Homebuilders do what it takes to sell homes in this market while sales of existing homes have collapsed.

By Wolf Richter for WOLF STREET.

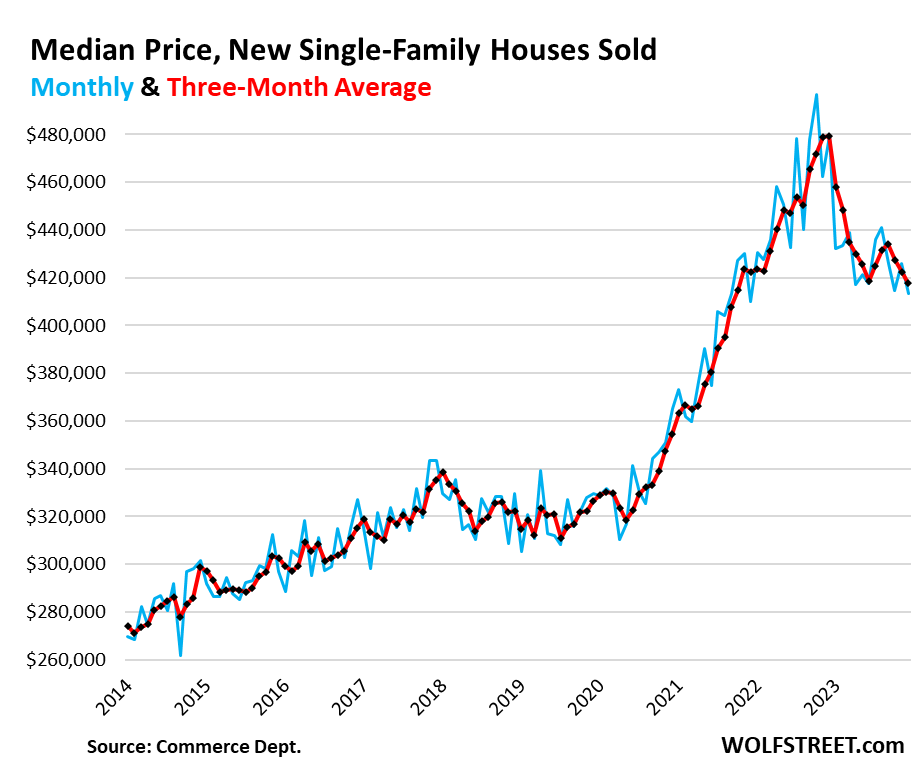

The median price of new single-family houses sold in December dropped to $413,200, down by about 17% from the peak in October 2022, and the lowest since December 2021, according to the Commerce Department today (blue).

The three-month moving average, which irons out the monthly ups and downs, fell to $417,900, the lowest since October 2021, and down 12.8% from the peak in December 2022 (red).

The largest homebuilders have been singing the same song in their earnings calls: This is a tough market where sales of existing homes have collapsed by one-third to just 4 million in 2023, the lowest in the data going back to 1995, from the normal level of around 6 million per year, but we, the homebuilders, know how to deal with this market. We’re building smaller houses with less costly amenities that we sell at lower prices, and we’re buying down mortgage rates at a considerable cost to us, and we’re hedging those buydowns, and when those hedges blow up, that costs us too, and we’re throwing other incentives at buyers, so that we can get the payment down. And now people can buy a new house for a lower mortgage payment than a resale home. And we’re competing with homeowners and taking sales away from them.

D.R. Horton, which reported earnings a couple of days ago, said these trends will continue, that it will continue to build and price homes in a way to take share away from homeowners thinking of selling their own homes, and even though it took a hit to its gross margin, it will continue with the pricing and the mortgage rate buydowns, and it also disclosed some details of its rate-buydown hedges, which malfunctioned in the quarter and led to a $65 million charge, which we discussed here. And all this caused its shares to plunge. But its sales and orders were pretty decent – unlike existing home sales.

