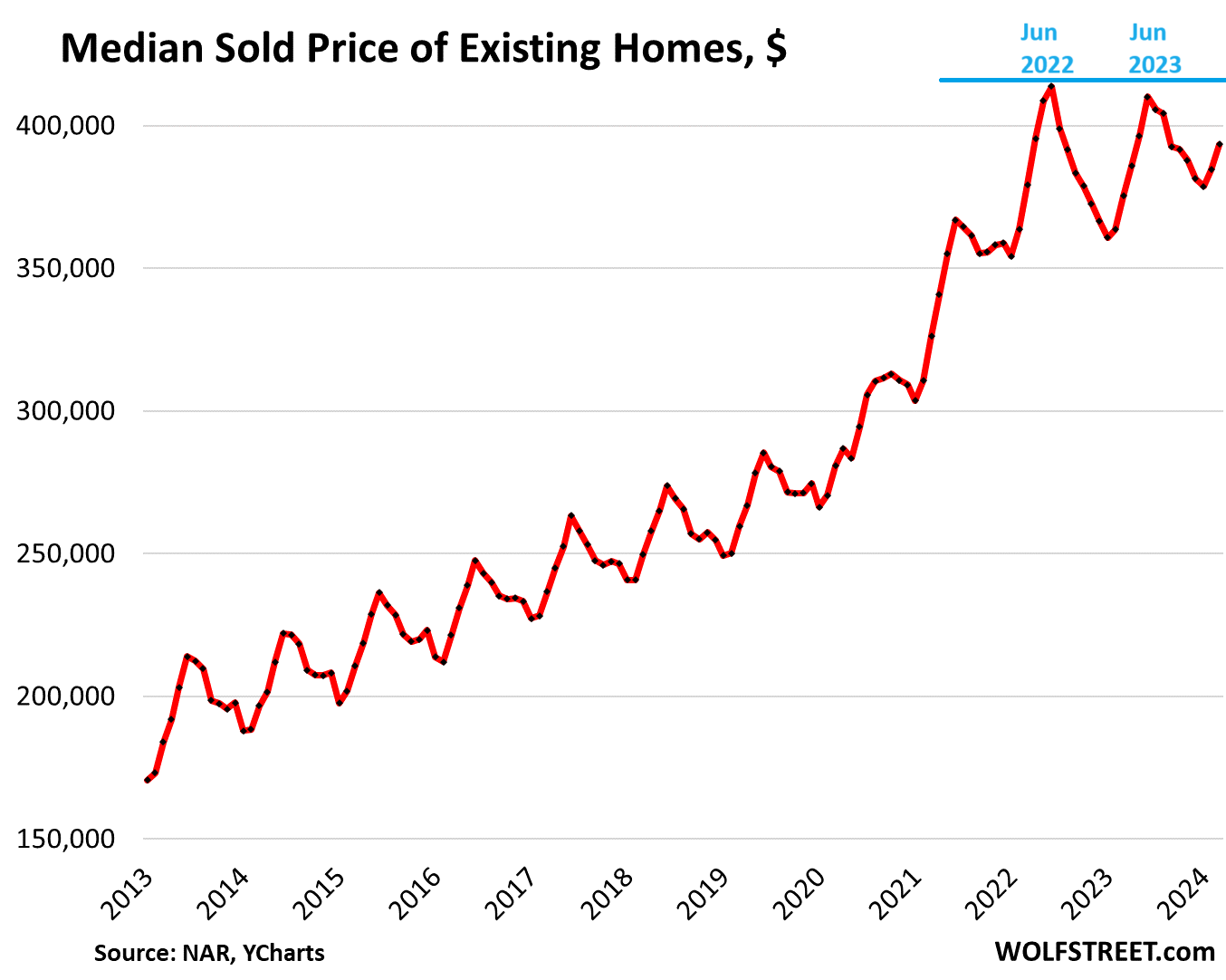

The national median sold price in March rose to $393,500. The very seasonal median price nearly always increases strongly in March from February. But this March, the month-to-month increase of 2.3% was the smallest increase for any March going back to the Housing Bust. The average month-to-month increase in March from 2012 through 2023 was 4.2%.

This much smaller than normal increase in March caused the year-over-year increase to get whittled down to 4.8% in March, from 5.7% in February.

From the peak in June 2022, the national median price was down 4.9%

The year 2023 was the first year since the Housing Bust when the seasonal high in June was lower than the seasonal high and all-time high a year earlier (historic data via YCharts):

Supply jumped to 3.2 months, the highest for any March since March 2020 (3.3 months).

