Multifamily lending ballooned 32% from early 2020, powered by low interest rates and soaring rents. Now there’s a price to pay.

By Wolf Richter for WOLF STREET.

The multifamily segment of Commercial Real Estate doesn’t face the structural issues that the retail CRE segment and the office CRE segment face. There is demand for apartments; and even as some areas have been overbuilt particularly with higher-end apartments for “renters of choice” – because that’s where the money is – population growth and the arbitrage with sky-high house prices will see to it that demand for apartments continues to grow.

What multifamily properties are struggling with are higher mortgage rates – like all segments of CRE. They are all getting hit by higher interest rates as they have to refinance existing mortgages at much higher rates, or as variable rates adjust to those higher rates. This has caused valuations of CRE properties to plunge and mortgages to go into default. Turns out, 15 years of interest-rate repression by the Fed messed up a lot of things, and there’s a price to pay. But office and retail, on top of facing higher mortgage rates, also have huge structural issues that multifamily doesn’t have.

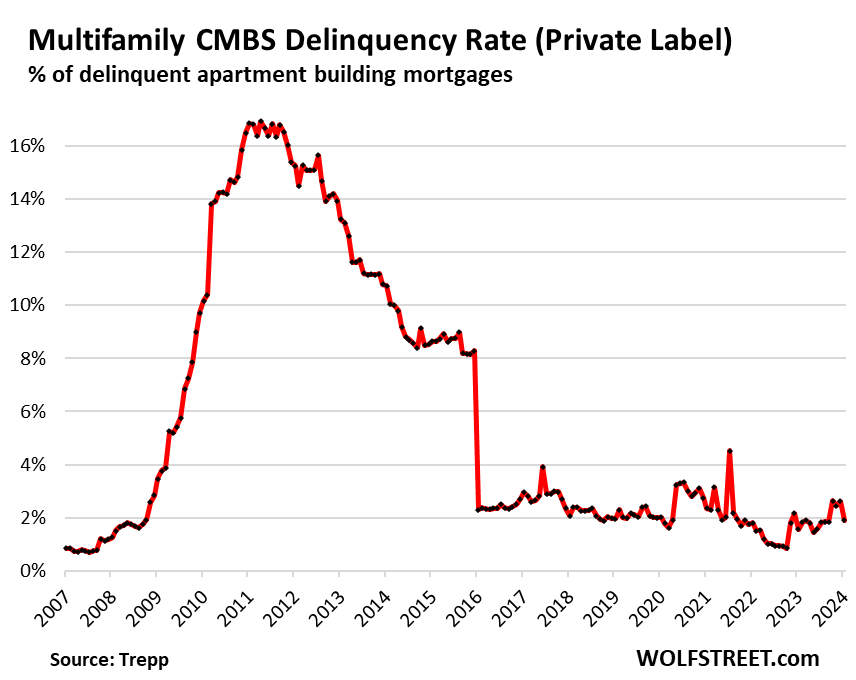

Default rates of mortgages backed by multifamily properties remain relatively low, compared to retail, office, and lodging. The default rate of multifamily mortgages that have been structured into Commercial Mortgage-Backed Securities (CMBS) was 1.9% in January, compared to 6.3% for retail and office (data via Trepp).

Multifamily lending ballooned, powered by low interest rates and soaring rents: Fitch

Fitch Ratings warned about banks’ exposure to multifamily loans – especially small banks that loaded up on multifamily loans that are now going bad.

“Multifamily loans facing pressure include those that are rent stabilized, reliant on overly optimistic rental income increase projections, or in submarkets with elevated rental vacancy rates and/or excess supply, many of which are in Sunbelt states, particularly Texas, Florida, Tennessee, and the Carolinas,” Fitch said in its report.

Multifamily lending has ballooned 32% since early 2020, to $613 billion in loans outstanding as of Q4, “driven by low interest rates, high levels of housing demand, and attractive rents,” Fitch said.

“Attractive rents” would be from the point of view of landlords and lenders; “soaring rents” would be from the renters’ point of view. The combination of ultra-low mortgage rates and soaring rents made all things possible. And it worked until it didn’t.

Some small banks with big concentrations of multifamily may topple, but no big deal.

Nearly 40% of total multifamily loans in the US banking system are held by 10 banks, Fitch said. And these would be larger banks with lots of other assets.

In terms of concentrated exposure to bad multifamily loans, 49 banks had multifamily nonperforming loans (NPLs) that exceeded 5% of their total multifamily loans. At those 49 banks, the multifamily NPL ratio of 5% is far higher than the default rate of multifamily CMBS (1.9%, chart above).

But these banks are small: they average $1.3 billion in total assets, Fitch said. By comparison, failed SVB had $209 billion in assets. JPMorgan, the largest bank, has $3.3 trillion in assets. A bank with $1.3 billion in assets would be the 689th largest bank in the US. So these are small community banks. Those are the banks at risk from bad multifamily loans.