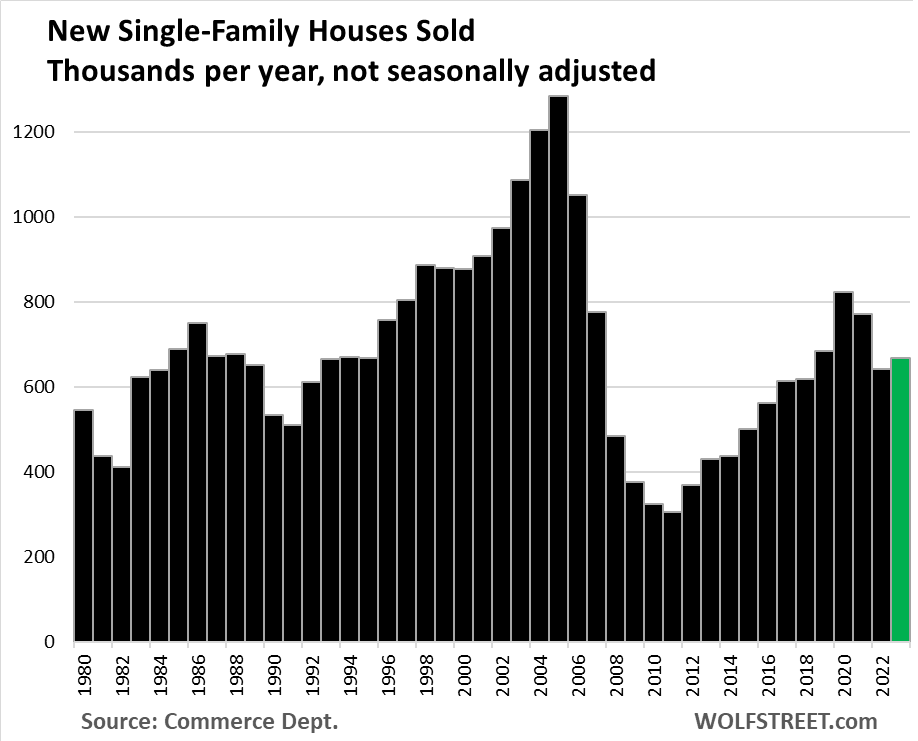

For the industry overall, sales of new houses (contract signings) in December rose to 50,000 houses, up 6.4% year-over-year and up by 2% from December 2019. Winter is the slow time of the year, but this was pretty decent.

This was the kind of stuff D.R. Horton said in its earnings call. Their strategies of trying to produce a lower mortgage payment and a lower price to take buyers away from the resale market is working.

For all of 2023, sales rose by 4.2% from 2022, but were down substantially from the boom years 2020 and 2021. They were just a tad lower than in 2019, but up by 8% from 2018. So homebuilders are muddling through this tough market by dealing with reality: getting prices and payments down – while existing home sales have collapsed.