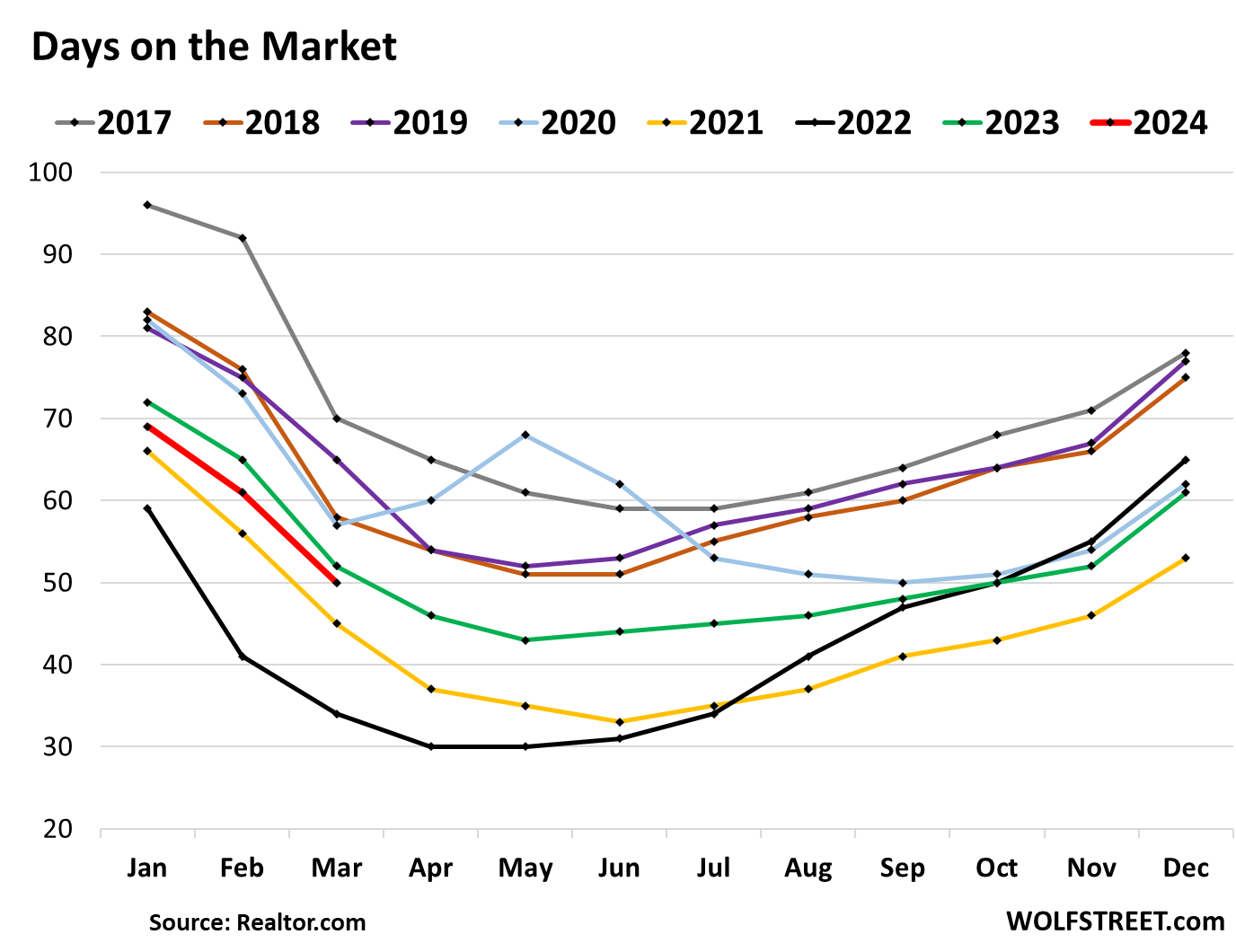

Days on the market – until the home is either sold or pulled off the market – followed seasonal patterns and declined to 50 days in March, down 2 days from March 2023 (52 days) and up from March 2022 (45 days) and from March 2021 (34 days). This metric is a function of both, how quickly a home sells, and how quickly it gets pulled off the market without selling.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks WR for this news.

Good to see this moving in the right direct.

The home prices are absurdly high.

It needs to come down drastically or rates need to come down drastically.

My realtors logic is.. best time to buy as rates are high.. when rates go down.. there would be bidding war.

Even mainstays media like cnbc is saying higher mortgage rates ahead now..

1. The reduced number of sales is causing a lot of unqualified real estate agents to leave the business – good news for the true professional real estate agents.

2. Article I read today stated 29% of sellers REALLY need to sell due to job moves, divorce, downsizing, upsizing etc. This coincides with your 32% price reductions. Most properties are overpriced and only the very best, or those in markets with extremely constrained inventory, like Miami, will sell close to asking price.

3. 50 days on market to sell and 3 .2 months inventory is still considered a sellers market.

4. New home starts and construction have dropped dramatically due to shrinking margins and higher costs. Soon new home sales will too. This will push more buyers to existing homes.

5. In spite of all the above, prices will eventually fall victim to higher mortgage rates, which will continue to climb, regardless of what happens to fed funds rates. Let’s not forget skyrocketing insurance rates, utility and maintenance costs and RE taxes.

Mortgage rates follow bond prices anyway, not fed funds. Incidentally, I think we will see higher fed funds before we see lower. Been saying this for a while.

I’m just looking to raise bit cash so as to buy 2 homes from price of 1 I sold

if not maybe I have to do the ole – owner carry at 8% or 9% interest only

if I get it back I make more

in mean time I’m making more than rent and they pay insurance/taxes and maintenance

Last night I dreamed so many people were sleeping in cars that homeowners were paying us to sleep in front of their house, that way they at least knew who was taking up the spaces.

I’m available in King County in anyone needs a friendly. I’ll also help watch for packages for you. 1999 Corolla that still runs, not much damage, and no pets or stuff outside my car.

Some people I knew used to live in Brooklyn.

There was a homeless guy who lived in front of their house.

They called him “the Night Watchman”.

When sellers can no longer stand the

increases in insurance and taxes, the

price reductions will pick up. Hopefully

sellers can rent something cheaper.

Great article as always! Do you have the month of supply chart by chance?

Are there any national average data for property taxes and insurance? Would be interesting data to see. Based on the complaints on U-Tube and such, both spiked (as have most everything else) in the last few years. My homeowners renewal just came in +$400, albeit taxes went down $1K due to a tax cut in TX.

Oh taxes went down? Must be getting less expensive to maintain things in Texas.

avg insurance went up 30-40% this year

taxes – well here in AZ they are ‘low’ compared to TX

$300,000 home is $2k+- in property taxes

Numbers don’t lie…

Bidding wars nonsense fired back up this past month here in Houston. We’ve been outbid 3 times at asking. I think we’re stepping out of this insanity until it burns itself out.

YOU are the problem. YOU are still bidding. YOU’re driving prices higher. You cannot complain about prices being too high while you drive them even higher.

Why do YOU complain when others do the same and bid against you???? You’re NOT entitled to a no-bid home purchase at the price you want.

Either buy and overpay, or stop bidding. But as long as you bid, you have no right to complain about high prices, because YOU are driving them higher. Multiply yourself by 10,000, and you see the impact.

There is lots of supply in the Houston metro. Sales are below where they were, prices are down from the peak in 2022… but they’re still way too high. You people need to stop bidding, and prices will come down.

LIghten up, Francis. Why bid on a house? Because the wife says to bid on the house!

“Either buy and overpay, or stop bidding,” is what I said in my comment just above. There are only two choices, A or B.

So in that case, blacken the oval next to A: “buy and overpay.”

My main message was: quit complaining about high prices while bidding to drive prices even higher. If you’re one of the bidders, high prices are YOUR fault, and that’s fine, but quit complaining about it.

Do not blame your wife for your personal actions.

If you placed the bid then you are directly causing “the insanity”.

If you conjointly placed the bid then you are both guilty together.

Why do some men hide behind their wives for their actions.