The amounts of multifamily loans at these community banks “is only a modest fraction of the overall industry, thereby limiting the contagion to the broader financial system if one or more of these banks were to fail,” Fitch said.

It’ll take years to play out.

“We expect any deterioration to play out for the banking sector over an extended period,” Fitch said. “During the Global Financial Crisis, losses did not peak until almost two years after a peak in delinquencies, and problem loans have yet to peak for the sector.”

For now, the big CRE problems are office and retail, though multifamily is warming up.

Retail and office CRE, in addition to higher mortgage rates, also face devastating structural issues, some of which will have to be dealt with through demolition and redevelopment of the properties into residential. This is more likely to happen – is more likely economically feasible – after a developer buys the property for cents on the dollar, essentially for land value, such as in a foreclosure sale, hitting lenders with huge losses, and there have been some already.

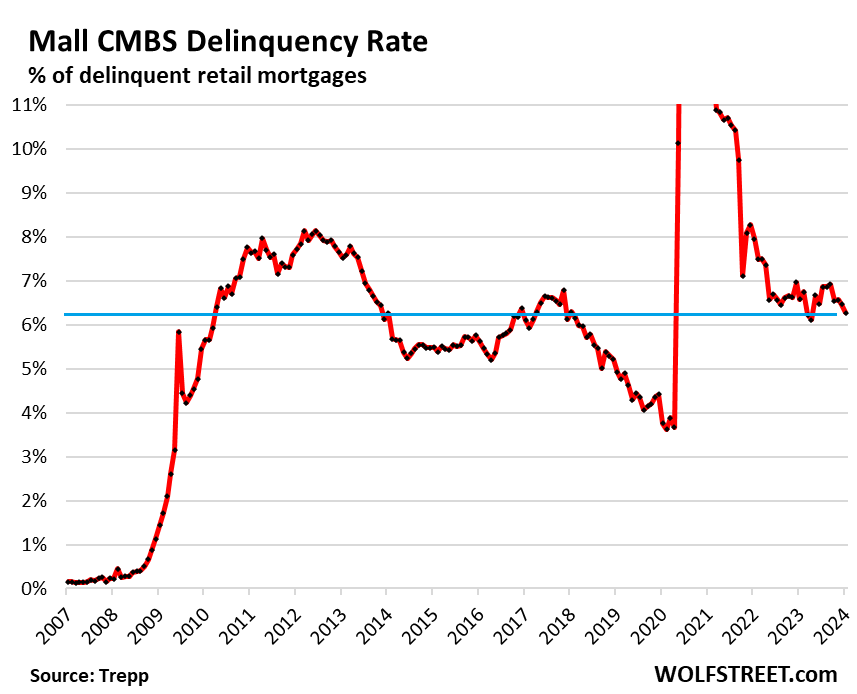

Retail CRE has gotten bludgeoned by ecommerce years ago, with hundreds of chain-retailer bankruptcies from Sears Holding on down. Recent entries on the bankruptcy and liquidation list included Bed, Bath, & Beyond. Countless malls have failed. Back in 2017, we started calling the phenomenon the Brick and Mortar Meltdown.

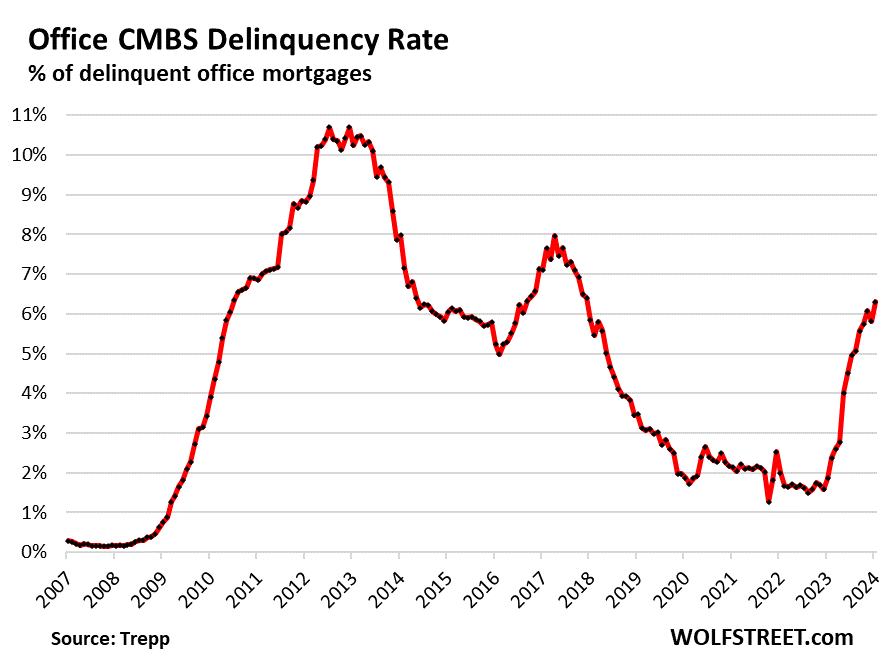

Office CRE got hit a couple of years ago by the sudden realization in corporate America that they will never need all this unused office space they’re sitting on, and they or landlords put this space on the market, on top of the vast space already on the market, leading to mindboggling office availability rates.