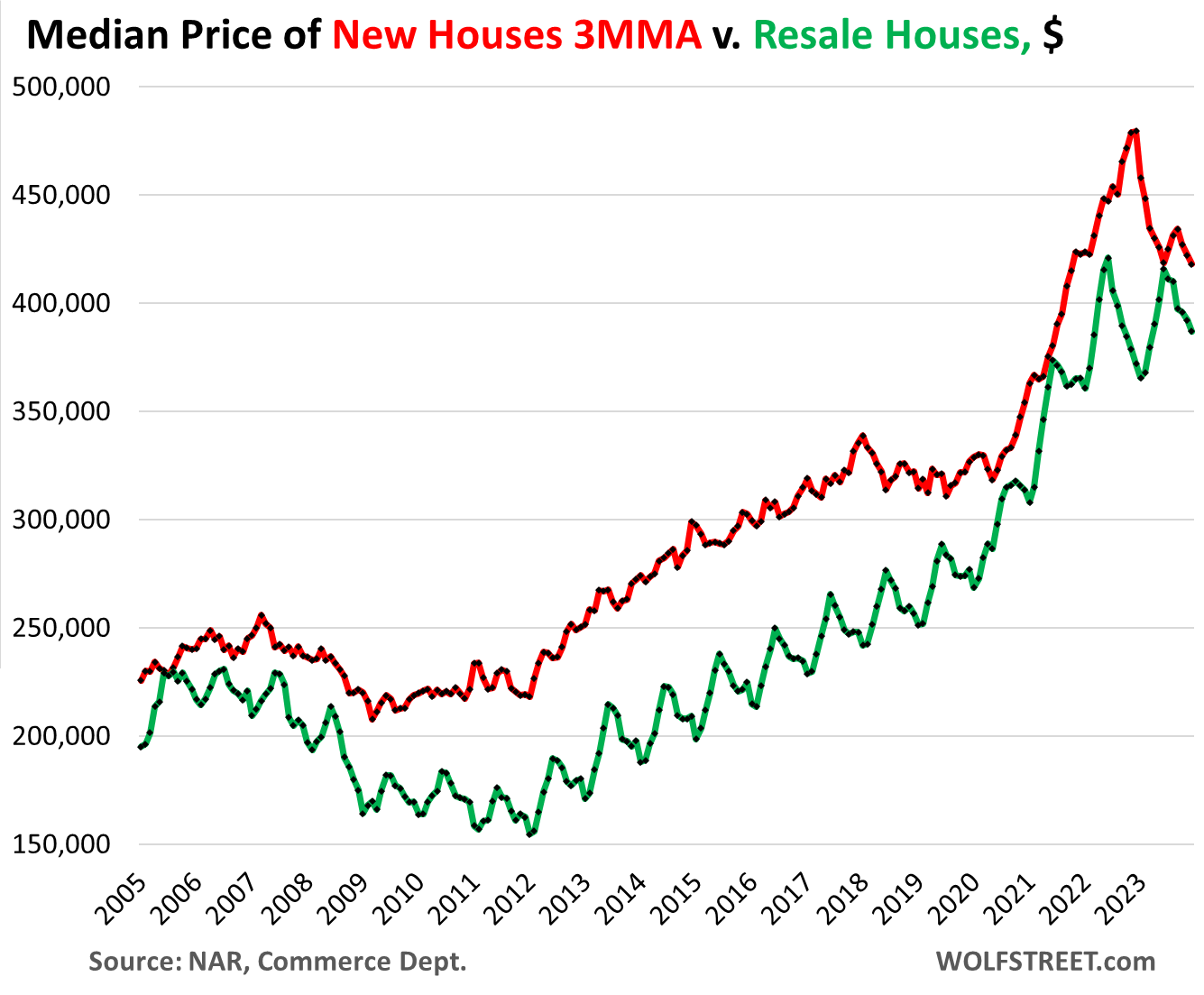

The price difference between new and resale homes.

The median price of resale single-family houses has also declined, but only a little. The record price of existing single-family houses was in June 2022 of $420,900. The year 2023 was the first year since the Housing Bust when the seasonal high in June was lower than a year ago. But the price drops have been small.

Since April, the price difference between new and resale houses was 10% or less, going as low as just 1%. In 2019, the spreads were roughly between 10% and 20%, and in the prior years back to 2012, the difference was roughly between 25% and 45%. You have to go back to the housing bust to see spreads of 10% or less.

In the chart below, the median price of new houses is shown as a 3-month moving average to iron out the month-to-month ups and downs.

And this does not include the costs of the mortgage-rate buydowns. Those buydowns are bridging the reduced gap in prices, and are bringing payments of new houses in the range or below where payments for the median resale home would be. This is the competition that homeowners who want to sell will have to deal with; they’re up against the pros who know how to sell in this market: by making deals.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Not in SD, LA, South OC or any cities outside of 909 :) I am sure some will say

Long long way to go to get back down to 320K from 2020.

RE is a long cycle asset.. it’s going back like in Canada Germany UK etc

I was surprised to see that this administration that relied heavily on urban middle class vote blew a housing mega bubble denying housing forever to its core urban middle class voters. And I am not even talking about the big inflation hole burned in their pockets that hurt middle class the most. Looks like both parties are serving the same masters.

We can proudly show increased dollar spending charts, but they are powered by both deficit / debt spending and by decreasing value of US Dollars. The purpose of all QE and deficit spending is to hide the signals that our economy us stagnating.

We seem to be in a crazy death spiral where quality of life in US keeps going down as dollar charts keep going up.

How quickly everyone forgets the pandemic. The FED was attempting to save our economy from turning into a depression when everything shut down, locked down and froze up.

They didn’t create the bubble. All the FOMO buyers out there who panicked and bought everything from cars to houses at any price did. They lost their minds and will pay the price now.

I stopped building homes in early 2022 because I felt this was exactly what was going to happen. It just took longer than I expected and still has probably another 5-15% downside left. See you at the bottom.

Nonsense. Everything was “shut down” and “locked down” for about 3 weeks. After that, outside of hospitality/restaurants/travel, most things were open. You talk about FOMO buyers panicking and buying things at any price creating the bubble. They did so because they had helicopter money dropped by Congress, made possible by the Fed printing $5 trillion (although nearly $1.4 of it has now been unprinted).

You talk about it like they’re not related. The fact is, the Fed’s actions were never appropriate, not prospectively or retrospectively.

They SAVED us. Praise be. I am so happy they did what they did lol.

They were doing stupid stuff long before the pandemic, it was just another excuse to to amp up the bad decisions they were already making.

Nobody knows what would have happened if they didn’t go through with what they did. But i have a feeling they maybe didn’t ‘save’ us after all . Perhaps they just further blew up an already existing asset bubble.

Is this a sarcasm post ?

If not, then you are missing the big picture.

This bubble is all created by FED/Govt.

FED kept rates too low too late along with QE and MBS buyings.