Haha you’ve all gotta calm down. As much as we would all love to be the change we wish to see here, not everyone can live in a van for the greater good! But it is true, it’s not until bidding up prices is truly no longer an affordable option for ppl, that things will stabilize. At that point the hand will be forced. Until then I will continue to complain AND try to find a place to live, simultaneously. I hope to see interest rates force the hand but it sure is taking some time.

if buyers don’t want to pay

I’ll rent it out instead

no big deal

my mortgage is as usual = $0

don’t care wolf

no INVENTORY right now

few deals with so much cash sloshing around

flippers in full swing yet – when they sit on chair then I know fat lady has sung her last breath

Great answer.

People don’t really understand these simple things.

Don’t know about Houston but in so cal ..when you do rent vs buy calcution.. renting come up way way ahead.. it’s a no brainer.

Thank WR.

And you can always put the money into the stock market to keep up with the gains that would have otherwise gone to the house.

“And you can always put the money into the stock market to keep up with the *gains* that would have otherwise gone to the house.”

Right… there’s no bubble there.

No, you’re right, but it’s easier said than done. We just bid at asking, then get outbid by multiple folks who want to pay above. If our living situation weren’t so difficult at the moment I would have an easier time convincing my wife to step away.

If it were up to me I would have given up on this months ago. I understand the why, she doesn’t.

I think she may be getting there, though. The frustration is jacking with her now as much as it is me.

We’re in the same boat @djreef. Mom is coming aboard with significant downpayment to add to ours (both are 6 figures) and doing an offer at asking gets laughed at. Moms co-op sold in one day at asking price, has to be out by July 1st.

We looked at places for her to rent to possibly buy us some time on a home but the rents got jacked up to almost 3k for renting a floor of a house, or a one bedroom apt. Studios are 2k plus. She’s retired and doesn’t want to burn through her retirement savings in rent while she waits for us (or the market) to have a heavy correction in our favor.

Let the truth be said, people just don’t get it. Same applies to food or anything..

Food is not an asset. Real estate is like stocks, it’s an asset.

Exactly. Whrn sellers float a price that is 20% above what they themselves think id reasonable, and 10 people show up to pay that price or more, it just emboldens sellers to push limits further. Indiscriminate buyers do *no one* any favors. As long as prices are unreasonable, sit things out. What, exactly, is the rush?

I am not going to stop buying food to do my part to reduce the price. That seems like a deadly approach.

I have to say real estate is booming in North and South Carolina also, tons of cash buyers out there. Want to buy a house in the Carolinas? Bid over asking or lose out. Also bid fast because you won’t get another look. Mortgage? Who needs one? Too much money chasing too little inventory. Got to love free markets!

Are you a realtor?

I am seeing this with my own eyes in Charlotte. Mainly at the 5-600k range. A friend of mine is desperate to overpay for a house so she can have a yard for her kids and has been outbid twice… above asking. It is what it is. Tons of 1.5m+ sitting though. The job market here doesn’t support Miami prices but they’re still asking for them lol.

I have been watching Western NC and SC markets for a decade. Lots of money coming from NY and the “half backs” from FL. Covid also brought transplants from high-cost California and Colorado. Agreed with bid fast and bid high on anything halfway decent under $400k. Interestingly seeing similar now in nicer flyover cities, expect to go over (20%) and bid fast on home less than $300k. Homes have >50% price increase since 2019-20 with no/limited improvements. If it is not an absolute Sh*tshack it is under contract within a week. The high-end may be coming down but that is about it. (no I am not a realtor, but an all cash potential buyer who has been sitting on the sidelines in many markets )

>real estate is booming in North and South Carolina

Not seeing it anymore in our Raleigh suburbs. We are in a slowly built new built community, and several move-in ready houses are already 150+ days on the market. However, nobody lowers prices, neither our builder, nor a few homeowners trying to sell after 1-2 years. It’s a wild ride to watch.

I’ve heard that more desirable communities in Cary, Morrisville and other popular locations near Raleigh are doing way better there, with some decent houses still sold way over asking. But it looks like the time of 500k+ crappy cookie-cutter houses in remote burbs is over for good here. Or so I hope, at least – too many cars with NJ, NY and PA plates around.

Around here, a lot of “lowball offers” are being accepted, so the tide is turning. The only question is how long it takes.

Man I can’t wait for that to come here. I’ll be happier than a pig in sh!t.

Prices up only 8.7% YoY here in NH, so things seem to be slowing down. Question is will the YoY trends slow down further before something breaks and the Fed is forced to QE again. Then prices will double or triple in the span of a few years and everyone will say “I wish I had bought in 2024 I got to stop waiting”. We are already 4 years past our last once in a lifetime event. They seem to happen every 8 to 10 years.

THIS ^^^

IF/WHEN my property sells I’ll be flush with cash

then I’ll go hunting

for off market property

I know how and have done so for past 20 years

I’ll get my 20%+++ return as usual

gotta keep up with BIDEN devaluation of fiat $dollar

Just got a call from realtor. We put in out first offer since buying our 2 BR starter home 7 years ago. It is a house 4 down from us.

We went in at ask. Some fools went 100K over. Oh well.

In a “bidding war,” the winner loses.

WOLF = In a “bidding war,” the winner loses.

actually I count on it when I go shopping as I don’t use MLS

but then again I use simple pay CASH plan

Yikes! I believe Djreef did in fact say that they were “stepping out of this insanity” effectively agreeing with you to stop bidding.

if you need house then maybe you should accept something less

or something that isn’t getting multiple bids

I sometimes get a little dyspeptic at the level of cognitive dissonance on display as well: you cannot grouse about the mania when you’re doing your bit to perpetuate the mania. This stuff will cool down if you stop throwing matches on.

I do get it, though. Renting sucks: Home Cheap-o finish-outs, shoddy repair work, five pounds of high-hiding white on all hinges & wall plates, moldering ducts. And supplementing some lame jockey’s passive income portfolio with the bruised fruits of your daily toil isn’t a very inspiring premise, either; but if it keeps you out of the casino and keeps your bank account growing, then consider it a necessary sacrifice. Live beneath your means for a season or two longer than you intended; defer gratification. Self-imposed austerity is quite effective!

True in general, but there are always some very good houses in very good places next to very good schools that will attract premium prices for these reasons. Many buyers with proper money will be competing for the rare chance to live in such desirable property and if you want, you have to pay, up to your limit. With inflation running hard the price you pay now will be meaningless in 5 years time.

He never said he bid them up. You put in a bid on a house and some “outbids” you doesn’t mean you were bidding up a house. DJreef could have put in a low bid for all we know and was “outbid”

Got an idea. Here in Dog Wood Lakes Florida I have a sawmill. Asked a builder to build me a house on a property with big trees on it. Said it would cost 80k only if I supplied all the wood. Seems wood costs are 1/3 to 1/2 cost of house. Can do. So get sawmill 5k, learn to use it, buy lot with trees and laugh at the rest of the idiot world. You are home free?