The astronomical availability rates, combined with much higher mortgage rates, caused transaction prices of office towers to collapse, and delinquency rates to spike:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Multifam trades a lot like bonds. Stands to reason that it would be taking a hit. Cap rates got absurdly low.

prices sky high

looking at buying houses instead

did that 2 years ago when I sold MH Park

Don’t worry guys, I got this and all other asset bubbles.

Do you really think that the Mag 7 stocks are rising based on fundamentals and not in anticipation of my bailouts (they call it rate cuts).

Don’t worry, I will keep my word about not cutting rates. But, if inflation were to rise over my FFR and 10 year treasury yields, Mag 7 get their negative rates and liquidity without official bailouts.

Now that would not be my doing, would it?

J. You really know on what side your bread is buttered don’t you.

And who supplies the butter.

Are we still on for golf next Sunday?

The Put is dead. Long live the Put!

The Mag 7 doesn’t need your liquidity. They’re the new money printers. $309.2 billion free cash flow per year, yahoo!!

“The Mag 7 doesn’t need your liquidity.”

Don’t you dare me mister. If I push rates and 10 year to 4% over CPI, all leveraged businesses and their leveraged customers will stop spending and the Mag 7 profits will convert to big losses.

The Mag 7 leadership knows only how to talk about making world better, build empires to get promoted, burn money on speculative tech with no real returns (Metaverse, Crypto, Video chat, AI) and pump their stocks with this speculative tech to insane valuations by luring high investors.

Even worse is that these new leaders know nothing about handling recessions as they have not seen once since they became executives. So they keep hiring and talking bull….

Only my Pivot can save them now.

Howdy JPow. You can create new tools too. Try negative interest rates.

LOL @ Fitch

Because of course a ratings agency with mid curve understanding of the interlinkages of debt and assets in all [global] markets will say publicly that they think contagion is limited…

Next thing they’ll tell me is that they are gonna down grade stuff to deep junk from IG after their diagnosis was worth used toilet paper.

Rating agencies are for CYA, not real risk management :P

If a bank with $1.3 billion in assets collapses — so this would be the 680th largest out of 4,000 banks or whatever — the FDIC will swoop in on Friday evening, take over the bank, and Monday morning, insured depositors will have their account at a new bank and outside of the name change won’t know the difference, and those CRE loans and other assets will be sold to other banks, and life goes on.

If you can do basic math, you will realize that a small bank like this poses no contagion risk to the banking system with $22 trillion in assets.

There may be some things that could cause contagion, but it’s not multifamily loans at small banks.

“Contagion is limited” has a very familiar ring to anyone who was around in 2006-2009. And the ratings agencies’ quick pivots to downgrades, likewise. Maybe they should be compelled to buy stakes in everything they rate: skin in the game works wonders. Or maybe they are just facilitators for selling off the stuff to suckers.

During the financial crisis, it was the biggest banks with trillions of dollars in bad regular mortgages that got hit.

1. Total CRE is just a fraction that size.

2. Multifamily debt is minuscule, compared to regular mortgages.

3. Much of CRE is owned by investors, not banks.

4. a portion of CRE is owned by foreign banks.

People always hope that the same thing will take down the banking system all over again because they hate banks. But it won’t. The same thing doesn’t exist anymore. Now the vast majority of residential mortgages are government backed and are no threat at all to the banking system.

The banks that failed in 2023 didn’t fail because of NPLs — far from it. They failed because they had a well-organized superfast run on the bank (depositors yanking their money out).

“Now the vast majority of residential mortgages are government backed…”

More accurately “tax-payer backed,” linked directly to the federal budget.

Government backstopping of problem loans replaces a problem with a problem — systemic baking crisis with a potential crisis of federal finance.

Seems that problems with the latter would logically lead to a general fall in respect for the currency. Eventual result, inflationary spiral and bond vigilanty-ism.

Key word “eventual” — no timeline predicted, of course!