The FED should never have bought trillions in MBS causing the rates to go so low. That’s what caused the massive house increase !

Howdy Leo. Those middle class voters don t realize we live with a one Party System as long as the Federal Govern ment is concerned……

Need a third party that loudly describes the affects of corporate lobbying on our lives and the economy.

From a prominent realtor in San Diego….

“From January to September 2023….despite interest rates peaking over 7%, our SD market saw a steady 10% increase in value for both single-family and attached homes.”

This is what will play out in the most splendid housing bubbles for the next few months . Maybe not 10% but things here are cooking despite what we’re being told to hear. I’ve substantiated, practically annotated why it’s happening, specifically within the city itself. I’ll take the punches.

Gattopardo,

Since when do I believe the lies of a “prominent realtor in San Diego” — a used home salesman — out to hype his business? What kind of shit are you posting here?

The Bob who cried Wolf,

That’s precisely why I look at the data so I don’t have to listen to this BS, such as “things here are cooking” LOL

RE hype BS is insidious, and it’s everywhere. And people are trying to abuse this site to spread it.

Wolf, since when did I expect you to believe it? I should have thrown the /s tag on the end. Apparently my views are not well enough remembered here yet. I’m a housing BEAR.

Got it, but The Bob who cried Wolf took that very seriously and ran with it, LOL

Never trust a real estate broker like government creates metrics.

Their livelihood depends on FoMo.

Very difficult to find an honest broker.

In this website also we have a lot of real estate BS hype especially people with vested interest.

Is it not magical how malls, commercial and office buildings, and homes in so many, many US locations are going down in value or just not selling but lenders somehow do not suffer any significant losses, not even those who held treasuries and bonds paying 2.5% to 4.5% a year when interest rates now almost doubled — like Silvergate Valley Bank. It is like the CCP’s hilarious claim of 5.2% gdp growth as their economy imploded! LOL

This is sarcasm?

I sell a lot of homes in LA and 17% is about accurate on flips. There used to be so much froth one could get on top and now you’re barely able to sell things for list. I’ve sold numerous flips that I used to sell for 1.6M, and now I’m only selling them for about 1.4M.

RE is due for a severe correction. Be patient it will take a while to come back to sanity

$25,000 per house for this stuff would be rather overpriced, but that’s where this new tract junk is headed in the near future.

There is zero chance of either of your premises being true. BS hyperbole.

Maybe it was a joke?

I wonder how much pressure this will actually put on existing home prices if the price reductions in new homes are being achieved by selling smaller houses with less amenities. And I’m not sure a comparison of median home prices tells you much if the size and amenities of existing vs new homes aren’t very similar.

New, smaller homes are being built for people that can’t afford (or want) bigger homes with lots of amenities. These buyers are young couples starting out, retirees that are downsizing and those who don’t want bigger homes with bigger bills.

I bought a smaller, new home after my wife died. I didn’t need the big house anymore. I love my new 1,489 sq. ft. house!

Most people that are buying the new, smaller, less amenity houses are not putting any pressure on the bigger homes that are overpriced and not selling because they didn’t want or couldn’t afford them in the first place.

My family of 5 is in a house that size cause it’s all we can afford without being house poor.

Sol, where I live in tampa, the latest batch of immigrants move into a house nearby, remodel it and turn the garage into a bedroom. Then some add on a second story immediately turning a 3-2 into a 5-2. THEN THEY RENT OUT SEVERAL ROOMS, the garage and the 2nd story addition, AND WAL-LA; Mortgage paid with 7 cars parked out front. What a country.

Money for nothin and your mortgage for free. This is happening in a near coastal community called town and country in tampa.. There are no deed restrictions in this community, so all good with this hood. And prices are still maintaining. I wish I could say this aint so, but it is. Except for the penchant to hate all lawns at all cost, and not a lick of english spoken, its working out OK, so far.

Markymark, this stuff is going on everywhere in places where there are immigrants pouring in.

@markymymark:

Same story in Southern Calif.

Yep, same in Miami, love these Frankenhouses with converted garages, tacked on rooms here and there with the yard looking like a small car dealership.

There won’t be much price pressure if they’re selling smaller houses. Although the sales price will be lower, the price per square foot will be HIGHER and that’s what’s used in comps and appraisals.

Unless lot/land prices and construction costs drop substantially, I don’t expect price per sq ft to come down much, if at all.

As a former appraiser, NO. You don’t comp a 1500 sq ft house to a 3000 sq footer. Law of diminishing returns – the extra 1500 sf aren’t worth the same as the first 1500. Also, different markets.