New homes (small tract homes) north of Houston in Conroe are selling like cold beer at an Astro’s home game.

Don’t say anything when you are walking inside the house. Some places are bugged with the stuffed animals nanny cams.

Weirdos out there. Also beware strange realtors.

Guess you just walk into their office and get a realtor and hope they don’t have mental problems, just my luck, I picked the crazy lady.

They often have hidden nanny cams as well.

I liked leaving remarks about the decor and such, and hoped they were heard. My agent, not so much.

The market continues to adjust to interest rates. Sellers have been overpricing their homes so they have to reduce prices; see how the median price is not getting clobbered. And, of course, sales and price change levels are different in each locality, town. Overpricing hurts sellers in two ways – buyers see the price, compare it to others and do not want to pay the premium for the high-priced home, then the seller waits and maybe has to reduce his price to sell. Just as buyers will not find the perfect house because it is them so too sellers will not get away with overpriced homes just because they “need” it.

Sellers aren’t over pricing anything. Try building a home – it’s even more expensive. The labor, the materials, everything is significantly more expensive compared to pre-pandemic. You’re mad at the wrong people. Be mad at the money printers, they’ve destroyed the value of your dollar.

During last crash.. my friend wanted to sell his home.

He started at 760k.. finally sold his home after 3 years at 470k.

Many offers he got which he rejected..

This is called classic chasing the down market .

It’s been said that people with $ have it bc they don’t give it away easily and spend wisely. Then why are some so willing to be taken by sellers who are so obviously ripping them off! Do your homework!

The FHFA conforming loan limit is ehat determines the pace of buying, end of story. Fannie snd Freddie buy 70% of all loans, and they are not able to buy at prices above the conforming loan limit. Roll back Conforming loan limits to 2019 levels, and suddenly, 50% of all buyers would disappear at current home prices.

PS When Fannie and Freddie securitize those mortgages, they have implicit guarantees from the US government if anything goes south. Not true for other mortgages if the bottom of the housing market were to ever fall out. Without Fanny and Freddie backing, there aren’t enough buyers out there stupid enough to buy that volume of mortgages at current housing prices. The idea that “the markdt” would step in to buy lozns if GSEs were out of the picture, is just not true.

Know what happens if no one can get a loan for something?

the price goes down until they can.

Risk free loans are one of the prime drivers for the endless price increases in housing and education.

Significant increase in Price Reductions as % of Active Listings in 2022 coincidentally when the stock market started dumping.

Time to get HELOC or refinance to access the cash the buyers aren’t willing to pay. After all Jerome Powell just made everyone in California a millionaire.

If there was a housing futures market, you could sell short end of June.

Things that Realtors avoid:

Garlic

Sunlight

Crucifix

WolfStreet

(just kidding)

Lots of Realtors read this site.

Old X Realtors also read your articles…….

Still way off 2019 inventory levels. That would be the last time we had somewhat of a normal housing market (but with much lower rates back then). It’s still amazing to me that there is ANY home sales market at all with prices 40% higher than 2019 + rates far higher than 2019.

And there were plenty of people that thought home prices were stretched back in 2019. Prices in CA for example by 2019 had already been rising swiftly since 2012, and plenty of people thought it was already getting late in the housing cycle. And that was 5 yrs ago!

That was how I felt back in 2019. Didn’t pull the trigger because the prices seemed high the economy seemed shaky after the taper tantrum . Little did I know what was around the corner. Now it feels eerily similar.

“Still way off 2019 inventory levels.”

20% of the market has vanished = 20% of demand has vanished and 20% of supply has vanished because the 3% mortgage-holders have left as buyers and as sellers. They’re happy where they are, and they’re not changing. That’s why demand is so low.

RTGDFA

RTGDFA = Read The G*Damned Freaking Article?

https://wolfstreet.com/rtgdfa-coined-by-wolf-street-in-feb-2022-mix-of-humor-exasperation-with-commenters-who-clearly-didnt-read-the-article/

Here in W. Hawaii it is a bit different. The high end buyers we attract could give a rip about rates. They see it, they like it, they buy it. Last Q mortgage report showed all cash buyers are 60%+ of the market and that is the high end of course. $2,000,000 and up to maybe $45m. I was talking about it with one of my agent’s clients that just paid 2.5m cash for a nice home. I said, “Yeah, the buyers just make a cash offer, verify funds with a screenshot from Schwab and close in 30 days. They figure their IRA is all just funny money at this point so take a knife out, scrape some frosting off the cake and buy the dream Hawaii home. If the market crashes they still have the home and the kids and grand kids can come and go as needed.”

The couple started laughing and said: “That’s exactly what we did!”

You seem to feel the three percent mortgage holder is the problem. There is another state gains tax, federal gains tax, moving costs, and sales fees. I can not sell a big house in Maine and buy another smaller one. The smaller one, a trailer type, costs more then the big one after these fees.

Ran some numbers a few weeks ago. In our local market, it turned out starter homes were just about obtainable with the median household income after the run up when rates were low. But now you need a 90th percentile household income to get one.

The market has just about held up, I suspect surviving on the fumes of those so desperate to buy they’re taking their 90th percentile income and buying this starter home.

But that then brings me to rents…you can rent here at about 5% of property value. Home ownership costs close to 10% on the mortgaged part, and you’re even losing money on the part you pay with cash given carrying costs vs savings rates. It’s hard to be that desperate for a home you’ll pay that premium. Landlords have spiked the rents, but their prices have now risen so far and fast that they’re marketing a basic house at a price you need an 80th percentile income to qualify for. They’re getting some takers, because people have to live somewhere, and they’ve enjoyed increased demand from those who are refusing to buy. Brokers, as they always do, are applying the same blanket increases to every new property on the market because, you know, comps and inventory is now starting to sit as that surge in demand is now dissipating.

It’s all very interesting. Feels like it’s balanced on a knife edge right now. Just wish I wasn’t caught in the middle of it :-(

It can take a very long time for an illiquid asset market to correct. People often trade one overpriced asset for another overpriced asset and it looks like demand, but the people aren’t very sensitive to the price as long as they can basically trade across. Forced sellers usually make up a small portion of the market until credit contracts or their cash flow shrinks. It might take more unemployment to sink this ship.