I appreciate that rigorous response, Wolf, thanks. But I note, the 2023 bank failures were each fairly small points of failure, that found a new way to threaten contagion. The key for me is not whether it was NPLs or some other particular stressor, but the way fear appeared and flashed across the system as a run, menacing not merely isolated smaller banks but, it was widely thought, perhaps the whole system. Suddenly insurance (actually bailout promises, not legitimately financed insurance) was extended on an emergency basis to non-insured accounts, which was potentially scary. To me, anyway.

re: “the vast majority of residential mortgages are government backed” (as predicted in IMTRAC by Dr. Pritchard in May 1980).

That’s because Congress turned the nonbanks into banks via the DIDMCA of March 31st 1980. So, the thrifts had to act like banks in order to survive.

Sources of mortgage funds shifted from the subsidized rates formally provided by the small saver to “bond-backed” sources which reflecting the interest rates prevailing in the longer-dated loan-funds markets.

This is not be directly related to topic. But today saw news of Capital One taking over Discover. I love Discover for their very good customer support and lot of benefits. Not sure why they want to go with crappy Capital One. I am guessing this is more of desperation than opportunity. Feels like they are masking the problems by unifying the balance sheets and deposits. DFS stock went 90 and back to 110-120 range. funny part is Deal is in All Stocks only. So basically instead of holding 2 useless ones, hold 1.

Those 2 in Consumer Financials and Credit Card business.

I have yanked my deposits from DFS long back to T-Bills. Why would anyone will keep money in banks even with 4-5% rates when 4 week T-Bills have given 5.4% yield for at least 9 months.

The corporate passion is to get bigger and fatter, get rid of competition, and gain pricing power. This is just another buyout with those goals. Nothing to do with “desperation.”

The Federal Trade Commission should sue Capital One to block the merger.

The drunken sailors, it has been said around here, have been holding up alright. I guess a main metric is revolving credit delinquencies. OK, there is some buffer still there. But the restructurings anticipated in this article suggest to me fragilities that may flash across the system. The Fed might rescue a certain echelon of players, but the lower 50 percent of Americans could have another 2008-magnitude stress test of their balance sheets (and retraction of credit). It doesn’t seem like even a modern high-speed QT and helicopter-drop could be without significant pain, which could drag out, as in the aftermath of 2008 (and the nasty echoes of 2020). Maybe I’m too anchored to those bottoming scenarios. But I’m not putting money in the hands of the Capital Ones of the world right now.

What don’t you like about cap one?

Just curious.

Customer Service. Their App. Very slow to raise the rates when Markets rates overall going up. Limited support for Trust Accounts.

I have both of them for long time. So I know my exp is not random or limited. If you compare Discover App and their Customer Service, you will know the difference.

Do you work for Cap one or any association with them?

Multifamily only works while people have money to pay rent.

What happens when job loss, no unemployment benefits able to be paid and rent stops getting paid. People get more room mates to be able to make their money go further.

Not long after that, those occupancy load factor ratios drop and you have mortgages not paid.

In any case, the entire real estate market in Canada and U.S. is well over its skis in the price to value perspective.

> What happens when job loss, no unemployment benefits able to be paid and rent stops getting paid.

My first thought is, Fed helicopter-drops to the rescue, but there is a question how many times this resuscitation works, and how quickly inflation takes off again. I think a lot of the resiliency has been wrung out, the seed corn eaten up. We have developed this clever fix, and now used it (sometimes unnecessarily) to the point of possible exhaustion.

phleep – …just another variant of the rot inherent of ‘ next-quarter thinking’ at various helms (…and a ‘Ball of Confusion’ as the band played on…).

may we all find a better day.

I got intrigued by a sharp decrease in MF CMBS default (and slow decrease in rest) around 2015 and looked for the historical FED fund rates. Here is the chart from St. Lous FED which did not solve the issue but only increases the intrigue. Why would the default take a sudden dive when the FED FR moved up from 0.0% to 2.5% Was there any invisible hand working simultaneously?

1. I deleted the link to the document on Google Drive, no way that I’m going to click on something like that, or let anyone else on my site click on it. Way too risky.

2. “I got intrigued by a sharp decrease in MF CMBS default (and slow decrease in rest) around 2015”

All you have to do is ask me, rather than googling around in no-man’s land. I discussed this before, including in this article here:

I am interested in smaller bank financing of condominium construction. It seems that where I live (Detroit) perhaps related to the boom, many optimists with backgrounds in other businesses like party stores or specialty construction like paving decided to become developers of generally small, 40 units or so condominiums. They seem to use smaller local banks. One is Flagstar that was acquired by troubled New York Community Bank. Could these developers have problems handling the complex financing needs associated with condominium development?

These failures wouldn’t happen if prudent banking norms were followed. Substantial down payments and a conservative approach to cash flow. Writing the loan that’s on the ragged edge of being illegal ends up like this when the market changes, as it always does.

Don’t forget that banks are now also using DEI metrics to originate loans. It’s not illegal at all, but may involve more risks than traditional lending norms.