A good measuring stick might be sq ft price? I have no idea what the sq ft median size of the houses that are being sold.

I like to visit new subdivisions to see the new designs, features, etc. Toll Bros, D.R. Horton, Lennar. They can be small and close together, but they are planned out well with parks, community center, walking paths, retail, etc. Most of you folks are old farts and do not realize what younger families want. Clean, brand new with modern features, unlike a remodel used home. I love older homes, like craftsman with intact lead paint stuck to the window sills, but many do not.

I have been to three this month and they are doing buy downs and free upgrades. The price you see listed is the usually the base model before upgrades. The model homes are usually the upgraded model. Many of them already have folks living on site while other homes are being built. Folks are very friendly and will talk to you (dunno if they get an incentive or not). Younger families with kid or two. Clean, safe, quiet, and friendly. Your kids will be friends with each and so will the parents. Nice community of similar minded folks for the most part.

They bring out their best real estate sales folks. Real f*cking sharks. These young folks have no chance against these folks. I stay about an hour or so and visit 3-5+ model homes. Tons and tons of people. Free cookies and barista made coffee for me. Honestly, if I were younger and had young kids and worked in the area, this is a no brainer if prices are comparable. Minimal yardwork and no fixing the house for 10 years.

Joe Homeowners need to wake up if they want to sell their home and move on. A home can be a tomb if you allow just money to be the only factor to move or to sell. Good luck.

No doubt complete with paper plates and plastic utensils as the younger generation has no taste whatsoever these days.

SoCalBeachDue,

Sorry no one wants your shitty fine china and antiques. Boomers are the biggest hoarders ever

100% agree. When we shopped for a home we quickly stopped seeing existing, older homes and only looked at new builds.

It’s like Tesla is giving you the same price and incentives for a nice, brand new EV compared some other car maker trying to sell you a used car for the same price that looks ugly and doesn’t even have car play/bluetooth.

It’s just a no brainer to skip over any house that’s older than a few years and look at brand new beautiful houses only.

The new stuff is full of shiny stuff of poor quality. Flimsy siding. Vinyl plank flooring that looks like distressed, painted wood.

At least here in SD the locals have long figured out how to avoid this competition – prohibit almost all new construction.

That’s because there isn’t much more land to build on. Unless you go east, there isn’t anything more open land….

That’s a misconception. There is always lots of land in cities that can be repurposed for housing. Even in small landlocked San Francisco (just 7 miles across), there’s room for at least 70,000 new housing units now in the pipeline, in areas that don’t have housing, or not much (Treasure Island, Naval Shipyards, Candlestick Park, South of Market, China Basin, the old power plant, etc.) These are all areas with old industrial and military installations that are being bulldozed and redeveloped into housing. Cities are full of them. But it won’t be single-family housing; it’ll be multifamily (condos and apartments). If you want new single-family, you need to look further out.

Goods schools, higher education, lack of homelessness, career drug addicts, section 8 voucher systems, clean air and safety. I seeing more and more up against the fight or flight approach in America. No matter the size of the matchbox big or small if you cannot afford the mortgage or the move you maybe stuck in renters Utopia. Less than 2 years ago their was foaming mouth FOMO, builders move to building the less for best budget. Oh well someone has too take the L

This is what is happening in many metro areas and certain zip codes within metro areas. Noticed far out suburbs here are experiencing an over supply of new homes. RE signs are everywhere as you approach these developments. Meanwhile existing town homes are not moving at all and the market is frozen. There are NO for sale signs in existing townhomes, even in these exurb developments. So, this is not like 2006/2007 yet.

In closer in suburbs, we haven’t seen any fall in the price of existing homes. Prices are rising still, at a slower rate. MLS data verifies this.

In Canada, there are talks about home prices going to the moon when the central banks cut interest rates.

It’s copium because I don’t believe that interest rates will go back to almost zero like before.

I agree it’s probably copium, but for me, what changed after the pandemic is that everyone now knows that housing is not driven by ‘fundamentals’ – it’s driven by the government’s desire to boost the housing market. This has basically de-risked the investment as all you have to consider is whether high house prices/house price boom is a net vote winner or not.

Sadly in most developed countries it is a vote winner, so I can’t really see prices ever falling substantially now. If they did the govt would be out stimulating the market like crazy. Here in the UK they are already floating the idea of govt backed 99% mortgages for first time buyers. This makes no economic sense unless you realise that their goal is to keep prices inflated by keeping the bottom of the pyramid scheme stuffed with desperate young people.