This. The crash of 2008 took until end of 2011 to bottom. And that was a clear housing market crash, not just higher rates.

Not only that, but they slashed rates to nothing to try to stop the slide. We are still raising at this point.

In my Seattle neighborhood homes are renting for 2.5% of property value, not 5%. That tells me the market thinks home prices are going nowhere but up, OR the RE market is trading based on narratives and not financial analysis, OR people have so much income and wealth they just don’t give a shxx. I tend to believe the last explanation is weighing heavy.

When your stock portfolio is full of Microsoft, Amazon, Google, and/or Facebook, you’ve done very well. Thinking about potential downsides becomes a theoretical pursuit, particularly with inflation running hot for four years running and financial conditions looser than when Powell’s “tightening” campaign started. Then you have the Fed talking about reducing interest rates if inflation drops. Given the stalled progress on inflation, the overall message is – the Fed has your back; we’re going for that soft landing; the economy is strong; spend away. Inflation might remain elevated for a long, long time, but we’ll eventually get that soft landing, or no landing.

On another note, I’m not sure Seattle has a great future ahead of it in terms of family life and community. There’s tons of people moving in and out, furthering gentrification and stifling relationships. Even family members are finding it difficult or impossible to live in the same area.

Johnny the tech engineer is able to buy that home next door, but sister Janie must move to Des Moines IA to afford a decent home in a good school district. It’s been nice knowing you Janie!

The Fed’s past actions have distorted financial conditions so drastically, some relationships with family and friends are lost or in jeopardy, particularly on the coasts. Not everybody cares about that, but many people do. Gentrification has a price.

I agree with you. I see a lot of Seattle buyers coming down to Hawaii. Not a few say just what you are saying.

I like to think of this market like Wile-E-Coyote, suspended in air off a cliff, before he realizes it and begins to fall.

Someone I know listed her Ponce Inlet, Fl condo for $495k, fully and nicely furnished two months ago.

Nada.

Price cut today of $49k. (She bought it cash in 2020 for $265K.)

Right, so she was trying to nearly double her money in 4 years.

That’s playing out throughout Florida including in Palm Beach County where I am, and prices have started dropping (but are still way too high).

I wouldn’t buy anywhere in Florida. Home insurance, flood insurance, etc. are finally reflecting reality, and premiums are doubling (or worse) depending on where you live.

I wouldn’t buy anywhere in Florida now. When you pay cash you don’t need home insurance or flood insurance.

Just wait. There will be a race to the bottom.

Brilliant financial move…. pay cash for a property and then don’t insure it against loss. You do realize that, if you don’t repair it, the city/county can raze it and send you a bill? Someone comes on the property, stealing copper after the house is destroyed, injures themselves, and then sues you? A curious kid gets injured while “exploring” the uninhabitable property?

How about your painter falls off a ladder and injures himself? Or a drunk neighbor who comes over for a cocktail, falls off the porch, and sues you all the way back to your birthday suit?

People who go “naked” are really stupid…. if they can’t afford the insurance, they can’t afford the property nor the aftermath of storm damage and the liabilities resulting from that.

As it’s been said: all insurance is a waste of money until you need it.

High end sellers are still refusing to lower their price. They are fueled by an occasional sale near their price. The problem is most of the time the comp is superior in one way or another. In my market the upper end has 1 buyer for every 3 listings. Anything under $600,000 has 2 buyers for every listing. Todays market is in an unusual flat line. In a rising market sellers can wait and the market will come up to their price so they are patient and in a falling market it is a race to the bottom. I’ve had sellers tell me “if I can’t get my price I will rent it out”. I don’t think anyone has seen such a strange time for real-estate. Sales won’t jump until it is clear where the market is going, up or down.

I’m seeing that here in Florida as well. People who bought houses for $1 million in 2021 are now trying to get $2.1 for them. When they don’t sell, they list it for “rent” at $20,000/month. Obviously, no one is interested in that either, so the houses just sit.

I hope these people lose their shirts.

Average home prices ae up 60% in Florida over the past 4-5 years and prime waterfront properties are up 100% and sometimes more.

The luxury market is a very narrow segment of the total market and it’s been fueled by all cash buyers, many of them from out of state from much higher priced markets. Compared to the places they’re running away from – California, New York – the current Florida prices are cheap.

Yes, to a point, but these prices are now causing the houses to sit. Many people have to go back to their New York offices, so it’s not like it was years ago.

They may say they’ll rent it out, but my guess is that’s not always pheasible if they plan to purchase another house. Unless they have another down payment saved they’ll need to pull out some equity out at 7% in order to buy a new property. After pulling out the equity I question whether they’ll come anywhere close to breaking even at 7% since rents are significantly below mortgage payments at 7% on similar properties.

In many markets, the very high end of the market is seeing MASSIVE price cuts and stalled sales, as in a property being on the market for a year and nothing happens.

WSJ: Title: “Buyers Are Back in Control as Luxury Home Sellers Slash Prices”

Subtitle: “Asking prices for high-end properties are being reduced at the highest level since 2017”

Starts:

“In April 2023, tech entrepreneur Jon Hunter and his wife, Laurie Hunter, listed their European-style Phoenix home for $10.995 million, a high price even for their upscale Arcadia neighborhood. A year later, following only a few lowball offers, they are gearing up to cut the price to about $8.7 million.”

and further down:

“Stories such as the Hunters’ are playing across the country, as sellers in luxury housing markets that boomed during the pandemic are having to reckon with prices coming back to earth. Those markets that saw the greatest increases during that period are “on the leading edge of the correction,” as sellers cut their asking prices, said Hannah Jones, senior economic research analyst at Realtor.com.”

Behind paywall:

https://www.wsj.com/real-estate/luxury-homes-five-million-price-cuts-dc39d99c

West Hawaii

Average high end sale 97.44% to asking(homes and condos)

That right, who would want to lower their selling price, let’s raise it? Seems logical, price rises on everything under the sun and I’m going to lower my price!!.

Note, (Wolfs charts…price reductions on a lower- volume of active listings )

Good jobs numbers,

Economy hot

A nice house in a nice area… cash buyers will sniff it out and pay bigly.

The force is strong with this one.

The force is strong with it for sure but thr numbers does not add up and although economy is strong home sales volume are down bigly for a reason

Just think what would happen if a recession comes..

I wonder what will happen with the Fed and MBS

Howdy. Good news on Used Homes. Watch the Lone Wolf charts on New Residential Construction and Multi Family. Should be just fine and going up…..