My sister is a bank officer.

Meh…

The risk for CRE is the worthless office buildings.

Sunbelt cities like Austin, Nashville, Charlotte, etc are where the jobs are moving as they leave the expensive coastal states. It’s where the young professionals are headed when they graduate from college. Rents aren’t going to decline much. Yes the owners will have to refi at higher rates, but that won’t be bad enough to cause lots of defaults.

Focus where the story is – it’s the offices.

“Focus where the story is – it’s the offices.”

RTGDFA.

Sorry Wolf – I should have been more clear.

I meant my comment as a retort to Fitch, not to you. Thanks for your excellent analysis!

Fitch is paying attention to office CRE, including here:

https://wolfstreet.com/2024/02/12/even-banks-in-asia-pacific-apac-on-the-hook-for-us-office-cre-fitch/

US banks are exposed to only a small-ish portion of office CRE. The rest are investors around the globe (CMBS holders, CLO holders, bond funds, insurance companies, pension funds, PE firms, mortgage REITS, etc.) and foreign banks.

I would be interested in your view of Walker and Dunlop (WD), as it has risk exposure to lending to Multi-Family loans both from a loan and a servicing point of view. It is not a bank. A very large part of its assets are “goodwill” and also based on an estimate of the value of servicing rights. It has reported very low loan losses so far in the cycle, but one has to wonder, is the worst still to come?

Doubt this will blow up in anyone’s face except for renters. Interest payments go up due to higher rates? Double rents. What are the renters going to do? Buy a house? LOL!

The contagion will be other sectors of the economy people are forced to cut back in. Housing is the last thing people will remove from their budget besides food.

No, rents are not determined by interest rates. Rents are determined by supply and demand, and by the employment and income of renters.

Landlords lose tenants, have vacant units, and go to hell if they try to raise their rents enough to cover the new 8% mortgage rates.

Where are those tenants going to go? Rents have a long ways up before buying a home is cost competitive, and rental vacancy rates are well below historical norms. Rents are not tied to interest rates sure, but landlords have all the power to pass that cost on to renters in this market.

Will rents double? No, thats hyperbole. But theyre going to go up, as they always have, just now at an accelerated pace. I dont see any landlords taking a loss out of the goodness of their hearts, and any tenants that flee a rate stressed landlord for another will only empower that new landlord to themselves raise prices. This will be a pricey game of musical apartments for tenants.

The renters go home, go to sleeping in their car, quadruple up and hot bunk, move to a tent. Plenty of alternatives.

What can’t be paid will not be paid.

In local markets, rents can collapse just fine. And this happens a lot. And it happened when I moved back to Tulsa in late 1985. I was one of the first tenants at a higher-end brand-new apartment complex for “renters of choice,” with river views, nice place. I paid $650 in rent at the time, which was a lot. Over the three-plus years that I lived there (before I bought my condo from a collapsed bank), my own rent dropped to $350 as the economy had spiraled down in Tulsa as all the big oil companies moved their headquarters to Houston and took their highly paid jobs with them, and the new apartment building I’d moved into had to fill the vacant units. Rents in Tulsa didn’t recover for decades. And they’re still relatively cheap.

People confuse the national averages with local markets. Landlords don’t own the national average building; they own buildings in local markets. And tenants don’t rent the national average either. And rents can and do go down sharply and stay for years in local markets.

In the Bay Area, the Dotcom Bust caused rents to plunge, and they stayed down for a decade.

“Where are those tenants going to go?”

They’re going to landlords that have vacant units and are lowering rents to fill them — this is the result of large amounts of new supply coming on the market.

When landlords have to fill vacant units or have to try to retain tenants as other landlords are cutting asking rents, then they will cut rents. This is already happening in a number of overbuilt markets, including Houston, for which I just got the multifamily data.

Vacant units kill landlords faster than cutting rents a little and keeping the place full.

If demand overwhelms supply, then renters scramble to find an apartment, and rents shoot up, as we have seen a couple of years ago in some markets.

Nationally, over the long term, rents are going up a little faster than incomes because people don’t spend all of their income on rent. For example, if they spend 40% on rent (say, $2,000), and their income (now $5,000) goes up 5% to $5,250, then landlords can capture more than 40% ($100) of that $250 increase, they might be able to capture $150 of the $250 increase in pay, which would be a rent increase of 7.5%. Just an example, but that’s kind of how it works long-term, nationally, on average, in non-rent-controlled units. But each local market is different, some with surging rents and others with declining rents, which makes up the national average.

Wolf’s former stomping ground Tulsa is now featured on the TV reality series 48 hours. They had a 10 part series on homicides in Tulsa Ok. I thought Washingoton, DC (the Swamp) was bad until I saw a few of these series.