I believe things are slightly different in the USA as people are more comfortable investing in businesses than housing. But in places like the UK, Canada, Australia, property investment is a religion. I believe we could have hyper inflation and a complete breakdown of the economy, and they’d still be dreaming up policies to keep the housing market inflated.

I’m not so sure. For example, Biden has lost a lot of support from younger people who supported him in 2020 because of inflation, especially in housing.

You’re right that propping up housing is a vote winner for people who already have it. It’s not so much of a vote winner for people aspire to own a house.

“A government that robs Peter to pay Paul can always depend on the support of Paul” – George Bernard Shaw

Dam you gave the most logical explanation. It’ll be hard to debate that. Like you said if the government dropped the house prices to what they were before they are defeating their own purpose. I also see a pull back before an all time high then it’ll settle and stay for a while. I will sell my investment home on the next all time high .

We don’t live in our ideal/desired neighborhood, and our 1920s house lacks a number of amenities my wife and I would like.

That said: it’s paid for, maintenance is reasonable, and the taxes are acceptable (if, too high generally for the neighborhood).

I keep fighting the urge to move “for the sake of moving”. Thankfully, a combination of stubbornly high prices and interest rates makes the decision to stay that much easier. ;-)

Truth be told, I kick myself for not buying back in 2012 when we were seriously looking to move: house prices in high end areas like Gates Mills, Chagrin Falls, Pepper Pike, Moreland Hills (Greater Cleveland suburbs) were hit fairly hard by the housing bust. As an example, three houses we looked at in the 2011-2012 period that listed for around $200k – $220k back then recently sold for between $550 – $725k.

That’s nuts – especially in this region. Again, makes staying a lot less painful.

Homes here in the Naples, FL area are being built like crazy – construction everywhere and premium prices. No recession here. People purchasing ANYTHING consumer like drunken sailors – and have been for years!

No riff-raff in that city. My brother owns a house there and in Boca Raton.

In my market (Metro Detroit), local home builders are opting to reduce their listing prices instead of offering these incentives. I can get a 2,200sqft 4bd3ba colonial, 9′ ceilings, LVP flooring throughout, hardwood cabinets, quartz countertops, semi-finished daylight basement, on 0.25 acre for $380k. Similar homes from national builders are still listed at 2022 $500k prices and comparable used homes ~$350k. It’s a great time to buy new from a local builder IMO.

There is nothing luxurious about vinyl plank flooring. It’s toxic waste and is most harmful when new and still off-gassing. The asbestos of 2020’s. The rest of the house sounds great, however.

Asbestos tiles would be a quantum improvement. Handsome & highly stable unless you start busting it apart and huffing it.

Vinyl is hideous, inert, soulless toxic future landfill fodder. It’s suitable as a record medium and that’s about it.

Well, it’s in your car and in your house plumbing. It’s everywhere in some form or fashion.

I like that things don’t break when dropped on vinyl floor

And cat puke cleans up easily…

I think in time, regular hardwood and classic ceramic style tile will prevail. Speaking from first hand experience, the vinyl floors i have used start to deteriorate and lift up after 5-10 years. Maybe mine is bad quality, but i’m not impressed at all. Wont do it again.

Hardwood also doesn’t last forever but i don’t have to tear it out and start over, just refinish it, which isn’t all too bad in my opinion. Its expensive, but a lot of things are.

Asbestos tiles? You’re kidding me.

Sometimes you can glue back down the vinyl planks/tiles. I’ve also had some luck with buffing and waxing it for shallow scratches and when the clear coat gets dull.

But overall I’m pretty skeptical of this idea that we should just be making everything out of plastic, especially when it’s just because it’s fashionable. Vinyl floors, cove base, melamine cabinets, PEX plumbing, Styrofoam and spray foam insulation, synthetic underlayment and house wrap etc. It’s all just adding to the “plastosphere”, much of it is incompatible with a sustainable “design for disassembly” approach, and not to mention the continuing findings about microplastics toxicity.

It’s not fashionable — it’s cheap disposable garbage promoted by the petroleum industries. It’s poison, it’s not aesthetic, and has no vibration to it. You’ll never see a violin made from plastic…

Asbestos tile: if it’s already installed in a home, and not friable, just leave it alone. It’s beautiful, durable, insulating and naturally flame retardant. I’ll risk my chances with mesothelioma versus outfitting a house in what is literally the excrement of oil.

Yup. All the low end flips use that awful modern day linoleum.

It’s bad enough that they dropped using brick and started wrapping houses in freaking Tupperware, but now, we’re supposed to walk on it too.

Take vinyl floor over hardwood floor any day. Spills don’t result in water damage. looks and feels great, easy to clean and lasts and much cheaper than hardwood flooring.