2008 style crash and nothing less. Have had it with the last four years’ B S.

1.35 mil s h i t shack in So. Snotsdale. Built in 1970, (2150 sqft only) nothing burger on the inside and downright ugly on the outside. No, it isn’t selling, they put it up for rent, but sellers need a huge wake-up call, a serious reset.

We are currently shopping in a midwest metro area, where prices are more reasonable than CA/TX/FL. Prices have been coming down a little, but our struggle is the tight market with only a ~35 day supply on the market here instead of the 100 day national supply average that Wolf mentioned.

Finding a house my wife likes with tight supply has not been easy. I would say that our current experience house shopping tracks the article pretty well.

We’re more likely to have a late 1980’s – early 1990’s style stagnant market that’s flat to slightly down in nominal prices, but much lower in real terms after you factor in inflation. Home prices are losing 5%+ plus to inflation every year.

I recently worked with a young couple who can easily afford anything in this area.

They wanted something smaller due to climate and all that. They are doing in their 20’s what I want to do in my 70’s.

Smaller, less of everything, home is not what it used to be.

Real Estate is all local, but you cannot avoid trends and the endless costs and regulations flooding our way.

I think many older people also don’t understand what an objectively rubbish investment housing is once you strip away the crazy gains they made through the 90/00s. There is no portfolio diversity (your equity is tied up in a single asset in a single asset class), you have to take on an outrageous amount of debt, and to top it all off, the asset is trying to destroy itself, requiring you to spend countless weekends fixing things up.

You’re also now chained to a location which means you can’t pursue new life/job opportunities as easily.

Many people I know with no kids and high incomes would rather rent and dump their money into ETFs. Here in the UK though, there is an effect where once your income reaches a high enough level, it makes sense to buy so that you can benefit from tax free imputed rent.

“Many people I know with no kids and high incomes would rather rent and dump their money into ETFs”

The no kids part of this equation is significant, rational or not (for those with kids)

Rubbish investment housing is once you strip away the gains thru the 90/00s?

It’s also the opposite if you include those gains.

“The asset is trying to destroy itself”

As you put it, we are all trying to destroy ourselves, by living.

The house becons, resistance if futile, you will be assimilated.

An add on. Stopped at my lumber yard just yesterday to buy some materials for a new project. Had a BS with the manager (also a friend) who told me he just sold off his bigger home in town for a 950 sq ft home, just 11 years old, on one acre…. a 10-15 minute further drive to work. He is extremely well paid and can afford pretty much anything he wants. Sees the writing on the wall as his yard supplies almost all local contractors. His drivers told me last fall there was a bigger than normal seasonal slowdown in new construction.

Want to know what is really going on with RE in the short term? Don’t talk to realtors or contractors, talk to the suppliers, mixer truck drivers, and handlers.

Exactly!

Learned that while working in construction as a kid….

Correct me if I am wrong, but until bond returns crush home appreciation, nothing will change.

Ceteris paribus, of course.

That started happening over a year ago.

New homes down 20% from PEAK and builders buying down the rates. When the builders are done liquidating……the bottom falls out.

F–k it

Ere’body gets a house with FNMA and FREDDIE letting 50% DTI’s through the door

The FHFA Conforming Loan limit was frozen at $417K from the year 2006 to 2016, and homes became more and more affordable throughout that period. The Conforming Loan limit for Orange county California today is $1,149,825. Coincidentally, the median home price in Orange county is $1,104,580, and the first time home buyer affordability index for California says that 17% of first time buyers in the county can afford to buy a home. (source: California Association of Realtors, whose data is likely optimistic)

Wolf, some of the language is confusing

“Down from March in prior years (from the prepandemic Marches in bold):”

I think you are comparing yoy changes and not the current March against all other March’es.

Same with “Compared to March in prior years:”

As a side note, consider moving the “Leave a Reply” to the top of Comments so we don’t have to fish for it at the bottom.

Thank you for your insights.

1. “I think you are comparing yoy changes and not the current March against all other March’es.”

Wrong think. That list compares the current March sales rate (4.19 million) to the sales rates in the Marches of those prior years, as stated. For example, in March 2018, the sales rate was 5.51 million, and the current March sales rate of 4.19 million is down 24% from that, as the list says.

2. “…so we don’t have to fish for it at the bottom.”

I want you to go fish for it at the bottom so you have a chance to read at least some of the comments.

Hi Wolf. Do you see this trend persisting and having a meaningful impact on employment in 2024? or 2025 early? Thanks

It’s not going to have an impact on employment. But the other way around: if there is a big problem in the labor market with an additional 3 million people out of work, that will have a downward impact on the housing market. But that’s not an issue I’m seeing on the horizon just yet.

What may be having an impact is that the 3%-mortgage holders are reluctant to move to a new job if it requires selling the old house and buying a new house. So the labor market has gotten a little less flexible, and it may be that people have to be offered more money to make the move.

How much more money, I wonder? For somebody in the 1M+ markets (I’m guessing a lot of relocations are to and from these areas), they’re adding minimum 50K onto their mortgage and losing another 50K in transaction costs. Possibly substantially more. That’s going to be hard to overcome.

Any idea what proportion of the market is relocations?

Sellers are still exuberant and cocky as all hell right now, because of all their equity they see on Zillow. Sellers feel rich and invincible.

But if inventory continues to mount, sellers will see their equity shrinking. Can’t tolerate that, better sell and cash out now. What’s that? Everyone else has the same idea?” Kablammo.

While this is directionally sound, real estate is local. Don’t see this applying to hot markets like LA, where buyers are bidding. Don’t worry we are staying out and if we make offer it’s under list! But these trends are too broad without local context of a few key markets.

Hype propaganda. Volume in Southern California has collapsed by 40% from 2021 even now, even in LA and San Diego, though sales are up from the collapsed levels a year ago. But they’re still dismal.

And these are the prices, they’re flat to down from mid-2022:

https://wolfstreet.com/2024/03/26/the-most-splendid-housing-bubbles-in-america-march-2024-update-biggest-price-drops-from-2022-peak-san-francisco-seattle-portland-denver-phoenix-dallas-las-vegas/

I think the most splendid reports coming up in a week or so will be interesting and tend to agree with Dutch Broadenhouse that local markets can react differently from a national norm. Sales of SFR in socal are down, but pricing continues to amaze. February SFR sale prices in San Diego, in particular, will have folks on this site’s heads spinning. What’s happened in March will be a different story, though, with the massive winter rates of appreciation being much less, which will be in the May splendid reports. Multi family here in San Diego (condos and such) are beginning to take a hit as the market is becoming over saturated. Multi-family apartment builders are starting the condo conversion thing again, even well before the typical 10 years they leave stuff rentals to avoid defect litigation. Existing stock of SFR combined with very permissive new zoning laws in San Diego have driven parcel costs way above what they should be in a normal market, that with the usual suspect list of things driving San Diego house demand.