Remember that it’s also not really up to the prospective renter to decide whether or not they can afford an apt; it’s the apts that do that via their arbitrary “3x the rent in gross income” rule. Raising rents raises that bar and eliminates all prospective renters under it, regardless of what those renters actually can afford.

Wolf thanks for the great summary, but as a 30 year apartment owner I want to let you know that most apartment “market data” is based on the big “corporate” rent data. For most Bay Area apartment owners rents went up just a little in the dot com “boom” and then went down just a little in the dot com “bust”. I looked at putting a loan on the (over 1,000 unit) Filmore Center in SF in 1998 and again in 2002 (in my day job as a commercial lender) and it had a massive increase in rents from 1998-2000 and a massive decrease in rents from 2000-2002 (and also had massive-way above average turnover since nobody wants to live there) while at my little low turnover apartment in San Mateo my rents just went up a little and went down a little (like most small landlords).

I see it every time rents raise. People move in with family, get room mates and down size. Landlord pricing power is limited to available income unless they want to deal with bad tenants and evictions. Landlords play an expensive game of roulette every time they raise prices.

What happened in ’08-’09? People doubled up. Kids moved back home. Some people lived in their car for a while. Theory was that with so many foreclosures apt rates would increase. Didn’t happen. Me? I moved from class C to class A for less. I vote with my feet. I don’ t know why people think moving is so horrible. What did the U-Haul trucks say? Adventure in Moving!

Now? I’m paying 27% less than 3 months ago. I moved. Low rent district. I don’t care – I just don’t care. I’m hidin’ out here until this whole thing blows over. Besides, I like it here; I’m learning a new language. I keep a low profile – nobody bothers me.

I’ve had it with their price-gouging, price-fixing algos! And all their little “fees” that they keep inventing. I saw what they were doing – holding apts vacant for 3 months. Anyone new to leasing might not realize that it did NOT used to be like this. An “invitation” to renew? What???? I understand it’s private property, but when there’s a 3rd party “suggesting” renewal rates for 50+ large property owners/managers, that’s collusion.

If 90% of renters moved when they got notice of a 15%+ rate increase, owners wouldn’t keep playing this game. They’re preying on residents’ unwillingness to move. They’re preying on inertia.

If you’re into home maintenance/home improvement, enjoy your hobby!

Water, water, everywhere, and not a drop to drink. That’s my take on liquidity anyway. As Wolf points out, this isn’t the 1930’s, when corporations and their owners actually went bankrupt. Depositors and owners will be made whole, but the owners will be unaffected by any inflationary pressures.

What I really want to know is who will be buying all the new debt coming out of the treasury…

Interesting times.

Judging by current [mediocre] yields, there’s zero shortage of buyers for new treasury debt right now. Something about the cleanest shirt in the dirty laundry pile, eh?

Maybe, the real issuance has not come yet, and the numbers are mind-boggling.

Don’t jump the shark, that pile of laundry is about to get much bigger. If not enough buyers show up, the world will go to war to hide the problem. At least that is the historical outcome, every, single, single, time.

Demand for bills is essentially unlimited since they are equivalent to cash. And the treasury has been skewing new issuance towards bills and away from notes & bonds.

Notes & bonds will continue to find buyers as long as the yield is right, but the right yield will have to be higher than it is now in the coming years.

Doesn’t seem like overwhelming treasury demand. No reason not to expect if all things stay the same the S&P couldn’t reach 5400 by end of year, which is 8% or so. Admittedly nobody knows what will happen so diversification and individual needs always best. Betting against Wall Street or Congress not printing money isn’t great but of course who knows what around the next corner?

Where might one view a list of the forty-plus banks that are so highly exposed to CRE loans?

Thank you Wolf

Fitch treats this info as highly confidential. If a bank name leaks out, that bank would instantly have a run, with all uninsured deposits getting yanked out overnight, potentially causing the bank to collapse. And it would be Fitch’s fault.

Portland (or) has had a declining population since 2001 but they are still adding new multi-family units. I realize that most of these were probably started ( or committed too) long before things went upside down. But every few weeks another one opens for renting, but where are the renters going to come from. Most of the new multi-family in PDX is 6 stories or less with balconies. Last Sunday I drove around when I had to go in to town and to use my ” patio index”. Almost anyone who moves in to an apartment with a balcony puts something on it ( if even it is just a place to store bikes). So by my rough estimation based on the number of vacant patios there is less than a 60% occupancy rate in buildings finished in the last 4 years but open for renters for at least 6 months. So I think in some places like Portland, Seattle, etc. the looming vacancy rate will also be a big factor in the upcoming collapse of multifamily finances. This will be a good thing as these properties need to get scooped up at much lower prices so the rents can be drastically lower.

“Portland (or) has had a declining population since 2001…”

Typo? 2021?

A Google search said that the population of Portland peaked in 2019 and while it is lower than 2019 it still has at least 100K more people than 2001.