That would be $800k plus here in Bend, OR.

That’s a decent deal, but in my neighborhood in Seattle you can buy a vintage 1982, all original cabinetry, carpet, windows, and drawer rollers, for $850/ft. You can get a 4 bdrm for only $2.2M. You basically get the overgrown landscaping and moss buildup for free. Plus, as you walk the neighborhood between daylight hours of 10:00AM to 3:00PM, piano and string music flows endlessly from the homes, courtesy of the Tiger Moms. If you match those walks with an umbrella subscription, supply of Starbucks caffeine syrup, and handheld Vitamin D lamp, you will be skipping with delight the rest of your life.

You could buy a fixer in Montlake for less than $300k 20 years ago. I just pulled up a house for sale there – asking $2 million. Sold in 1998 for $395k, and was probably turnkey but dated.

Yeah but it’s Detroit so a big no!

Not sure what to make of this. My developer is treading water. Input costs have not come down (materials, energy, and labor), banks are not lending under terms that that he can afford. Plenty of land available, but no financial motive to build, even a spec house. Sure, the big boys are building large apartment complexes (pack them in like lemmings). New single family construction is DOA in my area. It would be great to build another duplex, but in this market you can make that profitable with the present costs and interest rates.

That should read; “but in this market you CANNOT make that profitable with the present costs and interest rates.”

I will also add, many “mom and pop” landlords are leveraged t the hilt, in large part because banks refused to do short sales during the last housing crash (total BS by the way).

Again, when BAD DEBT isn’t allowed to truly clear, meaning people/corporations actually suffer REAL consequences for their bad behavior/investments, this is what we get.

Housing is depressing. 3 BR 2 BA home in my neighborhood which sold for 213K in 2017, 422K in 2021 was just listed this week for 529K and is already pending.

NW NJ

I suspect what you’re seeing is just muscle memory by buyers who pocketed 200K from whatever lipsticked pig of a hovel they offloaded to whatever sucker buyer in 2021. They’ve been skulking around Zillow with that equity burning a hole on their pocket and are ready to jump.

EZ money has a way of distorting value perception and warping sound decision making. Put a jam jar of cash & coins from tips you earned waiting tables for a year next to a check for the same amount gifted to you by whomever. Guess which ones going to be easier to spend?

NW NJ might actually be a place that has reasons for it other than a bubble. The Sussex County/Water Gap area is beautiful and, while it’s too far from NYC to commute 5 days a week, a 2-3 day hybrid arrangement is doable.

I wouldn’t be surprised if that accounts for some of the people buying.

Agreed on NWNJ being a beautiful place that is manageable on hybrid to get to the city, but still shocking to see these numbers in what has always been a much cheaper area.

Homes in my neighborhood, sold for 1 million in 2020, are being sold for 2 millions

jon: how about giving us your zip code so we can see “all” the homes that have doubled in price in less than 48 months. Truckee, Tahoe City, Vail and Aspen all went crazy in the last 48 months but probably don’t have a single 2020 million dollar home selling for double that in 2020 (without a major renovation).

I’m seeing lots of price drops. On a good note, more commission lawsuits being filed in other states. One just filed in AZ in the last two weeks.

On another good note I meant to say since both price drops and commission lawsuits are good news.

I prefer used homes pre 1970 construction.

Everything was well built up until 1978 or depending on the city as late as 1979 for non custom built homes.

Gotta watch out for that aluminum wiring…think that started to become a thing in late 50s,

Aluminum wiring (during the Vietnam War – copper was short). Lead paint (pre-1978). Asbestos in heating systems. Therefore, it takes a bit of detective work to make sure you’re not buying a future headache if you choose to renovate/repaint at some future date.

There’s still a lot of aluminum wire… the wire, itself, isn’t dangerous. It’s when people put CU rated outlets and switches on AL without proper preparation.

Mine was built in 1978 and it’s an excellent balance. New enough that the electrical bits are compatible with current tech, wiring is all 12awg copper, and no asbestos or lead detected. Copper pipe is reliable. But the house is old enough to have really solid lumber framing and very strong & thick gypsum board. If it has to be stick & drywall construction, a well maintained house from the late-70’s even up to the mid-80’s can be great quality. Early 70s is a crapshoot. Vietnam era aluminum wire, steel pipe, high potential for lead/asbestos. At least the lumber was good. New houses won’t last… Fast growth white wood lumber barely better than balsa. Thinnest drywall they can get away with. Press-fit plastic plumbing guaranteed to create water damage, sometimes immediately. Push-connect electrical with the lightest guage wiring allowed by code. Folks are really stretching to afford a new house that’s going to be a non-stop headache 10 years down the road.