Everyone reading this article is quibbling over the likelihood of real estate prices rising or falling. Y’all need to read, “The Theory of the Leisure Class” by Thorstein Veblen, written in 1899. That’s where “conspicuous consumption” first appeared. He was an economist/sociologist. He understood the human condition.

If you want to know why we’re so f-ed up, why we have FOMO, why our wives want a better house than maybe is wise to purchase, why each one of us wants to blame someone other than ourselves – the Fed, Fanny Mae, Realtors, Beanie Babies, et al – read it.

We also see conspicuous consumption by people who don’t have two beans to rub together thanks to unrelenting advertising and a lack of personal regard and/or confusing values. Sometimes people do what they think they’re supposed to do without much thought.

I think the housing market is highly specific to location. Some places (i.e. Florida, California, and Texas) are seeing price reductions due to local issues (rising insurance and property tax costs). This could be disproportionately impacting the national average.

Some markets, like the Sunbelt and the Northeast, are still doing quite well.

Lets see if I got this right. The sunbelt is doing good, but the three largest states in the sunbelt ( Texas, Florida, California) are doing bad. Kind of like saying Tech stocks are doing good, except for Apple, Microsoft, Google and Invidia.

By Sunbelt, I mean TN, KY, NC, SC, GA, AL, etc

This is going to be interesting. It won’t fall as much as some people want it to, but it will fall a little most likely for a little while. M1 is tightening, but the federal government isn’t, eventually the 2 roles will have to swap. When the eventual happens, we’ll teeter between above average and high inflation, likely in excess of a decade. The debt will largely get monetized, social programs annual adjustments will grow less than 50% the rate of inflation, and all assets will be much higher than present. It’s ultimately the only way to get out from underneath the poor fiscal and corporate policies of those born from 1900-1970. It will be painful and miserable, but we’ll likely result in a net poorer world, and as a bright spot, ultimately younger generations breaking the self-destructive trend boomers started, meaning younger generations will begin having kids in excess of 2 per female again. It will be a depression such that everyone makes much more per year, but costs increase considerably faster.

Birth rates decline all over the world.

Why would you say “meaning younger generations will begin having kids in excess of 2 per female again”?

Families that can’t afford a house

can’t have mom stay all day with too many kids.

Pusillanimous Powell’s premature pivot punishes punters!

Film at eleven!

Did I miss somewhere in here what the average price drop compared to asking price is?

Asking prices have been flat to down year-over-year over the past two month. This is weekly data from Realtor.com:

Strangest spring market I have ever been a part of (been doing mortgages for 12 years now). My pipeline of pre-approved buyers is so much smaller than it normally would be, and it seems like half of the buyers who are pre-approved are contemplating just waiting. I know that a lot of people in my business want rates to drop, but I think that would just unleash more of the insanity we saw in 2020 and 2021. I can tell you that a lot of good loan officers–people who know their stuff, work hard for their clients, and care about trying to help people–are considering other lines of work.

Anyone savvy enough to save up for and buy something in this market, is probably savvy enough to realize waiting a couple years is the better play.

The savvy to save, qualify and pay just has to line up with the need.

If a family (in particular) needs a home, it is almost always the “right time to buy.” As the down payment is eroding, due to high rents and inflation, and the qualification is only temporary (job, lending conditions etc).

The problem is the financialization of everything. People want their fas and dinner to have ROI.

A primary house is shelter. If you lose less than renting: it’s working. If you come out ahead on appreciation, the added benefit will cushion “retirement.”

The world has been led astray!

The originator who wrote our loans and refis the last decade called it a day after 23 years in the biz. From the outsides looking in it looks as though unless an originator is linked to a top 10% realtor feeding them clients who can actually afford this market they’re not going to make a lot of money these days. I wish you success through this market.

Thank you Rick. I work for a credit union so while I make much less per money per loan, I have a steady client base of people who prefer to work with the institution that has their money. I like working for a credit union because I don’t typically have to kowtow to realtors and beg for referrals–I have agents who know that i do good work and that I am an honest straight shooter. I’m never going to be rich but that is ok, I like what I do and am pretty good at it. It’s just a strange situation to be in as an industry. will be interesting to see what happens next.

Be well and be safe.

In the northeast rent growth has exploded. By permits issued, CT, MA and RI are all in the bottom 6-7 in terms of new construction. Unless people suddenly don’t want to live in those 3 states, I would love some clarity on how families “stop the madness and stop bidding at these crazy prices”. Seriously, what are those families to do? Spend $3,000/month on rent while simultaneously having no assurance that they’ll be able to stay in that house and keep their kids in that school district with their friends? The financial system is a joke, but real estate brings in real life issues as well.

To avoid paying 3000$ in rent, accumulate a 6000$ mortgage? How sound is that? You can find references that in the current market, even with rent growth, renting is preferred as prices haven’t collapsed in line with increase of monthly payment.

I did some back of the napkin math a while back. Essentially the price drop I arrived at was extra interest being paid over 5 years at the the new rates. It’s almost as if people internalized, that their payments are higher _now_ but they are sure to be able to refinance close to the magical 3% rate in 5 years. I’m not saying this is exact math, but I do believe the housing market is where it’s at, because a lot of people are banking on refinancing.

Outside of those buying cash, who can afford a 6 – 8 thousand dollar mortgage payment!!! It’s not like the paychecks doubled overnight.

The current housing market is absolutely crazy. If you’ve cash to burn, go for it. But these payments are outrageous.

You have hit a good point. Many young people are moving away from the mega shack mania gripping the West. They are into social responsibility and experiance.

I now face the problem that my kids don’t want my home when I bunt. Too much home and too much land.

Even location, location, location will fade with remote work etc. It will take time, but even those best areas will fade except for old people like those over thirty.

Too much house can understand,but…..,too much land?

Never!

That said,I again want chickens/goats/gardens/a place to shoot and walk out back door to hunt,not annoy neighbors with these activities by having a bit if distance and….,they not annoying me with their activities,small home but lots of land ideal for me at least.