As far as the “patio index” it is interesting that the number of my tenants with nothing on the patio has been increasing in the last five years.

It seems to relate to the big increase in young (under 40 young) people (both male and female) that seem to be making zero effort to be attractive to the opposite sex.

An increasing number of these young people are “trans” (usually female legal name on the lease that asks me to use a male name and pronouns) but I am amazed how many other under 40 people don’t own a bike, BBQ or even a deck chair (and never have a date or friends over).

my mistake 2021

Related tangentially to this article:

“According to Bloomberg data, 34 of China’s top 50 developers have defaulted on their debt obligations at some point over the past 2 1/2 years.”

— Epoch Times 2/20/24

China’s dependence on residential real estate is orders of magnitude higher that US CRE, but it struck me as an interesting parallel: both are the result of severe and over-stimulation by authoritarian governments.

putting the US alongside China as a comparable ‘authoritarian government ‘ tells me that you’ve never spent any time in China.

Let alone a basic comprehension of communism from a Marxist perspective. Admittedly the US has a narrative and will stick with it. Bread lines and all that gets old fast.

JanesO-

I noted a use in each country of strong central powers to influence and control their respective economies, each with undesirable side effects to parts of their real estate industries, one part of which (CRE) is subject of the present article.

If that’s inaccurate or somehow offensive, how?

But you are correct, I have never lived in China.

Yes, it is highly inaccurate. Central control of the U.S. economy us no where near central control of the Chinese economy.

Itis silly to even to pretend they are similar.

JimL-

I never meant to suggest that the US governmental apparatus and the CCP are equally authoritarian, but in several important categories (e.g. money/banking, military, housing finance, healthcare emergency response, etc.) both have exhibited authoritarian tendencies recently and in the past, in my opinion.

Which country has flexed its authoritarian muscle on international money and banking more vigorously, both recently and in the past half century?

Your objection appears to be based on magnitude, while my observation was one of vector…

“The fear of capitalism has compelled socialism to widen freedom, and the fear of socialism has compelled capitalism to increase equality. East is West and West is East, and soon the twain will meet.”

—Lessons of History, Will and Ariel Durant

Howdy Folks. Stupid is Stupid does and you cannot stop Stupid. Made a great living rehabbing residential foreclosures / short sales. Always a silver lining if you know how to look.

I guess I’m getting old, perhaps remind me of how mortgages in general work.

As I recall, writers obtain the mortgage clients. Banks fund the initial mortgage, then package them into MBS for sale to investors, or otherwise transfer the mortgage to a servicer or government agency.

Is this generally correct?

I wonder what the time line is from mortgage approval to sale of it to others or to MB securities.

7 decades and still trying to learn.

Those are the mortgages that get securitized, and banks are off the hook, and CMBS holders are on the hook. A lot of office mortgages were treated that way, as we have seen.

Here the risk is with smaller banks that kept the mortgages on their books to earn the interest income for years to come, rather than just earn the fees from originating the mortgage and from the securitizations.

Congrats on your “7 decades of learning!”

Wife says I forgot more than I learned…but she that started “decades ago”.

Its nice to have Wolf Street to get solid fact based info. Thank you!!

The amounts of multifamily loans at these community banks “is only a modest fraction of the overall industry, thereby limiting the contagion to the broader financial system if one or more of these banks were to fail,” Fitch said.

In the wake of the financial crisis of 2007–2010, the rating agencies came under criticism from investigators, economists, and journalists. The Financial Crisis Inquiry Commission (FCIC) set up by the U.S. Congress and president to investigate the causes of the crisis, and publisher of the Financial Crisis Inquiry Report (FCIR), concluded that the “failures” of the Big Three rating agencies were “essential cogs in the wheel of financial destruction” and “key enablers of the financial meltdown”

So, the lesson in 2024 is by all means trust Fitch?

Just asking the question.

Howdy Observer A lesson I learned was NEVER, NEVER, NEVER,

” ZERO DOWN MOVES YOU IN ”

Sold several properties where the buyer signed their name at closing and walked out with a check ….

We’re contributing to demise of the malls in America. Typical hair treatments are $300 in our local mall. Ms Swamp’s hairdresser operates out of her home now. The same treatment costs $85 at her home studio. Need I say more.

Swamp – …now THAT’s some real-world price-discovery!

may we all find a better day.

You make otherwise bland subjects into interesting ones.

I do have investments in a couple of multi-family CRE properties. Thankfully, the property management bought rate caps, although they still took a hit when the rates adjusted.

The approach was to buy somewhat distressed properties (usually because of bad and/or indifferent management) and improve them, increasing occupancy and also able to attract higher-end tenants. So far, the increase in cash flow has covered the higher interest payments.

Where’s the list of banks ?