But isn’t this what a reasonable person would want to see? For a long time, builders had been focused on 3000sqft+ luxury drywall palaces. Now they’re finally forced to build 1,000-1,500sqft boxes on smaller lots with down-to-earth basic hardware that might at least sort of be in-reach for entry level buyers with rate buy downs. Meanwhile prices have dipped back down not far off of where they would have been had they just remained on the 2012-2018 trend without the pandemic bump.

“But isn’t this what a reasonable person would want to see?”

Yes, I think the builders have figured it out, and buyers like it.

Nearly everyone I know between around 45 and 65 (without kids) want the same thing…1500 to 2000 sq ft. The problem is they also want a prime location, and a very high quality build, on a lot with at least some hope of privacy. This combo does not, and will never, exist with new homes. And so then why not build it? Well, because the cost of buying a teardown with a good lot in a great location is so high, you’d be nuts to build a tiny house on it.

So, no one does. And there are no great location, small, high quality homes. Sucks, because that’s what I’d like, too!

Peter Shit and all his followers have been wrong and a lot of money has been lost.

No you don’t have to ask me why I’m mad as hell. All these clown austrians living in fantasy land wanting to go back to something that’s never going to come back again

The thing is all these new homes are in new neighborhoods. Which means the land is worthless and you’re basically just throwing good money at a cheaply built depreciating structure. Anyone smart would buy property that has high land values (you know, properties that are actually in desirable locations) and low structure value. That means only buying older homes. The newer homes are pretty and shiny and make the wife happy but as an investment they stink. I would be surprised if any of these new homes are worth any more than they sold for 10 years from now. People will eventually flock back to the expensive locations where land values are high; ultimately there is always a flight back to quality.

Location location location boys and girls. Nothing else matters.

Right now they’re flocking to those new houses, LOL.

Places with high land values are building multifamily, BTW.

Examples?

Some of that may be from cities running into affordable housing requirements (in CA, at least). So munis are more apt to approve some of those projects.

Thanks for the update!

Is there any data on average square footage of the new houses being sold? I know they have said they have moved to smaller houses/lots. I curious what sizes they are moving too.

Correct, like education, healthcare is heavily subsidized.

The GFC and C-19 are diametrically opposed. One where housing was plentiful, the other where there was a housing shortage.

Money flows went negative prior to the GFC. Whereas money flows have always been positive during C-19.

There is absolutely no housing shortage in USA.

It is not as if population grew a lot post pandemic or USA lost lots of homes.

People would hoard houses as long as there is a belief out there that home prices would not go down.

Once this mentality is broken, you’d se flood of new inventory.

We just need to tax house vacancies

2x that for house vacancies of foreign holders

“New Houses” are an irrelevancy in North Metro Boston.

I live in a town of nearly 24,000 residents and since the end of 2019 our town as added……a whopping ELEVEN units of new housing.

There ARE proposals to add some 635 units of housing across three developments. All three are being held up in legal quagmires.

To give you an indication of the level of objection towards new houses in my town, I’ll share an anecdote from October, 2022.

Some 2,600 residents turned up that month at the Town Hall to protest a hearing by the Zoning Board to authorize a development of 190 houses. That is roughly 400 more residents than voted in the town’s election one month later.

As far as existing homes go – our local market is every bit as hot as it was from Summer 2020 – early-Spring 2022. We aren’t even getting a whiff of the usual Winter season softness that affects most New England markets.

https://wolfstreet.com/2024/01/26/on-the-surface-pce-inflation-is-encouraging-but-beneath-it-core-services-accelerated-housing-stuck-at-5-7-for-six-months/

“Is there any data on average square footage of the new houses being sold?”

In my northern California town it looks to be about 1750 sq ft. They’re all 2 story, 2 car garages. The lots are small of course but you could fit a certainly fit a doughboy and a swing set in the back yard.

New construction prices have PLUNGED here. (Been waiting to be able to say that about something.) If I wanted a starter home, had a kid, and could work mostly from home, north central California is where I’d go. It’s a beautiful backwater.

Race to the bottom on prices.

High end RE has some small and continuing volume here in skiville. (Anecdotal)

I think the scammers are out and the wealthy are trying to put money into something real, before we get hit with something real.

Interesting article. Watched a Youtube realty video about home owners insurance. Fella was saying it’s harder/ more money to get insurance for an existing home than a new home. Never bought a new home but if this is true it could be making a difference. Folks here in Florida are screaming about their insurance premiums.