One of these days the current wave of immigration will cease ( Political or nowhere affordable to live, etc. ) Once that happens we will have to face up to the fact that here in the US and Canada we have a declining population, and that will have profound effects on things like housing. It is not unlikely we could shift to a housing market like Japan where home prices decline for decades.

Don’t forget that there are billions of people in this world looking for a decent job so as long as the US produces jobs, they will come here legally or otherwise.

If they are educated they can work remote and live anywhere. If not, they will not be able to buy our mega shacks in what was a good area.

This is not remotely true, pun intended. And frankly naive. A lot of jobs requiring high education, even multiple levels of it, cannot be performed remotely.

Not historically true. During most of the 50’s 60’s and 70’s the US produced boatloads of good jobs, yet immigration levels were very low compared to today. Ironically during that time period home prices were relatively flat increasing no more than the rate of inflation.

I am not making a case that one thing is better than another, but that countries can have low immigration rates if they choose to. Other Examples are Switzerland and Japan.

Ha! You’re in for a real long wait before either of those happen!

How long did remote work mania take?

Projecting those numbers would make a heck of an article wouldn’t it?

(Just be sure to include the increased death rates).

I see some other interesting headwinds regarding real estate and the dollar factories associated with it.

Climate change: Some coast areas currently have greater chance of flooding and more intense storms. This of course has affected the insurance industry. But I’m wondering about salt water intrusion into ground water supplies? Other than very expensive desalinization how bad could water supply become? Of course there are areas that also are affected by drought/fires and the financial impact of lose there.

A.I.s effect on jobs. Yes remote working is now more possible. But the percentage of job loss or ‘job reduction’ due to A.I. has the potential to be staggering.

Real Estate is regional. But the ripples can go far and wide.

Think about it! With AI, vitural tours, and online public information, who needs a Real Estate Agent?

Who even needs a nice coastal house. Move to some cheap flyover dump and don your VR which reveals your vast Mediterranean vistas. AI driven dehumidifiers and fans will replicate the cool sea breeze.

You need to get out more. If the world is our home, the oceans are our sewers. I would rather live uphill from the septic tank.

They could even have an AI driven robot at each home for sale. You could show up for a tour at any time of day or night presenting your loan qualifications and credit score to the robot at the front door via a QR code. If accepted you would be given a tour of the home by the robot who would also be happy to answer questions.

Then if you liked the house you could insert your prequalified loan credit card in to the slot on the front of the robot, the robot would connect to headquarters and the AI would arrange a mortgage in a few seconds and then the deed and loan documents would spit out of the slot on the front.

Unqualified buyers, potential squatters, or vandals would be identified by the robot and drones called in to neutralize the perps.

Once the transaction is concluded a Waymo Autonomous taxi would show up to take the “RealtorBot” to its next gig.

I wish I could see what homeownership looks like in a demographic sense.

I have been doing a local construction job recently and in and out of dozens of residential neighborhoods. It seems as though at least 50% of the homes are inhabited by cranky near-death old folks with brand new shiny cars in the driveway. The areas with smaller “starter” homes are the same way. Rarely ever do I see a school bus stopping in the morning and loading kids. No couples leaving for work in the morning.

Meanwhile the apartment buildings and duplex areas have 3-4 buses lined up at them and the parking areas turn into ghost towns.

Some of these neighborhoods have houses in decent shape sitting abandoned but not for sale. No cars ever come and go, lights stay off, no mail put in the mailbox, landscaping crews show up and clean up the yard and that’s about it.

It’ll be interesting to see how the interest rates and the passing of the boomer crowd will affect home prices.

I’ve just become resigned at this point.

Last time I checked 48 out of 50 states had NEGATIVE birth rates. So on par with your observation.

MW: Mortgage rates hit highest level since November, pushing monthly payment for a typical home close to $3,000

Yep. Follow the herd and the touts. Follow money and miss life. Sucker. I’ve had a half a dozen lives and I’m tired. But I have some travel planned and will keep truckin on til it’s over, Somehow I figure it’s a sin to just give up. More people to meet who need some help.

Being a good compassionate person is it’s own reward and will pay you back as much as you need while you are temporarily alive.

Actually I’m feeling better already, glad we had this talk.

I’ll be compassionate and always be aware of others in need.

That’s why were here, so we are alike.

Hawaii outer islands – fit the coasts complaints and what is in the GDFA above. At least the prices have flattened. And I see these stagnant seller listings from 2020 1 mil for 2 million now that used to be on market for a day or two. Affordability is crap. Earning 400k and having to sit on the sidelines puzzles me… but rent is less than 50% cost of owning and has less risk. Wolfs sensible articles and my fear of being 1.7 million in debt helped me sit out two years ago … and I am still sitting out. But hoy shoots brah! I think I might have to wait awhile. Life is good though. Definitely am not hungry or looking for work.

At 3% for every 100,000$ of mortgage over 30 years, a person pays ~25,000$ in payments over 5 years (principal + interest only) and out of that 44% goes towards principal reduction.

At 7% for every 100,000$ of mortgage over 30 years, a person pays ~40,000$ in payments over 5 years (principal + interest only) and out of that only 14% goes towards principal reduction!!!!!!

One minor recession can spiral out of control for people with crazy payments.

Your chances of having equity is higher with a mortgage at 3% even with having bought at the 2022 peak if you can hold on and keep making that payment. That payment is also closer or lower than the current rent.

I’ve zero equity in my house having bought at 2022 peak but locked in <3% rate with 20% down. I don't care, because the downpayment was financed by the sale of another property. (:

Guess, who is holding the bag? The bank. It was a portfolio loan. Everyday is like taking money from the bank.. Unless the house goes down by 60%.. Which can happen. ¯\_(ツ)_/¯

So folks,would like to buy property and as do not care about near metro areas/looking for a minimum of 30 acres(more is fine)and am sitting on too much cash(no,don’t need help spending it!)wait or bite the bullet and at least have property in hand before dollar keeps losing it’s value.

I do not want to buy just land and build unless say unincorporated as I am a licensed and new home rules/reg.s completely out of control,way beyond basic/safe/habitable building practices.

I was in mid 6 figures cash wise and unfortunately a family member died

and I find myself in 7 figure cash position.I do have some investments and in hand metals but really want decent property,plan on working the land as I did in last home,very reasonable rent at moment.

I do consider places needing work as am a carpenter,still,seems insane pricing even in that realm.I also am looking for areas with a lower property tax,weird time to be a potential buyer.