Fitch treats this info as highly confidential. If a bank name leaks out, that bank would instantly have a run, with all uninsured deposits getting yanked out overnight, potentially causing the bank to collapse. And it would be Fitch’s fault.

We have nothing to worry about.

Fitch says so.

What a relief!!

From banks with on average $1.3 billion in assets? Correct.

Wolf – Is my thinking wrong here? Are all Commercial Realestate loans offices and retail spaces? Couldn’t we see CRE loans used to buy housing for a business to operate as rentals whether long or short term? And if that’s possible, and it might not be, couldn’t that influence the residential market somehow?

“Are all Commercial Realestate loans offices and retail spaces?”

First sentence of the article:

“The multifamily segment of Commercial Real Estate doesn’t face the structural issues that the retail CRE segment and the office CRE segment face.”

Multifamily = housing, so no.

I was thinking more along the lines are people able to hide single family housing inside a corporate realestate stucture.

@Longtime Listener there are “some” but (not a lot) of single family homes with “commercial” real estate loans (if a bank takes back a dozen homes in a failed development the bank will often sell to a guy that puts a commercial loan on all 12 homes to rent them as a big “12 unit” property until the market improves and he can sell them one by one). You will often see a single family home on the site of an apartment when a developer bought a home on a couple acres and built an apartment “around a home” rather than tear it down.

Multifamily CRE — the topic here — covers buildings with multiple apartment units in the building. Single-family rentals is separate from multifamily.

During WWII, my father told me he rented a house in Seattle for $15/month. Maybe he was misremembering, but the idea is clear. Housing was a utility – a good that served the needs of human beings for shelter.

Not sure what the theory is today, but any system that does not ultimately serve the needs of the human population will be burned to the ground by that population.

It takes time to reach that point, of course. But ask young people today if they would be willing to take up arms to defend the country, much less the country’s interests overseas. Most will roll their eyes and I have to say, that I think they would be making the right choice.

Everyone will say, “but Capitalism” !, however, people are not going to buy Capitalism for much longer. People might buy Free Enterprise, because the benefits of freedom and enterprise should be self evident to anyone except those educated in modern centers of higher learning. However, there are no champions of free enterprise any longer.

Time will tell.

What happens if the FDIC can no longer cover insured deposits? Last I looked it had a balance of about $130 billion.

Tons of US coverages are underfunded. FEMA and NFIP are other good examples. Move money from A to B or just spend more or “borrow” it.

The FDIC can borrow from the Treasury, as well as the FHLB and other banks.

More money will just magically appear, like it always does!

Are multi-family CRE mostly taken out as mortgages with a balloon final payment with an expectation to refinance, or are they mostly variable rate mortgages?

If balloon, what is the typical length until the balloon payment comes due?

If variable rate, how often do they typically adjust? Are the variable rates tied to LIBOR or something else?

Maybe nothing is typical?

Both are available. Agency loans tend to balloon in 5 to 10 years. Then they need to refinance leading with current rates. Combined with the higher CAP rates causing lower values this is what is causing the stress in the market. I know of folks with 3% mortgages due next year. Try cashflowing that at 7 or 8%. Depending on equity they may walk away. Then the bank has an REO and higher reserve requirements so they sell ASAP causing more pressure on prices.

Can we get the list of exposed banks?

If you read all the comments, or most of them, it was stated that Fitch keeps the list a secret to prevent runs on these banks.

The local Westfields mall near me just reported a half a dozen carjackings in the last two weeks. This recent crime wave at the local malls could put the final nail in the coffin of the malls. Who want’s them and who needs them.

I know of one multifamily investment /property management company that owns approximately 40 multifamily complexes, representing around 5,000 units. These are mostly B complexes in good markets.

Their model was to identify and purchase complexes that needed upgrades. They then would upgrade 1/2 the of units and possibly the entire complex before selling complex. This strategy has worked well for them up until now.

Because their normal hold time is 48 months to 72 months, they refinanced their entire portfolio with short term loans when rates bottomed out in the summer of 2020 through 2021. Their loans are now coming due and they can’t make the numbers work given current interest rates. This company is now working with the various banks to obtain loan modifications or restructure the debt. A lot of these banks are playing ball, and the most interesting thing is the reluctance of most of these banks to pursue foreclosure.

Granted a small sample size, but I have to wonder how many thousands of CRE property owners are in deep trouble and attempting to loan modifications. The questions becomes, what happens if at some point the number of destressed properties on the market dramatically balloons?

Yes, a common situation. I know of ones that needed to increase their reserves with the bank. No investor payouts at the moment.

There are funds getting commitments/money raised to buy these distressed properties. Grab your popcorn and watch the price discovery! :-)

Banks don’t want REO. Reworking loans into lower paying but current loans, especially if the borrower kicks in some cash is usually better for them.